#8. Stock market volatility

Text

what is gift nifty?

Title: Unwrapping the Gift of Nifty: A Guide to Navigating the Stock Market

Introduction:

In the dynamic world of finance, the stock market stands out as a fascinating arena where investors can explore various opportunities. One such avenue that has gained immense popularity is trading in Nifty, a flagship index of the National Stock Exchange of India (NSE). In this blog post, we’ll dive into…

View On WordPress

#1. Nifty trading#10. Futures trading#11. Liquidity in stock market#12. Portfolio benchmarking#13. Mutual fund performance#14. Market analysis#15. Risk management strategies#16. Stop-loss orders#17. Technical analysis tools#18. Price movements#19. Economic indicators#2. Share market opportunities#20. Global market events#3. NSE (National Stock Exchange)#4. Stock market diversification#5. Nifty index#6. Stock market trends#7. Gift Nifty#8. Stock market volatility#9. Nifty options

0 notes

Text

anyways the thing about tim & wealth is that it's not so much relatable on account of how well off the drakes are, but it is interesting. to me.

so, like. the drakes are well-off from their inception, yea. but like. they're so clearly implied to be new money esp considering the 80s when they were conceived with the stock market bubble. like the excess of the million dollar jet screams ppl whose business really boomed in the 80s and they were going to flash their gains. the facade of the new money with the mention of the jack buying an erte litho...the flashiness of owning nice things, but those things were still just a facsimile of the real thing....multiple apartments...buying a home completely in cash....but then a few bad investments is enough to wipe out most everything...god the fanon of drake industries being an unshakeable old titan like wayne enterprises is so uninteresting to me because drake industries was such a volatile company. it almost got wiped out by phil marin embezzling from them...pls see my vision it was a small but fairly stable family company that hit it big & could not sustain itself like that forever...tim's canonical issues with worrying about money & the idea that he was well aware that the company his family owned was always teetering on the edge. good years were good. bad years could mean they could lose it all. tim doesn't worry about food on the table and the roof over his head, but he does worry about the years they're in the red...his parents fights worsen when the company has a poor year...his dad thinks they should take a risk, his mom thinks they should be cautious...they don't fight about it in front of him, they don't want their son to worry about their finances, but he knows despite that...if the company doesn't make it, what will happen to them....he is 8, it isn't his responsibility, but he feels the weight of it in the background all the same...

#listen. like i know this feels very rich person problem#but jack and janet fighting over the company & the fact that it was very new money & not stable#means that tim as a child might have felt very insecure over the volatility of the company#what do u do when u are 8 and ur parents are talking in hushed whispers about how if they have another bad year...#sry i have so many thoughts about drake industries

109 notes

·

View notes

Text

Why Gen Z Should Start Learning About the Stock Market: Top 5 Reasons to Invest

Discover the top 5 reasons why Gen Z should start investing in the stock market today. From building wealth to gaining financial independence, learn why stocks are a smart choice for young investors.

Hello, Gen Zers!

You’re already a generation known for disrupting norms and rewriting rules.

Why not apply that fearless energy to conquering the stock market?

With today’s technology, investing is at your fingertips, and starting young gives you a massive advantage. Think about it: more time for your investments to grow, early lessons in financial resilience, and the first steps towards an abundant future.

Ready to see why the stock market could be your new playground?

Let’s dive into the five irresistible reasons you should start investing now.

1. Harness the Power of Compounding Early-

The sooner you start, the richer you get. Compounding means making money on your initial investment and then making more money on the earnings. Starting in your teens or early twenties means you have time on your side. Imagine this: invest $1,000 now with an average growth of 8% annually, and by the time you hit 50, that could swell into a sizable nest egg without adding another dollar. Now, imagine making regular contributions. We’re talking serious money!

2. Tech-Savvy Advantage-

You’re digital natives. Use it. Gen Z is the first generation to grow up with technology from the get-go. You’re already adept at navigating apps and online platforms, which are essential tools in today’s trading world. Tools like Robinhood, Acorns, or E*TRADE are designed for intuitive navigation and making trading a breeze. Plus, you have access to heaps of online resources and communities to learn from and share trading tips.

3. Economic and Social Change-

Invest in what you believe. More than any previous generation, Gen Z investors are likely to align their investments with their social and environmental values. Whether it’s renewable energy, tech innovations, or companies with strong ethics, your investments can reflect your commitment to making the world a better place, all while growing your wealth.

4. Financial Independence-

Break free from the 9-to-5 grind. Understanding and participating in the stock market can be your ticket to financial independence. Mastering investing now could mean the option to retire early or pursue a passion project without financial constraints. Imagine living life on your terms, powered by smart, early investments.

5. Weather Economic Storms-

Build your financial umbrella. The reality is, economic downturns, recessions, and market volatility are part of life. By investing young, you learn to ride out these storms without panic. Diversifying your investments in stocks, bonds, and other assets can protect you from financial rain and help you learn critical lessons about risk and resilience.

Ready to Rule the Market?

Alright, Gen Z, the ball is in your court. Investing in the stock market is not just about making money; it’s about building a secure, independent, and empowered future.

Start small, learn continuously, and stay committed.

The journey to financial freedom and becoming a savvy investor begins with your decision to act now. Are you ready to make your mark and watch your fortunes grow?

Frequently Asked Questions (FAQs):

Q1: How much money do I need to start investing?

You can start with as little as $50 or $100. Many platforms allow fractional shares, so even a small amount can get you started.

Q2: Isn’t investing risky?

All investments carry some risk, but diversifying your portfolio and investing for the long term can help manage and mitigate these risks.

Q3: How do I choose what stocks to invest in?

Start by researching companies or funds that align with your interests and values. Consider using tools and resources like financial news, investment apps, and financial advisors to make informed decisions.

#investing stocks#stock trading#option trading#share market#nseindia#stock tips#trading tips#investing#gen z humor#finance#income#profit

2 notes

·

View notes

Text

Unveiling Market Insights: Exploring the Sampling Distribution, Standard Deviation, and Standard Error of NIFTY50 Volumes in Stock Analysis

Introduction:

In the dynamic realm of stock analysis, exploring the sampling distribution, standard deviation, and standard error of NIFTY50 volumes is significant. Providing useful tools for investors, these statistical insights go beyond abstraction. When there is market volatility, standard deviation directs risk evaluation. Forecasting accuracy is improved by the sample distribution, which functions similarly to a navigational aid. Reliability of estimates is guaranteed by standard error. These are not only stock-specific insights; they also impact portfolio construction and enable quick adjustments to market developments. A data-driven strategy powered by these statistical measurements enables investors to operate confidently and resiliently in the financial world, where choices are what determine success.

NIFTY-50 is the tracker of Indian Economy, the index is frequently evaluated and re-equalizing to make sure it correctly affects the shifting aspects of the economic landscape in India. Extensively pursued index, this portrays an important role in accomplishing, investment approach ways and market analyses.

Methodology

The data was collected from Kaggle, with the (dimension of 2400+ rows and 8 rows, which are: date, open, close, high, low, volume, stock split, dividend. After retrieving data from the data source, we cleaned the null values and unnecessary columns from the set using Python Programming. We removed all the 0 values from the dataset and dropped all the columns which are less correlated.

After completing all the pre-processing techniques, we imported our cleaned values into RStudio for further analysis of our dataset.

Findings:

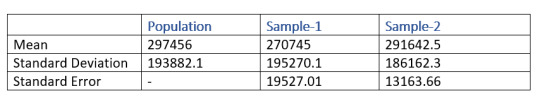

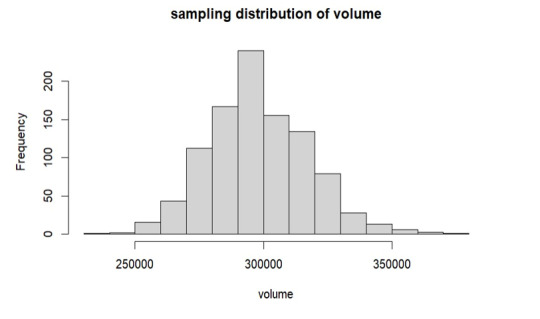

Our aim lies in finding how the samples are truly representing the volume. So, for acquiring our aim, we first took a set of samples of sizes 100 and 200 respectively. Then we performed some calculations separately on both of the samples for finding the mean, standard deviation, sampling distribution and standard error. At last we compared both of the samples and found that the mean and the standard deviation of the second sample which is having the size of 200 is more closely related to the volume.

From the above table, the mean of the sample-2 which has a size of 200 entity is 291642.5 and the mean of the sample-1 is 270745. From this result, it is clear that sample-2 is better representative of the volume as compared to sample-1

Similarly, when we take a look at the standard error, sample-2 is lesser as compared to sample-1. Which means that the sample-2 is more likely to be closer to the volume.

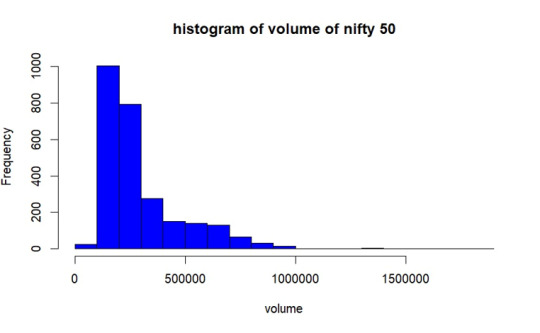

Population Distribution.

As per the graph, In most of the days from the year 2017 to 2023 December volume of trading of NIFTY50 was between 1lakh- 2.8lakhs.

Sample Selection

We are taking 2 sample set having 100 and 200 of size respectively without replacement. Then we obtained mean, standard deviation and standard error of both of the samples.

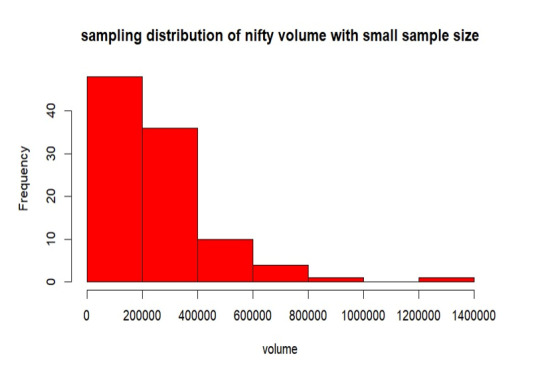

Sampling Distribution of Sample- 1

From the above graph, the samples are mostly between 0 to 2 lakhs of volume. Also, the samples are less distributed throughout the population. The mean is 270745, standard deviation is 195270.5 and the standard error of sampling is 19527.01.

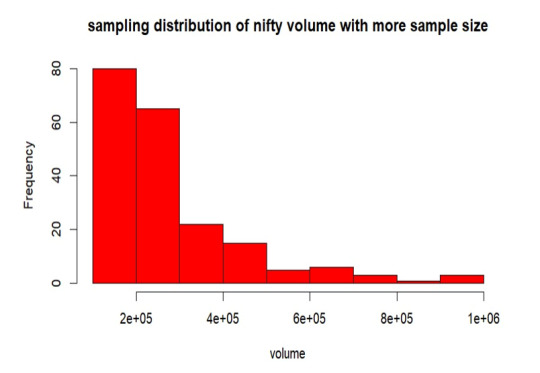

Sampling Distribution of Sample- 2

From the above graph, the samples are mostly between 0 to 2 lakhs of volume. Also, the samples are more distributed than the sample-1 throughout the volume. The mean is 291642.5, standard deviation is 186162.3 and the standard error of sampling is 13163.66.

Replication of Sample- 1

Here, we are duplicating the mean of every sample combination while taking into account every conceivable sample set from our volume. This suggests that the sample size is growing in this instance since the sample means follow the normal distribution according to the central limit theorem.

As per the above graph, it is clear that means of sample sets which we have replicated follows the normal distribution, from the graph the mean is around 3 lakhs which is approximately equals to our true volume mean 297456 which we have already calculated.

Conclusion

In the observed trading volume range of 2 lakhs to 3 lakhs, increasing the sample size led to a decrease in standard error. The sample mean converges to the true volume mean as sample size increases, according to this trend. Interestingly, the resulting sample distribution closely resembles the population when the sample mean is duplicated. The mean produced by this replication process is significantly more similar to the population mean, confirming the central limit theorem's validity in describing the real features of the trade volume.

2 notes

·

View notes

Text

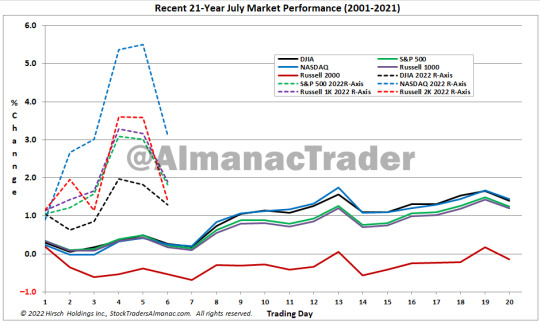

Early July Strength Hits the Wall

Early July strength arrived on cue. Stock rallied smartly off the June lows until bumping into resistance today near the 50 DMAs and recently broken support levels around S&P 3900. NASDAQ led the charge up 9.3% since the June 16 low through the close on Friday, July 8.

We have been honoring our stops all year long sidestepping much of the carnage, which has put the majority of our portfolio in cash. We are in no rush to jump back in. Our indicators are still flashing caution signs.

Seasonally we are in the worst months of the year and July is weaker in midterm years. Fundamentals are shaky, Atlanta Fed’s GDPNow latest Q2 estimate is -1.2%. Technically this looks like an oversold bounce with old support levels transformed into resistance and pre-pandemic levels in play. Inflation is still surging, and the Fed is still hiking. Consumer sentiment and market sentiment are still trending lower.

Our outlook is for continued weakness, volatility and likely lower lows. Cash is our main position for now. You don’t have to always be buying or selling positions. Cash gives you time to think. But we expect the Fed to be wrapping up this aggressive tightening cycle in September ahead of the midterms right on time for the midterm bottom and the “Sweet Spot” of the 4-year cycle.

So be sure to tune in tomorrow for my deep dive into summer seasonals in search of the midterm bottom. https://online.moneyshow.com/2022/july/accredited-virtual-expo/speakers/ed8d429050d5486abc818182ac141048/jeffrey-hirsch/?scode=057060

3 notes

·

View notes

Text

Never Altering Bitcoin Will Finally Destroy You

Instead, we plan to construct a model with the SolPerHeros NFT mission that enables donors and whales alike to help their favourite charity by proudly owning a SolPerHero NFT. In order for you a straightforward-to-use DeFi administration platform that helps your entire favourite apps then look no further than DeFi Saver. You will see all cryptocurrencies available and you can make a alternative of which one you need to purchase. So, if you are contemplating shopping for a automotive and wish to explore the choice of using cryptocurrencies because the fee methodology, AutocoinCars can offer you a handy and secure platform to take action. But if you'd like to essentially understand the topics and what modern cryptography is all about, your persistence is paid off. There is also no materials on hybrid encryption (i.e., using a combination of public key and symmetric primitives) or the KEM-DEM paradigm, which I might count on in any modern textbook. The draft standing and some missing matter areas make me hesitant to suggest it as your sole introduction to cryptography simply yet, but as a companion to a different textbook it has quite a bit to recommend it.

Secret sharing may be viewed as a sort of multi-get together computation (MPC) and the creator is an MPC researcher and co-creator of an MPC textbook. A scheme is secure if we will prove that no “reasonable” adversary can tell which implementation they have been given any better than a blind guess. An adversary is then given entry to two implementations of that API: one that is our real encryption scheme, and another that is a few idealised (usually random) implementation of it. The presentation can also be quite slow, taking its time to develop subjects and foster a real understanding. I discovered this uniform presentation very helpful in understanding the fabric and in seeing connections between safety notions that I hadn’t appreciated earlier than. This is a special strategy than numerous textbooks, which use this indistinguishability proof model just for encryption, and then change to other varieties of video games for different security notions (resembling message authentication). An another instance, the e-book introduces secret sharing early on after which factors out that a one-time pad can be considered as a easy 2-of-2 secret sharing approach, a connection I had by no means made before. This requires a good understanding of market traits and is usually a excessive-risk, high-reward strategy.

This is known as "mining," and it requires a strong pc and specialized software. This is a protracted-term strategy and requires persistence, as the worth of cryptocurrencies will be volatile and fluctuate significantly. For example, you'll be able to exchange a $1 invoice for one more $1 invoice, and you will nonetheless have $1 though your new bill has a unique serial quantity. Yes, all cryptocurrencies are interchangeable, that means you'll be able to alternate one coin for the opposite and also you make profit in accordance with their worth which could be risky. Trading: You should buy and sell cryptocurrencies on an exchange in an attempt to make a revenue. Buy and hold: You should buy cryptocurrencies and hold onto it in the hopes that its value will increase over time. Bitcoins price climbed above $26,000, representing a rise of 8% over the earlier twenty-4 hours, while crypto stocks comparable to Coinbase and Microstrategy posted vital good points as effectively. While these messages along with many others are unsolved right this moment, there isn't any purpose to consider they'll remain unsolved ceaselessly. Probably for that reason the hegemons will acquire much less bitcoin than they ought.

Alternatively, by the time you end the e-book you'll know sufficient to tackle a few of the more complete textbooks, corresponding to Smart’s Cryptography Made Simple (lol) or Boneh & Shoup’s Graduate Course in Applied Cryptography. Stablecoins are probably the most used type of forex for crypto loans as a result of they offer borrows more options. François R. Velde, Senior Economist on the Chicago Fed, described bitcoin as "an elegant answer to the issue of making a digital foreign money". There was a problem getting ready your codespace, please try again. In relation to NFTs, there was a crossover between traditional gaming firms and decentralized startups, as both sides look to capitalize on digital playing cards, artwork and even style on the blockchain. Even thought these metrics are simple, the do present essential data about the crypto below consideration. http://qa.rudnik.mobi/index.php?qa=user&qa_1=tvsound1 On a more fundamental word, the book is beautifully presented, and clearly a number of thought has gone into the typography, format, and diagrams (which have a delightful “tightness” in their use of space). I have learn a number of different textbooks on cryptography, however most are pitched extra at a degree for put up-graduate students (even if apparently meant for undergrads).

#Blockchain#Crypto Mining#Crypto Security#Crypto Wallets#Decentralized Finance#Crypto Exchanges#Non-Fungible Tokens#Cryptocurrency#DeFi#NFTs

1 note

·

View note

Text

Century Textiles and Industries Ltd Share Price Target 2024, 2025, 2026, 2035

Century Textiles and Industries Limited Stock Price Targets, Future Prediction, Perfomance 2024, 2025, 2026, 2027, 2028, 2029, 2030, 2031, 2032, 2035.

Century Textiles and Industries Ltd is a renowned conglomerate. It has a strong foothold in many industries. These include textiles, cement, and paper. Over the years, the company has changed a lot. It has shown strong growth, innovation, and sustainability. This article explores the journey of Century Textiles and Industries Ltd Share Price Target. It looks at its history, business, markets, challenges, and future.

History and Evolution of the Company

Founded in 1897, Century Textiles and Industries Ltd has a rich legacy of over a century. The company began as a textile maker. It later diversified into making cement and paper. Its commitment to quality and innovation has driven its expansion into many sectors. This has positioned it as a leader in the Indian industrial landscape.

Key Business Divisions

Century Textiles operates through distinct business divisions:

-

The company produces many types of textiles. It serves both domestic and international markets.

-

Cement: Century's cement division is a big player in construction materials. It is known for its quality and reliability.

-

The paper division makes paper and paperboards. It serves many industries, such as packaging and printing.

Market Presence and Global Reach

It has a strong distribution network. And, it has strategic partnerships. This has let Century Textiles expand beyond India. The company exports its products to many countries. This adds a lot to its global footprint and revenue.

Financial Performance and Revenue Streams

Century Textiles has shown strong financial performance. It has done this by using its diverse portfolio to make steady revenue and profit. The company is financially tough. It has weathered market ups and downs. And now, it is financially sound.

Century Textiles Share Price Target For the Next 10 Years

Period

Lower Targets

Higher Targets

1 Year

₹2,267.73

₹2,427.57

2 Years

₹2,484.70

₹2,700.51

3 Years

₹2,692.78

₹3,040.00

4 Years

₹2,907.47

₹3,404.30

5 Years

₹3,119.32

₹3,722.15

6 Years

₹3,344.49

₹4,078.21

7 Years

₹3,560.76

₹4,420.21

8 Years

₹3,777.63

₹4,763.16

9 Years

₹3,993.91

₹5,105.16

10 Years

₹4,210.18

₹5,447.17

Sustainability Initiatives

Century Textiles is committed to sustainable practices. It puts environmental stewardship and social responsibility first. The company invests in eco-friendly tech. It also invests in resource efficiency and community programs. This is to minimize its ecological footprint.

Innovations and Technological Advancements

Century Textiles embraces innovation. It integrates advanced technologies into its manufacturing to boost efficiency and product quality. Continuous R&D initiatives help the company stay ahead. They cover industry trends and consumer preferences.

Competitive Landscape

It faces competition from domestic and international players. But, Century Textiles has a competitive edge. It does so through its better products, focus on customers, and operational excellence.

Challenges Faced by the Company

Like any business, Century Textiles faces challenges. These include market volatility, regulations, and supply chain disruptions. But, its proactive strategies and adaptive mindset help the company. They allow it to navigate these challenges well.

Strategic Partnerships and Alliances

Century Textiles builds strategic partnerships and alliances with industry stakeholders. It uses synergies to drive growth and innovation in its business areas.

Future Outlook and Growth Prospects

Looking ahead, Century Textiles is set for continued growth. It will capitalize on emerging markets and strategic investments. The company's diversified portfolio and strong fundamentals position it favorably for future expansion.

Impact of COVID-19

The COVID-19 pandemic posed unprecedented challenges for businesses worldwide, including Century Textiles. Despite disruptions, the company adapted swiftly. It had strict safety rules. It used digital tech to cut risks and keep the business running.

Community and Corporate Social Responsibility

Century Textiles actively engages in community development and CSR initiatives. It supports education, healthcare, and environmental conservation. Its commitment to social welfare underscores its role as a responsible corporate citizen.

Leadership and Management Team

Seasoned professionals lead the company. They have a wealth of industry experience. They drive strategic vision and operational excellence across the organization.

Century Textiles Share Price Target 2024

2024

Lower Targets

Higher Targets

January

x

x

February

x

x

March

x

x

April

x

x

May

₹2,072.71

₹2,200.46

June

₹2,099.87

₹2,240.23

July

₹2,148.24

₹2,290.66

August

₹2,157.92

₹2,298.18

September

₹2,202.10

₹2,323.70

October

₹2,192.10

₹2,323.04

November

₹2,201.16

₹2,346.00

December

₹2,218.87

₹2,363.80

Century Textiles Share Price Target 2025

2025

Lower Targets

Higher Targets

January

₹2,222.81

₹2,368.90

February

₹2,222.76

₹2,382.66

March

₹2,241.79

₹2,383.29

April

₹2,267.73

₹2,427.57

May

₹2,284.35

₹2,444.72

June

₹2,321.04

₹2,477.16

July

₹2,365.47

₹2,542.81

August

₹2,367.81

₹2,542.80

September

₹2,415.72

₹2,587.53

October

₹2,399.67

₹2,583.65

November

₹2,413.09

₹2,586.41

December

₹2,431.26

₹2,623.28

Century Textiles Share Price Target 2026

2026

Lower Targets

Higher Targets

January

₹2,439.58

₹2,630.13

February

₹2,435.93

₹2,627.29

March

₹2,453.30

₹2,651.54

April

₹2,484.70

₹2,700.51

May

₹2,497.76

₹2,737.66

June

₹2,532.77

₹2,771.35

July

₹2,572.80

₹2,818.27

August

₹2,587.94

₹2,848.04

September

₹2,629.00

₹2,905.32

October

₹2,611.74

₹2,892.55

November

₹2,630.23

₹2,905.29

December

₹2,648.28

₹2,931.10

Century Textiles Share Price Target 2027

2027

Lower Targets

Higher Targets

January

₹2,654.34

₹2,954.36

February

₹2,647.94

₹2,958.78

March

₹2,666.51

₹3,015.55

April

₹2,692.78

₹3,040.00

May

₹2,715.59

₹3,043.82

June

₹2,746.17

₹3,101.38

July

₹2,784.59

₹3,153.41

August

₹2,800.62

₹3,203.09

September

₹2,845.89

₹3,231.18

October

₹2,824.81

₹3,229.61

November

₹2,844.40

₹3,271.40

December

₹2,855.40

₹3,321.02

Century Textiles Share Price Target 2028

2028

Lower Targets

Higher Targets

January

₹2,867.55

₹3,294.27

February

₹2,867.14

₹3,349.34

March

₹2,879.45

₹3,370.57

April

₹2,907.47

₹3,404.30

May

₹2,928.78

₹3,446.01

June

₹2,958.48

₹3,502.12

July

₹3,002.32

₹3,571.43

August

₹3,018.40

₹3,571.24

September

₹3,053.88

₹3,621.20

October

₹3,041.89

₹3,655.45

November

₹3,059.66

₹3,672.18

December

₹3,065.29

₹3,698.89

Century Textiles Share Price Target 2031

2031

Lower Targets

Higher Targets

March

₹3,560.76

₹4,420.21

June

₹3,614.68

₹4,505.48

September

₹3,669.20

₹4,591.68

December

₹3,723.71

₹4,677.89

Century Textiles Share Price Target 2035

2035

Lower Targets

Higher Targets

March

₹4,426.46

₹5,789.17

June

₹4,480.38

₹5,874.44

September

₹4,534.89

₹5,960.64

December

₹4,589.41

₹6,046.85

Conclusion

Century Textiles and Industries Ltd shows resilience. It also shows innovation and sustainability. This is in a dynamic business landscape. The company has a diversified portfolio. It is committed to excellence. It continues to chart a path to sustained growth and industry leadership.

FAQs

Read the full article

0 notes

Text

GRAINS-Corn rises for 5th session on US planting delay; wheat, soybeans retreat JAKARTA, May 7 (Reuters) - Chicago corn climbed for a fifth straight session on Tuesday amid reports of a delay in the U.S. planting season, while soybeans and wheat retreated from multi-months highs. Corn prices rose on the back of unexpected supply shortage, as volatile weather hit top producers U.S. and Brazil, while Argentina struggled with insect infestation in corn producing areas, a trader said. The most-active corn contract on the Chicago Board of Trade (CBOT) Cv1 gained 0.11% to $4.69-1/2 a bushel by 0248 GMT, hitting the highest since Dec. 29. Wheat Wv1 was down 0.15% to $6.47-3/4 a bushel after hitting a nine-month high earlier in the day, while soybeans Sv1 lost 0.18% to $12.46-1/2 a bushel. "Brazil is facing severe weather issues, and Argentina is having large scale insect infestation in corn production areas. This is further exacerbated by the rise in storms in US, which has delayed crop planting for both corn and soy," said a Vietnam-based trader. Nearly two weeks of wet weather in the western U.S. Corn Belt have put most of the Crop Watch producers' planting efforts behind schedule after what was an efficient start to the season, and more rain this week could prolong the delays. Wheat expected to move sideways the trader said, as market participants waiting on Russia crop projections amid report of dry weather, while the U.S. winter wheat crop progress in good-to-excellent condition and the highest for this time of year since 2020. Russia's April exports of wheat, barley and maize (corn) are estimated at 5.7 million metric tons, down from 6.1 million tons in March, the Sovecon agricultural consultancy said. Analysts estimate U.S. corn and soybean production for 2024-25 to be lower than the USDA's previous outlook, a Reuters survey showed, while wheat output is expected to be higher than 2023/24 production. The USDA is scheduled to release its May crop supply/demand report on May 10. Analysts estimate corn and soybeans production in Argentina and Brazil for 2023/24 to be lower than the USDA's estimate in April. Brazil weather will play significant role in soybean prices the trader said, as main producing areas were hit by flood and showers are expected to return at lower volumes this week and could pick up again between May 10 and 15, according to local weather forecaster MetSul Meteorologia. "While demand is stable, the unexpected supply shortage is expected to push crop prices higher in the short run," the trader said. Analysts expect world grain end-stocks for 2023/24 to be lower than the previous USDA estimate in April, while U.S. grain end-stocks are estimated to rise from 2023-24. The USDA is scheduled to release its report on May 12. Ukraine's grain exports in the 2023/24 marketing season had reached almost 42 million metric tons as of May 6 compared with 42.6 million sent abroad as of May 8, 2023, agriculture ministry data showed on Monday. Egypt has procured 1.8 million metric tons of wheat in local harvest so far this season that started on April 13, the supply ministry said on Monday.

0 notes

Text

Index Fund vs Real Estate

When determining how to invest your money, index funds and real estate are two popular choices. Both provide opportunities to increase your wealth over time. Is one better than the other? We will use a real-world example to compare index funds and real estate investing.

Index funds and real estate are asset types with distinct advantages and dangers. This essay will look at both the advantages and disadvantages of each. With careful preparation, index funds and real estate can complement each other in an investing portfolio. The right allocation between these two pillars of investment will be determined by taking into account your unique financial goals and risk tolerance. By the conclusion, you'll have a better understanding of which investment strategy would be best for your needs. Let's delve in and compare index funds against real estate objectively.

Setting the Investment Stage

Index funds and real estate are two common investing portfolio possibilities. Both have potential advantages, but they also differ significantly. Let's compare and contrast index funds and real estate investing to see which is a better fit for your financial objectives. The first and most significant aspect is your area of expertise and what draws you in. You'll perform best with the one you're most passionate about. People who enjoy the stock market but do not want to deal with property management may be better off investing in index funds. Those passionate and excited about real estate and the possibilities for leveraging debt and expanding in price over time in economic booms may be drawn to owning properties.

What is an Index Fund?

Definition & Basics

An index fund is a mutual fund or exchange-traded fund (ETF) that tracks a market index, such as the S&P 500. Index funds provide broad market exposure with passive management, which means the fund manager makes minimal stock-picking decisions. Index funds often feature modest costs and seek to equal, not outperform the market.

Pros and Cons of Investing in Index Funds:

The benefits of index funds include cheap expenses, market diversification, and passive management, which results in more predictable returns. Cons include a lack of control over specific assets and the inability to outperform the market.

What Is Real Estate Investment?

Types of Real Estate Investment

Real estate investing involves a variety of tactics, including house flipping, rental properties, REITs, and real estate crowdfunding. Investors can pick between residential and business properties.

Benefits and Drawbacks of Real Estate

The benefits of real estate include cash flow from rentals, long-term appreciation, leverage through mortgages, and a tangible asset. Cons include illiquidity, active management, property taxes and upkeep costs, and a lack of diversification.

Historical Returns: Index Funds against Real Estate

In the long run, index funds and real estate returns are comparable, averaging 8-12% per year. However, real estate tends to be more cyclical, with larger boom and bust cycles. Index funds provide more steady and less volatile returns year after year.

Liquidity and Accessibility: How Easy Is It to Access Your Money?

Index funds provide daily liquidity, allowing you to sell your shares promptly on any business day. Real estate is extremely illiquid, taking weeks or months to sell a home. This restricts access to your capital.

Diversification: Spreading Risk over the Market Index funds offer quick diversification over hundreds or thousands of stocks. Unless you own many properties in different markets, your real estate investments are significantly more concentrated in a single asset class and geographic area.

Tax Implications: How Both Investments Influence Your Tax Bill

Index funds earn taxable capital gains dividends, though most are postponed until you sell. Real estate can provide deductions, such as depreciation, to offset rental income. A 1031 exchange allows you to possibly delay taxes on gains.

Barriers to entry include initial costs and the learning curve.

Index funds do not require a minimum investment to begin. Real estate typically requires a 20% down payment, plus closing costs and charges. Real estate has a steeper learning curve regarding finance, management, and laws.

Management and Maintenance: Time And Effort Investment

Real estate requires active management, such as securing tenants, maintenance, and repairs, whereas index funds are passive investments. However, you can delegate many real estate chores to a property manager.

Long-Term Growth and Income Prospects

Index funds provide easy growth in the stock market. Real estate can also appreciate while providing rental revenue. Finally, both promote long-term wealth accumulation. The key is your investing time frame and goals.

Key Takeaways

Index funds offer passive, diversified exposure to stock markets at low cost and liquidity. Real estate requires diligent management, but it provides leverage, tax benefits, and income possibilities.

Over time, real estate and index funds produce comparable returns, averaging 8-12% each year. However, real estate is more volatile, with boom and bust cycles.

Index funds are significantly more accessible than real estate. Index funds have modest minimum investments, whereas real estate requires down payments and financing.

Real estate provides more active control and flexibility for managing your investments. Index funds are completely hands-off.

Leverage can improve gains in real estate, but it also increases danger. Index funds don't offer leveraged alternatives.

Market timing and cycles affect both investments. Index funds experience shorter downturns, but real estate is more cyclical.

0 notes

Text

What are Options?

Options are financial derivatives that provide the holder with the right, but not the obligation, to buy or sell an underlying asset (such as stocks, commodities, currencies, or indices) at a predetermined price, known as the strike price, within a specified period. The buyer of an option pays a premium to the seller for this right.

There are two types of options:

1. Call Option: A call option gives the holder the right to buy the underlying asset at the strike price within the specified period. Call options are typically used when investors anticipate the price of the underlying asset to rise.

2. Put Option: A put option gives the holder the right to sell the underlying asset at the strike price within the specified period. Put options are generally used when the holder expects the price of the underlying asset to fall.

Features of Options Trading

1. Flexibility: Options provide traders with a high degree of flexibility in structuring trades and managing risk. Traders can choose from a variety of options strategies, including buying calls or puts, selling covered calls or puts, constructing spreads, straddles, and strangles, among others. This flexibility allows traders to tailor their positions to specific market conditions, outlooks, and risk tolerance.

2. Leaverage: Options offer leverage, allowing traders to control a larger position with a smaller amount of capital compared to trading the underlying asset directly. This leverage amplifies potential returns but also increases the risk of losses. Options provide traders with the opportunity to achieve significant profits relative to the amount invested, but it's important to manage leverage carefully to avoid excessive risk-taking.

3. Defined Risk: Unlike futures or Forex trading, where losses can exceed the initial investment, options trading offers defined risk. The maximum potential loss for an options trade is limited to the premium paid or received, depending on whether the trader is buying or selling options. This defined risk makes options trading appealing for risk-averse traders who want to know their maximum potential loss upfront.

4. Hedging: Options can be used as effective hedging tools to protect against adverse price movements in the underlying asset. By buying or selling options contracts, traders can hedge existing positions in stocks, commodities, or other assets, reducing the impact of market volatility and downside risk. Options provide traders with the flexibility to tailor hedging strategies to their specific risk exposure and investment objectives.

5. Profit Potential in Any Market Condition: Options offer opportunities for profit in various market conditions, including bullish, bearish, or sideways markets. Depending on their outlook, traders can implement different options strategies to capitalize on anticipated price movements or volatility changes. For example, buying call options allows traders to profit from upward price movements, while buying put options enables them to profit from downward price movements.

6. Liquidity: Options markets are generally highly liquid, with active trading in a wide range of options contracts on various underlying assets. High liquidity ensures tight bid-ask spreads and efficient order execution, allowing traders to enter and exit positions with minimal slippage. Liquidity is particularly important for options traders, as it ensures that they can easily enter and exit positions at fair market prices.

7. Diverse Range of Underlying Assets: Options are available on a diverse range of underlying assets, including stocks, stock indices, commodities, currencies, and interest rates. This wide selection of underlying assets provides options traders with ample opportunities to diversify their portfolios and trade different markets according to their preferences and expertise.

8. Limited Capital Requirement: Options trading typically requires lower capital compared to trading the underlying asset directly. Instead of purchasing or short-selling the underlying asset, options traders only need to pay the premium to initiate a position. This lower capital requirement enables traders with limited funds to access the options market and participate in trading opportunities that would otherwise be inaccessible.

9. Versatile Strategies Options trading offers a wide range of trading strategies that cater to different market outlooks, risk profiles, and trading objectives. Traders can deploy directional strategies, such as buying calls or puts, to speculate on price movements, or implement non-directional strategies, such as iron condors or butterflies, to profit from range-bound markets or low volatility environments. The versatility of options strategies allows traders to adapt to changing market conditions and deploy strategies that align with their trading goals.

Advantages of Options Trading

1. Limited Risk: One of the key advantages of option trading is the ability to define and limit risk. Unlike trading stocks or futures, where losses can be unlimited if the market moves against you, options allow traders to know their maximum potential loss upfront. The premium paid to purchase an option contract is the most you can lose, providing a level of downside protection.

2. High Potential Returns: While the risk is limited, options also offer the potential for significant returns. Options provide leverage, allowing traders to control a larger position with a smaller amount of capital compared to trading the underlying asset directly. As a result, successful options trades can generate substantial profits relative to the initial investment.

3. Versatility: Options provide traders with a wide range of strategies to profit from various market conditions. Whether the market is trending up, down, or sideways, there are options strategies available to capitalize on different scenarios. Options can be used for speculation, hedging, income generation, or risk management, making them versatile instruments for portfolio management.

4. Flexibility: Options offer flexibility in terms of investment horizon and risk tolerance. Unlike stocks, which require a significant upfront investment and may tie up capital for extended periods, options contracts have expiration dates, allowing traders to choose short-term or long-term positions based on their investment objectives. Additionally, options can be traded on a variety of underlying assets, including stocks, indices, commodities, and currencies, providing ample opportunities for diversification.

5. Opportunities in Volatile Markets: Options thrive in volatile markets, where price fluctuations create trading opportunities. Volatility is a key determinant of options prices, and higher volatility generally leads to higher option premiums. Traders can benefit from increased volatility by employing strategies such as straddles, strangles, or iron condors to profit from anticipated price movements or capitalize on volatility expansion.

6. Risk Management: Options can be used as effective risk management tools to protect against adverse price movements in the underlying asset. Strategies like buying protective puts or selling covered calls can help hedge against downside risk or generate income to offset losses. Options also allow traders to implement stop-loss orders or adjust positions dynamically to manage risk effectively.

7. Liquidity: Options markets are highly liquid, with active trading in a wide range of contracts across different strike prices and expiration dates. High liquidity ensures tight bid-ask spreads and efficient order execution, enabling traders to enter and exit positions with minimal slippage and transaction costs.

8. Income Generation: Options trading can provide a steady stream of income through strategies like selling covered calls or cash-secured puts. These strategies allow traders to collect premiums upfront in exchange for assuming certain obligations, such as selling the underlying asset at a predetermined price. Income-generating strategies can supplement investment returns and enhance portfolio yields.

Disadvantages of Options Trading

1. Limited Time Horizon: Options contracts have expiration dates, limiting the time available for the underlying asset to move in a favorable direction. Unlike stocks, which can be held indefinitely, options positions must be managed within a specified timeframe. Failure to exit or adjust positions before expiration can result in the loss of the entire premium paid for the option.

2. Time Decay: Options contracts lose value over time due to a phenomenon known as time decay or theta decay. As expiration approaches, the value of an option diminishes, especially for out-of-the-money options, regardless of the direction of the underlying asset's price movement. Time decay accelerates as expiration nears, eroding the option's value and reducing profitability, particularly for buyers of options.

3. Complexity: Options trading involves complex strategies and concepts that can be challenging for novice traders to grasp. Understanding options terminology, pricing models, and various trading strategies requires a significant amount of education and experience. Novice traders may struggle to navigate the complexities of options trading, leading to costly mistakes and losses.

4. Leverage and Magnified Losses: While options provide leverage, amplifying potential returns, they also magnify losses. Options traders can control a large position with a relatively small amount of capital, but this leverage can work against them if the trade moves unfavorably. A small adverse price movement in the underlying asset can result in significant losses for option buyers, especially when trading highly leveraged strategies.

5. Unlimited Risk for Sellers: Option sellers, also known as writers, face unlimited downside risk. While option buyers' losses are limited to the premium paid, sellers' losses can be substantial if the market moves significantly against their positions. Selling naked options, without proper risk management or hedging strategies, exposes sellers to potentially catastrophic losses beyond their initial investment.

6. Market Volatility: Options are sensitive to changes in market volatility, which can affect their prices and behavior. Increased volatility can inflate option premiums, making options more expensive to buy. Conversely, declining volatility can reduce option premiums, impacting profitability for option buyers and sellers. Managing volatility risk is essential for options traders, as unexpected volatility spikes can lead to unpredictable outcomes.

7. Execution Risks: Options trading involves execution risks, including slippage and liquidity issues. Illiquid options contracts may have wider bid-ask spreads and limited trading volume, making it difficult to enter and exit positions at desired prices. Slippage, the difference between expected and actual execution prices, can erode profits and increase trading costs, particularly during fast-moving markets or low-volume periods.

8. Commissions and Fees: Options trading often incurs commissions and fees, including brokerage commissions, exchange fees, and regulatory fees. These costs can eat into profits, especially for frequent traders or those trading large volumes. It's essential to consider transaction costs when evaluating the profitability of options trades and incorporate them into overall trading strategies.

9. Emotional Challenges: Options trading can be emotionally taxing, especially during periods of market uncertainty or volatility. Fear, greed, and overconfidence can cloud judgment and lead to impulsive decision-making. Managing emotions and adhering to disciplined trading plans are critical for success in options trading, but it requires discipline, patience, and psychological resilience.

Precautions for Options Trading

1. Education: Gain a comprehensive understanding of options trading before venturing into the market. Familiarize yourself with basic concepts, strategies, and risk management techniques.

2. Risk Management: Implement robust risk management strategies, such as setting stop-loss orders and position sizing, to protect your capital and minimize potential losses.

3. Practice: Before trading options with real money, consider practicing on a virtual trading platform like SmartBulls. Virtual trading allows you to test strategies and hone your skills without risking actual capital.

4. Diversification: Avoid overexposure to a single asset or strategy. Diversifying your options portfolio can help mitigate risks and enhance overall returns.

In conclusion, options trading offers a plethora of opportunities for investors to profit from market movements and hedge against risks. However, it requires careful planning, diligent research, and prudent risk management to succeed in this complex and dynamic market. By understanding the nuances of options trading and taking appropriate precautions, investors can navigate the market with confidence and potentially achieve their financial goals. Practice on virtual trading app SmartBulls can help traders hone their skills and gain confidence before entering the market with real money.

#investing#stock market#stock trading#equity trading#financial literacy#finance#learn stock market trading#paper trading#virtual trading#derivatives trading#futures and options#options trading#options

0 notes

Text

Stock Market Update Today: Top Gainers in the Power Sector

The BSE Sensex fell by 188.5 points, ending at 74,482.78. Power stocks ended with losses on Tuesday, but some power companies still saw their stock prices rise.

Today, various power companies have seen significant increases:

1. Hitachi Energy India Ltd. rose by 10.54%

2. Jaiprakash Power Ventures Ltd. rose by 5.00%

3. Jyoti Structures Ltd. rose by 4.94%

4. Kalpataru Projects International Ltd. rose by 4.72%

5. JSW Energy Ltd. rose by 4.36%

6. NHPC Ltd. rose by 3.00%

7. Power Grid Corporation of India Ltd. rose by 2.78%

8. Adani Power Ltd. rose by 2.75%

9. KEC International Ltd. rose by 2.37%

10. Power and Instrumentation (Gujarat) Ltd. rose by 1.99%

The market was volatile throughout the day, with ups and downs in different sectors, including the power sector.

The performance of power stocks affected the overall market, which ended negatively because of the BSE Sensex decline.

For Trading Insights: thebusinesscorridor

0 notes

Text

Stock Market Mastery: 10 Easy Steps to Investing for Beginners

For more information, click the link - https://shurtitalks.com/stock-market-mastery-10-easy-steps/

Beginners may find stock market investing intimidating, but anyone can succeed in the market with the correct advice. We'll coach you through ten simple steps in this thorough book to help you grasp the stock market and create a strong investment portfolio. This guide will teach you the information and confidence to successfully navigate the world of investing, regardless of your level of experience.

Step 1: Recognize the Fundamentals of stock market

The basics of the stock market, including how it operates, the many investment options available, and important jargon you should be familiar with, will be covered first. Learn about the principles of the stock market, such as how stocks are purchased and sold, the function of exchanges, and the lingo used in investing.

Step 2: Make Specific Goals

Establish your financial objectives, whether they are home ownership, retirement savings, or supporting your child's school. Making well-informed investing decisions is facilitated by having well-defined goals. Establish definite, attainable targets for your investments and clearly define your financial ambitions. Having clear objectives will help you determine your investment approach, whether it is to increase wealth, save for retirement, or finance a significant purchase.

Step 3: Evaluate Your Capability for Risk

To ascertain the level of volatility you are comfortable with in your investment portfolio, assess your risk tolerance. This will direct your investing plan and asset allocation. Take into account variables like your age, financial status, and investing horizon when determining how much risk you can tolerate. Knowing how much risk you can tolerate will enable you to build a well-balanced portfolio that fits your comfort zone.

Step 4: Assemble a Diverse Portfolio

Understand the value of diversity and how to allocate your investments across a range of industries, geographical areas, and asset classes in order to minimize risk and optimize returns. To minimize risk and maximize profits, understand the value of diversity and distribute your investments throughout several businesses, asset classes, and geographical areas.

Step 5: Select the Appropriate Investment Instruments

Examine and compare different investment options such as equities, bonds, mutual funds, exchange-traded funds (ETFs), and index funds to see which ones fit your investing objectives and risk tolerance. Examine a variety of investing options, such as mutual funds, exchange-traded funds (ETFs), individual stocks, and bonds, and choose investments based on your risk tolerance and investing goals.

Step 6: Carry Out Research

Discover how to investigate possible investments in-depth, including examining financial accounts, reviewing market trends, and researching company fundamentals. Learn how to conduct effective research and assess investment opportunities via the application of basic and technical analysis methods. Thoroughly investigating possible investments might assist you in making well-informed choices.

Step 7: Create an Investment Strategy

Make a customized investing plan based on your time horizon, goals, and risk tolerance. This could entail growth investment, value investing, dollar-cost averaging, or a mix of these approaches. Make a tailored investment plan according to your objectives, time horizon, and risk tolerance. Your investment decisions will be guided by having a defined strategy, regardless of whether you chose an active or passive approach.

Step 8: Keep an Eye on Your Assets

Make sure your investing portfolio is still in line with your objectives and risk tolerance by reviewing and monitoring it on a regular basis. As necessary, make adjustments to maximize performance and reduce risk. Examine and track your investment portfolio on a regular basis to determine performance, evaluate risk, and make any required modifications. Remain self-controllable and refrain from acting rashly in response to transient market swings.

Step 9: Continue Learning

Keep up with news, economic indicators, and market developments that could affect your assets. Keep learning new things and keeping up with changes in the financial scene. Examine and track your investment portfolio on a regular basis to determine performance, evaluate risk, and make any required modifications. Remain self-controllable and refrain from acting rashly in response to transient market swings.

Step 10: Get Expert Counsel

If you need assistance building a thorough financial plan or are concerned about your investment decisions, you might think about seeing a financial planner or investment specialist. If you need specific counsel or assistance with complex investing plans, think about consulting a financial advisor or investment specialist. A qualified advisor can guide you through difficult market conditions and offer tailored solutions.

conclusion

In conclusion, you'll be well on your way to becoming an expert in the stock market and reaching your financial objectives if you adhere to these ten simple steps. Recall that investing is a journey that requires patience, dedication, and time to succeed. Anyone may become a wise investor and accumulate wealth for the future with the appropriate information and strategy.

You'll be ready to start your road to stock market expertise if you follow these ten simple steps. Recall that investing is a lifetime learning process, and that perseverance, self-control, and further education are necessary for success. By making wise stock market investments, you can reach your financial objectives and create a stable future for your family and yourself with commitment and the appropriate strategy.

0 notes

Text

So when interest rates go up, the tax shield increases for corporations. The value of the increase depends on the corporations tax rate. The higher the tax bracket, the more valuable the tax shield for the corporation. But this reduces the cost of interest rate increases.

Now the second thing they can do is one of these twelve ways to hedge interest rates. They can use a combination of these hedges as well......

According to Vinovest, short-duration stocks are a good way to hedge against rising interest rates. Other ways to hedge interest rates include:

Treasury Inflation-Protected Securities (TIPS): US Treasury bonds that increase in value when interest rates rise

Exchange-Traded Funds (ETFs): Can help offset the effects of lower or higher interest rates

Interest rate swaps: An agreement between two parties to exchange interest payments

Interest rate futures: Contracts that allow buyers and sellers to lock in rates on an interest-bearing asset

Real estate: Real estate prices tend to rise with interest rates

Short-term and floating-rate bonds: Can reduce portfolio volatility

Inflation-proof investments: Can help hedge against rising rates

Credit-based yields: Can help hedge against rising rates

Commodities: Can help hedge against rising rates

REITs: Real estate investment trusts that own and manage real estate, and are known for paying out substantial dividends

Investopedia

How to Invest for Rising Interest Rates

investopedia.com

What Is an Interest Rate Future? Definition and How to Calculate

Interest rate futures are contracts that allow buyers and sellers to lock in rates on an interest-bearing asset like a government bond or interbank lending rate.

Vinovest

12 Effective Ways to Hedge Against Interest Rates in 2024 ...

Visit the Vinovest website to know more! ... Invest in Short Duration Stocks. Investing in short-duration stocks is a brilliant way to hedge against rising rates. ... Buy Hedged Bond Funds. Some assets from the fixed income market also make it easy for you to hedge against rising rates. ... Buy TIPS. Treasury Inflation-Protected Securities (TIPS) are US Treasury bonds that rise in value during an interest rate hike. ... Buy ETFs. Exchange-Traded Funds (ETFs) can also help investors offset the effects of a lower or higher interest rate. ... Use an Interest Rate Cap. ... Use Forward Rate Agreements. ... Buy or Sell Interest Rate Futures. ... Use an Interest Rate Swap.

bankrate.com

8 Ways To Beat Low Savings Account Interest Rates

Apr 5, 2024 — Real estate investment trusts, or REITs, are a kind of company that owns and manages real estate, and they are well-known for paying out substantial dividends. Many REIT stocks trade on a stock exchange like a publicly traded company. The risk: Potential loss of principal. Like any stock, a REIT ...

linkedin.com

Hedging Your Interest Cost at the Time of Borrowing

Sep 4, 2023 — Interest Rate Swaps: Interest rate swaps involve an agreement between two parties to exchange interest payments. This can be especially beneficial for businesses with unique financing needs. For instance, a company with a variable-rate loan can enter into a swap arrangement to ...

Other hedging strategies include options and forward rate agreements (FRAs).

This is for informational purposes only. For financial advice, consult a professional.

How Do I Hedge Against Interest Rates? (12 Best Options to Explore)

Invest in Collectibles Such as Fine Wine. ...

Invest in Short Duration Stocks. ...

Buy Hedged Bond Funds. ...

Buy TIPS. ...

Buy ETFs. ...

Explore Embedded Options. ...

Use an Interest Rate Cap. ...

Use Interest Rate Floors.

More items...

https://www.vinovest.co › blog › h...

12 Effective Ways to Hedge Against Interest Rates in 2024 ...

Now learning how to blend different forms of hedges.

Investopedia

https://www.investopedia.com › ask

How Do Traders Combine a Short Put With Other Positions to Hedge?

A trader can use put options in a number of different ways, depending on the positions he is hedging and the options strategies he is using to

I'm watching Bloomberg as I put this together.

1 note

·

View note

Text

When Should You Diamond Hand a Stock?

🙌💎 When Should You Diamond Hand a Stock? 💎🙌

https://www.youtube.com/watch?v=ZO62i0cq0PQ

I see way too many traders focusing only on high volume, volatility plays,

squeeze set ups, etc. I believe in diversifying, balance.

Day trading, scalping is amazing, but you need plays that are STRESS FREE that will grow over months, years. When it comes to options, intraday trading small money is best.

✅ Time Stamps

0:00 Multi Billion Potential? $GANX Stock

3:18 All Time High Breakout $COYA Stock

5:14 Monster 400% Runner, Round 2? $PRTT Stock

8:16 Long Term Value Stock, FDA Approval? $POSC Stock

10:27 Bitcoin Mining Sector: Fire Sale Opportunity? $WULF Stock

12:28 Great Company to Hold, Stress Free $PODC Stock

13:36 Exposure to Space X, Open Ai???? $DXYZ Stock

✅ Subscribe To My Channel For More Videos: https://www.youtube.com/@AvidTrader/?sub_confirmation=1

✅ Stay Connected With Me:

👉 (X)Twitter: https://twitter.com/RealAvidTrader

👉 Stocktwits: https://ift.tt/kOeMxKy

👉 Instagram: https://ift.tt/6tTfdPY

==============================

✅ Other Videos You Might Be Interested In Watching:

👉 The ULTIMATE Guide to Finding Hidden Gem Stocks | AvidTrader

https://youtu.be/pZAKJLk9o0I

👉 How My Subscribers Doubled Their Money Today!!!

https://youtu.be/s5M_OGv8AtM

👉 7 Great Value Stocks to Buy BEFORE They Explode!

https://youtu.be/0I451lsCjAc

👉 💥Super Cheap Penny Stock Can Run 3-5X FAST💥

https://youtu.be/4B3EK7lb38k

=============================

✅ About AvidTrader:

Value Investor. Discussing Day & Swing Trades Also Long Term Investments! Stock Breakdowns. Grow Your Trading Account Effectively. Technical Analysis and Pattern Recognition. How to Make Money, But More Importantly Learning & Having Fun in The Process!

Avid Trader is not a Series 7 licensed investment professional, but a digital marketing manager/content creator to publicly traded and privately held companies. Avid Trader receives compensation from its clients in the form of cash and restricted securities for consulting services.

🔔 Subscribe to my channel for more videos: https://www.youtube.com/@AvidTrader/?sub_confirmation=1

=====================

#longterminvestment #technicalanalysis #stockpicks #stockstobuy #chartanalysis #stockbreakout #biotechstocks #pennystocks

Disclaimer: We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk. I am not a certified financial advisor and you must do your own research and due diligence before ever buying or selling a stock. never trade solely based on someone else's word or expectations of a stock!

Copyright Disclaimer: Under Section 107 of the Copyright Act 1976, allowance is made for "fair use" for purposes such as criticism, comment, news reporting, teaching, scholarship and research. Fair use is a use permitted by copyright statute that might otherwise be infringing. Non-profit, educational or personal use tips the balance in favor of fair use

© AvidTrader

via AvidTrader https://www.youtube.com/channel/UCK_XU3FW-ffEK8BG5EisnNA

April 18, 2024 at 07:47AM

#stockanalysis#investmenttips#investmentstrategy#tradingstrategies#tradingtips#fundamentalanalysis#stockmarket#technicalanalysis

0 notes

Text

Stocks to buy: SBI Card, CDSL, Jindal Saw among 8 stocks that can rise 5-31% in next 3-4 weeks, say analysts

Stocks to buy: Indian stock market benchmarks the Nifty 50 and the Sensex cracked over 1 per cent each in intraday trade on Monday, April 15, as concerns over escalating Israel-Iran tensions spooked investors. According to Anand James, Chief Market Strategist at Geojit Financial Services, Nifty's weakness may be arrested before 22,360 is breached, followed by an upswing attempt, which however, may not see past 22,600. "This scenario sees declines dominating, aiming at 22,110, but with hopes alive for a return to uptrend. However, the inability to close above 22,200 after volatility or a direct fall below 21,800 could confirm a break of the bullish structure that had 23,200 on the horizon, and line up 20,300 instead, as the first objective for the bear move," said James.

0 notes

Text

Step-by-Step Guide: How to Invest in India and Maximize Returns

Investment is the process of allocating resources, usually money, with the expectation of generating future income or profit. It involves deploying funds into various assets or financial instruments with the goal of increasing wealth or achieving specific financial objectives over time.

Key Aspects of Investment:

1. Objective: Investors typically have specific objectives when investing, such as wealth accumulation, capital preservation, income generation, or achieving long-term financial goals like retirement planning or funding education.

2. Risk and Return: Investments inherently involve risk. Generally, the higher the potential return, the greater the risk. Balancing risk and return is crucial, and different investment options offer varying levels of risk-reward trade-offs.

3. Asset Classes: Investments can be made across different asset classes, including stocks, bonds, real estate, commodities, mutual funds, exchange-traded funds (ETFs), and more. Diversifying across asset classes helps spread risk and optimize returns.

4. Time Horizon: Investment goals often have specific timeframes. Short-term goals may involve lower-risk assets, while long-term goals might allow for a more aggressive investment strategy, considering the potential for higher returns over an extended period.

5. Market Dynamics: Investment decisions are influenced by market conditions, economic factors, geopolitical events, and other external forces. Staying informed about market trends and economic indicators is crucial for making informed investment choices.

6. Risk Tolerance: Understanding one's risk tolerance is essential. Some investors can withstand higher volatility, while others prefer more stable, conservative investments. Assessing personal risk tolerance helps in selecting suitable investment options.

7. Diversification: Spreading investments across different assets or sectors reduces the overall risk of a portfolio. A diversified portfolio minimizes the impact of negative events affecting a single asset or sector.

8. Monitoring and Review: Regularly reviewing investments and adjusting the portfolio based on changing goals, market conditions, and life circumstances is vital. Rebalancing the portfolio ensures it aligns with the investor's objectives.

Investment involves a thoughtful allocation of funds with the aim of achieving financial objectives. It's a strategic process that considers risk, return, diversification, and market dynamics to maximize the potential for growth or income generation while aligning with the investor's goals and risk tolerance. Making informed decisions and staying disciplined in the investment approach are key to successful wealth accumulation and achieving financial milestones.

Investing in India's dynamic and rapidly evolving market offers a myriad of opportunities for both seasoned investors and those seeking to venture into the realm of international investments. As one of the world's fastest-growing major economies, India beckons with its diverse sectors, burgeoning consumer base, and a landscape ripe for innovation and growth.

Investing in India involves several avenues and methods. Here's a step-by-step guide on how to invest in India:

1. Research and Understanding:

- Market Analysis: Begin by researching India's economic trends, market performance, and sectors showing growth potential. Understand the country's regulatory environment, policies governing foreign investments, and macroeconomic indicators.

- Investment Goals: Define your investment objectives, risk tolerance, and preferred investment horizon. Determine whether you seek long-term growth, income generation, or capital appreciation.

2. Choose the Investment Vehicle:

- Equities: Invest directly in Indian stocks through brokerage firms or online trading platforms. Research companies, study their financials, and track market trends before investing.

- Mutual Funds and ETFs: Consider mutual funds or exchange-traded funds (ETFs) that provide diversification across various Indian stocks or sectors, managed by professional fund managers.

- Real Estate: Explore opportunities in Indian real estate, either directly or through real estate investment trusts (REITs) that offer exposure to commercial real estate properties.

3. Open an Investment Account:

- Brokerage Account: To invest directly in Indian stocks, open a brokerage account with a registered broker in India or an international broker offering access to Indian markets.

- **Mutual Fund Account:** For mutual fund investments, set up an account with a registered mutual fund house in India or through platforms offering access to Indian mutual funds.

4. Comply with Regulatory Requirements:

- Know Your Customer (KYC): Complete the KYC process mandated by regulatory authorities in India. This may include providing identity proof, address proof, and other necessary documents.

- Foreign Investment Regulations: Understand and comply with regulations related to foreign investments in India, including sectoral caps, reporting requirements, and tax implications for foreign investors.

5. Execute Investment Strategy:

- Stock Market Investments: Once your investment account is set up, start buying stocks based on your research and investment strategy. Monitor the market regularly and adjust your portfolio as needed.

- Mutual Fund Investments: Choose mutual funds aligned with your investment goals and risk profile. Invest based on fund performance, expense ratios, and fund managers' expertise.

6. Risk Management and Diversification:

- Diversify Portfolio: Spread your investments across different asset classes, sectors, and industries to reduce risk exposure.

- Regular Monitoring: Continuously track your investments, review portfolio performance, and stay informed about market changes and economic developments.

7. Tax Implications and Compliance:

- Understand Taxation: Familiarize yourself with India's tax laws and how they apply to your investments. Tax rates may vary based on the type of investment and duration.

- Compliance and Reporting: Ensure compliance with tax regulations and reporting requirements applicable to foreign investors investing in India.

8. Seek Professional Guidance:

- Financial Advisors: Consider consulting financial advisors, legal experts, or investment professionals who specialize in Indian markets to gain insights and guidance for your investment decisions.

Investing in India offers diverse opportunities, but it's essential to conduct thorough research, understand the regulatory landscape, and tailor your investments to align with your financial goals and risk tolerance. Additionally, staying updated on market trends and seeking expert advice can help optimize investment outcomes.

Understanding the Indian Investment Landscape

India's investment ecosystem is a mosaic of opportunities spanning various sectors, from technology and manufacturing to healthcare, infrastructure, and renewable energy. A comprehensive understanding of the market trends, regulatory environment, and economic indicators serves as the foundation for successful investment endeavors.

Assessing Investment Avenues

The Indian market offers diverse investment avenues, catering to different risk appetites and investment horizons. Equities, government securities, mutual funds, real estate, and venture capital are among the myriad options available to investors. Each avenue presents unique opportunities, risks, and potential returns, demanding a thorough assessment aligned with individual investment goals.

1. Equities and Stock Market: Investing in Indian equities offers opportunities in both large-cap and mid-cap companies across various sectors. Conducting thorough research, understanding company fundamentals, and monitoring market trends are key to making informed investment decisions in the stock market.

2. Government Securities and Bonds: India's government securities and bonds provide relatively stable investment options. These can offer fixed returns, making them suitable for investors seeking more conservative avenues.

3. Real Estate: The Indian real estate market has seen fluctuations but remains a significant investment avenue. Residential and commercial properties, along with the potential for rental income and capital appreciation, attract investors.

4. Mutual Funds and ETFs: Mutual funds and exchange-traded funds (ETFs) allow diversification across a range of assets, offering exposure to various sectors and reducing individual stock risk.

Research and Due Diligence

In-depth research and due diligence form the bedrock of successful investment decisions. Analyzing market trends, studying sector-specific growth trajectories, assessing financial performance, and understanding regulatory frameworks are pivotal steps in identifying lucrative investment opportunities.

Identifying High-Potential Sectors

1. Technology: India's thriving tech industry presents immense opportunities. Software development, IT services, digital innovation, and e-commerce are sectors experiencing rapid growth.

2. Healthcare: The healthcare sector, including pharmaceuticals, biotechnology, and telemedicine, is expanding due to increased healthcare spending and growing demand for quality healthcare services.

3. Renewable Energy: India's focus on renewable energy presents investment prospects in solar, wind, and other clean energy sources, supported by government initiatives and rising environmental consciousness.

4. Infrastructure: With ongoing infrastructure development projects, investing in areas like roads, railways, airports, and smart cities offers long-term growth potential.

Identifying High-Potential Sectors

Certain sectors within the Indian economy stand out as high-potential areas for investment. The technology sector, driven by India's prowess in software development and innovation, continues to attract attention, along with burgeoning opportunities in healthcare, renewable energy, e-commerce, and infrastructure development.

Navigating Regulatory Frameworks

Understanding India's regulatory landscape is crucial for investors. Familiarizing oneself with foreign investment regulations, taxation policies, and sector-specific guidelines is essential to ensure compliance and mitigate legal risks associated with investments.

Selecting the Right Investment Vehicle

Choosing the appropriate investment vehicle aligns with individual risk tolerance and investment goals. Direct stock market investments, mutual funds, exchange-traded funds (ETFs), or venture capital opportunities present varied options catering to diverse investment preferences.

Risk Management Strategies

Mitigating risks is an integral part of any investment strategy. Diversification of investments across sectors and asset classes, maintaining a balanced portfolio, and incorporating risk management techniques are prudent approaches to safeguard investments against market volatility.

Building Relationships and Networking

Establishing connections and fostering relationships within India's business ecosystem can provide valuable insights, access to market intelligence, and potential investment opportunities. Networking with industry experts, financial advisors, and local partners can be instrumental in identifying promising ventures.

Executing Investment Strategies

Executing investment strategies entails precise planning and timely execution. Leveraging market insights, adhering to investment timelines, and continuously monitoring portfolio performance are essential components of a successful investment journey.

Investing in India offers a gateway to a vibrant market fueled by innovation, demographic dividends, and robust economic growth. However, success in this venture demands a meticulous approach, comprehensive research, adherence to regulatory frameworks, and a dynamic strategy that evolves with market dynamics.