#wotc deadline

Note

Are you particularly surprised by WOTC saying in their newest feedback response video that they're pretty much reverting to the 2014 rule for anything that doesnt get a high positive feedback? How much of that do you think is 'the deadline is looming' and how much is just the result of their design intentions.

I think as long as Hasbro sticks with their "5E is evergreen and must appeal to all D&D fans equally" policy, the game's authors will never be allowed to make a change that doesn't focus-group well ever again.

3K notes

·

View notes

Text

Brexit blocks Microsoft’s $67 Billion Activision Blizzard merger

UK’s Competition and Markets Authority (CMA) is stopping a deal worth almost $70 billion by Microsoft to acquire Activision Blizzard. blocked in Britain, This deal would power Azure and Xbox dominance in cloud gaming. Sony had concerns trusting the competition with suspicions that Windows would tamper and sabotage games like Call Of Duty on other consoles. Fans had started work on filing lawsuits to stop the merger.

The effect of publishers merging proves affects different age groups and the intervention of business authorities proves a reminder that digital games are not just children’s toys. Last year November 2022 the world’s attention to US Court case filing Penguin Books getting blocked from the $2 billion deal to merge with rival publisher Simon & Schuster. By then $2.2 billion too little as Penguin Publishers had already taken the largest chunk of the literature industry including bookstores and associations. Microsoft president Brad Smith will try to overturn this ruling outside Brexit but isn’t it surprising how US Courts busted Penguin without noticing Windows, despite public outcry.

Microsoft’s $67 billion merger to acquire Activision Blizzard has been blocked

| Source: Microsoft

While UK Courts saw nothing wrong with Penguin doing these mergers on paperbacks, only to notice Windows Blizzard problems.The CMA blocks almost 70% everyone successfully when there’s cause of concern. Brad Smith spoke to the BBC saying the UK regulator’s decision the “darkest day” for Microsoft in its four decades of working in Britain. He said “the European Union is a more attractive place to start a business” than the UK. Interesting to see how Microsoft can keep this deal alive. And the company keeps Activision users decreasing, not sure if it’s because of tough competition or rumours of the Windows trade licence.

Dungeons & Dragons fans logged off to call out; Hasbro, D&D Beyond, and WoTC for what they called a few changes with restrictions. Changes that would affect third-party intellectual property. A boycott to D&D compared to the boycott from Windows who lately laying off thousands of staff, or Activision Blizzard recently forced to settle on paying $35 million for sexual misconduct harassment work complaint cases.

Activision x Microsoft | Source: Deadline

With almost 50 famous games, private cloud stores for accounting, the users being abused in this case, a number which Microsoft called miscalculated to argue this deal, statistics or facts concern for users, an error by the CMA. CMA sort of agreed to overlook those competing with Window stores, Azure, if third-party data is at stake and upon overlooking users of Call Of Duty, Windows services being limited to rival users still the biggest concern to winds up this failure to merge. The impact this deal would have on competition gaming consoles like Sony, Nintendo or Google and Open Source devices. So the subscribers of competing services for now rest protected by the CMA decision.It will take more to change the ruling.

https://upbeatradio.net/v3/News.Article?article=6541

6 notes

·

View notes

Text

Payroll and Tax Season: Tips for Smooth Navigation

Tax season can be a daunting time for small business owners, especially when it comes to managing payroll. With numerous regulations, deadlines, and potential pitfalls, it's essential to have a solid plan in place to navigate this period smoothly. Here are some practical tips to help you tackle payroll and taxes with confidence during tax season:

1. Stay Organized: Start by organizing all relevant payroll documents, including employee records, tax forms, and financial statements. Create a dedicated folder or digital file for easy access throughout the tax season.

2. Understand Tax Deadlines: Familiarize yourself with key tax deadlines, including deadlines for filing payroll tax returns, issuing W-2 and 1099 forms, and making quarterly estimated tax payments. Missing deadlines can result in penalties and fines, so mark these dates on your calendar and set reminders to ensure compliance.

3. Keep Accurate Records: Maintaining accurate payroll records is crucial for tax compliance. Keep detailed records of employee wages, hours worked, tax withholdings, and any other relevant information. This will help streamline the tax preparation process and minimize errors.

4. Review Employee Classification: Ensure that your workers are properly classified as employees or independent contractors for tax purposes. Misclassifying workers can lead to costly penalties and legal issues, so review classification criteria carefully and seek professional guidance if needed.

5. Calculate Taxes Correctly: Accurately calculating payroll taxes is essential to avoid underpayment or overpayment. Use reliable payroll software or consult with a tax professional to calculate federal, state, and local taxes, as well as Social Security and Medicare contributions, based on current rates and regulations.

6. Monitor Changes in Tax Laws: Tax laws and regulations are subject to change, so stay informed about any updates that may impact your payroll taxes. Subscribe to reliable tax news sources, consult with a tax advisor, and attend relevant seminars or webinars to stay up-to-date on changes that may affect your business.

7. Utilize Tax Credits and Deductions: Take advantage of available tax credits and deductions to reduce your tax liability. Research tax credits for small businesses, such as the Work Opportunity Tax Credit (WOTC) or the Employee Retention Credit (ERC), and explore deductions for business expenses, retirement contributions, and healthcare costs.

8. Implement a Payroll Compliance Checklist: Create a payroll compliance checklist to ensure that you're meeting all legal requirements and avoiding common pitfalls. Include tasks such as verifying employee information, reconciling payroll records, and filing tax forms accurately and on time.

9. Prepare for Audits: Be proactive in preparing for potential tax audits by maintaining thorough and accurate records, documenting any tax-related transactions or decisions, and responding promptly to any inquiries from tax authorities. Consider seeking assistance from a tax professional to navigate the audit process effectively.

10. Seek Professional Guidance: If you're unsure about any aspect of payroll and tax compliance, don't hesitate to seek professional guidance. Experts offering services of payroll for small businesses in Oklahoma City OK can provide valuable expertise and assistance tailored to your business's specific needs.

0 notes

Text

So this is the last day of Play it Forward, an event held by Drivethru in which drivethru and many IP holders (white wolf, WotC, onyx path...) don’t take their % of the sale of community content products.

And there’s a sale on everything.

So if you buy any of my stuff, I’ll get to keep the full amount, no fees!

And all that money, I’ll be giving out to a charity fund to pay for urgent vet care for those who can’t afford it otherwise (the same fund that helped me last year for Iris and it saved her).

Please consider going to the Vault and buy SotM stuff :)

Thanks a lot!

Edit: I’m an idiot it’s until May 17th, pls wishlist everything while it’s on sale and buy them before the deadline^^

#vampire the masquerade#vamily#vtm#hunter the reckoning#wraith the oblivion#vampire the requiem#vtr#wod#cofd#chronicles of darkness#vet fund#pet care#bloodlines

19 notes

·

View notes

Text

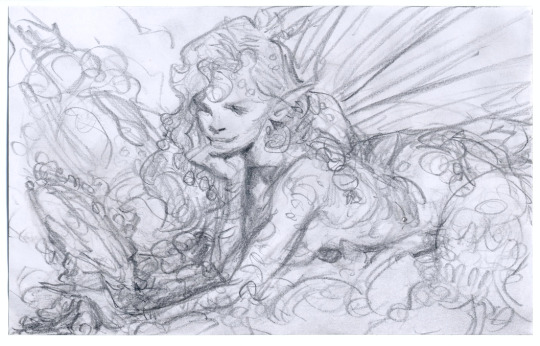

MTG Artist Interview: Iain McCaig

Iain McCaig is certainly no stranger to Magic art. He’s been producing pieces for Magic for years, but it’s but awhile since we’ve seen him. But he made a hugely triumphant return in Throne of Eldraine with some absolutely fabulous works. Today I am happy to present to you a closer look at Iain and one of his most recent MTG pieces!

Daniel: Hi Iain! Thanks so much for taking the time to share your artistic process with us fans. Your work is outstanding! How long have you been doing art for Magic: the Gathering?

Iain: Hey Daniel! Thanks for the kind words. I did my first set of Magic Cards soon after the change of the millennium—2002, if I remember rightly.

D: For those of us who love your work, where can we find more of your artwork (outside of your Magic pieces)?

I: Actually, these days most folk know me for concept artwork for the film industry. I designed Darth Maul and Queen Amidala and tons of other Star Wars characters, and contributed to Guardians of the Galaxy and the Avengers franchise for Marvel. But I’ve also done games like Titanfall and an album cover for Jethro Tull, illustrated the first choose-your-own-adventure books and even animated for Sesame Street cartoons. Here’s my IMDb page, for the insatiably curious: https://www.imdb.com/name/nm0564572/).

I have parallel careers as a screenwriter, author-illustrator and film-maker too. That might sound like I’ve got several different Iains inside my head, but those jobs are just different ways of being a storyteller, and we wants to do ‘em all, my precious!

D: Is there one Magic world or character that if given the chance you’d love to paint?

I: Yes! I would love to create an entire new universe for Magic: the Gathering! And write the stories to go with ‘em (WOTC, are you listening?)!

D: Let’s talk about one of your current pieces for Throne of Eldraine - Workshop Elders. Tell us about your process for painting this piece.

I: My process is always driven by the STORY, and all the usual stuff that fires up our empathy and curiosity and imaginations.

Take the faery on her treasure horde in ‘Gleaming Regalia’. Cynthia Shepard, my Art Director on this series, said that the faery was basking in the joy of shiny treasure, her eyes fixed on one particularly one bright-looking thing. So maybe she’s uber-greedy, like Smaug, lollygagging on a mountain of treasure. Greed is fun to depict, but I was much more interested in a Jekyll and Hyde tug-of-war, so I made her a ‘treasure addict’. Her expression is gleaming but possessed. She’s trapped by her new shiny, but we know from all the equally amazing stuff in her treasure horde that it won’t satisfy her for long. Kind of like me with a good cup of coffee, only a lot harder to come by.

Most of that, I work out as I sketch. My fingers are always smarter than I am. They tap into my subconscious and throw story twists and turns into the drawing to keep me entertained, and all I have to do is be sharp enough to recognize when something magical has happened. I send several of those in to Cynthia, and she unerringly picks the one I want to draw the most (one of her many mutant powers).

Then begins the work of making a drawing from my imagination look real. I’ve documented this process many times before, but in a nutshell, it’s a three-step thing: first, the imagination drawing. Second, studies from real life to augment my imagination with observation: anatomy and lighting and costumes and such. Third, combine the first and second steps into a third and final drawing, which—if I’ve done my work right on the other two, is a performance—I virtually become the character I’m making (woe betide anyone who enters my studio when I am creating monsters!).

I drew ‘Gleaming Regalia’ with pencil on paper, but painted it in Photoshop. I usually prefer traditional paint media, but when deadlines howl at the door, there’s nothing like super-digital powers.

One last note: during the real life study phase, I like to use real people. It’s a Norman Rockwell thing: inducing friends and family and random folk with great faces to pose. I was particularly lucky with both ‘Gleaming Regalia’ and ‘Feathered Artisans’. My wonderful niece and her equally wonderful best friend obligingly transformed themselves into elderly magical craftswomen, while the latter also doubled as the treasure-possessed faery. My gratitude (and virtual oscars) to both!

Thank you to Iain for this great behind the scenes look at your process and also for contributing to the amazing world of Eldraine! Hope to talk to you again soon!

#mtg#vorthos#magic the gathering#magic story#magic art#fantasy#fantasy art#lore#flavor#magic lore#iain mccaig

71 notes

·

View notes

Text

The other day, someone in our group chat asked, if you could do anything- job or school- and you wouldn't have to worry about how much it costs or paying bills or anything like that- all the financial stuff is taken care of, what would you do?

Answers ranged from fancy art schools to underwater archaeology, but mine was so... attainable that it really kicked my motivation back into gear. I want to write. I'd love to write a novel (and I’m still working on the ones I’ve started), but I feel like my real joy would be in writing games. Video games or tabletop, either work. I want to write things that invite the readers to help create with me. I want to write worlds and stories that can be interacted with and developed and lived in. I'd forgotten it along the way, but it's been a goal of mine ever since WotC had that settings contest that Keith Baker and Eberron won.

But honestly, what's stopping me? (Besides all that financial stuff, anyway.) I've been writing and developing my own homebrew world for two years now, the setting that my home game plays in and the setting of the novel I've been... slowly writing for longer. I go months without doing real work on it because I get distracted by life, DnD, and video games.

I am down to one part-time job doing content conversion with Roll20 which means I look at and read and convert tabletop games all day. I'm still looking for more income, still searching for a "real" job with benefits, but in the meantime, why not give this a real go?

I've been planning to develop the dungeon my players are running right now in Queertical Role for eventual publishing. But what if it's more than that? What if I documented my journey through deconstructing and studying games and the hours of reading books and blogs and watching videos about DMing and writing your own adventures and encounters and characters and monsters? What if I didn't just publish full dungeons or adventures, but everything from individual monsters/characters to encounters to locations to magic items to settings?

And what if I gave myself deadlines so I made sure that I make time to read and watch and study and write? After all, failing to carve out time to do these things is part of the reason I get so distracted and forget that I'm supposed to be writing until the day before the game when I'm throwing together enough of a plan that I can improv my way through the session.

I've had a Patreon for what seems like ages, but never really knew what I wanted to do with it... but I think I'm getting there. I'll have to do my research as well as asking those of you who read this far your opinions on what kind of tiers you'd want and what kind of benefits you'd look for....

...but this is a pretty good first step.

So if you’re interested, head over to https://www.patreon.com/jennawynn and give it a look.

8 notes

·

View notes

Photo

Hey! Few good news. I have just received a notice that my work for the MTG League Guildmage will be published in Spectrum 26. This makes me unimaginably happy, as I missed the deadline for applying for another year due to distraction or a lot of work. Fortunately, I have the support of the WOTC team, to whom I owe great thanks! #mtg #mtgart #mtgillustration #mtgcard #magicthegathering #wotc #rna #mtgaddict #mtgfan #art #characters #characterart #characterdesign #illustration #conceptart #creature #creatures #artistsoninstagram #artstation #artstationhq #digitalart #darkart #darkfantasy #drawing #digitalpainting #spectrum26 #spectrumfantasticart https://www.instagram.com/svetlin_velinov/p/Buf4teOFEFc/?utm_source=ig_tumblr_share&igshid=16r1pkmjrohwx

#mtg#mtgart#mtgillustration#mtgcard#magicthegathering#wotc#rna#mtgaddict#mtgfan#art#characters#characterart#characterdesign#illustration#conceptart#creature#creatures#artistsoninstagram#artstation#artstationhq#digitalart#darkart#darkfantasy#drawing#digitalpainting#spectrum26#spectrumfantasticart

36 notes

·

View notes

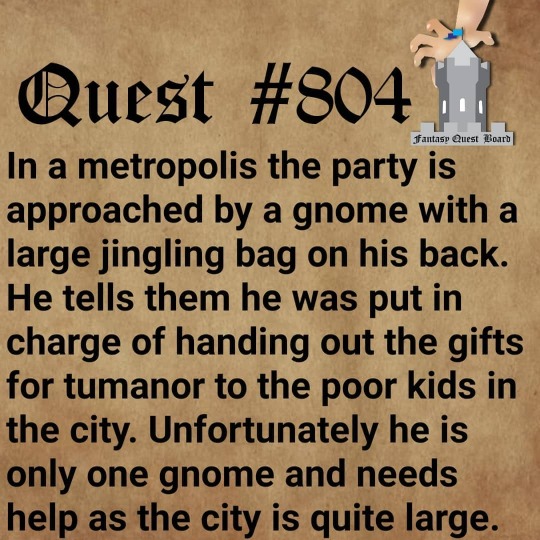

Photo

The deadline is soon and if he doesn't get it done the kids will no longer believe in the amazing holiday. If you don't want to do it or expect to be paid, just know that deep down inside you are not a good person. . . 🎁🎁🎁 Gnome For The Holiday Quest . . #Dnd #dndtable #voxmachina #roleplayingames#dungeonsanddragons5e #tabletoproleplaying #fantasyquestboard #pathfinderrpg #dndencounters #dungeonmastersguild#criticalrole #ttrpg #dndencounter @dndwizards #wotc#dnd5ed #dnd5e #dndhomebrew #wizardsofthecoast#dungeonsanddragons #roleplaying #pathfinder#dungeonmasters #roleplayinggame#dungeonmastertips #tabletoprpg #role20#roleplayinggames #dungeonmaster #dndcharacter (at Cincinnati) https://www.instagram.com/p/CW9tusjgFeG/?utm_medium=tumblr

#dnd#dndtable#voxmachina#roleplayingames#dungeonsanddragons5e#tabletoproleplaying#fantasyquestboard#pathfinderrpg#dndencounters#dungeonmastersguild#criticalrole#ttrpg#dndencounter#wotc#dnd5ed#dnd5e#dndhomebrew#wizardsofthecoast#dungeonsanddragons#roleplaying#pathfinder#dungeonmasters#roleplayinggame#dungeonmastertips#tabletoprpg#role20#roleplayinggames#dungeonmaster#dndcharacter

1 note

·

View note

Text

About 2011

So what now?

Not as much LFR. I feel less cranky about the campaign than I did when Susan and I talked it over before Christmas, which is when we made the initial decision to cut back. On the other hand, I'd bet that part of my good cheer is that decision itself, so revisiting it doesn't seem either wise or necessary. I'm glad to be stepping back in a good mood rather than a pissy one.

2010 was a very poor year for the campaign. I enjoyed it a lot personally, but that doesn't negate the fact that the rate of new content dropped alarmingly. Even worse, there were almost no new mods for private play. Private play was a very important part of the success of the campaign, and cutting off legal private play hurt badly. As a nasty side effect, this encouraged people to blow off the restrictions on private play and start breaking the rules. With no real enforcement available (or perhaps even desirable), this meant all the rules started to seem less important.

This combined poorly with a serious communication issue. I appreciate everything the globals do; I also think they, as a whole, are not skilled community managers. Which hey -- I'm not either. But it is absolutely awful when one of your global admins is bitching about how poorly the players treat him. Here, read the MMO take on it. All of that is relevant except the volunteer note, since some of our admins are pure volunteers -- but let us not grow confused about what it means that WotC isn't spending money on the campaign.

One of the other more cheery things in the last month is, however, improved communication, which is nice. While not all deadlines are getting met, they're getting better about communicating the issues at hand. Probably not coincidentally, the campaign has control over new module distribution. My uneducated hypothesis is that the admins had, for most of 2010, very little control over the mechanical process of releasing content and that this generated a lot of frustration. If this is accurate, the new livingforgottenrealms.com is helping a lot.

Organization has also been better. DDXP came off very well this year, although eyeballed attendance was down. Nonetheless, the BI was done before the show, people got modules in time to prepare, and the story was interesting and most forum reports were good. I was mentally prepared for a disappointing, semi-chaotic DDXP, and it wound up being quite the opposite.

This leaves me looking at 2011 and thinking that I can take my LFR when I feel like it and leave it alone otherwise. Our primary characters, Reed and Faral, hit level 19 at DDXP. We still don't plan on playing the epic any time soon (more on this later), which means they have four or so adventures left before they leave paragon play behind. We'd like to make three of those the upcoming Waterdeep adventures, and one is probably the end of the Tyranny arc. That is pretty much OK. I have a level 16 character who could do P2 and P3 content, but Susan doesn't, which means paragon play won't be a big feature of our gaming time.

We do have plenty of heroic level play in us. Whether or not we do a lot of it in practice -- well, we'll have to see if we ever get down to the Monday night Columbia game.

I also intend to run semi-regularly, because I like it. I am still looking for the sweet spot between creating a challenge and overpowering players.

0 notes

Text

Please Help Me Save Lady Abyss' Legacy

Please Help Me Save Lady Abyss’ Legacy

In order to be able to keep WitchesofTheCraft.com domain name that has been tied to the WOTC website for almost 20 years WordPress said need a copy of her death certificate. Now that someone I know was able to find her middle name today I can apply for it. I am working on a deadline that is only 11 days away and I am broke. I humbly ask if some of the 3, 500 + followers of WOTC could even donated…

View On WordPress

0 notes

Text

Guest Post – Range of Tax Issues for Manufacturers

I have a guest blog here from Whirlwind Steel. It lays out various state, federal and international tax matters for manufacturers. The timing is good as we are likely to soon see a tax reform bill (11/1/17 perhaps). What issues will remain, what might disappear, and what new issues might arise? Let’s start with Steve’s overview of taxation for manufacturers.

Range of Tax Issues for Manufacturers

By Steve Wright of Whirlwind Steel*

Taxes. Just the word can make manufacturers shudder. Trying to navigate the US tax rules makes your brain hurt. However, since taxes are a necessary evil, we put together a list of common tax issues manufacturers face and a few tips to help you through the jungle of tax regulations.

Tax time doesn’t just roll around; it jumps right out at you. Let's see about making it a little less stressful.

The Rapidly Changing State Tax Nexus

Businesses are putting more resources into sales tax compliance as the rules change and become less transparent. One of the biggest issues facing companies is the definition of a state tax nexus. Nexus complicates multi-state taxation for sellers and faces increasing legislation, litigation, and regulatory activity.

Nexus is defined as the threshold of activity a company must have with a state before a tax liability is imposed, requiring compliance responsibility.

The concept is not completely settled and differs from state to state.

States are facing a great deal of fiscal pressure and are casting about for more sources of revenue making nexus a target for constant change.

Not only is the requirement to file ambiguous, but other nexus problems can also impact the amount of total state income and franchise tax due; for example, whether you have the right to apportion or disregard sales from your sales tax factor.

With nexus defined and treated differently in each state, the burden of compliance grows exponentially with each state in which a company does business. There is a potential for a company to create a nexus in a state merely by selling to people there.

Confusion over Incentives, Credits, and Deductions

Federal, state, and local governments offer a variety of incentives, deductions, and tax credits, which are designed to encourage certain types of activity that impacts the economy, environment, or another sector. In some cases, the deductions, incentives, and credits are temporary, lasting until a certain tax year and then disappearing. Manufacturers may not have taken advantage due to confusion about eligibility or qualification.

One tax credit that is highly beneficial for manufacturers is the R&D tax credit.

This credit became a permanent part of the tax code in 2015.

It is a mechanism for capturing the costs of R&D activity to provide a credit on taxes for R&D activity.

Small businesses may be able to use this credit in place of the alternative minimum tax (AMT).

Several new projects and investments qualify you for this incentive, reducing risk and costs.

Other opportunities to reduce taxes include the following:

· Work Opportunity Tax Credit (WOTC) - reduces an employer’s tax liability up to a certain limit for each new hire from a qualified group such as veterans and people in the SNAP program. The credit is available through 2019.

· S-Corporation Tax Adjustment - if your business is organized as an S-corporation you can take advantage of a stock basis adjustment for charitable contributions of property andexemption from corporate tax on built-in gains assets.

· Capital Expenditure Expensing - Small businesses and some 39-year property qualify for the 15-year recovery under the federal PATH Act and bonus depreciation.

Business tax advisers and tax attorneys keep up with these changes and have the experience to determine whether or not a manufacturer qualifies.

International Taxes: Section 987, BEPS, and CbCR

Running a global manufacturing company becomes even more complicated, tax-wise, when dealing with a foreign country.

Section 987 Regulations - governs the recognition of exchange gain and loss for US remittances for multinational companies with disregarded or flow-through entities and use something other than US dollars for currency. The adoption deadline is 2018 for these regulations.

Base Erosion and Profit Shifting (BEPS) - world governments seek to ensure all companies pay tax on revenue in the country in which it was created. Not all countries will implement BEPS, but many have or will. For manufacturers, the chief concern is that BEPS will change the commissionaire structures.

Country by Country Reporting (CbCR) - the US federal government issued final regulations that require some US taxpayers that are the ultimate parent [Deloitte newsletter] of a multinational enterprise group to begin CbCR. The filing requirement applies to businesses with $850 million or more in global group revenues.

Multinational manufacturers will need to invest more in compliance with international taxes as changes come fast and furious from governments starved for revenues.

See a February 2017 RSM newsletter on tax and manufacturing for more details of some of these items.

Tips for Tax Time

Analyze how your tax accounting method for income and expenses affects your tax planning. Most manufacturers use either income deferral or expense acceleration.

Did you know that fringe benefits are taxable because they are forms of pay for the performance of services? The provider of the service does not have to be an employee. Fringe benefits are also subject to numerous exclusion rules.

The value of your inventoryis a significant factor in taxable income. Match the method you use to value inventory to your type of business. Common methods include the Cost Method, Lower of Cost or Market Method, and UNICAP (Uniform Capitalization Rules).

You may be liable for both manufacturer excise taxes and the federal highway vehicle use tax. To counter this liability, check your eligibility for an income tax credit or refund for gasoline, diesel fuel, or kerosene used for nontaxable activities.

Paying taxes is a requirement for operating a manufacturing business. Tax regulations change often and require near-constant monitoring to ensure you remain compliant, another regulatory burden you, as a business, must shoulder. However, if you and your tax adviser or attorney pay close attention, you may be able to counter some of your tax liability with available incentives, credits, and deductions.

If you are multinational, you will need to invest in services to help you keep up with international tax law and its impact on your US taxes. The IRS website contains valuable resources to help you navigate through the thicket of regulations while an experienced tax attorney can help you determine the best method of valuing your inventory, tracking excise taxes, and file timely returns.

All manufacturers are in the same tax boat. Consider the tips we offer and take advantage of every possible resource to help you comply yet remain a profitable business.

*Whirlwind Steel designs and manufactures Sturdi-Storage metal self-storage buildings.

from Tax News By Christopher http://21stcenturytaxation.blogspot.com/2017/10/guest-post-range-of-tax-issues-for.html

0 notes

Text

2 Tax Credits All Business Owners Should Know

One key to keep your bottom line as high as possible is keeping your taxes as low as possible. Here are two specialized tax credits you should know about.

"We've got to find a way to get our costs of doing business down." Sound familiar?

It's no secret that a key to maximizing your company's bottom line is decreasing business costs, and it's also no secret that one way to decrease business costs is to minimize your exposure to taxation. There's a long list of standard strategies for this, such as reviewing your business structure or the way you depreciate machinery and real estate, taking advantage of carryovers, sheltering profits in retirement plans, employing a family member, or timing large purchases differently.

Most CPAs and business tax preparers are excellent at suggesting and maximizing strategies for tax mitigation. However, there are a couple of ideas that are underused and better than a tax deduction on a dollar-for-dollar basis. But first, you need to understand the difference between a tax deduction and a tax credit.

Tax deduction vs. tax credit

A tax deduction is created by a tax-deductible expense or exemption that reduces your taxable income. Simply put, your taxable income is then multiplied by your tax rate to calculate your tax exposure, your bill. For example, let's say your gross income is $3 million. Your deductible expenses total $1 million, leaving a taxable income of $2 million. If your tax rate is 35 percent, you'll owe about $700,000.

A tax credit is different. The amount of your tax credit is subtracted after your tax exposure has been calculated, on a dollar-for-dollar basis. Let's go back to the above example: Your gross income is $3 million and you have $1 million in deductions, leaving your taxable income at $2 million and your tax bill at $700,000. But if you also have $300,000 in tax credits, that drops your tax bill, dollar for dollar, down to $400,000.

That makes a big difference. That's why $1 in tax credits is usually significantly better than $1 in tax deductions, and that's why we love tax credits.

WOTC

The first tax credit you should know about is WOTC, the Work Opportunity Tax Credit. Knowledge of this credit could alter the way you hire. Depending on the position for which the employee is hired and their anticipated work schedule, you could receive a tax credit of $1,200 to $9,600 for every person you hire under WOTC. This credit currently extends through 2019 and may very well be extended after that.

Here's how it works. WOTC is available to private-sector employers who hire individuals from several target groups, and to tax-exempt organizations that hire veterans. Here are the target groups:

Qualified veterans

Qualified disabled veterans

Qualified unemployed veterans

Qualified designated community residents (people who live in certain designated areas)

Qualified ex-felons

Qualified SNAP (food stamps) recipients

Qualified TANF (Temporary Assistance to Needy Families) recipients

Long-term unemployed individuals

Qualified vocational rehabilitation recipients

Qualified Supplemental Security Income (SSI) recipients

Qualified summer youth

The process is relatively simple, but it is also specific and time-sensitive. The clock starts ticking immediately upon hire, and there is a 28-day deadline for submission of the required document (IRS Form 584). This will include a questionnaire that the new hire must complete, and we have found this to be a potential bottleneck.

However, there are ways to streamline and automate this process to make it more efficient. And in case you're wondering if it would be in some way discriminatory to favor potential employees who qualify during the hiring process, the answer is no. Incentivizing the hiring of people from certain challenged groups is the whole point of the law.

Do you have your WOTC? Go to IRS – WOTC to learn more.

R&D

Next is the Research & Experimentation Tax Credit, also known as the R&D Tax Credit. While the credit itself is targeted to industries such as manufacturing, engineering, software, chemical and pharmaceutical, we have found that more businesses of all sizes are qualifying for it than ever before.

This program provides credits for companies involved in one or more of the following:

Development and improvement of quality and cost-efficient solutions and processes

Quality assurance and testing

Engineering and design

Manufacturing

Prototyping or modeling

Process improvement resulting in better productivity and turnaround cycle

Specialized assembly processes using technology

Development of tooling applications and solutions

Product development and improvement

As it turns out, we have found that not only do a wide swath of companies outside of the target industries engage in those functions, but that it's also possible to examine individual tasks within job descriptions and responsibilities to find qualified employees and businesses.

And it gets better. Newer rules now allow eligible employers to include prior years (generally two to five) and add to their tax credits, plus (as with WOTC) enjoy the credit in future years.

This is a specialized Federal Tax Credit under Section 41 of the Internal Revenue Code, and a study must be completed to both maximize its benefits and provide backup documentation and reasoning "just in case." There are companies that can provide that service, and Cornell Law provides a detailed description of this credit here.

0 notes

Photo

We have a draft tonight at 6pm! Which will it be? Current format draft for $15 or $30 modern masters 2017 DRAFT! You decide. MM17 prize packs for the the winners but every one gets a standard booster for participating if we go with modern masters draft. Deadline for deciding is at 6! #wotc #mtgfoil #shadowsoverinnistrad #planeswalker #mtgcommander #mtgcommunity #magicthegathering #mtg #mtgaddicts #wizards #foil #fnm #draft #wizardsofthecoast #standard #bfz #modern #legacy #eldritchmoon #flagstaff #nau #cabcomics #fromthevault #lore #flex #flexfriday #modernmasters #fetchlands (at Cab Comics)

#flagstaff#foil#mtg#bfz#mtgfoil#mtgaddicts#modernmasters#mtgcommander#cabcomics#flexfriday#wizardsofthecoast#magicthegathering#fetchlands#flex#standard#shadowsoverinnistrad#planeswalker#lore#wotc#draft#wizards#mtgcommunity#fnm#modern#legacy#nau#eldritchmoon#fromthevault

0 notes

Text

Military tax considerations and tips

(Pixabay via Pexels)

When you're in the military, taxes are likely far down on your list of concerns.

Members of the military, however, bear the same tax responsibility as do all U.S. citizens.

The one bit of good tax news here is that the tax code and Internal Revenue Service take into account the special circumstances that armed services personnel face.

Here are some tax highlights for military taxpayers.

Affected armed forces: Military tax benefits typically apply to active duty or reserve members of the armed forces. The eligible forces are:

United States Army (including Army Reserve and Army National Guard)

United States Navy (including Navy Reserve)

United States Air Force (including Air Force Reserve and Air National Guard)

United States Marine Corps (including Marine Corps Reserve)

United States Coast Guard (including Coast Guard Reserve)

Recently retired or separated members may also be eligible for benefits.

Service abroad means more filing time: If you're stationed in the United States, your tax returns are due on April 15. If, however, you're posted overseas, like other U.S. taxpayers living abroad you get two more months — until June 15 (or the next business day if that falls on a weekend) to file your taxes.

And if you're deployed to a combat zone, Uncle Sam definitely doesn't want you worrying about your taxes. In these hostile situations, tax deadlines automatically are extended, both for military personnel and those posted there to directly support these operations.

The deferral for combat zone service ranges from 60 days to up to 180 days after the end of their active service in the zone. It covers not only filing of forms, but also the payment of any due tax.

Your command will notify the Internal Revenue Service of your deployment so that you can receive the automatic federal tax return extension. Double-check that the IRS does have your correct combat information by e-mailing [email protected] with your name, stateside address, birth date and date of deployment.

And when you do file, you may still want to write "COMBAT ZONE" in red on top of your tax return.

More combat considerations: Being in the line of fire means you get added combat pay. Uncle Sam, however, gives enlisted service personnel, warrant officers and commissioned warrant officers a tax break here.

These military members don't have to include active duty combat pay as income for tax purposes.

The IRS also allows a similar tax exclusion for imminent danger/hostile fire pay; re-enlistment bonuses if voluntary re-enlistment occurred during a month while serving in a combat zone; pay for accrued leave earned while serving in a combat zone; and pay while hospitalized as a result of your service in a combat zone.

Commissioned officers also are allowed to exclude part of their combat pay, but that amount is capped.

Earned Income Tax Credit choice: Not owing tax on combat pay is a welcome benefit in most cases. However, sometimes a little extra could help out and not just for covering day-to-day expenses.

Whey you claim the Earned Income Tax Credit (EITC), you want enough earned income to get you the most benefit allowed by this tax break. In these cases, EITC-eligible military members can opt to include combat pay amounts for purposes of figuring the tax credit.

As with other tax situations where you have a choice, military taxpayers should calculate their taxes both with the nontaxable combat pay as earned income and without the nontaxable combat pay as earned income to find out what's best for you. Check the IRS' webpage for this special EITC situation and other factors to consider when considering combat pay in the claiming of this refundable tax credit.

Residency and state taxes: Military members also must deal with state taxes. That can be complicated and confusing when your service means you are deployed around the country.

The Servicemembers Civil Relief Act provides protections in this regard. Active-duty service members can file state income taxes in their state of legal residence. They are not required to change their legal residence when they move to a new state solely due to military orders. They may maintain their legal residence in a state where they have previously established it.

(Wyatt via Pexels)

The Military Spouse Residency Relief Act (MSRRA), which became law in 2009, allows military spouses to keep the same state of residency as that of their military spouse, regardless of which state they currently reside. In addition, the Veterans Benefits and Transition Act of 2018 amended the earlier military spouse residency law to allow husbands and wives to choose the same state of residence as their service member for tax filing and voting purposes, regardless of whether they have ever lived in the state. Prior to the 2018 change, spouses could only claim the same state of residence if they and their service member were from the same state.

For example, notes Army Capt. Capt. Thomas Sandbrink of the Fort Knox Tax Center, a Texas service member marries a spouse from North Carolina. When they moved to Fort Knox, the service member could continue claiming Texas residency under the Servicemembers Civil Relief Act, but the spouse's income would be taxed to Kentucky, requiring the couple to file separate state returns. Under the new law, both are able to claim Texas.

Home-sale profit tax exclusion extended: Most homeowners know that the sale of their homes is one of the best tax breaks around. If you meet some relatively easy eligibility rules, you don't owe any tax on profits of up to $250,000 if you're a single home seller or double that for married couples who sell a residence.

How long you've owned and lived in the home help determine whether you get this primary home sale capital gain tax exclusion. Generally, you must have owned the house for at least two years and lived there for at least two of the last five years. While that's not a problem for most civilian homeowners, military members tend to be more mobile and with little control over their departures. In these relocation situations, service personnel get some leeway.

Tax law allows for home qualified active duty sellers facing an ordered Permanent Change of Station (PCS) to suspend the ownership and residency period when you’re on qualified official extended duty. IRS Publication 523 has details and examples of how this works.

Military moving tax break: Military personnel still are allowed to deduct unreimbursed moving expenses related to PCS transfers. True, the Department of Defense usually covers most of these expenses for service members. Sometimes, however, there are unreimbursed expenses and service personnel, unlike civilians who move, still can deduct them.

Reservists travel deduction: For non-permanent travel, military reservists whose reserve-related duties take them more than 100 miles away from home, each way, get a tax break, too. They can deduct these unreimbursed travel expenses. They must file Form 2106 to do so, but that amount then is listed on Form 1040's Schedule 1. There's no need to itemize to claim these military-related costs.

More military tax resources: These are just a few quick hits of military tax considerations and potential tax breaks.

You can find more in the IRS' recently updated Publication 3, Armed Forces' Tax Guide. It covers the special tax situations of active members of the U.S. military.

You also should check out the information and help available at Military OneSource, a program offered by the Department of Defense. It provides a range of free resources, tax and otherwise, for military members, veterans and their families.

You find Military OneSource services at its website, at MilitaryOneSource.mil. If you prefer, you can call the service toll-free at (800) 342-9647.

(Pixabay via Pexels)

Military tax filing options: When it comes to filing your return, check out MilTax, Military OneSource's tax service. It provides online software to electronically file a federal and up to three state tax returns for free, regardless of income.

Military personal also can review the offerings at Free File. This IRS-private tax software industry partnership allows taxpayers to prepare and e-file their taxes for free. Military filers and their families who meet the $69,000 adjusted gross income limitation may choose from nine companies without regard to additional eligibility requirements. To access this option, head directly to IRS.gov/freefile.

If you prefer more personal help with your taxes, there are free face-to-face tax preparation services are available thanks to IRS-certified volunteers. These Volunteer Income Tax Assistance participants offer free tax return preparation and e-filing to those who earned less than $56,000 in 2019.

VITA services are found on many large military installations worldwide. Military.com's Base Guide can help you contact your local installation for more information about tax centers, hours of operation, scheduling appointments and necessary documentation.

I hope this overview helps alleviate some of your concern about meeting your tax responsibilities while simultaneously fulfilling your service obligations to our country.

Thanks for your commitment and sacrifices and good luck with your taxes!

You also might find these items of interest:

Gold Star families get eventual widow, kiddie tax fixes

End-of-year hires of WOTC workers could provide a tax benefit for businesses

U.S. Coast Guard, created to collect some taxes for a young America, turns 229

Advertisements

// <![CDATA[ // <![CDATA[ // <![CDATA[ // <![CDATA[ // <![CDATA[ // <![CDATA[ // <![CDATA[ // <![CDATA[ // <![CDATA[ // <![CDATA[ // <![CDATA[ // <![CDATA[ // <![CDATA[ // <![CDATA[ // <![CDATA[ // <![CDATA[ // <![CDATA[ (adsbygoogle = window.adsbygoogle || []).push({}); // ]]> // ]]> // ]]> // ]]> // ]]> // ]]> // ]]> // ]]> // ]]> // ]]> // ]]> // ]]> // ]]> // ]]> // ]]> // ]]> // ]]>

0 notes

Text

Armed Forces Day thanks to our military via celebrations, military-related tax breaks and tax-rewarded jobs

The first Armed Forces Day was celebrated on this day 67 years ago.

President Harry S. Truman led the effort to establish a single holiday to thank U.S. military members for their service in support of our country.

On Aug. 31, 1949, Truman's Secretary of Defense Louis Johnson announced the creation of Armed Forces Day to replace the separate Army, Navy, Marine Corps and Air Force Days. It was a logical move given the unification under Truman's administration of the Armed Forces under the Department of Defense.

President John F. Kennedy established Armed Forces Day as an official holiday in 1962. It now is observed each year on the third Saturday of May.

If there's a parade or other Armed Forces Day festivities today in your area to honor our men and women in uniform, go, pay your respects and enjoy the event.

Business tax break for hiring vets: If you're an employer, consider showing your appreciation for those who have completed their tours of duty.

There's even a possible tax bonus. Hiring a veteran, including those disabled during their course of service, could provide your business a tax break.

The Work Opportunity Tax Credit, or WOTC, is a long-standing income tax benefit that encourages employers to hire certain types of workers who face significant barriers to employment.

There are now 10 categories of WOTC-eligible workers. They are:

Unemployed veterans, including disabled veterans

Qualified IV-A Temporary Assistance for Needy Families (TANF) recipients

Ex-felons

Designated community residents living in Empowerment Zones or Rural Renewal Counties

Vocational rehabilitation referrals

Summer youth employees living in Empowerment Zones

Supplemental Nutrition Assistance Program, also known as SNAP or food stamp, recipients

Supplemental Security Income (SSI) recipients

Long-term family assistance recipients

Qualified long-term unemployment recipients

These 10 categories of WOTC-eligible hires are this week's By the Numbers figure.

Tax credit steps: The credit amount is generally based on wages paid to eligible workers during the first two years of employment.

To qualify for the credit, an employer must first request certification by filing Internal Revenue Service Form 8850 with the state workforce agency within 28 days after the eligible worker begins work. Other requirements and further details can be found in 8850's instructions.

Eligible businesses then claim the WOTC on their income tax return. The credit is first figured on Form 5884 and then becomes a part of the general business credit claimed on Form 3800.

Though the credit is not available to tax-exempt organizations for most categories of new hires, a special rule allows them to get the WOTC for hiring qualified veterans. These organizations claim the credit on Form 5884-C.

The WOTC page at IRS.gov has more information.

Military tax considerations: There also are several special tax provisions for the men and women being recognized today.

They include a later filing deadline in some situations, special consideration in claiming the Earned Income Tax Credit and some state tax breaks, too.

Rather than rewrite these military tax matters, you can find more in my previous blog posts listed below:

Tax tips for members of the military

Later filing deadline for combat zone taxpayers

State tax breaks for military personnel

Tax help for military members, veterans

Thanks to veterans via tax breaks

A bit of tax help is the least Uncle Sam can do for those who volunteer to put themselves in harm's way to protect the United States. He and I thank you, today and every day.

Sponsored Links

from Tax News By Christopher http://feedproxy.google.com/~r/DontMessWithTaxes/~3/H_zc6d-HtZE/armed-forces-day-military-tax-breaks.html

0 notes