#taxprep

Photo

🤯 Feeling overwhelmed by accounting and tax jargon?

We're here to help you understand your business's accounting obligations without the confusion! Our expert team handles bookkeeping, financial statements, cash flow forecasting, budgets, and financial planning. 🌟

💼 Not only do we simplify finances, but we also liaise with external parties crucial for your business growth. Save time and gain clarity on your company’s financial health with our services.

For more details : https://eliteaccounting.co.nz/services/accounting-and-tax/

2 notes

·

View notes

Text

Maximize Profits with Professional Business Consulting Services

Are you an experienced professional looking to leverage your skills and expertise for additional income?

Join our dynamic community of consultants on the Biz Consultancy app and start monetizing your knowledge today. Tailor your consultation schedule to fit your lifestyle, offering advice and sharing your expertise with those in need.

Earn financial rewards for your consulting services and expand your reach to clients worldwide, broadening your professional network.

Download the Biz Consultancy app from the App Store or Google Play Store and seize the opportunity to turn your expertise into income while making a positive impact on others' lives.

Join Biz Consultancy today!

#taxpreparation#taxseason#taxes#taxpreparer#tax#taxprofessional#taxrefund#taxreturn#taxplanning#taxprep#incometax#taxtips#accounting#bookkeeping#accountant#entrepreneur#smallbusiness#taxtime#business#payroll#finance#money#taxation#businesstaxes#businessowner#taxservices#taxpro#Business consultants#Business consulting services#Business advisor

0 notes

Text

#QuickBooks#BookkeepingServices#SmallBusinessBookkeeping#FinancialManagement#BusinessFinances#QBBookkeeping#OnlineBookkeeping#CloudAccounting#QBProAdvisor#AccountingServices#BookkeepingExperts#FinancialAccuracy#QBConsulting#SmallBizFinance#TaxPrep#FinancialReporting#QBTraining#BookkeepingSolutions#FinancialConsulting#QBSupport

1 note

·

View note

Text

Are you searching for a tax advice expert? Look no further! Stuart Iles Partners helps you to minimize your business taxes with strategic guidance in Hobart. Our tax consultants are fluent in the language of business accounting, ensuring compliance while optimizing your financial goals.

0 notes

Text

Accounting Career, Roles and Responsibilities

Accounting is a dynamic and versatile field that offers a multitude of career paths, each with its unique set of challenges and opportunities.

0 notes

Text

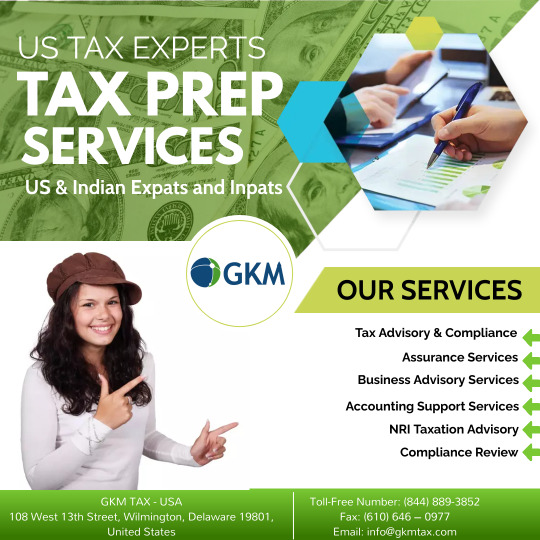

Best tax advisory services in Coimbatore - GKM Global

In this scenario, the use of different accounting frameworks in different countries can lead to confusion, bringing about inefficiency in capital markets across the world. The increasing complexity of business transactions and the globalization of capital markets call for a single set of high-quality accounting standards.

GKM was established by a team of professionals with several years of industry experience in bookkeeping services, taxation, payroll and consulting. Our team includes dedicated and experienced Certified Public Accountants, Chartered Accountants and senior management graduates. Our specializations blend perfectly to meet specific client requirements.

#Best tax advisory services in Coimbatore#tax preparer#taxservices#tax credits#bookkeeping#taxonomy#taxprep

0 notes

Photo

Call Today For An Estimate!!! #tax #taxpreparations #taxseason #taxprep #taxservices #taxes #taxservicecenter #taxaccountant #taxtime #taxhelp #taxpreparation #queens #professional ***** https://www.instagram.com/p/ClrGZGguvqF/?igshid=NGJjMDIxMWI=

#tax#taxpreparations#taxseason#taxprep#taxservices#taxes#taxservicecenter#taxaccountant#taxtime#taxhelp#taxpreparation#queens#professional

0 notes

Text

How can you correct your taxes with an amended tax return?

American taxpayers often make mistakes while filing taxes that can cost them a significant part of their tax deductions and returns. These mistakes often include missing out on several tax credits and deductions that need to be amended from the taxpayer’s side. Remember that they must not file an amended tax return form for clerical mistakes, as the IRS will take care of them for you. Let us understand how and when you can file an amended tax return. It must also be noted that there is a fixed time limit to filing an amended tax return.

When should you file an amended tax return?

To err is human. This proverb by Alexander Pope proves to be true in every aspect of life. Taxpayers often make mistakes while filing taxes, which is more common than you think. Keeping this in mind, the IRS has made provisions for taxpayers to submit an amended tax return, which can help them account for missed tax savings. Let us look at some of the tax filing mistakes that need to be revised in case you are guilty of making them while filing for your tax return.

If you find out that you forgot to mention a tax deduction or credit while filing your taxes for the year, you can submit an amended tax return to the IRS.

You can also go ahead and file an amendment request if you have mistakenly filed your taxes under an inappropriate filing status.

In case you forgot to mention a dependent person while filing your taxes, or if you need to remove a dependent from your tax return, you can file for an amendment.

If you missed mentioning some taxable income while filing your taxes and fail to report it within the time limit suggested by the IRS, you might have to incur a fine. You can avoid this by mentioning the additional taxable income on the suitable form.

Filing an expense, credit, or deduction you are not eligible for can also land you in trouble with the IRS. A taxpayer can file an amended tax return to avoid such a scenario.

Filing an amended tax return for math and clerical errors is not suggested, as the IRS will correct them for you. If you made a math mistake, you would receive a bill in the mail related to an additional tax due or a refund if your tax filing mistakes are in your favor. It is suggested that you file an amended tax return only when you have received the returns you have already filed for. Once you have received the tax returns for the year, you can be sure that your previous tax filing has been validated. If you send your amended tax returns before that, it might lead to both tax filings needing clarification, which is not desirable.

However, the IRS has set a fixed time limit for filing amended tax returns that last up to three years after the deadline for original tax filing for the year or within two years from the day of tax payment for that year. You must complete this window to file an amended tax return for missed deductibles or credits.

How you can correct your taxes with an amended tax return

To ensure that the IRS considers the amended taxes you have filed, it is suggested that you follow the below-mentioned steps:

1.Gather all the required documents: You must gather all the documents that might be needed to file an amended tax return before the initiation of the process. Collect the original documents and any new documents you can account for in the amended tax return filing. Different forms need to be filled out to address different tax filing mistakes. For example, if you need to make changes to the reported taxable income, you can do so with the help of a W-2 or a 1099 form. However, you need to enlist a new deduction. In that case, you need documents that support the deduction, in addition to the amended Form 1098 or form 1098-T, to claim a credit related to education.

2. Get the appropriate forms for the amendment you intend to carry out: You must ensure that you have the appropriate forms to file tax amendments. It is suggested that you get form 1040-X. You must also get all the forms affected by adding or removing new deductions or credits. To make changes to your itemized deductions, you should get Schedule A while adding new interests and income that is received in the form of dividends, and you would require a Schedule B. To make changes to the revenue or expenses related to a business, you must get schedule C or schedule SE, while modifying capital gains or losses requires you to get Schedule D and Form 8949.

3.Please fill out Form 1040-X carefully: It is suggested that you carefully fill out the three columns available in Form 1040-X. In column A you are required to mention the taxes reported earlier, which you can find in the tax return document you received. The second column allows taxpayers to mention the amount that needs to be added or deducted from the original numbers. If you need to amend your gross income by $1000, you must mention the amount in Line 1, Column B. The third and last columns should contain the correct amount, which can be obtained by adding the numbers in the first and second columns. Once you are done with making these amendments, it is required for you to explain why you are making amendments in Part 3 of Form 1040-X.

4.Submit the amended tax return: You can mail the documents to the address provided in the instructions or file your taxes electronically by downloading Form 1040-X and attaching the documents supporting the changes you intend to make to your taxes. If your amended taxes lead to a higher tax bill, you must pay the extra tax bill through a check in the mail or by logging on to the official IRS website. By paying the extra charges immediately, you can avoid extra charges in the form of interest or penalties.

Therefore, making mistakes while filing your tax return is not as grave as a mistake and can be amended easily if caught on time. You must get Form 1040-X to file for an amended tax return and other supporting documents. However, one must keep in mind that this does require extra work, and it is desired that the taxpayer does not make tax filing mistakes. However, if you have already done the deed, you can easily sort out the errors or get some tax professionals to do the same. However, you can also choose another alternative, seek professional help while filing your tax returns, and avoid making mistakes. NSKT Global has a dedicated team of qualified and trained professionals to help American taxpayers during every step of tax filing. This eliminates any chances of making errors on your tax returns and avoids the hassle of using Form 1040-X. You can click through to the official website of NSKT Global, and learn how you can benefit from the tax services offered by a well-qualified and dedicated team of professionals.

#Taxtips2023#businesstaxes#taxfiling#federaltaxreturns#GlobalTaxes#taxseason#tax2023#taxprofessional#taxation#businesssowner#freetaxconsultant#taxconsultant#cpa#audit#taxplanning#payroll#irs#taxrefund#taxprep#taxesforsmallbusiness#incometaxt#taxaccountant#amendedtaxes#amendedtaxreturn

0 notes

Photo

Happy Tax Day #taxday #taxes #taxseason #tax #taxpreparer #taxtips #taxreturn #taxrefund #taxtime #taxprofessional #taxprep #taxhelp #taxpreparation #taxplanning #taxation #taxprofessionals #taxservice #irs #taxmoney #taxcollection #incometax #taxfree #w #accounting #taxschool #money #taxreform #taxdeadline #cpa #bookkeeping

0 notes

Text

Estimated taxes are advance payments made to the IRS throughout the year on income not subject to regular withholding.

#estimated tax#tax filing#tax prep#bookkeeperlive#tax preparation service#accounting and tax preparation service

0 notes

Video

Darmowe rozliczenia podatkowe dla nowojorczyków from RAMPA on Vimeo.

Burmistrz Nowego Jorku Eric Adams i NYC Health + Hospitals ogłosiły, że kwalifikujący się nowojorczycy mogą korzystać z bezpłatnej usługi przygotowania rozliczeń podatkowych – z usługi skorzystać można osobiście w jednym z ponad 130 punktów zlokalizowanych w różnych częściach miasta, ale również drogą internetową.

Usługa realizowana jest we współpracy z BronxWorks, Grow Brooklyn, Urban Upbound i inicjatywą Code for America GetYourRefund.

Bezpłatne przygotowanie rozliczeń podatkowych jest dostępne dla nowojorczyków, którzy zarabiają 85 000 dolarów lub mniej rocznie i składają wnioski jako rodzina, lub którzy zarabiają 59 000 dolarów lub mniej rocznie i składają wnioski jako osoba indywidualna lub para bez osób na utrzymaniu. Nie ważny jest status imigracyjny. Dodatkowo, z bezpłatnych corocznych rozliczeń podatkowych, ale również przy realizacji kwartalnych płatności, skorzystać mogą osoby samozatrudnione, czyli rozliczające się jako SELF_EMPLOYED. Podczas konferencji informacyjnej z mediami etnicznymi, o szczegółach programu mówiła komisarz Consumer and Worker Protection (DCWP) Vilda Vera Mayuga.

Radio RAMPA zapytało o to, kto zajmuje się przygotowywaniem rozliczeń podatkowych, oraz, czy osoby te gotowe są rozliczać osoby samo-zatrudnione, których rozliczenia niejednokrotnie są dużo bardziej skomplikowane. Komisarz Mayuga odpowiedziała, że osoby zajmujące się rozliczeniami są licencjonowane przez IRS, oraz że na liście miejsc oferujących rozliczenia, są wyszczególnione te, które zajmują właśnie rozliczeniami dla osób samozatrudnionych.

Aby dowiedzieć się więcej - a także sprawdzić, gdzie znajdują się punkty rozliczeń - odwiedź stronę nyc.gov/taxprep lub zadzwoń pod numer 311 i powiedz TAX PREP – wtedy wybrać będziesz mógł język polski – w każdym z dostępnych punktów, można poprosić o tłumacza w języku polskim i z tłumaczem takim będzie można połączyć się telefonicznie.

Termin rozliczeń podatkowych mija 15 kwietnia 2024 roku.

0 notes

Text

The IRS is piloting new software that could let...

Though it's currently a limited pilot, the rollout of Direct File could result in a future where Americans can easily file both federal and state taxes for free without dealing with a for-profit middle man. #taxprep #irs #directfile

The IRS is piloting new software that could let...

Direct File will be open only to people with certain tax situations living in certain states at the outset.

Korn Ferry Connect

0 notes

Text

Getting ready for the start of tax season2023! #taxes #taxes2023 #taxes2023refund #taxes2023update #taxtime #taxtip #taxhelp #taxpreparation #taxprep #taxprep2023 #tax

#taxprep#taxhelp#taxtime#tax professionals#tax preparation#tax consultant#tax refund#taxation#income tax#tax credits#tax break#tax planning#tax review

0 notes

Text

CPA Firms Near Me

GKM provides quality tax preparation, affordable accounting & small business bookkeeping services to accounting firms, CPAs and tax preparers in the US.

GKM was established by a team of professionals with two decades of industry experience in tax preparation, bookkeeping, compilation services, consulting and payroll. GKM’s team includes dedicated and experienced Certified Public Accountants, Chartered Accountants and senior management graduates whose specializations blend perfectly to meet exact client requirements.

0 notes