#startupsidea

Text

Why Angel Investors May Reject Funding for Your Startup

Securing funding from angel investors is crucial for many startups, but it can be a challenging task. Angel investors are often high-net-worth people that offer funds in return for shares to early-stage firms. However, getting them to invest in your company is not always easy.

There are several reasons why angel investors might say no to funding your venture. These reasons can include a lack of trust in the management team, unrealistic valuations, unclear exit strategies, and poor research. It's essential to understand why potential investors might reject your proposal and to take steps to avoid these pitfalls.

This can increase the chances of success in raising capital and move your business forward. In this article, we will explore some of the reasons why angel investors might say no to funding your venture and provide insights on how to avoid them.

Investors find you untrustworthy:

Trust is crucial when it comes to securing funding from angel investors. If investors perceive you as untrustworthy, it's unlikely they will invest in your company. This could be due to a lack of honesty and transparency in your communication, or a history of shady business practices. To avoid this, it's essential to be transparent and honest with your investors and to establish a strong reputation in the startup community.

Lack of research:

Angel investors want to see that you've done your homework before approaching them for funding. If you haven't conducted thorough research on your market, competitors, and business model, they will likely reject your proposal. To avoid this, make sure to conduct extensive research and provide detailed data to back up your claims.

Unrealistic valuation and/or investment terms:

Valuation is one of the most critical factors in securing funding from angel investors. If your valuation is too high, investors will be less likely to invest, as they will see a lower potential for return on their investment. Similarly, if your investment terms are too onerous, investors may be hesitant to invest. To avoid this, make sure to conduct thorough research on industry standards for valuation and investment terms, and use this information to set realistic expectations for your company.

Poor management team:

Angel investors invest in people as much as they do in ideas. If your management team lacks the necessary skills, experience, and vision to execute your business plan, investors will be less likely to invest. To avoid this, make sure to assemble a strong management team with the necessary skills, experience, and vision to execute your business plan.

Unclear exit strategy:

Angel investors are looking for a return on their investment, and they need to know how they can exit their investment. If you don't have a clear exit strategy, investors will be less likely to invest. To avoid this, make sure to have a clear exit strategy in place, and communicate this to potential investors.

In conclusion, getting funds from angel investors might be difficult, but it is not impossible. By understanding the reasons why investors might say no to funding your venture, you can take steps to avoid these pitfalls and increase your chances of success. Remember to be transparent and honest, conduct thorough research, set realistic expectations, assemble a strong management team, and have a clear exit strategy in place.

#startup#impactfulpitch#fundraising#pitchdeck#business#enterpreneur#startuppitch#startupsidea#impact#impactful#investor#entrepreneur#ecosystem#funding#strategies#management#team

26 notes

·

View notes

Text

Why You'll Never Succeed at Railroads Market?

In the recent years, tourism industry has witnessed a substantial growth in Asia Pacific and European countries. These countries are attracting tourists from within the region and from other nations. Many tourists are selecting trains owing to their low fares and high connectivity. In addition, there has been an increasing demand for freight due to rapid industrialization and growth in imports and exports in Asian countries.

Many governments and private organizations are increasingly investing to expand railways in their countries. For instance, in October 2017, the Indian Railway minister announced USD 150 million investments over 2018-2023. These investments are expected to be directed towards comfortable, safe, and secure travel of the passengers in the country. Similarly, in January 2018, China’s national railway operator announced an investment of USD 113 billion in fixed rail assets. This fund is expected to be diverted towards the construction of 4,000 km of new lines in the country. Such investments are expected to boost the market growth during the forecast period.

0 notes

Photo

It's time to put your words into action. . . #personalbranding #personaltrainer #personaldevelopment #publicspeaking #publicspeaker #entrepreneurs #entrepreneurialjourney #entrepreneurialmindset #millionairemotivation #billionairemotivation #billionaire #startupsideas #startup #curiousraunak #youngtalent #youngentrepreneur #explorepage #TheCuriousRaunakShow #TheBusinessBoy #business #businessathome https://www.instagram.com/p/CDAb4GXjQi8/?igshid=1xl6aqtdp5uxk

#personalbranding#personaltrainer#personaldevelopment#publicspeaking#publicspeaker#entrepreneurs#entrepreneurialjourney#entrepreneurialmindset#millionairemotivation#billionairemotivation#billionaire#startupsideas#startup#curiousraunak#youngtalent#youngentrepreneur#explorepage#thecuriousraunakshow#thebusinessboy#business#businessathome

0 notes

Link

Got an inspiring entrepreneurial story or an exclusive entrepreneur interview?

0 notes

Video

Looking for great ideas to kickstart a new business? This video is going to unravel 5 exclusive #Startup ideas to help you with the process.Yes, it's time to boost your start-up with top-end business ethics- https://bit.ly/2ox7vyH

0 notes

Quote

Favorite tweets: Marketing Day: Local search, an Amazon holiday report & adaptive ana... https://t.co/4ShNHfOzAt #DigitalMarketing http://pic.twitter.com/QzsfIBUS1w…— Startups idea! (@startupsidea) January 4, 2017

http://twitter.com/startupsidea

0 notes

Text

The Role of Investors in Shaping the Future of the Business Ecosystem

A business ecosystem is a network of organizations and individuals, including suppliers, customers, competitors, and regulatory agencies, that are interconnected and interdependent, and that together create value for all participants.

Investors play a crucial role in shaping the future of business ecosystems by providing the financial capital necessary for growth and development, and by making strategic investment decisions that influence industry trends and drive innovation.

The purpose of this article is to explore the role of investors in shaping the future of business ecosystems and to examine the ways in which they influence the development of industries and the market.

The Influence of Investors on Business Ecosystems

A. Investment Capital: Investors provide the financial capital that businesses need to grow and succeed. Without access to capital, many businesses would be unable to develop new products, expand into new markets, or invest in new technologies.

B. Investment Decisions: Investors also play a key role in shaping the future of business ecosystems by making investment decisions that have a significant impact on industry trends and the development of new technologies. By investing in emerging technologies, for example, investors can help spur innovation and drive growth in new industries.

C. Impact on Industry Trends: Investors can also influence industry trends by choosing to invest in specific sectors, such as technology, energy, or healthcare. This investment can create new opportunities for businesses in these sectors, as well as drive competition and innovation.

Types of Investors and Their Role in Shaping Business Ecosystems

A. Venture Capitalists: Venture capitalists are investors who provide capital to early-stage companies with high growth potential. They play a critical role in shaping the future of business ecosystems by providing the resources necessary for startups to develop their ideas and bring new products to market.

B. Private Equity Firms: Private equity firms invest in mature companies that have established revenue streams and a proven track record. They play a role in shaping business ecosystems by providing the capital necessary for these companies to grow and expand their operations.

C. Angel Investors: Angel investors invest in early-stage companies. They play a role in shaping business ecosystems by providing seed capital and mentorship to entrepreneurs and helping to bring new ideas and technologies to market.

Ways Investors Shape Business Ecosystems

A. Investment in Emerging Technologies: Investors play a key role in shaping the future of business ecosystems by investing in emerging technologies and innovations. This investment can help spur innovation, create new industries, and drive economic growth.

B. Support for Entrepreneurs: Investors also play a role in shaping business ecosystems by providing support for entrepreneurs. This support can come in the form of mentorship, access to resources, and capital. This support can help entrepreneurs bring their ideas to market and grow their businesses, helping to drive innovation and growth in the ecosystem.

C. Investment in Social and Environmental Initiatives: Investors are increasingly recognizing the importance of social and environmental initiatives, and are making investments in companies that are committed to these initiatives. This investment can help shape business ecosystems by promoting sustainable practices and supporting companies that are making a positive impact on the world.

In conclusion, investors play a crucial role in shaping the future of business ecosystems by providing financial capital, making strategic investment decisions, and supporting entrepreneurs and emerging technologies. Their investment and support can drive innovation, create new industries, and promote sustainable practices.

As the world continues to evolve and change, the role of investors in shaping the future of business ecosystems is likely to become even more important. As new technologies emerge and industry trends shift, investors will play a key role in determining which companies and initiatives succeed and which fail.

Final Thoughts:

Ultimately, the role of investors in shaping the future of business ecosystems is to help create a better world by supporting innovation, promoting sustainability, and fostering economic growth. By making strategic investment decisions and providing support to entrepreneurs, investors have the power to shape the future and drive positive change in the world.

#startup#impactfulpitch#fundraising#pitchdeck#business#enterpreneur#startuppitch#startupsidea#impact#impactful#investor#funding#ecosystem#growth

9 notes

·

View notes

Text

G20 Summit in India: Fueling Growth for Startups

The G20 is a forum consisting of 19 countries and the European Union, representing 85% of the global GDP. The G20 aims to promote international economic cooperation and address global economic challenges.

India is set to host the G20 summit in 2023, making it the first time an emerging market economy will host the event. India's economy has been growing rapidly in recent years, and its startup ecosystem has been thriving.

In this article, we will explore India's initiatives for startups, the impact of the G20 Summit on Indian startups, collaboration and partnerships, and the challenges and opportunities faced by startups in India.

G20 Summit and its impact on Indian startups

The G20 has a crucial role in promoting international trade and investment, which can benefit startups in India. The G20 has several initiatives and policies that support startups, including the G20 Digital Economy Taskforce and the G20 Young Entrepreneurs' Alliance. These initiatives aim to create an enabling environment for startups to thrive by promoting access to funding, technology, and markets.

Several successful Indian startups have benefited from G20 policies. For example, OYO Rooms, a hotel aggregator, received funding from SoftBank, a Japanese multinational conglomerate, which is a G20 member country. Another example is BYJU's, an edtech startup, which received funding from Tencent, a Chinese technology company, which is also a G20 member country.

Importance of collaboration and partnerships for startups

Collaboration and partnerships are crucial for startups to succeed, especially in today's globalized world. The G20 has been encouraging collaborations among startups and investors from different countries. For example, the G20 Young Entrepreneurs' Alliance brings together young entrepreneurs from different G20 countries to exchange ideas, share best practices, and explore collaboration opportunities.

Overview of Indian G20's efforts to encourage collaborations among startups and investors

Here are some of the key efforts taken by the Indian G20:

G20 Young Entrepreneurs' Alliance: The G20 Young Entrepreneurs' Alliance brings together young entrepreneurs from different G20 countries to exchange ideas, share best practices, and explore collaboration opportunities. The alliance provides a platform for startups to network, learn from each other, and explore potential partnerships.

G20 Digital Economy Taskforce: The G20 Digital Economy Taskforce aims to promote digital innovation and facilitate the digital transformation of economies. The taskforce provides a forum for startups to engage with policymakers, industry leaders, and other stakeholders to promote the growth of the digital economy.

G20 Business Women Leaders Taskforce: The G20 Business Women Leaders Taskforce aims to promote the economic empowerment of women by removing barriers to their participation in the workforce. The taskforce provides a platform for women entrepreneurs to connect with each other, share their experiences, and explore collaboration opportunities.

G20 Investment and Infrastructure Working Group: The G20 Investment and Infrastructure Working Group aims to promote investment in infrastructure, which is crucial for the growth of startups. The working group provides a forum for startups to engage with investors and policymakers to promote investment in infrastructure.

G20 Digital Finance Working Group: The G20 Digital Finance Working Group aims to promote the development of digital finance, which can provide startups with access to funding and financial services. The working group provides a forum for startups to engage with policymakers, regulators, and industry leaders to promote the development of digital finance.

Conclusion:

In conclusion, the G20 Summit has played a significant role in promoting international trade and investment, supporting startups, and fostering innovation and entrepreneurship worldwide. Its initiatives and policies have been instrumental in nurturing the Indian startup ecosystem and encouraging collaborations between startups and investors. With the G20's continued support, the future of the Indian startup ecosystem looks bright, and startups are poised to make significant contributions to the global economy.

#startup#impactfulpitch#fundraising#pitchdeck#business#enterpreneur#startuppitch#startupsidea#impact#impactful

0 notes

Text

7 Common Red Flags in Pitch Deck One Must Avoid

Pitch decks are essential tools for startups and entrepreneurs seeking funding from investors. They serve as a visual representation of the business plan, outlining key aspects such as the problem, the solution, the target market, and the financial projections. A well-crafted pitch deck can make or break an investor's decision to invest in a startup. However, there are certain red flags that investors watch out for in pitch decks. In this article, we'll explore seven common red flags to avoid in a pitch deck and offer tips on how to create a strong and compelling pitch deck.

Lack of a Clear Problem Statement

One of the most critical components of a pitch deck is the problem statement. Make sure your question statement is clear and concise. If the problem statement is vague or too broad, investors will have a hard time understanding the startup's value proposition. To avoid this red flag, ensure that your problem statement is specific, concise, and clearly defines the problem the startup is addressing.

Poor Market Research

Investors want to see evidence that a startup has conducted thorough market research and understands its target market. If the market research is inadequate or nonexistent, investors will likely view it as a red flag. To avoid this, ensure that your pitch deck includes detailed market research that outlines the size of the market, the target audience, and the competition.

Unrealistic Financial Projections

Financial projections are a critical component of a pitch deck. However, unrealistic financial projections can turn investors off. It's essential to be realistic in financial projections and provide detailed reasoning and assumptions for the projections made. Investors want to see a clear path to profitability and a sound financial strategy.

Lack of a Clear Business Model

Investors want to understand how a startup plans to generate revenue and how it intends to scale. A pitch deck that lacks a clear business model can be a red flag for investors. To avoid this, ensure that your pitch deck includes a detailed description of the business model, including revenue streams, pricing strategy, and growth plans.

Use of complex language

A presentation deck ought to be clear and simple to comprehend. Investors might get turned off by overly technical terminology. The terminology used should be simple, direct, and jargon-free. Use plain words that investors can comprehend.

Lack of a Cohesive Brand Identity

A pitch deck should reflect the startup's brand identity. A lack of a cohesive brand identity can be a red flag for investors. Ensure that the pitch deck is consistent with the startup's branding, including the use of the logo, color scheme, and overall tone.

How to Avoid These Red Flags

Conduct thorough market research and ensure that your problem statement is clear and concise.

Be realistic in your financial projections and provide detailed reasoning and assumptions.

Clearly define your business model and outline your revenue streams and growth plans.

Use simple language that investors can easily understand.

Ensure that the pitch deck is consistent with your startup's branding.

Conclusion

Pitch decks are critical tools for startups and entrepreneurs seeking funding from investors. However, certain red flags can turn investors off. To create a strong and compelling pitch deck, it's essential to avoid these red flags.

Hope you found this article useful!

#startup#impactfulpitch#fundraising#pitchdeck#business#enterpreneur#startuppitch#startupsidea#impact#impactful#red flags

0 notes

Text

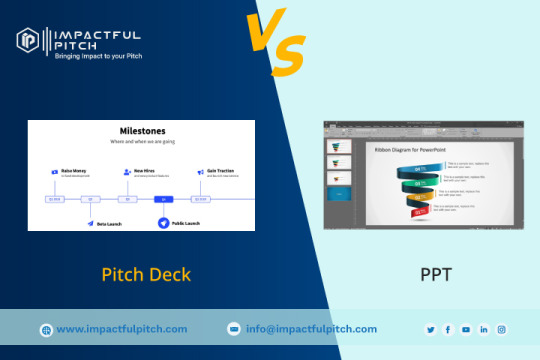

Key Differences between a Pitch Deck and a PPT

In the world of business, communication is key. Whether you're looking to pitch a new product, make a sales presentation, or share information with your team, having the right tools and techniques can make all the difference. Two common tools that are often used for these purposes are pitch decks and PPTs. Although they can both be used for similar things, there are some significant variations between the two that are important to note.

Pitch Deck vs. PPT

A pitch deck is a visual presentation that's typically used to pitch a business idea or proposal to potential investors, clients, or partners. It's usually a streamlined presentation that includes key information about the business, such as its products or services, market opportunity, revenue model, team, and financial projections. The goal of a pitch deck is to convince the audience that the business idea is worth investing in or supporting.

A PPT, on the other hand, is a more general term for any type of presentation created using Microsoft PowerPoint or similar software. PPTs can be used for a variety of purposes, from presenting data to training employees. Unlike a pitch deck, there's no specific goal or outcome that a PPT is designed to achieve.

Purpose of a Pitch Deck and PPT

While both pitch decks and PPTs can be used for presenting information, they have different purposes. The primary purpose of a pitch deck is to convince the audience to take a specific action, such as investing in a business idea. In contrast, the purpose of a PPT is more general, and may be used for anything from sharing information to training employees.

Differences in the Goals of a Pitch Deck and PPT

Because the goals of a pitch deck and PPT are different, the design and layout of each should also be different. Pitch decks are typically more streamlined, with a focus on the most important information.

They should be visually engaging and use images and graphics to help convey the key points. PPTs, on the other hand, can be more detailed and informational and may include more text and data. The goal of a PPT is to provide information, while the goal of a pitch deck is to persuade.

The Difference in Terms of Design and Layout

The design and layout of a pitch deck and PPT should be tailored to the specific audience and purpose of the presentation. For example, if you're presenting to potential investors, a pitch deck should be designed to be visually engaging and persuasive.

This might include using high-quality images, bold fonts, and clear, concise language. In contrast, if you're presenting data to your team, a PPT might be more detailed and informational, with graphs and charts to help convey the data.

The Difference in Terms of Content

While the design and layout of a pitch deck and PPT are important, the content is what really matters. The content of a pitch deck should be focused on the key points that are most important to the audience. This might include information about the business idea, the market opportunity, the team, and financial projections.

In contrast, the content of a PPT will depend on the purpose of the presentation. For example, if you're presenting data, the content might include graphs, charts, and tables. If you're training employees, the content might include step-by-step instructions and visual aids.

In conclusion, using the right format for the right audience is crucial when it comes to business presentations. Whether you're creating a pitch deck to convince investors, or a PPT to train your team, it's important to tailor the design, layout, and content to the specific audience and purpose of the presentation.

By doing so, you can ensure that your message is conveyed effectively and that you achieve the desired outcome. Remember, the goal of a pitch deck is to persuade, while the goal of a PPT is to provide information. By keeping these differences in mind, and by using the appropriate format for the situation, you can create powerful presentations that get results.

#startup#impactfulpitch#fundraising#pitchdeck#business#enterpreneur#startuppitch#startupsidea#impact#impactful#presentación#investor

0 notes

Text

The Art of Creating an Effective Video Pitch: A Comprehensive Guide

Video pitches are becoming increasingly popular for businesses and startups to introduce themselves to potential investors, partners, and clients. A well-crafted video pitch can be an effective way to convey your message and differentiate yourself from the competition. In this article, we’ll provide you with a comprehensive guide to creating an effective video pitch that can help you achieve your goals.

Defining Your Message

The first step in creating a video pitch is to define your message. Start by identifying your target audience and understanding what they want and need. You can determine your unique selling proposition if you have a firm grasp of your target market. What distinguishes your company from others? What benefit do you provide? You must develop a clear, succinct message that effectively communicates your value offer to your target audience.

Planning Your Video

When you've decided on your message, you must plan your video. Decide the tone you want your pitch to have. Depending on your audience and message, this might be serious, funny, or inspirational. It's crucial to construct a storyboard outlining the essential components of your video. This makes it easier for you to stay on task and guarantees that you cover all the crucial details in a logical sequence.

Scripting Your Video

While creating a video pitch deck, one of the most crucial things is to determine how would be your script for the video. I would recommend using layman's language to create the scrpit, in order to make your audience easily understand the business or your product. Using technical or jargon terminology would confuse them. Make sure your message is clear and that your script flows properly.

Filming and Editing

It's time to start filming your video after you have your script. Make sure your video and audio are of a high calibre by using a good camera and microphone. Lighting is also an important consideration. Poor lighting can make your video look unprofessional, so make sure you use proper lighting. After filming, you need to edit your video. This is where you can add captions, music, and other special effects that enhance your message.

Adding Visual Elements

Adding visual elements to your video can make it more engaging and help convey your message more effectively. Graphics, animations, and other visual effects can help bring your message to life. Using visual components strategically is crucial, though. Avoid adding too many graphics to your video as this may divert viewers from your content.

Creating a Compelling Call to Action

Every good video pitch should have a strong call to action. In this section of your video, you should instruct your viewers on what to do next. This can be to make a purchase, set up a meeting, or subscribe to a newsletter. Your call to action should push your audience to act by inspiring them to do so.

Final Tips for Success

To ensure that your video pitch is successful, there are a few final tips to keep in mind. In order to make your pitch fluent, make sure to rehearse it multiple times. In order to enhance your pitch, get other people's opinions. Lastly, make sure that your video pitch is accessible and shareable. Post your video to a video-sharing platform like YouTube or Vimeo and share the URL with your audience.

Conclusion

Creating an effective video pitch requires careful planning and execution. By defining your message, planning your video, scripting, filming and editing, adding visual elements, and creating a compelling call to action, you can create a video pitch that resonates with your audience and helps you achieve your goals. By following these steps, you can create a pitch that sets you apart from the competition and helps you succeed in the world of business.

#startup#impactfulpitch#fundraising#pitchdeck#business#enterpreneur#startuppitch#startupsidea#impact#impactful#investor#videopitch#startup pitch

1 note

·

View note

Text

Revolutionizing the Startup World: The Transformative Power of Technology

Startups are freshly established firms that are in the early phases of development. These companies are usually founded by entrepreneurs who seek to develop a unique business idea and bring it to the market.

Over time, technology has played a bigger and bigger part in startups. The way startups function has been completely transformed by technology, which has also provided a variety of development and success opportunities. This article will examine the significance of technology for startups, as well as its advantages, difficulties, and futures.

The importance of technology in the startup world

Technology plays a crucial role in the startup world, as it can help to level the playing field between small startups and large, established corporations. By leveraging technology, startups can compete with larger companies and gain a competitive advantage in the market.

With the advent of cloud computing, big data analytics, and mobile technologies, startups can access powerful tools and resources that were previously only available to larger organizations.

The benefits of technology for startups

A. Increased efficiency and productivity

Startups can improve their efficiency and productivity by streamlining their processes and using the appropriate technological solutions. For instance, startups can use project management tools to track progress, automate routine tasks, and enhance collaboration among team members.

B. Better data analysis and decision-making

Data is an essential asset for startups, as it can help them make informed decisions and identify opportunities for growth. By using data analytics tools, startups can collect and analyze data, gain valuable insights, and make data-driven decisions.

C. Cost savings and cost-effective operations

Technology can help startups to reduce their operating costs and improve their profitability. For example, cloud computing allows startups to access powerful computing resources without having to invest in expensive hardware and infrastructure.

The challenges of technology for startups

A. Keeping up with rapidly changing technology

Technology is constantly evolving, and startups must stay up-to-date with the latest developments to remain competitive. Failure to keep up with emerging technologies can lead to a competitive disadvantage.

B. Attracting and retaining top tech talent

Startups must attract and retain top tech talent to develop and implement effective technology solutions. However, competing with larger organizations can be challenging, as startups often have limited resources and must offer competitive compensation packages to attract the best talent.

C. Overcoming the high costs of implementing technology

Technology solutions can be costly, and startups may face challenges in acquiring the necessary funding to implement them. Startups must carefully balance their investment in technology with other essential expenses, such as marketing and product development.

Future of technology and startups

The future of technology presents several emerging trends that can have a significant impact on startups. These trends include artificial intelligence, blockchain, and the Internet of Things (IoT).

Artificial intelligence (AI) is expected to transform the way startups operate by automating routine tasks, improving data analysis, and enhancing customer experience. Blockchain technology can provide startups with a secure and transparent way to store and manage data, while IoT can help startups to collect data from connected devices and use it to optimize their operations.

Final Thoughts:

Startups must embrace technology and leverage it to achieve their business objectives and goals. By continuously monitoring emerging trends, developing a technology strategy, investing in training and development programs, and partnering with technology experts, startups can stay ahead of the curve and continue to grow and succeed. However, startups must also carefully balance their investment in technology with other essential expenses and ensure that their technology solutions align with their business needs and goals.

#startup#impactfulpitch#fundraising#pitchdeck#business#enterpreneur#startuppitch#startupsidea#impact#impactful#investor

0 notes

Text

What Research Says About Propane Market?

Depletion of non-renewable resources; crude oil and increasing environmental concerns have invigorated research of various innovative sustainable technologies that employ bio-based raw materials for production. Strengthening governmental and federal regulations which are likely to restrict traditional processing from non-renewable resources can be overwhelmed using innovative sustainable technologies.

Industrial was the largest end-use category in 2016 .and is expected to maintain a comparatively high growth rate over the forecast period. Chemicals and refinery were the primary market movers and achieved a share of over 14% in 2016.

#research#market research#startupsidea#business entrepreneur motivation success marketing love money mindset inspiration instagood entrepreneurship instagram lifestyle goals li...#entrepreneur#motivation#success#marketing

0 notes

Text

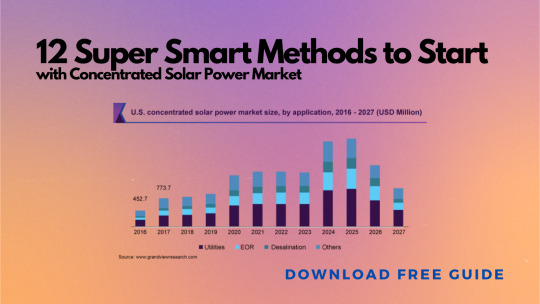

12 Super Smart Methods to Start with Concentrated Solar Power Market

Changing preferences for clean sources of energy over non-renewable sources of energy is projected to propel the market growth over the projected timeframe. Supportive government initiations and regulations on reducing greenhouse gas (GHG) and carbon emissions will further augment market growth. Increasing power demand, along with growing investments to enhance the efficiency index, will offer an incentive to the business growth.

0 notes