#social security cuts

Text

On Thursday, the Social Security Administration announced its largest cost of living adjustment for beneficiaries in four decades, an inflation-driven raise of 8.7% that will take effect in January 2023. That increase matches the average annual COLA from 1975 through 1982, an era of recessions and high inflation. Annual Social Security raises declined after that year. From 1996 through 2021, they averaged 2.3%, and were zero in some years. The 2021 raise was substantially higher: 5.9%.

The new increase in benefits will be pricey. On the other hand, the cost to taxpayers of the entire Social Security program pales in comparison with the cost of federal subsidies for rich Americans enrolled in private or supplemental retirement plans, such as individual retirement accounts (IRAs). According to Federal Reserve data from 2019, only 31% of households from the poorest half of the wealth spectrum contributed to such a plan, while 91% of households in the top wealth decile did.

This suggests that low-wealth retirees rely heavily or exclusively on Social Security, but all US workers get to collect benefits starting at age 62. As of last month, nearly 66 million Americans, rich and poor alike, were getting monthly checks. Most are retirees, but there are also spouses, disabled workers, survivors of deceased workers, and dependent children. The largest and best-compensated group, the retired workers, averaged $1,674 a month, or about $20,000 per year.

The SSA now pays out about $1.2 trillion a year in benefits all told, but those outlays are largely funded by payroll taxes paid by workers who will later reap the benefits. In 2021, the price tag of the entire program—benefits plus administrative costs—totaled $1.14 trillion, of which $1.09 trillion was covered by payroll taxes, income taxes on benefits, and interest. In other words, the federal Social Security subsidy was only about $50 billion.

Compare that with subsidies for private plans and IRAs, which cost the government nearly eight times as much—about $380 billion a year, according to the Joint Committee on Taxation. And unlike Social Security subsidies, these subsidies skew heavily toward the highest earners.

There’s a reason I noted the year 1996 above. Before then, as I point out in this earlier exposé about America’s retirement system, private retirement accounts were strictly regulated and not heavily subsidized. Starting that year, federal lawmakers—led by then Reps. Rob Portman (R-Ohio) and Ben Cardin (D-Md.), began introducing bipartisan retirement “reform” packages that pumped more and more federal dollars into bolstering private retirement savings, mainly to the benefit of high-income workers and Wall Street.

University of Virginia law professor Michael Doran, who dug deep into the subject for a January 2022 paper titled, “The Great American Retirement Fraud,” suggested that lawmakers, rather than helping rich Americans shuffle even more of their money into tax-deferred or tax-exempt retirement funds, could instead pass laws to benefit Americans who actually need help in retirement. That might include simply beefing up Social Security, he wrote.

Instead, yet another bill that benefits wealthy savers sailed through Congress. And Republican Rick Scott released a set of aspirations for his own party—an 11-point “Plan for America,” of which one provision would let all federal laws “sunset” every five years—including laws governing Social Security and Medicare.

#us politics#news#mother jones#social security administration#social security cuts#social security#social security works#individual retirement accounts#federal reserve#cost of living adjustment#Joint Committee on Taxation#Rep. Rob Portman#rep. Ben Cardin#Michael Doran#The Great American Retirement Fraud#sen. rick scott#Plan for America#2022

47 notes

·

View notes

Text

#us politics#republicans#conservatives#tweet#twitter#2023#gop#gop platform#gop policy#republicans be like#conservatives be like#social security cuts#medicare cuts#welfare programs#auctions#fundraising#rep. marjorie taylor greene#rep. kevin mccarthy

32 notes

·

View notes

Text

Social Security and Medicare might not be important to you, but I guarantee it's important to someone you know, whether it's your parents, or grandparents, or friends... someone you know relies on that money. Plus, you're paying into those programs with every pay check. That's your money. You will never get that money back.

#Social Security#Medicare#cuts#cut#reduction#reductions#ManChildTrump#Donald Trump#Trump#Drumpf#Crybaby Trump#Tiny Hands#Limp Dick#Spanky#Pee Brain#Cadet Bone Spurs#Five Deferment Don#The Orange Menace#The Manchurian Cantaloupe

550 notes

·

View notes

Text

By Jake Johnson

Common Dreams

Nov. 29, 2023

The Republican-led push to establish a fiscal commission for the U.S. debt was met with vocal opposition during a House Budget Committee hearing on Wednesday, with progressive advocates and Democratic lawmakers calling the proposal a thinly veiled ploy to further undermine and cut Social Security and Medicare.

Rep. Jim McGovern (D-Mass.), one of eight witnesses who testified at Wednesday's hearing, said he was "a little skeptical" that Republican lawmakers are now concerned about the national debt given that they have driven it up with tax cuts for the rich and large corporations in recent years—and are still trying to increase it.

According to one analysis, the series of tax cuts approved under former Presidents George W. Bush and Donald Trump have added $10 trillion to the debt since their enactment and are responsible for the bulk of the increase in the debt ratio since 2001.

Social Security, by contrast, is not a driver of federal deficits.

"If we want to ensure long-term solvency [for Social Security], there are two choices: Some on the other side think we should cut benefits, I think we should ask the ultra-rich to pay their fair share. We don't need a commission to tell us that," McGovern said during his testimony. "And my fear is that a commission would be used by some as an excuse to slash Social Security, Medicare, Medicaid, and other federal anti-poverty programs."

Rep. Jan Schakowsky (D-Ill.), a member of the House Budget Committee who served on the infamous Bowles-Simpson commission that proposed deep cuts to Social Security, expressed similar concerns during Wednesday's hearing.

Schakowsky said she was "happy" the Bowles-Simpson proposals—which she vocally opposed at the time—weren't adopted and warned that a fiscal commission of the kind backed by Republicans and right-wing Democrats is "a way for members of Congress to get out from under having to take the blame for the kinds of cuts that may be presented."

In an op-ed for Common Dreams on Wednesday, Schakowsky wrote that "if Republicans cared about improving our fiscal position, they would demand the rich pay their fair share."

"If Republicans wanted to actually solve our budget challenges, they would robustly fund tax enforcement to ensure corporations are complying with laws already on the books," she added. "But Republicans aren't serious about the deficit. They aren't even serious about governing. They are serious about only one thing, and that's ripping away Social Security from seniors behind closed doors."

Wednesday's hearing examined three pieces of legislation put forth by bipartisan groups of lawmakers in the House and Senate.

A bill introduced earlier this month by Sens. Mitt Romney (R-Utah) and Joe Manchin (D-W.Va.)—both of whom testified at Wednesday's hearing—would form a 16-member bipartisan, bicameral fiscal commission comprised of 12 elected officials and four outside experts tasked with crafting legislation to "improve solvency of federal trust funds over a 75-year period."

If approved by the commission, the legislation would be put on a fast track in the House and Senate.

Romney insisted during his testimony Wednesday that he doesn't know of a single Republican or Democrat who wants to cut Social Security and said benefit reductions should be off the table.

But Social Security Works, a progressive advocacy group, pointed out that a proposal released earlier this year by the Republican Study Committee (RSC)—a panel comprised of 175 House Republicans—called for raising the Social Security retirement age, which would de facto cut benefits across the board.

Rep. Jodey Arrington (R-Texas), who presided over Wednesday's hearing, is a member of the RSC. During his opening remarks, Arrington described efforts to prevent what he called a "sovereign debt crisis" as "our generation's World War."

Alex Lawson, executive director of Social Security Works, told Common Dreams that "at today's hearing, Republicans made the true purpose of their 'fiscal commission' crystal clear: demolish Social Security and Medicare behind closed doors, while avoiding accountability from voters."

"Chairman Jodey Arrington referred to the commission's supporters as 'partners in crime,'" Lawson added. "That's exactly what they are: criminals who are plotting to reach into our pockets and steal our earned benefits."

"It should be a national scandal that middle- and working-class families have to pay Social Security taxes on all of their income but millionaires and billionaires do not."

Instead of taking the deeply unpopular step of slashing benefits, Democrats who spoke at the budget committee hearing argued that Congress should pass legislation requiring the rich to contribute more to Social Security. This year, because of the payroll tax cap, millionaires stopped paying into the program in late February.

"It should be a national scandal that middle- and working-class families have to pay Social Security taxes on all of their income but millionaires and billionaires do not," said McGovern.

Rep. Brendan Boyle (D-Pa.), the top Democrat on the House Budget Committee, said at Wednesday's hearing that Congress could extend Social Security's solvency through the end of the century by requiring the rich to pay more in taxes.

"I think that is fair. I think that is appropriate," said Boyle. "And for those who disagree, I would be very interested in seeing what their plan is and their alternative."

Following the hearing, Rep. Summer Lee (D-Pa.) delivered a speech on the House floor condemning Republicans for working to "establish a death panel commission to gut earned benefits" and described the effort as part of a "cycle" that must be opposed.

"First, Republicans pass tax handouts for their filthy rich donors, promising a trickle-down miracle that never has and will never happen—from Reaganomics to Trump's tax scam," said Lee. "Then, when their tax scam causes the economy to slow and deficits to grow, they refuse to correct their mistake. Instead they blame immigrants, poor folks, Black folks, and brown folks."

"Then they repeat the cycle," she continued, "hoping enough of us will forgive or forget their scheme to tear away Medicare and Social Security and believe their lie that they were 'only after' food assistance, healthcare, and housing for poor folks—not your earned benefits—when the truth is that they always were and always will be after it all."

6 notes

·

View notes

Text

#GOP#republicans#rethuglicans#deficit#national debt#social safety nets#social security#medicare#trump tax cuts#income tax

5 notes

·

View notes

Text

Have patience . . .

November 7, 2023

ROBERT B. HUBBELL

Republicans can’t help themselves. On a day that should have been non-stop coverage about the NYTimes poll, Speaker Mike Johnson suggested that Republicans should cut Medicare and Social Security. See The Hill, Johnson embraces deficit fight, setting up battle over Medicare, Social Security. Johnson faces a November 17 shutdown and has nothing to show for his brief tenure as Speaker. Instead of passing the twelve funding bills necessary to enact a budget, Johnson resurrected Kevin McCarthy’s proposal of a “bipartisan commission” to reduce the deficit by cutting Social Security and Medicare.

Before his accidental elevation to Speaker, Mike Johnson chaired the Republican Study Committee (RSC), which has long advocated cutting Medicare and Social Security—even though both are fully self-funding programs with sufficient reserves to pay 100% of their benefits through 2031 and 2034 respectively. But Republicans view Social Security and Medicare as “socialist” programs that deprive Americans of the “freedom” to experience financial and medical insecurity in retirement.

Per The Hill (linked above),

As RSC chair in 2020, Johnson authored a budget that called for raising the Medicare and Social Security eligibility ages. It called for $2 trillion in cuts to Medicare and $750 billion in cuts to Social Security.

It also called for turning Medicare into a premium support program, where private plans compete alongside traditional Medicare. Instead of a guaranteed benefit, beneficiaries would use a voucher to buy coverage on either a private or Medicare plan.

Johnson’s past support for cutting spending on Medicare and Social Security is in line with longtime Republican dogma. GOP leaders in the past have hammered Social Security, Medicare and Medicaid as socialist initiatives—"inefficient and anti-American” —that threaten individual freedoms.

To be clear, Congress should take action to reduce deficits and the national debt. But the obvious place to start is by restoring the tax cuts gifted by Trump to corporations and wealthy individuals/families in 2017. (Certain cuts to individual income taxes are set to expire in 2025, but corporate, capital gains, and estate tax cuts remain in effect.) Trump's tax cuts (layered on top of Bush’s tax cuts) eliminated tens of trillions in tax revenue and are largely responsible for the increase in the US deficit and debt. See Tax Cuts Are Primarily Responsible for the Increasing Debt Ratio - Center for American Progress.

Per the Center for American Progress (CAP),

Taken together, the Bush tax cuts, their bipartisan extensions, and the Trump tax cuts, have cost $10 trillion since their creation and are responsible for 57 percent of the increase in the debt ratio since then. They are responsible for more than 90 percent of the increase in the debt ratio if you exclude the one-time costs for responding to COVID-19 and the Great Recession.

In short, the US has a tax revenue shortage problem created by Trump and Bush. As noted in the CAP report above, the US is a “low tax rate / revenue” country compared to equivalent economies—e.g., $36 trillion in less tax revenue than the EU over the last decade.

But rather than looking to GOP tax cuts as the source of the US’s current deficit spending, Republicans want to place the consequences of their reckless fiscal policy on the backs of hardworking Americans who earned the right to Medicare and Social Security.

Americans should be outraged. Republicans are threatening the financial and medical security of retirees—many of whom say they will vote for Trump in 2024!

I raise this story first on a day of many important stories to help ground us in the facts that matter regarding 2024. The truth about the GOP’s policies and Biden’s accomplishments has not broken through the noise of negative media narrative, but it will—so long as Democrats do their part as messengers for Biden, messengers for democracy, and messengers for the American people.

The Republican Party relies on deceit, deception, and misdirection in concealing its true agenda. Think of Governor Glenn Youngkin in Virginia—who presents himself as a “moderate” on reproductive liberty but will impose a total abortion ban if Republicans win control of both chambers of the legislature. In Ohio, the Republican Secretary of State wrote a deceptive and misleading description of Issue 1, the proposed constitutional amendment to protect the right to make reproductive decisions. Across the nation, Republicans have enacted “voter protection legislation” that suppresses the vote of Black Americans.

If Republicans were confident in their policies, they would not go to great lengths to conceal the true substance and purpose of those policies. Whenever Democrats have broken through the GOP smokescreen of lies, Democrats win most of the time. That knowledge should fill us with confidence after yesterday’s NYTimes poll: The truth is on our side; we need to work harder to break through the veil of disinformation and negative media narrative. If we can do that—and we can—we can win.

While we cannot rely on Republicans to defeat themselves, they are helping us at every turn. The fact that Speaker Mike Johnson has targeted Social Security and Medicare in his first month on the job is another misstep by Johnson and House Republicans. There will be plenty of additional opportunity in the next ten days as House Republicans use the threat of a government shutdown to slash budgets to make up for GOP tax cuts for corporations and ultra-wealthy taxpayers.

#Speaker of the House#Cutting Social Security#Cutting Medicare#US House of Representatives#Radical Republicans#Robert B. Hubbell Newsletter#Robert b. Hubbell

2 notes

·

View notes

Text

I don’t think we talk about how horrible it is to get a haircut as much as we should

#it's sensory hell and the hairdressers always want to t a l k#ma'am please just cut my hair you don't need to know my grade address and social security number

9 notes

·

View notes

Text

If you have time for one long read this holiday weekend, make it this one.

#Heather Cox Richardson#economy#economic policy#Bush tax cuts#trump tax cuts#supply-side economics#demand-side economics#social safety net#market forces#Social Security and Medicare

1 note

·

View note

Text

OH!!! FUCK I FORGOT I GOTTA FIND AN ARCHERY RANGE NOW THAT I DONT HAVE TITS IM SO EXCITED TO LEARN HOW TO SHOOT CORRECTLY

#i took a full oxy last night and slept well and took one again this morning and feel. pretty good#saw a tiktok that reminded me i love archery :) but it was really hard bc tig biddies but not anymore!!!#idk if i will Get A Bow again(depends on a lot#most of all money shits expensive even on craigslist)#(and my Tax Return Treat this year is going to be a nice seat for my kayak so i can stop sitting on bunches up towels)#(depending on how big my return is i might get a nice roof rack but i doubt it)#god im so excited to Go Do Sports this year im Never Going To Be Inside#i really hope Rob gets his social security so i can afford a pay cut and work a fun job at the audoban society as a tour guide#it speaks#i need a male thot job#also DEFINITELY going to learn to surf this summer the class is only 40$ and i need to do it#also i need. to wait at least a month if not more before i actually do that i know my accurate draw wieght is going too b something patheti#probably 20-30 lbs. if the range is cheap and close by id like to work up to 60-70 but if not its fun to just shoot#i was big talk last summer about deer hunting but i just cant find a good basement freezer#definitely going to fish though#foods too expensive not too

10 notes

·

View notes

Text

By Sharon Parrott

It’s tempting to ignore a budget resolution released just days before the start of the fiscal year that it’s meant to guide, and amid the chaotic debate around a short-term extension of government funding to avoid a shutdown. But House Budget Committee Chair Jodey Arrington’s proposed budget is important for what it illustrates about House Republicans’ disturbing vision for the country: health care stripped away from millions of people, higher poverty and hunger, capitulation to climate change, more tax cheating by high-income people, and large-scale disinvestment from the building blocks of opportunity and economic growth—from medical research to education to child care. It would narrow opportunity, worsen racial inequities, and make it harder for people to afford the basics. It reflects the wrong priorities for the country and should be roundly rejected.

Chair Arrington made clear in his remarks the intent to extend the expiring tax cuts from the 2017 tax law, which included large tax cuts for the wealthy. In addition, the budget resolution itself would pave the way for unlimited, unpaid-for tax cuts that could go well beyond those extensions. The extensions alone would give annual tax breaks averaging $41,000 to tax filers in the top 1 percent and cost more than $350 billion a year, the Congressional Budget Office estimates. The budget reflects none of these costs and fails to explain how—or whether—they will be offset.

A shocking share of the spending cuts Chair Arrington specifies target people with low and moderate incomes, including $1.9 trillion in Medicaid cuts and hundreds of billions in cuts to economic security programs, such as cuts to assistance that helps people afford food and other basic needs. Just last week the Census Bureau released data showing that poverty spiked last year, more than doubling for children. Rather than proposing policies that could reverse this deeply troubling trend, the budget proposal would deepen poverty and increase hardship.

The budget would also make deep cuts in the part of the budget that is funded annually through appropriations bills. Disingenuously, the budget resolution shows that these cuts total more than $4 trillion over ten years—but hides the program areas that would be cut, labeling them “government-wide savings.” But this year’s House Appropriations bills—which include substantial cuts—make clear that cuts would fall on a wide range of basic functions and services that support families, communities, and the broader economy, including Social Security customer service, support for K-12 and college education, funding for national parks and clean air and water, rental housing assistance for families with low incomes, and more.

Chair Arrington claims the budget’s deep and damaging program cuts are in the name of deficit reduction. But the failure to identify a single revenue increase for high-income people or corporations—and in fact, to potentially shower them with more unpaid-for tax cuts—is an extreme and misguided approach. Moreover, calling for a balanced budget in ten years is merely a slogan that has little to do with addressing our nation’s needs—and the budget resolution resorts to gimmicks and games to even appear to get there, including $3 trillion in deficit reduction it claims would accrue from higher economic growth it assumes would be achieved by budget policies.

A budget plan should focus on the nation’s needs and lay out an agenda that broadens opportunity, invests in people and families, reduces the too-high levels of hardship and financial stress faced by households across the country, and raises revenues for those investments. But the Arrington budget blueprint would shortchange much-needed investments and lock in wasteful tax cuts to the already wealthy for the next decade.

House Republicans are pursuing a damaging agenda at every turn—first threatening the nation with default, and now demanding deep cuts in an array of priorities in this year’s appropriations debate, risking a government shutdown, and proposing a budget blueprint that would take the country in the wrong direction.

#us politics#news#common dreams#2023#republicans#conservatives#rep. Jodey Arrington#house budget committee#house republicans#us house of representatives#federal budget#trump tax cuts#trump 2017 tax cuts#congressional budget office#Medicaid cuts#social security cuts#House Appropriations committee#federal deficit#op eds#Sharon Parrott

20 notes

·

View notes

Text

#us politics#2022#gop#Republicans#conservatives#social security checks#social security works#social security#2022 midterms#2022 elections#vote#vote blue#social security cuts

23 notes

·

View notes

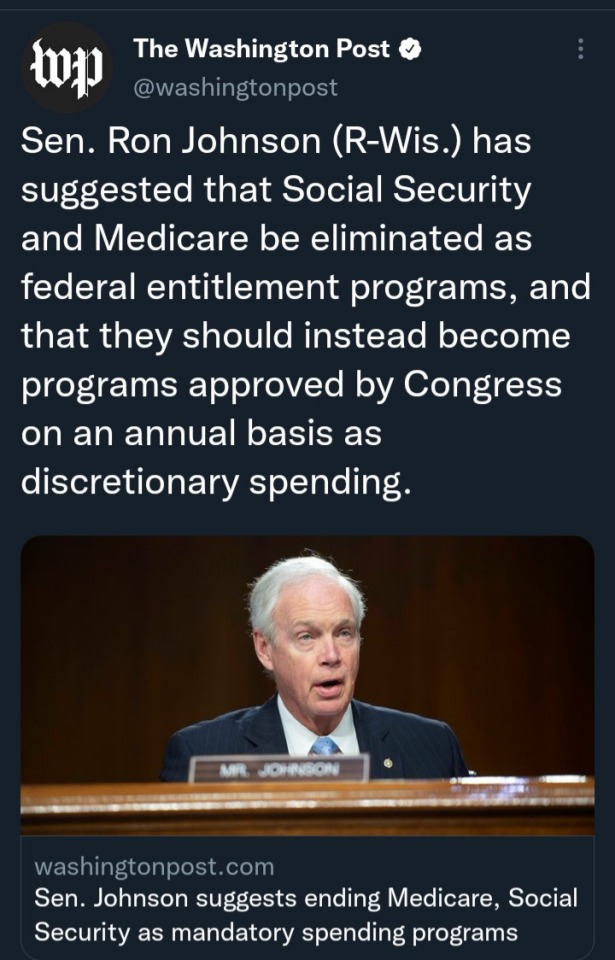

Photo

#Social Security#Medicare#tax#taxes#income tax#tax cuts#Ronald Reagan#Ron Johnson#entitlements#entitlement#benefits#benefit#earned benefits#Republican#Republicans#GOP#MAGA#GQP#spending#spend#budget

183 notes

·

View notes

Photo

Republicans aren’t going to tell Americans the real cause of our $31.4tn debt

5 notes

·

View notes

Text

Be angry

#social security#healthcare#Minimum wage#Billionaire tax cut#Tax cut for billionaires#eat the rich#medicare#medicaid#Child labor#SNAP#food stamps

2 notes

·

View notes

Text

i should become one of those people who sells those button pins on etsy of just like cutout images of characters on colored backgrounds. all of them look like they were cut out by someone who only started learning photoshop to make those pins i could bring something new to the table and also get money

#makes a pin of the girl on the cover of my year of rest and relaxation but actually well cut out and on a complementary background. profit#why does this seem like a good idea. i need to find out if social security will stop giving me disability money and kill me if i do this

4 notes

·

View notes