#rob margolies

Photo

TIM REALBUTO & NOLAN GOULD

2019 • Y E S • Horror • Drama • dir. Rob Margolies

#mᥲ𝗍ᥱ ᥕ᥆𝗍 kіᥒძ ᥆𝖿 ᥲᥴ𝗍іᥒ ᥣᥱss᥆ᥒ іs ძіs#filmedit#lgbtedit#nolan gould#tim realbuto#yes 2019#queer media#kiss#lgbtq+#gay#lgbt#rob margolies#modern family#luke dunphy#moviegifs#filmgifs#lgbtgifs#gaygifs#queergifs#movie#film#based on a play#couple#intimacy#affection#longing#desire#amor#passion#romantic

1K notes

·

View notes

Text

WEREWOLF GAME (2023) Movie adaptation of the adult party game - 4K teaser

‘Judge. Vote. Kill.’

Werewolf Game is a 2023 American mystery horror film based on the iconic party game of the same name in which strangers vote on who to kill.

Directed by Jackie Payne and Cara Claymore from a screenplay written by the former. Produced by Robbie Bryan, Daniel Lonsbury, Rob Margolies and Gretel Snyder.

The Sunstrike Pictures-Different Duck Films co-production stars Tony Todd,…

View On WordPress

#2023#adult party game#Bai Ling#Cara Claymore#horror#Jackie Payne#Lydia Hearst#movie film#Robert Picardo#Teala Dunn#Tony Todd#trailer#Werewolf Game

2 notes

·

View notes

Text

Bobcat Moretti (2024) Movie Review

Bobcat Moretti – Movie Review

Director: Robert Margolies (Immortal)

Writer: Rob Margolies, Tim Realbuto (Screenplay)

Cast

Tim Realbuto (Enchanted)

Vivica A Fox (Independence Day)

Taryn Manning (8 Mile)

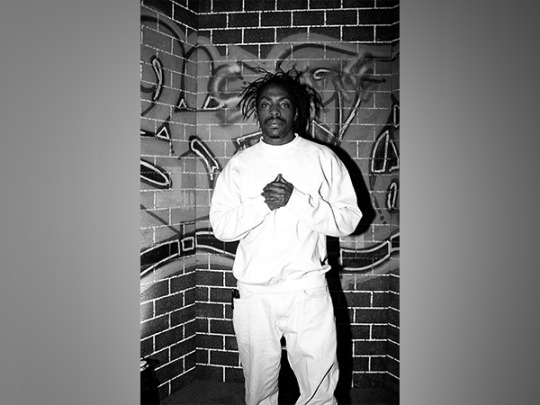

Coolio (Daredevil)

Matt Peters (Orange is the New Black)

Sally Kirkland (The Sting)

Plot: An obese MS patient takes up his late Father’s sport of boxing to overcome personal tragedy and…

View On WordPress

0 notes

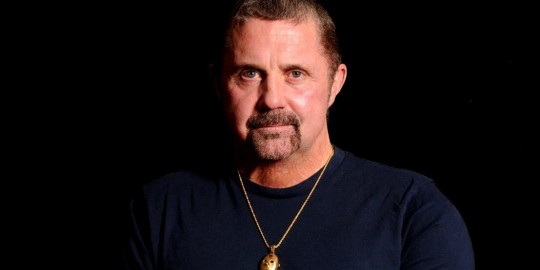

Photo

Come join this talented Filmmaker Rob Margolies and I support you in getting the roles you want to be the best actor you can be!

0 notes

Text

'Gangsta's Paradise' rapper Coolio passes away at 59

Sep 29, 2022 10:26 IST

Los Angeles , September 29 (Always First): US rapper Coolio, best known for his 1995 song 'Gangsta's Paradise', is no more. He was 59.

The news of Coolio's demise was confirmed to The Hollywood Reporter by his manager. The manager informed that the rapper died on Wednesday afternoon at a friend's house in Los Angeles.

"He went to use the bathroom and never came out," he said. The cause of death is not known yet.

Coolio rose to fame in the mid 1990s with three of his albums -- It Takes a Thief (1994), Gangsta's Paradise (1995) and My Soul (1997) -- crossing over into the mainstream, driven by a clutch of more chart-friendly singles, including "Fantastic Voyage," "1, 2, 3, 4 (Sumpin' New)" and "C U When U Get There." He had won Grammy Award for 'Gangsta's Paradise'.

He had also composed song for the 1996-2000 Nickelodeon sitcom Kenan & Kel, starring Kenan Thompson and Kel Mitchell; voiced the character Kwanzaa-bot on Futurama; and appeared in such movies as Dear God (1996), Batman & Robin (1997), Submerged (2000) and Stealing Candy (2003).

Coolio was born in Monessen, Pennsylvania south of Pittsburgh. He then moved to California where he attended community college. He also worked as a volunteer firefighter and in airport security before devoting himself full-time to the hip-hop scene.

According to his IMDb page, Coolio had three movies in the works: Rob Margolies' "Bobcat Moretti," a monster film called "It Wants Blood 2" and a TV movie "Vegas High." Coolio also continued to perform, having just recently played a set at Chicago's Riot Fest on September 18, Variety reported. (Always First)

Read the full article

0 notes

Text

Pollstar Live

Pollstar Live! is the world’s largest gathering of live entertainment professionals and the flagship event for Pollstar magazine, the leading trade publication for the global live entertainment industry. With over 30 years of history, the Pollstar Live! Conference offers three (3) days of compelling discussions led by visionaries in the live entertainment business beginning with Production Live!, a full day dedicated to production and transportation in live events, followed by Pollstar Live!, including our Annual Pollstar Awards celebration.

Last 2022 SPEAKERS INCLUDED:

Jenna Adler CAA | Omar Al-Joulani Live Nation Concerts | Jeffrey Azoff Full Stop Management | Jonathan Azy Culture Collective | Gerry Barad Live Nation | Adam Bauer Madison House | Cristina Baxter WME | David Beame Global Citizen | John Benn LA Fire Department | Mike Betterton Wasserman Music | Aloe Blacc Singer/Songwriter | Starr Butler Jemison Fiserv Forum & Milwaukee Bucks | Valeisha Butterfield Jones Recording Academy | Bryan Calhoun Yat Labs | Lauren Carpenter Embarc Events | Christy Castillo Butcher Sofi Stadium & Hollywood Park | Jamie Cheek FBMM | Stas Chijik Billfold | Brian Cross Monotone, Inc. | Amy Davidson MTheory | Marty Diamond Wasserman Music | Mike Downing Prevent Advisors | Boye Fajinmi TheFutureParty | Ken Fermaglich UTA | Rob Gibbs ICM Partners | Dr. K Elizabeth Hawk Ampersand Intelligence | Kell Houston Houston Productions | Zeke Hutchins Mick Management | Jamal Jimoh Venice/Q+A | George Leitner George Leitner Productions GmBh | Geni Lincoln The Forum | Joel Madden VEEPS | David Marcus Ticketmaster | Morgan Margolis Knitting Factory Entertainment | Michael Martin Effect Partners & r.Cup | Tom Martinez California Exposition & State Fair | Eric Mayers Red Light Entertainment | Denise Melanson Wasserman Music | Kurt J. Miner Allianz Entertainment | Derick Okolie Dreamville | Lesley Olenik Live Nation | Pitbull | Josh Rittenhouse APA | Rashad Robinson Color of Change | Heather Ryan SOFI TUKKER | Noelle Scaggs Fitz & The Tantrums | Fabrice Sergent Bandsintown | Jonathan Shank Terrapin Station Entertainment | Peter Shapiro Dayglo Presents | Drake Sutton-Shearer PIXL8 | Jaia Thomas Diverse Representation | Tara Traub Live Nation | Michelle Truman SOS Global | Dana Warg 313 Presents | Niel Warnock UTA | Scott Weiss Atomic Music Group | Donna Westmoreland I.M.P. | Chris Wright Allegiant Stadium | Molly Zidow Danny Wimmer Presents

0 notes

Text

HAYRIDE TO HELL Starts Production Outside Philadelphia, PA

Hayride To Hell, a new horror film from producer/director Dan Lantz, has started production in exurban and rural Southeastern Pennsylvania.

An original, darkly comic, gruesome revenge story written by Bob Lange and Kristina Chadwick, the film stars horror stalwarts Kane Hodder as Sheriff Jubell (FRIDAY THE 13TH PART VII: NEW BLOOD) and Bill Moseley as Farmer Sam (TEXAS CHAINSAW MASSACRE 2; Carnivàle). Director of Photography Tom MaCoy, producers Dan Lantz, Rob Margolies (SHE WANTS ME, ALL YOU CAN EAT) and Gretel Snyder (Star Trek: Renegades; who also serves as Assistant Director), and Executive Producers Bob Lange and Kristina Chadwick round out the production team.

Kane Hodder (Sheriff Jubell in Hayride to Hell)

In the film, a farmer (Moseley) takes his revenge in grand fashion on the unscrupulous town folk who try to steal his farm. Other cast members include Graham Wolfe (The Punisher, Mr. Robot, For Life) as Nixler, Amy Rutledge (RENT-A-PAL, NEIGHBOR, EYES OF THE DEAD) as Patty, and Brooke Stacy Mills (LAW ABIDING CITIZEN). HAYRIDE TO HELL will shoot on location in the exurban farmland west of Philadelphia, PA between now and the end of the month.

Bill Moseley (Farmer Sam in Hayride to Hell)

Following his breakout role as “Chop Top" in THE TEXAS CHAINSAW MASSACRE 2, William Lambert (Bill) Moseley has starred in numerous horror cult classics, including HOUSE OF 1000 CORPSES, REPO! THE GENETIC OPERA and THE DEVIL'S REJECTS, and he’s well-known as the cook in HBO’s Carnivàle. For his part, Kane Hodder has played horror legend Jason Voorhees in FRIDAY THE 13TH PART VII: THE NEW BLOOD, FRIDAY THE 13TH PART VIII: JASON TAKES MANHATTAN, JASON GOES TO HELL: THE FINAL FRIDAY, and JASON X, as well as the first three films in the HATCHET series (HATCHET, HATCHET II, and HATCHET III).

Director/Producer Dan Lantz

Dan Lantz spent the first twenty years of his career making TV commercials and reality TV shows before he transitioned into narrative short films, beginning with FELIX MELMAN. That film won several awards and led to Lantz writing and directing more shorts and a web series. In 2011, Lantz directed two low-budget feature-length horror films that got the attention of a few industry contacts. This led to him directing his fourth feature film BLOODRUNNERS, a Prohibition-era vampire thriller starring Ice-T with a worldwide release in 2017.

Most recently, Lantz achieved his dream of creating a film twenty-years in the making to life: ALPHA RIFT. A modern-day medieval sword and sorcery epic story of an average guy fated to hold a secret demon at bay, ALPHA RIFT releases November 19 from Vertical Entertainment. In ALPHA RIFT, Nolan Parthmore (Aaron Dalla Villa, PLEDGE, Gotham, Duels) is running his game store and flirting with his co-worker Gabby (Rachel Nielsen, GREEN PIECE, Mare of Easttown) when destiny comes calling. Nolan discovers he is an heir to the medieval bloodline “The Noblemen” when he dons an antique helmet and calls forth a demon recently released from his supernatural prison: Lord Dragsmere (Philip N. Williams, The Wire, The Blacklist, Broad City). He must quickly learn to harness his power and open the Alpha Rift: the only defense against these supernatural foes. Leading the Noblemen are Richard Corbin (Lance Henriksen, ALIENS, CLOSE ENCOUNTERS OF THE THIRD KIND, Millennium) and his lieutenant Vicars (Graham Wolfe) who must guide Nolan as he is forced to become the hero he never wanted to be.

Lantz, who recently won two awards as “Best Director of an Action Film” and “Best Director of a Fantasy,” from the bi-monthly Best Actor and Director Awards-New York, feels lucky to be making his second film in the Keystone State. “First, Pennsylvania may not have cornered the market on creepy, but it sure has a strong minority stake. The locations are dark and brooding—Wyeth country. Second, Pennsylvania does have a tax incentive program and that money is certainly helping a modestly budgeted production punch above its weight. The program is under constant threat to be axed by the state, so I do not know what the future holds. I do hope they keep it as it keeps proud Pennsylvania filmmakers like me from heading to other states.

“It’s an unusual spot to be in, making one film while releasing another,” Lantz concludes. “A lucky spot to be sure. It’s sometimes hard to keep things straight. But it’s a great spot to be in as a parent: I have one child going out into the world and another in gestation.”

#film news#movie news#hayride to hell#hayridetohellmovie#production start#dan lantz#kane hodder#bill moseley#horror#thriller#dark comedy#revenge#gruesome

2 notes

·

View notes

Text

Society of Behavioral Sleep Medicine Reflects on a Year Plagued by Sleeplessness

Society of Behavioral Sleep Medicine Reflects on a Year Plagued by Sleeplessness is courtesy of Elly Mackay's Sleep Blog

Psychologists add perspective to 2020 and share tips for better sleep in 2021.

By Earl C. Crew, PhD, Kelly Baron, PhD, DBSM, Michael V. DeSanctis, PhD, LP, ABPP, DBSM, Christina McCrae, PhD, CBSM, and Skye O. Margolies, PhD, DBSM

Having used the past few months to ponder it in full, the conclusion about 2020 remains the same: the year was a bit of a nightmare for sleep.

Between the COVID-19 pandemic, racial violence, pervasive wildfires, a contentious election season, and an economic collapse, it’s hardly surprising that people with insomnia, nightmares, and other concerns about poor sleep have flooded sleep medicine clinics.

At a time when our immune systems and mental health need as much support as they can get, sleep is like a frontline worker—essential. But how can we possibly sleep well when the future has been so uncertain? Especially since COVID-19 robbed many of their routines, social connection, and coping resources.

Early into the pandemic, we at the Society of Behavioral Sleep Medicine (SBSM) created a task force to help the public better understand how sleep might change in response to the pandemic, and how best to protect sleep even amidst the chaos. We published our top recommendations for keeping sleep on track.

Now that 2020 is behind us, but with the pandemic still raging, we share some additional thoughts about evolving challenges for sleep, as well as provide tips for getting through them.

[RELATED: After 4-year Gap, Behavioral Sleep Medicine Has a New Credential]

Why Sleep Has Suffered

For our ancestors, sleep was a high-risk activity, leaving them vulnerable to predation. When danger—like a saber-toothed tiger—lurked nearby, the fight-or-flight system provided a life-saving switch to override sleep and get to safety.

In 2020, our primary predator has been COVID-19. This invisible menace has kept us recurrently on-edge—constantly in fight-or-flight—making sleep difficult for many.

Understandably, some have turned to medications, alcohol, or other substances to help get to sleep. This often backfires by worsening sleep quality or creating dependence. For many, what may have started as a few nights of stress-induced sleeplessness back in March has morphed into chronic insomnia.

[RELATED: CBT-I Works in Young Drinkers to Reduce Insomnia Symptoms & May Help Lessen Alcohol Use Too]

Some Have Suffered More Than Others

But not everyone has had the same success navigating stress and the threats to sleep in 2020. COVID-19 has disproportionately affected communities of color, with minority Americans more likely to be out of work, hospitalized, or dead die due to COVID-19.

Similar disparities are also found for sleep. Black, Hispanic/Latinx, Native American/Alaska Native, and Native Hawaiian/Pacific Islander citizens are more likely to get fewer hours of sleep and experience more sleep interruptions compared to non-Hispanic Whites.

The burdens of systemic racism and discrimination, as well as having fewer opportunities to get enough sleep due to competing responsibilities, may explain some of these racial/ethnic disparities in sleep. This gap likely widened in 2020—due to added stress from the pandemic, as well as from the incidents of racial violence, police brutality, and resulting protests that occurred during the summer.

Children and Teens’ Sleep

Another casualty of the pandemic began in March and April, when schools closed and 57+ million kids in the United States started attending school virtually. Almost immediately, Zoom classrooms were flooded with hordes of sleep-deprived zombies.

Kids lost much of their structured activities, social interactions, and time outside under the sun. All of the things that kept their biological rhythms on track became wobbly. The loss of a consistent sleep-wake routine set them up for increased stress and fewer ways to cope. That’s why your child is having more nightmares or why your teen may be even crankier than usual.

What’s more, school closures took a toll on the nation’s parents, now forced to become impromptu educators while juggling everything else. Fall arrived and some schools returned to in-person instruction, only for surges of virus cases in “hotspots” to trigger a sudden return to virtual learning. Parents must now prepare to immediately react to whatever new protocol is needed for tomorrow.

There are no perfect solutions for how to teach our nations’ children during a global pandemic, but any parent is likely to tell you that this pattern is simply unsustainable. How can healthy sleep occur under these conditions?

Here’s How to Cope

Even though things may often feel apocalyptic and chaotic, we are not totally powerless and there are things we can do to protect our sleep health.

Get up at the same time each day.

“Sleep is a core human health behavior,” explains Christina McCrae, PhD, president of the SBSM. “When things seem overwhelming, commit to small behavior changes rather than taking on radical shifts in routine. The best way to start is through consistency.”

Getting up at the same time will help to reset your biological rhythms. The more predictable those are, the more easily your brain can help you to sleep well at night and function well during the day.

Make the bedroom all about sleep and only get in bed when sleepy.

This protects your bedroom for sleep. It also helps your brain to lose that habit of turning “on” as soon as you get into bed, because it will learn that the bed is place for sleep, a sleepy place, not a get-stuff-done place.

Limit screen time before bed.

The stimulation from your TV show or videogame might artificially override your brain’s sleepy cues.

Say “no” to work in the late evening. Unwind before bedtime.

Stretching, journaling, yoga, family time, or meditation can be great for unwinding before bed so the day’s stressors don’t follow you to it.

Increase daylight exposure and get outside early.

Believe it or not, sunlight is sleep’s best friend. More light exposure during the day helps to make your circadian rhythms robust, which helps you sleep better at night.

Put on pants. Go outside. Stay physically and socially active.

Not only will this give you a much-needed mood boost, it will also help to boost your circadian rhythms and give you more restful sleep at night.

This can be easier said than done. And sometimes, even following these recommendations may not be enough to solve your sleep concerns.

“If you are not good with self-management, or you have more severe sleep problems, see a behavioral sleep medicine specialist,” McCrae recommends.

These healthcare providers with specific expertise in sleep can conduct a more thorough assessment of your sleep problems and create a personalized treatment plan to improve your sleep and quality of life.

McCrae also stresses that seeking out professional help is crucial if you’re also experiencing serious mood issues, such as depression or suicidal thoughts. Awareness for when we’ve reached our personal limit is critical and seeking out professional help is a key next-step.

There Is Hope

Just like wearing a mask in public or getting vaccinated, we all benefit when ourselves and those around us are well-rested. Healthy sleep gives rise to safer workers, more effective educators, healthier children, and happier communities.

Promoting healthy sleep starts with the individual. That’s why we at the SBSM want to help you sleep well. Our website provides scientifically sound resources for many types of sleep problems, as well as an international directory of expert sleep therapists who are ready to help.

Together, let’s sleep our way to a healthier and more equitable 2021.

Earl C. Crew, PhD, is part of the behavioral health program, mental health care line at Michael E. DeBakey VA Medical Center, and assistant professor at Menninger Department of Psychiatry and Behavioral Sciences at Baylor College of Medicine in Houston, Texas. Kelly Baron, PhD, DBSM, is an associate professor in the Division of Public Health, Department of Family and Preventive Medicine at the University of Utah, Salt Lake, Utah. She is a clinical psychologist with specialty training in behavioral sleep medicine. In the clinic, she provides cognitive and behavioral treatment for insomnia, plus other sleep disorders including circadian disorders, problems using CPAP treatment in sleep apnea, nightmares, sleepwalking, and coping with disorders of excessive sleepiness such as narcolepsy. Christina McCrae, PhD, CBSM, is a professor in the Department of Psychiatry in the School of Medicine at the University of Missouri where she directs the Mizzou Sleep Research Lab. She is a licensed psychologist who is board certified in behavioral sleep medicine through the American Board of Sleep Medicine. McCrae has been continuously funded by NIH since 2003. McCrae is currently serving) on various review panels (i.e., NIH, American Sleep Medicine Foundation). She is an associate editor for two journals, Behavioral Sleep Medicine and Journal of Clinical Sleep Medicine. Skye Ochsner Margolies, PhD, DBSM, is clinical psychologist/assistant professor at UNC School of Medicine, Department of Anesthesiology in Chapel Hill, NC. Michael deSanctis, PhD, LP, ABPP, DBSM, is a clinical psychologist, in the states of Minnesota and Wisconsin, a published author, owner of Positive Sleep Journeys, PLLC, and has decades of experience teaching, offering community seminars on sleep, winter SAD and body clocks, and providing clinical service in the public and private sectors.

Photo 205063799 © Somwut Kamalastboocha – Dreamstime.com

from Sleep Review https://www.sleepreviewmag.com/sleep-treatments/behavioral-sleep-medicine/sbsm-year-plagued-by-sleeplessness/

from Elly Mackay - Feed https://www.ellymackay.com/2021/02/17/society-of-behavioral-sleep-medicine-reflects-on-a-year-plagued-by-sleeplessness/

1 note

·

View note

Photo

DWF ’19 Interview: Tim Realbuto and Nolan Gould on Their Indie Film, ‘YES’ I cover #DancesWithFilms every year, I'm happy to talk with all the terrific indie talents that bring their excellent labor of love passion projects to the event and so at this past #DWF2019 opening night, in celebration of the film YES which will have its world premiere at #DWF19 on Saturday, June 22nd, I had the opportunity to interview Tim Realbuto and Nolan Gould ("Modern Family) who star in the Rob Margolies-directed film about Patrick Nolan, a washed up ex-child star and blacklisted actor, mentors Jeremiah Rosenhaft, a teenage actor with dreams of stardom.

1 note

·

View note

Link

I truly, truly love this show. And everything about it.

I love how the villains are smug and super-confident. And how they underestimate Billy. But, in this episode, the beast has awakened.

Up to now, in this season, Billy wasn’t quite himself. But, as of this chapter, the wheels are turning. And it’s beautiful to watch.

0 notes

Text

Benefits of therapy:

In a society that is often focused on material things, it’s easy to justify spending that improves our attractiveness. We have a natural incentive to care about what we look like: physical appearance is emphasized as the end-all-be-all virtually everywhere we get our media. We buy gym memberships to look a certain way, as though mirroring the physical perfection we see in the media will magically make us happy. Going to the gym is also seen as the main route to “getting healthy” – and improving psychological health is not emphasized in the same way. Why?

Likely, the reason why psychological health is deemphasized is because improving it isn’t seen to have the same effect on our appearance as the gym. However, even the claim that therapy doesn’t impact our appearance can be contested: research has shown that our mental health affects how others perceive our physical appearance – and whether they want to befriend us (Rosenblatt & Greenberg, 1988; Chancellor, Layous, Margolis, & Lyubomirsky, 2017). Another (perhaps less superficial) argument for the importance of a therapy is the buoyancy effect. Therapy helps us through difficult times, which are inevitable given that life is unpredictable, often strange, and frequently painful. As a protective factor, therapy can help smooth the bumps in the road – as well as make a good thing even better. Intrigued but not yet convinced? Read 5 reasons how therapy positively impacts long-term psychological health.

1. Therapy can help you learn life-long coping skills.

Great, you’re thinking, but what exactly are coping skills? Coping skills are anything that helps you through difficult times, whether it’s not getting the promotion you deserve, anxiety about driving, or the death of a loved one. Therapists are educated and trained to help foster the natural coping skills everyone has. Coping skills will look a little different from person to person because everyone is unique. For example, I’m a writer, so I like to journal my thoughts as a way of coping – but someone else might find aromatherapy and bubble baths to be more relaxing. We’re all different, and that’s okay – but it also means that there is no “one size fits all” coping skill.

Therapists can also teach coping skills that might not be as innate. For example, cognitive behavioral therapists will often teach their clients that what they say to themselves has enormous influence on how they feel & how others respond to them. Attachment-focused therapists might ask their clients to think differently about how they interact with people in their lives. Person-centered therapists encourage their clients to treat themselves with unconditional positive regard and practice radical self-acceptance. Regardless of the modality of therapy, the idea is to bolster your personal strengths – often using evidence-based practices the therapist has taught you. Psychologist Rob Winkler agrees, asserting that “better coping leads to better responses and better responses lead to better experiences, which create more opportunity and prosperity in all aspects of our lives.” So while it may not seem as exciting as getting six-pack abs, learning coping skills improves your life exponentially in the long-run.

2. Therapy can change how you interact with people in your life – in a good way.

Sometimes we’re not aware of just how many ways we’re negatively impacting our relationships. We might snap and call our partner names when we’re mad and then forget about it after the fight, not realizing the effect that it has on our partner. On the other side of things, maybe we’re so used to keeping our feelings bottled inside that we have a hard time being assertive with the people we love. A therapist can help balance the way we communicate with our loved ones to improve our relationships. For example, for a client who has a hard time being assertive, a DBT therapist might teach the “Dear Man” skill. In a nutshell, “Dear Man” is a skill that helps a client describe what they want and advocate for themselves in a non-judgmental way.

It can also be useful to hear another person’s input on the important relationships in your life. Are you getting what you want out of your partner – do they make you feel fulfilled? Are your expectations reasonable, or do you think that your partner should be your everything? Or maybe you’re doing everything “right” but there are still ways you could make your connection stronger. A therapist, especially a therapist specialized in family and relationship counseling, can give you the tools and support you need to make changes that will positively impact your relationships. Increasing the positivity of your relationships builds to a more fruitful long-term future – because when it comes down to it, life is about having fulfilling relationships with the people you love and being able to successfully navigate relationships with people you don’t.

3. Therapy can make you feel happier.

True happiness is an elusive thing, and many times people chase the external – money, success, a fancy car – to try to achieve it. Even though it’s an old cliché, there’s truth to the statement that money can’t buy you happiness. Having too little money can cause unhappiness, but money doesn’t have an inherent value that makes our lives more fulfilled. Buying fancy things might give us a temporary thrill or a sense of satisfaction; however, these feelings don’t last and tend to scratch at the surface of true happiness. No one has ever claimed, for example, that the meaning of life is a car; the meaning of life is thought to have more breadth and importance than that.

So how does therapy help you feel happier on a deeper level? Talking over your past, present, and future with a therapist can lead to greater self-understanding. While self-understanding doesn’t always imply self-acceptance, it is the first step towards truly embracing who you are at the core. A related concept is self-compassion. Greater self-compassion helps you handle the bumps in the road that inevitably happen in life without getting stuck in a mire of negativity. Therapists, especially person-centered therapists, often emphasize self-acceptance and self-compassion – and talk us through techniques for increasing both. Learning self-compassion in therapy has tangible benefits: High self-compassion has been found to lead to more health-promoting behaviors (Sirois, Hirsch, & Kitner, 2015), nurture well-being (Neely, Schallert, Mohammed, Roberts, & Chen, 2009), increase empathy and altruism (Neff & Pommier, 2012), and provide a buffer against anxiety (Neff, Kirkpatrick, & Rude, 2007).

4. Through its link to happiness, therapy leads to more productivity.

In The Happiness Advantage, Shawn Achor explains how positive emotions lead to greater productivity: “Happiness gives us a real chemical edge…How? Positive emotions flood our brains with dopamine and serotonin, chemicals that not only make us feel good, but dial up the learning centers of our brains to higher levels” (44). In other words, feeling positive emotions allows you to work harder and learn more because of the “feel good” chemicals in your brain. While productivity isn’t everything, most of us have too much to do and not enough time to do it, especially those of us with demanding jobs or those of us with kids. Increasing your levels of happiness—and with it, your productivity—not only helps you in your career but also helps you cope with the messiness and hectic pace of life.

Therapy can also help you discover obstacles blocking you from performing at your best. These types of road blocks (e.g., perfectionism or overthinking) are challenges a therapist can help you work through to find an effective solution. You and your therapist can also discuss time-management skills and whether changing negative long-term habits—such as poor prioritization or inaccurate assessments—could help with your focus and productivity. These types of changes can lead to long-term benefits such as increased work performance, greater feelings of self-efficacy, and improved relationships. For more information, check out Shawn Achor’s TED Talk “The happy secret to better work.”

5. Therapy can help improve chronic stress.

The ways that therapy can improve long-term stress are numerous. A therapist can teach you methods of calming your body and mind, which might include techniques such as guided visualization, progressive muscle relaxation, and deep breathing. Therapists can also help problem-solve the sources of your stress and teach you stress-reduction techniques. They can introduce you to new concepts such as radical acceptance – that many things in your life are beyond your control and acceptance is the key to reducing your suffering. Best of all, once you learn these techniques, you carry them with you into the rest of your life. In other words, stress relief in the short-term can build into long-term patterns of stress management.

Crucially, a therapist can also be a sounding board who listens to you talk about your life and validates your feelings. This isn’t the same thing as agreeing with you and supporting your every decision, but it can be more valuable – because it nurtures the idea that you’re important, your feelings are worth listening to, and you’re understood. Social support has been shown to be essential for mental health, and, perhaps as importantly, lacking in situations where mental health issues are present. In both the short- and long-term, social support soothes the mind and improves health– as evidenced by numerous studies (Berkman, 1995; Cohen and Janicki-Deverts, 2009; Umberson and Montez, 2010). In short, therapists are effective social support, and feeling supported leads to greater psychological health.

I hope that this blog is an invitation to reexamine how we consider therapy in a wider context. Our culture is ready to accept going to the gym as a way to improve physical health; why not embrace therapy as a way of improving psychological health? Think of therapy as a method of self-improvement, a life-affirming way to make positive changes instead of stagnating. Therapy is not about fixing something that is broken: instead, it is about embracing what we have in order to reach our full, prosperous potential as human beings.

1 note

·

View note

Text

Trouble Managing Money May Be an Early Sign of Dementia

After Maria Turner’s minivan was totaled in an accident a dozen years ago, she grew impatient waiting for the insurance company to process the claim. One night, she saw a red pickup truck on eBay for $20,000. She thought it was just what she needed. She clicked “buy it now” and went to bed. The next morning, she got an email about arranging delivery. Only then did she remember what she’d done.

This story also ran on The New York Times. It can be republished for free.

Making such a big purchase with no forethought and then forgetting about it was completely out of character for Turner, then a critical care nurse in Greenville, South Carolina. Although she was able to back out of the deal without financial consequences, the experience scared her.

“I made a joke out of it, but it really disturbed me,” Turner said.

It didn’t stop her, though. She shopped impulsively online with her credit card, buying dozens of pairs of shoes, hospital scrubs and garden gnomes. When boxes arrived, she didn’t remember ordering them.

Six years passed before Turner, now 53, got a medical explanation for her spending binges, headaches and memory lapses: Doctors told her that imaging of her brain showed all the hallmarks of chronic traumatic encephalopathy. CTE is a degenerative brain disease that in Turner’s case may be linked to the many concussions she suffered as a competitive horseback rider in her youth. Her doctors now also see evidence of Alzheimer’s disease and frontotemporal dementia, which affects the frontal and temporal lobes of the brain. These may have roots in her CTE.

Turner’s money troubles aren’t unusual among people who are beginning to experience cognitive declines. Long before they receive a dementia diagnosis, many people start losing their ability to manage their finances and make sound decisions as their memory, organizational skills and self-control falter, studies show. As people fall behind on their bills or make unwise purchases and investments, their bank balances and credit rating may take a hit.

Mental health experts say the covid pandemic may have masked such early lapses during the past year. Many older people have remained isolated from loved ones who might be the first to notice unpaid bills or unopened bank notices.

“That financial decision-making safety net may have been weakened,” said Carole Roan Gresenz, interim dean at Georgetown University’s School of Nursing and Health Studies, who co-authored a study examining the effect of early-stage Alzheimer’s disease on household finances. “We haven’t been able to visit, and while technology can provide some help, it’s not the same … as sitting next to people and reviewing their checking account with them.”

Even during times that aren’t complicated by a global health crisis, families may miss the signs that someone is struggling with finances, experts say.

“It’s not uncommon at all for us to hear that one of the first signs that families become aware of is around a person’s financial dealings,” said Beth Kallmyer, vice president for care and support at the Alzheimer’s Association.

Early in the disease, Kallmyer said, dementia robs people of the abilities they need to manage money: “executive functioning” skills like planning and problem-solving, as well as judgment, memory and the ability to understand context.

People who live alone may be the most likely to slip through the cracks, their lapses unnoticed, Kallmyer said. And many adult children may be reluctant to discuss personal finances with their parents, who often guard their independence.

About 6 million Americans are living with Alzheimer’s disease, the most common cause of dementia. Dementia is an umbrella term for a range of conditions associated with declines in mental abilities that are severe enough to interfere with daily life. There is no cure. Alzheimer’s, which killed more than 133,000 Americans in 2020, is the seventh-leading cause of death in the U.S.

Many people have mild symptoms for years before they are diagnosed. During this stage, before obvious impairment, they may make substantial errors managing their finances.

In Gresenz’s study, researchers linked data from Medicare claims between 1992 and 2014 with results from the federally funded Health and Retirement Study, which regularly surveys older adults about their finances, among other things. Her study, published in the journal Health Economics in 2019, found that during early-stage Alzheimer’s, people were up to 27% more likely than cognitively healthy people to experience a large decline in their liquid assets, such as savings and checking accounts, stocks and bonds.

Another study, published in JAMA Internal Medicine in November, linked Medicare claims data to the Federal Reserve Bank of New York/Equifax Consumer Credit Panel to track people’s credit card payments and credit scores. The study found that people with Alzheimer’s and related dementias were more likely to miss bill payments up to six years before they were diagnosed than were people who were never diagnosed. The researchers also noted that the people later diagnosed with dementia started to show subprime credit scores 2.5 years before the others.

“We went into the study thinking we might be able to see these financial indicators,” said Lauren Hersch Nicholas, an associate professor of public health at the University of Colorado, who co-authored the study. “But we were sort of surprised and dismayed to find that you really could. That means it’s sufficiently common because we’re picking it up in a sample of 80,000 people.”

For decades, Pam McElreath kept the books for the insurance agency that she and her husband, Jimmy, owned in Aberdeen, North Carolina. In the early 2000s, she started having trouble with routine tasks. She assigned the wrong billing codes to expenditures, filled in checks with the wrong year, forgot to pay the premium on her husband’s life insurance policy.

Everyone makes mistakes, right? It’s just part of aging, her friends would say.

“But it’s not like my friend that made that one mistake, one time,” said McElreath, 67. “Every month I was having to correct more mistakes. And I knew something was wrong.”

She was diagnosed with mild cognitive impairment in 2011, at age 56, and with early-onset Alzheimer’s two years later. In 2017, doctors changed her diagnosis to frontotemporal dementia.

Receiving a devastating diagnosis is hard enough, but learning to cope with it is also hard. Eventually both McElreath and Maria Turner put mechanisms in place to keep their finances on an even keel.

Turner, who has two adult children, lives alone. After her diagnosis, she hired a financial manager, and together they set up a system that provides Turner with a set amount of spending money every month and doesn’t allow her to make large withdrawals on impulse. She ditched her credit cards and removed eBay and Amazon from her phone.

Though not a micromanager, Turner’s financial adviser keeps an eye on her spending and questions her when something seems off.

“Did you realize you spent X?” she’ll ask, Turner said.

“And I’ll be like, ‘No, I didn’t.’ And that’s the thing. I’m aware but I’m not aware,” she added.

In 2017, Pam and Jimmy McElreath sold their insurance agency to spend more time together and moved west to Sugar Grove, in the Blue Ridge Mountains. They worked with a therapist to figure out how to ensure Pam is able to continue to do as much as possible.

These days, Pam still signs their personal checks, but now Jimmy looks them over before sending them out. The system is working so far.

“At first I was mad, and I went through this dark time,” Pam said, adding: “But the more that you come to accept your problem, the easier it is to say, ‘I need help.’”

Jimmy’s gentle approach helped. “He was so good about telling me when I did something wrong but doing it in such a kind way, not blaming me for making mistakes. We’ve been able to work it out.”

Tips for Helping a Loved One

It’s not easy to broach financial management issues with an elderly parent or other relative experiencing cognitive trouble. Ideally, you and they will have these conversations before problems develop.

As an adult child, you might mention you’ve been talking with a financial adviser about managing your own finances to ease into a conversation about what your elder is doing, said Beth Kallmyer of the Alzheimer’s Association.

Or suggest that allowing a shared financial management arrangement would eliminate the hassle of tracking and paying bills.

“Often people are open to the idea of making their lives easier,” Kallmyer said.

Whatever the approach, it’s important to plan and take steps to protect assets.

“Part and parcel of any legal or estate planning is protecting oneself in the event of incapacity,” said Jeffrey Bloom, an elder law attorney at Margolis & Bloom in the Boston area.

Specific steps depend on the family and their financial situation, but here are some to consider:

Encourage the parent in need of help to sign a financial power of attorney.

These legal documents authorize you or another person to act on a parent’s behalf in financial matters. The terms may be narrow or broad, allowing you to make all financial decisions or to perform specific duties like paying bills, making account transfers or filing taxes.

A “durable” power of attorney allows you to make decisions even if your parent becomes incapacitated. In some states, power of attorney documents are automatically considered durable.

Put assets in a trust.

A trust is a legal vehicle that can hold a range of assets and property. It can spell out how those assets are managed and distributed while people are alive or after they die.

“We do believe in the power of attorney, but we believe in the trust as an even better tool in the event of incapacity,” Bloom said.

Trusts can be tailored to a client’s concerns and provide more guidance than a power of attorney document about what money can be spent on and who has access under what circumstances, among other things.

You might be a co-trustee on major distributions, for example, or there may be rules that provide for you or others to review and be notified of any changes, Bloom said.

The Alzheimer’s Association recommends working with an attorney who specializes in trusts to ensure all laws and regulations are followed, Kallmyer said.

Have your name added as another user on a parent’s bank accounts, credit cards or other financial accounts.

This may be a convenient way to make payments or monitor activity. But a shared account can be problematic if children are sued, for example, or wish to withdraw the money for their own use.

The funds typically belong to all parties whose names are on the account. Unlike a power of attorney, the child isn’t obligated to act in a parent’s best interest.

Each of these setups may help protect a parent’s assets. But parents may not welcome what they see as interference, no matter how well meaning family members are. Typically, they can refuse to permit children’s access to their financial information or revoke permission previously granted.

Finding a balance between protecting someone and usurping their rights is hard, said Bloom. The only way to ensure financial control is to go to court to establish guardianship or conservatorship. But that is a serious step not to be taken lightly.

“You only want to do that if there’s a major risk.”

KHN (Kaiser Health News) is a national newsroom that produces in-depth journalism about health issues. Together with Policy Analysis and Polling, KHN is one of the three major operating programs at KFF (Kaiser Family Foundation). KFF is an endowed nonprofit organization providing information on health issues to the nation.

USE OUR CONTENT

This story can be republished for free (details).

Trouble Managing Money May Be an Early Sign of Dementia published first on https://nootropicspowdersupplier.tumblr.com/

1 note

·

View note

Text

Trouble Managing Money May Be an Early Sign of Dementia

After Maria Turner’s minivan was totaled in an accident a dozen years ago, she grew impatient waiting for the insurance company to process the claim. One night, she saw a red pickup truck on eBay for $20,000. She thought it was just what she needed. She clicked “buy it now” and went to bed. The next morning, she got an email about arranging delivery. Only then did she remember what she’d done.

This story also ran on The New York Times. It can be republished for free.

Making such a big purchase with no forethought and then forgetting about it was completely out of character for Turner, then a critical care nurse in Greenville, South Carolina. Although she was able to back out of the deal without financial consequences, the experience scared her.

“I made a joke out of it, but it really disturbed me,” Turner said.

It didn’t stop her, though. She shopped impulsively online with her credit card, buying dozens of pairs of shoes, hospital scrubs and garden gnomes. When boxes arrived, she didn’t remember ordering them.

Six years passed before Turner, now 53, got a medical explanation for her spending binges, headaches and memory lapses: Doctors told her that imaging of her brain showed all the hallmarks of chronic traumatic encephalopathy. CTE is a degenerative brain disease that in Turner’s case may be linked to the many concussions she suffered as a competitive horseback rider in her youth. Her doctors now also see evidence of Alzheimer’s disease and frontotemporal dementia, which affects the frontal and temporal lobes of the brain. These may have roots in her CTE.

Turner’s money troubles aren’t unusual among people who are beginning to experience cognitive declines. Long before they receive a dementia diagnosis, many people start losing their ability to manage their finances and make sound decisions as their memory, organizational skills and self-control falter, studies show. As people fall behind on their bills or make unwise purchases and investments, their bank balances and credit rating may take a hit.

Mental health experts say the covid pandemic may have masked such early lapses during the past year. Many older people have remained isolated from loved ones who might be the first to notice unpaid bills or unopened bank notices.

“That financial decision-making safety net may have been weakened,” said Carole Roan Gresenz, interim dean at Georgetown University’s School of Nursing and Health Studies, who co-authored a study examining the effect of early-stage Alzheimer’s disease on household finances. “We haven’t been able to visit, and while technology can provide some help, it’s not the same … as sitting next to people and reviewing their checking account with them.”

Even during times that aren’t complicated by a global health crisis, families may miss the signs that someone is struggling with finances, experts say.

“It’s not uncommon at all for us to hear that one of the first signs that families become aware of is around a person’s financial dealings,” said Beth Kallmyer, vice president for care and support at the Alzheimer’s Association.

Early in the disease, Kallmyer said, dementia robs people of the abilities they need to manage money: “executive functioning” skills like planning and problem-solving, as well as judgment, memory and the ability to understand context.

People who live alone may be the most likely to slip through the cracks, their lapses unnoticed, Kallmyer said. And many adult children may be reluctant to discuss personal finances with their parents, who often guard their independence.

About 6 million Americans are living with Alzheimer’s disease, the most common cause of dementia. Dementia is an umbrella term for a range of conditions associated with declines in mental abilities that are severe enough to interfere with daily life. There is no cure. Alzheimer’s, which killed more than 133,000 Americans in 2020, is the seventh-leading cause of death in the U.S.

Many people have mild symptoms for years before they are diagnosed. During this stage, before obvious impairment, they may make substantial errors managing their finances.

In Gresenz’s study, researchers linked data from Medicare claims between 1992 and 2014 with results from the federally funded Health and Retirement Study, which regularly surveys older adults about their finances, among other things. Her study, published in the journal Health Economics in 2019, found that during early-stage Alzheimer’s, people were up to 27% more likely than cognitively healthy people to experience a large decline in their liquid assets, such as savings and checking accounts, stocks and bonds.

Another study, published in JAMA Internal Medicine in November, linked Medicare claims data to the Federal Reserve Bank of New York/Equifax Consumer Credit Panel to track people’s credit card payments and credit scores. The study found that people with Alzheimer’s and related dementias were more likely to miss bill payments up to six years before they were diagnosed than were people who were never diagnosed. The researchers also noted that the people later diagnosed with dementia started to show subprime credit scores 2.5 years before the others.

“We went into the study thinking we might be able to see these financial indicators,” said Lauren Hersch Nicholas, an associate professor of public health at the University of Colorado, who co-authored the study. “But we were sort of surprised and dismayed to find that you really could. That means it’s sufficiently common because we’re picking it up in a sample of 80,000 people.”

For decades, Pam McElreath kept the books for the insurance agency that she and her husband, Jimmy, owned in Aberdeen, North Carolina. In the early 2000s, she started having trouble with routine tasks. She assigned the wrong billing codes to expenditures, filled in checks with the wrong year, forgot to pay the premium on her husband’s life insurance policy.

Everyone makes mistakes, right? It’s just part of aging, her friends would say.

“But it’s not like my friend that made that one mistake, one time,” said McElreath, 67. “Every month I was having to correct more mistakes. And I knew something was wrong.”

She was diagnosed with mild cognitive impairment in 2011, at age 56, and with early-onset Alzheimer’s two years later. In 2017, doctors changed her diagnosis to frontotemporal dementia.

Receiving a devastating diagnosis is hard enough, but learning to cope with it is also hard. Eventually both McElreath and Maria Turner put mechanisms in place to keep their finances on an even keel.

Turner, who has two adult children, lives alone. After her diagnosis, she hired a financial manager, and together they set up a system that provides Turner with a set amount of spending money every month and doesn’t allow her to make large withdrawals on impulse. She ditched her credit cards and removed eBay and Amazon from her phone.

Though not a micromanager, Turner’s financial adviser keeps an eye on her spending and questions her when something seems off.

“Did you realize you spent X?” she’ll ask, Turner said.

“And I’ll be like, ‘No, I didn’t.’ And that’s the thing. I’m aware but I’m not aware,” she added.

In 2017, Pam and Jimmy McElreath sold their insurance agency to spend more time together and moved west to Sugar Grove, in the Blue Ridge Mountains. They worked with a therapist to figure out how to ensure Pam is able to continue to do as much as possible.

These days, Pam still signs their personal checks, but now Jimmy looks them over before sending them out. The system is working so far.

“At first I was mad, and I went through this dark time,” Pam said, adding: “But the more that you come to accept your problem, the easier it is to say, ‘I need help.’”

Jimmy’s gentle approach helped. “He was so good about telling me when I did something wrong but doing it in such a kind way, not blaming me for making mistakes. We’ve been able to work it out.”

Tips for Helping a Loved One

It’s not easy to broach financial management issues with an elderly parent or other relative experiencing cognitive trouble. Ideally, you and they will have these conversations before problems develop.

As an adult child, you might mention you’ve been talking with a financial adviser about managing your own finances to ease into a conversation about what your elder is doing, said Beth Kallmyer of the Alzheimer’s Association.

Or suggest that allowing a shared financial management arrangement would eliminate the hassle of tracking and paying bills.

“Often people are open to the idea of making their lives easier,” Kallmyer said.

Whatever the approach, it’s important to plan and take steps to protect assets.

“Part and parcel of any legal or estate planning is protecting oneself in the event of incapacity,” said Jeffrey Bloom, an elder law attorney at Margolis & Bloom in the Boston area.

Specific steps depend on the family and their financial situation, but here are some to consider:

Encourage the parent in need of help to sign a financial power of attorney.

These legal documents authorize you or another person to act on a parent’s behalf in financial matters. The terms may be narrow or broad, allowing you to make all financial decisions or to perform specific duties like paying bills, making account transfers or filing taxes.

A “durable” power of attorney allows you to make decisions even if your parent becomes incapacitated. In some states, power of attorney documents are automatically considered durable.

Put assets in a trust.

A trust is a legal vehicle that can hold a range of assets and property. It can spell out how those assets are managed and distributed while people are alive or after they die.

“We do believe in the power of attorney, but we believe in the trust as an even better tool in the event of incapacity,” Bloom said.

Trusts can be tailored to a client’s concerns and provide more guidance than a power of attorney document about what money can be spent on and who has access under what circumstances, among other things.

You might be a co-trustee on major distributions, for example, or there may be rules that provide for you or others to review and be notified of any changes, Bloom said.

The Alzheimer’s Association recommends working with an attorney who specializes in trusts to ensure all laws and regulations are followed, Kallmyer said.

Have your name added as another user on a parent’s bank accounts, credit cards or other financial accounts.

This may be a convenient way to make payments or monitor activity. But a shared account can be problematic if children are sued, for example, or wish to withdraw the money for their own use.

The funds typically belong to all parties whose names are on the account. Unlike a power of attorney, the child isn’t obligated to act in a parent’s best interest.

Each of these setups may help protect a parent’s assets. But parents may not welcome what they see as interference, no matter how well meaning family members are. Typically, they can refuse to permit children’s access to their financial information or revoke permission previously granted.

Finding a balance between protecting someone and usurping their rights is hard, said Bloom. The only way to ensure financial control is to go to court to establish guardianship or conservatorship. But that is a serious step not to be taken lightly.

“You only want to do that if there’s a major risk.”

KHN (Kaiser Health News) is a national newsroom that produces in-depth journalism about health issues. Together with Policy Analysis and Polling, KHN is one of the three major operating programs at KFF (Kaiser Family Foundation). KFF is an endowed nonprofit organization providing information on health issues to the nation.

USE OUR CONTENT

This story can be republished for free (details).

Trouble Managing Money May Be an Early Sign of Dementia published first on https://smartdrinkingweb.weebly.com/

1 note

·

View note

Text

Horse Named After Breonna Taylor Wins Kentucky Derby Race

Horse Named After Breonna Taylor Wins Kentucky Derby Race

A horse named after Breonna Taylor won a race at the Kentucky Derby, this week.

A horse named Breonna Taylor has won a race at the 2021 Kentucky Derby. The three-year-old horse won Race 4 at Churchill Downs, Thursday, with jockey Corey Lanerie. Taylor was trained by Steve Margolis.

The horse is owned by JS Stables, LLC, which is run by attorney Sam Aguiar, who represents Taylor’s family.

Rob…

View On WordPress

0 notes

Text

Human Rights in the News: Reproductive Rights in Poland, in Light of Abortion Ban

Allison Stacey

08 December 2020

Women’s reproductive rights within Poland have been in question for years now as the public has fought the courts over their access to effective health care. This October, the Polish Constitutional Tribunal ruled that women will not be allowed access to the option of abortion under the circumstances of “severe and irreversible fetal defect or incurable illness that threatens the fetus’ life” (“Poland’s...”). The court’s ruling has prompted protests in Poland, the largest that has been seen since the fall of communism over thirty years ago, where women are risking their livelihood during the COVID-19 pandemic. Protesting in the streets, the women not only risk their health by defying the restrictions during the pandemic but they also risk persecution to defend their human rights (Schmitz). The lawmaker’s defense claims that abortion is in violation of the constitution, therefore, there must be restrictions put in place (Pronczuk). This strips women of the option to receive this procedure under any other grounds exempt from pregnancies that result from rape and when the woman’s health is at extreme risk. Additionally, the ruling makes Poland one of the two out of the twenty-seven European Union member states that do not allow abortion on request, therefore, making it one of the most restrictive countries regarding women’s right to reproductive health care (Poland’s…”). Advocates of women’s rights urge the Poland government to reconsider the ban as it may endanger women’s safety in addition to instilling their right to proper medical treatment.

The restrictions being placed could be detrimental to women’s physical and mental health Leah Hoctor, regional director of the Center for Reproductive Rights explains. She urges that Poland redact this ruling immediately, stating, “...violates Poland’s obligations under international human rights treaties to refrain from retrogressive measures that roll back women’s rights to sexual and reproductive health care.” If Poland is not to do this, Esther Major, a senior researcher at Amnesty International urges that women will travel to foreign areas to receive the care they need. Already, doctors in Poland have the option to refuse to provide this legal medical service as well as prescribing contraception due to their belief systems (Pronczuk). By implementing this restriction, it will further force women to look for alternative ways to have this procedure whether it is deemed safe. This may include underground procedures or travelling across the country to receive the appropriate health care (“Poland’s…”). Last year, it was shown that 1,074 of 1,100 abortions performed were because of fetal abnormalities, however, this study is not entirely accurate because most women have already been given no choice but to travel abroad or to have them done illegally (Pronczuk).

Travelling across the country for this purpose is not a viable option for everyone as some who seek the procedure are doing so because of their lack of access to financial stability in order to support the child and give it the prenatal care that it needs. This can be seen in the evidence that the Lancet Global Health’s study proves that those who live in higher-income countries are provided with better access to sexual and reproductive health care than those who reside in lower-income countries, forcing those in lower-income areas where it is restricted to look for other options (Bearak). The Lancet Global Health’s study also revealed that in countries that were more restricted the rate of unintended pregnancies that ended in abortion were higher than in countries where it has been made broadly legal. In addition to this, between 1990-1994 and 2015-2019, the global unintended pregnancy rate has declined quite considerably, whereas the proportion of unintended pregnancies ending in abortion has increased. The researchers who were apart of this project made the statement, “These findings emphasise the importance of ensuring access to the full spectrum of sexual and reproductive health services, including contraception and abortion care, and for additional investment towards equity in health-care services.”(Bearak).

Although many researchers believe that these restrictions will cause an unequal opportunity to receive proper health care may lead to women taking matters into their own hands, researchers at Cochrane Library suggest otherwise. The group have conducted a study on women self-administering abortion drugs without supervision versus those who take drugs within the presence of one (Gambir). They hope that this comparison will allow the researchers to conclude as to whether performing this type of medical activity at home is a safe and effective alternative to the procedure administered by a health care professional, “It is important to understand whether women can safely and effectively terminate their own pregnancies when having access to accurate and adequate information, high‐quality drugs, and facility‐based care in case of complications” (Gambir). Data showed that women who administered the drugs within their early pregnancy (first nine weeks) experienced similar rates of successfully completed abortion as those who did so in the presence of a medical professional. However, the evidence of this procedure is uncertain and does not draw any conclusions on the safety matters of the woman within this scenario. More thorough research is needed to come to an understanding of the implications in doing this even though at this time results have shown that women can also effectively use the self-administration method to complete the second stage of abortion drugs (Gambir).

This ban on healthcare services has caused many to believe that lawmakers have made it based on their religious affiliations as Poland is a widely Catholic population. Due to this, most of the population is in support of the churches belief that abortion equates to murder, therefore, leaders of the protests are receiving extensive backlash. Specifically, the leader from Poland's ruling Law and Justice Party, Jaroslaw Kacynski, is targeting the women, claiming they are enemies of the country. While the party refers to themselves as a “pro-family” group, Hillary Margolis, a senior researcher on women’s rights at Human’s Rights Watch, calls the party an anti-LGBT and anti-women’s rights group that have been challenging these civil rights for years. She states, “And it’s using the idea of rights and the idea of family to undermine maliciously the actual human rights of significant groups of people throughout the country” (Schmitz). Marta Lempart, leader of the women’s strike group, Strajk Kobiet that is leading movements nationwide, has been consistently harassed by these people, enduring home visits from them as well as phone calls, forcing her to change her phone number numerous times. Lempart comments on these actions, “Because this is the classical situation when you can see why judicial independence is important and why the rule of law is important and why we've been betrayed by international institutions that did not react enough to the rule of law being - collapsing in Poland for so many years” (Schmitz). She explains that the movement is no longer just about abortion anymore but something much bigger, the government stepping down (Schmitz).

The implementation of this law has been postponed for the time being so there has yet to be a consensus as to whether or not the women’s rights activists' persistent protests will prove valuable or if the court ruling will remain in action. However, protestors are hopeful as they continue to rally in the streets of Poland, as represented by Adam Mrozowicki, a sociologist at the University of Wrocław, “This time, the core is made up of young people. The protests are largely spontaneous and seem to cut across social structures. A very important aspect in the opposition toward the [Roman] Catholic church and its influence over authorities, education, and culture in Poland.”

Bibliography

Bearak, Jonathan, et al. “Unintended Pregnancy and Abortion By Income, Region, and the Legal Status of Abortion: Estimates From a Comprehensive Model for 1990-2019.” The Lancet Global Health, 27 July, 2020, https://www.thelancet.com/journals/langlo/article/PIIS2214-109X(20)30315-6/fulltext

Gambir, Katherine, et al. “Self-Administered Versus Provider-Administered Medical Abortion.” Cochrane Library, 09 Mar. 2020, https://www.cochranelibrary.com/cdsr/doi/10.1002/14651858.CD013181.pub2/full

Pacula, Paulina. “[Feature] Poland: Abortion ‘Revolution’ Means End of Old Order.” EUobserver, 3 Nov. 2020, https://euobserver.com/justice/149933

“Poland’s Constitutional Tribunal Rolls Back Reproductive Rights.” Human Rights Watch, 28 Oct. 2020, https://www.hrw.org/news/2020/10/22/polands-constitutional-tribunal-rolls-back-reproductive-rights

Pronczuk, Monika. “Why Are There Protests in Poland?” The New York Times, 27 Oct. 2020, https://www.nytimes.com/2020/10/27/world/europe/poland-abortion-ruling-protests.html

Schmitz, Rob. “Polish Women Continue Protesting A Court Decision To Outlaw Nearly All Abortions.” NPR, NPR, 10 Nov. 2020, https://www.npr.org/2020/11/10/933548726/polish-women-continue-protesting-a-court-decision-to-outlaw-nearly-all-abortions

0 notes

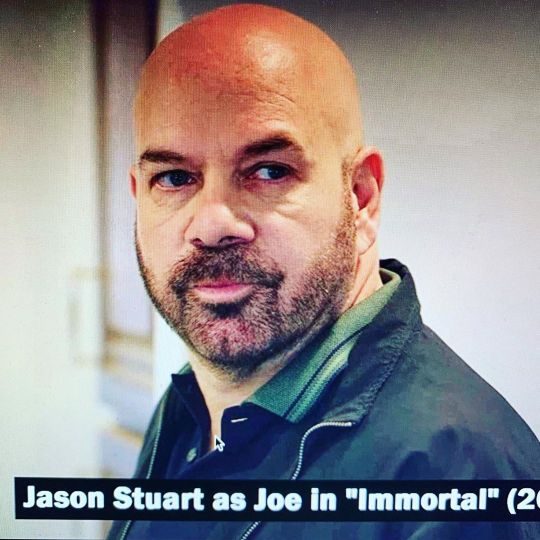

Photo

I have this really great role in the #thriller #immortal , now on #amazon and lotta other platforms. I play a Private Investigator who deals with spy equipment... really cool film I'm opposite Samm Levine from "Freaks & Geeks" and so many other TV shows. Stars Tony Todd (CandyLand), Dylan Baker (Homeland & Good Wife) really great character actor, Robin Barlett (Mad About You & Shutter Island) from "Postcards From the Edge" and so many great actors and filmmakers Jon Dabach, Rob Margolies, Danny Isaac and John Colley. We made it 2 years ago and its out for the world to see! https://www.instagram.com/p/CFLRqY0JOkX/?igshid=1eoejuhwmml64

0 notes