#planvision

Photo

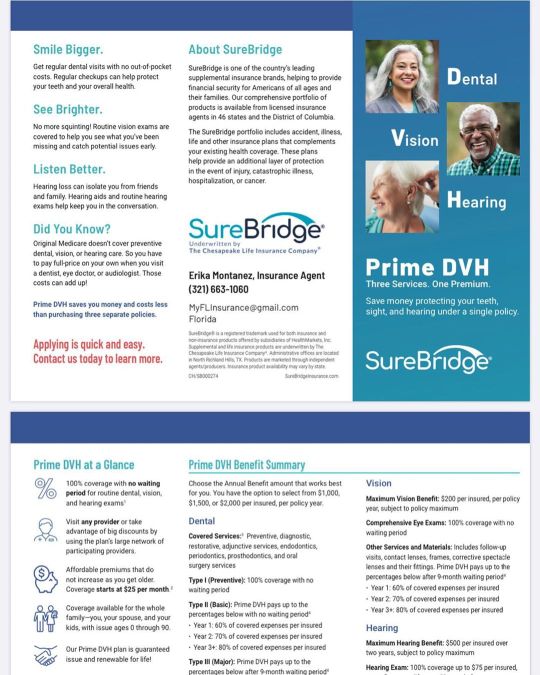

#Contactmenow #dental #visionplan #hearing #Supplemental #insurance #Agent #LOWRATES #GREATCOVERAGE #health #plandental #planvision #nocontracts #llamehoy. 331-663-1060 o #email [email protected] https://www.instagram.com/p/B5Fk3sthDzW/?igshid=1q7d0agwfa4n8

#contactmenow#dental#visionplan#hearing#supplemental#insurance#agent#lowrates#greatcoverage#health#plandental#planvision#nocontracts#llamehoy#email

0 notes

Text

Insurance Sales Agent Unlimited Income Potential with Combined Insurance

The position listed below is not with West Virginia Interviews but with Combined InsuranceWest Virginia Interviews is a private organization that works in collaboration with government agencies to promote emerging careers. Our goal is to connect you with supportive resources to supplement your skills in order to attain your dream career.Combined Insurance, founded in 1922, is currently seeking a Sales Agent.For over 90 years, Combined Insurance has been providing exceptional insurance products that have helped millions of policyholders and their families plan for and protect their futures. We are known for providing an environment which allows our employees to achieve their personal, business, family and financial goals.We currently have an exciting Sales Agent opportunity for a self starter with a goal oriented mindset who is willing to invest a serious amount of time in the pursuit of unlimited economic potential. Are you looking for just an opportunity or are you looking for a sales career?If you are:Motivated by challenges and rewards and can perseverePossess the ability to exceed target goalsPassionate about sellingWilling to invest the time necessary to attain end goalAble to follow through on your dreamsThen we have the career for you!Job Description:Generate sales by meeting with prospective and existing clientsMeet production and activity standardsAttend required company meetingsComplete required training activities and programsLearn and be able to demonstrate company sales materialsSkills&Competencies:Excellent sales and negotiation skillsStrong communication skillsAbility to interact with diverse clientsDemonstrate personal initiative and the ability to problem solveKnowledge&ExperienceSuccessful and stable work historyBasic computer skills (preferred)Commissioned sales experience (preferred)Knowledge of insurance industry (preferred)Minimum criteria to be considered:Valid Drivers LicenseA current bond or be eligible for bond1-2 years of customer service experienceHigh School Diploma or GED preferredLocal area travelReliable transportation with appropriate liability and property coverageState Accident&Health insurance license or willingness to obtain oneWe offer a competitive performance based compensation package; commissions, plus performance and quality business bonus programs.Benefit package includes:Medical PlanDental PlanVision PlanPrescription Drug PlanShort-Term and Long-Term Disability PlanCompany Paid Life Insurance401(K) planStock Purchase Plan for those who qualifyEqual Opportunity EmployerJob Posting- Jul 2, 2015 Associated topics: agent, call center, guest, health, life insurance sales, outside sales, phone, sales, sales associate, sales position InsuranceSalesAgentUnlimitedIncomePotentialwithCombinedInsurance

from Job Portal http://www.jobisite.com/extrJobView.htm?id=115427

0 notes

Text

A man on a financial mission against predatory investment schemes

Trying to be a sensible expat, Matthew Miller set up two long-term savings accounts in lieu of a pension soon after arriving in the UAE. By the time he pulled out of the plans three years ago, he had lost US$45,000 in locked-in fees and commissions.

Mr Miller, a 33-year-old Canadian teacher in Abu Dhabi, has been living here nine years. He bought a 25-year plan in 2009, paying in $2,000 a month, then set up an additional $2,000 a month 10-year plan three years later.

In 2014, having paid in a total of around $140,000, he felt "sick to his stomach" when he realised his savings were not growing. Crunching the numbers, he realised fees were wiping out profits and decided to shut down the plans early.

Mr Miller was spurred on to change his savings ethos by the book Millionaire Teacher: The Nine Rules of Wealth You Should Have Learned in School, written by Andrew Hallam.

A fellow Canadian, author Hallam - who has also written The Global Expatriate's Guide to Investing - is a teacher himself, and worked in Singapore for 11 years. He turned his frugal ways and prudent savings into $1 million before he turned 40 and is now on a crusade to help other expats.

Hallam, 46, left Singapore and his job in 2014 and is now in his third year of travelling with his American wife Pele. While he may return to teaching one day, he says, he no longer needs to work: he can live off his investment portfolio. Yet he has spent this year on an unpaid tour of the Middle East, South East Asia and parts of Africa, giving seminars on investment and how not to get caught out by fixed-term investment plans with inbuilt commissions and high fees like Mr Miller. Since January he has delivered 82 talks in 11 countries in his bid to "stop the spread of financial malaria".

Coming from a modest family upbringing, his father a mechanic and one of four children, Hallam was buying his own clothes by the age of 15 and, at 16, bought himself a car with the proceeds of a part-time supermarket job. He started saving $100 a month from the age of 19, which had turned into a million-dollar pension in his late thirties.

Hallam says he believes the long-term savings and investment plans sold in the UAE are "the most expensive financial products available anywhere in the world" and he hopes that his tour of the region could cumulatively save people in the UAE, Egypt, Kuwait, Jordan and further afield tens of millions of dollars.

"We don't learn financial literacy in school, so people are afraid," he says. "I present financial education. I don't want you to believe what I'm saying: I want you to question it. It's important for everyone to do their own maths.

"Going with compensation-based schemes is not good. There is a far greater conflict of interest because people get you into schemes that just pay them more money. Payment-based financial advice follows more of a fiduciary principle and is a partnership over time - there is no windfall. Commission-based, particularly in the Middle East, can become exploitation."

The UAE Insurance Authority (IA) has received numerous complaints from residents locked into these fixed-term savings products, typically provided by some of the world's largest insurance companies, that see gains eaten away by hefty upfront commissions paid out to local financial advisers by the insurers themselves and recouped from the saver - and which also charge savers the full fees of the plan, even if they exit early, to cover those initial commissions.

As a result the IA is now pushing ahead with tough new regulations to transform the way savings, investment and life insurance policies are sold. Its second draft proposal for the overhaul was issued in April, which included plans to impose limits on the indemnity commission - the upfront commission - advisers can earn and a ban on advisers recouping fees from the products they sell. Life insurance companies were given until May 11 to respond with the new regulations expected to be issued imminently.

Such regulations would prevent people like Mr Miller from losing out. When he exited his two savings plans, the process cost him dearly in surrender charges - some $21,000 of the $100,000-plus value of the first plan and a whopping $24,000 of the second plan that was worth $32,000. It was a "costly lesson", he says.

"Doing the maths, if I was earning 8 per cent but paying four per cent in fees, I was only getting four per cent. Over 25 years, that was hundreds of thousands of dollars. It still seemed better to surrender than lose $400,000 or $500,000 down the road."

Hallam agrees that "education is the enemy of exploitation".

With a wide smile, Hallam is a natural orator thanks to his background as a teacher. In one of two open talks he delivered in Abu Dhabi earlier this year, at Cranleigh School on Saadiyat Island, he leapt around the stage, firing off questions to the audience constantly and keeping them totally engrossed, drawing tuts and gasps at some of the numbers he demonstrated.

Often, he says, the targets are the schools, with a large "victim base" of 200-400 teachers which financial advisers "infiltrate". As "one of them" himself, he says teachers tend to trust him.

Another teacher caught in the net was Kate, a 34-year-old who did not want to reveal her full name. She left the UK for Abu Dhabi in 2012 and is moving away this summer. Five years ago, she and her husband signed up for a 25-year plan, paying in $2,000 a month.

They surrendered it 18 months ago after reading Hallam's book. Of their $47,000 pot, they got back just $10,000. "I'm very aware we've been burnt pretty badly," Kate admits.

"I was cynical - I didn't think we'd be expats for the 25 years of the plan - but the adviser managed to convince us we needed to save. He was very persuasive. While it was horrendous to walk away, the compound interest over time [on the amount we took out] is far better than the loss we suffered."

Lasse Lamminheimo, a 39-year-old Abu Dhabi-based Finnish helicopter engineer, has been in the UAE almost six years. For the last two years he has had one 15-year plan and a second 13-year plan, paying in $2,460 and $550 a month, respectively, but, after listening to Hallam talk, he says he will not be keeping them for much longer.

"It's not called a pension plan but it was my plan to retire after 15 years with the money it was making," Mr Lamminheimo says. But his $66,000 of savings has turned into an under-performing $64,000, with a surrender value of just $4,000 after taking into account the fees for the full term of the plan that must be paid regardless, while his other pot has made just $60, he says. "It makes you feel fairly deflated," he admits.

Hallam advises Middle East investors to steer clear of long-term pension schemes offered by at least seven firms, which he says all have fees of at least 4 per cent a year on average (when all platform costs and mutual fund expense ratio fees are considered).

These "devastating" fees are the "reality you face, investing in offshore pensions," says Mr Hallam. So how do you keep a check on such fees?

Firstly, look out for establishment charges, which could be in the realm of 1.6 per cent a year. These might be taken in the first two to five years - and that's either starting a policy or even just increasing the premiums.

Then there are annual administration charges, he says, of around 1.2 per cent per year of the gross value of each investment-linked fund. There are also underlying annual charges of potentially up to 3.5 per cent of the underlying fund value each year.

So in total you might easily be paying as much as 6.15 per cent in the early years, and 1.3 to 4.55 per cent thereafter.

In a 2015 report entitled Mind the Gap, US investment research firm Morningstar calculated that, after fees, an investor would have received 3 per cent less on international equity funds than the 8.77 per cent the funds had made in that time.

"Unfortunately, average investors often suffer from poor timing and end up buying and selling at the wrong times," writes author Kittikun Tanaratpattanakit. "Timing the market is too difficult. It is a losing strategy." Chasing "hot, trendy funds" has "never been a good investment idea", he adds.

So what's the alternative? Hallam suggests that investors create a diversified portfolio of low-cost index funds. An index fund is a type of mutual fund with a portfolio aiming to track a market index such as the Standard & Poor's 500, which is often used in pension plans.

"DIY investors", as he calls them, should buy exchange-traded funds (ETFs), which are funds traded on stock exchanges, much like stocks. The costs are just 0.1 to 0.15 per cent per year - and often even lower for American investors.

Kate has followed his advice, cutting out the middlemen and opening an account directly with a Luxembourg brokerage, TD Direct Investing International, to buy ETFs. As there is a fee per trade of €14.95 (Dh61), she builds up her monthly cash and buys only quarterly. The £20,000 (Dh93,106) she has invested so far in a year has already turned into £21,900.

However, Sam Instone, chief executive of AES International, which charges around 1.25 per cent per annum for investment management and financial planning, sounds a note of caution for the DIY investor, saying that "the size or cost of a mistake is not likely to become apparent for a number of years" (a comment that is equally true for fixed-term savings plans).

Professional advice is critical - but by a fee-based chartered planning firm, someone "who isn't incentivised or paid by the industry," he says. "Not an individual you play golf with who comes to your home, who works on commissions or referrals or who you consider to be a 'friend'," he stresses.

Mark Zoril is the founder of US-based PlanVision, a five-year-old financial advisory that Hallam recommends. Mr Zoril charges just $96 a year on retainer to set up a financial plan and help an investor set up their own low-cost funds.

He says other advisers "laughed" at his price point but he does not believe commissions are "appropriate" and that his service is "time-based", not related to whether the funds "go up or down".

But, says former fixed-term savings investor Mr Miller ruefully: "It's hard to know who to trust once you've been taken to the cleaners."

Follow The National's Business section on Twitter

from Personal Finance RSS feed - The National http://www.thenational.ae/business/personal-finance/a-man-on-a-financial-mission-against-predatory-investment-schemes

0 notes