#new crypto listings on exchanges

Photo

Welcome to Trade

Graviex Exchange Links:

USDT - https://graviex.net/markets/onixusdt

LTC - https://graviex.net/markets/onixltc

BTC - https://graviex.net/markets/onixbtc

Onixcoin Website: https://onixcoin.io

1 note

·

View note

Text

The megacity notice effectively stops the installation from conducting “ any cryptocurrency mining or related operations ” until Blockfusion is in compliance with original zoning bills.

The City of Niagara Falls has issued a check-and-desist notice to New York- headquartered crypto mining establishment Bit Digital over a data installation possessed and operated by its mate Blockfusion.

#world news#news#crypto#cryptocurrencies#cryptocurrency wallet development#cryptocurrency trading#cryptocurrency list#cryptocurrency#cryptocurrency ethereum#market#miners#exchanges

0 notes

Video

youtube

Should Billionaires Exist?

Do billionaires have a right to exist?

America has driven more than 650 species to extinction. And it should do the same to billionaires.

Why? Because there are only five ways to become one, and they’re all bad for free-market capitalism:

1. Exploit a Monopoly.

Jamie Dimon is worth $2 billion today… but not because he succeeded in the “free market.” In 2008, the government bailed out his bank JPMorgan and other giant Wall Street banks, keeping them off the endangered species list.

This government “insurance policy” scored these struggling Mom-and-Pop megabanks an estimated $34 billion a year.

But doesn’t entrepreneur Jeff Bezos deserve his billions for building Amazon?

No, because he also built a monopoly that’s been charged by the federal government and 17 states for inflating prices, overcharging sellers, and stifling competition like a predator in the wild.

With better anti-monopoly enforcement, Bezos would be worth closer to his fair-market value.

2. Exploit Inside Information

Steven A. Cohen, worth roughly $20 billion headed a hedge fund charged by the Justice Department with insider trading “on a scale without known precedent.” Another innovator!

Taming insider trading would level the investing field between the C Suite and Main Street.

3. Buy Off Politicians

That’s a great way to become a billionaire! The Koch family and Koch Industries saved roughly $1 billion a year from the Trump tax cut they and allies spent $20 million lobbying for. What a return on investment!

If we had tougher lobbying laws, political corruption would go extinct.

4. Defraud Investors

Adam Neumann conned investors out of hundreds of millions for WeWork, an office-sharing startup. WeWork didn’t make a nickel of profit, but Neumann still funded his extravagant lifestyle, including a $60 million private jet. Not exactly “sharing.”

Elizabeth Holmes was convicted of fraud for her blood-testing company, Theranos. So was Sam Bankman-Fried of crypto-exchange FTX. Remember a supposed billionaire named Donald Trump? He was also found to have committed fraud.

Presumably, if we had tougher anti-fraud laws, more would be caught and there’d be fewer billionaires to preserve.

5. Get Money From Rich Relatives

About 60 percent of all wealth in America today is inherited.

That’s because loopholes in U.S. tax law —lobbied for by the wealthy — allow rich families to avoid taxes on assets they inherit. And the estate tax has been so defanged that fewer than 0.2 percent of estates have paid it in recent years.

Tax reform would disrupt the circle of life for the rich, stopping them from automatically becoming billionaires at their birth, or someone else’s death.

Now, don’t get me wrong. I’m not arguing against big rewards for entrepreneurs and inventors. But do today’s entrepreneurs really need billions of dollars? Couldn’t they survive on a measly hundred million?

Because they’re now using those billions to erode American institutions. They spent fortunes bringing Supreme Court justices with them into the wild.They treated news organizations and social media platforms like prey, and they turned their relationships with politicians into patronage troughs.

This has created an America where fewer than ever can become millionaires (or even thousandaires) through hard work and actual innovation.

If capitalism were working properly, billionaires would have gone the way of the dodo.

415 notes

·

View notes

Text

As the criminal trial of FTX founder Sam Bankman-Fried unfolds in a Manhattan courtroom, some observers in the cryptocurrency world have been watching a different FTX-related crime in progress: The still-unidentified thieves who stole more than $400 million out of FTX on the same day that the exchange declared bankruptcy have, after nine months of silence, been busy moving those funds across blockchains in an apparent attempt to cash out their loot while covering their tracks. Blockchain watchers still hope that money trail might help to identify the perpetrator of the heist—and according to one crypto-tracing firm, some clues now suggest that those thieves may have ties to Russia.

Today, cryptocurrency tracing firm Elliptic released a new report on the complex path those stolen funds have taken over the 11 months since they were pulled out of FTX on November 11 of last year. Elliptic's tracing shows how that nine-figure sum, which FTX puts at between $415 million and $432 million, has since moved through a long list of crypto services as the thieves attempt to prepare it for laundering and liquidation, and even through one service owned by FTX itself. But those hundreds of millions also sat idle for all of 2023—only to begin to move again this month, in some cases as Bankman-Fried himself sat in court.

Most tellingly, Elliptic's analysis is the first to note that whoever is laundering the stolen FTX funds appears to have ties to Russian cybercrime. One $8 million tranche of the money ended up in a pool of funds that also includes cryptocurrency from Russia-linked ransomware hackers and dark web markets. That commingling of funds suggests that, whether or not the actual thieves are Russian, the money launderers who received the stolen FTX's funds are likely Russian, or work with Russian cybercriminals.

“It’s looking increasingly likely that the perpetrator has links to Russia,” says Elliptic's chief scientist and cofounder Tom Robison. “We can’t attribute this to a Russian actor, but it’s an indication it might be.”

From the first days of its money laundering process following the theft, Elliptic says the FTX thieves have largely taken steps typical for the perpetrators of large-scale crypto heists as the culprits sought to secure the funds, swap them for more easily laundered coins, and then funnel them through cryptocurrency "mixing" services to achieve that laundering. The majority of the stolen funds, Elliptic says, were stablecoins that, unlike other forms of cryptocurrency, can be frozen by their issuer in the case of theft. In fact, the stablecoin issuer Tether moved quickly to freeze $31 million of the stolen money in response to the FTX heist. So the thieves immediately began exchanging the rest of those stablecoins for other crypto tokens on decentralized exchanges like Uniswap and PancakeSwap—which don't have the know-your-customer requirements that centralized exchanges do, in part because they don't allow exchanges for fiat currency.

In the days that followed, Elliptic says, the thieves began a multi-step process to convert the tokens they'd traded the stablecoins for into cryptocurrencies that would be easier to launder. They used “cross-chain bridge” services that allow cryptocurrencies to be exchanged from one blockchain to another, trading their tokens on the bridges Multichain and Wormhole to convert them to Ethereum. By the third day after the theft, the thieves held a single Ethereum account worth $306 million, down about $100 million from their initial total due to the Tether seizure and the cost of their trades.

From there, the thieves appear to have focused on exchanging their Ethereum for Bitcoin, which is often easier to feed into "mixing" services that offer to blend a user's bitcoins with those of other users to prevent blockchain-based tracing. On November 20, nine days after the theft, they traded about a quarter of their Ethereum holdings for Bitcoin on a bridge service called RenBridge—a service that was, ironically, itself owned by FTX. “Yes, it is quite amazing, really, that the proceeds of a hack were basically being laundered through a service owned by the victim of the hack,” says Elliptic's Robison.

On December 12, a month after the theft, most of the bitcoins from that RenBridge trade were then fed into a mixing service called ChipMixer. Like most mixing services, the now-defunct ChipMixer offered to take in user funds and return the same amount, minus a commission, from other sources, in theory muddling the money's trail on the blockchain. But Elliptic says it was nonetheless able to trace $8 million worth of the money to a pool of funds that also included the proceeds from Russia-linked ransomware and dark web markets, which was then sent to various exchanges to be cashed out.

“There might have been a handoff from a thief to a launderer,” says Robison. “But even if that was the case, it would mean the thief was in contact with someone who is part of a Russian money laundering operation.” Robison adds that Elliptic has other intelligence pointing to the money launderers' Russian ties, but doesn't yet have permission from the source to make it public.

After their initial attempt to launder a portion of the funds through ChipMixer, the thieves went strangely quiet. The rest of their Ethereum would remain dormant for the next nine months.

Only on September 30, just days ahead of Bankman-Fried's trial, did the remainder of the funds begin to move again, Elliptic says. By that time, both RenBridge and ChipMixer had been shut down—RenBridge due to its parent company FTX's collapse and ChipMixer due to a law enforcement seizure. So the thieves pivoted to trading their Ethereum for Bitcoin on a service called THORSwap and then routing those bitcoins into a mixing service called Sinbad.

Sinbad has over the past year become a popular destination for criminal cryptocurrency, particularly crypto stolen by North Korean hackers. But Elliptic's Robison notes that despite this, the movement of funds appears less sophisticated than what he's seen in the typical North Korean heist. “It doesn't use some of the services that Lazarus typically use,” Robison says, referring to the broad group of North Korean state-sponsored hackers known as Lazarus. “So it doesn't look like them.” Robison notes that Sinbad is likely a rebranding of a mixing service called Blender that was hit with US sanctions last year, in part for helping to launder funds from Russian ransomware groups. Sinbad also offers customer support in English and Russian.

Does the timing of those new movements of funds ahead of—and even during—Bankman-Fried's trial suggest someone with insider knowledge is involved? Elliptic's Robison notes that, while the timing is conspicuous, he can only speculate at this point. It's possible that the timing has been purely coincidental, Robison says. Or someone might be moving the money now to make it look like an FTX insider—potentially one who fears they might be about to lose their internet access. Neither Bankman-Fried nor his fellow executives have been charged with the theft, and some of the money movements have taken place while Bankman-Fried has been in court, with only a laptop disconnected from the internet.

Eventually, no doubt, the thieves will attempt to cash out more of their stolen and laundered cryptocurrency for some sort of fiat currency. Robison is still hopeful that, despite their use of mixers, they can be further identified at that point. “I think they probably will be successful in cashing out at least some of these funds. I think whether they're going to get away with it is a separate question,” says Robison. “There's already a blockchain trail to be followed, and I think that trail will only become clearer with time.”

Two other cryptocurrency tracing firms, TRM Labs and Chainalysis, have both been hired by FTX's new regime under CEO John Ray III to aid in the investigation. TRM Labs declined to comment on the case. Chainalysis didn’t respond to WIRED’s request for comment, nor did FTX itself.

As those cryptocurrency tracers continue to follow the money, we may someday have a clearer answer to the mystery of the FTX heist. In the meantime, however, FTX's many aggrieved creditors will be left to keep one eye on Bankman-Fried's trial and the other on the Bitcoin blockchain.

12 notes

·

View notes

Text

Don't Miss Out: A Step-by-Step Guide to Claiming Airdrops on Binance with Trading DX

The world of cryptocurrency is rife with exciting opportunities, and airdrops are one way projects can generate buzz and attract new users. Binance, a leading cryptocurrency exchange, is a popular platform for launching airdrops. But how do you claim these free tokens and ensure you're not falling victim to a scam? Fear not, crypto enthusiasts! Trading DX is here to guide you through the airdrop claiming process on Binance with this comprehensive step-by-step guide.

Before You Begin: Understanding Airdrops

What is an Airdrop?

An airdrop is a distribution of free cryptocurrency tokens by a project or platform. The aim is to generate awareness, attract new users, and incentivize participation in their ecosystem. Projects may airdrop tokens directly to wallets or require specific actions, like holding a certain amount of another token on the platform.

Why Should You Care About Airdrops?

Airdrops offer a chance to acquire new cryptocurrencies for free, potentially leading to significant gains if the project behind the airdrop takes off. However, it's crucial to approach airdrops with caution and only participate in legitimate ones.

Identifying Legitimate Airdrops on Binance

Trust the Source: Always check if the airdrop announcement originates from Binance's official channels, like their website, social media (beware of fake accounts!), or announcements directly on the platform.

Research the Project: Before claiming an airdrop, research the project behind it. Is it a legitimate project with a clear purpose and development roadmap? Beware of airdrops promising unrealistic returns or requiring suspicious actions.

Beware of Scams: Never share your private keys or sensitive information to claim an airdrops. Legitimate airdrops will not require you to send cryptocurrency or pay any fees. If something feels off, it probably is!

Claiming Your Airdrop on Binance: A Step-by-Step Guide

1. Locate the Airdrop Announcement:

The first step is to identify the airdrop you're interested in claiming. Legitimate airdrops will be announced through official Binance channels, as mentioned previously. Look for details about the airdrop, including eligibility criteria, the distribution date, and how to claim your tokens.

2. Ensure Eligibility:

Each airdrop has specific criteria to determine who can claim the tokens. These criteria may involve factors like holding a certain amount of another cryptocurrency on Binance, completing specific tasks, or registering for the airdrop during a designated timeframe. Carefully review the eligibility requirements to ensure you qualify.

3. Access Your Binance Account:

Once you've confirmed your eligibility, log in to your Binance account. Ensure you're using the official Binance website or mobile app to avoid phishing scams.

4. Navigate to the Airdrop Section (if applicable):

Depending on the specific airdrop, you might need to navigate to a dedicated section on the Binance platform. This section could be labeled "Airdrop" or "Distribution" and may be found under the "Wallet" or "Rewards" tab. Refer to the airdrop announcement for specific instructions.

5. Locate the Specific Airdrop:

If there's a dedicated airdrop section, browse through the listed airdrops and find the one you're interested in claiming.

6. Claim Your Tokens:

Once you've located the airdrop, you'll likely find a button labeled "Claim" or "Receive." Click this button to initiate the claiming process. Follow any additional on-screen instructions specific to that airdrop.

7. Review Your Claimed Tokens (Optional):

After successfully claiming your airdrop, you may want to verify that the tokens have been deposited into your Binance account. Navigate to your "Wallet" section and check the balance for the airdropped tokens.

Important Takeaways:

Stay Vigilant: Always prioritize safety when claiming airdrops. Stick to official channels and thoroughly research the project behind the airdrop. Never share your private keys or sensitive information.

Double-check Eligibility: Ensure you meet all the criteria before attempting to claim an airdrop.

Beware of FOMO (Fear of Missing Out): Don't rush into claiming airdrops based on hype alone. Do your due diligence before participating.

Trading DX: Your Trusted Partner in the Crypto Space

The exciting world of cryptocurrency can be overwhelming, especially for newcomers. Trading DX is here to empower you with the knowledge and resources you need to navigate the crypto landscape with confidence. From educational content on YouTube (@tradingdx) to market analysis and a supportive online community, we're committed to your success.

Also See;

How to Earn Money from Crypto Market? How to Invest in Crypto 2024? Crypto Trading for Beginners

Buy/Sell USDT in INR, How to Buy USDT in India ✅, Easy way to Buy Crypto

How to Store Crypto Safely ✅, Best Crypto Wallet in 2024

How to Earn by Cryptocurrency Trading

cryptocurrency exchange

2 notes

·

View notes

Text

https://mediamonarchy.com/wp-content/uploads/2024/05/20240514_MorningMonarchy.mp3

Download MP3

Devastating hits, Bezos’ DARPA grandad and Pokémon maps + this day in history w/U.S. moves Jerusalem Embassy and our song of the day by Macklemore on your #MorningMonarchy for May 14, 2024.

Notes/Links:

Are BRICS Bucks coming soon? BRICS: Prepare for US Dollar Collapse, IMF Warns

https://watcher.guru/news/brics-prepare-for-us-dollar-collapse-imf-warns

Australia’s Tax Office Tells Crypto Exchanges to Hand Over Transaction Details of 1.2 Million Accounts: Reuters; The ATO said the data will help identify traders who failed to report their cryptocurrency-related activities.

https://www.coindesk.com/policy/2024/05/07/australias-tax-office-tells-crypto-exchanges-to-hand-over-transaction-details-of-12-million-accounts-reuters/

FTX customers get good-bad news as the bankrupt exchange rides the crypto rally

https://sherwood.news/snacks/crypto/ftx-customers-get-good-bad-news-as-the-bankrupt-exchange-rides-the-crypto/

GameStop shares surge 70% as meme stock craze returns

https://www.cnbc.com/2024/05/14/gamestop-amc-shares-jump-another-40percent-in-premarket-trading-as-meme-stock-craze-returns.html

Full list of closures as major bank to shut 36 branches and cut hundreds of jobs

https://news.sky.com/story/tsb-to-close-36-branches-and-cut-hundreds-of-jobs-13131574

Video: TSB to close 36 branches with 250 jobs devastatingly hit (Audio)

https://www.youtube.com/watch?v=9juP3_SZxAk

Laura Loomer Accuses Democrat Politician Who Told Trump to ‘Go Back to Court’ of Illicit Profiteering from Hush Money Trial

https://archive.ph/Og5Ny

Elon Musk, David Sacks Holds Secret ‘Anti-Biden’ Gathering of Billi

https://californiaglobe.com/fr/elon-musk-david-sacks-holds-secret-anti-biden-gathering-of-billionaires/

Melinda French Gates steps down from Gates Foundation, retains $12.5 billion for additional philanthropy; The Gates Foundation has, over three decades, made $77.6 billion in charitable contributions, making it one of the world’s largest donor organizations.

https://www.nbcnews.com/business/business-news/melinda-gates-stepping-down-from-gates-foundation-rcna152001

FBI File on Jeff Bezos’ Grandfather, a DARPA Co-Founder, Has Been Destroyed

https://vigilantnews.com/post/fbi-file-on-jeff-bezos-grandfather-a-darpa-co-founder-has-been-destroyed/

Video: America’s Book Of Secrets: DARPA’s Secret Mind Control Technology (Audio)

https://www.youtube.com/watch?v=wZRkfBsTTt8

EU’s Controversial Digital ID Regulations Set for 2024, Mandating Big Tech Compliance by 2026

https://reclaimthenet.org/eus-controversial-digital-id-mandating-big-tech-compliance-by-2026

UK airports latest: ‘Queues only getting bigger’

https://news.sky.com/story/uk-airports-latest-queues-only-getting-bigger-after-london-and-manchester-confirm-nationwide-border-system-issue-13131330

Marvel Rivals apologises after banning negative reviews

https://www.bbc.com/news/articles/cd1wwlvd9yko

28 years later, unopenable door in Super Mario 64’s Cool, Cool Mountain has been opened without hacks

https://www.tomshardware.com/video-games/28-years-later-unopenable-door-in-super-mario-64s-cool-cool-mountain-has-been-opened-without-hacks

Pokémon Go players are altering public map data to catch rare Pokémon

https://arstechnica.com/gaming/2024/05/pokemon-go-players-are-altering-public-map-data-to-catch-rare-pokemon/

Video: Pokemon Go Versus OpenStreetMap (Audio)

https://www.youtube.com/watch?v=fLPyXy39Sv0

Image: @Hybrid’s Cover Art – Pokemon Go’s ‘Modern Solutions’

https://mediamonarchy.com/wp-content/uploads/2024/05/20240514_MorningMonarchy.jpg

May 2014 – Page 6 – Media Monarchy

https://mediamonarchy.com/2014/5/page/6/

Flashback: Americans Will Never Have the ‘Right to Be Forgotten’ (May 14, 2014)

https://mediamonarchy.com/americans-will-never-have-right-to-be/

Flashback: Modern Pope Gets Old School On The Devil (May 14, 2014)

https://mediamonarchy.com/modern-pope-gets-old-school-on-devi/

Flashback: Frugal US Consumers Make It Tough for F...

View On WordPress

#alternative news#cyber space war#Macklemore#media monarchy#Morning Monarchy#mp3#podcast#Songs Of The Day#This Day In History

2 notes

·

View notes

Text

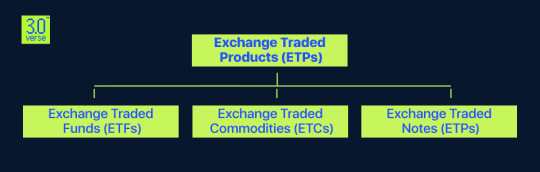

Comparison ETPs and ETFs

Exchange-traded products (ETPs) and exchange-traded funds (ETFs) are both important components of a diversified investment portfolio. This guide explores the differences, structures, and roles of ETPs and ETFs in various investment strategies.

Key Insights:

Insights include the unique features of ETPs and ETFs in terms of regulation, liquidity, and structure. While ETFs offer intraday liquidity, trading flexibility, and lower costs compared to other ETPs, each type caters to different asset classes with specific risks and structures. Additionally, ETFs provide superior diversification and investor protections as they are regulated under the Investment Company Act of 1940. When choosing between ETPs and ETFs, factors such as cost, risk tolerance, and desired market exposure should be considered. Lower-risk strategies often prefer ETFs for their lower costs while higher-risk strategies may utilize certain ETPs like leveraged or inverse products.

After previously rejecting them under former Chair Jay Clayton, the U.S. Securities and Exchange Commission (SEC) has now given its approval for the listing and trading of various spot bitcoin exchange-traded product (ETP) shares. The decision has been influenced by recent legal developments and changing circumstances, and is focused specifically on ETPs that hold bitcoin rather than a wider range of crypto assets. The SEC has emphasized the need for complete transparency, investor safeguards, and regulation when it comes to these products. However, the regulatory body has also cautioned that bitcoin is a highly speculative and volatile asset, and has advised investors to exercise caution.

Understanding ETPs and ETFs:

ETPs (Exchange-Traded Products):

Investment funds traded on stock exchanges.

Track underlying indices, commodities, or assets.

Offer trading convenience and access to diverse asset classes.

ETFs (Exchange-Traded Funds):

Diversified portfolios reflecting underlying indices.

Traded like stocks on an exchange with intraday liquidity.

Combine features of stocks and mutual funds.

ETPs Overview: ETPs encompass a variety of investment products, including ETFs, ETNs, ETMFs, and ETCs. Each category tailors its structure to different assets, providing a convenient tool for portfolio diversification.

Traditional Giants Embrace Bitcoin:

The propulsion of Bitcoin Adoption reached new heights when major giants joined the fray. Esteemed companies like Tesla, Overstock, and Microsoft have embraced Bitcoin as a viable payment option, marking a pivotal moment in mainstream acceptance. These household names not only validate the legitimacy of cryptocurrency but also serve as trailblazers, inspiring smaller businesses to explore the advantages of integrating Bitcoin into their payment methods. Basically in the year 2021, Tesla made waves by announcing that customers could purchase their electric vehicles using Bitcoin. Beyond introducing a novel purchasing avenue, this decision sparked conversations about the prospective role of cryptocurrencies within the automotive industry. Similar strategic moves by other influential companies have collectively contributed to the narrative that Bitcoin is transitioning into a recognized and widely accepted form of payment.

This evolution underscores Bitcoin's journey from being perceived solely as an investment opportunity to emerging as a practical and legitimate means of transaction in today's dynamic business landscape.

ETFs Unveiled:

Hold diversified portfolios of investments.

Traded on exchanges, mirroring underlying indices.

Include various investments like stocks, commodities, bonds, or crypto.

Offer intraday liquidity and real-time pricing.

ETPs vs. ETFs: ETPs and ETFs, while both traded on exchanges, differ in structure, regulation, and trading characteristics. ETFs, subject to stringent oversight, often exhibit superior liquidity and narrower bid-ask spreads compared to ETPs.

Structure and Regulation: ETFs, registered and regulated by the SEC under the Investment Company Act of 1940, adhere to strict oversight. Other ETPs, like ETNs, may lack board oversight, presenting a less rigorous regulatory framework.

Trading and Liquidity: ETFs generally boast higher liquidity and narrower bid-ask spreads than ETPs. The popularity, trading volume, and underlying securities influence the bid-ask spread, making ETFs more appealing for their trading flexibility.

Diversification and Risk Management: Both ETPs and ETFs offer diversification, but the extent depends on the specific product. ETFs, with broad underlying assets, usually provide extensive diversification. However, risks arise, particularly with leveraged or inverse ETFs impacting tax efficiency.

Types of ETPs and ETFs: Passive and active management options cater to diverse investment strategies. Passive ETFs replicate index performance, offering cost-effectiveness, while active ETFs aim to outperform by adjusting portfolios based on market conditions.

Sector and Industry Focus: ETFs and ETPs enable targeted investments in sectors or industries. Sector ETFs cover broader categories, while industry ETFs concentrate on specific industries within sectors, allowing focused exposure.

Leveraged and Inverse Products: Leveraged ETPs amplify underlying index performance using financial derivatives, presenting higher returns and risks. Inverse ETPs aim for returns inversely correlated to specific benchmarks, suitable for sophisticated investors.

Costs and Fees: Expense ratios, covering operating costs, vary between ETPs and ETFs. ETFs generally incur lower fees, with expense ratios around 0.16% for index ETFs. Consideration of brokerage commissions and transparent/hidden fees is crucial for cost-effective investing.

Choosing Between ETPs and ETFs: Deciding between ETPs and ETFs hinges on investment goals, risk tolerance, and exposure preferences. ETFs suit lower risk appetites, providing diversified options, while certain ETPs, like leveraged products, cater to investors comfortable with higher risk levels.

Advantages and Disadvantages: ETFs, as a subset of ETPs, offer benefits such as diversification, liquidity, and tax efficiency. Other ETPs, like ETNs or ETCs, present different cost structures and risks. Understanding their advantages and disadvantages aids in informed decision-making.

Real-Life Examples: Examples like SPDR® S&P 500® ETF Trust (SPY) and Bitcoin spot ETFs illustrate the diversity and innovation within ETPs and ETFs, showcasing varied investment options in the market. Moreover, Investors can now gain exposure to the world's largest cryptocurrency, Bitcoin, through recently approved spot ETFs. These cutting-edge ETFs showcase the extensive array of investment opportunities in the realm of ETPs and ETFs.

Potential Risks and Rewards: ETPs and ETFs carry market risks, influenced by volatility, socioeconomic factors, and geopolitical risks. Understanding the inherent risks and potential rewards, including attractive returns from ETNs tied to underlying indices, is vital for investors.

In Conclusion:

Both ETPs and ETFs contribute to effective portfolio diversification, each with unique characteristics. While ETFs are favored for liquidity and low-cost options, a broader spectrum of ETPs caters to specific investment needs. Choosing between them necessitates aligning with overall investment strategies.

3 notes

·

View notes

Text

The price fluctuations in the Shiba Inu shocked the Cryptocurrency market on Wednesday, September 27. The news was related to the vanishing of the Shiba Inu coin overnight which directly hiked the burn rate up to 1000%.

What is Actually Happening?

Shiba Inu (SHIB), one of the most popular meme coins introduced in August 2020 by Ryoshi, an anonymous founder. With time, the coin grasped much more popularity, ranking second in the list of meme tokens. Recently, the coin has become a highlight.

The coin vanished overnight, resulting in an increased burn rate.

On Wednesday, a sudden hike was experienced in the burn rate of Shiba Inu, hitting 1000% in the past 24 hours. The action of permanent removal of some of the Shiba Inu toke from circulation is considered to be one of the main reasons behind the same. Based on the report of Benzinga, the hike came just after a staggering 164 Million SHIB tokens were indelibly removed from circulation. The prediction is made based on the data from Shibu Inc. burn tracker Shibburn.

Considering the data of Etherescan, two dormant crypto wallets, including “0x6ab” and “0xA75”, received substantial withdrawals of SHIB tokens from exchanges such as MEXC and Binance. The withdrawal amount was around 16 Billion SHIB.

The current situation shows the emergence of new Shiba Inu whales in the market, holding around $500,000 in SHIB.

According to Shytoshi Kusama, the lead developer of Shiba Inu, the platform is planning to offer something unique to Crypto enthusiasts.

Shibarium, ShibaSwap’s gas token, the development team has revealed that the minting process for the remaining BONE supply is all set to be accomplished. Following the statement, rewards associated with the BONE over the ShibaSwap platform will be offered to the users soon. The rewards are expected to take the users to a new token named “TREAT”.

Current Stats of Shiba Inu

Shiba Inu gained much popularity in very little time, ranking second in the list of meme tokens only after Bitcoin (BTC). The passion of the SHIB community and the selling of NFT collections better represent the rising appeal of Shiba Inu in the crypto space.

Focusing on the current performance of Shibh Inu, the SHIB coin’s current price is $0.000007244, a hike of 0.39% in the past 24 hours. With a market cap of $4 Billion and a 24-hour volume of $78 Million, the coin is all set to rock the crypto stage.

The circulating supply of Shiba Inu is 589,346,914,631,298 SHIB and the total supply is 589,589,040,239,380 SHIB. The coin is available at cryptocurrency exchanges including Binance, Bybit, Cointr Pro, OKX, and DigiFinex.

Conclusion

Shiba Inu, one of the main tokens in the cryptocurrency world experiencing high burn rates, vanishes millions of tokens overnight. The active involvement of the community with the coin buying and selling represents the bright future of Shiba Inu.

2 notes

·

View notes

Text

Feb. 8 (UPI) -- A former employee of the cryptocurrency exchange Coinbase pleaded guilty to insider trading by using confidential information from his company to determine which crypto assets would be listed on the exchange.

Ishan Wahi, a former Coinbase product manager, admitted on Tuesday to giving information to others about cryptocurrencies that the company was going to be listing on its platform. Wahi is the first person to plead guilty to an insider trading case involving cryptocurrency, U.S. Attorney Damian Williams said.

"Whether it occurs in the equity markets or the crypto markets, stealing confidential business information for your own personal profit or the profit of others is a serious federal crime," said Williams.

Beginning in October 2020, Wahi worked at Coinbase as a product manager on the asset listing team. He used his job to provide confidential information about which crypto assets would be listed, to his brother Nikhil Wahi and Sameer Ramani. Wahi and Ramani then sold the assets for a profit after they were announced.

RELATED Puerto Rico man charged with $110 million cryptocurrency fraud

Prosecutors said the three men made $1.5 million in illegal profits.

Wahi faces a maximum of 20 years in prison and is set to be sentenced on May 10. Nikhil Wahi was sentenced to 10 months in prison. Ramani has also been charged.

The charge comes as cryptocurrency exchanges face increased turbulence and scrutiny following the collapse of FTX.

RELATED Report: North Korean hackers stepping up crypto attacks

Sam Bankman-Fried, the founder of FTX, pleaded not guilty last month to eight federal charges ranging from wire fraud and conspiracy to commit money laundering, to conspiracy by misusing customer funds as prosecutors said he used users' funds to purchase expensive real estate and to donate millions to political campaigns.

In the wake of the FTX scandal, Coinbase announced that it would lay off about 950 workers 900 and incur $149 million to $163 million in restructuring efforts, including severance packages and termination benefits, citing "market conditions" for the move.

Last month, the New York State Department of Financial Servicesordered Coinbase to pay $50 million to settle charges it failed to conduct proper background checks on new user accounts and another $50 million to bolster its compliance program.

9 notes

·

View notes

Text

Biswap (BSW), Terra Classic (LUNC) Holders Buy More Chronoly (CRNO) As It Launches on 6 October

The highly volatile crypto market still boasts of a token like Chronoly (CRNO) that has managed to weather the crypto waves without losing its value. The duo of Biswap (BSW) and Terra Classic (LUNC) have witnessed massive dumps by their holders in recent times due to the bearish posture of the crypto market. These two projects are backed by reputable individuals and influencers and offer exciting use cases.

Since the market is highly volatile, it is a no-brainer for investors to jump ship in search of projects that can beat the bear market, and that's why they are purchasing more Chronoly (CRNO), even as the latter's pre-sale has completely sold out.

Read on to find out the reason behind the ship jumping and other developments on the market.

Will Biswap (BSW) Get The Momentum Back?

The constant crypto crashes have taken a toll on not only Bitcoin, but also on smaller projects like Biswap (BSW). The market downturn has made token holders dump the project for a viable alternative like Chronoly (CRNO). However, the developmental team is working round the clock to reverse the narrative. First, it has partnered with reputable influencers to promote the brand and generate more younger leads/investors. Secondly, the team plans to list the native token, BSW, on multiple decentralized exchanges. The essence of the listing is to encourage massive adoption by investors from across the world.

At its core, Biswap (BSW) is a decentralized exchange that's built on the Binance Smart Chain to help crypto users easily swap tokens. Biswap (BSW) has a low crypto trading fee of 0.1%. As of the time of writing this piece, Biswap (BSW) trades for $0.263081 USD with a 24-hour trading volume of $5,945,816 USD.

Can Terra Classic (LUNC) Reach $1 By 2023?

Terra Classic (LUNC) experienced a boost from new users in the first quarter of 2022, and then the bear market struck the global crypto market. As with Biswap (BSW), Terra Classic (LUNC) holders have also joined investors jumping ship to join the Chronoly (CRNO) bandwagon. The reason for this may not be unconnected to the massive growth experienced by Chronoly.

Luna Classic (LUNC) is the original Terra Luna coin left behind following the launch of a new Terra chain after the recent UST/Luna collapse. Despite the move by Terra Classic (LUNC) holders, the project's CEO has assured the remaining investors still in the network that the bear market is temporary and that LUNC token will recover once the market breaks support.

At press time, Terra Classic trades for $0.000297 USD with a 24-hour trading volume of $286,803,165 USD.

Chronoly (CRNO) Launches On October 6 After a Successful ICO

Despite the dip in the global crypto market, Chronoly (CRNO) has been more successful than the duo of Biswap (BSW) and Terra Classic (LUNC). The reason for the success is not far-fetched: Chronoly (CRNO) is a project that is backed by real assets. Timepieces or luxury watches have been proven to be a hedge against inflation.

Timepieces usually shine during government upheaval and war, and the Chronoly team decided to invest in this space. Chronoly (CRNO) is an Ethereum-powered marketplace that's scheduled to launch on October 6. The marketplace will allow traders and investors can buy, sell, and trade in rare luxury watches from popular brands like Rolex, Patek Philippe, Richard Mille, and Audemars Piguet, with as low as $10.

Since its inception, Chronoly (CRNO) has grown by over 690%, attracting the attention of both institutional and retail investors from across the world. The Chronoly team recently completed and sold out its ICO. With the milestone recorded in the just concluded ICO, the Chronoly team will redouble its efforts to provide users with the opportunity to earn membership benefits and lottery prizes.

8 notes

·

View notes

Text

Difo Launchpad

is the first hybrid Multi-chain IDO Launchpad

#Difo #Launchpad is where you get access to the best new tokens before they list on other centralized or decentralized exchanges. #difofinance #difoswap #difolaunchpad #difodex #difo #difotoken #difocoin #DeFi #BTC #Bitcoin #crypto $DIFO @difofinance @difolaunchpad @difodex @difoswap

2 notes

·

View notes

Text

An indictment from the US Department of Justice may have solved the mystery of how disgraced cryptocurrency exchange FTX lost over $400 million in crypto. The indictment, filed last week, alleges that three individuals used a SIM-swapping attack to steal hundreds of millions in virtual currency from an unnamed company. The timing and the amount stolen coincides with FTX's theft. Meanwhile, in a letter obtained by WIRED this week, seven lawmakers have demanded the DOJ stop funding biased and inaccurate predictive policing tools until the agency has a way to ensure law enforcement won’t use them in a way that has a “discriminatory impact.”

In Florida, prosecutors say a 17-year-old named Alan Winston Filion is responsible for hundreds of swatting attacks around the United States. The news of his arrest was first reported by WIRED days before law enforcement made it public. It was the culmination of a multi-agency manhunt to piece together a trail of digital breadcrumbs left by the teenager. In Ukraine, unmanned aerial vehicles have been powerful tools since the Russian invasion began in February 2022. But as the war rages on, another kind of unmanned robot has increasingly appeared on the front-lines: the unmanned ground vehicle, or UGV.

For months lawyers affiliated with an India based hacker-for-hire firm called Appin Technology have used legal threats to censor reporting about the company’s alleged cyber mercenary past. The EFF, Techdirt, MuckRock, and DDoSecrets are now pushing back, publicly sharing details for the first time about the firm's efforts to remove content from the web. It’s a dangerous world out there, so we’ve also got a list of some major patches issued in January that you can use to update your devices to keep them secure.

And there’s more. Each week, we highlight the news we didn’t cover in-depth ourselves. Click on the headlines below to read the full stories. And stay safe out there.

China’s Hackers Keep Targeting US Water and Electricity Supplies

For years Western security officials have warned about the threat of China collecting data about millions of people and the country’s hackers infiltrating sensitive systems. This week, Federal Bureau of Investigation director Christopher Wray said hackers affiliated with the Chinese Communist Party are constantly targeting US critical infrastructure, such as water treatment plants, the electrical grid, and oil and gas pipelines. Wray’s testimony, at a House subcommittee on China, came as the FBI also revealed it removed malware from hundreds of routers in people’s homes and offices that had been planted by the Chinese hacking group Volt Typhoon.

“China’s hackers are positioning on American infrastructure in preparation to wreak havoc and cause real-world harm to American citizens and communities,” Wray said in the public appearance. “Low blows against civilians are part of China’s plan.” The FBI director added that China has a bigger hacking operation than “every other major nation combined,” and claimed that if all of the FBI’s cyber-focused agents were assigned to work on issues related to China, they would still be outnumbered “by at least 50 to 1.”

While concerns about the scale of China’s espionage and cyber operations aren’t new, the US intelligence community has been increasingly vocal and worried about critical infrastructure being targeted by Volt Typhoon and other groups. “The threat is extremely sophisticated and pervasive,” NSA officials warned in November. In May 2023, Microsoft revealed it had been tracking Volt Typhoon intrusions at communications and transportation infrastructure, among other critical infrastructure, in US states and Guam.

The FBI and DOJ, also revealed this week that they remotely removed the KV Botnet malware from hundreds of routers infected by Volt Typhoon. The impacted routers, from Cisco and Netgear, were mostly at the end of their life, but were being used as part of wider operations. “The Volt Typhoon malware enabled China to hide, among other things, pre-operational reconnaissance and network exploitation against critical infrastructure like our communications, energy, transportation, and water sectors,” Wray said. It isn’t the first time US officials have obtained a court order to remotely wipe devices infected by hackers, but the move is still rare.

‘Untraceable’ Monero Transactions Have Been Traced, Police Claim

Since the first cryptocurrencies emerged more than a decade ago, there has been the assumption that the blockchain-based digital currencies are anonymous and untraceable. They are, in fact, very traceable. Researchers have shown how people can be linked to the transactions they make and law enforcement have used the techniques to help bust illicit dark web markets and catch pedophiles. There are, however, still some privacy-focused cryptocurrencies that appear to be less traceable than Bitcoin. This includes Monero, which is increasingly being adopted by sellers of child sexual abuse materials.

This week investigators in Finland said Moreno-tracing helped reveal the identity of a hacker who allegedly attacked psychotherapy company Vastaamo in 2020, stealing thousands of patient records and threatening to leak them unless people paid a ransom. Investigators from the Finnish National Bureau of Investigation claim they used heuristic analysis to infer where funds were moved to. The investigators did not reveal the full methods of how they allegedly traced the Monero payments, however, they add to the growing body of evidence that cryptocurrency tracing firms and investigators may be able to track the currency.

Russia Likely Behind a Spike in GPS Interference, Officials Say

Planes flying over Europe have faced a spike in accuracy issues with GPS systems used for navigation in recent months. The head of Estonia’s Defense Forces has claimed that Russia is likely the source of this interference, according to an interview with Bloomberg. “Someone is causing it, and we think it’s Russia,” Martin Herem told the publication, adding that Russia may be testing its electronic warfare capabilities and “learning” the most effective tactics. Across Europe, and particularly the Baltics region, there has been a reported increase in GPS jamming, with Finland reporting large interferences in December and pilots repeatedly reporting issues with their navigation systems.

Vault 7 Hacking Tools Leaker Joshua Schulte Sentenced to 40 Years

In 2017, the Vault 7 leaks exposed some of the CIA’s most sophisticated hacking tools, including how the agency could compromise routers, phones, PC, and TVs. Joshua Schulte, a former CIA engineer in the agency’s Operations Support Branch who prosecutors identified as being behind the data breach and responsible for leaking the materials to Wikileaks, was convicted in numerous trials in recent years. Schulte, who denied the allegations, has been sentenced to 40 years in prison for the espionage and also for possessing thousands of child abuse images. Judge Jesse Furman, sentencing Schulte, said he had caused “untold damage to national security.” In June 2022, The New Yorker published this comprehensive investigation into the data breach and Schulte’s troubled history working at the agency.

2 notes

·

View notes

Text

At all relevant times, Coinbase was one of the largest cryptocurrency exchanges in the world. Coinbase users could acquire, exchange, and sell various crypto assets through online user accounts with Coinbase. Periodically, Coinbase added new crypto assets to those that could be traded through its exchange, and the market value of crypto assets typically significantly increased after Coinbase announced that it would be listing a particular crypto asset. Accordingly, Coinbase kept such information strictly confidential and prohibited its employees from sharing that information with others, including by providing a “tip” to any person who might trade based on that information.

Beginning in approximately October 2020,ISHAN WAHI worked at Coinbase as a product manager assigned to a Coinbase asset listing team. In that role, ISHAN WAHI was involved in the highly confidential process of listing crypto assets on Coinbase’s exchanges and had detailed and advanced knowledge of which crypto assets Coinbase was planning to list and the timing of public announcements about those crypto asset listings. Beginning at least in August 2021 and continuing through May 2022, ISHAN WAHI was a member of a private Coinbase messaging channel reserved for a small number of Coinbase employees with direct involvement in the Coinbase asset listing process. The private channel was used to discuss, among other things, “exact announcement / launch dates + timelines” that Coinbase did not wish to share with all of its employees.

12 notes

·

View notes

Text

What is the best exchange, OKX or Binance?

Binance and OKX are among the most talked-about crypto exchanges in the world. After reading this post, you will be able to choose the exchange that is most suitable for you.

youtube

Binance Review

Binance is a name you may have heard of even if you're new to crypto. Binance was established in the year 2017 and is the most popular crypto exchange by trading volume. There are currently over 28 million users.

Binance allows traders to experience huge trading volumes and liquidity, as well as low costs. It also offers an advanced trading platform.

Security, Fees, and other features of Binance

Binance has accounts that are tier-based, meaning traders can boost their VIP level by achieving the highest volume of transactions or having the native BNB tokens. In addition to the very lower cost of trading, Binance also offers a few trading pairs for absolutely no cost.

Concerning security, Binance follows industry standards and is attentive to its fund security. The exchange was hacked by a hacker in January 2019, resulting in a loss of $40,000. These funds were later returned.

Products from Binance Available

Binance is the home of the most number of products across the entire crypto industry. It will require a different article to list all the offerings. So, here are some of the most intriguing products of Binance.

A top-of-the-line trading platform.

Futures market that includes over 130 cryptocurrency assets.

You can leverage your tokens as high as 4x.

A launchpad with great IDO/ICO events.

Solid NFT market.

Binance Card for crypto spending

Earn an income that is passive with Binance.

OKX Review

OKX was launched in 2016 as one of the first cryptocurrency exchanges. It has made significant strides. The exchange was previously known as OKEX. The year 2022 was when OKX changed its name to OKX and revamped its platform.

Instead of being merely a trading exchange, OKX functions as a one-stop shop for everything crypto-related like the DeFi metaverse, DeFi, and Web3 projects. OKX is a fantastic choice for traders because it offers a range of crypto-related products as well as a high-performance trading platform. It also permits you to trade with no KYC.

Features, Fees, And Security Of OKX

Traders can select from several types of accounts on their KYC level and requirements. OKX provides high security and keeps 95% of client funds in cold storage.

OKX Products Offered

OKX offers a wide range of products that will satisfy all types of traders. Below are some of the most frequently used products offered by OKX.

Crypto trading is powered by an advanced platform.

Wide variety of kinds of trading orders.

OKX Earn provides passive income for cryptocurrency.

Dive into the world of DeFi metaverse, DeFi, and Web3 projects.

Take part in Polkadot & Kusama Slot Auctions.

Take advantage of integrated walled and trading bots.

OKX Vs. Binance

After you've gone through the report It's time to find out which one is the best about various criteria including security, user experience, and costs. Let's look at the offered products.

OKX Vs. Binary: Products Available

Both exchanges provide products with more in common than differences. Binance has greater financial support for crypto assets and offers a wider range of products. OKX however, has a better trading experience and a stronger self-custodial web3 account. While we like to place Binance as the best in this category, OKX is not that far from the top.

OKX vs. Binary: User-Friendliness

Newer traders will find it difficult to use the interfaces of both platforms due to the large range of products and features that are available. However, if you're an experienced trader who knows the ropes The user experience is likely to be better on both of the platforms. It's difficult to decide which platform is better in this case, therefore we referred to it as an "equal".

OKX vs. Binance: Fees

Both exchanges are renowned for their low-cost structures. In the beginning, the fees for the taker and maker are 0.1%. OKX charges 0.08% for both takers and makers, and 0.1 percent, respectively. Binance is the clear winner, despite significantly lower trading charges. It offers zero fees for trading with stablecoin BTC pairs, BUSD spot trading charges, and complete fiat banking services.

OKX vs. Security

A similar approach to security measures can be seen in both of these top-tier cryptocurrency exchanges. It's impossible to go wrong if security is your primary security concern.

Conclusion

Both Binance and OKX are among the largest crypto exchanges in the world. With both exchanges, you won't be disappointed. Binance is a good choice for traders who want better access to money. OKX is the best option for traders looking for KYC trading and more efficient bot implementation.

FAQs

Which is the better option, OKX or. Binance?

The demands of the trader will determine which exchange is the best. Binance is the largest cryptocurrency exchange. OKX has many impressive features. Doing research is the best method to find out what functions best.

Is Binance secure?

Binance, an exchange that is highly regulated has a global service, and has earned the trust of millions of customers. It also has great security features and even an insurance fund to safeguard clients' funds.

2 notes

·

View notes

Text

Are you looking for a way to earn free crypto?

Cryptocurrency is becoming increasingly popular, and there are now a variety of ways to earn free crypto. Here are some methods to get you started:

Participate in Airdrops:

Airdrops are Are you looking for a way to earn free crypto? essentially free distributions of crypto coins. Companies will often give away coins to create awareness and attract new users. To participate in an airdrop, you usually need to join a mailing list or social media group, and provide your wallet address.

2. Complete Online Tasks:

There are a variety of websites that pay users in crypto for completing tasks. These tasks range from filling out surveys to writing blog posts or articles.

3. Staking:

Staking is the process of holding coins in your wallet and earning interest. Some coins will offer users a percentage of their holdings in exchange for staking their coins.

4. Mining:

Mining is the process of verifying and recording transactions on the blockchain. This requires powerful computers, but there are some coins that are more easily mined with less powerful hardware.

5. Trading:

Cryptocurrency trading can be a great way to earn free crypto. If you’re familiar with trading, you can look for opportunities to buy low and sell high to turn a profit.

By following these steps, you can start to earn free crypto and get involved in the world of cryptocurrency. With the right knowledge and resources, you can start to build your own crypto portfolio.

3 notes

·

View notes

Text

What is Fiat Money?

Now my questions arise as to how this money was created in the beginning as I simply could not understand it from the videos I watched and how it is still being created today. If it is along the lines that our government creates our current fiat money by using printing presses to print it out of thin air, then Bitcoin would fall into the same category that our government is doing, which is, in my opinion, creating counterfeit money. Why do I say this? Because all paper money that has no gold or asset backing is simply what we call “fiat money.” Fiat money refers to any currency lacking intrinsic value that is declared legal tender by a government. As valid currency solely by a government declaration, fiat money, is not backed by any commodity, such as gold, but only by the faith of the bearer. The only thing that gives worth to our paper money is the confidence that the people have in it. If through inflation or other means, it loses its value it will no longer be worth anything. It is a currency that is not based on intrinsic money that should be created by labor. I will now have to define what true money should be.

Definition of Real Money:

It helps to understand the properties and functions of money.

The item serves as a medium of exchange. For an item to be considered money, it must be widely accepted as payment for goods and services.

The item serves as a unit of account. For an item to be considered money, it must be the unit that prices, bank balances, etc. are reported in.

The item serves as a store of value. For an item to be considered money, it has to (to a reasonable degree) hold its purchasing power over time.

As these properties suggest, money was introduced to societies as a means of making economic transactions simpler and more efficient, and it mostly succeeds in that regard. In some situations, items other than officially designated currency have been used as money in various economies. In biblical times, coins of silver and gold were used as that medium so the oldest medium used for the longest length of time has been gold and silver; therefore silver and gold fit this definition. My question does Bitcoin fit this description? Bitcoin only has a short history. Will it be accepted or rejected by the majority of the public as a new medium of exchange? Bitcoin is not a proven form of currency, like gold or silver which has been established as a form of money since the Bible days.

Here is a list of reasons I am having issues with accepting Bitcoin and other cryptocurrencies as a means of monetary exchange:

Bitcoin…Is Not Real Money: In my opinion, Bitcoin is not real money, but rather a digitized form of money, as true money (a means of exchange) is something you can hold in your hand. i.e.: gold and silver coins or paper money backed by gold. Of course, our money in the United States today is no longer backed by gold, so it is not real money either. (The government removed the gold-backing policy during President Nixon’s presidency. It is now called fiat money, but is considered legal tender by the US government and accepted by the general public.)

Is a Crypto Currency Investment with Risk: Bitcoin is traded on centralized and decentralized crypto exchanges. Investing or trading Bitcoin only requires an account on an exchange, though they have nearly the same level of features as their stock brokerage counterparts. Bitcoin being an investment is similar to stock investments with the potential risk of losing your investment. That being said, I would not want to invest in something unless I thoroughly understood it and knew the background of the people and technicians who developed it. With every stock investment, a person should investigate and vet the owners as to their integrity and company management guidelines and policies. Sadly most stock purchases are more speculative and more like gambling than investing.

I learned something from a book I read years ago entitled, “Business by the Book” written by Larry Burkett. He cautioned people not to invest money into something they did not understand, no matter how excited the seller or others might be about it. Here is a quote from that book: Get-rich-quick thinking leads to three basic errors: (1) Getting involved with things you cannot understand; (2) Risking funds you cannot afford to lose, that is, borrowed funds, and (3) Making hasty decisions. Each of these actions violates one or more biblical principles…Together they constitute a sin called greed.”

Now regarding Bitcoin, I did some research by reading and watching videos so I could understand how it operates. Even though I do have some IT understanding and have studied computers in college, have only a partial understanding of Bitcoin. Although I have researched Bitcoin tremendously, I just do not have the technical knowledge to fully understand how it operates and I am still learning.

From: Steven P. Miller

CEO/ Founder of Gatekeeper-Watchman International Groups

Jacksonville, Florida., Duval County, USA.

Instagram: steven_parker_miller_1956,

Twitter: @GatekeeperWatchman1, @ParkermillerQ,

Tumblr: https://www.tumblr.com/blog/gatekeeperwatchman

URL: linkedin.com/in/steven-miller-b1ab21259

Facebook: https://www.facebook.com/ElderStevenMiller

GWIG, #GWIN, #GWINGO, #Ephraim1, #IAM, #Sparkermiller,#Eldermiller1981

2 notes

·

View notes