Text

Comparison ETPs and ETFs

Exchange-traded products (ETPs) and exchange-traded funds (ETFs) are both important components of a diversified investment portfolio. This guide explores the differences, structures, and roles of ETPs and ETFs in various investment strategies.

Key Insights:

Insights include the unique features of ETPs and ETFs in terms of regulation, liquidity, and structure. While ETFs offer intraday liquidity, trading flexibility, and lower costs compared to other ETPs, each type caters to different asset classes with specific risks and structures. Additionally, ETFs provide superior diversification and investor protections as they are regulated under the Investment Company Act of 1940. When choosing between ETPs and ETFs, factors such as cost, risk tolerance, and desired market exposure should be considered. Lower-risk strategies often prefer ETFs for their lower costs while higher-risk strategies may utilize certain ETPs like leveraged or inverse products.

After previously rejecting them under former Chair Jay Clayton, the U.S. Securities and Exchange Commission (SEC) has now given its approval for the listing and trading of various spot bitcoin exchange-traded product (ETP) shares. The decision has been influenced by recent legal developments and changing circumstances, and is focused specifically on ETPs that hold bitcoin rather than a wider range of crypto assets. The SEC has emphasized the need for complete transparency, investor safeguards, and regulation when it comes to these products. However, the regulatory body has also cautioned that bitcoin is a highly speculative and volatile asset, and has advised investors to exercise caution.

Understanding ETPs and ETFs:

ETPs (Exchange-Traded Products):

Investment funds traded on stock exchanges.

Track underlying indices, commodities, or assets.

Offer trading convenience and access to diverse asset classes.

ETFs (Exchange-Traded Funds):

Diversified portfolios reflecting underlying indices.

Traded like stocks on an exchange with intraday liquidity.

Combine features of stocks and mutual funds.

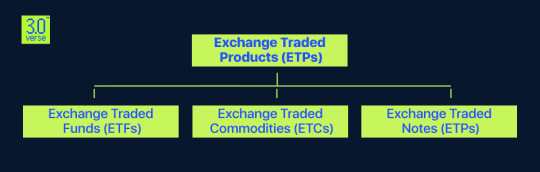

ETPs Overview: ETPs encompass a variety of investment products, including ETFs, ETNs, ETMFs, and ETCs. Each category tailors its structure to different assets, providing a convenient tool for portfolio diversification.

Traditional Giants Embrace Bitcoin:

The propulsion of Bitcoin Adoption reached new heights when major giants joined the fray. Esteemed companies like Tesla, Overstock, and Microsoft have embraced Bitcoin as a viable payment option, marking a pivotal moment in mainstream acceptance. These household names not only validate the legitimacy of cryptocurrency but also serve as trailblazers, inspiring smaller businesses to explore the advantages of integrating Bitcoin into their payment methods. Basically in the year 2021, Tesla made waves by announcing that customers could purchase their electric vehicles using Bitcoin. Beyond introducing a novel purchasing avenue, this decision sparked conversations about the prospective role of cryptocurrencies within the automotive industry. Similar strategic moves by other influential companies have collectively contributed to the narrative that Bitcoin is transitioning into a recognized and widely accepted form of payment.

This evolution underscores Bitcoin's journey from being perceived solely as an investment opportunity to emerging as a practical and legitimate means of transaction in today's dynamic business landscape.

ETFs Unveiled:

Hold diversified portfolios of investments.

Traded on exchanges, mirroring underlying indices.

Include various investments like stocks, commodities, bonds, or crypto.

Offer intraday liquidity and real-time pricing.

ETPs vs. ETFs: ETPs and ETFs, while both traded on exchanges, differ in structure, regulation, and trading characteristics. ETFs, subject to stringent oversight, often exhibit superior liquidity and narrower bid-ask spreads compared to ETPs.

Structure and Regulation: ETFs, registered and regulated by the SEC under the Investment Company Act of 1940, adhere to strict oversight. Other ETPs, like ETNs, may lack board oversight, presenting a less rigorous regulatory framework.

Trading and Liquidity: ETFs generally boast higher liquidity and narrower bid-ask spreads than ETPs. The popularity, trading volume, and underlying securities influence the bid-ask spread, making ETFs more appealing for their trading flexibility.

Diversification and Risk Management: Both ETPs and ETFs offer diversification, but the extent depends on the specific product. ETFs, with broad underlying assets, usually provide extensive diversification. However, risks arise, particularly with leveraged or inverse ETFs impacting tax efficiency.

Types of ETPs and ETFs: Passive and active management options cater to diverse investment strategies. Passive ETFs replicate index performance, offering cost-effectiveness, while active ETFs aim to outperform by adjusting portfolios based on market conditions.

Sector and Industry Focus: ETFs and ETPs enable targeted investments in sectors or industries. Sector ETFs cover broader categories, while industry ETFs concentrate on specific industries within sectors, allowing focused exposure.

Leveraged and Inverse Products: Leveraged ETPs amplify underlying index performance using financial derivatives, presenting higher returns and risks. Inverse ETPs aim for returns inversely correlated to specific benchmarks, suitable for sophisticated investors.

Costs and Fees: Expense ratios, covering operating costs, vary between ETPs and ETFs. ETFs generally incur lower fees, with expense ratios around 0.16% for index ETFs. Consideration of brokerage commissions and transparent/hidden fees is crucial for cost-effective investing.

Choosing Between ETPs and ETFs: Deciding between ETPs and ETFs hinges on investment goals, risk tolerance, and exposure preferences. ETFs suit lower risk appetites, providing diversified options, while certain ETPs, like leveraged products, cater to investors comfortable with higher risk levels.

Advantages and Disadvantages: ETFs, as a subset of ETPs, offer benefits such as diversification, liquidity, and tax efficiency. Other ETPs, like ETNs or ETCs, present different cost structures and risks. Understanding their advantages and disadvantages aids in informed decision-making.

Real-Life Examples: Examples like SPDR® S&P 500® ETF Trust (SPY) and Bitcoin spot ETFs illustrate the diversity and innovation within ETPs and ETFs, showcasing varied investment options in the market. Moreover, Investors can now gain exposure to the world's largest cryptocurrency, Bitcoin, through recently approved spot ETFs. These cutting-edge ETFs showcase the extensive array of investment opportunities in the realm of ETPs and ETFs.

Potential Risks and Rewards: ETPs and ETFs carry market risks, influenced by volatility, socioeconomic factors, and geopolitical risks. Understanding the inherent risks and potential rewards, including attractive returns from ETNs tied to underlying indices, is vital for investors.

In Conclusion:

Both ETPs and ETFs contribute to effective portfolio diversification, each with unique characteristics. While ETFs are favored for liquidity and low-cost options, a broader spectrum of ETPs caters to specific investment needs. Choosing between them necessitates aligning with overall investment strategies.

3 notes

·

View notes