#micro atm api provider

Text

Micro ATM API and Software Provider Company

Micro ATM is helpful if you are running a business. It helps your customer with cash withdrawal, mini statements, and instant settlement and has long durability. Buy the Micro ATM device or API to boost your business. Check our website for more details or call us for a quick response: 9667928122

#micro atm api provider#micro atm api provider in india#micro atm api#micro atm software#best micro atm service provider in india

0 notes

Text

#aeps api#atm machine apply#best aeps service provider#aeps service provider#aadhaar based payment system#micro atm machine price

0 notes

Text

AEPS API provider in mumbai-Paytrav

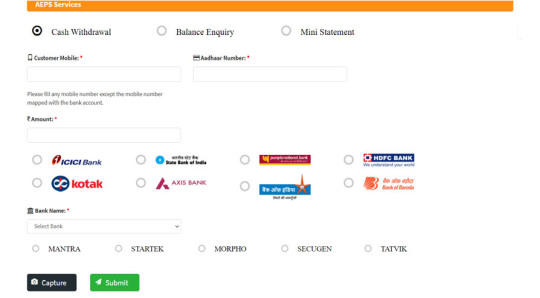

Paytrav is a widely successful AEPS API Provider Company in India. Paytrav AePS API enables Business Correspondent to conduct banking transactions using only the customer’s Aadhaar Number and Biometric Identification.

Some prerequisites are, KYC (Know Your Customer) details to open a new account, and Aadhaar number should be linked with the respective bank account. This AePS API Provider activates the service 1-2 minutes post Aadhaar seeding.

The elements required for transactions are Micro ATM, Aadhaar number, Bank name, Biometrics (Fingerprint and/or IRIS), and assisted mode. The transaction cost will be Nil for the customer while Business Correspondent may get charged or paid based on the bank’s discretion.

AePS service allows performing transactions like Balance Enquiry, Cash Withdrawal, Cash Deposits, Aadhaar to Aadhaar Funds Transfer, Payment Transactions (C2B, C2G Transactions). Only the Best AePS API Provider Company can deliver such benefits.

अच्च्छी आमदनी की तलाश करें पूरी। Edupoint- mATM & AEPS ,Recharge की बेहतरीन सर्विस और ज़बरदस्त कमीशन के साथ बढ़ाएं अपनी पहचान भी और इनकम भी!

"Retailer, Distributor, Master Distributor-ID k liye contact kre !

📞 Contact @ 089-763-15-910

Click Now-https://paytrav.in/

1 note

·

View note

Text

Best Micro ATMs device & service provider company in India - RBP Finivis

RBP Finivis is a leading service provider of aeps and micro atm services and solutions in India. It offers the best Micro ATM service with software, mobile app, and micro ATM devices. The most impressive part of this assistance is that it is likewise valuable to those who are not banked. They can likewise send cash to their friends and family immediately.

0 notes

Video

We are the leading AePS API Provider Company in India, started working for rural and urban regions over last few years. AePS API is the best solution for all your banking transactions using an Aadhaar card

#aeps api provider#aeps api#aeps service#aeps portal#aeps cash withdrawal#aeps api provider company#aeps commission#aeps service provider#aeps api provider company in india#micro atm service provider#micro atm api provider#API provider in India#Best API Provider#fintech#banking#financial service#digital payments#mobile banking#domestic money transfer api#dmt api#nsdl#npci#e-rupi#uidai#uidai aadhar#aadhaar enabled payment system aeps#aadhaar pay

2 notes

·

View notes

Text

Get Micro ATM API Solution to Start Your FinTech Business

RBP Finivis Pvt Ltd is India’s largest B2B fintech platform delivering various banking API & SDK solutions to individuals and businesses of all sizes. One such API solution is micro atm api that has made us one of the finest micro atm api provider company in India. This simple functionality of api offers ordinary citizens easy access to secure financial services like cash withdrawal, etc. while businesses can make a good commission and better-earning opportunities without much investment and effort.

What Role does API Play for the Growth of Digital Banking?

An API plays an important role in making the banking system interoperable. Application Programming Interface is a software application that empowers and allows to connect various banking networks to interchange products and services needed to offer customers. This enables banks to offer even more features and feasible services that have made banking services available to each and every corner of the country. However, the time has now come to digitally transform India with the invention of APIs.

A Mini Version of ATM is an Outcome of API Solution

Micro atm is a mini version of an atm that does not occupy much space for its set-up. It is a portable device that can be carried anywhere. It can carry out basic banking transactions within a few seconds at a click. This amazing device came into existence only because of the arrival of advancements in the technology with the introduction of API (Application Programming Interface)

We with our experienced and pro-active technical team of developers developed & designed fully customized and highly scalable API solutions for businesses. With this advanced payment gateway, entrepreneurs can use their business ideas and strategies in the fintech industry without having much technical knowledge. In other words, we will be available 24*7 for their technical quarries and will solve them as early as possible.

Benefits of Micro ATM With Its Features:

· One can extend banking services anywhere in remote locations using a micro atm machine

· Cheap – It is a low-cost option for the existing traditional ATMs

· Portable – It is a portable device, easy to carry, easy to set up anywhere.

· Interoperable – It can work for any bank using debit cards.

· Secure – Connects banking network through GPRS technology for carrying banking transactions, making it safe and secure

Working of Micro ATM is Similar to Usual ATMs

First of all, you need to undergo a verification process of your debit card. For verification card swipe option is available. Once the verification is completed micro atm screen will display various transaction options. You need to select the option and the device will process the transaction. On a successful transaction, a message will be displayed on the screen and a receipt will be generated. You will also receive an SMS alert from your bank about the transaction.

Conclusion

To offer customers a powerful payment solution, RBP as a micro atm api provider company become a force in supplying the best banking platform. With our fully automated banking api solutions, businesses will enjoy unlimited flexibility and fly at great heights with success all around.

aadhaar se cash withdrawal krnye ka app

#micro atm api#micro atm#micro atm api provider#micro atm api provider company#matm api#matm api proivder#mini atm api provider#mini atm api provider company#micro atm sdk#micro atm device#cash withdrawal api#digital payments api#fintech api#banking api

1 note

·

View note

Text

Micro ATM-How iServeU is Bringing ATMs to the Palm of Your Hands

10 years ago if I told you that soon there would be an app on which you can enter any location you wanted to go, and a cab would come to pick you up navigating through an electronic map automatically in a couple of minutes, you’d ask if I have totally lost it. But Uber is real now and used by millions of people every day. Today, it is almost impossible to imagine commute without these apps. The point here is technology has simplified every tedious task over time making things portable. Speaking of portability, there was a time when people had to visit a bank for simple transactions like balance inquiry or cash withdrawal. To make things easier ATMs came to rescue and the thing became easy but this ever-growing physical world demands more accessibility and speed, calling in for the next generation of ATMs – ‘Micro ATM or mATM’

In November 2018, iServeU became the first company in India to launch a Micro ATM. A Micro ATM or mATM is an alternate way of Aadhaar Enabled Payment System (AEPS) to withdraw cash and inquiry bank balance using a Debit card. The mATM service is a simple and reliable way of performing bank transactions without any extra charges or limitations. iServeU’s Micro ATM processes transactions through an android app using a card reader ATM device. This product operates under the National Financial Switch (NFS) and guidelines of NPCI which ensures the safety and security of your transactions. The Micro ATM uses Bluetooth connectivity to pair with an Android smartphone or tablet and the customer’s Debit card and ATM PIN are the only requirements to initiate a withdrawal or balance inquiry transactions.

Micro ATM is an on-the-go transactional service which is way more different from a traditional mPOS device or Cash@POS Service. With mPOS devices, you can perform transactions on Sale and Cash@POS mode. In POS service, above Rs. 2000/- amount there are some certain MDR charges for both Debit and Credit card. For credit card, MDR charges are even higher. In Sale transactions below Rs. 2000/- MDR charges are also there in POS services. The best thing about mATM service is that there are no Sale or Cash@POS modes. There are no MDR charges for any transactions. You can withdraw as per your card issuer banks’ limitations. iServeU aims to provide a significant number of Micro ATM services, mostly in rural areas to simplify conventional banking. Click here to learn more.

#DMT#MoneyTransfer#AEPS#FinTech#BBPS#Deposit#Micro ATM#Domestic Money Transfer#Aadhaar Enabled Payment System#Insurance#mATM#White Label Provider#Loan Software#Aadhaar Payment#API

1 note

·

View note

Video

Roundpay Merchant App is highly secure gives an ease of access to the merchants to work effectively & efficiently.

Roundpay App Features:

★ Easy Merchant Registration: Simple process to become Roundpay Money Merchant / Agent all you need is mobile number & basic KYC documents

★ Mobile and DTH Recharge: Recharge your Customer's prepaid mobile and DTH for all telecom operators like Jio, Airtel, Vodafone, Idea, Reliance,BSNL,Dish TV, Sun Direct,Videocon D2H & others.

★ Cash Withdrawal (Micro-ATM): Merchants can help customers to withdraw cash from ANY bank account (SBI, PNB, Allahabad Bank, Bank of Baroda, ICICI + 180 more banks) with Aadhaar number & fingerprint only

★ Easy movement of money to Bank : Roundpay Merchant can transfer earned money in bank account in few taps.

★ Money Transfer (DMT): Merchants/Agents can take cash from customers and transfer money to any bank accounts across India.

★ MPOS – Merchants can accept payments through credit cards/ debit cards with the help of their mobile phone and MPOS machine.

★ Bharat Bill Payment (BBPS): Merchant can fetch & pay utility bills of their customers which includes: Gas, Electricity, Water,Education Fees,Insurance Premium)

★ Railway Ticket:Become IRCTC authorized agent and use Roundpay wallet as payment method at booking check out

★ Travel: Roundpay Merchant can book Domestic and Internation Flights Ticket Air, Domestic and Internation Hotels Oyo Rooms for their customers.

★ Pancard Services: Merchant can create new PAN card for their customers online From UTI With Help of Our Expert.

★ Wallet Upload: On the go wallet upload feature using digital payments like UPI, NetBanking, Credit Card, Debit Card.

★ App Notifications: Stay updated with various attractive offers.

★ Transaction History: Roundpay provides you with a detailed Account Statement of your online shop. See all your transaction and how much have you earned on them. Control your online business with relevant reports at your disposal.

★ 24*7 Availability: Provide hassle free services to customer available 24*7

★ User Friendly Interface: Fast, simple & easy interface

★ Secure & Robust: Secure mobile app with multiple layers of authentication to ensure security and Most advanced Level (RD service) AEPS integration from four biometric companies - Morpho, Mantra

visit here for information: https://www.roundpay.in/

Source Link: https://youtu.be/YoQIorj6C-Q

#Mobile Recharge API Provider India#mini atm machine#aadhar micro atm#Aadhaar Enabled Payment System#Recharge API Provider In India

0 notes

Photo

Startling World Services has drawn a 5-day API Plan which is according to your budget, request from you, see and book it.

Visit Now: https://bit.ly/3lqeSXV

Call Now: 9956251008

0 notes

Text

Looking AEPS Service App with Secured B2B Admin Portal?

Payment methods are changing over the time with technology. India is moving towards digital banking. Government is encouraging and supporting cashless society in India by starting new banking alternatives like AEPS service. In this article, I will explain about AEPS service and AEPS service app with it’s benefits and key features.

So without wasting time, I come to the point.

Why AEPS is in Demand?

AEPS stands for Aadhaar enabled payment system. This is a payment method that encouraging banking in rural areas where no banking solutions available. AEPS is aadhaar card centric banking solution that can be performed by visiting nearby business correspondent.

To perform AEPS service, bank customer’s bank account must be linked with Aadhaar card.

Business correspondent has an AEPS service app linked with any bank through AEPS portal provider company.

It means no matter where you are living, If you have Aadhaar card in India, you can use banking anywhere hustle-free.

Best AEPS Service App Provider Company in India

So If you are planning to start your own AEPS business as an admin and looking for best AEPS service app provider then you are at right place.

Here I will explain you how you can start AEPS with your brand, your logo with top AEPS company.

Ezulix software is well known AEPS service provider company in fintech Industry that offers cost-effective AEPS service app integrated with b2b admin portal.

We have skilled AEPS software developers who are expert in fintech solution development.

We facilitate you secured AEPS service app integrated with AEPS portal and your brand website. As an admin, you have all the rights of your portal. You can make unlimited members and can provide all bank AEPS service by the name of your own brand.

For members we have AEPS service app so that they can easily access all banking services. Members can login into your admin app and can earn commission by offering banking services.

Also Read This: Top 5 AEPS Company 2022

Why Start AEPS Business with Brand Ezulix?

We provide you standard b2b AEPS software with AEPS service application and website.

Most of the retailers don’t have budget to buy a system like laptop or desktop. To resolve this problem, we provide AEPS service app to admin. All members can use AEPS service by login in this application.

This AEPS service app is fast, secured and easy to use for everyone. Members just have to login in this app and connect it with bio metric machine for user-authentication.

That’s it.

Admin can change software theme, function, services as per need

3 Tier security levels

24*7 real-time AEPS settlement

Provide AEPS service through multiple banks

Integrated with high commission AEPS API

Unique design

Success ratio of AEPS transaction is 99.7%

We provide you micro ATM with add-on mPOS feature

Manual training and free tech-support

So these are few highlights of our AEPS cash withdrawal app. You can manage all your members and employees by using its add-on employee management system.

Along with this, your members can use Khata Book and Online Shopping Features totally FREE.

Conclusion

Starting AEPS business in 2022 can be a great move by you. If we talk about AEPS transactions over the years, it is increasing exponentially.

Profit percentage is high while risk of failure is very low in AEPS business If you do it by process and by following guidelines of NPCI.

To start AEPS business with us, you have to apply for a free live demo. Our team contact you and explain you everything step by step. This is totally FREE.

2 notes

·

View notes

Text

AEPS Software Provider Company in Noida

Rainet Technology (ClicknCash)is one of the best AEPs provider company in noida which provides you AEPS payment and API for AEPS.The AEPS model is structured in a manner that allows easy interoperable financial transactions to be carried out through Micro ATM with the help of business correspondent of any bank.

https://clickncash.in/aeps-software-provider-company-in-noida/

1 note

·

View note

Text

Domestic Money Transfer Company in India

#recharge api service provider#atm machine apply#mini atm#micro atm machine#aeps service provider#aadhaar based payment system app

0 notes

Link

Cyrus Recharge Software is top Software Company in Delhi, Jaipur, India, working since 2010. We have high profile professionals in different department like Mobile Recharge Software, MLM Recharge Software, B2B,B2C,B2B2C,B2B2B, AEPS Software, API Reselling Softwares, and Whitelabel Recharge Software that capable to complete project requirement of clients..Our company objective is to provide 100% satisfied service and support.

0 notes

Text

Version 445

youtube

windows

zip

exe

macOS

app

linux

tar.gz

I had a great week mostly working on optimisations and cleanup. A big busy client running a lot of importers should be a little snappier today.

optimisations

Several users have had bad UI hangs recently, sometimes for several seconds. It is correlated with running many downloaders at once, so with their help I gathered some profiles of what was going on and trimmed and rearranged some of the ways downloaders and file imports work this week. There is now less stress on the database when lots of things are going on at once, and all the code here is a little more sensible for future improvements. I do not think I have fixed the hangs, but they may be less bad overall, or the hang may have been pushed to a specific trigger like file loads or similar.

So there is still more to do. The main problem I believe is that I designed the latest version of the downloader engine before we even had multiple downloaders per page. An assumed max of about twenty download queues is baked into the system, whereas many users may have a hundred or more sitting around, sometimes finished/paused, but in the current system each still taking up a little overhead CPU on certain update calls. A complete overhaul of this system is long overdue but will be a large job, so I'm going to focus on chipping away at the worst offenders in the meantime.

As a result, I have improved some of the profiling code. The 'callto' profile mode now records the UI-side of background jobs (when they publish their results, usually), and the 'review threads' debug dialog now shows detailed information on the newer job scheduler system, which I believe is being overwhelmed by micro downloader jobs in heavy clients. I hope these will help as I continue working with the users who have had trouble, so please let me know how you get on this week and we'll give it another round.

the rest

I fixed some crazy add/delete logic bugs in the filename tagging dialog and its 'tags just for selected files' list. Tag removes will stick better and work more precisely on the current selection.

If you upload tags to the PTR and notice some lag after it finishes, this should be fixed now. A safety routine that verifies everything is uploaded and counted correct was not working efficiently.

I fixed viewing extremely small images (like 1x1) in the media viewer. The new tiled renderer had a problem with zooms greater than 76800%, ha ha ha.

A bunch of sites with weird encodings (mostly old or japanese) should now work in the downloader system.

Added a link, https://github.com/GoAwayNow/Iwara-Hydrus, to Iwara-Hydrus, a userscript to simplify sending Iwara videos to Hydrus Network, to the Client API help.

If you are a Windows user, you should be able to run the client if it is installed on a network location again. This broke around v439, when we moved to the new github build. It was a build issue with some new libraries.

full list

misc:

fixed some weird bugs on the pathname tagging dialog related to removal and re-adding of tags with its 'tags just for selected files' list. previously, in some circumstances, all selected paths could accidentally share the same list of tags, so further edits on a subset selection could affect the entire former selection

furthermore, removing a tag from that list when the current path selection has differing tags should now successfully just remove that tag and not accidentally add anything

if your client has a pending menu with 'sticky' small tag count that does not seem to clear, the client now tries to recognise a specific miscount cause for this situation and gives you a little popup with instructions on the correct maintenance routine to fix it

when pending upload ends, it is now more careful about when it clears the pending count. this is a safety routine, but it not always needed

when pending count is recalculated from source, it now uses the older method of counting table rows again. the new 'optimised' count, which works great for current mappings, was working relatively very slow for pending count for large services like the PTR

fixed rendering images at >76800% zoom (usually 1x1 pixels in the media viewer), which had broke with the tile renderer

improved the serialised png load fix from last week--it now covers more situations

added a link, https://github.com/GoAwayNow/Iwara-Hydrus, to Iwara-Hydrus, a userscript to simplify sending Iwara videos to Hydrus Network, to the client api help

it should now again be possible to run the client on Windows when the exe is in a network location. it was a build issue related to modern versions of pyinstaller and shiboken2

thanks to a user's help, the UPnPc executable discoverer now searches your PATH, and also searches for 'upnpc' executable name as a possible alternative on linux and macOS

also thanks to a user, the test script process now exits with code 1 if the test is not OK

.

optimisations:

when a db job is reading data, if that db job happens to fall on a transaction boundary, the result is now returned before the transaction is committed. this should reduce random job lag when the client is busy

greatly reduced the amount of database time it takes to check if a file is 'already in db'. the db lookup here is pretty much always less than a millisecond, but the program double-checks against your actual file store (so it can neatly and silently fill in missing files with regular imports), however on an HDD with a couple million files, this could often be a 20ms request! (some user profiles I saw were 200ms!!! I presume this was high latency drives, and/or NAS storage, that was also very busy at the time). since many download queues will have bursts of a page or more of 'already in db' results (from url or hash lookups), this is why they typically only run 30-50 import items a second these days, and until this week, why this situation was blatting the db so hard. the path existence disk request is pulled out of precious db time, allowing other jobs to do other db work while the importer can wait for disk I/O on its thread. I suspect the key to getting the 20ms down to 8ms will be future granulation of the file store (more than 256 folders when you have more than x files per folder, etc...), which I have plans for. I know this change will de-clunk db access when a lot of importers are working, but we'll see this week if the queues actually process a little faster since they can now do file presence checks in parallel and with luck the OS/disk will order their I/O requests cleverly. it may or may not relieve the UI hangs some people have seen, but if these checks are causing trouble it should expose the next bottleneck

optimised a small test that checks if a single tag is in the parent/sibling system, typically before adding tags to a file (and hence sometimes spammed when downloaders were working). there was a now-unneeded safety check in here that I believe was throwing off the query planner in some situations

the 'review threads' debug UI now has two new tabs for the job schedulers. I will be working with UI-lag-experiencing users in future to see where the biggest problems are here. I suspect part of it will overhead from downloader thread spam, which I have more plans for

all jobs that threads schedule on main UI time are now profiled in 'callto' profile mode

.

site encoding fixes:

fixed a problem with webpages that report an encoding for which there is no available decoder. This error is now caught properly, and if 'chardet' is available to provide a supported encoding, it now steps in fixes things automatically. for most users, this fixes japanese sites that report their encoding as "Windows-31J", which seems to be a synonym for Shift-JIS. the 'non-failing unicode decode' function here is also now better at not failing, ha ha, and it delivers richer error descriptions when all attempts to decode are non-successful

fixed a problem detecting and decoding webpages with no specified encoding (which defaults to windows-1252 and/or ISO-8859-1 in some weird internet standards thing) using chardet

if chardet is not available and all else fails, windows-1252 is now attempted as a last resort

added chardet presence to help->about. requests needs it atm so you likely definitely have it, but I'll make it specific in requirements.txt and expand info about it in future

.

boring code cleanup:

refactored the base file import job to its own file

client import options are moved to a new submodule, and file, tag, and the future note import options are refactored to their own files

wrote a new object to handle current import file status in a better way than the old 'toss a tuple around' method

implemented this file import status across most of the import pipeline and cleaned up a heap of import status, hash, mime, and note handling. rarely do downloaders now inspect raw file import status directly--they just ask the import and status object what they think should happen next based on current file import options etc...

a url file import's pre-import status urls are now tested main url first, file url second, then associable urls (previously it was pseudorandom)

a file import's pre-import status hashes are now tested sha256 first if that is available (previously it was pseudorandom). this probably doesn't matter 99.998% of the time, but maybe hitting 'try again' on a watcher import that failed on a previous boot and also had a dodgy hash parser, it might

misc pre-import status prediction logic cleanup, particularly when multiple urls disagree on status and 'exclude previously deleted' is _unchecked_

when a hash gives a file pre-import status, the import note now records which hash type it was

pulled the 'already in db but doesn't actually exist on disk' pre-import status check out of the db, fixing a long-time ugly file manager call and reducing db lock load significantly

updated a host of hacky file import unit tests to less hacky versions with the new status object

all scheduled jobs now print better information about themselves in debug code

next week

Next week is a 'medium size job' week. I would like to do some server work, particularly writing the 'null account' that will inherit all content ownership after a certain period, completely anonymising history and improving long-term privacy, and then see if I can whack away at some janitor workflow improvements.

0 notes

Text

Leading AEPS micro ATMs Service Provider - RBP Finivis

RBP Finivis Micro ATMs is the best AEPS micro ATMs Service Provider that aims to connect rural areas by permitting clients to provide basic banking services by engaging neighborhood retailers and Kirana storekeepers with these devices. The AEPS frameworks include both unbanked and underbanked Indians. RBP Finivis Pvt. Ltd. offers FinTech-based APIs and software that can be used by hundreds of businesses from startups to large established enterprises to bring advancement in the finance industry.

0 notes

Text

Looking for Micro ATM API & SDK? Switch to RBP Finivis

Do you want to start your fintech business without much investment? Then switch to RBP where you will get micro atm api & sdk to get the best outcomes with 100% success.

#micro atm#micro atm device#micro atm device cost#micro atm api#micro atm api provider company#white label portal#micro atm api provider#mini atm#mini atm api#matm api#matm api provider#mini atm api provider#white label micro atm portal

1 note

·

View note