#AEPS

Text

#IFTTT#Flickr#nasa#nasasmarshallspaceflightcenter#nasamarshall#marshall#msfc#glennresearchcenter#grc#gateway#aeps#nasagrcjefjanis#cleveland#ohio#usa

51 notes

·

View notes

Photo

अधिक माहितीसाठी 9370125455 / 7350404036 वर कॉल करा. #navinyaurban #navinyaurbanpimparkhedbk #dhakalgaon #pimparkhedbk #navinyaurban #navinyaurbanpimparkhedbk #dhakalgaon #amolbone #pimparkhedbk navinya #dadhegaon #dhakalgaon #goldloan #loan #karj #dalycollection #pigmy #rd #fd #goldloan #sonetarankarj #upi #aeps #qrcode #phonepe #fixeddeposit #recuringdeposit #mis #pimparkhed_bk #bank https://www.instagram.com/p/CdhnLUnrwwQ/?igshid=NGJjMDIxMWI=

#navinyaurban#navinyaurbanpimparkhedbk#dhakalgaon#pimparkhedbk#amolbone#dadhegaon#goldloan#loan#karj#dalycollection#pigmy#rd#fd#sonetarankarj#upi#aeps#qrcode#phonepe#fixeddeposit#recuringdeposit#mis#pimparkhed_bk#bank

3 notes

·

View notes

Text

Domestic money transfer

Domestic Money Transfer (DMT) refers to the process of transferring money within the borders of a specific country. This type of financial transaction allows individuals to send funds to family members, friends, or others domestically. It plays a crucial role in facilitating economic activities and meeting the financial needs of people across different regions within a country.

0 notes

Text

Boosting Efficiency and Convenience: The Advantages of Upgrading to Online Recharge Portal Software

In today's fast-paced digital era, where convenience and efficiency are paramount, businesses are continually seeking ways to streamline their processes. One crucial aspect that demands attention is payment systems. If you haven't already upgraded to online recharge portal software, now is the time to do so. This technological solution offers a myriad of advantages that can significantly enhance your business operations.

The Evolution of Payment Systems

Traditionally, businesses relied on manual methods for recharging services or making payments. Whether it was through cash transactions, checks, or physical recharge cards, the process was time-consuming and prone to errors. The advent of online recharge portal software revolutionized this landscape, offering a seamless and automated approach to handling transactions.

Enhanced Efficiency

One of the primary benefits of adopting online recharge portal software is the significant boost in efficiency. Manual processes often involve a series of steps, paperwork, and potential delays. With an online recharge portal, the entire process is streamlined, reducing the time and effort required for recharging services. Customers can quickly and easily top up their accounts or make payments with just a few clicks, leading to a more efficient operation for both businesses and consumers.

Accessibility Anytime, Anywhere

Online recharge portal software enables customers to access the platform from the comfort of their homes or on the go. This level of accessibility is crucial in today's digital landscape, where consumers expect the convenience of handling transactions whenever and wherever they need to. By offering a 24/7 online recharge portal, businesses can cater to the diverse schedules of their customers, leading to increased customer satisfaction and loyalty.

Streamlined Record-Keeping

Traditional payment methods often result in a trail of paperwork that can be cumbersome to manage and prone to errors. Online recharge portal software automates the record-keeping process, maintaining accurate and easily accessible transaction histories. This not only reduces the risk of errors but also simplifies the reconciliation process for businesses, saving time and resources that can be better utilized elsewhere.

Secure Transactions

Security is a top priority for both businesses and consumers when it comes to financial transactions. Online recharge portal software is designed with robust security features, ensuring that sensitive information is protected. Advanced encryption and secure payment gateways safeguard against potential threats, instilling confidence in customers and maintaining the integrity of the payment system.

Customization and Integration

The flexibility of online recharge portal software allows businesses to customize the platform to their specific needs. Whether it's branding, user interface, or functionality, businesses can tailor the portal to create a seamless and branded experience for their customers. Additionally, these systems often integrate with other business applications, such as accounting software or customer relationship management (CRM) tools, creating a unified and efficient ecosystem.

Cost Savings

While the initial investment in online recharge portal software may seem significant, the long-term cost savings cannot be overstated. Automated processes reduce the need for manual intervention, minimizing the risk of errors and the associated costs of rectifying them. The efficiency gained through automation also allows businesses to allocate resources more effectively, leading to overall cost reductions.

Competitive Edge

In a competitive market, staying ahead of the curve is crucial for business success. By adopting online recharge portal software, businesses demonstrate their commitment to embracing technological advancements and meeting the evolving needs of their customers. This not only attracts new customers but also helps retain existing ones, positioning the business as a leader in the industry.

Conclusion

In conclusion, upgrading to online recharge portal software is a strategic move that offers numerous advantages for businesses looking to enhance efficiency, security, and customer satisfaction. The digital transformation of payment systems is not just a trend but a necessity in today's dynamic business landscape. Embracing this technology not only streamlines operations but also positions businesses for sustained success in an increasingly digital world. If you haven't made the switch yet, now is the time to take the leap into the future of payment systems.

#mobilerecharge#recharge#moneytransfer#aeps#bbps#dthrecharge#india#cashback#airtel#bkash#instagram#allservices#microatm#billpayment#domesticmoneytransfer#instagood#bills#business#offer#digitalindia#jio#atm#dmt#smartserve#money#insurance#b#onlinemobilerecharge#transfermoney#mobile

0 notes

Text

Sending Money Made Easy: Your Essential Guide to Domestic Money Transfers

In today's fast-paced world, the need for quick and convenient domestic money transfers has never been more crucial. It may save you time and guarantee smooth transactions whether you're paying bills, transferring money to relatives, or splitting costs with pals by being aware of how domestic money transfers operate.

Understanding Domestic Money Transfers Basics

Electronic money transfers inside the same nation are referred to as domestic money transfers. Traditional practices, such as writing checks or going in person to banks, have become less common due to technological improvements. Instead, the preferred instruments for easy transactions are now digital wallets, smartphone applications, and internet platforms.

Select the Platform wisely

Simplifying domestic money transfers starts with choosing the appropriate platform. Popular choices include banks, specialist money transfer services, and internet payment gateways. Banks provide stability and security, but their costs might be greater. Although they are easy to use, online payment methods like PayPal and Venmo might not be accepted everywhere. Money transfers are the focus of specialized businesses like MoneyGram and Western Union, which offer accessibility and ease.

Setting up Your Account

After selecting a platform, creating an account is a simple procedure. Usually, you'll have to confirm your identification, link your bank account or credit card, and submit personal information. Security protocols are used to safeguard your private data and guarantee the integrity of your transactions.

Start of a Transfer

It only takes a few clicks or taps to start a transfer once your account is set up. Input the recipient's information, such as name, contact details, and bank account information. You might be able to transfer money using merely the recipient's phone number or email address on some sites. Once you've verified the amount you want to send and looked over the transaction information, you may proceed.

Verifying and Monitoring

You should receive a confirmation email or message after starting the transfer. This attests to the fact that we have received and are handling your request. Additionally, a lot of platforms include monitoring tools that let you keep an eye on the progress of your transaction in real-time. For time-sensitive transfers, this openness provides an additional degree of confidence.

In a recap

The days of standing in huge lineups at the bank to send money domestically have changed. Nowadays, it's a simple process that just requires a few smartphone touches to finish. Domestic money transfers may be easy if you select the appropriate platform, create an account, and follow the easy instructions to start a transfer. Accept the ease of contemporary technology and manage your money with these crucial pointers for seamless transactions.

0 notes

Text

Banzope AEPS: Efficient and Secure AEPS Transactions

Empowering Every Aadhaar: Explore the Future of Secure Transactions with Benzope's AEPS Payment Gateway Page. 🌐💳 Unveil the simplicity and inclusivity of Aadhaar-authenticated transactions. Your financial journey, redefined.

Immerse yourself in the world of innovation as we unveil Benzope's AEPS gateway page, setting the stage for a transformative and inclusive approach to financial transactions.

Delve into the security and simplicity of Benzope's AEPS page. Explore how Aadhaar authentication adds an extra layer of security while ensuring a hassle-free and user-friendly transaction process.

0 notes

Text

AEPS सेवा खरीदें. सबसे पहले, आपको अपनी निकटतम बेफ़ी खुदरा शाखा में जाना होगा और एईपीएस सेवा खरीदनी होगी।

आवश्यक दस्तावेज़ अपलोड करें: व्यक्तियों को अपना आधार नंबर प्रदान करना होगा,

जो एईपीएस सेवा प्रदाता के बैंक खाते से जुड़ा होना चाहिए। आधार नंबर के साथ-साथ आपको उस बैंक का नाम भी देना होगा जिससे आधार लिंक है।

https://www.udaaanpe.com/aeps

0 notes

Text

Revolutionizing Rural India: AePS - A Gateway to Financial Inclusion

Introduction:

In the vast expanse of rural India, where traditional banking infrastructure faces challenges, Aadhaar-enabled Payment System (AePS) has emerged as a game-changer, transforming the lives of millions. This groundbreaking service not only brings banking to the doorsteps of rural communities but also offers an opportunity for individuals to earn extra income. In this article, we'll explore the significance of AePS in rural India, highlighting its impact on financial inclusion and the role of leading service providers like Ezeepay.

Understanding AePS:

AePS leverages the Aadhaar infrastructure to enable basic banking transactions at Micro ATMs using biometric authentication. This service allows individuals in rural areas to perform various financial transactions such as cash withdrawals, balance inquiries, fund transfers, and more, using their Aadhaar number and fingerprint verification. The simplicity and accessibility of AePS make it an ideal solution for the unbanked and underbanked population in rural India.

The Role of Ezeepay as a Leading AePS Service Provider:

Ezeepay has emerged as a trailblazer in the AePS domain, providing top-notch services for the past six years. As a reliable and trustworthy AePS service provider, Ezeepay has played a pivotal role in bridging the financial gap in rural areas. The company has been instrumental in creating a network of retailers who act as intermediaries, facilitating AePS transactions within their communities.

Ezeepay's Contribution to Rural Empowerment:

Ezeepay has effectively empowered rural individuals by offering them the opportunity to become retailers and provide AePS services to their neighbors. This not only enhances financial inclusion but also serves as an avenue for these retailers to generate extra income. The process is simple – individuals sign up with Ezeepay, undergo basic training, and are equipped with the necessary tools to offer AePS services locally.

Benefits of Ezeepay's AePS Services:

Accessibility in Remote Areas:Ezeepay's commitment to reaching the last mile ensures that even the remotest villages have access to AePS services, bringing banking services to areas that were previously underserved.

User-Friendly Technology:Ezeepay's user-friendly technology ensures that individuals with minimal technical knowledge can seamlessly conduct AePS transactions. This inclusivity is crucial for the success of financial inclusion initiatives.

High Commission Rates:Ezeepay stands out as a beacon for those looking to capitalize on the growing demand for AePS services. The company offers competitive commission rates, providing retailers with a lucrative income opportunity.

Extra Income Opportunity:Ezeepay's AePS services go beyond financial transactions – they offer individuals the chance to earn extra income by becoming retailers. This not only boosts household incomes but also creates a sense of entrepreneurship within rural communities.

Secure and Reliable Transactions:Security is paramount in financial transactions. Ezeepay ensures that every AePS transaction is secure, building trust among users and retailers alike. This reliability is crucial for the widespread adoption of AePS services.

Conclusion:

In conclusion, AePS has proven to be a life-changing service in rural India, bringing financial services to the doorstep of those who need it the most. Ezeepay, with its six years of dedicated service, stands as a beacon in the realm of AePS, providing a platform for rural individuals to become entrepreneurs and contribute to financial inclusion. The high commission rates, coupled with the extra income opportunities, make Ezeepay an ideal partner for those seeking the best AePS services in the market. As technology continues to bridge the urban-rural divide, AePS remains a powerful tool for empowering the underserved and unlocking the true potential of rural India.

1 note

·

View note

Text

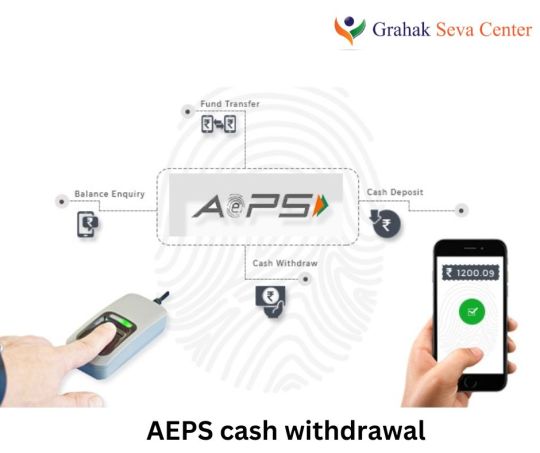

AEPS cash withdrawal

AEPS, or Aadhaar Enabled Payment System, is a financial inclusion initiative in India that allows people to make basic banking transactions using their Aadhaar number and fingerprint authentication. One of the services offered under AEPS is "AEPS cash withdrawal," which enables individuals to withdraw cash from their bank accounts without the need for a traditional ATM card or debit card.

0 notes

Text

Payment Services From Udaaanpe

Payment services encompass a wide array of financial activities and solutions designed to facilitate the transfer of funds from one party to another. These services play a fundamental role in modern commerce, enabling individuals and businesses to conduct financial transactions efficiently and securely.

Electronic Fund Transfers (EFT): Electronic Fund Transfers are at the core of payment services. They include various methods for electronically transferring money, such as bank transfers, wire transfers, and Automated Clearing House (ACH) transactions

Credit and Debit Card Processing: Payment services encompass the processing of credit and debit card transactions. This enables businesses to accept payments from customers using their credit or debit cards, whether in-person, online, or through mobile apps

Online Payment Gateways: Online payment gateways are platforms that facilitate e-commerce transactions by securely connecting online stores with financial institution

Mobile Payment Solutions: With the rise of smartphones, mobile payment services have gained prominence. These services enable individuals to make payments and transfers through mobile apps, often linked to their bank accounts or credit cards

1 note

·

View note

Text

Money transfer service in india

aeps service in india

aeps service near me

0 notes

Text

AePS ke bare me ek choti si jankari

आज मैं आपको बताने जा रहा हु एक AePS यानि आधार कार्ड से नकद निकाशी करने के बिज़नेस के बारे में

आपने डेबिट कार्ड से विभिन बैंको के एटीएम से पैसे निकलते हुए सुना होगा लेकिन NPCI यानि नेशनल पेमेंट कोरोपोरशन ऑफ़ इंडिया ने २०१६ में आधार कार्ड के नंबर लगा के आप अपने बैंक अकाउंट से नकद निकाशी कर सकते है

इसके लिए पूरी प्रक्रिया इस प्रकार है

सबसे पहले आपको आधार कार्ड से नकद निकाशी करने वाले सेण्टर का पता लगाना होगा| आजकल ज्यादातर डिजिटल सर्विस पॉइंट जैसे ईमित्र, csc सेण्टर, बैंक मित्र या कोई रोजगार सेण्टर पर आसानी से उपलब्ध है ये सेण्टर विभिन प्राइवेट कंपनी के पोर्टल पर अपना रजिस्ट्रेशन करते है और अपनी eKYC के माद्यम से बैंकिंग का ये पोर्टल एक्टिव करवाते है | इस तरह की बहुत सी कंपनी मार्किट में है जैसे Payrock एक प्रमुख कंपनी है

आधार से नकद निकाशी करने के लिए हमे आधार विथड्रावल सेण्टर पर जाना होगा और ओपेरटर को आधार कार्ड देना है और अमाउंट बताना है जो हम निकाशी करना चाहते है | हम Payrock कंपनी की aeps सर्विस के माध्यम से बैलेंस इन्क्वायरी, मिनी स्टेटमेंट और आधार से नकद जमा भी करवा सकते है

इस पोर्टल को उसे करके अगर आप भी अपना बिज़नेस स्टार्ट करना चाहते है तो आप इनकी ऑफिसियल वेबसाइट पर जेक रजिस्टर कर सकते है जिसका टोटल चार्ज 1700 रुपये है जिसमे आपको सबसे ज्यादा ���मीशन और एक डिवाइस भी प्रोवाइड करवाया जाता है

1 note

·

View note

Text

Zambo is a AEPS Service Provider with a robust platform for Aadhaar enabled Payment System which offers all types of banking transactions.

#AEPS#AEPS Portal#AEPS Login#AEPS Agent Registration#AEPS Service Provider Company#AEPS Service Provider#Aadhar Banking Services#Aadhaar Enabled Payment System

0 notes

Text

Why is Integration Capability Crucial for Retailers Using a Recharge Money Transfer Portal?

In the rapidly evolving landscape of financial technology, retailers are increasingly turning to recharge money transfer portals to offer convenient and efficient services to their customers. These portals serve as a bridge between retailers and financial transactions, enabling seamless recharge money transfer portal for retailers. However, the success of retailers in leveraging these portals depends significantly on their integration capabilities. In this article, we will delve into the reasons why integration capability is crucial for retailers using a recharge money transfer portal.

Enhanced Customer Experience:

Integration capability plays a pivotal role in enhancing the overall customer experience for retailers using a recharge money transfer portal. Seamless integration with existing point-of-sale (POS) systems and other retail platforms ensures a smooth and hassle-free transaction process for customers. Retailers can offer a one-stop solution for mobile recharges and money transfers, leading to increased customer satisfaction and loyalty.

Efficient Operations and Workflow:

Retailers dealing with a high volume of transactions need efficient operations and streamlined workflows. Integration capability allows the recharge money transfer portal to sync seamlessly with the retailer's backend systems, reducing manual efforts and minimizing the chances of errors. This results in faster transaction processing, improved operational efficiency, and ultimately, a more productive retail environment.

Real-time Transaction Monitoring:

For retailers, real-time visibility into transactions is crucial for monitoring and managing their financial activities effectively. Integration capability enables retailers to track transactions in real-time, providing instant updates on mobile recharges and money transfers. This transparency not only enhances trust between retailers and customers but also allows retailers to address any issues promptly, ensuring a reliable and secure transaction experience.

Diverse Payment Options:

The ability to integrate with various payment methods is a key factor in the success of recharge money transfer portals for retailers. Integration allows retailers to accept payments through credit/debit cards, mobile wallets, and other popular payment channels. This flexibility caters to a wider audience, accommodating diverse customer preferences and increasing the likelihood of completing successful transactions.

Inventory Management:

Retailers operating through recharge money transfer portals often deal with prepaid recharge cards and vouchers. Integration capability aids in effective inventory management by syncing real-time sales data with the portal. Retailers can effortlessly track stock levels, identify popular products, and replenish inventory as needed. This not only prevents stockouts but also helps retailers optimize their product offerings based on customer demand.

Seamless Loyalty Programs:

Integration capabilities allow retailers to seamlessly integrate loyalty programs with the recharge money transfer portal. This enables retailers to reward customers for their repeat business, encouraging brand loyalty. Whether through discounts, cashback, or other incentives, a well-integrated loyalty program can significantly boost customer retention and attract new business.

Compliance and Security:

Integration with regulatory and security protocols is imperative for retailers operating in the financial services sector. Compliance with industry standards and security measures is essential to protect both retailers and customers from fraudulent activities. An integrated recharge money transfer portal ensures that retailers can implement the necessary security features and adhere to regulatory requirements, safeguarding the integrity of financial transactions.

Conclusion:

In conclusion, the integration capability of recharge money transfer portal for retailers is a crucial factor that determines the success and efficiency of retailers operating in the financial services space. From enhancing customer experience and optimizing operations to ensuring compliance and security, integration plays a multifaceted role in the seamless functioning of these portals. Retailers looking to thrive in the competitive landscape must prioritize integration capabilities to provide a robust and user-friendly experience for their customers while staying ahead of technological advancements in the financial technology sector.

#mobilerecharge#recharge#moneytransfer#aeps#bbps#dthrecharge#india#cashback#airtel#bkash#instagram#allservices#microatm#billpayment#domesticmoneytransfer#instagood#bills#business#offer#digitalindia#jio#atm#dmt#smartserve#money#insurance#b#onlinemobilerecharge#transfermoney#mobile

0 notes