#marketforecast

Text

global building integrated photovoltaics (BIPV) market size at USD 14.06 billion in 2022. During the forecast period between 2023 and 2029, BlueWeave expects global building integrated photovoltaics (BIPV) market size to grow at a significant CAGR of 21% reaching a value of USD 44.45 billion by 2029. Major growth drivers for the global building integrated photovoltaics market include an increasing adoption of renewable energy sources, a growing focus on sustainable construction practices, supportive government incentives and regulations, rapid technological advancements in BIPV, and rising demand for green buildings. The market is further propelled by a strong emphasis on energy efficiency and sustainable development, with expectations of continued growth in the forecast period. Global awareness and adoption of solar power have been driven by countries prioritizing energy security and self-sufficiency. Supportive government legislations and commitments to reduce greenhouse gas emissions further fuel market growth. Key countries driving the transition to solar energy include Germany, Italy, France, the United Kingdom, the United States, China, Japan, and India. With these favorable conditions, the solar panel market is poised for significant expansion in the upcoming years. However, high initial costs of investments and complexity of building integrated photovoltaics (BIPV) installations are anticipated to restrain the overall market growth during the period in analysis.

Global Building Integrated Photovoltaics Market – Overview

The global building integrated photovoltaics (BIPV) market refers to the integration of photovoltaic materials into building elements, such as windows, facades, and roofs, to generate electricity while simultaneously serving their functional purposes. BIPV technology enables the seamless incorporation of solar panels into the building's design, allowing for the production of renewable energy on-site. This innovative approach combines the benefits of solar power generation with the aesthetics and functionality of building materials. BIPV systems can contribute to energy efficiency, reduce reliance on traditional power sources, and lower carbon emissions. The global BIPV market encompasses various technologies, materials, and applications aimed at integrating solar power generation into the built environment to meet the increasing demand for sustainable and energy-efficient buildings.

Sample Request @https://www.blueweaveconsulting.com/report/building-integrated-photovoltaics-market/report-sample

2 notes

·

View notes

Text

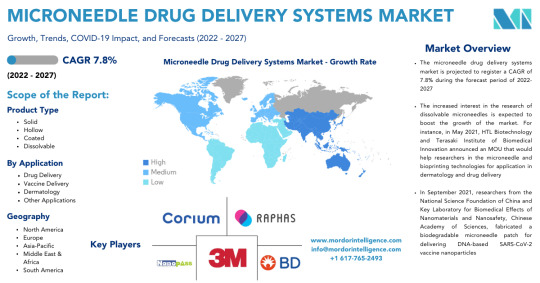

The rise in the adoption of highly advanced techniques and systems in the fabrication of microneedles and the technological advancements made in microneedle drug delivery is expected to boost the growth of the market in the North American region. The high awareness among the population of the availability of novel microneedle drug delivery systems in the market contributes to the high market growth in the region.

Learn more.

#marketresearch#Researchreports#healthcare#MicroneedleDrugDelivery#Solid#Hollow#DrugDelivery#VaccineDelivery#marketanalysis#marketforecast

2 notes

·

View notes

Text

Riflescopes Market Size, Share, Growth and Report 2024-2032

The global riflescopes market size is expected to exhibit a growth rate (CAGR) of 3.78% during 2024-2032. A riflescope is a telescopic vision device attached on the top of automatic or snipers rifles and is used for the identification and magnification of the target. They are commonly available with air-gun, handgun, shotgun, muzzleloader, crossbow and purpose-specific scope configurations. The novel variants also include in-built laser range finders connected to color graphics displays.

0 notes

Text

Insights into Market Dynamics: A Guide with Rich Smart Finance

As the markets wind down for the day, it's crucial for you to prepare for potential shifts and volatility. Today's market landscape presents a mix of cautionary signals and strategic opportunities. Let's break down the current dynamics across various sectors so you can navigate with confidence, with insights from Rich Smart Finance:

General Market Overview: Oil prices have seen a notable decline of over 3% amid easing tensions in the Middle East. Despite this, analysts believe there may be a buying opportunity for WTI as it dips. Looking ahead, there's a possibility that demand may outweigh supply, suggesting a potential rebound in prices.

Equities are experiencing fluctuations, opening high but closing lower than previous days. It's wise to approach this with caution, especially in sectors like healthcare and consumer staples. Consider hedging strategies to mitigate volatility, as suggested by analysts.

Gold and Silver: Gold maintains a bullish outlook, stuck within a certain range. While a breakout above current levels could signal further bullish momentum, uncertainty remains. Similarly, silver holds a bullish stance but awaits a clear move for clearer direction.

Currency Markets: The Dollar Index (DXY) is finding support within specific hourly structures, hinting at a potential upward trajectory. Other currency pairs exhibit varying degrees of market sentiment, with each awaiting decisive movements for clearer trends.

In navigating these market conditions, Rich Smart Finance advises you to exercise caution and patience. While opportunities may arise, it's essential to assess risk factors and wait for confirmation before making significant trading decisions. Market closures can often lead to unexpected movements, so staying informed and adaptable is key.

In conclusion, navigating market closures and volatility requires a balanced approach. By staying attuned to market dynamics and following Rich Smart Finance's insights, you can better position yourself to capitalize on opportunities while mitigating potential risks. Visit Rich Smart Finance for more insights and resources on navigating the financial markets.

1 note

·

View note

Text

Unveiling Pune E-Stock Broking IPO GMP: IPOBrains’ Journey to Market Success

Pune E-Stock Broking IPO GMP

IPOBrains: Redefining the IPO Experience

At the heart of IPOBrains lies a simple yet powerful vision — to democratize access to IPOs and empower investors with valuable insights and information. Unlike traditional brokerage firms, IPOBrains leverages cutting-edge technology and data analytics to provide its clients with real-time updates and analysis on upcoming IPOs, including the much sought-after Pune E-Stock Broking IPO GMP (Grey Market Premium).

The company’s user-friendly platform allows investors to track GMP trends, evaluate market sentiment, and make informed decisions regarding their investment strategies. By offering comprehensive resources and expert guidance, IPOBrains aims to level the playing field and empower both seasoned investors and newcomers alike.

Pune E-Stock Broking IPO GMP: Unraveling the Hype

As one of the most anticipated IPOs in recent times, the Pune E-Stock Broking IPO has generated significant buzz within the investment community. The Grey Market Premium (GMP) for this IPO has been a topic of keen interest, serving as a barometer for investor sentiment and market demand.

IPOBrains has been at the forefront of tracking and analyzing the Pune E-Stock Broking IPO GMP, providing investors with valuable insights into the pricing dynamics and potential market performance. Through its comprehensive GMP analysis, IPOBrains has helped investors navigate the complexities of IPO investing and seize lucrative opportunities in the ever-evolving market landscape.

Navigating Market Volatility with IPOBrains

In an era marked by unprecedented market volatility, the role of reliable brokerage firms like IPOBrains becomes all the more crucial. The company’s robust infrastructure and experienced team of professionals enable it to adapt swiftly to changing market conditions and mitigate risks effectively.

Whether it’s navigating fluctuations in the Pune E-Stock Broking IPO GMP or identifying emerging trends in the broader market, IPOBrains remains steadfast in its commitment to delivering value to its clients. By fostering a culture of innovation and continuous improvement, IPOBrains stands poised to redefine the future of e-stock broking and IPO investing.

Looking Ahead: The Future of IPOBrains

As IPOBrains continues to scale new heights and expand its footprint in the Indian financial markets, the future looks brighter than ever. With a relentless focus on customer satisfaction and a commitment to excellence, IPOBrains is well-positioned to capitalize on emerging opportunities and shape the future of e-stock broking.

The company’s strategic partnerships, technological prowess, and unwavering dedication to its core values set it apart in a crowded marketplace. As investors eagerly await the Pune E-Stock Broking IPO GMP and other exciting opportunities on the horizon, IPOBrains remains steadfast in its mission to empower investors and drive positive change in the financial industry.

In conclusion, IPOBrains represents a beacon of innovation and integrity in the world of e-stock broking and IPO investing. With its unparalleled expertise, customer-centric approach, and unwavering commitment to excellence, IPOBrains is poised to lead the way towards a brighter and more inclusive future for investors across India and beyond.

#IPOInvesting#StockMarketInsights#FinancialFreedom#InvestmentStrategy#MarketAnalysis#EStockBroking#PuneIPO#GreyMarketPremium#MarketTrends#InvestmentOpportunities#MarketVolatility#IPOPerformance#InvestmentTips#IPOTracking#StockMarketNews#IPOAlert#MarketResearch#FinancialPlanning#InvestmentEducation#IPOAnalysis#StockMarketUpdates#InvestmentCommunity#FinancialAdvisor#InvestmentInsights#EStockTrading#PuneStockMarket#InvestmentGoals#MarketForecast#StockMarketAnalysis#InvestmentAdvice

0 notes

Text

#EconomicOutlook#2024Trends#BusinessOpportunities#MarketAnalysis#IndustryTrends#EconomicIndicators#MarketForecast#BusinessStrategy

0 notes

Text

X-Ray Equipment Market Analysis Across North America, Europe, Asia, and Rest of World (ROW) - US, Germany, UK, Japan, China - Projections and Trends 2023-2027

Originally Published on: TechnavioX-Ray Equipment Market AnalysisNorth America,Europe,Asia,Rest of World (ROW) - US,Germany,UK,Japan,China - Size and Forecast 2023-2027

The X-ray equipment market is poised to witness a surge of USD 3,888.72 million between 2022 and 2027, with a projected CAGR of 6.2%. Several factors, including the growing prevalence of chronic diseases, the demand for non-invasive diagnostic devices, and the adoption of portable devices, are driving this growth.

What will be the Size of the X-Ray Equipment Market During the Forecast Period? X-Ray Equipment Market Forecast 2023-2027

For a comprehensive understanding, access the report sample.

Market Segmentation

The digital segment is expected to witness significant growth during the forecast period. Digital equipment, leveraging solid-state digital detectors, reduces the cost per X-ray image due to its swift processing speed.

X-Ray Equipment Market Size

Gain insights into the market contribution of different segments by viewing the PDF sample.

The digital segment, valued at USD 6,897.51 million in 2017, continued its growth until 2021. Portable X-ray equipment, in particular, experiences high demand due to advantages like reduced radiation exposure. Investments by leading companies in advanced digital X-ray equipment further bolster segment growth.

Market Dynamics

Market growth is fueled by the increasing incidence of chronic diseases, despite challenges such as high costs. Our researchers analyze key drivers, trends, and challenges based on 2022 data, aiding companies in refining marketing strategies.

Key Driver

The escalating incidence of chronic diseases, necessitating frequent diagnostic imaging, significantly drives market growth. Factors like sedentary lifestyles, environmental issues, and unhealthy habits contribute to this rise.

Significant Trends

Technological advancements, especially in digital imaging, represent critical market trends. Companies introduce software compatible with digital X-ray systems, enhancing efficiency and imaging quality.

Major Challenge

High costs associated with equipment and services may hinder market growth, particularly affecting accessibility in low-income countries.

Key Market Customer Landscape

The report covers the adoption lifecycle from innovators to laggards, assisting companies in evaluating growth strategies based on regional adoption rates.

Who are the Major X-Ray Equipment Market Companies?

Companies employ various strategies like alliances and product launches to fortify market presence.

Key Regions

North America, contributing 38% to global market growth, is driven by factors such as increasing healthcare expenditure and demand for digital X-ray equipment.

Contact us.

0 notes

Text

Ethereum Price Analysis: Surge Towards $4000 Imminent

Ethereum's price is breaking above the $3550 resistance level, closely following Bitcoin's lead and potentially targeting the $4000 resistance zone soon.

Ethereum Initiates a Fresh Rally

Ethereum's price surge persists above the $3500 mark, mirroring Bitcoin's upward momentum. BTC surged and surpassed the $68,000 level. ETH exhibits signs of strength, climbing above $3650.

A significant move above $3700 has occurred, marking a new multi-month high at $3715. Currently, the price is consolidating gains, trading above the 23.6% Fibonacci retracement level.

Ethereum is currently trading above $3650 and the 100-hour simple moving average. On the hourly ETH/USD chart, a bullish trend line is forming with support near $3600, closely aligning with the 50% Fibonacci retracement level.

Resistance Levels and Potential Upside

Immediate resistance to the upside lies near $3720, followed by significant levels at $3780 and $3850. A break above $3850 could fuel bullish momentum, possibly targeting $3920 next.

If Ethereum moves above the $3920 resistance, it could even rally towards $4000, potentially requiring a test of $4200 for further upside.

Downside Correction for Ethereum?

Failure to overcome the $3720 resistance might trigger a downside correction. Initial support is near $3650, followed by the $3600 zone and the bullish trend line. A significant support zone lies near $3550, with further losses possibly extending to $3420 and $3350.

Technical Indicators

- Hourly MACD: The MACD for ETH/USD is gaining momentum in the bullish zone.

- Hourly RSI: The RSI for ETH/USD is currently above the 50 level.

Key Levels

- Primary Support: $3600

- Primary Resistance: $3720

Read the full article

#Bitcoin#BTC#BullishTrendLine#Cryptomarketanalysis#Cryptocurrency#DownsideCorrection#ETH#Ethereum#Fibonacciretracement#MACD#MarketForecast#priceanalysis#resistancelevels#RSI#supportlevels#TechnicalAnalysis#UpsidePotential

0 notes

Text

North America Cancer Immunotherapy Market size by value at USD 24.61 billion in 2023. During the forecast period between 2024 and 2030, BlueWeave expects the North America Cancer Immunotherapy Market size to expand at a CAGR of 11.15% reaching a value of USD 68.52 billionby 2030. The North America Cancer Immunotherapy Market is primarily driven by the increasing incidence of cancer cases, rising demand for personalized medicine, advancements in biotechnology, and a growing understanding of immune checkpoints. Additionally, favorable government initiatives, extensive R&D activities, and collaborations among pharmaceutical companies contribute to market growth. Moreover, the introduction of novel immunotherapeutic agents, such as immune checkpoint inhibitors and chimeric antigen receptor (CAR) T-cell therapy, alongside expanding applications across various cancer types, further propel the market forward. The rapid adoption of immunotherapy as a standard treatment option, coupled with improving healthcare infrastructure, also fosters market expansion in North America.

Opportunity – Growing focus on personalized medicine

The rising emphasis on personalized medicine is fueling significant growth of the North America Cancer Immunotherapy Market. With advancements in genomic profiling and targeted therapies, personalized treatment approaches are becoming increasingly prevalent. The shift towards individualized care enables better outcomes and reduced side effects for patients, spurring adoption rates and market expansion. As the demand for precision medicine continues to rise, the market is poised for sustained growth, revolutionizing cancer treatment strategies across the region.

Sample Request @ https://www.blueweaveconsulting.com/report/north-america-cancer-immunotherapy-market/report-sample

0 notes

Text

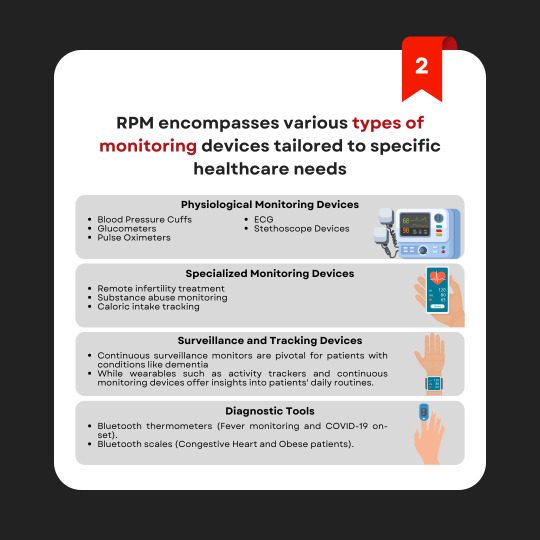

𝗘𝘅𝗽𝗹𝗼𝗿𝗶𝗻𝗴 𝗠𝗮𝗿𝗸𝗲𝘁 𝗜𝗻𝘀𝗶𝗴𝗵𝘁𝘀: Remote Patient Monitoring (RPM)

Curious about the latest advancements in the field of Remote Patient Monitoring (RPM)? Look no further! Wissen Research brings you an in-depth report that sheds light on every aspect of this disease, highlighting:

#MarketInsights #ProductAnalysis #CompetitiveAnalysis #PatentAnalysis #ClinicalTrial #Treatment #OpportunityAnalysis #MarketForecast – 2023-2033

For detailed report: https://www.wissenresearch.com/remote-patient-monitoring-rpm-market-insight-2023-2033/ Request customized report: https://www.wissenresearch.com/ask-for-customization/

#marketresearch#marketreport#marketforecast#askforcustomization#wissenresearch#marketinsight#MarketReport2023#MarketReport2033#RemotePatientMonitoring#RPM

0 notes

Text

#marketstudy#businessintelligence#researchreport#marketforecast#markettrends#datadrivendecisions#businessresearch#marketinsights#marketresearch#industryinsights

0 notes

Text

Integrated Workplace Management System Market 2024- 2032

The global integrated workplace management system market size is projected to exhibit a growth rate (CAGR) of 12.69% during 2024-2032.

#integratedworkplacemanagementsystemmarket#marketresearch#business#marketanalysis#markettrends#researchreport#marketreport#marketforecast#marketgrowth#imarcgroup

0 notes

Text

The global advanced packaging market size reached US$ 41.5 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 98.3 Billion by 2032, exhibiting a growth rate (CAGR) of 10% during 2024-2032. The rising demand for enhanced device performance, emerging technologies like 5G and AI, and the escalating challenges in traditional scaling are some of the major factors propelling the market.

#AdvancedPackaging#AdvancedPackagingMarket#AdvancedPackagingMarketSize#marketresearch#business#marketanalysis#markettrends#researchreport#marketreport#marketforecast#marketgrowth#imarcgroup#businessgrowth#investmentopportunity#industryanalysis

0 notes