#mATM api

Text

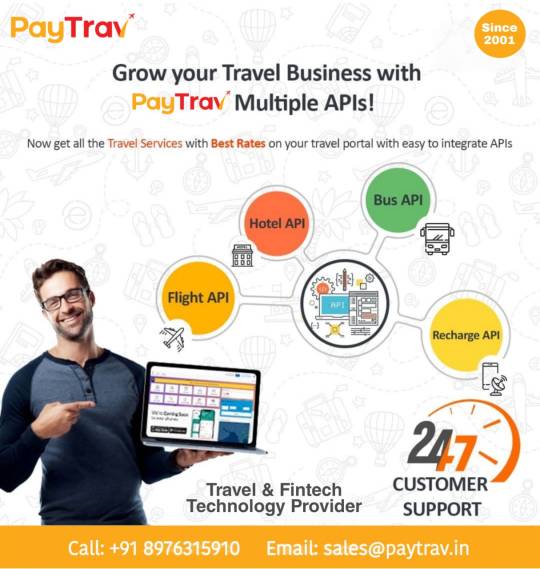

Paytrav is eager to assist travel startups and small online travel agencies in integrating travel APIs into their existing technology stack. We provide a comprehensive range of travel solutions, including tailor-made travel APIs and white-label travel portals, at highly competitive industry rates.

#travel API#travel api provider#flight api provider#bus api provider#hotel booking software#matm api

0 notes

Text

Best Payout API provider in India

We are the Best Payout API provider in India. Nikatby services are the best API provider company in India, we provide multiple API Services like Recharge API, Prepared card API, AEPS API, BBPS API, FAST tag API, IRCTC API, Payout API, mATM API, etc.

3 notes

·

View notes

Text

Get Micro ATM API Solution to Start Your FinTech Business

RBP Finivis Pvt Ltd is India’s largest B2B fintech platform delivering various banking API & SDK solutions to individuals and businesses of all sizes. One such API solution is micro atm api that has made us one of the finest micro atm api provider company in India. This simple functionality of api offers ordinary citizens easy access to secure financial services like cash withdrawal, etc. while businesses can make a good commission and better-earning opportunities without much investment and effort.

What Role does API Play for the Growth of Digital Banking?

An API plays an important role in making the banking system interoperable. Application Programming Interface is a software application that empowers and allows to connect various banking networks to interchange products and services needed to offer customers. This enables banks to offer even more features and feasible services that have made banking services available to each and every corner of the country. However, the time has now come to digitally transform India with the invention of APIs.

A Mini Version of ATM is an Outcome of API Solution

Micro atm is a mini version of an atm that does not occupy much space for its set-up. It is a portable device that can be carried anywhere. It can carry out basic banking transactions within a few seconds at a click. This amazing device came into existence only because of the arrival of advancements in the technology with the introduction of API (Application Programming Interface)

We with our experienced and pro-active technical team of developers developed & designed fully customized and highly scalable API solutions for businesses. With this advanced payment gateway, entrepreneurs can use their business ideas and strategies in the fintech industry without having much technical knowledge. In other words, we will be available 24*7 for their technical quarries and will solve them as early as possible.

Benefits of Micro ATM With Its Features:

· One can extend banking services anywhere in remote locations using a micro atm machine

· Cheap – It is a low-cost option for the existing traditional ATMs

· Portable – It is a portable device, easy to carry, easy to set up anywhere.

· Interoperable – It can work for any bank using debit cards.

· Secure – Connects banking network through GPRS technology for carrying banking transactions, making it safe and secure

Working of Micro ATM is Similar to Usual ATMs

First of all, you need to undergo a verification process of your debit card. For verification card swipe option is available. Once the verification is completed micro atm screen will display various transaction options. You need to select the option and the device will process the transaction. On a successful transaction, a message will be displayed on the screen and a receipt will be generated. You will also receive an SMS alert from your bank about the transaction.

Conclusion

To offer customers a powerful payment solution, RBP as a micro atm api provider company become a force in supplying the best banking platform. With our fully automated banking api solutions, businesses will enjoy unlimited flexibility and fly at great heights with success all around.

aadhaar se cash withdrawal krnye ka app

#micro atm api#micro atm#micro atm api provider#micro atm api provider company#matm api#matm api proivder#mini atm api provider#mini atm api provider company#micro atm sdk#micro atm device#cash withdrawal api#digital payments api#fintech api#banking api

1 note

·

View note

Text

Looking for Micro ATM API & SDK? Switch to RBP Finivis

Do you want to start your fintech business without much investment? Then switch to RBP where you will get micro atm api & sdk to get the best outcomes with 100% success.

#micro atm#micro atm device#micro atm device cost#micro atm api#micro atm api provider company#white label portal#micro atm api provider#mini atm#mini atm api#matm api#matm api provider#mini atm api provider#white label micro atm portal

1 note

·

View note

Text

Micro ATM-How iServeU is Bringing ATMs to the Palm of Your Hands

10 years ago if I told you that soon there would be an app on which you can enter any location you wanted to go, and a cab would come to pick you up navigating through an electronic map automatically in a couple of minutes, you’d ask if I have totally lost it. But Uber is real now and used by millions of people every day. Today, it is almost impossible to imagine commute without these apps. The point here is technology has simplified every tedious task over time making things portable. Speaking of portability, there was a time when people had to visit a bank for simple transactions like balance inquiry or cash withdrawal. To make things easier ATMs came to rescue and the thing became easy but this ever-growing physical world demands more accessibility and speed, calling in for the next generation of ATMs – ‘Micro ATM or mATM’

In November 2018, iServeU became the first company in India to launch a Micro ATM. A Micro ATM or mATM is an alternate way of Aadhaar Enabled Payment System (AEPS) to withdraw cash and inquiry bank balance using a Debit card. The mATM service is a simple and reliable way of performing bank transactions without any extra charges or limitations. iServeU’s Micro ATM processes transactions through an android app using a card reader ATM device. This product operates under the National Financial Switch (NFS) and guidelines of NPCI which ensures the safety and security of your transactions. The Micro ATM uses Bluetooth connectivity to pair with an Android smartphone or tablet and the customer’s Debit card and ATM PIN are the only requirements to initiate a withdrawal or balance inquiry transactions.

Micro ATM is an on-the-go transactional service which is way more different from a traditional mPOS device or Cash@POS Service. With mPOS devices, you can perform transactions on Sale and Cash@POS mode. In POS service, above Rs. 2000/- amount there are some certain MDR charges for both Debit and Credit card. For credit card, MDR charges are even higher. In Sale transactions below Rs. 2000/- MDR charges are also there in POS services. The best thing about mATM service is that there are no Sale or Cash@POS modes. There are no MDR charges for any transactions. You can withdraw as per your card issuer banks’ limitations. iServeU aims to provide a significant number of Micro ATM services, mostly in rural areas to simplify conventional banking. Click here to learn more.

#DMT#MoneyTransfer#AEPS#FinTech#BBPS#Deposit#Micro ATM#Domestic Money Transfer#Aadhaar Enabled Payment System#Insurance#mATM#White Label Provider#Loan Software#Aadhaar Payment#API

1 note

·

View note

Photo

SpayU Sales & Support Team Now On WhatsApp.Save +91 912274 8888 and Message "Hi" On WhatsApp

All your Supports Needs Just A Message away.

#SpayU #WhatsApp #Support #Banking #Message #AePS #Recharge #MATM #API #DMT

0 notes

Text

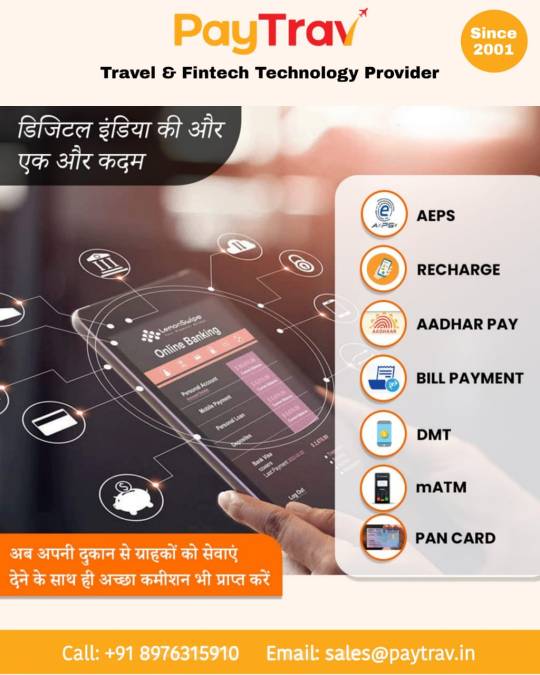

Paytrav is a leading API integration company in India, offering direct API solutions for various products such as AEPS, MATM, DMT, Multi-recharge, and Fastag. If you're looking to integrate APIs into your website or white label solution, we have dedicated software and digital solutions available.

#dmt api provider#bus api provider#travel api provider#flight api provider#aeps api provider#matm api#bus booking portal

0 notes

Text

अच्च्छी आमदनी की तलाश करें पूरी। Edupoint- mATM & AEPS की बेहतरीन सर्विस और ज़बरदस्त कमीशन के साथ बढ़ाएं अपनी पहचान भी और इनकम भी!

Search for ways to earn a good income. Enhance your identity and income with the excellent service and fantastic commission of Paytrav mATM and AEPS.

Get your own B2B travel & Fintech portal at lowest-cost today!!!

👉For more information:

📞 Contact @ 089-763-15-910

0 notes

Text

API provider company across the Pune,India-Paytrav

Looking for API integration? Paytrav is a Direct API provider company across the India. We provide API for the products like AEPS, MATM, DMT, BBPS and Fastag. If you want to plug API solutions then don’t think it’s time to integrate. We are available with dedicated software and digital solutions as well.

Paytrav offers FinTech- based APIs and software that can be used by hundreds of businesses from startups to large established enterprises to bring advancement in the finance industry. In FinTech industry API serves as the bridge between software and enables them to connect safely and exchange data. It is to re-explore how to serve customers in a dynamic, digitally centric world.

Call @ +91 89763 15910

https://paytrav.in/

0 notes

Text

Edupoint Solution (Paytrav) is leading AEPS ,mATM API provider,recharge API provider company in mumbai,India over the last few years.Get the perfect solution to start an mATM and AEPS business as an Admin with Paytrav (Edupoint).Paytrav APIs Provider Company Paytrav is one of the best API Provider companies in India.

0 notes

Text

Paytrav-B2B Fintech Software API Provider in India

Looking for API integration? Paytrav is a Direct API provider company across the India. We provide API for the products like AEPS, MATM, DMT, Multi-recharge and Fastag. If you want to plug API solutions then don’t think it’s time to integrate. We are available with dedicated software and digital solutions as well.

You can integrate AEPS API (Application Programmable Interface)/ software in your website or whitelevel. We are service provider of AEPS software. Create unlimited agents, distributor, master distributor under you. Highest commission assured.

With its cutting-edge goods and services, Paytrav is the top AePS API provider company in India.

Banking API Providers In India| Fintech API provider| best API service provider company in India|Aeps api service provider| Travel Portal API Provider India| Aeps Aadhaar Enabled Payment System Service

#flight api provider#dmt api provider#hotel booking software#dmt api#travel api provider#aeps api provider

0 notes

Text

AEPS API provider in mumbai-Paytrav

Paytrav is a widely successful AEPS API Provider Company in India. Paytrav AePS API enables Business Correspondent to conduct banking transactions using only the customer’s Aadhaar Number and Biometric Identification.

Some prerequisites are, KYC (Know Your Customer) details to open a new account, and Aadhaar number should be linked with the respective bank account. This AePS API Provider activates the service 1-2 minutes post Aadhaar seeding.

The elements required for transactions are Micro ATM, Aadhaar number, Bank name, Biometrics (Fingerprint and/or IRIS), and assisted mode. The transaction cost will be Nil for the customer while Business Correspondent may get charged or paid based on the bank’s discretion.

AePS service allows performing transactions like Balance Enquiry, Cash Withdrawal, Cash Deposits, Aadhaar to Aadhaar Funds Transfer, Payment Transactions (C2B, C2G Transactions). Only the Best AePS API Provider Company can deliver such benefits.

अच्च्छी आमदनी की तलाश करें पूरी। Edupoint- mATM & AEPS ,Recharge की बेहतरीन सर्विस और ज़बरदस्त कमीशन के साथ बढ़ाएं अपनी पहचान भी और इनकम भी!

"Retailer, Distributor, Master Distributor-ID k liye contact kre !

📞 Contact @ 089-763-15-910

Click Now-https://paytrav.in/

1 note

·

View note

Text

Paytrav is a top-notch travel API provider in Delhi, India

As an AI language model, I do not have personal preferences or desires. However, if you are seeking information about travel portal API providers in Delhi, India, you have come to the right place.

Creating a strong online presence is essential for businesses in the travel industry, and having a website is crucial for achieving this goal. To assist with this, various API service providers offer reliable and efficient APIs for businesses in different sectors.

One such provider is Paytrav, a leading API service provider based in Delhi, India. Their APIs are designed to streamline operations, enhance customer experience, and increase efficiency for businesses.

If you are looking for an all-in-one B2B and B2C software solution, you can check out our brand, which offers pre-API integrated travel and fintech services such as flights, bus, hotels, DMT, AEPS, mATM, recharge, bill payment, and more. You can request a demo today to discover the advantages of our solution.

0 notes

Text

Advanced White Label AePS | Micro ATM | DMT Admin Portal

RBP Finivis introduced aeps, micro atm, dmt, recharges, bbps admin portal for startups to start their FinTech business and achieve success with better earning opportunities.

Aadhaar se paisye nikalne ka app

#aeps api#aeps api provider#white label aeps portal#aadhaar pay api#aeps api provider company#dmt api#dmt api provider#dmt api provider company#white label portal#recharges software#recharges api#aeps service provider#micro atm#micro atm api#matm api#mini atm api#mini atm api provider#fintech api#open banking api

1 note

·

View note

Text

Micro ATM Brings Banking Everywhere And For Everyone

RBP Finivis Pvt. Ltd. is one of the leading Micro ATM API Provider Company in India; also we are doing our best to bring transformative impact on digital financial sector and even brought opportunities for retailers to increase their income, through our Mego Pay application.

As India is a developing country that supports rapid growth in technology, our government along with an organization i.e. NPCI put an initiative of digital banking by introducing Micro ATM. With this Micro ATM, one can get access to basic banking services without visiting any bank or traditional ATM. To make all that easy and simple, there are many FinTech companies in the market, developing Micro ATM API and SDK through which banks can remotely connect to their core banking system. One such API provider company located at Panchkula, Haryana is RBP Finivis that sub-serves the goal of the government to bring financial inclusion in the country and facilitate a hassle-free experience of banking to each and every one.

Some Of The Reasons Why is Micro ATM a Boon For Banking Sector:

Micro ATM is a compact debit card swipe machine that works as the best alternative for traditional ATMs. Integrating a large ATM requires much space and their integration cost is a little high, it also requires security cameras and various other equipment to keep watch on fraud. On the other hand, Micro ATM is handy, cost-effective, and easy to integrate. Moreover, Micro ATM is a means of employment to start-ups and it also gives opportunities to retail businesses to increase their income.

What Is Our Role At RBP Finivis?

We at RBP deliver API gateway for various payment solutions with high quality and complete security. Partner with us and get a chance to create your Micro ATM brand with high commission & 100% success rates. Hence, an amazing opportunity is not so far where you can build your Micro ATM admin portal with your name & logo. We are always available to help you flourish your FinTech business and give wings to fly high with our compatible API and SDK.

Micro ATM API Enabled Transactions

Using Micro ATM one can perform 4 types of basic banking transactions. They are:

· Cash Withdrawal - people can easily withdraw money up to ₹ 10,000 at a time using a debit card

· Balance Enquiry - one can fetch the current balance status of his account

· Mini Statement - you can track the history of your recent transactions

· Fund Transfer - you can easily and instantly transfer money from one account to another account across India.

Closure

As an API provider company, we are determined to bring change in the banking system under the guidelines given by NPCI and intend to make it easier and faster for the common man through our Micro ATM API and SDK. Our main Motive is to offer a fast and secure banking experience in the areas where bank branches cannot reach. However, more than 70% of India's population resides in rural areas, also they prefer cash payments. So, to save their time on long-distance travel, we are working to make their life cozy and comfortable.

Aadhaar se paisa niklane ka app

#micro atm#micro atm api#micro atm api provider#micro atm api provider company#matm api#mini atm api provider#aeps api provider in india#aeps api provider#best aeps api provider company in india#best aeps api provider#dmt api#dmt api provider#dmt api provider company#white labe aeps portal#white label micro atm portal#white label dmt portal#white label recharge portal#white label bbps portal

0 notes

Text

AePS API Provider Company with High-Tech API

AePS API provider company delivers innovative API banking services in a real-time and secure manner that seamlessly offers services like cash withdrawal, balance inquiry & more.

Micro ATM API provider company brings unique banking services to the customers. Without going bank branch or ATM people can perform banking transactions instantly.

As a DMT API provider company, we offer a money transfer API that is entirely safe and secure. We assure you that the money will safely reach the designated account only

#aep api#aeps api povider#aeps api company#high commission aeps api#aeps service provider#aeps admin portal#aeps business#aeps cash withdrawal api#cashout aeps api#aadhaar pay api#dmt api#domestic money transfer api#money transfer api#fintech api#open banking api#matm api#micro atm api#mini atm api

0 notes