#link unique code to PAN

Text

शेयर बाजार में पैसा लगाने वालों के लिए जरूरी खबर! SEBI ने इस ब्रोकर को किया बैन

शेयर बाजार में पैसा लगाने वालों के लिए जरूरी खबर! SEBI ने इस ब्रोकर को किया बैन

नई दिल्ली. अगर आप शेयर बाजार (Stock Market) में निवेश करते हैं ये खबर आपको जरूर पढ़नी चाहिए. भारतीय प्रतिभूति और विनिमय बोर्ड (SEBI) ने स्टॉक ब्रोकरेज कंपनी कार्वी स्टॉक ब्रोकिंग लिमिटेड (KSBL-Karvy Stock Brokers Limited) को एक ग्राहक का 2,000 करोड़ रुपये के डिफॉल्ट करने की वजह से बैन (Bans) कर दिया है. सेबी द्वारा कार्वी पर लगाया गया यह बैन तत्काल रूप से प्रभावी है. सेबी द्वारा लगाए गए बैन के…

View On WordPress

#link unique code to demat#link unique code to PAN#pan#sebi#Sebi direction#UCC#Unique client code of investors#कार्वी#कार्वी स्टॉक ब्रोकिंग#डिमैट अकाउंट#पैन#बाजार नियामक सेबी#शेयर बाजार#शेयर बाजार की जानकारी#शेयर बाजार के नियम#शेयर बाजार समाचार#सेबी#सेबी फुल फॉर्म#स्टॉक मार्केट न्यूज़#स्टॉक मार्केट न्यूज़ इन हिंदी

0 notes

Text

On coping with failure

A good friend of mine pointed out (rightfully) that I’d been doing a whole lot of talking about the game I want to make, and doing things kinda-sorta adjacent to it like working out details and the visual presentation (I’ll write about that in a later post), but not a whole lot of actually learning the engine. So I decided to really buckle down and give Godot a try.

After all, you can’t make a game with nothing but a design document - you need practical experience. And since I had next to no experience actually using the engine as opposed to watching videos, it was time to build that experience.

So I watched more of GDQuest’s Getting Started With Godot in 2021 playlist, most notably up to the “How to use Godot’s signals” video. I figured that was about all I needed to do some really basic playing around.

On the one hand, I was correct - on the other hand, I wasn’t ready for something like 3 hours of banging my head against a wall trying to get extremely basic things to work. (Given my prior experience with learning coding that was more or less exactly this, you’d think I would know better by now.)

Let’s backtrack a bit. Godot games, as far as I understand them, are largely composed of three things:

Scenes

Nodes

Signals

Nodes are your simplest building blocks. Scenes are a bit of a misnomer, because they’re more like... a container for nodes. If a scene is a toolbox, then nodes are the tools inside.

Despite the name “scene”, they are not related to scenery (I mean, they can be, but not inherently). A scene can be practically anything - so for example, a player character, an enemy, a stat bar, or, yes, your game’s scenery.

A good example is the protagonist of your game. Your Mario or your Link. They are a “scene”, as odd as that sounds. So, this scene might have a sprite node (your character’s appearance), a collision node (the hitbox), an audio node (sound that plays when you jump or get hurt), etc.

Again, it’s basically a box of parts - any components that a player character needs to function. The scene itself is a mere container and a label. Anything in your game that has a few interlocking parts, even if it’s simple? Probably a scene.

So once we’ve made our player character’s scene, what do we do with that? Well, the neat thing about scenes is that once you make a scene, you can drag them into *other* scenes. If you have an overworld scene, you can drag your player character scene in, then some enemy scenes, and an item scene... et cetera. In other words, you design various parts of your game, then put them all together in a bigger scene.

And you can use as many instances of a single scene as you want. Want 4 goombas? Drag the goomba scene in 4 times. And if your Goomba turns out to have a bug in its behavior, fixing the original Goomba scene will automatically fix it for all 4 of those Goombas.

Another neat thing is that scenes can act like nodes. In other words, you can take simple parts, create a slightly more complex object, then put it inside of a bigger object. Maybe you make an Oil Pan scene and an Engine Block scene and you add those together to make an Engine scene. Which then becomes part of your Car scene, which also has four Tire scenes, and a Wheel scene, which in itself is in a Garage scene... et cetera.

There’s no end to this nesting. You can go as simple or as complex as you want with it. It’s all made in the service of making parts of your game easier to design, reuse, and debug.

For example, you could make a base Animal scene for behavior you know you want all animals to have (like walking, eating, drinking water). Then you make a Cow scene with the Animal scene in it, but now you add some features unique to cows. And a Goat scene that does the same with features unique to goats, a Horse scene, etc. You didn’t have to program in those basic features for each animal because you created that “part” and reused it.

But it’s kind of overwhelming. And the terminology, to be frank, kind of sucks. “Scene” is just a really unnecessarily confusing term. I think it’d be much easier if you called nodes “attributes” and scenes “objects” or something, but I’m sure those words are taken by other game engines so it’d get confusing? I don’t know.

It takes a bit of getting used to. And to be honest, it’s part of why I bounced off Godot a few times. But I feel a bit more comfortable with it now.

So! Signals. Signals are how your scenes (and the nodes within) *talk* to each other. In other words, if we were making Super Mario in Godot, and Mario jumps on a goomba, how do we have Mario’s scene talk to the Goomba’s scene?

The Mario scene has a hitbox node. It detects collision, checks if it’s from the bottom (so Mario jumping on something instead of running into it), and sends out a signal. It says, hey whatever I jumped on, you should probably die now? And the Goomba scene receives that and is like, “Yeah man” and deletes itself. It’s also received by the sound node that plays a fun little noise. It’s ALSO received by the score scene, which increases score, and sends a signal to the UI scene, which is supposed to update every time the score changes.

Or maybe you jumped on spikes instead. So the hitbox node would need to check if it was an enemy you jumped on, or spikes. And if it’s spikes, it’d have to send a message to Mario’s health node to make him either lose his mushroom or die, and that would send a message to the sound node, saying “play either this sound or that sound”. Et cetera.

Once you wrap your head around it all, it’s not too bad. But there are problems like... picking the wrong node for something, because you don’t know what to choose. Or something not working and you don’t know why. Or having to redo an entire thing because you were stupid and didn’t set it up right.

Or... maybe you went about it in a really inefficient way just because you didn’t think about it right in the first place, because programming and ANY software development means learning to think about things in the most efficient ways.

These are normal steps. They’re all part of learning. You can’t really sidestep them unless you’re watching tutorials that teach you off the bat the most efficient ways to do things, but even then, you’re going to need to go off script and make your own mistakes if you want to make games beyond Baby’s First Unity Platformer.

And God, it’s normal, but it can be really irritating when it takes you three hours to do something that feels like it should’ve taken - and will, in the future - only 30 minutes.

For a bit of an odd segue...

I’ve been learning Japanese on and off for a while, and though I can’t say I’m any level of “good” at it, I’m often struck by the parallels between natural language and programming languages.

There’s often this impulse, especially if you’re a newbie, to translate a sentence or sentiment 1:1 into the language you’re learning. A few months ago I was looking up how to say “hello from America” in Japanese, as kind of a friendly “hi, sorry my Japanese sucks ass, I’m a dumbass American” sentiment. It’s a common enough sentiment you hear enough times from other overseas folks that I assumed it was fairly universal - greetings from France, and whatnot. I didn’t really think anything of it.

But Google pretty immediately told me that yes, while you can say アメリカからこんにちは (very literally, “hello from America”), it will always sound artificial and translated because it simply is not a phrase that exists in Japanese. It sounds very normal to a native English speaker, and certainly, the meaning would get across, but it comes across as odd.

It’s sort of like if I said to you, “Not like we’re riding on a rabbit’s back”. From context, you’d probably be able to glean that I meant “We’re not in a hurry”, but it would sound very strange, because that is an idiom that only exists in Finnish, not in English. (Sorry to any Finns if ei tässä jäniksen selässä olla isn’t a common phrase or something, I got that off Reddit.)

In other words, it’s not enough to know how to say every individual word in another language. It’s also about learning the right way to do things. You’re not trying to be a dictionary that translates every word 1:1. You’re trying to learn to think in another language, and abandon your preconceived notions.

You aren’t supposed to think of an English sentence and translate it. You’re supposed to think of a sentiment, a concept, one without language, and in your target language, express that in a way that is natural - as you would in your native tongue.

Programming, and developing in an engine, feels a lot like that.

Programming is not just learning what an if/else loop and a function is. It’s learning to properly consider concepts from the very start, so that you can write them out as efficiently as possible. You have to learn how to break down broader ideas and translate them into code, or code-and-nodes-and-scenes-and-signals-or-whatever.

You have to fundamentally change the way you think about problems. You cannot look at it in the way you’re used to. You have to view it entirely through the lens of whatever tool you’re using. And, using that, you have to figure out the best, most efficient solution for the problem.

And then do that like, 200 times.

And, of course, you can’t learn the most efficient ways until you bang your head against the less efficient ways, and learn why those ways suck, and what ways work for you.

So, then, to the crux of this post: It’s honestly humiliating. And overwhelming. And I took a break for like a fucking week. My first real attempt at working with Godot, and it demoralized me so much that I stopped for a week.

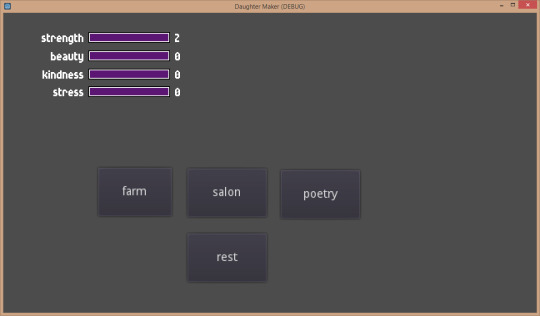

(Pictured: This took me hours, and only one of the buttons works.)

I have trouble with stumbling blocks where if I run into a significant impediment, I get very demoralized and stop. It’s derailed projects for me more times than I can count. I think a lot of ADHD people can probably relate. But the problem is - when you get used to only doing things that don’t involve a lot of failure and risk, it really limits your opportunities.

I just wanted to admit that, like, this is fucking hard, I guess. And it’s okay for it to be hard. It’s okay to be struggling to learn something no matter how old you are. But that I’m not going to give up, either. I made this blog for a reason - to stay accountable.

I am tired of leaving behind a string of failures.

I’m going to go back to watching tutorials, and see if I can’t get a little more insight into what the best way to handle certain things is (like lowering and incrementing stats). Then I’ll come back, and I’ll take another crack at it. And we’ll see what I can do.

And I will probably bang my head against the wall for another 3 hours, and accomplish far less than I’d hoped in that amount of time.

But I will have learned something. Hopefully.

14 notes

·

View notes

Text

How to update UAN and EPF KYC details Online

UAN stands for Universal Account Number is a 12-digit number given to each EPFO member. This number, which acts as a pivot, connects many Member Identification Numbers (Member Ids) assigned to a single member. Here are few important FAQs on UAN KYC, release by EPFO.1. What is KYC?

Know Your Customer or KYC is a one-time process which helps in identity verification of subscribers by linking UAN with KYC details. The Employees / Employers need to provide KYC details viz., Aadhaar, PAN, Bank etc., for unique identification of the employees enabling seamless online services.2. How can I seed my KYC details with UAN?

o Login to your EPF account at the unified member portal

o Click on the “KYC” option in the “Manage” section o You can select the details (PAN, Bank Account, Aadhar etc) which you want to link with UAN

o Fill in the requisite fields o Now click on the “Save” option

o Your request will be displayed in “KYC Pending for Approval”

o Once employer approves the details the message will be changed to “Digitally approved by the employer”

o Once UIDAI confirms your details, “Verified by UIDAI” is displayed against your Aadhaar.

3. What to do if my employer is not approving KYC?

In case your employer is not approving KYC details, you can directly approach administration or HR department with request. If it is taking more time you can escalate it to higher authority in the organization. If no one is responding to your request you can approach EPF Grievance via http://epfigms.gov.in.

4. How do I know that KYC updated by me is approved by the employer?

The status will be shown against updated KYC document on the same page. The system will also trigger SMS on your register mobile number.5. How can I seed my Bank account details?

o Login to your EPF account at the unified member portal o Enter your bank account number and IFSC code. o The details have to be approved by your employer. o Once approved the bank account gets seeded.6. What can I do if my UAN is not seeded with Aadhaar? Member can himself seed UAN with Aadhaar by visiting member portal. Thereafter the employer must approve the same to complete the linkage. Alternatively, member can ask his employer to link Aadhaar with UAN. The member can use “e-KYC Portal” under Online Service available on home page of EPFO website or e-KYC service under EPFO in UMANG APP to link his/her UAN with Aadhaar without employer’s intervention.7. Can I change my already seeded Bank account number?

Yes. The bank account number can be updated any number of times by following the steps mentioned above. However, the bank account details cannot be changed during pendency of any claim with EPFO.

8. What precautions should I take while seeding Bank account number?

You should seed active bank account to which you are either an individual or joint holder with your spouse. Also ensure that the bank account does not have a deposit cap greater than your withdrawal benefit.

9. I have changed my job. Should I activate my UAN again?

UAN has to be activated only once. You do not have to re-activate it every time you switch jobs.

10. Do I have to pay any fee for UAN registration?

No, UAN registration is free of cost and you do not have to pay any fee to activate it.

Source link

Read the full article

2 notes

·

View notes

Text

Apply for new pan card in New York

A Permanent Account Number (PAN) card is an essential document for various financial transactions and is required for all Indian citizens and entities conducting business in India. If you’re an Indian residing in New York or an Indian-origin individual needing a PAN card, the process to apply for one has been streamlined and can be completed from abroad. Here’s a comprehensive guide on how to apply for a new PAN card in New York.

What is a PAN Card?

A PAN card is a unique 10-character alphanumeric identifier issued to all tax-paying entities in India. These entities include individuals, companies, partnerships, trusts, and foreign nationals conducting business in India. The PAN is unique to each entity and is valid for a lifetime, regardless of any changes in address or employment.

Importance of a PAN Card

Tax Identification and Compliance:

Income Tax Returns: PAN is essential for filing income tax returns. It ensures that the tax-related activities of individuals and entities are tracked.

TDS/TCS: It helps in the tracking of tax deducted at source (TDS) and tax collected at source (TCS).

2. Financial Transactions:

Banking: Required for opening bank accounts, applying for loans, and conducting transactions above a certain limit.

Investments: Necessary for investments in securities, mutual funds, and fixed deposits exceeding a specified amount.

Property: Essential for purchasing or selling immovable property above a certain value.

3. Identity Proof:

PAN card is widely accepted as valid proof of identity across various sectors, including financial institutions, government services, and private organizations.

4. Prevention of Tax Evasion:

The PAN system links all financial transactions of an individual or entity, thereby reducing the chances of tax evasion and ensuring transparency.

Features of a PAN Card

If you want to apply for new pan card so you can contact us +1 (416) 996–1341 or [email protected] for apply new pan card in new york.

Unique Identification Number:

Each PAN card has a unique 10-character alphanumeric code that follows a specific format, ensuring no two PAN cards are identical.

2. Validity:

The PAN card remains valid for a lifetime. It is not affected by changes in personal information such as address or employment status.

3. Universal Acceptance:

Recognized across India as a valid proof of identity and essential for various financial and legal transactions.

4. Structure of PAN:

The PAN number consists of 10 characters, where the first five characters are letters, followed by four numerals, and the last character is a letter. For example, ABCDE1234F.

The fourth character signifies the type of PAN holder (individual, company, trust, etc.).

5. Details on the Card:

The PAN card contains the cardholder’s name, father’s name, date of birth, signature, and a photograph. For non-individual entities, it includes the entity’s name and date of incorporation.

Applying for a New PAN Card

Who Can Apply?

Individuals: Indian citizens, NRIs, PIOs, and OCIs.

Entities: Companies, firms, HUFs, trusts, and foreign nationals/entities conducting business in India.

Conclusion

Apply for a new PAN card in New York is a straightforward process if you follow the correct steps and provide the necessary documentation. Whether you’re an NRI or an individual of Indian origin, having a PAN card is crucial for managing your financial affairs in India. By following this guide, you can ensure a hassle-free application experience and receive your PAN card without any complications.

Contact Us-

Phone- +1 (416) 996–1341

Email Us- [email protected]

0 notes

Text

Disney Villains Geeki Tikis Ceramic Mugs by Beeline Creative

You say Villain like it’s a bad thing! Beeline Creative has just released an evil new line of Disney Villains Geeki Tikis Ceramic Mugs featuring some of Disney’s most iconic bad guys. Geeki Tikis is the only line of drinkware that combines pop culture’s most beloved characters with the unique stylization seen in American tiki culture. Continuing its popular line of ceramic mugs and cups based on the Wonderful World of Disney, the Disney Villains Geeki Tikis series includes Sleeping Beauty’s Maleficent, 101 Dalmatians’ Cruella de Vil, The Little Mermaid’s Ursula, and Peter Pan’s Captain Hook.

Each Disney Villains Geeki Tikis Ceramic Mug stands 7.25”-9.25” tall, holds 20-28 fluid ounces and features a colored glaze with additional colored detailing. Fans can pre-order these ceramic mugs now at Entertainment Earth for $34.99 each here. If you click the affiliate links in this post – or use coupon code “TheBlot” at checkout – you can get 10% off all in-stock purchases at Entertainment Earth AND free US domestic shipping on orders of $79+! http://dlvr.it/T3H13v

0 notes

Text

What Is An "IEC Certificate"?

An IEC Certificate, also known as the Importer-Exporter Code Certificate, is a unique 10-digit code issued by the Directorate General of Foreign Trade (DGFT) in India. This code is mandatory for businesses or individuals involved in importing or exporting goods and services to or from India.

Here are key points about the IEC Certificate:

Purpose:

The primary purpose of the IEC Certificate is to facilitate international trade and regulate foreign trade transactions. It serves as a key identification number for businesses engaged in cross-border trade.

Mandatory Requirement:

Obtaining an IEC is mandatory for any individual or entity seeking to engage in the import or export of goods and services from India. Even if the business does not plan to undertake export or import immediately, having an IEC is advisable for future flexibility.

Unique 10-Digit Code:

The IEC is a 10-digit alphanumeric code that uniquely identifies the importer or exporter. This code remains the same throughout the business's existence and is used for all interactions with customs authorities and other government agencies.

Application Process:

Businesses or individuals can apply for an IEC through the DGFT's online portal. The application process involves submitting the necessary documents, such as PAN (Permanent Account Number), proof of address, bank details, and other relevant information.

No Need for Renewal:

Once issued, an IEC does not require renewal. It is valid for the lifetime of the entity or individual, and there is no need to periodically update or renew the code.

Exemptions:

Some transactions or categories of individuals may be exempt from obtaining an IEC. However, in most cases involving international trade, having an IEC is a standard requirement.

Bank Account:

The IEC is linked to the business's or individual's bank account. All transactions related to foreign trade are tracked using this code.

Documents Required:

The specific documents required for obtaining an IEC may vary, but commonly requested documents include PAN card, proof of address, bank details, and a canceled cheque.

Use in Customs Declarations:

The IEC is a crucial element in customs declarations. It is used in various import and export documents, and customs authorities verify the IEC to ensure compliance with regulations.

Businesses involved in international trade in India need to obtain and maintain an IEC to conduct their import and export operations legally. It is essential for smooth customs clearance and compliance with foreign trade regulations.

0 notes

Text

A Step-by-Step Guide to How to Withdraw Cash from ATM using UPI and How to Apply for GST Number

In the digital age, financial transactions have undergone a significant transformation, with innovative technologies simplifying everyday processes. Two crucial aspects of modern financial dealings are withdrawing cash seamlessly from ATMs using Unified Payments Interface (UPI) and obtaining a Goods and Services Tax (GST) number for businesses. Let's delve into the step-by-step procedures for both these essential financial tasks.

How to Withdraw Cash from ATM using UPI:

With UPI revolutionizing the way we transact, withdrawing cash from ATMs has become more convenient than ever. Follow these steps to make a hassle-free cash withdrawal using UPI:

Access Your UPI-Linked App: Ensure your UPI-enabled mobile banking app is installed and linked to your bank account.

Select UPI Withdrawal Option: Locate the UPI Withdrawal or Cardless Cash Withdrawal option on your app.

Enter Withdrawal Amount: Specify the desired cash amount you wish to withdraw from the ATM.

Generate UPI Pin: Generate a UPI Pin through your app for the transaction.

Receive Transaction Code: Upon successful pin generation, you will receive a unique transaction code on your registered mobile number.

Visit UPI-Enabled ATM: Go to a UPI-enabled ATM and select the cardless withdrawal option.

Enter Transaction Code: Enter the transaction code received earlier.

Collect Cash: Once verified, collect the dispensed cash from the ATM.

How to Apply for GST Number:

Obtaining a GST number is a crucial step for businesses to comply with tax regulations. Here's a guide on how to apply for a GST number:

Visit GST Portal: Access the official GST portal (www.gst.gov.in).

Click on 'Services': On the homepage, click on the 'Services' tab and select 'Registration.'

Choose 'New Registration': Opt for 'New Registration' to initiate the application process.

Fill in Part A of Form GST REG-01: Provide details such as the legal name of the business, PAN, email, and mobile number.

Verification: Verify the application through an OTP sent to the registered mobile number and email.

Fill in Part B of Form GST REG-01: Complete the registration process by providing additional business details.

Upload Documents: Upload necessary documents, including PAN, proof of business registration, bank details, and address proof.

Submit Application: After thorough verification, submit the application.

Acknowledgment: Once submitted, you'll receive an acknowledgment in Form GST REG-02.

Verification by Authorities: The GST authorities will verify the application, and upon approval, you will be issued a GST number.

By following these comprehensive guides on how to withdraw cash from ATM using UPI and How to Apply for GST Number?, you can streamline your financial transactions and ensure compliance with taxation regulations for businesses. Embrace the convenience of digital financial processes to navigate the modern financial landscape effectively.

0 notes

Text

Barcarolle in Yellow by Víctor Ojuel

============= Links

Play the game

See other reviews of the game

============= Synopsis

Barcarolle in Yellow (1975, released in Italy as "Barcarolla in Giallo"), starring Eva Chantry.

This lurid but stylish Italian thriller is set in Venice during the filming of an eponymous exploitation film, with the lead actress credited as "playing herself". In the day it was critically panned by highbrow critics as "yet another entertainment for those who relish scantily clad ladies being murdered in grisly ways, trippy camerawork and nonsensical plot twists" and relegated to the relative obscurity of other "video nasties".

In the ensuing decades, this giallo has attained cult status, fondly remembered for its bold photography, ambiguous subtext, and of course the tragic circumstances that surrounded the production. Rumours abound about alternative endings that were cut from the theatre version, either by the Italian censors or the American distributor, with bootleg Betamax copies commanding high prices online.

============= Other Info

Barcarolle in Yellow is an Inform 7 parser, submitted to the 2023 Edition of the IFComp. It ranked 55th overall.

Status: Completed

Genre: Giallo

CW: Murder, blood, sex, nudity, terrible acting

============= Playthrough

Played: 15-Dec-2023

Playtime: around 1h-ish (with walkthrough)

Rating: 2/5

Thoughts: Missed the mark with loads of potential

============= Review

Barcarolle in Yellow is a meta parser, working as an interactive movie script for a pulpy giallo, blurring the lines between reality and movie scenes. You play as B-list probably-washed-out actress Eva Chantry as she gets the call to star in the eponymous movie. With a twist-on-twist-on-twist, the game includes multiple endings (found A, I know of at least 6), in-game hints, and a walkthrough for one ending (A).

Spoilers ahead. It is recommended to play the game first. The review is based on my understanding/reading of the story.

This game got me a bit conflicted.

The premise is enticing, the poster is so eye-catching, and the starting scene? an incredible way of hooking players. So darn unique! With the formatting the game introduction and credits, the game seem to play heavily on movie codes. With its whole fake-cult movie vibe, it reminded me a bit of the Goncharov meme. I was really intrigued with what the game had to offer, what meta commentary it might be making about the genre, or how to approach the scene/real-life aspect.

Then I started the game... and the problems started. During the first proper playable scene, a Spaghetti Western filmed in Spain, events ended up repeating itself when I took off my costume after the shoot ended, with the director screaming CUT again, belittling Eva for screwing with filming.

The following scene is timed, with any wrong move, any missing action, leading you to your early death. I died and restarted the game so many times because of that ONE scene needed a very specific sequence of actions to ward off your stalker. The timing is so tight it barely takes into account failing or asking for hints.

The rest of the game feels pretty railroady, with us/Eva getting few opportunities to have agency. This makes sense, considering she is an actress playing the role given to her, following the directions told. You have some options of choices here and there, which influences the story, but not much more. There is only one path you can take, or you'd lose the game, essentially.

But the game is not always clear about which actions are the wanted ones. It does provide hints, which are formatted like snippets of a movie script, telling the player a general idea of what they should do next (this was so smart!). Sometimes, the necessary (and unusual) action is not included in the hint... making things complicated.

This maybe the most obvious in that first times scene. I had to look the walkthrough up to avoid (finally) dying right at the start. It really takes you out of the immersion the game so craft-fully created in the prior moments. It happens again when shooting the scene on the bridge. The undercluing really messes with playing.

After trying and failing to get through the game... I just opened the walkthrough and followed it to the letter... or tried to. Your hotel in Venice changes name with every playthrough (that was neat), but only one is included there (so I died... again and again, until I realised what was wrong). I would have been nice if the walkthrough included all possible paths instead of just that one ending...

I'm sure someone will end up publishing a comprehensive walkthrough at some point...

The writing goes all-in in the giallo genre, with the depiction of Eva as this seductress woman in her hotel room - the character being overtly sexualised, but also wink-wink hihihi - as well as being the subject of quite a large amount of violence... and not being able to do much about it on or off screen. It's not really pleasant to go through, honestly, and I am not sure what the point of the game was concerning this.

Was it discussing how movies with shitty budgets have bad production periods where accidents happen but everyone have to deal with it? Is this a commentary on standards in the entertainment industry for actresses, especially in terms of being replaceable when their attractiveness fade? Or about the psychology being having no agency through the frame of an "adventure" game? Is there even a message in all this? Do you need to find all the endings to get the overall picture? (I hope not...)

This game had ticked all the checkboxes for being incredible, but its potential just fell flat with the muddled and sometimes buggy implementation. It has a good solid back bone, and some neat things (the script formatting and custom messages), but it still needs quite a bit of tweaking to make it the cult movie/game it is hoping to be.

Final note: spam Z at the end of the game for bonus features.

1 note

·

View note

Text

How to Link Aadhaar Card with Pan Card Online

Overview

The linking of the Aadhaar number with the Permanent Account Number (PAN) card has been a significant move in India’s financial landscape. This process aims to streamline and enhance transparency in financial transactions, prevent tax evasion, and promote efficient governance. In this blog, we will delve into the importance of linking your Aadhaar number with your PAN card, the process involved, and the implications of not doing so.

What is PAN and Aadhaar?

The Permanent Account Number (PAN) is a 10-digit alphanumeric identifier issued by the Income Tax Department of India. It plays a vital role in monitoring financial transactions that attract tax liability from a single source, making it convenient for the government to maintain accurate tax records. Notably, having a PAN card is mandatory for filing income tax returns. Moreover, PAN serves as an authentic identity proof for various purposes.

The Aadhaar card is a 12-digit unique identification number issued by the Unique Identification Authority of India to every Indian citizen. It serves the dual purpose of identity and address proof. In recent times, the Indian government has made it compulsory for all citizens to possess a single identification document. This requirement includes linking your Aadhaar card with PAN, irrespective of whether you file an income tax return or not.

Why is it important to link Aadhaar number with PAN card?

Linking your Aadhaar number with your PAN card is essential for several reasons:

Prevent tax evasion: It enables the government to monitor financial transactions effectively, reducing the scope for tax evasion.

Simplified income tax filing: It streamlines the process of filing income tax returns, making it more convenient for taxpayers.

Effective identity verification: Linking Aadhaar with PAN ensures the accuracy of personal details, reducing the risk of identity fraud.

Eligibility for government subsidies:Many government welfare schemes require Aadhaar-PAN linkage for beneficiaries to receive their entitlements.

How to link Aadhaar number with PAN card

There are multiple methods to link your Aadhaar card with PAN, such as through SMS, online portals, and during the PAN application process. The official Income Tax e-filing website provides a user-friendly platform for creating an Aadhaar-PAN link. The online linking facility is accessible to all citizens of the country, ensuring a hassle-free process. This mandate for linking Aadhaar with PAN aims to enhance transparency and streamline financial transactions, making it a crucial step in India’s financial compliance framework.

Online Method of Linking Aadhaar number with PAN

Follow these steps to link PAN with Aadhaar:

Visit the official website www.incometaxindiaefiling.gov.in and click on the link to link Aadhaar.

Provide PAN number, Aadhaar number, enter the actual name as per Aadhaar card and enter the captcha code. Then click on ‘link Aadhaar’.

Make sure the name, gender and date of birth in Aadhaar in PAN is exactly the same.

Follow these steps to link PAN and Aadhaar after logging to the income tax website:

Register yourself on the portal of income tax e-filing.

Go to the profile setting and click on ‘link Aadhaar’.

Enter your login ID, password and date of birth to log in to the official portal of Income Tax Department.

Click on the option ‘Aadhaar link to PAN’ in the pop up window.

Cross check the details that will automatically appear on the e-filing portal.

Enter your Aadhaar card number and captcha code and click on ‘link Aadhaar’ button. A message will pop up confirming the successful linking process.

Apart from the online process, you can link Aadhaar card with PAN card using the simple SMS process:

Send SMS to 567678 or 56161 in the format: UIDPAN <12 DIGIT AADHAAR NUMBER> <10 DIGIT PAN>

Missed due date for Aadhaar-PAN linking? Here’s what you need to know!

The deadline for linking your Aadhaar and PAN card was June 30, 2023, and the government has not granted an extension to this deadline. Failure to link your PAN and Aadhaar by this date will render your PAN inoperative.

Starting from July 1, 2023, if your PAN is not linked with Aadhaar, it will be considered inoperative. However, there is an option to reactivate your PAN by submitting the Aadhaar-PAN linking request after June 30, 2023. This reactivation process will require you to pay a penalty.

It’s crucial to stay updated with any changes or announcements from the government regarding the Aadhaar-PAN linking process to ensure compliance with tax regulations and avoid any disruptions in your financial transactions.

Who is exempted from linking Aadhaar with PAN?

Referece:

There are specific categories of individuals who are not mandated to link their Aadhaar with their PAN card. These exemptions include:

Residents of Assam, Jammu and Kashmir, and Meghalaya.

Non-residents as defined by the Income Tax Act, 1961.

Individuals aged 80 years or above at any point during the previous year.

Non-citizens of India.

It’s important to note that individuals falling within any of these exempt categories can voluntarily choose to link their Aadhaar with their PAN without incurring any fees. Furthermore, it’s essential to stay updated on any potential modifications to these exemptions, as they are subject to change in the future.

Implications of not linking Aadhaar with PAN

If you fail to link your Aadhaar with PAN, the consequences can be significant. The most notable impact is on the Tax Deducted at Source (TDS) rate. Suppose your PAN is not linked to Aadhaar by the specified deadline. In that case, the TDS rate on various financial transactions may increase to 20%, which is substantially higher than the usual rates.

Illustration: Let’s say you have a Fixed Deposit (FD) with a bank that provides an interest rate of 6% annually. Without Aadhaar-PAN linkage, the TDS rate on the interest earned would be 20%. So, if your FD earns Rs. 10,000 in interest, Rs. 2,000 would be deducted as TDS, leaving you with only Rs. 8,000.

PAN Card Status: Operative and Inoperative

PAN cards can have two statuses: operative and inoperative. An operative PAN card is one that is linked with your Aadhaar number, while an inoperative PAN card is not linked.

Consequences of an Inoperative PAN Card

If your PAN card becomes inoperative due to the lack of Aadhaar linkage, you may face difficulties in conducting various financial transactions. Additionally, you could be penalized with a higher TDS rate, as mentioned earlier.

How to Make a PAN Card Operative

After June 30, 2023, PAN which is not linked with Aadhaar, will be considered inoperative. However, there is an option to reactivate your PAN card by submitting the Aadhaar-PAN linking request which comes with a penalty.

If your PAN has become inactive, you can reactivate it by paying a fine. To initiate the Aadhaar-PAN linking request, follow these steps:

Go to incometax.gov.in/iec/foportal/ and navigate to ‘e-Pay Tax’ to start the Aadhaar-PAN linking process.

Enter your PAN details and proceed to CHALLAN NO./ITNS 280 for submitting the Aadhaar-PAN linking request.

Ensure that the fee payment is made under Minor head 500 (Fee) and Major head 0021 [Income Tax (Other than Companies)] in a single challan.

Choose the mode of payment.

Enter your PAN, select the Assessment year, and provide your address details.

Enter the Captcha code and click on the Proceed tab to complete the process.

Conclusion

Linking your Aadhaar number with your PAN card is not just a regulatory requirement; it’s a crucial step toward a more transparent and efficient financial system. Failing to link the two may lead to higher TDS rates and complications in your financial transactions. So, it’s essential to complete this process in a timely manner to enjoy the benefits and avoid unnecessary hassles. Those who failed to complete the process must know the implications and submit a linking request to further make their PAN card operative.

MI Lifestyle is dedicated to incorporating best practices and complying with all regulatory standards, maintaining the utmost levels of ethics and transparency. It is crucial to highlight that the compulsory linking of Aadhaar with PAN is a requirement for all citizens of India. And hence, it is necessary for every Indian citizen, including MI Lifestyle distributors to be vigilant towards the government updates and announcements.

#How to Link Aadhaar Card with Pan Card Online#Link Aadhaar Card with Pan Card#Aadhaar Card with Pan Card

0 notes

Text

How To Invite Friends and Earn Referral Income with Viva11 Fantasy Cricket

If you're a fan of fantasy cricket and you're already enjoying the exciting world of Viva11 Fantasy Cricket, you can take your gaming experience to the next level by inviting your friends to join. Not only will you have more fun competing with your buddies, but you'll also have the chance to earn referral income. Here's how you can do it:

Open the Viva11 Fantasy Cricket App: Launch the Viva11 Fantasy app on your smartphone. If you haven't already installed the app, you can easily download it from the official website or your device's app store.

Tap on the Menu Bar: Once you're inside the app, navigate to the menu bar. You can usually find this icon in the top-left or top-right corner of the app's interface.

Choose Refer & Earn: In the menu options, look for "Refer & Earn" or a similar section that pertains to referrals and earning rewards. Tap on it to proceed.

Click on the Refer Button: Inside the Refer & Earn section, you'll typically find a "Refer" or "Invite Friends" button. Click on this button to generate your unique referral code.

Share the Referral Code and Earn Money: Your unique referral code will now be available for sharing. You can send it to your friends through various channels such as WhatsApp, SMS, email, or social media platforms. When your friends use this code to sign up for Viva11 Fantasy, you'll earn referral income.

How To Withdraw Your Winnings from Viva11 Fantasy Cricket App

Congratulations on your winnings in Viva11 Fantasy Cricket! Now, you might be wondering how to withdraw those hard-earned rewards from the app. The process is straightforward, but there are a few essential steps to follow:

Verify Your Mobile Number: To ensure the security of your account, Viva11 Fantasy may require you to verify your mobile number. This verification helps confirm your identity and protects your winnings.

Verify Your Email ID: Similar to mobile number verification, email ID verification adds an extra layer of security to your account. It ensures that your email address is accurate and linked to your account.

Verify Your PAN Card: To comply with financial regulations, Viva11 Fantasy may ask you to verify your PAN (Permanent Account Number) card. This step helps confirm your eligibility for financial transactions on the platform.

Once you've completed these verification steps, your application for withdrawal will be submitted for review. Viva11 Fantasy ensures that all necessary security measures are in place before processing your withdrawal request.

Now, you can withdraw your winnings to your bank account. Please note that the Paytm withdrawal option may not be available, but you can conveniently transfer your earnings to your bank. Viva11 Fantasy typically allows withdrawals for amounts as low as ₹100, making it accessible for a wide range of users.

Keep in mind that withdrawal processing times may vary, but it usually takes around 1-2 days for your request to be completed.

By following these guidelines and making the most of the Viva11 Fantasy referral program, you can enhance your fantasy cricket experience, enjoy friendly competition with your friends, and potentially earn extra income while doing what you love. So, invite your friends, play, win, and relish the thrill of fantasy cricket with Viva11 Fantasy!

0 notes

Text

First week SDL supplement.

1.Comment on how the ideas and practices discussed in the essay might relate to your own thinking and development as a photographer.

(1) There is no 'one size fits all' pan-tribal set of protocols regarding photography . Rather than strict laws governing Te Ao Maori regarding photography on the marae , it is in fact a negotiable space, albeit one that has many underlying codes.

answer: No Universal Rules: The phrase "no 'one size fits all'" indicates that there isn't a blanket set of rules that applies to all Māori tribes or marae. Each tribe or community may have its own unique customs and expectations regarding photography.

(2) Mana is a term that includes the spiritual and inherited force of a place, person or thing and is closely linked with tapu , that which is sacred or restricted. 10 Therefore , to photograph without having an understanding of the cultural and spiritual realm of the marae opens up the possibility of transgressing multiple thresholds .

answer: For a photographer, this statement underscores the profound importance of understanding and respecting the cultural and spiritual dimensions of the marae (Māori meeting grounds) when taking photographs.

For a photographer, the statement highlights the need for cultural awareness, respect, and sensitivity when photographing marae. Recognizing the spiritual and cultural significance of the marae is essential to avoid inadvertently violating sacred aspects and to ensure that the photography process is conducted with the utmost respect for Māori traditions and values.

0 notes

Text

Can I Store Cardholder Data?

This article aims to clarify the requirements imposed by PCI DSS compliance, the Payment Card Industry Data Security Standard (PCI DSS), concerning the safeguarding of cardholder data (CHD) and specifically, sensitive authentication data (SAD).

Let's begin with a brief overview. The PCI DSS serves as an information security standard for organizations that handle the storage, processing, and/or transmission of payment card data. Back in 2004, five major card brands (Visa, MasterCard, JCB, American Express, and Discover*) collaborated to establish the Payment Card Industry Security Standards Council (PCI SSC). Their objective was to develop PCI DSS version 1, which aimed to assist businesses in securely processing card payments and minimizing card fraud. Over time, the Standard has evolved, and the latest version (4.0) was released on March 31, 2022. It outlines a set of fundamental controls that all organizations processing payment card data are expected to adhere to.

However, it is important to note that when referring to payment card data, a distinction is made between the storage, processing, or transmission of cardholder data (CHD) and sensitive authentication data (SAD). In this article, we will explore the disparities between the two and highlight the additional PCI DSS requirements that apply specifically to SAD.

*In 2020, UnionPay became a strategic partner of the Payment Card Industry Security Standards Council (PCI SSC), joining the original five brands.

CHD vs. SAD

The Payment Card Industry Data Security Standard (PCI DSS) classifies both cardholder data (CHD) and sensitive authentication data (SAD) as account data. CHD includes a complete primary account number (PAN) along with cardholder name, expiration date, and service code, if stored together with the PAN. It is important to note that the PCI DSS storage requirements pertain to the PAN and the associated data. If only the other data is stored without the PAN, the storage requirements do not apply.

SAD comprises the track data present in the magnetic strip, the PIN and PIN block data stored in the chip, and the verification code. Different card brands use varying terms to refer to the verification code, such as 'card verification value' (CVV2), 'card authentication value' (CAV2), 'card verification code' (CVC2), and 'card identification number' (CID). CVV2 is used by Visa, CAV2 by JCB, CVC2 by MasterCard, and CID by American Express and Discover.

For Discover, JCB, MasterCard, and Visa payment cards, the card verification values or codes are the three-digit values printed on the signature panel at the back of the card. In the case of American Express payment cards, the code is a three-digit, unembossed number printed above the PAN on the front of the card. This code is unique to each card and links the PAN to the card.

Regarding SAD, the PCI DSS audit imposes additional security requirements. Most notably, unless issuers or issuing organizations have a legitimate business need to store the authentication data, SAD must never be stored after authorization, even if encrypted. This requirement applies even if there is no PAN in the environment. It is essential for organizations to consult their acquirer or the individual payment brands directly to understand if storing SAD prior to authorization is allowed, the permitted duration of storage, and any associated usage and protection requirements.

0 notes

Text

PAN Status Unveiled: Navigating Tax Regulations with Confidence

In the realm of taxation, the Permanent Account Number (PAN) is a crucial identification code for individuals and businesses in India. With the ever-evolving tax landscape, understanding PAN status and navigating through tax regulations is imperative. This blog post aims to provide comprehensive insights into PAN status, its significance, and how to maneuver tax regulations with confidence.

Unveiling the Significance of PAN Status

The Permanent Account Number (PAN) is a unique ten-digit alphanumeric identifier issued by the Income Tax Department of India. It serves as an essential tool for tracking financial transactions and ensuring tax compliance. PAN status holds great importance due to the following reasons:

Financial Transactions: PAN status is vital for various financial activities, including opening bank accounts, conducting high-value transactions, and investing in securities. It acts as a safeguard against fraudulent transactions by providing a traceable record.

Tax Filing: PAN status is mandatory for filing income tax returns. It helps the government monitor tax payments and prevent tax evasion, contributing to a fair and transparent taxation system.

Property Transactions: PAN status is required for property transactions beyond a specified threshold. This measure curbs black money and enhances transparency in real estate dealings.

Navigating PAN Status and Tax Regulations

Understanding PAN status and effectively navigating tax regulations is essential to avoid penalties and ensure a seamless compliance process. Here's how you can do it with assurance:

Applying for PAN: If you don't have a PAN, apply for one through the official portal of the Income Tax Department. Fill out the application form with accurate details to expedite the process.

PAN Verification: Verify PAN status online to confirm its authenticity. This prevents misuse of your PAN details and safeguards against identity theft.

Updating PAN Details: In case of any changes in personal information, such as name, address, or contact details, update your PAN records promptly to maintain accuracy.

Linking PAN with Aadhaar: As per government regulations, linking your PAN with Aadhaar is mandatory. This linkage streamlines various financial activities and prevents duplication.

Tax Planning: Leverage your PAN status for effective tax planning. Keep track of your financial transactions and investments to optimize tax deductions and exemptions.

Ensuring Compliance and Security

While understanding PAN status and tax regulations is crucial, ensuring compliance and security should also be a top priority:

Timely Tax Filing: Adhere to tax filing deadlines to avoid penalties. Your PAN status will reflect your tax payment history, showcasing your commitment to compliance.

Securing PAN Documents: Keep physical and digital copies of your PAN card in a secure location. Avoid sharing your PAN details with unauthorized individuals.

Regular Updates: Stay informed about changes in tax regulations and PAN-related policies. This knowledge will empower you to adapt to new requirements seamlessly.

Professional Assistance: If you find tax regulations complex, seek professional assistance from chartered accountants or tax consultants. They can guide you through intricate matters.

Understanding the Importance of PAN Status

In the realm of financial transactions, having a PAN (Permanent Account Number) is not just an obligatory identification number; it's a pivotal factor that holds significant importance. PAN status plays a crucial role in various financial activities, from taxation to investments, and its understanding is paramount for individuals and entities alike.

Importance of PAN for Individuals

Taxation: PAN status is mandatory for filing income tax returns in India. It enables the government to track an individual's financial activities and ensures proper tax assessment. With a PAN, taxpayers can accurately report their income and claim deductions, contributing to a transparent tax ecosystem.

Financial Transactions: A PAN is required for high-value financial transactions such as purchasing or selling properties, buying vehicles, and opening bank accounts. It helps in curbing black money circulation by establishing a connection between the individual and the transaction.

Investments: PAN status is indispensable for investing in mutual funds, stocks, and other financial instruments. It helps regulatory authorities monitor investment activities, ensuring that investors comply with relevant regulations and preventing fraudulent activities.

Opening Bank Accounts: Opening a bank account, particularly a savings or fixed deposit account, mandates providing a PAN. This measure aids in verifying the source of funds and preventing illegal activities.

Importance of PAN for Businesses

Legal Entity: PAN status is crucial for registering a business entity in India. It is required for obtaining licenses, permits, and conducting financial transactions in the entity's name. This ensures transparency and accountability in business operations.

Financial Reporting: Businesses with PAN status can accurately report their financial transactions and income. This facilitates proper accounting practices and helps in avoiding discrepancies in financial statements.

Tax Compliance: Just as individuals file income tax returns, businesses also need to file their tax returns. PAN status helps businesses meet their tax obligations, avoid penalties, and maintain their credibility.

GST Registration: For businesses exceeding a certain turnover threshold, obtaining a PAN is essential for GST (Goods and Services Tax) registration. This enables them to comply with indirect tax regulations and contribute to the country's revenue.

In a world driven by digitalization and transparency, the importance of PAN status cannot be overstated. It serves as a linchpin in connecting financial activities with the relevant individuals or entities, contributing to a more accountable and well-regulated financial ecosystem. Whether you're an individual or a business entity, understanding and maintaining a valid PAN status is not just a legal requirement but a responsible step towards contributing to the nation's economic growth and development.

So, ensure that you possess a PAN and keep it up to date to navigate the financial landscape smoothly, staying on the right side of the law, and securing your financial future.

Conclusion

In the dynamic landscape of taxation, PAN status serves as a cornerstone for financial transactions and tax compliance. By understanding its significance and navigating through tax regulations with confidence, individuals and businesses can ensure a seamless and hassle-free experience. Stay informed, keep your PAN status updated, and embrace the world of taxation with assurance.

0 notes

Text

.🔥 Real wood fire without the mess!! Check out our Tiki brand fire pit from @tikibrandproducts! This Fire Pit’s unique internal patented airflow system means low smoke and less ash! I love the way it looks in our desert outdoor space and it's incredibly easy to start too!! You get a full flame in under 5 minutes with the included #TIKIbrand wood pack. Each pack lasts 30 minutes and then I just add another pack or firewood to keep it going.

🔥 The box includes everything needed - a stand, weather resistant cover, wood pack and an ash pan for easy clean-up. Right now you can save 15% on fire pits using my code SHANNAN15 Or my unique link https://aspireiq.go2cloud.org/SH1kr

1 note

·

View note

Text

A Comprehensive Guide: How to File Income Tax in India

In India, filing income tax returns is a critical financial obligation for both individuals and corporations. Seeking the advice of a trained professional, such as a chartered accounting business like CAnest, can be very beneficial in ensuring a smooth and correct filing procedure. We'll outline the procedures, required paperwork, and internet tools in this article's step-by-step guide to filing income taxes in India.

Step 1: Gather Essential Documents

Before proceeding with the filing process, it is essential to gather the necessary documents. These typically include:

1. PAN Card: Your Permanent Account Number (PAN) card is a unique identification number required for income tax filing.

2. Form 16: If you are a salaried individual, your employer will issue Form 16, which contains details of your salary, tax deductions, and TDS (Tax Deducted at Source).

3. Bank Statements: Collect your bank statements, as they will help you verify your income and transactions during the financial year.

4. Investment Proofs: Keep records of investments made under various tax-saving schemes, such as life insurance policies, provident fund contributions, and equity-linked savings schemes.

Step 2: Choose the Appropriate ITR Form

Next, determine the correct Income Tax Return (ITR) form to use. The appropriate form depends on your income sources and category. The different ITR forms cater to individuals, businesses, and specific income types. Seek professional advice from a chartered accountant to select the correct form based on your circumstances.

Step 3: Online or Offline Filing

India's income tax filing process offers two options: online and offline filing.

1. Online Filing: This is the most convenient and popular method. Visit the official income tax e-filing portal (incometaxindiaefiling.gov.in) and register yourself as a taxpayer. Complete the relevant ITR form, upload the required documents, and submit your return online.

2. Offline Filing: If you opt for offline filing, download the applicable ITR form from the official portal. Fill in the form manually, and submit it at the nearest Income Tax Office or authorized centers.

Step 4: Verify and Submit Returns

Regardless of the filing method, ensure you verify your returns. The most common methods of verification include:

1. Digital Signature Certificate (DSC): Obtain a DSC and sign your returns electronically. This is mandatory for certain categories of taxpayers.

2. Aadhaar OTP or EVC: Use your Aadhaar-linked mobile number to generate a One-Time Password (OTP) or EVC (Electronic Verification Code) for verification purposes.

Step 5: E-Verification or Physical Verification

After submitting your returns, you can choose either e-verification or physical verification.

1. E-Verification: Use any of the electronic verification methods mentioned in Step 4 to complete the verification process online.

2. Physical Verification: In case you choose physical verification, print your ITR-V (Income Tax Return - Verification) form generated after filing your returns. Sign the form and send it via regular or speed post to the Centralized Processing Center (CPC) within 120 days of e-filing.

Although submitting income tax returns in India may seem difficult, it can be made simple and trouble-free with the correct advice and assistance from a reputable chartered accounting business like CAnest. Do not forget to gather all required paperwork, select the appropriate ITR form, and decide whether to file electronically or manually. Verify your returns using digital signatures or OTP/EVC, then carry out the necessary steps for physical or electronic verification. You can efficiently complete your tax duties and ensure compliance with Indian tax rules by following these steps.

#IncomeTax#incometaxseason#incometaxes#incometaxtime#IncomeTaxRefund#IncomeTaxReturn#incometaxballers#incometaxreturnfiling#IncomeTaxMoney#incometaxmiami#incometaxspecials#incometaxeffect#incometaxseason2023#incometaxswag#incometaxballer#incometaxReturnFly#incometaxclapback#IncomeTaxPreparer#IncomeTaxPrep#incometaxloans#incometaxballin#IncomeTaxPreparation

1 note

·

View note

Text

What Are The Steps For "Ad Code Registration"?

Ad Code is a code used in the context of foreign exchange transactions and dealings in India. It is a requirement for businesses to register an Ad Code with their bank for processing foreign exchange transactions. Here are the general steps for Ad Code registration in India:

Open a Current Account:

To obtain an Ad Code, you need to have a current account with an authorized bank in India. Choose a bank that is authorized by the Reserve Bank of India (RBI) for handling foreign exchange transactions.

Get Importer Exporter Code (IEC):

If you don't have an Importer Exporter Code (IEC), you need to obtain one from the Directorate General of Foreign Trade (DGFT). The IEC is a mandatory requirement for businesses engaged in import and export activities.

Submit Application for Ad Code:

Submit an application for the issuance of an Ad Code to the authorized bank where you have your current account. The application form may vary from bank to bank.

Provide Necessary Documents:

The bank will require certain documents along with the application. Typical documents may include:

Copy of the PAN card

Copy of the IEC

Address proof of the business

Copy of the partnership deed or certificate of incorporation (depending on the business structure)

Verification Process:

The bank will verify the submitted documents and information. This may involve background checks to ensure compliance with regulatory requirements.

Ad Code Issuance:

Once the verification is complete, the bank will issue an Ad Code. This code is a unique identification number that is used in all foreign exchange transactions.

Linking Ad Code to Customs:

If you are involved in import/export activities, you need to link your Ad Code with the Customs Department. This is done by providing the Ad Code details to the Customs authorities.

Compliance with RBI Guidelines:

Ensure that your foreign exchange transactions comply with the guidelines and regulations set by the Reserve Bank of India. Any deviation may result in penalties.

Renewal and Updates:

Ad Codes may have a validity period, and you may need to renew them. Additionally, update the bank if there are any changes in your business structure or contact information.

Please note that the exact procedures and documentation may vary slightly from bank to bank, and it's advisable to check with your specific bank for their requirements and procedures for Ad Code registration. Additionally, it's always a good idea to seek professional advice to ensure compliance with regulatory requirements.

0 notes