#insurance policy management

Text

Insurance Policy Management Software: A Balanced Solution for Insurance Providers.

Insurance companies face a wide range of difficulties in managing policies in the digital age. The manual record-keeping methods and paperwork turn out to be slow, laborious processes that are easily subjected to errors. However, the emergence of insurance policy management software has proved to be a modern solution that makes operations much more efficient and results towards increased productivity. This blog will clarify the advantages and features of this software to help insurers make prudent choices.

Insurance Policy Management Software: Empowering Insurance Providers

With this technology, the insurance industry is always changing and outdoing other competitors. Insurance policy software provides a vast collection of tools and features that allow insurance companies to streamline their processes while enhancing customer service. Being a software that changes the face of the insurance industry, it is used in policy creation and administration as well as claims processing and document management.

Advantages of the Insurance Policy Management Software

1. Improved Efficiency: One of the major advantages resulting from using such software is a significant increase in total efficiency due to reducing manual tasks. Completion of the policy creation, renewal and endorsement processes may become much quicker in this manner to minimize paperwork or administrative needs. It, therefore allows insurance suppliers to pay more attention and why not dedicate additional staff towards customer service?

2. Enhanced Customer Service: Insurers can offer premium customer service with the help of this software. The software gives easy access to customers’ information, policy details and claims history data in real time agents can answer customer queries instantly. In addition, this software reimbursement process helps in faster settlements thereby increasing customer satisfaction.

3. Accurate Policy Management: Manual record-keeping results in policy management full of errors and inconsistencies. Policy Management Software completely reduces the possibility of human error that comes with policy calculations, downloadable premium adjustments and automatic document generation. This ensures effective policy management and eliminates any arguments or conflicts that might be between the organization.

4. Integrated Document Management: Insurance companies handle a large number of documents including policy forms, endorsements and claim letters. The software comes along with integral document management systems for storing, retrieving and organizing documents. It speeds up the process, reduces paperwork and makes documents safer.

Essential Rules of Insurance Policy Management Software

5. Policy Creation and Administration: With policy management software, insurance providers can now design policies that are customized to their needs and also easily manage them. It provides pre-formatted templates, product catalogues and configurable policies. This enables insurers to customize their policies to individual clients’ needs, thereby increasing client satisfaction.

6. Claims Processing: The program automates the whole claims procedure, from claim initiation to settlement. It makes it possible for insurance companies to streamline claim processing, shortening the time necessary for claims as well as improving customer service. Furthermore, the software has built-in fraud detectors and prevents insurance fraud.

7. Customer Relationship Management: Note that the customer relationship management feature is a significant benefit for the software. It allows insurers to have a centralized database of customer information and create it, as well as record interactions while effectively managing communication with customers. This enhances customer relations and gives better services.

8. Reporting and Analytics: Timely analysis of data can be beneficial to insurance providers in determining and closely monitoring the performance of their business, and making decisions in this area. Using the software, users have access to full-spectrum reporting and analytics tools that create actionable real-time reports based on dashboards and performance metrics. This enables insurers to measure and determine the areas where improvement is necessary.

Conclusion

The modern way of operation for insurance providers is providing a degree of an organized strategy with the aid offered by insurance policy management software, saving time and optimizing operations while ensuring a high level of customer service. With the modernization of processes, reduction in paperwork and strong features like policy creation management systems claims processing systems customer relationship maintenance this software enables insurance organizations to succeed by embracing the digital age. For insurance service providers, it is important to get used to insurance policy software since the desire of your business organization is one that’s aiming at competition in all sectors for guaranteed best customer services as well as growing into a sustaining and stable state.

#insurance policy management#policy management system#policy management#insurance software#insurance policy#insurance software solutions

0 notes

Text

ran into some trouble with my pharmacy being unable to bill my health insurance for my prescriptions and it turns out this was because my insurance company reverted the gender they have listed in my file for some fucking reason

#ash.txt#I'm very upset right now#thank you to my pharmacy for managing to get my meds covered anyway though#I'm not entirely sure that it's not a violation of some fraud policy somewhere to change my info for just long enough to bill my insurance#but it did indeed work

9 notes

·

View notes

Text

#assessment Small#Business asset protection#Business continuity#Business credibility#business finance#Business protection#Commercial insurance#Cyber insurance#Insurance advice#Insurance coverage#Insurance for entrepreneurs#Insurance policies#Insurance tips Risk#Legal requirements#Liability insurance#Professional liability#Property insurance#Risk management#Small business insurance#Worker's compensation

2 notes

·

View notes

Text

the worst part about having a big stupid crying breakdown at work is you still have to go back there tomorrow. and people will be all like “why did you do that yesterday” and you have to admit to being insane

#girl help my facade of neurotypicality is crumbling#forreal tho my manager told me I had to stay an hour and a half after my usual off-time#b/c the fuckface moron who made the scedule forgot to bring in another cashier#BUT I had a clarinet lesson sceduled that day after work so I couldn't stay. so I had to call the next cashier and ask her to come in early#but I didn't have her phone number so I tried to check the list of phone numbers they keep in the office#couldn't find it b/c the manager had thrown it away b/c it was ''outdated''#and on top of all that we were still customer-every-30-seconds busy and the damn tills kept shitting the bed#AND a health inspector turned up (which is why I couldn't leave in the first place apparantly no cashier is a Store Policy Violation)#tell that to our esteemed upper manager Rade Shadow Legends who never fucking scedules any fucking cashiers#''oooooo why do so many of our cashiers quit'' BECAUSE YOU MAKE THEM WORK THE DINNER RUSH BY THEMSELVES RADE#fucking. i need to quit this job anyways so I gan get one that actually gives me health insurance#anyways I cried in the bathroom for like 10 minutes and the store manager called another manager so I could leave. fuck#Moose Talks

9 notes

·

View notes

Text

Phone calls have been made! I have not cried in frustration while on the phone! This is a win.

I still can’t get anything filled before Thursday, though I have at least confirmed I will be RECEIVING them on Thursday, but I at least get where the issue is. (Either: There has in fact been a massive misunderstanding between the pharmacist and the person giving the instructions on how often it has to be taken, and calling the clinic while I’m at the pharmacy on Thursday to make sure everyone’s on the same page while I’m there to clarify ‘This means I need it refilled every twelve days, is this doable?’ should get us what we need, OR everyone does in fact understand that I’m on a prescription where I will go through a new box every twelve days, however, it cannot be filled every twelve days for whatever arbitrary bureaucratic reason, so I cannot take it as prescribed, in which case calling the clinic while I’m at the pharmacy on Thursday should make it clear that I have to be taking it three times a day logistically.)

(The person at the clinic who gives instructions believed the ones she gave were very clear and explicit. Given the previous instructions were at least ‘not clear enough NOT to confuse an autistic person whose memory is still spotty enough from all the Assorted Issues not to remember the doctor said to take it four times daily,’ I’m a bit skeptical, but I can also fully believe it’s a problem on insurance’s end and arbitrary limitations, so.)

Either way, come Thursday afternoon there WILL be both cromolyn and a gameplan so that I know how to take my meds to get them sustainably refilled. So there’s that.

#long post#medication#offering a new service to doctors and prescribers everywhere:#are your instructions clear enough for an autistic with mild brain fog to understand your intent?#if not then you might want to reword#offering a new service to health insurance policy makers everywhere:#you now have to try and get a medication for managing your chronic condition filled#it's okay that you don't have a chronic condition that requires constant medicating! You decided COVID is over and we can all just die.#you'll get it eventually.#I no longer have the grace in my heart not to wish on you what your actions have inflicted on millions of others#have fun with that. side note: seems like half the specialists in this field have some part of the trifecta themselves#they'll all make sure you receive the care you deserve

3 notes

·

View notes

Text

What's the difference between HO-1, HO-2, HO-3, HO-4, HO-5 and HO-6 policies? Nearly 75% of Homeowners Don’t Know Their Policy Coverage?

#insuranceclaims #hurricaneclaims #hurricaneseason #insurancebrokers #homeownersinsurance #propertyinsurance #insurancebrokers #insuranceclaims #insuranceagency #floridainsurance #homeowners #homeownertips #claimsmanagement #stormdamage #homeownershipgoals #insuranceclaims #claims #insuranceagency #publicadjuster

Here is a simple breakdown:

HO-1: Basic form — this only covers you from 10 named perils. "Named-peril" means that your home and personal property are covered against losses that are expressly listed on your policy. Any loss that occurs outside of that list would not be covered by the policy. The 10 named perils are:

• Fire or smoke / Explosions / Lightning

• Hail and windstorms

• Theft or Vandalism

• Damage from vehicles or aircrafts

• Riots and civil commotion

• Volcanic eruption

HO-2 — Designates a "broad form" homeowners insurance policy that provides insurance coverage on a "named-peril" basis. There are 16 covered perils on a broad form policy. They are:

• Lightning or fire

• Hail or windstorm

• Damage caused by aircraft

• Explosions

• Riots or civil disturbances

• Smoke damage

• Damage caused by vehicles

• Theft or Vandalism

• Falling objects

• Volcanic eruption

• Damage from the weight of snow, ice, or sleet

• Water damage from plumbing, heating, or AC overflow

• Water heater cracking, tearing, and burning

• Damage from electrical current

• Pipe freezing

HO-3 — Designates a "special form" homeowners insurance policy that provides insurance coverage for the structure of your home on an "open-peril" basis. "Open-peril" means that you are covered against all losses except those that are expressly excluded in your policy. It's important to note that your personal property is still covered on a "named-peril" basis with an HO-3 policy. This is the most common type of policy.

HO-4 — Simply speaking, this policy type describes a renters insurance policy. Typically, with these policies, your liability and your personal property are covered up to the policy limits. This is an ideal policy for someone renting an apartment or house.

HO-5 — Designates a "comprehensive form" homeowners insurance policy. This policy type covers both your home and personal property on an "open-peril" basis. This is the broadest form of home insurance available. Given the comprehensive levels of coverage, this isn't as common of a home insurance policy as an HO-2 or HO-3 policy but is highly encouraged if you have valuable belongings.

HO-6 — Designates a condo insurance policy. These policies generally cover your personal property and the structure of your condo from the wall studs in. You should still consult with the agent quoting a policy for your home and ask about the specifics of how that policy would apply. BE PREPARED!!

For a FREE Consultation:

www.TheHomeOwnersAdvocate.com

Nearly Three Out Of Four Homeowners Don’t Know Their Policy Coverage

claimspages.com • 1 min read

#insurance policy#insurance claims#claims#florida homeowners#hurricanes/typhoons#hail storm#insurance broker#property management#insurance#home improvement#general contractor

5 notes

·

View notes

Text

Strategic Insurance Choices: Unlock Financial Freedom Now

Hey there! Have you ever considered how strategic insurance choices can help you protect your finances and loved ones? Explore this idea and see why insurance is essential to your financial plan. Insurance provides a safety net during unexpected events and can be critical to your financial strategy. This guide will help you understand and evaluate the types of insurance you need and how to…

View On WordPress

#assessing insurance needs based on financial goals#benefits of life insurance in financial strategies#best insurance policies for young adults#choosing the right insurance for financial protection#Financial Planning.#Financial Security#how to compare insurance policies effectively#how to integrate insurance with investments#Insurance Policies#integrating long-term care insurance with retirement planning#Investment Strategies#Risk Management#tax benefits of purchasing insurance policies#the impact of insurance on financial stability#types of insurance for financial planning

1 note

·

View note

Text

How AI-Powered Insurance Solutions Improve Policyholder Experience

Discover how an AI-powered insurance system can minimize paperwork across claims, policy administration, and customer onboarding to streamline policyholders’s journeys. Read full blog here:

0 notes

Text

#insurance and risk management#insurance brokers#marine insurance#risk management#office insurance#office package insurance#office package policy

0 notes

Text

A Floridian Landlord's Playbook for Overcoming Common Rental Hurdles

Florida Eviction Lawyers

Hey there, fellow Landlord,

Diving into the world of Florida real estate can be as thrilling as a rocket launch at Cape Canaveral. Here’s my personal guide, honed from years in the trenches, to help you navigate the common ups and downs of renting out property.

Ensuring Rent Arrives on Time We’ve all felt the sting of late rent payments. Clear communication about…

View On WordPress

#commercial eviction attorney Florida#effective property management#eviction court representation Florida#eviction legal services Florida#eviction notice filing Florida#Florida Eviction Attorney#florida eviction process#Florida landlord guide#Florida real estate laws#Florida rental market analysis#handling tenant disputes#landlord financial planning#landlord legal compliance Florida#landlord tenant lawyer Florida#landlord-tenant relationships#lease agreement essentials#lease termination lawyer Florida#legal advice for landlords#property condition inspections#property damage management#property eviction legal advice.#property maintenance Florida#property management services#real estate attorney Florida#real estate investment Florida#real estate investment tips#real estate market trends Florida#rent payment policies#rental business profitability#rental insurance Florida

0 notes

Text

Unleashing Success: How Insurance Policy Management Software Drives Competitive Advantage

Competition is a critical component of success in today's highly competitive and digital insurance industry. The implementation of efficient insurance policy management software should be regarded as one of the main points affecting the insurer’s competitiveness substantially. This blog explores the various ways in which this software gives an upper hand to insurers as they carry on amidst these ever-changing times.

With the arrival of the technology, policy management software has become a blessing for the insurance companies. Covered with powerful functionalities and capabilities, the insurance policy management software empowers insurers to improve their processes and deliver unparalleled customer satisfaction while also creating a competitive edge in the market.

1. Improving Workflow Efficiency:

Insurance policy management software takes away the manual processes, paperwork and also multiple data entry requirements that insurers face when performing this task which helps in maximizing their workflow efficiency. As insurers eliminate routine tasks such as policy creation, renewals, endorsements and underwriting through automation they free up valuable time for customer interactions or value-added services.

2. Enhancing Customer Experience:

In the age of customer-centricity, an insurance company should focus on creating exceptional experiences for its many customers. The software enables insurers to provide customized, smooth and easy services for many customers. With self-service portals, policyholders can view and change their policy information even if they can file a claim through the Internet. It leads to increased customer satisfaction, and loyalty and consequently puts the insurers ahead of the competition.

3. Analytical Functionality:

The advanced analytics feature in the insurance policy management software enables insurers to get such data insights. Through the application of predictive analytics, insurers can identify various risk patterns and prevent fraudulent activities along with using pricing strategy for optimisation. These data-based insights allow insurance companies to make informed business decisions and also quickly respond to emerging market trends, which makes them more competitive.

At the same time, this software can become a natural part of other core systems that include underwriting, claims handling and accounting software. This integration allows data sharing, removes the inconsistencies of the reporting system and also favours greater operational performance. In addition, the software is very scalable and enables insurers to accommodate their growing business needs without interrupting any other operations. This agility equips the firms with the capabilities to grow their product line and access new market segments vigorously.

4. Ensuring Regulatory Compliance:

Compliance with numerous regulations and data privacy laws is a prerequisite in many such regulated industries as the insurance sector. Insurers use this software to allow them the tools required for tracking and also managing compliance requirements. With the compliance checks automated, the correct records maintained and audit reports generated by insurers they can very easily meet their regulatory requirements. This not only improves risk management but also creates a positive reputation for insurers in the industry, which makes them different from other competitors.

Conclusion:

Insurance policy management software acts as a platform that inspires insurance firms to pursue and maintain a competitive edge rivalry the era of today’s information technology realization. Through the realization of workflow efficiency, the enhanced customer experience, data-based insights as well as integration capacities and uncomplicated regulatory compliance ability insurers will be able to become leaders in their industry. Insurers attempting to remain competitive and thrive in the increasingly dynamic world of insurance have no other choice but to adopt insurance policy software.

#insurance software#software solutions#software development#insurance solutions#insurance policy management

0 notes

Text

Insurance Policy Management Software offers a comprehensive solution for insurance companies and agencies to streamline their operations and enhance customer service. Visit to blog to read more!

0 notes

Text

Things I've learned from getting covid for the first time in 2023

I wear an N95 in public spaces and I've managed to dodge it for a long time, but I finally got covid for the first time (to my knowledge) in mid-late November 2023. It was a weird experience especially because I feel like it used to be something everyone was talking about and sharing info on, so getting it for the first time now (when people generally seem averse to talking about covid) I found I needed to seek out a lot of info because I wasn't sure what to do. I put so much effort into prevention, I knew less about what to do when you have it. I'm experiencing a rebound right now so I'm currently isolating.

So, I'm making a post in the hopes that if you get covid (it's pretty goddamn hard to avoid right now) this info will be helpful for you. It's a couple things I already knew and several things I learned. One part of it is based on my experience in Minnesota but some other states may have similar programs.

--------

The World Health Organization states you should isolate for 10 days from first having symptoms plus 3 days after the end of symptoms.

--------

At the time of my writing this post, in Minnesota, we have a test to treat program where you can call, report the result of your rapid test (no photo necessary) and be prescribed paxlovid over the phone to pick up from your pharmacy or have delivered to you. It is free and you do not need to have insurance. I found it by googling "Minnesota Test to Treat Covid"

--------

Paxlovid decreases the risk of hospitalization and death, but it's also been shown to decrease the risk of Long Covid. Long Covid can occur even from mild or asymptomatic infections.

--------

Covid rebound commonly occurs 2-8 days after apparent recovery. While many people associate Paxlovid with covid rebound, researchers say there is no strong evidence that Paxlovid causes covid rebound, and rebounds occur in infections that were not treated with Paxlovid as well. I knew rebounds could happen but did not know it could take 8 days. I had mine on day 7 and was completely surprised by it.

--------

If you start experiencing new symptoms or test positive again, the CDC states that you should start your isolation period again at day zero. Covid rebound is still contagious. Personally I'd suggest wearing a high quality respirator around folks for an additional 8-9 days after you start to test negative in case of a rebound.

--------

Positive results on a rapid test can be very faint, but even a very faint line is positive result. Make sure to look at your rapid test result under strong lighting. Also, false negatives are not uncommon. If you have symptoms but test negative taking multiple tests and trying different brands if you have them are not bad ideas. My ihealth tests picked up my covid, my binax now tests did not.

--------

EDIT: I'd highly suggest spending time with friends online if you can, I previously had a link to the NAMI warmline directory in this post but I've since been informed that NAMI is very much funded by pharmaceutical companies and lobbies for policies that take autonomy away from disabled folks, so I've taken that off of here! Sorry, I had no idea, the People's CDC listed them as a resource so I just assumed they were legit! Feel free to reply/reblog this with other warmlines/support resources if you know of them! And please reblog this version!

--------

I know that there is so much we can't control as individuals right now, and that's frightening. All we can do is try our best to reduce harm and to care for each other. I hope this info will be able to help folks.

#covid#covid 19#harm reduction#apparently only 16% of Americans even got their booster#it's wild out there#which makes sense because our public health messaging has been super unhelpful and intentionally shifted the burden#of infection control onto individuals to avoid us holding them accountable because it's politically and economically inconvenient to them

9K notes

·

View notes

Text

Types of Insurance Coverage Your Business Should Carry To Avoid A Potential Loss.

The specific insurance policies your business needs can vary depending on your industry, location, and other factors. However, here are some common types of insurance policies that can help cover your business from potential risks:

General Liability Insurance: This policy provides coverage for bodily injury, property damage, and personal injury claims. It’s often considered essential for most…

View On WordPress

#business insurance#Business Protection#Business Risk#Business Safety#Commercial Insurance#Coverage Options#Financial Protection#Industry Specific Insurance#Insurance Advice#Insurance Coverage#Insurance Experts#Insurance Needs#Insurance Planning#Insurance Policy#insurance tips#liability insurance#Location Based Insurance#Risk Management#Risk Mitigation#Small Business Insurance

0 notes

Text

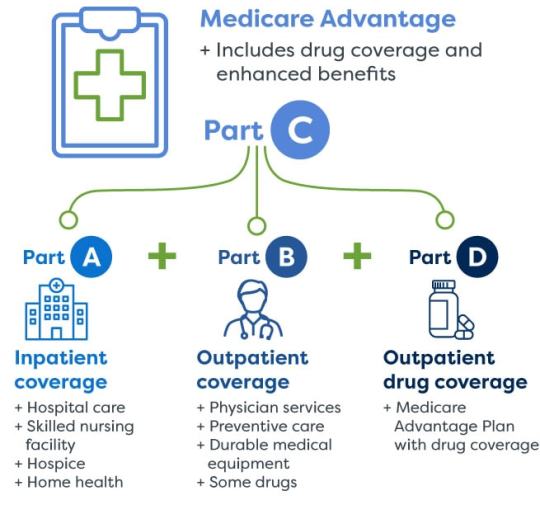

Medicare Advantage - Status Update

Medicare Advantage plans or Medicare Part C and D plans continue to grow in popularity. I’ve written a number of posts on various Medicare Advantage topics, of late, coverage issues and denials, particularly for post-acute care stays. A recent post on that topic is here: https://wp.me/ptUlY-wI

Medicare Advantage plans (Part C plans) include Parts A, B, and D (inpatient, outpatient and…

View On WordPress

#C-SNP#D-SNP#Economics#I-SNP#Industry Outlook#insurance#Management#Medicaid#Medicare#Medicare Advantage#Money#Part A#Part B#Part C#Part D#Payment#Plans#Policy#SNP#Trends

0 notes

Text

Understanding Hedging in Finance

When it comes to managing finances, we often find ourselves juggling various risks and uncertainties. Enter hedging – the financial superhero that can shield your investments from the turbulent winds of the market. In this article, let's break down the concept of hedging in the world of finance, keeping things simple and informative.

What Is Hedging?

Hedging is like an insurance policy for your investments. Imagine you're a farmer, and you've planted a crop that you plan to sell in a few months. Now, you're worried about the unpredictable weather ruining your harvest. To secure your income, you might buy weather insurance. In the finance world, this concept translates to hedging.

Also Read: Investor's Playbook on Taxation Strategies

Why Do We Hedge?

We hedge to minimize risks. Financial markets are notorious for their unpredictability, and even the most seasoned investors can't control every aspect of the market. Hedging helps us protect our investments from potential losses. It's like wearing a helmet while riding a bike - you hope you won't need it, but it's there just in case.

Types of Hedging

1. Forwards and Futures Contracts

These are like the crystal ball of finance. They allow you to lock in a price for a future date. Let's say you're a retailer and you're worried about the rising price of a certain product. By using a futures contract, you can secure a lower price now for delivery in the future.

2. Options

Options give you the right, but not the obligation, to buy or sell an asset at a specific price on or before a certain date. It's like making a reservation at a fancy restaurant - you have the option to dine there, but you're not committed to it.

3. Swaps

These financial tools are like trading places. They allow you to exchange cash flows with another party, helping you manage risks related to interest rates or currency exchange rates.

4. Asset Diversification

Diversifying your investment portfolio is like having a variety of ingredients to cook with. If one ingredient doesn't taste good (i.e., it loses value), you've got others to rely on.

Real-World Hedging Examples

1. Airline Fuel

Airlines often use hedging to protect themselves from volatile fuel prices. They might purchase oil futures contracts to lock in a stable price for fuel.

2. Exporters and Importers

Businesses involved in international trade use currency hedging to protect themselves from fluctuations in exchange rates.

Pros and Cons of Hedging

Pros:

- Reduces financial uncertainty.

- Protects investments from unexpected events.

- Offers peace of mind.

Cons:

- Costs money, as hedges themselves can be expensive.

- Over-hedging can limit potential profits.

- It's not a guarantee; hedges can sometimes fail.

Also Read: The Role of Bots, Assistants, AIs in Customer Communication

Conclusion

In the intricate world of finance, understanding hedging is like having a secret weapon against financial turmoil. It's a practical way to guard your investments and navigate the unpredictable waters of the market. By using various financial instruments, you can tailor your hedge to fit your specific needs and goals.

0 notes