#ewaybill registration

Text

Easy to Generate Bulk E-way Bills

Under the GST era, generation of E-Way bill has been made compulsory which in turn has also become a time-consuming or tedious process.

To simplify the process of generating E-Way Bill, BUSY has introduced Auto Generation of E-Way Bill. With this option, you can automatically create E-Way Bill No. from BUSY at the time of saving the voucher. E-Way Bill No. will be then automatically updated in the corresponding voucher, and you can print the Invoice from there only.

#gst software#accounting software#inventory software#small business accounting services#gst accounting software for retail#billing software#financial planning#gst registration#EwayBill#Business#AccountingSoftware#GSTSoftware#GST

0 notes

Text

GST Return Filing Delhi

Goods and Service Tax is the most popular form of indirect tax over the world. France was the first country to introduce this kind of tax in its economy. Since then, more than 140 countries over the world have adopted this form of tax. India has also added itself to this list, recently. In 2017, enactment of the Goods and Service Tax Act has totally changed the indirect tax regime of the country. GST Act has subsumed in itself multiple indirect tax laws that were prevailing in the country during pre- GST era. Get GST Return Filing Delhi online with Aplite Advisors-

GST Registration

GST Compliances

GST Audit

GST Refund

GST Consultancy / Advisory

Ewaybill Training / Generation

Anti – Profiteering working & Certification

#CAFirminDelhi#CAinJanakpuri#GST Return Filing Delhi#Income Tax Return Filing Delhi#Accounting and Bookkeeping Services Delhi#Company Registration in Delhi#Financial Accounting Advisory Services in Delhi

0 notes

Photo

Under the new e-invoicing system, a taxpayer will have to generate his invoices on his own accounting/ERP system and then upload the same into the IRP i.e the government’s Invoice Registration Portal. The IRP will then generate a unique Invoice Reference Number, after which, the invoice details are transferred from the IRP to the GST portal and e-way bill portal. Therefore, it eliminates the need for manual data entry each time! #gst #gstupdates #gstcouncil #einvoice #einvoicing #ewaybill #eway #chartered #charteredaccountant #taxation (at TAXAJ) https://www.instagram.com/p/Cmx0RDOBAtG/?igshid=NGJjMDIxMWI=

0 notes

Photo

Get one month free E-Way Bill generation absolutely free, get free gst billing format, complete guide of what is eWay bill, who should generate eWay bill, how to register?

#e way bill#e way bill procedure#generate e way bill#e way bill registration#eway bill online#ewaybill registration

0 notes

Photo

E-way Bill under GST

0 notes

Photo

Get one month free E-Way Bill generation absolutely free, get free gst billing format, complete guide of what is eWay bill, who should generate eWay bill, how to register?

https://www.gstregistrationonline.org/eway-bill

#e way bill#e way bill procedure#generate e way bill#e way bill registration#eway bill online#ewaybill registration

0 notes

Text

#gst#gst registration#eway bill#eway bill generation#ewaybill#ewaybillnews#ewaybillgeneration#ewaybillupdate

0 notes

Photo

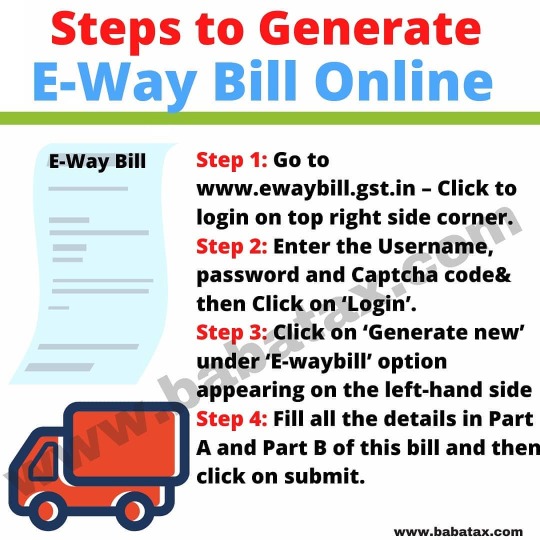

Like ❤️, Comment your Question 👇 & Share with your Friends 💯 Website Link: 👉http://www.babatax.com 👉http://www.update.babatax.com Follow 👉@baba_tax 👈 to get Full updates on GST, Income Tax and Finance🙌 Get smarter day by day!💯 ➖➖➖➖➖➖➖➖➖ ⚡@baba_tax 🔥 @baba_tax ⚡ ⚡@baba_tax 🔥 @baba_tax ⚡ 〰️〰️〰️〰️〰️〰️〰️〰️〰️ . . #gst #incometax #taxconsultant #financialfreedom #finance #lic #nse #incometips #stockmarketnews #bank #financetips #commerce #investment #government #online #income #registration #june #transport #ewaybill #eway https://www.instagram.com/p/CQigF9sL56n/?utm_medium=tumblr

#gst#incometax#taxconsultant#financialfreedom#finance#lic#nse#incometips#stockmarketnews#bank#financetips#commerce#investment#government#online#income#registration#june#transport#ewaybill#eway

0 notes

Photo

GST Services

A One Stop Solution for your GST...!

We will help you in GST Registration to the following Compliance Services.

CONTACT US @ 9620806777 / 9620049886 / 9620633337

OUR SERVICES:

• GST REGISTRATION

• GST MONTHLY / QUATERLY RETURN FILING

• GST CANCELLATION

• GST CONSULTANCY

• GST RECONCILATION

• GST MODIFICATION

• GST NOTICE REPLY

• GST AUDIT

• GST ANNUAL RETURN FILING

• E-WAY BILL REGISTRATION & GENERATION

• LUT - LETTER OF UNDERTAKING

• GST REGISTRATION FOR BRANCHES

#gst #gstregistration #gstmonthlyfiling #gstquaterlyfiling #gstcancellation #gstmodification #gstconsultancy #ewaybill #gstaudit #gstlut #gstforbranchs #gstnoticereply #gstannualreturns

0 notes

Photo

Download our All in one GCA APP from Playstore.... Features of App: Search GST Number, Track GST Registration Status, Search HSN/SAC, View/Print eWayBill, Pin to Pin Distance Track PAN/TAN Status, Get New PAN instantly, track Income Tax Refund, Income Tax Calculator, Track ITR Status (check Authenticity), Link your Aadhar with PAN, eVerify your ITR Verify UDIN, Verify CBDT/CBIC DIN (Notice from Department) Check TDS Challan, Check BIN (for govt deductor) View Company/LLP Master Data, View Director master Data Search Trademark, Verify Aadhar Number Download Various Forms/Formats from GCA Resources https://play.google.com/store/apps/details?id=gupta.chandan.associates (at Gupta Chandan & Associates) https://www.instagram.com/p/CUsaR0zASLs/?utm_medium=tumblr

0 notes

Text

You can do GST registration online easily and safely. You will get a secure GST identification number. Everything will be done online for your time saving and safety.

#gst

#ewaybill

#gstregistration

#gstin

0 notes

Text

e Waybill Login - Make GST Login to Generate e Waybill from ewaybill.nic.in

e Waybill Login – Make GST Login to Generate e Waybill from ewaybill.nic.in

ewaybill.nic.in, is an official e waybill portal for every state to generate e waybill for the movement of business purpose goods and products. The portal is engaged with the services of e waybill registration and e waybill Login and enrolment for transporters. Through the portal transporter can easily generate e way bill and make login on ewaybill.nic.in to regularly use the services.

There are…

View On WordPress

0 notes

Text

Generate E Waybill in Tamilnadu at E- Way Bill Portal ewaybill.nic.in

GST E Way Bill Tamilnadu : Central government has made GST e waybill registration compulsory from today for 10 states across the country. GST e waybill for Tamilnadu / e way bill in Tamilnadu will be at E waybill portal ewaybill.nic.in. In Tamilnadu the businesses worth Rs. 50000 transportation have to generate e waybill in Tamilnadu. To make the transportation of the business products the people…

View On WordPress

0 notes

Text

How to register for e-way bill in Karnataka ?

How to register for e-way bill in Karnataka ?

As we know from our earlier post e-WAY BILL SYSTEM is live in Karnataka one can register using the link http://gst.kar.nic.in/ewaybill and new user click on e-way bill registration which will get redirected to a new page asking you to enter your GST number.

Once you enter your GST number your details will appear like this but make sure details belong to your GST only. There are some cased data…

View On WordPress

0 notes

Text

Information About E-way Bill

What is E-way Bill under GST?

EWay Bill is an Electronic Way bill for movement of goods to be generated on the eWay Bill Portal. A GST registered person cannot transport goods in a vehicle whose value exceeds ₹ 50,000 (Single Invoice/bill/delivery challan) without an e-way bill that is generated on ewaybillgst.gov.in Alternatively, Eway bill can also be generated or cancelled through SMS, Android App and by site-to-site integration through API.

When aneway bill is generated, a unique Eway Bill Number (EBN) is allocated and is available to the supplier, recipient, and the transporter.

What is an e-way bill?

e-way bill is a document required to be carried by a person in charge of the conveyance carrying any consignment of goods of value exceeding fifty thousand rupees as mandated by the Government in terms of Section 68 of the Goods and Services Tax Act read with Rule 138 of the rules framed thereunder. It is generated from the GST Common Portal for eWay bill system by the registered persons or transporters who cause movement of goods of consignment before commencement of such movement.

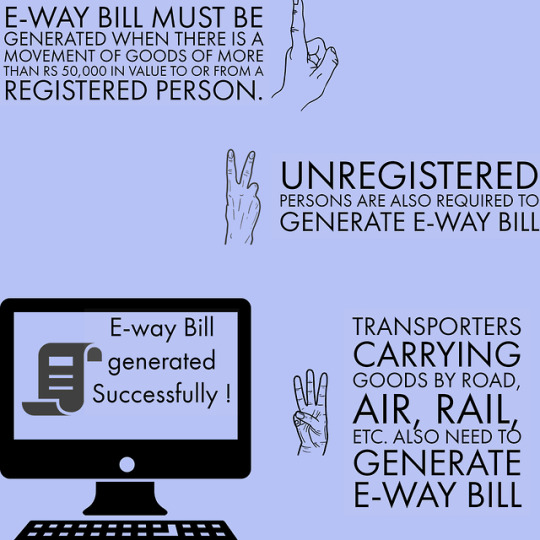

Who should Generate an eWay Bill?

Registered Person – E-Way bill must be generated when there is a movement of goods of more than Rs 50,000 in value to or from a Registered Person. A Registered person or the transporter may choose to generate and carry E-way bill even if the value of goods is less than Rs 50,000.

Unregistered Persons – Unregistered persons are also required to generate e-Way Bill. However, where a supply is made by an unregistered person to a registered person, the receiver will have to ensure all the compliances are met as if they were the supplier.

Transporter – Transporters carrying goods by road, air, rail, etc. also need to generate e-Way Bill if the supplier has not generated an e-Way Bill.

What is TRANSIN or Transporter ID?

TRANSIN or Transporter id is 15 digit unique number generated by EWB system for unregistered transporter, once he enrolls on the systemwhichissimilar to GSTIN format and is based on state code, PAN and Check sumdigit. This TRANSIN or Transporter id can be shared by transporterwithhis clients, who may enter this number while generating e-waybills for assigning goods to him for transportation.

Why the transporter needs to enroll on the e-way bill system?

There may be some transporters, who are not registered under the Goods and Services Tax Act,but such transporters cause the movement of goods for their clients. They need to enroll on the e-way bill portal to get 15 digit Unique Transporter Id.

How does the unregistered transporter get his unique id or transporter id?

The transporter is required to provide the essential information for enrolment on the EWB portal. The transporter idis created by the EWB system after furnishing the requisite information. The details of information to be furnished is available in the user manual.

Apply Now @ https://www.gstregistrationonline.org/eway-bill

For More Information visit us @

For GST Registration & GST Amendments

Phone No. +91 91122 55597

Email : [email protected]

Website: http://www.gstregistrationonline.org.

For GST Compliance & GST Surrender

Phone No. +91 91122 11467

Email : [email protected]

#e way bill#e way bill procedure#generate e way bill#e way bill registration#eway bill online#ewaybill registration

0 notes

Photo

GST E-Way Bill Registration Online

#eway bill#eway bill procedure#generate eway bill#eway bill registration#eway bill online#ewaybill registration

0 notes