#digital payment platform

Text

Paytm Stock Price Today | The Financial Express

Paytm Stock Price Today | The Financial Express

Paytm is being seen for the past few days. The stock has strengthened about 38 percent from its record low of Rs 511. The rally is expected in the future as well.

One 97 Communications Stock Price: Digital payment platform Paytm has been the worst return giving IPO in the last 1 year. However, for the past few days, there has been some rally in the stock. The stock has strengthened 38 percent…

View On WordPress

#Big drop in Paytm stock#buy or sell paytm#buy paytm#digital payment platform#experts positive on paytm#IPO#One 97 Communications#One 97 Communications share price#payment bank stocks#Paytm#paytm build a strong base after big fall from IPO#paytm ceo#paytm consumer base#paytm loan business#paytm owner#paytm seen breakout#paytm share new target#paytm short term target#Paytm stock at new low#paytm stock price#RBI&039;s action on Paytm#share of paytm#vijay shekhar sharma#wealth destroyer ipo

0 notes

Text

I've officially updated and re-opened my Etsy shop!!

Here it is!

The basic policies and process information are in the listings' descriptions but a couple other basic things:

I will not do harassment-based or bigoted art (duh).

Suggestive/light NSFW is fine, but nothing explicit and nothing lewding minors (also duh). (All individuals involved must be 18+ in canon)

I won't do mechs. Sorry, they're cool, but the idea of drawing them scares me

Examples:

#this took the better part of 4 hours but hey it's done now!#i also changed the shop name so it's not referencing my deadname lol#I'm only selling via etsy atm but I'm planning on expanding/changing payment platforms eventually#commissions open#etsy commissions#etsy shop#artists of tumblr#my art#digital art#commissions#art commissions#commission info#my post#are 12 examples excessive? maybe#but im an adult and can do what i want#the listings are (roughly) sorted by price and style type

19 notes

·

View notes

Text

BitNest

BitNest: The Leader of the Digital Finance Revolution

BitNest is a leading platform dedicated to driving digital financial innovation and ecological development. We provide comprehensive cryptocurrency services, including saving, lending, payment, investment and many other functions, creating a rich financial experience for users.

Our story began in 2022 with the birth of the BitNest team, which has since opened a whole new chapter in digital finance. Through relentless effort and innovation, the BitNest ecosystem has grown rapidly to become one of the leaders in digital finance.

The core functions of BitNest ecosystem include:

Savings Service: Users can deposit funds into BitNest's savings system through smart contracts to obtain stable returns. We are committed to providing users with a safe and efficient savings solution to help you achieve your financial goals.

Lending Platform: BitNest lending platform provides users with convenient borrowing services, users can use cryptocurrencies as collateral to obtain loans for stablecoins or other digital assets. Our lending system is safe and reliable, providing users with flexible financial support.

Payment Solution: BitNest payment platform supports users to make secure and fast payment transactions worldwide. We are committed to creating a borderless payment network that allows users to make cross-border payments and remittances anytime, anywhere.

Investment Opportunities: BitNest provides diversified investment opportunities that allow users to participate in trading and investing in various digital assets and gain lucrative returns. Our investment platform is safe and transparent, providing users with high-quality investment channels.

Through continuous innovation and efforts, BitNest has become a leader in digital finance and is widely recognised and trusted globally. We will continue to be committed to promoting the development of digital finance, providing users with more secure and efficient financial services, and jointly creating a better future for digital finance.

#BitNest: The Leader of the Digital Finance Revolution#BitNest is a leading platform dedicated to driving digital financial innovation and ecological development. We provide comprehensive crypto#including saving#lending#payment#investment and many other functions#creating a rich financial experience for users.#Our story began in 2022 with the birth of the BitNest team#which has since opened a whole new chapter in digital finance. Through relentless effort and innovation#the BitNest ecosystem has grown rapidly to become one of the leaders in digital finance.#The core functions of BitNest ecosystem include:#Savings Service: Users can deposit funds into BitNest's savings system through smart contracts to obtain stable returns. We are committed t#Lending Platform: BitNest lending platform provides users with convenient borrowing services#users can use cryptocurrencies as collateral to obtain loans for stablecoins or other digital assets. Our lending system is safe and reliab#providing users with flexible financial support.#Payment Solution: BitNest payment platform supports users to make secure and fast payment transactions worldwide. We are committed to creat#anywhere.#Investment Opportunities: BitNest provides diversified investment opportunities that allow users to participate in trading and investing in#providing users with high-quality investment channels.#Through continuous innovation and efforts#BitNest has become a leader in digital finance and is widely recognised and trusted globally. We will continue to be committed to promoting#providing users with more secure and efficient financial services#and jointly creating a better future for digital finance.#BitNest#BitNestCryptographically

3 notes

·

View notes

Text

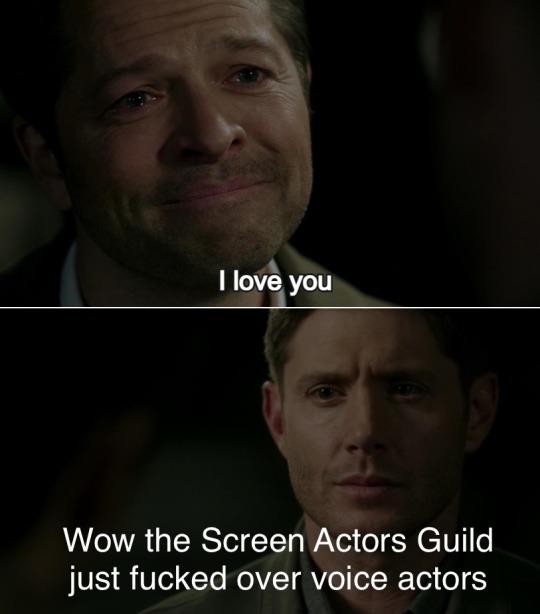

WE LIVE IN A HELL WORLD

Snippets from the article by Karissa Bell:

SAG-AFTRA, the union representing thousands of performers, has struck a deal with an AI voice acting platform aimed at making it easier for actors to license their voice for use in video games. ...

the agreements cover the creation of so-called “digital voice replicas” and how they can be used by game studios and other companies. The deal has provisions for minimum rates, safe storage and transparency requirements, as well as “limitations on the amount of time that a performance replica can be employed without further payment and consent.”

Notably, the agreement does not cover whether actors’ replicas can be used to train large language models (LLMs), though Replica Studios CEO Shreyas Nivas said the company was interested in pursuing such an arrangement. “We have been talking to so many of the large AAA studios about this use case,” Nivas said. He added that LLMs are “out-of-scope of this agreement” but “they will hopefully [be] things that we will continue to work on and partner on.”

...Even so, some well-known voice actors were immediately skeptical of the news, as the BBC reports. In a press release, SAG-AFTRA said the agreement had been approved by "affected members of the union’s voiceover performer community." But on X, voice actors said they had not been given advance notice. "How has this agreement passed without notice or vote," wrote Veronica Taylor, who voiced Ash in Pokémon. "Encouraging/allowing AI replacement is a slippery slope downward." Roger Clark, who voiced Arthur Morgan in Red Dead Redemption 2, also suggested he was not notified about the deal. "If I can pay for permission to have an AI rendering of an ‘A-list’ voice actor’s performance for a fraction of their rate I have next to no incentive to employ 90% of the lesser known ‘working’ actors that make up the majority of the industry," Clark wrote.

SAG-AFTRA’s deal with Replica only covers a sliver of the game industry. Separately, the union is also negotiating with several of the major game studios after authorizing a strike last fall. “I certainly hope that the video game companies will take this as an inspiration to help us move forward in that negotiation,” Crabtree said.

And here are some various reactions I've found about things people in/adjacent to this can do

And in OTHER AI games news, Valve is updating it's TOS to allow AI generated content on steam so long as devs promise they have the rights to use it, which you can read more about on Aftermath in this article by Luke Plunkett

#video games#voice acting#voice actors#sag aftra#ai#ai news#ai voice acting#video game news#Destiel meme#industry bullshit

25K notes

·

View notes

Text

The Future of Finance: RWA Blockchain and Its Transformative Potential

Blockchain technology has revolutionized numerous sectors, including finance, supply chain, and healthcare. One of the latest innovations in this space is the concept of Real World Assets (RWA) on blockchain. This article explores RWA blockchain, regulated blockchain, layer one blockchain, e-money tokens blockchain, MiCA-compliant blockchain, zk proof blockchain, and RWA launchpad. We will delve into these technologies' benefits, challenges, and future potential.

What is RWA Blockchain?

RWA blockchain refers to tokenising real-world assets such as real estate, commodities, and securities on a blockchain. This process involves creating digital tokens representing ownership of these assets, making them tradable on blockchain platforms. The primary advantage of the RWA blockchain is that it brings liquidity to otherwise illiquid assets, enabling easier and faster transactions.

Advantages of RWA Blockchain

Increased Liquidity: Tokenizing real-world assets allows them to be traded on blockchain platforms, thus enhancing their liquidity.

Fractional Ownership: Investors can purchase fractions of high-value assets, making it easier for retail investors to participate in markets previously dominated by institutional players.

Transparency and Security: Blockchain technology ensures transparency and security in transactions, reducing the risk of fraud and enhancing trust among participants.

Understanding Layer 1 Blockchain

Layer one blockchain refers to the base layer of a blockchain network that handles the primary functions of transaction processing and consensus. Examples of layer-one blockchains include Bitcoin, Ethereum, and Solana. These blockchains are responsible for the security and decentralization of the network.

Key Features of Layer One Blockchain

Decentralization: Layer 1 blockchains operate on a decentralized network of nodes, ensuring no single entity has control over the entire network.

Security: Layer 1 blockchains provide a high level of security through consensus mechanisms like Proof of Work (PoW) and Proof of Stake (PoS).

Scalability Challenges: One of the main challenges faced by layer one blockchains is scalability. As the number of transactions increases, the network can become congested, leading to slower transaction times and higher fees.

The Role of Regulated Blockchain

Regulated blockchains are blockchain networks that comply with regulatory standards set by governments and financial authorities. These blockchains aim to provide the benefits of blockchain technology while ensuring compliance with laws and regulations.

Benefits of Regulated Blockchain

Compliance: Ensures that the blockchain operates within the legal framework, reducing the risk of regulatory actions.

Trust: Regulated blockchains can enhance trust among users, investors, and regulators.

Integration with Traditional Finance: By adhering to regulatory standards, regulated blockchains can more easily integrate with traditional financial systems.

E-Money Tokens Blockchain

E-money tokens are digital representations of fiat currency issued on a blockchain. These tokens are backed by traditional currency and can be used for transactions and payments in a similar manner to fiat money.

Advantages of E-Money Tokens Blockchain

Stability: E-money tokens are typically pegged to fiat currency, providing stability compared to other cryptocurrencies.

Efficiency: Transactions with e-money tokens can be processed quickly and with lower fees compared to traditional banking systems.

Regulatory Compliance: E-money tokens often comply with regulatory standards, making them a viable option for businesses and consumers.

MiCA Compliant Blockchain

Markets in Crypto-Assets (MiCA) is a regulatory framework proposed by the European Union to provide legal certainty and consumer protection in the cryptocurrency market. MiCA-compliant blockchains adhere to these regulations, ensuring that they operate within the EU's legal framework.

Importance of MiCA Compliance

Legal Certainty: Provides a clear regulatory environment for blockchain projects and investors.

Consumer Protection: Ensures that consumers are protected from fraudulent activities and market manipulation.

Market Stability: Aims to create a stable and well-regulated market for crypto-assets.

Real World Assets (RWA)

Real-world assets (RWA) are physical or tangible assets that have been tokenized and brought onto a blockchain. These can include real estate, art, commodities, and more.

Benefits of Tokenizing Real-World Assets

Accessibility: Makes high-value assets accessible to a broader range of investors.

Liquidity: Enhances liquidity by enabling fractional ownership and easier trading.

Transparency: Provides a transparent and immutable record of ownership and transactions.

ZK Proof Blockchain

Zero-knowledge (ZK) proof is a cryptographic method that allows one party to prove to another that a statement is true without revealing any information beyond the validity of the statement. ZK-proof blockchain utilizes this method to enhance privacy and security.

Applications of ZK Proof Blockchain

Privacy: Enables private transactions without revealing the details of the transaction to the network.

Security: Provides a high level of security by ensuring that transactions are valid without exposing sensitive information.

Scalability: Scalability can be improved by reducing the amount of data that needs to be processed and stored on the blockchain.

The Concept of RWA Launchpad

RWA launchpads facilitate the tokenization and issuance of real-world assets on a blockchain. These platforms provide the necessary tools and infrastructure for asset owners to create and manage digital tokens representing their assets.

Benefits of RWA Launchpads

Ease of Use: Simplifies the tokenising of real-world assets, making it accessible to asset owners.

Funding Opportunities: Provides a new avenue for raising capital by issuing tokens to investors.

Market Access: Opens up new markets and investment opportunities for both asset owners and investors.

Conclusion

The integration of blockchain technology with real-world assets is transforming the financial landscape. RWA blockchain, regulated blockchain, layer one blockchain, e-money tokens blockchain, MiCA compliant blockchain, zk proof blockchain, and RWA launchpads are at the forefront of this transformation. These technologies offer increased liquidity, enhanced security, and regulatory compliance, making them attractive options for businesses and investors.

How Can E Money Network Help You with Blockchain Technology?

E Money Network offers comprehensive solutions to leverage blockchain technology, including developing and managing blockchain payment platforms, e-money tokens, MiCA compliance, and zk-proof security features. By utilizing our expertise, businesses can enhance their financial operations, ensure regulatory compliance, and explore new investment opportunities through RWA launchpads.

FAQs

Q1: What is the RWA blockchain?

RWA blockchain refers to the tokenization of real-world assets on a blockchain, allowing them to be traded more quickly and efficiently.

Q2: What is a layer one blockchain?

A layer one blockchain is the base layer of a blockchain network responsible for transaction processing and consensus. Examples include Bitcoin and Ethereum.

Q3: Why is regulated blockchain important?

Regulated blockchains comply with legal standards, ensuring trust, compliance, and integration with traditional financial systems.

Q4: What are e-money tokens?

E-money tokens are digital representations of fiat currency on a blockchain, providing stability, efficiency, and regulatory compliance.

Q5: How does ZK-proof blockchain work?

ZK-proof blockchain uses cryptographic methods to prove the validity of transactions without revealing sensitive information, enhancing privacy and security.

Q6: What is an RWA launchpad?

An RWA launchpad is a platform that facilitates the tokenization and issuance of real-world assets on a blockchain, simplifying the process for asset owners and providing new investment opportunities.

#blockchain#e- money network#cryptocurrency#real world assets#zk proof blockchain#zk proof#crypto payment gateways#best wallet for crypto#digital wallet crypto#top crypto wallets#e money app#blockchain payment#blockchain payment platform#digital banking solutions#next generation digital banking solutions#digital money transfer#electronic money#electronic money transfer#digital currency#blockchain wallet#blockchain wallet app#crypto wallet#crypto wallet app#best crypto wallet

0 notes

Text

In the current rapidly evolving digital currency market, decentralized finance (DeFi) platforms are redefining the shape of financial services with their unique advantages. Bit Loop, as a leading decentralized lending platform, not only provides a safe and transparent lending environment, but also opens up new passive income channels for users through its innovative sharing reward system.

Personal links and permanent ties: Create a stable revenue stream

One of the core parts of Bit Loop is its recommendation system, which allows any user to generate a unique sharing link when they join the platform. This link is not only a “key” for users to join the Bit Loop, but also a tool for them to establish an offline network. It is worth noting that offline partners who join through this link are permanently tied to the recommender, ensuring that the sharer can continue to receive rewards from the offline partner’s activities.

Unalterable referral relationships: Ensure fairness and transparency

A significant advantage of blockchain technology is the immutability of its data. In Bit Loop, this means that once a referral link and live partnership is established, the relationship is fixed and cannot be changed. This design not only protects the interests of recommenders, but also brings a stable user base and activity to the platform, while ensuring the fairness and transparency of transactions.

Automatically distribute rewards: Simplify the revenue process

Another highlight of the Bit Loop platform is the ability for smart contracts to automatically distribute rewards. When the partner completes the circulation cycle, such as investment returns or loan payments, the smart contract automatically calculates and sends the corresponding percentage of rewards directly to the recommender’s wallet. This automatic reward distribution mechanism not only simplifies the process of receiving benefits, but also greatly improves the efficiency of capital circulation.

Privacy protection and security: A security barrier for funds

All transactions and money flows are carried out on the blockchain, guaranteeing transparency and traceability of every operation. In addition, the use of smart contracts significantly reduces the risk of fraud and misoperation, providing a solid security barrier for user funds. Users can confidently invest and promote boldly, and enjoy the various conveniences brought by decentralized finance.

conclusion

As decentralized finance continues to evolve, Bit Loop offers a new economic model through its unique recommendation system that enables users to enjoy highly secure and transparent financial services while also earning passive income by building and maintaining a personal network. Whether for investors seeking stable passive income or innovators looking to explore new financial possibilities through blockchain technology, Bit Loop provides a platform not to be missed.

#In the current rapidly evolving digital currency market#decentralized finance (DeFi) platforms are redefining the shape of financial services with their unique advantages. Bit Loop#as a leading decentralized lending platform#not only provides a safe and transparent lending environment#but also opens up new passive income channels for users through its innovative sharing reward system.#Personal links and permanent ties: Create a stable revenue stream#One of the core parts of Bit Loop is its recommendation system#which allows any user to generate a unique sharing link when they join the platform. This link is not only a “key” for users to join the Bi#but also a tool for them to establish an offline network. It is worth noting that offline partners who join through this link are permanent#ensuring that the sharer can continue to receive rewards from the offline partner’s activities.#Unalterable referral relationships: Ensure fairness and transparency#A significant advantage of blockchain technology is the immutability of its data. In Bit Loop#this means that once a referral link and live partnership is established#the relationship is fixed and cannot be changed. This design not only protects the interests of recommenders#but also brings a stable user base and activity to the platform#while ensuring the fairness and transparency of transactions.#Automatically distribute rewards: Simplify the revenue process#Another highlight of the Bit Loop platform is the ability for smart contracts to automatically distribute rewards. When the partner complet#such as investment returns or loan payments#the smart contract automatically calculates and sends the corresponding percentage of rewards directly to the recommender’s wallet. This au#but also greatly improves the efficiency of capital circulation.#Privacy protection and security: A security barrier for funds#All transactions and money flows are carried out on the blockchain#guaranteeing transparency and traceability of every operation. In addition#the use of smart contracts significantly reduces the risk of fraud and misoperation#providing a solid security barrier for user funds. Users can confidently invest and promote boldly#and enjoy the various conveniences brought by decentralized finance.#conclusion#As decentralized finance continues to evolve#Bit Loop offers a new economic model through its unique recommendation system that enables users to enjoy highly secure and transparent fin

1 note

·

View note

Text

ICICI Bank – Record-breaking growth in digital and payments platform

ICICI Bank – Record-breaking growth in digital and payments platform

Suggested Title:

ICICI Bank Q3 Results: Net interest income grew by 13.4%

Sector Outlook – Positive

In Q3FY24, ICICI Bank showed solid performance with its Net Interest Income reaching Rs. 18,679 crores, a 13.4% increase compared to last year.

Its operating profit before provisions also rose by 10.9% to Rs. 14,724 crores. However, the bank had to set aside more money for potential losses (provisions), which jumped to Rs. 1,049 crores due to new regulatory requirements for investments in alternative funds.

Despite this, the bank’s profit for the quarter still managed a 23.6% year-over-year increase, reaching Rs. 10,272 crores. Its interest margin slightly declined, and the ratio of bad loans (Gross NPA) improved, indicating better loan quality.

One major expense was a one-time payment for retirement benefits. The bank’s total deposits grew by 18.7% to Rs. 13,32,315 crores, and loans increased by 18.5% to Rs. 11,53,771 crores, showing strong growth especially in business banking and SME sectors. However, the proportion of low-cost deposits (CASA) decreased compared to last year.

Key Concall Highlights

ICICI Bank’s goal is to increase profits before taxes, focusing on customer needs across different sectors.

Personal loan growth was slower in Q3FY24 due to higher loan pricing, tighter lending criteria, and reduced sourcing costs.

New defaults occurred in retail, rural, and business banking, but didn’t significantly impact total bad loans thanks to improvements in corporate and SME loans.

Profit margins from lending (NIM) faced pressure but were balanced by additional income from tax refunds.

Non-interest income, including dividends from ICICI Securities and other investments, showed significant annual growth.

Operating expenses rose due to increased sales and marketing activities during the festive season.

The bank aims to maintain profit margins at FY23 levels, anticipating a slight decrease in NIM in Q4FY24.

Changes in term deposit rates are expected to impact profits in Q4FY24 and Q1FY25.

Management has implemented stricter measures for unsecured loans, such as increasing prices, rationalising sourcing costs, and tightening lending standards.

Valuation and Outlook

ICICI Bank, one of India’s major private banks, had a strong performance in the third quarter of the fiscal year 2024. Despite some challenges with profit margins from lending (NIM), the bank did well due to its fee income, beating profit expectations. The bank managed to reduce its provisions for bad loans thanks to fewer new defaults and a good approach to risk. A key achievement was attracting over one crore customers from other banks using its digital platform, iMobile Pay. The bank has been focusing more on attracting deposits lately. While its loan quality looks stable for now, there might be some concerns about potential loan defaults in the future, but the bank’s strong lending history suggests this won’t be a major problem. ICICI Bank’s strategy includes expanding its services in rural areas and using its large network of branches and ATMs for more product sales, which should keep its profits high. With a Return on Assets (RoA) within the expected range, the bank is positioned for double-digit growth. In case of any pressure on revenue, the bank might reduce its operational expenses to maintain profitability, but this could mean losing some market share due to stiff competition in the banking sector.

0 notes

Text

In the fast-paced world of digital marketing, businesses are constantly seeking innovative ways to reach their target audience and drive growth. E-commerce has emerged as a powerful tool that not only expands the reach of businesses but also enhances customer experience. In this comprehensive guide, we will explore the dynamic realm of e-commerce and how it can elevate your business in the digital marketing landscape.

Do Read: https://ennobletechnologies.com/e-commerce/e-commerce-solutions/

#Conversion Rate Optimization#Cross-Platform Shopping#Customer Retention Strategies#Digital Payment Solutions#Digital Storefronts#E-Commerce Analytics#E-Commerce Branding#E-commerce content marketing#E-Commerce Data Analysis#E-Commerce Marketing#E-Commerce Optimization#E-Commerce Platforms#E-Commerce Sales Funnels#e-commerce SEO services#E-Commerce Solutions in Digital Marketing#E-Commerce Website Development#Mobile Shopping Apps#Online Retail Strategies#Payment Gateway Integration#SEO for E-Commerce#Shopping Cart Integration#Social Commerce

1 note

·

View note

Text

Unleashing Success: The Power of Ecommerce Development Companies

In the rapidly evolving digital landscape, ecommerce has become the driving force behind countless successful businesses. Behind the seamless online shopping experiences and robust digital storefronts are the unsung heroes – ecommerce development companies. In this blog post, we’ll delve into the pivotal role these companies play in unleashing success for businesses in the digital…

View On WordPress

#Brand Identity Online#Business Growth#Custom Ecommerce#Digital Commerce#Digital Storefront#Ecommerce Development#Ecommerce Features#Ecommerce Maintenance#Ecommerce Platforms#Ecommerce Security#Ecommerce Solutions#Ecommerce Success#Ecommerce Website#Mobile Ecommerce#Online Store Development#Payment Gateways#Scalable Ecommerce#User Experience Design#Web Development Services#Website Customization

0 notes

Video

youtube

How to Install Martvill - A Global Multivendor Ecommerce Platform to Sel...

🔗 Script Download Link: https://webthemeapp.com/?p=6875

#cart#digital products#e-commerce#e-commerce platform#ecommerce#ecommerce platform#ecommerce website#multi seller#multi vendor#multivendor#online marketplace#online store#payment gateway#shopping cart#vendor management

0 notes

Text

#Go digital with MargMart! Create your own e-commerce platform effortlessly with Marg ERP's user-friendly website.#Enjoy live order updates and real-time payment tracking for a hassle-free experience.📋✅✨

0 notes

Link

Perhaps, you’re concerned about the security of your personal information or no longer want to share your data with Macy’s. If so, deactivating your Macy's online account is a valid option. #privacy concerns #online shopping

#deactivate#loyalty program benefits#clear cache#clear browser’s cookies#macys#Confirm Deactivation#order history#delete account#deactivate account#profile settings#account settings#account clean-up#privacy concerns#digital payment solution#online account#Macys Online Account#macys department store#macy online#online shopping platform

0 notes

Text

Twitter is now X. Here's what that means.

Trend – The internet is abuzz as the app formerly known as Twitter announced a name change over the weekend. X.com now redirects to Twitter.com, although the social media platform still invites users to “tweet.”

The rebrand is another step in the ongoing transformation of Twitter, an online watering hole for hyper-connected people that aspires to become an app that can do “everything,” according…

View On WordPress

#Advertising#Affiliate#Content to Shopping#Cross-Border#Digital Marketing#Drop Shipping#Ecommerce#Facebook Content#Infographic#Make Money Online#Market Trend#Markets#MMO#Omichannel#Online Business#Payment#Platforms#Print On Demand#Review#Shoppable#Social Content#Social Content. Payment#Social Media#TikTok#Tiktok Ads#Tiktok Content#Tiktok Shop#Tools#Trend#Twitter

1 note

·

View note

Text

Benefits of Using a Digital Payment Platform in Your Contractor Business

In the past, contractors typically only accepted payments via check. But nowadays, you can use a digital contractor payment platform to accept credit cards, debit cards, eCheck and more. These platforms take contractor businesses into the digital age, allowing them to take advantage of numerous benefits. Here are just a few reasons why you need to accept digital payments.

Get Paid Faster

Written checks usually take far longer to process than digital alternatives. Not only do you have to wait several business days for the check to clear, but you're also limited to bank hours. Plus, there's the headache of picking up checks, endorsing them, etc.

With a digital payment platform, those hurdles are a thing of the past. Payments can clear almost instantaneously. That means you get paid faster and can reduce downtime before you start your work.

Convenience

A digital contractor payment platform is considerably more convenient. For contractors like you, there's no need to chase checks or waste resources keeping those slips organized. But the convenience doesn't stop there.

Customers also love having the option to make digital payments. Check usage is slowly dwindling. Most people use cards to make payments, and it's not uncommon for clients to not even own a checkbook! Going digital is much easier on them, and offering those options could be the thing that sets you apart from your competition.

Fewer Payment Issues

Ask any contractor what the worst part of this business is, and most will tell you it's getting customers to pay their invoices. No contractor wants to hound clients. But you also need to get paid! It's one of the more frustrating parts of this industry, but digital payments could be the solution you're after.

Digital payments are far easier for clients to make. We already know that. But many platforms also have additional features to make things easier for your business. For example, you can send digital invoices to your customer's email or smartphone. You can even schedule reminders and keep track of payments to ensure all your clients take care of their invoices.

Read a similar article about contractor billing app here at this page.

#best financing for hvac contractors#construction contracts generator#digital contractor payment platform#digital marketing for contractors

0 notes

Text

Four Nations Embrace Ripple's Innovative CBDC Platform: A Closer Look

Ripple, a prominent player in blockchain-based payment technology, recently unveiled its enhanced Ripple CBDC Platform, a comprehensive solution designed to support central banks, governments, and financial institutions in issuing their own central bank digital currencies (CBDCs). This avant-garde platform taps into the transformative potential of blockchain technology, the backbone of the XRP…

View On WordPress

#Blockchain Technology#Central Bank Digital Currencies#Cross-border Payments#Digital Currency#Global Adoption#Ripple CBDC Platform#XRP Ledger

0 notes

Text

Rocks pay is a digital payment solution that allows businesses to accept and manage online payments from customers. It offers a secure and easy-to-use platform that simplifies the payment process for both businesses and customers.

1 note

·

View note