#churn

Text

Cold mountain water churning through Bash Bish Brook on a rainy autumn afternoon.

PRINT SHOP

#water#intimate landscape#photography#new england#churn#flow#liquid#contemporary photography#michael j. clarke photography#new england fine art#vibe#beauty#the berkshires

62 notes

·

View notes

Text

There are many ways to make your own butter the simplest and most effective way is to use a butter churner. If cream has collected on the sides and the mixture still looks a bit creamy and not completely separated..scrape the sides and continue the process.

20-25 minutes.

14 notes

·

View notes

Photo

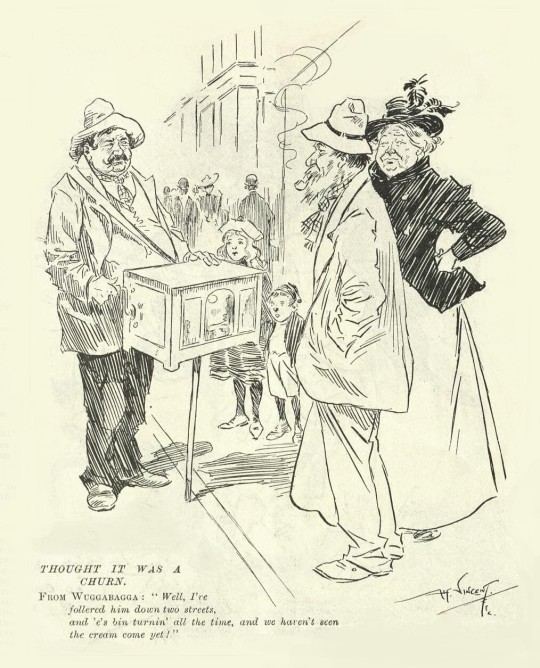

Thought it was a Churn

From Wuggabagga: "Well, I've follered him down two streets, and 'e's bin turnin' all the time, and we haven't seen the cream come yet!"

Alf Vincent - The Bulletin, Vol. 30 No. 1543, 9th September, 1909

#Alf Vincent#Alfred Vincent#The Bulletin#Australian cartoonist#comic#vintage comic#churn#butter#1900s#1909

5 notes

·

View notes

Text

“Timothy… Lydia was always waiting for you to turn up. Come on. Kitchen’s mostly packed up, only thing I have left is tea.”

Amos Timothy accepting that invitation…..

11 notes

·

View notes

Text

.... We know that peace of mind and running a scalable store is really critical, obviously for higher volume or larger merchants...

Full episode here.

2 notes

·

View notes

Text

𝗥𝗲𝗱𝘂𝗰𝗲𝗱 𝘁𝗿𝗮𝗶𝗻𝗶𝗻𝗴 𝗰𝗼𝘀𝘁 𝗮𝗻𝗱 𝗰𝗵𝘂𝗿𝗻?😅𝗛𝗮𝗵𝗮𝗵𝗮...𝗬𝗼𝘂 𝗺𝘂𝘀𝘁 𝗯𝗲 𝗸𝗶𝗱𝗱𝗶𝗻𝗴😄!....𝗧𝗵𝗶𝘀 𝗰𝗮𝗻'𝘁 𝗯𝗲 𝗱𝗼𝗻𝗲🙅♂️

But guess what🤨?.... we have cracked it, and curated a 𝗙𝗥𝗘𝗘 𝗕2𝗕 𝗦𝗮𝗹𝗲𝘀 𝗢𝘂𝘁𝘀𝗼𝘂𝗿𝗰𝗶𝗻𝗴 𝗚𝘂𝗶𝗱𝗲𝗯𝗼𝗼𝗸 📓😀 for you!

But before that, let's discuss some crucial facts about the 👉 𝗶𝗺𝗽𝗼𝗿𝘁𝗮𝗻𝗰𝗲 𝗼𝗳 𝗯2𝗯 𝘀𝗮𝗹𝗲𝘀 𝗼𝘂𝘁𝘀𝗼𝘂𝗿𝗰𝗶𝗻𝗴.

Any sales leader may have 👨💼👑 Sisyphus-like feelings as a result of the vicious circle of training and customer win-back.

Aspiring sales development representatives (SDRs) 👨💼 are pushed to the top ⬆️ just to watch them roll-off to a new opportunity so the process can start all over again.

𝗛𝗢𝗪?🤔����

💁♀️ Let's analyze this typical SDR employment cycle.

⌚ 𝗠𝗼𝗻𝘁𝗵𝘀 𝗼𝗻𝗲 𝘁𝗼 𝘁𝗵𝗿𝗲𝗲

🧑💼 SDR completes the onboarding and ramp-up process.

⌚ 𝗠𝗼𝗻𝘁𝗵𝘀 𝗳𝗼𝘂𝗿 𝘁𝗼 𝘀𝗲𝘃𝗲𝗻𝘁𝗲𝗲𝗻

👨💻 SDR is operating at full workflow capacity.

⌚ 𝗠𝗼𝗻𝘁𝗵𝘀 𝘀𝗲𝘃𝗲𝗻𝘁𝗲𝗲𝗻 𝘁𝗼 𝗲𝗶𝗴𝗵𝘁𝗲𝗲𝗻

👨💼🎉SDR is now promoted in or separated from the company.

With an SDR's typical annual compensation being 💲76k, we can calculate that...

just the cost of onboarding and ramp-up for each individual is rough 💲19k.

Other costs💸, such as the time and materials required to hire, train, and manage the SDR, are not included in this.

Now....you must be thinking, so what?🤷♂️...

𝗪𝗵𝘆 𝘄𝗲 𝗺𝘂𝘀𝘁 𝗰𝗼𝗻𝘀𝗶𝗱𝗲𝗿 𝗢𝘂𝘁𝘀𝗼𝘂𝗿𝗰𝗶𝗻𝗴 𝗦𝗮𝗹𝗲𝘀 𝗧𝗲𝗮𝗺!?🤔

✅ When you have expert sets of hands working for your sales, you free up your in-house team for other tasks.

✅ Also, now your team can focus better on how to keep your customers stick with you for a longer duration.

WE AGREE😌...that the connection between outsourcing and customer retention is not directly related to each other.

However, because of the function that outsourced teams play...

your team 🧑🤝🧑 may now devote more time and resources to providing excellent customer service, creating features that customers want, and obtaining referrals🤝😀!!

The rise in customer retention is strengthened ✊ by this.

Wanna learn more about - B2B Sales Outsourcing❓

Then we suggest checking out our website to get a 💡𝗙𝗿𝗲𝗲 𝗗𝗼𝘄𝗻𝗹𝗼𝗮𝗱𝗮𝗯𝗹𝗲 𝗕2𝗕 𝗦𝗮𝗹𝗲𝘀 𝗢𝘂𝘁𝘀𝗼𝘂𝗿𝗰𝗶𝗻𝗴 𝗚𝘂𝗶𝗱𝗲𝗯𝗼𝗼𝗸💡

If this post adds value to your business, do share 📤 it with your colleagues 🧑🤝🧑 and team!

Thank you for reading! :D

#B2B#Sales#outsourcing#b2bsalesoutsourcing#business to business#customerservice#customerexperience#smallbusiness#marketing#digitalmarketing#b2bsales#leads#leadgeneration#customers#entrepreneur#entreprenuerlife#entreprenuership#churn rate#no churn#churn#traningcost#traning

6 notes

·

View notes

Text

I can't wait for art fight, I can't wait to churn out art for @ofcatsandstars and @foxgirlophelia and @ hornwyrm and @ zenelionn!!!!!!!!!!!!

#churn#is maybe the wrong adjective#I'll be doing it as fast as possible haha#I love doing art fiiighhhttt#<33333333333333333333#art fight 2022#art fight

3 notes

·

View notes

Text

As the World Churns

(seen at today’s North Star Auction)

3 notes

·

View notes

Text

Found at HyVee 28 April 2022

Purchased the Milka, White Chocolate Loacker, and Oberweis

2 notes

·

View notes

Text

Vtg Cast Iron Trivet w Ceramic Tile AmishDutch Scenes Set of 2 Made in Japan ebay Will's Vintage Treasures!

1 note

·

View note

Text

More Copy Paste

So copy/paste is BIG at the Ohio DDS. Not only employee evals, but also other areas of decision-making such as PDNs, personal decision notices. The only thing personal about those are the allegations that are changed from one claimant to the next.

For more fun, more employee evaluations from 3 different disability claims supervisors. Clearly, they all share the same templates with some making a slight effort to spice things up. Enjoy!

T demonstrates awareness of diversity & inclusion issues and supports positive change in the workplace. He listens to peers and customers regardless of differences with and responds respectfully and civilly. T is receptive to others' views, seeks understanding, asks questions, and respects boundaries. T uses inclusive language and understands its impact on customer service and work environment

This one below makes a bold move and breaks up the first sentence into 2 sentences!

Mr. C supports awareness of diversity and inclusion issues. He supports positive change in the workplace. He listens to peers and customers regardless of differences and responds respectfully and civilly. He is receptive to others' views. He seeks understanding, asks questions, and respects boundaries. Mr. C uses inclusive language and understands its impact on customer service and the work environment. He seeks educational opportunities

S demonstrates awareness of diversity and inclusion issues and supports positive change in the workplace. She listens to peers and customers regardless of differences with and responds respectfully and civilly. She is receptive to others' views, seeks understanding, asks questions, respects boundaries, etc. She seeks educational opportunities. She uses inclusive language and understands its impact on customer service and work environment.

#SSI#ssdi#Ohio DDS#same shit different day#copypaste#disability#churn#disability claims adjudicator#employee evaluations

0 notes

Text

The Art of Churn Analysis in Modern Banking

Churn analysis in modern banking is like having a crystal ball that helps financial institutions predict customer behavior, minimize attrition, and enhance customer satisfaction. Imagine having the ability to see into the future of your customer relationships. While we can't predict the lottery numbers, we can certainly get a grasp on churn analysis.

Understanding Churn

Churn, in banking lingo, refers to the rate at which customers leave a bank to seek services elsewhere. It's akin to a revolving door, and banks are eager to make sure it doesn't spin too fast. The churn rate isn't something any bank wants to ignore, as it directly impacts profitability and reputation.

Also Read: Best Financial Strategies for Newlyweds

Data is the Canvas

To master the art of churn analysis, banks need to embrace the power of data. Every transaction, interaction, and behavior of a customer is like a stroke on a canvas. Collecting this data, from ATM withdrawals to online transactions, is the first step.

Segmentation - The Paintbrush

Once the canvas is filled with data strokes, it's time to pick up the segmentation paintbrush. Segmenting customers based on their behaviors and preferences helps banks understand the unique needs of different groups. It's like creating different paintings on the same canvas.

Predictive Analytics - The Palette

Predictive analytics is the artist's palette in churn analysis. By using historical data, banks can forecast customer behavior. For instance, if a customer regularly withdraws cash and suddenly starts using digital wallets, it could signal a potential churn. It's like predicting that the canvas will turn from a serene landscape into a stormy sea.

Intervention - The Brushstroke

Once banks identify customers at risk of churning, they can take action to retain them. This could involve offering personalized services, discounts, or simply reaching out to understand their needs better. It's like adding a gentle brushstroke to smooth out the rough edges of the canvas.

Feedback Loop - The Art Critic

Every artist needs a critic, and in churn analysis, the feedback loop plays that role. Banks need to continuously assess the effectiveness of their retention strategies. If a particular intervention doesn't yield results, it's time to switch brushes or change the color palette.

The Masterpiece - Customer Loyalty

The ultimate goal of churn analysis is to create a masterpiece of customer loyalty. When customers feel understood, appreciated, and satisfied, they become the most valuable assets a bank can have. A loyal customer is like a priceless painting, treasured for years to come.

Also Read: Emerging Trends in the NBFC Sector

Conclusion

Churn analysis isn't just about retaining customers; it's about building lasting relationships. So, while we can't predict the lottery numbers, we can certainly predict and prevent churn in the world of modern banking. It's an art form that every financial institution should master to thrive in today's fast-paced financial landscape.

0 notes

Text

Unveiling Churn Analysis in Banking and Its Benefits

In the realm of banking, understanding customer behavior is like deciphering a treasure map. Fortunately, churn analysis is the "X" that marks the spot. If you're wondering what churn analysis is and why it's a game-changer in the Indian banking landscape, read on.

What is Churn Analysis?

Churn analysis is like having a crystal ball for your bank's customer base. It involves studying customer data to identify those who are likely to leave (churn) and take their business elsewhere. It's not about predicting the future with mystic powers, but rather using data science to make informed decisions.

Also Read: The Influence Of Technology On The Finance Sector In India: A Paradigm Shift

Benefits of Churn Analysis

1. Customer Retention

Imagine you have a favorite neighborhood café. They know your order by heart, and you love the personalized service. Now, think about how great it would be if your bank offered the same level of personalized service. Churn analysis helps banks identify customers at risk of leaving, allowing them to tailor offers and services to keep these valuable clients onboard.

2. Cost Savings

Losing customers is not just emotionally draining; it's also costly. Acquiring new customers can be up to five times more expensive than retaining existing ones. Churn analysis helps banks save money by focusing on retaining customers rather than constantly chasing new ones.

3. Improved Products and Services

Churn analysis provides insights into why customers leave. It's like feedback on steroids. By understanding the pain points and issues that drive customers away, banks can make meaningful improvements to their products and services, enhancing the overall customer experience.

4. Targeted Marketing

Imagine receiving an offer for a home loan just when you're actively looking for one. It's like the universe is conspiring in your favor. Churn analysis helps banks identify the right customers for specific products or services, ensuring that marketing efforts are not wasted on disinterested parties.

5. Competitive Edge

In the fiercely competitive banking sector in India, staying ahead of the curve is vital. Banks that utilize churn analysis can proactively address customer issues, create more appealing offers, and ultimately gain a competitive edge in the market.

6. Predictive Analytics

Churn analysis doesn't just tell you who might leave; it also provides insights into when they might leave. This predictive aspect is a game-changer. Banks can take preventive actions before it's too late.

Also Read: What Is NPA And Its Impact On Indian Economy?

7. Customer Segmentation

Not all customers are the same. Churn analysis helps banks segment their customer base effectively. This allows for a more targeted approach in terms of marketing, customer service, and product development.

Conclusion

Churn analysis is like having a superpower in the world of banking. It empowers banks to retain customers, save costs, and stay ahead of the competition. It's not just about data; it's about using that data to create a better banking experience for customers.

0 notes

Text

Are you seeking proven ways to lower your customer churn rate? Our latest blog post provides actionable strategies for leveraging Salesforce Clouds to strengthen customer relationships and boost retention. Transform your customer journey today!

#salesforce#salesforce partner#crmsolutions#cloud#crmconsulting#churn#churn rate#business#crmintegration#salesforce consulting services#getoncrm

0 notes