#chargebacks explained

Text

Chargebacks: Unraveling Their Impact on Your Business

#Chargebacks: Unraveling Their Impact on Your Business#chargebacks#small business payment processing#merchant account for high risk business#high-risk business#credit card chargebacks#payment processing for small business#ecommerce business#credit card processing for small business#high risk business#chargebacks explained#a deep dive into high-risk business transactions#visa chargebacks#business transaction#cycles of chargebacks#discover chargebacks#chargeback on credit card#fight chargebacks

2 notes

·

View notes

Text

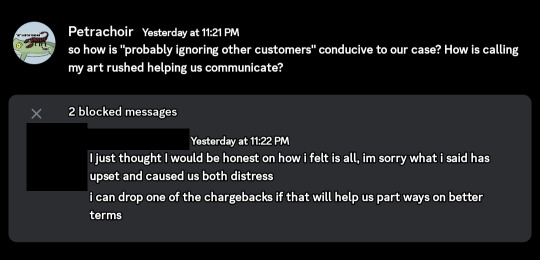

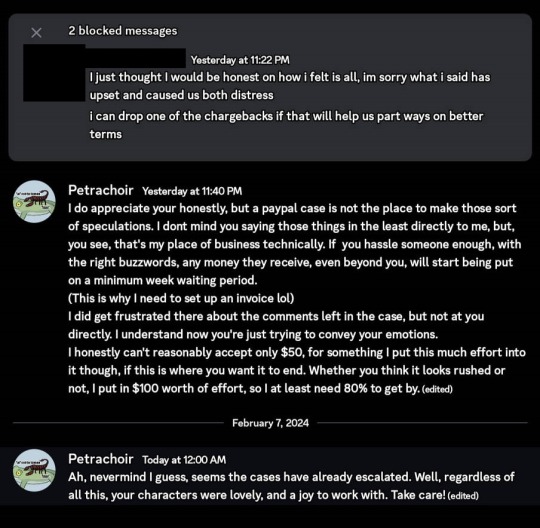

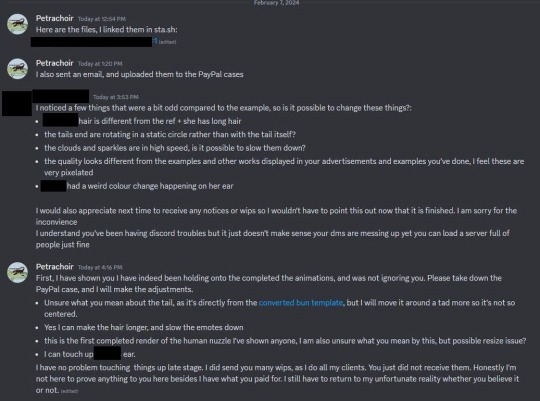

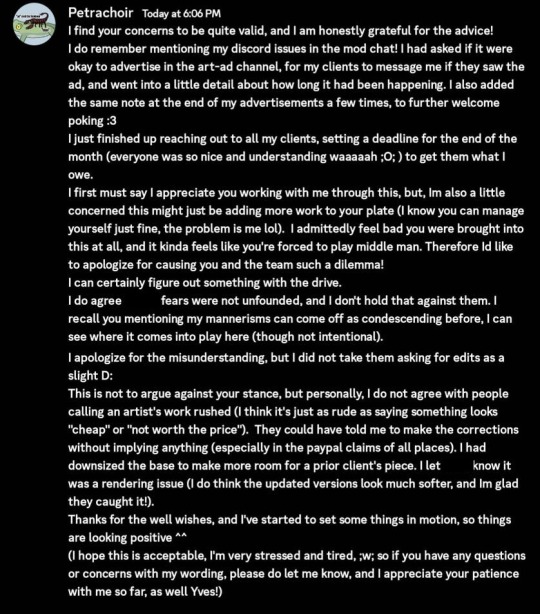

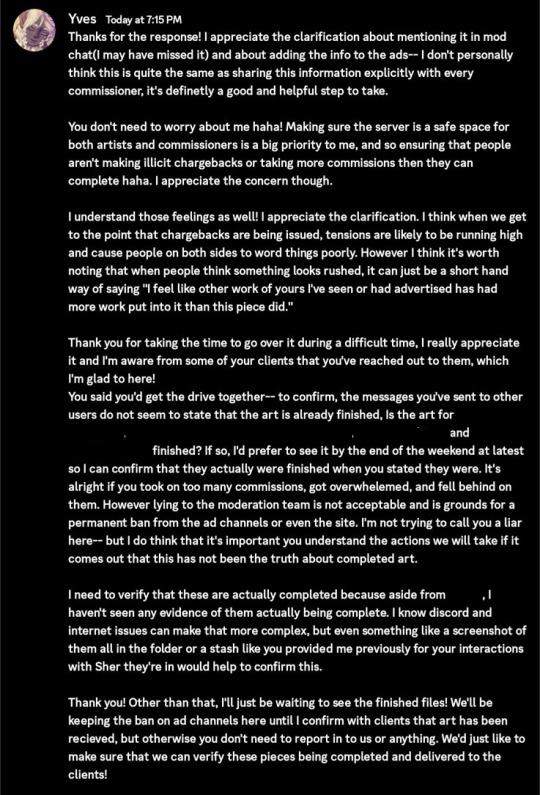

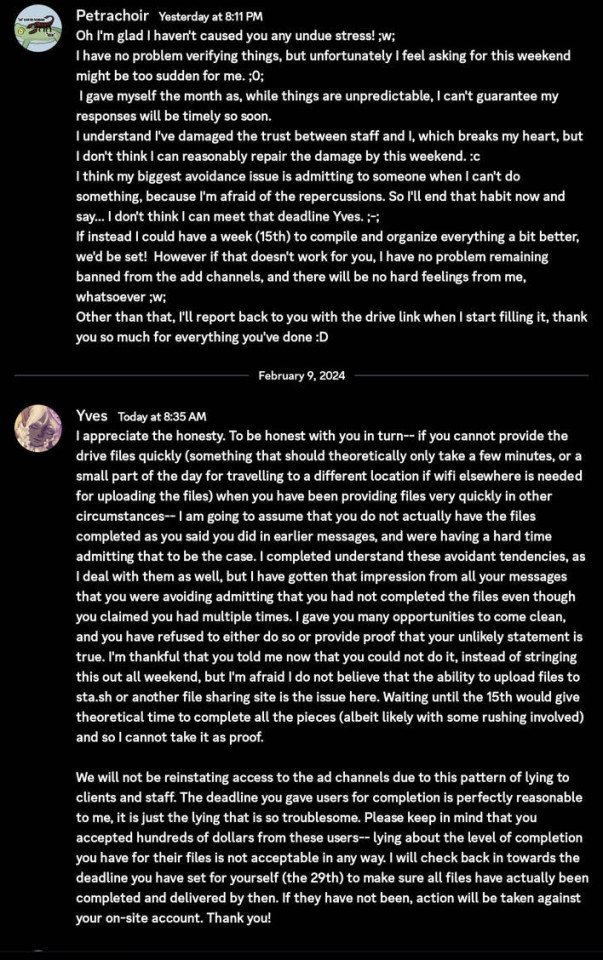

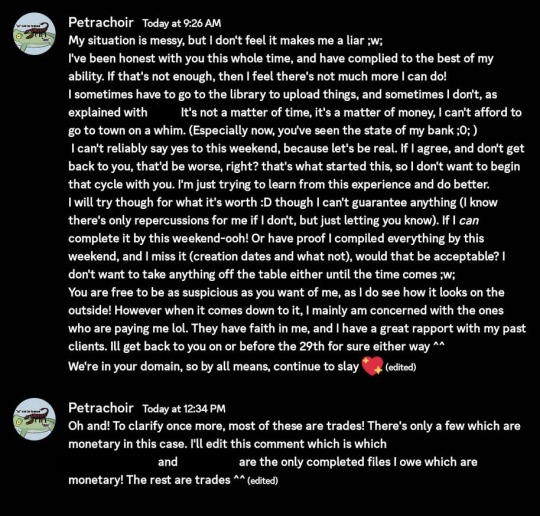

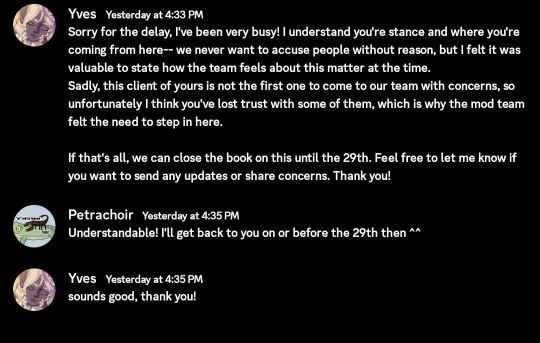

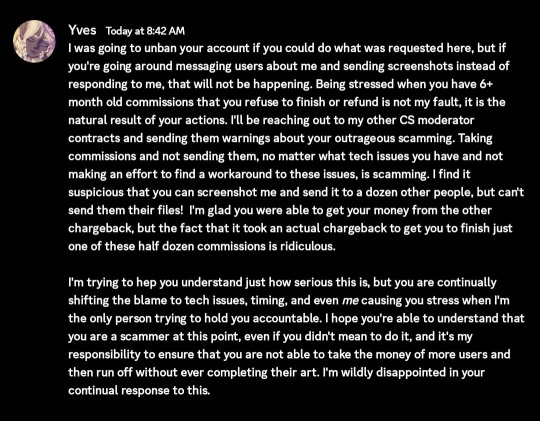

Petrachoir Banning Situation

All names of the people involved apart from Petra and Yves have been censored and all art and file names also censored to prevent anyone from searching for users.

Petra is not here to argue against the ban but to explain the situation.

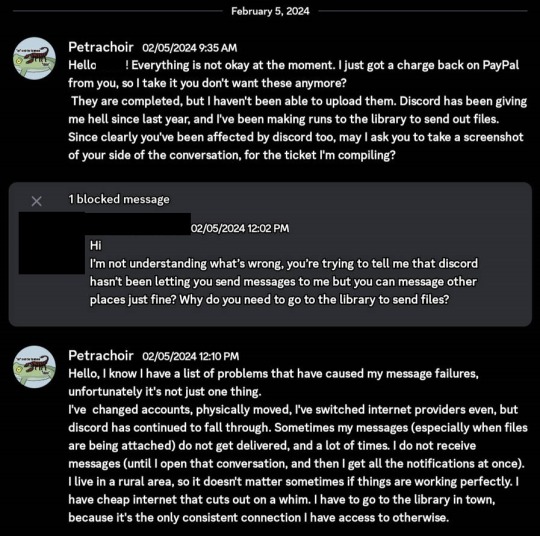

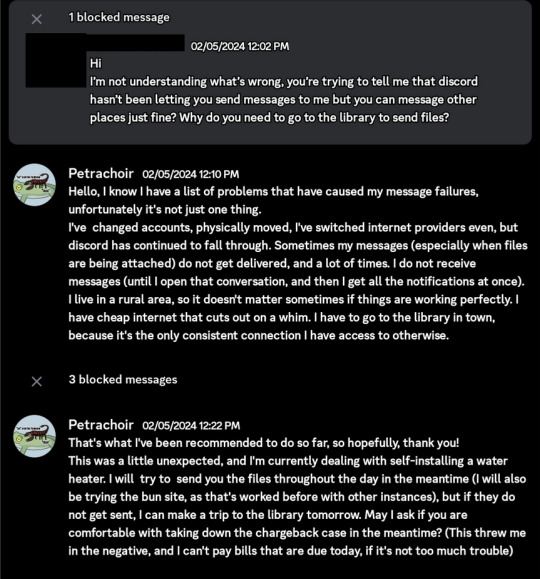

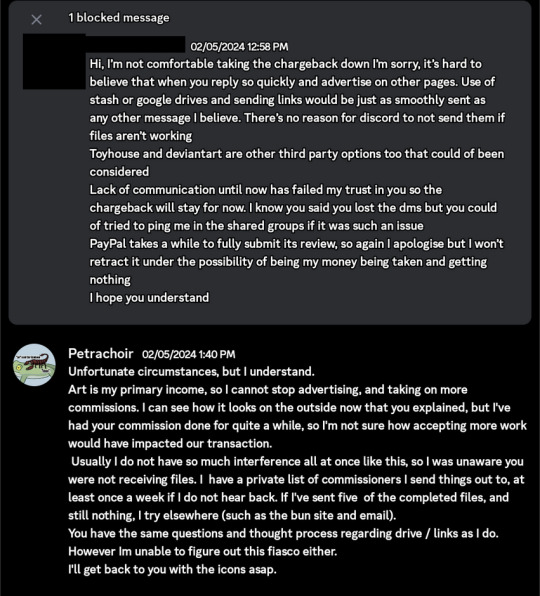

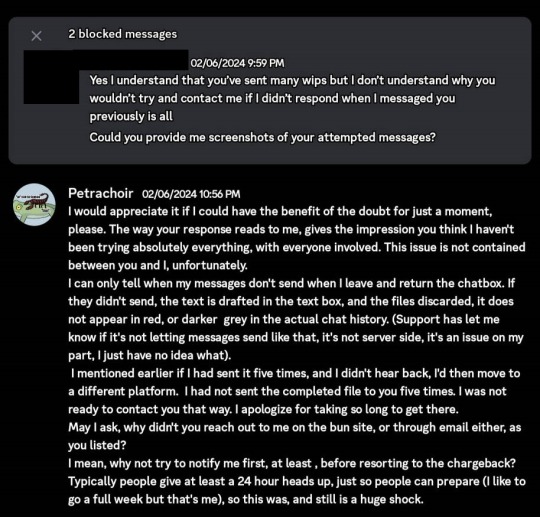

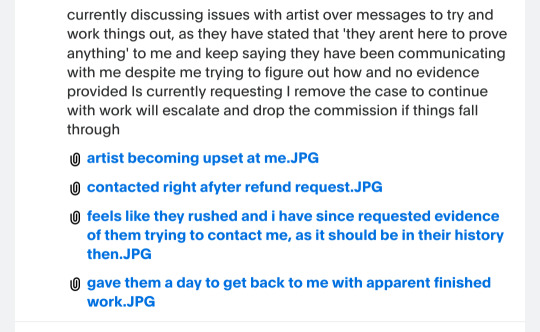

Petra reached out to me about a chargeback situation. Petra's discord seems to have an error with messages being sent/received that they reached out to discord support about but the issue has not been resolved.

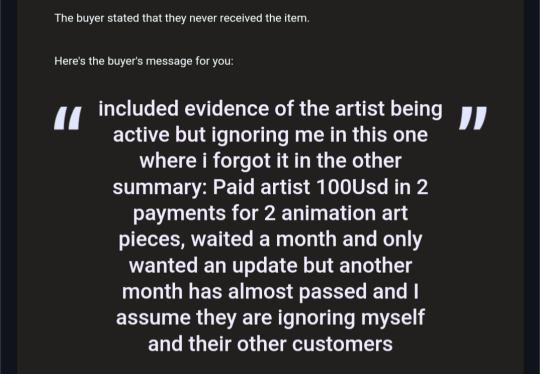

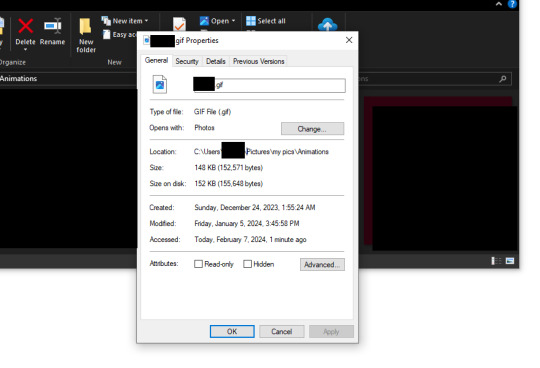

A client from december had filed a chargeback in february on a project they'd completed but did not receive because of the discord error. Here are the screenshots of this conversation and the paypal dispute.

I did receive proof of the upload dates of the files given to the client as well as the email sent to them. I also was sent the updated version that had been sent to the client as well.

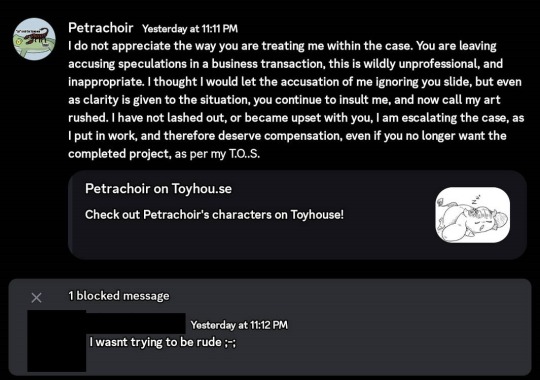

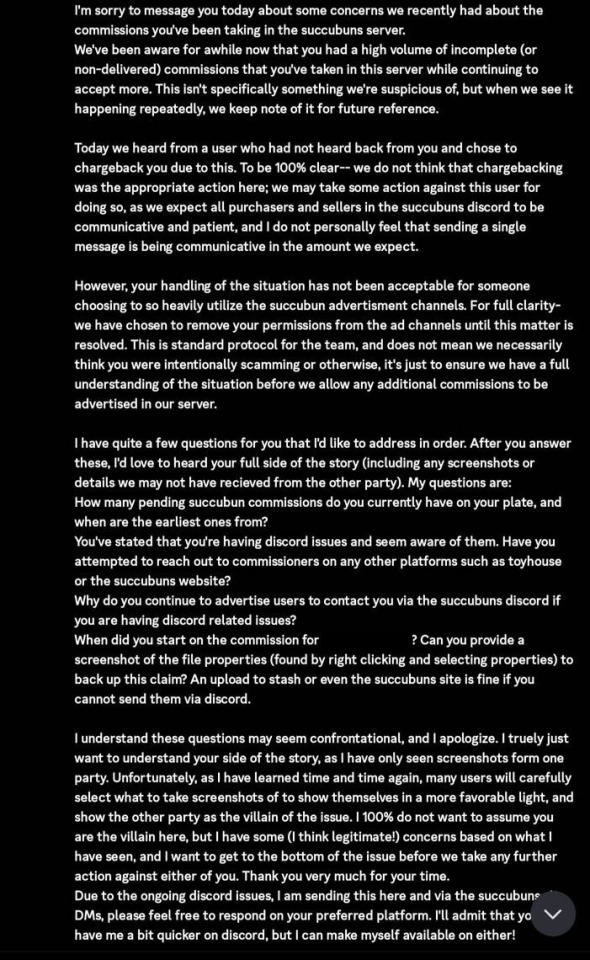

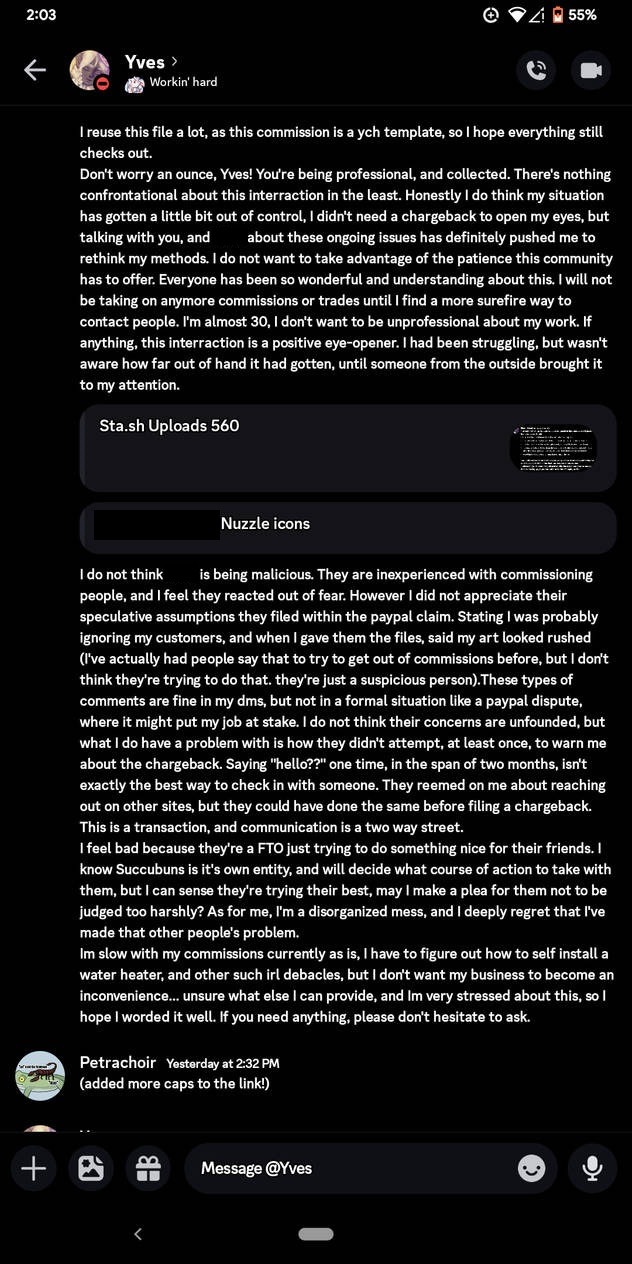

The client contacted Yves about the situation which led to the following conversations.

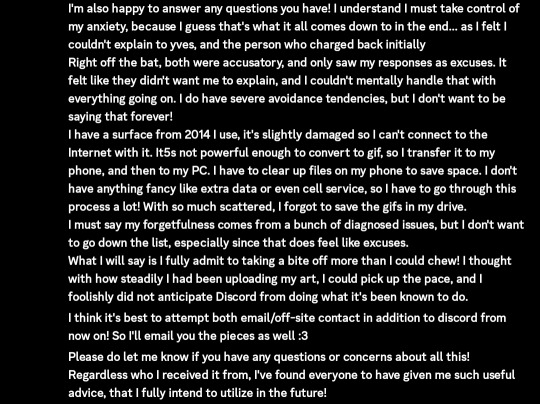

This is the explanation that was sent to a client on why they were having difficulties as well.

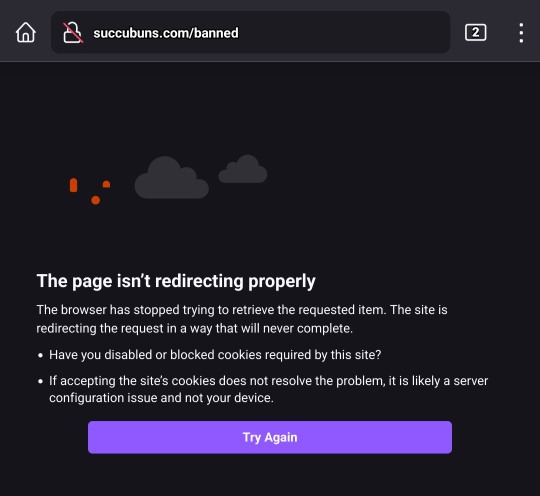

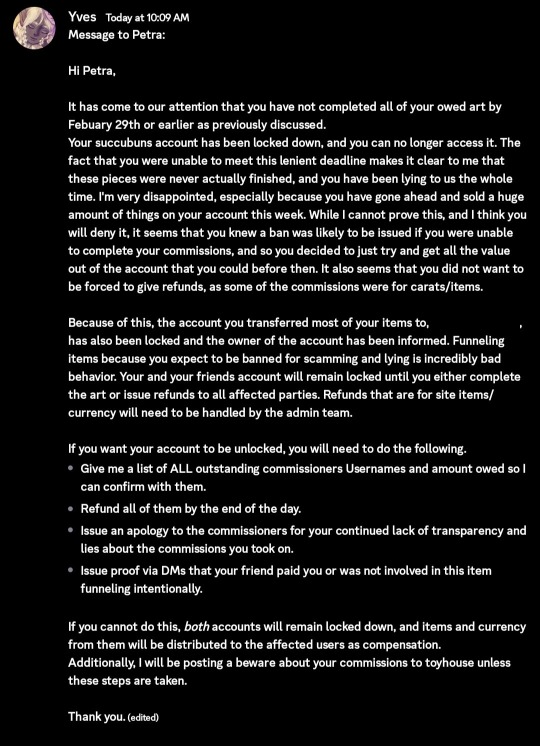

Paypal settled in Petra's favor and cited that proper evidence was given to them but Petra was unable to meet the deadline with Yves so they were banned as a result.

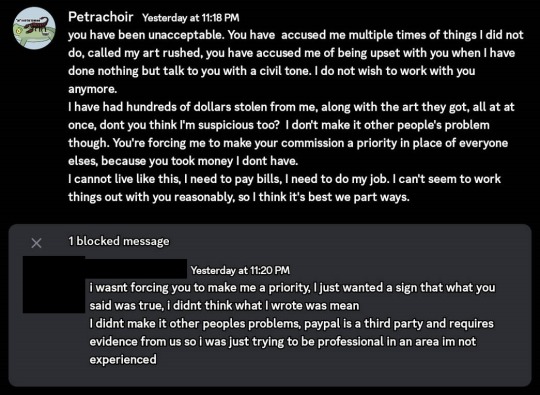

Petra states they felt uncomfortable with the confrontation with Yves from the beginning and feels it was inappropriate to ban someone who wasn't involved. Because of the financial situation they were selling everything as a result.

Petra also informed all clients of the situation to have transparency and all responded that they still wanted the art that was owed to them.

They did not respond to Yves and this was the result.

Petra isn't sure where the 6+ month old commissions part is coming from since the situation was about the december commission. I have also not heard anything about it from the people I was contacted by.

They also felt like they couldn't explain further to Yves due to how they felt uncomfortable and like there was hostility from Yves.

Petra additionally does not agree with how they handled the situation and has been offered advice from many people on how to proceed with commissions and business from now on. They feel like they've been irresponsible and have since made changes to the way they do things but that they have always completed work for their clients in the past.

I have also had two other clients anonymously contact me about this. I will not be disclosing if they are current or previous clients to protect their identities.

Both clients have vouched for Petra's discord issues and working around them. They both have said that discord did delete and not deliver dms multiple times. They were both able to work around this by the means that Petra had been putting out (saying to bump dms in ads they put out, status updates, etc.)

8 notes

·

View notes

Text

The good news is that I managed to get PayPal to let me pay for shipping labels, so I can continue sending out the plushies. The bad news is that I see myself forced to close my bigcartel store, because of a chargeback an individual who clearly does not know how pre-orders & A & B grades of products work (even though it had been explained in the item descriptions).

I will not be using PayPal for anything but occasional commissions anymore. I also had to deal with funds to manage this matter being taken out of my own pocket. I am tired, but at least I know I can continue getting the plushies out to you guys.

All that I ask for now is to please have a little patience with me, while I manage this debacle & deal with the fallout of it all. Please, please PLEASE make sure to message me beforehand, if you end up having questions regarding any of my products. I thank you in advance.

2 notes

·

View notes

Text

Aglobaltrade Review

Is Aglobaltrade Legit?

After taking a look at their website, it shows that they do not fall under any regulating agency. That is a MAJOR RED FLAG!! That should be enough for you NOT to invest with them. And they also work with websites that offer “Automated trading software” which is another red flag, as this kind of websites are infamous for scamming schemes.

So, Aglobaltrade is just another unregulated forex broker, which means the customers aren’t protected, and there is highly likely they will get away with your hard-earned money and there will be no regulating agency to hold them responsible.

How does the scam work?

Usually, unregulated forex brokers work in the following way. They will call people to persuade them to make the initial minimum deposit. And they will try any conceivable method in order to make that happen. They will offer deals that sound too good to be true. Like we will double your initial deposit or you will make hundreds of dollars per day easily. Please don’t fall for anything they say!!! It is a SCAM! After making the initial deposit, they transfer clients to a smarter scammer, called a “retention agent”, who will try to get more money out of you. Also, one thing we need to add here is: don’t trust the good Aglobaltrade reviews you might see online. They pay websites and services to improve their online reputation by posting good reviews about them.

Withdrawing funds

You should submit a withdrawal request ASAP, because your funds are never safe with an unregulated broker. And here is when things get tricky.

If you want to withdraw your money and it does not matter if you have profits or not, they will delay the withdrawing process for months. If they delay it for six months, you won’t be able to file a chargeback anymore and your money is gone for good. It doesn’t matter how often you remind them or insist in withdrawing your money, you will NOT get them back. And if you signed the Managed Account Agreement or MAA, which is basically authorizing them to do anything they want on your account, they will lose all your funds so there won’t be anything to request anymore.

How to get your money back Aglobaltrade?

If you already deposited your money with them and they refuse to give your money back, which is very likely to happen, don’t worry, it might be a way or two to get your money back.

First of all, you need to keep the emails as proof that you have been requesting the money back from them but they don’t give it to you. Or they delay the process for too long, with the intention of not refunding your money.

The first thing you should do is perform a chargeback! And you should do this right away! Contact your bank or credit card provider and explain how they deceived you into depositing money for a non-regulated trading company. Mention also that they refuse to give your money back. This is the simplest way of getting your money back and is also the way that hurts them the most. Because if there are many chargebacks performed, it will destroy their relation with the payment service providers. If you haven’t done this before or you are not sure where to start or how to present your case to your bank or credit card company, we can assist you in preparing your chargeback case. Just contact [email protected] but don’t let your broker know they you read this article or that you are contacting us.

What about wires?

If you sent them a wire, there is no way to perform a chargeback on a wire. For this step you need to raise the fight to a different level. Tell them you will go to the authorities and file a complaint against them. That will get them to rethink the refund possibility. Another thing you can do is prepare a letter or email for the regulating agencies. Depending on where you live, you can search google to find the regulatory agency for Forex brokers in your country. After that you can prepare a letter or an email describing how they deceived you. Make sure you show this letter or email to them, and tell them you will send it to the regulating agency if they don’t refund your money. If you don’t know where to start, reach us at [email protected] and we’ll help you with this step as well.

Make sure you leave Aglobaltrade reviews in other sites

Another way to hurt them and save other people from falling victims is to leave bad reviews on other sites. See what other sites have posted reviews about Aglobaltrade, and describe shortly what happened. If you fallen victim, please leave a review and a comment on this site at the comment section. Also, when these people change their website, they tend to call the old clients. So, if they call you from a new website, mention it in the comment or let us know about it. That would be really appreciated by us by our users. Also, if you get phone calls from other companies, please put the name of these companies also in the comment. Or you can send them to us and we will expose them too.

Aglobaltrade Review Conclusions

Making the Aglobaltrade review was our pleasure, and we hope to save as many people from losing their hard-earned money. A good rule of thumb is to carefully review all the Forex companies and any other company for that matter, before you perform any transaction. We hope that our Aglobaltrade review has been helpful to you. If you have any questions or you need an advice about the withdrawing process, feel free to contact us at [email protected]

If you like to trade, please do it with a trustworthy, regulated broker, by choosing one of the brokers listed below.

2 notes

·

View notes

Text

Ravelry took sides. Against the fiber arts community.

Ravelry has had issues for the last few years. They redesigned the site in such a way that it was triggering seizures in people, the heads of Ravelry dismissed such issues as bs and insulted and ignored the people that were complaining, and they took a hands off stance while a scam artist was stealing thousands of dollars from users (that scam artist would end up in jail by the end of that fiasco, all thanks to DT and not to Ravelry).

Earlier today someone, an unknown someone but there are three very good culprits suggested (Jasmin of Knitmore Girls, that toxic Ben guy from Stitches, or BzyPeach), complained about the discussion about the Lady Dye Yarns situation.

And, because of that complaint, two mods got banned. One mod, Chupacabra, got banned for commenting that Diane of Lady Dye Yarns is being taken to court for credit card debt (this is confirmed knowledge that is available to the public on the Massachusetts website, it was not protected knowledge) and not posting proof. And then, when a second mod stepped in, TnyPirate, and posted a screenshot of the, once again, publicly available evidence of Diane being taken to court over credit card debts, she was banned for posting proof!

It turned into a damned if you do, damned if you don’t situation. All in an attempt to silence the consumer advocacy group DT because they were sitting on knowledge that hadn’t been released yet.

Well fuck that. Diane, if you were so scared of this getting out before, well, it’s out now. Chupacabra posted what had not been said on Reddit. Diane, of Lady Dye Yarns, was taking grants from the state of Massachusetts, and was specifically only shipping complete and well dyed yarns to people involved with giving those grants. And that’s how she was supporting her business for ten years. That’s why she was gathering information on people’s real names and linking them to social media accounts, so she could continue to make herself and her company look good, all while throwing the ‘lesser’ customers under the bus.

She was also raising money, for charity she claimed, and keeping it for herself.

She has started fighting chargebacks, so if you’re owed yarn or a refund by her, you need to fight for that money now. She doesn’t have the cash to refund money any longer. Especially now that people are backing away from her now that her thefts have come to light, including stealing and distributing patterns from designers she knew in real life!

All in all, it’s coming out that she really is just a terrible, terrible human being and scam artist that was able to keep the balls in the air for ten long years.

This is what Chupacabra posted on Reddit today:

Harvard Business School, Faculty & Research, Publications

August 2022 Case

HBS Case Collection

Titled ’Boston Impact Initiative: Investing in Local Change’ (Note that this save can be twitchy at times)

Oversight looks to have been an issue for this program. Intriguing considering the financial state and general disorganization of LDY and the company having received a grant with such obvious to accounting Ravelry screaming loud issues, including issues with the Mass Secretary of the Commonwealth, and what that recent debt collection court case implies as iffy credit.

Then, this was found about another program that LDY was involved in that may explain why it appears (and I am alleging) that Diane had to artificially inflate and cheerlead the state of the company. This may be a touch hard to follow because the narrative of what it is and why it is important to the story was still being fully fleshed out for following along. It wasn't quite ready for prime time yet, but was getting close.

From 2021.

First you'll need to open this archived webpage from FBE (Foundation for Business Equity) and then scroll down to the “Our Cohorts” section (almost at the bottom). On the left side there’s orange text/button labelled: “Click on logos to learn more about our Participating Enterprises in Cohort IX and X”

Have a look at the logos.So LDY is listed in their “Cohort IX” &/or “Cohort X”. That’s very recent.For more details on what the BEI Accelerator does, search this document for the phrase “Business Equity Initiative”. Keep searching because there are a few hits worth reading so that the structure of the program makes better sense.

Diane was 100% certainly a member of the BEI Accelerator program in late 2021.

Confirmation was found on Twitter. The tweet is from FBE’s acct and it says:

“As the holiday season arrives, we are highlighting some of the incredible businesses in our Business Equity Initiative (BEI) program. Today we are sharing two businesses that are perfect for classic gifts: Elegant Stitches and ladydyeyarns”, followed by a photo of four dyed skeins with the LDY logo below them.

Diane better have shipped ALLLLL of the contents of her “Ready-To-Ship: The Fabulous Holiday Box” to customers who were directed via this site …. to this one..

It is suspected that things like that tweet above, plus other FBE-generated industry puff articles, were one of the contributing factors to Diane feeling she needed to keep separate league tables/lists of customers to single out for special treatment.

There’s no way she would have ripped off an investor or some big-wig/big-name by giving them the plebeian version of one of her boxes (or none at all!). They’d receive the bespoke one with 120% of the contents plus a hand-composed note. Delivered on. time. or kablooey … shit says hello to fan. Nobody complains like a burned donor. NOBODY.

It is also suspected that all of the above is why she also has bigger name defenders. She cultivated those relationships to cultivate more relationships to bring in more money to look better to programs. It's an ouroboros of networking to get more money to network to get more money.

It's bullshit all the way down, and at the very bottom are the customers who were simply rungs on the ladder to the real moneymakers and grant program approvers.

Now that it's been reported that on top of the inability to confirm claimed donations, stall on any refunds, and the outright theft from designers that she knew in real life and served on the Vogue Diversity Councel with that she is possibly fighting disputes, the Mass AG is making calls, and the DT forum and mods have been targeted for official shutting the fuck up it's starting to look like this was possibly just another scammer in some extra pretty packaging.

For what it is worth I absolutely think her defenders are being just as manipulated as everyone else has been. I just can't say if they are victims or volunteers yet, and they aren't talking so I'll leave that up to everyone else to decide.

#lady dye yarns#lady dye yarn scandal#scam artist#fiber arts community#knitting community#ravelry#false charity fundraising#stealing from customers

25 notes

·

View notes

Text

Don’t Let Chargebacks Hurt Your Business: How to Handle Them Like a Pro!

Introduction: Chargeback

A chargeback is a transaction reversal initiated by a customer's bank or credit card issuer. It allows the customer to dispute a transaction and request a refund of the funds that were previously transferred to a merchant's account. Chargebacks are typically initiated when a customer believes that they have been charged for a product or service that they did not receive or when they are not satisfied with the product or service they received. Chargebacks can also be initiated in cases of fraudulent activity or unauthorized transactions. When a chargeback occurs, the merchant may be required to provide evidence to dispute the chargeback and retain the funds. If the merchant is unable to successfully dispute the chargeback, the funds are returned to the customer, and the merchant may be subject to additional fees and penalties.

Chargebacks can be a frustrating and costly experience for businesses. Not only can they result in the loss of revenue, but they can also harm your reputation and impact your ability to process payments in the future. However, chargebacks are not always avoidable, and it's essential to know how to handle them effectively when they do occur. Here are some tips on how to handle chargebacks from customers:

Understand the Reason for the Chargeback

The first step in handling a chargeback is to understand why it happened. There are many reasons why a customer might initiate a chargeback, such as unauthorized transactions, fraudulent activities, or dissatisfaction with the product or service. It's essential to identify the root cause of the chargeback to determine the best course of action.

Gather Evidence

Once you understand the reason for the chargeback, the next step is to gather evidence to dispute it. This might include customer receipts, shipping documents, or any other relevant documentation that supports your case. It's also a good idea to review your internal records to ensure that the chargeback is valid and not the result of an administrative error.

Respond Quickly

Chargebacks are time-sensitive, and there are specific deadlines that must be met to respond to them. It's essential to respond quickly to ensure that you have a chance to dispute the chargeback effectively. Most payment processors require that you respond within a specific timeframe, usually between 10 and 30 days.

Contact the Customer

If you have identified the reason for the chargeback and have gathered evidence to dispute it, the next step is to contact the customer directly. This can be an opportunity to resolve the issue and avoid further chargebacks. Be polite and professional in your communication, and try to find a mutually beneficial solution.

Dispute the Chargeback

If you have gathered evidence and believe that the chargeback is invalid, it's essential to dispute it with your payment processor. Provide all relevant documentation and explain why you believe the chargeback is not valid. Your payment processor will review the evidence and make a decision on the chargeback.

Learn from the Experience

Handling chargebacks can be a frustrating experience, but it's also an opportunity to learn and improve your business processes. Take the time to review your procedures and identify any areas that need improvement. This might include improving customer service, enhancing fraud detection, or improving product quality.

In conclusion,

Chargebacks can be a challenging and frustrating experience for businesses, but they are not always avoidable. Understanding the reason for the chargeback, gathering evidence, responding quickly, contacting the customer, disputing the chargeback, and learning from the experience are all essential steps in handling chargebacks effectively. By following these tips, you can minimize the impact of chargebacks on your business and maintain your reputation with your customers.

2 notes

·

View notes

Text

Don’t get scammed ever again, bitcoin has payment reversal.

Payment Reversals Explained (And 10 Ways to Avoid Them)October 15, 2021

Security

Payment Processing 101

Merchant Tips

If you’ve been in business longer than a month, you’ve probably experienced a payment reversal of some kind. Certain payment reversals are so prevalent that business owners have to budget them into their expenses every month.

The frequency of payment reversals is tied to an interesting intersection of technology, law, and product/market type. If your online store doesn’t do a good job with its descriptions, you may deal with more payment reversals. Or if your product is expensive and highly bespoke (think high-end mattresses or musical instruments), returns may be more common.

Some payment reversals are just normal business. Others can be exploitations of fraudulent customers, but the burden of payment reversals is often placed on businesses. The major credit card networks (Mastercard, Visa, etc.) have more incentive to favor their customers, and it’s up to you to fight back when appropriate. The more systems and processes you have in place, the better you’ll be at proving when a reversal is wrong.

Experiencing consistent payment reversals can be super frustrating. Fortunately, there are ways to combat payment reversals, and understanding the different types and how they occur is your first step to doing so.

What does payment reversal mean?

Payment reversal (also "credit card reversal or "reversal payment") is when the funds a cardholder used in a transaction are returned to the cardholder’s bank. This can be initiated by the cardholder, merchant, issuing bank, acquiring bank, or card association.

Common reasons why payment reversals occur include:

The item ended up being sold out.

The customer is trying to commit fraud.

The customer changed their mind after ordering.

The product wasn’t what the customer expected due to bad descriptions or shady selling.

The wrong amount was charged.

The transaction was duplicate.

There are three common branches that payment reversals fall into:

Payment reversal type 1: Authorization reversal

Authorization reversals reverse a payment before it officially goes through and is the "quick fix" of payment reversals.

The ACH (automated clearing house) network is slow and limited, so it’s normal for transactions to be pre-authorized. In other words, a transaction can be initiated even if the address or other information is incorrect.

If you or your employees notice something incorrect after submitting the authorization request, you can call your bank to stop the transaction from occurring. This is known as an authorization reversal, and it’s highly preferable over a future chargeback or refund. The further a payment gets along it’s path to completion and the more entities it communicates with (issuing bank, card network, etc.), the more of a hassle it is to take back.

Authorization reversals are better for the customer, won’t mess up your sales data, and reduce fees associated with chargebacks by stopping the payment early.

Usually, authorization reversals are quick and in stores mentioned in front of the customer. If you address the problem immediately and let the customer know that any charges they see will be gone shortly thereafter, you have a better chance of them just swiping and trying the transaction again with the correct information. Be quick, and be courteous!

Payment reversal type 2: Refund

Refunds reverse a payment after the transaction has completed but before the customer has filed an official dispute.

We all know refunds. This is when something is wrong with the product or purchase and a customer calls your business to get their money back.

Instead of just canceling the transaction like an authorization request, a refund completes the transaction in reverse. It’s like the acquiring bank is now paying the cardholder instead of the other way around. It’s treated like a new, separate transaction.

Keep in mind that refunds are not a neutral agreement. Not only do you as the business owner lose the product sale, you also have to pay the fees (interchange, etc.) that incur along the way.

Payment reversal type 3: Chargeback

Chargebacks are when a customer calls their bank and files a dispute against your transaction.

If authorization reversal and refunds are out of the picture, or if a customer just decides to go directly to their bank, you will have to deal with a chargeback. Not only do chargebacks make you lose revenue on the product, the fees, the shipping, etc., but you also have to pay extra, chargeback-specific fees.

Chargebacks are arguably the bane of many business owners' existence. They’re not easy to fight, they’re expensive, and the process can be confusing and frustrating. It’s difficult to figure out what is a fair chargeback and what is fraud, and you’re responsible for fighting back against chargebacks.

As a business owner, you’ll have to deal with:

Losing revenue

Paying for shipping fees

Recovering or forfeiting sold products

Eating transaction fees incurred during the fraud.

Filing a claim and disputing chargebacks.

If you incur enough chargebacks, you may be flagged by the card networks and be unable to accept credit cards, so there’s a sustainability and reputational threat inherent within each chargeback.

Your best bet is to be proactive and take the fight to them, developing an internal system of processes and best practices to reduce the number of chargebacks and easily identify which ones are fraudulent.

10 ways to reduce payment reversals

Don’t count on eliminating payment reversals from your business, but reducing your payment reversals can be achieved through a combination of thorough payment technologies and best practices from your employees.

Just having a foolproof payment system isn’t enough since a lot of chargebacks and payment reversals are due to human error.

With that in mind, here are ten ways you can make a big dent in yours. For the first six, check with your POS provider to make sure your software has these systems set in place.

Link your authorization request to future transaction messages. A transaction identifier or (TID) makes sure that particular requests and their related messages stay with each other.

Use a surface trace audit number. This attaches a number to all the communication regarding a particular transaction.

Make sure your system delivers retrieval reference numbers. This ties estimated sales to the customer’s original authorization request.

Make sure your system has an authorization characteristics indicator. Notes an estimated incremental/estimated transaction total.

Keep track of your duration field. This is the total number of days when charges will be tabulated. It helps you be able to inform your customers of what to expect and when.

Submit transaction data promptly. Clear your transactions as soon as possible to make sure you don’t run into empty checking accounts or people forgetting what certain charges are.

Use clear billing descriptors. A billing descriptor appears on a customer’s statement as the name of a transaction. Make sure yours is easily read, something like BELGACOFFEE instead of 35030BE.

Confirm the projected clearing date. Set up an automated email that confirms a customer’s purchase and when they can expect those funds to withdraw. This helps the customer remember when and what they purchased and helps them properly prepare for the withdrawal.

Use incremental and estimated authorizations when appropriate. If your business is in rentals or anything that the final rate is determined by time instead of upfront, you should consider using incremental authorizations. These basically continue to set up transactions over time instead of waiting until the end to slap a big charge on a card — reducing the pain of a chargeback.

Process authorization referrals quickly. If you detect any type of error during the transaction, don’t wait for a chargeback to occur. Go ahead and reverse it as an authorization reversal. This will help return the funds to the customer’s account quickly and encourage them to try the transaction again.

The bottom line on payment reversals

Payment reversal or credit card reversal is somewhat of a broad term, but whether you’re dealing with authorization reversals, refunds, or chargebacks, they all have different applications and consequences for your business.

Above all, be quick, and be smart. Don’t wait for the problems to come to you!

With Tidal, we actually devote an official chargeback assistant to your team when you use our merchant services. Instead of spreading yourself super thin and picking up extra responsibility, why not get an expert to help you fight while saving up to 35% on processing fees?

8 notes

·

View notes

Text

What is payment processing and how does it work?

Online shopping has become a new way of life for many people. So much so that online shopping has been projected to reach $3 trillion in sales by 2030. In order to make online shopping easy and fun, most ecommerce websites offer a variety of payment options and other services. Payments processing is one of those services and it can be difficult to understand. The goal of this blog is to explain payment processing in a way that’s easy to understand.

What is a payment processing service?

A payment processing service is basically a company who takes your money and pays for the service you need. You can use them to pay for things like Netflix, PayPal, or even for your monthly cell phone bill. Payment processing services are typically a third party, so you don’t have to pay for them out of your own pocket.

How does a payment processing service work?

Whilst some weight-loss supplements are proven to work, there are others that are only marketed to help people lose weight. The supplements that are proven to work are those that provide a lot of different nutrients and a high level of protein. The supplements that are just marketed to help people lose weight are those that have a lower level of protein and are more likely to contain more sugar. These supplements are often marketed to women and children because they are much more likely to believe in the product and are more likely to trust the company.

What are the advantages of using a payment processing service?

A payment processing service is a good way to make sure that your business is operating smoothly. The benefits of using a payment processing service are many. They are able to mitigate the risk of fraud and chargebacks. This is important because these are the most common reasons why businesses go out of business. They also provide a safe and secure payment environment. This is important because it can help to protect your company from any security breaches. Furthermore, they provide a wide range of payment processing options. This is important because it can help to reduce your costs and increase your profits.

What are the disadvantages of using a payment processing service?

There are many disadvantages to using a payment processing service. The biggest disadvantage is that you are giving your personal information to a third party. This means that the company has access to your personal information. This can cause a lot of problems, especially if the company goes out of business. If the company goes out of business, your personal information may be lost. It is important to keep in mind that this is a huge risk. Another disadvantage is that you are giving a third party your personal information. This means that they have the ability to take your personal information and sell it to another company. With this in mind, you should be careful what information you give to a payment processing service.

Conclusion

We hope you enjoyed our blog about payment processing and how it works. If you are new to the payment processing industry or need a refresher on the basics, this article is for you. Thank you for reading, we would love to hear from you!

4 notes

·

View notes

Text

An Overview of Social Gaming Merchant Account

Gaming has become a huge market and a rapidly growing business with almost 2 billion + gamers worldwide. This has become a huge market and people are connected continuously worldwide are being connected to this profession with great speed. This sector has shaped very broad social, cultural, and business trends and made way for many companies and many individuals to earn and make a career in it.

We always expect this sector to grow regardless of age group and for those cashless methods for payments or contactless methods for payments are important. For this change need for growing customer contactless and cashless transactions solutions should be in the future to make this online business grow.

There are many Online Gaming Merchant Accounts that can make this possible with ease your Social Gaming Merchant Account can grow with ease and you can accept any kind of online cashless payment with ease.

What is a merchant account?

A merchant account is basically a kind of bank account that allows a business to accept payments majorly in debit cards and credit card forms. It is established with a mutual agreement between the acceptor and bank for cashless transactions.

KEY TAKEAWAYS

• A vendor account is a ledger explicitly settled for business purposes where organizations can make and acknowledge instalments.

• Vendor accounts permit, for example, a business to acknowledge Visas or different types of electronic instalments.

• Vendor account benefits frequently accompany added expenses, yet in addition a variety of administrations.

Is the gaming industry a high-risk industry?

The following points can explain why the gaming industry is called a high-risk industry -

The gaming business has a high-volume turnover which is viewed as a gambling factor by banks and shipper account suppliers who are giving them a credit line.

The gaming organizations are based seaward and there have been occasions of tax evasion and misrepresentation making it a high-risk business.

The item presented by the gaming industry is a high-risk item as there is a potential for various chargebacks and discounts, expanding the obligation the processor would probably cause while handling the business.

The gaming business vendors might be somewhat new in their fields and in this way have no credit line, expanding the possibilities of bankruptcy and hence setting the bank/shipper account supplier guaranteeing them at a monetary risk.

Conclusion

With 5 Star Processing, you can get an Online Gaming Merchant Account or a Social Gaming Merchant Account with ease. We lead the way in helping small businesses grow. We offer a variety of products and services that fit our business owners’ needs every day either your goal is to accept credit card payments, or you are looking for a sense of direction on how to get started. We can help!

2 notes

·

View notes

Note

Doing a chargeback and then lying about it is kinda a pathetic move honestly, then making your bf threaten to dox for you? Yea good luck trying to explain that honey. Enjoy being black listed by every artist known to man for that one. Fireflea said she put her on artistbeware for that lil stunt. Guess she has to learn to draw (draw, as in not trace) from now on for her art lol.

.

1 note

·

View note

Note

for those waiting on customs, breedings, or just overall have spent cs currency or real money on CLs, PLEASE know that you are absolutely allowed to ask for your money/pets/c$ back and to escalate the situation if arcade isn't communicating with you. ESPECIALLY since they literally are not letting you trade off your CLs and froze everyone's SDs (live link).

if you've paid money directly to arcade for CL currency/anything else related to CLs and you have not used the item/currency, dispute it. message them on cs and discord asking for a refund on your stuff. it's ridiculous that you're not allowed to trade away your designs or currency, which is something that YOU paid for. unfortunately for things that you've traded for and not directly put pets/c$/irl money on, you're going to have to cut your losses. but if anyone else has any suggestions to recoup the shit that was taken away feel free to add on!

if arcade is not communicating with you or giving you bullshit? send in a help ticket to cs staff explaining the situation and that you would like a refund. or if you paid thru paypal to arcade, you might be eligible for buyer protection and you are totally allowed to file a chargeback if you're still within the window. please note, that if you paid through friends & family you do not have buyer protection and i implore you to never pay through F&F in the future. be wary of artists that do this! it is against paypal TOS, and you will not be eligible for buyer protection if the commission goes awry

.

2 notes

·

View notes

Text

hello again.

i thought about it this blog randomly today and i wanted to talk about something. wanted to talk about my suspension, no i’m not coming back.

i requested a suspend and the original reason was for mental health and about two weeks later, the suspension was changed to suspicion for owning more than two accounts and funneling.

i took a very large commission from a roleplay from for a 40 chapter story since ya know we’re writers, it costed a decent amount where mods though it was funneling so we got a warning and eventually an embargo. tried to explain the situation and mods didn’t really give a fuck.

my other roleplay buddy stepped up since they’re dating this person, as an agreement we set up a payment plan to hold a couple lions for me and i’d give a small discount. accused of funneling and owning that account so i now have a permanent suspension.

I also chargeback every purchase I made which was over 2,000 usd so 🫢 fuck lioden and katze

2 notes

·

View notes

Text

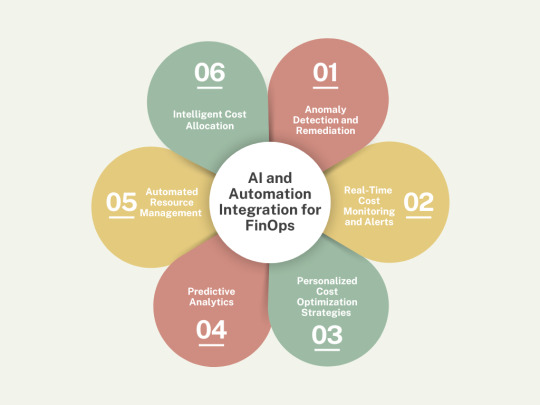

AI and Automation in FinOps to Streamline Processes

“The mindset and culture is changing among finance professionals with AI making big strides in financial operations (FinOps).” Sigma Solve Inc.’s CEO, Biren Zaverchand, explains AI and automation solutions in finance.

Finance professionals increasingly recognize the scope and benefits of AI-driven automation in financial operations. They are eager to partner with AI ML development companies like Sigma Solve Inc. to leverage cutting-edge technology. This technology can help them overcome the complexities of cloud cost management, resource optimization, and regulatory compliance, leading to more efficient and cost-effective FinOps.

Synopsis

The financial world is going through a transformative phase. Risk aversion and efficient operations are the core concerns of the finance sector, and synthesizing AI and automation solutions with FinOps is revolutionizing the fundamentals of the financial world.

This blog explains how fintech process automation and artificial intelligence can help finance businesses enhance productivity, scalability, and agility and optimize resource allocation for better visibility, security, and profitability.

Understanding FinOps: A Primer

FinOps is a technical term popularized after financial institutions started migrating their business processes from physical IT infrastructure to the cloud. Financial operations became FinOps with cloud management of financial processes to streamline workflows, risk aversion, transparency, and resource optimization.

Fintech process automation is gaining traction as the world becomes more constrained by inflation, high interest rates, diminishing ability to borrow, and excessive investment in war machines. Amid this conundrum, data security and operational efficiency bother finance managers the most.

Financial institutions have been moving their business processes to the cloud to achieve data security, resource optimization, and market agility. Finance businesses spend less on cloud-based financial operations than on physical IT infrastructure. Still, many businesses are quickly learning that the cost of the cloud may shoot up fast if not managed well, or systems may be rendered vulnerable if not migrated to the cloud.

The Power of Automation in FinOps

FinOps automation solutions take over iterative financial tasks, ensuring minimum human interventions, free from errors, and scale for peak performance to save human resources and cloud costs. Sigma Solve designs AI and automation solutions for FinOps to identify inefficiencies, anomalies, and vulnerabilities to track waste and excessive human capital to improve productivity, cost-effectiveness, and data security.

Financial forecasting:

Advanced AI algorithms can be deployed to analyze historical data and data-created patterns to identify various financial trends and forecast future outcomes.

Tagging:

Automation in FinOps helps financial institutes identify the need for funds for a particular project, branch, or department, enabling efficient cost allocation and accurate cost management.

Provisioning and Scaling:

AI and automation solutions bring seamless scalability to FinOps, ensuring human and financial resources are well-allocated based on defined rules to prevent wastage.

Cost Allocation and Chargeback:

Transparency and accountability are at the core of financial transactions. Automation solutions help banks allocate costs and chargeback to ensure optimum cloud usage and avoid overspending.

Reporting and Budgeting:

Report preparation and budget planning are repetitive tasks that fintech process automation solutions take over to help businesses gain data-driven insights into cloud spending and cost-cutting.

Integrating AI and Automation into Your FinOps Strategy

Assess Current FinOps Maturity:

Begin by evaluating your current financial operations. Understand the intricacies of your processes and identify bottlenecks where AI and automation can significantly impact them. This assessment will give you a clear starting point for integration.

Define Automation and AI Goals:

Set specific, measurable goals for what you aim to achieve with process automation solutions and AI. Whether it’s reducing manual data entry, speeding up report generation, or achieving real-time cost analytics, having clear goals will guide your integration process.

Select the Right Tools:

With a plethora of fintech process automation tools available, choosing the right one is crucial. Look for tools that offer Advanced Predictive Analytics, Automated Cost Optimization, Anomaly Detection, and Root Cause Analysis capabilities that align with your goals.

Develop a Data Governance Strategy:

Data is the lifeblood of AI. Implement a robust strategy for data collection, storage, and security. It will ensure that AI systems can access high-quality data to generate reliable insights.

Implement and Monitor:

Integrate the chosen AI ML development services and automation tools into your workflows. Monitor their performance continuously and be prepared to iterate and refine your strategy. Remember, integrating AI and automation is not a one-time event but an ongoing process that evolves with your business needs.

By following these steps, you can ensure that your FinOps strategy is up-to-date and primed for future advancements in AI and automation.

The Future of FinOps: A Collaborative Dance with AI and Automation

Collaborating artificial intelligence solutions with FinOps creates multiple impact points rather than just saving cloud costs. AI and automation solutions, in general, help businesses save costs; therefore, they play a critical role in saving cloud costs. However, the major impact will be protecting user data and preserving the applications and systems from cyberattacks.

The symbiotic relations between artificial intelligence and FinOps speak of a promising future for financial institutions’ operations. Finance businesses are assured that AI will be prominent in shaping FinOps for cost-cutting, strategic decision-making, and effective operations implementation.

Continuous Optimization:

AI solutions are built to monitor, evaluate, and adapt systems for continuous optimization, ensuring resources are well-allocated and costs are proportional to resources utilized.

Predictive Analytics:

Data from the past will be deeply analyzed to predict future trends and patterns using advanced machine learning algorithms to gauge future demands and market trajectory.

Automated Governance:

Adhering to government regulation and compliance is critical for financial institutions. AI-empowered automation will ensure that all policy-level measures align with regulations across the cloud infrastructure.

Intelligent Cost Allocation:

We will witness rational and accurate allocation of costs across business units and projects on the cloud based on predefined allocation models to create a sense of transparency and accountability.

Actionable Insights:

The decision-making will completely change in FinOps with advanced data-driven insights and visualization. FinOps teams can add strategic value to the business with informed decisions.

How Sigma Solve Can Help Streamline FinOps with AI and Automation

Sigma Solve has been making significant strides with AI and automation solutions to enhance business efficiency and help businesses cut costs to become competitive. Our advanced machine learning algorithms help financial institutes reduce operations and cloud costs and gain much-needed insights into their FinOps, financial sector, and market to grow strategically and lead the competitive sector.

Sigma Solve’s developers and engineering experts conduct rigorous reviews of the project, clients’ objectives, functionalities, practical usage, and scalability to determine the project timeline, team combination, and scalability. Finance institutes can easily hire AI solution developers as their dedicated resources from Sigma Solve’s vast and experienced talent pool.

Sigma Solve is a proven technology partner for your enterprise application development needs. Consult our IT experts to acquire new capabilities and set a progressive path toward building better AI and automation solutions. Call us at +1 954-397-0800 for a free consultation.

Original Source: Here

0 notes

Text

RENTALZI (Rentalzi.com Scam?)

Who are they?

After taking a look at their website, it shows that they do not fall under any regulating agency. That is a MAJOR RED FLAG!! That should be enough for you NOT to invest with them. And they also work with websites that offer “Automated trading software” which is another red flag, as these kinds of websites are notoriously famous for scamming schemes.

So Rentalzi is just another unregulated forex broker, which means the customers are not protected, and it is highly likely they will get away with your hard-earned money and there will be no regulating agency to hold them responsible.

In today’s forex market flooded with scam brokers, traders must tread every online financial trading company carefully. You must be particularly aware of shady brokerage firms like Rentalzi that are anonymous, do not hold any trading credentials, and provide poor services based on deception.

If you have come across the Sundell- fx broker, you will soon realize how fraudulent this company is. So, continue with our Rentalzi review for more information about this investment scam.

On top of that, we seriously recommend you not invest in the fake brokers BCH Advance, iToroStocks, and WiseFXPr. Do not trade with these unlicensed brokers if you want to save your money!

Broker status: Unregulated Broker

Regulated by: Unlicensed Scam Brokerage

Blacklisted as a Scam by: N/A

Owned by: N/A

Headquarters Country: Australia

Foundation year: 2022

Supported Platforms: Web Trader

Minimum Deposit: 2,500 USD

Cryptocurrencies: Yes (Bitcoin, Litecoin, Ripple)

Types of Assets: Cryptocurrencies, Forex

Maximum Leverage: 1:100

Free Demo Account: No

Accepts US clients: No

How does it work?

Usually, unregulated forex brokers work in the following way. They will call people to persuade them to make the initial minimum deposit while trying any conceivable method in order to make that happen. They will offer deals that sound too good to be true like we will double your initial deposit or you will make $100 per day easily. Please don’t fall for anything they say!!! It is a SCAM! After making the initial deposit, people get transferred to a smarter scammer, called a “retention agent”, who will try to get more money out of you.

Withdrawing funds

You should submit a withdrawal request ASAP because your funds are never safe with an unregulated broker. And here is when things get tricky.

If you want to withdraw your money and it does not matter if you have profits or not, they will delay the withdrawal process for months. If they delay it for six months, you won’t be able to file a chargeback anymore and your money is gone for good. It does not matter how often you remind them or insist on withdrawing your money, you will NOT get them back. And if you signed the Managed Account Agreement or MAA, which is basically authorizing them to do anything they want on your account, they will lose all your funds so there won’t be anything to request anymore.

How to get your money back?

If you already deposited your money with them and they refuse to give your money back, which is very likely to happen, don’t worry, it might be a way or two to get your money back.

First of all, you need to keep the emails as proof that you have been requesting the money back from them but they don’t give it to you, or they delay the process for too long, with the intention of not refunding your money.

The first thing you should do is perform a chargeback! And you should do this right away! Contact your bank or credit card provider and explain how you were deceived into depositing for a trading company that is not regulated and refuses to give your money back. This is the simplest way of getting your money back and is also the way that hurts them the most. Because if there are many chargebacks performed, it will destroy their relationship with the payment service providers. If you haven’t done this before or you are not sure where to start or how to present your case to your bank or credit card company, we can assist you in preparing your chargeback case.

What about wires?

If you sent them a wire, there is no way to perform a chargeback on a wire. For this step, you need to raise the fight to a different level. Tell them that you will go to the authorities and file a complaint against them. That will get them to rethink the refund possibility. Another thing you can do is prepare a letter or email for the regulating agencies. Depending on the country where you live, you can search on google to find the regulating agency for Forex brokers in that country. After that, you can prepare a letter or an email describing how you got deceived by them. Make sure you show this letter or email to them and tell them you will send it to the regulating agency if they don’t refund your money.

Is Rentalzi a Licensed Forex Broker?

Forex trading is a heavily controlled industry by financial regulatory agencies closely cooperating with governments and ensuring that every broker complies with relevant legislation.

When a phony broker like Rentalzi doesn’t state its headquarters or any information about the company’s registration, it is hard to determine its jurisdiction. This is done with the purpose to cover up the fact that it is an unlicensed and unregulated business.

The only info about Rentalzi available on its website is a telephone number, which is an Australian phone number according to the dialing code. That brings us to the assumption that this broker might be based in Australia, which is one of the most stringent jurisdictions.

If it is the case, it is impossible to be a legitimate broker without being authorized by the Australian financial authority, ASIC. Not unexpectedly, Rentalzi is not licensed under this or any other financial market regulatory agency.

Why Is Trading On a Licensed Broker’s Platform Preferable?

Unlike unauthorized brokers, certified companies can be trusted with money since they adhere to a strict code of conduct – especially forex providers regulated by top-level supervisory bodies like the Australian ASIC, British FCA, and German BaFin. For example, ASIC’s eligibility conditions stipulate a broker maintain a minimum operating capital of 1M AUD and keep its and traders’ money separated (segregation of funds).

Additionally, traders of licensed brokers are protected by indemnification programs run by supervisory agencies. For example, ASIC covers traders with a 100,000 AUD indemnification in the event of a broker’s bankruptcy. On top of that, legitimate companies implement a range of risk management measures to mitigate trading risks, such as offering negative balance protection (a trader can lose more than deposited), cooperating with first-rate banks, providing reliable trading platforms, and ensuring propitious trading conditions.

So Rentalzi GLOBAL ICM a Decent Broker or a Scam?

Rentalzi is an anonymous and unregulated broker running online trading scams and cheating traders from the UK, Canada, Australia, the US, and Sweden.

What Trading Software Does Rentalzi Offer?

Speaking of the Rentalzi portal, a trading platform available here, it is a web trader with limited functionality. This unscrupulous broker claims that its web trader fits the needs of both beginners and experienced traders. However, we are dubious about that since it has generic functions that can’t ensure profitable trading.

As far as that is concerned, your best option is the latest trading programs – MetaTrader 4, MetaTrader 5, cTrader, and Sirix – providing advanced tools such as expert advisors, stop loss, fast execution, unlimited pending orders, copy trading, and more.

Make sure you leave reviews about Rentalzi on other sites

Another way to hurt them and save other people from falling victims is to leave bad reviews on other sites, and describe shortly what happened. If you have fallen victim please leave a review and a comment on this site in the comment section. Also, when these people change their website they tend to call the old clients, so if they call you from a new website please write it down on the comment or let us know by contacting us. That would be really appreciated by us and families all over the world. Also if you get phone calls from other companies please put the name of these companies also in the comment or send it to us. We will expose them too.

Rentalzi Review Conclusions

Making the Rentalzi review is actually a pleasure for us, and we hope to save as many people as possible from losing their hard-earned money. A good rule of thumb is to carefully review all the Forex companies and any other company for that matter before you perform any transaction. We hope that our Rentalzi review has been helpful to you.

1 note

·

View note

Text

RENTALZI (Rentalzi.com Scam?)

Who are they?

After taking a look at their website, it shows that they do not fall under any regulating agency. That is a MAJOR RED FLAG!! That should be enough for you NOT to invest with them. And they also work with websites that offer “Automated trading software” which is another red flag, as these kinds of websites are notoriously famous for scamming schemes.

So Rentalzi is just another unregulated forex broker, which means the customers are not protected, and it is highly likely they will get away with your hard-earned money and there will be no regulating agency to hold them responsible.

In today’s forex market flooded with scam brokers, traders must tread every online financial trading company carefully. You must be particularly aware of shady brokerage firms like Rentalzi that are anonymous, do not hold any trading credentials, and provide poor services based on deception.

If you have come across the Sundell- fx broker, you will soon realize how fraudulent this company is. So, continue with our Rentalzi review for more information about this investment scam.

On top of that, we seriously recommend you not invest in the fake brokers BCH Advance, iToroStocks, and WiseFXPr. Do not trade with these unlicensed brokers if you want to save your money!

Broker status: Unregulated Broker

Regulated by: Unlicensed Scam Brokerage

Blacklisted as a Scam by: N/A

Owned by: N/A

Headquarters Country: Australia

Foundation year: 2022

Supported Platforms: Web Trader

Minimum Deposit: 2,500 USD

Cryptocurrencies: Yes (Bitcoin, Litecoin, Ripple)

Types of Assets: Cryptocurrencies, Forex

Maximum Leverage: 1:100

Free Demo Account: No

Accepts US clients: No

How does it work?

Usually, unregulated forex brokers work in the following way. They will call people to persuade them to make the initial minimum deposit while trying any conceivable method in order to make that happen. They will offer deals that sound too good to be true like we will double your initial deposit or you will make $100 per day easily. Please don’t fall for anything they say!!! It is a SCAM! After making the initial deposit, people get transferred to a smarter scammer, called a “retention agent”, who will try to get more money out of you.

Withdrawing funds

You should submit a withdrawal request ASAP because your funds are never safe with an unregulated broker. And here is when things get tricky.

If you want to withdraw your money and it does not matter if you have profits or not, they will delay the withdrawal process for months. If they delay it for six months, you won’t be able to file a chargeback anymore and your money is gone for good. It does not matter how often you remind them or insist on withdrawing your money, you will NOT get them back. And if you signed the Managed Account Agreement or MAA, which is basically authorizing them to do anything they want on your account, they will lose all your funds so there won’t be anything to request anymore.

How to get your money back?

If you already deposited your money with them and they refuse to give your money back, which is very likely to happen, don’t worry, it might be a way or two to get your money back.

First of all, you need to keep the emails as proof that you have been requesting the money back from them but they don’t give it to you, or they delay the process for too long, with the intention of not refunding your money.

The first thing you should do is perform a chargeback! And you should do this right away! Contact your bank or credit card provider and explain how you were deceived into depositing for a trading company that is not regulated and refuses to give your money back. This is the simplest way of getting your money back and is also the way that hurts them the most. Because if there are many chargebacks performed, it will destroy their relationship with the payment service providers. If you haven’t done this before or you are not sure where to start or how to present your case to your bank or credit card company, we can assist you in preparing your chargeback case.

What about wires?

If you sent them a wire, there is no way to perform a chargeback on a wire. For this step, you need to raise the fight to a different level. Tell them that you will go to the authorities and file a complaint against them. That will get them to rethink the refund possibility. Another thing you can do is prepare a letter or email for the regulating agencies. Depending on the country where you live, you can search on google to find the regulating agency for Forex brokers in that country. After that, you can prepare a letter or an email describing how you got deceived by them. Make sure you show this letter or email to them and tell them you will send it to the regulating agency if they don’t refund your money.

Is Rentalzi a Licensed Forex Broker?

Forex trading is a heavily controlled industry by financial regulatory agencies closely cooperating with governments and ensuring that every broker complies with relevant legislation.

When a phony broker like Rentalzi doesn’t state its headquarters or any information about the company’s registration, it is hard to determine its jurisdiction. This is done with the purpose to cover up the fact that it is an unlicensed and unregulated business.

The only info about Rentalzi available on its website is a telephone number, which is an Australian phone number according to the dialing code. That brings us to the assumption that this broker might be based in Australia, which is one of the most stringent jurisdictions.

If it is the case, it is impossible to be a legitimate broker without being authorized by the Australian financial authority, ASIC. Not unexpectedly, Rentalzi is not licensed under this or any other financial market regulatory agency.

Why Is Trading On a Licensed Broker’s Platform Preferable?

Unlike unauthorized brokers, certified companies can be trusted with money since they adhere to a strict code of conduct – especially forex providers regulated by top-level supervisory bodies like the Australian ASIC, British FCA, and German BaFin. For example, ASIC’s eligibility conditions stipulate a broker maintain a minimum operating capital of 1M AUD and keep its and traders’ money separated (segregation of funds).

Additionally, traders of licensed brokers are protected by indemnification programs run by supervisory agencies. For example, ASIC covers traders with a 100,000 AUD indemnification in the event of a broker’s bankruptcy. On top of that, legitimate companies implement a range of risk management measures to mitigate trading risks, such as offering negative balance protection (a trader can lose more than deposited), cooperating with first-rate banks, providing reliable trading platforms, and ensuring propitious trading conditions.

So Rentalzi GLOBAL ICM a Decent Broker or a Scam?

Rentalzi is an anonymous and unregulated broker running online trading scams and cheating traders from the UK, Canada, Australia, the US, and Sweden.

What Trading Software Does Rentalzi Offer?

Speaking of the Rentalzi portal, a trading platform available here, it is a web trader with limited functionality. This unscrupulous broker claims that its web trader fits the needs of both beginners and experienced traders. However, we are dubious about that since it has generic functions that can’t ensure profitable trading.

As far as that is concerned, your best option is the latest trading programs – MetaTrader 4, MetaTrader 5, cTrader, and Sirix – providing advanced tools such as expert advisors, stop loss, fast execution, unlimited pending orders, copy trading, and more.

0 notes

Text

Most common reasons why is your Cash App account closed?

Cash App is one the most popular digital payment app among millions of smartphone users. It allows you to send money, receive it, and manage your account with just a couple of taps. Cash App is a convenient app, but some users find that their account has been closed unexpectedly. Your Cash App account closed due to several reasons. These include violating the Terms of Service, engaging in suspicious or unauthorized activities, having verification issues, and suspicions of money laundering. A notification will usually be sent with specific instructions for what to do after an account is closed. Cash App may have closed your account due to a violation of their terms and conditions.

Cash App will ask you to follow their instructions and provide documentation, such as your transaction history or proof of identification. This will ensure that your account is treated fairly and impartially. Let's start by learning about the most common reasons why did my Cash App get closed. We will also discuss what you can do if this happens to your account and how to avoid it in the future.

Why Your Cash App Account Was Closed?

Cash App aims to offer a smooth and secure financial experience to its users. However, Cash App accounts can be closed for a variety of reasons which are mentioned below:

Cash App account closed for violating terms of service. This includes fraud, the use of false identities or illegal transactions. Accounts may be immediately closed and funds seized if someone violates the rules.

Cash App accounts can also be closed if they are suspected of being used to gamble. This is a violation of their terms of service agreement, and it allows them to close any suspected account of gambling activity.

Cash App's policy is to close any account that has been dormant or inactive for an extended period. This ensures users are active on the platform.

Cash App monitors account activity closely to detect signs of fraudulent or suspicious behaviour. Cash App may close your account if it is flagged as having unusual activity. This will protect you and the platform.

Cash App's security measures require users to confirm their identity. Your account could be closed if you do not complete the verification process or provide incorrect information.

Excessive chargebacks can cause account closure. These occur when customers dispute transactions through their bank and request refunds. Cash App may consider many chargebacks to be a sign that the platform is being abused or fraud.

How to Avoid Cash App Account Closed?

Cash App users are often in the unfortunate situation of having their accounts closed. This can be frustrating and confusing if they still have money in it. Do not worry: you can recover your money with the right knowledge. It is essential to follow the Cash App's guidelines and terms of service to avoid frustration and inconvenience. Here are some helpful tips to prevent account closed issues on Cash App:

Cash App will only allow you to keep your account operational if you adhere to the terms of service. For example, using Cash App to fund gambling activities is against their rules and could result in its closure. Other instances include unapproved behaviour, identity verification problems and suspicious behaviours.

If you have a Cash App account closed with money that was intended to be there, your first step should always be to contact customer service to explain the situation and get clarification. If an account is closed for violating the terms of service or due to fraud, all funds will be returned.

Cash App should be notified immediately if you notice any suspicious or unauthorized transactions.

Avoid engaging in prohibited activity such as fraud, money laundering or excessive chargebacks.

Cash App customer support takes all allegations of fraud or illegal activity seriously and will work hard to resolve any issues quickly. Please follow their instructions, including completing any requests for identity verification and documents. Also, be sure to review your account activity regularly and report any suspicious or unauthorized transactions.

0 notes