#bitcoin scam protection

Text

mercs on the dark web headcanons

(dark!characterization below/general taboo dark web subject mater. proceed at your own discretion.)

Sniper

red room live streamer

Women fear him, the CIA want him.

Aside from profiting on the mutilation of the lives of the innocent he's a regular poacher and sells exotic/protected animals hides, meat, or sometimes live specimens.

Scout

Amphetamines manufacturer and distributer. He regularly gets high off his own supply who's gotten into run-in with the police as far back as he can remember.

Got scammed out of $10k buying a fake Alligator skin couch.

Big fan of Sniper's live streams, but doesn't have the guts to sit through the truly grizzly parts.

Pretends to know how Bitcoin works.

Spy

Hitman for hire.

Everyone hates his ass because he acts like a narc, and no one can trust him. But despite his unknown affiliations and methods, he always gets the job done.

Has seen an unfortunate amount of political figure's nudes searching through confidential documents.

Medic

Black market organ harvester and consumer.

The most likely to have Reddit threads about himself and his infamy. (maybe he would sneakily encourage this some how? he would really thrive off of that kind of attention.)

He's the only person Sniper's ever collaborated with and featured as a second party torturing a victim in a live stream.

Likely has some insane history with the human experimentation crowd.

OG member of the cannibal cafe

Pyro

She has no idea how to access the dark web, but watches a lot of "Lost Media" videos, creepypastas and pirates cartoons and anime. She assumes that's a part of what everyone else is talking about

Engie and Demo

Producing, modifying and manufacturing wildly unsafe and unregulated: firearms, explosives, chemical weapons- maybe even automobiles.

They don't do this for the rush, or the money, or the feeling of power; but rather out of an almost pure-hearted love for their craft.

Have somehow never been raided by the FBI or the DEA

Soldier

His special interest is HiddenWiki articles about terrorism and conspiracy theories.

No one understands how he managed to access the deep web in the first place.

Bulk buys his percs here.

Heavy

¯\_(ツ)_/¯ My best guess is he's buying some of the animal meat Sniper sells. He doesn't seem like someone who would care much for digital carnage.

#mdni#dead dove do not eat#also not to sound like a massive tool. but- i think 'women fear him. the cia want him' is my favorite thing i've ever written#dark!character#this au has potential alright just trust me guys

21 notes

·

View notes

Text

I think what artists, musicians, writers, pretty much every creative person really, all need to understand is that under capitalism, everything they make is worthless. AI, piracy, whatever, they're all just windmills you're tilting at. Even if by some miracle you did manage to defeat it, it would soon be replaced by some other terrible mechanism which alienates you from your creation, because that's how Capitalism works.

This is just the latest iteration of a process that's been happening for over 500 years now. It's just now instead of enclosing a physical commons for the private profit of aristocrats, oligarchs are enclosing the digital commons. Consolidating the public spaces of forums, message boards, webrings, and other democratically driven online spaces into the few mega-sites of Facebook, Reddit, Twitter, and so on has run its course. Now the capitalists have turned to trawling the rest of the internet to try and wring whatever value they can get from it.

And just like the process of enclosure or mechanization or industrialization, there's no putting that genie back in the bottle. They've already scoured the internet for untold trillions of pages of data and images and what not. The damage is done. It doesn't matter what further damage is going to come from it either, because the dirty not-so-secret of the tech world is that this is it. They have no more bright ideas. Pretty much every great thing to Google's name, they bought. All their in house initiatives failed. Google video? Google groups? Google glass? They make their money selling ads that nobody cares about. Same with Facebook. They just spent billions to create a crappy Second Life clone that no one gives a fuck about. These tech corporations are massive, lumbering, doomed empires, especially now that covid has pretty much brought the era of 0%-interest loans to an end. Without the billions of dollars of venture capital being pumped into Uber and Twitter and all the rest, now they've got to actually start making money, which none of them are actually able to do. Now they're desperate for some new gimmick to latch onto to try and turn a profit or attract ever dwindling venture capital. Bitcoin was the last big scam. Remember Libra? NFTs were the big thing after that. NFT images! NFT tv shows! NFT games! Here we are a year later and no one fucking talks about them any more. AI is just more of this magic bean bullshit.

Aside from all of that, even if AI was managed to be beaten back, you can assume that whatever the cure the powers that be settle on will be worse than the disease. Whatever "protections" get put into place will only be used against individual artists. At the end of the day, these big corps are just going to end up keeping all the information they've already stolen, the algorithms they used to steal it, and then will put laws into place legitimizing that theft after the fact. You're simply not going to win that fight, because the battle's already been lost.

The only long term solution to this is to attack the root cause, which is a system that relies upon exploitation in order to accumulate profit. Profits are what feed these massive corporate beasts, and as they're starved by falling profits, they'll only grow more ravenous and rapacious. We're only at the opening stages of this trend now, and things are only going to get worse.

17 notes

·

View notes

Note

My mom just got scammed out of ~$2500 through one of those "oops you accidentally bought something (in this case it was Bitcoin) we'll refund you - oops we refunded too much just get a Vanilla gift cards and tell us the pin numbers to pay back the difference" scams so here's a reminder to never click strange links in your text messages, or call those "customer support" numbers. Call your bank instead and get a new card issued.

... Also what can she do? Will the bank pay her back?

Oh no! This literally gives me a stomachache. Your poor mom!

She should file a fraud claim with her bank. In certain cases, the bank's insurance will cover the theft and give her the money back. She should also take measures to protect any aspects of her identity or finances that might have been stolen. We go over how to do that in our Equifax data breach article:

The Equifax Data Breach and Identity Theft: Dafuq Just Happened?

Your mom should NOT feel dumb. These scammers are very good at targeting vulnerable folks and they have no compunctions over doing lots of harm. One of my favorite YouTubers is Scammer Payback because he goes to great lengths to expose them and give them a taste of their own medicine.

Also, make sure she reads this so she can protect herself against other scams:

10 Ways to Spot Financial Scams and How to Defend Yourself

50 notes

·

View notes

Text

Leverage Redemption Log: The Unwellness Job

We start this episode in a room with an expository camera-pan past some pictures and boxes of MLM herbal remedies.

---

Client is a doctor, suspects its an autoimune disorder. All tests are inconclusive.

what in the heck is a "maven"? (google says "expert or connoiseur")

Parker will be too busy with the International part of the branch to do much in the first few acts.

---

Our marks are Bronwyn and Melanie. (former is Influencer, latter is about to have a medical licence revoked)

"have you ever fought a shark" Breanna, do you even need to ask?

Well, the rabbit hole is working off some pretty evil word association. Lets ensure that by the end of the day, half those words will be coming from Bronwyn's own mouth.

I side with Breanna, what is with the knives today?

---

Ok so we're introducing a third mark: Bitcoin Bastard. Because we really needed a second pyramid scheme in this plot. (im worried this'll get cluttered quickly)

Bronwyn seems actually excited by the idea that nanobots are real.

Privacy is dead, and Breanna is absolutely right: Her generation doesnt know what it means because Sophies generation killed it.

---

Elliot is playing a slightly-creepy pseudo-hippie? ("i listen to their eternal song" feels verry... serial-killer-ey? but then anything with "eternity" sounds like "death" so i guess its just that)

"sweet nectar" like its the way he says it, definitly intended to be creepy.

No Melanie, dont apologise you are the only sane one here.

I legitimately didnt recognise Breanna until i rewound the scene cause i was like "who the heck is Zazi?"

---

I like Sophie's yellow jacket.

Classic divide-and-conquer, plead to Bronwyn's ego, make her remember how she's too good for Melanie.

Honeyed handshake (of eternal life... they're definitly setting up Elliots character to be some kind of serialkiller. Would be a good scandal, but also... kinda likely to backfire if she just backs out and becomes the Hero of the Beautyscene by outing her competitor as a serialkiller....)

---

Parker has grown enough in the timeskip that she now refuses to push people off roofs unless they have roof-jumping-training. Good for her.

---

Bitcoinbro wants to use the MLM to harvest private medical data. Because of course.

Sophie is actively hating herself every moment she spends with Bronwyn.

---

You launched too early. She hasnt yet said anything that would associate herself with Hank specifically, just with bees and honey in general. You've given her an enemy to rally against to become more succesfull by claiming that her honey-based products are different from Hanks.

unpaused the episode, i was right. (though she's not selling honey but stinger-juice). Good quick thinking on her part though. 10/10.

---

I absolutley agree with sophie, stealing thoughts in exchange for ones and zeroes, where's the style, the panache.

"I've been keeping up on my evil-lawyering reading" 7/10.

Sophie pulling the "only one who really understands", Harry doing the Accountant Special

Breanna's digging a little burrow of her own (and she's a good digger)

Even if he didnt go down it he'd still be paranoid (because he's guilty of moneylaundering and doesnt want to get caught) so its only really a cherry-on-top but its a well-crafted one.

---

Melanie is in the studio so Breanna needs to distract her. Time to turn an inside man..

Peggy and Hurley mention! Crowd going wild!

Chad is bringing his armed goons to the table. (certainly gonna help Sophie turn Bronwyn against him)

---

"Eivor is gonna have to kill you"

Well... Guess thats one way to ensure that Bronwyn cant ever run her little scam again, get her to turn on Chad and force her into witness protection, it'd be hell for her the same way it was for the car-enthusiast in the original series. Worse then prison or a fine, (those would actually make her more popular. She'd just brand herself as "persecuted by the system" and a "controversial truth-teller", but if she's on the run from Chads Murdermen... Well, goodbye influencer status)

Oh sophie is pulling the "we're conmen and you're just our mark"-excuse. Which is technically true but as long as you make them think you're after something different then your actual goal, you continue to mislead them.

Now Melanie is going to give us the data, Breanna is switching it out for the virus, and 40 mllion bitcoin goes down the drain.

---

Back at the Theatre the team has caught on to Sophie's Missing Person Status.

Melanie calls Zazi. "Hank" is coming to help.

"that would've stung, huh" obligatory joke. (also we're about to pretend to lose the fight. the fight is a distraction while we switch the drive for the virus)

Honestly, this might be the most humiliating way of taking down a goon yet (and im counting the Looney-Tunes Hole from the Sheherezade job in that. Beaten unconcious with a Qwynneth Paltrow Dildo while getting stung by bees is a humiliation you do not want in your armed-goon resume.)

---

Ah we're not switching drives by feigning a loss. We're knocking Eivor out and just bringing a fake drive. Much simpler and it doesnt force Elliot to take an L for dramatic fake-out.

Also yes, Harry is good at what he does.

that is a pen. That isnt even an EMP its a stopwatch app used as a distraction while the database whipes itself.

---

Oh magnetic phone-covers to pretend them sliding in the car. Didnt know they made those. (but then, i dont use my phone that much, nor do I own or drive a car)

And the look on his face when he realises what he just did to himself.

And i guess im right, Bronwyn is going into Witness Protection which means she cant work as an influencer ever again.

---

Back at the theatre Client and Melanie are working together to create a plan to actually help the people whose medical data Bronwyn took.

Parker once more becomes the most relateable character ever by outright admitting that for over a year, she didnt know Elliots name, only remembering it when other people used it.

"Janice" is in her own personal hell.

---

"you dont need my validation, but I will offer it" is such a dynamic. 10/10 line.

3 notes

·

View notes

Note

Its ok i have clicked on several scam links and may have one or more bitcoin miners on my computer. I will protect tou

Thank you Anon ;w;

I will send vibes so that those bitcoins go away!!

18 notes

·

View notes

Text

Notice on Comments

Hello! Just popping in real quick to say that I’ve gotten a couple suspicious comments with nonsense & a link. For reference, they look like this:

I am deleting comments like these without regard because they are likely spam or malicious links. As such, please refrain from posting any links on my fanfics -- of course, exceptions can be made with thorough explanation and verification that the links aren’t malicious or spam, but if they seem suspicious I will 100% delete comments from here on out that strike me as bots or as potentially dangerous.

That being said, allow me to run through a little Online Scam PSA. If you are unsure of the warning signs of a scam, hazard links, etc, please click to read more :)

I highly recommend all my followers to study up on ways to prevent yourself from being hacked or scammed -- be wary of any suspicious/unprompted emails, comments, or messages promising some kind of financial support or “free” gift. If you can, avoid even clicking on a message (especially DMs or texts) as these can potentially lead to your computer or account being hacked. Absolutely, under no circumstances should you ever send money to people you are unfamiliar with, unprompted and unreasonably. If they are accusing you of debt and are demanding payment through gift cards or Bitcoin, it is a 100% a scam and you will not be able to receive your money back.

I am not a legal reference, but my dad is a fraud detective who specializes in Embezzlement, Pyramid Schemes/White Collar Crime, and most common forms of Fraud, so I try to offer that knowledge whenever possible to protect others. If you’re ever unsure if something is a scam or if an offer seems too good to be true, it’s likely bad news :D But seriously, don’t be afraid to drop in my DMs any questions/comments/concerns if y’all have any questions on the matter bc the world is crazy rn and none of us can afford to lose more money than we already are XD

I’m more active on my main Tumblr @danni-dollarsign, so send DMs there if you can! Thank you and pls be careful out there!!!

#psa#online fraud#online scams#spam links#I got 2 on my fics on ao3#freaked me out cuz I don't want any of my readers to click those links#can never have too much awareness on digital fraud/scams#I am not kidding pls reach out if you're unsure#better safe than sorry

14 notes

·

View notes

Text

What is Worldcoin? Is Worldcoin the Next Bitcoin?

If you have been asking yourself, " What is Worldcoin? " then you have arrived at the appropriate location. This blog post will explain what "worldcoin" is, how "worldcoin" works, what "makes it special," and what "the creators had in mind when they made it when they made it." So, shall we get started?

The recently released "Iris biometric crypto project, Worldcoin," which has been creating a stir across the internet, was established by Sam Altman, the Chief Executive Officer of OpenAI. It seeks to differentiate humans from online AI while at the same time protecting personal privacy, improving democratic procedures, and possibly introducing a universal basic income that is supported by AI.

In spite of the fact that the endeavor garnered a respectable amount of support, there has been a great deal of criticism leveled against it. Internet users have been seen holding signs that read "Scam" and "Rekt soon" and have posed inquiries regarding the existence of possible deficiencies.

What exactly is a Worldcoin?

The Chief Executive Officer of OpenAI, Sam Altman, is the one who initiated the Worldcoin cryptocurrency project with the intention of creating a decentralized proof-of-personhood solution. It was established in 2019 by OpenAI CEO Sam Altman, along with Alex Blania and Max Novendstern, and it is supported financially by venture capital firm Andreessen Horowitz.

WLD is a native token of Worldcoin that operates on the Ethereum Blockchain. WLD The WLD token has been a sensation on the cryptocurrency market ever since it was first introduced. despite the fact that it won't be sold in the United States.

READ MORE

2 notes

·

View notes

Text

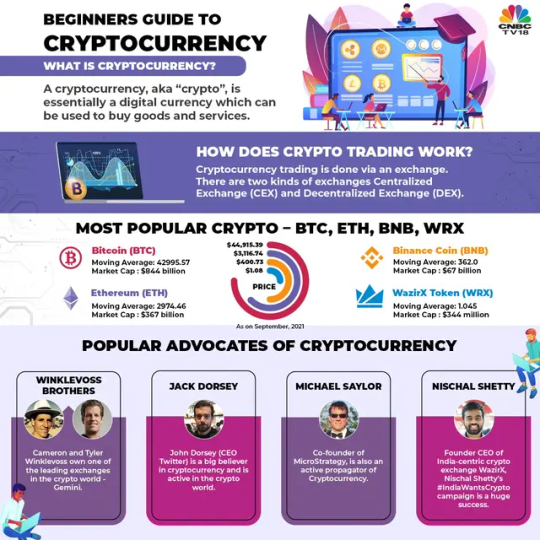

Cryptocurrency for Beginners: Essential Insights and Guidance

Cryptocurrency, a digital and decentralized form of money, has transformed the way we think about finance and technology.

For beginners, navigating the world of cryptocurrency can be both exciting and overwhelming.

This article serves as a comprehensive guide, offering beginners insights into the fundamental aspects, benefits, risks, and practical steps to get started in the cryptocurrency realm.

youtube

Understanding Cryptocurrency: The Basics

At its core, cryptocurrency is a digital or virtual form of currency that utilizes cryptographic techniques to secure transactions and control the creation of new units.

Unlike traditional currencies issued by governments and central banks, cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

1. How Cryptocurrencies Work

Cryptocurrencies operate on blockchain technology, which is a distributed and immutable ledger that records all transactions.

Each transaction is grouped into a "block," and these blocks are linked together, creating a chain of information.

This decentralized nature ensures transparency, security, and resistance to censorship as Perseus Crypto explains it nicely.

2. Key Cryptocurrency Concepts

Blockchain: A decentralized ledger that records all transactions in a secure and transparent manner.

Wallet: A digital tool that stores your cryptocurrency holdings, enabling you to send, receive, and manage your coins.

Private and Public Keys: Cryptographic keys that grant access to your cryptocurrency. The public key is like an address, while the private key is your password.

Mining: The process of validating transactions and adding them to the blockchain using powerful computers and solving complex mathematical puzzles.

Benefits of Cryptocurrency

1. Financial Inclusion: Cryptocurrencies enable access to financial services for the unbanked and underbanked populations around the world.

2. Decentralization: Cryptocurrencies operate on decentralized networks, reducing the influence of central authorities and intermediaries.

3. Security: Blockchain's cryptographic techniques ensure secure transactions and protection against fraud and hacking.

4. Transparency: Transactions on a blockchain are public and transparent, enhancing accountability.

5. Borderless Transactions: Cryptocurrencies enable fast and low-cost cross-border transactions.

6. Potential for Growth: Some cryptocurrencies have experienced significant price appreciation, offering opportunities for investment growth.

Risks and Considerations

1. Volatility: Cryptocurrency prices can be highly volatile, leading to rapid and unpredictable value changes.

2. Security Concerns: Cryptocurrencies are susceptible to hacking, scams, and phishing attacks. Secure storage is crucial.

3. Regulatory Environment: Regulations for cryptocurrencies vary by jurisdiction and can impact their legality, taxation, and use.

4. Lack of Understanding: The complexity of the technology and market can lead to uninformed decisions.

5. Lack of Regulation: The decentralized nature of cryptocurrencies means there may be no recourse for fraudulent activities or disputes.

Getting Started with Cryptocurrency

1. Education Is Key

Before investing in or using cryptocurrencies, educate yourself about the technology, terminology, and potential risks.

Numerous online resources, courses, and communities provide valuable insights.

2. Choose the Right Cryptocurrency

Research different cryptocurrencies to understand their purposes, use cases, and market trends.

Bitcoin, Ethereum, and others have distinct features and applications.

3. Select a Reliable Exchange

Choose a reputable cryptocurrency exchange to buy, sell, and trade cryptocurrencies.

Look for factors like security measures, fees, user-friendliness, and available coins.

4. Secure Your Investments

Use strong, unique passwords for your exchange accounts and enable two-factor authentication (2FA).

Consider using hardware wallets for enhanced security.

5. Start Small and Diversify

For beginners, start with a small investment you can afford to lose.

Diversify your investments across different cryptocurrencies to manage risk.

6. Stay Informed

Stay updated with the latest news and trends in the cryptocurrency space.

Follow reputable cryptocurrency news websites, blogs, and social media accounts.

7. Avoid FOMO and Emotional Decisions

Fear of missing out (FOMO) and emotional decisions can lead to impulsive actions.

Stick to your investment strategy and avoid making decisions solely based on short-term price movements.

8. Be Prepared for the Long Term

Cryptocurrency investments are often more successful with a long-term perspective.

Avoid making decisions based on daily market fluctuations.

Conclusion

As you embark on your journey into the world of cryptocurrency, remember that education and caution are your best allies.

Understand the technology, the benefits, and the risks before making any investment decisions.

With the right knowledge and a thoughtful approach, you can navigate the complex and dynamic cryptocurrency landscape, potentially harnessing its benefits and contributing to the evolution of modern finance.

2 notes

·

View notes

Text

2 notes

·

View notes

Text

Bitcoin recovery, in its essence, involves reclaiming lost or stolen bitcoins, often due to fraudulent activities such as scams, hacks, or thefts. While the decentralized nature of Bitcoin makes transactions immutable, it also poses challenges when attempting to reverse unauthorized transactions. Traditional financial institutions or legal frameworks are often ill-equipped to handle such cases, leaving victims in a state of despair. Yet, there is a beacon of hope in the form of technical analysis strategies tailored for Bitcoin recovery.

0 notes

Text

Maximize Your Profits: Where and How to Sell Bitcoin in Istanbul

Unlike when Bitcoin was first introduced, it has gained massive popularity globally over the years. Istanbul has certainly not been left behind as far as crypto trading goes as it become a significant commercial hub for crypto thanks to its strategic location as a bridge between Europe and Asia. It does not matter if you’re a newbie to the crypto world or a seasoned investor, you can reap the maximum profits if you know where and how to sell Bitcoin in Istanbul.

Below are some guidelines to help you optimize your gains as you sell your Bitcoin in Istanbul:

Understand the Market

You should first have a good grasp of the local crypto market before you begin to explore how to sell Bitcoin in Istanbul. One thing you should appreciate is that Istanbul attracts a diverse group of crypto traders and enthusiasts, including international traders, business professionals, and upcoming young investors. Consequently, there’s a high demand for BTC which often translates to a favorable market for sellers.

It’s also crucial to understand that the price of Bitcoin is highly volatile, and many factors can impact it. These factors include economic policies, political stability, and global markets. You should monitor these factors closely and time your sale accordingly for optimal returns.

Where to sell Bitcoin in Istanbul

Here are some of the popular platforms or avenues you can use to sell Bitcoin in Istanbul:

Cryptocurrency exchanges

You can use the various crypto exchanges to sell Bitcoin in Istanbul. Luckily, some exchanges operate physical premises that you can visit and trade your BTC, but most are online platforms making the entire process of selling Bitcoin easy. As you consider which exchange to use, factor in some things like security, transaction fees, and user-friendliness.

Peer-to-peer platforms

There are also peer-to-peer (P2P) platforms such as LocalBitcoins which are popular among many crypto investors and traders. You can use them to sell your Bitcoin in Istanbul. They allow you to sell directly to buyers, and most of the time, at competitive prices. In addition, some P2P platforms like LocalBitcoins offer a secure escrow service, to protect your digital currencies from scams.

Bitcoin ATMs

Another way you can use to sell Bitcoin in Istanbul is by using Bitcoin ATMs. These machines are situated in strategic places such as shopping malls and business districts and are pretty easy to use. However, Bitcoin ATMs often have higher charges than online exchanges, even if they offer great convenience.

How to Sell your Bitcoin Profitably in Istanbul

Below are some tips that can help you optimize your profits as you sell your BTC in Istanbul:

Time your sale appropriately

Timing is crucial when selling BTC if you want to get the highest possible amount for them. You should monitor Bitcoin trends and other local economic indicators. For example, for better sales, sell when the demand is high, or when the Turkish Lira is going through inflation.

Minimize your transaction fees

To get reasonable profits as you sell Bitcoin in Istanbul, ensure you keep your transaction fees at the lowest. Take time and compare the different selling options and choose those with better rates. For example, you should opt for crypto exchanges to reduce fees, as opposed to using Bitcoin ATMs that tend to have higher fees.

Observe maximum security

You don’t want to lose your Bitcoin to scammers so use platforms with water-tight security measures such as escrow services and two-factor authentication. And if you’re using P2P exchanges, meet buyers in safe public spaces and scrutinize them beforehand.

Conclusion

Have you been wondering how and where to sell Bitcoin in Istanbul? The above guidelines can help you. Always prioritize the security of your assets as you trade BTC, to avoid being scammed. Also, choose user-friendly selling avenues that also have reasonable fees.

via https://claudeai.uk/sell-bitcoin-in-istanbul/

0 notes

Text

How to Reclaim Lost Money from Bitcoin and Other Cryptocurrency Scams

Technology plays a pivotal role in the successful recovery of lost Bitcoin assets, with advanced tools and techniques enabling efficient and thorough retrieval processes. By using machine learning techniques, Recuva Hacker Solutions expedites the detection and retrieval of misplaced Bitcoin assets, cutting down on the time and resources needed for recovery operations. Recuva Hacker Solutions leverages artificial intelligence to improve its recovery procedures. Recuva Hacker Solutions tracking capabilities and digital ledger analytics enable it to painstakingly locate and retrieve misplaced Bitcoin holdings. With the use of these sophisticated tools, they can precisely explore the complex blockchain network and help their clients retrieve their digital funds. Offering revolutionary solutions to counter the growing issue of cryptocurrency theft, Recuva Hacker Solutions is a top service provider that specializes in the recovery of stolen Bitcoin holdings. Recuva Hacker Solutions is at the forefront of the industry, committed to protecting digital assets and providing peace of mind to individuals and organizations impacted by cybercrime. The main services offered by Recuva Hacker Solutions are examined in detail in this article, along with successful case studies of recovered stolen Bitcoin and professional advice on improving security protocols. Recuva Hacker Solutions mission is crystal clear: to assist clients in recovering stolen Bitcoin holdings efficiently and effectively. Their objectives revolve around providing top-tier services, employing innovative strategies, and ultimately bringing a sense of justice to those affected by cryptocurrency theft. When the wallet service I was utilizing went permanently offline, I was unable to access my cryptocurrency. I have thus been having trouble trying to figure out how to get back into my wallet for months. After a lot of effort, Recuva Hacker Solutions came to my rescue. You can communicate with them for help with the information listed below. Contact Details: Email: recuvahackersolutions @ inbox . lv WhatsApp: +1 (315) (756) (1228)

0 notes

Text

Bitcoin bridge XLink is making a comeback following a $10M hack, as reported by TradingView News. The resurrection process is currently underway, signaling a potential recovery for the platform. Stay tuned for more updates on this development in the cryptocurrency world.

Click to Claim Latest Airdrop for FREE

Claim in 15 seconds

Scroll Down to End of This Post

const downloadBtn = document.getElementById('download-btn');

const timerBtn = document.getElementById('timer-btn');

const downloadLinkBtn = document.getElementById('download-link-btn');

downloadBtn.addEventListener('click', () =>

downloadBtn.style.display = 'none';

timerBtn.style.display = 'block';

let timeLeft = 15;

const timerInterval = setInterval(() =>

if (timeLeft === 0)

clearInterval(timerInterval);

timerBtn.style.display = 'none';

downloadLinkBtn.style.display = 'inline-block';

// Add your download functionality here

console.log('Download started!');

else

timerBtn.textContent = `Claim in $timeLeft seconds`;

timeLeft--;

, 1000);

);

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

[ad_1]

XLink, a well-known Bitcoin blockchain bridge, is making a comeback after being forced to shut down due to a $10 million hack on May 15. The hack targeted XLink's Ethereum and BNB Smart Chain (BSC) endpoints, leading to the unauthorized withdrawal of around $4.3 million by exploiting compromised private keys in a phishing scam.

Fortunately, a white hat hacker was able to recover the stolen assets, bringing some relief to the situation. However, approximately $5 million in LunarCrush tokens remain locked on the Ethereum blockchain. Despite this setback, XLink and the LunarCrush team are working together to secure these funds, with the majority already being recovered or secured.

Additionally, around $500,000 worth of residual crypto funds are still locked on Ethereum, but efforts are underway to retrieve or secure the majority of these funds. The XLink team is gearing up to resume normal operations after taking a brief pause to address the security breach, ensuring that their users' assets are safe and secure.

In a statement, XLink assured the public that no other endpoints were affected by the exploit, focusing solely on the BSC and Ethereum platforms. The team is committed to maintaining transparency and security to prevent any future breaches and continue providing reliable services to their users.

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

[ad_2]

1. What is the Bitcoin bridge XLink?

It's a platform that allows users to trade cryptocurrencies and digital assets securely.

2. What does it mean that the resurrection is underway after a $10M hack?

It means that the platform is being restored and rebuilt after a significant security breach.

3. Is my money safe on XLink after the hack?

The team is working to enhance security measures to protect user funds moving forward.

4. How can I access my account after the resurrection?

You can log in using your existing credentials once the platform is back up and running.

5. When will XLink be fully operational again?

The team is working diligently to restore functionality, but an exact timeline has not been provided yet.

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

[ad_1]

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

Claim Airdrop now

Searching FREE Airdrops 20 seconds

Sorry There is No FREE Airdrops Available now. Please visit Later

function claimAirdrop()

document.getElementById('claim-button').style.display = 'none';

document.getElementById('timer-container').style.display = 'block';

let countdownTimer = 20;

const countdownInterval = setInterval(function()

document.getElementById('countdown').textContent = countdownTimer;

countdownTimer--;

if (countdownTimer < 0)

clearInterval(countdownInterval);

document.getElementById('timer-container').style.display = 'none';

document.getElementById('sorry-button').style.display = 'block';

, 1000);

1 note

·

View note

Text

Why Cryptocurrency Tracing is the Future of Fraud Prevention

Cryptocurrency has revolutionized the way we think about money and transactions. However, with this innovation comes new challenges, particularly in the realm of fraud prevention. This article explores why cryptocurrency tracing is becoming a crucial tool in the fight against fraud.

2. Understanding Cryptocurrency

2.1 What is Cryptocurrency?

Cryptocurrency is a type of digital or virtual currency that uses cryptography for security. Unlike traditional currencies, it operates on decentralized networks based on blockchain technology.

2.2 Brief History of Cryptocurrency

The concept of cryptocurrency dates back to the early 1980s, but it wasn’t until the launch of Bitcoin in 2009 by an anonymous entity known as Satoshi Nakamoto that it gained widespread attention. Since then, thousands of cryptocurrencies have been created, each with unique features and uses.

3. The Rise of Cryptocurrency Fraud

3.1 Types of Cryptocurrency Fraud

Cryptocurrency fraud comes in various forms, including phishing scams, Ponzi schemes, and fraudulent Initial Coin Offerings (ICOs). Each type exploits the relative anonymity and unregulated nature of the cryptocurrency market.

3.2 Impact of Cryptocurrency Fraud

The impact of cryptocurrency fraud is significant, leading to financial losses for individuals and businesses, undermining trust in digital currencies, and attracting regulatory scrutiny.

4. What is Cryptocurrency Tracing?

4.1 Definition and Basics

Cryptocurrency tracing involves tracking and analyzing cryptocurrency transactions to identify and prevent illegal activities. It leverages the transparency of blockchain technology, where all transactions are recorded in a public ledger.

4.2 How It Works

Cryptocurrency tracing works by examining transaction histories on the blockchain to trace the movement of funds. This process involves sophisticated software tools that can link seemingly anonymous transactions to real-world identities.

5. Tools and Techniques for Cryptocurrency Tracing

5.1 Blockchain Analysis Tools

Blockchain analysis tools, such as Chainalysis and CipherTrace, are designed to monitor and analyze blockchain transactions. These tools can identify suspicious activity, trace stolen funds, and help law enforcement agencies in investigations.

5.2 Machine Learning Algorithms

Machine learning algorithms enhance cryptocurrency tracing by identifying patterns and anomalies in transaction data. These algorithms can predict fraudulent activities and provide insights that are not easily detectable through manual analysis.

6. Benefits of Cryptocurrency Tracing

6.1 Fraud Prevention

One of the primary benefits of cryptocurrency tracing is its ability to prevent fraud. By monitoring transactions in real-time, suspicious activities can be flagged and investigated promptly, reducing the risk of fraud.

6.2 Enhanced Security

Cryptocurrency tracing contributes to enhanced security within the cryptocurrency ecosystem. It helps protect users from scams and ensures that their investments are safe.

6.3 Regulatory Compliance

As governments and regulatory bodies seek to control and monitor the use of cryptocurrencies, tracing tools can help businesses comply with regulations. This compliance is crucial for the legitimacy and widespread adoption of digital currencies.

7. Challenges in Cryptocurrency Tracing

7.1 Privacy Concerns

While cryptocurrency tracing is beneficial, it raises privacy concerns. Users value the anonymity provided by cryptocurrencies, and tracing can be seen as an invasion of privacy.

7.2 Technical Complexities

Cryptocurrency tracing is technically complex, requiring advanced knowledge of blockchain technology and data analysis. This complexity can be a barrier for smaller organizations or those lacking technical expertise.

7.3 Legal and Ethical Issues

There are also legal and ethical issues to consider. The legality of tracing activities can vary by jurisdiction, and there are ethical considerations around the balance between fraud prevention and privacy rights.

8. Case Studies of Successful Tracing

8.1 Example 1: Silk Road

One of the most notable cases of cryptocurrency tracing involved the Silk Road, an online black market. Law enforcement used blockchain analysis to trace transactions, leading to the arrest of its founder, Ross Ulbricht, and the seizure of millions of dollars in Bitcoin.

8.2 Example 2: Mt. Gox

Another significant case was the Mt. Gox exchange hack, where hundreds of thousands of Bitcoins were stolen. Through detailed blockchain analysis, investigators traced the stolen funds and identified the perpetrators, recovering some of the lost assets.

9. The Future of Cryptocurrency Tracing

9.1 Technological Advancements

The future of cryptocurrency tracing looks promising with ongoing technological advancements. Enhanced blockchain analysis tools and more sophisticated machine learning algorithms will make tracing even more effective.

9.2 Integration with Financial Systems

As cryptocurrencies become more integrated with traditional financial systems, tracing tools will play a crucial role in ensuring the integrity and security of these systems. This integration will help bridge the gap between digital and fiat currencies.

10. Conclusion

Cryptocurrency tracing is a vital tool in the fight against fraud. It not only enhances security and compliance but also helps build trust in the cryptocurrency market. Despite the challenges, the benefits of tracing far outweigh the drawbacks, making it a cornerstone of future fraud prevention strategies.

11. FAQs

1. What is the main purpose of cryptocurrency tracing?

The main purpose of cryptocurrency tracing is to track and analyze transactions to prevent illegal activities and fraud.

2. How does blockchain technology aid in cryptocurrency tracing?

Blockchain technology provides a transparent and immutable ledger of all transactions, which can be analyzed to trace the movement of funds.

3. Are there any privacy concerns with cryptocurrency tracing?

Yes, cryptocurrency tracing can raise privacy concerns as it involves monitoring transactions that users may expect to be anonymous.

4. What are some tools used for cryptocurrency tracing?

Some popular tools include Chainalysis, CipherTrace, and various machine learning algorithms designed to analyze blockchain data.

5. Can cryptocurrency tracing help in recovering stolen funds?

Yes, cryptocurrency tracing has been instrumental in several cases, such as Silk Road and Mt. Gox, in recovering stolen funds and identifying perpetrators.

0 notes

Text

Table of ContentsUnderstanding the Regulatory Landscape: Comparing STOs and ICOsInvestor Protections: The Advantages of Security Token Offerings Over ICOsThe Future of Blockchain Fundraising: Trends in STOs and the Decline of ICOsConclusion"STOs: Elevating Blockchain Fundraising with Enhanced Security and Compliance over ICOs."Security Token Offerings (STOs) and Initial Coin Offerings (ICOs) are two distinct methods for raising funds within the blockchain industry. ICOs emerged as a revolutionary way for startups to bypass traditional capital-raising processes by issuing digital tokens in exchange for cryptocurrency. These tokens often grant investors access to a future service or product but do not necessarily confer ownership or equity rights.

STOs, on the other hand, represent an evolution in blockchain fundraising, addressing many of the regulatory and security concerns associated with ICOs. Security tokens are digital assets that derive their value from an external, tradable asset and are subject to federal securities regulations. STOs provide investors with ownership interests in a company, such as equity, dividends, or a share in the profits, and are designed to comply with regulatory governance, offering a more secure and legally compliant investment option compared to ICOs. This compliance with securities laws aims to protect investors and adds credibility to the fundraising process, potentially attracting a broader range of institutional investors.Understanding the Regulatory Landscape: Comparing STOs and ICOsSecurity token offerings (STOs) and initial coin offerings (ICOs) are two methods of fundraising that leverage blockchain technology, yet they operate within markedly different regulatory frameworks. Understanding the nuances between STOs and ICOs is crucial for investors and issuers alike, as the choice of fundraising mechanism can significantly impact the success of a blockchain venture and its compliance with financial regulations.

ICOs burst onto the scene as a revolutionary way for blockchain projects to raise capital directly from a global pool of investors. In an ICO, participants invest typically through cryptocurrencies like Bitcoin or Ethereum, in exchange for a project's native tokens. These tokens often grant holders access to a future service or platform, and in the early days of ICOs, they were frequently marketed with the promise of substantial returns. However, the lack of regulatory oversight led to a proliferation of scams and fraudulent schemes, resulting in substantial financial losses for many investors. This Wild West phase of ICOs prompted regulators around the world to take a closer look at the burgeoning industry.

In contrast, STOs emerged as a response to the regulatory challenges posed by ICOs. Security tokens are digital assets that represent ownership or an interest in an asset, such as real estate, a company, or dividends. Unlike ICO tokens, which are often utility tokens with no claim on assets or cash flow, security tokens are subject to federal securities regulations. This means that STOs must comply with the same legal requirements as traditional securities offerings, including registration with regulatory bodies or fitting within an exemption, providing disclosures, and conducting due diligence.

The regulatory rigor surrounding STOs provides a layer of protection for investors and imbues the process with greater legitimacy. For issuers, conducting an STO can be more complex and costly due to the need to navigate securities laws, but it also opens up the opportunity to reach accredited investors and institutions that may have been wary of the unregulated nature of ICOs. Moreover, the transparency and compliance associated with STOs can foster trust and stability, potentially leading to more sustainable long-term growth for blockchain projects.

While ICOs have not disappeared, their popularity has waned as the market has matured and as participants have become more aware of the risks involved.

The shift towards STOs reflects a broader movement within the blockchain space towards regulatory compliance and institutional acceptance. However, it's important to note that the regulatory landscape is still evolving, and different jurisdictions may have varying approaches to both STOs and ICOs. For instance, some countries have banned ICOs outright, while others have sought to create a more conducive environment for blockchain innovation by providing clear guidelines and frameworks for conducting token offerings.

In conclusion, when comparing STOs and ICOs within the context of blockchain fundraising, it is evident that the primary differentiator lies in their relationship with regulatory frameworks. STOs offer a more secure and compliant route for raising capital, aligning with traditional financial market regulations and providing investor protections. ICOs, while offering a more open and potentially less costly approach, carry significant risks due to their historically unregulated nature. As the blockchain industry continues to evolve, the regulatory landscape will undoubtedly shape the future of fundraising mechanisms, with STOs likely to play an increasingly prominent role in bridging the gap between the innovative potential of blockchain technology and the established financial ecosystem.Investor Protections: The Advantages of Security Token Offerings Over ICOsSecurity token offerings (STOs) vs ICOs for blockchain fundraising

In the rapidly evolving landscape of blockchain fundraising, two prominent methods have emerged: Initial Coin Offerings (ICOs) and Security Token Offerings (STOs). While both serve as mechanisms to raise capital for projects, they differ significantly in their approach to investor protections, which is a critical aspect for both investors and issuers. Understanding these differences is essential for stakeholders to make informed decisions in the blockchain space.

ICOs, which gained massive popularity during the 2017 crypto boom, are a form of crowdfunding where new cryptocurrencies are sold to investors to raise capital for blockchain-related projects. However, the ICO model has been criticized for its lack of regulatory oversight, leading to numerous scams and projects that failed to deliver on their promises. The absence of a legal framework often left investors with little to no protection, resulting in significant financial losses for many.

In contrast, STOs represent a more mature and regulated approach to blockchain fundraising. Security tokens are digital assets that derive their value from an external, tradable asset and are subject to federal securities regulations. This compliance with securities laws is the cornerstone of STOs, providing a structured and secure environment for investors. By treating tokens as securities, STOs are required to adhere to the same legal requirements as traditional securities, including disclosures, registration, and reporting obligations.

One of the primary advantages of STOs over ICOs is the enhanced investor protection they offer. Since STOs are regulated by securities laws, they must provide investors with detailed information about the company, the project, and the terms of the investment. This transparency ensures that investors have access to all the necessary data to make an educated decision about the potential risks and rewards associated with the investment.

Moreover, STOs are often backed by tangible assets, profits, or revenue of the company, which provides a level of security not typically found in ICOs. This backing by real-world assets means that security tokens have an intrinsic value, reducing the likelihood of fraud and increasing the potential for recovery in the event of a project's failure.

Another significant benefit of STOs is the legal recourse available to investors. Should an STO fail to comply with its obligations or engage in fraudulent activities, investors have a clear path to seek restitution through the legal system.

This is a stark contrast to ICOs, where the unregulated nature of the offerings often leaves investors with no legal avenue to recover their funds.

Furthermore, the regulatory framework surrounding STOs helps to filter out low-quality projects. The rigorous process of complying with securities laws means that only serious and well-prepared projects are likely to pursue an STO. This vetting process serves to protect investors from the high-risk, speculative ventures that were common in the ICO market.

In conclusion, while ICOs opened the door to innovative methods of fundraising in the blockchain space, their lack of regulation and investor protections have led to significant challenges and risks. STOs have emerged as a more secure and regulated alternative, offering investors a level of protection akin to traditional securities. By embracing the regulatory framework, STOs provide a safer environment for investors, ensuring that only projects with a solid foundation and a commitment to transparency can access capital through this method. As the blockchain industry continues to mature, STOs are likely to become the preferred choice for both investors and issuaries seeking to raise funds while maintaining a high standard of investor protection.The Future of Blockchain Fundraising: Trends in STOs and the Decline of ICOsThe Future of Blockchain Fundraising: Trends in STOs and the Decline of ICOs

In the rapidly evolving landscape of blockchain fundraising, security token offerings (STOs) have emerged as a significant trend, signaling a shift away from the once-dominant initial coin offerings (ICOs). This transition reflects a maturation of the blockchain industry as it seeks to align with regulatory frameworks and attract a broader base of institutional investors.

ICOs, which peaked in popularity around 2017, provided a revolutionary way for blockchain projects to raise capital. By issuing their own digital tokens, startups could bypass traditional venture capital routes, accessing funds directly from a global pool of investors. However, the ICO boom also brought with it significant challenges. The lack of regulation led to numerous scams and projects that failed to deliver on their promises, resulting in substantial losses for investors. This Wild West phase of blockchain fundraising raised concerns among regulators worldwide, who scrambled to protect investors and maintain the integrity of financial markets.

In response to these concerns, STOs have gained traction as a more secure and regulated alternative to ICOs. Unlike ICOs, which often involve the sale of utility tokens that grant access to a future service or platform, STOs involve the issuance of security tokens that represent an investment in a real-world asset, such as equity, debt, or real estate. These tokens are subject to securities regulations, which means that issuers must comply with the legal requirements of the jurisdictions in which they are offered.

The shift towards STOs is indicative of the blockchain industry's efforts to build credibility and trust with investors. By adhering to regulatory standards, STOs provide a level of investor protection that was largely absent in the ICO model. This compliance with securities laws has opened the doors for institutional investors, who were previously wary of the regulatory risks associated with ICOs. As a result, STOs are attracting a more sophisticated investor base, which is crucial for the long-term sustainability of blockchain projects.

Moreover, STOs offer several advantages over traditional fundraising methods. They provide increased liquidity for investors, as security tokens can be traded on specialized exchanges. This liquidity is a significant draw for investors who are used to the more liquid markets of traditional securities. Additionally, STOs can offer more transparency and efficiency through the use of blockchain technology, which can streamline the issuance process and reduce costs.

Despite these advantages, STOs are not without their challenges.

The regulatory landscape for security tokens is still evolving, and compliance can be complex and costly. Furthermore, the market for STOs is relatively young, and the infrastructure for trading and managing security tokens is still being developed. These factors have led to a slower adoption rate compared to the explosive growth of ICOs in their heyday.

As the blockchain industry continues to mature, it is likely that STOs will play an increasingly prominent role in fundraising. The decline of ICOs reflects a broader trend towards greater regulatory compliance and investor protection in the blockchain space. While STOs may not replicate the frenzied excitement that surrounded early ICOs, they represent a more sustainable and responsible approach to raising capital on the blockchain. As the market infrastructure for STOs strengthens and regulatory clarity improves, we can expect to see a more stable and secure environment for blockchain fundraising—one that is better equipped to support the long-term growth of the industry.ConclusionSecurity Token Offerings (STOs) provide a more regulated and secure approach to blockchain fundraising compared to Initial Coin Offerings (ICOs). STOs are backed by real assets and are compliant with securities regulations, offering better investor protection. ICOs, while enabling broader participation and innovation, have been associated with higher risks and scams due to their unregulated nature. The shift towards STOs reflects a maturation of the blockchain industry, seeking legitimacy and stability through adherence to legal frameworks.

0 notes

Text

Bitcoin fraud encompasses a myriad of deceptive practices aimed at exploiting vulnerabilities within the cryptocurrency ecosystem. From phishing attacks and Ponzi schemes to fake ICOs and malware-infected wallets, fraudsters employ various tactics to defraud unsuspecting investors of their hard-earned Bitcoins. The decentralized and pseudonymous nature of Bitcoin transactions makes it an attractive target for cybercriminals, who capitalize on the anonymity afforded by the blockchain technology.

#bitcoin fraud reversal#bitcoin scam protection#cryptocurrency fraud prevention#secure bitcoin transactions

0 notes