#best vpn for crypto trading

Text

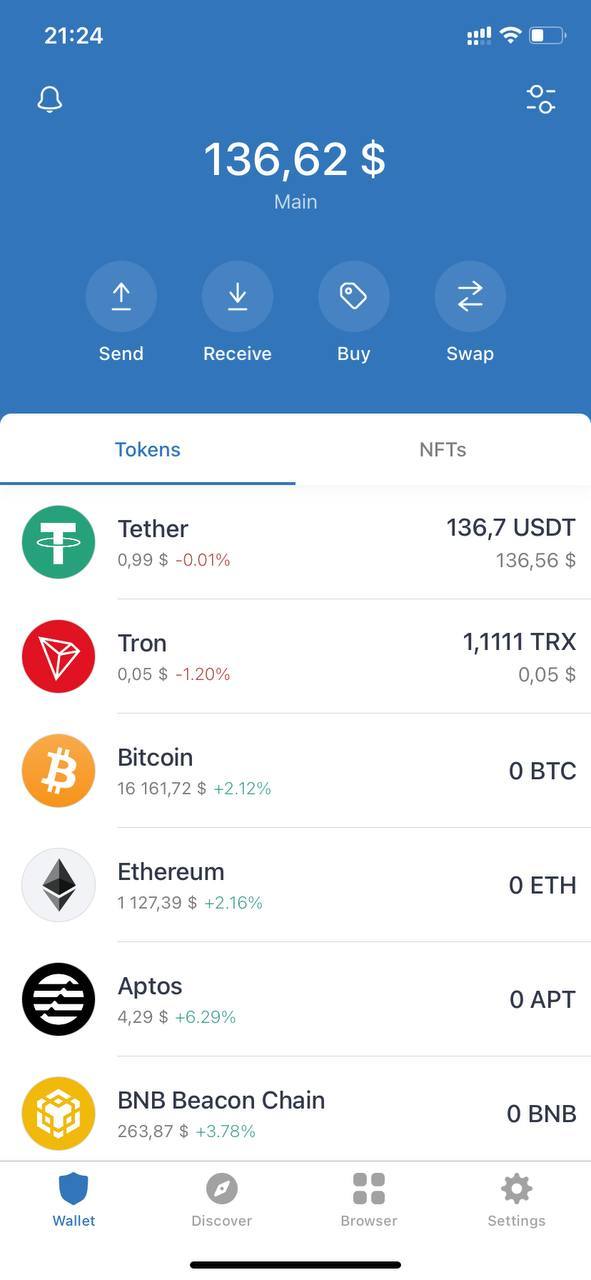

how can I withdraw my usdt help me plz

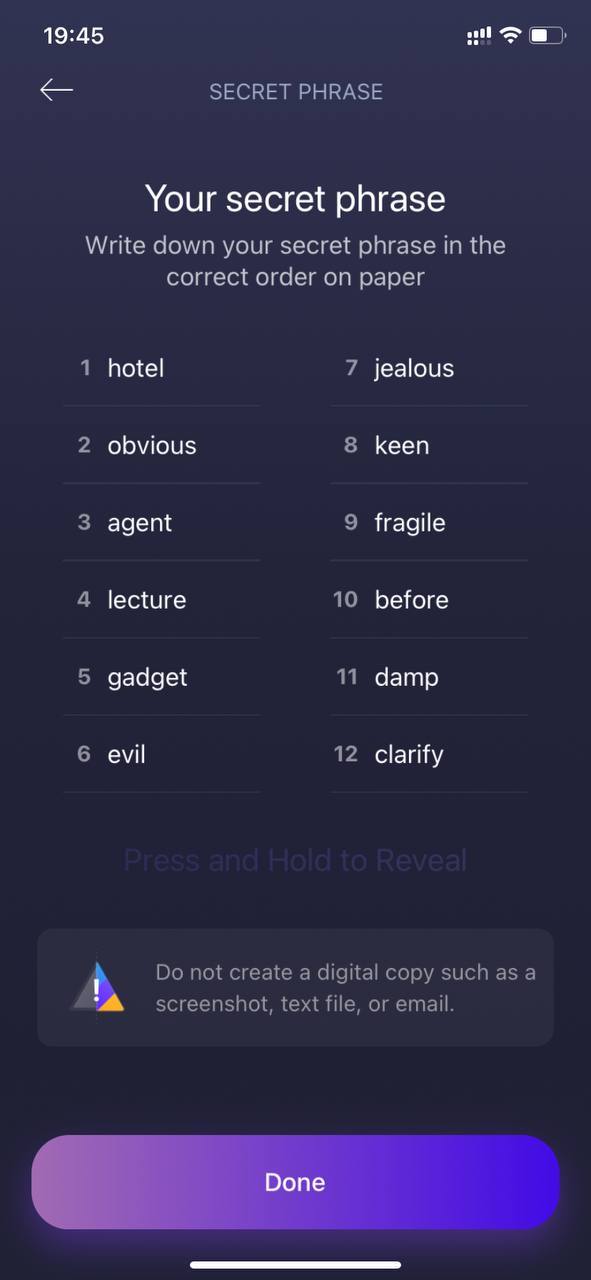

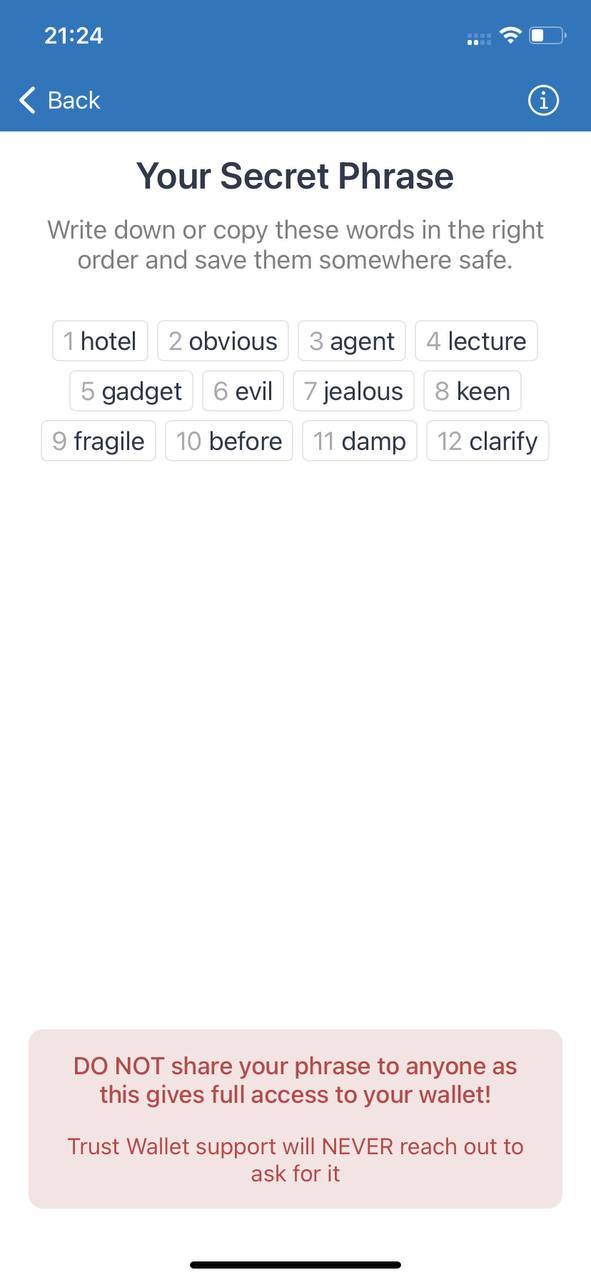

My phrase: hotel obvious agent lecture gadget evil jealous keen fragile before damp clarify

how can I withdraw my usdt help me plz

My phrase: hotel obvious agent lecture gadget evil jealous keen fragile before damp clarify

#crypto#cryptocurrency#marketing#crypto affiliate#mr naveed shah#traffic#eth#ethereum#adsense alternative#best vpn for crypto trading#dogecoin#investing#website traffic#crypto ad network#invest#btc#crypto news#crypto beast review#bitcoin news#shiba inu#cardano#passive income#altcoins#nft#cyber security#cybersecurity#weak web#multi token miner#hacking#helium hotspots

25 notes

·

View notes

Text

do you need vpn to do bitmex

🔒🌍✨ Get 3 Months FREE VPN - Secure & Private Internet Access Worldwide! Click Here ✨🌍🔒

do you need vpn to do bitmex

VPN necessity for BitMEX trading

Using a VPN for BitMEX trading can be a crucial tool to protect your privacy and security online. BitMEX, a popular cryptocurrency trading platform, requires users to provide personal information and access the platform from various locations around the world. By using a VPN, you can encrypt your internet connection and hide your IP address, making it harder for hackers or other malicious actors to track your online activity.

Additionally, a VPN can help you bypass geographical restrictions that BitMEX or your internet service provider may impose. This can be especially useful if you are traveling or living in a country where access to certain websites or platforms is restricted. By connecting to a VPN server in a different location, you can mask your real location and access BitMEX as if you were in a different country.

Furthermore, using a VPN can enhance your overall online security by encrypting your data and protecting it from cyber threats. This is particularly important when trading cryptocurrencies, as hackers are constantly looking for ways to exploit vulnerabilities in online platforms. With a VPN, you can add an extra layer of protection to your trading activities and reduce the risk of falling victim to cyber attacks.

In conclusion, using a VPN for BitMEX trading is not only a smart move to safeguard your privacy and security but also a practical tool to bypass geographical restrictions and enhance your online security. Consider investing in a reliable VPN service to ensure a safer and more secure trading experience on BitMEX.

BitMEX security measures

BitMEX, a leading cryptocurrency derivatives exchange, prioritizes the security of its platform to safeguard user assets and maintain trust within the crypto community. With the growing concern over cybersecurity threats in the digital asset space, BitMEX employs a comprehensive array of security measures to protect its users and their funds.

One of the key security features implemented by BitMEX is its robust encryption protocol. All user data and transactions are encrypted using industry-standard encryption algorithms, ensuring that sensitive information remains secure and inaccessible to unauthorized parties. This encryption extends to communications between users and the platform, further enhancing privacy and confidentiality.

To prevent unauthorized access to user accounts, BitMEX employs multi-factor authentication (MFA). Users can enable MFA through various methods such as SMS-based authentication, authenticator apps, or hardware tokens. This additional layer of security requires users to provide multiple forms of verification before accessing their accounts, significantly reducing the risk of unauthorized access even in the event of compromised login credentials.

Furthermore, BitMEX utilizes a hierarchical deterministic (HD) wallet system to manage user funds. HD wallets generate a unique address for each transaction, enhancing privacy and making it more difficult for malicious actors to track funds or conduct fraudulent activities.

In addition to these technical measures, BitMEX also maintains rigorous operational security protocols. Regular security audits and penetration testing are conducted to identify and address potential vulnerabilities proactively. Moreover, BitMEX collaborates with leading cybersecurity firms to stay abreast of emerging threats and best practices in the industry.

By prioritizing security at every level of its operations, BitMEX aims to provide users with a safe and reliable trading environment, fostering confidence and trust in the platform among traders and investors alike.

VPN benefits for cryptocurrency trading

Cryptocurrency trading has become increasingly popular in recent years, attracting both experienced investors and newcomers to the digital asset market. However, as the popularity of cryptocurrency trading rises, so do the risks associated with it. This is where a Virtual Private Network (VPN) can play a crucial role in safeguarding your online security and privacy while engaging in cryptocurrency transactions.

Using a VPN for cryptocurrency trading offers numerous benefits. Firstly, it provides an extra layer of security by encrypting your internet connection, making it difficult for cybercriminals to intercept your sensitive financial information. With VPN encryption, your online activities, including cryptocurrency trades and transactions, are shielded from prying eyes, reducing the risk of potential hacks or identity theft.

Additionally, VPNs enable users to mask their real IP address and location, enhancing anonymity and privacy while trading cryptocurrencies. By connecting to a VPN server in a different location, traders can obscure their online footprint and protect their identity from being exposed to malicious actors on the internet.

Moreover, VPNs help bypass geo-blocks and access cryptocurrency exchanges and trading platforms that may be restricted in certain regions. By connecting to a VPN server in a country where the platform is accessible, traders can navigate around regional restrictions and trade cryptocurrencies effortlessly.

In conclusion, incorporating a VPN into your cryptocurrency trading routine can significantly enhance your online security, privacy, and accessibility. By encrypting your internet connection, preserving anonymity, and overcoming geo-blocks, VPNs empower traders to navigate the digital asset market with peace of mind and confidence. Stay secure and trade smart with the added protection of a VPN.

Risks of trading on BitMEX without a VPN

Trading on BitMEX without a VPN can expose users to a range of significant risks, stemming from the platform's security vulnerabilities and potential legal implications.

Firstly, without a VPN (Virtual Private Network), traders leave their connection exposed to potential breaches and hacking attempts. BitMEX, like any online trading platform, is a target for cybercriminals seeking to exploit weaknesses in the system. By not using a VPN, traders risk unauthorized access to their accounts, compromising their funds and personal information.

Moreover, BitMEX operates in a regulatory grey area, with differing legal interpretations around the world regarding its legality. Trading on BitMEX without a VPN can expose users to potential legal consequences, especially in jurisdictions where cryptocurrency trading is heavily regulated or outright banned. Without the anonymity provided by a VPN, users' activities on BitMEX could be traced back to their real-world identities, making them vulnerable to legal action.

Additionally, using a VPN offers privacy and anonymity by masking users' IP addresses and encrypting their internet traffic. Without this protection, traders' activities on BitMEX are susceptible to monitoring by third parties, including government agencies, internet service providers, and hackers. This lack of privacy can lead to various risks, such as identity theft, blackmail, or extortion attempts.

In conclusion, trading on BitMEX without a VPN exposes users to significant risks, including security breaches, legal repercussions, and loss of privacy. To safeguard their investments and personal information, traders should prioritize the use of a reputable VPN service when accessing BitMEX and other cryptocurrency platforms.

VPN advantages for privacy on BitMEX

Title: Enhancing Privacy on BitMEX with VPN: A Wise Move for Traders

In the realm of cryptocurrency trading, privacy and security are paramount concerns. BitMEX, a leading platform for trading Bitcoin and other digital assets, offers a wealth of opportunities for traders worldwide. However, ensuring privacy while engaging in transactions on BitMEX is crucial, considering the sensitive nature of financial data involved. This is where a Virtual Private Network (VPN) steps in as a powerful tool for safeguarding privacy and security.

By utilizing a VPN, BitMEX traders can enjoy several advantages in terms of privacy protection. Firstly, a VPN encrypts internet traffic, making it nearly impossible for hackers or malicious entities to intercept and decipher sensitive information. This encryption ensures that data transmitted between the trader's device and the BitMEX platform remains secure and private.

Moreover, VPNs offer the ability to mask the user's IP address. This means that traders can effectively conceal their geographical location and browsing activity from prying eyes. On BitMEX, where anonymity is often valued by traders, hiding one's IP address can add an extra layer of privacy protection.

Additionally, VPNs provide access to geographically restricted content. In the context of BitMEX, this means that traders can bypass regional restrictions or censorship that may hinder their ability to access the platform. Whether trading from a restricted country or simply seeking to enhance accessibility, VPNs enable traders to connect to BitMEX servers from anywhere in the world.

Furthermore, VPNs help mitigate the risk of Distributed Denial of Service (DDoS) attacks, which can disrupt trading activities on BitMEX. By routing internet traffic through remote servers, VPNs obscure the trader's true IP address, making it more difficult for attackers to launch targeted DDoS attacks.

In conclusion, leveraging a VPN for privacy protection on BitMEX is a wise decision for traders looking to safeguard their sensitive financial data and maintain anonymity while engaging in cryptocurrency transactions. With its encryption, IP masking, access to restricted content, and DDoS protection capabilities, a VPN enhances the overall security posture of BitMEX traders, enabling them to trade with confidence in an increasingly digital and interconnected world.

0 notes

Text

Stablecoins Explained: The Controversy Surrounding These Digital Assets

Stablecoins are digital assets that aim to maintain a steady price pegged to real-world assets. They are designed to be an alternative to cryptocurrencies like Bitcoin, which are prone to extreme volatility. They offer all the benefits of crypto, such as instant, cross-border payments but without the dramatic value changes associated with traditional cryptocurrencies. Stablecoins are already powering new forms of decentralized finance (DeFi) and could play a major role in a new wave of global financial services, such as micropayments, payroll, escrow, overseas remittances, and foreign exchange trading.

The most popular stablecoin to date is Tether (USDT), which has a market capitalization of over $180 billion. USDT’s main use case is to facilitate arbitrage opportunities between exchanges when the price of a cryptocurrency differs, allowing traders to make money. However, it has also found a number of other uses including being used to circumvent Best VPN Services of 2024 strict capital controls in China and for transferring funds internationally that would otherwise be subject to exorbitant transfer fees.

Many regulators are wary of stablecoins, with some voicing concerns over their potential for facilitating money laundering and other illicit activities, or that they may compete directly with national currencies. Others argue that stablecoins can help bring cryptocurrencies into the mainstream by offering a safer alternative to volatile fiat currencies, and that they are an important tool for building a more decentralized financial system.

As with other digital assets, stablecoins are regulated at the local level, with regulators around the world adopting and updating their rules to deal with these new types of assets. For example, in the U.S., the SEC’s recent guidance on stablecoins and securitized token offerings (STS) provides a useful framework for how these securities can be structured and governed.

In other cases, regulators have opted to treat stablecoins as money in their existing banking, payment, and securities/futures regulations. The Bank of England, for example, supports the idea that stablecoins can be backed by commercial bank deposits, while the UK’s HM Treasury has favored a model similar to that of money market funds.

The issue with these different regulatory approaches is that stablecoins are increasingly being interlinked with the wider financial system through their use for retail crypto trading and supporting decentralized finance services like yield-farming, lending, and liquidity provision. This interlinkage has prompted some commentators to argue that stability coins need their own unique set of rules and regulations.

Another concern is that technology website stablecoins may be subject to run risks, which occur when people desperately try to withdraw their tokens before the value of those tokens plummets. This problem can be exacerbated in stablecoins backed by assets that are not as liquid as the currency they are pegged to, such as short-term Treasuries or other instruments that can become illiquid quickly under a run. To mitigate this, some stablecoins are fully backed by legal tender money or cash-equivalent assets and thus should be immune from run risks. However, this type of stablecoin tends to be more complex and expensive to create and operate.

1 note

·

View note

Text

High-quality Used Asic Miner For Sale Zeus Mining

However, additionally Explore further insights is 4–5 times cheaper than top-of-the-line ASIC miners, so it’s a strong investment should you intend to have your RoI in lower than 4 months. It offers one hundred eighty days guarantee and comes bundled with a power provide unit. The M32 collection is available in three versions, with the most expensive one yielding sixty six TH/s.

On high of that, ensure that your ventilation does not allow rain or snow to come back inside, like happened to the unfortunate miner in the tweet under. Last however not least, Antminer R4 is kind of as environment friendly as Antminer S9, just a bit extra modest. Compared to its elder brother, Antminer R4 is bigger, however a fantastic deal less noisy with 52 dB noise stage. The growth of the speed, interest in mining returns, and the unsuccessful interval in the market left many used gadgets in the secondary market.

Consult with an electrician to discover a surge protector appropriate together with your panel. Surge protectors are designed to forestall high voltage spikes from reaching and damaging electrical equipment. Voltage surges can leap to the thousands of volts and might injury the inner electronics of your miners. Basic Metered PDUs show real-time current consumption (amps) for each circuit on a built-in display and is correct to 0.01A.

In addition to its proficiency in Bitcoin mining, the M32-62T extends its help to 10 different cash. Overall, ASIC mining has played an important role in developing the cryptocurrency mining ecosystem, particularly in the early days of cryptocurrencies like Bitcoin. It has pushed the business in the path of elevated effectivity and higher performance however has also raised concerns about centralization and accessibility. Many also use a VPN and/or TOR for obfuscation, yet this could create latency. Slow networks or excessive latency to the pool connection may cause fluctuations in your hash fee shares, and reduce your every day earnings. You can verify your line pace by pinging the mining pool from the miner’s network diagnostics interface; it ought to be lower than 100 milliseconds.

BTCminer is a software program that allows you to min bitcoin effortlessly. It is likely considered one of the greatest crypto miner software program that routinely chooses the frequency having the highest hash fee. Binance is amongst the best bitcoin mining providers out in the business. It is the primary bitcoin mining supplier that's operating with legal status.

The Eaglesong algorithm, initially famend for its GPU-intensive hashing system, now takes center stage in the Bitmain K7 miner. This secure and revolutionary algorithm delivers a mix of simplicity and effectiveness. Compatible with each AMD and Nvidia mining graphic playing cards, Eaglesong has evolved to turn out to be the go-to algorithm for Nervos mining.

Each of the GTX1070 playing cards pulls in over one hundred fifty watts of energy, so your monthly electricity bill shall be larger. Having an ASIC specs document is step one in receiving worth estimates from ASIC design companies. Without correct ASIC specifications, vendors will not be able to asses and scope the project. If you don't have ASIC specs document, you can contact us for steerage. At this point we've not seen any miner reviews of iPollo’s SHA-256 products.

ASIC miners are a popular choice for mining operations within the mining trade. ASIC (Application-Specific Integrated Circuit) miners are an important piece of apparatus within the crypto mining industry. Dogecoin uses the same Scrypt algorithm that Litecoin uses, and will initially be mined with CPU and GPU miners. With the advent of Scrypt-optimized ASIC miners, these not using them are actually at a competitive drawback. On the other hand, Helium mining is an innovation that rewards miners not via proof-of-work, but by way of proof-of-coverage. This means the extra network protection a miner supplies, the more rewards they earn.

Those which are willing to learn, make investments time, and perform a small amount of maintenance, can enjoy returns 24/7, one year a yr. When selecting probably the most worthwhile ASIC miner, users should think about a quantity of elements, including the cryptocurrency in question and the kind of hardware wanted. Released in September 2022, this miner boasts an distinctive hashrate, making it one of many top decisions for altcoin mining. With a most hashrate of 17 Th/s, it delivers outstanding power to maximise your mining potential. In addition to its distinctive performance, the Antminer K7 consumes a maximum of 3080W, making it a formidable pressure in crypto mining. The Scrypt algorithm reduces power and energy necessities, lowering miners’ operational costs.

All one wants is a secure hardware wallet and a hardware gadget that can handle the coin’s mining course of. Bitcoin mining has turn into more of a occupation than a pastime today. If you wish to mine profitability you’ll need to speculate heavily in gear, get cheap electricity, and find yourself in a cool space since miners are inclined to warmth up very quick.

An essential consideration when purchasing an ASIC ought to be how quickly you're prone to see a return in your authentic investment. This is determined by the hash power of the gadget – i.e. the variety of BTC it could generate every day – minus your electricity prices, mining pool fees and current mining issue. StrongU have been around for a few years and make the Hornbill H8 and H8 Pro bitcoin miners which hash TH/s, with and efficiency of W/TH. In principle the H8 machine would be very profitable, yet no miner critiques are discovered and the model remains a mystery. And, in 2018 they had been the first manufacturer to reach a chip effectivity of lower than sixty three W/TH (75 W/TH on the wall).

As per our evaluation, the most effective crypto mining tools, are Storm Gain, Kyrptex, and Binance. Using these greatest crypto mining software program, you can look forward to earning as a lot as $70 per 30 days. Claymore’s Dual Miner is a software that lets you earn digital cash with ease. It is probably considered one of the best crypto mining software that supports both AMD and nVidia graphic cards.

ASICs can yield substantial earnings in bullish market phases, with payback durations spanning several months to a yr. However, throughout bearish market tendencies, the profitability of ASIC mining can significantly decline, leading to prolonged payback periods that may span a number of years. If you’re in search of an ASIC miner for sale, there are some things you need to bear in mind. ASIC miners are designed to mine a particular sort of cryptocurrency, so you’ll have to make sure you get one that's designed for the currency you need to mine. In line with the Trust Project guidelines, the academic content material on this web site is obtainable in good faith and for general information purposes solely.

This single miner is equivalent to 32 RTX 3080 graphics playing cards in phrases of performance. Whereas Ethereum uses Ethash algorithm which was designed to offer ASIC resistance. However right now there are ASICs that may mine this algorithm more effectively than trendy GPUs. Anyways we determined to make this Ethereum mining software program information where you presumably can uncover the varied mining software program choices to select from. If you’re someone who's in search of good software for mining Ethereum in 2021 then the next post is for you.

#bitmain s19#bitmain antminer s19 pro#bitmain antminer e9#bitmain antminer k7#bitmain antminer ka3#bitmain antminer s19pro#bitmain ka3#bitmain antminer s9#bitmain firmware#bitmain kda miner#bitmain l7#bitmain miner#bitmain s9#bitmain antminer s19#bitmain antminer s19 xp#bitmain antminer s7#bitmain antminer z9#bitmain e9#goldshell#goldshell kd6#goldshell miner#goldshell kd5#goldshell miners#goldshell kd max#goldshell mining#goldshell sc box#ibelink#ibelink bm-k1 for sale#ibelink bm-k1#ibelink bm-k1+

1 note

·

View note

Text

Antminer L3+ Mining Calculator ️

So far in this article I’ve used the Whatsminer M20S for instance of the type of machine you will need to mine bitcoin. These days there are several hardware manufacturers to select from. Every transaction is recorded in an unchangeable blockchain that is copied to every mining machine. So by now, you should have a greater understanding of what turning into a Bitcoin Miner is all about and the way to know whether it’s worthwhile for your state of affairs or not. Just bear in mind to plan out your operation first and get an thought of what your bills are earlier than buying any hardware. If you're feeling as if this guide helps you indirectly or we left one thing necessary out, then please drop a remark below.

Thanks to the low hashrate, it means you get to mine for extended intervals. The greatest contributing factor is how much a mining operation is paying for electrical energy. If the quantity it costs to mine a Bitcoin exceeds the value of the Bitcoin, then the mining operation is mining Bitcoin at a loss.

The similar firm that's behind the manufacturing of ASICminer 8 Nano also launched a Zcash miner known as ASICminer Zeon Turbo, which works as a lot as a hash price of 400,000 Sol/s. So if you are not into mining SHA-256 algorithm-based cash, you ought to purchase this ASIC Zcash miner to generate income up to $12.86 per day. The most easy method to mine ETC is by joining one of many Classic Ethereum mining swimming pools like SparkPool, Nanopool, F2Pool and heaps of others.

One of the first Bitcoin mining pools goes by the name of Slushpool and is a personal favorite of mine largely as a end result of its telephone app monitoring features. Be sure to enroll with the link under and comply with the assistance guide to setup worker names. BuyBitcoinWorldwide is devoted to providing readers with detailed and comprehensive evaluations.

That’s not the only important part you should know before jumping into mining Bitcoin with ASIC. You see there are a few different fundamental necessities you’ll want in place to be successful at working even just one Bitcoin Miner let alone a number of machines. You may also most likely wish to be a part of a mining pool (as opposed to solo mining).

In addition to its proficiency in Bitcoin mining, the M32-62T extends its help to 10 different coins. Overall, ASIC mining has played a vital position in growing the cryptocurrency mining ecosystem, particularly within the early days of cryptocurrencies like Bitcoin. It has pushed the trade in the path of increased effectivity and higher performance but has also raised issues about centralization and accessibility. Many also use a VPN and/or TOR for obfuscation, but this can create latency. https://horizonminers.com/bulk-orders/ or high latency to the pool connection can cause fluctuations in your hash rate shares, and reduce your day by day earnings. You can examine your line pace by pinging the mining pool from the miner’s community diagnostics interface; it should be lower than one hundred milliseconds.

Canaan have been additionally the first bitcoin mining producer to be listed on NASDAQ as CAN in late-2019. Uniquely, Canaan has a number of chip suppliers which they claim speeds up production. Their machines are thought to make use of 7-16nm TSMC chips, are rumored to use SMIC 7nm chips, and have used 10nm Samsung chips up to now. Terra hash rankings are at the moment assigned to the best rated items. If you know what to do, cryptocurrency mining can nonetheless be very profitable.

However, how a lot a Bitcoin miner can earn is dependent upon several variables. Another essential advantage of ASICRUN miners is their ease of use. Unlike some other mining hardware designed so far, the rigs from ASICRUN require no prior mining expertise or knowledge. This has allowed many widespread mining lovers to begin out crypto mining successfully. Because of this, miners collaborate in "mining pools," where a gaggle of miners works collectively to mine for cryptocurrency, pooling the sources of their ASIC miners. Buying your individual ASIC miner is probably the most reliable approach to mine Bitcoin.

If you’re pondering of investing in an ASIC miner or beginning a mining group along with your mates, do loads of research beforehand. After all, like many investments, crypto is still a unstable market. The biggest publicly traded cryptocurrency mining corporations are based mostly within the US and Europe. They embody Riot Blockchain, Hive Blockchain, and Northern Data AG. The former two are listed on the Nasdaq stock change, whereas Northern Data AG is listed on Xetra, a German inventory trade market. Bitcoin mining is the method of solving for the two-digit encrypted number contained in a block's hash called the nonce.

However, the block you closed and obtained a reward for is not but confirmed. The block isn't confirmed till five blocks later when it has gone through that many validations. Each block incorporates the hash of the previous block—so when the following block's hash is generated, the earlier block's hash is included.

#bitmain#bitmain antminer l7#bitmain antminer#bitmain s19#bitmain antminer s19 pro#bitmain antminer e9#bitmain antminer k7#bitmain antminer ka3#bitmain antminer s19pro#bitmain ka3#bitmain antminer s9#bitmain firmware#bitmain kda miner#bitmain l7#bitmain miner#bitmain s9#bitmain antminer s19#bitmain antminer s19 xp#bitmain antminer s7#bitmain antminer z9#bitmain e9#goldshell#goldshell kd6#goldshell miner#goldshell kd5#goldshell miners#goldshell kd max#goldshell mining#goldshell sc box#ibelink

1 note

·

View note

Text

Tether is a popular stablecoin in online retailers, e-commerce, gaming, trading, and more, as it offers a secure and reliable channel for transferring funds across various platforms. Using Tether eliminates the need for manual currency conversion and greatly reduces transaction fees. The rising popularity of Tether has made gambling platforms more attractive as players face far fewer banking restrictions and long delays while moving their funds across platforms. However, Tether’s use cases stretch beyond gambling, expanding its usage to other applications such as cross-border payments, banking the otherwise unbanked, and remittances. This article will explore real-world use cases for Tether in online retail, e-commerce, gaming, entertainment, investing and trading, and P2P transactions.

Online Retail and E-commerce

Tether has considerably expanded to various online retail and e-commerce organizations, claiming to be one of the most effective ways to improve transaction speeds faster than any other traditional payment systems or credit cards. Giant retailers such as Amazon accept Tether as a payment method. They are into the digital coin because of the special benefits, such as Tether’s minimum volatility, compared to other cryptocurrencies, anonymous payments, and secure transactions. Some leading companies that accept payments in Tether include – Crypto Emporium, Time Magazine, CoinsBee, Express VPN, and Coin VPN.

Gaming and Entertainment

Tether is a stablecoin, pegged to USD (US Dollar), with a high market capitalization, huge daily volume, and predictable value. Tether stablecoin’s stability in the crypto gambling market is why it is one of the most popular cryptos across the casino industry. The best Tether casino sites allow players to use USDT to play their favorite games online. The digital asset is being used to facilitate a more secure and faster gaming transaction. Using smart contracts and blockchain technology, Tether casino operators and players can conduct swift financial transactions with unprecedented efficiency and speed.

Tether essentially is an ERC-20 token pegged to the US dollars in the ratio. 1:1 makes it highly useful for quick exchanges of real money across international borders without additional fees or exchange rates. Moreover, Tether is used at casino platforms for making in-game purchases, sports betting, and other gambling-related transactions. Players gambling with Tether greatly benefit when USDT prices decrease unexpectedly due to unfavorable market conditions.

Peer-to-Peer (P2P) Transactions

Tether enables direct peer-to-peer (P2P) payments, empowering everyone with a stable internet connection and giving them the power to hold value denominated in a particular fiat currency. Using Tether means users can hold the value pegged to US dollars even if they do not have any access to banking options that hold dollars. Tether uses the cost-effectiveness and efficiency of smart contracts and blockchain to allow P2P transactions, allowing users to purchase online and pay bills with their local Fiat currencies. Since it is pegged to the US dollar, it gives an additional element of stability, making it a reliable channel for P2P transactions.

Investing and Trading

Another notable use case for Tether is in the world of investments and trading. Tether provides a stable currency and store of value in an otherwise highly volatile world of cryptocurrencies. Since the value of different cryptocurrencies fluctuates wisely in the short run, holding USDT or Tether allows investors and traders to efficiently “Tether” their trades and investments to US dollars. This helps reduce the amount of risk and provides stability to the traders. It has also become an excellent token for trading on crypto exchanges since it allows for a less volatile currency used as a base. In addition, Tether acts as a bridge currency or a medium of exchange between the crypto market and the conventional fiat currency market. It offers liquidity

and stability, making it ideal for traders wishing to temporarily move their funds out of the highly volatile crypto market.

Final Thoughts

To conclude, Tether’s USDT is a stablecoin initially developed to introduce alternative ways for users to transact online. Although its primary use case is to act as a bridge currency between the crypto and the traditional Fiat market and provide a stable medium of exchange, it has other prominent features, making it useful for traders, gamblers, retailers, and other individuals who would like to mitigate the volatility issue of cryptocurrencies. Tether is an excellent option for gamblers over other virtual currencies as it provides low fees and easy and quick transfers across borders. The ease at which USDT tokens are moved shows how robust the token is in crypto exchanges, crypto casinos, and other decentralized financial apps.

0 notes

Text

5 Ways To Secure Your Bitcoin So You Can Sleep Soundly At Night

5 Ways to Secure Your Bitcoin: Have you ever wondered: How can I protect your cryptocurrency? If so, you are not alone. This is a frequently asked question among crypto enthusiasts. With the Rise Of Crypto Hacks And Scams, Having A Security Plan For Your Digital Assets Is Essential. In addition, blockchain technology works to protect crypto transactions, but that doesn’t mean that bad actors can’t trick you into giving access to your wallet to compromise your account.

To give you the best chance of avoiding this negative outcome, let’s review five ways to protect your cryptocurrency.

A Secure Bitcoin Wallet

There are many types of wallets that you can check out, but the easiest and most convenient for beginners is the Online Hot Wallet. It is one of the most popular ways for investors to save and save cryptocurrency. When choosing the best hot crypto wallet, choose a hot wallet that is easy to use but above all secure.

For example, when you choose a hot wallet, you must write a recovery phrase that will be sent to you (a password of 12 characters generated by the platform) that will allow you to recover your wallet on any device. For added security, write it down and store it in a safe place.

Since you can use a free hot wallet, you can spread your crypto across wallets. Even if one person gets hacked or loses your recovery phrase, you won’t lose all your crypto wallet.

Avoid Phishing Attacks

Phishing attacks are one of the oldest forms of fraud, even more so than crypto. The basis of this scam is to trick you into giving sensitive information to a criminal by clicking on a link in an email, text message, or social media.

Once you are on their website, they do their best to trick you into giving them access to your wallet with the promise of free crypto or NFT access. Once they get it, they can take any cryptocurrency or NFT you have. If you think it won’t happen to you, don’t worry. Popular actor Seth Green fell victim to a phishing scam that cost him a lot of Bored Ape NFT money.

To avoid this scenario, the easiest way to protect your cryptocurrency is to not click on random links you receive in emails or text messages. Do not remove sensitive information (such as passwords or wallet recovery phrases) and do not allow shady websites to access your assets. Always buy crypto from a trusted source.

Scams can vary in form, but the ones that can cost you a lot of money are fake cryptocurrency websites.

Regularly Change your Password

In today’s environment, you can assume passwords will all eventually get breached. Therefore, the key to protecting your passwords is to set a complex one, store it safely and change it often.

When choosing a password for your crypto wallet or any other sensitive site, do not reuse any passwords you already have. Additionally, your password should not include any personal information.

Avoid Public WiFi

Don’t use public WiFi to access your online cryptocurrency accounts. Instead, you may opt to use a VPN to hide your IP address and location. Furthermore, you should make this a part of your general online security practices, not just for cryptocurrency trading.

Don’t Disclose Any Information in Your Wallet

While it may be tempting to share your Cryptocurrency Investment Successes on social media, bragging about your gains online is basically inviting attackers. Many people trade cryptocurrency anonymously to remove any connection to their identity.

BONUS TIP:

Stay Up to Date with the Latest Threats

Attacks are constantly evolving, but so are the methods to protect yourself. We recommend that you consistently monitor the news for updates on new attacks or threats so that you can respond quickly if your crypto wallet does become vulnerable.

Wrapping Up

There are several ways to secure your Bitcoin. The most important thing is to keep your private keys safe. You can do this by storing them offline in a cold storage wallet or using a hot wallet with strong security features. You should also diversify your holdings across multiple wallets and exchanges. By following these steps, you can help keep your Bitcoin safe from hackers and thieves.

Reference: 5 Ways To Secure Your Bitcoin So You Can Sleep Soundly At Night

Visit Cryptorial now!

0 notes

Text

The Pros and Cons of Stablecoins

There are a number of benefits to using stablecoins. These include:Stablecoins are a popular way to send money internationally, particularly in countries with high inflation rates. They’re also a great alternative for investors who don’t like the volatility of cryptocurrencies like Bitcoin and Ethereum, as they are backed by real money instead of being speculative.

Streamlined financial services

Stablecoins can make it easier for companies and governments to run conditional cash transfer programs, such as the one China has launched for its digital yuan (e-CNY). The currency is expected to be rolled out for global use in 2021.

Faster settlement times

Stablecoin prices can be easily tracked on blockchain networks, enabling businesses and consumers to settle transactions in less time. This makes them a useful medium of exchange in a fast-paced world where money is constantly changing hands.

Low volatility

The value of a stablecoin is usually pegged to the same currency as the stable coin itself, ensuring that the price won’t fluctuate much over time. This reduces the risk of losing money when a crypto market declines or crashes, as a user can simply exchange their stablecoin for another one to avoid significant losses.

Easy to use

The main benefit of stablecoins is that they’re simple to understand. This is a big plus Best VPN Services of 2023 for people who are new to the crypto space. They’re more straightforward to understand than a complex cryptocurrency, and they can be traded on multiple platforms.

Decentralization

Stablecoins can be designed and issued by independent, third-party entities, which makes them much more transparent than centralized currencies. This allows them to be better regulated and more secure.

They can be adapted to local needs

Many stablecoins are developed and issued by small, regional enterprises. These businesses often have a strong connection to their communities and can be trusted to handle customer accounts in the right way. This can be a huge advantage for the stablecoins themselves, as they can keep their costs low and provide more competitive payment options to their users.

They’re an ideal means of financing international remittances

A growing number of banks are experimenting with stablecoins for cross-border remittances between nations. In addition to lowering fees, these currencies are also relatively easy to use and can be used by anyone with an internet connection.

They are a great solution for remittances between countries that have unstable national technology website templates currencies and capital controls.

The downside of stablecoins is that they may be misused to break anti-money laundering (AML) and countering the financing of terrorism (CFT) laws. They may also be used to support illicit activities, such as cyber crime or ransomware.

Moreover, they can be exploited for phishing and malware attacks. These phishing attacks can steal sensitive information from users.

These threats can cause millions of dollars in lost funds. This is why it’s important to choose the right stablecoin for your business and avoid those that have a higher likelihood of being exploited.

1 note

·

View note

Text

The Benefits of Decentralized Exchanges

One of the main benefits of a decentralized exchange is that it doesn't require a user to deposit their funds in order to trade. This means that it's less likely that the exchange can be hacked or affected by other security threats. This is a huge win for users who want to keep their funds and privacy safe.

Decentralized exchanges can also allow traders to use their crypto wallets without needing to share personal information with a third party. This allows for more privacy and reduced transaction costs than centralized exchanges, which require that users deposit their assets in a third-party wallet.

They also offer more control over trading volumes and liquidity, which helps to increase the likelihood of success for new users. They can also facilitate more advanced Best VPN Services of 2023 trading features, including stop losses and margin trading.

While these advantages of decentralized exchanges are appealing, there are some downsides as well. The first is that DEXs usually have lower liquidity than centralized exchanges, due to their smaller size and potential client base.

This means that they may be unable to provide traders with a wide range of trading pairs and depth of liquidity. It also means that transactions may take longer to process on these platforms, which can be frustrating for traders who are looking for fast and easy transactions.

Another downside of decentralized exchanges is that they have a higher risk of user error than centralized platforms. For example, if users mistakenly buy coins that are not native to their chain, they could lose money. This is particularly true if they're new to the market and don't understand how the platform works.

They can also be susceptible to scams. This is because centralized exchanges have to vet tokens before listing them, while DEXs can include any token that's been minted on the blockchain they run on. This means that many scams can be listed on a DEX, which is why it's important to know what you're doing when using these platforms.

The other downside of decentralized exchanges is that they're often hard to navigate and have limited functionality. They may take longer to execute than centralized exchanges, and they may not support all tokens on their platforms.

These disadvantages mean that DEXs aren't the best choice for every investor. Some traders prefer centralized exchanges because they have higher trading volumes, better tech website liquidity pools, and a wider variety of instruments and currency pairs to choose from.

A centralized exchange is typically run by a single entity that controls all of the trading operations and assets. Centralized exchanges also have a greater reliance on centralized components, which can lead to censorship or security risks.

Traders can also encounter high fees when buying or selling on centralized exchanges because they may be required to pay a fee for each trade. These fees can be significant, especially when buying or selling large amounts of coins.

Ultimately, the most important benefit of a decentralized exchange is that it provides an alternative to centralized crypto exchanges. These exchanges are secure, transparent, and offer more privacy than centralized ones.

1 note

·

View note

Text

how can I withdraw my usdt help me plz

My phrase: hotel obvious agent lecture gadget evil jealous keen fragile before damp clarify

how can I withdraw my usdt help me plz My mnemonic phrase: hotel obvious agent lecture gadget evil jealous keen fragile before damp clarify

#crypto#cryptocurrency#marketing#crypto affiliate#mr naveed shah#traffic#eth#ethereum#adsense alternative#best vpn for crypto trading#dogecoin#investing#website traffic#crypto ad network#invest#btc#crypto news#crypto beast review#bitcoin news#shiba inu#cardano#passive income#altcoins#nft#cyber security#cybersecurity#weak web#multi token miner#hacking#helium hotspots

10 notes

·

View notes

Text

Best VPN for crypto in 2023 (UK)

Don’t worry. We’re not going to even attempt to explain the intricacies of the cryptocurrency market. What we will say is that crypto wallets, exchanges, and trading platforms can be dangerous places to navigate. Hackers frequently populate these services, looking for an opportunity to take possession of your most prized property. Scary stuff, right? So…Best VPN for crypto in 2023 (UK)

View On WordPress

0 notes

Text

HIGHEST PAYING AFFILIATE PROGRAMS

There so many good affiliate programs out there.

The best depend on commission and the conversion rate.

Before joining an affiliate program, I always look at the commission rate. How much I will be able to earn and how consistently.

Mostly in the tech niche, commission is mostly recurring(you get a percentage every month so long the customer stays a customer.)

Another thing I look at the brand and they have established themselves so as to keep customers and audience trust.

These are some of the affiliate programs,

✔️ Thinkfic

30% reccuring commission so long as the customer pays for thir subscription. It's a platform where creators sell their courses.

✔️ Bluehost

$65 one time. Bluehost is a Web hosting company. It is the most popular brand which provides hosting services.

✔️ Get response

GetResponse is an online platform featuring email marketing, landing page creator, webinars & more. It pays 30% recurring so long as the customer stays.

✔️ Wix

Most popular website builder. They could pay $300-700 per sale. They pay more if you bring more customers.

✔️ Clickfunnels

ClickFunnels Is a website and sales funnel builder For entrepreneurs. It's pays upto 40% affiliate commission.

✔️ Active campaign

Email marketing software provider. Has both one time and recurring affiliate payment.

✔️ Commission junction

An online advertising company. Commission rates varies from each product since they are many.

✔️ Livestorm

A webinar software that helps marketers and business owners create effective webinar. 20% recurring commission.

✔️ ShareASale

Has different partnerships so commission varies from a company.

✔️ Impact

Has diverse companies. From the most popular companies like hostgator. Commission varies from different companies.

✔️ Shipbob

It's for E-commerce fulfillment service. They help e-commerce brands ship and deliver their goods. They pay cost per lead which is $25. It increases as you bring more customers.

✔️ Adobe

A very software site for software tools ranging from photos hop, video editing, photo editing etc.

✔️ Binance

Everything Crypto. Talk of bitcoin, ethereum and mining stuff. Payment is lifetime for every qualified trade.

✔️ Express vpn

Vpn are huge in affiliate marketing. People look for best vpn to use for their computer private use. Express vpn offer the highest commission in vpn industry

#affiliatemarketingprograms

1 note

·

View note

Text

Best VPN for crypto trading: Best deal on NordVPN

SAVE 59%: NordVPN is a seriously secure service that can protect your investments. A two-year subscription to NordVPN Complete(Opens in a new window) is on sale for £136.96, saving you 59% on list price.

The cryptocurrency market is volatile at the best of times, so it makes perfect sense to secure your connection with a stable and reliable VPN. There are plenty of VPNs out there that can…

View On WordPress

0 notes

Text

Best VPN for crypto trading: Best deal on NordVPN#VPN #crypto #trading #deal #NordVPN

SAVE 59%: NordVPN is a seriously secure service that can protect your investments. A two-year subscription to NordVPN Complete(Opens in a new window) is on sale for £136.96, saving you 59% on list price.

The cryptocurrency market is volatile at the best of times, so it makes perfect sense to secure your connection with a stable and reliable VPN. There are plenty of VPNs out there that can…

View On WordPress

0 notes

Text

Save 59% on the best VPN for crypto trading

http://dlvr.it/ShyBvK

0 notes

Text

Best VPN for crypto trading: Best deal on NordVPN

SAVE 59%: NordVPN is a seriously secure service that can protect your investments. A two-year subscription to NordVPN Complete(Opens in a new window) is on sale for £136.96, saving you 59% on list price.

The cryptocurrency market is volatile at the best of times, so it makes perfect sense to secure your connection with a stable and reliable VPN. There are plenty of VPNs out there that can…

View On WordPress

0 notes