#best online trading platforms for beginners

Text

Top-Rated Online Stock Trading Platforms for Beginners

Top-Rated Online Stock Trading Platforms: Choosing the right online stock trading platform is crucial for beginners looking to enter the world of investing.

With numerous options available, it’s essential to select a platform that offers user-friendly interfaces, educational resources, low fees, and robust trading tools.

Top-Rated Online Stock Trading Platforms for Beginners

In this guide,…

View On WordPress

#best online stock trading for beginners#best online stock trading platform for beginners#best online trading platforms for beginners#best stock trading platform for beginners#forex trading#forex trading for beginners#investing for beginners#online stock trading for beginners#stock market for beginners#stock trading#stock trading apps for beginners#stock trading for beginners#stocks for beginners#trading platform beginners#trading platforms for beginners

1 note

·

View note

Text

Explore the World of Forex Trading with Finecapitals and Metatrader 4!

Finecapitals introduces the future of forex trading with Metatrader 4. Access the MetaTrader Webtrader and experience the freedom of trading on the go. Join us today and unlock the potential of the Meta Trader 4 platform.

#forex trading for beginners#best forex trading platform#meta trader 4 platform#online forex trading platform#how to trade in forex market#tips on how to trade forex#metatrader webtrader

2 notes

·

View notes

Text

Do You Know the Best Way to Start Trading?

Understanding the best way to start trading with UltratrendFX best forex trading accounts. To improve the trading experience. Begin your journey today!

#online currency trading platforms#online foreign exchange account#best forex charts online#make money online by trading forex#forex easy online trading#best foreign currency trading platform#top online forex brokers#best online forex broker for beginners#best mobile forex trading platform

0 notes

Text

Essential Tips for Beginner Forex Traders

Forex trading, the exchange of currencies on the foreign exchange market, can be a lucrative venture for those who approach it with knowledge and caution. However, for beginners, navigating the complexities of the forex market can be daunting. Here are some essential tips to help beginner forex traders embark on their trading journey with confidence.

Education: Before diving into forex trading, it's crucial to educate yourself about the fundamentals of the market. Understand how currency pairs are traded, learn about different trading strategies, and familiarize yourself with technical and fundamental analysis. There are numerous resources available online, including tutorials, articles, and courses, that can help you build a solid foundation of knowledge.

Choose the Right Broker: Selecting a reputable forex broker is paramount. Look for brokers that are regulated by respected authorities, offer competitive spreads, provide reliable execution, and have a user-friendly trading platform. Take the time to research and compare different brokers to find the one that best suits your needs and preferences.

Start Small: As a beginner, it's advisable to start with a demo account or with a small amount of capital that you can afford to lose. This will allow you to practice trading in a risk-free environment and gain valuable experience without putting your hard-earned money on the line. As you become more comfortable and confident, you can gradually increase your position sizes.

Develop a Trading Plan: Before executing any trades, develop a clear trading plan that outlines your goals, risk tolerance, and strategies. Determine your entry and exit points, as well as your position sizing and risk management rules. Having a well-defined plan will help you stay focused and disciplined during volatile market conditions.

Manage Risk Effectively: Risk management is crucial in forex trading. Never risk more than you can afford to lose on a single trade, and always use stop-loss orders to limit potential losses. Additionally, consider diversifying your portfolio and avoiding over-leveraging, as these practices can expose you to unnecessary risks.

By following these essential tips and continuously learning and adapting to market conditions, beginner forex traders can increase their chances of success and build a profitable trading career over time. Remember, patience, discipline, and perseverance are key attributes of successful traders.

#forextrading#best trading platform#Best Online Trading Platform In India#forex trading#forex trading for beginners

1 note

·

View note

Text

8 Best Trading Apps in India

Experience seamless trading with the 8 Best Trading Apps in India. These user-friendly platforms offer real-time market data, advanced charting tools, and quick execution, empowering both beginners and seasoned traders. Stay informed, execute trades with precision, and optimize your portfolio effortlessly. Navigate the dynamic financial markets with confidence using the top-rated trading apps for a rewarding trading experience. If you need any assistance or queries connect with Best Stocks Broker at: 8920927713

#8 Best Trading Apps in India#best trading platform in india 2023#best trading app in India#best online trading platform in india#Best Trading Apps in India 2023#top trading app in india#trading app in india#best stock trading app for beginners in india

0 notes

Text

Explore the best stock trading courses and premier trading education in USA at TradersHub. Elevate your trading skills with our innovative approach. Start your journey to success today with our comprehensive online trading courses.

#trading courses#trading courses online#trading courses in usa#stock trading education#best stock trading courses online#best trading courses online#best trading education#trading education websites#trading courses near me#online trading tools#Trading Platform in usa#Financial Markets#trading courses for beginners#Advanced trading courses#best price action trading course#best indicator for option trading buy and sell#Trading pricing plans in USA#best Subscription options for traders#Pricing for trading courses#Trading services cost

1 note

·

View note

Text

Top 10 Best Stock Trading Apps for Beginners

10 Best Stock Trading Apps for Beginners

Revolutionize Your Trading: Check Out the Top 10 Best Stock Trading Apps for Beginners!

Welcome to the Top 10 Best Stock Trading Apps for Beginners post written by the MoneyHustle team, In this post, we will talk about the 10 Best Stock Trading Apps for Beginners. Additionally, we will discuss which applications are free to use, how many people have…

View On WordPress

#Best Brokers for Free Stock Trading#Best Free Stock Trading Apps#best free trading platform#best free trading platform for beginners#Best Investment Apps#Best Online Brokers for Free Stock Trading#best stock trading app for beginners#Best Stock Trading Apps & Platforms Free + Paid#best trading app to earn money#free stock apps for beginners#free trading app without investment#trading app with free real money#trading apps that give you money to start

0 notes

Text

The Best International Online Trading Platform for Everyone: CappmoreFX

CappmoreFX is The Best International Online Trading Platform for everyone. Whether you're a beginner or an experienced trader, our platform offers the flexibility and resources you need to succeed. With a user-friendly interface, advanced trading tools, and a wide range of tradable assets, CappmoreFX provides an exceptional trading experience.

Enjoy competitive spreads, fast execution, and personalized support from our team of experts. Join CappmoreFX now and take your trading to new heights.

#forex money transfer#best way to start trading#the best copy trade forex#best forex social trading#best investment platform for beginners#The Best International Online Trading Platform

0 notes

Text

Introduction to Investment and Online Trading in India

When it comes to investment and online trading in India, there are five essential steps that you need to take before starting out. These are:

1. Choose the right broker: There are many stock brokers available in India, so it is important to choose the one that best suits your needs. Make sure to check out the fees, commissions and other charges before opening an account.

2. Get familiar with the platform: Once you have chosen a broker, take some time to get familiar with the best trading platform. This will help you understand how the system works and also give you a chance to test out its features.

3. Learn about different types of orders: There are various types of orders that you can place when trading online. It is important to learn about these so that you can place the right order for your trade.

4. Manage your risk: One of the most important aspects of online trading is managing your risk. Make sure to set stop-losses and take-profits so that you can limit your losses and lock in profits.

5. Have a plan: Make sure that you have a plan in place before starting to trade online. This should include your investment goals, risk tolerance and time frame. By having a plan, you will be more likely to succeed in online trading in India.

Understanding the Basics of Share Market & Investing Strategies

When it comes to online trading in India, there are a few things you need to understand before getting started. The first is the share market. This is where stocks and other securities are traded. It’s important to understand how the share market works before investing any money.

There are two types of shares: equity and debt. Equity shares represent ownership in a company. Debt shares, on the other hand, are like loans. You’re lending money to the company and will be paid back with interest.

It’s also important to understand how different investment strategies work before putting any money into the market. There are many different ways to trade, but some of the most common include day trading, swing trading, and position trading.

Each of these strategies has its own risks and rewards, so it’s important to understand them all before choosing one that’s right for you.

Five Essential Steps before You Start Trading Online in India

If you want to trade online in India, there are a few essential steps you need to take before getting started. Here are five of the most important things to do before you start trading online in India:

1. Choose the right broker: Not all brokers are created equal, and not all of them will be a good fit for your trading style and needs. Do your research and make sure you choose a reputable broker that offers the products, services, and features you need.

2. Get familiar with the platform: Once you’ve chosen a broker, take some time to get familiar with their trading platform. This is where you’ll place your trades, so it’s important that you understand how it works and feel comfortable using it.

3. Learn about the markets: Before you start trading, it’s important to have at least a basic understanding of the different markets available to trade in. Research different asset classes and familiarize yourself with key concepts like market order types, charting tools, etc.

4. Develop a trading plan: A trading plan outlines your investment goals, risk tolerances, and strategies for achieving those goals. Without a plan, it will be difficult to make consistent, profitable trades. So take the time to develop a solid plan before getting started.

5. Stay disciplined: Once you’re up and trading, it’s important to stay disciplined and stick to your plan. Don’t let emotions influence your decisions; stay calm and objective

Research the Broker and Platform You Will Use

The first step to take before starting online trading in India is to research the broker and platform you will use. There are many different brokers and platforms available, so it is important to find one that is right for you.

There are a few things to consider when choosing a broker or platform. First, look at the fees associated with each option. Make sure to compare the fees charged by different brokers and platforms before making your final decision.

Next, consider the features offered by each broker or platform. Some brokers and platforms offer more features than others. Consider which features are most important to you and make sure the broker or platform you choose offers them.

Read reviews of different brokers and platforms before making your choice. Ask friends or family members if they have any recommendations. Once you have chosen a broker or platform, be sure to test it out before actually investing any money.

Learn About Different Types of Assets You Can Trade

Before you start trading online in India, it’s important to learn about the different types of assets you can trade. Here are five essential steps to take:

1. Decide what asset class you want to trade in. There are four main asset classes: stocks, bonds, commodities, and foreign exchange (forex). Each one has its own risks and rewards.

2. Research the different types of assets within your chosen asset class. For example, if you’re interested in stocks, you might want to research different sectors or industries.

3. Consider your investment goals. What are you hoping to achieve by trading online? Are you looking to make a quick profit or build a long-term portfolio?

4. Compare different online brokers. Not all brokers offer the same products or services. Some specialize in certain asset classes or have lower fees than others.

5. Open and fund an account with your chosen broker. Once you’ve done your research and found a broker that fits your needs, you’ll need to open an account and deposit money before you can start trading.

Understand the Risk Involved With Trading Online

Before you start trading online, it’s important to understand the risks involved. Trading in stocks and other securities can be a risky proposition, and there are a number of factors that you need to take into account before you begin.

First, you need to understand the nature of the stock market. The stock market is volatile, and prices can go up and down without any warning. This means that you could lose money on your investment if you’re not careful.

Second, you need to have a good understanding of the company whose stock you’re buying. Make sure you research the company thoroughly before investing any money.

Third, don’t invest more money than you can afford to lose. The stock market is risky, and you could lose all of your investment if the market takes a turn for the worse.

Fourth, be prepared to hold onto your investments for the long term. It takes time for the stock market to recover from a downturn, so don’t expect to make a quick profit.

Don’t forget to diversify your portfolio. Don’t put all of your eggs in one basket by investing only in one company’s stock. Spread your investments around so that you’re not as exposed to risk if one particular company doesn’t do well.

Set a Budget for Your Investment

1. Before you start online trading in India, it is important to set a budget for your investment. This will help you to control your spending and avoid over-investing.

2. You need to determine how much money you can afford to lose without affecting your lifestyle. This will help you to set a limit on your trading activity.

3. Once you have set a budget, you need to stick to it. Do not be tempted to over-invest or take risks that exceed your budget.

4. Review your budget regularly and make adjustments as needed. This will help you stay on track and ensure that your investment remains within your affordability range.

5. If at any time you feel like you are struggling to stick to your budget, seek professional financial advice. This will help you get back on track and make the best decisions for your investment goals.

Take Advantage of Free Demo Accounts to Practice With

If you’re thinking about starting online trading in India, there are a few essential steps you need to take first. One of the most important is to take advantage of free demo accounts to practice with.

A demo account is a simulated trading account that allows you to test out a trading platform and experience how it works without having to risk any real money. This is an essential step for anyone new to online trading, as it gives you a chance to get familiar with the platform and learn how to place trades before putting any real money on the line.

Most online brokerages offer free demo accounts, so be sure to take advantage of this opportunity before starting your trading journey. Happy trading!

Conclusion

Online trading is an exciting way to make money, but it’s important to take the right steps before getting started. By taking the time to research different types of investments, understand the risks and regulations associated with online trading in India, create a budget and plan for success, analyze your financial goals and objectives, and find a trustworthy broker or platform provider who can help you achieve them — you’ll be well on your way towards successful online trading. With these five essential steps taken care of beforehand, you’ll be ready to jumpstart your journey into profitable investing!

#beginners guide to Share Market#Online Trading In India#stock brokers available in India#best trading platform#icici direct#icici direct login#icicidirect#upstox login#dhan login#5paisa

0 notes

Text

Trading cryptocurrencies can be risky without enough knowledge about the cryptocurrencies and it requires you to do your research to understand what suits you the best. However, one should always choose the best cryptocurrency platform with adequate credibility in the industry to perform successful trading. It is not just the trader but the cryptocurrency platform that matters. Whether you are a beginner starting your crypto trading journey or an existing trader in the industry planning to improve your portfolio with cryptocurrency trading, NAGA always has your back. Unlike most online cryptocurrency trading platforms that offer standard trading functionalities, NAGA provides its social trading features for traders to perform copy trading.

#best crypto exchange platform#best crypto trading platform#best cryptocurrency exchange#best online crypto trading apps#crypto broker for beginners#trade crypto online

0 notes

Text

The world of cryptocurrency trading can be complex and overwhelming, especially for those who are new to the market. However, by using the right technical tools and strategies, traders can automate their trading strategies, identify potential entry and exit points for trades, and gain a more comprehensive understanding of market trends and momentum. Automated trading platforms, such as Cornix, can be a valuable tool for traders who want to take advantage of market opportunities but do not have the time or expertise to execute trades manually. Charting tools, such as TradingView, can help traders to visualize market trends and identify potential entry and exit points for trades.

#automated trading platform#best crypto trading bot for beginners#best social trading platform#cryptocurrency trading platform#trade crypto online

0 notes

Text

Diversified equity funds with tax deduction benefits are known as Tax Saving Mutual Funds or Equity Linked Savings Schemes under Section 80C of the Income Tax Act. Therefore, ELSS funds are appropriate for any taxpayer willing to accept the risk of an equity-oriented tax savings instrument.

#share broker#online trading platform#best trading accounts#stock market#lowest brokerage#stock market basics#basics of share market#stock market beginner#stock split

0 notes

Link

Oil prices fall to their lowest since February and are fluctuating near levels around the time of the Russian invasion of Ukraine since Saudi Arabia, Russia and other major oil producers agreed to a small supply boost. Oil and gas prices have been falling after reaching high levels recently. Learn about current trends in oil and gas prices.

#best online trading platform#best online trading platform for beginners#best forex trading online#Best Forex Trading Platform#online forex trading

0 notes

Text

Best Forex Broker: Fraud Free Trading with the Forex Broker.

The Best Forex Broker is a proven and reliable platform that helps you trade the global financial markets like the pros. You can trade in two popular asset classes - currencies and commodities - at any time of the day with just a click on your mobile, desktop or tablet device.

#Best Forex Broker\#Top Forex Brokers#Online Forex Trading#Forex Broker in India#Best Forex Trading Platform for Beginners

1 note

·

View note

Text

#best trading app in india#best trading apps in india 2023#best app for trading in india#best stock trading app for beginners in india#trading app in india#top trading app in india#best online trading app in india#best online trading platform in india#best trading platform in india 2023

0 notes

Text

the beginner's guide to making money by investing in stocks (hot girl version)

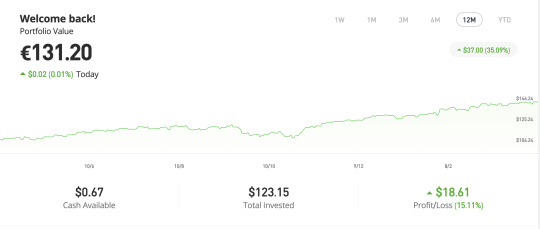

since one of my goals here is to make money i wanted to teach you about what i know about investing in stocks. i use the website etoro to invest, below you can see a picture of my portfolio at the moment. i am by no means an expert but i've found the whole process of investing to be unnecessarily mystified so i thought i'd share what i have learned so far.

what does buying stocks mean?

in simple terms, buying stocks means buying a (tiny) fraction of a company. if the value of the company increases the value of your share goes up, if the company loses money the value goes down.

when should i buy and sell?

ideally, you should buy when you think that the value of a stock will increase in the future and you should sell when you have made a profit. in practice, this means you try to invest when a stock has reached its lowest value and you sell when you think it has reached its peak (but this is, of course, impossible to predict perfectly).

where can i buy stocks?

i would personally recommend going through an online stock trading platform, like etoro. you can look up what the best stock trading platforms are for your country. you should pick one with minimal fees that offers some tutorial or introduction to trading.

you can also go through a stock broker (a person that makes the investments for you) or more broadly your bank - be aware though, that they might take a cut of your profit for their services which is something you need to subtract from your expected profit.

how do i know what to invest in?

There are a few recommendations that I have seen time and time again:

ETFs - exchange-traded funds are bundles of stocks that are traded together. the advantage of ETFs is that they don't rely on a single company making a profit, the companies just need to make a profit overall. they are much less volatile than individual stocks and since economies usually always grow in the long-term, you are very likely to make a profit.

large companies - you can also invest in large, well-established companies that are very likely to make a profit and very unlikely to go bankrupt (e.g., apple, amazon, etc.)

diversify - this means you should invest in a wide variety of companies and industries. even when one of them does really poorly you are likely to make a profit overall.

copy-trading - this means 'copying' the investments of a more experienced trader. so you specify an amount of money and invest it the same way someone who knows what they're doing is.

how much should i invest?

most websites have a minimum amount you need to invest so you could start with that to get a feel for how it works.

as a rule of thumb, they say you should not invest money that you will need within the next 5-10 years. that rule prevents you from having to sell your stock at an unfortunate moment - even if you initially write losses, you can wait for a moment when your stocks have increased in value again.

if you have a fixed income you can commit to investing a part of your income every month. i've seen this referred to as dollar-cost averaging and i have not tried it yet but it is said to be a good way to build wealth in the long term.

how do i actually make money using this knowledge?

simple answer: by selling your stock at the right time and withdrawing the money. investing is a marathon, not a sprint - you should generally give your money some time to make a profit instead of checking every day and panic selling when you see a slight change. disclaimer: at least where i am from you need to declare what you made from stocks as income and pay taxes on it.

thank you so much for reading!

if you have questions or know more about this and want to add something please leave a comment 💕

#financial freedom#law of assumption#stock trading#financial empowerment#financial education#neville goddard#manifesting money#manifestation#rich girl

7 notes

·

View notes