#autopay discount

Text

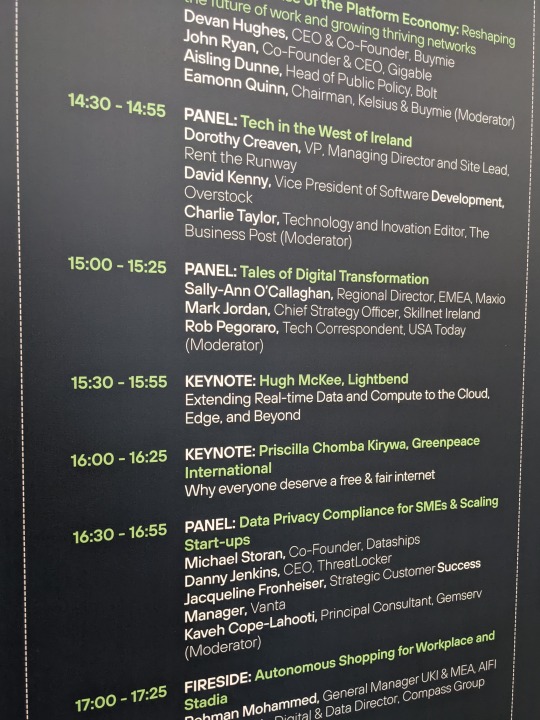

Weekly output: autopay discounts, Apple MLS streaming, investor-founder relationships, Maxio and Skillnet Ireland, fighting disinformation, health and location-data privacy

Weekly output: autopay discounts, Apple MLS streaming, investor-founder relationships, Maxio and Skillnet Ireland, fighting disinformation, health and location-data privacy

A month of speaking at conferences–with a one-week break when I came down with a gentle and brief case of Covid–wraps up this week with my short trip to Toronto to lead two panels at Collision.

6/15/2022: Setting up autopay for your broadband or wireless can require careful aim, USA Today

Broadband providers’ inability to document the finer points of their pricing once again served up a story…

View On WordPress

#Apple soccer#autopay discount#Collision#Comcast autopay#D.C. United#data brokers#disinfo#disinformation#Dublin#Dublin Tech Summit#Ireland#Jonathan Heiliger#location privacy#Major League Soccer#Maxio#misinfo#MLS#Skillnet Ireland#Toronto#Verizon autopay

0 notes

Text

Some peeps: oh autopay so helpful for my ADHD (and that’s fine if it is)

Me: autopay will take money out of my bank when I have none and drive up my Overdraft Fees and makes me wanna dIE

#me.#therapy.#(fucking tmobile would even give me a dISCOUNT if I used autopay#(but I can’t. because I can’t afford the potential overdraft fee being MORE THAN THE DISCOUNT

0 notes

Text

does nord vpn autopay

🔒🌍✨ Get 3 Months FREE VPN - Secure & Private Internet Access Worldwide! Click Here ✨🌍🔒

does nord vpn autopay

NordVPN automatic payment

NordVPN offers users the convenience of automatic payments for their subscription plans, making it easier for customers to enjoy uninterrupted access to secure and private internet browsing. By setting up automatic payments, users can ensure that their NordVPN subscription is always up to date without the need for manual renewal each month. This feature is particularly beneficial for individuals who rely on NordVPN for their online privacy and security needs on a regular basis.

Automatic payment options are available for all NordVPN subscription plans, including monthly, annual, and multi-year packages. Users can choose to link their credit or debit card, PayPal account, or other accepted payment methods to enable automatic billing. By doing so, they can avoid the hassle of remembering to make manual payments and reduce the risk of service interruptions due to missed renewals.

In addition to the convenience factor, opting for automatic payments with NordVPN also offers added security. The platform uses advanced encryption and security protocols to protect payment information, ensuring that sensitive data remains safe and secure at all times. This gives users peace of mind knowing that their financial details are safeguarded when processing automatic payments for their subscription.

Overall, NordVPN's automatic payment feature streamlines the subscription process, enhances user convenience, and provides an extra layer of security for customers. By taking advantage of this option, users can enjoy uninterrupted access to NordVPN's comprehensive suite of online privacy and security tools without the hassle of manual payment management.

NordVPN subscription billing

NordVPN subscription billing is a crucial aspect to consider when utilizing the service for online security and privacy needs. NordVPN offers different subscription plans ranging from monthly to annual billing cycles, providing users with flexibility based on their preferences and budget.

One key feature of NordVPN subscription billing is the ability to enjoy cost savings through long-term plans. By opting for an annual subscription, users can benefit from significant discounts compared to monthly plans. This not only allows users to save money in the long run but also ensures uninterrupted access to NordVPN's services without the hassle of monthly renewals.

Moreover, NordVPN offers a seamless billing process, making it easy for users to manage their subscriptions. Users can easily upgrade or downgrade their plans, change billing information, and view payment history through the user-friendly account dashboard. The platform also provides various payment options, including credit cards, PayPal, and cryptocurrencies, catering to a wide range of user preferences.

NordVPN prioritizes user privacy and security, extending to its billing practices. The platform ensures secure transactions through encryption protocols, safeguarding user payment information from potential cyber threats. This commitment to privacy and security aligns with NordVPN's overall mission of providing a safe and anonymous online experience for its users.

In conclusion, NordVPN subscription billing offers users a convenient and secure way to access premium VPN services. With flexible plans, cost savings, and robust privacy measures, NordVPN remains a top choice for individuals seeking reliable online security and privacy solutions.

NordVPN recurring charges

Title: Understanding NordVPN Recurring Charges: What You Need to Know

NordVPN, a leading virtual private network (VPN) service provider, offers users privacy, security, and access to geo-blocked content. However, some users may encounter questions or concerns regarding recurring charges associated with NordVPN subscriptions. Here's a breakdown to help you understand these charges better.

Subscription Plans:

NordVPN offers various subscription plans, including monthly, yearly, and multi-year options. Users can choose the plan that best suits their needs and budget. Typically, longer subscription periods come with discounted rates compared to monthly plans.

Recurring Payments:

When you subscribe to NordVPN, you agree to recurring payments based on your chosen subscription plan. Monthly subscribers are billed every month, while yearly subscribers are billed annually. These charges are automatically deducted from the payment method you provided during sign-up.

Transparency:

NordVPN maintains transparency regarding its pricing and billing policies. Users can easily find information about subscription plans, pricing, and billing cycles on the NordVPN website. Additionally, NordVPN sends email notifications prior to recurring charges, allowing users to manage their subscriptions effectively.

Managing Subscriptions:

Users have full control over their NordVPN subscriptions. You can easily manage your subscription, including upgrading or downgrading plans, changing payment methods, or canceling your subscription altogether. NordVPN provides step-by-step guides and customer support to assist users with managing their accounts.

Value for Money:

Despite recurring charges, NordVPN offers excellent value for money with its robust security features, high-speed servers, and reliable customer support. Many users find NordVPN's subscription plans affordable and worthwhile considering the benefits they receive in return.

In conclusion, understanding NordVPN's recurring charges is essential for users to make informed decisions about their subscriptions. By knowing what to expect and how to manage your account, you can enjoy a seamless and secure VPN experience with NordVPN.

NordVPN payment settings

NordVPN offers a variety of payment settings to cater to different preferences and needs of its users. When it comes to purchasing a NordVPN subscription, users can choose from multiple payment methods including credit cards, various online payment platforms, and even cryptocurrency for those who prioritize anonymity.

To access the payment settings on NordVPN's website, users simply need to log in to their account and navigate to the billing section. From there, they can select their preferred payment method and enter the necessary information to complete the transaction securely.

One of the key benefits of NordVPN's payment settings is the flexibility it provides to users. Whether you prefer the convenience of using your credit card, the privacy of using cryptocurrency, or the ease of using an online payment platform, NordVPN has you covered.

Moreover, NordVPN takes the security of its users' payment information seriously. By using industry-standard encryption protocols and secure payment gateways, NordVPN ensures that all transactions are protected from unauthorized access or fraud.

In conclusion, NordVPN's payment settings offer a seamless and secure way for users to purchase and renew their subscriptions. With a range of payment methods to choose from and a commitment to data security, NordVPN makes it easy for users to enjoy a safe and private browsing experience.

NordVPN billing cycle

When considering a VPN service like NordVPN, understanding the billing cycle is crucial for managing your subscription effectively. NordVPN offers various subscription plans, each with its own billing cycle options.

The most common billing cycles for NordVPN are monthly, annually, and biennially. The monthly plan charges users on a monthly basis, providing flexibility but usually at a higher cost per month compared to longer-term plans. The annual plan bills users once a year, offering a discounted rate compared to the monthly plan. Similarly, the biennial plan bills users once every two years, providing the most significant savings per month among the three options.

Choosing the right billing cycle depends on your usage and budget. If you prefer flexibility and short-term commitment, the monthly plan might be suitable. However, if you're a regular VPN user and want to save money in the long run, opting for the annual or biennial plan would be more cost-effective.

It's essential to note that NordVPN often runs promotions and discounts, especially for longer-term plans. Keeping an eye out for these offers can help you save even more on your subscription.

Once subscribed, NordVPN automatically renews your subscription at the end of each billing cycle unless you choose to cancel. Users can manage their subscription settings, including billing information and renewal preferences, through their NordVPN account portal.

Understanding the NordVPN billing cycle empowers users to make informed decisions about their subscription plans, ensuring they get the best value for their money while enjoying a secure and private internet browsing experience.

0 notes

Text

Empowering Global Education Dreams with MPOWER Financing Education Loan

Navigating the financial journey to study abroad can be daunting for many students. MPOWER Financing emerges as a beacon of hope, dedicated to simplifying this path with its education loan services. For nearly a decade, MPOWER Financing, based in Washington DC, has committed itself to diminish financial barriers, enabling students to pursue higher education in the USA and Canada.

Revolutionizing Student Loans

MPOWER Financing distinguishes itself by providing education loans without the need for collateral or co-applicants. This innovative approach opens up opportunities for a broader range of students, especially international ones and U.S. residents, including DACA recipients. With a focus on supporting over 400 educational institutions, MPOWER has adapted its loan process to be entirely online, enhancing accessibility and convenience for students worldwide.

Unique Loan Features

MPOWER Financing is recognized for its unique loan features, such as the opportunity for autopay enrollment, which offers an interest discount. This benefit is part of MPOWER's strategy to make education loans as manageable as possible for borrowers. The eligibility criteria for MPOWER loans are inclusively designed, welcoming a broad spectrum of students aiming to start or continue their studies in approved universities across the USA and Canada.

Simplified Loan Application

The application process for an MPOWER Financing education loan is streamlined and user-friendly, ensuring students can efficiently secure the funding they need. Upon successful application and review, the loan disbursement is made directly to the educational institution, ensuring tuition fees and other expenses are covered without hassle.

Tailored for Global Aspirants

MPOWER Financing's education loans are specifically designed for students aiming to study in the US and Canada, offering up to ₹1,000,000 with terms that reflect the company's understanding of the students' financial situations. The loan structure includes a grace period, allowing students to focus on their studies before worrying about repayments.

In closing, MPOWER Financing Education Loan stands as a pillar for students aspiring to achieve their educational goals abroad. With its innovative loan offerings, MPOWER Financing ensures that financial obstacles no longer hinder the pursuit of higher education on the global stage, enabling students to focus on what truly matters - their academic and professional growth.

0 notes

Text

Cricket Phones and Their Ability to Get Copied, Cloned, Pasted, and Hacked By Organized Criminals

Are Cricket Wireless Phones Are Prone to Getting Cloned, Copied, Pasted, and Hacked?

Stress less. Smile more.

You're covered with Cricket!

Are Cricket Wireless Phones prone to get copied, cloned, pasted, and hacked by Organized Criminals? This is a very good question because I have had my cellular phone services for going on 13 years now. The answer to this question is yes. Any wireless phone companies’ phone is prone to get hacked.

Next, I want to inform all of you that this is the second time that my cell phone has been hacked by Organized Criminals. I want you to know that it cost money to remove your phone number from the Dark Web. I really like Cricket Wireless because of its inexpensive phones.

Further, I want to inform all of you that I am paying a total of $130.00 per month for three phone lines right now. I realize that Metro PCS Phone Services tend to be a lot cheaper than Cricket Wireless.

Moreover, Metro PCS is owned by T-Mobile right now. They have phones that are cheaper than some retailers.

Welcome to holidays without the gotcha.

You won’t find yada yadas like hidden fees or credit checks here. Just prepaid wireless that fits your needs.

Find out more

‘Tis the season for ZERO activation fees.

5G Home Internet for just $20/mo.

Shop in store and:

Sign up for a Metro phone plan

Qualify for the Affordable Connectivity Program (ACP)

Pay $25 for the 1st month, then $20/mo. after with AutoPay and your ACP discount

You’ll need to purchase a modem, but it can be returned within 60 days if you’re not happy

Check it out

Tell me more BLAST PAST FAST

iPhone 12

Only $99.99

Get the lowest price in prepaid when you shop in store and:

Get it today with instant rebate

Pay ZERO activation fees

Sign up with our most popular plan

Bring your number

Show valid ID in store

Pay $99.99 and tax

Check it out

Tell me more BRING YOUR PHONE

Get one line with all the data you need for $25/mo.

Pay $30/mo. for your first month and $25/mo. after with AutoPay. Switch online or in-store with ZERO activation fees.

Check it outALL THE DATA YOU NEED

4 lines for $100/mo. Plus 4 FREE Samsung Galaxy 5G smartphones.

Shop in store and:

Get them today with instant rebate

Pay ZERO activation fees

Bring 4 phone numbers

Bring your own phone

Only $99.99

Shop in store and:

Get an additional $100 off via a virtual prepaid Mastercard after third monthly payment

Pay ZERO activation fees

Bring your number

Choose the $40/mo. or higher rate plan

Show valid ID in store

Pay $99.99 and tax

Check it out

Tell me more

Get it for $49.99.

Shop in store and:

Get it today with instant rebate

Pay ZERO activation fees

Choose the $40/mo. or higher rate plan

Bring your number

Pay tax

Shop now

Tell me more

Oh, what fun it is to save.

Get iPhone 11

ON US.

It's the best deal in prepaid. Shop in store and:

Get it today with instant rebate

Sign up with our most popular plan

Bring your number

Show valid ID in store

Check it out

Tell me more

High performance without the high price.

Step up to 5G performance and features without the big price tag. Get more from your devices like bigger screens and longer-lasting batteries—all with the speed of 5G.

Shop REVVL 6X 5G phonesShop REVVL TAB 5G

Get it FREE

Shop online and:

Get it today with instant rebate

Add a $40/mo. voice line to your existing Metro plan

Shop now

Tell me more

Get one FREE.

Shop in store and:

Add a $20/mo. tablet plan to your voice line

Pay $49.99 after instant rebate & tax

Keep your service active for three months

Receive a $50 virtual prepaid Mastercard after your third month of service

Shop in store

Tell me more

Plans with all the data you need.

Start with our single-line plans. Taxes and fees included. No annual contracts.

$40/mo. $50/mo. $60/mo.

$40/mo.

Promotion

Unlimited high-speed data

MLS Season Pass ON US

ViX Premium ON US

T-Mobile Tuesdays perks size=2 width="100%" align=center aria-hidden=true aria-orientation=horizontal style='box-sizing: inherit;outline-offset: 0.4rem; --divider--size: 2px;--divider--color: var(--tdds-color-brand-grayscale-800); --divider--length: 100%;--divider--style: solid;border-image: initial; border-top:var(--divider--size) var(--divider--style) var(--divider--color); margin:var(--phx--spacer-1) auto;max-width:var(--divider--length)'>

$10/mo. for qualified customers with the federal Affordable Connectivity Program

$5 AutoPay discount available on select plans; discount begins month after enrolling in AutoPay. Sales tax and regulatory fees are included in the monthly plan price. If congested, users > 35GB/mo. may notice reduced speeds and Metro customers may notice reduced speeds vs T-Mobile due to prioritization. Video streams in SD. ACP: Limit 1 ACP discount per eligible household. Get full terms

Shop all plansAFFORDABLE CONNECTIVITY PROGRAM

Save up to $30/mo.

Eligible households can save on their wireless bill with the federal Affordable Connectivity Program. One discount per eligible household.

Check it out

Tell me more

Find out more

Apparently, T Mobile Metro PCS has monthly phone plans that are reasonable. It is not too bad for phone services. I still like Cricket Wireless because their phones are very inexpensive. I also want to inform all of you that both Phone Carriers have excellent customer services. I had to get a Network Refresh for a total of 5 times with Cricket Wireless. My phone is 4 years old now. It is a 4G Phone. I am getting ready to upgrade my phone services very soon. I have to upgrade my phone services because my current phone runs very slow right now. It is not as advanced as a 5G Phone.

Finally, I want to inform all of you that my phone bill might be expensive but it is worth it. I know that a 5G Phone is much better and you get up to 128 Gigabytes of RAM. It is much better than a 16G Phone. Please be very careful when it comes to Phone Services. Honestly, I-Phones tend to offer a lot of protection than a regular smartphone. It is that a person will have to pay more money to maintain services with an I-Phone rather than a regular smartphone. To ask all of your questions, any phone can be copied, cloned, pasted, and hacked by criminals. Please make sure that you do not consult with scammers and computer hackers. In my case, I was online with a series of people, and I got scammed out of over $18,000 dollars in Western Union Funds by people that I really did not know personally. My money was wire transferred overseas, where it collected interest, and then wired to a specified person. I have learned my lesson because these people do not have any remorse towards their victims. God is taking care of me right now. Every time I consult with a mere human being about my problems, they tend to laugh in my face. Do you know that having your phone number on the Dark Web cost money to remove it from that form of Web Operation?

Please be very careful because criminals are using Artificial Intelligence as a means to take full advantage of their victims. They record your voice and use your voice to communicate with your phone contacts without you even

knowing it. Do you know that you can steal Research Papers on AI? This is the truth!!

Please make sure that you can copyright your information immediately! Cell Phones are compromised on a daily basis. Only speak to people that you know personally.

0 notes

Text

How to Apply and Manage Your Tire Discounters Credit Card Online

If you are looking for a convenient and flexible way to finance your auto care needs, you might want to consider applying for a Tire Discounters credit card. This card, issued by Synchrony Bank, offers you many benefits, such as:

- No interest if paid in full within 6 months on purchases of $199 or more

- Accepted at auto parts and service businesses and gas stations nationwide

- Credit decision within minutes

- Convenient monthly payments

- No annual fee

- $0 fraud liability

- Exclusive cardholder offers

In this article, we will show you how to apply for and manage your Tire Discounters credit card online. We will also answer some frequently asked questions about the card and provide some tips on how to use it wisely.

How to Apply for a Tire Discounters Credit Card Online

Applying for a Tire Discounters credit card online is easy and fast. You can do it in three simple steps:

- Visit the Tire Discounters website and click on the “Credit Card” link at the top of the page. This will take you to the Synchrony website, where you can learn more about the card and its features.

- Click on the “Apply Now” button and fill out the online application form. You will need to provide some personal information, such as your name, address, phone number, email, social security number, date of birth, and income. You will also need to agree to the terms and conditions and the privacy policy of Synchrony.

- Submit your application and wait for a credit decision. You will receive an instant response on whether you are approved or not. If you are approved, you will also receive your credit limit and other account details.

That’s it! You have successfully applied for a Tire Discounters credit card online. You can start using your card right away at any Tire Discounters location or any other participating auto parts and service businesses and gas stations.

Tire Discounters Credit Card Login

To log in to your Tire Discounters credit card account online, you need to follow these steps:

- Visit the Tire Discounters website and click on the “Credit Card” link at the top of the page. This will take you to the Synchrony website, where you can learn more about the card and its features.

- Click on the “Manage Account” link at the top of the page. This will take you to the login page, where you can access your account.

- Enter your user name and password and click on the “Secure Login” button. If you are a new user, you will need to register your account first by clicking on the “Register” link and following the instructions.

- Once you are logged in, you can view your account balance, make a payment, see your transactions, set up alerts, enroll in autopay, and more. You can also access the MySynchrony mobile app, where you can do all these things on the go.

How to Manage Your Tire Discounters Credit Card Online

Managing your Tire Discounters credit card online is also easy and convenient. You can do it in four simple steps:

- Visit the Synchrony website and click on the “Manage Account” link at the top of the page. This will take you to the login page, where you can access your account.

- Enter your user name and password and click on the “Secure Login” button. If you are a new user, you will need to register your account first by clicking on the “Register” link and following the instructions.

- Once you are logged in, you can view your account balance, make a payment, see your transactions, set up alerts, enroll in autopay, and more. You can also access the MySynchrony mobile app, where you can do all these things on the go.

- Log out of your account when you are done. Remember to keep your user name and password secure and do not share them with anyone.

That’s it! You have successfully managed your Tire Discounters credit card online. You can do this anytime and anywhere, as long as you have an internet connection and a device.

Frequently Asked Questions About the Tire Discounters Credit Card

Here are some of the most common questions that people have about the Tire Discounters credit card and their answers:

What is the interest rate and fees of the Tire Discounters credit card?

The Tire Discounters credit card has a purchase APR of 29.99% and a minimum interest charge of $2. There is no annual fee, but there may be other fees, such as late payment fees, returned payment fees, and cash advance fees. You can find the full details of the fees and charges in the card agreement that you received when you opened your account.

How can I avoid paying interest on the Tire Discounters credit card?

You can avoid paying interest on the Tire Discounters credit card if you pay your balance in full within the promotional period. For example, if you make a purchase of $199 or more and pay it off within 6 months, you will not pay any interest. However, if you do not pay your balance in full within the promotional period, you will be charged interest from the purchase date. You will also need to make the minimum monthly payments on time to avoid paying late fees and losing your promotional offer.

How can I increase my credit limit on the Tire Discounters credit card?

You can request a credit limit increase on the Tire Discounters credit card by contacting Synchrony customer service at 1-866-396-8254. You will need to provide some information, such as your income, expenses, and credit history. Synchrony will review your request and notify you of their decision. Please note that requesting a credit limit increase may result in a hard inquiry on your credit report, which may affect your credit score.

How can I cancel my Tire Discounters credit card?

You can cancel your Tire Discounters credit card by contacting Synchrony customer service at 1-866-396-8254. You will need to provide your account number and some personal information. Synchrony will close your account and send you a confirmation letter. Please note that closing your account may affect your credit score, depending on your credit utilization and credit history.

Conclusion

The Tire Discounters credit card is a great option for anyone who needs a convenient and flexible way to finance their auto care needs. It offers many benefits, such as no interest if paid in full within 6 months on purchases of $199 or more, acceptance at auto parts and service businesses and gas stations nationwide, credit decision within minutes, convenient monthly payments, no annual fee, $0 fraud liability, and exclusive cardholder offers.

If you are interested in applying for a Tire Discounters credit card, you can do it online in three simple steps. If you already have a Tire Discounters credit card, you can manage it online in four simple steps. You can also find answers to some of the most frequently asked questions about the card in this article.

We hope this article has helped you learn more about the Tire Discounters credit card and how to apply and manage it online. If you have any questions or comments, please feel free to contact us. We are always happy to hear from you.

Thank you for choosing Tire Discounters and Synchrony for your auto care needs.

Apply for a Tire Discounters credit card today and enjoy the convenience and flexibility of monthly payments.

Read the full article

0 notes

Text

9.18.23 Monday

4:52 am

Thank God we or I'm still a survivor... Just got back from the floor of Iqor...

We took a certification on tools... Whew! It was hard, some took a take 3.... I was on a take 3 as well, coz it wasn't easy for me coz it is really something new to me....Navigating the system is stressful while you wanted to synchronize the concern of the customer.

Plus, our test was not spoon feeding... They twist the question... I hate that kind of exams where you have to choose 3 on 5 choices... A lot are not yet tackled but we need to check in documents.

So,many documents to read and link and analyze...

Control F and Control C got from Coach Vangie or Angie, the small but terrible.

Again,the wave 468 is still on "sweet & spicy" kind of thing... In a way you wanted to give up... You wanted to break down...You clashed with each other but still you need one another.

Me as an individual, this call center world in Iqor really shake me...It really shake my inner emotion. The fear and madness are accidentally blending inside me... My self-esteem is crashing and I felt that I wanna give up but I need money in spite of it really challenge me so much...

But the fear is still here with me... For me it is so a stressful job this call center that you wanted to break down and depend on someone coz your inner self is breaking coz of the callers or the metrics that you have to maintain.

I had coaching so I wasn't able to call that much, but I had one quality call and I'm fulfilled today coz of my 1 quality call....

** Enrolling Autopay Debit Card on 2 lines.

There will be $5 discount per line if customer applied in an autopay....

I had payment and enrolling an autopay card for my customer.... At first I wasn't able to save his card coz I missed that my customer got a past due, the reason of I can't save his card details.

I have to make a payment first on the past due of my customer then I can save his card on the system.

1:26 pm

Uncle Jun is still a big question mark to me... He told me that he will help me on food but Ate Liza told me that I'm the only one who is paying her and these coming days...

I told you guys,I wanted to visit ilocos, I wanna see the sand dunes and I wanna do collagen on my feet, hands and down there whatever...

I can't shoulder that much here coz my salary is not that big and I have my personal expenses for me and John... I'm not yet regular and I'm still shaking in Iqor.... But thankful on some friends who backed me up and guided me such as Alver and most specially Harvey ( the master of navigating ).

But I really wanted to earn and I need money... I badly need this job and I need money.

Hmm... Saw Dread-locks guy yesterday well his hair was fixed, wrapped on a piece of cloth that supposed to be I'm gonna do... The last time I told him that his hair looks messy and musty.But yesterday he looked fresh but I was not on the mood to bug around... If there is a chance to pester him I will do that... But I was shaking in my job these days... Fear and madness, I have now with me...

2:59 pm

It is weird no text from wave 468 and from Mia and Lexa... Hmmm....

Well, I just need to flow and experience and treasure this world in Iqor coz I badly need money and work...

What happened to the gang of wave 468? We are all certified now..

0 notes

Text

Wireless Carriers Are Messing With Your Autopay Discount

http://i.securitythinkingcap.com/SvSPBH

0 notes

Text

Wireless carriers are messing with your autopay discount

https://www.theverge.com/2023/8/30/23852255/verizon-att-t-mobile-autopay-discount-debit-bank-credit-card

0 notes

Text

T-Mobile's Autopay Change Complicates My Favorite Credit Card Perk

T-Mobile is the latest carrier to change how it gives out auto pay discounts: Starting in July, customers are required to pay their bills using either a linked bank account or a debit card in order to receive a $5 per line discount on their service.

However, if you already set up auto pay with a credit card, not complying with this policy change is effectively a price hike. And as a result, if…

View On WordPress

0 notes

Text

Discover Student Loans | Review

Discover is an exception. It charges no fees at all: It doesn’t have application or origination fees, and it doesn’t even have a late fee. With Discover’s competitive interest rates and lack of fees, it’s a good choice for borrowers looking for private loans to cover their remaining education costs.

Table of Contents:

Discover Student Loans Overview

Discover’s Services

Discover’s Credentials

Discover’s Accessibility

Discover’s Customer Satisfaction

Discover FAQ

How We Evaluated Discover

Summary of Money’s Discover Review

Discover Student Loans Overview

Although Discover is well known for its credit cards and home loans, it’s also a popular student loan lender. According to the company’s annual report, it works with over 2,400 schools and issued over $10 billion in student loans in 2021.

Pros

Cash reward for earning good grades

No application, origination or late fees

No loan maximums for most loan options

Cons

Does not offer cosigner releases

Only offers two repayment terms

Does not offer loans for career training or certificate programs

None of Discover’s loans charge origination fees, application fees or late fees. You never have to worry about prepayment penalties either, so you can pay off your loans early and save money on interest. The lender also offers a 1% cash-back reward for eligible students who get at least a 3.0 GPA.

While some private lenders have caps on how much you can borrow, Discover doesn’t have loan limits; you can borrow up to the total cost of attendance at your school. Repayment terms vary based on the type of loan you take out — undergraduate loans have a single 15-year term — but you can choose from three different repayment options to manage your loans while you’re in school. Repayment options include interest-only, flat monthly and deferred payments.

Because students tend to have limited credit histories, most student borrowers will need a cosigner on their loan application to qualify. However, be aware that Discover doesn’t offer cosigner releases. The cosigner remains responsible for the loan if you fall behind on your payments until the loan is paid in full. The only workaround is if you refinance the loan and qualify for it to be solely in your name.

Discover’s Services

Discover offers loans for undergraduates, graduate school, medical school, law school, healthcare profession residencies, bar exam study and parent student loans. Other useful products for students include student loan refinancing options and student credit cards.

What they offer: Private student loans

Discover Student Loans

Loan Types

Loan Amounts

Loan Terms

Repayment Options

Variable Rates

Fixed Rates

Undergraduate student loans

$1,000 to total cost of attendance

15 years

Deferred

Interest-only

Flat Monthly

6.37% to 16.62%

4.49% to 14.99%

Grad

$1,000 to total cost of attendance

20 years

Deferred

Interest-only

Flat Monthly

6.37% to 16.37%

5.24% to 14.59%

Law

$1,000 to total cost of attendance

20 years

Deferred

Interest-only

Flat Monthly

6.37% to 16.37%

5.24% to 14.59%

MBA

$1,000 to total cost of attendance

20 years

Deferred

Interest-only

Flat Monthly

6.37% to 16.37%

5.24% to 14.59%

Medical school

$1,000 to total cost of attendance

20 years

Deferred

Interest-only

Flat Monthly

6.37% – 12.12%

4.99% – 9.99%

Healthcare residency

$1,000 to $18,000 (amount varies by profession)

20 years

Deferred

Interest-only

Flat Monthly

7.62% – 10.62%

6.24% – 8.49%

Bar exam

$1,000 to $16,000

20 years

Deferred

Interest-only

Flat Monthly

8.12% – 16.37%

6.99% – 14.49%

Parent

$1,000 to total cost of attendance

15 years

Immediate

11.37% – 16.62%

9.99% – 14.99%

Rates current as of Aug. 4, 2023. Lowest-possible rates include interest-only repayment discount and auto debit reward

All of Discover’s loan options can have variable or fixed interest rates. You can get an interest rate reduction of 0.25% by enrolling in autopay, and student borrowers that opt for interest-only repayment can qualify for an additional 0.35% rate discount.

With most of Discover’s loans, you can select one of the three following payment plans:

Deferred: The most costly of the three plans, deferred repayment allows you to postpone making payments until after you graduate or leave school. You’ll also have a short grace period before monthly payments are required.

Interest-only: With the interest-only plan, you make payments against the interest that accrues each month. You don’t start paying against the principal until after you leave school.

Flat: The flat monthly payment option allows you to pay just $25 per month while you’re in school. After you graduate, your payments will increase to include the principal and interest.

However, parent student loans aren’t eligible for any of those payment options. All of Discover’s parent loans are on immediate payment plans, so you’ll have to start making full monthly payments immediately after the final loan disbursement.

Discover does have repayment options for borrowers experiencing financial issues. For example, borrowers may be eligible for a temporary loan deferment or payment extension. And Discover offers loan discharges for borrowers who pass away or become totally and permanently disabled.

What they don’t offer

If you’re considering a loan from Discover, consider these drawbacks:

No loan prequalification tool: Most student loan lenders have prequalification tools that allow you to check your rates without damaging your credit. However, Discover doesn’t have that feature, so you have to start the application process and consent to a hard credit check to view your loan options and check your eligibility.

No cosigner releases: Most private student loans will require a cosigner. Many companies allow you to apply for a cosigner release after making your payments on time for two or three years, but Discover doesn’t have cosigner releases.

No loans for certificate or career training programs: Discover student loans can only be used to pursue degrees. If you want to attend a coding bootcamp or complete a certificate program, you’ll have to work with another lender.

Discover’s Credentials

Unlike other companies that partner with banks to issue their loans, Discover is its own lender. It also services all of the loans it issues. Discover is a member of the Federal Deposit Insurance Corporation (FDIC).

Licenses and Registrations

Discover is licensed to issue private student loans in all 50 states, so borrowers nationwide can apply for its loans.

Awards and Certifications

Discover is regularly a top pick in student loan rankings. It was selected by Forbes Advisor as the “best no-fee lender” in 2023.

Third-Party Ratings

Like other student loan companies, Discover hasn’t been ranked by a third-party consumer agency for its student loan products. However, Discover has been highly ranked for its other financial products, including its credit cards and loans. J.D. Power ranked Discover third out of 18 companies on its consumer lending satisfaction survey in 2023. Discover ranked second in J.D. Powers’s 2022 credit card study.

Regulatory Actions

In 2020, the Consumer Financial Protection Bureau (CFPB) issued a consent order against Discover. The order stated that Discover violated a 2015 consent order that was based on the CFPB’s findings that Discover misrepresented minimum loan payments, the amount of interest consumers owed and other material information. The order required Discover to pay at least $10 million in consumer redress and a $25 million civil penalty.

Regulatory action against a lender of Discover’s size isn’t uncommon, but it highlights the importance of carefully reviewing loan documents and ensuring you understand the terms and fees before signing a contract.

Discover’s Accessibility

Discover stands out from other lenders because of its customer service. Its support team is available around the clock, and Discover also provides educational guides online.

Availability

Unlike other lenders, Discover’s customer service team is available 24 hours a day, seven days a week.

Contact Information

Discover’s support staff is accessible via phone, online chat or secure message:

Phone: 1-800-788-3368

Secure message

User Experience

While other companies rely on third-party loan servicers to handle borrower issues after the loan is disbursed, Discover services its own loans. Discover is the company to reach out to if you have difficulties affording your payments or if you have questions about your account.

Limitations

Discover has robust educational resources about student loans on its sites, but it doesn’t have a prequalification option. To check your eligibility for a loan and view your rates, you must consent to a hard credit inquiry.

Discover’s Customer Satisfaction

Discover is a huge company that offers a range of financial products. Customer complaints tend to focus on its other products, such as its credit cards or mortgages, rather than its student loans.

Customer Complaints

On TrustPilot, Discover has a 1.7 out of five TrustScore, based on about 220 reviews. Although Discover is accredited by the Better Business Bureau (BBB) with an A+ rating, it has a 1.13 out five rating based on a limited number of customer reviews.

Third-Party Ratings

Like other student loan lenders, Discover has not been rated by third-party organizations for its customer service.

Discover Student Loans FAQ

What credit score is needed for a Discover student loan?

Discover doesn't disclose its minimum credit score requirement for its student loans. But you will need good credit to get the lowest rates. The company's 2022 annual report shows that 94% of Discover student loan borrowers -- or their co-signers -- had credit scores of 660 or above. A score in that range is in the good to excellent category.

Is it possible to consolidate student loans with Discover?

Yes, Discover offers student loan consolidation, also known as student loan refinancing. However, keep in mind that refinancing federal student loans with Discover -- or any student loan refinancing company -- has some drawbacks. Your loans will no longer be part of the federal loan program, so you won't be able to take advantage of perks like loan forgiveness or income-driven repayment plans.

Can you pay off Discover student loans early?

You can make extra payments or pay off the balance on your Discover student loans at any time, without penalty.

Can Discover loans be forgiven?

Because Discover student loans are private, they aren't eligible for federal loan forgiveness programs like Public Service Loan Forgiveness (PSLF). However, Discover does offer loan forgiveness if the borrower dies or becomes permanently disabled.

How We Evaluated Discover

To evaluate Discover, we compared it to 18 other student loan companies. We looked at Discover’s available loan options, repayment terms, loan amounts, customer support and financial hardship programs. We particularly focused on available in-school repayment options and alternative payment plans when choosing the top lenders.

Summary of Money’s Discover Review

Whether you’re entering your first year of college or are preparing for your medical residency, Discover has loan options for you. Unlike other lenders, Discover doesn’t charge any fees, so you never have to worry about origination fees, late fees or prepayment penalties.

However, borrowers should be aware that Discover doesn’t offer cosigner releases, nor does it have loans for certificate programs or coding bootcamps. If you’re looking for other education financing options, check out our picks for the best student loans of 2023.

Read the full article

0 notes

Text

Any Other Xfinity Internet Customers Get The Notice Saying You Have To Change Your Paperless/AutoPay From Your Credit Card to Your Bank Account or You'll Lose Your Paperless/AutoPay Discount? Read on...

https://www.reddit.com/r/SeattleWA/comments/152p8zz/any_other_xfinity_internet_customers_get_the/?utm_source=dlvr.it&utm_medium=tumblr

0 notes

Text

261 - Brydge Lives and Emergency SOS Saves - With Jeff Gamet and Guests Guy Serle, Mike Potter

The latest In Touch With iOS with Dave he is joined by guest, Guy Serle, Mike Potter, and Jeff Gamet. The revival of iPad keyboard maker Brydge with new owner, the iPhone's life-saving SOS feature saves another person, a case involving stolen Apple products, iCloud storage price increase in UK and other countries. Some nostalgia for the first iPhone which went on sale June 29, 2007 16th anniversary., A new Motorola Defi pocket satellite link gadget lets you text messages immediately. The Apple Trade-in plan worked well for Dave with good pricing and a review of experience. Plus tips on what to do before you send in your trade-in out and more.

The show notes are at InTouchwithiOS.com

Direct Link to Audio

Links to our Show

Click this link Buy me a Coffee to support the show we would really appreciate it. intouchwithios.com/coffee

Another way to support the show is to become a Patreon member patreon.com/intouchwithios

Website: In Touch With iOS

YouTube Channel

In Touch with iOS Magazine on Flipboard

Facebook Page

Twitter

Instagram

News

iPad keyboard maker Brydge revived under new ownership; details on unpaid salaries and unfulfilled orders unknown

iPhone 14's Emergency SOS via Satellite Feature Saves California Hiker

New Hampshire Man Pleads Guilty to Taking Huge Bribe to Ship $2M Worth of Stolen Apple Products

Apple Hikes iCloud+ Subscription Prices in Many Countries Around the World

Apple No Longer Offers Interest-Free Financing in Canada

Stardew Valley Coming to Apple Arcade on July 21

T-Mobile ditches AutoPay discount for Apple Pay despite history of security woes - 9to5Mac

Apple Store employees get their iPhone X upgraded to iPhone 14

Topics

Beta this week. 1OS 16.6 Beta 4 was released this week. iOS 17 Beta 2 continues.

Apple Seeds Fourth Betas of iOS 16.6 and iPadOS 16.6 to Developers

Apple Seeds Fourth Beta of watchOS 9.6 to Developers

Apple Seeds Fourth Beta of tvOS 16.6 to Developers

iOS 17: Eight Privacy and Security Improvements Coming in Apple's Next Update

iOS 17 Photos App Can Tell You What Those Confusing Laundry Symbols Mean

How to turn photos into iMessage stickers with iOS 17

What iOS 17 features you aren't going to get at launch

The first iPhone went on sale on June 29, 2007. We discuss this anniversary and what the future holds for iPhone.

Lets see what ChatGPT says about this anniversary. This highly anticipated device, developed by Apple Inc., revolutionized the mobile phone industry and set a new standard for smartphones. The release of the original iPhone marked the beginning of a new era in mobile technology, combining a sleek design with a multi-touch interface and introducing the concept of mobile applications. With its groundbreaking features, such as web browsing, email functionality, and a built-in iPod, the iPhone quickly captured the imagination of consumers worldwide. The launch of the first iPhone paved the way for subsequent generations of smartphones, fundamentally changing the way people communicate, access information, and interact with technology.

Is this a new way to use satellite SOS? The Motorola Defy Satellite Link is a keychain sized device that provides Satellite connectivity plus SOS. SOS in the iPhone is only available in emergencies; this can give you connections for text and check-ins.

This small gadget gives you the iPhone 14's best feature for $149

Apple Trade in guide. Dave bought a new iPhone 14 for a family member and gives his experience.

How to trade in your MacBook, macOS desktop, iPhone, or iPad

Macstock 7 is here! Tickets are Sold Out but Virtual Tickets are available.Dave is speaking again at the event along with Jeff Gamet, Brittany Smith, Chuck Joiner, and many others. Please join in all the fun July 22-23, 2023! Speakers Link.

Our Host

Dave Ginsburg is an IT professional supporting Mac, iOS and Windows users and shares his wealth of knowledge of iPhone, iPad, Apple Watch, Apple TV and related technologies. Visit the YouTube channel https://youtube.com/intouchwithios follow him on Mastadon @daveg65,

Twitter @daveg65.and the show @intouchwithios

Our Regular Contributors

Jeff Gamet is a podcaster, technology blogger, artist, and author. Previously, he was The Mac Observer’s managing editor, and Smile’s TextExpander Evangelist. You can find him on Mastadon @jgamet as well as Twitter and Instagram as @jgamet His YouTube channel https://youtube.com/jgamet

Ben Roethig Former Associate Editor of GeekBeat.TV and host of the Tech Hangout and Deconstruct with Patrice Mac user since the mid 90s. Tech support specialist. Twitter @benroethig Website: https://roethigtech.blogspot.com

About our Guest

Guy Serle Is the host of the MyMac Podcast email [email protected] @MacParrot and @VertShark on Twitter Vertshark.com, Vertshark on YouTube, Skype +1 Area code 703-436-9501

Mike Potter is the organizer of Macstock Conference: and the host of the For Mac Eyes Only Podcast. You can reach him on Mastodon: https://tooting.ninja/@formaceyesonly https://tooting.ninja/@macstockexpo

Here is our latest Episode!

0 notes

Text

Everything About simplified loan solutions reviews

What's an underwriter? Chevron icon It signifies an expandable section or menu, or in some cases previous / future navigation selections.

Now its better and my friends and family continue to appreciate hearing their names. I've an iphone now and I do not REALLY need it due to the fact I am able to choose which VM to hear, but like i reported the individuals who call me adore it.

Get the most recent guidelines you might want to manage your cash — delivered to you biweekly. Loading Anything is loading.

A personal loan can be a type of loan which you can use for virtually any order. The key perk of personal loans is that they’re unsecured. In case you default over the loan, you don’t hazard getting rid of collateral.

Start off your automation journey Amplify your underwriting productivity by automating processes, lowering manual effort and hard work by around 90%. Request Demo

You notify us your objectives. We’ll offer you the solutions that very best healthy your preferences. No matter whether you’re buying your initially dwelling or relocating towards your up coming property, PrimeLending has the products, men and women and system to provide the ideal residence loan in your problem. We’ll maintain you up to date with authentic-time notifications on how to an economical, on-time closing.

We also look at regulatory steps submitted by organizations like the Consumer Financial Protection Bureau. We weigh these aspects dependant on our evaluation of which might be The most crucial to shoppers And just how meaningfully they affect individuals’ ordeals.

Howdy This is often Tina calling you in the simplified loan Solutions Underwriting Department. We're just reaching out to observe up on a preapproval recognize that was mailed out for you a couple of days again. It appears like we just need some further facts to finalize your approval and we also like to tell you the $seventy five,000 preapproval provide is due to expire shortly so we urge you to definitely reap the benefits of this terrific possibility to pay back your large interest loans and credit cards and possibly keep some additional cash in hand. Give us a call back so certainly one of our brokers can support you with finalizing your funding.

Prequalified charges are based upon the information simplified loan solutions underwriting department you supply as well as a tender credit inquiry. Getting prequalified prices won't guarantee that the Lender will extend you a suggestion of credit. You are not but accredited for the loan or a certain level. All credit history decisions, together with loan acceptance, if any, are based on Lenders, inside their sole discretion.

A variable APR can fluctuate In line with market tendencies. Whilst a variable APR usually starts off out reduced than a hard and fast APR, it could improve Later on — which might also trigger your regular monthly payments to increase.

1Personal Loans Level and Conditions Disclosure: Rates for personal loans provided by lenders over the Credible System range between 5.forty% - 35.99% APR with phrases from 12 to 84 months. Rates presented involve lender discounts for enrolling in autopay and loyalty programs, where relevant. Genuine prices might be click here different from the fees advertised and/or shown and may be based upon the lender’s eligibility requirements, which contain components for instance credit score score, loan total, loan phrase, credit rating utilization and history, and change determined by loan objective. The lowest rates simple loan solutions reviews out there typically call for superb credit history, and for many lenders, could possibly be reserved for particular loan uses and/or shorter loan terms. The origination cost billed from the lenders on our System ranges from 0% to eight%. Every lender has their own individual qualification conditions with respect to their autopay and loyalty bargains (e.

With a personal line of credit history, you'll be able to borrow revenue as essential during the draw period. The attract interval is actually a established length of time after you can withdraw funds, up to the credit history limit. Some private traces of credit score have two-12 months attract durations, while others are for a longer time.

If you might want to pay for a sizable cost — for instance dwelling improvements, professional medical bills, or a wedding — a personal loan might be a choice to obtain the income you may need.

Remember to support us safeguard Glassdoor by verifying that you're a real human being. We've been sorry to the inconvenience. Should you continue on to view this message, please e mail to let us know you might be obtaining difficulty. Aidez-nous à protéger Glassdoor

0 notes

Text

T-Mobile's AutoPay Credit Card Discount Is Ending in May

T-Mobile is updating its automatic payment (or AutoPay) rules, including dropping the ability for credit card users to gain the AutoPay discount on its plans. The carrier confirmed to CNET on Thursday that starting “as early as May” it will be limiting these discounts just to those who pay with a debit card or bank account.

The move marks a change from the carrier’s current policy, which allows…

View On WordPress

0 notes

Photo

Verizon’s new prepaid plans are cheaper — but not really It’s basic wireless plan ABC’s: Always Be Confusing. | Illustration by Alex Castro / The Verge Yesterday, Verizon announced new prepaid phone plans with lower prices — but thanks to some clever shuffling of plan discounts, they’re not actually getting any cheaper. While the published prices on its unlimited and 15GB prepaid plans are indeed $5 lower, the company will no longer let you apply autopay and loyalty discounts — meaning the lowest price on each plan stays exactly the same. Here’s how it adds up: the “standard” price on Verizon’s top-tier prepaid plan, Unlimited Plus, is now $70 per month, reduced from $75. After the first month, you can apply a $10 / month autopay discount to bring that cost down to $60. Image: Internet Archive Previously, you could combine a $5 autopay discount and $10 loyalty... Continue reading… https://fancyhints.com/verizons-new-prepaid-plans-are-cheaper-but-not-really/?utm_source=tumblr&utm_medium=social&utm_campaign=ReviveOldPost

0 notes