#Trends and Forecast 2023 – 2030

Text

#Flare Gas Recovery System Market – Ireland Industry Analysis#Size#Share#Trends and Forecast 2023 – 2030

0 notes

Text

Veiled by discussion of headline global trends in new renewables capacity investment is the fact that almost all the incremental progress is currently being made in one country: China. Trumpeting 2023’s 50 percent growth in annual global capacity installations as a global achievement is wrongheaded, given that China by itself delivered nearly 80 percent of the increment.

And the IEA, for its part, expects China to continue to be the sole meaningful over-achiever. It recently revised upwards by 728 GW its forecast for total global renewables capacity additions in the period 2023–27. China’s share of this upward revision? Almost 90 percent.

While China surges ahead, the rest of the world remains stuck.

This raises a crucial question. What is different about the development of solar and wind resources in China from the rest of the world?

The main answer is that in China, such development is capitalist in only a very limited sense. Certainly, the entities centrally involved in building out new solar and wind farms in China are companies. But almost all are state-owned. Take wind. Nine of the country’s top 10 wind developers are owned by the government, and such state-owned players control in excess of 95 percent of the market.

Moreover, the state is far from being a passive shareholder in these companies. The companies are best seen as instruments wielded by the state in the service of achieving its industrial, geopolitical, and – increasingly – environmental objectives.

The best example of this concerns the gargantuan ‘clean energy bases’ first announced by President Xi Jinping in 2021. To be built mainly in the Gobi and other desert areas by 2030, these new bases will have a combined capacity of in excess of 550 GW – more than Europe’s total solar and wind capacity at the time of this writing.

Such development is as far from ‘capitalist’ as is imaginable. This is the state, in its most centralized and authoritative form mustering whatever resources it needs at its disposal to ensure that it delivers what it has said it will deliver.

Add to this the fact that the banks financing all the new renewables development in China are generally also state-owned and directed, and a stark reality comes into focus. This is essentially central planning in action.

Does the profit motive figure? To be sure, it does. But usually only marginally, and it is ridden roughshod over whenever Beijing deems fit.

112 notes

·

View notes

Text

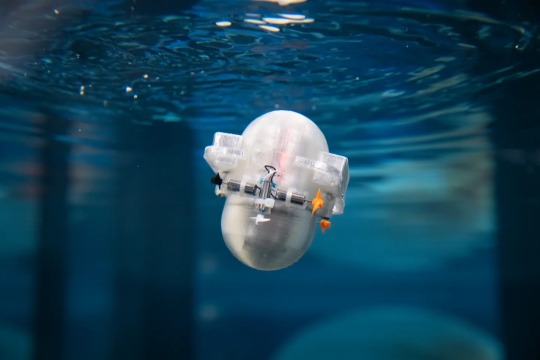

Aquatic Robot Market to Eyewitness Huge Growth by 2030

Latest business intelligence report released on Global Aquatic Robot Market, covers different industry elements and growth inclinations that helps in predicting market forecast. The report allows complete assessment of current and future scenario scaling top to bottom investigation about the market size, % share of key and emerging segment, major development, and technological advancements. Also, the statistical survey elaborates detailed commentary on changing market dynamics that includes market growth drivers, roadblocks and challenges, future opportunities, and influencing trends to better understand Aquatic Robot market outlook.

List of Key Players Profiled in the study includes market overview, business strategies, financials, Development activities, Market Share and SWOT analysis:

Atlas Maridan ApS. (Germany), Deep Ocean Engineering Inc. (United States), Bluefin Robotics Corporation (United States), ECA SA (France), International Submarine Engineering Ltd. (Canada), Inuktun Services Ltd. (Canada), Oceaneering International, Inc. (United States), Saab Seaeye (Sweden), Schilling Robotics, LLC (United States), Soil Machine Dynamics Ltd. (United Kingdom)

Download Free Sample PDF Brochure (Including Full TOC, Table & Figures) @ https://www.advancemarketanalytics.com/sample-report/177845-global-aquatic-robot-market

Brief Overview on Aquatic Robot:

Aquatic robots are those that can sail, submerge, or crawl through water. They can be controlled remotely or autonomously. These robots have been regularly utilized for seafloor exploration in recent years. This technology has shown to be advantageous because it gives enhanced data at a lower cost. Because underwater robots are meant to function in tough settings where divers' health and accessibility are jeopardized, continuous ocean surveillance is extended to them. Maritime safety, marine biology, and underwater archaeology all use aquatic robots. They also contribute significantly to the expansion of the offshore industry. Two important factors affecting the market growth are the increased usage of advanced robotics technology in the oil and gas industry, as well as increased spending in defense industries across various countries.

Key Market Trends:

Growth in AUV Segment

Opportunities:

Adoption of aquatic robots in military & defense

Increased investments in R&D activities

Market Growth Drivers:

Growth in adoption of automated technology in oil & gas industry

Rise in awareness of the availability of advanced imaging system

Challenges:

Required highly skilled professional for maintenance

Segmentation of the Global Aquatic Robot Market:

by Type (Remotely Operated Vehicle (ROV), Autonomous Underwater Vehicles (AUV)), Application (Defense & Security, Commercial Exploration, Scientific Research, Others)

Purchase this Report now by availing up to 10% Discount on various License Type along with free consultation. Limited period offer.

Share your budget and Get Exclusive Discount @: https://www.advancemarketanalytics.com/request-discount/177845-global-aquatic-robot-market

Geographically, the following regions together with the listed national/local markets are fully investigated:

• APAC (Japan, China, South Korea, Australia, India, and Rest of APAC; Rest of APAC is further segmented into Malaysia, Singapore, Indonesia, Thailand, New Zealand, Vietnam, and Sri Lanka)

• Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe; Rest of Europe is further segmented into Belgium, Denmark, Austria, Norway, Sweden, The Netherlands, Poland, Czech Republic, Slovakia, Hungary, and Romania)

• North America (U.S., Canada, and Mexico)

• South America (Brazil, Chile, Argentina, Rest of South America)

• MEA (Saudi Arabia, UAE, South Africa)Furthermore, the years considered for the study are as follows:

Historical data – 2017-2022

The base year for estimation – 2022

Estimated Year – 2023

Forecast period** – 2023 to 2028 [** unless otherwise stated]

Browse Full in-depth TOC @: https://www.advancemarketanalytics.com/reports/177845-global-aquatic-robot-market

Summarized Extracts from TOC of Global Aquatic Robot Market Study Chapter 1: Exclusive Summary of the Aquatic Robot market

Chapter 2: Objective of Study and Research Scope the Aquatic Robot market

Chapter 3: Porters Five Forces, Supply/Value Chain, PESTEL analysis, Market Entropy, Patent/Trademark Analysis

Chapter 4: Market Segmentation by Type, End User and Region/Country 2016-2027

Chapter 5: Decision Framework

Chapter 6: Market Dynamics- Drivers, Trends and Challenges

Chapter 7: Competitive Landscape, Peer Group Analysis, BCG Matrix & Company Profile

Chapter 8: Appendix, Methodology and Data Source

Buy Full Copy Aquatic RobotMarket – 2021 Edition @ https://www.advancemarketanalytics.com/buy-now?format=1&report=177845

Contact US :

Craig Francis (PR & Marketing Manager)

AMA Research & Media LLP

Unit No. 429, Parsonage Road Edison, NJ

New Jersey USA – 08837

Phone: +1 201 565 3262, +44 161 818 8166

[email protected]

#Global Aquatic Robot Market#Aquatic Robot Market Demand#Aquatic Robot Market Trends#Aquatic Robot Market Analysis#Aquatic Robot Market Growth#Aquatic Robot Market Share#Aquatic Robot Market Forecast#Aquatic Robot Market Challenges

2 notes

·

View notes

Text

Indonesia Smart Cities Market Outlook for Forecast Period (2023 to 2030)

Indonesia's Smart Cities are Expected to Grow at a Significant Growth Rate, and the Forecast Period is 2023-2030, Considering the Base Year as 2022.

The development of smart cities revolves around the utilization of cutting-edge technologies and data analytics to optimize urban systems. Key components include the implementation of the Internet of Things (IoT) infrastructure, which involves the deployment of connected devices and sensors to gather real-time data.

This data is then analyzed to provide valuable insights that inform decision-making by city officials. Smart mobility solutions play a vital role in improving transportation networks, easing traffic congestion, and promoting eco-friendly transit options. E-governance platforms are adopted to streamline administrative processes and facilitate seamless citizen-government interactions.

Sustainability initiatives are emphasized, including energy-efficient buildings, renewable energy integration, waste management, and environmental conservation. Moreover, citizen engagement is fostered through digital platforms, allowing residents to actively participate in shaping urban policies and providing feedback to authorities.

One of the notable examples of smart city development in Indonesia is the "Jakarta Smart City" initiative. As the capital and most populous city in the country, Jakarta faces numerous urban challenges such as traffic congestion, waste management, and environmental pollution. To tackle these issues, the Jakarta Smart City program leverages technology and data to improve various urban services. Real-time traffic data is collected through IoT sensors to optimize transportation routes and manage traffic flow efficiently.

Waste management is enhanced by implementing smart waste bins that alert authorities when they need to be emptied, reducing unnecessary waste collection trips. Moreover, the program employs digital platforms and mobile applications to engage citizens, allowing them to access information about city services, report issues, and participate in decision-making processes. These efforts have aimed to transform Jakarta into a more sustainable, efficient, and citizen-centric smart city.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart) @

The latest research on the Indonesia Smart Cities market provides a comprehensive overview of the market for the years 2023 to 2030. It gives a comprehensive picture of the global Indonesia Smart Cities industry, considering all significant industry trends, market dynamics, competitive landscape, and market analysis tools such as Porter's five forces analysis, Industry Value chain analysis, and PESTEL analysis of the Indonesia Smart Cities market. Moreover, the report includes significant chapters such as Patent Analysis, Regulatory Framework, Technology Roadmap, BCG Matrix, Heat Map Analysis, Price Trend Analysis, and Investment Analysis which help to understand the market direction and movement in the current and upcoming years. The report is designed to help readers find information and make decisions that will help them grow their businesses. The study is written with a specific goal in mind: to give business insights and consultancy to help customers make smart business decisions and achieve long-term success in their particular market areas.

Market Driver:

One of the key drivers propelling the growth of the Indonesia Smart Cities market is the government's strong commitment to urban development and digital transformation. Initiatives such as the 100 Smart Cities Movement and various smart city pilot projects across the archipelago are driving the integration of smart technologies. The government's emphasis on creating efficient and sustainable urban ecosystems through the adoption of smart solutions is encouraging both public and private sector investments. As a result, there is a growing demand for intelligent infrastructure, smart transportation systems, and data-driven governance to address the challenges of rapid urbanization.

Market Opportunity:

An exciting opportunity within the Indonesia Smart Cities market lies in the development of smart transportation systems. As urbanization accelerates, traffic congestion and transportation inefficiencies pose significant challenges. Implementing smart transportation solutions, including intelligent traffic management, integrated public transportation systems, and the adoption of electric vehicles, can greatly enhance urban mobility. The integration of these technologies not only addresses current challenges but also creates a foundation for sustainable and future-ready urban transportation. Entrepreneurs and businesses investing in smart transportation solutions stand to benefit from a burgeoning market with the potential to transform how people and goods move within cities.

Leading players involved in the Indonesia Smart Cities Market include:

PT Aplikanusa Lintasarta (Indonesia), PT Telkom (Telekomunikasi Indonesia Tbk) (Indonesia), PT XL Axiata Tbk (Indonesia), Siemens (Germany), Schneider Electric (France), Philips (Netherlands), Huawei Tech Investment (China), PT Waskita Karya (Indonesia), PT KAI Commuter Jabodetabek (Indonesia), PT Indosat Ooredoo (Indonesia), PT Link Net Tbk (First Media) (Indonesia), PT Surya Semesta Internusa (Indonesia), Ace Hardware Tbk (US), PT Sinar Mas Land (Indonesia), PT Cipta Kridatama (Indonesia), SICE (Spain), PT Cyberindo Aditama (CBN) (Indonesia), PT Sampoerna Telekomunikasi Indonesia (STI) (Indonesia), PT Pelayaran Tempuran Emas Tbk (TEMAS) (Indonesia), PT Bangun Cipta Kontraktor (BCK) (Indonesia), and Other Major Players.

If You Have Any Query Indonesia Smart Cities Market Report, Visit:

Segmentation of Indonesia Smart Cities Market:

By Solution and Service

Smart Mobility Management

Smart Public Safety

Smart Healthcare

Smart Building

Smart Utilities

Others

By Component

Hardware

Software

Service

By Level

Emerging Smart Cities

Developing Smart Cities

Mature Smart Cities

By End-user

Government & Municipalities

Transportation & Logistics

Energy & Utilities

Healthcare

Education

Others

Owning our reports (For More, Buy Our Report) will help you solve the following issues:

Uncertainty about the future?

Our research and insights help our clients to foresee upcoming revenue pockets and growth areas. This helps our clients to invest or divest their resources.

Understanding market sentiments?

It is imperative to have a fair understanding of market sentiments for a strategy. Our insights furnish you with a hawk-eye view on market sentiment. We keep this observation by engaging with Key Opinion Leaders of a value chain of each industry we track.

Understanding the most reliable investment centers?

Our research ranks investment centers of the market by considering their returns, future demands, and profit margins. Our clients can focus on the most prominent investment centers by procuring our market research.

Evaluating potential business partners?

Our research and insights help our clients in identifying compatible business partners.

Acquire This Reports: -

About Us:

We are technocratic market research and consulting company that provides comprehensive and data-driven market insights. We hold the expertise in demand analysis and estimation of multidomain industries with encyclopedic competitive and landscape analysis. Also, our in-depth macro-economic analysis gives a bird's eye view of a market to our esteemed client. Our team at Pristine Intelligence focuses on result-oriented methodologies which are based on historic and present data to produce authentic foretelling about the industry. Pristine Intelligence's extensive studies help our clients to make righteous decisions that make a positive impact on their business. Our customer-oriented business model firmly follows satisfactory service through which our brand name is recognized in the market.

Contact Us:

Office No 101, Saudamini Commercial Complex,

Right Bhusari Colony,

Kothrud, Pune,

Maharashtra, India - 411038 (+1) 773 382 1049 +91 - 81800 - 96367

Email: [email protected]

#Indonesia Smart Cities#Indonesia Smart Cities Market#Indonesia Smart Cities Market Size#Indonesia Smart Cities Market Share#Indonesia Smart Cities Market Growth#Indonesia Smart Cities Market Trend#Indonesia Smart Cities Market segment#Indonesia Smart Cities Market Opportunity#Indonesia Smart Cities Market Analysis 2023#US Indonesia Smart Cities Market#Indonesia Smart Cities Market Forecast#Indonesia Smart Cities Industry#Indonesia Smart Cities Industry Size#china Indonesia Smart Cities Market#UK Indonesia Smart Cities Market

2 notes

·

View notes

Text

Global Decarbonization Service Market Is Estimated To Witness High Growth Owing To Growing Environmental Concerns

The Global Decarbonization Service Market is estimated to be valued at US$69.73 billion in 2023 and is expected to exhibit a CAGR of 12.3% over the forecast period 2023 to 2030, as highlighted in a new report published by Coherent Market Insights.

This market involves the provision of decarbonization services that help reduce carbon emissions and promote sustainable energy practices. With increasing concerns over climate change and the need to transition towards clean energy sources, organizations and governments around the world are seeking decarbonization solutions. These services offer various advantages, such as reduced environmental impact, improved energy efficiency, and compliance with regulatory standards.

Market key trends: Technological advancements driving decarbonization efforts

One key trend in the global Decarbonization Service Market is the increasing focus on technological advancements to drive decarbonization efforts. Advancements in renewable energy technologies, energy storage systems, and carbon capture technologies are enabling organizations to adopt more sustainable practices.

For example, the implementation of smart grids and advanced metering infrastructure allows for better monitoring and management of energy consumption, leading to optimized energy usage and reduced carbon emissions. Similarly, the development of carbon capture and storage technology enables the capture and sequestration of CO2 emissions from industrial processes, reducing their impact on the environment.

PEST Analysis:

- Political: Governments worldwide are implementing policies and regulations to encourage decarbonization. This includes carbon pricing mechanisms, renewable energy targets, and incentives for clean energy adoption.

- Economic: The economic benefits of decarbonization, such as cost savings from improved energy efficiency and the creation of green jobs, are driving market growth. Additionally, the declining costs of renewable energy technologies make them more affordable and attractive alternatives to fossil fuels.

- Social: Increasing public awareness and concern about climate change are driving demand for decarbonization services. Consumers and organizations are actively seeking sustainable solutions to reduce their carbon footprint and contribute to a greener future.

- Technological: Technological advancements, as mentioned earlier, are playing a crucial role in accelerating decarbonization efforts. The development of innovative solutions and the integration of renewable energy sources into existing infrastructure are enabling a more sustainable energy transition.

Key Takeaways:

1: The Global Decarbonization Service Market Size is expected to witness high growth, exhibiting a CAGR of 12.3% over the forecast period. This growth is driven by increasing environmental concerns and the need for sustainable energy practices. For example, the rising global temperatures and extreme weather events are motivating governments and organizations to adopt decarbonization services.

2: In terms of regional analysis, North America is expected to be the fastest-growing and dominating region in the Decarbonization Service Market. This can be attributed to government initiatives promoting clean energy adoption, favorable regulatory frameworks, and high awareness among consumers about the importance of decarbonization.

3: Key players operating in the global Decarbonization Service Market include Schneider Electric, ENGIE, Siemens, AECOM, EDF Group, Johnson Controls, DNV, Honeywell, Carbon Clean Solutions, Green Charge Networks (ENGIE Impact), ERM (Environmental Resources Management), First Solar, Tesla, CarbonCure Technologies, and Ørsted. These companies are actively providing decarbonization services and developing innovative solutions to address the increasing demand for sustainable energy practices.

#Decarbonization Service Market#Decarbonization Service Market Insights#Decarbonization Service Market Forecast#Decarbonization Service Market Analysis#Decarbonization Service Market Values#Decarbonization Service#climate change#carbon footprint#stor#age technologies#renewable energy#Coherent Market Insights

6 notes

·

View notes

Text

Sports Technology Market Size, Trends, Huge Opportunities, 2023

The Sports Technology market report by stats and research is a research study that concentrates on all the key marketing variables fueling the market's growth. The market's regional and segmental sections were considered when creating the research report on the Sports Technology market. The SWOT analysis, PESTEL analysis, and PORTER'S five forces analyses are all included in the report, along with all qualitative and quantitative market characteristics. The report provides a comprehensive understanding of the Sports Technology market by covering the market's size, growth rates, estimates, and value predictions for the forecast period.

Sports Technology from 2018 to 2021 and its CAGR from 2018 to 2021, and also forecasts its market size to the end of 2030 and its expected to grow with a CAGR of 20.8% from 2023 to 2030.

Get Free Sample Copy of Report:

https://www.statsandresearch.com/request-sample/40247-global-sports-technology-market

Top Key players in Sports Technology Market: Apple Inc., Catapult Group, ChyronHego Corporation, Cisco Systems, Inc., HCL Technologies Limited, IBM Corporation, Infosys Limited, Modern Times Group MTG, Oracle, Panasonic Corporation

#Sports Technology Market#Sports Technology#Sports Technology Market Growth#Sports Technology Market Trends

2 notes

·

View notes

Text

Will SHIB reach $1?

Shiba Inu, or SHIB, as it's called, is a meme coin that has experienced a spectacular price rise in the recent past. SHIB was introduced as an ERC-20 token in August 2020. Its price rocketed from nothing in January 2021 to a pinnacle nine months later, in October 2021. Despite this instance, SHIB had fallen back.

However, there is still a ray of hope for its price to reach $1 shortly. Its investors also hopefully anticipate the same. So the surfacing question is, “Will SHIB reach 1 cent?” Fingers crossed! Just read on, and you shall comprehend.

Shiba Inu's Historical Performance

Since its inception, SHIB has encountered monumental growth by attaining its ATH (all-time high) of $0.00008845, 2 years ago. Currently, it is trading at a value of $0.000009866, down by 88.83% from its ATH!

However, since last one month, the token has seen a decent uprise of more than 20%. Which again prompts the question, “Will this uptrend continue? And Will SHIB reach 1 dollar?” A quick answer to this from its fans’ perspective is affirmative anticipation.

Will SHIB coin reach $1?

No, SHIB may not reach $1 price very soon! In August 2023, SHIB traded around a peak price of $0.00001072. Four months later, it is trading around $0.0000099.

SHIB prediction for 2025 suggests that the token may trade between $0.0000227 and $0.0000326, where the former is its minimum value and the latter is its maximum value. While Shibu Inu’s 2030 price prediction anticipates its maximum to be $0.0001204 and its minimum to be around $0.0000836.

Factors to Support Shiba Inu's $1 Price

Some of the factors that may support Shiba Inu’s price to attain $1 are:

Mainstream Adoption: Increasing the mainstream adoption utility of SHIB through payment modes or decentralized financial apps aids in price rises.

Affirmative Market Sentiment: The prevailing affirmative market sentiment is controlled by optimistic trends in prime cryptocurrencies like Bitcoin and Ethereum.

Community Engagement: The growing SHIB community called the “SHIB Army” drives social media trends and plays a key role in attracting new potential investors.

Strategic Burn: An increase in SHIB price can be driven by reducing its supply. This is positively achieved by a marked decrease in circulating SHIB’s supply via strategic token burns.

Regulatory Clarity: Constructive developments in regulatory measures offer much clarity and intensified security to cryptocurrency investors, thereby increasing the price.

Conclusion

Shiba Inu’s unique features have been pivotal in its journey so far. This immense growth and stability are real assets to the cryptocurrency. Its investors are testimonials to its significant trait of “Loyalty,” assumed to be imbibed from Shiba Inu, the Japanese dog breed. The price forecasts furnished here are purely based on the coin’s past performance and technical analysis.

Before arriving at any financial decisions, marketers, investors, traders, and other users of the SHIB must, therefore, do their research based on the coin’s market status. This greatly helps in avoiding risks of any intensity. Sit back, take a deep breath, and analyze well, for your decisions to make brighter impacts on your SHIB-based investments and transactions.

2 notes

·

View notes

Text

Global Thin film Solar Cell Market Is Estimated To Witness High Growth Owing To Increasing Adoption of Renewable Energy Sources

The global Thin film Solar Cell Market is estimated to be valued at US$ 33.01 Bn in 2022 and is expected to exhibit a CAGR of 19.4% over the forecast period 2023-2030, as highlighted in a new report published by Coherent Market Insights.

A) Market Overview:

Thin film solar cells are made from semiconductor materials that convert sunlight into electrical energy. These solar cells offer various advantages such as flexibility, lightweight, and superior aesthetics compared to traditional solar panels. The need for clean and sustainable energy sources is driving the demand for thin film solar cells as they provide an efficient way to generate electricity from the sun. With the increasing focus on reducing carbon emissions and combating climate change, the demand for renewable energy sources like thin film solar cells is expected to witness significant growth.

B) Market Key Trends:

One key trend in the thin film solar cell market is the increasing investment in research and development activities to enhance the efficiency of these solar cells. Researchers and manufacturers are investing in developing new materials and technologies to improve the conversion efficiency of thin film solar cells. For example, Oxford Photovoltaics, one of the key players in the market, is developing perovskite-based solar cells that have shown promising results in terms of efficiency and cost-effectiveness. This trend is driving innovation in the market and is expected to lead to the commercialization of more efficient thin film solar cell products.

C) PEST Analysis:

Political: Governments around the world are implementing favorable policies and incentives to promote the adoption of renewable energy sources. This is creating a conducive environment for the growth of the thin film solar cell market.

Economic: The declining cost of thin film solar cells, coupled with the increasing demand for clean energy, is driving the economic feasibility of these solar cells. This is attracting investments from both government and private entities.

Social: The increasing awareness about the environmental impact of traditional energy sources is driving the social acceptance and demand for renewable energy solutions like thin film solar cells. Additionally, the aesthetics and design flexibility offered by these solar cells are appealing to consumers.

Technological: Advances in thin film solar cell technologies are improving their efficiency and performance. New materials and manufacturing processes are being developed, leading to the commercialization of more efficient and cost-effective products.

D) Key Takeaways:

Paragraph 1: The Global Thin Film Solar Cell Market Demand is expected to witness high growth, exhibiting a CAGR of 19.4% over the forecast period, due to increasing adoption of renewable energy sources. The need for clean and sustainable energy solutions is driving the demand for thin film solar cells.

Paragraph 2: The Asia Pacific region is expected to dominate the thin film solar cell market, with countries like China, India, and Japan leading the way in terms of installation and production capacity. The region's favorable government policies, abundant solar resources, and growing energy demand are contributing to its fast-paced growth in the market.

Paragraph 3: Key players operating in the global thin film solar cell market are Ascent Solar Technologies, Inc., FIRST SOLAR, Kaneka Corporation, MiaSolé Hi-Tech Corp., and Oxford Photovoltaics. These companies are investing in research and development activities to improve the efficiency and performance of their thin film solar cell products. They are also focusing on strategic collaborations, partnerships, and mergers and acquisitions to expand their market presence.

#Thin Film Solar Cell Market#Thin Film Solar Cell Market Demand#Solar Cells#Thin Film Solar Cell Market GRowth#Thin Film Solar Cell Market Trends#Coherent Market Insights

3 notes

·

View notes

Text

Tech-Driven Solutions: A Comprehensive Overview of the Digital Diabetes Management Market

In recent years, the healthcare industry has witnessed a transformative shift with the integration of technology into various aspects of patient care. One notable area that has seen significant advancement is the management of diabetes through digital solutions. The Digital Diabetes Management Market is at the forefront of this revolution, offering a wide array of tech-driven tools and services that aim to empower patients, improve outcomes, and streamline healthcare processes. Mobile Applications and Glucose Monitoring Mobile applications have become instrumental in the lives of individuals living with diabetes. These apps offer features such as glucose monitoring, medication tracking, and meal planning, allowing users to gain valuable insights into their condition. With the advent of continuous glucose monitoring (CGM) technology, patients can now access real-time data on their blood sugar levels, enabling better control and management of their diabetes. Wearable Devices and Remote Patient Monitoring Wearable devices have emerged as a game-changer in diabetes management. From smartwatches to glucose monitors, these devices offer continuous tracking of vital health parameters, including heart rate, blood sugar levels, and physical activity. Physicians can remotely monitor their patients' health data, providing timely interventions and personalized care plans. Telemedicine and Virtual Care Digital diabetes management has transcended traditional clinic visits. Telemedicine and virtual care platforms enable patients to connect with healthcare providers through video consultations, eliminating the need for physical visits. This not only saves time and resources but also ensures better accessibility to specialized care, especially for those in remote areas. The global digital diabetes management market was valued at US$ 7.60 Bn in 2022 and is forecast to reach a value of US$ 38.55 Bn by 2030 at a CAGR of 22.5% between 2023 and 2030. Artificial Intelligence and Predictive Analytics Artificial Intelligence (AI) algorithms and predictive analytics play a crucial role in digital diabetes management. By analyzing vast amounts of patient data, AI can identify patterns and trends that may be missed by human analysis. This allows for more accurate risk assessment and early detection of potential complications, leading to timely interventions and improved outcomes. Personalized Treatment Plans Digital diabetes management platforms are designed to offer personalized treatment plans tailored to each patient's unique needs. By integrating data from various sources, such as glucose levels, medication adherence, and lifestyle choices, these platforms can recommend customized interventions and lifestyle adjustments to achieve better diabetes control. The global traditional wound management market is estimated to be valued at US$ 2,080.8 million in 2023 and is expected to exhibit a CAGR of 3.4% during the forecast period (2023-2030). The Digital Diabetes Management Market represents a paradigm shift in diabetes care, leveraging the power of technology to enhance patient experiences and outcomes. From mobile applications and wearable devices to telemedicine and AI-driven analytics, these tech-driven solutions empower patients to take charge of their health and collaborate more effectively with healthcare providers. As the landscape of digital healthcare continues to evolve, we can expect even more innovative solutions to emerge, further revolutionizing diabetes management and transforming the lives of millions affected by this chronic condition. With ongoing research and technological advancements, the future holds great promise for improving the quality of care and ushering in a new era of patient-centric diabetes management.

#Coherent Market Insights#Healthcare Industry#Medical Devices#Digital Diabetes Management Market#Diabetes Tech#Digital Healthcare#Diabetes Care

3 notes

·

View notes

Text

Isolator Gloves Market Size, Type, segmentation, growth and forecast 2023-2030

Isolator Gloves Market

The Isolator Gloves Market is expected to grow from USD 141.10 Million in 2022 to USD 228.10 Million by 2030, at a CAGR of 7.11% during the forecast period.

Get the Sample Report: https://www.reportprime.com/enquiry/sample-report/11101

Isolator Gloves Market Size

Isolator Gloves are a type of protective gloves that are designed to provide a barrier between the wearer's hands and harmful substances such as chemicals, viruses, and bacteria. The Isolator Gloves market research report includes an analysis of the market segment based on type, application, and region. The types of Isolator Gloves include Nitrile, Hypalon, EPDM, Neoprene, Latex, and Butyl. The primary applications of Isolator Gloves are in Electronics, Pharmaceutical, Food, Chemical, and Laboratory industries. The report covers the market players such as Ansell, PIERCAN, Renco Corporation, Safetyware Group, Inert Corporation, Jung Gummitechnik, Terra Universal, Honeywell, Nichwell, and Hanaki Rubber. The report also covers regulatory and legal factors specific to market conditions. Isolator Gloves are subject to strict regulations due to their use in critical industries, and market players must ensure compliance with standards set by regulatory bodies. The report provides an in-depth analysis of the Isolator Gloves market, including its market size, growth rate, competitive landscape, and future prospects.

Isolator Gloves Market Key Player

Ansell

PIERCAN

Renco Corporation

Safetyware Group

Inert Corporation

Buy Now & Get Exclusive Discount on this https://www.reportprime.com/enquiry/request-discount/11101

Isolator Gloves Market Segment Analysis

The Isolator Gloves market caters to a niche customer base, which includes pharmaceutical manufacturers, biotechnology companies, healthcare institutions, and medical device manufacturers. These gloves are extensively used in cleanroom environments to maintain hygiene, prevent contamination and ensure aseptic handling of drug substances and medical devices.

The driving factors for revenue growth in the Isolator Gloves market are the increasing demand for sterile pharmaceutical products, the growing prevalence of chronic diseases, and the strict regulatory requirements for cleanroom environments. Furthermore, the Isolator Gloves market is experiencing growth due to the ongoing research and development activities and technological advancements in the field of medical devices.

The latest trends followed in the Isolator Gloves market include the adoption of non-latex gloves to reduce the risk of latex allergy, increasing demand for powder-free gloves to minimize the transfer of allergens, and the use of vibration-dampening gloves to reduce hand fatigue in workers. Moreover, manufacturers are focusing on developing gloves with improved tactile sensitivity and flexibility, which can provide better user comfort and dexterity.

The major challenges faced by the Isolator Gloves market include the high cost of raw materials and production, stringent regulations for cleanroom environments, and increasing competition from local players in the market. Additionally, the COVID-19 pandemic has disrupted the supply chain and logistics operations, resulting in the temporary closure of manufacturing facilities and delays in delivering products to customers.

The report's main findings suggest that the Isolator Gloves market is projected to grow at a significant rate over the forecast period due to the increasing demand for sterile pharmaceutical products and the stringent regulatory requirements for cleanroom environments. Furthermore, the report recommends that manufacturers focus on developing eco-friendly and biodegradable gloves, as the demand for sustainable products is increasing. Moreover, manufacturers should prioritize improving their supply chain management and logistics operations to meet the market demands and maintain a competitive edge.

In conclusion, the Isolator Gloves market caters to a niche customer base, and the major factors driving revenue growth are the increasing demand for sterile pharmaceutical products and the strict regulatory requirements for cleanroom environments. The Isolator Gloves market is experiencing growth due to technological advancements and ongoing research and development activities. The latest trends in the market encompass the adoption of non-latex gloves, powder-free gloves, and vibration-dampening gloves. However, the Isolator Gloves market is also facing challenges due to high production costs, stringent regulatory requirements, and increasing competition from local players. The report's main recommendations include focusing on sustainable products, improving supply chain management, and logistics operations.

This report covers impact on COVID-19 and Russia-Ukraine wars in detail.

Purchase This Report: https://www.reportprime.com/checkout?id=11101&price=3590

Market Segmentation (by Application):

Electronics

Pharmaceutical

Food

Chemical

Laboratory

Information is sourced from www.reportprime.com

2 notes

·

View notes

Text

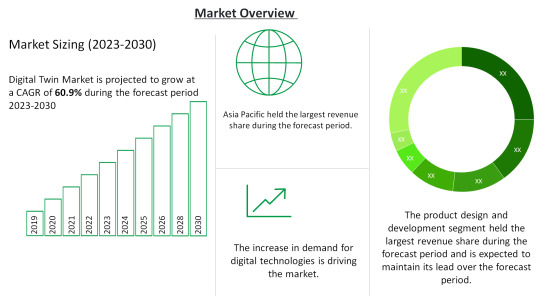

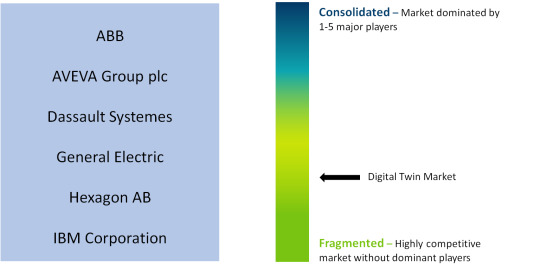

Digital Twin Market Size 2023-2030: ABB, AVEVA Group plc, Dassault Systemes

Digital Twin Market by Power Source (Battery-Powered, hardwired with battery backup, Hardwired without battery backup), Type (Photoelectric Smoke Detectors, Ionization Smoke Detectors), Service, Distribution Channel, and region (North America, Europe, Asia-Pacific, Middle East, and Africa and South America). The global Digital Twin Market size is 11.12 billion USD in 2022 and is projected to reach a CAGR of 60.9% from 2023-2030.

Click Here For a Free Sample + Related Graphs of the Report at: https://www.delvens.com/get-free-sample/digital-twin-market-trends-forecast-till-2030

Digital twin technology has allowed businesses in end-use industries to generate digital equivalents of objects and systems across the product lifecycle. The potential use cases of digital twin technology have expanded rapidly over the years, anchored in the increasing trend of integration with internet-of-things (IoT) sensors. Coupled with AI and analytics, the capabilities of digital twins are enabling engineers to carry out simulations before a physical product is developed. As a result, digital twins are being deployed by manufacturing companies to shorten time-to-market. Additionally, digital twin technology is also showing its potential in optimizing maintenance costs and timelines, thus has attracted colossal interest among manufacturing stalwarts, notably in discrete manufacturing.

The shift to interconnected environments across industries is driving the demand for digital twin solutions across the world. Massive adoption of IoT is being witnessed, with over 41 billion connected IoT devices expected to be in use by 2030. For the successful implementation and functioning of IoT, increasing the throughput for every part or “thing” is necessary, which is made possible by digital twin technology. Since the behavior and performance of a system over its lifetime depend on its components, the demand for digital twin technology is increasing across the world for system improvement. The emergence of digitalization in manufacturing is driving the global digital twin market. Manufacturing units across the globe are investing in digitalization strategies to increase their operational efficiency, productivity, and accuracy. These digitalization solutions including digital twin are contributing to an increase in manufacturer responsiveness and agility through changing customer demands and market conditions.

On the other hand, there has been a wide implementation of digital technologies like artificial intelligence, IoT, clog, and big data which is increasing across the business units. The market solutions help in the integration of IoT sensors and technologies that help in the virtualization of the physical twin. The connectivity is growing and so are the associated risks like security, data protection, and regulations, alongside compliance.

During the COVID-19 pandemic, the use of digital twin technologies to manage industrial and manufacturing assets increased significantly across production facilities to mitigate the risks associated with the outbreak. Amid the lockdown, the U.S. implemented a National Digital Twin Program, which was expected to leverage the digital twin blueprint of major cities of the U.S. to improve smart city infrastructure and service delivery. The COVID-19 pandemic positively impacted the digital twin market demand for twin technology.

Delvens Industry Expert’s Standpoint

The use of solutions like digital twins is predicted to be fueled by the rapid uptake of 3D printing technology, rising demand for digital twins in the healthcare and pharmaceutical sectors, and the growing tendency for IoT solution adoption across multiple industries. With pre-analysis of the actual product, while it is still in the creation stage, digital twins technology helps to improve physical product design across the full product lifetime. Technology like digital twins can be of huge help to doctors and surgeons in the near future and hence, the market is expected to grow.

Market Portfolio

Key Findings

The enterprise segment is further segmented into Large Enterprises and Small & Medium Enterprises. Small & Medium Enterprises are expected to dominate the market during the forecast period. It is further expected to grow at the highest CAGR from 2023 to 2030.

The industry segment is further segmented into Automotive & Transportation, Energy & Utilities, Infrastructure, Healthcare, Aerospace, Oil & Gas, Telecommunications, Agriculture, Retail, and Other Industries. The automotive & transportation industry is expected to account for the largest share of the digital twin market during the forecast period. The growth can be attributed to the increasing usage of digital twins for designing, simulation, MRO (maintenance, repair, and overhaul), production, and after-service.

The market is also divided into various regions such as North America, Europe, Asia-Pacific, South America, and Middle East and Africa. North America is expected to hold the largest share of the digital twin market throughout the forecast period. North America is a major hub for technological innovations and an early adopter of digital twins and related technologies.

During the COVID-19 pandemic, the use of digital twin technologies to manage industrial and manufacturing assets increased significantly across production facilities to mitigate the risks associated with the outbreak. Amid the lockdown, the U.S. implemented a National Digital Twin Program, which was expected to leverage the digital twin blueprint of major cities of the U.S. to improve smart city infrastructure and service delivery. The COVID-19 pandemic positively impacted the digital twin market demand for twin technology.

Regional Analysis

North America to Dominate the Market

North America is expected to hold the largest share of the digital twin market throughout the forecast period. North America is a major hub for technological innovations and an early adopter of digital twins and related technologies.

North America has an established ecosystem for digital twin practices and the presence of large automotive & transportation, aerospace, chemical, energy & utilities, and food & beverage companies in the US. These industries are replacing legacy systems with advanced solutions to improve performance efficiency and reduce overall operational costs, resulting in the growth of the digital twin technology market in this region.

Competitive Landscape

ABB

AVEVA Group plc

Dassault Systemes

General Electric

Hexagon AB

IBM Corporation

SAP

Microsoft

Siemens

ANSYS

PTC

IBM

Recent Developments

In April 2022, GE Research (US) and GE Renewable Energy (France), subsidiaries of GE, collaborated and developed a cutting-edge artificial intelligence (AI)/machine learning (ML) technology that has the potential to save the worldwide wind industry billions of dollars in logistical expenses over the next decade. GE’s AI/ML tool uses a digital twin of the wind turbine logistics process to accurately predict and streamline logistics costs. Based on the current industry growth forecasts, AI/ML might enable a 10% decrease in logistics costs, representing a global cost saving to the wind sector of up to USD 2.6 billion annually by 2030.

In March 2022, Microsoft announced a strategic partnership with Newcrest. The mining business of Newcrest would adopt Azure as its preferred cloud provider globally, as well as work on digital twins and a sustainability data model. Both organizations are working together on projects, including the use of digital twins to improve operational performance and developing a high-impact sustainability data model.

Reasons to Acquire

Increase your understanding of the market for identifying the best and most suitable strategies and decisions on the basis of sales or revenue fluctuations in terms of volume and value, distribution chain analysis, market trends, and factors

Gain authentic and granular data access for Digital Twin Market so as to understand the trends and the factors involved in changing market situations

Qualitative and quantitative data utilization to discover arrays of future growth from the market trends of leaders to market visionaries and then recognize the significant areas to compete in the future

In-depth analysis of the changing trends of the market by visualizing the historic and forecast year growth patterns

Direct Purchase of Digital Twin Market Research Report at: https://www.delvens.com/checkout/digital-twin-market-trends-forecast-till-2030

Report Scope

Report FeatureDescriptionsGrowth RateCAGR of 60.9% during the forecasting period, 2023-2030Historical Data2019-2021Forecast Years2023-2030Base Year2022Units ConsideredRevenue in USD million and CAGR from 2023 to 2030Report Segmentationenterprise, platform, application, and region.Report AttributeMarket Revenue Sizing (Global, Regional and Country Level) Company Share Analysis, Market Dynamics, Company ProfilingRegional Level ScopeNorth America, Europe, Asia-Pacific, South America, and Middle East, and AfricaCountry Level ScopeU.S., Japan, Germany, U.K., China, India, Brazil, UAE, and South Africa (50+ Countries Across the Globe)Companies ProfiledABB; AVEVA Group plc; Dassault Systems; General Electric; Hexagon AB; IBM Corp.; SAP.Available CustomizationIn addition to the market data for Digital Twin Market, Delvens offers client-centric reports and customized according to the company’s specific demand and requirement.

TABLE OF CONTENTS

Large Enterprises

Small & Medium Enterprises

Product Design & Development

Predictive Maintenance

Business Optimization

Performance Monitoring

Inventory Management

Other Applications

Automotive & Transportation

Energy & Utilities

Infrastructure

Healthcare

Aerospace

Oil & Gas

Telecommunications

Agriculture

Retail

Other Industries.

Asia Pacific

North America

Europe

South America

Middle East & Africa

ABB

AVEVA Group plc

Dassault Systemes

General Electric

Hexagon AB

IBM Corporation

SAP

About Us:

Delvens is a strategic advisory and consulting company headquartered in New Delhi, India. The company holds expertise in providing syndicated research reports, customized research reports and consulting services. Delvens qualitative and quantitative data is highly utilized by each level from niche to major markets, serving more than 1K prominent companies by assuring to provide the information on country, regional and global business environment. We have a database for more than 45 industries in more than 115+ major countries globally.

Delvens database assists the clients by providing in-depth information in crucial business decisions. Delvens offers significant facts and figures across various industries namely Healthcare, IT & Telecom, Chemicals & Materials, Semiconductor & Electronics, Energy, Pharmaceutical, Consumer Goods & Services, Food & Beverages. Our company provides an exhaustive and comprehensive understanding of the business environment.

Contact Us:

UNIT NO. 2126, TOWER B,

21ST FLOOR ALPHATHUM

SECTOR 90 NOIDA 201305, IN

+44-20-8638-5055

[email protected]

WEBSITE: https://delvens.com/

#Digital Twin Market#Digital Twin#Digital Twin Market Size#Digital Twin Market Share#Semiconductors & Electronics

2 notes

·

View notes

Text

Aluminum Market: Products, Applications & Beyond

Aluminum is a versatile element with several beneficial properties, such as a high strength-to-weight ratio, corrosion resistance, recyclability, electrical & thermal conductivity, longer lifecycle, and non-toxic nature. As a result, it witnesses high demand from industries like automotive & transportation, electronics, building & construction, foil & packaging, and others. The high applicability of the metal is expected to drive the global aluminum market at a CAGR of 5.24% in the forecast period from 2023 to 2030.

Aluminum – Mining Into Key Products:

Triton Market Research’s report covers bauxite, alumina, primary aluminum, and other products as part of its segment analysis.

Bauxite is anticipated to grow with a CAGR of 5.67% in the product segment over the forecast years.

Bauxite is the primary ore of aluminum. It is a sedimentary rock composed of aluminum-bearing minerals, and is usually mined by surface mining techniques. It is found in several locations across the world, including India, Brazil, Australia, Russia, and China, among others. Australia is the world’s largest bauxite-producing nation, with a production value of over 100 million metric tons in 2022.

Moreover, leading market players Rio Tinto and Alcoa Corporation operate their bauxite mines in the country. These factors are expected to propel Australia’s growth in the Asia-Pacific aluminum market, with an anticipated CAGR of 4.38% over the projected period.

Alumina is expected to grow with a CAGR of 5.42% in the product segment during 2023-2030.

Alumina or aluminum oxide is obtained by chemically processing the bauxite ore using the Bayer process. It possesses excellent dielectric properties, high stiffness & strength, thermal conductivity, wear resistance, and other such favorable characteristics, making it a preferable material for a range of applications.

Hydrolysis of aluminum oxide results in the production of high-purity alumina, a uniform fine powder characterized by a minimum purity level of 99.99%. Its chemical stability, low-temperature sensitivity, and high electrical insulation make HPA an ideal choice for manufacturing LED lights and electric vehicles. The growth of these industries is expected to contribute to the progress of the global HPA market.

EVs Spike Sustainability Trend

As per the estimates from the International Energy Agency, nearly 2 million electric vehicles were sold globally in the first quarter of 2022, with a whopping 75% increase from the preceding year. Aluminum has emerged as the preferred choice for auto manufacturers in this new era of electromobility. Automotive & transportation leads the industry vertical segment in the studied market, garnering $40792.89 million in 2022.

In May 2021, RusAl collaborated with leading rolled aluminum products manufacturer Gränges AB to develop alloys for automotive applications. Automakers are increasingly substituting stainless steel with aluminum in their products owing to the latter’s low weight, higher impact absorption capacity, and better driving range.

Also, electric vehicles have a considerably lower carbon footprint compared to their traditional counterparts. With the growing need for lowering emissions and raising awareness of energy conservation, governments worldwide are encouraging the use of EVs, which is expected to propel the demand for aluminum over the forecast period.

The Netherlands is one of the leading countries in Europe in terms of EV adoption. The Dutch government has set an ambitious goal that only zero-emission passenger cars (such as battery-operated EVs, hydrogen FCEVs, and plug-in hybrid EVs) will be sold in the nation by 2030. Further, according to the Canadian government, the country’s aluminum producers have some of the lowest CO2 footprints in the world.

Alcoa Corporation and Rio Tinto partnered to form ELYSIS, headquartered in Montréal, Canada. In 2021, it successfully produced carbon-free aluminum at its Industrial Research and Development Center in Saguenay. The company is heralding the beginning of a new era for the global aluminum market with its ELYSIS™ technology, which eliminates all direct GHG emissions from the smelting process, and is the first technology ever to emit oxygen as a byproduct.

Wrapping Up

Aluminum is among the most widely used metals in the world today, and is anticipated to underpin the global transition to a low-carbon economy. Moreover, it is 100% recyclable and can retain its properties & quality post the recycling process.

Reprocessing the metal is a more energy-efficient option compared to extracting the element from an ore, causing less environmental damage. As a result, the demand for aluminum in the sustainable energy sector has thus increased. The efforts to combat climate change are thus expected to bolster the aluminum market’s growth over the forecast period.

#Aluminum Market#aluminum#chemicals and materials#specialty chemicals#market research#market research reports#triton market research

4 notes

·

View notes

Text

Life Science Tools Market Segmented On The Basis Of Technology, Product, End-Use, Region And Forecast 2030: Grand View Research Inc.

San Francisco, 19 Jan 2023: The Report Life Science Tools Market Size, Share & Trends Analysis Report By Technology (Cell Biology, Proteomics), By Product, By End-use, By Region, And Segment Forecasts, 2022 – 2030

The global life science tools market size is expected to reach USD 248.05 billion by 2030, according to a new report by Grand View Research, Inc., expanding at a CAGR of 6.95% from…

View On WordPress

#Life Science Tools Industry#Life Science Tools Market#Life Science Tools Market 2030#Life Science Tools Market Revenue#Life Science Tools Market Share#Life Science Tools Market Size

2 notes

·

View notes

Text

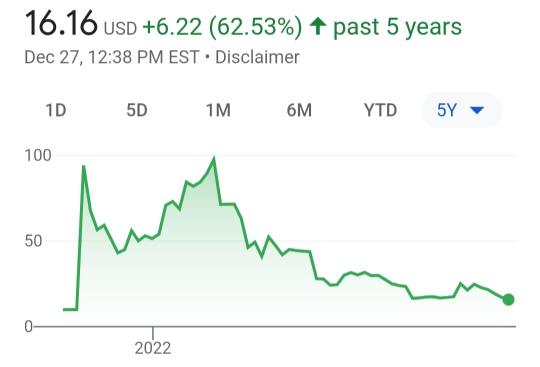

DWAC Stock Price Prediction 2023, 2025, 2030, 2035, 2040, 2045, and 2050

The stock market is always an unpredictable roller coaster of highs and lows, and predicting the stock price of a company can be an even more daunting task. As technology advances, digital companies are becoming more prominent in the stock market and investors need to be aware of trends and forecasts in order to make informed decisions. For this reason, many are asking: what will be the stock price of DWAC (Digital World Acquisition Corp.) in 2023, 2025, 2030, 2035, 2040, 2045, and 2050? In this blog post, we will explore the current stock trends of DWAC, analyze past predictions, and present our own forecasts for DWAC’s stock price in the years ahead. We’ll look at the company’s past performance and current strategies to provide a comprehensive overview of the stock's future outlook. By the end of this blog post, readers should have a better understanding of the future of the company and its stock price, allowing them to make better informed decisions. Read more

#DWAC (Digital World Acquisition Corp.) Stock Price Prediction 2023#2025#2030#2035#2040#2045#and 2050#banking#stock market#loan#finance#nft#moneymol#DWAC Stock Price Prediction 2023

4 notes

·

View notes

Text

The transition to remote and hybrid work will drive U.S. office vacancies 55 percent above pre-COVID levels and leave 1.1 billion square feet of office space unused by 2030, according to a new study by real estate services firm Cushman & Wakefield.

About 330 million square feet will fall vacant because of the new work pattern. Another 740 million will sit empty because the buildings are aging, lack key amenities, or need “significant upgrades” to refurbish or repurpose them, the study said.

Pledge your support

About 25 percent of U.S. office space has become “undesirable,” while another 60 percent risks obsolescence without major investment, the firm warned.

Rising interest rates are making it much harder, and in many cases impossible, to finance upgrades that would make older buildings competitive with new ones as tenants seek the most alluring spaces at the cheapest rates.

Share

“Obsolescence is the word of the day right now,” Cushman president Andrew McDonald said in comments quoted by the Financial Times, adding that the U.S. office real estate market has reached “an inflection point.”

Only a third of office leases due to expire between 2020 and 2030 have run out. That means landlords likely will see a steady wave of tenants cutting back their space or leaving for more attractive buildings or better lease terms.

“The trend is downward, but the magnitude of the shift is still in flux,” Cushman’s chief economist Kevin Thorpe said in comments quoted by the FT.The sun rises over downtown Los Angeles.

One measure of the magnitude: “Friday [in the office] is dead forever” and “Monday is touch and go,” Steven Roth, president of the Vornado Realty Trust, said in an earnings call earlier this month.

Vornado’s plan to build several new office towers around Penn Station in Manhattan is now “almost impossible” to finance, Roth admitted.

While the U.S. is the chief victim of the office building bust so far, it is also underway in Asia and Europe, Cushman’s report noted.

TRENDPOST: We have long detailed the implosion of the office real estate industry in a series of reports, including:

● “Commercial Real Estate in a Tailspin” (20 Oct 2020)

● “Deloitte Abandons More London Office Space” (26 Apr 2022)

● “GM Softens Back-to-the-Office Requirement After Worker Backlash”(4 Oct 2022)

● “Business Office Bust Begins to Bite” (20 Dec 2022)

● “New York City’s Workforce Sharply Shrinking” (24 Jan 2023)

● “Office Occupancy Half of What It Used to Be” (7 Feb 2023)

TREND FORECAST: As we forecast in our Top Trend for 2023 (3 Jan 2023) this next phase in the office building bust, the office property crisis is accelerating as landlords face stiffer competition to get and keep tenants, wrangle with local governments to try to minimize their tax assessments, and see their margins shrink—many to the point of disappearing.

And for many with adjustable rate mortgages, the higher interest rates rise, the more they have to pay on their loans.

To survive, many landlords will let go of older buildings needing maintenance or repairs, either offering them at fire-sale prices or handing the keys back to lenders.

Property owners will consolidate, those having deep pockets or access to cash buying up others for cheap.

As property values are reassessed downward, cities will confront hard decisions about which workers and services to cut.

And as for converting offices into residential apartments and/or condominiums, as we have noted in previous issues of The Trends Journal, thousands of office buildings, especially older ones, across the U.S., are not eligible for that kind of salvation for reasons we explained in “Plan to Turn New York’s Vacant Hotels To Housing Not Working” (5 Apr 2022) and “Wall Street, Dead Street. Office Buildings Going Condo” (28 Jun 2022).

OFFICE TOWER OWNER DEFAULTS ON $1.7 BILLION IN MORTGAGES

Columbia Property Trust, a division of private equity giant Pacific Investment Management, has defaulted on $1.7 billion worth of mortgages on seven office towers in Boston, Jersey City, New York, and San Francisco.

The mortgages carried adjustable interest rates, causing monthly payments to skyrocket through 2022 as the U.S. Federal Reserve steadily raised its benchmark interest rate.

The seven buildings were appraised at $2.27 billion in 2021. Citigroup, Deutsche Bank, and Goldman Sachs made the original mortgage loans, totaling about $1.9 billion.

“We, like most office owners, are addressing the unique and unprecedented challenges currently facing our asset class and customer base,” Columbia spokesperson Justina Lombardo told Bloomberg.

“We have engaged with our lenders on a restructuring…we look forward to a collaborative process yielding thoughtful solutions that reflect current market conditions,” she added.

Older office buildings that need to be refurbished to compete with newer digs with more amenities are in particular trouble, as current high interest rates make those investments impractical, as we reported in “Study: One Billion Square Feet of Office Space Will Be Empty by 2030” in this issue.

The value of those older, troubled properties has fallen an average of 20 percent since March 2020, real estate research firm Green Street noted.

TREND FORECAST: These defaults are another step along the office real estate industry’s downward path, following Brookfield Corp.’s default on $755 million worth of loans, which we detailed in “Top Private Equity Firm Defaults on Two Office Tower Loans” (21 Feb 2023).

As we wrote then, these defaults are harbingers of the mounting crisis facing landlords that we explained in our Top Trend 2023 (3 Jan 2023) forecast of this next phase in the office building bust: owners of older buildings needing maintenance and repairs will increasingly dump their properties for rock-bottom prices or simply default.

Owners lucky enough to hold newer, more desirable properties still will have to compete for tenants by offering free months’ rent, free redecoration, and other perks.

The office real estate business will recede to become a niche in real estate investing, not the cornerstone it has been for the last century.

CORNER BAKERY RESTAURANT CHAIN GOES BUST

The Corner Bakery, a chain of casual dining spots with 140 locations across 20 U.S. states, declared Chapter 11 bankruptcy last week after a lender threatened to foreclose.

The 31-year-old company blamed the office building bust, one of our Top Trends for 2023, for its failure. Its restaurants derived much of their revenue from commuters stopping in for breakfast and lunch, it said.

Sales crashed during the COVID War and never recovered after the work-from-home trend became permanent.

The chain also has been beset by higher wages to recruit and keep workers, rising costs for foods, and landlords who ran out of patience after COVID-era federal relief funds dried up, company founder Jignesh Pandya said in comments cited by The Wall Street Journal.

Corner Bakery was negotiating with lenders to restructure a $20-million loan when the lenders sold the loan to SSCP Restaurant Investors LLC, which then halted negotiations and began foreclosure proceedings.

TRENDPOST: We are noting this company’s demise to mark yet another casualty of the office building bust and as a harbinger that the worst is yet to come.

The transition to remote and hybrid work will drive U.S. office vacancies 55 percent above pre-COVID levels and leave 1.1 billion square feet of office space unused by 2030, according to a new study by real estate services firm Cushman & Wakefield.

About 330 million square feet will fall vacant because of the new work pattern. Another 740 million will sit empty because the buildings are aging, lack key amenities, or need “significant upgrades” to refurbish or repurpose them, the study said.

Pledge your support

About 25 percent of U.S. office space has become “undesirable,” while another 60 percent risks obsolescence without major investment, the firm warned.

Rising interest rates are making it much harder, and in many cases impossible, to finance upgrades that would make older buildings competitive with new ones as tenants seek the most alluring spaces at the cheapest rates.

Share

“Obsolescence is the word of the day right now,” Cushman president Andrew McDonald said in comments quoted by the Financial Times, adding that the U.S. office real estate market has reached “an inflection point.”

Only a third of office leases due to expire between 2020 and 2030 have run out. That means landlords likely will see a steady wave of tenants cutting back their space or leaving for more attractive buildings or better lease terms.

“The trend is downward, but the magnitude of the shift is still in flux,” Cushman’s chief economist Kevin Thorpe said in comments quoted by the FT.The sun rises over downtown Los Angeles.

One measure of the magnitude: “Friday [in the office] is dead forever” and “Monday is touch and go,” Steven Roth, president of the Vornado Realty Trust, said in an earnings call earlier this month.

Vornado’s plan to build several new office towers around Penn Station in Manhattan is now “almost impossible” to finance, Roth admitted.

While the U.S. is the chief victim of the office building bust so far, it is also underway in Asia and Europe, Cushman’s report noted.

TRENDPOST: We have long detailed the implosion of the office real estate industry in a series of reports, including:

● “Commercial Real Estate in a Tailspin” (20 Oct 2020)

● “Deloitte Abandons More London Office Space” (26 Apr 2022)

● “GM Softens Back-to-the-Office Requirement After Worker Backlash”(4 Oct 2022)

● “Business Office Bust Begins to Bite” (20 Dec 2022)

● “New York City’s Workforce Sharply Shrinking” (24 Jan 2023)

● “Office Occupancy Half of What It Used to Be” (7 Feb 2023)

TREND FORECAST: As we forecast in our Top Trend for 2023 (3 Jan 2023) this next phase in the office building bust, the office property crisis is accelerating as landlords face stiffer competition to get and keep tenants, wrangle with local governments to try to minimize their tax assessments, and see their margins shrink—many to the point of disappearing.

And for many with adjustable rate mortgages, the higher interest rates rise, the more they have to pay on their loans.

To survive, many landlords will let go of older buildings needing maintenance or repairs, either offering them at fire-sale prices or handing the keys back to lenders.

Property owners will consolidate, those having deep pockets or access to cash buying up others for cheap.

As property values are reassessed downward, cities will confront hard decisions about which workers and services to cut.

And as for converting offices into residential apartments and/or condominiums, as we have noted in previous issues of The Trends Journal, thousands of office buildings, especially older ones, across the U.S., are not eligible for that kind of salvation for reasons we explained in “Plan to Turn New York’s Vacant Hotels To Housing Not Working” (5 Apr 2022) and “Wall Street, Dead Street. Office Buildings Going Condo” (28 Jun 2022).

OFFICE TOWER OWNER DEFAULTS ON $1.7 BILLION IN MORTGAGES

Columbia Property Trust, a division of private equity giant Pacific Investment Management, has defaulted on $1.7 billion worth of mortgages on seven office towers in Boston, Jersey City, New York, and San Francisco.

The mortgages carried adjustable interest rates, causing monthly payments to skyrocket through 2022 as the U.S. Federal Reserve steadily raised its benchmark interest rate.

The seven buildings were appraised at $2.27 billion in 2021. Citigroup, Deutsche Bank, and Goldman Sachs made the original mortgage loans, totaling about $1.9 billion.

“We, like most office owners, are addressing the unique and unprecedented challenges currently facing our asset class and customer base,” Columbia spokesperson Justina Lombardo told Bloomberg.

“We have engaged with our lenders on a restructuring…we look forward to a collaborative process yielding thoughtful solutions that reflect current market conditions,” she added.

Older office buildings that need to be refurbished to compete with newer digs with more amenities are in particular trouble, as current high interest rates make those investments impractical, as we reported in “Study: One Billion Square Feet of Office Space Will Be Empty by 2030” in this issue.

The value of those older, troubled properties has fallen an average of 20 percent since March 2020, real estate research firm Green Street noted.

TREND FORECAST: These defaults are another step along the office real estate industry’s downward path, following Brookfield Corp.’s default on $755 million worth of loans, which we detailed in “Top Private Equity Firm Defaults on Two Office Tower Loans” (21 Feb 2023).

As we wrote then, these defaults are harbingers of the mounting crisis facing landlords that we explained in our Top Trend 2023 (3 Jan 2023) forecast of this next phase in the office building bust: owners of older buildings needing maintenance and repairs will increasingly dump their properties for rock-bottom prices or simply default.

Owners lucky enough to hold newer, more desirable properties still will have to compete for tenants by offering free months’ rent, free redecoration, and other perks.

The office real estate business will recede to become a niche in real estate investing, not the cornerstone it has been for the last century.

CORNER BAKERY RESTAURANT CHAIN GOES BUST

The Corner Bakery, a chain of casual dining spots with 140 locations across 20 U.S. states, declared Chapter 11 bankruptcy last week after a lender threatened to foreclose.

The 31-year-old company blamed the office building bust, one of our Top Trends for 2023, for its failure. Its restaurants derived much of their revenue from commuters stopping in for breakfast and lunch, it said.

Sales crashed during the COVID War and never recovered after the work-from-home trend became permanent.

The chain also has been beset by higher wages to recruit and keep workers, rising costs for foods, and landlords who ran out of patience after COVID-era federal relief funds dried up, company founder Jignesh Pandya said in comments cited by The Wall Street Journal.

Corner Bakery was negotiating with lenders to restructure a $20-million loan when the lenders sold the loan to SSCP Restaurant Investors LLC, which then halted negotiations and began foreclosure proceedings.

TRENDPOST: We are noting this company’s demise to mark yet another casualty of the office building bust and as a harbinger that the worst is yet to come.

1 note

·

View note

Link

0 notes