#Treasury management

Photo

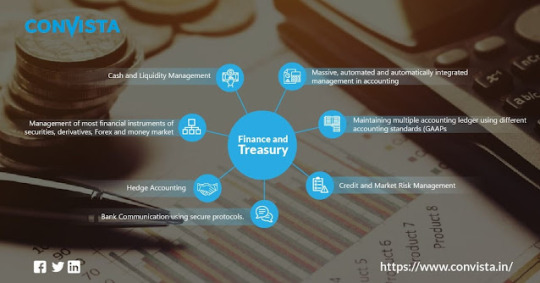

Finance and Treasury with ConVista

Treasury involves money management and financial risks in a business. The priority is to ensure the business has the money needed to manage daily business obligations, while also helping to develop its long-term financial strategies and policies

#Treasury Management#Treasury Management system#Function of Treasury Management#Bank Treasury Management#Treasury Management in Bangalore#Treasury Management in India#Treasury Management in SAP#SAP Treasury Management#Responsibilities of Treasury Management#Treasury Management system in India

3 notes

·

View notes

Text

Stronghold Boosts Network: Acquires 20022 Labs

Stronghold has officially completed the acquisition of 20022 Labs, a company known for its pioneering work in advancing the ISO 20022 financial messaging standard. This strategic move will greatly bolster Stronghold's proprietary payment network, StrongholdNET, by further aligning it with ISO 20022 standards. The expertise, technology, and relationships brought by 20022 Labs will drive innovation in payment systems, offering businesses a competitive advantage through improved operational efficiencies, treasury management, customer experience, regulatory compliance, and domestic and global interoperability in the digital economy. This collaboration will enhance the implementation of the standard in StrongholdNET, promoting interoperability among various payment networks within Stronghold's ecosystem.

More Information: https://www.techdogs.com/tech-news/business-wire/stronghold-enhances-payment-network-with-strategic-acquisition-of-20022-labs

0 notes

Text

Looking to outsource your finance and accounting tasks? Check out UNison Globus. They offer a range of specialized services, including R&D tax credit, virtual CFO services, Treasury management, estate planning, and comprehensive business advisory. Their team is dedicated to handling your financial tasks with precision and confidentiality. With over 25+ years of expertise and serving over 500+ clients worldwide, they are a trusted partner for businesses of all sizes. Do not miss their top-notch service. Visit their website to learn more about their services and book an appointment at: https://unisonglobus.com/contact-us/

#Finance#accounting firms#accounting#Accounting Outsourcing Services#unison globus#US accounting#virtual CFO services#Treasury management#estate planning#R&D tax credit#comprehensive business advisory services

0 notes

Text

Exploring Treasury Optimization Strategies in India

#Treasury management#Treasury management service#Cash flow optimization#cash flow optimization techniques#What is cash optimisation#Liquidity management#Financial efficiency#Treasury management in India#Treasury operations#Financial strategy

0 notes

Link

The global Treasury and risk management software market reached around US$ 400 Mn in 2022 and is expected to witness a moderate growth rate of around 6.5% during the forecast period 2022-2028, driven mainly by the increased need for fraud prevention in banks, where treasure management is used more frequently. The Treasury and risk management software market is expected to be significantly driven by banks' growing demand over the forecast period.

0 notes

Text

Multisig Solana: Everything you Need to Know

Multisig Solana is an increasingly popular technology that offers enhanced security and control over your digital assets. It enables multiple users to have their private keys, allowing them to sign transactions together to move or access funds. It makes it an excellent option for both individuals and businesses looking for an extra layer of protection for their cryptocurrency investments.

In this blog post, we will discuss everything you need to know about multisignature Solana, from what it is and how it works to the various benefits it provides.

What is Multisig Solana?

Multisig Solana is a form of treasury management utilizing the power of blockchain technology. This innovative form of secure financial management enables businesses to securely manage multiple accounts. It can take place with multiple users requiring authorization before any transactions.

Additionally, multisignature Solana is an excellent way for businesses to manage their payrolls. Multisig allows employees to receive payments securely and on time, thereby reducing the risk of theft or fraud. By using a secure blockchain-based system for payroll management, businesses can rest assured that their payrolls are secure and their employees are getting their salaries without any issues.

How Does it Work?

For financial services like treasury management, Multisignature Solana uses blockchain technology to increase security, scalability, and efficiency. It allows multiple parties to control and manage funds, eliminating the need for a central authority.

The multisignature Solana system works by requiring two or more separate parties to sign off on any transaction before it can be processed. It means that if one party wishes to send funds, they must first obtain approval from the other involved parties before it can go through. This added layer of security makes it impossible for any single individual to gain access to funds without the permission of all involved parties.

When it comes to treasury management and payroll management, the use of multisignature Solana allows businesses to better manage their finances. By introducing multiple layers of security, businesses can ensure that only authorized personnel have access to their funds. These funds are used as per the rules and regulations set out by the business.

Overall, multisignature Solana is an efficient and secure way to manage finances while reducing the risks associated with cybercrime. Businesses can rely on multisignature Solana as an effective tool for improving their financial security, allowing them to focus on more essential aspects of their operations.

What are the Benefits?

Multisig Solana is an innovative solution for treasury management crypto in the crypto space. It enables users to secure their digital assets with enhanced security measures while providing an additional layer of protection against fraud or unauthorized transactions.

With multisig Solana, you can provide stronger security than with a single-signature wallet. A single-signature wallet is one where only one user has access to a wallet’s funds. However, with multisignature Solana, multiple users must sign off on a transaction before it gets completed. It makes it much more difficult for someone to steal funds as they would have to gain access to multiple keys at once.

Another advantage of multisig Solana is that it provides improved control over funds within a wallet. With this type of wallet, users can set different levels of access for each user. For example, one user might have full access to all the funds, while another user might only have access to the usual amounts or types of funds. Especially useful for businesses or organizations that want to limit spending and allocate funds efficiently.

Finally, multisignature Solana also allows for improved privacy and anonymity. It is more exhausting to identify wallet owners since transactions require multiple signatures. It is beneficial in many ways, including the prevention of identity theft or money laundering.

Conclusion

In conclusion, multisignature Solana offers numerous benefits when it comes to treasury management and payroll management in the crypto space. It allows for enhanced security, improved control over funds, and greater privacy and anonymity.

#treasury management#multisig solana#payroll management#multisig wallet#how to set up multisig solana#token vesting solana#mass crypto payouts#best streaming protocol

0 notes

Quote

But I remember you before you became a story.

MARIE HOWE, from “Gretel, from a Sudden Clearing.”

#*#i managed to hunt down a pdf of an anthology of poems based on the grimm brothers' tales and boy oh boy.#i sure am Losing it on this lovely may saturday.#(no but. it IS such a treasury! also: marie howe you are everything to me.)

4K notes

·

View notes

Text

women want us the wildlife of farm arrays fears us

#how did we do this? simple#we set up our home base in the shelter that's right next to a scav treasury#so we had a practically infinite supply of explosive spears and puffballs#and easy access to two rooms where noots spawn very frequently#coincidentally there are also a lot of vulture spawns in those rooms#and two guaranteed caramel lizards#along with a red lizard but we never managed to kill that#so every day we set out with an explosive spear and a puffball#if we found a mama noot we used the puffball to kill her and the little noots#if we didn't find one then we looked for a vulture or lizard and used the explosives to kill that#very efficient system. we were done in 16 cycles#only about ten of those actually spent in farm arrays since we spawned in industrial complex#we are very tired now. noot hunting is hard work

4 notes

·

View notes

Text

hey since the student theater group on campus is apparently only interested in doing musical cabarets instead of actual staged musicals anymore why don't they grow a pair and do something cool like 35mm

#sasha speaks#actually i dont think its entirely up to them what shows they can produce i think theyre limited by what they can get student gov to fund#and ive worked with treasury. it can be like pulling teeth to get funded.#still i could bring it up to the eboard im friends with one of the managers#content wise it might be iffy but its not really much worse than she kills monsters and they did that so

9 notes

·

View notes

Text

There are consequences from US interest-rates remaining at 5.5% for the fiscal deficit and the Japanese Yen

Today is Federal Reserve day when just after 7pm (they are usually late) we learn the interest-rate decision of Jerome Powell and his colleagues. On the surface not much is expected which is highlighted by the front page of the Financial Times not mentioning it at all as I type this.Yet underneath the surface it is being very powerful via what the apocryphal civil servant Sir Humphrey Appleby…

View On WordPress

#Bank of Japan#business#debt management#Economics#economy#Finance#Fiscal Boost#GDP#Interest Rates#Investing#Japanese Yen#Jerome Powell#Treasury Secretary Yellen#US bond yields#US Federal Reserve

0 notes

Text

Finance and Treasury with ConVista

Treasury involves money management and financial risks in a business. The priority is to ensure the business has the money needed to manage daily business obligations, while also helping to develop its long-term financial strategies and policies

What is treasury?

Treasury is a main financial function that is very important for financial health and the success of every business, large or small.

Where do treasury professionals work?

Treasury offers a diversity of careers in finance with many opportunities. You can work anywhere throughout the world, and for all types of businesses, from large global organizations, non-profit, and government departments, to new and small and medium companies (SMEs). Treasury functions will vary depending on the size and nature of each business. Whatever business or type of organization, treasury activities will always be there even though there is no treasurer or treasurer.

Cash and Liquidity Management

Cash management and liquidity are often described as 'main tasks' treasury. Basically, the company must be able to fulfill its financial obligations due to maturity, namely to pay employees, suppliers, lenders, and shareholders. This can also be described as a necessity to maintain liquidity, or company solvency: companies need to have available funds that will enable them to remain in business.

Besides dealing with payment transactions; Cash management also includes planning, account organizations, cash flow monitoring, managing bank accounts, electronic banking, collection, and nets as well as the functions of the bank in-house.

Today's Treasury

Increasing interest rates, market volatility, and fears of recession increase pressure on the Ministry of Finance's team to protect the balance sheet, predict cash flows against various risk scenarios, and streamline treasury operations to provide more intelligence.

ConVista empowers the treasurer to make more confident cash and liquidity decisions, along with analytic tools to manage more complex global cash structures and optimize liquidity throughout the company.

Treasury Features

ConVista is a leading global provider of treasury management solutions for companies of all sizes and all industries.

What do treasury professionals do?

As a professional treasury, you are basically a trusted advisor to businesses about financial problems, always looking forward and planning how you can add value and encourage success. The decision you make will have a direct impact on performance and profit.

Your role is about managing money and financial risks in business. This involves ensuring the business has the capital needed to manage daily business obligations while helping to develop its long-term financial strategies and policies. You will do this by focusing on how and where to put money - while managing related risks - to add value and encourage business success.

Every business takes risks. This is the professional role of the Treasury to identify, assess, and manage this risk so that they support business goals. You will also help identify and create new opportunities that can be useful for business.

What career opportunities are there for treasury professionals?

The Treasury recruitment landscape is currently very positive. Over the past few years, there has been a collection marked in recruitment at all levels including more opportunities for graduates, with more organizations now searching to place talent at the entry level directly from the university.

You can be expected well, and highly valued for your expertise and get real satisfaction from knowing what you are doing can make a real difference for any business success. Do you want to work for multi-national organizations, charities, government agents, or start-ups, Treasury offers a diverse and profitable career that can make you on track to the most senior roles in business and finance and open doors for international opportunities. Adding recognized ACT qualifications and membership to your CV can further improve your work ability by showing your commitment to achieving and maintaining the highest professional standards. It can also give you a valuable advantage in a competitive market

From the level of entry-level to the council, there are various roles and job titles that include treasury aspects. Some of them include:

Treasury analyst, treasury dealer, and treasury accountant

Risk manager and cash manager

Credit risk and financial analyst

Group Treasurer, Head of Treasury Operations, and Tax Director

Relationship Manager and Transaction Service Analyst

Finance Director, Financial Control

Implementing Director, Corporate Secretary

Owner and business entrepreneur

Non-Executive Director

Head of Finance Officer (CFO) and Head of Executive (CEO)

For more information visit: www.convista.com

#Treasury Management system in India#Responsibilities of Treasury Management#SAP Treasury Management#Treasury Management in SAP#Treasury Management in India#Treasury Management in Bangalore#Bank Treasury Management#Function of Treasury Management#Treasury Management system#Treasury Management

3 notes

·

View notes

Photo

Historical Practices in Treasury Management

The tradition of sealing Treasury doors was believed to have persisted until the time of Sultan Murat II.

Importance of Treasury Register Books

During Sultan Mehmet IV’s reign, significant emphasis was placed on Treasury register books. This focus stemmed from a notable incident following the death of Superintendent of the Treasury, Mermer Mehmet Pasha, who had been promoted to the Kubbealti vizierate. A substantial quantity of jewels and valuable goods belonging to the Treasury were discovered among his possessions.

Rise of Heritage Seizing

The practice of seizing heritage became more common from 1679 A.D., eventually becoming a primary source of income for the Imperial Treasury. However, Sultan Mahmut II later abolished this practice Private Istanbul Tours.

Distinction Between Heritage and Confiscation

While both heritage seizure and confiscation contributed to the Treasury’s income, they differed in nature. Heritage seizure involved acquiring the property of individuals who died naturally, whereas confiscation targeted the assets of individuals like Vizier Hasan, who had been executed.

Contributions from Foreign Envoys

During Sultan Mehmet IV’s reign, gifts from foreign envoys significantly enriched the Treasury. For instance, the French envoy presented ninety purses of jewelry and thirty purses of assorted gifts, while the envoy from the Tsar in Moscow arrived with one thousand one hundred ninety-eight sable furs and various other items.

Tradition of Gifting to the Treasury

Gifts presented to the Sultan by the Valide Sultan (queen mother), the Grand Vizier, and other high-ranking officials as tokens of congratulations were also directed to the Imperial Treasury, continuing a longstanding tradition within the empire.

0 notes

Photo

Historical Practices in Treasury Management

The tradition of sealing Treasury doors was believed to have persisted until the time of Sultan Murat II.

Importance of Treasury Register Books

During Sultan Mehmet IV’s reign, significant emphasis was placed on Treasury register books. This focus stemmed from a notable incident following the death of Superintendent of the Treasury, Mermer Mehmet Pasha, who had been promoted to the Kubbealti vizierate. A substantial quantity of jewels and valuable goods belonging to the Treasury were discovered among his possessions.

Rise of Heritage Seizing

The practice of seizing heritage became more common from 1679 A.D., eventually becoming a primary source of income for the Imperial Treasury. However, Sultan Mahmut II later abolished this practice Private Istanbul Tours.

Distinction Between Heritage and Confiscation

While both heritage seizure and confiscation contributed to the Treasury’s income, they differed in nature. Heritage seizure involved acquiring the property of individuals who died naturally, whereas confiscation targeted the assets of individuals like Vizier Hasan, who had been executed.

Contributions from Foreign Envoys

During Sultan Mehmet IV’s reign, gifts from foreign envoys significantly enriched the Treasury. For instance, the French envoy presented ninety purses of jewelry and thirty purses of assorted gifts, while the envoy from the Tsar in Moscow arrived with one thousand one hundred ninety-eight sable furs and various other items.

Tradition of Gifting to the Treasury

Gifts presented to the Sultan by the Valide Sultan (queen mother), the Grand Vizier, and other high-ranking officials as tokens of congratulations were also directed to the Imperial Treasury, continuing a longstanding tradition within the empire.

0 notes

Text

Exploring Treasury Optimization Strategies in India

Treasury optimization strategies are the secrets to financial success. By implementing treasury optimization strategies, businesses aim to enhance their financial performance, minimize risks, optimize working capital and maximize the utilization of available financial resources. Don't miss out – dive in now

🌐 Connect with Us:

Call Us: +91-7771009009

Visit Our Website: www.myforexeye.com

Finance #TreasuryManagement #FinancialStrategy #CashManagement #FinancialOptimization #RiskManagement #WorkingCapital #FinancialEfficiency #FinancialPlanning #BusinessFinance

#Treasury management#Treasury management service#Cash flow optimization#cash flow optimization techniques#What is cash optimisation#Liquidity management#Financial efficiency#Treasury management in India#Treasury operations#Financial strategy

0 notes

Text

Streamline Your Financial Operations: Take Charge of Treasury with Our Innovative System

Are you tired of navigating the complexities of loan management? Streamline your processes and maximize shareholder value with our Treasury Management system on Dynamics 365.

Revolutionize your loan management experience with our intuitive system. Designed for ease of use, our streamlined processes and user-friendly interface empower you to seize control, enhance efficiency, and simplify management tasks. Experience a smoother and more productive lending journey for you and your team.

0 notes