#Roger demuth

Text

Scarlet Runner Beans climbing over a bird house. They put on a show, don’t they?

35 notes

·

View notes

Text

From The March issue of Create Magazine.

#pearlpaint#the painted room#oil paintings#roger DeMuth#Cazenovia#NY artist#water soluble oil paints

0 notes

Text

A really neat little store in Skaneateles NY. Worth a trip if you haven’t seen it. This is a small watercolor that’s 8x10”

5 notes

·

View notes

Photo

#Sochu Suzuki#gempo yamamoto#soen nakagawa#koun franz#Myoko Laura Demuth#Seiso Paul Cooper#Myogen Kathryn Stark#Peg Koan Syverson#Myoshi Roger Thomson#Engu Michel Dobbs#Zenshin Greg Fain#James Genjo Gallagher

1 note

·

View note

Photo

London Wedding, Arnold Rönnebeck, 1924, Art Institute of Chicago: American Art

Born in Germany, the sculptor, printmaker, and photographer Arnold Rönnebeck studied art in Munich andParis, where he befriended the American artists Charles Demuth and Marsden Hartley. This work, executed in New York after Rönnebeck immigrated to the United States in 1923, combines a traditional subject with a Cubist abstraction of form. The artist also produced a sculpture entitled American Wedding, which may have been intended to form a pair with London Wedding. The photographer and art dealer Alfred Stieglitz supported Rönnebeck’s career and provided him with important connections in the American art world. Roger and J. Peter McCormick Endowments

Size: 35.6 × 15.2 × 15.9 cm (14 × 6 × 6 1/4 in.)

Medium: Bronze

https://www.artic.edu/artworks/183318/

12 notes

·

View notes

Photo

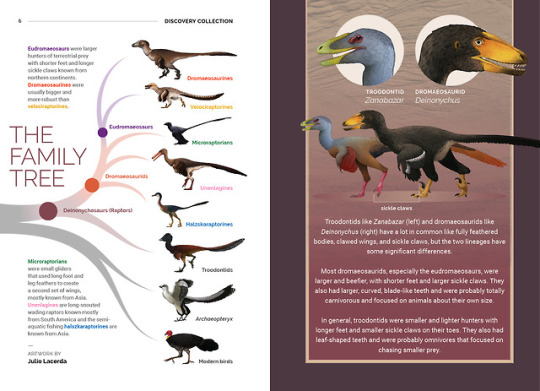

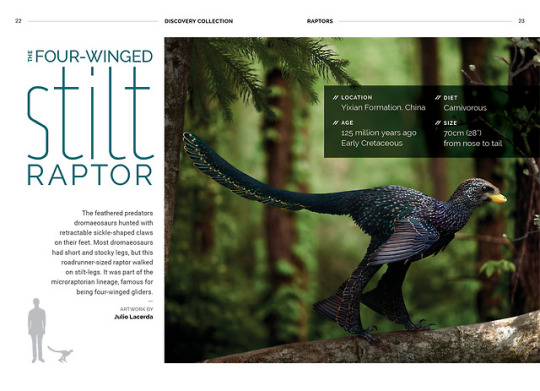

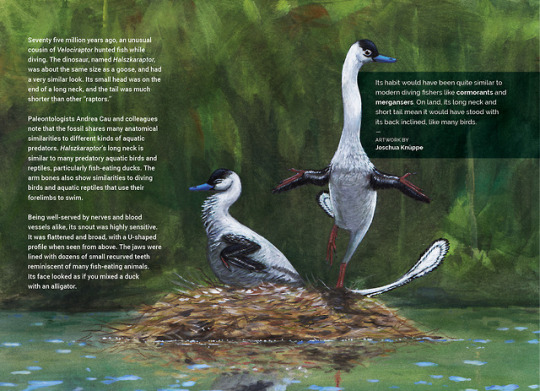

Oh hey. We also did a digital zine, it's called "Raptors" and features artwork from Julio Lacerda, Nathan Rogers, Fabrizio De Rossi, Joschua Knüppe, Midiaou Diallo, and Oliver Demuth.

All proceeds go to feeding our writer Pete Buchholz, who has written thousands of words for this, so go get yourself a copy now!

#zine#scientific illustration#sciart#dinosaur#palaeoblr#animal#graphic design#art#science#paleontology

3K notes

·

View notes

Text

Mary-Hunter McDonnell & Brayden G. King, Order in the Court: How Firm Status and Reputation Shape the Outcomes of Employment Discrimination Suits, 83 Am Sociol Rev 61 (2017)

Abstract

This article explores the mechanisms by which corporate prestige produces distorted legal outcomes. Drawing on social psychological theories of status, we suggest that prestige influences audience evaluations by shaping expectations, and that its effect will differ depending on whether a firm’s blameworthiness has been firmly established. We empirically analyze a unique database of more than 500 employment discrimination suits brought between 1998 and 2008. We find that prestige is associated with a decreased likelihood of being found liable (suggesting a halo effect in assessments of blameworthiness), but with more severe punishments among organizations that are found liable (suggesting a halo tax in administrations of punishment). Our analysis allows us to reconcile two ostensibly contradictory bodies of work on how organizational prestige affects audience evaluations by showing that prestige can be both a benefit and a liability, depending on whether an organization’s blameworthiness has been firmly established.

Much sociological research documents elite corporations’ considerable advantages, including in the policymaking process (Mizruchi 2013; Useem 1984), the creation of market institutions (Fligstein 2008), and the production of culture (Peterson and Anand 2004). Scholars offer numerous explanations for business’s influence, but one common theme is that societal institutions tend to promote business interests due to their social prestige (e.g., Kim 2012; Mizruchi 2004). When firms occupy positions of prominence, individuals act favorably toward them, even when the firms’ behavior would normally elicit negative reactions. In turn, this favorable treatment allows corporations to reproduce their advantages and influence. The tendency toward favorable treatment of prominent businesses mirrors Matthew effect propositions (Merton 1968): an organization’s prestige, including its high status or good reputation, predisposes audiences to view it favorably, especially under conditions when the quality of its behavior is in question (Benjamin and Podolny 1999; Bothner, Podolny, and Smith 2011; Kim and King 2014; Podolny 1994; Sine, Shane, and Di Gregorio 2003; Stuart, Hoang, and Hybels 1999; Thye 2000; Waguespack and Sorenson 2011).

Of course, the advantages the corporate sector enjoys often come at the expense of employees and communities. Theoretically, legal action against corporations, whether civil or criminal, operates as an external constraint on corporate power by punishing businesses that engage in prohibited behaviors. In this way, the law is meant to provide an autonomous means through which society holds business accountable for its actions. However, the legal system’s ability to promote prosocial corporate behavior may be undermined by the Matthew effect, insofar as elite firms are able to garner more favorable outcomes. This possibility is supported by past work finding that elite corporations enjoy considerable influence within the legal domain (Heinz and Laumann 1982; Shaffer 2009), and that litigation generally favors business interests (Brace and Hall 2001; Dunworth and Rogers 1996; Hadfield 2005; Kenworthy, Macaulay, and Rogers 1996). In fact, in one of the earliest sociological treatments of the subject of corporate crime, Sutherland (1949) explicitly warned that status within the business sector distorted the enforcement of laws applied to corporate offenders.

Despite Sutherland’s proposition, the precise mechanisms through which corporate prestige influences judicial outcomes remain unclear. Furthermore, research on corporate litigation has to date “devot[ed] next to no attention to distinctions between litigant types” (Hadfield 2005:1277), which hampers our understanding of why certain corporations seem to receive more favorable treatment than do others (Dunworth and Rogers 1996). The lack of research in this area is surprising, considering the substantial body of work at the individual level devoted to exploring the characteristics associated with sentencing biases. This work provides robust evidence that evaluators respond to the uncertainty and complexity of legal proceedings by searching for salient characteristics of defendants that can be heuristically used to assess blameworthiness. Individual characteristics that prior work has linked to biased outcomes include race, age, gender, socioeconomic status, and perceived character (Albonetti 1998; Nadler and McDonnell 2011; Steffensmeier and Demuth 2006; Steffensmeier, Ulmer, and Kramer 1998). Yet we know little about the characteristics of organizational defendants that produce similarly biased outcomes in legal proceedings. The present article addresses this issue by exploring whether and through what mechanisms corporate prestige operates as a salient organizational characteristic that distorts legal outcomes.

Our exploration of the relationship between corporate prestige and legal outcomes provides an additional opportunity to reconcile two ostensibly contradictory findings about the effects of organizational prestige in evaluative settings. The first, consistent with the Matthew effect proposition, suggests that prestige leads audiences to give organizations the benefit of the doubt in evaluative situations (Davies et al. 2003; Dowling 2002; Fombrun and van Riel 2003). For example, organizational status eases regulators’ concerns when a company experiences product failures (Kim 2012), and investors react less negatively to earnings restatements when a firm belongs to a high-status industry (Sharkey 2014).

Interestingly, a second body of research supports a contrary proposition that prestige can be a liability to firms in evaluative settings, insofar as it can translate into increased scrutiny and harsher reactions from audience members. For example, reputable companies’ actions are more consistently subject to scrutiny from their peers and the media (Edelman 1992; Fombrun 1996; Pollock, Rindova, and Maggitti 2008) as well as agitated stakeholders (Bartley and Child 2014; Briscoe and Safford 2008; King 2008, 2011; King and McDonnell 2015; McDonnell and King 2013). Kovács and Sharkey (2014) found that books that receive prestigious awards are subsequently rated more negatively by users, suggesting that status markers can produce heightened expectations that lead to more negative evaluations (for other examples, see Malmendier and Tate 2009; Rhee and Haunschild 2006).1 In these cases, rather than inducing more favorable evaluations as the Matthew effect would predict, prestige appears to amplify concerns about motives or behavior (Hahl and Zuckerman 2014).

We seek to reconcile these opposing sets of findings by exploring the boundary conditions under which an organization’s prestige might shift from a benefit to a liability in the litigation process. Specifically, we propose that the influence of prestige on legal judgments depends on whether a firm’s blameworthiness for a charged transgression has been firmly established. Drawing on social psychological theories of status (Berger et al. 1977; Correll, Benard, and Paik 2007; Ridgeway 1991; Wagner and Berger 2002), we claim that the mechanism through which prestige influences stakeholder evaluations is elevated expectations (Kim and King 2014). When an organization is initially accused of deviant behavior but its blameworthiness has not yet been firmly established, a positive reputation or high status will lead evaluators to expect that it behaved appropriately. But once an attribution of guilt or blameworthiness has been established, a positive reputation and high status become a liability, as evaluators react harshly to violation of their expectations. Evaluators are more likely to feel betrayed when an organization they trust and admire has deviated, which can elicit an especially punitive response: what we call a halo tax. Accordingly, once an attribution of blameworthiness has been substantiated, we expect evaluators to punish a more prestigious organization more harshly than its peers.

Importantly, in the context of civil litigation, our proposed boundary condition suggests that an organization’s prestige is likely to affect legal outcomes differently at different stages of a lawsuit. In the first phase—the trial—the jury is asked to determine culpability. During this phase, it is uncertain whether the company’s actions merit blame. The aggrieved party will provide evidence to show that the company’s behavior was wrongful or negligent, and the company will offer evidence of its innocence. Under these conditions, we argue that the positive expectations associated with prestige ought to benefit the accused company, creating a halo effect for the accused. Firms that are found blameworthy in the first stage of the lawsuit then move to the second stage: the punitive phase. Here, the company’s blameworthiness has been established with certainty and the jury is asked to determine an appropriate punishment. Under these conditions, the positive expectations associated with prestige have been clearly violated, which we expect will lead to a halo tax in the form of harsher punishments.

We test our hypotheses using a unique archival dataset of jury verdicts from employment discrimination claims filed against a sample of large U.S. companies between 1998 and 2008. We chose employment discrimination as our empirical context because it is a clear example of an organizational transgression, as indicated by highly institutionalized efforts to suppress it, including anti-discrimination laws and ubiquitous sensitivity training programs (Nelson, Berrey, and Nielsen 2008). Legal research documents that employment discrimination lawsuits are especially difficult to win, partly due to biases held by judges and juries (Selmi 2000), which emphasizes the uncertainty of these proceedings.

Ultimately, our results provide evidence for both the halo effect and the halo tax. In our model predicting a jury’s initial assessment of liability, we find that a firm’s status is negatively associated with the likelihood of being deemed blameworthy for employment discrimination. However, in the second stage of litigation, after a company’s blameworthiness has been established, we find that a firm’s status becomes a liability, especially when it is coupled with a good reputation in the domain in which the transgression occurred. We argue that these observed effects can be explained by the benefit (in the former case) and the burden (in the latter) of positive expectations.

Background and Theory Development

Before delving into an analysis of how organizational prestige affects evaluative outcomes, it is necessary to first clarify what we conceptualize as complementary components of prestige: status and reputation (Bitektine 2011; Sorenson 2014). Although they are sometimes used interchangeably (Lang and Lang 1988; Lange, Lee, and Dai 2011; Love and Kraatz 2009; McDonnell and King 2013; Rindova, Williamson, and Petkova 2010; Rindova et al. 2005), status and reputation are different forms of prestige. Status refers to an actor’s “relative social standing” (Sorenson 2014:63) and usually denotes an actor’s position in a hierarchy (Graffin et al. 2013; Podolny 2001) or social rank (Washington and Zajac 2005). Although different sociological literatures vary in their definitions of status, a common theme is an emphasis on a hierarchy that emerges within a group and allows actors with certain status characteristics to obtain greater power and influence (Berger et al. 1977; Correll and Ridgeway 2003). Among organizations, status is often made visible in the form of rankings or patterns of deference that elevate one organization over another (Espeland and Sauder 2007; Podolny 2001).

Reputation, in contrast, refers to shared perceptions of an actor’s unique and distinguishing qualities (Fombrun and Shanley 1990; King and Whetten 2008) and frequently invokes an audience’s perceptions of a firm’s past actions or performance in a particular domain (Fombrun 1996; Roberts and Dowling 2002; Sorenson 2014). Reputation is multidimensional and can be rooted in a variety of different performance criteria (Rao 1994). The same organization can have a positive reputation in one domain, such as product quality, and yet have a weak or negative reputation in another domain, such as treatment of employees.2 In evaluative settings such as legal proceedings, we expect a firm’s reputation in the precise domain in which it is being evaluated will have the strongest effect on outcomes.

Although status and reputation differ conceptually, they are both thought to confer advantages. The benefits that come from being associated with a high-status position are sometimes treated as equal to the positive outcomes associated with having a good reputation. In fact, recent research demonstrates that actors benefit from having both, especially when they are aligned (Kim and King 2014; Stern, Dukerich, and Zajac 2014). Kim and King (2014) argue that the evaluative benefits that come from status and reputation stem from the same underlying mechanisms: behavioral expectations. Status characteristics theory and expectation states theory propose that certain qualities are ascribed with status and subsequently shape expectations associated with actors who have those qualities (Berger et al. 1977; Correll et al. 2007; Ridgeway 1991; Wagner and Berger 2002). Similarly, an actor’s reputation in a particular domain can shape expectations for future performance in that domain (Raub and Weesie 1990). As evidence of this, Kim and King (2014) find that high-status baseball pitchers and pitchers who have reputations for throwing with great accuracy receive more favorable calls from umpires than do low-status pitchers or pitchers who have reputations for being wild and inaccurate.

Lawsuits in the United States provide a natural setting in which to test the effects of reputation and status on audience evaluations. Key to our theory is the notion that these prestige markers ought to matter differently when an actor’s blameworthiness is uncertain versus when it has been clearly established. The U.S. legal system bifurcates a lawsuit into two discrete phases that vary in terms of established blameworthiness. In the next sections, we discuss how the enhanced expectations triggered by organizational prestige are likely to influence audience evaluations within these two separate phases.

The Trial Phase: How Prestige Influences Evaluations Made Under Conditions Where Blameworthiness Has Not Been Established

The positive expectations associated with prestige ought to be especially beneficial when actors face controversial situations for which their level of responsibility is unclear (Lange et al. 2011; McDonnell and King 2013; Rindova, Petkova, and Kotha 2007). For example, some past research finds that audiences are less likely to assign a reputable organization responsibility for a crisis, such as when its products are deemed harmful or dangerous (Fombrun 1996; Klein and Dawar 2004). Other work finds that key external audiences, like the media, are less critical of prestigious organizations implicated in a crisis (Balzer and Sulsky 1992; Coombs 1999; Ulmer 2001). Critical stakeholders like politicians are also less likely to cut ties with high-status organizations accused of bad behavior (McDonnell and Werner 2016).

Reputation and status inform the holistic assessments evaluators make of firms by shaping expectations (O’Donnell and Schultz 2005). Specifically, people tend to infer less blame and responsibility for actors’ bad actions when they have pre-established positive expectations about the actor. This tendency stems from various social psychological theories, including status characteristics and expectation states theories (Berger et al. 1977; Correll and Ridgeway 2003), as well as theories of motivated reasoning (Traut-Mattausch et al. 2004). The former theories propose that an actor’s position in a status hierarchy produces performance expectations, and these expectations lead to reproduction of the hierarchy. The concept of motivated reasoning, in contrast, emphasizes that people tend to interpret evidence presented to them in a way that allows them to confirm their priors (Ditto and Lopez 1992; Kunda 1987). In explorations of motivated reasoning within the context of jury decisions, prior work shows that decision-makers are likely to interpret the evidence presented in a way that confirms their preexisting beliefs derived from racial stereotypes (Rachlinski et al. 2009) or initial impressions of a defendant’s moral character (Nadler and McDonnell 2011).

When the quality or appropriateness of performance is difficult to evaluate, observers will fall back on previously held beliefs and expectations about an actor. In turn, these expectations color observers’ judgments and inferences when they are faced with evidence of a potential organizational transgression, such that the actions of high-status and reputable companies are likely to be interpreted in a more favorable light. For example, one experimental study found that participants evaluating a price increase were more inclined to infer that the action stemmed from a positive and fair motive when the company was reputable, but they tended to infer a negative and unfair motive when the company was less reputable (Campbell 1999). Applied to the context of employment discrimination trials, this research suggests that juries tasked with evaluating a defendant firm’s culpability for employment discrimination are less likely to deem a prestigious organization’s actions as blameworthy. Thus, we expect the following:

Hypothesis 1a: In the first stage of a lawsuit where a company is charged with a transgression, the defendant firm’s status will be negatively associated with its likelihood of being found liable.

Hypothesis 1b: In the first stage of a lawsuit where a company is charged with a transgression, the defendant firm’s reputation will be negatively associated with its likelihood of being found liable.

We also contend that the positive effects of status and reputation on jury evaluations will be greater when the two forms of prestige are aligned. Past research indicates that alignment between status and reputation magnifies the potential for an actor to receive advantages (e.g., Stern et al. 2014). One reason for this is that, as Kim and King (2014) found, status and reputational alignment sharpens behavioral expectations, magnifying innate biases. Another reason is that whereas status is a diffuse signal of prestige and quality, reputation is domain-specific and informs evaluators’ choices about when and how status should influence their judgments. Accordingly, alignment between status and reputation reinforces expectations about a particular kind of behavior, which may be directly relevant to evaluations of blameworthiness for a particular transgression. Thus, if a high-status company is also known for being a good employer, the jury in an employment discrimination lawsuit may believe that the company’s high status is partly a result of being such an outstanding employer, giving the jury more reason to expect the company treats its employees responsibly.

Hypothesis 2: When charged with a transgression, a firm’s status will interact with its domain-specific reputation to negatively affect the likelihood that it will be found liable.

The Punitive Phase: How Prestige Influences Evaluations Made Under Conditions When Blameworthiness Has Been Established

The same positive expectations associated with high status and good reputations can, however, have detrimental effects once an organization’s blameworthiness for a transgression has been established. Prestigious organizations are held to a higher standard precisely because more is expected of them. When it is proven that they have engaged in actions that do not accord with their proffered image, they are more likely to be pegged a hypocrite, provoking a more punitive response from evaluators (Harrison, Ashforth, and Corley 2009).

The scope condition of this halo tax is that an organization’s blameworthiness has previously been established, such that observers have no choice but to revisit and question their prior beliefs and expectations. Evaluators who previously believed that an organization maintained a high standard are motivated to punish the organization for failing to live up to that very standard. Illustrative of this, King and McDonnell (2015) found that organizations with better reputational standing are more likely to be targeted by activist groups when they fail to live up to their reputation. Similarly, Rhee and Haunschild (2006) found that firms with higher reputations for product quality suffer greater market penalties in response to a product recall.

Psychological research on the inclination to punish suggests there is a strong relationship between the anger elicited by an offense and the extent to which people are inclined to punish the offender (Bies 1987; Kahneman, Schkade, and Sunstein 1998). Demonstrating a phenomenon they call “betrayal aversion,” Koehler and Gershoff (2003) found that people recommend more severe punishments when a person or entity they trust behaves in a way that violates their trust. Relatedly, Rosoff (1989) discovered that high-status physicians found guilty of a serious crime were evaluated more negatively than low-status physicians who committed the same crime, and Skolnick and Shaw (1994) found that high-status criminals were judged more harshly when their crime was deemed to be related to their profession.

Extended to the organizational setting, betrayal aversion suggests that the transgressions of high-status or reputable organizations are especially likely to provoke feelings of outrage from their audiences, as audience members may feel duped, jilted, or betrayed given the strong, positive expectations they had for those organizations. This should, in turn, provoke an especially punitive response.

Hypothesis 3a: Once an organization has been found blameworthy for a transgression, higher status will be associated with harsher punishments.

Hypothesis 3b: Once an organization has been found blameworthy for a transgression, more positive reputations in the domain of the transgression will be associated with harsher punishments.

We also expect that the alignment of status and reputation will magnify the harshness of punishment. Inasmuch as alignment sharpens expectations associated with status in a domain-specific area, juries will see employee discrimination by high-status companies that have a reputation for being a good employer as an even greater betrayal.

Hypothesis 4: Among firms found blameworthy for a transgression, a firm’s status will interact with its domain-specific reputation to positively affect the harshness of punishment.

Research Setting

Employment discrimination lawsuits in the United States result when an employee or prior employee of a company alleges that the company treated them adversely (e.g., by firing or refusing to promote them) because of their membership in a protected class. Federally recognized protected classes include those based on gender, age, disability, religion, race, or nationality. This context presents an ideal setting for exploring our theory. The United States has formally prohibited discrimination since the passage of Title VII in the 1964 Civil Rights Act (Sutton et al. 1994), which remains the primary federal cause of action that gives victims of discrimination a right to sue their employer. However, discrimination continues to be a pervasive problem in the U.S. workplace (Edelman 2016); in recent years, the U.S. Equal Employment Opportunity Commission has received nearly 100,000 discrimination charges per annum (USEEOC 2013). Employment discrimination is therefore a clear example of misconduct that is nevertheless common enough to enable empirical investigation.

These cases also represent an ideal opportunity to study how prestige affects organizational punishment because of the manner in which punishment occurs. Organizations found liable for discrimination have to pay a monetary sum to the employee, referred to as the employee’s “damages award.” One portion of that sum, the “compensatory damages award,” is meant to compensate injured parties for the direct financial or emotional harms they suffered as a consequence of the discriminatory action. This aspect of damages is legally limited to the wronged individual’s real or projected losses established in the evidence (e.g., the value of their lost salary), giving the jury little discretion over the awarded amount. However, the jury has more discretion to determine a separate portion of the plaintiff’s damages, the “punitive damages award,” which reflects a sum that the jury can make the corporation pay for purely punitive reasons, meant to demonstrate society’s disapproval of its deviant behavior. The punitive damages award, which can vary extensively from case to case, provides an easily observable and quantifiable proxy for the severity of audience reactions across different cases of deviance. For this reason, punitive damages have been used in other research exploring the mechanisms that affect the severity of punitive responses (e.g., Nordgren and McDonnell 2011).

The structure of employment discrimination suits makes them especially useful for testing our predictions about the disparate role of prestige in attributions of blameworthiness (when there is uncertainty about the firm’s culpability) versus allotments of punishment (when a firm’s deviance has been established). Employment discrimination lawsuits are bifurcated into two discrete phases. The first phase, the trial, determines whether the company is liable, or blameworthy, for a proscribed discriminatory action. Aggrieved employees will provide evidence to show that a company wrongfully discriminated against them, and companies will offer evidence of their innocence. During this first stage, a company’s blameworthiness is uncertain. Some charges of employment discrimination are supported by overwhelming evidence, such that blameworthiness is clearly apparent before a formal declaration by a jury, but such clear-cut cases are unlikely to be in our sample of cases that go to trial and are ultimately decided by a jury. We interviewed a prominent corporate defense attorney who explained this as follows:

There are very high expenses associated with litigating a case through trial, so it is not in the interests of either party to litigate a trial where the outcome of the case is clear. If there is clear and compelling evidence of discrimination, the economic incentives of the defendant are to settle the case, as opposed to waiting for a jury verdict. The cost of a jury verdict is typically greater than a settlement . . . and precedential consequences of having an adverse judgment that could be applied in future cases strongly push companies to not litigate the case if the evidence is clear. So, really, it is only the hard cases that go to trial.

As this quote illustrates, the cases typically litigated before a jury are those for which the outcome is difficult to predict, such that the first stage of a trial is properly characterized as having a considerable degree of uncertainty about whether the defendant company’s actions were in fact deviant.

Firms found liable for discrimination in the first stage of a trial then move on to the second, punitive, stage: the damages phase. At this stage, the court holds a separate proceeding to ascertain the appropriate amount to make the company pay the aggrieved employee. Again, both the employee and the company will present evidence to encourage the jury to award an amount in their favor. But here, the company’s blameworthiness for a deviant action is no longer uncertain because the company has already been found liable. The two stages of a lawsuit thus represent two evaluative settings that vary in terms of whether blameworthiness has been established, providing an ideal context to test our hypotheses.

Past research on corporations and litigation points to numerous advantages that companies have in the process. For one, the “size and complex interrelationships of large corporations make it difficult [for ordinary plaintiffs] to compete with them on an equal basis in investigations and in litigation” (Clinard and Yeager 1980:313). Moreover, because corporations are often “repeat players,” they accumulate more legal expertise and relationships with judges that improve their chances of successfully navigating the litigation process when compared to “one shot” plaintiffs (Galanter 1974). We propose prestige as an additional source of power that corporations uniquely possess over relatively unknown, individual plaintiffs, but we also account for the relative influence of corporate resources and past experience in our analyses.

Methods

Sample Creation

To test our hypotheses, we built a dataset of all employment discrimination cases against any of the 826 unique companies that were surveyed for Fortune’s Most Admirable Companies rankings between 1998 and 2008. The Fortune rankings are regularly used in organizational scholarship as an indicator of a company’s prominence in the corporate field (e.g., Fombrun and Shanley 1990; King 2008; McDonnell and King 2013; Roberts and Dowling 2002; Staw and Epstein 2000). To create the sample each year, Fortune surveyors begin with the Fortune 1,000, from which they select the 10 largest firms (based on asset size) from each industry. They then collect survey data about these firms from industry executives, directors, and security analysts. Fortune aggregates the survey results for each company, then assigns each company a reputation score that ranges from 0 to 10. Fortune ultimately uses this data to create and publish a list of the 50 Most Admired Companies, but our sample includes every company surveyed (including those that were not ultimately selected for the final published list), providing a sample of organizations with a wide variation of scores. By limiting our analysis to companies surveyed for the rankings, we are able to more accurately quantify and compare the relative status of all companies in our analysis. However, this sampling strategy does limit the scope of our findings to firms that are fairly large and visible, which are likely to have the kind of well-established reputations and status orderings that are perceptible to lay audience members. As past research shows, the Fortune ranking has become a commensurable status hierarchy within the corporate realm (Bermiss, Zajac, and King 2014), and maintaining one’s position in the ranking is greatly valued by prestigious firms (McDonnell and King 2013). Thus, the ranking exhibits similar qualities to other status rankings (see Espeland and Sauder 2007).

Having established our sample, we searched the Westlaw jury verdicts database for all employment discrimination cases brought against sampled firms. This database is a comprehensive legal resource that includes a searchable archive with information on the jury verdicts or outcomes of civil (noncriminal) cases brought in all 50 states and the District of Columbia. Ultimately, we identified a total of 922 employment discrimination cases brought against companies included in the Fortune rankings that were decided between 1998 and 2008. From these, we culled a subset (n = 176) that settled out of court and never went to trial, as well as a subset (n = 112) that were dismissed by the trial judge for failure to provide a colorable case or for lack of adequate evidence (i.e., dismissal or summary judgment). We ran several robustness checks to ensure that culling of this subset does not introduce selection bias for our ultimate analysis. Unpaired t-tests of means comparing the firms in the top 50 percent of status and domain-specific reputation with the firms in the bottom 50 percent yielded no evidence of significant differences in the incidence of settlement or dismissal between these two groups. Supplemental regressions of the likelihood of settling out of court and of early dismissal also showed no indication of a company’s reputation or status being significantly associated with either outcome.

To focus on cases that were decided by comparable juries, we omit from our analysis a subset of 17 cases that were decided by a judge (i.e., bench trials) or an arbitrator. Additionally, because class action suits, as opposed to suits brought by individuals or small groups, are likely to present idiosyncratic incentives against litigating due to the potentially extreme damages awards they invite when successful, we omit a further four cases that were expressly labeled as class action lawsuits.3

Of the remaining 613 employment discrimination cases in our sample that went to jury, the company was found liable for discrimination in 303 cases and was deemed not blameworthy in 310. Data on incorporated controls were missing for 94 of these firms, reducing our final sample size to 519 cases.

Dependent Variable

In our analysis predicting the outcome of the first stage of employment discrimination suits, we use a binary dependent variable coded “1” if the jury found the company liable and “0” if the company was found not to have engaged in employment discrimination.

For companies found liable of employment discrimination, we capture the extent of punishment through the punitive damages award, a continuous count variable indicating the amount (in dollars) that the company was assessed as punishment for its discriminatory action. A total of 303 cases in our sample resulted in a verdict of liability and produced a damages award. Federal guidelines do not allow punitive damages to be awarded for violations of the Age Discrimination in Employment Act (ADEA), so we omit 24 cases that rested solely on claims brought under the ADEA. Data on punitive damages were not reported in three cases, and data on incorporated controls were missing for 38 firms, reducing the sample size to 238 cases in models predicting punishment.

Independent Variables

Our measure of organizational status is based on the general score of favorability a firm received in the Fortune Most Admirable Companies rankings. This Most Admired index is a proxy for overall audience assessments, being founded, in part, on surveys capturing industry leaders’ and analysts’ perceptions Each organization included in the list is given a raw score that ranges from 0 to 10. Inherent in this process are comparisons that executives and analysts make between peer firms. Surveyed individuals are asked to rate the 10 largest firms in their industry along various dimensions, allowing Fortune to construct a positional hierarchy of firms within and across industries (for details about the ranking process, see Bermiss et al. 2014). Because the Fortune rankings are collected from surveys administered in the year prior to that in which they are reported, the rankings have a natural one-year lag. We therefore base our status variable on each company’s score in the same year that the verdict in a given case was decided.

We chose to use the Fortune Most Admired rankings to capture status because they (1) are positional, (2) convey relative standing of general favorability to an organization, as opposed to the domain-specific judgment of quality associated with reputation (Rhee and Haunschild 2006; Sorenson 2014), and (3) are available for a large sample of firms across the full panel of our archival analysis. Importantly, we are not arguing that jurors are aware of the Fortune rankings per se, but rather that the Fortune rankings provide a colorable and quantifiable proxy for perceptions of organizational status in the general population from which jurors are drawn (Bermiss et al. 2014). Although the Fortune rankings are constructed from surveys of industry insiders, prior work provides evidence that the rankings reliably align with perceptions held by external audience members. For example, the Fortune rankings predict the willingness of a broad set of actors to associate with a given firm, including audience members within its corporate community, like business partners (Sullivan, Haunschild, and Page 2007), as well those outside its corporate community, like politicians (McDonnell and Werner 2016). Other work demonstrates that a firm’s Fortune ranking predicts how it will respond to social activists and manage its public image in the media (e.g., King 2008; McDonnell and King 2013). These findings suggest that the Fortune rankings accord with a firm’s own beliefs about the general public’s assessment of its status. We acknowledge that the Fortune ranking is an imperfect proxy for specific juries’ assessments of corporate status, and it does introduce potential measurement error. But given that prior research demonstrates that the ranking has validity among activists and other outsiders to the corporate community and maps on to their strategic interactions with companies (e.g., King and McDonnell 2015), we deem it a defensible assumption that the rankings align with jury members’ perceptions of status.

One concern about the Fortune rankings as a proxy for general audience assessments of status is that the measure has been historically dominated by recent performance (Bermiss et al. 2014). This could introduce measurement error in our setting insofar as industry insiders are more likely than the general public to prioritize performance indicators in their assessment of status (Brown and Perry 1994). Substantiating this concern, the raw reputation scores in our sample show strong correlations with firm size and performance. We address this issue by implementing Brown and Perry’s (1994) method for removing the financial performance halo from the Fortune ranking, which involves a two-stage empirical strategy. First, we ran a regression in which we predicted reputation as a function of four indicators of size and performance: liquid assets, Tobin’s Q, total employees, and logged assets. The models show that each of these variables significantly predict Fortune rankings. Next, we computed the residuals from this model, which substantively correspond to that portion of the Fortune ranking that cannot be explained by size and recent performance. We then used these residuals as the measure of status in our models, rather than the raw Fortune ranking.4

In contrast to status, reputation scholars argue that most organizations’ reputations rest on a set of specific practices or characteristics that distinguish them from competitors in a particular domain (e.g., Bitektine 2011; King and Whetten 2008; Lange et al. 2011). We examine the effect of domain-specific reputation by utilizing the annual ratings of firms’ social reputations provided by Kinder, Lydenberg, Domini & Co (KLD) STATS (Statistical Tool for Analysis of Trends). The KLD data draw from diverse sources, including media reports and firm disclosures, to construct yearly numerical ratings of firms’ strengths and weaknesses in seven social domains: community, corporate governance, diversity, employee relations, environment, human rights, and product. Employment discrimination naturally touches on two of the social domains covered in the KLD STATS: diversity and employee relations. To create our proxy for domain-specific reputation, we computed a net composite score of the number of strengths minus the number of concerns in these two areas.5

Like our measure for status, KLD data are an indirect proxy for an individual jury’s perceptions of domain-specific reputation. However, KLD data are a common proxy for reputation in organizational sociology (see, e.g., McDonnell, King, and Soule 2015) that corresponds with perceptions held by outsiders to the corporate community (Werner 2015). Although the precise data collection practices utilized to construct the KLD reputation scores are proprietary, the organization reports that its scores are at least partially constructed using sources readily observable by the average member of the public, including media reports and public criticisms by major NGOs. Thus we deem it a defensible assumption that these scores align broadly with the perceptions of typical jurors. KLD data were only available for around 75 percent of the firms in our full sample, leading to a smaller sample size in models that include our proxy for domain-specific reputation.

Control Variables

We introduce a battery of control variables to account for case-level and firm-level attributes that might influence perceived blameworthiness and punitive responses in the course of a discrimination suit. Among the case attributes that drive outcomes, prior work in criminology suggests that the severity of the defendant’s offense is a primary determinant of the severity of punishment (Steffensmeier, Kramer, and Streifel 1993). The severity of firms’ discriminatory behaviors can vary considerably, and we account for this in several ways in our models. First, we consider the underlying adverse employment actions that allegedly occurred in each case. The summaries of sampled cases in jury reporters provide a detailed breakdown of 25 separate categories of adverse actions, ranging from termination to harassment to a failure to hire. Often several adverse actions are alleged within a single case. We include binary indicators in the models for each of these adverse actions, coding them “1” if a given action is alleged to have taken place in a case, and “0” otherwise.6 A second way we account for offense severity is by controlling for the number of people who were allegedly adversely affected by a discriminatory action, as indicated by the number of plaintiffs in the case.7 Finally, in models predicting punishment, we account for varying offense severity by controlling for the level of harm the victim suffered as a direct result of the discrimination, a sum captured in the compensatory damages portion of the verdict. This portion of a verdict is meant to compensate a plaintiff for losses accrued as a direct result of the discrimination. Compensatory damages may include economic (e.g., lost wages) and non-economic (e.g., emotional pain and suffering) damages. To correct for a pronounced right-skew in these latter two variables, we transformed each by taking its natural log.8

Because different classes of discrimination may elicit different punitive responses from jury members, we include a dummy variable for each federally-recognized protected class on which a discrimination claim is based. These include race or nationality discrimination, gender discrimination, age discrimination, disability discrimination, and religious discrimination. Recognizing that juries’ responses to cases involving different classes of discrimination are likely to vary between communities and over time, we also include a variable, win ratio for similar suits in prior year, that captures the percentage of cases in the same state in the prior year where a company was found liable for the same category of discrimination as a given observation (e.g., religious discrimination, racial discrimination). Additionally, prior research suggests that the victim’s gender may affect punishment. Defendants tend to be punished more severely when they victimize women, who are perceived as more vulnerable (Curry, Lee, and Rodriguez 2004). To control for this possibility, we include a binary variable, female plaintiff, coded “1” if any plaintiff in a case is female, and “0” otherwise.

To protect the anonymity of jurors, information on individual jury members in a case is not publically available. We are accordingly unable to control for the demographic composition of individual juries. Given that jury members are selected from random drawings of local voting populations, we do not expect jury compositions would vary systematically with respect to firm prestige. However, because legal and cultural responses to discrimination may differ by region, we do include fixed effects for the circuit in which each case was brought. We account for potentially meaningful differences in venue in two additional ways. First, federal and state venues can differ in their discrimination statutes, rules of discovery, and standards for summary judgment, each of which could affect case outcomes. We thus include a binary control capturing whether the case was brought in federal, as opposed to state, court. Second, to address the possibility that companies may enjoy a “home field advantage” when they face a jury in their home state, we include a binary variable, home state case, that is coded “1” when the case is in the state where the defendant company is headquartered, and “0” otherwise.

In addition to these case-level controls, we account for several firm-level characteristics that may be associated with legal outcomes. One variable likely to play a central role in attributions of blameworthiness and punishment is the defendant’s prior experience with similar cases. Interestingly, the organizational and criminological literatures suggest two competing mechanisms through which prior experience could influence case outcomes. The organizations literature predicts that prior experience should benefit firms through a “repeat player” effect, whereas the criminology literature suggests that prior experience could provoke a disadvantageous “repeat offender” effect. The repeat player effect, first posited by Galanter (1974), suggests that firms acquire expertise and develop critical relationships over the course of repeated litigation in an area, improving their ability to successfully navigate the complex litigation process. The repeat offender effect, supported by robust evidence in the individual criminal context, suggests that a lengthier record of deviance can disadvantage defendants in the legal process by indicating a pattern of deviance that makes the defendant appear more blameworthy and less capable of rehabilitation (Steffensmeier et al. 1993). To control for the effect of prior experience, we include a variable capturing the total number of times a firm was charged in a discrimination lawsuit in the prior three years.9

To account for each firm’s general size and performance, each of which have been shown to correlate with the commission of proscribed conduct (Clinard and Yeager 1980), we include controls for logged assets and Tobin’s Q. In the organizations literature, Tobin’s Q is a common proxy for market performance that is operationalized as the market value of assets divided by the replacement cost of assets. This variable is superior in this setting to other common metrics for performance (e.g., ROA), because it is less susceptible to managerial manipulation, which is common during periods of social scrutiny (McDonnell et al. 2015; Watts and Zimmerman 1986). To account for variance in the available resources that firms can devote to their defense, we include a control for the total amount of a firm’s cash stores. Given that firms are naturally more likely to be accused of employment discrimination when they employ more people, we also control for each firm’s number of employees.

We account for potential temporal factors that might affect jury outcomes through fixed effects for the year in which each verdict was decided. Finally, to address the possibility that jury members may have different expectations and responses to discrimination committed by companies in different industries, we include fixed effects for each company’s major SIC industry division (i.e., two-digit SIC code), as reported in Compustat. Table 1 provides summary statistics and correlations of these variables.

Table 1. Summary Statistics and Correlation Matrix

Model Specification

We test Hypotheses 1 and 2 using a probit model that predicts the likelihood a firm charged with employment discrimination is found liable. The probit regression is appropriate for models with a binary dependent variable. Every case that went to jury was included in this first stage.

The models testing Hypotheses 3 and 4 include only firms that have been deemed blameworthy for employment discrimination, as only firms found liable will go on to be assigned a punishment by the court. Our dependent variable, punitive damages, is a highly overdispersed count variable, so we use a generalized linear model with negative binomial errors and a log-link function, using the glm command in Stata. One common way to correct for potential bias in a skewed count dependent variable is by log-transforming it and then running an OLS regression. The alternative we use, a log-link function in a generalized linear model, has the advantage of returning predictions directly on the dependent variable’s original measured scale, negating the need for back-transformation and simplifying interpretation (Cox et al. 2008; McDonnell and Werner 2016).

We expect that results within a state are more likely to be correlated than those between states due to localized laws as well as potential regional differences in attitudes toward discrimination. Additionally, our data include multiple within-firm observations, which are also likely correlated with one another. Accordingly, we cluster standard errors at both the state and firm levels. All models were run using Stata 14.0.

Results

Results from the models predicting the likelihood that a company charged with employment discrimination was found liable are shown in Table 2. Model 1 includes only the control variables. The models provide mixed evidence that larger firms (in terms of number of employees) are less likely to be found liable than smaller firms. Models 1 and 2 provide additional suggestive evidence that firms do enjoy a home court advantage, as firms are significantly less likely to be found liable when a case is brought in the state in which they are headquartered.

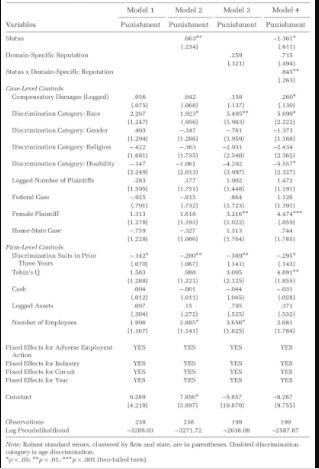

Table 2. Probit Regression Predicting the Likelihood of Being Found Liable in Cases of Alleged Employment Discrimination, 1998 to 2008

Model 2 introduces our measure of status to test Hypothesis 1a. In support of this hypothesis, the model demonstrates a statistically significant and negative relationship between a firm’s status and its likelihood of being found liable for employment discrimination. Post-estimation margins analysis of Model 2 indicates that firms with a status score one standard deviation above the mean are around 14 percent less likely to be found liable in a discrimination trial than are firms with a status score one standard deviation below the mean.

Model 3 of Table 2 introduces the proxy for domain-specific reputation to test Hypothesis 1b. This hypothesis is not supported, as the model provides no evidence that a company’s reputation, as indicated by its net KLD score for employee relations and diversity, is related to the likelihood of liability. Model 4 of Table 2 tests Hypothesis 2 by including an interaction of status and domain-specific reputation. Again, we find no support for the hypothesized effect. Taken as a whole, these results suggest that holistic, generalized signals of prestige, such as status, may carry more weight for evaluations of corporate conduct in ambiguous situations than do more applied indicators of prestige, like domain-specific reputations.

Table 3 shows models predicting the extent of punishment through assessed punitive damages. These models yield several interesting results for control variables that warrant mentioning. First, across all models we find that past involvement in discrimination suits appears to broadly benefit a defendant firm, as the number of past discrimination suits a firm has faced is negatively related to the level of punitive damages a liable firm is assessed. This finding supports Galanter’s (1974) notion that firms are advantaged by being repeat players in the legal system: past experience confers enhanced capabilities for achieving more favorable outcomes in future suits. This also highlights that punitive processes are distinct for organizations and individuals, given that the latter tend to be punished more harshly when they have prior charges on their record that mark them as “repeat offenders.” Because the offensive actions at issue in discrimination cases are normally undertaken by different deviant individuals within a firm, juries might not perceive firm-level offenses as contributing to an aggregated “record” in the same way as they accumulate for individuals. This may be remiss, as some scholars argue that corporate recidivism signals a firm-level problem, suggesting “a corporate atmosphere favorable to unethical and illegal behavior” (Clinard and Yeager 1980:117).

Table 3. Generalized Linear Models Predicting Punitive Damages Levied Against Companies Found Liable for Employment Discrimination, 1998 to 2008

Results for the other control variables vary markedly across the models and should be interpreted with caution. Here we discuss only the variables that show a significant association with punishment in the final model (Model 4 in Table 3), which incorporates all hypothesized effects. This model suggests that cases alleging racial discrimination, as compared to age discrimination, draw significantly more punitive damages, whereas those alleging disability discrimination yield significantly smaller awards. Cases that produced more costly harm—indicated by greater compensatory damages—draw significantly larger awards, supporting the notion that discriminatory actions that caused more harm are punished more aggressively. The significant effect of the female plaintiff variable suggests that juries may be more punitive when at least one of the victims of discrimination is female. This finding complements criminological work that shows violent crimes with female victims are sentenced more stringently (Curry et al. 2004). Finally, the significant effect of Tobin’s Q suggests that better-performing firms may be punished more harshly for transgressions. Predicted values from the final model suggest that a firm with performance one standard deviation below the mean would pay around $23,000 in punitive damages, whereas a firm with performance one standard deviation above the mean would pay over 20 times more: $470,000. One possible explanation for this is that outperformance might carry a connotation of corruption or injustice when it is won during periods of objectionable conduct. This resonates with the more general claim that stakeholders respond negatively to outperformance that appears to have been achieved through illicit means (Harris and Bromiley 2007; Mishina et al. 2010).

Model 2 in Table 3 introduces the proxy for status. In this second stage of litigation—once an organization’s culpability has been established—we find that organizational status becomes a liability, in support of Hypothesis 3a. Notably, the effect of status on punitive damages is net of the effects of firm size and profitability. Post-estimation margins analysis of Model 2 indicates that a firm with status one standard deviation below the mean would pay a predicted value of $183,143 in punitive damages, whereas a firm with status one standard deviation above the mean would pay $674,860.

Model 3 in Table 3 introduces the proxy for domain-specific reputation. This model produces no evidence of reputation having a significant independent effect. Hypothesis 3b is thus not supported. The interaction of status and domain-specific reputation in Model 4 is statistically significant, suggesting initial support for Hypothesis 4. However, interaction terms in a nonlinear model must be interpreted with caution (Ai and Norton 2003; Mood 2010), and post-estimation margins analysis of this model yielded no evidence that the interaction produces a significant effect at any particular point in the observed distribution of our data. Given this mixed evidence, we explore the interaction effect in more detail through a battery of additional models (see the online supplement). As a key robustness check, we replicate the interaction effect in a linear model (an OLS regression with a logged dependent variable), which allows for a more straightforward interpretation. In the linear model, the interaction term remains statistically significant and positive. This evidence provides clearer support for Hypothesis 4, insofar as it demonstrates that the interaction has a significant average effect across the full distribution of status and reputation. However, we are unable to identify exactly where in the distribution the effect is driven. Future work is needed to more precisely illustrate the moderating role that reputation (and the associated mechanism of hypocrisy) plays in driving the halo tax.

We ran a number of additional alternative models to probe the robustness of our findings. First, we acknowledge the potential for selection bias to affect our results, as only the firms found liable for employment discrimination are selected into the second stage of a lawsuit and assigned punishment. To mitigate concerns about selection bias, we replicated our models as a two-stage Heckman selection model. In this estimation, the probit regression predicting liability is used as a first-stage model to estimate a selection effect coefficient (referred to as the inverse Mills coefficient, or λ) that is included as a control in the second-stage model predicting punishment. We use the win ratio for similar suits in prior year variable (described earlier) as a selection instrument. Supporting its efficacy as a selection instrument, this variable is highly correlated with a firm’s likelihood of being found liable for employment discrimination, but it is not significantly associated with punishment levels or the underlying error term of the second-stage model. Results for all key variables are substantively identical in these models. Furthermore, the lambda coefficient in the second-stage model does not approach statistical significance, which suggests that selection is not a serious concern in this context.

Our data also include a handful of significant outliers vis-a-vis punitive damages, introducing concerns that these outliers may be unduly biasing the effects we observe. To rule this concern out, we replicated the models in Table 3 with models winsorizing the dependent variable at the top and bottom 10 percent of its distribution. Although the size of the coefficients for our independent variables is expectedly smaller in these models, their statistical significance increases, which provides strong evidence that the effects observed in Table 3 are not being driven by the presence of outliers.

In summary, our results suggest that an organization’s status generates a halo effect during the first stage of litigation. However, in the second stage, when blameworthiness has been unambiguously established, high status can provoke a halo tax, especially when it is paired with an admirable reputation in the domain in which the transgression occurred. We discuss the theoretical implications of these findings in the next section.

Discussion and Conclusions

Many observers argue that corporations receive deferential treatment in society. One of the arenas in which they are advantaged is the legal domain (Nielsen, Nelson, and Lancaster 2010). In the United States, legal intervention is a primary mechanism through which social proscriptions of employment discrimination are enforced, and yet past research shows that legal means are often quite ineffective at improving workplace conditions for the underrepresented (Edelman 2016; Hirsh 2009; Kalev and Dobbin 2006). One key reason for this seems to be that prestigious companies are less likely to be found liable when discrimination charges are brought against them. Interestingly, we also found mixed evidence that larger firms (in terms of number of employees) and firms headquartered in the state in which a suit is brought are less likely to be found liable.10 Our analysis confirms that the legal arena is not an even playing field. The most powerful firms—larger and more prestigious ones—are more likely to avoid sanctioning by courts when charged with discrimination. Firms are also less likely to be held liable for discrimination when cases are brought in their home state, where their status and political power are likely augmented.

However, our analysis provides a twist to the story of corporate legal favorability. Although prestigious firms are less likely to be found liable of discrimination charges, once juries rule against them and find them blameworthy, those firms are punished more harshly for their wrongdoing. In the case of employment discrimination suits, we see that juries assign greater punitive damages to higher status companies, especially when their high status is coupled with a strong reputation in the same domain as their transgression.

We assert that the same social psychological mechanism—expectations associated with prestige—underlies both phenomena. Because juries have high expectations of prestigious firms and are motivated to see behavior that matches those expectations, prestigious companies are initially treated more favorably, but once those expectations have been demonstrably violated, juries turn against them. The former process, which is grounded in aligning judgments with expectations, is commonly referred to as a halo effect and is thought to underlie the Matthew effect (Kim and King 2014). We refer to the latter process, which is driven by a violation of expectations, as a halo tax.

Our analysis also produced one unexpected finding: although an organization’s status led to both a halo effect when juries assessed blameworthiness and a halo tax after blame was established, a firm’s reputation had no clear independent effect. Rather, reputation only augmented the extent to which a high-status firm experienced a halo tax in the punitive stage of litigation. Why would this be the case? Although we did not hypothesize the difference in effects, we can speculate. Because status represents “common knowledge” that captures a global heuristic of quality, audience members may rely more heavily on status signals in uncertain evaluative settings (Chwe 2013). But domain-specific reputation might play an important role in punitive processes because of its instrumentality in identifying hypocrisy. A high-status organization that has a good reputation in the domain of its transgression may be perceived as having intentionally dissembled and unjustly benefitted from its repute, triggering a more punitive reaction from audience members. When a high-status company deviates from its domain-specific reputation, audience members may be especially likely to punish it for being inauthentic (Hahl and Zuckerman 2014; Hahl, Zuckerman, and Kim 2017).

Our findings have several important theoretical implications. First, they help resolve a contradiction in the literature on organizational status and reputation. On the one hand, reputation and status should protect a firm from outside scrutiny, inasmuch as the halo effect predisposes audiences to give reputable firms the benefit of the doubt. On the other hand, audiences are more likely to attend to controversies involving high-status or reputable firms, and might judge them more harshly, given that these firms are not meeting audience members’ high expectations for their behavior. Our study attempts to reconcile these contradictory roles of prestige and provide a theoretical explanation for the conditions that underlie the halo effect and the halo tax. We argue that positive expectations associated with prestige benefit organizations when there is uncertainty about their blameworthiness for alleged wrongdoing. Once their culpability for a transgression is established, however, the positive expectations associated with prestige turn into a liability. Demonstrable violations of positive expectations lead audiences to punish high-status actors more harshly than their peers who are culpable for similar wrongdoings.

Our findings also provide several unique insights for the sociology of law, particularly pertaining to corporate power over legal outcomes and the effectiveness of the legal system to address discrimination. Contributing to research on the social construction of organizational misconduct (Greve, Palmer, and Pozner 2010), our study provides evidence that organizational prestige plays an important role in processes of labeling and punishing organizational misconduct. In labeling processes, where social-control agents are tasked with categorizing actions as either transgressive or not, our findings suggest that organizational prestige may incline evaluators to interpret ambiguous actions as appropriate rather than deviant. This is particularly likely for actions at the margins of misconduct, where prestigious companies may be given more leeway to engage in actions that would raise a red flag for other companies. It is also likely to be important in more ambiguous situations where information is sparse and actions are less readily observable, when evaluators are likely to place greater weight on a firm’s status as a heuristic device. Thus, prestigious firms may be freer to cross normative boundaries in contexts characterized by a lack of monitoring and transparency. In contexts characterized by a lack of ambiguity, however, as when deviant organizations are “caught red handed,” our results suggest that prestige operates as an aggravating factor likely to provoke more severe punitive reactions from evaluators, especially when an organization has a positive reputation in the domain in which it has deviated.

From a policy perspective, these findings underscore the complex role that prestige plays in deterring (and incentivizing) illegal corporate behavior. It is arguably especially critical to deter prestigious firms’ misconduct, given the extensive damage that transgressions by trusted organizations can do to stakeholder confidence. Prior research suggests that reputable firms that violate normative expectations spread legitimacy losses far beyond their isolated transgressions, shaking stakeholders’ confidence in business partners, public sector collaborators, and innocent industry peers (Jensen 2006; Jonsson, Greve, and Fujiwara-Greve 2009; McDonnell and Pontikes 2017). We find that prestigious firms are less likely to be deemed blameworthy for transgressions, which suggests these firms could face perverse incentives to push the envelope, knowing they are less likely to be held legally accountable for their transgressions. This is especially worrisome given recent evidence that actors within reputable firms are in fact more likely to transgress legal boundaries (Mishina et al. 2010). However, we also find that prestigious firms pay a considerably higher price for their transgressions when they are deemed blameworthy. To the extent that this halo tax is recognized, it may serve as a mechanism of reputational fitness that operates ex post to discourage prestigious firms from straying too far from the high expectations the public holds for them.

Our study has a number of limitations that warrant acknowledgment but that also signal opportunities for future research and extension of these initial findings. First, we exploit the structure of legal cases as offering a natural way to test our theory, insofar as they separate attributions of liability (when blameworthiness has not been established) from assignments of punishment (when blameworthiness has been established with certainty). But the rigid procedural structure in this setting also represents a limitation of our study. Future work is needed to understand the circumstances in which the halo effect and halo tax affect evaluative outcomes outside the legal setting, where attributions of blameworthiness and administrations of punishment are not so cleanly bifurcated. For example, how does the status of the accused organization operate to influence a consumer’s decision about whether to join a boycott, or a government’s administration of sanctions for alleged human rights violations?

Rooting our analysis in the context of employment discrimination lawsuits poses two additional important and related potential limitations. First, because employment discrimination is a civil claim, it is not clear to what extent our findings would generalize to the criminal setting, where the burden of proof is more stringent.11 Second, it is not clear how our findings might generalize to legal claims brought against individual agents or employees of a firm, rather than the firm itself. Rooting our analysis in the civil setting arguably has more practical real-world application, given that criminal claims are rarely litigated against organizational defendants (Garrett 2016). In the legal academy, the reputational consequences of corporate prosecution for criminal acts are thought to be so severe that it is often equated to a “corporate death penalty” that would unjustly punish countless innocent stakeholders of a firm, such as its employees and shareholders (Hamdani and Klement 2008). Accordingly, rather than naming a firm as defendant, prosecutors of white-collar crimes often work closely with a firm and its independent counsel to identify and charge the individuals responsible for the deviant acts. The extent to which our findings generalize to the context of white-collar crime at the individual level is not clear, but it would likely be of interest to many given the considerable scholarly attention devoted to the subject (Benson, Madensen, and Eck 2009; Simpson 2002, 2013). A large body of work in criminology, and in white-collar crime more specifically, examines the attributes of defendants that affect legal outcomes, such as race, age, gender, socioeconomic status, and perceived character (e.g., Albonetti 1998; Nadler and McDonnell 2011; Steffensmeier and Demuth 2006; Steffensmeier et al. 1998). To our knowledge, this work has not considered how the status of the employer of individual white-collar defendants affects the outcomes of their prosecutions. Does working for a high-status company convey the same halo effect and halo tax for a deviant employee as it would for the company? This represents an interesting question that might be pursued in future research.

Although it helps establish the practical validity of our theoretical propositions, our decision to empirically pursue our research questions using archival data drawn from real legal cases does limit our ability to establish with certainty the causal role of our proposed mechanisms. This is because our data are subject to a first-order selection problem: discrimination charges are not assigned randomly, and we cannot rule out the possibility that an employer’s status and reputation may affect the circumstances in which employees who are discriminated against will bring charges, or whether employees themselves will perceive that an adverse employment action was taken with discriminatory intent. Future work might address these limitations by exploring the halo effect and halo tax in a controlled context, such as through an experiment, where evaluators’ expectations could be measured directly and our proposed mechanisms could be manipulated to provide more robust evidence of causality.

Our use of archival cases also imposes data limitations, as we have no ability to directly observe jurors’ perceptions or access full case transcripts. Instead, we rely on common proxies for prestige from the organizational literature. The construct validity of these proxies in the context of discrimination suits rests on an assumption that they meaningfully align with status perceptions of the general populous from which jurors are drawn. Given that prior work shows these measures meaningfully predict how organizations interact with activists and outsiders to the corporate community (e.g., King 2008; McDonnell and King 2013; McDonnell and Werner 2016; Werner 2015), we think this assumption is defensible. But we acknowledge that individual jurors’ familiarity with the firms in our sample is likely to vary considerably, which does introduce measurement error. Further work is needed to shed light on the precise manner in which information about a defendant’s status and reputation is shared with jurors over the course of a trial, as well as how prestige signals might be manipulated by legal counsel to their clients’ advantage.

Another limitation of our study is that we only measure reputation that aligns with the domain of the transgression, rather than reputation in unrelated domains. Work in impression management finds that firms that face social challenges often try to buffer their public images by bolstering their reputation with charitable endeavors in other, less contentious domains (McDonnell and King 2013). A firm’s reputation along unrelated dimensions might prime evaluators to see them as less blameworthy, without triggering as strong a repulsion to hypocrisy when they are deemed blameworthy. Future work is necessary to assess our theory and the generalizability of our findings with respect to other dimensions of reputation.

In summary, our study provides evidence that prestige confers a beneficial halo effect when audience members make attributions of guilt under conditions of uncertainty, but prestige produces a detrimental halo tax when audience members allot punishment after blameworthiness has been established. Our findings demonstrate the unevenness of the legal playing field and provide evidence that prestige plays an important role in shaping corporate legal outcomes. But our study also provides insight into the limits of corporate prestige by showing that in instances of proven blameworthiness, prestige becomes a liability for corporations. Thus, prestige both elevates corporate influence and creates an inherent risk for firms that engage in deviant behavior.

Notes

Status research at the individual level also indicates that status may be a liability in certain situations. Graffin and colleagues (2013), for example, found that high-status members of the British Parliament who were implicated in an expense scandal experienced greater pressure from journalists nd were consequently more likely to leave Parliament. And Wheeler, Weisburd, and Bode (1982) found that the severity of punishment meted out to individuals prosecuted for white-collar crime was positively related to their occupational status.

In a review of theoretical work on the reputation construct, Lange and colleagues (2011) said that researchers tend to think of reputation in one of three ways: (1) as being known, (2) as being known for something, and (3) generalized favorability. Reputations certainly consist of different dimensions, but our purpose is not to offer a new operationalization but rather to note that underlying all these definitions is a belief that organizational reputations consist of shared perceptions about quality and standing.

Only six of the 53 class action suits in our data went to trial. Of these six, two were dismissed on summary judgment and two ended in a verdict for the defense. The two that resulted in a verdict of liability produced an average damages award of nearly 30 million dollars.

We also ran the models with the simple raw score from the Fortune ratings; these models produced substantively identical findings as those incorporating the variable produced by Brown and Perry’s (1994) method.

In separate models, we used an alternative measure of domain-specific reputation by utilizing Fortune magazine’s annual rankings of the Best Places to Work. The results for this alternative measure are substantively similar to those using the KLD-derived proxy. We opt for the KLD proxy in our primary models because it allows for consideration of both strengths and weaknesses in the domain at issue (providing a score that encapsulates both good and bad reputations). Additionally, while the KLD data cover the full Fortune 500 for the period we study, firms had to apply to be considered for the Fortune ranking, such that the latter proxy for reputation potentially suffers from unobservable selection bias.

To avoid overestimating our models, we only include controls for adverse actions that occurred in at least 5 percent of the cases in our sample. These include, in order of frequency, termination or constructive discharge, harassment, hostile work environment, failure to accommodate, loss of benefits or pay, failure to promote, failure to hire or rehire, closer supervision or scrutiny, and demotion.