#Mobile trading app

Text

How To Choose The Best CRM for Forex Brokers

Choosing the right CRM for Forex Brokers is essential for a successful trading business. A good CRM will help Forex Brokers to manage customer data, track sales and marketing activities, and improve customer service. It should be able to provide real-time data on customer behavior and trends in order to make informed decisions quickly. Additionally, it should have features like automated emails, lead scoring, contact management, and reporting capabilities that can help Forex Brokers maximize their profits. When selecting a CRM for Forex Brokers it is important to consider the features offered by different providers and determine which one best suits your needs.

The best forex CRM should have features that enable brokers to manage customer data efficiently, generate leads, automate customer service tasks, and provide real-time analytics about their business. With the right Forex CRM, brokers can streamline their operations and maximize profits. In this article, we will discuss some of the best Forex CRMs in the market today and how they can help you achieve success in your forex business.

Metatrader 5 CRM Software is a powerful tool designed to help businesses manage their customer relationships. It provides a comprehensive suite of features that enable businesses to easily manage customer accounts, track customer interactions, and create custom reports. With its intuitive interface and customizable features, Metatrader 5 CRM Software makes it easy for businesses to stay organized and keep track of their customers. With its powerful automation capabilities, Metatrader 5 CRM Software can help companies save time and money by streamlining customer service processes. By utilizing this software, businesses can ensure that their customers receive the best possible service and support.

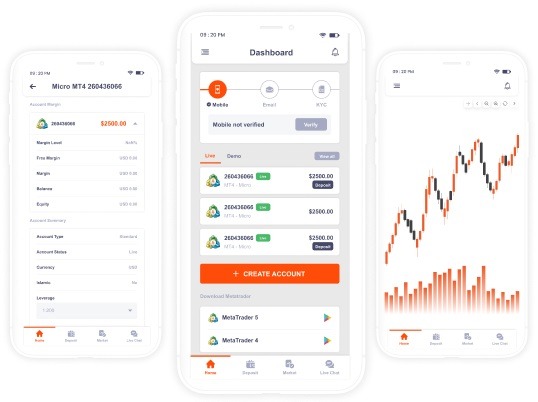

Easy to Use Mobile Trading App

Mobile trading apps are becoming increasingly popular amongst investors and traders. They offer a convenient and easy way to trade stocks, commodities, currencies, and more from the comfort of your own home. With a mobile trading app, investors can easily access their accounts, monitor their investments in real-time, and make trades with just a few taps on their smartphone. These apps also provide users with detailed market analysis and research tools to help them make informed decisions about their investments. With the right mobile trading app, you can take control of your finances without ever having to leave your house.

Tradesoft is one of the best Forex Broker in forex trading platforms that offers its clients and traders with a wide range of services including Forex Training, Forex account opening like Demo and Live account, Mobile Trading App, and more. With their advanced mobile app, they provide an easy-to-use platform to enable traders to access the global markets at any time. The app is designed with the latest technology to ensure a secure trading experience and provide access to real-time data feeds from major exchanges around the world. With their sophisticated yet intuitive mobile trading app, traders can stay ahead of the market trends and make informed decisions on when to buy or sell.

2 notes

·

View notes

Text

Mobile Trading App

Forex CRM empowers you with a high-end Mobile Trading App that has been programmed to keep the traders one step ahead with insights and knowledge.

0 notes

Text

good morning my dog hss been laying with me the past several hours i need to get a food in me and thn guess what. back to the pokedex grind i still have 95+ more slots to fill NOT even including scarlets paradoxes

#buddy likes eepin with me we are the eepers#he never lays with me when i call him its only at bedtime smh#ayway i gotta get a 2nd ceruledge to trade for the other one. with the power of the pkmn home mobile app#torch chatter

1 note

·

View note

Text

Investing on the Go: Top Mobile Trading Apps for Indians

In today's fast-paced world, the ability to trade stocks and manage investments on the go has become increasingly important for Indian investors. With the rise of mobile trading apps, investors now have the freedom to monitor market movements, execute trades, and stay informed about their portfolios from anywhere, at any time. In this guide, we'll explore the best mobile trading app in India, empowering you to make informed decisions and seize trading opportunities on the move.

Introduction to Mobile Trading Apps

Mobile trading apps are software applications designed to enable investors to trade stocks, commodities, currencies, and other financial instruments using their smartphones or tablets. These apps provide access to real-time market data, trading platforms, research tools, and account management features, revolutionizing the way investors engage with the stock market.

Benefits of Mobile Trading for Indian Investors

Convenience: Trade anytime, anywhere, without being tied to a desktop computer or physical trading terminal.

Accessibility: Access real-time market data and execute trades on the go, even in areas with limited internet connectivity.

Speed: React quickly to market movements and capitalize on trading opportunities with instant order execution.

Criteria for Selecting the Best Mobile Trading App

When evaluating mobile trading apps, consider factors such as user interface, trading features, security measures, reliability, and customer support. Additionally, assess compatibility with your device's operating system (iOS or Android) and any additional services offered, such as research reports or educational resources.

Top Mobile Trading Apps in India

Explore the leading mobile trading apps available in India, comparing features, functionalities, and user reviews. Assess each app's performance, reliability, ease of use, and compatibility with your trading style and preferences.

User Interface and Experience

Evaluate the user interface and experience offered by each mobile trading app, considering factors such as layout, design, intuitiveness, and customization options. A user-friendly interface enhances efficiency and makes trading a seamless experience.

Trading Features and Tools

Assess the trading features and tools provided by each app, including real-time market data, customizable watchlists, technical analysis tools, and order types. Look for apps that offer comprehensive trading functionalities to cater to your investment needs.

Security Measures

Prioritize mobile trading apps that prioritize security measures, such as encryption, biometric authentication, and two-factor authentication, to protect your sensitive information and investments from unauthorized access and cyber threats.

Reviews and Ratings

Gain insights from user reviews and ratings of mobile trading apps, considering factors such as stability, reliability, customer support, and overall satisfaction levels. Real-life experiences shared by other investors can provide valuable insights into the pros and cons of each app.

Conclusion

In conclusion, mobile trading apps have revolutionized the way Indian investors engage with the stock market, offering unprecedented convenience, accessibility, and speed. By carefully evaluating the features, functionalities, security measures, and user experiences offered by top mobile trading apps, you can harness the power of mobile trading to manage your investments effectively and seize trading opportunities wherever you are.

0 notes

Text

youtube

How to Register as a Copy Trading Provider - Exclusive Markets

Ready to turn your trading game up a notch? Learn how to become a Copy Trading Provider with Exclusive Markets in this step-by-step tutorial! This video will guide you through becoming a Copy Trading Provider, allowing you to share your expertise with our Exclusive community.

Watch now and don't miss out on this opportunity to expand your trading potential!

Subscribe to our channel ➡️ / @exclusivemarkets-official

Visit our website ➡️ https://www.exclusivemarkets.com/

Exclusive Markets offers a powerful platform to invest in thousands of financial instruments.

Follow us on our other channels:

Facebook: https://rb.gy/rscn6

Instagram: https://rb.gy/ohe5n

Twitter: https://rb.gy/whl27

LinkedIn: https://rb.gy/boz8f

TikTok: https://rb.gy/0jnn5

Risk Warning: Trading involves risk.

0 notes

Text

Smart Ways to Make Money: Profitable Passive Income Ideas to Secure Your Future

Smart passive income ideas can secure your financial future and provide steady earnings. Explore profitable ventures like rental properties, dividend stocks, and online businesses.

Securing a prosperous future requires savvy income strategies that work for you around the clock. Passive income streams offer a way to earn money without the need to actively work all the time. These strategies include investing in real estate for long-term rental profits, engaging in the stock market for dividends, or leveraging digital platforms to sell products or create content that generates revenue continuously.

My Best Recommended & Proven Way to Make $100 Daily — Watch THIS Video FREE Training to START >>

Passive Income Essentials

Securing your financial future doesn’t have to mean working endless hours. Smart passive income strategies can unlock a world where earnings grow even as you sleep. There’s a wealth of options out there — each with its unique strengths. To navigate this domain, understanding the basics and choosing the right streams is vital.

Demystifying Passive Income

Passive income often seems shrouded in mystery. Many people wonder if it’s a practical goal. In essence, it’s earning money from investments or work you’ve done once. This could mean rental income, dividends, or sales from an e-book. Distinct from active income, it requires less time to manage daily.

Purchase and rent out property

Invest in dividend-paying stocks

Create digital products for sale

It’s about smart choices now for long-term benefits. For the ideal start, assess the potential risks and returns of each option.

Financial Stability Through Passive Streams

Passive income is more than just extra cash. It’s a step toward lasting financial safety. The goal is to create multiple income sources that can support your lifestyle, even if you stop working. Diversification is key — spreading your investments across different areas reduces the risk.

Type of Passive Income Benefits Real Estate Steady income and property value growth Stocks with Dividends Regular income plus potential stock value increase Creating an Online Course Earn with each new student enrollment

Review these options to align with your life goals and economic situation. Start building that foundation for a more secure and sustained income stream today. Remember, the path to financial freedom involves planning and the savvy generation of earnings on the side. Get started, and watch your financial health flourish over time.

Diving Into The Stock Market

Exploring the stock market opens up a world of possibilities for passive income. It’s a tried-and-true approach that savvy investors leverage for long-term financial gains. You don’t need to be a Wall Street expert to get started. With the right strategy, anyone can tap into this lucrative avenue.

Dividend-yielding Stocks

Dividend-yielding stocks stand out as a solid option for passive income. They pay out a portion of profits to shareholders regularly. This means you earn money simply for owning the stock. Consider these key points:

Choose companies with a history of stable dividends.

Look for those with potential for dividend growth.

Reinvest dividends to compound your earnings.

Index Funds & Etf Portfolios

Index funds and ETFs offer a more hands-off investment approach. They track specific market indices and spread your investment across numerous stocks. This leads to a balanced and diversified portfolio. Here’s why they’re advantageous:

Lower fees: Expense ratios are typically minimal with index funds and ETFs.

Automatic diversification: Instant exposure to a variety of assets helps mitigate risk.

Simplicity: They’re easy to purchase, making them ideal for first-time investors.

Comparison of Dividend Stocks vs. Index Funds & ETFs Investment Type Income Potential Risk Level Dividend Stocks High Moderate to High Index Funds & ETFs Varies Low to Moderate

My Best Recommended & Proven Way to Make $100 Daily — Watch THIS Video FREE Training to START >>

Real Estate For Residual Income

Earning while you sleep sounds ideal, and real estate often fits this dream. With strategic investments, you can build a robust stream of passive income. Real Estate remains top-tier for growing wealth. Let’s dive into real estate strategies that can secure a more prosperous future.

Rental Properties Revenue

Rental properties can turn a tidy profit monthly. Location is everything, so choose areas with growth potential. Starting can be more hands-on, but many opt for management services to handle day-to-day tasks. Here’s why rentals rock:

Steady Cash Flow: Monthly rent payments go straight into your pocket.

Tax Advantages: Deduct property expenses from your income.

Appreciation Over Time: Rentals can increase in value, boosting your net worth.

Your investment in real estate can grow with careful planning. Understanding the market helps ensure success.

Real Estate Investment Trusts (reits)

REITs are powerful for portfolio diversification. They allow small investors to earn from large real estate ventures without owning the properties themselves. Stock-like ease with real estate rewards! Key REITs facts include:

Pros Cons High Dividend Yields Sensitive to Interest Rates Liquidity Like Stocks Market Fluctuations Diversified Assets Less Control Over Investments

Credit: printify.com

Online Ventures That Generate Cash

Embarking on online ventures unlocks doors to a world where income flows even as you sleep. The internet is bustling with opportunities to create a stream of passive income. Let’s explore some smart ways to fill your pockets without the constant hustle.

Blogging And Affiliate Marketing

Blogging is not just a platform for sharing ideas. It’s a robust money-making tool. A successful blog captures the attention of thousands, opening avenues for monetization. Adding affiliate marketing turns your content into a cash magnet. Here’s how to start:

Select a niche that you love and know well

Launch a blog with a user-friendly CMS like WordPress

Regularly post high-quality content

Apply SEO strategies to increase visibility

Join affiliate programs related to your niche

Recommend products through your posts

Remember, consistency is key. Regular updates paired with SEO will drive traffic. Higher traffic leads to more earnings through affiliate links.

Creating And Selling Digital Products

Digital products offer a limitless income potential. They’re convenient to create, distribute, and sell globally. Popular digital products include:

Type of Product Examples Platforms to Sell eBooks Guides, Novels, How-tos Amazon Kindle, Your Website Online Courses Video Tutorials, Lectures Udemy, Teachable Stock Photography Photos, Graphics Shutterstock, Adobe Stock

To succeed, identify your audience’s needs. Create valuable content. Market through social media and email lists. An initial effort can translate into regular sales without any added work.

My Best Recommended & Proven Way to Make $100 Daily — Watch THIS Video FREE Training to START >>

Turn Hobbies Into Income Channels

Imagine your favorite hobby making cash while you sleep. Turn hobbies into income channels and see the magic happen. Your passion can unlock a stream of income. Transform leisure activities into lucrative ventures. Dig deep into hobbies and spot money-making potentials. Read on for smart ways to monetize your interests!

Monetizing Creative Skills

Got a knack for creativity? Harness this power for passive income. Here’s how:

Create digital products: E-books, courses, art pieces, and music tracks.

Print-on-demand services: Sell custom designs on tees, mugs, and more.

Stock photography: Click and sell images to stock photo websites.

Remember, quality content stands out. Polish your skills consistently. Keep your digital presence strong. Engage with online communities. These steps help sell more.

Leveraging Peer-to-peer Platforms

Peer-to-peer platforms are goldmines for passive income. Here’s a quick look at options:

Platform Activity Etsy Sell handmade goods. Airbnb Rent out extra space. Turo List your car for others to use.

Credit: www.bankrate.com

Frequently Asked Questions

Q. What Is Passive Income?

Passive income involves earning money without active, daily involvement. It’s generated from ventures like rental properties or royalties from creative works. This approach can offer financial security over time through consistent, scalable streams.

Q. Can Blogging Generate Passive Income?

Yes, blogging can generate passive income. Once you create quality content and optimize for SEO, you can earn through affiliate marketing, ads, or selling digital products. Regular updates and marketing strategies help maintain and grow your earnings.

Q. What Are The Best Passive Income Strategies?

The best passive income strategies include investing in dividend stocks, real estate rentals, peer-to-peer lending, creating an online course, and writing an ebook. These require varying levels of initial effort but can provide ongoing income with minimal maintenance.

Q. How Does Affiliate Marketing Provide Passive Income?

Affiliate marketing provides passive income by promoting other people’s products. You earn commissions for sales made through your unique referral links. It’s effective when you have a strong online presence and can persuade your audience to make purchases.

Conclusion

Embracing passive income strategies can transform your financial landscape, securing a brighter future. Diverse options, from real estate investments to digital products, offer paths to sustainable earnings with minimal ongoing effort. Start small, scale sensibly, and watch your wealth grow.

Your financial freedom might just be a well-chosen venture away. Dive in and let your money work for you.

My Best Recommended & Proven Way to Make $100 Daily — Watch THIS Video FREE Training to START >>

Thanks for reading my article on Smart Ways to Make Money: Profitable Passive Income Ideas to Secure Your Future

Affiliate Disclaimer :

This article Contain may be affiliate links, which means I receive a small commission at NO ADDITIONAL cost to you if you decide to purchase something. While we receive affiliate compensation for reviews / promotions on this article, we always offer honest opinions, users experiences and real views related to the product or service itself. Our goal is to help readers make the best purchasing decisions, however, the testimonies and opinions expressed are ours only. As always you should do your own thoughts to verify any claims, results and stats before making any kind of purchase. Clicking links or purchasing products recommended in this article may generate income for this product from affiliate commissions and you should assume we are compensated for any purchases you make. We review products and services you might find interesting. If you purchase them, we might get a share of the commission from the sale from our partners. This does not drive our decision as to whether or not a product is featured or recommended.

Source : Smart Ways to Make Money: Profitable Passive Income Ideas to Secure Your Future

#Online Business Opportunities#Affiliate Marketing Strategies#Real Estate Investment#Stock Market Investing#Cryptocurrency Earnings#Peer-to-Peer Lending#E-commerce Dropshipping#Digital Products Selling#Blogging for Income#Automated Trading Systems#Dividend Stocks#Royalties from Intellectual Property#High-Yield Savings Accounts#Mobile App Development#Virtual Real Estate#Social Media Monetization#Online Courses Creation#Crowdfunding Investments#Passive Income Apps#Freelance Passive Income#Bond Investing#Passive Income Books#Niche Websites#YouTube Channel Revenue#Rental Income Strategies#Affiliate Earnings#Affiliate Marketing#Affiliate Marketing Guide#Affiliate Marketing Mastery#Affiliate Marketing Training

0 notes

Text

Mobile TCG Pokémon Trading Card Game Pocket Announced

New Post has been published on https://thedigitalinsider.com/mobile-tcg-pokemon-trading-card-game-pocket-announced/

Mobile TCG Pokémon Trading Card Game Pocket Announced

While the main headline event from today’s Pokémon Presents showcase was the announcement of Pokémon Legends: Z-A, it wasn’t the only new game that got announced. It shares that status with Pokémon Trading Card Game Pocket, a new mobile game that allows players to collect, trade, and battle with the franchise’s signature trading cards.

Check out the reveal trailer below:

[embedded content]

While there are several features available in the game, Pokémon Trading Card Game Pocket seems to focus the most on the collection aspect, which is fitting given the renaissance of physical card games in recent years. While no details on microtransactions are given, the end of the trailer notes that players will get two free packs a day – implying that more than that might come at a cost.

You’ll also be able to trade cards with other players and battle them online as well. The trailer also shows off immersive cards, which seem to feature a 3D cinematic inside the cards.

The app is being developed by DeNA (best known for their work on Pokémon Masters) and is due out sometime later this year. For more Pokémon cards, check out our Trading Card hub, which features some of our favorite pulls from the game’s big releases.

#2024#3d#app#Canonical#data#details#Features#game#games#it#Mobile#notes#Other#Pokemon#Showcase#styles#Trade#work#youtube

0 notes

Text

Switch to a mobile trading app that paves way for endless profits for you. With Tradesoft, it is possible for every individual to have a fruitful portfolio.

1 note

·

View note

Text

Mobile Trading App

Forex CRM empowers you with a high-end Mobile Trading App that has been programmed to keep the traders one step ahead with insights and knowledge.

0 notes

Text

To Develop a Finance App like Investing.com, consider partnering with Dev Technosys, a leading Trading App Development Company. Utilize their expertise to design a user-friendly interface with real-time stock data, personalized watch lists, and comprehensive market analysis tools. Incorporate features for portfolio management, news updates, and customizable alerts. Ensure robust security measures and seamless integration across platforms for a dynamic user experience that empowers investors to make informed decisions.

#App Like Investing.Com#Trading App Development Company#Build an App Like Investing.Com#Investing.Com Mobile App

0 notes

Text

0 notes

Text

Exploring the World of Fintech: Understanding its Popularity and the Development Process

Introduction:

In recent years, the term "fintech" has become increasingly popular, shaping the way we manage and interact with financial services. This article delves into the world of fintech, exploring what it is, why it has gained immense popularity, and the intricacies of fintech software and app development processes.

What is Fintech?

Fintech, short for financial technology, refers to the innovative use of technology to deliver financial services efficiently. It encompasses a broad range of applications, from online banking and digital payments to investment management and blockchain technology. Fintech solutions are designed to enhance and streamline various financial activities, ultimately providing users with more accessible, convenient, and cost-effective financial services.

Why Fintech is So Popular:

Convenience and Accessibility: Fintech has revolutionized the way people access financial services. With the advent of mobile apps and online platforms, users can manage their finances from the comfort of their homes. The convenience of 24/7 access to banking, payments, and investment tools has significantly contributed to the popularity of fintech.

Cost-Effective Solutions: Traditional financial services often come with high fees and hidden costs. Fintech companies leverage technology to reduce operational expenses, enabling them to offer more cost-effective solutions. This affordability appeals to a wide range of users, including those who were previously underserved by traditional financial institutions.

Innovative Features and Services: Fintech constantly introduces new and innovative features. From robo-advisors for investment management to peer-to-peer lending platforms, these services provide users with options that were once unimaginable. The appeal of cutting-edge financial solutions contributes significantly to the widespread adoption of fintech.

User-Friendly Interfaces: Fintech companies prioritize creating user-friendly interfaces. Intuitive designs and easy navigation contribute to a positive user experience, attracting individuals who may have been hesitant to engage with complex financial tools. The focus on user experience is a key factor in the popularity of fintech.

Fintech Software Development:

Fintech software development involves the creation of applications and systems that power the various financial services offered by fintech companies. The process is multifaceted, combining technology, finance, and regulatory compliance to ensure the development of robust and secure solutions. Here's an overview of the key stages in fintech software development:

Market Research and Analysis: Before beginning the development process, fintech companies conduct extensive market research to identify opportunities and assess potential risks. Understanding user needs, market trends, and competitor offerings is crucial for creating a successful fintech product.

Conceptualization and Planning: Once market research is complete, the development team works on conceptualizing the fintech solution. This involves outlining the core features, functionality, and the overall architecture of the application. Planning includes setting development milestones, defining the technology stack, and estimating project timelines.

Design and Prototyping: The design phase focuses on creating an intuitive and visually appealing user interface. Prototypes are developed to provide a tangible representation of the proposed solution. User feedback is often gathered during this stage to refine the design and ensure it aligns with user expectations.

Development: With the design in place, developers start building the fintech application. The development process may involve coding for web platforms, mobile applications, or both. Security is a top priority, and encryption protocols are implemented to safeguard sensitive financial data.

Testing: Rigorous testing is conducted to identify and resolve any bugs or issues. This includes functional testing to ensure all features work as intended, security testing to safeguard against potential vulnerabilities, and performance testing to optimize the application's speed and responsiveness.

Regulatory Compliance: Fintech solutions deal with sensitive financial information, and compliance with regulatory standards is imperative. Developers work closely with legal experts to ensure that the application adheres to industry-specific regulations, such as Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements.

Deployment: Once the application has undergone thorough testing and compliance checks, it is deployed for public use. Deployment involves making the fintech solution available to users through app stores, websites, or other distribution channels.

Maintenance and Updates: Fintech software requires ongoing maintenance to address emerging issues, implement security updates, and introduce new features. Continuous improvement is essential to keep the application relevant in a rapidly evolving financial technology landscape.

Fintech App Development Process:

The development process for fintech applications shares similarities with general fintech software development but has specific nuances due to the focus on creating user-centric mobile experiences. Here's a closer look at the fintech app development process:

Platform Selection: Fintech apps can be developed for various platforms, including iOS, Android, and cross-platform solutions. The choice of platform depends on the target audience, market share, and development resources. Many fintech companies opt for cross-platform development to reach a wider user base efficiently.

Mobile App Design: Mobile app design is a critical aspect of the development process. The design should be responsive, ensuring a seamless experience across different devices. The user interface (UI) and user experience (UX) are carefully crafted to prioritize simplicity, ease of use, and accessibility.

Integration of Security Measures: Security is paramount in fintech app development. Encryption, secure authentication methods, and biometric authentication are integrated to protect user data and financial transactions. Compliance with industry-specific security standards is strictly adhered to during development.

API Integration: Fintech apps often rely on external data sources and services. Application Programming Interface (API) integration allows the app to connect with external systems, such as payment gateways, banking APIs, or third-party financial services. Seamless integration enhances the app's functionality and provides users with a comprehensive financial experience.

Real-Time Data Processing: Fintech apps often require real-time data processing to provide users with up-to-date financial information. This includes real-time transaction updates, account balances, and investment portfolio performance. The development team implements robust data processing mechanisms to ensure the accuracy and timeliness of information.

Testing for Mobile Devices: Mobile app testing involves assessing the app's performance on different devices and screen sizes. Compatibility testing ensures that the fintech app functions seamlessly across a diverse range of mobile devices. Testing also includes checks for responsiveness, usability, and overall user satisfaction.

User Feedback and Iteration: Fintech app development is an iterative process. Developers seek user feedback during and after the development phase to identify areas for improvement. Continuous iteration based on user input helps refine the app, enhance features, and address any usability concerns.

Conclusion:

The popularity of fintech is a testament to its transformative impact on the financial services landscape. From providing convenient access to financial tools to offering innovative solutions, fintech has become an integral part of how individuals and businesses manage their finances.

The software development processes behind fintech solutions are complex and multifaceted, requiring a combination of technical expertise, financial acumen, and regulatory compliance. Whether developing a comprehensive fintech platform or a user-friendly mobile app, the key is to prioritize security, user experience, and continuous improvement.

#fintech#digitalcurrency#blockchain#crypto#cryptocurreny trading#digital currency#crypto currency#insurtech#mobile app development#app development#app developers#webdevelopment#web developing company

0 notes

Text

Navigating the Stock Market: Unveiling the Top Mobile Trading Apps in India for 2024

Introduction:

In the dynamic landscape of stock trading, mobile trading has emerged as a game-changer. This article explores the best mobile trading app in India in 2024, shedding light on their features, pros and cons, and user reviews. As technology continues to reshape the financial sector, the significance of mobile trading apps for investors cannot be overstated.

Importance of Mobile Trading Apps:

Discussing the accessibility and convenience offered by mobile trading apps, this section emphasizes how real-time market updates and user-friendly interfaces contribute to a seamless trading experience.

Criteria for Evaluating Mobile Trading Apps:

Before delving into the specifics, the article outlines essential criteria for evaluating mobile trading apps. Security measures, user interface, features, and customer support are highlighted as key aspects for consideration.

Top Mobile Trading Apps in India 2024:

This section provides an in-depth analysis of three leading mobile trading apps in India, presenting their features, pros and cons, and user reviews. A comparative evaluation assists readers in making informed choices tailored to their preferences.

Below is a list of 10 mobile trading apps, presented in no particular order, along with brief descriptions:

Zerodha Kite: Renowned for its simplicity and low brokerage fees, Zerodha Kite provides a user-friendly interface and a range of features for both beginners and experienced traders.

Upstox: With a focus on fast order execution and a comprehensive set of analytical tools, Upstox is a popular choice among traders. It offers a seamless trading experience and competitive pricing.

Angel Broking: Known for its robust research and advisory services, Angel Broking's mobile app combines user-friendly features with a variety of investment options. It caters to diverse trading needs.

ICICI Direct: Backed by a trusted financial institution, ICICI Direct's mobile app offers a wide array of features, including real-time market data, research reports, and an intuitive interface.

HDFC Securities: Providing a secure and efficient trading platform, HDFC Securities' app is appreciated for its reliability and user-friendly design. It offers a range of investment and trading options.

Kotak Stock Trader: Kotak Stock Trader is known for its comprehensive market research tools and seamless order execution. The app caters to both novice and experienced traders, offering a diverse set of features.

TradeSmart Online: Recognized for its cost-effective brokerage plans, TradeSmart Online's app is designed to provide a hassle-free trading experience. It offers advanced charting tools and customization options.

5paisa: Offering a budget-friendly platform, 5paisa combines stock trading with mutual fund investments. The app provides a simple yet powerful interface for users with varying levels of expertise.

Sharekhan: Sharekhan's mobile trading app is known for its robust research capabilities and a user-friendly interface. It provides a seamless trading experience with various investment options.

Motilal Oswal MO Investor: Motilal Oswal's app is recognized for its comprehensive market insights, research reports, and a user-friendly interface. It caters to the needs of both investors and active traders.

Key Features to Look for in a Mobile Trading App:

Enumerating crucial features, this section educates readers on what to look for in a mobile trading app. Real-time market data, analytical tools, order placement, security features, and customization options are explored.

Tips for Successful Mobile Trading:

Providing practical advice, this section offers tips for successful mobile trading. Staying informed, setting clear goals, practicing risk management, and regularly reviewing portfolios are emphasized.

Challenges and Risks in Mobile Trading:

Highlighting potential challenges and risks, this section addresses connectivity issues, security concerns, and market volatility, guiding users on how to navigate these obstacles effectively.

Future Trends in Mobile Trading:

Anticipating the future, this section explores emerging trends in mobile trading, such as the integration of AI and machine learning, the expansion of cryptocurrency trading, and enhanced personalization features.

Conclusion:

The article concludes by summarizing the top mobile trading apps, emphasizing the importance of informed decision-making, and encouraging readers to embrace the evolving landscape of mobile trading.

0 notes

Text

How AI in Stock Trading Will Transform Markets?

In the exciting world of finance and investments, a powerful tool called artificial intelligence is revolutionizing how people trade in the stock market. AI brings super-smart computer technology to the table, making it possible to analyze massive amounts of data and make clever decisions when trading stocks. This technology is transforming stock trading into a more efficient and informed process.

Imagine you’re trying to make money by buying and selling stocks inthe stock market. Artificial Intelligence is like a smart helper that uses computers to do this trading in a clever way. It’s really good to look at a lot of information quickly and make smart decisions based on that information.

Here’s How AI Stock Trading Work

1.Collecting Information: First, AI gathers much information about companies and the economy. This info comes from things like past stock prices, company financial details, news articles, and even what people are saying on social media.

2. Cleaning and Getting Ready: The gathered information is a bit messy, so AI cleans it up and gets it ready for understanding. It’s like sorting out your room before studying.

3. Finding Useful Clues: AI tries to find hints or patterns in the information that might help predict what will happen in the stock market. This is similar to figuring out patterns in a game to win.

4. Choosing the Right Moves: There are different ways AI can decide what to do with stocks. It can use lessons from the past to decide what to buy and sell. It can also watch the market in real time and decide what to do based on what’s happening right now.

5. Testing and Learning: Before actually doing the trading, AI practices with past information to see if its decisions would have worked well in the past. It’s like practicing a game to get better.

6. Real Trading: Once AI is good at making decisions, it starts buying and selling stocks for real. It keeps an eye on the stock market all the time and acts fast when it sees good opportunities.

7. Staying Up to Date: The stock market changes significantly, so AI keeps learning from new information to stay smart and make better decisions over time.

Advantages of AI in Stock Trading

1.Better Risk Management: AI helps traders make safer decisions when dealing with stock futures by quickly analyzing risks and suggesting ways to prevent big losses.

2. No Emotions: Unlike people, AI doesn’t feel emotions like fear or greed, so it doesn’t make impulsive choices based on feelings. This makes AI a more stable and reliable trader.

3. Handling More: AI can keep an eye on many stock futures at once, allowing traders to invest in different things and catch good opportunities in various markets.

4. Learning from History: AI can look at past data to improve trading strategies. It’s like learning from the mistakes and successes of the past to do better in the future.

5. Always Learning: AI keeps getting smarter by learning from new information and trends in the stock futures market.

6. Fast and Accurate: AI can make trades really quickly, taking advantage of tiny opportunities that people might miss. It also reduces mistakes, so you can trust it to make good choices.

AI in stock trading is like a helpful friend who works super fast, predicts stock futures, and keeps going non-stop. It can help traders make smarter choices, potentially earn more money, and is cost-effective.

Conclusion

AI has revolutionized stock trading by quickly analyzing vast amounts of data, making smart decisions, and predicting market trends. This technology acts like a fast, reliable assistant that helps traders make better choices, potentially leading to higher profits and cost savings.

If you want to have your own AI-powered stock trading app, you can team up with Whiten App Solutions, a top custom software development company that makes special computer programs. We’re really good at creating apps for businesses, including ones for stock trading. With Whiten App Solution’s help, you could have a really cool app that uses AI to make your stock trading even better and earn more profit.

#Stock Market#Stock Trading#AI#Ai In Stock Trading#Mobile App Development#app development#app#softwaredevelopment#mobileappdevelopment#mobileapp

0 notes

Text

Mobile Trading App

Switch to a mobile trading app that paves way for endless profits for you. With Tradesoft, it is possible for every individual to have a fruitful portfolio.

0 notes

Text

Best Mobile Trading App for 2023

Forex CRM empowers you with a high-end Mobile Trading App that has been programmed to keep the traders one step ahead with insights and knowledge.

youtube

1 note

·

View note