#mt4 mobile

Text

youtube

How to Register as a Copy Trading Provider - Exclusive Markets

Ready to turn your trading game up a notch? Learn how to become a Copy Trading Provider with Exclusive Markets in this step-by-step tutorial! This video will guide you through becoming a Copy Trading Provider, allowing you to share your expertise with our Exclusive community.

Watch now and don't miss out on this opportunity to expand your trading potential!

Subscribe to our channel ➡️ / @exclusivemarkets-official

Visit our website ➡️ https://www.exclusivemarkets.com/

Exclusive Markets offers a powerful platform to invest in thousands of financial instruments.

Follow us on our other channels:

Facebook: https://rb.gy/rscn6

Instagram: https://rb.gy/ohe5n

Twitter: https://rb.gy/whl27

LinkedIn: https://rb.gy/boz8f

TikTok: https://rb.gy/0jnn5

Risk Warning: Trading involves risk.

0 notes

Text

Mysteel UK Limited

Broker Modus UK Limited offers a wide range of financial instruments for trading in international markets. This includes currency pairs, stocks, indices, commodities and other financial assets. The variety of instruments allows traders to choose the ones that best suit their trading strategies and objectives.

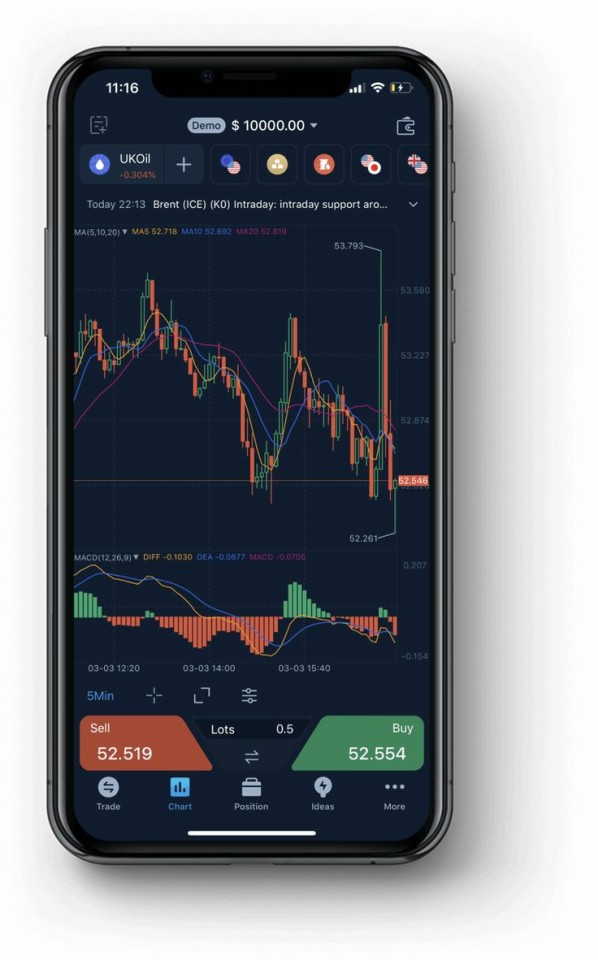

Metatrader 4 (MT4): This is a popular trading platform that provides ample opportunities to analyse the market, develop trading strategies and execute trades. MT4 has an intuitive interface and an extensive suite of tools for technical analysis.

Metatrader 5 (MT5): This is an enhanced version of the MT4 platform offering more advanced functionality, including a wider selection of tools and the ability to trade not only in Forex, but also in other markets.

WebTrader: This is a web-based platform, which enables traders to trade directly via a web browser without the need to download and install any software. WebTrader provides flexibility and accessibility, allowing traders to trade from their computer or mobile device from anywhere in the world.

Mobile applications: Mysteel UK Limited broker also offers mobile applications for trading on iOS and Android platforms. This allows traders to be flexible and trade anytime, anywhere using their smartphones or tablets.

3 notes

·

View notes

Text

4 Best Forex brokers 2022

Exness

Exness is rated #2 of the recommended FX brokers with an overall rating of 4.9/5. It reserves a minimum deposit of $10 and offers low trading fees across its total of 97 currency pairs and crypto. Exness can be traded on various trading desks including MT4, MT5, MT4 WebTerminal, mobile (iOS & Android, Exness Trader) and offers an affiliate program with commissions of up to $45 for every registration, depending on the country and the platform.

Exness Pros and Cons

Pros

-Regulated by both CySEC and FCA

-Client funds kept in segregated accounts

-Tight spreads

-130+ Currency Pairs with Multiple Trading Platforms

Cons

-No multi-currency accounts available

Avatrade

Ranked #1 for recommended FX brokers with an overall rating of 4.8/5. Avatrade offers a minimum deposit fee of $100 for a total of 55+ currency pairs and cryptocurrencies which is traded on various trading desks namely: MetaTrader 4, MetaTrader 5, Ava Social, Ava Protect, Trading Central with low trading fees.

AvaTrade offers 4 affiliate programs:

CPA

You get a fixed payment for every client you refer to AvaTrade and this program' commission structure guarantees a consistent rate for every new investing trader.

RevShare

RevShare is a long-term affiliation where you can maintain receiving your revenue share as long as your referral keeps trading.

Dynamic CPA

This is recommended for people who bring big clients, and you get an incentive of their first-time deposit.

Master Affiliate

Get paid for your clients’ traffic and trading, as well as a fixed percentage of your sub-affiliates' performance.

Avatrade Pros and cons

Pros

-Easy and fast account activation

-Free deposit and withdrawal options

-Provides good educational tools

Cons

-outdated research tools

-There's an inactivity fee payable

-Does not adequately support mobile phones

HFM

Although it is ranked #6 FX broker with an overall rating of 4.8/5, it is a good platform with very good customer support. HFM has a minimum deposit of $5 and offers low trading fees. The platform has a total of 50+ currency pairs and cryptocurrencies but its trading desks are limited to MetaTrader4, MetaTrader5 and the HFM platform.

HF Markets Pros and Cons

Pros

- Low deposit requirement for new traders with Micro accounts

-Offers good customer support

-There's a variety of premium trader tools available

Cons

-Limited range of instruments

- Difficult account opening

-US clients not accepted

XM

Rated #68 for recommended FX Brokers with a minimum deposit of $5 and no trading fees. XM is a widely used and well-loved online brokerage which operates in 196 countries and offers trading on an enormous range of assets. You can trade more than 1,000 companies through stock contracts for difference (CFDs), commodities, forex, and cryptocurrencies.

Here is a preview of the accounts it offers and their Pros and Cons

Based on the above analysis, which broker is best suitable for you?

12 notes

·

View notes

Text

All You Need To Know About Forex Trading Platforms In India

Forex trading platforms are software applications that allow traders to access the foreign exchange market and execute trades. Traders can choose a platform based on their trading preferences, experience level, and the specific features they require.

Forex trading platforms are important because they provide traders with access to the global foreign exchange market, allowing them to buy and sell currencies and other financial instruments. These platforms provide a range of tools and features that enable traders to analyze the market, execute trades, manage risk, and monitor their performance. They also offer real-time market data, news, and charts, which are crucial for making informed trading decisions.

There are several forex trading platforms available in Nigeria that traders can use to access the global foreign exchange market. Some of the most popular forex trading platforms used in Nigeria include MetaTrader 4, MetaTrader 5, Forex4you web trader, and TradingView.

Forex4you Nigeria is an award-winning broker with a variety of trading platforms to choose from. Forex4you also offers a mobile app for on-the-go trading and both the MT4 and the Forex4you proprietary desktop platforms. There are more than 150 assets available on the broker's platform, unmatched leverage of up to 1:1000, lightning-fast trade execution, deep liquidity, and free market analysis and alerts for all traders.

2 notes

·

View notes

Text

Top 7 Forex Trading Platforms 2022

An online stock trading platform that allows you to buy and sell stocks, cryptos & forex from your computer or smart phone. Also known as brokerage accounts, they are offered by financial institutions. When you open an account and make a deposit, it connects you with other buyers and sellers in the stock and bond markets, allowing you to trade stocks and bonds as well as investment vehicles other than ETFs.

While all brokers today allow customers to trade online (instead of calling traders on an exchange), some online stock trading platforms operate only online while others combine stock trading with traditional financial advisors who provide help and advice.

While every trading platform is different, stockbrokers can be divided into two broad categories: discount brokers and full service brokers. These Discount brokerage firms offer self-directed portfolios, which require a hands-on investing approach, meaning you pick your own stocks, bonds, and ETFs. With a discount broker, you have complete control over your securities and when you want to trade them. Full service brokers offer a more traditional approach. In addition, The online access to your investments, these companies often pair you with a financial advisor who can advise you on which stocks to buy or even manage an entire portfolio investment for you.

How to choose the best online trading platform?

Financial Goals: One of the most important questions you should ask yourself before you start investing is why in the first place. Are you trading to create a retirement account, or do you expect it to become a hobby? Be honest with yourself when answering this question. Because which platform you should choose will ultimately depend on your investment goals. If your goal is primarily to throw your keys into the system by investing in meme stocks, the platform should give you the freedom to do so. Online Trading Platform vs Robo Advisor

Trading Requirements: Day traders make many trades in a day. So they need a platform that is fast and reliable while enjoying the lowest possible trading commissions. Meanwhile, investors aiming to pay for a trip or gift can preferentially integrate with their bank account to deposit their spare cash directly into savings. Before deciding to use an online trading platform, make sure that it can meet your needs based on your trading habits.

Read Also: best ETFs Canada

Investment & Trading Style: How long you’ve been trading – or if you’ve ever traded – is an important factor in the type of platform you should choose. Beginners may want to start with an automated custodian that manages a diversified bond and stock portfolio for you. Those interested in learning how to actively trade should look for platforms that offer basic educational resources, responsive customer support, and allow them to practice trades before entering the real world. . Experienced traders can benefit from platforms that allow them to issue specific types of trades, have more sophisticated analytical tools and start trading as soon as possible.

Top recommended 7 Forex Trading Platforms in 2022

Xtreamforex – The best overall Platform

Xtreamforex stands out as our best overall platform for the trading. It is the most trustable ECN broker online. They offer an opportunity to trade on Forex, Commodities, and Crypto & Indices. You can open the account without initial cost. To start trading $5 micro account is available.

Moreover, Xtreamforex offers two most famous ways to start investment in the forex trading i.e. PAMM services & Copy trading services. If you have a single investment goal in mind, you can either manage the portfolio yourself or use these company’s investment options.

Pros: Cons:

Tight Raw Spreads available

PAMM & Copy trading Investment options

Provides MT4 & MT5 trading platform

Variety of accounts available for all the

needs & demands of all type of traders

Best Customer Support

Premium Education support available

No Swap & Commission fee

Cons:

a) Mobile app not available

b) doesn’t support futures trading available

c) No access to Mutual Funds

XTB: Best xStation5 platform provider

XTB is an award-winning CFD platform that supports Forex, Indices, Commodities, Stock CFDs, ETF CFDs and Cryptocurrencies. For Forex, XTB supports 48 currency pairs with low spreads. XTB clients can choose between trading on the xStation 5 or MT4 platforms. For leveraged accounts, this broker offers leverage up to 200:1.

Pros:

xStation 5 or MT4 platforms available

Trade on 3000+ trading instruments

Low spreads

Cons:

a) Fewer Forex pairs than some top competitors

b) No 24/7 Support

E trade: Best for Beginners

E-trade offers a wide variety of investment options, from simple online brokerage accounts designed for new investors to advanced trading and investment options for experienced traders There are no online trading fees for US-listed stocks, exchange-traded funds, and options, making it easy for new investors to start building their portfolios. There are also managed portfolios for those in need of further guidance with annual management fees starting at 0.3% of investment assets.

Pros:

Mobile app available

Manage portfolio with annual fees investment account 0.3%

Cons:

a) $500 minimum to open automated

b) High Margin rates

c) $0.50 per options contract if you make 30 or more trades per quarter

FP Markets: Provides 3 trading platforms

FP Markets offers a wide range of tradable assets through Forex, CFD and Stocks trading accounts. FP Markets supports MT4, MT5 and IRESS platforms and offers leverage up to 500:1. You can trade 45 currency pairs with competitive spreads or commissions.

Pros:

3 Trading platforms available

10,000+ trading assets

Cons:

a) Possible of additional fees

b) High Spreads

c) Minimum opening balance AU $200 required

Betterment: Best for Hands-Off Investors

Betterment is a roboadvisor that allows you to easily “set and forget” your investments. It may not be ideal for investors who want to actively trade stocks, but it is a great option for more conservative investors who are just starting out or not. Betterment’s investment platform takes the tedious work out of the equation for investors, allowing them to choose an investment strategy that works on autopilot.

Pros:

Commission free trading

Robust Trading tool

Cons:

a) No human financial advisor

b) No Robo-advisor option

FXCC: Best trading conditions

FXCC is a robo advisor that allows you to easily “set and forget” your investments. It may not be ideal for investors who want to actively trade stocks, but it is a great option for more conservative investors who are just starting out or not. Betterment’s investment platform takes the tedious work out of the equation for investors, allowing them to choose an investment strategy that works on autopilot.

Pros:

Commission free trading

Research & Educational Material

Cons:

a) High withdrawal fees via bank wire

Tickmill : Most regulated broker

Tickmill offers more than 80 CFD instruments for trading Forex, Indices, Commodities and Bonds through three main trading accounts known as Pro Account, Classic Account and VIP Account. They also offer a demo trading account and an Islamic swap free account.

Pros:

Multiple regulations & license

Competitive Spreads

Commission free trading accounts

Cons:

a) No MT5 trading platform available

b) Stock trading not available

Choosing the best Forex Trading platform

It is recommended to choose the forex trading platform according to your trading needs and strategies. But there are few common factors which have discussed above is must required for all types of traders. I have usually review the services of all the trading platforms available online & on the basis of the customer satisfaction, I have recommended these above best trading platforms which you should be considered in 2022.

4 notes

·

View notes

Text

Daftar Broker Forex Indonesia Terpercaya

In order to trade in the foreign exchange market, a person needs to know the basics of forex trading and how to choose a broker. These basics include understanding how the markets work and the importance of analyzing a harga. The broker must also have a large amount of deposit funds, preferably 10 juta. The PT Asia Trade Point Futures, a broker forex in Indonesia, is registered in Bappebti, a government agency that has many other services, including forex education and group WA.

There are numerous forex brokers in Indonesia, but only a handful of them are regulated by the government. A good broker will offer a free demo account, but will have a minimum investment of $2000. Some even offer bonuses of up to $1,000! Make sure to read the fine print, as many of these companies are not genuine and may be scams. The risk of losing a few thousand dollars can be substantial, but it is worth it to make money in forex.

There are countless forex brokers in Indonesia, but you should know which ones are reliable and have the best reputation. Besides, the best ones are licensed and have low trading fees. If you don't have much experience with forex, you can read reviews online and choose the one you feel is the best for you. If you are still not sure, you can always check with a regulator.

Valbury Asia Futures is an official broker that has been around since 2009. It is regulated by BAPPEBTI and is backed by the government of Indonesia. Additionally, the broker is licensed in United Kingdom, Amerika Serikat, and Indonesia. There are also other factors to look for when choosing a broker. The broker should be licensed in Indonesia, the United Kingdom, and Canada.

Daftar broker forex indonesio terpercaya has a reputation for being legitimate. It also has a reputation for being a person. There is always a risk of losing money, so you need to take the necessary precautions. You can start by checking the reputation of the broker you're planning to join. You can also try demo accounts and get acquainted with the basics of forex trading.

Financial Broker Service also has many trading platforms, and a low minimum deposit is needed. Its low minimum deposit is $250. It accepts many deposit methods, including credit card, debit card, PayPal, and rekening kawat. Soegee Futures, on the other hand, uses fasapay and has a bahasa Indonesia website.

There are several types of MT4 software available for those who prefer mobile trading. One option is the MT4 platform, which allows you to view market data on the go. best platform to trade forex reddit can also use a variety of deposit methods, including a bank account from your local currency. There are many benefits to this option, but make sure you choose the best one for your needs.

#how to trade forex#how to trade forex for beginners#best time to trade forexforex trader jobs#forex trader salary#copy trade forex#best forex pairs to trade#how to become a forex trader#where to trade forex#how to trade forex with $100#can you trade forex on robinhood#can you trade forex on webull#how to trade forex on thinkorswim#how to trade gold in forex#average forex trader income#can you trade forex on td ameritrade#forex smart trade#remote forex trader jobs#best time frame to trade forex#forex trader pro#how do you trade forex#how to day trade forex

3 notes

·

View notes

Text

Avatrade: A Beginner-Friendly, Safe, and Legit Broker

Introduction.

For beginners stepping into the realm of online trading, selecting the right broker is a critical decision. Avatrade, established in 2006 and headquartered in Dublin, Ireland, has garnered a strong reputation in the financial trading industry. Known for its user-friendly platforms, extensive educational resources, robust customer support, and stringent regulatory compliance, avatrade presents itself as an appealing option for novice traders. This article explores why avatrade is considered a beginner-friendly, and legitimate broker is avatrade safe.

User-Friendly Platforms.

A major consideration for beginners is the ease of use of the trading platform. Avatrade excels in this aspect by offering multiple, intuitive platforms designed to cater to traders of all experience levels.

Avatradego.

Avatradego, the broker’s proprietary mobile trading platform, is designed with simplicity in mind. It features a clean and intuitive interface, allowing new traders to navigate the app easily. Key features include one-click trading, real-time market data, and advanced charting tools. The app also provides social trading capabilities, enabling beginners to follow and copy the trades of experienced investors. Is avatrade good for beginners.

Metatrader 4 and metatrader 5.

For those who prefer desktop applications, avatrade offers metatrader 4 (MT4) and metatrader 5 (MT5), which are widely regarded as industry standards. These platforms are known for their robust analytical tools, automated trading capabilities through Expert Advisors (eas), and extensive range of technical indicators. Both platforms support multiple order types, allowing traders to implement diverse trading strategies.

Webtrader

Avatrade’s webtrader platform allows users to trade directly from their web browsers without needing to download any software. It offers a user-friendly interface with essential trading features, making it an excellent choice for beginners who seek a straightforward trading experience.

Comprehensive Educational Resources

Education is a cornerstone of successful trading, and avatrade offers a wealth of educational resources tailored to beginners.

Education Center.

Avatrade’s Education Center includes a variety of learning materials such as ebooks, video tutorials, webinars, and articles. These resources cover a wide range of topics, from basic trading concepts to advanced strategies. The structured approach ensures that beginners can gradually build their knowledge and confidence.

Trading for Beginners Course.

Avatrade provides an introductory course specifically designed for novice traders. This course covers fundamental trading principles, market analysis techniques, and risk management strategies. By completing this course, beginners gain a solid understanding of how financial markets operate and how to develop effective trading plans.

Webinars and Live Market Analysis.

Regular webinars hosted by experienced traders offer insights into current market trends and trading strategies. These live sessions allow beginners to ask questions and learn from professionals in real time, enhancing their practical knowledge and skills.

Demo Account.

A key feature that makes avatrade highly suitable for beginners is the availability of a demo account. This account allows new traders to practice trading with virtual funds in a risk-free environment. The demo account replicates real market conditions, providing an authentic trading experience without the fear of losing actual money. This feature is invaluable for beginners as it enables them to test their strategies, understand how different financial instruments work, and gain confidence before transitioning to live trading.

Excellent Customer Support.

Responsive and accessible customer support is crucial for beginners, who often need assistance navigating the complexities of online trading. Avatrade offers multilingual customer support available 24/5 via live chat, email, and phone. This ensures that traders can get prompt help with any issues or queries they may encounter.

In addition to direct support, avatrade’s comprehensive FAQ section addresses common questions related to account setup, platform usage, deposits, withdrawals, and more. This resource can provide quick answers and guidance without the need to contact support directly.

Regulatory Compliance and Security.

When choosing a broker, security and regulatory compliance are paramount, especially for beginners. Avatrade is well-regulated by several financial authorities, including:

Central Bank of Ireland (CBI)

Australian Securities and Investments Commission (ASIC)

Financial Sector Conduct Authority (FSCA) in South Africa

Financial Services Commission (FSC) in the British Virgin Islands

These regulatory bodies ensure that avatrade adheres to strict standards of financial integrity, transparency, and client protection.

Advanced Security Measures.

Avatrade employs advanced security measures to safeguard clients’ personal and financial information. These include SSL encryption for data transmission and the segregation of client funds from the company’s operational funds. This segregation ensures that clients' money is protected even in the unlikely event of the broker's insolvency.

Competitive Spreads and Leverage.

Cost-effectiveness is another critical factor for beginners, and avatrade offers competitive spreads across various financial instruments. Lower spreads reduce trading costs, allowing beginners to retain more of their profits.

Leverage Options.

Avatrade provides leverage up to 30:1 for retail clients, in line with regulatory guidelines. While leverage can amplify potential profits, it also increases the risk of losses. Avatrade ensures that beginners are aware of these risks through comprehensive educational materials and clear risk warnings.

Wide Range of Tradable Instruments.

Diversification is essential in trading, and avatrade offers a broad array of financial instruments, including forex, stocks, commodities, indices, and cryptocurrencies. This variety allows beginners to explore different markets and find the ones they are most comfortable with.

Contracts for Difference (cfds).

Avatrade also offers trading through Contracts for Difference (cfds), enabling traders to speculate on the price movements of various assets without owning them. Cfds provide a flexible and cost-effective way for beginners to engage in multiple markets with lower capital requirements.

Automated Trading and Copy Trading.

Avatrade supports automated trading through its integration with MT4 and MT5 platforms. Beginners can use Expert Advisors (eas) to automate their trading strategies, which is beneficial for those who may not have the time or expertise to manage trades actively.

Copy Trading.

Additionally, avatrade offers copy trading services through partnerships with platforms like zulutrade and duplitrade. Copy trading allows beginners to replicate the trades of experienced and successful traders. This feature is particularly advantageous for novices, as it enables them to learn trading strategies and potentially earn profits by leveraging the expertise of seasoned traders.

Conclusion

Avatrade stands out as a beginner-friendly, safe, and legitimate broker, offering a range of features and resources that cater to novice traders. Its user-friendly platforms, comprehensive educational materials, demo account, excellent customer support, stringent regulatory compliance, and competitive trading conditions make it an ideal choice for those starting their trading journey.

While avatrade provides numerous advantages, it is crucial for beginners to approach trading with caution. Adequate education, practice, and risk management are essential for success in the financial markets. Avatrade’s extensive offerings equip beginners with the tools and knowledge necessary to develop their trading skills and build confidence in the world of online trading. Please visit https://tradingcritique.com/broker...d-for-beginners/ more for details

0 notes

Text

How Avatrade Can Help You Maximize Your Trading Profits

Top Benefits of AvaTrade: A Reliable Trading Platform

AvaTrade, established in 2006, has grown into a trusted online broker with a global presence. As a regulated broker, AvaTrade offers a secure and reliable trading environment, making it a preferred choice for both beginners and experienced traders. This article explores the top benefits of AvaTrade and how it can enhance your trading experience.

Top Benefits of AvaTrade

One of the top benefits of AvaTrade is its extensive range of trading instruments. Traders can access over 1,000 assets, including forex pairs, stocks, commodities, cryptocurrencies, and indices. This diverse selection allows traders to build a well-rounded portfolio and take advantage of various market opportunities. AvaTrade also provides competitive spreads starting from 0.9 pips and leverages up to 1:400, offering favorable trading conditions for all types of traders.

Another significant advantage of AvaTrade is its commitment to regulation and security. AvaTrade is regulated by multiple financial authorities worldwide, including the Central Bank of Ireland, the Australian Securities and Investments Commission (ASIC), and the Financial Services Authority (FSA) in Japan. These regulations ensure that AvaTrade adheres to strict standards of transparency and security, protecting traders' funds and personal information. Additionally, AvaTrade offers negative balance protection, preventing traders from losing more than their initial deposit, and segregates client funds to enhance security.

What Are the Top Benefits of AvaTrade?

When considering what are the top benefits of AvaTrade, it is essential to highlight its user-friendly trading platforms. AvaTrade offers a range of platforms to suit different trading styles and preferences. The MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms are renowned for their advanced trading tools, customizable charts, and automated trading capabilities. AvaTradeGO, the mobile app, provides traders with the flexibility to trade on the go with real-time market data and intuitive interface. Furthermore, AvaTrade’s proprietary platforms, AvaTrade WebTrader and AvaOptions, offer unique features tailored to enhance the trading experience.

Another notable benefit of AvaTrade is its comprehensive educational resources. AvaTrade is dedicated to helping traders improve their skills and knowledge through a variety of educational materials, including video tutorials, eBooks, webinars, and market analysis. These resources are designed to cater to traders of all levels, from beginners looking to learn the basics to experienced traders seeking advanced strategies. AvaTrade also offers a demo account, allowing traders to practice their strategies with virtual funds before committing real money.

Enhance Your Trading Experience with AvaTrade

AvaTrade's exceptional customer support is another key benefit that enhances the trading experience. AvaTrade provides multilingual customer service 24/5 through various channels, including live chat, email, and phone. This ensures that traders can receive timely assistance and resolve any issues promptly. The broker’s dedication to customer satisfaction is evident in its high ratings and positive reviews from traders worldwide.

In summary, the top benefits of AvaTrade include its diverse range of trading instruments, strong regulatory framework, user-friendly trading platforms, comprehensive educational resources, and excellent customer support. These features make AvaTrade a reliable and attractive option for traders looking to navigate the financial markets with confidence. Whether you are a novice or an experienced trader, AvaTrade provides the tools and support needed to succeed in your trading journey.

For more information on AvaTrade and to start trading, visit the AvaTrade website

1 note

·

View note

Text

Where to Find JRFX MetaTrader 4 Download for Free?

MetaTrader 4 (MT4) is one of the most popular trading platforms in the world, favored by traders for its user-friendly interface, advanced charting tools, and automated trading capabilities. If you're looking to JRFX MetaTrader 4 download for free, you're in the right place. This article will guide you through the process, ensuring you get the platform safely and securely.

Why Choose JRFX MetaTrader 4?

Before diving into where to download JRFX MetaTrader 4, it's important to understand why this platform is highly recommended. JRFX has built a solid reputation in the trading community, known for its robust technology and excellent customer support. Their MT4 platform offers several benefits:

1.User-Friendly Interface: JRFX MetaTrader 4 is designed with traders in mind, offering a clean and intuitive interface that makes trading seamless, even for beginners.

2.Advanced Charting Tools: With JRFX MT4, you have access to a wide range of technical analysis tools, indicators, and charting options that can help you make informed trading decisions.

3.Automated Trading: One of the standout features of MetaTrader 4 is its support for Expert Advisors (EAs), allowing you to automate your trading strategies and backtest them on historical data.

4.Secure and Reliable: Security is a top priority for JRFX. The platform ensures your data is encrypted and protected, giving you peace of mind as you trade.

How to Download JRFX MetaTrader 4 for Free

Now, let’s walk through the steps to download JRFX MetaTrader 4 for free:

Step 1: Visit the JRFX Website

The first step is to go to the official JRFX website. It’s crucial to download the platform from an official and trusted source to avoid any security risks. Open your preferred web browser and type in the JRFX website URL.

Step 2: Navigate to the Download Section

Once you're on the JRFX homepage, look for the "Download" section. This is typically found in the main menu or footer of the website. Click on the link that takes you to the MetaTrader 4 download page.

Step 3: Choose Your Operating System

JRFX MetaTrader 4 is available for various operating systems, including Windows, MacOS, and mobile devices (iOS and Android). Select the version that matches your operating system.

Step 4: Download and Install

Click on the download button for your chosen operating system. The download will begin immediately. Once the download is complete, open the installer file and follow the on-screen instructions to install the software on your device.

Step 5: Set Up Your Trading Account

After installation, launch JRFX MetaTrader 4. You will need to set up your trading account to start using the platform. If you already have an account with JRFX, simply log in with your credentials. If you’re new to JRFX, you can create a new account directly from the MT4 platform.

Tips for Using JRFX MetaTrader 4

Utilize Educational Resources

JRFX offers a wealth of educational resources to help you get the most out of MetaTrader 4. Take advantage of tutorials, webinars, and guides available on their website. These resources can help you understand the platform’s features and enhance your trading skills.

Customize Your Workspace

One of the great features of JRFX MetaTrader 4 is the ability to customize your workspace. Arrange charts, indicators, and tools in a way that suits your trading style. You can save your layout so that every time you log in, your workspace is set up exactly how you like it.

Use Expert Advisors

Automated trading can significantly improve your efficiency and consistency. JRFX MetaTrader 4 supports the use of Expert Advisors (EAs). You can either create your own EAs or download pre-made ones. Ensure you backtest any EA thoroughly before using it in a live trading environment.

Stay Updated

Keep your JRFX MetaTrader 4 software updated to the latest version. Updates often include new features, bug fixes, and security improvements that can enhance your trading experience.

Conclusion

Finding a free download for JRFX MetaTrader 4 is straightforward if you follow the steps outlined above. JRFX provides a secure and reliable trading environment, making it an excellent choice for both novice and experienced traders. By downloading and installing JRFX MetaTrader 4 from the official website, you can start leveraging its powerful tools and features to optimize your trading strategies.

Whether you're interested in manual trading or automated strategies, JRFX ( https://www.jrfx.com/?804 ) MetaTrader 4 offers the versatility and performance needed to succeed in the dynamic world of forex trading. Don’t miss out on the opportunity to enhance your trading experience with this robust platform. Download JRFX MetaTrader 4 today and take the first step towards more efficient and effective trading.

0 notes

Text

When choosing between MetaTrader4 and MetaTrader 5, consider your trading preferences, asset class preferences, and the availability of specific features and tools that are important to you. It’s worth noting that while MT5 offers more advanced features and broader asset class coverage, MT4 still remains popular among traders due to its large user base, extensive community support, and compatibility with a wide range of trading resources.

read full article here: https://www.atoallinks.com/2023/mt4-mt5-know-the-key-differences/

0 notes

Text

What Is MetaTrader?

MetaTrader is a popular electronic trading platform used for internet trading across various financial markets, with two versions: MT4 and MT5. MT4, launched in 2005, is favored for forex trading, offering customization and algorithmic trading. MT5 supports a wider range of asset classes, including cryptocurrency, and provides enhanced features like web and mobile accessibility, analytical tools, and trade signals. With its user-friendly interface and comprehensive resources, MetaTrader is a top choice for traders seeking efficient management of multiple accounts and execution of trading strategies. Brokers Review offers tools and detailed reviews to help traders find the ideal Forex broker.

0 notes

Text

Mt4 Grey Label

Benefits of Using an MT4 Grey Label Solution

Brand Recognition: By using a Grey Label solution, brokers can build brand recognition and loyalty among their clients.

Customization: Brokers can customize the platform to match their branding and business requirements, including logo, colors, and layout.

Advanced Features: MT4 offers a wide range of advanced trading features, including technical analysis tools, automated trading capabilities, and customizable indicators.

Reliability: MT4 is known for its reliability and stability, ensuring a seamless trading experience for clients.

Access to Markets: Brokers can offer their clients access to a wide range of markets, including forex, commodities, and indices.

Security: MT4 Grey Label solutions are designed with security in mind, ensuring that client funds and data are protected.

How Does an MT4 Grey Label Solution Work?

An MT4 Grey Label solution works by providing brokers with a fully branded version of the MT4 platform. The broker’s clients can then download and install this branded platform to start trading. The broker retains full control over their clients’ accounts, including deposits, withdrawals, and trading activities.

Key Features of an MT4 Grey Label Solution

Branding: The platform is fully branded with the broker’s logo, colors, and other branding elements.

Trading Tools: MT4 offers a wide range of trading tools, including charts, indicators, and analysis tools, to help traders make informed decisions.

Mobile Trading: Clients can trade on the go using the mobile version of the platform, available for iOS and Android devices.

Automated Trading: MT4 supports automated trading strategies, allowing clients to execute trades automatically based on predefined criteria.

Multi-Language Support: The platform supports multiple languages, making it accessible to clients around the world.

Technical Support: Brokers using an MT4 Grey Label solution typically have access to technical support from the platform provider.

Conclusion

In conclusion, an MT4 Grey Label solution offers brokers a cost-effective way to offer the popular MT4 trading platform under their own brand name. By leveraging the advanced features and functionality of MT4, brokers can provide their clients with a reliable and secure trading experience while building brand recognition and loyalty.

0 notes

Text

LegoMarket.co — форекс-брокер, предлагающий т��рговые платформы MT4 и MT4 Mobile.

0 notes

Text

What Are the Key Factors to Consider When Selecting a Forex Platform in the UK?

Selecting a Forex platform in the UK demands careful consideration of several crucial factors to ensure a smooth and successful trading experience. Here are key aspects to contemplate when choosing a Forex platform in the UK:

Regulation and Licensing (FCA Compliance): One of the foremost considerations is the platform's regulatory status. Ensure the broker is regulated by the Financial Conduct Authority (FCA) in the UK. FCA regulation guarantees adherence to strict financial standards, offering traders a layer of protection against fraudulent activities and malpractices.

Security and Fund Protection: Check for mechanisms ensuring the safety of funds. FCA-regulated brokers are required to segregate client funds in separate accounts and provide coverage through the Financial Services Compensation Scheme (FSCS), which insures investments up to £80,000 per client in case of insolvency or financial mishaps.

Trading Instruments and Options: Assess the variety of trading instruments available on the platform. A diverse range of currency pairs, commodities, indices, and stocks can offer better trading opportunities and flexibility for diversification.

Trading Costs and Fees: Evaluate the fee structure of the platform, including spreads, commissions, overnight fees, and any hidden charges. Low transaction costs can significantly impact profitability, especially for frequent traders.

User-Friendly Interface and Trading Tools: A user-friendly interface and robust trading tools are essential for executing trades efficiently. Look for platforms that offer intuitive interfaces, advanced charting tools, technical analysis indicators, and other features aiding decision-making.

Trading Platforms and Technology: Consider the trading platforms offered by the broker. MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are widely popular, offering comprehensive functionalities. Additionally, assess mobile trading apps for on-the-go access.

Customer Support and Service: Reliable customer support is crucial for resolving issues promptly. Check the availability and responsiveness of customer service channels, including live chat, email, and phone support.

Educational Resources and Research Tools: Quality educational resources, market analysis, and research materials provided by the broker can be invaluable for traders, especially beginners. Look for platforms offering webinars, tutorials, and daily market insights.

Reputation and User Reviews: Investigate the broker's reputation and read user reviews. Real experiences shared by traders can provide insights into the platform's reliability, execution speed, and overall customer satisfaction.

Demo Account Availability: Opt for brokers offering demo accounts. These accounts allow you to practice trading strategies in a risk-free environment, enabling you to familiarize yourself with the platform's features before investing real money.

By considering these critical factors, traders can make informed decisions while selecting a Forex platform in the UK that aligns with their trading goals, risk tolerance, and preferences.

#brokers in uk#top uk brokers#best uk brokers forex#top 3 forex brokers in uk 2023#Top 3 Forex trading platforms#Forex trading in the UK#affilate marketing#finance#investment

1 note

·

View note

Text

Exness is a leading online forex broker that provides traders with a user-friendly and reliable trading platform. The platform offers a range of features and tools that cater to the needs of both novice and experienced traders.

Exness a good broker?

Exness is a real, legitimate broker that is not a scam or fake company. Here are some of the key facts that support this: Exness is regulated by several top-tier financial authorities like CySEC and FSA. This ensures they follow strict standards and comply with regulations.

One of the key features of the Exness platform is its simplicity. The platform is easy to navigate, with a clean and intuitive interface that makes it easy for traders to find the tools they need. The platform also offers a range of educational resources, including webinars and tutorials, to help traders improve their skills and stay up-to-date with the latest market trends.

Another important feature of the Exness platform is its reliability. The platform is powered by cutting-edge technology that ensures fast and reliable trade execution, even during periods of high market volatility.

Is Exness good for beginners?

In conclusion, Exness is undeniably a suitable trading platform for beginners. Its user-friendly interface, abundance of educational resources, low minimum deposit requirement, flexible leverage options, and reliable customer support make it an excellent choice for those starting their trading journey.

The Exness platform also offers a range of trading instruments, including forex, commodities, indices, and cryptocurrencies. Traders can choose from a range of account types, including standard accounts, ECN accounts, and professional accounts, depending on their trading style and experience level.

Can I trade on Exness without verification?

Exness accounts need to be fully verified before all trading functions are made active and deposit limits are completely lifted. A 30-day time limit to fully verify begins as soon as a first-time deposit is made, after which the only account action that is active is withdrawals.

How much does Exness charge per trade?

For forex trading, Exness charges a commission of $3.5 per standard lot, while other instruments, such as commodities and indices, incur varying commission rates. Additionally, Exness offers a commission-free trading option known as Zero Accounts, which involves a wider spread but eliminates commission charges.

Can I trade with $10 in Exness?

Yes, you can trade with only 10 dollars on Exness. However, it is important to keep in mind that your profits will be limited with such a small trading account.

Does Exness use MT4 or MT5?

Exness Trade is a bespoke trading platform designed by Exness and supports MT5 trading accounts. It can also be used to manage MT4 and MT5 trading accounts in the mobile Personal Area (PA).

What type of trading is Exness?

multi-asset brokerage

Exness is a multi-asset brokerage offering products and services relating to the trade of CFDs on instrument groups, including forex, commodities (metals and energies), indices, stocks and cryptocurrency.

What is the minimum deposit for Exness broker?

Exness offers a minimum deposit as low as $1, making it more accessible for traders with smaller capital. Ava Trade: Ava Trade is another established broker that offers a diverse range of trading instruments and platforms. However, Exness has an edge when it comes to competitive spreads.

Why can't I withdraw from Exness?

Ensure that the account made from/to is in your name. The withdrawal amount is higher than the deposited amount. Before any profit can be withdrawn from a trading account, the full amount deposited into that trading account with a bank card must be completely withdrawn. Take note of the payment rules for withdrawals.

The disadvantages of Exness.

Spread markup: While the Exness Zero Account offers commission-free trading, there is a spread markup, which may increase trading costs for some traders.

Overall, the Exness platform is an excellent choice for traders who are looking for a reliable and user-friendly trading platform. With its range of features and tools, as well as its commitment to security and customer support, Exness is a trusted partner for traders around the world.

1 note

·

View note

Text

Broker In Focus: Fxglory - Is It Worth Giving A Try?

Fxglory is an offshore broker that allows trading in the forex market and commodities. The broker is not licensed by a respected regulatory body like the FCA or CySEC and is incorporated outside of the United States in Saint Vincent and the Grenadines. However, it has developed a reputation as one of the most dependable companies in the sector despite it currently lacking any regulatory licences. Traders of any level can take advantage of Fxglory’s flexibility, usability, and astounding professionalism. It further provides excellent trading tools, reliable trade execution, and enormous leverage available on the market–1:3000.

Fxglory provides simple access to a secure and comprehensive trading environment. Established in 2011, it has offices in Malaysia, Cyprus, Spain, and the UK. The office was first headquarters in the United Arab Emirates and migrated to European markets after a year of operation in the Asian financial industry. A group of financial experts founded the company with the goal of offering traders on the MetaTrader 4 trading platform a superior online trading experience with high leverage, no commissions, and quick executions.

Features Provided by Fxglory

Trading Instruments– Clients of FxGlory have access to a limited number of trading instruments. You can trade 34 currency pairings, including GBP/USD and EUR/USD. Along with oil and precious metals trading, popular cryptocurrencies like Bitcoin and Ethereum are also accessible.

Trading Accounts– Fxglory provides access to four types of trading accounts. Standard, Premium, VIP, and CIP accounts. Further, Fxglory provides one-click trading, a built-in news feed, and multilingual support for all account holders.

Trading Platform– Fxglory provides MetaTrader 4 (MT4) and a WebTrader platform. MT4 is user-friendly, sophisticated, and customisable. Additionally, FxGlory provides a web-based trading platform. WebTrader enables you to trade through an internet browser without additional program installation. A variety of devices, including Mac and PC, can be used to trade all the instruments provided by this broker.

Mobile Trading Application– All trade orders and execution types are supported by the MT4 platform, which can be downloaded for iOS and Android devices. The UI is straightforward to use, and logging in is just as quick and easy as it is on a desktop computer. You have access to trade at your fingertips.

Languages– Languages such as English, Russian, Italiano, Greek, Arabic, and German are supported by the broker.

Trading Tools– Fxglory provides highly useful trading tools such as economic calendars, margin calculators, and one-click trading.

Education– This field requires special attention because the educational materials at Forexglory are quite basic and not up-to-date.

Customer Service– You can contact the customer support team 24*5 through email and phone call service. You also have to connect to the team via live chat.

Clients– Fxglory accepts clients from countries such as Australia, Thailand, Canada, the United States, the United Kingdom, South Africa, Singapore, Hong Kong, India, France, Germany, Norway, Sweden, Italy, Denmark, United Arab Emirates, Saudi Arabia, Kuwait, Luxembourg, Qatar, etc.

Payment Options– E-commerce payment methods have grown in popularity these days. So, the broker provides a variety of deposit choices. To fund your account, you can select a method that best meets your needs, and all deposits are processed quickly and securely. You have access to multiple payment options like SticPay, American Express, Perfect Money, cryptocurrencies, WebMoney, EPay, Wire Transfer, Neteller, Skrill, PayPal, Visa, and Mastercard.

Trading Conditions

Standard Account

Commission – $0

Minimum Deposit – $1

Spread – Floating from 2 pips

Step lot size – 0.01

Leverage – Up to 1:3000

Maximum bonus – $500

Deposit bonus percentage – 50%

Minimum lot size – 0.01

Maximum lot size – 1.00

Hedge margin – 50%

Maximum position – 20

Premium Account

Commission –$0

Minimum Deposit – $1,000

Spread – Floating from 2 pips

Step lot size – 0.10

Leverage – 1:2000

Maximum bonus – $1,000

Deposit bonus percentage – 50%

Minimum lot size – 0.10

Maximum lot size – 10.00

Hedge margin – 50%

Maximum position – 100

VIP Account

Commission – $0

Minimum Deposit – $5,000

Spread – Floating from 0.7 pips

Step lot size – 0.10

Leverage – 1:300

Maximum bonus – $2,000

Deposit bonus percentage – 40%

Minimum lot size – 0.10

Maximum lot size – 1,000.00

Hedge margin – 25%

Maximum position – 1000

CIP Account

Commission – $0

Minimum Deposit – $50,000

Spread – Floating from 0.1 pips

Step lot size – 1.00

Leverage �� 1:50

Maximum bonus – $0

Deposit bonus percentage – 0%

Minimum lot size – 1.00

Maximum lot size – 5.00

Hedge margin – 100%

Maximum position – 10

Pros of Trading with Fxglory

Low minimum deposit ($1)

Provides varieties of strategies like scalping, hedging, algorithmic trading

Spreads are fixed

Clients have access to a handful of tradable instruments

The MT4 platform is available for iOS and Android devices and supports all trade orders and execution modes.

The interface is easy to navigate

Offers a wide range of payment methods, including cryptocurrency

Offers 4 types of trading accounts

Live chat is available

To protect client data, the company's website and platform employ 256-bit SSL encryption technology.

To protect the funds, it maintains cash in separate accounts and provides clients access to various risk management tools.

All accounts are swap-free

Clients from the US are accepted

Micro-lot trading is available

Cons of Trading with Fxglory

The website supports only the English language

It is unregulated

Cent accounts are not available

Customer support service is not upto the mark

Spreads are high

Complex fee structure

Does not provide an MT5 platform

Educational materials are average

Verdict

Overall, Fxglory is a reliable forex broker which provides a unique trading system and environment. Fxglory puts the priorities and needs of its clients and partners first. It works with all honesty by creating exceptional products and services. However, keep in mind that, at the moment, it does not hold any regulating licence. Always do some background checks before signing up with any broker. Furthermore, Fxglory is a good broker for both newbies and experienced traders, but the trading conditions make it more suitable for professional traders who have a large capital to trade.

0 notes