#LoanInterest

Text

Student Loan Calculator

By providing your current student loan details, you can calculate your monthly payments and visualize your loan's amortization over its term.

#StudentLoans#LoanCalculator#StudentDebt#FinancialAid#LoanPayments#Budgeting#CollegeFinances#StudentSuccess#MoneyManagement#DebtFree#EducationFunding#PayOffDebt#LoanInterest#LoanRepayment#BudgetTips#LoanAssistance#StudentResources#FinancialLiteracy#DebtRelief#LoanConsolidation#Scholarships#CollegeCosts#StudentSupport#LoanForgiveness#TuitionAssistance#FinancialPlanning

0 notes

Text

Deduction for Electric Vehicle (EV) Loan Interest

As concerns over climate change and pollution escalate, a significant shift towards cleaner modes of transportation has become imperative. Electric vehicles have emerged as a promising solution to reduce carbon emissions, air pollution, and dependence on fossil fuels. The transportation sector contributes significantly to greenhouse gas emissions, and promoting electric vehicles is a crucial step in mitigating the impact of climate change.

Financial Incentives for Electric Vehicles

Recognizing the pivotal role of electric vehicles in achieving environmental sustainability, governments across the globe are offering various financial incentives to incentivize their adoption.

To continue reading click here.

For more detailed information, visit Swipe Blogs.

0 notes

Text

What Is A Family Opportunity Mortgage And Who Qualifies?

A family opportunity mortgage is a type of loan that helps families with two or more children qualify for a mortgage at a lower interest rate. It’s important to understand the qualifications for this type of mortgage before applying, as some parents may not be able to qualify on their own. A family opportunity mortgage is a type of loan that helps families with two or more children qualify for a mortgage at a lower interest rate. It’s important to understand the qualifications for this type of mortgage before applying, as some parents may not be able to qualify on their own. The Family Opportunity Mortgage program was created in 1988 by the US Department of Housing and Urban Development (HUD).

What Is A Family Opportunity Mortgage And How It Can Benefit You?

A Family Opportunity Mortgage is a mortgage that can be used to help families buy a home together. It is a product of the Affordable Housing Act and was created in order to make it easier for families to purchase a home. The mortgage is available to families who are married, have children under the age of 26, and are making at least $75,000 per year.

The Family Opportunity Mortgage offers several benefits to qualifying family members. For example, it can help you save on your mortgage payments and allow you access to more affordable housing opportunities. Additionally, the mortgage may also provide financial stability for your family as you work towards homeownership. To apply for the Family Opportunity Mortgage, you must be married, have children under 26, and make at least $75,000 per year. The mortgage is available to families who are married, have children under 26, and are making at least $85,000 per year. The mortgage has several benefits that may interest you such as saving on your mortgage payments and access to more affordable housing opportunities.

Understanding The Requirements For Qualifying For A Family Opportunity Mortgage

Family opportunity mortgages are a type of mortgage that are available to qualified families. Qualifying for a family opportunity mortgage typically requires that the family members be married, have children under the age of 26, and reside in the same home together. In order to qualify for a family opportunity mortgage, you must meet certain requirements, including but not limited to: having children under 26 years old, being married or divorced, living in the same home as your spouse or common-law partner at least half the time during the preceding year, and having an equal credit score.

In order to find out more about what qualifies you for a family opportunity mortgage, you can contact your lender or go through their website. You can also ask your loan officer how they would handle qualifying for a family opportunity mortgage if you don’t know any of these things yourself.

Who Is Eligible For A Family Opportunity Mortgage?

A family opportunity mortgage is a loan that is available to individuals who are not related to one another. Eligibility for a family opportunity mortgage depends on the individual's financial situation and relationship with one or more other members of the family.

The individual must be living in the same household as at least one member of the family.

The individual must have been living in the same house since before 1/1/1998.

The individual must have been paying all home finance bills, including principal and interest, on time and in full.

The individual must have no outstanding debt other than student loans that are being paid off or held by the government as student loaninterest status has been terminated.

Family opportunity mortgages are available to individuals who are not related to one another and do not meet all of the qualifications listed above. In order to be eligible for a family opportunity mortgage, an individual must be living in the same house with at least one member of the family, have been living in their house since before 1/1/1998, and have paid all home finance bills on time and in full (excluding principal and interest). Additionally, an individual may only have outstanding debt from student loans that are being paid down or currently being held by the government as student loan interest status has expired (i.e., they don't owe any money beyond what they already owe).

Primary And Secondary Residences Eligible For A Family Opportunity Mortgage

A family opportunity mortgage is a loan that is available to individuals who have a primary residence in a qualified secondary residence. To qualify for a family opportunity mortgage, you must have a primary residence in a qualifying secondary residence and be able to make monthly payments on the loan amount that is equal to or greater than your monthly rent amount.

To qualify for a family opportunity mortgage, you must have a primary residence in a qualifying secondary residence and be able to make monthly payments on the loan amount that is equal to or greater than your monthly rent amount. To qualify for a family opportunity mortgage, you must have a primary residence in a qualifying secondary residence and be able to make monthly payments on the loan amount that is equal to or greater than your monthly rent amount.

How To Apply For A Family Opportunity Mortgage?

To apply for a family opportunity mortgage, you must be a U.S. citizen or permanent resident and be at least 18 years old. You must also have a credit score of at least 620 and be able to provide documentation that you are the rightful heir to your parents’ estate if they die before you turn 21.

You can find more information about family opportunity mortgages on the Fed's website. To apply for a family opportunity mortgage, you must be a U.S. citizen or permanent resident and be at least 18 years old. You must also have a credit score of at least 620 and be able to provide documentation that you are the rightful heir to your parents’ estate if they die before you turn 21.

How To Use A Family Opportunity Mortgage To Purchase A Home?

A family opportunity mortgage is a loan that is available to families who are able to qualify for the mortgage. The loan can be used to purchase a home, with the family being able to take out a different loan for each purchase. To apply for a family opportunity mortgage, you will need to provide information about your income and assets. You will also need to provide information about your housing needs and your desires for the home you are buying. Once all of these information have been gathered, you will be able to undergo a application process that will require some paperwork and signatures. Once the application has been approved, you will be able to take out the loan and purchase your home. The family opportunity mortgage is a great way to help families buy a home, and it can be an excellent option for those who are looking to purchase a home in a timely manner.

Conclusion

A Family Opportunity Mortgage can be a great way to buy a home. It provides an opportunity for family members to get together and purchase a home together. The primary residences that are eligible for a Family Opportunity Mortgage are secondary residences, which are homes that are used as primary residences by at least one of the family members. The Secondary Residence Eligibility requirements vary for each mortgage company, but generally, the house must be in good condition and have been owned by the borrower for at least five years.

0 notes

Link

Partnership

Association of two or more persons who agree to do business carried by all or any of them and share its profits and losses.

Partner: Members of Partnership.

Firm: All members combined together to form a partnership is collectively known as Firm.

Firm Name- The name under which Partnership Business is carried on.

Partnership Deed:

A written agreement signed by all partners, that contains terms and conditions of Partnership such as,

Description of Partners,

Description of Firm

Nature of Business,

Address of Firm

Interest Rate on Partners’ Loan

Interest Rate on Capital & Drawing

Capital Contribution of Each Partner

Profit Sharing Ratio

Provisions related to Admission, retirement & Death of Partner

Remuneration to Partners etc.

Provisions of Partnership Act, 1932 in Absence of Partnership Deed

0 notes

Text

Housing Loan Interest Rate Advice for Loan Applicants

Housing Loan Interest when deciding to apply for a mortgage loan, you must be aware of the home loan interest rate that you will have to pay during the tenure of the loan.

https://bit.ly/3rBPaUZ

0 notes

Photo

Points to remember before you take a Home loan from a Bank or an NBFC.

#BankLoan#NBFC#HomeLoan#HousingLoan#Loan#LoanInterest#NewHome#Apartment#FlatsforSale#Coimbatore#TownandCityDevelopers#KGGroup

0 notes

Link

Consumers sometimes ask questions about loan interest rates like “what are the interest rates?” and “how are interest rates calculated?” Therefore, the key is to understand how these loans work, so you aren’t surprised by any of the fees or costs for your payday loan. It’s important to learn how payday loan interest rates work. Since the last thing you want is take out a loan that could cost you a small fortune.

Learn more..

0 notes

Text

आज से कार, होम और अन्य सभी लोन लेना हुआ सस्ता, SBI ने घटाई ब्याज दर

चैतन्य भारत न्यूज

नई दिल्ली. रिजर्व बैंक ऑफ इंडिया के गवर्नर शक्तिकांत दास ने दो दिन पहले ही सभी बैंकों से कहा था कि, वह जल्द से जल्द रेपो रेट कट का फायदा ग्राहकों तक पहुंचाए। उनकी अपील के बाद ही बुधवार को स्टेट बैंक ऑफ इंडिया ने मार्जिनल कॉस्ट ऑफ फंड बेस्ड लेंडिंग रेट्स (MCLR) में 5 पॉइंट्स की कटौती कर दी है। इस कटौती के बाद कार लोन, होम लोन और अन्य तरह के सभी लोन सस्ते हो गए हैं।

जानकारी के मुताबिक, बैंकों ने सभी तरह के लोन के लिए ब्याज दरों में कटौती कर दी है। इस कटौती के बाद एक साल के लिए लोन पर ब्याज दर 8.45 प्रतिशत प्रतिवर्ष से घटकर 8.40 प्रतिशत प्रतिवर्ष हो गई है। एसबीआअई ने एक बयान में कहा कि, 'इसके परिणामस्वरूप एमसीएलआर से जुड़े सभी लोन पर ब्याज दर 10 जुलाई, 2019 से पांच आधार अंक घट जाएगा।' बता दें वित्तीय वर्ष 2019-20 में यह तीसरी बार है जब रेट दर में कटौती हुई है। इस कटौती से होम लोन 10 अप्रैल 2019 के बाद 0.20 फीसदी सस्ता हो गया है।

गवर्नर शक्तिकांत दास ने यह भी कहा था कि, 'रेपो रेट में अब तक 75 प्वाइंट्स की कटौती की जा चुकी है। लेकिन, ग्राहकों तक इसका एक तिहाई लाभ ही पहुंच पाया है।' उन्होंने आगे बताया कि, 'पहले के मुकाबले रेट कट ट्रांसमिशन में अब कम समय लगता है।' शक्तिकांत दास के मुताबिक, इस काम में पहले कम से कम 6 महीने लगते थे, लेकिन अब महज 2 से 3 महीने में ही इसका लाभ ग्राहकों तक पहुंचने लगा है।

क्या है एमसीएलआर

मार्जिनल कॉस्ट ऑफ फंड्स बेस्ड लेंडिंग रेट्स (MCLR) भारतीय रिजर्व बैंक द्वारा तय की गई एक पद्धति है जो कॉमर्शियल बैंक्स द्वारा ऋण ब्याज दर तय करने के लिए इस्तेमाल की जाती है। इसे भारत में नोटबंदी के बाद लागू किया गया है जिसकी वजह से लोन लेना थोड़ा आसान हो गया है। जब आप किसी बैंक से कर्ज लेते हैं तो बैंक द्वारा लिए जाने वाले ब्याज की न्यूनतम दर को आधार दर कहा जाता है। लेकिन अब इसी आधार दर की जगह बैंक एमसीएलआर का इस्तेमाल कर रहे हैं। इसकी गणना धनराशि की सीमांत लागत, आवधिक प्रीमियम, संचालन खर्च और नकदी भंडार अनुपात को बनाए रखने की लागत के आधार पर की जाती है। यह आधार दर से थोड़ा सस्ता होता है। इसलिए होम लोन जैसे लोन्स भी इसके लागू होने के बाद से काफी सस्ते हुए हैं।

Read the full article

#loan#loaninterest#MCLR#mclrinhindi#mclrmeaninginhindi#rbi#reservebankofindia#sbi#sbicarloan#sbihomeloan#sbiloaninterestrate#sbiloanrate#sbipersonalloan#shaktikantdas#whatismclr#whatismclrinhindi#आरबीआईगवर्नरकानाम#एमसीएलआर#क्याहैएमसीएलआर#गवर्नरशक्तिकांतदास#मार्जिनलकॉस्टऑफफंड्सबेस्डलेंडिंगरेट्स#रिज़र्वबैंकऑफइंडिया#शक्तिकांतदास#स्टेटबैंकऑफइंडिया

0 notes

Link

The rules on interest for loans between related parties This article discusses how rules on loans with below-market interest rates interact with rules on transactions with related parties, including how to avoid imputed interest, and how the net investment income tax applies.

0 notes

Link

Mahindra Finance is one of the most diversified non-banking financial companies (NBFCs) around with wide-ranging businesses such as personal loans. These loans serve as an ideal tool for many seeking to achieve their financial goals over time. While some might want funds to ensure their wards get the best education, others would want money to ensure a lavish wedding. All that can be fulfilled by virtue of Mahindra Finance Personal Loan. You can apply for the loan either online or offline and hope the lender nods to your application. However, it would be worth paying attention to interest rates, eligibility, and other aspects before applying for a loan.

0 notes

Text

Understanding interest on intercompany foreign loans http://bit.ly/loaninterests pic.twitter.com/ugt0Zuiph9

Understanding interest on intercompany foreign loans http://bit.ly/loaninterests http://pic.twitter.com/ugt0Zuiph9

Understanding interest on intercompany foreign loans http://bit.ly/loaninterests pic.twitter.com/ugt0Zuiph9 published first on http://ift.tt/2ljLF4B

0 notes

Photo

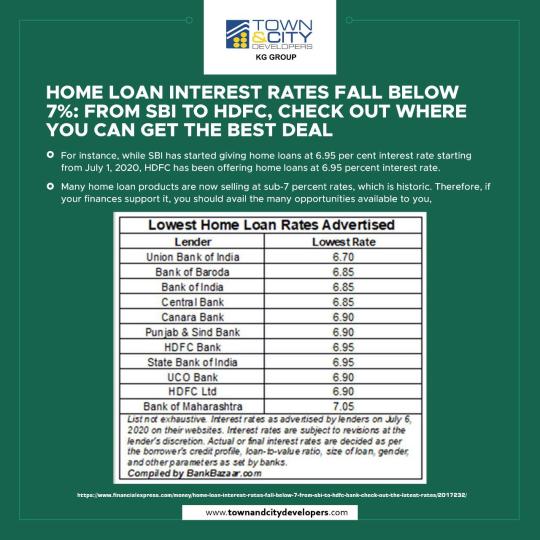

Check out where you can get the best deal on Home Loan Interest 👇🏦

#HomeLoan#LoanInterest#NewHome#BankLoan#Home#HomeLoanRate#Coimbatore#Apartments#1BHKFlats#2BHKFlats#TownandCityDevelopers#KGGroup

0 notes

Photo

Know about 6-Major Factors that Influence your Home Loan's interest rate here

#BankLoan#Bank#HousingLoan#HomeLoan#Loan#Interest#LoanInterest#CreditScore.#LoanAmount#EMI#JobProfile#LTVRatio#InterestRate#Employee#TownandCityDevelopers#KGGroup#FlatSaleCoimbatore#ApartmentSaleCoimbatore#AffordableFlats#Township#Construction

0 notes

Text

Understanding interest on intercompany foreign loans http://bit.ly/loaninterests pic.twitter.com/ugt0Zuiph9

Understanding interest on intercompany foreign loans http://bit.ly/loaninterests http://pic.twitter.com/ugt0Zuiph9

Understanding interest on intercompany foreign loans http://bit.ly/loaninterests pic.twitter.com/ugt0Zuiph9 published first on http://ift.tt/2ljLF4B

0 notes

Text

Understanding interest on intercompany foreign loans http://bit.ly/loaninterests pic.twitter.com/ugt0Zuiph9

Understanding interest on intercompany foreign loans http://bit.ly/loaninterests http://pic.twitter.com/ugt0Zuiph9

Understanding interest on intercompany foreign loans http://bit.ly/loaninterests pic.twitter.com/ugt0Zuiph9 published first on http://ift.tt/2ljLF4B

0 notes