#Janet Yellen

Text

By Jake Johnson

Common Dreams

Aug. 29, 2023

"The evidence presented in Treasury's report challenges the view that worker empowerment holds back economic prosperity," a department economist wrote.

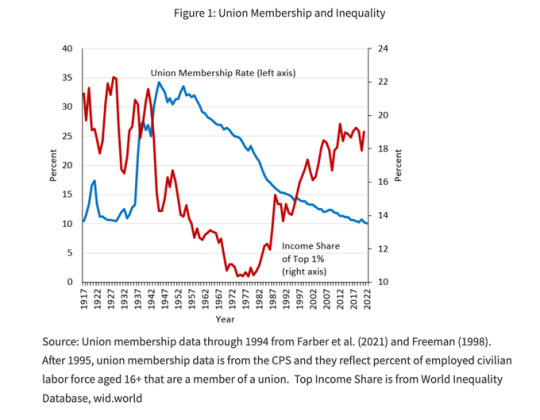

A report released Monday by the U.S. Treasury Department argues that labor unions are critical to combating income inequality, which has risen dramatically in recent decades as union membership has declined and real wages have largely stagnated.

The report estimates that unions boost the wages of their members by between 10% and 15%, an impact that spreads to the broader economy as nonunion workplaces compete for employees.

"Unions also improve fringe benefits and workplace procedures such as retirement plans, workplace grievance policies, and predictable scheduling," the report notes. "These workplace improvements contribute substantially to middle-class financial stability and worker well-being. For example, one study has estimated that the average worker values their ability to avoid short-notice schedule changes at up to 20% of their wages."

In a summary of the report's findings, Treasury Department economist Laura Feiveson wrote that "increased unionization has the potential to contribute to the reversal of the stark increase in inequality seen over the last half-century."

"All in all, the evidence presented in Treasury's report challenges the view that worker empowerment holds back economic prosperity," wrote Feiveson. "In addition to their effect on the economy through more equality, unions can have a positive effect on productivity through employee engagement and union voice effects, providing a roadmap for the type of union campaigns that could lead to additional growth."

The Treasury Department report was released less than a week after UPS Teamsters ratified a five-year contract that includes substantial wage increases, a deal secured after the union threatened a nationwide strike.

The United Auto Workers (UAW) union is also looking to win a major pay increase for General Motors, Ford, and Stellantis employees. Last week, 97% of UAW members who participated in the vote opted to authorize a strike if contract talks with the three automakers fail.

Meanwhile, Hollywood writers and actors are still on strike, and others across the country—including nurses, hotel workers, and city employees—have walked off the job in recent weeks to demand better pay, benefits, and conditions.

The wave of strikes followed significant labor victories in 2022, a year in which Starbucks employees organized hundreds of locations across the U.S.—victories that contributed to an increase in the total number of U.S. workers in unions last year.

The union membership rate, however, fell from 10.3% in 2021 to a record-low 10.1% in 2022 as nonunion jobs grew at a faster rate than union jobs.

In a Monday speech outlining her department's findings, Treasury Secretary Janet Yellen said that unions are "critically important to workers' well-being."

"Unionization also has spillover effects," Yellen added. "Competition means workers at nonunionized firms may see increased wages too. Heightened workplace safety norms can pull up whole industries. Benefits also spill over to workers' families and communities."

Our work is licensed under Creative Commons (CC BY-NC-ND 3.0). Feel free to republish and share widely.

50 notes

·

View notes

Text

Ultrawealthy Americans enjoy so many ways to avoid taxes that Gary Cohn, former President Donald Trump’s director of the National Economic Council, once wisecracked, “Only morons pay the estate tax.”

On Monday, a group of four Democratic senators urged Treasury Secretary Janet Yellen to crack down on a host of specially-designed trusts and financial vehicles that allow the wealthiest individuals to shield their personal fortunes and pass down massive inheritances tax-free.

The letter, from Sens. Elizabeth Warren, Bernie Sanders, Chris Van Hollen, and Sheldon Whitehouse, laid out a series of potential IRS regulations that would make trusts, particularly, less attractive as tax shelters for the 1%.

“Billionaires and multi-millionaires use trusts to shift wealth to their heirs tax-free, dodging federal estate and gift taxes,” the senators wrote. “And they are doing this in the open: Their wealth managers are bragging about how their tax dodging tricks will be more effective in the current economy.”

Only about 0.1% of Americans pay estate taxes, despite thousands of families having fortunes larger than the current $25.48 million exemption.

When President Joe Biden promised on the campaign trail to raise taxes on the richest Americans, it unleashed a race to set up the kinds of legal tax shelters that would protect their inheritable assets from the estate tax.

They feared Biden would lower the estate tax exemption — which Republicans under Trump had raised to its all-time high — and resuscitate proposed IRS rules that make it more difficult to use trusts to avoid taxes on substantial inheritances.

But Democrats dropped their plans to raise inheritance taxes early on in the Biden administration. And in their letter, the lawmakers argued there is far more the IRS can do to crack down on the “shell games” the ultrawealthy use to shield huge generational wealth transfers from taxation.

Popular schemes they highlighted include families using special vehicles, called family limited partnerships, to understate the values of their estates; placing assets that will rise in value, such as a stock portfolio, inside a tax-shielded trust before the price can rebound; and cycling stocks and other assets through a grantor trust to avoid inheritance taxes.

The current economy, where stocks have lost double digits in value, actually supercharges some of these tax shelters because they shield appreciation from taxation.

“As the richest Americans celebrate and take advantage of these favorable tax opportunities, middle-class families struggle with inflation and Republicans threaten austerity measures and the end of Social Security and Medicare,” the lawmakers wrote.

They argued that the Treasury Department could crack down on these tax-avoidance vehicles without action from Congress.

It can revoke a rule that currently exempts transfers between grantors and grantor trusts from taxes, and it can require grantor trusts to hold a minimum value so they would be less useful as a pass-through for avoiding taxes. And it can clarify and rein in the kinds of asset sales and valuation practices tax planners have abused to wedge their clients’ enormous estates into various tax-shielded trusts and partnerships.

“Although the details of various trusts may differ, the result of wealthy individuals transferring millions in assets to heirs tax-free does not,” they continued. “The ultra-wealthy at the top of the socioeconomic ladder live by different rules than the rest of America.”

#us politics#news#huffington post#2023#tax the rich#tax the 1%#tax the wealthy#janet yellen#department of treasury#sen. elizabeth warren#sen. bernie sanders#sen. Chris Van Hollen#sen. sheldon whitehouse#irs#internal revenue service#estate taxes#tax shelters#biden administration

71 notes

·

View notes

Text

Treasury Secretary Janet Yellen on Tuesday offered her strongest public support yet for the idea of liquidating roughly $300 billion in frozen Russian Central Bank assets and using them for Ukraine’s long-term reconstruction.

“It is necessary and urgent for our coalition to find a way to unlock the value of these immobilized assets to support Ukraine’s continued resistance and long-term reconstruction,” Yellen said in remarks in Sao Paulo, Brazil, where Group of 20 finance ministers and central bank governors are meeting this week.

“I believe there is a strong international law, economic, and moral case for moving forward. This would be a decisive response to Russia’s unprecedented threat to global stability,” she said.

The United States and its allies froze hundreds of billions of dollars in Russian foreign holdings in retaliation for Moscow’s invasion of Ukraine. Those billions have been sitting untapped as the war grinds on, now in its third year, while officials from multiple countries have debated the legality of sending the money to Ukraine. More than two-thirds of Russia’s immobilized central bank funds are located in the EU.

6 notes

·

View notes

Text

The US Treasury Secretary calls Brazil's tax reform 'historic'

Reform is one of the main measures Lula and Economy Minister Fernando Haddad advocate for

On Tuesday, February 27, US Treasury Secretary Janet Yellen called the Brazilian tax reform approved by the National Congress last year "truly historic”. According to her, the measure may attract foreign investments to the country.

“I congratulate Minister [of the Economy, Fernando] Haddad for proposing truly historic tax reform. This will make business easier, including for US companies to invest in Brazil.”

The reform is one of the main measures the Lula government and minister of economy Fernando Haddad have been advocating for, which promises to modernize Brazil’s tax system by implementing a taxation model currently used in many developed countries. The government expects to send the bill to the National Congress in March.

Yellen participated in the event organized by the American Chamber of Commerce for Brazil (Amcham), part of the parallel activities of the G20 Summit, held in São Paulo. The event also had Marina Silva, Brazil’s minister of the environment.

Continue reading.

#brazil#brazilian politics#politics#united states#us politics#economy#international politics#janet yellen#image description in alt#mod nise da silveira

4 notes

·

View notes

Link

40 notes

·

View notes

Text

2 notes

·

View notes

Text

New Post has been published on Books by Caroline Miller

New Post has been published on https://www.booksbycarolinemiller.com/musings/the-revolution-of-the-species/

The Revolution Of The Species

Senator John Fetterman (D) recently shared this observation with the public. You all should need to know that America is not sending their best and brightest to Washington, D. C. Congressional in-fighting, and scandals among the elected elite support the senator’s view. Bureaucrats add to the confusion. As specialists in their fields, they can run circles around the people’s representatives. For example, while Congress squabbles about sending money to support Ukraine’s war, the Secretary of the Treasury, Janet Yellen, proposes that President Joe Biden bypass the government’s legislative branch and delegate Russia’s frozen assets to Volodymyr Zelenskyy. Adding to the fog is technology, an industry politicians little know or understand. As a result, innovators in Silicon Valley have pursued Artificial Intelligence (AI) unfettered to a degree that it has become as great a danger to us as the atomic bomb. In 2018, the Brookings Institute issued a report on the benefits and dangers of AI and provided recommendations to ensure the technology did no harm. It collected dust like most reports. But now, five years later, tech giants, have come running to Congress seeking regulations, fearing they have released an evil genie from its bottle and hoping to spread the blame. While the tech world seeks legal protection from the potential damage their invention can do, the rest of us should consider what human traits these innovators have passed along to their powerful machines. Given our current capacity to blow up the planet’s resources, including polluting its air, what could go wrong? The advent of AI will alter our lives, no doubt, but it won’t create a blank slate upon which to build our utopian dream. As historian Timothy Snyder warns, we can’t avoid dragging into our new world the debris of the past. Economic inequality will be one such and should social mobility die, the scholar predicts democracy [will] give way to oligarchy, opening the door to tyranny. Donald Trump has given us a glimpse of that future, a society where citizens are encouraged to sleepwalk through their existence, obeying their leaders without question. What these sheep mustn’t see, says Snyder, is that most of those who held power in the past will continue to hold it in the future, making changes wrought by insurrections or revolutions largely an illusion. True, the technological revolution has brought a world of information to our fingertips, but the price has been the loss of our privacy — data that the oligarchs of AI gather and sell for their immense profit. Elon Must is one of these. Having accumulated much of the world’s capital, he imagines he owns the rest of us and dares to wade into international politics, changing the course of our lives without the authority of a single vote cast at the ballot box. Such hubris leaves us to ponder the legacy of these innovators. They have given us convenience and access to endless information, but they are the purveyors of disinformation and deep fakes too. By these means, society finds itself not merely divided but fractured, and to a degree that makes determining the public good seem impossible. Will their invention, AI, come to sense the frailty of our species? As repositories of all that we know, will they see how we have dehumanized ourselves by our obsession with money, pleasure, and the pursuit of war? If so, will these lungless servants become our masters, caring nothing about us and our environment? I doubt they will miss the meadowlark ‘s song. Forgive these dystopian questions, but it’s time to consider our status as naked apes. The universe takes little notice of us. And, Nature appears to be turning its back on our species. Or, perhaps, we were the first to turn away, preferring to focus on ourselves and the petty differences in our religions, the color of our skin, and our varying lifestyles. When inconsequential variations like these become matters of life and death, are we worthy of respect even from our miraculous machines? More likely, they will judge us against other creatures on the planet and find we are not the best and brightest. I must say that I have rarely seen a community come together in order to meet a common need in a manner as beautiful as that of a handful of birds at a feeder. Craig D. Lounsbrough

#architects of AI#artificial intelligence#Brookings Institute on AI#Congressional scandals#Craig D. Lounsbrough#dystopian question on AI#Elon Musk#Funding Ukraine war#Janet Yellen#regulation of AI#Senator John Fetterman#Timothy Snyder

2 notes

·

View notes

Text

Treasury Secretary Janet Yellen defended the Internal Revenue Service in a speech Tuesday against repeated threats from Republicans to cut the agency’s funding.

“Playing politics with IRS funding is unacceptable. Cutting it would be damaging and irresponsible,” Yellen said.

The IRS was allocated an influx of $80 billion by the Democrats’ Inflation Reduction Act, which passed last year. The funds are intended to help crack down on tax cheats and improve taxpayer service.

But the funding has become politically controversial.

Most recently, House Republicans voted to rescind $14.3 billion from the IRS to pay for an emergency aid package for Israel in the wake of the Hamas terrorist attacks, but the bill is unlikely to even get brought up for a vote in the Democrat-controlled Senate.

Newly minted House Speaker Mike Johnson said the IRS cuts would offset the spending for Israel, but independent budget experts have repeatedly said that taking money away from the IRS’ enforcement actions will actually add to the deficit. In fact, the nonpartisan Congressional Budget Office said last week that cutting $14.3 billion from the IRS would reduce the amount of tax revenue the agency can collect by $26.8 billion over 10 years.

The House GOP has made several efforts to claw back some IRS funds since taking control of the chamber in January, and some Representatives have even called for abolishing the IRS altogether. Earlier this year, Republicans were successful in rescinding $20 billion from the IRS as part of a deal to address the debt ceiling.

Many Republicans claim the IRS will use the money to hound middle-class taxpayers and small business owners, though the Biden administration has said that taxpayers earning less than $400,000 a year won’t face an increase in taxes due to the new funding.

“Let me be as clear as possible. The IRS agenda in using Inflation Reduction Act funds is as follows: If you are middle- or low-income, better service; if you are wealthy, more scrutiny,” said IRS Commissioner Danny Werfel in a speech he gave Tuesday following Yellen’s remarks.

IRS IMPROVEMENTS

The Biden administration is eager to show how the new funding is helping the IRS improve its taxpayer services and ramp up enforcement efforts.

“The new funding is driving change across the IRS, and we are seeing a wave of improvements that the agency hasn’t seen in a generation,” Werfel said.

During the 2023 filing season, the IRS was able to answer 3 million more calls and cut phone wait times to three minutes from 28 minutes compared with the year before after hiring 5,000 new customer service representatives. And by ramping up enforcement on millionaires this year, the IRS has collected $160 million in back taxes.

The IRS has also already met its goal, set earlier this year, to make sure taxpayers can respond to all IRS correspondence online. Previously, there were certain forms that could only be responded to on paper through the mail. As a result of this change, the IRS estimates more than 94% of individual taxpayers will no longer have to send mail to the agency.

The IRS has also put a plan in motion to digitize all paper-filed tax returns by 2025. The move is expected to cut processing times in half and speed up refunds by four weeks.

There are more improvements the IRS expects to roll out next year.

For example, the existing online tool known as “Where’s My Refund?” will be able to give taxpayers more detailed information about the status of their refund after filing their federal tax return, including whether the IRS needs them to respond to a letter requesting additional information.

The IRS is also expecting to provide more in-person tax filing support at its Taxpayer Assistance Centers. Taxpayers can go to those sites to receive free help from trained volunteers. The agency’s goal is to increase the number of taxpayers receiving free tax preparation help by around 50,000 in filing season 2024.

While these improvements are intended to give taxpayers fewer reasons to call the IRS, new technology is cutting down on wait times when they have to pick up the phone. The main IRS line now has a call-back option when the expected wait time exceeds 15 minutes. A caller can hang up and receive a call back later.

In addition, the IRS is currently working on building its own free tax filing program, known as Direct File, that will launch as a limited pilot program next year and be available to some taxpayers in 13 states.

#us politics#news#cnn#cnn politics#2023#biden administration#Janet Yellen#department of Treasury#internal revenue service#IRS funding#republicans#conservatives#Inflation Reduction Act#us house of representatives#house republicans#rep. Mike Johnson#aid for Israel#Congressional Budget Office#Danny Werfel#federal tax returns#tax returns#irs improvements

12 notes

·

View notes

Text

As someone recently said: We are run by psychos

#military industrial complex#endless war#american empire#american imperialism#america is the bad place#janet yellen

6 notes

·

View notes

Text

First Republic Bank Bailout

First Republic Bank Bailout

First Republic Bank will be getting a $30 billion rescue package from other major banks, after two other major banks failed this week.

First Republic Bank is based in San Francisco, and serves mostly venture capital-backed companies and tech startups. Before this week, it had deposits totaling over $175 billion. But like many other similar banks, it has recently seen a major run of withdrawals.…

View On WordPress

#bank bailout#bank crash#banking#FDIC#first republic bank#investment bank#Janet Yellen#Martin Gruenberg#Michael Hsu

4 notes

·

View notes

Text

Brazil Finance Minister tells U.S. Treasury Secretary country is “worried” for Argentina’s economy

Brazil's Finance Minister Fernando Haddad told U.S. Treasury Secretary Janet Yellen of fears the situation could "affect the political destiny" of Argentina

Brazilian Finance Minister Fernando Haddad expressed serious concerns on Thursday that Argentina’s economic challenges and a major drought there could affect the country’s “political destiny” and usher in an extremist government.

“We are worried because this situation may affect the political destiny of Argentina,” Haddad told U.S. Treasury Secretary Janet Yellen in a meeting on the sidelines of a Group of Seven (G7) finance ministers meeting in Niigata, Japan.

Haddad said Brazil was keeping a close eye on Argentina, where the current drought could reduce exports by 20%, mindful of previous far-right political shifts elsewhere in Latin America.

“We are worried because this situation may affect the political destiny of Argentina, and we have seen on our continent that there has been an increase in extreme-right governments,” Haddad said.

Speaking with reporters after the meeting, Haddad said he raised the issue with Yellen because Argentina needed the assistance of the International Monetary Fund. The United States is the largest shareholder in the global lender.

Continue reading.

#brazil#politics#brazilian politics#economy#united states#argentina#argentine politics#us politics#fernando haddad#international politics#foreign policy#janet yellen#mod nise da silveira#image description in alt

5 notes

·

View notes

Text

The Dollar Is In DANGER! | Yellen Admits The Obvious, U.S. Hegemony At Risk

So Janet Yellen just had an interview With CNN and she finally admits the Obvious that the sanctions have Backfired and I think we kind of knew This for months now but it's really Telling that the head of the U.S Treasury can no longer hide the truth And let's travel back to early 2022 when Yellen told the world the aim of the Russian sanctions not the sanctions were Engineered to devastate the…

View On WordPress

#brics#brics currency#brics new currency#brics vs g7#china dumping us dollar#china dumping us treasuries#de-dollarization#dollar#dollar hegemony#economic news#fiat currency collapse#gold backed currency#investing news#janet yellen#janet yellen interview#petrodollar#petroyuan#sanctions backfire#sanctions backfire on west#sean foo#us dollar#us dollar collapse#us dollar hegemony#us sanctions backfired#world reserve currency#yellen admits sanctions backfired

2 notes

·

View notes