#Income tax service provider

Text

Best Brand Registration Service Providers in India

Get Trademark Registration online in India with Indian Salahkar. Learn about documents required & Brand Registration process. Get the Free Consultation on Trademark Registration Services.

#trademark registration#india#best#accounting audit services#business setup#business advisory#taxation and support services#GST registration service provider#company registration in India#partnership firm registration online#Income tax service provider#best accounting firm in India

0 notes

Text

Income Tax Notice

Income Tax Notice

The Income Tax Department issues notices for various reasons such as failure to file income tax returns, errors in filed returns, or requests for additional documents or information.

Receiving a notice isn't necessarily alarming, but it's essential for the taxpayer to comprehend the notice, its nature, and the instructions provided. Taking appropriate steps to comply is crucial.

efiletax offers a comprehensive range of services for families and businesses to assist them with maintaining compliance. If you receive an income tax notice, contact a Tax Expert at efiletax to understand the notice and determine the necessary course of action.

Let's explore the different types of notices or communications issued by the Income Tax Department.

Income Tax Notices are served in various ways as per the Income Tax Act, 1961. Here's a simplified explanation:

Recipient: Notices are directly addressed to individuals. If for a minor, it goes to the guardian. Incorrect details can usually be corrected, but if it's crucial to the taxpayer's identity, it's important to ensure accuracy.

Service by Post: Notices are sent through registered post. It involves properly addressing, pre-paying, and posting the letter. It can be delivered to the address, an employee, agent, or authorized person.

Service by Affixture: If the recipient refuses to sign or can't be found, the notice is affixed on their residence or business premises.

HUFs and Partnerships: For Hindu Undivided Families (HUFs), notices can be served to the manager. For partnerships, it's served to former partners or members if the entity is dissolved.

Closed Businesses: Notices for closed businesses are served to the person assessed. For firms, it goes to former members, and for companies, to the principal officer or director.

These methods ensure that notices are properly delivered to taxpayers.

Documents required to reply to an Income Tax Notice

What documents are required to reply to an Income Tax Notice?

Depending on the type of income tax notification that the taxpayer receives, different documents must be included. The following are the standard documentation required to respond to an income tax notice:

The Income Tax Notice copy.

Proof of Income source such as (Part B ) of Form 16, Salary receipts, etc.

TDS certificates, Form 16 (Part A)

Investment Proof if they are applicable.

Checklist for Handling an Income Tax Notice:

Review and Respond: Upon receiving an intimation notice under Section 143(1) of the Income Tax Act, 1961, respond within 30 days from the date of service.

Timely Response: Failure to respond within the specified time may lead to processing of tax returns with adjustments without providing further opportunity.

Check Details: Verify the accuracy of name, address, PAN number, and assessment year mentioned in the notice.

Verify Acknowledgment Number: Cross-check the e-filing acknowledgment number mentioned in the notice.

Consider Revision: File revised returns if mistakes were made in the original filing within 15 days.

Rectification Returns: File rectification returns if errors are found in the order issued by the Income Tax Department.

Understand Reason for Notice: Review page 2 of the notice to understand the reason for issuance and discrepancies in income mentioned in returns, Form 16/16A, and Form 26AS.

Notice of Demand: If the notice demands additional tax payment (demand notice), treat it as a notice of demand under section 156.

Respond to Demand: Respond to the notice of demand within 30 days to avoid interest penalties and additional fines imposed by the assessing officer.

By following this checklist, taxpayers can effectively handle income tax notices and ensure compliance with the requirements of the Income Tax Department.

#incometax#income tax notice#efiletax#taxes#business plan#business growth#business ideas#finance#tax service provider#tax service

0 notes

Text

Let Taxonation be your financial companion this tax season. Trust in our expertise to navigate the intricacies of income tax return filing service provider, providing you with peace of mind and financial security. For more details visit our website.

0 notes

Text

Brazil Approves New Income Tax Rules for Cryptocurrencies

Cryptocurrencies have been gaining popularity worldwide, and Brazil is no exception. To regulate and tax earnings obtained from cryptocurrencies held on foreign exchanges, the Brazilian Senate has approved new income tax regulations. This move is expected to have significant implications for individuals and businesses operating in the cryptocurrency space. In this article, we will delve into the…

View On WordPress

#Banco Central do Brazil#Brazil income tax rules for cryptocurrencies Secondary Keywords: Brazilian Senate#Comissão de Valores Mobiliários#crypto tax rate#cryptocurrency regulations#exclusive funds#foreign companies#foreign exchanges#funds held on international exchanges#income tax modifications#President Luiz Inácio Lula da Silva#revenue target#tax regulations#virtual asset service providers

0 notes

Text

Class 3 DSC Service Provider in Mumbai

This type of certification is required for individuals who are making bulk payments online. This will help these individuals to make their payment more secure and that too in an easier way. In order to know with a simple example, we can consider e-ticketing railway agents who need to make the payment in bulk for several tickets. Hence, they need this type of certification from a trusted and authorized organization.

#class 3 dsc service provider in mumbai#class 3 dsc service provider for income tax#class 3a dsc for e-tendering#class 3 foreign individual#foreign individual dsc service provider in mumbai

0 notes

Text

#LegalTax is a legal services provider in India that offers a wide range of services#including trademark registration#company registration#GST registration#income tax filing#and other legal and compliance services. They have a team of experienced professionals who provide efficient and reliable legal services to

0 notes

Text

gst registration in dwarka expressway

#CA in Gurugram Chartered Accountant firm Located in Dwarka Delhi. We provide services such as gst registration#company registration#income tax return and more.

1 note

·

View note

Text

Most Reliable Chartered Accounting Firm in Ahmedabad

Home ownership is a goal that many people have. A home is a valuable asset and can be a great source of pride. One of the biggest hurdles to homeownership is coming up with the down payment and closing costs. A home loan can help make homeownership possible. For those who are looking for a home loan in Ahmedabad, there are several options available. Here we will provide an overview of home loan service providers in Ahmedabad so that you can make an informed decision about which one is right for you. The Gujarat government has come up with an innovative way to finance solar energy projects. The state will offer low-interest loans to businesses and individuals who want to install solar panels. This is a great step forward for renewable energy in India.

-The new policy was announced at the Vibrant Gujarat Summit, which is an annual event that attracts investors from all over the world. More than 8,000 delegates attended this year’s summit, including representatives from major corporations like Shell and GE.

-The Gujarat government plans to invest Rs 1 trillion ($14 billion) in renewable energy over the next five years. This will create more than 2 million jobs in the state.

-Solar Projects Loans in Gujarat are a good investment for two reasons: They will help reduce greenhouse gas emissions, and they will create jobs.

Take Expert Advice Before Filling Income Tax Return

Are you looking for an income tax consultant in Gujarat? If so, you've come to the right place. At our firm, we offer expert advice and services related to income tax preparation and compliance. We're proud to be one of the leading providers of income tax consulting in Gujarat, and we're dedicated to helping our clients save money and comply with all relevant regulations. Contact CA firms in Ahmedabad today to learn more about services or schedule a consultation!

#home loan service providers in Ahmedabad#Solar Projects Loans in Gujarat#income tax consultant in Gujarat#best ca firms in ahmedabad#ca firms in ahmedabad

0 notes

Link

Tax consultants are expert in all tax-related matters in which they help a company or a businessman to solve any issue. Following points can be helpful to you.

#Best Tax Planning Service Near Me#Tax Preparation Services in Manassas VA#Professional Tax Services#Pro Taxes Services#Payroll Services Provider#Tax Consultant Services#Income Tax Consultancy Services

1 note

·

View note

Text

Top Best Business Advisory Firm in India

India's most trusted Tax & Compliance Platform & Best Business Advisory firm in India. IndianSalahkar offer accounting audit services, business setup, business advisory, taxation and support services.

#accounting audit services#business setup#business advisory#taxation and support services#Trademark Registration Services#Brand Registration#best accounting firm in India#GST registration service provider#company registration in India#Income tax efiling

1 note

·

View note

Text

Some of Joe Biden’s accomplishments:

**Domestic policy**

* **American Rescue Plan (2021)**: Provided $1.9 trillion in COVID-19 relief, including direct payments, enhanced unemployment benefits, and funding for vaccines and testing.

* **Infrastructure Investment and Jobs Act (2021)**: Allocated $1.2 trillion for infrastructure projects, including roads, bridges, broadband, and clean energy initiatives.

* **Bipartisan Safer Communities Act (2022)**: Expanded background checks for gun purchases and provided funding for mental health services.

* **Child Tax Credit Expansion (2021-2022)**: Temporarily expanded the Child Tax Credit to provide up to $3,600 per child in monthly payments.

* **Affordable Care Act Expansion (2021)**: Made health insurance more affordable for low- and middle-income Americans by reducing premiums and expanding subsidies.

**Foreign Policy**

* **Withdrawal from Afghanistan (2021)**: Ended the 20-year war in Afghanistan.

* **Re-joining the Paris Agreement (2021)**: Re-committed the United States to global efforts to address climate change.

* **Strengthening Alliances with NATO and the EU (2021-present)**: Repaired relationships with key European allies after strained relations during the Trump administration.

* **Supporting Ukraine in the Ukraine-Russia War (2022-present)**: Provided military, humanitarian, and diplomatic support to Ukraine in its defense against Russia's invasion.

* **Nuclear Deal with Iran (2023)**: Revived negotiations with Iran on a comprehensive nuclear deal, aimed at preventing Iran from developing nuclear weapons.

**Other Notable Accomplishments**

* **Appointing Ketanji Brown Jackson to the Supreme Court (2022)**: Made history by being the first Black woman appointed to the nation's highest court.

* **Signing the Respect for Marriage Act (2022)**: Ensured federal recognition of same-sex and interracial marriages.

* **Establishing the Office of the National Cyber Director (2021)**: Coordinated federal efforts to combat cybersecurity threats.

* **Creating the COVID-19 National Preparedness Plan (2021)**: Developed a comprehensive strategy to respond to future pandemics.

* **Launching the Cancer Moonshot (2022)**: Re-energized the government's efforts to find a cure for cancer.

170 notes

·

View notes

Text

Fellah Cultivation Methods and Crops (1840-1914)

At the end of Ottoman rule, 75% of land was devoted to growing grains. A two-field system was common, with wheat and barley grown as winter crops on one half while the other half had a summer dew crop of sesame and Indian millet. The following season, the second half had the winter crop with the first half left fallow (Atran, 1986: 277). Other crops grown included dura, beans, fenugreek, and chickpeas, along with olives, grapes, cotton and oranges. Fallowing was widely used, allowing grazing cattle to feed on the fallow lands. The extensive system was not geared towards profit making but subsistence. The Ottoman government tried to outlaw fallowing by repossessing untilled land, but was largely unsuccessful (Atran, 1986: 278). Terracing was practiced in the hills with olive trees grown everywhere used as a source of oil and soap. By 1910 citrus groves covered 3,000 hectares. Vegetables were grown where irrigation was possible. The fellah [peasants] used homemade implements – a light nail plow, a sickle, a threshing board and two sieves [...].

Beginning with the 1858 Land Code, the Ottoman government, in an attempt to extract more taxes from the Fellaheen, tried to institute policies to transform land ownership. The goal was effectively to undermine «the system of collective holding and to institute an individual land-holding system» (Atran, 1986: 274). The code stipulated that a village could not communally own land and that titles should be given to each individual. Moreover, non-cultivated (Musha’a [collectively held]) land could not be the property of the fellah and would belong to the state. The 1876 Land Law decreed that Mulk [Sultan-granted] land held by notables who were not providing to services to the Sultan would be seized and could be sold to Europeans. One of the most notable purchasers was Baron Rothschild, who spent an estimated 10 million pounds sterling on land purchases, the construction of settlements, the establishment of plantations and manufacturing plants producing silk, glass, wine and water. He guaranteed the Jewish settlers who came to work on these plantations a minimum income (Aharoni, 1991: 57). At the same time the World Zionist Organization (WZO) was founded in 1897 and created the Keren Kayemet fund (JNF) for land purchases two years later. With their help, Jewish-owned land increased from 25,000 dunums [square kilometers] in 1882 to 1.6 million dunums by 1941.

Throughout these changes, the situation of the peasantry grew progressively worse as the tax burden increased. Often the fellah was forced to borrow money to make ends meet and many ended up selling the titles to their land, which they continued to work on, but with reduced benefits. By the turn of the century, six families in Palestine (the effendi) owned 23% per cent of all cultivated land, while 16, 910 families owned only 6% (Awartani, 1993).

The British Mandate (1914-1948)

Following the First World War, Palestine was designated as a mandated territory to Britain to rule the country until it become ready for independence. Along with this was the provision, first enshrined in the Balfour Declaration of 1917, to secure a national home for the Jewish people in Palestine. When the British received the Mandate for Palestine, the land issue was highly contentious. This is because the Mandate included the incompatible goals of «encouraging close settlement by Jews on the land» while at the same time «ensuring that the rights and position of other sections of the population are not prejudiced».

The British put into place policies that permitted the transfer of the land to the European settlers. The first being the transfer law of 1921, which granted individual holders the right to become the private owners of their land. Another law, the rural property tax, stipulated that land not cultivated for three years could be seized by the state and «be made use of in a more efficient way» (Zu’bi, 1981: 99). [...][D]espite new policies which tightened laws regarding Jewish land acquisition after 1929, the period of the mandatory government saw widespread expansion of Jewish agricultural settlements in Palestine (Table 1). For example, from 1900 to 1927, the area owned by the Jewish sector expanded from 42,060 to 90,300 ha: an average increase of under 2,000 ha a year. While from 1932 to 1941, after the riots, the area expanded from 105,850 ha to 160,480 ha – an average annual increase of 6,000 ha.

The quality of the soils of the land purchased is debated among scholars. According to Alon Tal, an Israeli environmental historian: «Though the real estate that Arab landlords were willing to sell was largely malaria infested swamps and wastelands, new agricultural settlements soon began to dot the map of Palestine» (Tal, 2006: 4). On the other hand, «The main areas appropriated by European investors were those concentrated in the maritime plain, the most fertile area in Palestine, specializing in citrus production» (Atran, 1989: 739).

Zu’bi (1981: 99) also writes, «Under British Colonization, the land appropriated by European (Jewish) settlers was the most densely populated areas. In 1921, the transfer of 240,000 dunums in the Beisan (Galilee) area to the European sector resulted in the dispossession of 8,730 families living from this land. By 1929 it was reported, 29.4% of peasant families’ land [that is, the land of 29.4% of peasant families] was expropriated as a result of the Zionist settlement».

– 2009. Leah Temper, “Creating Facts on the Ground: Agriculture in Israel and Palestine (1882-2000),” Historia Agraria 48, pp. 75-110.

101 notes

·

View notes

Text

Class 3 Organization DSC

Any authorized representative can buy digital signature on behalf of organization by submitting duly filled and signed application form and supporting documents. For issuance of organizational digital certificate, applicant must submit his personal documents as well as organizational documents to prove that he is authorized by organization to obtain digital signatures.

#class 3 dsc service provider for income tax#foreign individual dsc service provider in mumbai#class 3 foreign individual

0 notes

Text

ACP Cladding in Jaipur

Introduction:

When it comes to creating the perfect living or working space, windows play a crucial role in enhancing the overall aesthetic appeal and functionality. In Dubai, a city known for its architectural marvels and modern designs, finding the right manufacturer for uPVC windows is essential. This is where Fabiron Export comes into the picture. With their commitment to quality, innovation, and customer satisfaction, Fabiron Export has established itself as a trusted name in the industry. In this blog, we will delve into why Fabiron Export is the go-to manufacturer for uPVC windows in Dubai.

Superior Quality and Craftsmanship:

Fabiron Export takes great pride in delivering uPVC windows of exceptional quality. Their commitment to using premium materials and advanced manufacturing techniques ensures that each window is built to withstand the harsh climatic conditions of Dubai. By focusing on quality and craftsmanship, Fabiron Export guarantees windows that not only look stunning but also provide optimal insulation, noise reduction, and security.

Wide Range of Designs and Styles:

Understanding the diverse tastes and preferences of customers, Fabiron Export offers a wide range of designs and styles to suit every architectural requirement. Whether you prefer sleek and modern designs or classic and elegant styles, Fabiron Export has the perfect uPVC windows to match your vision. Their experienced team of designers and engineers works closely with clients to create customized windows that blend seamlessly with the overall design aesthetic.

Energy Efficiency:

With the increasing focus on sustainability and energy efficiency, Fabiron Export's uPVC windows are designed to meet the highest standards. uPVC, or unplasticized polyvinyl chloride, is a material known for its excellent insulation properties. Fabiron Export's windows effectively prevent heat transfer, resulting in reduced energy consumption and lower utility bills. By choosing uPVC windows from Fabiron Export, you contribute to a greener and more eco-friendly future.

Durability and Low Maintenance:

One of the key advantages of uPVC windows is their durability and low maintenance requirements. Fabiron Export's uPVC windows are built to withstand extreme weather conditions, including high temperatures and humidity levels. They are resistant to rotting, fading, and corrosion, ensuring that your windows retain their beauty and functionality for years to come. Additionally, the smooth surface of uPVC makes it easy to clean and maintain, saving you time and effort.

Exceptional Customer Service:

Fabiron Export places utmost importance on customer satisfaction. Their team of dedicated professionals strives to provide exceptional service from the initial consultation to the installation and after-sales support. They understand the unique requirements of each project and work closely with clients to ensure that their expectations are met or exceeded. With Fabiron Export, you can expect a seamless and hassle-free experience throughout your uPVC window journey.

When it comes to choosing a manufacturer of uPVC windows in Dubai, Fabiron Export stands out as a reliable and innovative company. With their commitment to superior quality, wide range of designs, energy efficiency, durability, and exceptional customer service, Fabiron Export is the ideal choice for transforming your living or working spaces. Trust Fabiron Export to provide you with uPVC windows that not only enhance the aesthetics of your property but also offer enhanced functionality and long-lasting performance.

Mobile Number:

+91 9828366377

+91 9166988888

Mail:

OUR OFFICES

HEAD OFFICE JAIPUR

Plot No.10/164, 2nd Floor, Chitrakoot, Vaishali Nagar, Jaipur - 302021, Rajasthan.

BRANCH OFFICE AJMER

Plot No. H-1-84, Gegal Industrial Area, Ajmer - 305802, Rajasthan.

BRANCH OFFICE KOTA Plot No. 2, New Jawahar Nagar, Kota - 324006, Rajasthan

#gst registration service provider#brand registration#trademark registration services#income tax filing india#architects#best accounting firm in india#designers#company registration in india#doors#construction

0 notes

Text

Hey if you live in the usa and you either:

are enrolled in any govt assistance programs like SNAP, medicaid, ssi, etc

live on tribal lands*

or have a household income at or below the values on the table below

you should enroll in the affordable connectivity program to get an automatic discount to your internet bill. $30/mo off your service--$75 off if you meet the second condition--and a device discount of $100 for hardware (computers, tablets, laptops, etc.) Full qualification page HERE.

it takes like. 20 minutes maybe? Google "[your internet provider] affordable connectivity program" to find the application directly through your ISP. they'll want you to first find out if you qualify through the National Verifier HERE. if you want to qualify through income, you'll probably have to upload a paystub or tax return but other than that it's very painless. The application through your ISP should also be pretty painless.

definitely do this. it's free money. it's for you. take it.

Link 1: https://www.affordableconnectivity.gov/do-i-qualify/

Link 2: https://getinternet.gov/apply

*phrasing from the govt site. I'm not sure if this is appropriate phrasing in casual conversation, so I apologize if not. please let me know if there is a better way to say this.

#myaa#sorry for being awkward abt the tribal lands phrasing but i kno tribal is a p loaded word#but i know reservation is also very loaded#and I don't know if there's a less loaded way to talk about them#i at least wanted to acknowledge that could be an issue

223 notes

·

View notes

Note

I’m confused. Why would he get deported? He’s married to (presumably) a US citizen already. Not sure if I missed something?

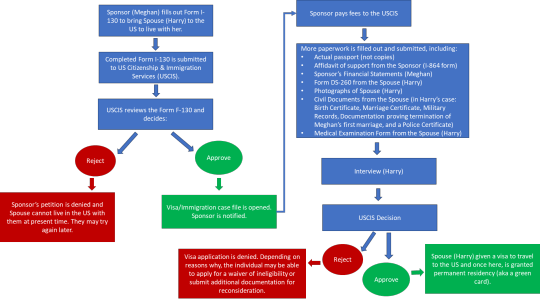

Well, the simplest explanation is that everyone who immigrates/emigrates to the US has to fill out paperwork to stay here. Doesn't matter who you are, who your family is, who you're married to, where you're from, what money you have. Everyone fills out the paperwork.

Being married to a US citizen only affects the type of visa (Spouse of US Citizen) you get and which application (Form I-130, the Petition for Alien Relative) your sponsor fills out to start the process.

The longer/more detailed explanation of the process, and the background for the lawsuit about Harry's visa application, is this:

(Apologies for how small the text is. I didn't want it to be a multi-page thing.) I'll describe it below the jump.

But essentially, Harry's process to become a legal permanent resident through his marriage to a US citizen is:

Sponsor/Meghan submits Form I-130 to the US Citizenship and Immigration Service (USCIS), requesting approval to bring her spouse to live with her in the US.

USCIS reviews the form and will approve (left green circle) or deny (left red circle) the application. If they deny it, that ends the process. They can try again later. If they approve it, then:

Sponsor/Meghan pays a bunch of fees and a visa case is opened.

(The big giant square text) More paperwork and documents are submitted. Meghan and Harry do this together. (I'll explain this in a bit.)

The Spouse/Harry has his immigration interview.

USCIS will review the visa case file and make a decision on whether to approve or deny the visa request. If they deny the visa, then depending on the justification for denial, the Spouse/Harry may request a waiver or he can submit additional documentation for further consideration. If the visa is approved, then the Spouse/Harry is given approval to travel to the US and once he's here, he gets permanent residency - aka "the green card."

Now, getting back to the giant text block and the "more paperwork" requirement. In this phase of the process for a spousal visa, the couple must provide:

An affadavit of support from the Sponsor/Meghan (this basically says that she has enough income to support Harry and they won't need government assistance)

Supporting financial documents (probably tax declarations)

Harry's passport

Additional photographs of Harry

Form DS-260, the Immigrant Visa and Alien Registration Application from Harry (this is Harry's application for residency)

Harry's birth certificate

Their marriage certificate

Harry's military records (the US requires anyone with military service in any country to submit)

Harry's police certificate (information about whether he has been arrested or charged with crimes/what kinds)

Harry's Medical Examination form (which sometimes is done after the interview)

Form DS-260 is the big one. It basically asks the immigrant (Harry, in this case) about everything in his life: his childhood, his work history, his social media accounts, where he's lived, his family of origin, his children, previous travel to the US, medical and health details (including history of substance abuse. communicable diseases, and vaccination record), criminal history, security and background details, and social security.

If you're found to have lied about anything on this form - for instance, something pops on the background check that isn't disclosed or your answers in the interview are inconsistent with what's reported on the form or your social media tells a totally different story - it's grounds for your application to be denied and, if you're already here in the US, you to be deported.

This is what the DHS/Homeland Security lawsuit is about. The DS-260 has a question about drug use. The Heritage Foundation (the plaintiff in the case) is suing DHS to find out what Harry reported about his drug use on the form and in his medical history because historically, the US does not allow people with drug addictions or past drug use into the country. After Harry's admissions in Spare that he's basically a functioning addict, the Heritage Foundation assumed that Harry said "no" on the drug use question (which would be a lie) and they want to find out if he was given special treatment because of being Queen Elizabeth's grandson. (I also suspect the Heritage Foundation wants to find out if Harry has a regular passport or is traveling/living in the US on a diplomatic passport as well.)

So going back to your original question, yes, Harry can still be deported even if he is the spouse of a US citizen and even if he is a permanent resident. All the marriage to a US citizen means is what forms get filled out and what supporting documentation is submitted. That's all; there aren't any other protections involved in being married to a US citizen.

But there is a benefit to immigrating via a "green card marriage" - if you come to the US on any other kind of visa, the requirements are much stricter and the waiting period for eligibility can sometimes take much longer. Particularly on the latter, the US actually has requirements on how many people per country can immigrate/travel in a given a year, even if you're sponsored by a business or a friend or a family member (eg a brother or uncle). So some people end up waiting years to move to the US; that's just the demand on the system. But with a "green card marriage," you get to jump most of the queues and your waiting period for eligibility disappears in an instant. You can literally begin your application to move to the US the day you get engaged to a US citizen or the day you get married.

But you still have to go through all the hoops and fill out all the paperwork anyway. No way around that. No matter who your grandmother is.

Now for the part that makes all of this even more complicated: COVID.

A lot of rules government-wide were relaxed because of the COVID national emergency. One of the areas in which a lot of rules, standards, and regulations were relaxed is immigration, which caused an enormous backlog of paperwork and cases. Why? Because we're the goverment, y'all, and we move at slower-than-glacial-pace. In March 2020, we still processed a million things by hand on actual physical paper. (Remember, I'm a fed. I've got horror stories for days about this.) So part of the issue with everyone going home is that the paperwork didn't come home with us. It just kept stacking up and stacking up and stacking up in the office because we were still using paper systems and there hadn't been enough time to automate processes or digitize systems when we were ordered to work from home on March 16th. (Particularly in the DC area, talks/plans to send us all home started literally the week before, on March 9th. That was zero time to do anything but scale up the VPN and give everyone a laptop so whole entire agencies can work from home - because remember, before March 2020, it wasn't a thing for us in government to work from home.) So in June/July 2020 when the local stay-at-home orders were finally lifted, we all went back to the office to huge backlogs of paperwork and casework. Backlogs that were still growing by the day, and backlogs that needed to be handled quickly. As a result, there were a lot of decisions made to just "rubber-stamp" everything as quickly as possible. In DHS/USCIS, that meant citizenship and visa applications weren't as closely reviewed as they may have been in the past because the bosses were telling us "just get it done" because the Trump Administration was breathing down everyone's necks to deliver results that they could use in his re-election campaign.

So there's speculation now that Harry's visa/immigration application is one of those cases that got "rubber stamped" to get through the backlog. And part of that speculation is an attempt to understand when exactly did the visa paperwork get processed and whether there was undue special treatment in doing so. Was he part of the backlog that was grandfathered/rubber-stamped into the US? Or was his application processed before that?

Because if his application was processed before he moved here in March 2020, well, then the Sussexes aren't telling the truth about where they lived or what they were doing. Reason being that typically on a spousal visa, you usually can't already be living here in the US when you apply for it. You apply from your home country and come to the US only once your visa request has been granted.

So did the Sussexes apply for Harry's visa when they were living in Canada, starting the process as early as November 2019 when the BRF forced them into a vacation and panicking in February 2020 when COVID started closing borders? In that case, did the Sussexes apply diplomatic pressure to expedite DHS's review of Harry's case so they could be in the US before borders closed? Or did they say "screw it" and moved to the US without waiting for a decision and then applied diplomatic pressure to have Harry's case approved retroactively?

Or did the Sussexes apply for Harry's visa much earlier, when they were still living in the UK/working as full-time royals? And if that's the case, then did they really go to Canada like they said they did, or did they just hide out in the US for a bit so Harry could pick up his green card, and then they traveled to Vancouver/Canada for New Year's?

Or - perhaps the more tinhatty scenario - did the Sussexes apply for Harry's visa right after the marriage, at the earliest opportunity Meghan could've filed the paperwork? In which case, their secret honeymoon could really potentially have been a trip to the US so Harry could claim his green card.

Option 3 is incredibly farfetched. We know the Sussexes can't keep their stories straight so I feel like if that's what had actually happened, there would've been holes poked into their "fleeing to Canada" narrative already.

I probably lean towards Option 1 (they exploited COVID to move here) but Option 2 is pretty plausible too.

Anyway, that's a ton more than you/anon probably expected. (It's a whole lot more than I expected to write about too.) But hopefully this clears up some confusion about what exactly is happening with Harry's immigration status, why it's possible he can still be deported, and sheds a little light on the Homeland Security lawsuit.

Edit: added some clarification (see bolded part under the flowchart)

44 notes

·

View notes