#Hydrocarbons dispute

Text

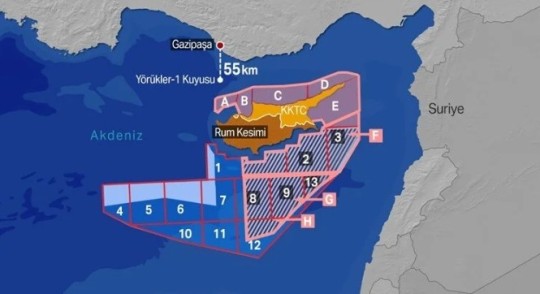

Çavuşoğlu: They are trying to usurp the rights of TRNC and Türkiye

Çavuşoğlu: They are trying to usurp the rights of TRNC and Türkiye

Turkish Foreign Minister Mevlüt Çavuşoğlu said, “The Greek Cypriots and Greece, relying on the EU, are trying to usurp the rights of the TRNC and Türkiye instead of fair sharing. Just as in the past, it is out of the question for us to allow it.” Çavuşoğlu made the comment concerning the agenda in a televised interview with broadcaster Haber Global. (more…)

View On WordPress

#Creek Cypriots and Greece#Hydrocarbons dispute#statement#TRNC and Turkey share#Turkish Foreign Minister Mevlüt Çavuşoğlu

0 notes

Text

By Jake Johnson

Common Dreams

Aug. 9, 2023

"To avoid the point of no return," argued Colombian President Gustavo Petro, "we need an ambitious transnational policy to phase out fossil fuels."

The leaders of eight Amazon nations closed out a two-day summit in Brazil on Wednesday without reaching a shared agreement to end deforestation by 2030, a failure that stemmed in part from disputes over oil extraction in the critical ecosystem.

Colombia, represented by leftist President Gustavo Petro, pushed for an end to oil development in the Amazon, whose status as a key carbon sink has suffered severe damage in recent years due to the deliberate clearing of trees, corporate exploitation, and runaway planetary warming.

"Are we going to let hydrocarbons be explored in the Amazon rainforest? To deliver them as exploration blocks? Is there wealth there or is there the death of humanity?" Petro asked in a speech last month. Colombia is home to roughly 10% of the Amazon.

Colombia's fellow Amazon nations rejected Petro's call.

A joint declaration issued by Bolivia, Brazil, Colombia, Ecuador, Guyana, Peru, Suriname, and Venezuela states that the South American countries agree "urgent action" is needed to "avoid the point of no return in the Amazon" and combat deforestation, which has surged in recent years.

But the declaration stops short of a cooperative pledge to end deforestation entirely by 2030 and contains no mention of fossil fuels. Individual nations, including Brazil and Colombia, have pledged to take their own steps to end deforestation by decade's end.

Colombia this week also became the first country to back an Indigenous-led call to protect at least 80% of the Amazon by 2025.

"Indigenous territories and Indigenous rights are a critical tool for the long-term protection of Amazonia," said Alicia Guzman, Amazon program co-director at Stand.earth. "As Colombia and other countries move forward to protect the Amazon, protecting current and establishing new Indigenous Territories will be an essential element of protecting 80% of the Amazon by 2025. Amazonia for Life: Protect 80% by 2025 centers the importance of Indigenous Territories, and also encourages national-level debt forgiveness, local economic development, and an end to extractivism."

Environmental groups voiced outrage that Amazon countries were unable to agree to cooperate on ending deforestation by 2030.

"Temperature records are broken every day," said Márcio Astrini of the Climate Observatory. "It's not possible that under those circumstances, the eight presidents of the Amazon nations can't include a line in the declaration stating, in bold letters, that deforestation needs to be zero, that it won't be tolerated anymore."

"To avoid the point of no return, we need an ambitious transnational policy to phase out fossil fuels."

Reuters reported Wednesday that "tensions emerged in the lead-up to the summit around diverging positions on deforestation and oil development."

"Bolivia and Venezuela are the only Amazon countries not to sign onto a 2021 agreement among more than 100 countries to work toward halting deforestation by 2030," the outlet noted. "A Brazilian government source told Reuters in the lead-up to the summit that Bolivia, where forest destruction is surging, is a hold-out on the issue."

Reuters added that "Brazil is weighing whether to develop a potentially huge offshore oil find near the mouth of the Amazon River and the country's northern coast, which is dominated by rainforest."

Petro has implored Lula—who has overseen a sharp decline in deforestation—to rule out the fossil fuel project, which would be led by Brazilian oil giant Petrobras.

In an op-ed for the Miami Herald last month, Petro warned that "even if we get deforestation under control, the Amazon faces dire threats if global heating continues to climb. To avoid the point of no return, we need an ambitious transnational policy to phase out fossil fuels."

Researchers have estimated that one in nine tanks of gas, diesel, or jet fuel pumped in the U.S. state of California comes from the Amazon.

"To avoid the point of no return," Petro argued, "we need an ambitious transnational policy to phase out fossil fuels."

To that end, Petro called on "Amazon countries and our partners in the 'Global North' to commit to phasing out fossil fuel development, and to do so in a way that protects our right to a just transition to a post-carbon world."

15 notes

·

View notes

Text

Ukrainian President Volodymyr Zelensky visited Romania on Oct. 10, but the visit did not go entirely as planned, with a scheduled speech in front of the country’s legislature scuppered at the last minute.

Zelensky himself called off the speech, but the real reason was pushback from Romania’s nationalist opposition party, the Alliance for the Union of Romanians (AUR), which threatened to protest the speech. The party has seen its support more than double since the 2020 parliamentary election. It leads in some polls for next year’s European Union elections in the country, even though Ukraine and Moldova have both banned its leader from entering their countries over alleged connections to the Kremlin.

The country faces a turning point—both in terms of its position on Ukraine and its position in Europe. In the aftermath of the return of Slovakia’s controversial populist Robert Fico and its subsequent shift toward a stance approaching Hungary’s in terms of resisting European support for Kyiv, Bucharest is likely to prove the next battleground for the agenda. Except it is far more significant.

Romania plays a major role in providing humanitarian aid and delivering military equipment to Ukraine, but most importantly, it is the linchpin ally in enabling grain to reach world markets. More than half of Ukrainian grain has been exported via Romania since Russia’s full-scale invasion began last February.

Romanian relations with Kyiv are a sensitive issue domestically and internationally. Romania’s potential turn will have major ramifications for Europe’s wider economic and political environment, as the country is also set to play a key role in European, and global, energy security over the coming years.

This June, Austria-based multinational OMV and Romanian gas company Romgaz announced that they plan to invest up to 4 billion euros (about $4.26 billion) in developing natural gas fields in the Black Sea, a project that the companies believe could produce at least 10 billion cubic meters of natural gas per year. Infrastructure development is due to begin next year, and it is hoped that production will begin in 2027. The development of this resource offers the promise of mitigating Russian threats over the medium term because of the promise of Romania’s own hydrocarbons industry.

The successful development of Romania’s gas production offers the ability to blunt the key economic weapon that the Kremlin has used against Europe alongside its war in Ukraine, namely, the weaponization of natural gas supplies that began before the full-scale invasion and subsequently intensified in its aftermath.

The impact of the Kremlin’s strategy has been significant, driving inflation to highs not seen in decades, although the European Union has been successful in decreasing its dependence on Russian natural gas—with Russian gas falling to just 8.4 percent of European imports in the first seven months of 2023, down from 45 percent in 2021.

Nevertheless, the Kremlin has made clear that it is willing to target European economies, and in turn support for Ukraine, through other commodities as well. Its withdrawal from the Black Sea Grain Initiative in July has not had the feared major impact on global grain prices, but it has driven up tensions over European gas markets, including a World Trade Organization dispute from Kyiv against Hungary, Poland, and Slovakia over their unilateral restrictions on Ukrainian grain, while the AUR and other Romanian political parties have also flirted with such action. There is little doubt that Russia will continue such efforts across various classes of commodities.

But gas is undoubtedly the most significant, with a tight global market that is jittery about any disruptions in supply for the foreseeable future. In the past week, European and global gas prices have spiked over a suspicious leak in an offshore pipeline between Finland and Estonia, as they did over threatened strikes in Australia in August. Further gas price increases also threaten to drive renewed inflation, which in turn will require further elevated interest rates and the political and economic costs that those bring.

It is therefore paramount for Ukraine, Europe, and the wider West to see Romanian gas flow as soon as possible. Russia, inversely, has every reason to oppose it. Russia’s militarization of the Black Sea—where it claims territorial waters bordering Romania through its illegal occupation and annexation of Crimea—is an obvious immediate threat, but not the only one, and in Romania it may seek to take advantage of the relative lack of attention that the market receives to try to undermine the project.

Russia has a long history of using networks of influence and business partners to gain a foothold in energy projects across Europe, including in Romania. Russian companies have investments in the country’s metals sector and across its hydrocarbons and port industries. A number of Romanian businessmen have also been long-standing partners of the Kremlin in providing services in Russia.

Far too often, these actions have sailed under the radar. And while the United States and European Union have both adopted significant new anti-kleptocracy agendas in recent years—and underpinned them with threats of sanctions—the bark has been worse than the bite.

For example, the Romanian oil services company Grup Servicii Petroliere (GSP)—controlled by CEO and Board President Gabriel Comanescu—has a long history of contracting with the Kremlin. It also has not announced plans to leave the Russian market, despite increased sanctions following the outbreak of war and even as the brutality of Russia’s invasion and associated war crimes has become apparent.

The company has previously undertaken work that would now be in violation of international sanctions, most notably in July 2014, when it helped the Russian state oil company Gazprom Neft by undertaking drilling work in the Arctic Sea. That contract was announced just five days before the United States introduced its sectoral sanctions on Russia, which specifically banned support for Russian Artic hydrocarbon development projects for affected companies. Gazprom Neft was added to the list shortly thereafter, but GSP’s contract slipped by just in time.

GSP has also been the subject of investigations resulting in revelations from the Panama Papers. Romania’s RISE project, a nonprofit investigative journalism group working in collaboration with the Organized Crime and Corruption Reporting Project, reported in 2017 that the firm had not only extensively used offshore structures to minimize its tax payments, but also engaged in suspicious transactions to acquire 10 drills from OMV’s joint venture with the Romanian government, OMV Petrom. A local union leader was subsequently jailed for embezzlement.

Romania’s track record in targeting corruption and Russian influence networks on its own has been mixed. The state’s National Anticorruption Directorate (DNA) was not long ago highlighted as a leading example in Eastern Europe for such efforts, but its reputation has since suffered substantial hits. Former directorate head Laura Codruta Kovesi was sacked in 2018 after the Social Democratic Party (PSD) demanded her removal despite President Klaus Iohannis seeking to stop the move, a sacking that the European Court of Human Rights ruled violated due process.

Although Codruta Kovesi has since become the European Union’s chief prosecutor, the anti-corruption agenda in Romania has effectively been frozen in its tracks since her removal. There has been quick turnover in the leadership of the DNA, and Romanian media has repeatedly reported that its directorship has become subject to the political preferences of the government rather than prioritizing effectiveness in tackling corruption.

Romanians repeatedly took to the street in 2017 and 2018 to protest against judicial reforms perceived as institutionalizing political control over the justice system, and the December 2020 election saw the liberal USR Plus alliance record its best-ever result with nearly 16 percent of votes, putting it in third place behind the long-dominant political factions, the PSD and its rivals in the nominally center-right National Liberal Party (PNL).

Even before the rise of AUR’s electoral threat, Romania’s fractured parliament has been highly dysfunctional—and left the country without a credible capability to tackle corruption and potential Russian influence on its own.

A brief alliance between USR and PNL collapsed after just nine months. Romania has had four prime ministers in the past three years, and the latest coalitions have brought together the PNL and PSD, albeit with the prime minister office rotating between the two. Their latest government, formed in June 2023, is headed by PSD leader Marcel Ciolacu, himself once investigated over potential corruption by the DNA under Codruta Kovesi.

Meanwhile, the USR Plus alliance has split, and many of the PNL’s voters appear set to abandon it for the far-right populist Alliance for the Union of Romanians, dragging the country’s entire political discourse to the right and away from the challenge of corruption.

Romania’s gas promise, however, also needs to be a priority to ensure that it is developed for the benefit of Romanians—and for Europe and Ukraine. Yet, with a track record of serving as a vehicle for Russian influence, sanctions evasion must be kept out of Romania’s burgeoning Black Sea gas industry. Europe must also act now to engage proactively to address Romanians political concerns, lest the AUR take advantage of the situation.

But there are still glimmers of hope—a recent poll found that NATO Deputy Secretary Mircea Geoana is favored to win the presidency if he runs as an independent.

It is not too late for Romania’s turning point to be a positive one.

3 notes

·

View notes

Text

STOP THE WILLOW PROJECT

The US Department of the Interior has approved the Willow Project, a disputed hydrocarbon drilling license advanced by ConocoPhillip on Alaska's North Slope. Under the plan approved by the Biden administration, ConocoPhillips will be allowed to develop three wells (it had requested 5), in one of the largest oil and gas projects on federal public lands and could emit about 287 million tons of pollution emissions over the next 30 years, equivalent to reactivating one-third of all coal-fired plants in the United States. The decision comes after that, the day before. the Biden administration had announced new protections for Arctic lands and waters, banning oil and gas drilling on millions of acres of the National Petroleum Reserve-Alaska and the Arctic Sea. Environmental groups, indigenous communities and several Democratic parliamentarians had opposed the controversial Willow project, a "carbon bomb" that would block US efforts to get out of fossil fuels for decades. Ben Jealous, executive director of the Sierra Club, the largest US environmental association (very close to the Democrats) harshly criticized the decision: «We cannot drill our way towards a sustainable future. We must conserve public lands, not sell them off to polluting corporations. The damaging effects of President Biden's decision cannot be underestimated. By allowing ConocoPhillips to do this, he and his administration have made it nearly impossible to achieve the climate goals they set for public lands. Willow will be one of the largest oil and gas operations on federal public lands in the country, and the carbon pollution it will release into the air will have devastating effects on our communities, wildlife and climate. We will suffer the consequences for decades to come. As we celebrate the administration's unprecedented protections for Alaska's land and waters, the decision to approve Project Willow could very well wipe out many of these climate and ecological benefits. And as you approve one of the largest oil and gas projects on federal public lands, one must ask the question of what the Biden administration has in store for the Arctic Refuge. For People vs. Fossil Fuels, “The Willow Oil Project locks us into decades of fossil fuel pollution at a time when we desperately need to shut down all new fossil fuel projects and quickly begin phasing out existing production. The approval is a denial of climate science and directly contradicts the administration's commitment to protect Alaskan wilderness from resource extraction and Biden's stated climate goals. The coalition of which Greenpeace USA is also part highlights that «Global scientists have been absolutely clear: we must end the expansion of fossil fuels if we are to avoid irreversible climate devastation and immediate damage to frontline communities. The approval of a massive new oil drilling project estimated to release 280 million tons of greenhouse gases when we are already in a climate emergency is shaping our future. Biden's presidential powers allow him to reject all new fossil fuel projects and declare a climate emergency that would ensure the survival of our communities and our planet. Instead, it is choosing to fatten the wallets of oil CEOs by expanding the fossil fuel infrastructure that will push us further into climate chaos. The fight for #StopWillow and all new fossil fuel projects is not over. Our movement to fight fossils continues to grow and we will continue to fight for a livable future aligned with science and justice."

from: green report.it

#stopwillow#willow project#alaska#stop willow project#joe biden#protest#protest against willow project#stop the willow project

5 notes

·

View notes

Text

Olefin, a beloved hydrocarbon, is feeling down these days.

The main source of Olefin’s sadness stems from its lack of widespread use as an industrial feedstock. For years, Olefin has been viewed as too expensive to use in the larger volume and quantity needed for the production of various synthetic materials. This has caused a significant decline in volume production for Olefin-based products.

Moreover, some of Olefin’s key characteristics of being non-flammable and chemically stable are actually being used against it as companies are looking to use other hydrocarbons that are safer and more cost effective. Olefin’s sole reliance on petroleum means that prices and demand will always fluctuate, causing further industry uncertainty.

In a further blow, there is a lack of support from the government for this hydrocarbon, as research into renewable alternatives has become much more prominent in recent years. Additionally, more stringent environmental regulations coupled with disputes over trade have further contributed to Olefin’s financial woes.

Unfortunately, Olefin’s outlook doesn’t look to be improving any time soon, but the hydrocarbon remains hopeful for a revival in its use among industry and continued research into alternatives that utilize the many unique properties it possesses.

2 notes

·

View notes

Text

[eKathimerini is Greek media]

The Greek government sees last week’s signing of a preliminary hydrocarbon exploration agreement between Turkey and the Tripoli-based Libyan government of Abdulhamid al-Dbeibah as a possible prelude to aggressive moves by Turkey to dispute its sovereignty over parts of the Mediterranean, most likely south of Crete.

To forestall such moves or mitigate their intensity and effect, Athens is looking to its allies, both inside and outside the European Union. Already, the European Commission and countries such as France and Germany have declared that the Libyan-Turkish deal does not bind Greece because it directly clashes with its rights and interests. Within bitterly divided Libya itself, the agreement is opposed by the Benghazi-based Parliament. Egypt, a country directly south of Greece and, like it, in the way of non-neighboring Libya and Turkey, is also affected.

Egypt and Greece signed a deal delimiting their maritime jurisdiction zones after the similar, legally questionable Turkish-Libyan agreement of 2018, the basis of which is Turkey’s claim that islands, notably Crete, cannot have their own continental shelf.

Practically, the hydrocarbons deal means that Libya can invite Turkey to search for oil and gas in “its” zone, south of Crete. This would be an escalation, compared to Turkey’s similar forays in the Aegean during the summer of 2020. Athens believes an Egyptian naval presence in the area, perhaps as part of joint exercises, could help counter Turkey’s moves.

Athens is also concerned that Turkish President Recep Tayyip Erdogan, facing a difficult reelection bid next year, will choose the interim between the, very likely, two Greek elections, also in 2023, for a sharp escalation.

10 Oct 22

8 notes

·

View notes

Text

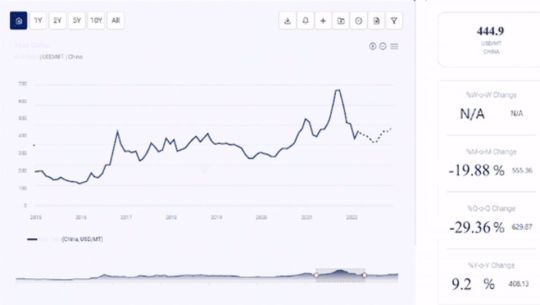

Hexene Prices, Price Trend, News, Analysis & Forecast

Hexene Prices: For the Quarter Ending March 2024

Hexene prices are subject to a myriad of factors, ranging from market demand and supply dynamics to geopolitical tensions and economic indicators. Understanding these influences is crucial for businesses operating within the petrochemical industry, as hexene serves as a vital component in the production of various plastics and polymers. The pricing of hexene is inherently tied to the broader trends in the oil and gas sector, given that it is derived from the cracking of hydrocarbons. Therefore, fluctuations in crude oil prices can have a significant impact on hexene prices, as they directly affect the cost of feedstock used in its production.

Moreover, the global demand for plastics and polymers plays a pivotal role in determining hexene prices. As these materials find extensive applications across diverse industries such as packaging, automotive, construction, and electronics, any shifts in consumer behavior or industrial output can create ripples in the hexene market. For instance, during periods of economic expansion, there tends to be greater demand for plastic products, leading to an uptick in hexene prices. Conversely, economic downturns or slowdowns may result in decreased demand, exerting downward pressure on prices.

Supply-side factors also exert influence on hexene pricing. Production capacity, availability of raw materials, and technological advancements in manufacturing processes all contribute to the overall supply of hexene in the market. Any disruptions in production, such as plant maintenance or unexpected outages, can restrict supply and push prices higher. On the other hand, innovations in extraction and refining techniques may increase production efficiency, leading to an oversupply situation and subsequent price declines.

Get Real Time Prices of Hexene: https://www.chemanalyst.com/Pricing-data/hexene-1230

Furthermore, geopolitical events and regulatory developments can introduce volatility into the hexene market. Political tensions in key oil-producing regions, trade disputes between major economies, and changes in environmental policies can disrupt supply chains and trade flows, impacting hexene prices. For example, sanctions imposed on oil-exporting countries can restrict access to crucial feedstock supplies, driving up production costs and, consequently, hexene prices.

In recent years, environmental considerations have emerged as a significant factor influencing hexene pricing. With growing awareness of climate change and sustainability concerns, there is increasing pressure on industries to adopt eco-friendly practices and reduce their carbon footprint. This has led to greater interest in bio-based alternatives to traditional petrochemicals, including bio-based hexene derived from renewable sources such as biomass or agricultural waste. The development and commercialization of these green technologies have the potential to reshape the competitive landscape of the hexene market and introduce new pricing dynamics.

In addition to these external factors, market participants also need to consider internal industry dynamics and competitive forces. The concentration of producers, bargaining power of suppliers, and the threat of substitutes all contribute to the pricing strategies adopted by hexene manufacturers. In a highly competitive market, companies may engage in pricing wars or strategic alliances to gain market share, which can influence overall price levels.

Amidst these complex dynamics, forecasting hexene prices with precision remains a challenging task. However, industry players can mitigate risks and capitalize on opportunities by staying abreast of market trends, conducting thorough supply chain analyses, and implementing robust risk management strategies. By understanding the interconnectedness of various factors shaping hexene prices, businesses can make informed decisions to navigate the volatility of the petrochemical market and maintain competitiveness in the long run.

Get Real Time Prices of Hexene: https://www.chemanalyst.com/Pricing-data/hexene-1230

Contact Us:

ChemAnalyst

GmbH - S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Call: +49-221-6505-8833

Email: [email protected]

Website: https://www.chemanalyst.com

0 notes

Text

Navigating the Diesel Market: Price Forecast, Index, Trend, and Historical Chart

Diesel (C12H23) is a liquid fuel designed particularly for Diesel engines. These internal combustible engine oils ignite the fuel through compression of the inlet air inside the engine. It comprises 75% saturated hydrocarbons, 25% aromatic hydrocarbons, and its boiling point ranges around 150-380°C. The chemical constituents may generally vary from 10 carbon along with 20 hydrogen atoms to 15 carbons along with 28 hydrogen atoms.

Request for Real-Time Diesel Prices: https://procurementresource.com/resource-center/diesel-price-trends/pricerequest

Diesel fuel is a complex mixture of hydrocarbons comprising paraffin, olefins, naphthene, and aromatics. It appears to be a slightly brown viscous liquid, which is highly volatile and has a characteristic odor.

The key importing countries for Diesel include India, Vietnam, and Indonesia. On the other hand, the key exporting countries are India, the United States, and China.

Key Details About the Diesel Price Trend:

The trends in diesel prices can be influenced by various factors, including global oil demand and supply dynamics, geopolitical tensions, economic conditions, government policies, and environmental regulations. Here are some key details about the diesel price trend:

Global Oil Market Trends: Diesel prices are closely tied to trends in the global oil market. Fluctuations in crude oil prices, driven by factors such as production levels, geopolitical tensions, and global economic conditions, have a significant impact on diesel prices.

Supply and Demand Dynamics: Like any commodity, diesel prices are influenced by supply and demand dynamics. Increases in demand, particularly from growing economies or during peak travel seasons, can lead to higher prices if supply cannot keep pace. Conversely, oversupply can put downward pressure on prices.

Geopolitical Factors: Political instability in major oil-producing regions, such as the Middle East, can disrupt oil production and distribution, leading to fluctuations in diesel prices. Geopolitical tensions, trade disputes, and sanctions can also affect market sentiment and prices.

Economic Conditions: Economic factors, such as GDP growth, inflation rates, and unemployment levels, can impact diesel prices. Strong economic growth typically leads to increased demand for diesel fuel, while economic downturns can dampen demand.

Government Policies and Taxes: Government policies and regulations, including taxes, subsidies, and environmental standards, play a significant role in diesel pricing. Taxes can vary widely between countries and can account for a significant portion of the retail price of diesel.

Environmental Regulations: Environmental policies aimed at reducing emissions can influence diesel prices by requiring the use of low-sulfur diesel fuel or mandating the adoption of cleaner technologies, which may involve additional costs for refineries and consumers.

Seasonal Variations: Diesel prices can also exhibit seasonal variations, with prices typically higher during peak demand periods such as winter, when diesel is used for heating, and summer, when there is increased demand for transportation.

Currency Exchange Rates: Diesel prices are often denominated in local currencies, but they are also influenced by fluctuations in exchange rates. Changes in currency values relative to the US dollar, in which oil prices are usually quoted, can impact the cost of diesel imports and exports.

Understanding these key factors can help stakeholders, including consumers, businesses, and policymakers, anticipate and respond to changes in diesel prices.

Industrial Uses Impacting Diesel Price Trend:

Industrial uses can significantly impact diesel prices due to their reliance on this fuel for various operations. Here are some ways industrial uses can influence diesel price trends:

Transportation and Logistics: The transportation sector, including trucks, trains, and ships, heavily relies on diesel fuel. Any increase in demand for transporting goods, whether due to economic growth or seasonal factors, can lead to higher diesel prices. Similarly, disruptions in transportation networks or geopolitical tensions affecting oil supply can cause diesel prices to rise.

Construction and Infrastructure: Diesel is commonly used in construction equipment such as bulldozers, excavators, and cranes. Increased construction activity, particularly during economic booms or large infrastructure projects, can drive up diesel demand and consequently its price.

Manufacturing Processes: Many manufacturing industries use diesel-powered machinery for operations such as material handling, processing, and power generation. Fluctuations in manufacturing output, such as increased production during economic expansions or decreased production during downturns, can impact diesel consumption and prices.

Agriculture: Diesel is essential in agriculture for powering tractors, harvesters, and irrigation pumps. Seasonal factors, weather conditions affecting planting and harvesting, and changes in agricultural practices can all influence diesel demand and prices.

Power Generation: In some regions, diesel generators are used for backup power or in areas where access to electricity grids is limited. Events like natural disasters or power grid failures can increase demand for diesel for emergency power generation, affecting prices temporarily.

Global Economic Conditions: Overall economic conditions, both domestically and internationally, play a significant role in diesel price trends. Economic growth tends to increase industrial activity and demand for diesel, while economic slowdowns can lead to reduced demand and lower prices.

Government Policies and Regulations: Changes in government policies and regulations related to environmental standards, fuel taxes, or subsidies can also impact diesel prices. For example, stricter emissions regulations may require the use of more expensive low-sulfur diesel, affecting its price.

Global Oil Market Dynamics: Diesel prices are ultimately influenced by broader trends in the global oil market, including factors such as oil production levels, OPEC decisions, geopolitical tensions in oil-producing regions, and fluctuations in crude oil prices.

Understanding these factors and their interplay is crucial for predicting diesel price trends and managing their impact on industrial operations and costs.

Key Players:

Chevron Corporation

Robert Bosch GmbH

Ishtar Company LLC

PJSC Gazprom

Royal Dutch Shell Plc

Exxon Mobil Corporation

PetroChina Company Limited

News & Recent Development

Date: January 10, 2023- Delhi government imposes a temporary ban on the BS-IV Diesel and BS-III petrol vehicles to control the air quality in the NCR region.

About Us:

Procurement Resource stands as a premier provider of meticulously researched market intelligence spanning over 500 chemicals, commodities, and utilities, updated dynamically on a daily, weekly, monthly, and annual basis. Our comprehensive suite of services offers invaluable insights into product pricing, market trends, cost models, and benchmarking analysis, empowering clients across the value chain to optimize their procurement strategies effectively. Bolstered by a team of seasoned analysts, we pride ourselves on delivering the latest and most relevant data, enabling organizations to navigate the intricacies of procurement with confidence. By fostering collaboration with diverse procurement teams across industries, we continuously refine our methodologies and stay abreast of emerging trends, ensuring our clients stay ahead of the curve and achieve sustainable growth. At Procurement Resource, we are committed to providing unparalleled support and innovative solutions, equipping our clientele with the tools they need to thrive in an ever-evolving marketplace.

Contact Us:

Company Name: Procurement Resource

Contact Person: Chris Byrd

Email: [email protected]

Toll-Free Number: USA & Canada – Phone no: +1 307 363 1045 | UK – Phone no: +44 7537 132103 | Asia-Pacific (APAC) – Phone no: +91 1203185500

Address: 30 North Gould Street, Sheridan, WY 82801, USA

1 note

·

View note

Text

Laying the Foundations: Exploring the Offshore Pipeline Market

Offshore pipelines serve as the backbone of the global energy infrastructure, enabling the transportation of oil, natural gas, and other hydrocarbons from offshore production facilities to onshore processing plants and distribution networks. This article delves into the intricacies of the offshore pipeline market, its significance in the energy sector, and the factors driving its growth and evolution.

At the heart of the offshore pipeline market lies the need for safe, reliable, and cost-effective solutions for transporting energy resources from offshore reserves to onshore markets. Offshore pipelines play a critical role in connecting offshore oil and gas fields with processing facilities, refineries, and distribution terminals located onshore, facilitating the efficient extraction, production, and distribution of hydrocarbons to meet global energy demand.

Moreover, offshore pipelines are essential for accessing remote and deepwater offshore reserves that are beyond the reach of traditional onshore infrastructure. As technology advancements enable the exploration and development of offshore fields in deeper waters and harsher environments, the demand for offshore pipelines continues to grow, driving investments in pipeline construction, installation, and maintenance.

Request the sample copy of report @ https://www.globalinsightservices.com/request-sample/GIS24290

The growth of the offshore pipeline market is further fueled by increasing demand for natural gas as a cleaner alternative to coal and other fossil fuels, as well as the expansion of offshore oil and gas production in emerging regions such as Latin America, Africa, and the Arctic. Additionally, advancements in pipeline materials, design, and construction techniques are enhancing the reliability, integrity, and longevity of offshore pipelines, enabling operators to transport larger volumes of hydrocarbons over longer distances with minimal environmental impact.

Furthermore, the offshore pipeline market is influenced by regulatory frameworks, environmental considerations, and geopolitical factors that shape the development and operation of offshore energy projects. Regulatory agencies impose strict requirements on the design, construction, and operation of offshore pipelines to ensure safety, environmental protection, and compliance with international standards and best practices. Environmental impact assessments, risk assessments, and mitigation measures are integral parts of the planning and permitting process for offshore pipeline projects, requiring operators to adopt sustainable practices and technologies to minimize ecological disturbance and mitigate potential impacts on marine ecosystems.

Additionally, geopolitical factors such as territorial disputes, international sanctions, and geopolitical tensions can impact the development and operation of offshore pipelines, affecting investment decisions, project timelines, and market dynamics. Uncertainty surrounding regulatory frameworks, permit approvals, and geopolitical risks can pose challenges for developers and operators of offshore pipeline projects, requiring strategic planning, risk management, and stakeholder engagement to navigate complex legal, political, and regulatory landscapes.

Despite the opportunities for growth, the offshore pipeline market also faces challenges, including volatile commodity prices, project delays, and technological risks. Fluctuations in oil and gas prices can impact the profitability and viability of offshore pipeline projects, affecting investment decisions and project economics. Additionally, project delays due to technical issues, logistical constraints, or regulatory hurdles can increase construction costs and extend project timelines, posing challenges for developers, investors, and stakeholders involved in offshore pipeline projects.

In conclusion, the offshore pipeline market plays a crucial role in facilitating the extraction, production, and transportation of offshore oil and gas resources to global markets. With its ability to connect remote offshore fields with onshore processing facilities and distribution networks, offshore pipelines are indispensable components of the global energy infrastructure. By navigating the challenges and leveraging the opportunities presented by the offshore pipeline market, stakeholders can contribute to the continued growth, sustainability, and resilience of the offshore energy sector.

0 notes

Link

0 notes

Text

Analyzing Security and Legal Challenges in French Maritime Domain

The French maritime domain, consisting of vast coastlines and overseas territories, presents unique security and legal challenges. Over the years, France has witnessed the evolution of these challenges, including historical conflicts and contemporary threats. This article aims to analyze the security and legal challenges in the French maritime domain, exploring their historical context, contemporary complexities, security measures, legal framework, and future prospects. By understanding these challenges, France can effectively safeguard its maritime interests and contribute to global maritime security.

===Historical Context: Understanding the Evolution of Security and Legal Issues

The historical context of security and legal challenges in the French maritime domain is crucial to comprehend the present-day scenario. France's rich maritime history, marked by colonial expansion and naval conflicts, has shaped its current challenges. From the Age of Exploration to the Napoleonic Wars, numerous security threats emerged, including piracy, territorial disputes, and smuggling. These challenges created a need for robust security measures and legal frameworks that would safeguard French maritime interests.

===Contemporary Challenges: Examining Current Threats and Legal Complexities

In the contemporary era, France faces a range of security threats and legal complexities in its maritime domain. One of the primary challenges is maritime terrorism, with pirates and extremist groups posing a significant threat to commercial vessels and offshore installations. Additionally, drug trafficking and illegal immigration contribute to the security concerns, requiring enhanced surveillance and cooperation with international partners. Moreover, the increasing competition for maritime resources, such as fisheries and hydrocarbons, creates legal complexities and potential conflicts with neighboring states.

===Security Measures: Analyzing Strategies to Safeguard French Maritime Interests

In response to the security challenges, France has implemented various strategies to safeguard its maritime interests. These include strengthening naval forces, enhancing surveillance capabilities, and conducting joint patrols with international partners. The establishment of specialized maritime security units and the integration of technology, such as satellite monitoring and unmanned aerial vehicles, have significantly bolstered France's ability to respond to security threats. Furthermore, international cooperation and information sharing play a vital role in ensuring effective security measures within the French maritime domain.

===Legal Framework: Evaluating the Applicable Laws and International Conventions

France operates within a comprehensive legal framework that governs its maritime domain. This framework includes national legislation, European Union regulations, and international conventions. The United Nations Convention on the Law of the Sea (UNCLOS) serves as the primary legal instrument, defining maritime boundaries, rights, and responsibilities. Additionally, France collaborates with neighboring states in the Mediterranean and Atlantic regions to establish bilateral agreements for cooperation on maritime security. The legal framework ensures the protection of French maritime interests while respecting international law and promoting cooperation with other nations.

===Conclusion: Assessing the Future Prospects and Recommendations for Enhanced Security

In conclusion, the security and legal challenges in the French maritime domain require constant analysis and adaptation. Historical conflicts have shaped the current scenario, and contemporary threats demand innovative security measures. France's strategies to safeguard its maritime interests, coupled with a robust legal framework, contribute to maritime security not only within its waters but also globally. To enhance security, France should continue investing in advanced surveillance technologies, fostering international partnerships, and promoting regional cooperation. By doing so, France can overcome the challenges it faces and pave the way for a safer and more secure future in its maritime domain.

Read the full article

#AnalyzingSecurityandLegalChallengesinFrenchMaritimeDomain#ContemporaryChallenges:ExaminingCurrentThreatsandLegalComplexities#Frenchmaritimedomain#HistoricalContext:UnderstandingtheEvolutionofSecurityandLegalIssuesoffrancewatersdomain#LegalFramework:EvaluatingtheApplicableLawsandInternationalConventions#SecurityMeasures:AnalyzingStrategiestoSafeguardFrenchMaritimeInterests

0 notes

Text

Oil and Gas Custody Metering System Market Size Worth USD 15.85 billion, Globally, By 2030 At 6.50% CAGR.

The latest market report published by Credence Research, Inc. “Global Oil and Gas Custody Metering System Market: Growth, Future Prospects, and Competitive Analysis, 2016 – 2028. The Oil and Gas Custody Metering System Market has witnessed steady growth in recent years and is expected to continue growing at a CAGR of 6.50% between 2022 and 2030. The market was valued at USD 10.2 billion in 2022 and is expected to reach USD 15.85 billion in 2030.

Oil and Gas Custody Metering System Market Drivers refer to the various factors that propel the growth of this market. As a critical component within the oil and gas industry, custody metering systems play a crucial role in accurately measuring and monitoring the flow of oil and gas during production, transportation, and distribution processes. One significant driver is the increasing demand for energy resources globally. With rising populations and industrialization, there is an ever-growing need for reliable measurement systems to ensure fair transactions between buyers and sellers while preventing revenue loss due to inaccuracies or disputes. Additionally, stringent government regulations regarding accurate measurement practices further drive the adoption of custody metering systems as they enable compliance with environmental standards and prevent any potential environmental hazards caused by leaks or spills during exploration or transportation phases.

Oil and gas industries are instrumental in powering the world's economy. As these sectors continue to experience dramatic growth, the significance of custody transfer metering systems has come to the forefront. These systems, often referred to as fiscal metering systems, ensure accurate measurement and accountability in the transfer of petroleum products from one party to another, becoming an essential cog in the oil and gas industry's machinery.

Custody Metering System: An Indispensable Resource

In today's complex, high-stakes energy market, precision is the key to efficiency and profitability. Custody metering systems play a critical role in delivering this precision. These systems offer accurate measurements in the transfer of hydrocarbons, from crude oil to natural gas, under different conditions of temperature and pressure. The ultimate objective is to mitigate disputes over volumes and facilitate fair and equitable trade.

Technological Advances: Ushering a New Era

Rapid advancements in technology have expanded the capabilities of these custody metering systems. With the implementation of ultrasonic meters, Coriolis flow meters, and other cutting-edge devices, it's possible to achieve unparalleled accuracy in fluid measurements, reducing error margins to near-zero levels. These innovations have not only enhanced the accuracy but also improved the operational efficiency of oil and gas companies.

Decoding the Metering System

Flow Computers: The Brain Behind the Operation

Flow computers are at the heart of the custody transfer metering system. They collect and process data from various flow meters and sensors to calculate the precise volume of hydrocarbons transferred. The more advanced the flow computer, the more accurate the measurements, and the greater the profitability.

Meter Proving: The Guardian of Accuracy

Meter proving is a procedure to verify the accuracy of flow meters. It ensures that the metering system is performing optimally, providing a solid basis for trust in transactions. Regular meter proving not only helps maintain accuracy but also extends the operational lifespan of the metering system.

Browse 210 pages report Oil and Gas Custody Metering System Market By Flow Meter (Coriolis, Ultrasonic, Vortex, Thermal, Differential Pressure, Positive Displacement, Others) By Application (Offshore, Onshore) - Growth, Future Prospects & Competitive Analysis, 2016 – 2030)- https://www.credenceresearch.com/report/oil-and-gas-custody-metering-system-market

The Role of Pressure and Temperature Compensation

In oil and gas custody transfer, the volume of hydrocarbons can fluctuate with changes in pressure and temperature. Therefore, the metering system includes pressure and temperature compensators to adjust the measurements and ensure they remain accurate under varying conditions.

Growing Market: A Snapshot

The market for oil and gas custody metering systems has been expanding steadily. The surge in oil and gas exploration activities, increasing demand for petroleum products, stringent government regulations, and the global shift towards sustainable energy resources have all played a part in fueling this growth.

The Future Landscape

As technology continues to evolve, so will the capabilities of custody metering systems. The incorporation of Artificial Intelligence (AI) and Machine Learning (ML) technologies, for example, could enhance the system's ability to predict and mitigate potential errors, ensuring even greater accuracy and efficiency.

The oil and gas custody metering system market is poised to undergo exciting transformations, providing limitless opportunities for investors and stakeholders in the oil and gas industry. The time to engage with this expanding market is now. With an in-depth understanding of these systems and their growing importance in the global energy landscape, one can navigate the challenges of the industry and tap into its immense potential.

Why to Buy This Report-

The report provides a qualitative as well as quantitative analysis of the global Oil and Gas Custody Metering System Market by segments, current trends, drivers, restraints, opportunities, challenges, and market dynamics with the historical period from 2016-2020, the base year- 2021, and the projection period 2022-2028.

The report includes information on the competitive landscape, such as how the market's top competitors operate at the global, regional, and country levels.

Major nations in each region with their import/export statistics

The global Oil and Gas Custody Metering System Market report also includes the analysis of the market at a global, regional, and country-level along with key market trends, major players analysis, market growth strategies, and key application areas.

Browse Full Report: https://www.credenceresearch.com/report/oil-and-gas-custody-metering-system-market

Visit: https://www.credenceresearch.com/

Related Report: https://www.credenceresearch.com/report/lithium-ion-battery-binders-market

Related Report: https://www.credenceresearch.com/report/oil-and-gas-actuators-market

Browse Our Blog: https://www.linkedin.com/pulse/oil-gas-custody-metering-system-market-size-worth-usd-priyanshi-singh

Browse Our Blog: https://tealfeed.com/oil-gas-custody-metering-system-market-ir5zb

About Us -

Credence Research is a viable intelligence and market research platform that provides quantitative B2B research to more than 10,000 clients worldwide and is built on the Give principle. The company is a market research and consulting firm serving governments, non-legislative associations, non-profit organizations, and various organizations worldwide. We help our clients improve their execution in a lasting way and understand their most imperative objectives. For nearly a century, we’ve built a company well-prepared for this task.

Contact Us:

Office No 3 Second Floor, Abhilasha Bhawan, Pinto Park, Gwalior [M.P] 474005 India

0 notes

Text

For decades, scholars and policymakers have puzzled over the question: What is China trying to accomplish with its extensive maritime claims throughout the South and East China seas?

A few answers are floated regularly: Perhaps Beijing wants to control natural resources. The South China Sea is a rich source of fisheries and other living resources, and it contains commercially viable hydrocarbon deposits. Or, perhaps, Chinese leaders seek security. After all, Beijing has constructed military bases on Woody Island in the Paracels and on all seven of the Spratly Islands that it occupies. Chinese leaders may also want to bolster Beijing’s status in the larger regional order by setting the maritime agenda and making the rules for dispute resolution.

But neither resource interests, security, nor status alone provide satisfactory explanations for Beijing’s behavior. Instead, as China analyst Isaac B. Kardon argues in his groundbreaking book, China’s Law of the Sea: The New Rules of Maritime Order, Beijing sees itself as fundamentally above the law and beyond accountability to others, especially smaller states. And while full-scale global change to the oceans regime is beyond China’s grasp, Kardon writes, Beijing’s actions may have consequences beyond its nearby waters.

The law of the sea—codified for decades in the United Nations Convention on the Law of the Sea—is pretty clear on most things. Countries have territorial seas stretching 12 nautical miles off their coasts. Islands do, too. Rocks and submerged features do not. Countries also have resource zones that stretch at least 200 nautical miles, theirs alone to fish, mine, and harvest deep-sea riches. Every state can fly, sail, and operate in waters beyond the territorial seas and pass freely through straits. The problem is that China, though a party to the U.N. convention, flouts each of these elements.

China, as Kardon systematically demonstrates, challenges the prevailing law of the sea by undermining the geography-based rules for defining coastal zones, controlling ocean resources that belong to other states, hampering freedom of navigation, and ignoring its commitment to abide by dispute resolution provisions.

In East Asia, Kardon argues, “China is not so much changing the rules as it is reducing their importance.” In other words, existing international law is fine elsewhere, but in this region, what China says goes. For instance, China exercises regional “veto jurisdiction” in maritime resources zones by blocking Japan, Vietnam, and the Philippines from developing their oil and gas fields unless they accept Beijing’s terms. When it comes to unwanted litigation, Kardon writes, China asserts a “great power exception” and reinforces “a sovereignty norm” as excuses for dodging South China Sea arbitration brought by the Philippines.

China’s maritime policies have opened the door for other states to flout the rules, inviting a world in which international law has little relevance at sea. “China is changing the international environment in which those rules take effect,” Kardon writes. That said, China is unique: It backs its maritime claims with formidable naval, law enforcement, and maritime militia fleets. How will that translate to less powerful states? Will they now decide to make expansive historic rights claims? Are all parties to the U.N. convention free to ignore arbitration required by the convention? Will other states decide it is fair game to shoulder out neighbors from enjoying their resource rights?

As Kardon makes clear—and this is a particular strength of his book—the eight states he analyzed that surround the narrow semi-enclosed seas of East Asia have mixed answers to these questions. Like China, they prize the economic value of their coastal waters. They, too, care about their sovereignty and security. Perhaps this is why they also prize the capacity of international law to hold raw power at bay and are generally more supportive of the U.N. convention’s provisions than their more powerful neighbor. But in the face of muscular Chinese coercion, Kardon writes, resorting to the protection of law carries little weight.

At least some countries in the region have been willing to follow China’s lead in ignoring the rules. For instance, Kardon writes, some regional states have claimed a full exclusive economic zone from islets and rocks not entitled to them. This is seen in Japan’s approach to tiny, isolated Okinotorishima, as well as in Vietnam’s greatly excessive baselines—the lines along a country’s coast from which the territorial sea and resource zones are measured. Both cases mirror China’s similarly excessive claims. These are signs of the legal erosion Beijing’s behavior presages.

Meanwhile, only the United States openly and actively opposes Beijing’s limitations on maritime navigational rights and freedoms for foreign ships. Kardon finds no appetite in Southeast Asia to support this area of international law. Some states, such as Brunei, fully acquiesce to Beijing’s legal preferences. Others straddle a middle path. Close U.S. ally Japan is the only regional state to object across the board to China’s attempts to limit military exercises and intelligence gathering—both clearly permitted activities—in the exclusive economic zone.

Even so, Southeast Asians have mustered unified resistance to some of Beijing’s more outrageous claims. China’s so-called nine-dash line and related claims to historic rights cast a net over almost the entirety of the South China Sea, denying Vietnam, Malaysia, Indonesia, and the Philippines access to the maritime resources that international law allocates to them. Aside from Brunei, China’s neighbors universally reject the nine-dash line. And perhaps because they have little but the law to protect their interests, Vietnam, Indonesia, and the Philippines also give full support to the U.N. convention’s mandatory dispute resolution procedures. The problem is that Beijing complains that these procedures offend its sovereignty despite its promise to submit to them when it acceded to the convention. In the face of China’s rejection of tribunals, smaller regional states are left with few, if any, remedies.

Pushback alone is clearly not enough to stop China’s growing sea power—and Beijing’s desire for what Kardon terms a “post-liberal international order”—from potentially reshaping the global oceans regime. Kardon believes that we may see a return to raw power as the organizing principle for the world’s oceans. To paraphrase Thucydides—the strong do what they can; only the weak resort to law. Kardon writes that “[t]he normative flux brought about by China’s law of the sea shows the beginning of a possible rejuvenation of a less universal type of international law.” Indeed.

In steering the international system back toward a realist approach to international law, however, Chinese leaders see themselves as following in the footsteps of the United States. Unlike Beijing, Washington never acceded to the U.N. Convention on the Law of the Sea, despite active support for most of its provisions. Over the past four decades, senators have objected to its encroachments on U.S. sovereignty and the country’s ability to freely project power. China, Kardon writes, has benefited greatly from the absence of U.S. leadership in this important arena.

In particular, China’s membership has allowed it to appoint a judge to the International Tribunal for the Law of the Sea and take a leading role in the International Seabed Authority. Beijing thus “exercises substantive leadership,” as Kardon notes, while undermining the law’s substantive provisions. Because the United States declined to ratify the convention, in part to avoid the same mandatory dispute resolution provisions China refuses to submit to, it gave up an opportunity to exercise leadership over the development of the global oceans regime from inside its institutions. China stepped into this breach. Today, the steady breakdown of the law of the sea in East Asia in the face of Chinese coercion stands as evidence of the failure of U.S. leadership.

This may be the most serious insight of Kardon’s book. We are left to wonder whether U.S. accession to the convention would have changed things. Would the full weight of U.S. support have put sufficient pressure on Beijing to comply? Would it have buttressed an international legal regime against the rise of a competitor? U.S. accession might have reinforced those aspects of international law that are essential to the U.S. national interest, but which now can only be maintained through power.

In this sense, Kardon’s book stands as an epitaph for the end of an era when a truly global, Washington-led maritime order might have been achieved. Perhaps this, more than advancing any resource, security, or status interest, is what China has been trying to accomplish all along.

0 notes

Text

Oil and Gas Transaction Lawyers

Oil and gas transactions lawyers provide legal representation to companies and individuals involved in the exploration, development, production, transportation, storage, refining and marketing of petroleum products. The petroleum industry involves a variety of complex issues, from contract law to environmental and regulatory compliance. Many of these issues are unique to the oil and gas industry, and it is essential for an oil and gas transaction lawyer to be well versed in these issues so they can represent their clients effectively.

Mineral Rights and Leases

Oil-and-gas contracts are complicated, and the mineral rights involved can be divided up among multiple owners. These contracts often govern the terms of operations for oil and gas wells. Having a texas oil rig injury lawyer who understands the nuances of these agreements is key to ensuring each party gets their fair share of compensation and is protected from liability for future violations of the agreement.

Negotiating with a Pipeline Company

The oil and gas industry involves a lot of negotiations with companies who want to build pipelines or modify existing ones. The complexities of negotiating with an energy company can be daunting, but GKT's attorneys know how to handle these negotiations and help our clients receive top dollar for their property.

Litigation and Dispute Resolution

While some disputes can be resolved informally, others need to go to court. Whether it is a dispute between oil and gas companies or between landowners and the energy companies, each side needs an experienced and tenacious attorney to stand up for their interests.

Developing oil and gas can take months, and even years, to accomplish. Those who are part of the industry are constantly dealing with change and must be ready to adjust their business model to accommodate changes in the market and new opportunities. The complexity of the petroleum industry makes it essential for a good oil and gas transaction lawyer to be on the scene from the beginning of a project so that they can advise their client and ensure they are in the best position to achieve their objectives.

Aside from litigation, there are a number of other issues that an oil and gas transaction lawyer may be called upon to handle. One of the most common concerns is to protect property rights from being disrupted by the use of the energy resources.

When an oil and gas well is drilled, the property owner typically transfers their property rights to the oil and gas company. This may include a deed or lease, as well as a royalty payment, pooling and unitization agreement, or surface use agreement.

There are also a number of ancillary matters that can arise, such as water disposal or environmental permits. These are also governed by the same laws, so an experienced oil and gas transaction lawyer on https://oilrigslawyer.com/unpaid-wages/ must be on hand to advise their client.

The energy and natural resources group at Skadden, Arps, Slate, Meagher & Flom LLP has a broad and comprehensive practice advising on a wide range of transactional and regulatory matters. Practice head Frank Bayouth leads from the Houston office, which has strong expertise in domestic US hydrocarbons M&A, joint ventures, strategic alliances, corporate and project financing and major energy-project development. Having full-service capability, the team has extensive experience in both conventional and unconventional onshore basins in North America and offshore transactions in the Gulf of Mexico.

Find out more details in relation to this topic here: https://www.encyclopedia.com/social-sciences-and-law/law/law-divisions-and-codes/lawyer.

0 notes

Text

Why Turkey will not de-escalate its aggression towards Greece. Analysis

Why Turkey will not de-escalate its aggression towards Greece. Analysis

Brief

For decades, the Hellenic Republic and the Republic of Turkey have been in dispute about maritime jurisdiction and other issues in the Aegean Sea. With the discovery of large hydrocarbon deposits in some parts of the Eastern Mediterranean, the relationship between the two states has become even more strained. As their continental shelf entitlements in the Eastern Mediterranean overlap to a…

View On WordPress

#Aegean Sea#AKP TURKEY#Ataturk and Venizelos#Cyprus#Cyprus 1974#Diplomacy#eastern Mediterranean tensions#Geopolitics#Greece#Recep Tayyip ERDOGAN#relations between Turkey and Greece#treaty of lausanne#turkey#ultranationalists turkey

1 note

·

View note