#GreenFinance

Video

youtube

Carbonomics: Rethinking and accelerating Carbon supply chain finance wit...

#youtube#Carbonomics#CarbonSupplyChain#ClimateAction#Sustainability#GreenFinance#CarbonNeutral#SupplyChainManagement#ClimateFinance#RenewableEnergy#EcoFriendly

0 notes

Text

Mastering Material Data Management: A Cornerstone for Sustainable Decision-Making in Green Finance

In today's world, sustainability isn't just a buzzword - it's a driving force for businesses and investors alike. And at the heart of it all lies ESG data. This critical information paints a picture of a company's environmental, social, and governance performance, but gathering it can be a real challenge.

Imagine sifting through mountains of spreadsheets, deciphering cryptic reports, and chasing down data scattered across departments. It's enough to give even the most sustainability-minded individual a headache.

That's where Master Data Management (MDM) steps in, playing a crucial role in ensuring accurate, reliable, and consistent ESG reporting.

Understanding ESG Data:

At the heart of sustainable finance lies ESG data, providing information about a company or investment's environmental, social, and governance (ESG) attributes. This data is used by a wide range of stakeholders, including investors, analysts, companies, policymakers, and more, to understand and make informed decisions about business effectiveness, risk, and sustainability.

Sustainable data management is the responsible management and handling of data throughout its lifecycle. This includes the collection, processing, storage, and disposal of data. Sustainable data management aims to minimize the environmental impact of data management practices, reduce energy consumption, and optimize the use of resources. Sustainable data management also focuses on ensuring that data is used in a socially responsible and ethical way.

Why is Sustainable Data Management Important?

Sustainable data management is essential for several reasons. Firstly, it helps to minimize the environmental impact of data management practices. Data centres and other IT infrastructure consume significant amounts of energy and produce a considerable amount of carbon emissions. Sustainable data management practices aim to reduce energy consumption and carbon emissions by optimizing data centre design, improving energy efficiency, and using renewable energy sources.

88% of publicly traded companies have ESG initiatives in place followed by 79% of venture and private equity-backed companies and 67% of privately-owned companies. (Src:Navex)

Data Collection for ESG Reporting

ESG reporting demands transparency on a company's environmental, social, and governance practices. The first step is choosing the relevant metrics based on your industry, reporting framework (e.g., GRI, SASB, TCFD), and stakeholder interests.

Each framework defines specific metrics for different ESG categories like:

Environment: Greenhouse gas emissions, water usage, waste generation, resource consumption, etc.

Social: Labor practices, diversity and inclusion, employee health and safety, community engagement, etc.

Governance: Board composition, executive compensation, shareholder rights, anti-corruption practices, etc.

Gathering the data to tell this story is crucial, but it can be a complex process. Once the metrics are identified, you need to gather data from various sources:

Internal Data: This includes energy consumption, waste generation, employee diversity, community engagement, and governance policies. Data may reside in various systems like energy meters, HR databases, and financial records, etc.

External Data: Suppliers, industry groups, and governmental agencies provide data on things like raw material sourcing, labor practices, and regulatory compliance, etc.

Prioritizing your Data Collection with Double Materiality

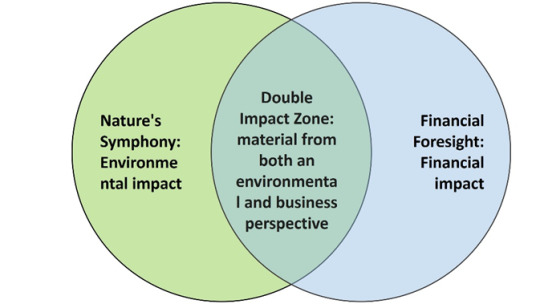

Before diving into data mountains, it's crucial to define your Everest. Enter double materiality, the guiding compass for prioritizing the most impactful ESG and sustainability data your organization needs to collect.

Double materiality emphasizes matters that are significant:

From an ESG perspective: How your operations and actions affect the environment, society, and governance.

From a financial perspective: How ESG issues can impact your business risks and opportunities.

Think of it like Venn diagram of "sustainability is good for the planet" and "sustainability is good for business." The overlapping area forms your double materiality sweet spot, focusing data collection efforts on topics that matter most, both ethically and economically.

Practically, focus your data collection laser! By identifying the most critical ESG topics and risks, you ensure your efforts aren't scattered. Take for example the rising threat of extreme weather events for an energy and utility company – a double materiality double whammy for both sustainability and the bottom line! Now, let's turn the screws: what are the key climate risk data points and KPIs this company needs to track? Where's this data hiding, internally or externally? And how can they grab it efficiently? Prioritization isn't just about sorting – it's about taking targeted action for maximum impact.

The Challenges of Data Cleansing and Management:

Gathering the valuable information isn't always a picnic. Here are some common hurdles:

Data Silos: ESG data often gets trapped in isolated pockets across different departments and systems.

Inconsistent Formats: Metrics may be measured and reported differently, making comparisons difficult.

Data Quality Issues: Missing or inaccurate data can undermine the entire reporting process.

Lack of Resources: Companies may struggle to dedicate time and expertise to data collection.

Inaccurate or missing data can undermine the credibility of your ESG report. MMDM solution providers like Verdantis offers data cleansing, validation, and enrichment tools, enhancing data quality and minimizing errors.

Your ESG materiality should be a mirror reflecting your unique identity, values, and business model. Sustainability and ESG initiatives should build upon this foundation, not replace it.

By prioritizing data management, you ensure your focus remains on the issues that truly matter, driving both environmental progress and financial success.

MDM: The Powerhouse for ESG Data:

As ESG reporting requires accurate and comprehensive data across multiple dimensions, MDM provides the necessary framework to ensure data integrity and consistency.

MDM (Master Data Management) provides the foundation for effective management of ESG data, offering several key benefits:

Single Source of Truth: MDM establishes a single, centralized repository for all ESG data, eliminating inconsistencies and streamlining access for various stakeholders.

Data Quality and Integrity: MDM ensures data accuracy, completeness, and consistency, mitigating risks associated with poor data quality.

Improved Reporting and Compliance: By centralizing and standardizing ESG data, MDM facilitates efficient reporting and compliance with evolving ESG regulations.

Enhanced Decision-Making: Accurate and reliable ESG data empowers companies to make informed decisions about sustainable investments, operations, and stakeholder engagement.

Planting the Seeds for a Sustainable Future:

In our data-driven future, sustainable finance practices are no longer optional but imperative. Robust Master Data Management (MDM) solutions like Verdantis unlock the full potential of ESG data, fostering informed decision-making and transparency. Empower your organization in sustainable finance with MDM, navigating the complex financial landscape one well-governed data point at a time.

Mastering material data management is not just a business necessity but a strategic advantage in our evolving world. Prioritizing accurate material data helps companies navigate green finance, meet ESG standards, and reduce carbon footprints. Integrating sustainability into core decision-making processes contributes to a more resilient and environmentally conscious global economy.

To embark on a data led ESG strategy, organizations require internal support and guidance from consulting partners like Verdantis to craft a blueprint. Considering the vast amount of data involved, the right technology becomes essential.

Remember, MDM is not just about managing data, it's about managing your organization's journey towards a sustainable and responsible future.

Get In Touch Today To Embrace A Sustainable Future: [email protected]/

www.verdantis.com/contact

#ESG#Sustainability#SustainableFinance#GreenFinance#ImpactInvesting#ClimateAction#CorporateSocialResponsibility#CSR#DataDrivenDecisions#FutureProofing#MasterDataManagement#MaterialDataManagement#DataGovernance#GreenInvesting#SustainableInvesting#ESGInvesting#FinTech#ClimateTech#CleanTech#CircularEconomy#Datacleansing

0 notes

Text

youtube

Watch the American Climate Leadership Awards 2024 now: https://youtu.be/bWiW4Rp8vF0?feature=shared

The American Climate Leadership Awards 2024 broadcast recording is now available on ecoAmerica's YouTube channel for viewers to be inspired by active climate leaders. Watch to find out which finalist received the $50,000 grand prize! Hosted by Vanessa Hauc and featuring Bill McKibben and Katharine Hayhoe!

#ACLA24#ACLA24Leaders#youtube#youtube video#climate leaders#climate solutions#climate action#climate and environment#climate#climate change#climate and health#climate blog#climate justice#climate news#weather and climate#environmental news#environment#environmental awareness#environment and health#environmental#environmental issues#environmental justice#environment protection#environmental health#Youtube

17K notes

·

View notes

Text

Northvolt Secures Record $5 Billion in Debt Financing for Expansion and Recycling Facility

Europe’s Leading Battery Manufacturer Readies For Possible Stock Market Listing

In a significant development, Northvolt, the Swedish battery manufacturer, has solidified its status as Europe’s best-funded start-up by securing a groundbreaking $5 billion in debt financing. The funding, acknowledged as the largest green loan in Europe to date, is poised to fuel the expansion of the company’s inaugural gigafactory and the construction of a state-of-the-art recycling facility on the same site. This move highlights the insatiable demand for capital in the region’s burgeoning battery sector and positions Northvolt for potential stock market listing, pending improved market conditions.

Record-Breaking Financing

Northvolt’s recent announcement validates earlier reports from the Financial Times in March, indicating the company’s intent to raise $5 billion in debt. The funds were sourced from a consortium of 23 banks, alongside significant contributions from the European Investment Bank and the Nordic Investment Bank. This financing, which encompasses the refinancing of a $1.6 billion debt package from July 2020, brings the company’s total raised capital to over $13 billion, facilitating its ambitious plan to establish four major factories across Sweden, Germany, and Canada by the decade’s end.

Challenges and Milestones at Northvolt Ett

The financing will play a pivotal role in realizing the full potential of Northvolt Ett, the company’s inaugural gigafactory situated below the Arctic Circle in northern Sweden. Although the company Ett commenced battery production in late 2021, it faced delays and setbacks, impacting overall production. Notably, the Swedish truckmaker Scania, among other customers, has been awaiting deliveries from Northvolt Ett, contributing to the company’s losses, which surged eight-fold to nearly SKr11 billion ($1.1 billion) for the first three quarters of 2023 compared to the previous year.

Focus on Sustainability and Circular Practices

Peter Carlsson, Northvolt’s CEO and co-founder, emphasized the financing as a milestone for the European energy transition. The funds will not only support the gigafactory but also finance the adjacent recycling plant, Revolt Ett. This marks the first instance of a company outside Asia placing a recycling facility next to battery manufacturing. According to Northvolt, recycled battery materials boast a 70% lower carbon footprint than mined minerals, reinforcing the company’s commitment to sustainable and circular business practices.

Environmental Recognition and Future Challenges

Northvolt received a commendable “dark green” rating from Cicero, a Norwegian consultancy assessing the environmental quality of debt offerings. Emma Nehrenheim, Chief Environmental Officer at Northvolt, expressed pride in attracting top-tier financial partners, noting that global capital is increasingly keen on investing in electrification and climate change mitigation. Despite the challenges faced by the company, executives remain optimistic, anticipating that future gigafactories will necessitate their own multibillion-dollar financing packages.

Northvolt received advisory support from BNP Paribas, Allen & Overy, and Mannheimer Swartling, underscoring the strategic collaboration behind this monumental financing endeavor. As Northvolt navigates its expansion and sustainability initiatives, the battery manufacturer is positioned as a trailblazer in Europe’s transition towards greener energy solutions.

Also Read: Pallet Jacks: The Backbone of Efficient Warehousing and Logistics

#Northvolt#GreenFinance#BatteryTechnology#Sustainability#EuropeanStartups#DebtFinancing#RecyclingFacility#Gigafactory

0 notes

Text

ESCOs Reinforce Energy Efficiency’s Role in Building Back Better in India

Billion-dollar ESCO industry can be created in Indian markets that motivate stakeholders to take some intended risks to bring important value in relation to sustained energy savings to end users.

ESCOs play a significant role in delivering energy-efficiency advances. Many industrial operators and building managers lack the technical knowledge to take on energy efficiency developments themselves.

At Yantra, our team of specialists can help you design effective systems, and as their revenues are directly linked to energy savings, Yantra Harvest Energy is going to ensure that the savings are as large as possible.

Here's our latest blog on ‘ESCOs reinforce energy efficiency’s role in building back better in India’

#yantraharvest#powerqualitysolutions#yantraharvestenergysavingsolutions#energysavingsolutions#energysaving#ESCO#Carbonneutrality#innovativeenergysolutions#guaranteedperformance#energyefficiency#zerocapitalinvestment#netzerocarbon#greenfinance#netzero#netzeroemissions

0 notes

Photo

🙌 Impact.Liebe - Impact Investing oder wirkungsorientiertes Investieren ist eine Möglichkeit, um Geld noch gezielter und nachhaltiger anzulegen. 🌱 Mit der Unterstützung ausgewählter Aktien, Projekte etc., soll neben einer positiven Rendite auch ein (messbarer) positiver Effekt auf Umwelt und / oder Gesellschaft erzielt werden. 🌿 Im Gegensatz zur klassischen Geldanlage, wird die soziale oder ökologische Wirkung gemessen und oft ein Wirkungsziel gesetzt. Damit geht Impact Investing über die bisherigen ESG- oder SRI-Divestment-Ansätze hinaus. ESG = Environment, Social und Governance SRI = Socially Responsible Investment ⚠️ Dennoch gilt auch hier: Wie bei den ESG-Kriterien, gibt es keine Standards. Informiert euch daher vorab und prüft, ob die Kriterien auch eurem Verständnis von Nachhaltigkeit entsprechen. ⚖️ Wichtig: Achtet auf eine ausreichende Risikoverteilung eures Vermögens und vernachlässigt trotz ehrgeizigen Impact-Zielen die Diversifikation nicht. ➡️ Was haltet ihr von Impact Investing? Wäre das was für euch? Meint ihr das bringt mehr als nur in bestimmte Aktien nicht zu investieren? In welchem Bereich würdet ihr gerne Impact generieren? #ImpactInvesting #Nachhaltigkeit #NachhaltigeFinanzen #NachhaltigeGeldanlage #NachhaltigInvestieren #GreenFinance #SustainnableFinance #ESGInvesting #GrüneFinanzen #FinanceForFuture #NachhaltigeFinanzen #GrünesGeld #EthischesInvestment #NachhaltigLeben #NachhaltigkeitImAlltag #Umweltbewusstein #SinnFluencer #GreenFluencer #Frugalismus #FinanzielleBildung #Altersvorsorge #FridaysForFutureGermany #AllesFürsKlima #Klimagerechtigkeit #OvershootDay (hier: Stuttgart, Germany) https://www.instagram.com/p/CgoazfLsDYC/?igshid=NGJjMDIxMWI=

#impactinvesting#nachhaltigkeit#nachhaltigefinanzen#nachhaltigegeldanlage#nachhaltiginvestieren#greenfinance#sustainnablefinance#esginvesting#grünefinanzen#financeforfuture#grünesgeld#ethischesinvestment#nachhaltigleben#nachhaltigkeitimalltag#umweltbewusstein#sinnfluencer#greenfluencer#frugalismus#finanziellebildung#altersvorsorge#fridaysforfuturegermany#allesfürsklima#klimagerechtigkeit#overshootday

0 notes

Photo

I want to thank the people of Cameroon 🇨🇲 for hosting a very successful #afrofuturist teambuilding session with French 🇫🇷🇪🇺 leaders . I look forward to our collective efforts under the leadership of new ambitions and visions at #cop27egypt 🇪🇬 #cop28dubai 🇦🇪 #osakaexpo2025 🇯🇵 or #greenfinance event in NYC 🇺🇸 (à Club Yannick Noah, Tongolo) https://www.instagram.com/p/Cggi7maObSj/?igshid=NGJjMDIxMWI=

0 notes

Text

youtube

Watch the 2024 American Climate Leadership Awards for High School Students now: https://youtu.be/5C-bb9PoRLc

The recording is now available on ecoAmerica's YouTube channel for viewers to be inspired by student climate leaders! Join Aishah-Nyeta Brown & Jerome Foster II and be inspired by student climate leaders as we recognize the High School Student finalists. Watch now to find out which student received the $25,000 grand prize and top recognition!

#ACLA24#ACLA24HighSchoolStudents#youtube#youtube video#climate leaders#climate solutions#climate action#climate and environment#climate#climate change#climate and health#climate blog#climate justice#climate news#weather and climate#environmental news#environment#environmental awareness#environment and health#environmental#environmental issues#environmental education#environmental justice#environmental protection#environmental health#high school students#high school#youth#youth of america#school

17K notes

·

View notes

Text

0 notes

Text

0 notes

Text

🌍 Startling UN report at #COP28 reveals a staggering $7 trillion annually fuels activities harming our planet, overshadowing investments in nature-based solutions. It's time to #GreenFinance and redirect these funds towards a sustainable future. The call for action is louder than ever! 🌿💰

#ClimateAction#NaturePositive#COP28UAE#sustainablefuture#climatecrisis#netzero#biodiversity#GlobalGoals#geohoney

6 notes

·

View notes

Text

Buy Flats in Ajmera Greenfinity by IndexTap

Ajmera Greenfinity is a high-end residential complex in Mumbai located in the heart of Wadala (East). This upcoming project, which is being developed by the eminent Ajmera Group, will be ready for possession in January 2024. This gated community promises a luxurious living experience with an emphasis on sustainability.

The budget-friendly housing society, which is spread across a generous land parcel, offers 1, 2 and 3 BHK apartments in a variety of configurations. Ajmera Greenfinity consists of a single 22-floor tower. The apartments in the complex are spacious and well-ventilated, with plenty of natural light and cross-ventilation.

0 notes

Video

youtube

Perma Tokens with Terry Mollner

#youtube#permatokens#terrymollner#sustainableinvesting#ethicalfinance#regenerativeeconomy#socialimpactinvesting#consciousinvesting#ecofriendlyfinance#tokenization#blockchaininvesting#impactfulfinance#holisticinvesting#circulareconomy#greenfinance

0 notes

Text

0 notes

Video

youtube

Green Shoots in a Time of Change: 5 Sustainable Investing Trends Shaping 2024 2024: The Year Sustainable Investing Takes Root Imagine a world where your investments heal the planet, fuel innovation, and create a brighter future for generations to come. This isn't a fictional utopia; it's the burgeoning reality of Sustainable Investing. "The biggest investment today is the one we make in ourselves and in the future of our planet." - Al Gore, former US Vice President Why is now the time to turn your gaze towards green finance? Here's a glimpse into the thriving landscape: * Global ESG assets are projected to hit $53 trillion by 2025 (Bloomberg Intelligence, 2023). * 81% of institutional investors consider ESG factors in their investment decisions (US SIF Foundation, 2023). ♻️ * Companies with strong ESG practices outperform the market by 5% on average (Morgan Stanley, 2023). Sustainable Investing isn't just about saving the planet; it's about unlocking new sources of profit, empowering social good, and shaping a future we can be proud of. Curious to discover the 5 key trends reshaping this exciting field? Then dive into the full first edition of the Sustainable Investing Digest 2024! You'll find actionable insights, inspiring case studies, and expert predictions to equip you for a prosperous journey in green finance. Click here to read the full article and subscribe to the Sustainable Investing Digest for ongoing guidance on navigating the future of finance: https://lnkd.in/e4VWKdM6 Here is Sustainable Investment Digest’s first video of 2024 regarding 5 Trends in Sustainable Investing: https://video.pictory.ai/170733165419... • The Power of Sustainable Investing: D... Remember, every investment you make is a vote for the future you want to see. Together, let's cultivate a forest of sustainable prosperity for all! ✅ Subscribe to Sustainable Investing Digest: • LinkedIn: https://bit.ly/46aQNtW: https://bit.ly/46aQNtW • Youtube: http://bit.ly/3HPwVmi: http://bit.ly/3HPwVmi #sustainableinvesting #batterystorage #GreenFinance #FutureofFinance #cleanenergy #InvestingforChange #2024Trends #hashtag#ImpactInvesting #climateaction #SubscribeNow #climatechange #sustainability #sustainabilityjourney #ai #ml #artificialintelligence

0 notes

Text

Finance verte : les fonds labellisés Greenfin financeront le nucléaire

Extraction d'uranium, raffinage, construction et exploitation de réacteurs… Alors que la filière nucléaire était exclue des critères permettant d'obtenir le label Greenfin « France finance verte », un nouveau référentiel publié au Journal officie

0 notes

Text

Ajmera Greenfinity Wadala East

Ajmera Greenfinity Wadala East is a visionary residential project, epitomizing sustainable and luxurious living. With meticulous design, it seamlessly blends eco-friendly features and modern amenities. The development boasts thoughtfully crafted residences, surrounded by lush greenery, fostering a serene atmosphere. Residents enjoy a harmonious balance between nature and urban conveniences, with cutting-edge architecture and energy-efficient systems. Ajmera Greenfinity is a testament to sustainable living, featuring rainwater harvesting, solar panels, and green spaces, ensuring a lower carbon footprint. Embrace a green lifestyle at this avant-garde development, where innovation meets environmental consciousness for a truly holistic living experience.

0 notes

Text

The Rise of ESG Investing

The Rise of ESG Investing

https://www.youtube.com/watch?v=sSmfPjb68zE

Explore the dynamic world of ESG (Environmental, Social, and Governance) investing in our latest video. Discover why ESG considerations are gaining momentum among investors worldwide and how they are reshaping the financial landscape. Stay informed about the future of responsible investing by watching now!

🔔Ready to achieve Financial Independence by 2025? Click 'Subscribe' and embark on a transformative journey with us: https://www.youtube.com/@family.fire.by.2025

✅ For Business Inquiries: [email protected]

=============================

✅ Recommended Playlists

👉 Financial Independence Facts

https://www.youtube.com/watch?v=OSsqUU0UnJ8&list=PLFbNQzXkUGyw0P-rfVrdiC4-ph8ky3uL_&pp=iAQB

👉 Financial Independence

https://www.youtube.com/watch?v=VG-32QwZ1T0&list=PLFbNQzXkUGyytYLW5TZHFg_Kxdd-bEOfU&pp=iAQB

✅ Other Videos You Might Be Interested In Watching:

👉 Overcoming Money Setbacks Road to Financial Freedom!💰

https://www.youtube.com/watch?v=5avpEXdIbE8

👉 Supercharge Your F.I.R.E Journey: Unleashing the Power of Dividend Reinvestment!

https://www.youtube.com/watch?v=1Jq-nmMxplU

👉 Stop Losing Money! How Lifestyle Inflation Erodes Your Financial Freedom

https://www.youtube.com/watch?v=_uRVmjuZyWU

👉 A Surprising Way to Retire Early & Keep Your Luxury Life! Financial Independence Retire Early

https://www.youtube.com/watch?v=w0GfswvQmrI

👉 Location is the Key to Financial Freedom--But How? Financial Independence Retire Early

https://www.youtube.com/watch?v=SbGOvfoTptE

=============================

✅ About Family FIRE 2025.

Welcome to "Family Fire 2025"! Join our Singaporean family's quest for Financial Independence Retire Early (F.I.R.E) by 2025.

Our channel is your ultimate guide to understanding the F.I.R.E movement, achieving financial freedom, and exploring effective investment strategies, personal finance, budgeting, stock market investing, real estate, saving techniques, and essential financial tools.

We're on a mission to educate and inspire you by sharing our family's journey toward financial independence and demonstrating how smart money habits can lead to a life free from financial stress. We believe everyone can achieve F.I.R.E. with dedication and the right knowledge.

Subscribe to our channel, and let's ignite the F.I.R.E within you together!

Let us embark on this transformative journey, empowering you to take control of your financial destiny and attain the freedom you've always desired.

For Collaboration and Business inquiries, please use the contact information below:

📩 Email: [email protected]

🔔From real estate to stock markets, discover the roadmap to financial freedom with us. Hit that subscribe button: https://www.youtube.com/@family.fire.by.2025

=================================

#ESGInvesting

#SustainableFinance

#ResponsibleInvesting

#ImpactInvesting

#SustainableInvestment

#SociallyResponsible

#ClimateAction

#EthicalInvesting

#GreenFinance

#CorporateGovernance

#SustainableBusiness

#ESGPerformance

#ESGMetrics

#InvestingForGood

#ESGAwareness

Disclaimer: We do not accept any liability for any loss or damage incurred from you acting or not acting as a result of watching any of our publications. You acknowledge that you use the information we provide at your own risk. Do your research.

Copyright Notice: This video and our YouTube channel contain dialog, music, and images that are the property of Family FIRE 2025. You are authorized to share the video link and channel and embed this video in your website or others as long as a link back to our YouTube channel is provided.

© Family FIRE 2025

via Family FIRE 2025 https://www.youtube.com/channel/UCUbT9IupjUO551P-H-NAH1g

October 18, 2023 at 01:00AM

#FinancialIndependence#Budgeting#SavingMoney#Investing#PassiveIncome#DebtReduction#WealthCreation#Entrepreneurship#FinancialFreedom#MoneyManagement#PersonalFinance

0 notes