#File your ITR

Text

How to file your ITR in Delhi as a company or LLP

If you own a business in Delhi and need to file your Income Tax Return (ITR), then this blog post is for you. In this post, we will discuss the steps required to file ITR as a company or LLP in Delhi. We will also provide some useful tips on how to make the process smoother and easier. So read on to find out more about filing ITR in Delhi as a company or LLP.

Register on the e-filing portal

Filing your ITR in Delhi as a company or LLP is easy with the help of the e-filing portal. To get started, you need to first register on the portal by providing your PAN details and other required information. Once your registration is complete, you will be able to access the forms needed for filing your ITR and make the necessary payments. With the e-filing portal, you can quickly and easily complete the filing process without having to worry about any paperwork.

File your ITR

Filing your ITR in Delhi as a company or LLP is a simple process. The first step is to obtain all the necessary documents, such as balance sheets and income tax returns, from the company or LLP. Once these documents are obtained, the ITR must be filed online through the Income Tax Department website. All you have to do is fill out the forms with the relevant information, pay the fees, and submit the form. The process is quick and easy, and you'll be done in no time!

Fill in the company details

Filing your ITR as a company or LLP in Delhi can seem like a daunting task. Fortunately, the process is quite straightforward. First, you will need to collect all of your financial information and documents. Then, you will need to log onto the official Income Tax Department website and register your company or LLP. Once registered, you can begin to fill out the various forms for filing your ITR. Be sure to carefully review all of the information and make sure it is accurate before submitting. With the right preparation, filing your ITR should be hassle-free.

Fill in the LLP details

Filing your ITR in Delhi as an LLP is easy. All you need to do is to provide the necessary information about your LLP such as the name of the LLP, its registered address, PAN details, and financial statements for the past financial year. After filling in the relevant information, your ITR will be processed and filed by a tax professional in Delhi. It is important to remember that all ITRs must be submitted within the prescribed time frame.

Submit the ITR

Submitting your ITR in Delhi is an easy process. You will need to fill out the appropriate ITR forms with your financial information and submit them online or by post. The Income Tax Department of India will then assess your return and determine the amount of tax you owe. With the help of a professional, the process of filing your ITR can be made much simpler.

0 notes

Photo

If you have not filed ITR yet, file your ITR today with the help of experts from Humsabka Advisor

Contact us Now

7669256170/ 87008 46995

Know More: https://humsabkaadvisor.com/

#ITR Filing#ITR Benefits#File your ITR#GST Filing#GST Registration#GST Update#ISO#FSSAI#MSME#Humsabka Group#Humsabka Advisor

1 note

·

View note

Text

Filing your Income-Tax Return is a significant financial undertaking, and avoiding these common mistakes is essential for a seamless process. Take the time to review your details, seek professional guidance if needed, and stay updated with the latest tax regulations. By doing so, you can ensure compliance with tax laws and maximize your financial well-being. Read More

#mistakes to avoid in itr#common mistakes to avoid when filing itr#itr mistakes to avoid#common mistakes to avoid while filing itr#itr mistakes#common mistakes while filing itr#common mistakes in itr#itr filing mistakes#common mistakes to avoid when filing your income tax return#mistakes to avoid while filing itr#5 mistakes to avoid while filing itr#how to file income tax return#itr filing#mistakes in filing itr#mistakes while filing itr

0 notes

Text

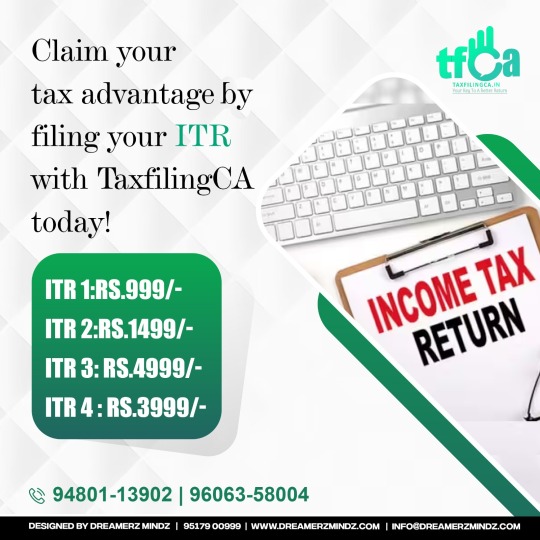

Maximize Your Tax Advantage Today!

File Your ITR with TaxFilingCA for Expert Guidance and Maximum Savings!

ITR 1: Rs.999

ITR 2: Rs.1499

ITR 3: Rs.4999

ITR 4: Rs.3999

To know more, get in touch with us.

Reach us at 9480113902| 9606358004

#taxfilingca#Taxfiling#ITR#itrreturn#ITR1#ITR2#ITR3#income tax return#taxseason2023#tax filing made easy#tax#tax tips#tax savings#smart tax filing#Accurate filing#Maximize your refund#tax professionals#experts

0 notes

Text

Earning and spending are a part of the job cycle and so is tax filing as the country runs on our taxes, hence it is necessary to file ITR on the stipulated time. Many big businessmen do not file GST and after the deadline, they get anxiety attacks. Sometimes they take impulse decisions and get into the trap of fraudsters.

0 notes

Text

Advantages Of Tax Filing For Small Business

Advantages Of Tax Filing For Small Business

Financial literacy direct relationship with your awareness of taxes and how you can use them for your betterment.

In the game of life, your success is measured in numbers in your bank account, and your annual earnings are reflected through your income tax return.

Filling tax returns from businesses and professionals not only paying taxes or showing their annual income and source of income but…

View On WordPress

0 notes

Text

Why is ITR filing important for businesses?

Life is all about money which can be estimated through your income, and bank account. Life is all about numbers in your bank account and income. The filing of ITR is not only for declaring your income to the income tax department but also to avail several benefits. These benefits can be beneficial for you in the short and long-term period.

Benefits of filing ITR for businesses :

It helps as a legal document: it holds high legal value for the business. It is a government document. It acts as legal proof in 2 ways :

IDENTITY PROOF: The return you fill can be used as identity proof in various scenarios such as while applying for an adhar card, or any other document. The government also accepts adhar as the address proof.

INCOME PROOF: An ITR form consists of a detailed list of your income and accounts. The tax you have to file is calculated. ITR can also be used as income proof as some of the transactions like the purchase of property require you to show some proof of income.

Can help you claim deductions: To reduce the burden of tax on taxpayers and to encourage more people to pay tax, the government provides you some deduction in tax. TDS and rebates can also be claimed back. For this deduction, you need to file ITR and if you have not filed any ITR can you will be left from these benefits.

Important document while applying for a loan: when you decide to apply for a loan this ITR file is important. One important document they ask for before you apply for a loan is income proof. Banks generally ask for ITRs for the last 3 years. This is to access your past and current financial situation which shows if you can pay the loan or not.

Helps if planning to go abroad: If you do not file your ITR then it can cancel your plans for going abroad. ITR document is the one item that is required by the countries you need to visit.

Avoid penalty and punishment: If you are eligible to pay taxes on your income and yet still fail to file an ITR then you may be charged. The income tax officer can charge you a penalty of Rs.5000 and other punishments can also be incurred on you if you do not file an ITR.

ITR filing is beneficial for businesses even if it’s small businesses or large ones. ITR can be useful in many fields and work as it contains multiple information or details about you and can be used in multiple sectors in multiple ways.

File your ITR easily now with BTHAWK!

Ease your accounts with us.

BTHAWK !!

#GST billing software#ITR filing#ITR#File your ITR easily#gst registration#billing software#accounting software#billing solution#bthawk#audit#accounting solution#compliance#itr filing#gst billing software

0 notes

Text

instagram

File your Income Tax Return (ITR) at the best cost with Accteez

For more details Call: +91-8860632015

#accteezindia#entrepreneur#buisnessowner#services#partnership#Businessman#startups#networking#startupfunding#onlinebusiness#sociamediatips#socialmediamarketing#digitalmarketing#importexport#fssai#iso9001#trademark#accountingservices#indianentrepreneurs#itrfiling#delhi#gurgaon#noida#faridabad#haryana#mumbai#india#indian#Instagram

3 notes

·

View notes

Text

What is the purpose of an income tax return?

ITR is a tax return form used in India to disclose one's income and assets to the government's IT department. It comprises information regarding the personal and financial details of the taxpayers. ITRs are essentially a taxpayer's self-declaration of their earnings, assets, pending refunds, and taxes paid. While it is usually completed online, it is also possible for senior citizens to complete it manually.

Who is required to file a tax return?

An ITR is not required for everyone. Taxpayers can assess whether or not they need to file an ITR based on a variety of variables. The following are the elements:

An individual whose annual income exceeds the applicable taxable limit of 2.5 lakhs, 3 lakhs, or 5 lakhs.

An ITR must be filed by anyone who owns assets outside of India and earns income from them.

An individual who pays more than Rs. 1 lakh in power bills in a fiscal year is required to file an income tax return.

In a financial year, assesses who deposit more than 1 crore in one or more bank accounts must file an ITR.

If you spend more than $25,000 on international travel throughout the fiscal year, you must file an income tax return.

The Top Advantages of Electronically Filing Income Tax Returns on Time in India

Avoid Penalty

Individuals and corporations can save money by filing their ITRs on time. You may be charged a late fee of up to INR 5,000 if you file your ITR after the deadline. It is in addition to any other penalties that the Act may impose. In addition, you may be obliged to pay the penalty's interest.

Unintentional Claim

If you continue to file ITRs for yourself or your spouse, it will assist you in the event of an accident. Insurance companies demand proof of income to compute the amount of a claim, and if any returns are missing, particularly from the previous three years, the claim amount may be lowered or refused since the court views the ITR as the only evidence.

Furthermore, if a person dies in an automobile accident after completing income tax returns on a regular basis for the previous three years, the government is required to pay the deceased person's relatives. Compensation might be up to three times the deceased person's typical annual salary.

Evidence of Net Worth

The most reliable proof of your net worth or income is an ITR. Form 16, which is supplied by their employer and acts as proof of income, is beneficial to the salaried class. The ITR filing form, on the other hand, can be used as proof of income for self-employed people. It gives a detailed breakdown of these people's income and expenses for each fiscal year.

It can be utilized for a variety of things, including obtaining loans, obtaining insurance coverage, purchasing real estate and other valuable assets, and so on. If you need to provide proof of your income or net worth, the ITR is your only option.

Receiving a Refund

You must file tax returns if a refund of TDS deducted earlier is pending; otherwise, you will have to forego the refund. Some taxpayers may decide to put their money into fixed deposit accounts. On such investments, tax is deducted at source (TDS), which is over 10%.

You can save money on taxes on income from savings vehicles like term deposits if you file an ITR. You can also save money on your dividend income by filing an ITR. While these instruments are subject to taxation, ITR refunds can be used to reduce the amount of tax owed.

In a loan application, eligibility is important

ITR filing on a regular basis reveals stable income and that the individual has been paying taxes on time. Financial institutions use the applicant's prior year ITRs to approve loans and other credit lines such as overdrafts, bank credit cards, cash credits, and bill discounting alternatives. If you are unable to provide any documentation, including an ITR, that the lender/bank deems required, your house loan application may be denied.

Losses can be carried forward

Taxpayers must file a tax return by the due date to claim specified losses that may occur as a result of capital gains, a business, or losses under the Income from House Property head. For example, if you make a profit on the sale of mutual funds or stock, you can offset it by filing tax returns on time and claiming losses from past years.

The basic conclusion is that if tax returns are not submitted on time, unadjusted losses (with limited exceptions) cannot be rolled over to following years. As a result, you'll need to file a tax return to ensure that your losses are carried over and adjusted in the future.

Getting Tenders from the Government

Contractors may have a solid track record of obtaining significant projects in their field of business, whether it's a service or works contract, but if they don't file tax returns on time or at all, they could face serious implications that could harm their firm.

Contractors must not only file their forms on time, but they must also be exceedingly correct and audited (if necessary). This is very important when applying for a government contract. This work may be inspected by the tender scrutiny committee on occasion, and it is normal procedure to review the ITR for the previous five to seven years.

2 notes

·

View notes

Text

Who has to File an Income Tax Return Mandatorily in Delhi?

In the bustling metropolis of Delhi, navigating the maze of income tax regulations can be daunting. Understanding who is obligated to file an income tax return is crucial for every resident. Let's delve into the criteria that make income tax return filing mandatory in Delhi and explore key considerations to streamline the process effectively.

Criteria for Mandatory Income Tax Return Filing in Delhi

Resident Status: Individuals residing in Delhi, whether citizens or non-citizens, are required to file an income tax return if their total income exceeds the prescribed threshold set by the Income Tax Department.

Income Thresholds: The income thresholds vary depending on the age and residential status of the individual. For instance, for the assessment year 2023-24, individuals below 60 years of age with an income exceeding ₹2.5 lakhs are required to file returns. For senior citizens aged 60 to 80, the threshold is ₹3 lakhs, and for super senior citizens above 80 years, it stands at ₹5 lakhs.

Understanding Income Thresholds and Eligibility

Age-based Thresholds: The income tax slabs and thresholds are categorized based on age to provide relief to different segments of taxpayers. It's essential to ascertain the correct slab applicable to your age group to determine your tax filing obligations accurately.

Types of Income: Apart from salary income, various sources such as rental income, interest income, capital gains, and income from business or profession contribute to the total income. Individuals must consider all sources of income to assess whether they meet the mandatory filing criteria.

Implications of Residential Status on Tax Filing Obligations

Resident vs. Non-Resident: The residential status of an individual greatly impacts their tax liabilities. Residents are taxed on their global income, including income earned abroad, whereas non-residents are taxed only on income earned in India. Understanding your residential status is crucial for determining your tax filing obligations accurately.

Double Taxation Avoidance: Individuals who qualify as residents in more than one country may be subjected to double taxation. It's imperative to leverage double taxation avoidance agreements, if applicable, to prevent paying taxes on the same income in multiple jurisdictions.

Importance of Aadhaar Linking and PAN Verification

Aadhaar Linking: Linking Aadhaar with PAN is mandatory for filing income tax returns. It streamlines the verification process and helps in curbing tax evasion by ensuring transparency and authenticity in financial transactions.

PAN Verification: Verifying PAN details ensures that the information provided in the tax return is accurate and matches the records with the Income Tax Department. Any discrepancies in PAN Registration details can lead to delays or rejections in the filing process.

Streamlining the Process With Taxgoal: Online ITR Filing in Delhi

Simplified Online Filing: Taxgoal provides a user-friendly platform for individuals to file their income tax returns seamlessly. With step-by-step guidance and intuitive interfaces, taxpayers can navigate through the filing process effortlessly.

Expert Assistance: Taxgoal offers expert assistance to address queries and provide personalized tax advice. Whether you're a salaried individual, a freelancer, or a business owner, Taxgoal caters to diverse tax filing needs with precision and reliability.

Conclusion

Navigating the intricacies of regulations For Income Tax Return Filing in Delhi requires a clear understanding of the criteria for mandatory filing and compliance with verification procedures. By leveraging technology-driven solutions like Taxgoal, taxpayers can streamline the filing process and ensure adherence to regulatory requirements, thus fostering a culture of tax compliance and transparency.

Final Words

As Delhi continues to evolve as a dynamic economic hub, staying abreast of tax regulations is paramount for individuals to fulfill their civic responsibilities and contribute to the nation's growth story. With the right tools and knowledge at their disposal, taxpayers can navigate the tax landscape with confidence and efficiency.

#Taxgoal#IncomeTax#TaxFiling#DelhiTax#TaxRegulations#Aadhaar#PANVerification#TaxCompliance#ResidentialStatus#TaxThresholds#OnlineFiling#DoubleTaxation#TaxationLaws#FinancialCompliance#TaxAdvice

0 notes

Photo

File your ITR Now. Last Date for ITR Filing is tomorrow.

Contact us to know the details

7669256170/ 87008 46995

Know More: https://humsabkaadvisor.com/

Facebook: https://www.facebook.com/humsabkaadvisor

Instagram: https://www.instagram.com/humsabkaadvisor/

LinkedIn: https://www.linkedin.com/company/humsabkaadvisor

Twitter: https://twitter.com/HumsabkaAdvisor

#ITR Filing#Income Tax Return Filing#File Your ITR#Just 1 Day Left#Last Date#31st July 2022#GST Filing#GST Registration#Trademark Registration#ISO#FSSAI Registration#MSME Registration#Humsabka Group#Humsabka Advisor

0 notes

Text

Streamline Your Tax Filing: ITR-6 Form Online with Taxcellent

File your income tax hassle-free with Taxcellent's online ITR-6 form. Our user-friendly platform simplifies the filing process, ensuring accuracy and compliance. From business income to deductions, we've got you covered. Trust Taxcellent for seamless tax filing and maximize your returns. Start filing today for a stress-free tax season!

0 notes

Text

Gear Up for Financial Freedom: Essential Documents for Your ICICI Personal Loan Application

Life throws unexpected financial curveballs, and sometimes, a personal loan can be the perfect solution to navigate these challenges. ICICI Bank, a leading financial institution in India, offers a variety of personal loan options to help you meet your financial needs. However, before securing the funds you need, ensuring you have the necessary documents for a smooth ICICI Personal Loan application process is crucial.

This comprehensive guide equips you with the knowledge of essential documents required for an ICICI Personal Loan application, ensuring you're well-prepared to navigate the process efficiently.

Understanding the Document Requirements

The specific documents required for your ICICI Personal Loan application may vary slightly depending on your employment status (salaried, self-employed) but generally, here's a breakdown of the most common documents you'll likely need:

Identity Proof:

Aadhaar Card: This is a mandatory document for all loan applicants in India.

PAN Card: Your Permanent Account Number (PAN) card is crucial for tax identification purposes.

Passport (Optional): While not always mandatory, a valid passport can serve as additional proof of identity, especially if you don't have a driver's license.

Address Proof:

Utility Bills (Electricity, Water, Telephone): Recent utility bills (not older than 3 months) with your name and address are acceptable.

Ration Card/Voter ID Card: These documents can also serve as address proof.

Income Proof (Salaried Individuals):

Salary Slips: The last 3 months' salary slips showing your salary structure and deductions are essential.

Bank Statements: Recent bank statements (usually for the last 6 months) provide an overview of your income and expenses.

Form 16 (Latest): This income tax return form verifies your income declared to the government.

Income Proof (Self-Employed Individuals):

Business Proof: Documents like a shop establishment license or a copy of the company registration certificate demonstrate your business existence.

Income Tax Returns (ITRs): The last 2-3 years' ITRs along with audited financial statements showcase your business's financial health.

Bank Statements: Recent bank statements (personal and business accounts) for the last 6 months provide a snapshot of your financial transactions.

Additional Considerations:

While not always mandatory, some additional documents might be requested depending on your specific situation:

Loan Purpose Justification (if applicable): For specific loan purposes like medical treatment or wedding expenses, relevant documents like hospital bills or wedding invitations might be required.

Property Documents (if applicable): If you're offering collateral to secure the loan, property documents like ownership papers will be necessary.

Planning for a Smooth Application Process:

Gather Documents Early: Starting early ensures you have all the necessary documents well before your application submission.

Maintain Order: Organize your documents neatly in a folder or file to facilitate easy verification by the bank.

Double-Check for Completeness: Ensure you have all the required documents and that the information is accurate and up-to-date.

Clear Copies: Submit clear and readable photocopies of all documents.

A Helpful Tool: ICICI Personal Loan EMI Calculator

This calculator allows you to estimate your monthly EMI (Equated Monthly Installment) based on your desired loan amount, interest rate, and repayment tenure.

By using the EMI calculator, you can:

Plan Your Budget: Estimate your monthly loan repayment obligation and ensure it aligns with your financial capabilities.

Compare Loan Options: Experiment with different loan amounts and tenures to find the combination that offers a comfortable EMI for your budget.

Make Informed Decisions: The EMI calculator empowers you to make informed decisions about your loan amount before submitting your application.

Conclusion

Having the necessary documents readily available streamlines your ICICI Personal Loan application process and increases your chances of a swift loan approval. By understanding the required documents, following these tips, and utilizing the ICICI Personal Loan EMI Calculator, you can navigate the loan application process with confidence and take a step towards achieving your financial goals. Remember, ICICI Bank offers a variety of personal loan options to suit diverse needs, so explore their offerings and embark on your journey towards financial freedom.

0 notes

Text

Income-tax return filing: Should you file your ITR in April or wait until July 31?

Income-tax return filing: The income tax (I-T) department has enabled all utilities and notified all forms needed to file income tax returns online in April.

Typically, this exercise is not completed right at the beginning of the financial year, but later. However, this does not mean income taxpayers can start completing their yearly obligation right away. At least not all of them.

Read Also:…

View On WordPress

0 notes

Text

Navigating Tax Season: A Guide For NRIs in Income Tax Return Filing

Sometimes, it becomes a difficult journey for NRIs i.e. Non-Resident Indians to file the income tax return in India. But you can make this journey smooth with the help of right guidance & preparation. Here, in this comprehensive guide we will provide some essential tips for NRIs so that they can navigate the IR Filing process effectively:

Some ITR Filing Tips for NRIs

Understand Your Residential Status: NRIs must have to determine their residential status for tax purposes. NRIs have to pay tax in India on the basis of their residential status that depends on the number of days spent by them in India during the financial year.

Declare Global Income: If you are an NRI, then you have to declare your global income in India that includes the income that has been earned in abroad. It is essential to report all the sources of income accurately including income from salaries, rental properties, capital gains, interest, dividends, etc. to avoid the penalties.

Familiarize Yourself with DTAA: NRIs can utilize the benefit of Double Taxation Avoidance Agreements (DTAA) that has been signed between India & other countries. Under this, you as an NRI can claim relief from double taxation by either claiming tax credit or opting for exemption on certain types of income.

Explore Tax Benefits: Under the Indian Income Tax Act, NRIs can claim deductions and exemptions to reduce their tax liability. NRIs can claim exemptions on certain incomes like long-term capital gains on specified investments.

File Timely Returns: Make sure that you file the Income Tax Returns on time to avoid penalties and interest. Usually, the due date for filing returns for NRIs is July 31st of the assessment year, but you should stay updated with any changes in deadlines.

Conclusion

NRIs can navigate the complexities of filing Income Tax Return easily and confidently by following the above mentioned tips. Always remember, stay informed and proactive which is a key to navigate the world of taxation smoothly.

#income tax#income tax return#income tax return filing#income tax return filing online#itr filing#ITR Filing by NRIs#ITR Filing tips for NRIs

0 notes

Text

Filing Income Tax Returns in India: A Comprehensive Guide with Ensurekar

Introduction

Filing your income tax return (ITR) in India can seem daunting, but with the right information and guidance, it can be a smooth and efficient process. This guide provides a comprehensive overview of e-filing income tax returns in India, including registration, types of returns, filing procedures, and crucial details for the Assessment Year (AY) 2023-24.

What is eFiling Income Tax Return?

The Income Tax Department of India offers a convenient online platform for electronically filing your ITR. This e-filing portal eliminates the need for physical visits to tax offices and streamlines the entire process.

Why File Your ITR?

Individuals falling under specific tax slabs are mandated to file their returns. Here are some reasons why filing your ITR is important:

Fulfilling Tax Obligations: It ensures compliance with tax regulations and avoids potential penalties for non-filing.

Claiming Refunds: If you've paid excess taxes through TDS (Tax Deducted at Source), filing your ITR is necessary to claim a refund.

Loan and Visa Applications: Many financial institutions and embassies require a clean tax filing history for loan approvals and visa processing.

Carrying Forward Losses: If you've incurred losses under a specific income head, filing your return allows you to carry them forward and offset future income.

Building a Credit History: A consistent record of timely ITR filing can positively impact your creditworthiness.

Types of eFiling Income Tax Returns

There are two main ways to file your ITR electronically:

Self-e-Filing: This involves filing your return directly through the Income Tax Department's e-filing portal. You'll need to fill out the ITR form with all necessary information, attach required documents, and submit it online.

Assisted ITR Filing: You can opt for assistance from authorized professionals like tax consultants, chartered accountants, or online tax-filing platforms. These intermediaries will handle the entire filing process, from collecting information to submitting your return online.

Benefits of eFiling Income Tax Return (ITR):

Convenience: Eliminates the need for physical visits and saves time and effort.

Security: The online process protects sensitive information with secure protocols.

Timely Processing: E-filing leads to faster processing and quicker refunds compared to paper returns.

Accuracy: The online platform helps with accurate tax calculations and reduces the chances of errors.

Environmentally Friendly: E-filing reduces paper usage and contributes to a greener environment.

How to File an eFiling Income Tax Return

Step 1: Registration

New users need to register on the Income Tax Department's e-filing portal using their PAN card details.

Step 2: Gather Documents

Collect all relevant documents like PAN card, Aadhaar card, Form 16 (salary certificate), TDS certificates, bank statements, investment proofs, and any other income or deduction-related documents.

Step 3: Choose the Right ITR Form

The appropriate ITR form depends on your income sources and category. Common forms include ITR-1 (for income up to ₹50 lakhs) and ITR-2 (for income with capital gains or foreign assets). For AY 2023-24, ensure you use the most recent versions of the forms.

Step 4: Fill and Verify the ITR Form

Fill out the chosen ITR form with accurate details about your income, deductions, and exemptions. Carefully review the entries to avoid errors. You can verify the return electronically using Aadhaar OTP or EVC (Electronic Verification Code), or by sending a signed physical copy of ITR-V to the Centralized Processing Center (CPC) within 120 days of filing.

Step 5: File the Return Online

Log in to the e-filing portal, navigate to the 'e-File' section and select 'Income Tax Return.' Upload the prepared ITR form or XML file and submit it.

Step 6: Keep Records for Reference

Maintain copies of the filed return, acknowledgment receipt, and supporting documents for future reference.

How Ensurekar Can Help

At Ensurekar, we understand the complexities of tax filing. We offer a comprehensive range of services to ensure a smooth and efficient ITR filing experience:

Expert Guidance: Our experienced tax professionals can guide you through the entire process, from choosing the right ITR form to maximizing deductions and claiming refunds.

Accurate Calculations: We ensure accurate tax calculations to minimize any tax liabilities or penalties.

Timely Filing: We help you meet all deadlines and avoid late filing penalties.

Stress-Free Experience: We take the stress out of tax filing, allowing you to focus on other important matters.

Additional Information:

Penalty for Late Filing of ITR: Filing your ITR after the due date can attract penalties and interest charges on the tax payable.

Steps to File ITR without Form 16: If you don't have Form 16, you can still file your ITR by gathering income proofs from various sources, calculating your TDS using Form 26AS, and claiming eligible deductions.

Conclusion:

Filing your income tax return is a crucial responsibility. By leveraging the benefits of e-filing and potentially seeking professional assistance from Ensurekar, you can ensure a smooth, accurate, and timely filing process.

0 notes