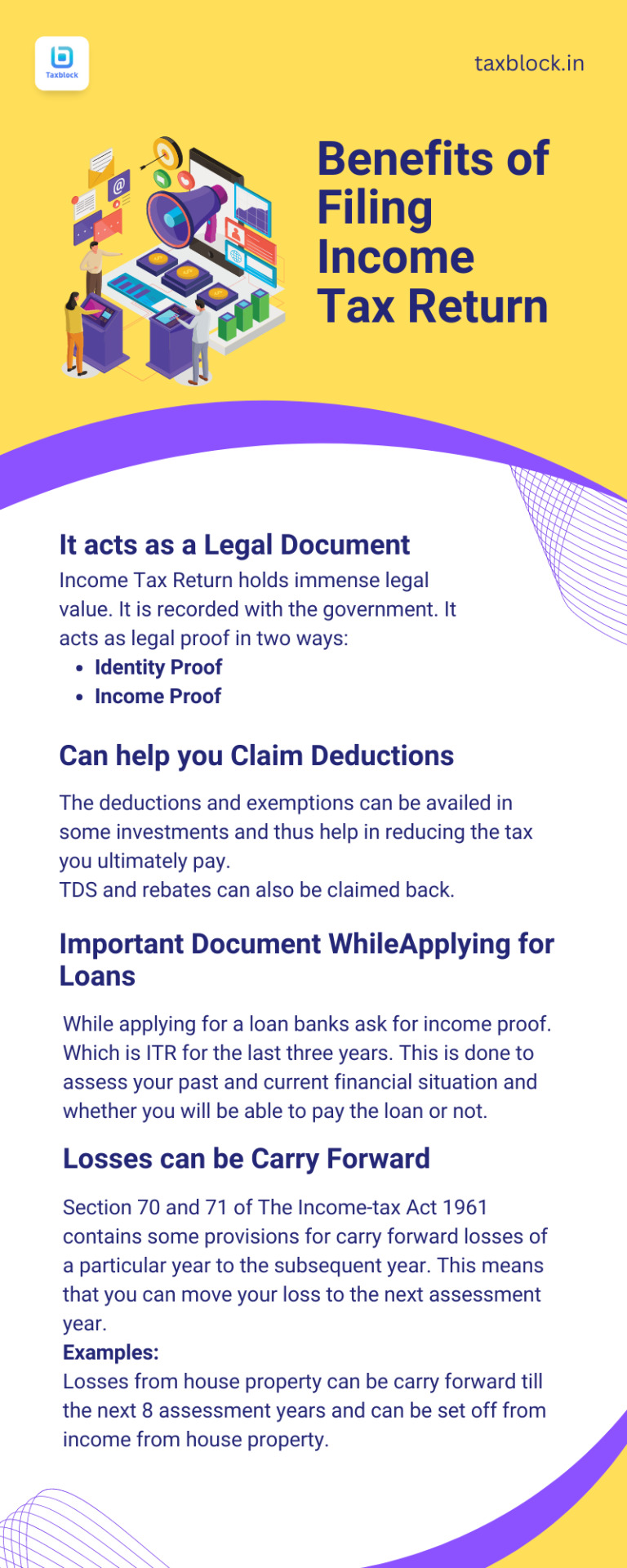

#ITR Benefits

Text

Income-Tax Return (ITR) filing is a crucial financial responsibility for every taxpayer. With the advent of technology, the process of filing income tax returns has become significantly more convenient through E-filing. This article explores the benefits of ITR E-filing process and highlights important precautions taxpayers should take while filing their returns. Read More

#how to fill out income tax and benefit return#benefits of filing income tax return#benefits of itr#health insurance tax benefit#benefits of filing itr#benefits of filling itr#itr tax filing benefits in hindi#tax benefit#benefits of filing nil income tax return#benefits of income tax return#mutual fund tax benefits#benefits#final accounts and itr#itr benefits#tax benefits#benefit of income tax retunr#benefit of an income tax return#80d tax benefits

0 notes

Photo

If you have not filed ITR yet, file your ITR today with the help of experts from Humsabka Advisor

Contact us Now

7669256170/ 87008 46995

Know More: https://humsabkaadvisor.com/

#ITR Filing#ITR Benefits#File your ITR#GST Filing#GST Registration#GST Update#ISO#FSSAI#MSME#Humsabka Group#Humsabka Advisor

1 note

·

View note

Text

Mohabbat Pane Ki Dua

Mohabbat Pane Ya Hasil Karne Ki Dua ek aisa dua hai jo apko apke pyar pane ke liye bahut madad karega. Jab aap pyar mein hote hain, to aap mahsoos karte hain ki har koi wafadar hai aur sab kuchh sundar hai. Ush samay, apko vibhinya cheje pasand hone lagti hai, jaise ki romantic gane, kavitaen, bhavuk upanyas, aur dukhi films dekhna bhe pasand hai.

Prem dimag mein jatil vabnao ko late hai. Ush…

View On WordPress

#Banaye Kisi Ko Bhi Apni Mohabbat Me Bechain#Dil Me Allah Ki Mohabbat Paida Karne Ka Wazifa#Mohabbat Hasil Karne Ki Dua#Mohabbat Ka Bemisaal Rohani Amal#Mohabbat ka itr wala Amal#Mohabbat Ka Sabse Taqatwar Amal#Mohabbat ka Wazifa#Mohabbat Ko Pane Ka Amal#Mohabbat Me Bechain Karne Ka Wazifa#Mohabbat me bechain karne wazifa benefits#Mohabbat me bechain karne wazifa in urdu#Mohabbat Pane Ki Dua

0 notes

Text

Tax Audit Services in India for Businesses The Tax Heaven

Looking for professional tax audit services in India? At The Tax Heaven, we offer expert tax audit solutions for businesses, ensuring compliance and accuracy. Our experienced team specializes in comprehensive tax audit services tailored to meet your business's unique needs. Partner with us for reliable and efficient tax audit solutions. https://www.thetaxheaven.com/

#tax audit service in india#itr benefits for salaried individuals#itr return services in jaipur#the tax heaven#tax audit services for businesses

0 notes

Text

To know more visit our website.

Follow for more.

#ITR#filing itr#income tax#gst tax#benefits of itr#claim deduction#financialservices#tax#entrepreneur#gst#taxblock#fintech

0 notes

Link

ITRs are official records that attest to your on-time tax payments. It is an official document from the Income Tax Department acknowledging a tax return. ITR is used by banks to evaluate your financial situation. However, if you want to apply for a home loan, you are not required to submit an ITR.

0 notes

Text

Unlocking Your Goals: Who Qualifies for an ICICI Personal Loan in 2024?

Personal loans offer a convenient and versatile financial tool to manage unexpected expenses, consolidate debt, or even finance a dream vacation. But before diving into the world of ICICI Personal Loans, it's crucial to understand their eligibility criteria. This comprehensive guide explores who qualifies for an ICICI Personal Loan in 2024, empowering you to assess your eligibility and make informed decisions.

Understanding ICICI Personal Loans

ICICI Bank, a leading financial institution in India, offers a variety of personal loan options to cater to your diverse needs. These unsecured loans, meaning they don't require collateral like a car or house, are disbursed as a lump sum and repaid in fixed monthly installments (EMIs) over a predetermined period.

Who Can Apply for an ICICI Personal Loan?

The eligibility criteria for ICICI Personal Loans vary slightly depending on whether you're a salaried individual or self-employed. Let's delve into the specifics:

Salaried Individuals:

Age: The minimum age requirement is typically 23 years, and the maximum age is generally 58 years. However, it's advisable to check the latest eligibility criteria on the ICICI Bank website, as these may change.

Minimum Monthly Income: You'll need to demonstrate a minimum monthly income, which can vary depending on your city of residence. In major cities like Mumbai or Delhi, the minimum income might be higher than in smaller towns.

Work Experience: You'll typically need to be employed with your current company for at least two years to be eligible.

Employment Type: While permanent employment strengthens your application, some lenders, including ICICI Bank, might consider applicants with contractual employment depending on the specific contract terms.

Credit Score: A good credit score (generally considered 700 or above) significantly increases your chances of loan approval and can lead to more favorable interest rates.

Self-Employed Individuals:

Age: The minimum age requirement is usually 28 years (25 years for doctors) and the maximum age can be up to 65 years.

Business Stability: Your business needs to be operational for a minimum period, typically ranging from three to five years (depending on the profession). Doctors might benefit from a lower minimum business stability requirement.

Profitability: You'll need to demonstrate a minimum level of annual profit through audited financial statements. The specific amount can vary depending on your business type and loan amount.

Income Tax Returns (ITR): Filing your Income Tax Returns (ITR) consistently demonstrates financial responsibility and strengthens your application.

Credit Score: Just like salaried individuals, a good credit score plays a vital role for self-employed applicants.

Beyond the Basics: Additional Factors

While the above criteria form the core eligibility requirements, ICICI Bank and other lenders might consider additional factors during the application process. These may include:

Debt-to-Income Ratio (DTI): This ratio compares your total monthly debt obligations to your gross monthly income. A lower DTI indicates a stronger ability to repay the loan.

Employer Reputation: For salaried applicants, working for a reputable company can positively impact your eligibility.

Employer-Bank Relationship: If your employer has a positive relationship with ICICI Bank, it might expedite the loan approval process.

Loan Purpose: The purpose for which you seek the loan can influence the lender's decision. Some lenders may view specific purposes, like debt consolidation, more favorably than others.

Tips for Enhancing Your ICICI Personal Loan Eligibility

Knowing the eligibility criteria is just the first step. Here are some tips to improve your chances of securing an ICICI Personal Loan:

Build a Strong Credit Score: Maintain a good credit history by paying your bills on time and keeping your credit utilization ratio low.

Increase Your Income: If possible, explore ways to increase your income to meet the minimum requirements.

Reduce Debt Obligations: Lower your existing debt to improve your DTI ratio.

Maintain Employment Stability: A stable employment history strengthens your application.

Prepare a Strong Loan Application: Gather all required documents like salary slips, bank statements, proof of business ownership (for self-employed), and ITRs.

Compare Loan Offers: Don't settle for the first offer. Compare interest rates and terms from different lenders, including ICICI Bank, to find the best deal.

Conclusion

Understanding ICICI Personal Loan eligibility criteria empowers you to make informed financial decisions.

0 notes

Text

Navigating Tax Season: A Guide For NRIs in Income Tax Return Filing

Sometimes, it becomes a difficult journey for NRIs i.e. Non-Resident Indians to file the income tax return in India. But you can make this journey smooth with the help of right guidance & preparation. Here, in this comprehensive guide we will provide some essential tips for NRIs so that they can navigate the IR Filing process effectively:

Some ITR Filing Tips for NRIs

Understand Your Residential Status: NRIs must have to determine their residential status for tax purposes. NRIs have to pay tax in India on the basis of their residential status that depends on the number of days spent by them in India during the financial year.

Declare Global Income: If you are an NRI, then you have to declare your global income in India that includes the income that has been earned in abroad. It is essential to report all the sources of income accurately including income from salaries, rental properties, capital gains, interest, dividends, etc. to avoid the penalties.

Familiarize Yourself with DTAA: NRIs can utilize the benefit of Double Taxation Avoidance Agreements (DTAA) that has been signed between India & other countries. Under this, you as an NRI can claim relief from double taxation by either claiming tax credit or opting for exemption on certain types of income.

Explore Tax Benefits: Under the Indian Income Tax Act, NRIs can claim deductions and exemptions to reduce their tax liability. NRIs can claim exemptions on certain incomes like long-term capital gains on specified investments.

File Timely Returns: Make sure that you file the Income Tax Returns on time to avoid penalties and interest. Usually, the due date for filing returns for NRIs is July 31st of the assessment year, but you should stay updated with any changes in deadlines.

Conclusion

NRIs can navigate the complexities of filing Income Tax Return easily and confidently by following the above mentioned tips. Always remember, stay informed and proactive which is a key to navigate the world of taxation smoothly.

#income tax#income tax return#income tax return filing#income tax return filing online#itr filing#ITR Filing by NRIs#ITR Filing tips for NRIs

0 notes

Text

Filing Income Tax Returns in India: A Comprehensive Guide with Ensurekar

Introduction

Filing your income tax return (ITR) in India can seem daunting, but with the right information and guidance, it can be a smooth and efficient process. This guide provides a comprehensive overview of e-filing income tax returns in India, including registration, types of returns, filing procedures, and crucial details for the Assessment Year (AY) 2023-24.

What is eFiling Income Tax Return?

The Income Tax Department of India offers a convenient online platform for electronically filing your ITR. This e-filing portal eliminates the need for physical visits to tax offices and streamlines the entire process.

Why File Your ITR?

Individuals falling under specific tax slabs are mandated to file their returns. Here are some reasons why filing your ITR is important:

Fulfilling Tax Obligations: It ensures compliance with tax regulations and avoids potential penalties for non-filing.

Claiming Refunds: If you've paid excess taxes through TDS (Tax Deducted at Source), filing your ITR is necessary to claim a refund.

Loan and Visa Applications: Many financial institutions and embassies require a clean tax filing history for loan approvals and visa processing.

Carrying Forward Losses: If you've incurred losses under a specific income head, filing your return allows you to carry them forward and offset future income.

Building a Credit History: A consistent record of timely ITR filing can positively impact your creditworthiness.

Types of eFiling Income Tax Returns

There are two main ways to file your ITR electronically:

Self-e-Filing: This involves filing your return directly through the Income Tax Department's e-filing portal. You'll need to fill out the ITR form with all necessary information, attach required documents, and submit it online.

Assisted ITR Filing: You can opt for assistance from authorized professionals like tax consultants, chartered accountants, or online tax-filing platforms. These intermediaries will handle the entire filing process, from collecting information to submitting your return online.

Benefits of eFiling Income Tax Return (ITR):

Convenience: Eliminates the need for physical visits and saves time and effort.

Security: The online process protects sensitive information with secure protocols.

Timely Processing: E-filing leads to faster processing and quicker refunds compared to paper returns.

Accuracy: The online platform helps with accurate tax calculations and reduces the chances of errors.

Environmentally Friendly: E-filing reduces paper usage and contributes to a greener environment.

How to File an eFiling Income Tax Return

Step 1: Registration

New users need to register on the Income Tax Department's e-filing portal using their PAN card details.

Step 2: Gather Documents

Collect all relevant documents like PAN card, Aadhaar card, Form 16 (salary certificate), TDS certificates, bank statements, investment proofs, and any other income or deduction-related documents.

Step 3: Choose the Right ITR Form

The appropriate ITR form depends on your income sources and category. Common forms include ITR-1 (for income up to ₹50 lakhs) and ITR-2 (for income with capital gains or foreign assets). For AY 2023-24, ensure you use the most recent versions of the forms.

Step 4: Fill and Verify the ITR Form

Fill out the chosen ITR form with accurate details about your income, deductions, and exemptions. Carefully review the entries to avoid errors. You can verify the return electronically using Aadhaar OTP or EVC (Electronic Verification Code), or by sending a signed physical copy of ITR-V to the Centralized Processing Center (CPC) within 120 days of filing.

Step 5: File the Return Online

Log in to the e-filing portal, navigate to the 'e-File' section and select 'Income Tax Return.' Upload the prepared ITR form or XML file and submit it.

Step 6: Keep Records for Reference

Maintain copies of the filed return, acknowledgment receipt, and supporting documents for future reference.

How Ensurekar Can Help

At Ensurekar, we understand the complexities of tax filing. We offer a comprehensive range of services to ensure a smooth and efficient ITR filing experience:

Expert Guidance: Our experienced tax professionals can guide you through the entire process, from choosing the right ITR form to maximizing deductions and claiming refunds.

Accurate Calculations: We ensure accurate tax calculations to minimize any tax liabilities or penalties.

Timely Filing: We help you meet all deadlines and avoid late filing penalties.

Stress-Free Experience: We take the stress out of tax filing, allowing you to focus on other important matters.

Additional Information:

Penalty for Late Filing of ITR: Filing your ITR after the due date can attract penalties and interest charges on the tax payable.

Steps to File ITR without Form 16: If you don't have Form 16, you can still file your ITR by gathering income proofs from various sources, calculating your TDS using Form 26AS, and claiming eligible deductions.

Conclusion:

Filing your income tax return is a crucial responsibility. By leveraging the benefits of e-filing and potentially seeking professional assistance from Ensurekar, you can ensure a smooth, accurate, and timely filing process.

0 notes

Text

Natural Attar Perfume: A Timeless Elegance in Fragrance

In a world saturated with synthetic scents, the allure of natural attar perfume remains unmatched. Crafted from botanical extracts and essential oils, attar perfumes exude a timeless elegance that captivates the senses. From its rich history to its sustainable production methods, there are many reasons why attar perfume stands out in the fragrance industry.

The History of Attar Perfume:

Dating back centuries, attar perfume has roots in ancient civilizations such as Egypt, India, and Persia. The word "attar" itself is derived from the Persian word "itr," meaning fragrance. Historically, attar perfumes were created through a meticulous process of distillation, where botanical ingredients were carefully selected and infused to capture their essence.

Unlike modern perfumes that rely heavily on synthetic chemicals, attar perfumes embrace nature's offerings. Rose, jasmine, sandalwood, and oud are just a few examples of the natural ingredients used to create these exquisite fragrances. Each ingredient brings its own unique aroma, contributing to the complexity and depth of attar perfumes.

Craftsmanship and Sustainability:

One of the defining characteristics of attar perfume is the craftsmanship involved in its production. Perfumers who specialize in attar take great pride in their work, often following traditional techniques passed down through generations. This dedication to craftsmanship ensures that each bottle of attar perfume is a work of art, carefully curated to deliver an unparalleled olfactory experience.

Moreover, attar perfume aligns with the growing demand for sustainable and eco-friendly products. By utilizing natural ingredients sourced from sustainable farms, attar perfumers minimize their environmental impact. This commitment to sustainability resonates with consumers who prioritize ethical and responsible consumption.

The Appeal of Natural Fragrances:

In a world inundated with artificial fragrances, the appeal of natural attar perfume is undeniable. Beyond its exquisite scent, attar perfume offers numerous benefits for both body and mind. The therapeutic properties of essential oils used in attar perfumes can uplift mood, reduce stress, and promote overall well-being.

Furthermore, natural fragrances tend to be more long-lasting and complex compared to their synthetic counterparts. The synergy of botanical ingredients creates a harmonious blend that evolves over time, revealing new layers of fragrance with each wear. This dynamic nature adds to the allure of attar perfume, making it a truly captivating sensory experience.

Choosing the Right Attar Perfume:

With a myriad of options available, selecting the perfect attar perfume can seem daunting. Consider factors such as personal preference, occasion, and seasonality when choosing a fragrance. Whether you prefer floral, woody, or oriental scents, there is an attar perfume to suit every taste and occasion.

Additionally, don't hesitate to explore different fragrance families and experiment with layering to create your own signature scent. The beauty of attar perfume lies in its versatility and ability to adapt to individual preferences.

In a world where synthetic fragrances dominate the market, the allure of natural attar perfume endures as a beacon of timeless elegance. From its rich history to its sustainable production methods, attar perfume embodies the essence of craftsmanship and luxury. Embrace the beauty of natural fragrances with Pujaperfumery and experience the timeless elegance of attar perfume firsthand.

0 notes

Text

The PAN card is a fundamental document for taxpayers in India, playing a crucial role in the ITR filing process. It not only serves as a means of identification but also aids in preventing tax evasion and ensuring transparency in financial transactions. Therefore, it is imperative for individuals and entities to obtain and maintain an active PAN card for their financial activities. Read More

#itr filing#income tax return filing#benefits of filing income tax return#nri income tax return filing in india#benefits of itr filing in hindi#use of pan card in hindi#how to file itr in case of no income#income tax filing#benefits of itr filing#income tax filing in tamil#itr 1 filing online 2022-23#nri tax in india#inoperative pan card itr filing#nri tax filing india#how to register for efiling#tax filing school

0 notes

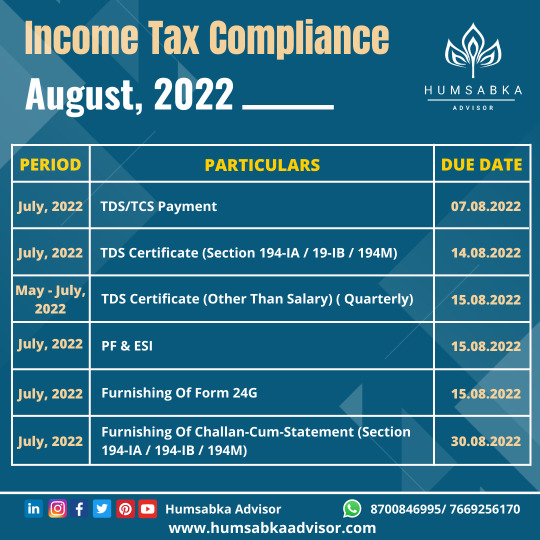

Photo

August 2022 - Don't miss any due date for various tax compliance

Follow us for more tax-related updates.

Contact us now!

7669256170/ 87008 46995

Know More: https://humsabkaadvisor.com/

Facebook: https://www.facebook.com/humsabkaadvisor

Instagram: https://www.instagram.com/humsabkaadvisor/

LinkedIn: https://www.linkedin.com/company/humsabkaadvisor

Twitter: https://twitter.com/HumsabkaAdvisor

#Income Tax Compliance#Aug 2022#Tax-Related Updates#ITR Filing#ITR Benefits#GST Registration#Humsabka Group#Humsabka Advisor

0 notes

Text

8 benefits of new tax regime, see all the details from income tax slab to standard deduction

Income Tax Slabs: If you are going to file ITR for the financial year (2023-24) i.e. assessment year 2024-25, then it is very important for you to know whether the new tax regime is better or the old. Today we will tell you 8 benefits of the new tax system, which have been told by our experts CA Ajay Bagadia, CA Santosh Mishra and CA Abhinandan Pandey.

8 benefits of the new tax system

1) Lower…

View On WordPress

0 notes

Text

Tax Audit: All You Need to Know

As a business owner, staying updated with the latest tax regulations is essential. One important aspect of taxation that all business owners must be aware of is tax audit and its applicability to your business. Tax audit refers to the process of inspection and verification of the books of accounts of a taxpayer to ensure their adherence to the provisions of the Income-Tax Act, of 1961.

In India, Section 44AB of the Income-Tax Act, 1961 lays an obligation on certain persons mentioned thereunder carrying on business or profession, to get their accounts audited before the “specified date” by a Chartered Accountant, if their turnover exceeds the specified threshold limits or in cases where they are eligible to declare their income on a presumptive income basis as per section 44AD if they claim that their income is lower than the income so computed as per presumptive income.

The key objectives of the tax audit are as follows:

Ensures that the books of accounts are maintained properly and certified by a Chartered Accountant.

Prepares and submits an audit report according to the requirements of Form no. 3CA/3CB and 3CD.

Gives assurance to shareholders that the books of accounts are free from any discrepancies and financial statements and audit reports give a true and fair view of the business.

Helps in checking fraudulent practices.

It is important to understand the applicability of tax audit based on the category of person- business. Here’s a breakdown:

Assessee carrying on a business but not opting for presumptive taxation scheme:

Applicability:

If total sales, turnover, or gross receipts exceed INR one crore in the previous financial year.

If cash transactions are up to 5% of total gross receipts and payments, the threshold limit is increased to INR ten crores.

Assessee carrying on business eligible for presumptive taxation under Section 44AE, 44BB or 44BBB:

Applicability:

If the profit claimed is lower than the prescribed limit under the presumptive taxation scheme.

Assessee carrying on business eligible for the presumptive taxation under Section 44AD:

Applicability:

If taxable income declared is below the limits prescribed under the presumptive tax scheme and has income exceeding the basic threshold limit.

Assessee carrying on the business and is not eligible to claim presumptive taxation under Section 44AD due to opting out for presumptive taxation in any one financial year of the lock-in period i.e. 5 consecutive years from when the presumptive tax scheme has been opted:

Applicability:

If income exceeds the maximum amount not chargeable to tax in the subsequent 5 consecutive tax years from the financial year when the presumptive taxation was not opted for.

Assessee carrying on a business where declaring profits as per presumptive taxation scheme under Section 44AD:

Applicability:

If income exceeds the maximum amount not chargeable to tax in the subsequent 5 consecutive tax years from the financial year when the presumptive taxation was not opted for.

If the total sales, turnover, or gross receipts do not exceed Rs 2 crore in the financial year, then tax audit will not apply to such businesses.

Category of person - Profession:

Assessee carrying on the profession:

Applicability:

If the total sales, turnover, or gross receipts do not exceed Rs 2 crore in the financial year, then tax audit will not apply to such businesses.

Assessee carrying on a business where declaring profits as per presumptive taxation scheme under Section 44AD:

Applicability:

If the total sales, turnover, or gross receipts do not exceed Rs 2 crore in the financial year, then tax audit will not apply to such businesses.

Category of person - Business Loss:

Where the assessee is carrying on business with loss and has not opted for a presumptive taxation scheme under section 44AD:

Applicability:

Where total sales, turnover, or gross receipts exceed Rs 1 crore.

Where the assessee’s total income exceeds the basic threshold limit but he has incurred a loss from carrying on a business and not opted for a presumptive taxation scheme under section 44AD:

Applicability:

In case of loss from business when total sales, turnover, or gross receipts exceed INR 1 crore, the assessee is subject to tax audit under 44AB.

Where the assessee is carrying on a business (opted presumptive taxation scheme under section 44AD) and having a business loss but with income below the basic threshold limit:

Applicability:

Tax audit not applicable.

Where the assessee is carrying on a business (opted presumptive taxation scheme under section 44AD) and having a business loss but with income exceeding the basic threshold limit:

Applicability:

Declares taxable income below the limits prescribed under the presumptive tax scheme and has income exceeding the basic threshold limit.

Chartered accountants are responsible for providing the tax audit report. They must furnish the prescribed particulars in Form No. 3CD, which also forms a part of the audit report. The auditor shall furnish the tax audit report in any of the following prescribed forms: Form No. 3CA is furnished where an assessee is carrying on business or profession and is already mandated to get the books of accounts audited under any other law. Form No. 3CB is furnished where an assessee is carrying on business or profession and is not required to get the books of accounts audited under any other law.

If an assessee fails to comply with the provisions of section 44AB and does not get their books of account audited, they will be liable to pay a penalty as per section 271B. According to section 271B, the penalty shall be lower of the following amounts: (a) 0.5% of the total sales, turnover, or gross receipts or (b) Rs. 1,50,000.

In conclusion, it’s important for business owners to determine if they meet the criteria for tax audit applicability based on their category of person - business. Not complying with tax audit regulations can lead to hefty penalties. It's advisable to seek the help of a chartered accountant to ensure the timely preparation and submission of your tax audit report.

#itr return services in jaipur#tax audit service in india#itr benefits for salaried individuals#the tax heaven#tax audit services for businesses#tax audit services india

0 notes

Text

Why Income Tax Return Filing is Important?

Although submitting income tax returns (ITR) can be time-consuming, the advantages greatly exceed the short-term difficulty. ITR filing is required regardless of which category one falls into, even if it is voluntary for certain taxpayers and necessary for others, according to income tax laws.

Every responsible citizen of the nation has a social and moral obligation to file tax returns every year. The government examines the residents’ financial situation and level of spending. It offers a platform for people to request a refund after assessing the tax return.

Take assistance from a Tax Consultant in Kochi, Kerala if you find the ITR filing process to be complicated or challenging.

The government requires that those with an annual income of a certain level file a tax return by the predetermined deadline. Each individual is accountable for paying tax in the appropriate amount. Furthermore, the Department of Income Tax frequently imposes fines for unpaid taxes.

Even if your income is ineligible for required filing of returns, it will be a good idea to file returns on your own initiative. The registration of immovable properties, for instance, calls for confirmation of tax returns from the previous three years in the majority of states. Instances when people file returns make it simpler to register the transaction.

You can offset losses from the prior year with future capital gains by paying taxes within the allotted time frame. You cannot, however, carry through unadjusted losses to the following year or take advantage of the tax authorities’ set-off benefits if your ITR is not submitted on time.

If you have any future plans to apply for a home loan, it is a good idea to keep up a consistent record of filing taxes. Most home loan providers will require it.

You desire to visit another country. Never neglect to file your tax returns on time. Copies of your most recent tax returns are required by consulates of nations including the US, UK, and Canada among others in order to process your visa application.

Although we recognise that completing IT returns may be burdensome for you, VBV & Associates, the top income tax consultant in Kochi, Kerala, is here to assist you.

0 notes

Text

Best Attar Shop in Delhi: A Fragrant Journey Through Facts and Stats

In the bustling streets of Delhi, amidst the chaos and cacophony, lies a hidden gem that tantalizes the senses and transports you to a world of mesmerizing fragrances. Yes, we are talking about the best attar shop in Delhi, where centuries-old traditions meet modern elegance, offering an olfactory experience like no other.

Delhi, the heart of India, is not just known for its rich history and vibrant culture but also for its diverse array of attar shops. Attar, derived from the Persian word 'itr' meaning scent, has been an integral part of Indian culture for centuries. From perfumes to therapeutic oils, attars hold a special place in the hearts of many.

Why Choose Attars?

Attars offer a plethora of benefits beyond just their enchanting aromas. From therapeutic properties to mood enhancement, here are some reasons why attars are the preferred choice for many:

Natural Ingredients: Unlike synthetic perfumes, attars are made from natural ingredients such as flowers, herbs, and spices, making them safe for all skin types.

Long-lasting Fragrance: The concentrated nature of attars ensures that the fragrance lingers on the skin for hours, offering a lasting olfactory experience.

Therapeutic Effects: Many attars are known for their therapeutic properties, ranging from stress relief to improved focus and concentration.

Quest for the Best Attar Shop in Delhi

Delhi, being a melting pot of cultures, hosts a myriad of attar shops catering to diverse preferences and budgets. However, to crown one as the best demands a closer examination based on several key factors:

Authenticity and Quality

Authenticity stands as the cornerstone of a reputable attar shop. The best attar shop in Delhi source their ingredients meticulously, ensuring purity and quality.

Quality transcends mere fragrance; it encompasses longevity, projection, and the overall sensory experience offered by the attars.

Variety and Range

A wide array of choices caters to the diverse tastes of customers. From classic floral blends to exotic wood essences, the best attar shop in Delhi boasts an extensive range to captivate every olfactory palate.

Customer Experience

Exceptional customer service sets the best attar shops apart. Knowledgeable staff members guide patrons through their selection, offering insights into fragrance families, notes, and application techniques.

Comfortable ambiance and hygienic sampling practices enhance the overall shopping experience.

Affordability and Value

While quality comes at a price, the best attar shop in Delhi strikes a fine balance between affordability and value. Customers seek not only premium products but also fair pricing and occasional discounts or promotions.

Why Fragrance Haven Stands Out

Located in the heart of Delhi's bustling markets, Fragrance Haven encapsulates the essence of excellence in the realm of attars.

Authenticity and Quality

With a legacy spanning over four decades, Fragrance Haven prides itself on its commitment to authenticity and quality. Each attar is meticulously crafted using traditional methods, ensuring purity and potency.

Variety and Range

From timeless classics like rose and jasmine to exotic blends of oud and saffron, Fragrance Haven offers an unparalleled variety of attars to suit every preference and occasion.

Customer Experience

Stepping into Fragrance Haven feels like entering a fragrant oasis. Knowledgeable staff members provide personalized recommendations, allowing customers to explore and discover their signature scent with ease.

The shop's elegant decor and welcoming ambiance elevate the shopping experience, making every visit a sensory delight.

Affordability and Value

Despite its reputation for premium quality, Fragrance Haven remains accessible to all, with prices that reflect the craftsmanship and value of its products. Special promotions and loyalty programs further enhance the value proposition for customers.

Resource Link : Best Attar Shop in Delhi

Conclusion

In the vibrant landscape of Delhi's attar shops, Fragrance Haven shines as the epitome of excellence, embodying the qualities that define the best attar shop in Delhi. With its unwavering commitment to authenticity, quality, variety, customer experience, and value, Fragrance Haven continues to captivate fragrance enthusiasts and connoisseurs alike, cementing its status as a true fragrance haven in the heart of the city. Whether you seek a timeless classic or a unique olfactory adventure, Fragrance Haven beckons you to indulge in the art of scent and discover the magic of attars like never before.

#best attar shop in delhi#attar shop in delhi#top attar shop in delhi#attar in delhi#best attar in delhi#top attar in delhi

0 notes