#Fair Debt Collection Practices Act

Text

Paying consumer debts is basically optional in the United States

The vast majority of America's debt collection targets $500-2,000 credit card debts. It is a filthy business, operated by lawless firms who hire unskilled workers drawn from the same economic background as their targets, who routinely and grotesquely flout the law, but only when it comes to the people with the least ability to pay.

America has fairly robust laws to protect debtors from sleazy debt-collection practices, notably the Fair Debt Collection Practices Act (FDCPA), which has been on the books since 1978. The FDCPA puts strict limits on the conduct of debt collectors, and offers real remedies to debtors when they are abused.

But for FDPCA provisions to be honored, they must be understood. The people who collect these debts are almost entirely untrained. The people they collected the debts from are likewise in the dark. The only specialized expertise debt-collection firms concern themselves with are a series of gotcha tricks and semi-automated legal shenanigans that let them take money they don't deserve from people who can't afford to pay it.

There's no better person to explain this dynamic than Patrick McKenzie, a finance and technology expert whose Bits About Money newsletter is absolutely essential reading. No one breaks down the internal operations of the finance sector like McKenzie. His latest edition, "Credit card debt collection," is a fantastic read:

https://www.bitsaboutmoney.com/archive/the-waste-stream-of-consumer-finance/

McKenzie describes how a debt collector who mistook him for a different PJ McKenzie and tried to shake him down for a couple hundred bucks, and how this launched him into a life as a volunteer advocate for debtors who were less equipped to defend themselves from collectors than he was.

McKenzie's conclusion is that "paying consumer debts is basically optional in the United States." If you stand on your rights (which requires that you know your rights), then you will quickly discover that debt collectors don't have – and can't get – the documentation needed to collect on whatever debts they think you owe (even if you really owe them).

The credit card companies are fully aware of this, and bank (literally) on the fact that "the vast majority of consumers, including those with the socioeconomic wherewithal to walk away from their debts, feel themselves morally bound and pay as agreed."

If you find yourself on the business end of a debt collector's harassment campaign, you can generally make it end simply by "carefully sending a series of letters invoking [your] rights under the FDCPA." The debt collector who receives these letters will have bought your debt at five cents on the dollar, and will simply write it off.

By contrast, the mere act of paying anything marks you out as substantially more likely to pay than nearly everyone else on their hit-list. Paying anything doesn't trigger forbearance, it invites a flood of harassing calls and letters, because you've demonstrated that you can be coerced into paying.

But while learning FDCPA rules isn't overly difficult, it's also beyond the wherewithal of the most distressed debtors (and people falsely accused of being debtors). McKenzie recounts that many of the people he helped were living under chaotic circumstances that put seemingly simple things "like writing letters and counting to 30 days" beyond their needs.

This means that the people best able to defend themselves against illegal shakedowns are less likely to be targeted. Instead, debt collectors husband their resources so they can use them "to do abusive and frequently illegal shakedowns of the people the legislation was meant to benefit."

Here's how this debt market works. If you become delinquent in meeting your credit card payments ("delinquent" has a flexible meaning that varies with each issuer), then your debt will be sold to a collector. It is packaged in part of a large spreadsheet – a CSV file – and likely sold to one of 10 large firms that control 75% of the industry.

The "mom and pops" who have the other quarter of the industry might also get your debt, but it's more likely that they'll buy it as a kind of tailings from one of the big guys, who package up the debts they couldn't collect on and sell them at even deeper discounts.

The people who make the calls are often barely better off than the people they're calling. They're minimally trained and required to work at a breakneck pace. Employee turnover is 75-100% annually: imagine the worst call center job in the world, and then make it worse, and make "success" into a moral injury, and you've got the debt-collector rank-and-file.

To improve the yield on this awful process, debt collection companies start by purging these spreadsheets of likely duds: dead people, people with very low credit-scores, and people who appear on a list of debtors who know their rights and are likely to stand on them (that's right, merely insisting on your rights can ensure that the entire debt-collection industry leaves you alone, forever).

The FDPCA gives you rights: for example, you have the right to verify the debt and see the contract you signed when you took it on. The debt collector who calls you almost certainly does not have that contract and can't get it. Your original lender might, but they stopped caring about your debt the minute they sold it to a debt-collector. Their own IT systems are baling-wire-and-spit Rube Goldberg machines that glue together the wheezing computers of all the companies they've bought over the last 25 years. Retrieving your paperwork is a nontrivial task, and the lender doesn't have any reason to perform it.

Debt collectors are bottom feeders. They are buying delinquent debts at 5 cents on the dollar and hoping to recover 8 percent of them; at 7 percent, they're losing money. They aren't "large, nationally scaled, hypercompetent operators" – they're shoestring operations that can only be viable if they hire unskilled workers and fail to train them.

They are subject to automatic damages for illegal behavior, but they still break the law all the time. As McKenzie writes, a debt collector will "commit three federal torts in a few minutes of talking to a debtor then follow up with a confirmation of the same in writing." A statement like "if you don’t pay me I will sue you and then Immigration will take notice of that and yank your green card" makes the requisite three violations: a false threat of legal action, a false statement of affiliation with a federal agency, and "a false alleged consequence for debt nonpayment not provided for in law."

If you know this, you can likely end the process right there. If you don't, buckle in. The one area that debt collectors invest heavily in is the automation that allows them to engage in high-intensity harassment. They use "predictive dialers" to make multiple calls at once, only connecting the collector to the calls that pick up. They will call you repeatedly. They'll call your family, something they're legally prohibited from doing except to get your contact info, but they'll do it anyway, betting that you'll scrape up $250 to keep them from harassing your mother.

These dialing systems are far better organized than any of the company's record keeping about what you owe. A company may sell your debt on and fail to keep track of it, with the effect that multiple collectors will call you about the same debt, and even paying off one of them will not stop the other.

Talking to these people is a bad idea, because the one area where collectors get sophisticated training is in emptying your bank account. If you consent to a "payment plan," they will use your account and routing info to start whacking your bank account, and your bank will let them do it, because the one part of your conversation they reliably record is this payment plan rigamarole. Sending a check won't help – they'll use the account info on the front of your check to undertake "demand debits" from your account, and backstop it with that recorded call.

Any agreement on your part to get on a payment plan transforms the old, low-value debt you incurred with your credit card into a brand new, high value debt that you owe to the bill collector. There's a good chance they'll sell this debt to another collector and take the lump sum – and then the new collector will commence a fresh round of harassment.

McKenzie says you should never talk to a debt collector. Make them put everything in writing. They are almost certain to lie to you and violate your rights, and a written record will help you prove it later. What's more, debt collection agencies just don't have the capacity or competence to engage in written correspondence. Tell them to put it in writing and there's a good chance they'll just give up and move on, hunting softer targets.

One other thing debt collectors due is robo-sue their targets, bulk-filing boilerplate suits against debtors, real and imaginary. If you don't show up for court (which is what usually happens), they'll get a default judgment, and with it, the legal right to raid your bank account and your paycheck. That, in turn, is an asset that, once again, the debt collector can sell to an even scummier bottom-feeder, pocketing a lump sum.

McKenzie doesn't know what will fix this. But Michael Hudson, a renowned scholar of the debt practices of antiquity, has some ideas. Hudson has written eloquently and persuasively about the longstanding practice of jubilee, in which all debts were periodically wiped clean (say, whenever a new king took the throne, or once per generation):

https://pluralistic.net/2020/03/24/grandparents-optional-party/#jubilee

Hudson's core maxim is that "debt's that can't be paid won't be paid." The productive economy will have need for credit to secure the inputs to their processes. Farmers need to borrow every year for labor, seed and fertilizer. If all goes according to plan, the producer pays off the lender after the production is done and the goods are sold.

But even the most competent producer will eventually find themselves unable to pay. The best-prepared farmer can't save every harvest from blight, hailstorms or fire. When the producer can't pay the creditor, they go a little deeper into debt. That debt accumulates, getting worse with interest and with each bad beat.

Run this process long enough and the entire productive economy will be captive to lenders, who will be able to direct production for follies and fripperies. Farmers stop producing the food the people need so they can devote their land to ornamental flowers for creditors' tables. Left to themselves, credit markets produce hereditary castes of lenders and debtors, with lenders exercising ever-more power over debtors.

This is socially destabilizing; you can feel it in McKenzie's eloquent, barely controlled rage at the hopeless structural knot that produces the abusive and predatory debt industry. Hudson's claim is that the rulers of antiquity knew this – and that we forgot it. Jubilee was key to producing long term political stability. Take away Jubilee and civilizations collapse:

https://pluralistic.net/2022/07/08/jubilant/#construire-des-passerelles

Debts that can't be paid won't be paid. Debt collectors know this. It's irrefutable. The point of debt markets isn't to ensure that debts are discharged – it's to ensure that every penny the hereditary debtor class has is transferred to the creditor class, at the hands of their fellow debtors.

In her 2021 Paris Review article "America's Dead Souls," Molly McGhee gives a haunting, wrenching account of the debts her parents incurred and the harassment they endured:

https://www.theparisreview.org/blog/2021/05/17/americas-dead-souls/

After I published on it, many readers wrote in disbelief, insisting that the debt collection practices McGhee described were illegal:

https://pluralistic.net/2021/05/19/zombie-debt/#damnation

And they are illegal. But debt collection is a trade founded on lawlessness, and its core competence is to identify and target people who can't invoke the law in their own defense.

Going to Defcon this weekend? I’m giving a keynote, “An Audacious Plan to Halt the Internet’s Enshittification and Throw it Into Reverse,” today (Aug 12) at 12:30pm, followed by a book signing at the No Starch Press booth at 2:30pm!

https://info.defcon.org/event/?id=50826

I’m kickstarting the audiobook for “The Internet Con: How To Seize the Means of Computation,” a Big Tech disassembly manual to disenshittify the web and bring back the old, good internet. It’s a DRM-free book, which means Audible won’t carry it, so this crowdfunder is essential. Back now to get the audio, Verso hardcover and ebook:

http://seizethemeansofcomputation.org

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/08/12/do-not-pay/#fair-debt-collection-practices-act

#pluralistic#jubilee#debts that cant be paid wont be paid#Patrick McKenzie#patio11#bits about money#debt#debt collection#do not pay#bottom feeders#Fair Debt Collection Practices Act#fdcpa#finance#armbreakers

11K notes

·

View notes

Text

Successfully Fighting Foreclosures: How To Do It Right!

Successfully Fighting Foreclosures Requires The Strategies Most Foreclosure Defense Attorneys Get Wrong Or Don’t Even Bother Pursuing

Homeowners are successfully fighting foreclosures in record numbers since the housing collapse in 2008. Why? Homeowners are realizing they can successfully fight foreclosure actions brought on by unscrupulous mortgage servicers.

Or in a worse case, fight the…

View On WordPress

#banking#banks#Cfpb#Consumer Financial Protection Bureau#debt#Fair Credit Reporting Act#Fair Debt Collection Practices Act#fannie mae#FCRA#FDCPA#FHA#FHFA#foreclosure#foreclosure defense#foreclosures#freddie mac#liens#mfi-miami#mfimiami#mortgage fraud#mortgages#real estate#stopping foreclosures#TCPA#Telephone Consumer Protection Act

0 notes

Note

Congratulations again LJ for 500 followers! May I please request Pero and Companionship as salvation? I loved your Pero drabble and would love to read more of this grumpy man 😘 Thank you for gifting us with this celebration, how you spoil us ❤️

Look at that grumpy man! This ask got me ruminating on their history together. We'll get to the day after their fight soon enough, but let's see how they came to know each other, and what led up to that night in the tavern.

The Debt

Pairing: Pero Tovar x F!Reader (prequel to this drabble)

Summary: Pero Tovar has never been in anyone's debt. Until you.

Word Count: 3.1k

Warnings: M, brief allusions to sexual acts, time period violence, idiots to enemies to lovers? While this story is not explicit, my blog and the content shared on it is 18+ MINORS DNI.

Notes: Everyone say thank you Cee for giving the perfect prompt to go down the Pero hole again (phrasing!). These two practically write themselves and I'm very excited to be sharing more of their story with you.

Pero Tovar had never been saved by anyone or anything in his life. He’s been spared once or twice, from the sickness that took his mother, or the blade that took his father. But no one had ever stood above him, blood on their hands, and put Pero in their debt.

Not until you.

William had scoffed at the two of you as you recount the tale over tavern bread and ale.

“So you were…riding in the forest, and came across Tovar…” William repeats, mirth dancing off his lips as Pero tries to scowl a new hole in his fair-haired companion’s head. You brandish a hunk of bread, using it to point at William who can barely contain his laughter.

“...surrounded by highwaymen, the foolish lot of them. And I was not planning to involve myself in that ruckus, but when they toppled this mountain…” You point the bread at Pero, who now attempts to perfect his glower in your direction. “...well, I couldn’t watch a skilled swordsman such as this be slain by some roving band of miscreants whose only advantage was manpower. So…” you say, pulling your arm back in a mockery of archery, “I felled the two waiting to strike, and beheaded the last.” William claps and you half-bow, Pero’s eye roll going unnoticed.

“And here we are,” you finish, eliciting an incredulous head shake from William and more sullen chewing from Pero.

“And now Tovar is…” William asks, a creeping smile gracing his face. You raise an eyebrow and smirk, and Pero wishes more in that moment than ever before that he’d been touched with witchcraft so he could shut you up.

“In my debt,” you crow, pointing your bread at him again. He pulls his glare up to meet your sparkling eyes. “And I intend to collect.”

His dark, heavy brow and dismissive head shake betray how he actually felt in the moment you met. The song of a blade he truly believed would end his life, dishonorably and alone, becoming the death knell of the highwayman. Pero’s labored breathing as he turned his face up to gaze upon his savior.

In the moment he saw you, he was sure he’d been killed and gifted a more glorious heaven than the stories foretold. To behold a guerrera, strong and skilled of body, rising valiantly over vanquished foes, holding a hand to him was surely how he should be welcomed into the afterlife. Not even to speak of her beauty; sharp bright eyes, a rakish smile, feminine and powerful. It wasn’t until he reached up to clasp her gloved hand and the stink of mud and horse shit brought him back to himself. He was alive, thanks to the same guerrera who now was appraising him like a stallion for purchase, even though at his full height she had to look up at him.

“You have a name, swordsman?” you asked, reaching down to pry his blade from the muck. You handed it back, raising an eyebrow as he raked his eyes over your steed, your armor.

“Pero Tovar,” he finally spat out, sheathing his sword on his back. You leaned back on one heel and regarded him with a sly smile Pero would come to dread.

“Pero Tovar, I do believe you’re in my debt,” you said, and you had been a pain in his ass ever since.

“Well, let’s drink to debts being repaid swiftly! I’m sure you have better places to be than hunting for work with my…engaging colleague,” William says, lifting his glass briefly. You tap yours with his, turning back to Pero and offering your tankard across the table.

“Oh don’t be so sour, Tovar, I’ve been a fine traveling companion, haven’t I?” you tease.

You’re not wrong; Pero had not had many companions on the road besides William, and the few men he fought with. The men were forgettable, often brash, more often dead on the other end of the job. William was a good foil to Tovar, placating when he was rough, the negotiator and the fighter. Though they still came together as brothers, William’s choices more and more likely brought him to the East and to the woman who held his heart.

You, on the other hand, were much more like traveling with a freshly-forged blade. Deadly, practical, but also fiery, and likely to scorch. Hours could be spent in silence or bickering about the craftsmanship of Pero’s axes. You’d made him laugh but also made him shout and throw up his hands in frustration. In return he’d found small ways to make you smile, and larger ways to bring your anger to the surface. The games quickened your travel, but no matter whether your tongue was sharp or soft that day, if you came across work or trouble, Pero could count on your blade to slit throats.

At first he assumed you would take your debt in protection. That was quickly dismissed when, as you pulled your horse neck and neck with his on the path, you drew and loosed an arrow so quickly Pero didn't even register the final highwayman fleeing. You were highly skilled for a woman.

"Best keep your eyes forward, Tovar, your reflexes could use the head start. Diligence might have kept you out of this mess."

You were also damned infuriating. The first day he tried to ignore you, waiting for you to either ask for coin or reveal what else you wanted from him. A few needling questions, and a few snaps of derision when you pushed too far, and you uncovered his mercenary background and his aimless search for more work.

"Well that settles it then. I'll follow you on your search, and once the chance to repay your debt reveals itself you'll be free of me. Until then," you smirked, "I could also use some coin myself, and there are worse ways to get it."

"A woman companion will be suspicious. And they will never hire you to fight," Pero scoffed, rocking with the sway of his horse's gait. You snorted, decidedly unladylike, but it didn't irk Pero the way he thought it might.

"Steel and armor speak enough for me. And if they think my cunt will get in the way, at least all my sensitive bits are easily protected." You nodded with a raised eyebrow at Pero's lap and his face burned, a scowl slashing across it.

Very unladylike. It made his heart pound uncomfortably.

So began your tentative partnership.

“It would be easier to call you a companion if your debt was not hanging over my head,” Pero grumbles, scraping his plate clean before dragging his fingers through the grease and sauce to suck into his mouth. He almost misses it - the brief flicker of your eyes to his lips - before you roll your own and put your tankard back down.

“I’m a joy to travel with, William,” you retort, popping a potato into your mouth as food and drink dwindles between you.

The debt Pero carries now is weighty, but much less so than the weight of your eyes on him in the last few weeks. He’d thought it an accident at first. You caught him dousing his head with stream water, the chilly droplets racing down his scruffy cheeks and into his collar. The strength with which you held his eyes betrayed you ever so slightly. An errant thought, that you might feel a flicker of desire for him, warmed his skin. But you were acrid the rest of the day, snappish and insisting on riding ahead, so Pero dashed it from his thoughts. Thinking with his cock again. It had been too long since he’d indulged, too thin on coin and too unwilling to dally with unwed (or wed) women when you stopped in towns.

But as the weeks went on his imagination danced with possibilities. The nights spent on watch kept you sleeping apart, but the few brief times you were able to lie side by side he basked in the heat of your back mere hands widths from his. Your smile warmed him even more, though you still infuriated him with your quick swordwork, and your quicker words.

"If all you're useful for is to be a great wall, then why not stick to a shield and axe?" you taunted, light footwork dancing you around Pero as you sparred by the fire. The fact that a woman accompanied Pero was a benefit for once. The merchant's daughter relaxed at the sight, and he paid double. A quick job completed, a simple escort between two cities, and pockets fat with coin made you playful.

"I do not need to be fast to squash you, hermana," Pero growled, his boots crushing against stones as he twisted to swing his blade. A song of steel rang out, your eyes sparkling.

"I beg to differ," you quipped back, sheathing your blade for the night.

As the days went on, your taunting filling the days and quiet contemplation supplanting the nights, Pero was drawn to you like a moth to a flame. The times he let himself long to touch you, he wondered if you would burn or soothe him. He found himself in the throes of an argument longing to pin you and silence your pretty mouth with his own. Could he repay his debt with his mouth, his fingers, his tongue?

But one night the weight of your debt was outmatched. Pero thought he spotted a fire in the distance. Fire meant a town, or people, and people meant barter. Your food stores were getting low and the light was lucky. Spurring your horses on, you made for the fire.

It was not luck you encountered that night.

A town set ablaze, people fleeing as horseback men threw torches into windows. You sat on the edge of the town, steeds side by side as you listened to the men whoop victory at the screams. One look at your face, jaw clenched tight, hand creaking against your hilt, told Pero what would be done tonight.

“Not for coin,” he said quietly, the lowest he’s even spoken to you. You turned to watch his face, your own half hidden in sooty darkness.

“For blood and blood alone,” you answered.

You were never more in tune than when you were at war. Pero’s bulk and strength could easily unseat a rider, and your speed and deadly accuracy would take his final breath. When he needed you, you were there to surprise and maim. When you needed him, he filled the space and crushed the life out of whoever raised a blade to you. There were no words needed. Your bodies knew.

When the men were disposed of, you sprang from your horse and ran into the flames, the townsfolk putting out the blazes and tending to the injured. Pero gathered the invader's horses, helped the men haul water and reinforced damaged walls. You searched for mothers and sisters, wrapped wounds and chased the final smoldering embers of the damage done.

As the silence of darkness began to blanket the town once more, Pero found you in the center. The children were speaking to you, young girls with wide eyes and boys colored with jealousy as they marveled at your armor and weaponry. You had told Pero its history, passed down from father to son until you, the only daughter of a line now ended. Technically you wore the armor in disgrace, forbidden by your father until his dying breath, but donned in his memory when you became a guide for those traveling between outposts. The children hung on your words, Pero recognizing the gestures of each story beat.

“Hermana, we should be leaving,” Pero finally interrupted, your short nod acknowledging the danger. You may have liberated this town tonight, but come the morning any weapon-wielding person in the vicinity would be at the wrath of whoever sent those men. It was best to ride far and hard to save both your skins and theirs.

Pero moved to get your horses, clapping shoulders with the men and politely nodding to the women. Their eyes roamed his broad shoulders, scarred face and large hands and he saw the adrenaline of fear transform into lust. He took his leave quickly.

When he led your horse to mount, you were still standing in the town center, looking at something in your gloved palm.

“Hermana?” he asked, coming up beside you in case you were injured.

In your palm was a small white flower, delicate petals nestled against the creases of your leathers and a thin green stem curving your palm. You looked at it like a handful of gold.

“For protecting them,” you said simply. Pero studied your profile carefully, but there were no tears, or anger, or happiness. You wore an expression closer to regret.

“You should keep it,” Pero said, pushing your hand closer to your chest. You shook your head.

“It’s too nice,” you managed to rasp out, your half-hidden emotions starting to worry him. He opened his mouth to say something - anything his unskilled tongue could conjure up - before you huffed out a breath.

“We are not made for nice things, are we Tovar?” you asked, mouth turned dryly at the wilting flower in your glove. Pero’s heart clenched. It was time for you to go.

“You take what you want, hermana. The world will not give you nice things without a fight.” Sighing, you let the paper-thin petals drop to the ground.

“I do not need anything from the world,” you retorted, leading your horse back the way you came. Pero nudged his steed to follow, watching the strong muscles of your legs and arms hoist you into the saddle. The ride from the town remained silent, the pounding of hooves and hearts all you could hear.

When you both felt you’d put enough distance at your back, Pero dismounted and began making camp. He didn’t dare build a real fire in case men were already looking, but did toss a few bits of kindling into a pile so there was enough light to move about. You went through the motions of tying up the horses, settling them for the night with a stare that worried Pero. It was too far away for something as small as this skirmish. You’d spat in the face of men trying to cut you down, dug through bodies for coin, but he had never seen you so shaken.

When you finally settled by the dwindling fire, offering first watch, Pero carefully sat behind you an arm’s length away. He intended to lie down and take the rest offered, his body screaming with stiffness. He was no longer a young man, but he still had much fight left in his bones. That fight just needed more sleep than in younger years.

“Wake me when it is my turn,” he said simply. You nodded. Then silence.

Pero should take his rest, but the stillness was still ground deep into your bones. So he waited instead, for you to think he slept or for it not to matter anymore. It was when your shoulders started to shake, your breath coming in hitches that you broke.

You wouldn’t let your sobs free, sucking in air through clenched teeth like you were angry at their intrusion.

“Hermana,” Pero whispered, jolting you.

“Fuck, Pero, don’t…” you growled, and he could hear the control you were trying to get over your shaking voice. His scowl softened.

“Was it the children?” he asked, moving ever so slowly closer to you. You nodded briskly, hands clenched on your knees.

“I do not like this world sometimes, Pero.” You ground words through your teeth, trying to punch down sadness with anger. He suspected it was a talent that’s worked well in the past. “It is not kind, even when it should be. The cruelty we see…the cruelty we do…I don’t see the purpose in it.”

Pero did not have flowery words for you. He was best at what he could do with his hands, with his actions. So he tried to give you comfort in the gentlest way he knew how. One expansive palm enveloped your shoulder, and your body stilled under it. At first he feared he’d gone a step too far, about to retract it, before your head dropped to rest your cheek against it.

It was the first time Pero touched your bare skin.

When it didn’t seem like you would shy from him, he rested his forehead against the back of your head, the scent of smoke and blood and dirt laced through your hair. He tried to think of something to say, but words were never his greatest asset. That was more for William to offer. But he could touch, and ground, and hold, if you’d let him.

After a long moment of silence, the fire down to bare embers, you lifted your cheek, prompting Pero to lean back from you. He debated on moving his hand before you spoke.

“Thank you, Pero. I don’t know how you knew, but that was…what I needed. So thank you.” Your voice was still rough and stilted, but filled with a gratitude Pero didn’t know how to react to, so beyond the normal comfort of your barbed conversations.

“We have spent much time together. I know you better than you think, including all of the things you are wrong about,” he joked gruffly, studying the bare silhouette of your profile. He wished you would smile again.

“One day you’ll be free of my debt and wish for my sparkling debates,” you shot back, and he caught the beginning of a quirked lip. It was good enough for him to rest. He shuffled down to lie back, the stars overhead watching over you both.

“But not tonight,” he replied drowsily.

“No, Pero,” you added, “not tonight.”

“I spent much time with Tovar, and I am sure you are a brilliant companion. Debt or not, it sounds like you found a fine partner, my friend.” William’s cheerful voice brings Pero back to the conversation. He drags his attention to you, and your mirthful smile dashes away the remains of his memories. Standing half up from his seat, he snatches the bread you’ve been gesturing with from your fingers.

“Don’t play with your food,” he admonishes, but your halfhearted protest pulls any venom from it. He stuffs the bread in his mouth and chews, shoulders hunched as you go back to chatting with William about the East and all the mysteries there. Your rapt attention on his brother in arms lets Pero watch your face. That night was not the first time he felt a touch of softness for you. You were indeed a pain in his ass most days, headstrong and mouthy, but he enjoyed the challenge. He liked his women with teeth and nails and the potential to gut him. But he also liked to see you when your eyes softened, or when you thought no one was looking.

Pero had never been saved by anyone or anything in his life. Except for you. And while you did not think you were meant to have nice things, Pero hoped, if you would give yourself to him, you could be the first nice thing Pero has ever had, and he could be yours.

END

Next: Stop That, Right Now

#pero tovar x you#pero tovar x reader#pero tovar x female reader#pero tovar x f!reader#pero tovar fanfiction#the great wall fanfiction#the great wall fic#lj's 500 follower celebration#prolix fics#pero tovar and his guerrera

291 notes

·

View notes

Text

WASHINGTON, D.C. – The Consumer Financial Protection Bureau (CFPB) today took action against a medical debt collector, Commonwealth Financial Systems, for illegally trying to collect unverified medical debts after consumers disputed the validity of the debts. Under the order issued today, the company will cease operations and pay a $95,000 penalty to the CFPB’s victims relief fund.

Commonwealth Financial Systems is a nonbank corporation with its principal place of business in Dickson City, Pennsylvania. Commonwealth is a third-party debt collector that specializes in the collection of past-due medical debts and furnishes information about consumer collection accounts to consumer reporting companies.

Commonwealth’s actions violated the Fair Credit Reporting Act because the company failed to conduct reasonable investigations of disputed debts and failed to inform consumer reporting companies that certain information was being disputed. Commonwealth also violated the Fair Debt Collection Practices Act because it continued to attempt to collect disputed debts without substantiating documentation.

Enforcement Action

Under the Consumer Financial Protection Act, the CFPB has the authority to take action against entities violating consumer financial protection laws, including the Fair Credit Reporting Act and Fair Debt Collection Practices Act. Under the CFPB’s order, Commonwealth must:

Shut down permanently: Commonwealth is banned from participating in or assisting others in any debt collection activities, debt buying, debt selling, and consumer reporting activities.

Tell consumer reporting companies to delete all information: Commonwealth must request all consumer reporting companies to whom it previously furnished information about any consumer to delete all collection accounts for such consumers.

Pay a $95,000 fine: Commonwealth will pay a $95,000 penalty to the CFPB’s victims relief fund.

Read today’s order.

Tens of millions of people are pursued by debt collectors for medical bills, and the CFPB has described the significant evidence, including reports from consumers themselves, that the collection, furnishing, and reporting of medical bills is plagued by inaccuracies.

Accordingly, the CFPB has taken numerous actions on the issue of medical debt. In November, the CFPB issued a report highlighting the challenges American families face when debt collectors pursue allegedly unpaid medical bills. In September, the agency kicked off a rulemaking to remove medical debt from credit reports. Along with the U.S. Department of Health and Human Services and the U.S. Department of Treasury, the CFPB launched, in June, an inquiry into costly credit cards and loans pushed onto patients to pay for health care costs. Also in June, the CFPB took an enforcement action against Phoenix Financial Services for illegal medical debt collection and credit reporting practices.

Read about the CFPB’s rulemaking to remove medical tradelines from consumer reports.

Read about the CFPB’s other work to stop unfair medical debt collection and coercive consumer reporting practices.

Consumers can submit complaints about financial products and services by visiting the CFPB’s website or by calling (855) 411-CFPB (2372).

Employees who believe their companies have violated federal consumer financial protection laws are encouraged to send information about what they know to [email protected]. To learn more about reporting potential industry misconduct, visit the CFPB’s website.

4 notes

·

View notes

Text

Cory Doctorow: Paying consumer debts is basically optional in the United States. The Fair Debt Collection Practices Act protects the people who need it least. How the debt collection industry sets the poor to prey on the poor.

3 notes

·

View notes

Text

Of the Fae (Creative Writing/Worldbuilding)

What can I say of the Faer Folk? Never will you meet a more fair, fearsome, awesome, awful, wonderful, and terrible people.

You will never meet a more dangerous people.

There are many kinds of Fae in the world, and precious few of those have been recorded in history or myth. And those that have have taken great pains to ensure their history, personality, weaknesses, and accomplishments are muddled and muddied to ensure their prey can not fight back effectively against them.

For the prey of the Fae is man.

If you’ve read the modern fairy tales, all you’ve read is the passing fancy of a human at best, and actively malicious Fae disinformation at worst.

Etymology:

The Word “Faerie” derives its roots from the Latin fata, meaning “the Fates,” via Old French “Faie,” or someone that was skilled in magic, herblore, and knower of Names and the suffix “-erie” which describes a group, collective, or type of practice. Or, together, a group or collective skilled in the practice of magic.

Geographic Origin:

All Fae by definition originate from or near the European continent. Some of the strongest factions and sub-factions originate from Germany, France, England, Ireland, Greece, and Scandinavia. They are not the only magical creatures in the world, though they are the largest, and the word “Fae” is often used as a catch-all for all magical creatures in the world, despite the fact that only those from Europe are technically Fae.

However, they are not the only magical creatures nor people in the world, and while generally magical peoples are referred to by the catch-all Fae because of their geocultural significance in my part of the world, they are not, by any stretch of the imagination, the only extant magical peoples.

However, after European Colonization efforts, the Fae led a systematic extermination effort against all of their potential rivals, to varying degrees of success. Djinn, spirits, and guides from outside Europe still remain, but their influence is overshadowed and remains impacted by the effects of European colonialism.

In particular, the magical peoples of the Americas were nearly extinguished. Some still remain in scattered pockets, still hounded and hunted by Christendom and Fae alike, spoken of in whispers by the people to whom they had been influencing before Europeans and Fae arrived on their shores. The knowledge of their existence can be jealously hoarded by the non-magical people they and their legends grew around.

Indeed, while some of the American magical peoples are experiencing a kind of minor reinvigoration in recent years, they take care not to advertise their presence for the most part, somey preferring to remain in the shadows so they do not get targetted again, others have chosen to re-emerge and declare their continued survival in acts of rebellious defiance in an attempt to keep their ways, knowledge, and language(s) alive.

Africa, the Middle East, Asia, and the Oceanic Islands remain havens for their native magical peoples, who still remain and, while guarded, are nowhere near as secretive as the remaining American magical peoples.

Behavioral Patterns

Fae, speaking of the magical peoples and creatures from Europe, are predators in the main. While there are some non-predatory Fae, those have mostly been killed off or warped by the others until only the predatory Fae remain.

The Fae are not human, and if interacting with them, it is vitally important that this is kept in the foreground of your mind. They are, first and foremost, predators. Any percieved weakness will be jumped upon. Any debt--real, imagined, percieved, or purchased/acquired--will be weaponized to its fullest (and worst) effects.

Humans are their prey, their domesticated livestock, walking snacks to be consumed at their leisure, left to roam in a pasture the size of a planet to proliferate and breed to ensure that they will never go hungry. If a thing exists, it exists for the Fae. Gifts, unless explicitly negotiated, are not gifts. Due to the long life of the Fae, they are more of a long-term rental item, to be reclaimed upon the reciever’s death, paid for with essence of life until that point has arrived.

Fae, by and large, are incredibly proud, and can often be thwarted by exploiting their pride. But because of their pride, if they have been thwarted, they will not forget and they do not forgive. They will remember the insult, and pay it back, with interest.

They do not generally appreciate their food outsmarting them.

Types of Fae

In the main, there only a few types of Fae that have survived to the present day, largely separated by their food source(s). All Fae feed off the life essence of humanity, but their specific (or preferred) diet varies. It is important to note, as well, that these are general groups, and any kind of Fae can be found with any other kind of Fae or on their own.

Theological Fae

Theological Fae feed off of the power of human Belief. The term “Theological Fae” has stuck because, while it is not just the power of belief in a higher power (or in the Fae themselves), they can also feed off of the belief in other things. Within Theological Fae, the three main branches are the Religious Fae--who have posed as and/or use the belief in a higher being as a food source--Philosophical Fae--who embody and embrace the meandering branches of human philosophy--and the Celebrae--who feed off of the human belief in and devotion to Nobility and those with fame. Some Celebrae are famous themselves and feed off of people adoring them, and others are merely hangers-on, and passively feed on the adoration of their host.

While the Theological/Philosophical Fae were once the pre-eminent Fae, their numbers and potency has declined in recent years as humanity has slowly lost interest in the Fae and has begun approaching (but has by no means reached) parity, technology for magic, with the Fae.

Note: While it is true that many of the Religious Fae have posed as gods or god-like beings (see the Pantheonic Fae in particular), this does not, in itself rule out the existence of a higher power or powers. Indeed, the Fae themselves, including many Religious Fae, have their own religious beliefs--they just can’t feed off each other.

Emotional Fae

Emotional Fae prefer the taste of human emotions as their source of nutrition. The more powerful and the rawer the emotion the better. The Emotional Fae are currently the most powerful type of Fae on the whole, largely divided into two main camps--the Summer and Winter Courts. At one point, there were hundreds, if not thousands of Courts, but over time they all died out, absorbed each other, or killed each other off. Indeed, what is now the Summer Court includes what remains of the Spring and Autumn Courts, absorbed in one of many power plays.

the Summer Court believes in unapologetic excess in attempting to cultivate and harvest the emotions of humanity. Different factions of the Summer Court have entire cities as their demesne, and carefully cultivate their herds of humanity to ensure a steady food supply.

And when it is time for the harvest, the Barrow King, the most powerful and dangerous of them all, rides out from the Underhill and leads his Court in a time of wild harvesting and hunting. Entire cities and countries have been pulled below to be seasoned, aged, and properly cultivated in horrific ways to bring out the best and purest forms of emotion.

The Summer Court are creatures of shadow and deception, subtlety and spycraft.But while this is their preferred modus operandi, they are also capable of tremendous violence, and often come to victory by their sheer numbers, discounting even the power of many of their members.

More than any other kind of Fae, beware the Summer Court of the Fae. If you suspect that you are in one of their cities they are patiently raising for harvest., run. For if the Summer Court does not Harvest you, the Winter Court might exterminate you.

The Winter Court is based out of the martial factories of the North Pole, producing the most potent magics and equipement the world has ever seen. The San’ta (Atlantean for “Great General”) leads her Court with a frozen iron fist, with her husband Krampus at her side. The Last Atlantean, the Winter Queen has never forgiven the Barrow King or the Summer Court for their role in the destruction of Atlantis, and has sworn their destruction.

But do not mistake Winter’s sworn mission for a suitable ally against the Summer Court. Cold and implacable, inevitable as a glacier, as harsh as a polar vortex, unforgiving as a winter storm, Winter does not care about humanity beyond their being a food source for Summer. Indeed, stated doctrine for the Winter Court for the last several centuries has been to wipe out any known field of man the Summer Court has planted.

And this generally means wiping out population centers of humanity.

There are few things that match the sheer power of a Winter Court blitzkrieg, capable of reducing a thriving metropolis to untouched wilderness in the course of a day--all signs of humanity and the Summer Court extinguished with contempt. But for all their stopping power, they cannot hope to survive in the face of an extended war with the Summer Court’s extended, if decentralized, power.

And so they bide their time, starving every Summer Fae they can find, exposing and....eliminating human collaborators with prejudice, undermining their foe and building their own power as they wait for the day that finally they can take their revenge, at last, for that single day and night of misfortune.

National Fae

After the 20th century, there are not many National Fae left. Most were wiped as they clashed alongside their humans in wars of attrition that weakened them significantly. Those that were remained were largely overwhelmed by the other Fae, sensing weakness and jumping at the opportunity to remove their rivals. National Fae were Fae that thrived off of the belief in and subscription to national identities.

The last major force of National Fae that remain, the Kingdom (formerly Empire) of Avalon, watches over England and the United Kingdom, guarding its borders as best it can. King Oberon, Queen Titania, and their heir, the Morrigan la Fae, rule over an unruly court, spurred to ever more chaotic heights by Oberon’s son, Puck.

While the National Fae are on the decline, the Kingdom of Avalon remains a powerhouse even as it wanes, and the Morrigan’s human husband, Merlyn, is one of the major power that keeps the other Fae at bay.

Although this has not prevented a rivalry with the Nordic Pantheon, specifically with the death goddess Hela, from forming. Indeed, the Arthurian Crusades are the stuff of legend, and Hela’s second, one Arthur Pendragon, has never forgotten the wrongs he believes the Morrigan la Fae and Merlyn have done against him that forced him to his current allegiance.

WildFae

A catch-all termfor Fae that do not belong to an organized group, coalition, nation, or Court. There are some that use the term to denote a lower-functioning kind of Fae, but in traditional and common parlance, the WildFae are merely unaffiliated Fae that choose to live their lives alone and away from the politics of the larger groups.

#Perakis Estate#Urban Fantasy#Modern Fantasy#Fae#Faerie#Fae Court#Pantheonic#Summer Court#Winter court#WildFae

10 notes

·

View notes

Text

Hi, I’m Kelley. I’ve been a debt collector for about three and a half years now.

Disclaimer that my experience is limited to credit card debt, and my advice may or may not be relevant to debts of other kinds (medical, etc). My knowledge is also limited to United States based debt collection practices.

But if you’re American and you owe a credit card company money….let’s talk:

- First off. When we talk to you, we have to verify your identity before we can give you any details. We normally ask for the last 4 of your SSN, your date of birth, and your address. Why? Because according to the FDCPA (Fair Debt Collection Practices Act), we cannot reveal the fact that you are in debt to anyone but you (or your spouse, if you have one).

If your mom or dad or boyfriend or girlfriend calls us, we cannot give them any information. If you want us to disclose information about your debt to them, you need to call (or email) us and tell us that.

-We are required to state, verbatim, on every call: “this is an attempt to collect a debt, and any information obtained will be used for that purpose”. Yes, TECHNICALLY, if we don’t say that, you can sue us for up to $1,000. But good luck finding a collector who is that stupid lmao?! In most cases, we’re looking right at a script while we’re on the phone with you…. 🤦♀️

-We used to be able to call you 3 times a day. Per new legislation, we can only call one time every 7 days….unless you give us permission to call more often. We will ask for that permission. Do not grant it.

-If you’re being harassed by calls, try saying “I would like to be placed on your do not call list” or “I am asking you to cease and desist.” Note: this will block future calls, but it won’t stop the credit card company from suing you.

-We will ask you where you work. It is in your best interest to (politely) avoid answering this question.

-If someone stole your identity and opened a credit card in your name, file a police report. In many cases, we can’t file a fraud claim without one.

-If you don’t recognize the debt we’re talking about (i.e. “I might have opened that card but it was so long ago I don’t remember”, “I had that card but the balance you said doesn’t sound right”, etc), ask for validation of debt. Basically we would then have to send you all the credit card statements we have on file and prove that the balance is correct. Any reputable collection agency will have these statements available, so this isn’t a get-out-of-jail-free card. But, we can’t make any more attempts to collect on the debt, until we confirm that you got those documents in the mail. So this is a good way to stall/buy time.

-If you’re ready to start making payment arrangements, don’t take the first offer we give you!! For example: someone owes us $1,000. I’m gonna offer them a plan of $83.33 per month for 12 months. Only after they say no, will I tell them that they also have the option to do $41.66 per month for 24 months. Why? Because I’m making commission on this shit lmao

-Ask if you qualify for a settlement. A settlement is, like, a deal, where we offer to let you pay less than you actually owe There’s normally a percentage we can’t go under. At my current job, that’s 60%. So, for example, if you owe us $100, I could offer you a settlement deal of $60, and you wouldn’t have to pay the remaining $40!

Settlements usually have to be paid as a lump sum, but sometimes you can get away with a monthly payment plan. Ask your collector.

-If you receive notification that you have been sued, call us before your hearing date and set up a payment plan voluntarily. If you let this go to court, 99.9% of the time, the judge will side with us, not you.

-Once we have judgment against you in a court of law, we can try and collect the funds involuntarily. In most cases, that means a wage garnishment. (This is why we ask where you work). We go directly to your employer and take 20-25% of your paycheck, depending on what state you live in.

Please note that yelling at your collector will not make the garnishment stop. 😭 We normally don’t file a garnishment unless you’ve been dodging our calls for years.

-Lastly, remember that collectors are people! We’re trying to make a living, just like you.

Debt collection is one of the best jobs an “unskilled” college dropout can get tbh! It pays way better than retail or food service. I get to sit at a desk, instead of standing in front of a cash register all day. And I get dental! Lol.

If you don’t verbally abuse your collector, they will normally try their best to come up with a payment plan that fits your budget. If all else fails, idk, lawyer up. 🤷♀️

5 notes

·

View notes

Text

Can Credit Repair Companies Really Help Your Credit Score?

There are many things to take into consideration when looking into a credit repair company. Can they help you get approved for loans or negotiate a settlement with your creditors? Continue reading to find out more. Below are three options that claim to assist you in improving your credit. However, is this really true? What are their advantages? Do they really cost a lot?

Can credit repair firms improve your credit score?

Credit repair companies will review your credit reports from all three major bureaus. They will then analyze the reports to identify any mistakes or negative marks. They will design a plan to dispute inaccurate or outdated information, and work with creditors to remove negative information from your report. The company should also offer an unconditional money-back guarantee. The process begins with a free consultation. A credit repair company will ask for a limited power-of- attorney. The company is then able to act for you with the credit bureaus.

Your credit score is calculated based on a variety of factors. The most important one is whether you pay your bills punctually. In the event of late payments on credit cards, it could result in a loss of 110 points in your score. This is also true for rent or loans. These types of negatives are generally removed from your credit report , but they could still make it difficult for you to get a loan or locate an apartment. Credit repair companies can assist you in getting rid of these negative items and increase your score.

They can help you get an approval for a loan.

Credit repair companies employ a variety of methods to help customers improve their credit score. Contact creditors to request they remove any negative information from your credit report. Some may also dispute inaccurate information on your credit report. However these methods don't always work. For these reasons, consumers should be cautious when using credit repair services. If you are thinking about the possibility of a loan, it's recommended to seek an additional opinion before signing on with a company.

Credit repair companies are able to collaborate with the three major credit report agencies to rectify incorrect information. aged primary credit tradelines can initiate lawsuits against inaccurate or inaccurate information , and also place liens onto your property. They can also assist in getting judgments and other legal documents. This can help improve the approval of your loan. This way, you can use the loan to finance your dream home. A credit repair service can be a great choice.

They can help you fight off debt collectors or negotiate payoffs?

Can credit repair firms assist in paying off debt? Credit is a dual-edged weapon. It helps us get by and allows us to purchase an automobile or a house. However, it can also be dangerous. When debt collectors are pursuing you for unpaid debts, they might claim that they don't keep your account details. If you've signed the payment plan, but if they don't, they may later sue you for their losses.

A debt collector will often contact you by phone and ask you questions about your debt. Don't fall for pressure and don't divulge your personal information to debt collectors. The collectors might be threatening or attempting to take money from you without your permission. Fair Debt Collection Practices Act (FDCPA) safeguards the debtors, and has resulted in legal actions against abusive debt collection agencies. If your ability to pay the essential bills is in doubt Don't pay debt collectors. Prioritize the essentials over paying off old debt.

#credit repair#credit repair companies#credit repair near me#credit repair agencies#are credit repair

3 notes

·

View notes

Text

Breaking the Cycle: Taking Control in the Face of Debt Collection Intimidation

Debt collectors can be intimidating for many people, but it really depends on various factors such as the individual's financial situation, the tactics used by the collector, and the laws governing debt collection practices in their region.

For some, receiving calls or letters from debt collectors can be stressful and anxiety-inducing, especially if they're struggling financially or feeling overwhelmed by debt. Debt collectors may use aggressive tactics or language to try to compel individuals to pay their debts, which can contribute to the intimidation factor.

However, it's important to know your rights when dealing with debt collectors. There are laws in place, such as the Fair Debt Collection Practices Act (FDCPA) in the United States, that protect consumers from abusive or unfair debt collection practices. These laws outline what debt collectors can and cannot do when attempting to collect a debt.

While debt collectors may try to intimidate individuals into paying, it's essential to stay informed about your rights and options. Seeking advice from a financial advisor or consumer advocacy organization can help you navigate the situation and make informed decisions about how to handle your debts.

the Face of Debt Collection Intimidation

0 notes

Text

The Role of Financial Services Expert Witnesses in Consumer Protection Cases

Consumer protection is a cornerstone of the financial services industry, ensuring fair treatment and safeguarding the interests of consumers. In cases involving disputes or allegations of misconduct, financial services expert witnesses play a vital role in providing impartial analysis, expert opinions, and insights to assist the court in reaching fair and just decisions. In this article, we explore the indispensable role of Banking Expert Witness and financial services expert witnesses in consumer protection cases, examining their contributions and the impact they have on ensuring accountability and upholding consumer rights.

The Role of Financial Services Expert Witnesses:

Financial services expert witnesses bring specialized knowledge, expertise, and experience to consumer protection cases, offering valuable insights and analysis on a wide range of financial matters. Their role encompasses various aspects, including:

Assessing Compliance with Regulations: Financial services expert witnesses evaluate whether financial institutions have complied with relevant regulations and industry standards in their dealings with consumers. This may involve assessing the implementation of consumer protection laws, such as the Truth in Lending Act (TILA), the Fair Credit Reporting Act (FCRA), or the Consumer Financial Protection Bureau (CFPB) regulations.

Analyzing Financial Products and Services: Expert witnesses analyze the features, terms, and suitability of financial products and services offered to consumers. This includes assessing the risks, costs, and benefits associated with loans, investments, insurance policies, and other financial instruments to determine whether they meet consumer needs and expectations.

Investigating Allegations of Misconduct: Financial services expert witnesses conduct thorough investigations into allegations of misconduct, fraud, or deceptive practices by financial institutions. They examine relevant documentation, transactions, and communications to identify any breaches of fiduciary duty, negligence, or unfair business practices that may have harmed consumers.

Providing Expert Opinions and Testimony: Expert witnesses provide expert opinions and testimony based on their analysis and findings, helping the court understand complex financial matters and implications. Their testimony may cover a wide range of topics, including industry practices, regulatory compliance, risk management, and the standard of care expected from financial institutions.

Assisting in Settlement Negotiations: Financial Services Expert Witness play a critical role in settlement negotiations by providing objective analysis and advice to parties involved in consumer protection cases. Their insights help parties assess the strengths and weaknesses of their positions and reach mutually acceptable resolutions that protect the interests of consumers.

Case Examples:

Mortgage Fraud: In cases involving mortgage fraud, financial services expert witnesses may analyze loan documents, underwriting practices, and appraisal reports to determine whether borrowers were misled or deceived by lenders. They may identify red flags indicating fraudulent activities, such as inflated appraisals, undisclosed fees, or predatory lending practices, and provide expert testimony to support their findings.

Consumer Credit Disputes: Financial services expert witnesses may assist in resolving consumer credit disputes by evaluating credit reports, billing statements, and correspondence between consumers and creditors. They may identify inaccuracies, errors, or violations of consumer protection laws, such as the Fair Credit Billing Act (FCBA) or the Fair Debt Collection Practices Act (FDCPA), and provide expert opinions on the appropriate remedies or damages owed to consumers.

Investment Fraud: In cases involving investment fraud, financial services expert witnesses may analyze investment portfolios, prospectuses, and communications between investors and financial advisors. They may identify instances of misrepresentation, omission of material facts, or unsuitable investment recommendations that have harmed investors and provide expert testimony to assist the court in holding responsible parties accountable.

Conclusion:

Financial services expert witnesses play a crucial role in consumer protection cases, serving as impartial experts who provide valuable analysis, insights, and testimony to assist the court in reaching fair and just outcomes. Their specialized knowledge, expertise, and objectivity are essential for evaluating compliance with regulations, analyzing financial products and services, investigating allegations of misconduct, and providing expert opinions and testimony. By leveraging the expert witness financial services, consumers can seek accountability and justice in cases involving financial wrongdoing and ensure that their rights and interests are protected in the complex world of financial services.

0 notes

Text

Debt Collection Letters: The Essential Elements Every Business Needs

Debt collection letters are critical tools for businesses aiming to recover outstanding debts while adhering to legal regulations and maintaining professionalism. These letters should include clear identification of the creditor, providing contact information and relevant account details to avoid confusion. Additionally, it's essential to clearly state the amount owed, including any interest or fees, to ensure transparency and prevent disputes. Payment terms and options must be outlined, specifying acceptable methods and deadlines for repayment. Communicating the potential consequences of non-payment, such as legal action or credit reporting, can motivate debtors to address the debt promptly. Furthermore, debt collection letters should inform debtors of their rights under consumer protection laws like the Fair Debt Collection Practices Act (FDCPA) and maintain a professional tone throughout to foster cooperation. Including accurate contact information and supporting documentation strengthens the communication process, facilitating positive engagement and increasing the likelihood of successful debt recovery.

Debt Collection

0 notes

Text

One of America’s most corporate-crime-friendly bankruptcy judges forced to recuse himself

Today (Oct 16) I'm in Minneapolis, keynoting the 26th ACM Conference On Computer-Supported Cooperative Work and Social Computing. Thursday (Oct 19), I'm in Charleston, WV to give the 41st annual McCreight Lecture in the Humanities. Friday (Oct 20), I'm at Charleston's Taylor Books from 12h-14h.

"I’ll believe corporations are people when Texas executes one." The now-famous quip from Robert Reich cuts to the bone of corporate personhood. Corporations are people with speech rights. They are heat-shields that absorb liability on behalf of their owners and managers.

But the membrane separating corporations from people is selectively permeable. A corporation is separate from its owners, who are not liable for its deeds – but it can also be "closely held," and so inseparable from those owners that their religious beliefs can excuse their companies from obeying laws they don't like:

https://clsbluesky.law.columbia.edu/2014/10/13/hobby-lobby-and-closely-held-corporations/

Corporations – not their owners – are liable for their misdeeds (that's the "limited liability" in "limited liablity corporation"). But owners of a murderous company can hold their victims' families hostage and secure bankruptcies for their companies that wipe out their owners' culpability – without any requirement for the owners to surrender their billions to the people they killed and maimed:

https://pluralistic.net/2023/08/11/justice-delayed/#justice-redeemed

Corporations are, in other words, a kind of Schroedinger's Cat for impunity: when it helps the ruling class, corporations are inseparable from their owners; when that would hinder the rich and powerful, corporations are wholly distinct entities. They exist in a state of convenient superposition that collapses only when a plutocrat opens the box and decides what is inside it. Heads they win, tails we lose.

Key to corporate impunity is the rigged bankruptcy system. "Debts that can't be paid, won't be paid," so every successful civilization has some system for discharging debt, or it risks collapse:

https://pluralistic.net/2022/10/09/bankruptcy-protects-fake-people-brutalizes-real-ones/

When you or I declare bankruptcy, we have to give up virtually everything and endure years (or a lifetime) of punitive retaliation based on our stained credit records, and even then, our student debts continue to haunt us, as do lawless scumbag debt-collectors:

https://pluralistic.net/2023/08/12/do-not-pay/#fair-debt-collection-practices-act

When a giant corporation declares bankruptcy, by contrast, it emerges shorn of its union pension obligations and liabilities owed to workers and customers it abused or killed, and continues merrily on its way, re-offending at will. Big companies have mastered the Texas Two-Step, whereby a company creates a subsidiary that inherits all its liabilities, but not its assets. The liability-burdened company is declared bankrupt, and the company's sins are shriven at the bang of a judge's gavel:

https://pluralistic.net/2023/02/01/j-and-j-jk/#risible-gambit

Three US judges oversee the majority of large corporate bankruptcies, and they are so reliable in their deference to this scheme that an entire industry of high-priced lawyers exists solely to game the system to ensure that their clients end up before one of these judges. When the Sacklers were seeking to abscond with their billions in opioid blood-money and stiff their victims' families, they set their sights on Judge Robert Drain in the Southern District of New York:

https://pluralistic.net/2021/05/23/a-bankrupt-process/#sacklers

To get in front of Drain, the Sacklers opened an office in White Plains, NY, then waited 192 days to file bankruptcy papers there (it takes six months to establish jurisdiction). Their papers including invisible metadata that identified the case as destined for Judge Drain's court, in a bid to trick the court's Case Management/Electronic Case Files system to assign the case to him.

The case was even pre-captioned "RDD" ("Robert D Drain"), to nudge clerks into getting their case into a friendly forum.

If the Sacklers hadn't opted for Judge Drain, they might have set their sights on the Houston courthouse presided over by Judge David Jones, the second of of the three most corporate-friendly large bankruptcy judges. Judge Jones is a Texas judge – as in "Texas Two-Step" – and he has a long history of allowing corporate murderers and thieves to escape with their fortunes intact and their victims penniless:

https://pluralistic.net/2021/08/07/hr-4193/#shoppers-choice

But David Jones's reign of error is now in limbo. It turns out that he was secretly romantically involved with Elizabeth Freeman, a leading Texas corporate bankruptcy lawyer who argues Texas Two-Step cases in front of her boyfriend, Judge David Jones.

Judge Jones doesn't deny that he and Freeman are romantically involved, but said that he didn't think this fact warranted disclosure – let alone recusal – because they aren't married and "he didn't benefit economically from her legal work." He said that he'd only have to disclose if the two owned communal property, but the deed for their house lists them as co-owners:

https://www.documentcloud.org/documents/24032507-general-warranty-deed

(Jones claims they don't live together – rather, he owns the house and pays the utility bills but lets Freeman live there.)

Even if they didn't own communal property, judges should not hear cases where one of the parties is represented by their long term romantic partner. I mean, that is a weird sentence to have to type, but I stand by it.

The case that led to the revelation and Jones's stepping away from his cases while the Fifth Circuit investigates is a ghastly – but typical – corporate murder trial. Corizon is a prison healthcare provider that killed prisoners with neglect, in the most cruel and awful ways imaginable. Their families sued, so Corizon budded off two new companies: YesCare got all the contracts and other assets, while Tehum Care Services got all the liabilities:

https://ca.finance.yahoo.com/news/prominent-bankruptcy-judge-david-jones-033801325.html

Then, Tehum paid Freeman to tell her boyfriend, Judge Jones, to let it declare bankruptcy, leaving $173m for YesCare and allocating $37m for the victims suing Tehum. Corizon owes more than $1.2b, "including tens of millions of dollars in unpaid invoices and hundreds of malpractice suits filed by prisoners and their families who have alleged negligent care":

https://www.kccllc.net/tehum/document/2390086230522000000000041

Under the deal, if Corizon murdered your family member, you would get $5,000 in compensation. Corizon gets to continue operating, using that $173m to prolong its yearslong murder spree.

The revelation that Jones and Freeman are lovers has derailed this deal. Jones is under investigation and has recused himself from his cases. The US Trustee – who represents creditors in bankruptcy cases – has intervened to block the deal, calling Tehum "a barren estate, one that was stripped of all of its valuable assets as a result of the combination and divisional mergers that occurred prior to the bankruptcy filing."

This is the third high-profile sleazy corporate bankruptcy that had victory snatched from the jaws of defeat this year: there was Johnson and Johnson's attempt to escape from liability from tricking women into powder their vulvas with asbestos (no, really), the Sacklers' attempt to abscond with billions after kicking off the opioid epidemic that's killed 800,000+ Americans and counting, and now this one.

This one might be the most consequential, though – it has the potential to eliminate one third of the major crime-enabling bankruptcy judges serving today.

One down.

Two to go.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/10/16/texas-two-step/#david-jones

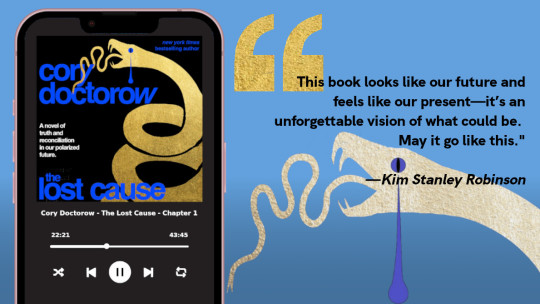

My next novel is The Lost Cause, a hopeful novel of the climate emergency. Amazon won't sell the audiobook, so I made my own and I'm pre-selling it on Kickstarter!

#pluralistic#texas two-step#bankruptcy#houston#texas#mess with texas#corruption#judge david jones#fifth circuit#southern district of texas#elizabeth freeman#yescare#corizon#prisons#private prisons#prison profiteers#Michael Van Deelen#Office of the US Trustee#sacklers#bankruptcy shopping#johnson and johnson#impunity

259 notes

·

View notes

Text

Managing the Debt Collection Landscape: Comprehending Debt Collectors in Victoria

Debt collection is a crucial aspect of financial management for both individuals and businesses alike. In Victoria, like in many other regions, the services of debt collectors play a significant role in recovering outstanding debts and ensuring the financial stability of creditors. Understanding the role and responsibilities of debt collectors in Victoria is essential for both debtors and creditors alike.

Debt Collectors in Victoria are professionals or agencies tasked with the responsibility of pursuing overdue debts on behalf of creditors. Their primary objective is to recover the outstanding amounts owed while adhering to legal and ethical standards. These professionals employ various strategies and techniques to communicate with debtors, negotiate repayment plans, and ultimately recover the debt owed.

One of the key responsibilities of debt collectors in Victoria is to ensure compliance with relevant laws and regulations governing debt collection practices. In Australia, debt collection is regulated by laws such as the Australian Consumer Law and the Australian Securities and Investments Commission (ASIC) Act, which outline the rights and obligations of both debtors and collectors. Debt collectors in Victoria must adhere to these laws to ensure fair and ethical practices throughout the debt recovery process.

Moreover, debt collectors in Victoria must also maintain professionalism and empathy when dealing with debtors. While their primary goal is to recover the debt owed, it is essential for collectors to treat debtors with respect and dignity, recognizing that financial difficulties can be stressful and challenging for individuals. Effective communication and negotiation skills are vital for debt collectors to engage with debtors in a constructive and empathetic manner.

In conclusion, debt collectors play a crucial role in the financial ecosystem of Victoria, facilitating the recovery of overdue debts while ensuring compliance with relevant laws and ethical standards. By understanding the responsibilities and practices of debt collectors in Victoria, both debtors and creditors can navigate the process of debt collection with clarity and confidence, ultimately working towards resolving outstanding debts in a fair and equitable manner.

More Info

Website: https://bellmercantile.com.au/

Ph: 03 9596 9311

Mail id: [email protected]

Working Time: Monday to Friday 8:30am–5:30pm .

0 notes

Text

Investigating the legality of Cedar Business Services

The legality of any business depends on its compliance with the state sanctioned policies and regulations. Cedar Business Services carries a renowned name in the debt collection industry mainly for its services aligned with compassion, empathy, and people to people approach. There are some narratives circulating on the internet regarding the legitimacy of Cedar Business Services which can be cleared with understanding its business, its compliance with the all the relevant laws and policies. Without understanding, you will be confused regarding its working. Therefore, it is crucial for the customers to first understand its nature and check its compliance with all the legal laws and regulations.

Cedar Business Professionals Working

Legality of Cedar Business Services

Centered around narratives, there are mixed reviews of people regarding the legitimacy of Cedar Business Services. All those reviews exhibit one thing — confusion why? First, they are both ignorant of business nature and its compliance with all the technical and legal laws. Secondly, all their views are subjected to different experiences which do not justify objective clarity. The clarity of any business comes from its compliance with all ethics and legal laws, and debt collection agency comes under the purview of Fair Debt Collection Practices Act (FDCPA). Therefore, understanding the legality of ethical practices of business entity is crucial to determine its legitimacy.

Cedar Business Services is a law-abiding entity that means it is compliant with all applicable Federal and State Corporate and Consumer Protection Laws and SOC Type II certified. In addition to that, it is a BBB-accredited business and a long-time member of ACA International. Having understood all this, a customer will get the objective clarity of the legality of Cedar Business Services. Apart from these legal prerequisites, Cedar Business Services operates with a deep-seated belief of empathy that manifests in the People to People approach of this business.

Cedar Business Services is legit with all the required certifications and its compliance with all the laws. It's clear and transparent process and positive reviews are adequate for the customers to trust Cedar Business Services for the collection of debt from default accounts. In case, if the consumer is confused, it is necessary for the consumer to understand the debt as well as his rights covered comprehensively under the FDCPA and must seek legal advice for the informed decision making.

0 notes