#Best Micro Finance Company Registration

Text

Get Best Micro Finance Company Registration Service by Legal Dev

Are You Looking for Best Micro Finance Company Registration Service ? Now you can Register Your Micro Finance Company with Easy process that saves you time and effort, allowing you to focus on other aspects of your business. Visit our Website for more information.

0 notes

Text

Which is the No 1 micro finance company in India?

Introduction: Microfinance has emerged as a powerful tool for financial inclusion, empowering individuals and communities by providing access to credit and financial services. In the vast landscape of microfinance companies in India, one question looms large: "Which is the No 1 microfinance company in India?" In this comprehensive guide, we delve into the intricacies of microfinance and explore the process of Section 8 Microfinance Company Registration.

The Significance of Microfinance in India: Microfinance plays a pivotal role in fostering economic development, particularly in regions where traditional banking services may not be easily accessible. It enables individuals, especially those in rural and underserved areas, to start or expand small businesses, ultimately contributing to poverty alleviation and economic empowerment.

Identifying the No 1 Microfinance Company in India: Determining the top microfinance company in India involves evaluating various factors such as outreach, impact, financial stability, and customer satisfaction. As of our last knowledge update in January 2022, specific companies may have held prominent positions, but the landscape is dynamic, and rankings can change over time. It is advisable to refer to the latest reports and industry analyses for the most current information.

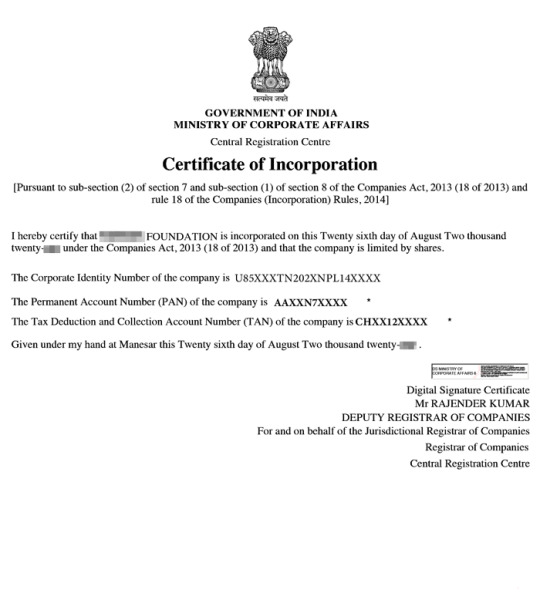

Understanding Section 8 Microfinance Company Registration: Section 8 of the Companies Act, 2013, pertains to the incorporation and regulation of non-profit organizations. Microfinance institutions often opt for Section 8 company registration to operate with a social welfare objective. This legal framework allows companies to function as non-profit entities, channeling their efforts towards social and community development.

The registration process involves several steps, including the preparation of necessary documents, obtaining Digital Signature Certificates (DSC), Director Identification Numbers (DIN), and filing the application for incorporation with the Registrar of Companies (RoC). Compliance with regulations is crucial to ensure that the microfinance company operates within the legal framework.

Key Considerations for Microfinance Companies:

Social Impact: The success of a microfinance company is measured not only by financial metrics but also by the positive impact it creates on the lives of beneficiaries.

Financial Inclusion: A leading microfinance company should demonstrate a commitment to extending financial services to the unbanked and underserved populations.

Transparent Operations: Transparency in financial transactions and clear communication with stakeholders are essential for building trust and credibility.

Innovation: Embracing technology and innovative financial solutions can enhance the efficiency and reach of microfinance operations.

Conclusion: While determining the No 1 microfinance company in India involves considering multiple factors, it is imperative to stay informed about the latest industry developments and rankings. Section 8 Microfinance Company Registration provides a legal framework for organizations to contribute meaningfully to the socio-economic development of the country. As the microfinance sector continues to evolve, staying abreast of regulatory changes and industry trends is crucial for both aspiring entrepreneurs and established players in the field.

#micro finance company#micro finance#micro finance hindi#micro finance in india#best microfinance company in india#microfinance company#how to register micro finance company in india#how to do micro finance registration#best finance company in india#microfinance company in india#microfinance in india#best micro finance video#micro finance company registration#meaning of micro finance company#type of micro finance company

0 notes

Text

Business Migration: Choosing a Country for Business Success - projectcubicle

Business Migration: Choosing a Country for Business Success

Many entrepreneurs think about which countries offer the best conditions for beginners and experienced businessmen. Practical reviews from capital holders and expert opinions will help you figure out how to start or expand a business abroad while obtaining a residence permit. It is worth noting that there is a growing number of entrepreneurs seeking to expand their business beyond the borders of their country. Some open branches abroad, others organize relocation, and for some, commercial activity has become a way to obtain migration status.

Our company is an expert in establishing, licensing, and further supporting businesses. We are ready to provide you with comprehensive assistance in resolving any corporate issues, including in assessing and creating a business model, as well as choosing the most suitable jurisdiction for the implementation of your commercial ideas.

Introduction to Business Migration

Over the past two years, relocation and business creation in different countries have become very popular among entrepreneurs. When looking for the best conditions, businessmen first all pay attention to the level of convenience of registering and doing business, the cost of taxes, as well as the degree of legal protection in the field of private property and concluding contracts.

Business conditions vary by country. Work is affected by the company registration process, tax laws, the state of the economy, and even the level of corruption. The option of obtaining migration status through the establishment of a commercial project is especially attractive because it allows you not only to register a business but also to obtain a residence permit of one or another attractive country when opening a company. This status opens up access to tax benefits, business development programs, and a European bank account for capital diversification - there are enough associated benefits.

There’s specific criteria for choosing a country for business success: ease of registering a company, including for a foreign entrepreneur, the amount of taxes and their administration, access to financing, competitive environment, legal protection, ease of scaling a business, in particular to other countries.

As a rule, the authorities actively support local small businesses, in particular helping unemployed citizens open their businesses. For example, the employment service holds special educational meetings and even helps financially until the business gains momentum. There are free courses on running and promoting a business and even emergency business assistance - business consultants who help you get out of such micro-crises. However, such support is not available to non-residents.

Factors in Country Selection for Business: Legal, Regulatory, and Economic Analysis

First of all, it is important to consider not only the possibility of remote registration but also some other factors. In addition to this, it is necessary to take into account the general aspects of running a business.

Prospects for specific investor activities. Analyze trends and the competitive environment to make informed investment decisions.

Prospects for the company's growth and scaling. Research market opportunities and business expansion strategies.

Restrictions for shareholders. Conditions for owning and trading shares, possible restrictions on transfer or sale.

Restrictions for non-residents who own an enterprise. Laws and regulations governing the participation of non-residents in company ownership.

Maximum annual cash turnover. Established standards or restrictions on a company's income during the year.

Economic analysis for business success: restrictions and prohibitions of banks on the activities of non-residents. Bank rules and policies related to relations with non-residents.

Restrictions on authorized capital. Minimum and maximum values of the authorized capital established by law.

Signed an agreement to avoid double taxes. Agreement on the prevention of double taxation between countries to protect the interests of investors.

Company security. Measures to ensure the physical, information, and financial security of business.

Confidentiality of data on fund turnover. Policies and technical measures to protect confidential financial transaction information.

Business Migration Case Studies

Preparing to register a company abroad is a complex process that consists of several stages.

Choice of jurisdiction, particularly, market analysis for business migration. Perhaps the most important stage is when the business owner determines the state in which the company will be registered.

Company forms. A limited liability company (LLC) is suitable for small businesses. Management does not have to have citizenship of the state of registration; a minimum number of employees is required.

3. Clarification of tax obligations. You should find out in advance how much and where you will have to pay. Otherwise, the company may have debts out of thin air, which will still have to be paid.

Although, thanks to technological progress today, it is not difficult to learn the rules and features of doing business in a particular country, in practice, it is not an easy task. First, you will have to familiarize yourself with and comply with all the requirements, as well as deal with exchange rates and language barriers.

Easy business registration.

The speed of business registration varies. In some countries, this may take only one day, while in other jurisdictions, it may take more than a month. This depends on infrastructure problems, bureaucracy, and strict regulation. The speed of starting your business may also depend on factors such as the availability of office space, technology, electricity, water, etc. In this regard, each country also has its own situation. However, if the market is right for your product or service, then the speed of registration does not matter.

You also need to take into account the costs of registering a business and further servicing the company. You need to make sure that your profits can cover your costs. If you want to reduce risks and costs, you should enlist the support of professionals who will familiarize you with the rules of starting a business in a particular country and help you do everything correctly to minimize any delays.

Access to qualified talent.

Entering a new market, international level, increases your chances of finding specialists for your company. Try to choose a country where there is an abundance of the specialists you need. If you offer IT services, you will need employees with the appropriate technical skills.

Tax consequences.

One of the key factors that affects the profit margin of your company is, of course, taxes. How strong the tax burden is in the country will affect everything - hiring employees, compliance with state income tax requirements. Therefore, it is worth paying special attention to this aspect. In some jurisdictions, businesses are required to make significant contributions to employee housing and welfare schemes; this is very different from what businesses are accustomed to in most Western countries.

Political and economic stability.

Registration of a company abroad does not make sense if it occurs in an unstable state, where the regime, policy direction, or serious economic downturns frequently occur. All this can lead not only to losses but also to problems with local legislation. Therefore, it is better to consider the most stable countries.

Features of the mentality of the local population.

To effectively interact with government officials and local clients, it is necessary to understand the mentality of the population of the country where the company is registered. It is on him/her that the behavior of people and the specifics of working with them will largely depend.

Running your business through migration has many strengths, including the following:

possibility of a low tax burden: some various regimes and benefits can minimize tax risks;

ability to avoid paying double taxes in some countries: thanks to agreements between countries, entrepreneurs who have managed to open a company abroad often avoid double taxation of their income;

access to a more developed economic environment: entrepreneurs gain access to a wide range of tools and services to effectively manage finances, ensure liquidity, and access credit resources;

foreign account: access to banking systems that are characterized by a high level of service, security, and confidentiality;

opportunity to work in more stable political and economic systems: this creates favorable conditions for business development;

prospects for obtaining a business visa or residence permit: in many countries some programs enable entrepreneurs to obtain various types of visas or residence and work permits;

global business opportunities: registering a company abroad allows you to enter the global market. Entrepreneurs can find new clients and partners, expand the geography of their business, and increase its profitability;

prestige: the desire to register a company in another jurisdiction is associated with high-quality products and services, innovation and social responsibility. You can always use this fact to improve the company’s image and attract new clients or investors.

Choosing a country to open a business in is a strategic decision that can determine the future success of your enterprise. Various factors, such as tax policies, bureaucratic processes and the general business environment become key criteria when deciding where to incorporate.

Our company is ready to provide you with comprehensive assistance in establishing a company, as well as in its further support. Our specialists will select for you the jurisdiction with the best conditions for the implementation of your commercial project. Contact us now.

Read the full article

0 notes

Text

The Benefits of Hiring the Best Real Estate Brokers in Dubai

Dubai’s glitzy high-rises and investor-friendly policies have established its real estate market as one of the fastest-growing globally. With a rising expatriate population and surging demand for properties, Dubai offers lucrative returns for investors. However, navigating regulations, zoning laws, amenities, and pricing can prove challenging without local expertise. Hiring an experienced, ethical, and knowledgeable property management company and the best real estate brokers in Dubai provides distinct advantages.

A Better Understanding of Local Market Dynamics

The top-tier real estate brokers in Dubai possess an in-depth understanding of market conditions, pricing trends, and neighborhoods. Factors like upcoming infrastructure projects, community planned development, and changes in rental yields can impact property valuations. Instead of attempting to research these dynamics independently, investors can rely on expert brokers. They leverage their extensive networks and proprietary data to guide clients towards profitable properties that suit their budget and lifestyle needs.

Access to Diverse Property Listings

Well-connected real estate agents have exclusive access to listings often not available on public portals or directly from developers. Geographic expertise allows them to profile neighborhoods and developments to shortlist options well aligned with what investors seek. For instance, those catering to expatriate tenants would suggest areas with multicultural communities and leisure facilities rather than quiet suburbs. Expert brokers save time and effort in property searches while matching client priorities accurately.

Guidance on Ownership Rules

Dubai allows expatriates to buy properties easily, but localized ownership legislation applies based on community category and investor nationality. While freehold areas permit complete foreign ownership, certain zones only allow leaseholds. Expert real estate brokers in Dubai keep abreast of the latest ownership rules, financing schemes, and investor eligibility. Their guidance can prevent legal complications and exploit opportunities like co-investing with citizen sponsors for ownership rights.

Due Diligence Assistance

A reputable property management company in Dubai assists in verifying aspects that impact investment decisions: developer reputation, construction quality, community facilities, occupancy rates, and fair pricing. For off-plan purchases, they examine project conceptualization, escrow accounts, approvals, and builder track records to assess risks. Their localized insights and prudent due diligence enable clients to avoid pitfalls and gain assurance when finalizing property purchases.

Rental and Sales Management

Top real estate firms in Dubai offer end-to-end services encompassing rental management, lease execution, rent collection, and inventory control. They handle property advertisements, screening tenants, security checks, and lease renewals. Additionally, ethical brokers honestly represent all aspects of sales to buyers rather than hide defects or overstate valuations. Outsourcing rental management and sales to specialists allows property owners to hold investments passively with regular income.

Market segment expertise

The leading real estate brokers in Dubai cater to specific property segments such as luxury homes, affordable housing, commercial buildings, hospitality assets, or industrial infrastructure. Their sharp sectoral focus equips them with micro-market intelligence pertaining to demand drivers, valuations, and investor preferences to deliver specialized advisory services. Property buyers gain access to a wider range of off-market deal flows customized to their investment objectives.

Financial and Legal Advisory

Large real estate agencies in Dubai offer vicinity services spanning financial arrangements, mortgages, title transfers, registration, taxation, and escrow accounts. They have dedicated financial advisors and legal consultants to steer clients on optimal loan products, ownership frameworks, and compliance aspects for smooth property acquisitions and transfers. Their expertise handles the entire paperwork chain without buyers struggling through bureaucratic processes.

Insurance and home services

Established brokers also assist homeowners in taking out residential building and content insurance to safeguard against accidents, damages, or liabilities. They provide seamless facilitation by liaising with leading insurance providers. Additionally, they offer contacts for reliable home service professionals for maintenance jobs or renovations required by property owners and tenants.

Property technology integration

Progressive real estate consultants leverage next-gen property technology tools like digital contract management, virtual tour simulations, customer relationship management (CRM) systems, and data analytics for superior consumer experiences. Their digital capabilities enable faster matching of property listings to tenant or buyer preferences and proactive communications through centralized dashboards accessible across devices.

Global Investor Assistance

Dubai attracts significant real estate investments from foreign buyers who may be unable to travel frequently for site visits and paperwork. The finest brokers have multilingual teams and international representative offices to provide end-to-end facilitation to offshore investors. They assist in spotting profitable properties, due diligence, financing, paperwork, and post-acquisition management through dedicated account representatives.

Diversified Offerings

Large brokers operate through extensive group networks encompassing lending, building materials supply, fitting outs, maintenance, and home services. Their financial strength and diversified capabilities give clients the assurance of integrated advisory and extended project implementation capabilities. Turnkey solutions improve convenience and speed for investors operationalizing or enhancing property assets.

Market expansion support

As Dubai evolves into a global business hub, many multinational corporations seek to expand into the Emirate. The top-tier real estate consultants leverage their market relationships to source ideal office spaces that meet enterprise requirements while negotiating optimal leasing terms on their behalf. They tap into their resources to oversee corporate workplace delivery, encompassing interior designs, telecom/audio-visual integration, manpower supply, etc.

Community networking platforms

Influential brokers also serve as conduits, bringing together investors, developers, property owners, financiers, and other stakeholders through networking events, conferences, and digital platforms. These enable idea exchanges, new partnership opportunities, and smarter investments leveraging collective experiences. Their community engagement allows unique market perspectives beyond typical property listings.

Consultative Sales Approach

Customer-focused real estate advisors act as consultants rather than transaction agents. They invest time upfront counseling buyers on property selection aligned to lifestyle, budget, and neighborhood preferences. Their solutions-oriented advisory builds lasting rapport and prevents acquisition remorse or mismatches. They prioritize nurturing enduring client relationships based on trust over one-time sales volumes.

CONCLUSION

Hiring competent and best real estate brokers in Dubai provides distinct advantages to property buyers, sellers, landlords, and tenants. Expert area knowledge, personalized services, and depth of offerings enable clients to make prudent decisions aligned with their needs. Reputable brokers focus on nurturing long-term investor relationships rather than quick sales turnover. Partnering with the right property advisor and management company offers convenience and trust in one of the world’s most dynamic real estate markets.

0 notes

Link

0 notes

Text

Get mudra loan Benefits with MSME registration

Ever wanted to get mudra loan Benefits? If you're an MSME or Micro and Small Medium Enterprises, this article is for you. With the registration process becoming more straightforward, this article will explain MSME registration with Mudra Bank.

How to get mudra loan Benefits?

Mudra loans can be used for a variety of purposes. While opting for a mudra loan, many people look forward to the benefits attached to it. With the advantages of getting a mudra loan, one can easily select their desired loan amount. Some of them are a flexible repayment schedule, quick loan processing, and an easy repayment method. If you are looking for a loan to buy your dream home or a vehicle, mudra loans are the best option. It's one of India's most popular online loan providers, working with banks to help you get rid of your financial burden and follow your dreams.

Is MSME registration required for Mudra Loan?

Were you thinking of starting a business or buying a property? Then, it is essential to ensure that you go through the registration process with msme. This way, your loan application will be processed faster, and you will easily access financing for future investments. As per the MSME registration notification, the Mudra bank gives a loan up to Rs. 10 Lakhs to the small and medium businesses within a prescribed limit of Rs. 20 million. The credit amount will be given in the form of a revolving loan, and it will be repaid with very cheap interest and principal installments.

How do I register under MSME registration?

MSMEs are required to register under msme with the Ministry of Micro, Small, and Medium Enterprises (MSME), and certain documents need to be submitted for MSME registration. The following is a rundown of what needs to be done for an MSME to be registered:-Applicant's name-Date of birth-Place of establishment-Main business activities-Authority issued by the competent authorities evidence that said the applicant would conduct the activity in question within the geographic area specified in the application.

Entrepreneurs with a vision can create a powerful brand for their company or service using the MSME platform. You can get a loan for your Business monitoring with MSME registration. MSME registration is one of the quickest and simplest ways to get a loan. You have to register yourself as an individual or company, and you are good to go!

What are the benefits of MSME registration?

Msme registration is registering a manufacturing company with the Ministry of Small and Medium Enterprise Development (MSMED). The primary benefit of MSME registration is that it can help you avail of loans from various banks such as SBI, UCO Bank, IDBI Bank, LIC, etc.

Registration with the MSME is mandatory for those who are not already registered. The benefits of MSME registration include any document issued by the ministry, a list of members, a copy of their membership card, and the opportunity to receive an MSME loan for their business startups with cheap interest, ie... a mudra loan.

Conclusion

Mudra loans are an excellent solution for everyone having a hard time getting a loan from banks. People have been searching for ways to manage their debt and spend less, which is why there has been an increase in the number of people who apply for mudra loans. Mudras are beneficial because they allow people to reduce their loan repayment amount and make payments in installments instead of all-inclusive financers. The Mudra loan is a good option for you to get the benefits of Mudra loan as a short-term loan. Moreover, you will be given a loan as per your eligibility. Finding a loan for MSME is not an easy task. There are many benefits to the loan, with low-interest rates and quick disbursement of funds.

Mudra loan Benefits : The Mudra loan is a unique loan facility offered by MSME Finance to its member MSMEs. It provides finance for the purchase or setup of capital assets/innovations, enabling the business to grow and contribute to national GDP. In addition, the facility fosters an innovative culture in industries by providing loans for projects that may not be bankable in the ordinary course.

#udyog aadhar free registration#msme free registration#msme registration free#print udyam certificate#free udyog aadhar registration#udyog aadhar update

0 notes

Text

Section 8 Microfinance Company Registration - Fees, Process, Documents

Section 8 Microfinance Company or Micro-finance Institution (MFI) is a financial organisation that provides credit to people and organisations who are denied access to traditional financial institutions due to poverty, occupation, ethnicity, religion, or nationality.

A Microfinance Company is registered with the Registrar of Companies as per Section 8 of the Indian Companies Act, 2013. Thus, it comes under the Ministry of Corporate Affairs (MCA).

Microfinance companies are the most convenient business to register that can provide unsecured loans without RBI approval at rates upto 26% p.a.

Benefits of Section 8 Microfinance Company:

No RBI Approval required

Can lend Unsecured loan

No Demographic Barrier

Best Rate of Interest

Minimum capital not required

Defaulters can be sued for non-payment

Limited Compliances

Documents required for Section 8 Microfinance Company:

PAN & Aadhar Card of both the directors

Bank Statement with the address of both the directors (not older than 2 months)

Passport Size Photo

Email address & Phone number

Utility Bill of the premises

To know more (click here)

#business#startup#india#business growth#manage business#partnership firm registration#nidhi company registration#private limited company registration in bangalore#private limited company registration in chennai#private limited company registration online#section 8 microfinance company registratioin#microfinance#section 8 registration

0 notes

Text

What are payroll reports? How is it useful for business decisions?

There is more to payroll than just doling out paychecks for minimum wage. If an organisation needs to double-check its finances or prove their tax obligations, they can use a payroll report as a resource. This information is crucial for making long-term and short-term company plans based on historical trends. These documents are outputted throughout the payroll process and deal mostly with human resources as the name suggests. Pay, hours worked, overtime pay, taxes withheld, and employer contributions to taxes are all included. These reports aid a payroll service provider in all elements of payroll reporting and are useful during audits and tax form preparation.

Your payroll department should maintain a payroll register that records each employee's gross pay, deductions, and tax withholdings for each pay period. You'll need all of this information to put together the payroll registration report. If you do your payroll by hand, you'll want to put all of that information into a spreadsheet so it's all in one place and easy to see. This is a common report that may be generated with minimal effort from payroll software. Choose Streamfix as your payroll outsourcing partner. We provide payroll services in nagpur

Here are some examples of payroll reports

1. Time tracking reports

Time tracking reports are useful for gaining insight into company operations if employees are required to fill out timesheets. All hours working for a client can be limited by the criteria you choose. The results of your team's efforts can now be more precisely reflected in the invoices you send to clients. You can also assess your employees' productivity by looking at micro-level time tracking reports.

2. Paid time off report

Typically, an employee is only allowed so many vacation days or hours per year. Using payroll software to keep track of PTO allows you to see how much time each employee has left and if anyone has requested vacation on the same dates as others.

3. Payroll detail/preview

Payroll previews and details show how much was paid to each person, team, or division in a company. You can also use this report to look for an error in a specific transaction or on a pay stub.

4. Report of Benefits and Deductions

You can see exactly how much was taken out of each worker's paycheck in the form of deductions and benefits thanks to a benefits and deductions report. Information such as the employee's name, the amount the firm paid for the benefits, the amount the employee paid for the benefits, and any other deductions that weren't tax-related are included.

If you need to create this report manually, you can add it to your list of payroll tasks. You may easily keep tabs on your entire employment expenditure by duplicating the data you enter for payroll in a spreadsheet. This report should come standard in your payroll software, allowing you to manage your business in the way that works best for you.

Why do businesses need payroll reports:-

1. Keeping an eye on the employee turnover rate

Accurate tracking of employee turnover can be achieved through analysis of payroll records. Streamfix HR Consultant in Nagpur manages your entire payroll process, ensuring accurate and on time payment of employees while maintaining compliance with all local and national regulations. A high turnover rate, for instance, may be an indicator of disinterest on the part of workers in that division. On the other hand, low turnover could reflect a lack of training or motivation among your staff. By spotting these tendencies, you can take preventative measures.

2. Managing taxes properly

It is the duty of every business owner to not only pay their own taxes, but also withhold payroll taxes from their employees and to supply them with appropriate tax information. By computerising the payroll process, you can consolidate your tax records for easy access and updates. Furthermore, you will have all of your paperwork structured to reduce the amount of time it takes to settle up with the IRS in the event of an audit or a tax deadline.

3. Payroll information is useful for calculating the expenses of labour and materials.

With an ageing staff, you may need to anticipate or manage overtime expenses and get an understanding of resource allocation to maximise business production. This and much more can be comprehended with the aid of payroll data.

Using this information, you may better prepare for the current and future needs of your staff. When it comes to managing finances, transparency is key; payroll data can help with this. Distribution and generation of cash flow are both crucial, but it's hard to manage what you can't quantify.

Streamfix takes care all of your payroll processing activities. Being your strategic partner, our dedicated payroll support professionals will provide the highest quality service with the best personalized solution. We also offered service for payroll management in nagpur, outsourcing manpower services and labour contractor services.

0 notes

Text

Important things to know about Start up business loan

What is start up business loan -

A start-up loan, as the name implies, is appropriate for entrepreneurs or micro-businesses looking to launch a new business venture. lenders or banks consider the borrower's personal credit profile in addition to the company's when determining the individual's eligibility for a business loan. Lenders consider current turnover figures and other financials when determining loan amount, tenure, and applicable interest rate so excellent credit histories is an important factor.

The candidate must launch their firm before requesting for a loan. At the time of the application, documentation of the business's existence and registration must be provided.

How much startup business loan you can get - In some cases, your small business might need just a little bit of money to reach that next goal. Microloans are a type of small business loan with amounts of $50,000 or less also known as microloans. These loans can be used for working capital, expansion, or startup costs, and the qualification requirements generally aren’t too stringent.

Who provides startup business loans - These startup loans mostly you get through non profit banks. Mainstream banks like Barclays, NatWest, Santander, Co-operative, HSBC, and more. Government & Other Grants offer small business loans, as well as private loan companies specializing in business finance. EFT capital is the australian financial service provider providing both secured and unsecured business loans online with same day funding and lower interest rate very easily.

Who can take startup business loans - Everyone can apply for this loan but it is best suited for female business owners. Or microbusiness owners or entrepreneurs. These small business owners can take this loan. The range of options is quite wide, so it's important to compare interest rates, repayment terms, and any other fine print before you commit.

#EFT capital#business loan#personal loan#startup business loan#startup loan#microbusiness#loan for small business

1 note

·

View note

Link

#Micro finance company#microfinance company#Microfinance company registration#Micro finance company registration'#how to start micro finance company#microfinance company registration consultant

0 notes

Link

0 notes

Text

THE INDIAN MANUFACTURING LANDSCAPE - Foreign Company Registration

Foreign Company Registration in India

Over the years, India has been relying on its service sector prowess which is the major contributor to the Indian GDP.

But slowly and steadily, India has realised the fact that it has missed the bus to China when it comes to manufacturing landscape.

Accordingly, the recent Modi government has taken quite a few initiatives to develop a manufacturing eco-system in India which has attracted lots of foreign investment in India as well as led to more and more foreign company registration in India.

Some initiatives taken during the recent years like Make in India, Production linked Incentive Schemes, Ease of doing business schemes has restore the faith and confidence of foreign companies and provided them business opportunities to earn huge profits by setting up business in India.

The government has been extending support to the manufacturers through training programmes in order to ensure availability of skilled workforce, providing subsidies and incentives for technological upgradation along with special scheme focused on micro, small and medium enterprises (MSMEs) for ensuring overall development.

Further tax and legal reforms has been done for development of manufacturing sector and ease of business in India which also lead to India becoming preferred destination for foreign company registration.

Some Facts relating to Indian manufacturing sector

Here are some facts:

· IN the first half of FY21 India received US$30 billion worth of funds through foreign direct investment.

· In September 2021, the government of India approved PLI Scheme worth RS26058 crore for auto industry.

· By the end of 2022 the government of India aims at creating 100 million job in this sector

· The appliances and consumer electronics (ACE) market is expected to grow US$21.18 billion by 2025

· As per NITI Ayog electric vehicle financing industry is projected to US$50 billion by 2030.

India’s major industrial landscape

India already has a number of centre scattered across the country that contributes significant to manufacturing sector of economy. It should be highlighted that several substantial steps and improvements in the infrastructure domains, including as power, water, highways, and airports are required to expand the capacity and power of these landscapes.

Despite this it continues to attract a large number of foreign direct investment and will do in future. Here are brief description of factories:

· Aurangabad, Maharashtra: located to east of Mumbai. It is known as health care manufacturing centre. Many brewing and pharmaceutical companies have set up shop in India.

· Creator Noida, Uttar Pradesh: this city is best known for auto mobile centre. It has steady supply of resources, making it a big draw for multinational corporations like Samsung, LG, and Yamaha etc.

· Haspate, Bangalore: located in central region of south India, haspate is only a five hour drive north to Bangalore. It regarded as iron and steel manufactured centre. This location draws significant investment and will continue to increase manufacturing strength.

· Manesar, Haryana: it is well connected with train and highways make it an ideal location for vehicle manufacturing.

· Nasik, Maharashtra: located to north east state of Mumbai. Nasik is popular tourist destination/.

Thus, various initiatives taken by the government of India has started giving its fruits and more and more Indian and foreign companies have shown interests in setting up manufacturing plants in India.

This trend will continue to be increasing in coming years and India will attract lot of foreign direct investments and will also witness more and more foreign company registration in India.

In case you have any queries or require any clarification, please contact @ +919899217778 or visit our website www.ezybizindia.in

0 notes

Text

Best Forex Broker

Exactly how should you contrast forex brokers, and also discover the very best one for you? In our forex brokers reviews list, our experts have taken into account a wide variety of ranking variables, coming from spreads and also fees, to trading platforms, laying out and also study alternatives-- every thing that makes a broker beat, and also influences your results as an investor.

The "absolute best" foreign exchange broker will definitely frequently refer individual option for the forex investor. It might boil down to both you need to trade, the system, forex trading utilizing spot markets or even every aspect or basic simplicity of use demands.

Just how To Find The Best Forex Broker

The major requirements for locating the most effective Forex Brokers are actually these-- our experts will definitely increase on each region later on in the short article:

Investing Conditions/Fees-- This is one of the most vital part of your global Forex broker appraisal. There is no other way around that. One forex broker may demand you 10 opportunities less for the very same field than another. Take note of "concealed" expenses, including drawbacks expenses, or sluggishness charges.

Market Coverage-- You need to have to become able to trade the fx pair or item of your option/preference.

Availability and also Affordability-- Beginner forex investors and small-timers need passion very. You must never be actually forced into bring in a minimum deposit that you may not afford to drop. Minimum required deposits range coming from $10 to $1000 (or even the ₤/ EUR equivalent). It might be worth committing a lot more for a system that meets you a lot better, so stay open minded.

Investing Platforms-- The forex investing platform as well as the resources it features are your primary weapons in your private war for profits. Decide on the one that suits you ideal. Keep in mind many systems are configurable, so they can be tailored to match you. Personal preference is going to participate in a huge part right here, as many exchanging platforms provide very comparable services, however look really various. Is a mobile system your top priority, or even a desktop internet trading system?

Mobile Trading Apps-- Being able to trade on the go may be very important. Some mobile phone apps transcend to others. Preferably the mobile platform is going to work equally the web based model.

Withdrawals as well as deposits-- You have to move funds to and from the broker, rapidly and also preferably at low costs. The Deposit/Withdrawal strategies assisted by the forex broker find out whether you can easily accomplish that. Financing an account may likewise demand a details remittance procedure.

Credibility-- People speak. It is actually effectively worth paying attention to what traders mention concerning a forex broker they have currently made an effort.

Policy-- When push comes to push, lawful recourse is your 1st, final as well as only intend to clear up the complications you may have with your forex broker. An effective governing platform is precautionary in nature. It intends to maintain such complications coming from turning up in the first place.

Consumer Support-- You require a person to talk to when you bump into concerns with your deposits, real trading, or even-- God forbid-- withdrawals. Capable help is a must. Coming from opening a profile, to aid with the platform, consumer support can be essential.

Business Background as well as History-- Knowing recent ventures of your forex broker can offer you a better tip of what it depends on right now. A specified company has to publish various elements of information regarding their annual report for example. You yearn for assurance that your exchanging funds are actually set apart, as well as stored safely and securely and firmly.

Education-- It never injures to enhance your understanding of exactly how the foreign exchange markets job as well as exactly how you can easily take advantage of the opportunities they show. Some brokers give substantial academic devices.

Profile Opening/ Registration-- Is it a basic procedure to open an account? Do customers need to be validated? If opening a trading account has been problematic in the past times, these methods are certainly not regularly the very same and might be worth looking at.

Broker Costs

The companies that forex brokers deliver are actually not cost-free. You pay for all of them with spreadings, commissions and also roll-over costs. Reduced exchanging charges are actually a massive draw.

The expense structures vary coming from one forex broker to another, and also from one account kind to one more. There are pair of widely utilized general arrangements.

The broker demands a spreading merely. All other charges-- except the carry over cost-- are featured in the escalate.

The array, a commission is asked for. This percentage is based upon the volume you trade.

youtube

Spreadings

Of these pair of forex broker cost agreements, the 2nd one is actually probably the much more straightforward. That mentioned, the commission/spread mix may certainly not be actually the much cheaper selection in every circumstances.

The spread may be resolved or variable. Taken care of spreadings are actually constantly consistent. ECN broker might also provide no spreads. Variable spreads transform, depending on the traded asset, volatility as well as available assets. An unit of forex market and spreading go hand in hand.

Daily escalates might merely contrast slightly among brokers, yet energetic investors (or perhaps hyper energetic investors) are actually trading so frequently that small differences can easily mount up and require to become determined to match up trading prices. The most affordable spreads suit constant investors.

Some brokers pay attention to taken care of spreadings. There are actually without a doubt 1 pip repaired spread forex brokers on the market too.

Forex brokers with reduced spreadings are surely popular. Do take commission and rollover/swap in to profile as well with such brokers.

What Is The Rollover Rate?

forex positions always kept open through the night accumulate an added cost. This charge results from the expansion of the employment opportunity at the end of the time, without working out. The roll-over fee results from the distinction between the rates of interest of both unit of forex. The very first of both is the base unit of forex, while the 2nd is the quote forex.

Trading Conditions/Fees-- This is the very most important component of your global Forex broker evaluation. One foreign exchange broker may charge you 10 times less for the exact same trade than yet another. The Deposit/Withdrawal techniques supported by the forex broker establish whether or even not you can achieve that. Law-- When push happens to shove, legal alternative is your first, last and only hope to resolve the concerns you may possess along with your foreign exchange broker. Company Background and History-- Knowing the previous deeds of your forex broker may provide you a better concept of what it is up to right now.

forex Pairs Traded

While most foreign exchange brokers use impressive-looking options of forex sets, certainly not each one of them cover smalls as well as exotics. Performs the broker offer the markets or even forex sets you wish to trade? All brokers will certainly accommodate for you if you are trading primary pairs (see listed below). If you want to trade Thai Bahts or Swedish Krone as the bottom forex you will definitely need to have to check the asset checklists and also tradable forex.

Majors

usd/gbp

usd/eur

usd/jpy

eur/jpy

eur/gbp

youtube

The Aussie dollar ans Swiss Franc, while considered 'slight' sets, are actually frequently stocked higher amount. You may learn more regarding those listed here: aud/usd or usd/chf

That pointed out, there are brokers around that will really walk out of their means to satisfy their investors' needs. Some will certainly even incorporate global exotics and forex markets on request. Such adaptability is obviously a primary resource, efficiently influencing the total quality of the service.

Cryptoforex sets are actually pretty ubiquitous nowadays. Crypto/fiat and crypto/crypto pairings are each preferred. The substantial volatility related to these products produces heading a worthwhile technique for successful exchanging.

Some investors remain in the foreign exchange game especially to trade the crypto dryness. Such drivers undoubtedly need to have a foreign exchange broker that includes as several crypto sets as feasible.

Micro Accounts

Not everybody trades foreign exchange on a gigantic scale. Many forex investors are actually small-timers. Such forex customers cherish foreign exchange brokers' small profiles, some of which possess the United States Dollar as their servile forex.

Some foreign exchange micro accounts do not even have actually a set minimum down payment criteria. Such affordable investing options absolutely make good sense for those wanting to plunge deeper right into real money trading, without jeopardizing their nest egg.

Keep in mind nonetheless that the spreads/commissions on such small profiles usually tend to be pretty unpleasant. It is actually having said that, a much cheaper intro to a complicated market (identical to cfd accounts)-- and trading for real beats a trial make up authentic adventure learning just how to trade.

Investing Platforms

Foreign exchange trading platforms are actually basically customisable investing atmospheres for on the web investing. They supply traders with specialized review resources, reside headlines feeds, diverse order styles, automation, advanced laying out as well as forming options etc. Some may feature view red flags or event calendars.

MetaTrader 4 or 5

Integration along with well-known software like Metatrader 4 or 5 (MT4 or MT5) could be essential for some traders. Several brand names offer automated investing or even combination right into associated software, but if you are visiting rely on it, you need to ensure.

Investing View

TradingView is actually additionally a preferred option. Some foreign exchange brokers permit their traders to trade directly on the globe's best social trading system.

Proprietary options are typically fascinating, though in some cases lower than ideal. For traders that base their strategies on the use of EAs and VPS, a proprietary platform that performs not reinforce such components, is useless.

While our company are actually going over tactics: not all forex brokers sustain methods like hedging, scalping as well as EAs.

Ensure you comprehend any plus all constraints in this regard, before you join.

See if your broker is actually a foreign exchange broker for scalping if you prefer scalping.

For those who want to trade on the move, a mobile phone exchanging application is actually undoubtedly important. While all forex brokers include such apps in today times, some mobile phone platforms are actually very simple. They lack all the state-of-the-art evaluation and marketing research attributes, and also because of this, are barely practical.

Tools & Features

Coming from laying out to futures pricing or bespoke trading robots, brokers give a series of resources to improve the investing knowledge. Once again, the schedule of these as a determining element on opening account will definitely be down to the individual. Level 2 information is one such tool, where desire could be provided to a company providing it.

Deposits as well as Withdrawals

There are actually some massive differences between the prices linked with deposits as well as drawbacks coming from one broker to yet another. Such variations mostly come from the inner treatments noticed through various brokers.

At one given broker, it may take as high as 5 opportunities longer to finance a profile than at another. The acquired expenses vary quite a bit too.

Typically, the payment process greatly hinges on the approved amount of money transactions procedures.

It would make sense for brokers to adopt as many such approaches as possible, yet some still drop effectively except the smudge.

Education

Some investors may depend on their broker to help discover to trade. From manuals, to webinars and training class, informative resources differ coming from company to label. A broker having said that, is certainly not consistently the best resource for neutral investing guidance. Look at inspecting various other sources as well-- such as our Trading Education webpage!

Repayment Methods

The most common methods are bank cable, VISA as well as MasterCard. The a large number brokers tend to allow Skrill as well as Neteller too.

Foreign exchange brokers along with Paypal are actually much rarer. The very same selects foreign exchange brokers accepting bitcoin. Our team are not speaking about bitcoin trading, however true down payments created in the top cryptoforex.

Correct forex brokers regularly provide a local-specific repayment service to their target countries.

Consumer Feedback

Based upon real customer feedback, forex broker online reputation may better be amassed from a variety of area review sites as well as discussion forums.

You have to take this form of reviews along with a restriction, to claim the minimum.

Of all: unhappy investors are actually constantly a lot more encouraged to publish reviews. They are actually not most likely to become unprejudiced.

: not all of this reviews is actually factually correct. There is actually no way to in fact fact-check/verify this records. Even sites like TrustPilot are blighted along with fake blog posts or even rip-off information. There is no quality control or proof of messages.

That mentioned, it is actually still applicable. Chances are it might have issues if there is actually a forex broker regarding which no one has actually ever before claimed anything really good. To the qualified eye, legitimate investor testimonials are reasonably effortless to area.

The utter absence of area comments is actually red flag. Folks consistently have something to mention concerning their forex broker or exchanging profile. One thing is actually definitely amiss if there is actually no info readily available in this regard.

While most forex brokers use impressive-looking options of unit of forex sets, certainly not all of all of them cover exotics and also minors. Such foreign exchange customers appreciate foreign exchange brokers' micro accounts, some of which possess the US Dollar as their servile forex.

While all forex brokers feature such applications these days, some mobile systems are actually extremely simplistic. If there is actually a forex broker about which no one has ever claimed just about anything really good, opportunities are it may have issues. Individuals constantly possess something to point out about their forex broker or even investing profile

1 note

·

View note

Text

Trademark Registration in Delhi

Now one can easily Register a Trademark in Delhi. There are so many consultancy firms which offer legal advisory services and try to give their best to help the clients in the best possible way they can. GSB InfoTech Business Solutions(LLP) is one of them. They are a large team of experts and offer their services in all over India. They offer more than 100 services and the best part is their customer support team. They are always on their toe to assist an entrepreneur or an established business owner in India.

Our only motto is to assist all enthusiastic, passionate persons who are looking for establishing or have already established their business and facing any kind of legal issues, we have one-stop solutions for your all queries.

The Services we offer:

Company Registration (Pvt Ltd Company, One Person Company, Limited Liability Partnership, Indian Subsidiary, Section-8 Company, etc)

NBFC Registration, Nidhi Company Registration, Micro Finance Company, Credit Co-operative Society.

Digital Signature Certificate, MSME Registration, NSIC Registration, Agmark Registration, ISI Registration, ISO Registration, 12a & 80g Registration, and many more services at one-stop.

1 note

·

View note

Link

Dear Sir/Madam,

I have found your web contact email. I would like to discuss a business opportunity with you.

My name is Md. Imran Ahmed from United IT Solution Ltd.

We are a Web Design and Software Development firm based in Bangladesh, with more than 9 years of experience. We have served a lot of domestic and international clients with our proven and smart IT solutions and services.

HOT Offer: Offering Free HR & Payroll Software for any Industry , Garments and Corporate.(Conditions apply)

We offer following Services that are efficient and cost effective: -

Website Development

Software Development

Value Added Services

Business Website

Accounting Software

Domain Registration

Corporate Website

HR & Payroll Software

Web Hosting

E-Commerce Website

Purchase, Inventory & Sales Software

Web Server

Wordpress based Website

Point-of-Sales (POS) Software

Email Marketing

Joomla based Website

CRM Software

SMS Marketing

Custom CMS based Website

Production ERP

Search Engine Optimization (SEO)

Celebrity Website

School/College/University Software

Search Engine Marketing (SEM)

Community Website

Garments/Textile Software

Pay-per-Click (PPC) Advertisement

Job Site

Co-operative Society Management Software

Social Media e.g. Facebook, Twitter Marketing

Information Directory

LC Management Software

Web Content Writing Support

Business Directory

Micro Finance ERP

System Automation & Integration

News Portal

Restaurant ERP

Network Solutions

Company Blog

Order Management Software

Graphic Designs

Company Forum

Attendance Management Software

Call Center Support

Customized Web Portal

Mobile e.g. Android, iOS, Java Application

IT Infrastructure Setup

Fully Customized Website

Customized Application Software

IT Asset Management

Website Upgrade

Integrated Business Solution

IT Consulting Services

I will highly appreciate if you have any requirement for the same or any other requirement on the above mentioned services provided by us.

Looking forward to hearing from you soon.

Kinds Regards,

Md. Imran Ahmed

Executive, Online Marketing

United IT Solution Ltd.

House 1287, Road 11, Ave 02, Mirpur DOHS

Dhaka 1216, Bangladesh

Contact No: 01994807555, 01994807111

Email: [email protected], [email protected]

Website: www.uniteditbd.com

1 note

·

View note