Text

To Help the Economy, Wear a Mask

“You can lead a horse to water but you can’t make him drink,” says an old saying.

That’s right but, as I learned growing up in Texas, it doesn’t go far enough. Horses recognize hazards their riders miss. Maybe there’s a reason not to drink that water.

I say that because, with all 50 states starting to reopen, the US economy is waking up. Politicians say it’s our patriotic duty to get out and spend money.

In other words, they’re leading horses to water the horses may not want to drink.

Simply letting businesses open doesn’t necessarily bring customers back, particularly when they sense danger.

Thirsty horses won’t drink water they think is poisoned. You have to show them it’s clean.

Photo: Pxfuel

Reopening Isn’t Enough

Some think states are reopening the economy too fast, others think too slow. Both are wrong.

Government can’t reopen the economy because the government didn’t close it. Consumers and businesses began closing down long before they were ordered to. Political “leaders” simply claimed credit for what was already happening anyway.

Studies are now beginning to quantify this. State-level data shows most of the US consumer spending decline happened 10–20 days ahead of official orders. It also shows little recovery so far, though reopening has only just begun in most states.

A European study shows similar patterns. Using bank payment card data, researchers compared spending in Sweden—widely noted for imposing only mild restrictions—and neighboring Denmark, which took more extensive measures.

Compared to the same period in 2019, consumer spending in closed-down Denmark fell 29%, vs. a 25% decline in relatively open Sweden.

That suggests the government orders had some effect on spending (reducing it an additional four percentage points in Denmark) but the drop was mostly consumer choice.

If so, the spending won’t come back simply because people can go out shopping again.

Missing Message

Americans celebrated Memorial Day weekend as best they could. Many stayed home. Others went to the usual lakes and beaches. News stories showed packed boardwalks and parks, with few wearing the masks the governor had recommended (but not required).

Photo: Pxhere

When a virus spreads easily long before you show any symptoms, masks should be common courtesy. Many in the US see it as an attack on their freedom. “I should be able to risk my life if I want to,” the thinking goes.

Fair enough, but that’s not how a pandemic works. It’s impossible to risk only your own life. Exposing yourself to a contagious virus necessarily forces your choice on others.

In game theory this is called a “collective action problem.” An act that would help everyone, if widely followed, also has individual costs, so some people don’t do it. Then no one gets the benefit.

But masks do more than just protect against the virus. If widely worn, they send a message: “It’s safe to come out now.”

The economy will not recover until almost everyone gets that message.

How to Stimulate

Let’s consider some ballpark numbers.

Suppose, once we get all the data, the shutdowns turn out to have reduced US consumer spending by 30%.

Further suppose two-thirds of that spending comes back once full reopening is allowed.

So now consumer spending is off only 10% from the prior baseline. That’s still an economic catastrophe. It spells deep recession, high unemployment, and many business failures.

Much of the missing consumption belongs to people who, concerned about the virus, aren’t re-engaging with the economy. Why are they concerned?

Well, one reason is they keep seeing unmasked people everywhere.

Whether the virus is really dangerous or not, most Americans believe it is dangerous. This affects their economic activity. That belief has to change or “reopening the economy” won’t work.

President Trump and some governors are treating this as a political problem, similar to getting votes.

The problem: 51% doesn’t win this kind of contest. They need 95% or more, which isn’t likely, given how many Americans distrusted them even before the pandemic.

So when people go out in public without masks, or are otherwise careless, they aren’t stimulating the economy. They are depressing it even more by convincing other people to stay home.

What would change minds (and behavior)? At this point, we have no good options. The US waited too long to employ the measures that succeeded elsewhere.

But it would help if more people would simply wear masks in public, even if not legally required. It may be the best thing any of us can do for the economy.

The Great Reset: The Collapse of the Biggest Bubble in History

New York Times best-seller and renowned financial expert John Mauldin predicts an unprecedented financial crisis that could trigger in the next five years. Most investors seem completely unaware of the relentless pressure that’s building right now. Learn more here.

1 note

·

View note

Text

The Giant Presumption behind Re-Opening America

Newly “liberated” Americans are flocking to beaches, parks, and restaurants, eager to prove the novel coronavirus doesn’t scare them.

In fact, the virus doesn’t care how brave they are. It just wants to spread. I suspect it found many new hosts at those gatherings, and this will be apparent soon.

At the same time, many others are still staying home whenever possible, not yet convinced it is safe to go out.

But regardless of who’s right, Wall Street people are thrilled. The stock market shot higher in April. Many experts think the economy will soon be back to normal.

What any of us think matters less than what the virus does. This “normal” everyone wants to see is an economy unmolested by this virus.

Will it just go away? Let’s see what experts think.

Photo: NIH

Three Scenarios

The economic outlook is cloudy right now because it isn’t entirely economic. It’s also medical and sociological. The economy’s course depends on how this virus behaves, and how people behave in response.

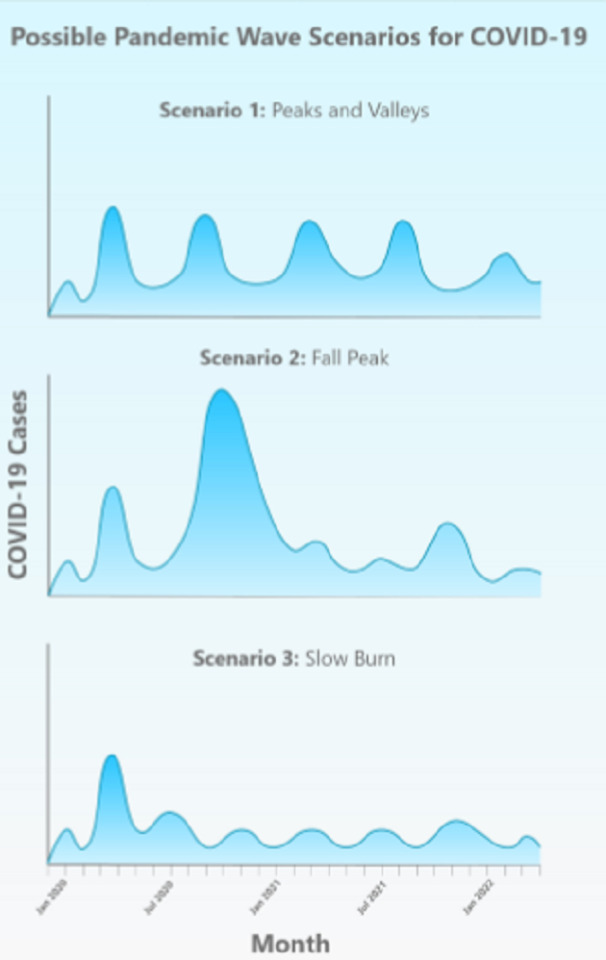

A report last week from the University of Minnesota’s Center for Infectious Disease Research and Policy (CIDRAP) outlined three scenarios this pandemic could follow.

Scenario 1, which they call “Peaks and Valleys,” says this first wave will recede, but will be followed by similar waves every few months for the next year or two. Their severity will vary somewhat, but they will keep happening.

Economically, this is the middle-ground outlook. We’ll still have a recession, and the recurring outbreaks would delay recovery. After a lot of pain, people and businesses would adapt.

Scenario 2, the “Fall Peak,” says that what we just saw in March and April was the prelude to a larger wave this fall or winter. That’s what happened in the 1918 flu epidemic. Smaller third and fourth waves would probably follow in 2021.

That scenario could be an economic knock-out blow. Faced with a national breakdown of the healthcare system, authorities would likely impose far more severe and lengthy lockdowns than the US has seen so far. Businesses that were just getting back on their feet would close permanently. The government, having already spent trillions, might not be able to offer more stimulus.

Scenario 3, the “Slow Burn,” would see the virus keep spreading, but slowly enough for the healthcare system to handle. Further lockdowns would be unnecessary.

This is the economic best-case. It would mean the worst is behind us and the recovery will proceed. This is what many investors seem to be betting on.

Chart: University of Minnesota/CIDRAP

The CIDRAP team believes that in any of these scenarios, we should be prepared for at least another 18–24 months of significant COVID-19 activity. That’s how long it will take to either develop and deploy an effective vaccine, or for the population to develop “herd immunity.”

Wishful Thinking

With even the best-case scenarios looking dark, why are so many investors and businesspeople so sure the worst is over?

I think some of it is denial or “wishful thinking.” They don’t want it to be true and so convince themselves it is not. They expect to find a four-leaf clover that solves everything.

But I think the main problem is they don’t understand how hard this has hit the service part of the economy, and how difficult recovery will be.

Today’s investors love businesses that “scale.” A website like Facebook, for instance, can double its revenue without doubling expenses.

Not so for restaurants. One chef can’t make an infinite number of meals. And now, with different rules and customer expectations, they have to reengineer everything. It will take time and money. Meanwhile, unemployment will remain high and consumer spending will suffer.

And don’t forget, large events and conventions are probably off the table for months. The impact on the hotel, air travel, and entertainment industries alone would trigger a harsh recession.

But that’s not the scariest part.

Photo: Pixabay

Feeling Lucky?

If governors keep relaxing the restrictions this month, most of the US will have spent six to eight weeks offline or in some kind of lockdown situation.

That seems like a long time. But Wuhan, China, where the outbreak originated, had to stay in a far more restrictive lockdown for 10 weeks. Ditto for hard-hit parts of Italy and Spain.

In the US, new cases seem to have stabilized to around 30,000 daily. The number is not shrinking nationally. It’s not shrinking in places like Georgia and Texas that are beginning to re-open. As more people resume contact in public spaces, even more infections seem likely.

It is true that lockdowns can’t go on indefinitely. People have limits. The isolation causes other problems and even deaths. But, as I explained last week, the economy isn’t going to bounce right back. This urgency to re-open businesses before customers are ready is odd.

Our leaders seem to presume the virus will behave differently in the US than it did elsewhere, and we don’t need to do what other countries did.

If that presumption proves false, then the “Fall Peak” scenario is a real possibility.

In March and April, millions of Americans lost their jobs and 63,856 lost their lives. It’s been awful. And it may have been a dress rehearsal for worse in November/December.

The Great Reset: The Collapse of the Biggest Bubble in History

New York Times best-seller and renowned financial expert John Mauldin predicts an unprecedented financial crisis that could trigger in the next five years. Most investors seem completely unaware of the relentless pressure that’s building right now. Learn more here.

0 notes

Text

No, the Economy Isn’t Re-Opening Soon

“America will be open for business very soon,” said President Trump on March 23, just a week after local authorities began issuing stay-at-home orders.

At that point, the novel coronavirus had killed a total of 689 Americans. Now, a little over a month later, 689 deaths would be a really good day. And America still isn’t open for business. But the president and some governors think it should be and are trying to make it so.

Unfortunately, politicians can’t order the economy open again because they didn’t close it. Consumers and businesses began shutting down long before they were forced to, and they won’t re-open just because they legally can.

This is way more complicated than many people think… which means it will take time.

Probably a long time.

Photo: Pixabay

Reacting Swiftly

The news cycle is moving so fast it’s hard to remember what happened last week, much less last month. So let’s review.

In early March, companies and local officials had already cancelled many conventions and other large events. Then several important things happened on Wednesday, March 11.

Actor Tom Hanks and his wife Rita Wilson announced they had tested positive for the virus.

The National Basketball Association suspended its season.

President Trump, in an Oval Office address to the nation, said risk to most Americans was “very, very low” but also banned travel into the US from much of Europe.

The president’s address, combined with the popular, well-known Hanks becoming ill, and the NBA’s drastic action, suddenly made the coronavirus threat seem “real” to millions.

They reacted swiftly.

Disney closed its theme parks on March 12.

Colleges told students not to come back from spring break.

Churches cancelled services.

Restaurants, theaters, and casinos began shutting down.

All this happened before the first mandatory stay-at-home orders, which were in California’s Bay Area on March 16.

The idea that “Big Brother” government closed everything is incorrect. The orders simply codified what was already happening.

Photo: Pxhere

Viral Aversion

The hardest-hit businesses are those that put people in close proximity to unknown others: airlines, restaurants, hotels, retailers, hair and nail salons, etc.

Your odds of encountering an infected person are much higher in those places. Avoiding them is perfectly rational if you want to avoid the virus. That’s why many businesses closed before being ordered.

What will bring customers back?

Well, they need to be convinced that visiting those businesses won’t make them sick. Or, to use economic terms, people must perceive a favorable cost-benefit ratio. The reward has to outweigh the potential harm.

Survey data says most Americans don’t think we are there yet. Here’s a CBS News nationwide poll conducted April 20-22.

Photo: CBS News

A large majority seem uninterested in venturing out to nonessential places. That probably won’t change until they feel safe.

Now, there are things businesses can do to reassure customers—extra cleaning, temperature checks, and so on. They help, but they also have a cost. Often, it won’t outweigh the additional revenue it generates.

So financially, the smartest things many businesses can do is stay closed until they are confident customers will come back and spend freely.

Giant Quandary

Restaurants and retailers can’t re-open without workers who must be paid. Presently, many of those workers are furloughed and receiving (or hoping to receive soon) unemployment benefits.

Those benefits are now extra-generous, thanks to Congress and President Trump. In some states, they are equivalent to a full-time job at $25/hour. That’s more than many laid-off workers were making before (and more than some “essential workers” are making now).

How, then, is the employer supposed to lure them back? “Come back to work, Joe. You’ll make less money, have to wear a mask all day and might still get the virus and die.” Not very compelling.

Business owners have to think about liability and reputation, too. What if people get the virus in your restaurant? That’s another unknown and only partially controllable cost.

It’s a giant chicken-and-egg quandary. Customers can’t go to a business that’s closed, but the businesses have no reason to open unless they think customers will come, and maybe not even then.

See the problem?

Government isn’t keeping the economy closed. The people who compose the economy are keeping it closed, by their own free choices.

No matter what governors say, no matter what the president says, business as usual is not coming back as long as this coronavirus is still a significant health risk. And it will be until we get effective treatments, a proven vaccine, or herd immunity.

All those are months away, at best. That means economic recovery is also months away, at best, and probably longer.

It could get even worse.

Some states are relaxing the lockdowns. I think most businesses will stay closed, but some will re-open. Some customers will visit them, too.

Two or three weeks later, we may see hospitalizations and deaths jump higher. Then the lockdowns will come back and people will be even more frightened than they are now. The deep recession that was already coming will be even worse.

We’ll know soon if the risk was worth it.

The Great Reset: The Collapse of the Biggest Bubble in History

New York Times best-seller and renowned financial expert John Mauldin predicts an unprecedented financial crisis that could trigger in the next five years. Most investors seem completely unaware of the relentless pressure that’s building right now. Learn more here.

0 notes

Text

We Don’t Have Markets Anymore

The novel coronavirus is destroying human lives: almost 170,000 worldwide as I write this, including 40,000+ in the United States.

These aren’t just numbers. They were people who were loved. Now they are gone. Next to that, all other effects are secondary.

But some are still serious. For one, government actions and consumer choices are pushing an already-weak economy into deep recession.

I said in a video interview last week (watch here) the world economy we knew three months ago won’t be back, ever. It is gone. After a transition period, we will find something different, whose contours are not yet known.

That makes the debates over the stock market a little strange. It doesn’t matter what markets do when we don’t even have “markets.”

A market is where buyers and sellers meet. But that’s not what happens anymore.

Firehose Fed

Not so long ago, Wall Street was complaining about the Federal Reserve’s tighter monetary policies. Now the Fed is doing the opposite, having opened a firehose in the last few weeks.

In fact, even that metaphor fails. It’s more like Jerome Powell blew up an entire dam.

Photo: pxfuel

In partnership with the Treasury Department, the Fed is gearing up to spend about $4.5 trillion on private assets, via bond purchases and other transactions.

For perspective, in 2019, US companies issued a total of $1.41 trillion in corporate bonds last year. And all outstanding commercial and industrial loans totaled $2.35 trillion as of year-end.

The Fed’s staggering new spending power is on top of its existing programs to buy Treasury and agency securities, which are trillions more.

Executing all these purchases falls on the New York Fed’s trading desk—a task now so huge that the desk is outsourcing some work to BlackRock.

But in any case, the Fed is ultimately in charge. And it sometimes reveals clues about its activity, with press releases saying it plans to buy this or that.

For instance, here’s one from March 26.

The Desk will conduct its first purchase of agency CMBS on Friday March 27, 2020 with a deadline to submit offers to its investment manager at 11:00 am ET.

In this operation, the Desk will purchase up to $1 billion of fixed rate Fannie Mae Delegated Underwriting and Servicing (FNMA DUS) pools, with a 10 year loan term, a yield maintenance protection term of 9.5 years (FNMA DUS 10/9.5), and a weighted average life greater than or equal to 7 years. The Desk, through its investment manager, will solicit offers from primary dealers and will purchase up to $1 billion in total, subject to reasonable market prices.

Notice a couple of things here.

First, the desk is highly specific about what it wants to buy—I suspect because it knows some liquidity-starved institution owns those particular securities. The press release is a hint: “Hey guys, let us help you.”

Second, what does that “subject to reasonable prices” part mean? Is the Fed bargain hunting? Unlikely. Right now, the goal is to inject money, not save it.

There is no “reasonable market price” in this situation because there is no market. The Fed simply uses its unlimited balance sheet to dictate the desired price for these bonds no one else wants to buy.

A market price would be what actual investors are willing to accept, given real-world conditions. That’s not how it works when the Fed is involved.

This little story is being repeated thousands of times, in a wide range of debt securities. The Fed hasn’t yet brought stocks into the program, but I think it eventually will. And even now, the liquidity injections have an indirect impact on stock prices. That’s why the Dow rises every time the Fed announces a new program.

Photo: Pixabay

No Consequences

If you are an investor, this activity should alarm you. It means your account statement, and therefore your net worth, is an illusion. The assets you own probably have some value, but you can’t be sure what it is—or would be if the Fed wasn’t sticking its nose into everything.

If you’re not an investor, it should still alarm you. Maybe you’re a firefighter who plans to retire someday with your department’s pension. The pension plan probably owns bonds on your behalf. What are they really worth? No one knows.

Officially, the Fed is doing all this because it needs to keep capital markets and banks functional. But in fact, the Fed is saving overleveraged private companies from the consequences of poor decisions.

The better move would be for these companies to go bankrupt. We have courts that can sort out the liabilities and reach a fair, transparent compromise. There are ways to do this without laying off workers, too. It happens all the time.

But it’s not happening now, perhaps because bankruptcy would reduce these companies’ share prices to their actual market value, which in many cases is zero.

That would hurt investors, but the long-run harm is even greater. Financial markets don’t work when people feel no consequences for bad decisions.

Of course, no one knew the coronavirus was coming. But the business cycle isn’t new. Wise managers prepare for bad times because bad times always come.

So now, we are going to have even more zombie companies standing in the way of progress, and Potemkin markets whose prices are meaningless.

That scheme will reward some people. But probably not you.

The Great Reset: The Collapse of the Biggest Bubble in History

New York Times best-seller and renowned financial expert John Mauldin predicts an unprecedented financial crisis that could trigger in the next five years. Most investors seem completely unaware of the relentless pressure that’s building right now. Learn more here.

0 notes

Text

Why the Coronavirus Could Raise Wages

US unemployment shot higher in the last month, thanks to coronavirus closures. Some 17 million people filed new jobless benefit claims.

But it’s actually even worse.

Overwhelmed web sites and bureaucratic snafus kept many from applying. Others, while still nominally “employed,” saw their wages or hours cut. It’s terrible and will keep getting worse until the shutdowns ease and people believe they can circulate safely again.

But while the immediate outlook is dire, these events could ultimately mean higher wages for many workers. To see why, we have to think a few steps ahead.

Photo: Flickr

Side Effects

Let’s first assess the problem. Survey data already shows widespread pain.

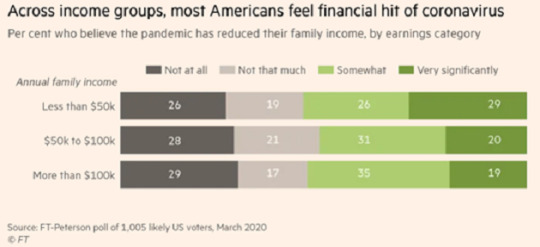

The FT-Peterson US Economic Monitor poll, conducted March 24–29, says a majority lost at least some income due to the coronavirus.

This survey shows a difference between income groups but less than you might expect. Nonetheless, it seems around 20% of respondents are now either unemployed or working for “very significantly” lower pay.

Source: Financial Times

Or are they? The FT/Peterson poll isn’t random. It samples “likely voters.” Responses are weighted to reflect the voting population, which is different from the working population.

But that’s not necessarily good news. It means something like three-quarters of the electorate just took at least a small pay cut. That matters to them, and therefore to politicians… especially since this is an election year.

This sort of thing makes voters unhappy across the board. Republicans and Democrats both want to “do something.”

And, to be fair, they should do something, because otherwise this widespread, simultaneous income loss will devastate the economy. Even many fiscal conservatives agree cushioning the blow is necessary and proper.

But how they do it matters. Crisis-driven policies usually have unintended side effects.

For one: Congress temporarily added a $600/week federal bonus to existing state unemployment benefits until July 31. That’s roughly equivalent to a $15/hour full-time job, and the job is to… stay home and not spread the virus. Which is the right move for now, but it’s also an impromptu “guaranteed national income” experiment.

What if, as seems likely, we get into July and the unemployment rate is still in double digits? Are Congress and the president going to cut benefits for millions of voters? Three months before an election?

That’s hard to imagine… which means the added benefits will last even longer. And the longer they last, the harder they are to take away. Meanwhile, they effectively act as a $15/hour national minimum wage.

And that’s not all. Congress also mandated paid sick leave in certain situations. Many companies voluntarily added similar benefits. Those, too, will be hard to take away. Crisis measures tend to become a “new normal.”

Photo: Needpix

No More Settling

Let’s talk about the people whom the pandemic hasn’t unemployed.

Educated, well-paid “knowledge workers” moved to work-at-home arrangements pretty smoothly. But think about the millions of low-paid workers in “essential” businesses.

Imagine, for instance, you are a grocery store cashier or a hospital janitor. You used to make $12 an hour. Your employer added another $3 to “compensate” you for the present risky conditions.

Now you make $15 an hour. That’s nice… but you could still get the coronavirus and take it home to your family. Not so nice.

Meanwhile, your “non-essential” friends will, once the unemployment system gets in gear, be making as much as you are (and possibly more in some states) just to sit safe at home, watching Netflix and chilling.

Worse, you can’t get that deal unless your employer is kind enough to fire you. Quitting would disqualify you for benefits. You are stuck in a suddenly dangerous job whether you like it or not.

You know society depends on you, so you stick it out. But you’re going to remember, and you probably won’t settle for mediocre wages anymore.

Photo: Pixabay

Tables Turning

Eventually, we will have more effective treatments and vaccines for the new coronavirus. Its economic effects will last longer, but they will pass, too. Then what?

Well, we’ve just seen two important changes.

People who lost their jobs are adjusting their pay expectations higher, thanks to more generous government benefits.

People who kept their jobs are also adjusting their pay expectations higher, because those same government benefits act as a higher minimum wage.

Throughout this recovery, it’s been kind of a mystery why wages didn’t rise more even as unemployment fell to record lows.

One theory: the 2007–2009 recession and housing crisis were so painful, people were glad just to have any job at all, and afraid of losing it. Employers gained the upper hand in pay negotiations.

That may change.

A new study by San Francisco Federal Reserve Bank researchers looked back at pandemics throughout history. It turns out they almost always led to higher wages, years and even decades later.

Unlike war, pandemics don’t destroy buildings and physical capital. They do, however, reduce the labor supply. That makes workers more valuable and lets them demand higher pay.

If that happens this time, it will reverse a decades-long trend in which productivity grew faster than wages—one reason stocks have done so well since the 1980s. Capital won, labor lost.

The tables may be turning.

The Great Reset: The Collapse of the Biggest Bubble in History

New York Times best-seller and renowned financial expert John Mauldin predicts an unprecedented financial crisis that could trigger in the next five years. Most investors seem completely unaware of the relentless pressure that’s building right now. Learn more here.

0 notes

Text

Coronavirus Socialism

When (hopefully soon) we all get out of coronavirus lockdown and try to resume normal life, we will probably find a different “normal.”

The best-case outcome: scientists discover a “magic bullet” treatment that quickly restores the most serious cases to health. We could then ease restrictions and get on with business.

But more likely, any such treatment is months away and a vaccine probably a year away, so many precautions will have to stay in place. We won’t see large gatherings and crowded restaurants anytime soon.

But we’ll see something else: a radically different economic structure.

The US has never been truly “capitalist” but at least it had a free market façade. Thanks to the coronavirus, the façade is now crumbling.

We will come out of this further from capitalism and closer to socialism. We know this because a leading capitalist said so.

Photo: Needpix

Shoved Left

Back in January, about the time Chinese authorities quarantined Wuhan, the world’s billionaires gathered in Davos, Switzerland, as they do each year.

CNBC interviewed JPMorgan Chase (JPM) CEO Jamie Dimon on January 22. Asked about the Democratic presidential candidates, Dimon said he preferred a moderate, not a socialist. He went on:

Capitalism is the greatest thing that ever happened to mankind. I think that people who haven’t read history books about socialism really should… Once you have governments taking control of businesses it ends up in corruption…

If you’re talking about governments controlling corporations that’s socialism. You can do it in a small way or a big way. The small way is to put a commissar on your board remember the old Russian commissars could sit in the room or do it through regulatory or stuff like that the other way is that they actually own the company. Look at all the other countries and they start to take over the oil companies and the steel companies and utility companies.

And the banks. The banks start making loans not to good companies not because they are properly allocating capital to its highest and best use but to keep that factory open. The bridge to nowhere to make sure the mayor doesn’t lose jobs in his town and once you do that you will have an eroding society. (full transcript)

As I wrote at the time (see Socialism Is Coming But Not the Way You Think), Dimon actually loves misallocating capital. His bank routinely makes “bridge to nowhere” loans and does so happily as long as it gets repaid with interest.

So if those activities define socialism, Jamie Dimon is a very confused billionaire. He professes to love capitalism, but his actions say otherwise.

My point back then was that the US-China “Phase 1” trade deal was nudging the US toward some kind of socialism. I didn’t expect the coronavirus would soon shove us that same direction. Yet it is.

Photo: Flickr

Collectivized Production

Two months after Jamie Dimon said socialism doesn’t work because governments can’t properly allocate capital, Congress allocated $2.2 trillion via the Coronavirus Aid, Relief, and Economic Security (CARES) Act.

Note, left-leaning Democrats didn’t do this alone. The bill was as bipartisan as it gets.

The CARES Act does some useful things. It will help workers and small businesses who had to close down to stop the virus from spreading.

But that’s not all. The new law gives the Treasury Department $454 billion to invest in a “special purpose vehicle” jointly with the Federal Reserve. The Fed will then allocate (or perhaps misallocate, to use Dimon’s favorite word) that money in loans to private businesses.

But in fact, it’s way more than $454 billion. Here’s how two economists described the arrangement in a Wall Street Journal article (my emphasis in bold).

The expectation is that the central bank will leverage this money 10 to 1, enabling it to lend up to $4.54 trillion to companies.

That sum is more than all U.S. commercial and industrial loans outstanding at the end of 2019 ($2.35 trillion) plus all the new corporate bonds issued during 2019 ($1.41 trillion).

Thus, if this capital is all deployed by the Fed, and at rates that will surely crowd out private capital, all capital allocation in the U.S. in 2020 will be done by the Federal Reserve System, not by the capital market. This is the largest step toward a centrally planned economy the U.S. has ever taken.

Will the Treasury-Fed partnership wisely allocate this money? We don’t know yet, but the plan is exactly what Jamie Dimon says won’t work. Quoting him again:

…The banks start making loans not to good companies not because they are properly allocating capital to its highest and best use but to keep that factory open. The bridge to nowhere to make sure the mayor doesn’t lose jobs in his town.

Keeping factories open and avoiding job losses is the CARES Act’s entire point, and government, not private lenders, will decide how to do it.

Maybe this centrally-planned financing will find the “highest and best use” Dimon thinks it should, but we don’t know that yet. We do know that private companies will get money from taxpayers, and taxpayers will bear the loss if those companies don’t repay it. The government might get equity in those companies, too.

In other words, we are (for now, at least) collectivizing the means of production. Mao Zedong would be pleased.

Photo: Flickr

Power to Some People

If, like Jamie Dimon, you fear socialist misallocation, Bernie Sanders should be the least of your worries. It’s already happening on a massive scale and President Trump, not Sanders, signed the bill.

We were heading that direction anyway; the coronavirus sped up the process. And where it will lead isn’t clear yet. But it won’t be anything you can plausibly call “capitalism.”

More likely, we will get even more state-enforced corporatism, with socialized losses and privatized profits.

The Great Reset: The Collapse of the Biggest Bubble in History

New York Times best-seller and renowned financial expert John Mauldin predicts an unprecedented financial crisis that could trigger in the next five years. Most investors seem completely unaware of the relentless pressure that’s building right now. Learn more here.

0 notes

Text

An Investment in Life

If you’re following the coronavirus news from home, thank you for helping society through this hard time. Home is where we should all be, except for medical, food, public safety and other such essential workers. Please be careful if you do have to run out for necessities.

None of us have seen anything like this. Even in wartime, there are rear areas and safe zones where people can breathe easily. In this situation, we’re all vulnerable everywhere.

Virus mitigation measures, while necessary, are severely straining the economy. Places like mainland China, Taiwan, South Korea and Singapore show that early, aggressive measures can work. But they come at tremendous cost.

Every human decision is a tradeoff between cost and benefit. Is what you get worth more than what you give?

So, while it may seem cold-blooded, it’s fair to ask whether all this is really worthwhile.

Photo: Picpedia

Value of Life

Governments around the world have to both deal with a health crisis and manage the economic side effects. Some are doing it better than others, at least so far … but this is nowhere near over.

In any case, it’s clear the U.S. government will spend several trillion dollars in direct healthcare costs, business aid and payments to workers.

The federal budget was already over a trillion dollars in deficit. Now, it will probably be several times that amount, especially since tax revenue will probably drop.

That’s the “cost” side. We’ll spend that money to minimize the economic damage of closing businesses and keeping people home for weeks, possibly months.

The “benefit” side is harder to quantify. These measures will, experts think, greatly reduce the number of coronavirus-related deaths. But what is that number?

The real answer is unknowable. Experts assembled last month by the US Centers for Disease Control and Prevention considered various scenarios. They estimated a death toll somewhere between 200,000 and 1.7 million if we did nothing. Some people think that’s too low or too high, but let’s go with it for now.

Humans are the ultimate “natural resource.” Each of us has economic value. Every life lost is both a personal tragedy and a cost to the economy.

What is That Cost, in Dollar Terms?

This is actually a common question. It comes up in wrongful-death lawsuits where a family seeks damages. Lawmakers and regulators also have to consider it when they enact new safety requirements.

They could, for instance, impose a national speed limit to 30 miles per hour, everywhere, and greatly reduce highway deaths. But it would generate other costs, so they don’t do it.

Economists have a concept called “Value of a Statistical Life” (VSL) to help answer these questions. We can use VSL to measure how much coronavirus deaths would cost the economy.

VSL drops with age, and we know those who die from the condition tend to be older. Healthcare website STAT ran the numbers assuming the average death would be age 60. In that case, the VSL per life would be $5 million.

If that’s right, and using the CDC estimated death totals, then unmitigated coronavirus would cost the economy somewhere between $1 trillion and $8.5 trillion.

But that’s actually low because the deaths wouldn’t be the only cost. Before they die, these people would consume a lot of healthcare resources. So would many others who get sick but survive.

That’s money sucked out of the economy, too.

How much?

CDC estimated total cases (mostly non-fatal) would range from 160 million to 214 million. If we assume an average $10,000 to treat each one, the cost would be between $1.6 trillion and $2.14 trillion.

Then there’s a hard-to-pinpoint psychological cost of such a national trauma. It would affect productivity and investment for years. I think easily a few more trillion, over time.

But in any case, we can plausibly estimate the coronavirus costing the economy something like $3 trillion on the low end, and $10 trillion or more in a worst case. Keeping everyone home and shutting down much of the economy is an attempt to prevent that outcome.

Photo: Wikimedia

Defense Spending

So now, we can look at this more intelligently.

If shutting down large parts of the economy forces the government to spend $5 trillion, but also saves the economy $5 trillion in prematurely lost lives and medical costs, did we really spend anything extra?

No, we simply offset the damage.

That’s in the aggregate. Not everyone would be made whole. Some people will lose more than they gained, and vice versa.

It’s also true that no amount of money can replace a child’s lost parent or restore a devastated community’s spirit. But we can establish economic conditions that help.

Of course, much depends on how the government conducts its repair programs. A lot could go wrong. I’m not confident they will do it well.

We should also note that maintaining these lockdowns has a cost, too. Humans are social creatures. Sure, we like solitude sometimes, but as a species, we don’t do well alone. We need each other. We need to get closer than six feet. This mass separation, if it persists, will have unpredictable effects apart from whatever the virus does to us.

But on the narrow question of whether fiscal stimulus makes sense in this situation, I think it does. This is a natural disaster in which most victims have no personal fault. Protecting people from it isn’t conceptually different than the military protecting them from foreign attack.

And the cost will probably be less than a few years of “defense” spending.

The Great Reset: The Collapse of the Biggest Bubble in History

New York Times best-seller and renowned financial expert John Mauldin predicts an unprecedented financial crisis that could trigger in the next five years. Most investors seem completely unaware of the relentless pressure that’s building right now. Learn more here.

0 notes

Text

How COVID-19 Leads to 2008-Style Bank Crisis

The COVID-19 virus is pushing an economy that was already approaching a cliff. Will it go over the edge?

Probably. And the Federal Reserve lifeline is wearing thin.

I have to admit, I didn’t foresee this. Six weeks ago, I said 2020 would probably bring continued low growth. Then I noted several brewing crises that could cause major problems. A pandemic wasn’t on my list.

But then, using the impeachment trial as an example, I added…

This Ukraine/Biden thing came out of nowhere just a few months ago. Something else could, too. And it might not be in Washington.

That’s kind of what happened. COVID was just a Chinese problem at the time. Now it is our problem, too.

And it may be a big one.

Photo: Pixabay

Lost Quarter

Right now everyone is worried about protecting their own health. We also see lower stock prices. This is not coincidence.

To understand why, we need to observe how the dominoes are falling.

The Chinese government responded to the initial Wuhan outbreak with containment measures that shut down many businesses. Production and economic activity dropped hard. Ships that normally export goods to the West never left.

That was a problem, and still is. Many US businesses depend on Chinese parts and components. If they can’t find substitutes, they may have to shut down, too. But that’s happening slowly, so far.

This wasn’t the only impact, though.

Millions of Chinese small businesses (and some large ones) have gone weeks with little or no incoming cash flow.

Some won’t be able to make up for the lost time. An unrented hotel room is a permanently lost opportunity. Same for a restaurant table, theater chair, or taxi seat.

So these businesses lost sales they can’t recover, even as their bills continued: mortgages, maintenance, sometimes payroll.

And if they were able to stop payroll, that doesn’t eliminate the problem. They just shifted it to workers, who didn’t get paid but still have their own bills.

In due course, China will get back to business, but only after losing an entire quarter’s activity, or close to it. That is a serious problem in highly leveraged economies, of which China is not the only one. This affects corporate earnings, so stock prices fall.

Photo: Flickr

School Closures

Now, let’s talk about the US. Changes are happening fast so forgive me if this is out of date.

As I write this, we have outbreaks on both the East and West coasts. Many more are likely infected. We don’t know because testing has been quite limited so far.

People who think they may become homebound are flocking to stores for essential items.

Some large companies are telling workers to cancel nonessential travel.

Unlucky folks who simply came in contact with a COVID-positive person are in isolation, essentially removed from the economy.

At least one school has been closed due to an infected staff member exposing everyone.

In Japan, they’ve closed all schools for at least a month. This ties down working parents, meaning either they or their employers will lose money. And making up the lost instructional time when this is over will disrupt other plans.

Japan is an advanced economy with modern health care, sanitation, and disease control. And COVID is still hitting it hard.

I see no reason to think the US will fare any better. The virus is here and spreading. Even if few people die, controlling it could still close many businesses.

My best guess is we’re a couple of weeks behind Japan on this. If so, the debt that propelled much of our growth will go in reverse.

Note, all this is on top of the China-related supply chain problems, which would seriously affect the US even if the virus hadn’t reached here.

Which brings us to the banks.

Photo: Pixabay

Eating Losses

As the old saying goes, you can’t get blood from a turnip. What happens when millions of debtors suddenly can’t make their loan payments?

That’s not a crazy idea. It’s entirely possible if the US has as much trouble controlling the coronavirus as China did, putting people out of work for weeks.

Keep in mind, about 40% of US adults can’t handle a $400 unexpected expense. If you are, say, a restaurant worker or flight attendant who gets laid off because people are staying home and not travelling, you’ll lose that much income pretty fast. Many of those affected will fall behind on their debts.

Banks assume a certain number of loans will default. They have reserves for that purpose. But because the banks themselves are also in debt, too many defaults in a short time can burn through the reserves. Then what?

In China, the government is allowing (or perhaps ordering) banks to ignore the problem, and stop recognizing bad loans.

Could that happen here? Maybe. I can imagine regulators giving banks more “flexibility” to manage their loan portfolios. The Federal Reserve can also loan money to banks that need it.

But such measures won’t change reality. The debt will still be there. Someone will eat the losses. Who?

China will do it the Communist way: collectivize the pain.

The rest of us may be headed toward something like the 2008 financial crisis, with a highly leveraged bank industry holding mass numbers of nonperforming consumer and business loans. But this time…

The Fed can’t cut rates much unless it wants to go negative.

Any fiscal stimulus will add to an already-gargantuan federal deficit.

Everyone may be dealing with a giant healthcare crisis, on top of a recession.

People of all political persuasions dislike bank bailouts and won’t want to do it again.

And all this will unfold in an already-contentious election year.

I don’t know where this is going. Maybe the Fed will pull a rabbit from its hat. Maybe the virus fears are overblown and this will all pass quickly.

But if it doesn’t, we are going to have a problem.

The Great Reset: The Collapse of the Biggest Bubble in History

New York Times best-seller and renowned financial expert John Mauldin predicts an unprecedented financial crisis that could trigger in the next five years. Most investors seem completely unaware of the relentless pressure that’s building right now. Learn more here.

0 notes

Text

Lockdown Risk and Viral Attitudes

Financial professionals talk about all kinds of risk: credit risk, interest rate risk, political risk, inflation risk… the list goes on. Now, we have a new one.

I first heard about it last week. A Wall Street economist, speaking about coronavirus business impact, called it “lockdown risk.”

Lockdown risk is the possibility you were near someone with the COVID-19 virus and find yourself quarantined for weeks. That’s costly and inconvenient even if you aren’t infected.

Businesses don’t want to see highly paid employees on lockdown. Hence, some are cutting back on travel, which is bad for hotels, airlines, and their workers.

This is a problem even if the coronavirus proves less infectious and/or less harmful than it now appears. And the costs are getting higher every day.

A big part of the present economic challenge is in our heads. Our attitudes affect our decisions, and our decisions affect the economy. Today we’ll talk about healthy attitudes.

Photo: Picserver

Space to Breathe

Later this week I was supposed to go to the South by Southwest Conference in Austin. I go every year and always find new ideas and unexpected technologies.

That won’t happen now. Last week local authorities cancelled the event due to coronavirus concerns.

If you haven’t been, it is hard to grasp how big SXSW is. Over 200,000 people attend its various components. The crowds are legendary, so I get the health concerns. Moving forward would have been risky.

Many sponsors and exhibitors—perhaps worried about that lockdown risk—had already pulled out.

One company called EPX Worldwide (with which I have no connection) cancelled its party but sent an announcement I really liked. Quoting in full:

After internal debate, talking to experts and monitoring other major brands & events, we’ve decided to postpone our SXSW white party until 2021. Furthermore, EPX will take a hiatus from our relentless pace of adventure until late May when Vegas re-appears on our calendar.

There will always be more parties and more adventures but we feel compelled to act responsibly for our friends, families and peers.

We’re not experts in viruses but here’s what we think after reading pretty much everything from everyone.

No one completely knows what’s going on – not on virality, incubation, or fatality rates. There’s evidence that the virus has been in the US far longer than anyone thinks and is under reported because of the lack of available and accurate testing. After all, most experts believe a host can carry the virus with zero symptoms for up to 14 days. Because of this, we expect the number of reported cases to rise significantly – we all should expect that without panic. Of course, these underreported cases could also mean fatality rates are far less than we think.

To some degree, who cares.

What matters is doing the right thing. If there is a virus that can cause deaths in those we love and that the world’s greatest minds don’t fully understand, we believe it’s our duty to help prevent further spread, angst and fatality.

Of course we want to do what we do best and bring smart people together to network and crush some of the greatest experiences on earth. We also we want our home city of Austin, Texas to shine and feel the boost SXSW gives our city. But the world needs time to slow things down and get this right. Just for a little while.

We don’t feel panicked. We aren’t worried. We don’t feel immediate risk. And like every issue we’ve faced before, this too will pass.

In the meantime, there is something we can do so we are doing it – remain calm, stay patient and help give the world some space to catch its breath so we can close this chapter of human history and get back on the magic trail again.

Let us all have the courage to always do what is right and not what is easy. We love you.

I think that strikes just the right note. We’re facing something new, unknown, and possibly dangerous. That doesn’t mean we should panic. It means we should think beyond ourselves, and try to protect each other from harm.

Now, that’s easy to say, but how does it work in practice? We can’t all seal ourselves into bubbles. Life has to go on.

Finding Balance

None of us knows how this will develop. The health risks are only part of it. Local and national governments will rightly try to protect their people but excessive caution could add up to recession. That’s not good for our health, either.

Here in Austin, many people depend on SXSW for a substantial part of their annual income. And not wealthy people. I’m talking about hotel workers, waiters, bartenders, food truck owners, musicians, security guards, and many others.

They’ll have less spending money now. That’s bad for the economy. Worse, if they feel sick and can’t afford to see a doctor, they might spread the virus even more.

Multiply this times hundreds of cancelled events and millions of people not traveling. It’s going to be a big hit. And as I said last week, widespread income loss could even affect the banking system.

So we have to find a balance that keeps life going and reduces infection risk. Both are important.

As EPX said, we need to get this right. A lot depends on how we do it.

The Great Reset: The Collapse of the Biggest Bubble in History

New York Times best-seller and renowned financial expert John Mauldin predicts an unprecedented financial crisis that could trigger in the next five years. Most investors seem completely unaware of the relentless pressure that’s building right now. Learn more here.

0 notes

Text

Trump’s China Agreement Is a Fake Deal

We have a trade deal! Should we pop the champagne corks?

If so, we better hurry. The Trump administration wants to slam 100% tariffs on French champagne—retaliation for France’s new digital services tax. This trade war has more than one battlefield.

But China is the biggest, and last week the Trump administration said it had reached a “Phase 1” agreement with China. The president postponed a new round of tariffs that would have taken effect Dec. 15.

That’s about where the good news ends, though. Everything else is what Silicon Valley cynics call “vaporware.”

Maybe this deal will develop into something worth celebrating. But it’s not there yet.

Opposite of Agreement

Before we get to the deal, let’s first talk about why we need it.

The US has legitimate issues with China surrounding intellectual property and market access. President Trump has been using tariffs to coerce change, so far unsuccessfully and with significant damage to the US economy.

Cancelling and/or reducing tariffs helps, but the real problem is the confusion surrounding them. Businesses can’t make effective growth plans without some minimal stability.

If you’re a CEO or CFO, and you have no idea what your cost structure will look like a year from now, you would be foolish to invest in new machinery or train a bunch of new workers. Not being fools, they have grown reluctant to do those things. This reduces US growth.

The latest Business Roundtable CEO Survey and a Duke University CFO survey show both ends of the C-suite are anything but “confident” right now. We see the results in shrinking capital investment. Eventually, this leads to recession, though we aren’t there yet.

That’s where we are. Now, imagine you are on the White House trade team. You need to boost business confidence as you announce Phase 1 of the solution. How would you do that?

Well, you might start by giving everyone as many specific details as possible. If the full text isn’t ready, you reveal as much as you can.

But most important, you would make sure both governments say the same thing. Otherwise, it’s not an “agreement” but the opposite of an agreement.

Last week, instead of a joint event featuring negotiators from both sides, we got a two-page fact sheet from the US Trade Representative, which was basically a list of things China committed to do.

Did China really commit to those things? We don’t know. Beijing had little to say.

So Phase 1 consists mainly of vague, secondhand promises, and the promising party declines to confirm it made them.

That shouldn’t build confidence.

Different Stories

Phase 1’s main winners, if we can believe the spin, are US farmers. The US says China committed to buy large quantities of American grain and other food products. Here again, Beijing has a different story.

Let’s note, too, that China was already buying megatons of US grain until quite recently. This trade war is what made those exports fall. Restoring them would be nice, but unnecessary had Trump not gone tariff-crazy.

We should also note that US taxpayers have spent billions helping affected farmers. Simply returning exports to prior levels doesn’t reimburse the taxpayers, nor does it repay what farmers already lost.

What we need is for exports to rise substantially above the prior levels and stay there for a long time. The USTR fact sheet claims that will happen. Brian Kuehl of Farmers for Free Trade told Fox Business, “We’ll believe it when we see it.”

It’s not clear US farmers can produce enough grain to do what Trump promises. We have other domestic and export customers, too. There’s a high probability raising exports will raise food prices here. That’s not what we need.

Midwestern farmers are a key Trump constituency. He wants them to believe he is protecting them. The lack of specificity, and the different story coming from Beijing, ought to give farmers pause.

Reality Is Real

A “Potemkin village” is something that portrays a false reality. Russian minister Grigory Potemkin ordered fake villages to be built to impress Empress Catherine II on her 1787 journey through what is now Ukraine.

That might be a legend, but the term fits. You build a Potemkin village when you want people to see something that isn’t actually there—for instance, the false building facades used to make films or TV shows.

Could “Phase 1” be a Potemkin trade deal? If so, it won’t accomplish much. No one can be confident it will do what it claims, or that it will last long enough to help the economy.

Yes, it’s nice the newest round of tariffs didn’t happen. But they are postponed, not cancelled. And even if they had been cancelled, we all know President Trump can reverse himself at any time.

This deal looks designed to give both leaders the appearance of an accomplishment to impress their domestic bases. No surprise—that’s how politics works. But it doesn’t fix the real problems.

Reality is, well, real. You can’t hide from it forever. Anyone making financial decisions because they think last week changed anything should think again.

The Great Reset: The Collapse of the Biggest Bubble in History

New York Times best-seller and renowned financial expert John Mauldin predicts an unprecedented financial crisis that could trigger in the next five years. Most investors seem completely unaware of the relentless pressure that’s building right now. Learn more here.

0 notes

Text

OK Boomers, About That Working-Through-College Thing

Many young Americans struggle just to stay afloat. The difference between sinking and swimming often comes down to education. A college degree is the key to getting a stable job with the kind of income that lets you build a middle-class life.

Or so we’re told. Maybe it’s not. But regardless, young people are desperate to get those degrees. The problem: college is expensive.

To some in the Baby Boomer generation, this shouldn’t be a problem. “Kids are too soft these days. I worked my way through college. These snowflakes can, too.”

Note the assumption here. Because you did something a certain way decades ago, you think a different generation can do the same today. But that was a different world. A lot has changed.

Impossible Math

Paying for college is a math equation. You need to earn, borrow, or already have enough cash to pay for the direct costs (tuition, fees, books, etc.) and also your living costs (food, housing, healthcare).

Consider someone whose family has no college savings, but who can work at minimum wage while going to school. Maybe that describes you, say, 30 years ago.

According to the College Board, average tuition, fees, and room and board for a full-time student living on campus at a four-year state university was $9,730 in 1989–90, adjusting for inflation.

In 1989, the federal minimum wage was $3.35, which equates to roughly $7 today. So, if we divide $9,730 by $7, back then you could have paid for a year of college by working 1,390 hours at minimum wage.

If you worked full time for 12 weeks in the summer, you could get 480 hours. You would also have had to work 23 hours a week the rest of the year while going to school full time. Tough, but possible.

Fast-forward to now.

Again according to the College Board, this year you need $21,950 to pay for tuition plus room and board. The federal minimum wage is $7.25. But let’s be generous, since the job market is so tight, and assume anyone can make $9 an hour.

To pay for a year of college now, you would need to work 2,438 hours—equivalent to one full-time job plus a part-time job while you are taking a full class load. That math doesn’t add up.

No Guarantees

Today’s students can’t work their way through college, as was once possible, because college costs rose and wages didn’t. This is why we have a student debt problem.

Yes, there’s aid for low-income families, veterans, athletes, and those with academic talent, but that’s not everyone. So two-thirds of college students and/or their families go into debt.

As happens with other kinds of debt, it’s easy to get in over your head. The average US household with student debt owes almost $48,000. That’s on top of car, mortgage, or any other debt. This affects their spending, productivity, and mental health.

Worse, taking on this debt doesn’t guarantee anything. Yes, as a general rule, earning a college degree will raise your income, but not always. And lots of people go into debt and never get a degree.

This is not a small problem. Total US student loan debt is around $1.6 trillion. Not surprisingly, some people want to eliminate it. Bernie Sanders, Elizabeth Warren, and some other Democrats have plans to forgive or reduce student loans.

It may happen anyway if the borrowers can’t pay. Almost all that college debt is already government-guaranteed under programs both parties approved. So like it or not, this is everyone’s problem.

But set that aside. The other, rarely asked question is why young people feel so driven to get that college degree when its economic benefits are uncertain at best. And why the rest of us push them to do it when we don’t want to pay for it.

Parental Influence

If you’re a parent like me, you probably underestimate how influential you are. We make offhand comments, and the kids treat them as Gospel Truth, even years later.

So when we tell them they should aspire for a top college and a great career, they believe that’s the thing to do. And they’re naturally disappointed if circumstances prevent it.

The popular idea that college is necessary to make a good living may be true in the aggregate data, but not always and not everywhere. It’s possible to build an excellent, well-paid career without a single hour of college.

TV host Mike Rowe (of Dirty Jobs fame) has been preaching this for years. Even in our high-tech world, low-tech trade jobs pay quite well. That’s in part because people don’t want those jobs, because they think they should be in college because their parents told them college was critical.

So maybe we older generations should stop complaining the kids don’t work hard enough and think about the direction we’re pushing them. It may be the wrong one.

The Great Reset: The Collapse of the Biggest Bubble in History

New York Times best-seller and renowned financial expert John Mauldin predicts an unprecedented financial crisis that could trigger in the next five years. Most investors seem completely unaware of the relentless pressure that’s building right now. Learn more here.

#college#college is expensive#education fees#low-tech trade jobs#paying for college#college debt#us student loan debt

0 notes

Text

How to Stop Elizabeth Warren’s Wealth Tax

Wealthy Republicans—and even some Democrats—are worried about Elizabeth Warren. Specifically, they fear her wealth tax idea.

That makes sense. Their wealth is important to them. They don’t want to lose any of it.

But they will, if the Massachusetts senator wins the presidency and convinces Congress to pass her idea, or something similar.

I am not here to endorse any candidates. You can vote however you like.

But tax policy is a matter of economic interest, and the fear Warren inspires tells us something important. So does the haphazard effort to stop her. It’s not working and may even be backfiring.

And that could bring big changes that affect everyone.

Limited Recovery

Conventional wisdom says Donald Trump won the 2016 election, despite losing the popular vote, because he appealed to Midwestern voters for whom globalization hadn’t worked out so well.

Other things mattered, too, but economics was certainly a big factor. The post-crisis recovery hadn’t reached everyone in 2016 (and still hasn’t reached them today).

We’ve seen some improvement. The unemployment rate is historically low. Wages have finally started to move up. That’s good.

But keep it in perspective. A 3% real wage increase for a full-time worker making $15 an hour is about $18 a week—helpful, but not a game-changer.

Inflation is considerably higher for the items average people need just to survive. And if you’re unlucky enough to get a serious illness, there’s a good chance you won’t be able to pay your insurance deductible (if you even have insurance) and the hospital will sue you into bankruptcy.

The people who face these problems have no wealth but they do have votes, so the wealthy are rightly concerned.

Bread and/or Circuses

An aristocracy worried the masses will rise up against it is nothing new. The usual answer, dating back to ancient Rome, is to offer “bread and circuses.”

That works pretty well, too, until it doesn’t, as numerous monarchs learned the hard way.

Note, however, the formula is bread and circuses. It takes both. In present US context, the masses are getting mostly circuses and little bread. Hence the discontent that led to Trump.

If wealthy Republicans—whose party controlled the presidency, House, and Senate for two full years—had fixed this imbalance, they might not need to worry about Warren winning the election and taxing their wealth.

That’s not what happened. So it should be no surprise average people are considering alternatives.

Republicans have their own theory: Economic growth will solve everything, and cutting taxes is the way to produce it.

There are two problems with that idea.

First, they did cut taxes in 2017, and it didn’t generate much growth—at least not yet.

Second, GDP growth won’t address some important structural issues like inadequate healthcare, housing, transportation, and income instability.

Those are key reasons ideas like the wealth tax are getting traction.

A laissez-faire response that consists mainly of billionaires going on TV to say (paraphrasing), “You people don’t know how good you have it! Hands off my wealth!” probably won’t work.

That doesn’t mean Warren’s wealth tax is a good idea. It means those who oppose it need a better strategy.

Here’s a radical suggestion: fix the problems Warren talks about.

These struggles aren’t imaginary. People really are hurting. So if you at least try to help, they might vote for you.

Will solutions be expensive? Yes. But if you, Mr. Wealthy Person, don’t implement them yourself, somebody else will, and you probably won’t like their methods. And you really won’t like the funding mechanism.

Blue Wave?

The 2020 election is a year away, and a lot can change by then. We don’t know what will happen but we can speculate.

For business-oriented Republicans, the best-case outcome would be a Democratic president plus a GOP Senate. The trade-war craziness would ease and taxes wouldn’t go up.

Consider, though, that Democrats recaptured the House last year and just this month made major gains in states like Kentucky, Louisiana, Pennsylvania, and Virginia.

Consider also, Trump barely won in 2016. He is president now only due to 78,000 votes in three key states. Millions of his older voters have died since then. The younger ones who have reached voting age don’t lean Republican (to say the least).

So, there is a significant and growing chance a blue wave will put a Democrat in the White House, and his or her party will control both House and Senate, too.

That would mean a good chance a wealth tax, national health care, and other liberal policies will pass. Whether they will work is another question. But we’ll get to find out.

There are things Republicans can do to prevent that outcome. They aren’t doing those things.

Which means, unless the GOP changes course in the very near future, a blue wave could build momentum, and eventually reach the shoreline. Best not to get in its way.

The Great Reset: The Collapse of the Biggest Bubble in History

New York Times best-seller and renowned financial expert John Mauldin predicts an unprecedented financial crisis that could trigger in the next five years. Most investors seem completely unaware of the relentless pressure that’s building right now. Learn more here.

0 notes

Text

Financial Success Formula Failure

The US economy grew at a 2.1% annualized pace in the second quarter, according to data released last week. That was better than economists expected but hardly impressive.

Even President Trump recognized this, tweeting the growth rate was “not bad considering we have the very heavy weight of the Federal Reserve anchor wrapped around our neck.”

That’s the same Federal Reserve of which Trump himself appointed the chair and a majority of board members. But I guess he has to blame somebody.

Sadly, though, quite a few Americans really do have financial anchors wrapped around their necks. I recently reported on Federal Reserve survey data showing 39% of American adults can’t cover a $400 emergency expense without borrowing money or selling something.

That story drew a lot of positive response, but distressingly, I also heard from people who would rather blame the victims.

It’s their own fault, you see. They don’t know “The Secret.”

Missing Factors

My Left-Behind Economy article provoked some disagreement. Several comments went like this (paraphrasing):

“These people who don’t have $400 for emergencies should have done like me: work hard, save money, live frugally. It’s their own fault. They get what they deserve.”

Let’s unpack this.

First, congratulations to these financially stable readers who made good choices. However, it’s worth asking: What enabled those choices?

Success comes from good decisions but not everyone has the same menu. The choices in front of you are different if, for instance…

Your parents were a hedge fund manager and a corporate lawyer, or

You got a college athletic scholarship that let you earn a degree without accruing student debt, or

You’re the child of a single mom who had to work instead of help you study your math and science.

Are these choices? Not really. Even hard-training athletes benefit from their genetic attributes and coaching.

That doesn’t relieve us of responsibility, of course. We can all make the best of what we have. But the data doesn’t support this idea that everyone “gets what they deserve.”

That’s obvious when you think about it. If the formula is…

Hard work x frugal living x smart decisions = financial success

… then everybody who does those three things should get the same results. But clearly they don’t.

We all know smart people who work hard and live simple lives, yet accrue very little money.

We also know less-than-intelligent folks who waste their time and cash, yet stay wealthy.

These exceptions tell us the equation must have other factors. Yet people still believe it.

Law of Attraction

American culture is deeply invested in the “self-made man” idea, that anyone can do anything if they just put their mind to it.

That stems partly from our Puritan religious heritage. Calvinist theology said God favored the chosen “Elect.” If that’s your belief, you are highly incentivized to prove you are in that group. Those who appeared unfavored were sometimes shunned.

Versions of that attitude survive today—sometimes overtly in “Name It and Claim It” fundamentalist sects, but more often in tacit form. Otherwise non-religious people fervently believe their own talents and hard work led to a kind of financial redemption. They insist others must follow this same plan of salvation.

This idea exists in New Age movements, too.

Remember The Secret book and film? It was wildly popular in the early 2000s, describing a “Law of Attraction” that made success inevitable if you wanted it badly enough.

(Saturday Night Live did a hilarious satire you can watch here.)

The implicit flip side Oprah didn’t mention: Anyone who isn’t successful must be somehow deficient. You should avoid them so it doesn’t rub off.

From there, it’s a quick jump to “They got what they deserve.”

No One Wins Alone

We all need a little motivation to work hard and do our best. Slothful behavior doesn’t have the immediate life-or-death consequences it once did.

But more often, we take it too far. Very few people achieve financial and career success on their own. They had help—from family, friends, strangers, and yes, the government. There shouldn’t be any shame in that.

In economic reality, no one fails or succeeds alone. So the question is: Who helps whom, and how? It can happen many different ways, some of which work better than others.

But we don’t have that discussion if we’re busy lauding ourselves for “success” that isn’t fully ours and denigrating others who haven’t achieved the same.

These attitudes are far less common in some parts of the world. Those regions are growing faster. Maybe there’s a connection.

The Great Reset: The Collapse of the Biggest Bubble in History

New York Times best-seller and renowned financial expert John Mauldin predicts an unprecedented financial crisis that could trigger in the next five years. Most investors seem completely unaware of the relentless pressure that’s building right now. Learn more here.

0 notes

Text

RIP Economic Cooperation, 1944–2019

Last month, world leaders observed the 75th anniversary of D-Day, when Allied troops stormed the beaches of Normandy, France. It was a critical day in world history.

However, other things happened that year.

As that massive invasion took place, a smaller group quietly planned how to reshape the world economy.

The Second World War was, in part, a result of failure to establish a stable currency system after the first one. That led to tariffs and other trade barriers in the 1930s. Economists and bankers wanted to keep it from happening again, and spent the war years discussing solutions.

Now we’re in a similar predicament. The postwar economic system has worked pretty well in some ways, but it left many people behind. They are unhappy. Populist leaders are responding with the same kind of protectionism that didn’t work back then.

It probably won’t end well.

Photo: Wikimedia

Imbalances

“When goods don’t cross borders, armies will,” is a quote often attributed to 19th-century French economist Frederic Bastiat. It’s unclear if he actually said it, but history shows it is often right.

Nations that trade with each other rarely resort to war because a) war disrupts business and b) trade creates relationships and open communication.

Conversely, lack of trade breeds suspicion, which sometimes leads to conflict. So free trade is a good way to promote international peace.

But that only goes so far. Importing countries get useful products while exporters receive money, the value of which may change for reasons beyond the exporter’s control. The resulting losses breed resentment and distrust.

Trade would be easier and war less common if the entire world shared a common medium of exchange. But that can’t happen because national governments want to control their own currencies. There are good reasons for that, too, but the resulting imbalances, combined with other conditions, led to World War II.

But even as that war raged on, a movement emerged to keep it from happening again. It culminated 75 years ago this month at a New Hampshire resort hotel.

Photo: Wikimedia

Fixed Rates

On July 1, 1944, at the Mount Washington Hotel in Bretton Woods, New Hampshire, 730 delegates from the 44 Allied nations gathered to redesign the international financial order.

That’s no exaggeration, nor was it a shadowy conspiracy. That’s really what happened. Formally called the “United Nations Monetary and Financial Conference,” it created the International Monetary Fund and the World Bank.

More important, Bretton Woods created a system of exchange rates pegged to gold, and a pledge by member nations to convert their currencies as needed to facilitate international trade.

I know… boring stuff. But it was important. British economist John Maynard Keynes, his US counterpart Harry Dexter White, and others designed a system they hoped would allow robust trade without the occasional currency crises they had seen several times.

Was theirs the only solution? Probably not. Nor was it the best one, or the fairest one. But the goal was improvement, not perfection. The following decades suggest they accomplished it.

Photo: Wikimedia

Hasty Change

The Bretton Woods agreement worked pretty well for about 20 years. Many people now look back on the 1950s as a kind of golden age. If only we could go back, they say.

But weirdly, those same folks often don’t want the kind of international cooperation that made those halcyon days so prosperous. They want to retreat within their own borders and keep their economies independent.

They can do that, but it has a cost. Free trade in goods and ideas leads to maximum prosperity for everyone. That is why the golden age was so golden (for some, at least).

Bretton Woods began falling apart in the 1960s. Then in 1971, Richard Nixon suspended the dollar’s gold convertibility and the fixed-rate system fell apart. Now exchange rates float with markets.

Is that an improvement? Maybe. But the 1970s were also when the economy started shifting toward the winner-take-all system we now find problematic. Maybe there’s a connection.

Obviously, much has changed since 1944. A system designed for that world probably isn’t what today’s world needs.