Photo

Influencers and Social Media Artists on #Instagram and other Online platforms put in a lot of work and efforts to create profiles online and try to make a business out of the same. ⠀ Income can be professional fees from paid partnerships with brands, Incentive on Post sharing and more. Such income should be accounted on time, and the expenses incurred by the artists can be claimed against such income. ⠀ Expenses can be Subscription charges like #publer #canva #filmora and many more. Also, salaries paid to staff/interns can also be claimed. Any influencer requires a good enough laptop and/or a mobile phone, and they can be capitalised in the business. ⠀ If you have any other suggestions, would love to hear in the comments. ⠀ For any queries, please email on [email protected] ⠀ #artistsoninstagram #brand #instagram #partnership #income #business #biz #work #effort #artists #influencer #influencermarketing #socialnetwork #socialmedia #accounting #ledgerprofinance https://www.instagram.com/p/CDVqAc9jxK-/?igshid=1k12p9gl8tw1o

#instagram#publer#canva#filmora#artistsoninstagram#brand#partnership#income#business#biz#work#effort#artists#influencer#influencermarketing#socialnetwork#socialmedia#accounting#ledgerprofinance

0 notes

Photo

WE as a community, tribe, gathering, family, and cities all suffered losses, personal, financial or both during the Covid-19 pandemic. ⠀ As a prudent practice, the losses incurred in businesses during this period needs to be claimed against profits in future period. ⠀ This can only be done if return of income is filed on time. The due date for Personal Return is 30th November 2020, and Tax Audit to be filed till 31st October 2020 for FY 2019-20. ⠀ So make sure you get the claim of losses incurred by filing returns on time. ⠀ For queries please email at [email protected] ⠀ #filing #audit #tax #income #business #november2020 #taxaudit #duedate #entrepreneur #business #entrepreneurship #smallbusiness #entrepreneurlife #startup #businessowner #goals #cpa #cfo #ceo #smallbusinessowner #accountant #virtualcfo #taxes #ledgerprofinance #IncomeTaxUpdate #IncomeTaxReturn #CBDT #IncomeTaxEfiling #TaxReturn #IncomeTaxIndia https://www.instagram.com/p/CDTgrVMD3mu/?igshid=ccrrmp9hrhlh

#filing#audit#tax#income#business#november2020#taxaudit#duedate#entrepreneur#entrepreneurship#smallbusiness#entrepreneurlife#startup#businessowner#goals#cpa#cfo#ceo#smallbusinessowner#accountant#virtualcfo#taxes#ledgerprofinance#incometaxupdate#incometaxreturn#cbdt#incometaxefiling#taxreturn#incometaxindia

0 notes

Photo

Special Rates for Domestic companies. Applicable for FY 19-20 and FY 20-21 Section 115BA 25% (Manufacturing / Surcharge 7%/12% / MAT 15%) Section 115BAA 22% (Can be any kind of Business / Surcharge 10% / MAT NA) Section 115BAB 15% (Manufacturing setup post 1.10.2019 / Surcharge 10% / MAT NA) Manufacturing companies can be divided into Existing Units, Newly setup units, and Other companies. Accordingly these provisions can be levied and taken advantage of. For queries please email at [email protected] #entrepreneur #business #motivation #success #entrepreneurship #smallbusiness #entrepreneurlife #startup #businessowner #goals #cpa #cfo #ceo #businessquotes #realtor #insurance #smallbusinessowner #accountant #virtualcfo #taxes #financialfreedom @ledgerprofinance https://www.instagram.com/p/CDAw-otDc0q/?igshid=lkp4hwjpt6em

#entrepreneur#business#motivation#success#entrepreneurship#smallbusiness#entrepreneurlife#startup#businessowner#goals#cpa#cfo#ceo#businessquotes#realtor#insurance#smallbusinessowner#accountant#virtualcfo#taxes#financialfreedom

0 notes

Photo

This post is a special address for Free-lancers and Contractors. Your business can be a Sole-proprietorship, wherein the current account with the bank is in your businesses name, but for income tax purpose you and your business identities are the same. You may register as an LLP (Limited Liability Partnership), which is similar to a Partnership Firm, and compliance is similar to that of a Private Limited Company. Or you may register as a Pvt Ltd Company, which gives a firm structure to business, and tax rates are beneficial than SP or LLP in certain cases. Before starting any biz, it is prudent to consult a Tax-expert to understand the benefits of various options, and opt for a structure most suitable to you in terms of taxes and difficulty in terms of compliance. For queries please email at [email protected] #entrepreneur #business #motivation #success #entrepreneurship #smallbusiness #entrepreneurlife #startup #businessowner #goals #cpa #cfo #ceo #businessquotes #realtor #insurance #smallbusinessowner #accountant #virtualcfo #taxes #financialfreedom https://www.instagram.com/p/CDAxzbjDzdN/?igshid=14k15fvssvdb9

#entrepreneur#business#motivation#success#entrepreneurship#smallbusiness#entrepreneurlife#startup#businessowner#goals#cpa#cfo#ceo#businessquotes#realtor#insurance#smallbusinessowner#accountant#virtualcfo#taxes#financialfreedom

0 notes

Photo

25% Tax rate is applicable on Companies incorporated in India. T/O in FY 17-18 being less than 400 Crores, rate in FY 19-20 is 25% T/O in FY 18-19 being less than 400 Crores, rate in FY 20-21 is 25% For domestic companies other than these, rate is 30% for FY 19-20 and FY 20-21 Surcharge is applicable as per normal rules For queries please email at [email protected] #entrepreneur #business #motivation #success #entrepreneurship #smallbusiness #entrepreneurlife #startup #businessowner #goals #cpa #cfo #ceo #businessquotes #realtor #insurance #smallbusinessowner #accountant #virtualcfo #taxes #financialfreedom https://www.instagram.com/p/CDAwpO3ja5C/?igshid=hhxedazv5740

#entrepreneur#business#motivation#success#entrepreneurship#smallbusiness#entrepreneurlife#startup#businessowner#goals#cpa#cfo#ceo#businessquotes#realtor#insurance#smallbusinessowner#accountant#virtualcfo#taxes#financialfreedom

0 notes

Photo

In exercise of the powers conferred by the Micro, Small and Medium Enterprises Development Act, 2006, the Central Government, after obtaining the recommendations of the Advisory Committee in this behalf, hereby notifies certain criteria for classifying the enterprises as micro, small and medium enterprises and specifies the form and procedure for filing the memorandum (hereafter in this notification to be known as “Udyam Registration”), with effect from the 1st day of July, 2020 namely: Micro Enterprise: Investment upto ₹ 1 Cr AND Turnover upto ₹ 5 Cr Small Enterprise: Investment upto ₹ 10 Cr AND Turnover upto ₹ 50 Cr Medium Enterprise: Investment upto ₹ 50 Cr AND Turnover upto ₹ 250 Cr . . . #IncomeTaxUpdate #IncomeTaxReturn #ITR1 #CBDT #IncomeTaxEfiling #TaxReturn #IncomeTaxIndia#ledgerprofinance#incometaxindia#stockanalysis#nationalstockexchange#incometaxes#stockmarketquotes#taxpreparer#dailymarketupdate#sharemarketindia#futuresandoptions#gstr #udyamregistration #msme https://www.instagram.com/p/CCY9TZTjc0N/?igshid=1k947ja3zs1x

#incometaxupdate#incometaxreturn#itr1#cbdt#incometaxefiling#taxreturn#incometaxindia#ledgerprofinance#stockanalysis#nationalstockexchange#incometaxes#stockmarketquotes#taxpreparer#dailymarketupdate#sharemarketindia#futuresandoptions#gstr#udyamregistration#msme

0 notes

Photo

Only those enterprises are considered eligible for Udyam Registration which are either in manufacturing or production or processing or preservation of Goods OR in the providing or rendering of services. In other words, the enterprises which are engaging only in trading i.e. buying, selling importing, exporting of Goods are not even eligible for applying for Udyam Registration. #IncomeTaxUpdate #IncomeTaxReturn #ITR1 #CBDT #IncomeTaxEfiling #TaxReturn #IncomeTaxIndia#ledgerprofinance#incometaxindia#stockanalysis#nationalstockexchange#incometaxes#stockmarketquotes#taxpreparer#dailymarketupdate#sharemarketindia#futuresandoptions#gstr #udyamregistration #msme https://www.instagram.com/p/CCY9G-UDA1X/?igshid=g8p3tzvb9pgb

#incometaxupdate#incometaxreturn#itr1#cbdt#incometaxefiling#taxreturn#incometaxindia#ledgerprofinance#stockanalysis#nationalstockexchange#incometaxes#stockmarketquotes#taxpreparer#dailymarketupdate#sharemarketindia#futuresandoptions#gstr#udyamregistration#msme

0 notes

Photo

The Union Ministry of Micro, Small and Medium Enterprises (MSME) had made the announcement regarding the new process of classification and registration of MSME Enterprises which was launched on July 1, 2020 under the name of ‘Udyam registration’ through a notification on June 26. The MSME Ministry launched a new portal for Udyam Registration www.udyamregistration.gov.in. The portal will help guide the entrepreneurs step by step as to what they should know, what they should do. The Central Government, after obtaining the recommendations of the Advisory Committee in this behalf, hereby notifies certain criteria for classifying the enterprises as micro, small and medium enterprises . . . .#IncomeTaxUpdate #IncomeTaxReturn #ITR1 #CBDT #IncomeTaxEfiling #TaxReturn #IncomeTaxIndia#ledgerprofinance#incometaxindia#stockanalysis#nationalstockexchange#incometaxes#stockmarketquotes#taxpreparer#dailymarketupdate#sharemarketindia#futuresandoptions#gstr #udyamregistration #msme https://www.instagram.com/p/CCY9B1sj9tt/?igshid=m99pbba0wbqm

#incometaxupdate#incometaxreturn#itr1#cbdt#incometaxefiling#taxreturn#incometaxindia#ledgerprofinance#stockanalysis#nationalstockexchange#incometaxes#stockmarketquotes#taxpreparer#dailymarketupdate#sharemarketindia#futuresandoptions#gstr#udyamregistration#msme

0 notes

Photo

BENEFITS ON GETTING REGISTERED AS UDYAM: 1.Udyam registration helps in getting government tenders 2.Due to the Udyam, the bank loans become cheaper as the interest rate is very low (Upto 1.5% lower than interest on regular loans 3.There are various tax rebates available for Udyam 4.Becomes easy to get licenses, approvals and registrations, irrespective of field of business as business registered under Udyam are given higher preference for government license and certification. 5.They get easy access to credit in lower interest rates 6.Registered Udyams gets tariff subsidies and tax and capital subsidies 7.Once registered the cost getting a patent done, or the cost of setting up the industry reduces as many rebates and concessions are available. #IncomeTaxUpdate #IncomeTaxReturn #ITR1 #CBDT #IncomeTaxEfiling #TaxReturn #IncomeTaxIndia#ledgerprofinance#incometaxindia#stockanalysis#nationalstockexchange#incometaxes#stockmarketquotes#taxpreparer#dailymarketupdate#sharemarketindia#futuresandoptions#gstr #udyamregistration #msme https://www.instagram.com/p/CCY8zx_j81-/?igshid=d15zlyz9a35d

#incometaxupdate#incometaxreturn#itr1#cbdt#incometaxefiling#taxreturn#incometaxindia#ledgerprofinance#stockanalysis#nationalstockexchange#incometaxes#stockmarketquotes#taxpreparer#dailymarketupdate#sharemarketindia#futuresandoptions#gstr#udyamregistration#msme

0 notes

Photo

In exercise of the powers conferred by the Micro, Small and Medium Enterprises Development Act, 2006, the Central Government, after obtaining the recommendations of the Advisory Committee in this behalf, hereby notifies certain criteria for classifying the enterprises as micro, small and medium enterprises and specifies the form and procedure for filing the memorandum (hereafter in this notification to be known as “Udyam Registration”), with effect from the 1st day of July, 2020 . . . BENEFITS ON GETTING REGISTERED AS UDYAM: 1.Udyam registration helps in getting government tenders 2.Due to the Udyam, the bank loans become cheaper as the interest rate is very low (Upto 1.5% lower than interest on regular loans 3.There are various tax rebates available for Udyam 4.Becomes easy to get licenses, approvals and registrations, irrespective of field of business as business registered under Udyam are given higher preference for government license and certification. 5.They get easy access to credit in lower interest rates 6.Registered Udyams gets tariff subsidies and tax and capital subsidies 7.Once registered the cost getting a patent done, or the cost of setting up the industry reduces as many rebates and concessions are available. #IncomeTaxUpdate #IncomeTaxReturn #ITR1 #CBDT #IncomeTaxEfiling #TaxReturn #IncomeTaxIndia#ledgerprofinance#incometaxindia#stockanalysis#nationalstockexchange#incometaxes#stockmarketquotes#taxpreparer#dailymarketupdate#sharemarketindia#futuresandoptions#gstr #udyamregistration #msme https://www.instagram.com/p/CCY8rSoDcCH/?igshid=x9lpr19qbvg7

#incometaxupdate#incometaxreturn#itr1#cbdt#incometaxefiling#taxreturn#incometaxindia#ledgerprofinance#stockanalysis#nationalstockexchange#incometaxes#stockmarketquotes#taxpreparer#dailymarketupdate#sharemarketindia#futuresandoptions#gstr#udyamregistration#msme

0 notes

Photo

For more information please email at [email protected] . . . #income #incometaxseason #incometaxreturn #incometaxindia #moneytalks #moneymaker #moneymaking #moneymanagement #moneymoney #taxes #taxation #taxpreparer #taxtime #taxrefund #taxcollection #india_news #corporate #indiaig #modi #financetips #financialplanning #finance #Budget2020 #BudgetWithMC #budget #budgeting #nirmalasitharaman @ledgerprofinance https://www.instagram.com/p/CCVjGSZjc9E/?igshid=kns8zjszudjo

#income#incometaxseason#incometaxreturn#incometaxindia#moneytalks#moneymaker#moneymaking#moneymanagement#moneymoney#taxes#taxation#taxpreparer#taxtime#taxrefund#taxcollection#india_news#corporate#indiaig#modi#financetips#financialplanning#finance#budget2020#budgetwithmc#budget#budgeting#nirmalasitharaman

0 notes

Photo

7/7 https://www.instagram.com/p/CCRgNMcjfaj/?igshid=16u5olknij8ue

0 notes

Photo

For more details, emails us at [email protected] . . . . . #income #incometaxseason #incometaxreturn #incometaxindia #moneytalks #moneymaker #moneymaking #moneymanagement #moneymoney #taxes #taxation #taxpreparer #taxtime #taxrefund #taxcollection #india_news #corporate #indiaig #modi #financetips #financialplanning #finance #Budget2020 #BudgetWithMC #budget #budgeting #nirmalasitharaman #ledgerprofinance https://www.instagram.com/p/CCVjbaID1cE/?igshid=waiho9mkwc4

#income#incometaxseason#incometaxreturn#incometaxindia#moneytalks#moneymaker#moneymaking#moneymanagement#moneymoney#taxes#taxation#taxpreparer#taxtime#taxrefund#taxcollection#india_news#corporate#indiaig#modi#financetips#financialplanning#finance#budget2020#budgetwithmc#budget#budgeting#nirmalasitharaman#ledgerprofinance

0 notes

Photo

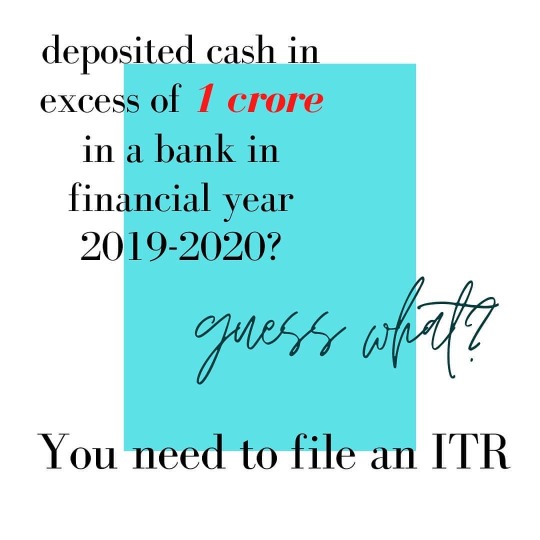

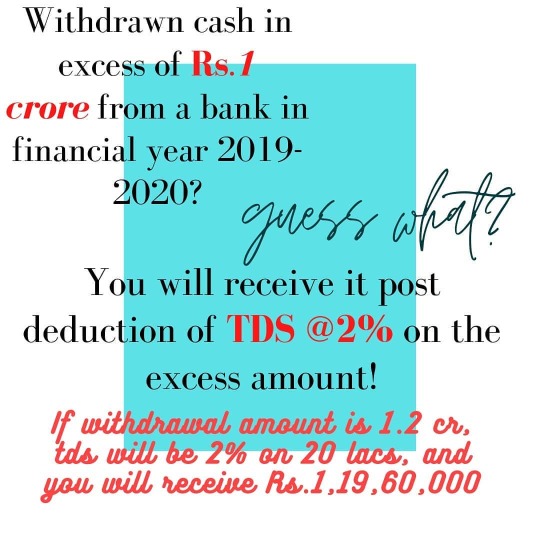

Section 194N is applicable in case of cash withdrawals of more than Rs 1 crore during a financial year. This section will apply to all the sum of money or an aggregate of sums withdrawn from a particular payer in a financial year. The tax will be deducted @2 % by the payer while making payment to any individual in cash from a taxpayer’s bank account on the amount in excess of Rs 1 crore. The limit of Rs 1 crore in a financial year is with respect to per bank or post office account and not a taxpayer’s individual account. For example, a person having three bank accounts with three different banks, he can withdraw cash of Rs 1 crore * 3 = Rs 3 crores without any TDS. Separately, in case of business payments, payment made through a bearer cheque would not be allowed as an expenditure under section 40(A)(3) of the income tax act. Any payment made exceeding Rs 10,000 per day (in a single transaction or in aggregate) is not allowed as business expenditure. TDS will be deducted by the payer while making the cash payment over and above Rs 1 crore in a financial year to the payee. If the payee withdraws a sum of money on regular intervals, the payer will have to deduct TDS from the amount, once the total sum withdrawn exceeds Rs 1 crore in a financial year. Further, the TDS will be done on the amount exceeding Rs 1 crore. For example, if a person withdraws Rs 99 lakh in the aggregate in the financial year and in the next withdrawal, an amount of Rs 1,50,000 is withdrawn, the TDS liability is only on the excess amount of Rs 50,000. The payer will have to deduct TDS at the rate of 2% on the cash payments/withdrawals of more than Rs 1 crore in a financial year under Section 194N. Thus, in the above example, TDS would be on Rs 50,000 at 2% i.e. Rs 1,000. In case the individidual receiving the money has not filed income tax return for three years immediately preceding the year, then the TDS is 2% on the cash payments/withdrawals of more than Rs 20 lakh and up to Rs 1 crore . #income #incometaxseason #incometaxreturn #incometaxindia #moneytalks #moneymaker #moneymaking #moneymanagement #moneymoney #taxes #taxation #taxpreparer #taxtime #taxrefund #taxcollection https://www.instagram.com/p/CCVjS5WD0CS/?igshid=1n0g4uaqtggso

#income#incometaxseason#incometaxreturn#incometaxindia#moneytalks#moneymaker#moneymaking#moneymanagement#moneymoney#taxes#taxation#taxpreparer#taxtime#taxrefund#taxcollection

0 notes

Photo

📃💰📝 . . . . . . #income #incometaxseason #incometaxreturn #incometaxindia #moneytalks #moneymaker #moneymaking #moneymanagement #moneymoney #taxes #taxation #taxpreparer #taxtime #taxrefund #taxcollection #india_news #corporate #indiaig #modi #financetips #financialplanning #finance #Budget2020 #BudgetWithMC #budget #budgeting #nirmalasitharaman #ledgerprofinance https://www.instagram.com/p/CCVisRYjShf/?igshid=72oqpsegv8ns

#income#incometaxseason#incometaxreturn#incometaxindia#moneytalks#moneymaker#moneymaking#moneymanagement#moneymoney#taxes#taxation#taxpreparer#taxtime#taxrefund#taxcollection#india_news#corporate#indiaig#modi#financetips#financialplanning#finance#budget2020#budgetwithmc#budget#budgeting#nirmalasitharaman#ledgerprofinance

0 notes

Photo

📝💰📃 . . . . . #income #incometaxseason #incometaxreturn #incometaxindia #moneytalks #moneymaker #moneymaking #moneymanagement #moneymoney #taxes #taxation #taxpreparer #taxtime #taxrefund #taxcollection #india_news #corporate #indiaig #modi #financetips #financialplanning #finance #Budget2020 #BudgetWithMC #budget #budgeting #nirmalasitharaman #ledgerprofinance https://www.instagram.com/p/CCVio20DYLI/?igshid=cd2h7sv498dq

#income#incometaxseason#incometaxreturn#incometaxindia#moneytalks#moneymaker#moneymaking#moneymanagement#moneymoney#taxes#taxation#taxpreparer#taxtime#taxrefund#taxcollection#india_news#corporate#indiaig#modi#financetips#financialplanning#finance#budget2020#budgetwithmc#budget#budgeting#nirmalasitharaman#ledgerprofinance

0 notes

Photo

This is the Proof that trademark is finally granted to your brand/logo/product name. This confirmation can take up to 18 months, but this client was fortunate enough to receive it in 4 months without a glitch. The exclusivity of the Brand-name is s very important factor here, as well as the class under which TM is applied for. . . . #ledgerprofinance #copyright #trademark #sayyestosuccess #thisgirlmeansbusiness #laptoplife #lovemybiz #femalebusinessowner #protectyourbiz #buildyourtribe #growyourbiz #buildyourbrand #createandcultivate #createpreneur #bizcoach #ownyourlife #fireyourboss #womeninbiz #motivatedwomen #womenwholead #theimperfectboss #thebossbabesociete #sheconquers #hersuccess #madeformore #ladybossmindset #ladypreneur https://www.instagram.com/p/CCRg5XMDcb0/?igshid=6vrque5p4vkf

#ledgerprofinance#copyright#trademark#sayyestosuccess#thisgirlmeansbusiness#laptoplife#lovemybiz#femalebusinessowner#protectyourbiz#buildyourtribe#growyourbiz#buildyourbrand#createandcultivate#createpreneur#bizcoach#ownyourlife#fireyourboss#womeninbiz#motivatedwomen#womenwholead#theimperfectboss#thebossbabesociete#sheconquers#hersuccess#madeformore#ladybossmindset#ladypreneur

0 notes