Text

Private Equity 101 for MSPs: New Platforms vs. Add-Ons

Over the past 18 months Abe Garver (FOCUS’ MSP Team Leader) has catapulted eight (8) MSPs into “New Platforms” for private equity groups (PEGs). Six (6) of the 8 run on ConnectWise’s RMM/PSA and two (2) of the 8 run on Datto’s Autotask RMM/PSA software

New Platform investments are the life blood of private equity, as they are viewed as the starting point for more acquisitions in the future. Conversely a strategic “Add-On” is designed to complement an existing platform business.

For New Platforms, PEGs have historically viewed each transaction as stand-alone. There are no synergies to consider, there is only a transaction with an investment rationale on how to grow the business and generate a targeted return. That rationale is the driver behind the deal, and it defines how the PEG will create value through things like capital infusions, operating partners and even future add-on acquisitions.

However, because of the limited supply of New Platform MSP assets (e.g. in the $2.5MM-$5.0MM EBITDA range), PEGs that want a New Platform are turning to M&A advisors like FOCUS’ MSP Team to find Merger of Equal targets to combine.

Combinations like Domain Computer Services and Tier One are especially appealing to PEGs when there is a:

1. Cultural 'fit'

2. Geographic 'fit'

3. Strategic 'fit' (e.g. cross-selling opportunities)

4. Financial 'fit' (e.g. pro-forma EBITDA of $2.5MM to $5.0MM)

5. Low integration risk (e.g. similar 'tech' stacks)

6. Leadership gap being filled

7. Inactive shareholder being taken out, and

8. Reduction of customer concentration

Interestingly Mr. Garver states that 4 of the 7 MSPs he advised in 2020 would not have been offered a New Platform investment had it not been for their use of M&A with IT Nation peers.

In Mr. Garver's opinion the trend is gaining momentum as 88% (7 of 8) MSPs he is advising on New Platform transactions in 2021 are also employing M&A with peers to increase their MSP’s marketability and valuation.

For Add-On acquisitions, PEGs frequently lean more on the expertise of its relevant portfolio company's management to determine the fit, synergies and strategic benefits of a transaction.

However Mr. Garver cautions that, ”On the buy side private equity groups show up for important first calls with their portfolio companies. This is especially important when offers involve rolling equity.”

For New Platforms without a strong track record of M&A, it is a disaster when PEGs won’t provide adequate support which I also experienced last year advising a New Platform on the buy side.

I advised Network Support Co. in its sale to Logically which is PE-backed by Riverside. Riverside did an incredibly efficient job of supporting Logically assess fit, synergies and strategic benefits of the transaction.

When talking to a PEG, try to understand what their investment case is. Why are they interested in your MSP? Are they planning to consolidate it with a Platform? What is their plan for helping the MSP grow?

For New Platforms, key questions PEGs focus on include:

1. How attractive is our industry from a total addressable market and compound average growth perspective (link)?

2. Does the target MSP have multiple avenues of growth?

3. How can we, as a financial sponsor, add value?

4. What is the path to generating an acceptable risk-adjusted return?

Mike McInerney, Director at Prospect Partners adds:

5. How many new customers / how much new business has the company added over time? In other words, what’s the pace of growth?

6. How does customer retention look?

7. Normalized cost structure – additions/subtractions to the existing P&L?

8. For add-ons, how do we integrate the businesses?

On the other hand, PEGs buying a MSP as an Add-On are much more focused on the strategic and financial benefits of adding an acquisition to an existing portfolio company. The strategic side is more clearly defined because the add-on is serving a more specific purpose (e.g. geographic expansion, new products, complementary customer base, economies of scale, etc.). Thus, the Add-On can be narrower in focus and growth potential.

For Add-On acquisitions, PEGs ask questions such as:

1. How does this acquisition support the platform company?

2. Does this make the two businesses more valuable together than separate and what are the tangible synergies?

3. How will this increase the overall return to investors and is this an acceptable return on capital?

MSP owners need to be aware of these differences in perspectives because they have a significant impact on how PEGs will view your business and what they are willing to pay. If you're an Add-on, you probably offer the PEG some synergies. If you are a New Platform, you probably need to prove your growth story more.

Where can you start?

1. Join a Peer Group (IT Nation Evolve Peer Groups by ConnectWise)

2. Email FOCUS’ MSP Team Leader, Abe Garver, or one of his references about their experience.

Abe Garver

Managing Director & MSP Team Leader

8065 Leesburg Pike, Suite 750

Vienna, VA 22182

Cell 646.620.6317 | Connect on LinkedIn

[email protected] | www.focusbankers.com/msp

Washington DC Metro | Atlanta | Los Angeles Metro |

#MSP#private equity#platform acquisition#add-on acquistion#abe garver#FOCUS Investment Banking MSP Team

0 notes

Text

Want To Launch A NextGen Commerce Business? Voila, 20 Business Models & A Community To Help At Shoptalk

Flightcar CEO Rujul Zaparde, poses outside a small rental shack on their lot in Burlingame, Calif. A San Francisco Bay area startup company founded by three teenage Ivy League dropouts is trying to change the airport car rental business. FlightCar rents out people's personal vehicles while they are traveling, giving them a share of the proceeds and free airport parking in exchange. (AP Photo/Eric Risberg)

How consumers discover, shop and buy has been changing at breakneck speed. And if you’re an entrepreneur interested in launching a next-generation commerce business but don’t know where to start, a new annual event called Shoptalk, which will be held on May 15-18, 2016 at the Aria in Las Vegas, may be just the springboard you need to find a community to help.

In addition to being an entrepreneur who sold his last tech company to Google in 2012 for over $200 million, Shoptalk’s co-founder Anil Aggarwal co-founded Money20/20, the world’s largest FinTech event. In his own words Aggarwal describes Shoptalk as a “Gathering of more than 2,000 industry stakeholders to share, network, collaborate and discuss how they can work to evolve commerce with innovation in business models and through technology”.

As I studied the agenda for the event and while there are plenty of established companies on the agenda, twenty distinct “NextGen Commerce” business models specifically jumped out at me. Here they are, including 44 separate examples:

Peer-to-Peer (FlightCar, HelloTech, DogVacay & Airbnb)

Subscription (Birchbox & Dollar Shave Club)

Rental (RocksBox, TheBlackTux and LeTote)

Marketplace + (Move Loot, Shift, Everything but the house, OfferUp)

On-demand professional services (UpCounsel & Hourly Nerd)

On-demand personal services (Hello Alfred & delivery.com)

On-demand home services (PaintZen & MakeSpace)

Vertically integrated direct to consumer (Casper)

Re-commerce (thredUP, Tradesy, Poshmark)

Virtual and augmented reality experiences (Modsy & ModiFace)

Disruption to value chain (Greats, Parachute, Madison Reed, Adore Me)

Car-enabled (Metromile & Automatic Labs)

Product returns (Shyp, Happy Returns)

Smart homes (Arrayent, ivee, & B8ta)

Product comes with a person (Enjoy)

Mass customization (Stich Fix)

Wearables (Ringly & OMsignal)

Guided (Laurel & Wolf & Plated)

Same day (Deliv, drizly)

Pickup (Curbside)

Who will be speaking to the community at Shoptalk?

When I asked Aggarwal to give me more color about the speaker group he said, “We’ve just pulled this information together: We have 65+ CEOs of disruptive direct-to-consumer start-ups, that have collectively raised over $7 billion in venture funding; 40+ established retailers and brands at the C, EVP, SVP and VP levels with over $1 trillion in sales; more than 10 heads of commerce, monetization and product from leading Internet companies, like eBay, Facebook Messenger, Google, Pinterest and Twitter; 60+ CEOs and executives from tech companies that are enabling commerce including startups that have raised more than $1.5 billion; and over 15 prominent VCs and more than 50 onsite mainstream and trade media.” One of my favorites is Bernardine Wu, Founder & CEO of FitForCommerce whose company helps retailers make smarter investment decisions. According to Shoptalk’s website, as of April 21, 2016 there were 318 confirmed speakers.

All working to redefine commerce

In my opinion, part of the genius of Shoptalk is that Aggarwal and his team realized from the outset that every voice in the retail and ecommerce ecosystem was important to include as part of a single community—and that’s an entirely new concept. "You can't have a bright line and just have a conversation with retailers talking to retailers. Similarly, you can't just have a conversation with startups getting together at a tech event or startups getting together with investors. Ultimately they're all working on redefining one thing—how consumers discover, shop and buy any product, service or experience—so you need them all together to have a rich and robust commerce conversation," said Aggarwal. “When we share our thesis, immediately people get it. Whether they're start-ups or established companies. They all recognize this is the new journey.”

Bottom Line

If you’re an entrepreneur interested in launching a next-generation commerce business but don’t know where to start, a new annual event called Shoptalk to be held on May 15-18, 2016 at the Aria in Las Vegas may be just the springboard you need. How consumers discover, shop and buy any product, service or experience is changing at a breakneck speed and as you peruse the agenda, twenty distinct “NextGen commerce” business models emerge. Lastly, in my opinion, it’s a safe bet that Shoptalk will exceed expectations in its inaugural year as its being put on by the guys and gals who grew Money20/20 into the world’s largest FinTech event.

Disclosure: The views contained in this article are my own and not those of my employer, BG Strategic Advisors. To avoid a conflict of interest, I don’t trade stocks.

#shoptalk#anil aggarwal#NextGen Commerce#ebay#$ebay#facebook#$FB#google#$goog#twitter#$twtr#flightcar#rujul zaparde#bernardine wu#FitForCommerce#amazon#$amzn

0 notes

Text

Groupon Buyout At $7.35?

The Groupon Inc. application as displayed on an Apple Inc. iPhone (Photo credit: Michael Nagle/Bloomberg)

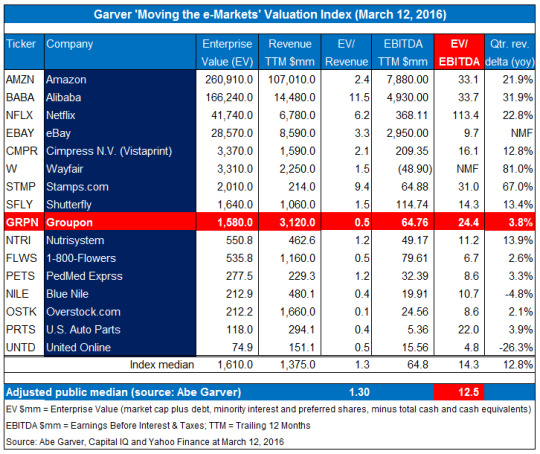

In a Global Credit Research report on August 17, 2015, Moody’s Investors Service stated, “While Liberty/QVC’s acquisition of zulily is strategic, it is fully priced, with the purchase price of $2.4 billion representing around 54 times zulily’s fiscal 2014 EBITDA (as defined by zulily) of $44 million.” Assuming Alibaba paid 54.0x EBITDA for Groupon, implied enterprise value is $3.5 billion dollars ($64.76 million of trailing-twelve-month EBITDA multiplied by 54.0x). Adding back $800 million of cash to implied enterprise value gives us a market capitalization of $4.3 billion, which when divided by 584.49 million shares outstanding suggests a per share valuation of $7.35.

‘Moving The E-Markets’ Valuation Index suggests Groupon’s stock is worth $2.75, not $7.35

Absent Alibaba’s disclosure that it purchased a 5.6% stake in Groupon, it’s reasonable to assume Groupon’s enterprise value would be $1.38 per share (12.5x EBTIDA) plus approximately 1.37 of cash equal to $2.75. If you’re thinking of buying the stock at its current level of $4.14 a share (in hopes that it may go to $7.35) be careful, because my read is that the market has already priced in a 100% buyout premium ($2.77 of enterprise value instead of $1.38). In other words if Alibaba were to take a step away from Groupon (e.g. sell its shares) shares could fall by 50% (from $4.15 to $2.75).

What is Groupon worth to Alibaba?

In The Art & Science Of Valuation: 10 Factors That Affect Your Firm’s Value I describe how sophisticated strategic buyers reach value conclusions. Since Groupon’s shares are publicly traded and the company is required to disclose certain business and financial information to the public, it was relatively easy for me to conclude that Groupon is worth $2.75 a share to a financial buyer. What we don’t know is how valuable Groupon is to Alibaba.

Why is Groupon important to Alibaba?

The best analysis I’ve read on the subject comes from fellow Forbes Contributor Doug Young in Alibaba Eyeing Buyout Bid with Groupon Investment?. In the article Doug concludes, “The biggest reason Alibaba would be interested in acquiring Groupon relates to concurrent developments in China, where Alibaba is dumping its relatively large stake in a leading local group buying site Meituan-Dianping. Alibaba’s reasons for selling the stake are complex, but the bottom line was that it didn’t get along with top management at the company, which was formed last year by the merger of the industry’s two leading players. Thus a Groupon buy could help Alibaba to quickly re-enter the group buying space, even though geographically Groupon has little or no operations in China.”

All Eyes on Demand, Purpose for Alibaba Mega-Loan

According to an even more recent story by Doug Young, All Eyes on Demand, Purpose for Alibaba Mega-Loan “Alibaba will come close to meeting the top end of its target of raising $3-$4 billion with a new bank loan, and chances are as much as 50-50 that it will use the funds to make bids for Groupon.”

Alibaba’s first substantial attempt to break into the U.S. retail market failed

As you may remember, Alibaba launched 11 Main to grow its U.S. presence before its record American IPO in June of 2014 (see Forbes). However one short year later the companyannounced it was selling 11 Main to rival marketplace OpenSky. At the time Scot Wingo, Executive Chairman of ChannelAdvisor summed up the problem, “11Main never seemed to get much traction with either buyers or sellers.” After such a setback, I’m almost certain Alibaba’s board wouldn’t have a problem over-paying for Groupon if it meant it could control the 3rd largest web-only retailer in the U.S (Amazon and eBay hold 1st and 2nd place, respectively).

Bottom Line

Assuming Alibaba paid 54.0x EBITDA (same multiple QVC paid for zulily) for Groupon, market capitalization is $4.3 billion, which when divided by 584.49 million shares outstanding suggests a per share valuation of $7.35. In my opinion, Absent Alibaba’s disclosure that it purchased a 5.6% stake in Groupon, shares of the company are worth $2.75.

If you’re thinking of buying the stock at its current level of $4.14 a share (in hopes that it may go to $7.35) be careful, because my read is that the market has already priced in a 100% buyout premium. At the same time there are compelling strategic reasons for Alibaba to buy including re-entery into the group-buying space, and opportunity to catapult its size ranking in the web-only U.S. retail market.

Disclosure: The views contained in this article are my own and not those of my employer, BG Strategic Advisors. To avoid a conflict of interest, I don’t trade stocks.

#$GRPN#$qvca#$baba#Groupon#QVC#Alibaba#zulily#amazon#$amzn#ebay#$ebay#Moving the e-Markets Index#Moving the e-Markets#e-commerce M&A#buyout

0 notes

Text

What’s in a name? A lot more business, Supply.com hopes

Guest post by NONA TEPPER Associate editor, B2BecNews

SUPPLY.com Co-Founders (L to R): Kevin Wallace, Marcus Morgan, and Heath Hyneman

Known until recently as National Builder Supply, Supply.com is updating its image and product line to reach out to a broader market.

With a new name and an expanding product line, wholesaler and retailer Supply.com has high hopes for growing its sales to a broader base of customers, says Matt Hobbs, director of user experience.

The company—until last month known as National Builder Supply—decided to switch to the snappier as well as more general Supply.com moniker in an effort to appeal to customers beyond its traditional base of building contractors. “‘Builder was in the old name, but a lot of our customers don’t identify as builders,” Hobbs says. “They identify as general plumbers, contractors and electricians. The new name is more authoritative, lets us speak to all these folks and opens up the opportunity to help the people we want to help.”

The new name will also help the company stand out in a market dominated by several major brands, he adds. “We’ve found ourselves in a competitive pool that includes brands like Home Depot, Amazon and Build.com,” Hobbs says. “We really had to step up our brand as a way to continue to grow. Our primary goal is to act as a solution that takes care of contractors, builders, designers, plumbers and helps them run their business better.”

Supply.com CEO Marcus Morgan figures there is plenty of potential for growth, particularly in its core market of plumbing and heating, ventilation and air-conditioning, or HVAC, supplies. “By our calculations, we’ve only touched 1% of the market,” he says in a blog posted on Supply.com, adding: “There are still 1 million contractors, designers, and remodelers who don’t know we exist. “

To read the complete article go to B2BeCommercWorld.com

Sign up for a free subscription to B2BecNews, a twice-weekly newsletter that covers technology and business trends in the growing B2B e-commerce industry.

B2BecNews is published by Vertical Web Media LLC, which also publishes the monthly business magazine Internet Retailer. Follow Nona Tepper, associate editor for B2B e-commerce, on Twitter @ntepper90.

#Supply.com#National Builder Supply#Matt Hobbs#Supply.com CEO Marcus Morgan#Marcus Morgan#Home Depot#Amazon#$HD#$AMZN#wolseley plc#$wos.l#build.com#Internet Retailer#Carey Tucker#lowe's#$low#Abe Garver#Kevin Wallace#Heath Hyneman#Heath Hyneman Co-Founder Supply.com#Kevin Wallace Co-Founder Supply.com#HVAC Supplies#Nona Tepper#@ntepper90#B2BecNews#Wayfair#$w

0 notes

Text

How e-retailers can drive additional sales between Black Friday and Christmas

Guest Post: BY TRACY MAPLE Managing Editor, Digital Content, Internet Retailer

With one big rush down and three weeks to go, online retailers can cater to their existing customers and keep targeting them with emails.

Diving into the details about existing customers can make a difference in holiday performance for online retailers, especially during the period between Thanksgiving and Christmas.

Knowing who bought what during this time last year can pay off this year, says Abe Garver, Managing Director of BG Strategic Advisors. “If I’m in charge at any online retailer who’s not in the top 250, I’m looking at who I’ve sold to before and going through those orders. I’m emailing them. If it takes calling customers on the phone, I’m doing that.”

Acquiring new customers is expensive, so it makes sense, especially for an e-retailer who isn’t Amazon.com or Kohl’s or Wal-Mart, to dig into its existing customer base and get those consumers to become repeat customers, he says. “The (retailers) at the top have been giving money away. It’s a sandbox that 750 (of the Top 1000) should not be in,” he says.

Building customer loyalty is a holiday and long-term strategy. Those retailers already have customers’ emails and phone numbers, so “be close to your top and existing customers and don’t chase everybody,” Garver says.

Email marketing figures to be a big part of many e-retailers’ strategy in the next three weeks. During Thanksgiving weekend, email marketing accounted for more than 15% of sales referrals between Thanksgiving and Sunday, and the number of sales generated by shoppers clicking from an email and buying jumped 25% over the same period a year ago, according to a report by Adobe Systems Inc.’s Adobe Digital Index. A report by marketing platform vendor Custora found that 25.1% of e-commerce transactions on Friday stemmed from shoppers clicking from emails.

Shipping deadline reminders are another way to motivate consumers to act, says Scot Wingo, chairman at ChannelAdvisor, which helps companies selling on Amazon Marketplace and other such venues. “Remind them of your shipping deadline as a helpful 'nudge' to get them to take action to make sure their items arrive for the holidays,” he says. “Another idea is weather. Let's say a snow storm is coming to the Northeast in five days—letting customers know of potential weather-related delays in that region could be enough to get them to take action to beat the snow.”

Amazon sellers need to focus on maintaining seller performance and managing their inventory, whether they’re using Fulfillment by Amazon to fulfill orders or handling that task themselves, says Peter Kearns, a former member of the Amazon Services team and now strategic customer success manager at automatic repricing services platform Feedvisor.

Seller performance also requires attention, Kearns says. “Sellers must be checking their Perfect Order Percentage (found under Account Health in Customer Satisfaction) to make sure it's over 95%. If it's not, they can download the bottom-performing ASINs (Amazon Standard Identification Numbers) report to make corrections or stop selling problematic ASINS,” he says.

Any notifications from Amazon require immediate attention and must not be ignored, Kearns says. “Now is not the time to get suspended, as it usually takes a few weeks for an account to be reinstated. An account suspension today will most likely mean the seller will be missing out on the rest of the holiday shopping season.”

And don’t forget how much procrastinators can add to the season.

A Deloitte study found that 44% of consumers surveyed planned to do most of their shopping in December and January, an increase from the 37% who said the same thing in 2013, when the study was last done.

“Use this prolonged shopping pattern to your advantage,” Ruth Hamer, director of digital marketing for pricing software company Marketyze, writes in a blog. “Purchases more evenly spread out across the holiday season means that you can fine-tune your supply chain logistics, as well as make sure that your deliveries are timely and customer satisfaction remains high.” Coupons for redemption later in the season or free shipping days can prompt customers to buy beyond peak days, she says.

“There's definitely a 'U shape' to the holiday,” Wingo says. Buyers are drawn in by Cyber Monday and the deals that follow that week, then they take a break and return as Dec. 25 nears. “Anything you can do to get folks out of that cycle is a huge benefit,” he says.

Follow @TracyCopygrrl and @AbeGarver on Twitter.

For a portfolio of Tracy’s stories click Internet Retailer.

#Tracy Maple#Internet Retailers#$amzn#Amazon#channel advisor#$ecom#$wmt#Walmart#Kohl's#$kss#Adobe#$adbe#Abe Garver#BG Strategic Advisors#drive additional sales between Black Friday and Christmas#Black Friday#Christmas

0 notes

Text

Online sales surge while in-stores sales drop to start the holidays

Guest Post: BY SANDRA GUY Senior Editor Internet Retailer

The future may hold far fewer and radically redesigned stores, analysts say.

Online retailers’ holiday sales increased 15%-16% thanks to strong showings on Black Friday and Cyber Monday, but in-store sales for the Thanksgiving holiday weekend declined 4.7%-10%, according to analytics reports out Tuesday.

Cyber Monday—the Monday after Thanksgiving-set a record as the largest online sales day ever, with $3.07 billion spent by end of the day, or 16% more than the $2.64 billion spent in 2014, according to Adobe Inc.’s Adobe Digital Index. Thanksgiving Day through Cyber Monday drove $11 billion in online sales, a 15% increase year over year and 30% of all online sales in November ($39.5 billion), the Adobe data show.

Moving into December the month’s first 18 days in December each are expected to generate $1 billion in online sales, Adobe says. Adobe measures 80% of all online transactions from the top 100 U.S. retailers.

In-store sales declined. RetailNext, which primarily compiles data about bricks-and-mortar stores, shows declines of 4.7% for the Thanksgiving weekend, while ShopperTrak, which monitors traffic to stores and malls, reported 10% declines during the holiday weekend.

Physical stores are far from dead, but as online sales take a bigger percentage of retailers’ overall sales, analysts expect fewer stores—and those will operate differently from how they have in the past, especially during the holidays.

Paula Rosenblum, managing partner at RSR Research, says no tipping point will occur until Black Friday no longer creates a shopping frenzy. When Black Friday fails to generate increased sales in stores, retailers will rethink paying overtime to employees and incurring extra utility and other expenses to open early, she says. “I’m fairly certain for no apparent reason that Target won’t open on Thanksgiving Day next year.”

Rosenblum says she believes the United States has had too many stores for more than 20 years, and chains already are opening smaller sites staffed with more highly trained workers.

Anne Marie Stephen, founder of Smart Women In Retail Leadership and CEO and founder of KWOLIA, a strategic advisory firm for retail and emerging retail technologies, says she agrees with a forecast in a recent CNBC series on the future of retail that 30% of the 1,000 shopping malls in the United States may shutter in the next 25 years “Online commerce will be a strong influence on this decreasing retail footprint,” she says. “Other trends we see today will also contribute, such as on-demand delivery services like Amazon Prime, Google Express and Uber that deliver goods within one hour. These e-retailers will have centralized warehouses that will use drones and autonomous cars to exclusively meet the needs of on-demand delivery.”

Consumers will become more comfortable renting apparel or other goods, she says. “You will be able to shop a virtual mall that appears in your living room via your entertainment and gaming systems. Store locations will continue to exist but they will become more experiential showrooms featuring products and services that connect consumers to the brand through touch, feel and community.”

Colin Sebastian, senior research analyst at investment firm Robert W. Baird & Co., says he won’t call a tipping point for retail until online sales growth soars significantly from one year to the next, say, to a 30% jump, because e-commerce holiday sales have been increasing at a 15% rate for several years now.

And there’s a difference between the results of large e-retailers and smaller merchants. Adobe’s research shows large retailers, those with average sales revenue of $25 million, grew sales 12% on Cyber Monday, while online sales for small retailers or those with average sales revenue of $100,000, increased by 6% year over year.

But Sebastian says, “There is going to be a lot of carnage in traditional bricks-and-mortar retail for companies that don’t adapt quickly to consumer expectations that are constantly shifting.”

In-store retailers must keep discounting prices in the short term to compete, he says. “The lever that in-store retailers think they can pull is to cut prices, but that’s not a game that ends well,” Sebastian says.

Hayley Silver, vice president of Bizrate Insights, says stores still matter. “The majority of retail still takes place in stores and 38% of online shoppers find shipping to a retail store or a local pickup of an online order important,” she says, citing a Bizrate Insights study of 6,767 online buyers.

Leslie Hand, vice president at IDC Retail Insights, says overall and not just during holiday periods, store sales still far outweigh Internet-based sales. “Retailers will have to continue to rationalize physical and online presence, as well as rethink how to attract customers to stores,” she says.

Matthew Nemer, consumer and retail equity analyst at Wells Fargo Securities, LLC, says his research shows the growing divide, with Amazon continuing to grab a larger share of the retail market.

“We estimate Amazon captured about 40% of all applicable retail growth dollars in the U.S. during the third quarter and 38% year-to-date in 2015, up from 21% in third quarter 2014 and 22% for all of 2014,” he says. “In contrast Wal-Mart has only captured 11% year to date, only including the two periods Wal-Mart has reported in 2015. This is an interesting reversal from prior to the recession when Wal-Mart was driving 13-16% of retail sales growth and over 20% prior to 2003 and Amazon was only driving 1-5%.”

Follow @SandraGuy and @AbeGarver on Twitter.

For a portfolio of Sandra’s stories click Internet Retailer and MuckRack

#$amzn#Amazon#$wmt#Walmart#$TGT#Target#$adbe#Adobe#$GOOG#Google#Internet Retailer#Sandra Guy#Abe Garver

0 notes

Text

Heavy Cyber Monday traffic takes down Target.com and slows PayPal

Guest Post: BY SANDRA GUY Senior Editor Internet Retailer

Shoppers received error messages at Target.com and PayPal customers experienced login delays early on Cyber Monday.

Target Corp.’s website appeared to be functioning by noon after earlier Cyber Monday traffic overwhelmed the retailer’s system, although mobile load times were slow. While the site was unavailable, a notice in large type greeted shoppers, urging them to hold tight while Target worked out the issues.

Target.com first went down at about 9 a.m. Central on Monday, expected to be the busiest online shopping day of the year.

“We are seeing a tremendous response to today’s 15% off sitewide offer,” Target said. “The volume is already twice as high as our busiest day ever, which occurred this past Thursday. We continue to receive and process thousands of orders from guests who are shopping the entire site and taking advantage of the discount coupled with free shipping.”

“As we experience spikes in traffic, our systems place guests in a queue and prompt them to access the site later,” Target’s statement continues. Target appeared to be diverting some customer traffic Monday to prevent overload, allowing the diverted shoppers onto the site once it could handle the load.

“We apologize to guests who experience any delays, we appreciate their patience, and encourage them to try again in a few minutes by refreshing their browser,” the spokesman said.

PayPal also experienced delays, as customers experienced problems logging in, according to a PayPal spokeswoman.

“Earlier today, PayPal experienced a brief, intermittent interruption in our service,” the payment services company said Monday at 11 a.m. Central. “We have resolved the issue and customers can pay with PayPal on Cyber Monday.”

Top500Guide.com data shows that 202 of the Top 1000 online retailers in Internet Retailer’s Top 500 and Second 500 Guides use PayPal as their payment systems vendor. PayPal, which also had an outage in late October, did not disclose what caused delays Monday.

As for Target, the retailer last week announced a website-wide discount of 15% on Cyber Monday and trumpeted free shipping and free returns on every order.Its website promoted deals on items ranging from bicycles to cameras to clothing to home decor.

While Target’s website was down, shoppers saw this on their screens: “Hold tight. So sorry, but high traffic’s causing delays. If you wouldn’t mind holding, we’ll refresh automatically and get things going ASAP. Thank you for your patience.”

Target.com had been performing well over the weekend. In fact, on Sunday afternoon it was the fastest-loading site of the e-retail sites Catchpoint was tracking, posting a median load time of only .99 seconds. Yet at 1:50 p.m. Central Time on Monday, Catchpoint described Target.com’s mobile load times as “still through the roof, as high as 21 seconds in our most recent measurements.”

Target’s decision to manage access to its site in order to prevent a site outage is in line with advice a website performance expert offered recently on the InternetRetailer.com blog. “Only allow as many customers into your web store as you can safely accommodate,” Sven Hammar, CEO of website monitoring and optimization firm Apica, wrote. “If not, all users will get poor response times and the site might cease to function for everyone. It is better to serve the customers who are already in the virtual store and let the others receive a polite error message or wait a little longer.

Target wasn’t the first retailer to suffer online traffic woes during the holiday weekend. Neiman Marcus, Newegg, HP, Jet.com, Saks, Victoria’s Secret, Shutterfly and Foot Locker experienced glitches, according to Catchpoint Systems, which tracks e-commerce sites’ performance.

Newegg had a brief outage early Sunday morning and then was down for 45 minutes starting at 11:30 a.m. Eastern, Catchpoint reported. There were intermittent problems on Foot Locker’s mobile commerce site caused by a third-party technology provider, Catchpoint said.

Like Newegg.com, NeimanMarcus.com was unavailable for a period on Friday. On Sunday, the Neiman Marcus site again experienced problems for much of the day.

A Neiman Marcus spokeswoman on Monday said, "Our site outages caused an inconsistent shopping experience over the weekend. We have seen no reason to suspect outside interference or sabotage; however, the exact cause of the outage has yet to be determined."

David Jones, a director of sales engineering at Dynatrace, a digital performance management firm, says he is not surprised by e-retailer outages because user visits to retailer websites as of mid-afternoon on Cyber Monday are easily 10%-15% higher than the highest peak experienced on Black Friday. Black Friday's peak, from 12:01 a.m. to 1 a.m. on Friday, saw three times the amount of traffic to retailers' websites than on a regular day, Jones says. Dynatrace doesn't give out traffic numbers, but Jones says the shopping traffic surges are colliding with retailers' ever more complicated e-commerce software and applications and shoppers' growing use of mobile devices to shop online.

Follow @SandraGuy and @AbeGarver on Twitter. For a portfolio of Sandra’s stories click Internet Retailer and MuckRack

#catchpoint#cyber monday#neiman marcus#newegg#overload#PayPal#site delays#site performance#target#victoria's secret#Sandra Guy#Internet Retailer#Internet Retailer 2015 Top 500 Guide#abe garver#BG Strategic Advisors#$TGT#$PYPL#$FL#$HPQ#$LB#$SFLY

0 notes

Text

Kohl’s hires away Walgreens’ e-commerce chief

Guest Post: BY SANDRA GUY Senior Editor Internet Retailer

Kohl’s aims to boost customer engagement with mobile devices and apps as Walgreen’s did under Sona Chawla’s leadership.

Kohl’s Corp. has hired Walgreens Boots Alliance Inc.’s e-commerce chief, Sona Chawla, to its newly created position of chief operating officer, as the department store aims to increase its customer engagement via apps, e-commerce and mobile devices.

Kohl’s, No. 22 in the Internet Retailer 2015 Top 500 Guide, announced Chawla’s hire Tuesday. Chawla, who will start Nov. 30, will oversee e-commerce strategy, information and digital technology, planning and operations, and logistics and supply chain network, in addition to store operations and store construction and design, Kohl’s said.

Kohl’s, which does not break out quarterly e-commerce sales, last week reported third-quarter earnings, and for the first nine months of the year, net revenue was $12.82 billion, up 1.2% from $12.67 billion during the same time last year. E-commerce sales for 2014 were $2.17 billion, up 23.3% from $1.76 billion in 2013, according to Top500Guide.com data. The company in September relaunched its mobile commerce site with an eye toward making it easier for on-the-go shoppers to buy online.

“Kohl’s want its apps, e-commerce and mobile strategy to help differentiate itself competitively and be seen as a thought leader in the digital space,” says Forrester Research analyst Brendan Witcher.

“Kohl’s is asking themselves, ‘How can we offer something new?’” he says. “When Neiman Marcus introduces Snap. Find. Shop feature, Kohl’s leaders are asking, ‘Why didn’t we do that? We need to bring in the kind of talent that can create that level of creativity.’”

CEO and president Kevin Mansell said of Chawla’s hire, “We saw an enormous opportunity to create something truly unique in retail—a leader who has oversight for the full omnichannel experience. When stores, online and digital teams are not just compatible but truly integrated, new thinking and new ways of delivering a seamless customer experience emerge.”

Chawla’s hiring also coincides with Kohl's push to target female customers as parents shopping for their families and as women looking for fashion and workplace apparel.

But challenges are ahead for Chawla and Kohl’s, Abe Garver, M&A adviser with BG Strategic, says. “Walgreen’s, where Sona comes from most recently, is a $90.3 billion dollar company, while Kohl’s is 10x smaller ($8.6 billion). I understand Kohl’s may be fast-tracking Sona to take over the CEO position, and I would bet on her to turn the e-commerce business around. My concern is that the deck is very stacked against her given her new employer has $5.1 billion of debt on the balance sheet,” Garver says.

As Walgreen’s president of digital and chief marketing officer, Chawla led a team responsible for increasing such customer conveniences as refilling prescriptions in seconds, printing photos from smartphones directly to stores, linking its loyalty program with Apple Pay, and launching digital health coaching and health apps. Walgreen is No. 44 in the 2015 Top 500 with an Internet Retailer-estimated $1.13 billion in web sales in 2014, up 15.4% from $975.0 million in 2013, Top 500 data shows.

Prior to joining Walgreens, Chawla was vice president of global online business at Dell Inc.; executive vice president of online sales, service and marketing at Wells Fargo’s Internet Services Group and worked at Andersen Consulting and Mitchell Madison Group.

Follow @SandraGuy and @AbeGarver on Twitter. For a portfolio of Sandra’s stories click Internet Retailer and MuckRack

#Abe Garver#BG Strategic Advisors#Internet Retailer#Internet Retailer 2015 Top 500 Guide#Sandra Guy#kohl's#Sona Chawla#walgreens#$KSS#$WBA#neiman marcus#Apple pay#$AAPL#Dell#Wells fargo#$WFC

1 note

·

View note

Text

Overstock Shares Plummet 21%, Should You Buy Or Avoid?

Overstock employees watch the company’s CEO Patrick Byrne parachute into the groundbreaking ceremony of the company’s new corporate campus, referred to as the “Peace Coliseum,” in Midvale on Friday, Oct. 10, 2014. (Laura Seitz, Deseret News)

It’s been a rough week for Overstock.com.

On Monday, Overstock.com reported its first loss in 15 quarters (-$2.1M vs. $1.6M in Q3 2014), an 18% increase in Sales and Marketing Expense ($30.1M vs. $25.4M), a 17% increase in G&A/Technology Expense ($45.8M vs. $39.3M), and a 48 basis point contraction in Gross Margin (18.5% vs. 19.0%). When the market opened the next morning investors pummeled shares to a fresh 52-week low of $13.74 (down 19%).

What’s really going on here, and should we buy at the 52-week low?

If the CEO of a web-only retailer tells me he believes his core business is inherently less efficient than his brick and mortar competitors, AND larger web-only retailers (e.g. Wayfair) are paying 2x to 3x what he believes to be the economically correct price (to advertise) on Google, I would never recommend you buy the shares. Here is exactly what CEO Dr. Patrick Byrne said: I think that in general, the Gods of economics think that the most efficient model is brick and click. There are such synergies between having a brick operation and a click because look at how much money we spend on marketing.Competition from the pure plays who’re getting huge funding and huge buckets of cash and who’re going out and spending — suddenly they’re bidding 2 or 3 times what we see as the economically correct price to bid for a term on Google. And they’re just throwing money and their shareholders are willing to accept $100 million losses and they’re saying this can be that way for however many years and such. (SA Transcript)

If a web-only retailer tells me its Gross Margin (markup above product cost) is contracting like Overstock’s (GM fell by 48 basis points in Q3) I would also never recommend the shares because directional changes in GM are positively correlated with future stock performance. For more color on this phenomenon read Here’s Why Amazon’s Gross Margins Could Expand Again.

Assuming $24.3M of, ttm EBITDA, a self-described inherently less efficient business model, competitors bidding 2 or 3 times the economically correct price for Google key words, and GMs that are compressing, I personally would not spend the next 4 years of hypothetical profits (e.g. $100M dollars) on a “Peace Coliseum” (new corporate campus) with a roof that from the air looks like a peace sign and from the ground level mimics the appearance of the Roman Coliseum. When asked by the Salt Lake Tribune to comment on the building’s design Byrne said, “The coliseum speaks to the fact we’re for the long term, we’re bold, we’re proud, we’re established. The peace sign is a reflection of the duality of man.” In its Q2 2015 investor deck Overstock offers more color on the financial terms (page 18) and benefits it sees (slide 20 below).

As an M&A advisor in the e-commerce sector I’m frequently asked to analyze new capital projects and provide an opinion as to how a company should deploy its capital if its objective is to maximize shareholder value. In other words when your family gets bigger is it better for you to add a bedroom to your house, or sell it and rent/buy a bigger one.

In my experience if you’re a web-only retailer competing on price (e.g. Overstock), its not mission critical that employees work in fancy class A office space. What is critical however is that your business be able to handle spikes in demand and not screw up orders. I’ve been in more than 50 e-commerce fulfillment centers over the past 5 years (where product is received, picked, packed and shipped to the customer) and will tell you that it is a very capital intensive business. Further, it is the exception rather than the rule for a CEO to decide to tie up capital in real estate as opposed to leasing space and outsourcing fulfillment to a 3PL (third-party logistics provider).

Eric McCollom who is President of Red Stag Fulfillment (a company I represent for potential clients in the e-commerce sector) had this to say, “Specifically to the $100MM spend on facilities… 3PLs offer scalable “pay for what you use” services that dramatically reduce the risk and eliminate the need for capital outlays required for growth. Perhaps Overstock’s cash could have been spent on activities to improve value to customers rather than on depreciable assets. Does Overstock want to be an e-retailer or a warehousing company. If the former, they should be focused on online marketing/SEO, product sourcing/pricing, and customer service.”

Bottom Line

As I’ve explained above, I don’t see a single reason to buy Overstock shares – candidly at any price. I’d love for someone to inform my thinking in the article comment section below if I’m missing something. The WSJ wrote an article in 2014 The Promise (and Limits) of Overstock’s Crypto Stock Exchange discussing a business that Overstock has been incubating for some time. I’m not an expert in Crypto Stock Exchanges, so perhaps there is value there, but until there are real profits I’m a skeptic.

I wrote this article myself and it expresses my opinions, and not those of my employer,BGSA. To avoid a conflict of interest, I don't trade stocks.

Click @AbeGarver to follow me on Twitter.

#Eric McCollom President Red Stag Fulfillment#RSF#Red Stag Fulfillment#Eric McCollom#Overstock.com#$OSTK#Wayfair#$W#Google#$AMZN#Amazon#Abe Garver#@AbeGarver#3PLs offer scalable “pay for what you use”#3PL#3PLs

1 note

·

View note

Text

Why Shopify Stock May Drop 40% After Q3 Beat

In Shopify’s Q3 2015 earnings report, the Company told us that 56.1% ($29.6M/$52.8M) of its revenue comes from ‘Subscription Solutions’ (a.k.a. Software-as-a-Service or SaaS) and the balance 43.9% ($29.6M/$52.8M) from ‘Merchant Solutions’. Why is this important?

Having recently represented a seller of an Inc. 500 Fastest Growing in the sale of its SaaS business, I know from negotiating valuation with sophisticated strategic and financial buyers (e.g. private equity groups) that investors won’t pay a premium SaaS valuation for any revenue that: (1) Isn’t SaaS or (2) Has a low customer retention rate. In the case of Shopify 43.9% of the Company’s revenue isn’t SaaS, and its customer retention rate (reported at over 100.0%) was calculated in a non-traditional manner that in my opinion significantly overstates retention.

Why I think Shopify stock could drop 40%

In Buy or Sell Shopify? What You Need To Know About Amazon’s Favorite Ecommerce Firm I stated that over a sample of 38 public Software-as-a-Service (SaaS) companies, enterprise value / revenue valuation multiples ranged between 2.0x and 28.9x, with a median of 6.8x and mean of 8.0x. If we counted all of Shopify’s revenue as SaaS (what I believe the market is doing right now) the Company shares currently trade at 15.1xrevenue. However only $81.23M ($144.8M * 56.1%) is SaaS.

Dividing Shopify’s $2.18B enterprise valuation by $81.23M of SaaS revenue implies a 26.8x enterprise value / revenue valuation multiple. That’s ridiculously high to me in light of the fact that merchant retention is ’consistent with what we would associate with early stage businesses’ (page 55 of Form F-1). Of course there is value in the low margin Merchant Solutions (Merchant Payment) business, but overall Shopify loses money and the merchant payment business is wildly competitive so I’m not inclined to assign a nose bleed valuation to that segment of the business.

101.0% customer retention rate ‘may be calculated in a manner different than (that) used by other companies’

(Financial table presented in F-1 Filing)

(As described in Form 6-K)

Key performance indicators that we use to evaluate our business, measure our performance, identify trends affecting our business, formulate financial projections and make strategic decisions include Monthly Recurring Revenue and Gross Merchandise Volume. Our key performance indicators may be calculated in a manner different than similar key performance indicators used by other companies. We calculate Monthly Recurring Revenue, or MRR, at the end of each period by multiplying the number of merchants who have subscription plans with us at the period end date by the average monthly subscription plan fee revenue in effect on the last day of that period, assuming they maintain their subscription plans the following month. MRR allows us to average our various pricing plans and billing periods into a single, consistent number that we can track over time. We also analyze the factors that make up MRR, specifically the number of paying merchants using our platform and changes in our average revenue earned from subscription plan fees per paying merchant. In addition, we use MRR to forecast and predict monthly, quarterly and annual subscription solutions revenue. We had $ 9.8 million of MRR as at September 30, 2015 .

The Big Picture

Although I’m critical of the company’s valuation, you may be surprised to hear that I am one of the 200,000+ merchants using its product (See ShoppablePics.com). In my experience a key point of differentiation that I’ve found is that merchants are able to sell products through Facebook, Twitter and Pinterest. Given the market for social commerce is so massive (FB has 1.5 billion monthly active, Instagram and Twitter are in the 300 million monthly active range) it’s likely that Shopify will continue to grow at a healthy clip, and ultimately become profitable. Until that happens though I would be a seller and not buyer of the stock.

Follow me on Twitter @AbeGarver

I am not receiving compensation for this article. I wrote it myself and it expresses my opinions, and not those of my employer, BGSA. To avoid a conflict of interest, I don't trade stocks.

#shop#Shopify#ShoppablePics#ShoppablePics.com#abe garver#Shopify Q3 2015 earnings report#SaaS Valuation#Inc 500 Fastest Growing

1 note

·

View note

Text

Tinder Owners Prep IPO: Should Investors Swipe Right?

Earlier this month, IAC’s Match Group, the online dating giant with 45 brands including Match.com, OkCupid and Tinder, filed an S-1 to go public.

Jonathan Badeen, Sean Rad and Justin Mateen of Tinder, photographed in their offices in west Hollywood, CA October 27 2014.

The filing noted one of the company’s strengths: “Connecting with people and fostering relationships are critical needs that influence everyone’s happiness.” But will a Match Group IPO be love at first sight for investors?

The Case to Swipe Right (Match Group has a lot going for it)

According to the Company’s prospectus, there’s a a lot to love about the company:

59 million monthly active users (MAUs) and approximately 4.7 million paid members

Dating products in 38 languages across more than 190 countries

A target market of approximately 511 million people which is estimated to grow to 672 million people by 2019

2014 revenue of $888.3 million with “substantially all” of its dating-services revenue coming from user membership fees

Trailing twelve months revenue of $1 billion ending June 30 this year, and revenue of $483.9 million for the first half of 2015.

2014 adjusted EBITDA of $273.4 million

The Case to Swipe Left (Match Group’s valuation may be too frothy)

What’s a reasonable valuation range for shares in Match Group’s IPO? As you read my opinion you should know that I don’t buy or sell individuals stocks to avoid a conflict of interest. I do however help strategic and institutional investors acquire private companies, and credit the experiences I’ve had with giving me a sixth sense for valuation.

The 9 Factors I consider to be most relevant in valuing the shares of Match Group, Inc.

I believe a modified version of the criteria I outlined in The Art & Science Of Valuation: 10 Factors That Affect Your Firm’s Value, is appropriate. Here are the 9 factors I view as being the most important:

Customer acquisition cost

Lifetime value of customers (function of customer retention rate)

Addressable market size and share

Growth rates associated with revenue, EBTIDA (earnings before taxes and interest, plus depreciation and amortization) and gross margin

Whether gross margins are expanding or contracting (See: Is Gross Margin Our New Prophet?)

Match Group’s reputation with and closeness to its customers (e.g. process used to measure and rankings)

The amount of recurring revenue (e.g. DollarShaveClub)

Discount for lack of control (From the S-1, “IAC controls our company and will have the ability to control the direction of our business”

Valuations paid in M&A Transactions ($575M cash for $100M revenue PlentyOfFish.com)

Reduced reporting requirements will make it more difficult to assign a reasonable valuation

As a company with less than $1.0 billion in revenue during its last fiscal year, Match Group qualifies as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. This means the company may take advantage of reduced reporting requirements generally unavailable to other public companies. These reduced reporting requirements allow Match Group to:

Provide less than five years of selected financial data in an initial public offering registration statement

Provide reduced disclosure regarding its executive compensation arrangements pursuant to the rules applicable to smaller reporting companies, which means it does not have to include a compensation discussion and analysis and certain other disclosure regarding its executive compensation, and

Not provide an auditor attestation of its internal control over financial reporting

It’s safe to assume that someone will propose $5 billion dollar as a ’reasonable’ valuation

As we get closer to the IPO date when more information has been disclosed, I’ll drill down into each of the 9 factors and opine on a reasonable valuation. Similar to Wayfair’s IPO there will be a journalist without, or analyst with, a conflict of interest who proffers a number (e.g. Forbes Staff writer Abram Brown was the 1st propose what he thought was a ‘reasonable’ valuation of Wayfair). Shortly after a bunch of us including the underwriters and company will opine on its reasonableness (e.g. After Abram Brown proposed a valuation for Wayfair I wrote Wayfair IPO Pricing: Hardly Fair?).

Stay tuned for the debate by following me on Forbes and Twitter @AbeGarver. It is bound to be colorful.

I am not receiving compensation for this article. I wrote it myself and it expresses my opinions, and not those of my employer, BGSA. To avoid a conflict of interest, I don't trade stocks.

#Tinder#IAC’s Match Group#Match.com#okcupid#online dating#Abe Garver#BG Strategic Advisors#IPO#Match IPO#plentyoffish#Swipe right#business valuation#$IACI

0 notes

Text

Buy Or Sell Share of Shopify? What You Need To Know About Amazon's Favorite Ecommerce Firm

Summary

Shopify's stock is up 113% since it's May 21, 2015 IPO, due in part to recenlty announced partnerships with Facebook, Amazon and Twitter.

Shopify is growing revenues quickly (average 89.7% quarterly year-over-year growth), however its SaaS (Software as a Service) revenue is growing slower than its Merchant Payment (MP) revenue.

Mix of revenue is approximately 60% SaaS and 40% MP. According to its financial disclosures, MP revenue is much lower margin, than SaaS.

Shopify stated in its offering documents that merchant retention is 'consistent with what we would associate with early stage businesses'

From a valuation perspective, there are a number of red flags for us to keep out eyes on.

Shopify offers a cloud-based all-in-one commerce platform that's used by more than 175,000 small business merchants. On it's first day of trading in May, shares skyrocketed 51% (from $17 to $25.68). In less than five months the stock is up another 41% (to $36.21). The company's market capitalization (# of shares outstanding multiplied by stock price) is $3.0 billion dollars. In the latest twelve months Shopify lost $16.9 million dollars, on $144.8 million of revenue. What is driving the meteoric rise in the stock, and should you be a buyer or seller of Shopify stock (NYSE: SHOP)?

Recent Partnership Announcements with Facebook, Amazon Twitter and Pinterest

The market for social commerce is a massive. And new sites like ShoppablePics.com are springing up help facilitate it. Facebook (NASDAQ:FB) has 1.5 billion monthly active, Instagram and Twitter (NYSE:TWTR) are in the 300 million monthly active range). On September 16, Facebook said Shopify merchants will soon be able to sell their wares through a new Shop section on small business Facebook pages. When a user clicks on a product, merchants can either direct shoppers from Facebook to their online store or let them checkout directly on the Facebook site or mobile app. Shopify will handle payment processing and transaction tracking. On September 17, Amazon (NASDAQ:AMZN) selected Shopify to be its preferred platform for helping small and midsize retailers build and manage online stores. Then on October 6, Shopify launched a partnership with Twitter to allow Shopify merchants to sell products directly on Twitter. Twitter's "Buy Now" buttons will be available to U.S.-based Shopify merchants. The Canadian company has also inked a partnership with Pinterest that allow its merchants to sell products via buyable Pins.

Financial considerations

Shopify is growing revenues quickly (average 89.7% quarterly year-over-year growth), however its SaaS (Software as a Service) revenue is growing slower than its Merchant Payment (MP) revenue

Mix of revenue is approximately 60% SaaS and 40% MP

According to its financial disclosures, MP revenue is much lower margin, than SaaS

To be successful, SaaS companies count on very high user retention (e.g. 90% of new merchants are still customers at the end of the year)

Shopify stated in its offering documents that merchant retention is 'consistent with what we would associate with early stage businesses'

8 out of 10 SMBs fail in the first 18 months (Forbes)

Shopify merchant perspective

About a month ago I decided to experiment with the Shopify platform to see how much time and effort it would really take to launch a business on the platform. Here is what I found:

In general the platform is robust there is a growing community of 3rd-party app developers (who have created about 1,000 apps)

There is a steep learning curve to get up and running (I'm still not 100% ready to launch ShoppablePics.com)

When I needed phone support to customize my site, the experience was akin to Apple's (NASDAQ:AAPL) genius bar (no availability today)

The 20 minute support call I scheduled, didn't resolve all my issues, so it was recommended that I hire a 3rd-party "expert"

"Liquid", the backbone of Shopify themes (and also used to load dynamic content on storefronts) is not a common programming language

I tend to complete things that I start, so expect the store to be live soon

The jury is out on whether I'll still be a Shopify merchant 12 months from now

Should you sell Shopify Stock?

In order to avoid any conflict of interest I don't trade individual stocks. I also don't give price targets. However I will tell you that I believe Shopify's stock is currently overvalued and here is why.

In an article I wrote last year I reported that enterprise value / revenue multiples ranged between 2.0x and 28.9x over a sample of 38 public SaaS companies. After having dug into Shopify's financial statements, my sense is that about 60% of Shopify's $144.8 million dollars of revenue is SaaS. In other words there is about $86.9 million in the latest twelve months.

Of course there is value in the low margin MP business, but if we stripped that out, today's $3 billion dollar valuation implies a 34.5x multiple to SaaS revenue. That's ridiculously high to me in light of the fact that merchant retention is 'consistent with what we would associate with early stage businesses'. My own experience on the platform also confirms this.

Yes, Shopify's potential to become an integral part of the selling process on Facebook is exciting. Personally I'll wait until the company begins to 'show me the money' before recommending that anyone buy shares.

If you found the article to be informative and are interested in the state-of-the-art for ‘social commerce’ follow me on Twitter @abegarver

Disclosure: The opinions expressed in this article are my own and not those of my employer, BG Strategic Adivsors.

#ShoppablePics.com#abe garver#ShoppablePics#Social Commerce#Shopify#$SHOP#Amazon#$AMZN#Facebook#$FB#Twitter#$TWTR#pinterest#apple#$aapl#@abegarver#Moving the e-Markets Index#Moving the e-Markets#Forbes

0 notes

Text

Shareholders seek class-action lawsuit against Zulily over its $2.4 billion acquisition by QVC

(Guest post) BY SANDRA GUY Senior Editor, Internet Retailer To follow @Sandraguy or email [email protected] (photo credit Brendan McDermid / Reuters Traders at a Goldman Sachs kiosk at the New York Stock Exchange.)

Complaints allege flash-sale merchant’s top insiders and executives influenced the sale on terms that unfairly disadvantage Zulily’s public shareholders.

Zulily Inc.’s shareholders aren’t going down without a legal fight when it comes to the discount online merchant’s sale to QVC.

Three Zulily shareholders seek to have their lawsuits joined in a class action to fight what they allege are terms that are unfair to public stockholders in the company’s $2.4 billion sale to QVC.

Zulily, the publicly traded flash-sale merchant that grew sales to more than $1.2 billion in five years, has recently fought slowing growth, and its shares have plunged 46% year to date. Zulily’s shares, which closed at $17.78 on Tuesday are down 73.9% from the stock’s all-time high of $68 per share in February 2014. Zulily, No. 39 in the Internet Retailer 2015 Top 500 Guide, uses a business model that has limited up-front inventory risk, as it doesn’t purchase products and house inventory until consumers purchase items on its website. This makes for a complicated and time-consuming fulfillment process, as truckloads of products are pouring into and out of its warehouses on a daily basis. It also leads Zulily to have one of the longest delivery times among large online retailers, as most of its items arrive on consumer doorsteps in about two weeks, on average.

Liberty Interactive Corp., the parent company of home shopping giant QVC (No. 15 in the 2015 Top 500), is paying $18.75 per share for Zulily—a 4.7% premium over Zulily’s latest stock-price close. But the price is less than Zulily’s $22 a share value when Zulily went public in November 2013.

In separate lawsuits, three public shareholders claim the transaction is unfair to them and that the statement telling shareholders to tender their shares contained material omissions.

The lawsuits allege that Zulily’s sale had been decided from early on because Vadon and Cavens not only stood to benefit personally, but also had the support of two of Zulily’s biggest early investors—private equity firms Andreessen Horowitz and Maveron Equity Partners.

To support the claim, they point out that Zulily co-founders Mark Vadon and Darrell Cavens will collectively make more than $1 billion from the deal—Vadon $648 million from his 34 million shares, while Cavens, $394 million due to his 21 million shares. The two men, along with other Zulily directors and executive officers, collectively own 91.3% of the voting power of Zulily’s outstanding capital stock. “The economic interests of Maveron and Andreessen Horowitz undoubtedly influenced the board’s sale process, as their willingness to invest in Zulily were critical components to the company’s early growth,” the lawsuits say. “But private equity firms are eager to cash out on their investments and return capital to their investors. Accordingly, the interests of Maveron and Andreessen Horowitz are not fairly aligned with Zulily’s other public stockholders because both firms acquired a significant portion of their Zulily shares below market price.” Andreessen Horowitz will net about $78 million in cash and stock before taxes, while Maveron’s stake is worth about $107.1 million, almost all in capital gains, the lawsuits allege. The complaints also allege the defendants failed to disclose other important financial information such as Goldman Sachs’s economic interest in a big Liberty Interactive shareholder.

The shareholders—Scott Mao, Karan Jugal and Patrick Pisano—seek class-action status for similar shareholders and a jury trial. Lawyers for the plaintiffs had no further comment. Zulily spokeswoman Andrea Conrad says the company does not comment on pending litigation.

Such shareholder lawsuits are not uncommon in blockbuster merger-and-acquisition deals, according to industry research. The average deal valued over $100 million garnered 4.5 lawsuits in 2014, according to data compiled by Cornerstone Research. Only one such case went to trial in 2014—the 2011 buyout of Rural/Metro Corp. by Warburg Pincus.

The companies’ executives laud the deal as benefiting both businesses since Zulily, whose customers are mostly children and so-called Millennium moms seeking discounted toys and clothes, would supplement QVC’s audience of older shoppers who make purchases with a TV remote. The company says Zulily will be able to leverage QVC’s global assets, vendor relationships and video commerce experience, while QVC will benefit from Zulily’s younger customer demographic, personalization expertise and e-commerce capabilities.

Abe Garver, managing director at BG Strategic Advisors, says, “It’s a pretty weak case to say shareholders got a bad deal for three reasons: Liberty’s offer reflects a 49% premium from Zulily’s share price; in a rare apology, investment banking firm Stifel says Zulily’s stock was fairly valued at $12 on May 6, not its previous price target of $24; and Goldman Sachs & Co. wrote that the deal was fair, knowing its conclusion would get challenged in court.”

QVC reported $8.8 billion in revenue in 2014, of which $3.5 billion came from e-commerce.

Zulily posted revenue of $298 million during the second quarter, and forecast $1.3 billion to $1.4 billion in sales for the year.

If you’re interested in more breaking news about QVC’s acquisition of zulily, or hot topics “Moving the e-markets”, follow me on Twitter @AbeGarver

I (Abe Garver) am not receiving compensation for this article, it expresses my own opinions, and not those of my employer, BGSA.

#zulily#$Zu#Liberty Interactive#$qvca#$qvcb#goldman sachs#$gs#Sandra Guy#Internet Retailer#abe garver#BG Strategic Advisors#Maveron Equity Partners#Mark Vadon#Andreessen Horowitz#darrell cavens#e - commerce#Internet Retailer 2015 Top 500 Guide

0 notes

Text

The Art & Science Of Online Retail Valuation: 10 Factors That Affect Your Firm's Value

Amazon.com founder and CEO Jeff Bezos (Photo credit SAJJAD HUSSAIN/AFP/Getty Images)

I recently helped business leaders of one of the largest online retailers in the world in the divestiture of 11 e-commerce businesses. At the end of the day my client pocketed millions, and I strengthened my relationship with its $13 billion dollar private equity group investor.

I can tell you that sophisticated strategic and financial buyers reach value conclusions after considering each of the following factors, and you should too:

The ‘Art’ of valuation: Top 10 factors influencing value today

Fulfillment economics (e.g. number of orders, average weight, annual shipping spend, whether in-house or outsourced, etc.)

Expansion or contraction in the retailer’s gross margin (See: Is Gross Margin Our New Prophet?)

Reputation with customers (e.g. process used to measure and rankings)

Growth rates associated with revenue, EBTIDA (earnings before taxes and interest, plus depreciation and amortization) and gross margin

Percentage of revenue derived from 1st party sales (e.g. retailer takes physical ownership of inventory and percentage of revenue derived from 3rd party sales

Amount of recurring revenue in both 1st and 3rd party sales (e.g. DollarShaveClub and Amazon’s Web Services, respectively)

Percentage of revenue derived from sales in 3rd party marketplaces (e.g. Amazon Marketplace or eBay)

Closeness to the customer (e.g. when a merchant sells through Amazon’s marketplace it is not given its customer’s email address)

Customer acquisition cost, lifetime value, and market share

Marketability (e.g. how easy is it to convert stockholder’s equity to cash)

Not all ‘Art’ factors are created equal

For example, if 100% of revenue is recurring (Factor #6) the business could be worth 2x-3x more than if it had no recurring revenue. At the same time, if 100% of revenue is derived from sales in 3rd party marketplaces (Factor #7) a 90% haircut may be warranted.

The ‘Science’ of valuation:

Top factors influencing value todayFrom a ‘Science’ perspective, the Guideline Public, and comparable transaction methods are used more frequently than the discounted cash-flow method.A widely used source for the Guideline Public Company method is the ‘Moving the e-Markets Valuation Index’, (See: Yahoo Finance, Seeking Alpha, or email the publisher)

The 17 publicly traded companies that make up the Index are: Alibaba, Amazon, Blue Nile, Cypress, eBay, Groupon, Netflix, Nutrisystem, Overstock.com, PetMed Express, Shutterfly, Stamps.com, United Online, U.S. Auto Parts, Wayfair, zulily, and 1-800-FLOWERS.

What are the Guideline Public Company Multiples Today?

To make a long story short, a reasonable starting place for public company valuation (based on the adjusted medians in the Moving the e-Markets Valuation Index) is 1.0x revenue, and 17.5x EBITDA (earnings before interest and taxes, plus depreciation and amortization). See below:

What are the Guideline Private Company Multiples Today?

A reasonable starting place for private company valuation (based on the adjusted medians in the Moving the e-Markets Valuation Index) is 0.2x revenue, and 4.5x EBITDA (remember valuation multiples for private companies are generally smaller because discounts have been applied for lack of marketability). See below:

About the Guideline Public Company Method

The Guideline Public Company method involves a comparison of the subject company to publicly traded companies. The comparison is generally based on published data regarding the public companies’ stock price and earnings, sales, or revenues, which is expressed as a fraction known as a “multiple.”

If the guideline public companies are sufficiently similar to each other and the subject company to permit a meaningful comparison, then their multiples should be similar. The public companies identified for comparison purposes should be similar to the subject company in terms of industry, product lines, market, growth, margins and risk.

If the subject company is privately owned, its value must be adjusted for lack of marketability. This is usually represented by a discount, or a percentage reduction in the value of the company when compared to its publicly traded counterparts. This reflects the higher risk associated with holding stock in a private company.

The difference in value can be quantified by applying a discount for lack of marketability. This discount is determined by studying prices paid for shares of ownership in private companies that eventually offer their stock in a public offering. Alternatively, the lack of marketability can be assessed by comparing the prices paid for restricted shares to fully marketable shares of stock of public companies.

I am not receiving compensation for this article, I wrote it myself, and it expresses my own opinions, and not those of my employer, BGSA.

Follow me Twitter @AbeGarver or email [email protected]

#$amzn#$baba#$nflx#$ebay#$w#$cmpr#$grpn#$sfly#$zu#$stmp#$flws#$ntri#$ostk#$nile#$pets#$untd#$prts#Amazon#Alibaba#Netflix#eBay#Groupon#Shutterfly#zulily#stamps.com#1-800-Flowers#nutrisystem#Overstock#Blue Nile#petmed express

1 note

·

View note

Text

Will Gay Marriage Ruling provide an economic windfall to 1-800-FLOWERS.COM, Inc.? (Stock down 11.7% today)

Each week I trade insights with some of the most influential minds (CEOs, boards, shareholders, and leading journalists) in the e-commerce sector. Here are my thoughts after the earnings call. Find me @AbeGarver

I don’t believe shareholders are going to benefit much at all

In my opinion, it’s safe to assume that the Supreme Court Ruling making same-sex marriage a right nationwide will not provide an economic windfall to 1-800-FLOWERS.COM (NasdaqGS: FLWS) given the company’s announcement today that consolidated revenue growth in Fiscal 2016 will be in the 5%-7% range.

Here is why company’s Fiscal 2016 revenue guidance today was surprising

On the surface the guidance is surprising for two reasons:

(1) Last year FLWS was named to Internet Retailer’s 2015 Top 500 for fast growing e-commerce companies turning in 51.3% growth

(2) in an article last year, the Washington Post estimated that the (Supreme Court) decision could prove to be a $2.6 billion economic windfall for the wedding industry in the next three years when passed across the U.S.

1-800-FLOWERS is not a ‘Pure-play’ beneficiary of the Gay Marriage Ruling

Under the hood however, FLWS primary business (as a result of the Harry & David acquisition last year) is now Gourmet Food and Gift Baskets ($614.0M), followed by Consumer Floral ($422.2M), and Bloom Wire Services ($86.0M). In addition, we know occasions other than weddings (e.g. Mother’s Day, Valentine’s Day) contribute to the Consumer Floral and Bloom Wire Services. In other words FLWS is not a pure-play.

Here are two companies that could benefit however

If you are trying to profit from the Supreme Court’s gay marriage ruling, BlueNile.com (core business is the engagement category), and XO Group, Inc. (The Knot - the nation’s leading wedding resource) may be more attractive.

If you’re interested in more breaking news about the e-commerce sector including 1-800-FLOWERS, Blue Nile, or XO Group, please follow me on Twitter @AbeGarver

#abe garver#@abegarver#Moving the e-Markets#$flws#1-800-flowers#Blue Nile#$NILE#xo group#$XOXO#The Knot#gay marriage ruling#Internet Retailer#valentine's day#Mother's day#ecommerce#same-sex marriage

3 notes

·

View notes

Text

Dimensional Weight Pricing: How a ‘17 pound’ feather can affect your ecommerce profit margins

BY DANIEL BURSTEIN, Director of Editorial Content, MarketingSherpa MECLABS Twitter @DanielBurstein

Ecommerce has long been considered to have a cost advantage over brick-and-mortar retailers. After all, real estate, inventory and human resource costs are all lower.

However, these reduced costs come at an expense — Internet retailers rely on a third-party for fulfillment. Which means their margins and perhaps overall business model is at the mercy of other companies.

This dependency became all the more clear recently when UPS and FedEx announced a significant change to shipping policies by applying dimensional weight pricing (also known as DIM) to all ground shipments. This means that the size (length, weight and height) of even lightweight objects could cause increases in shipping costs for ecommerce vendors.

A concrete example of this is The Wall Street Journal estimating a 37% increase in price for a 32-pack of toilet paper and a 35% increase for a two-slice toaster.

How shipping changes are affecting ecommerce companies (7 min. Interview)

At the MarketingSherpa Media Center at IRCE 2015, I spoke with Abe Garver, a Contributor to Yahoo! Finance and an M&A (mergers and acquisitions) investment banker, to discuss how these shipping changes are affecting ecommerce companies. Abe used the example of a peacock feather — which may really only weight six ounces, but due to its large size is considered weighing 17 pounds when calculating the cost of shipping.

In speaking with CEOs at some of the top ecommerce companies, “I’ve heard it referred to as a once-in-a-generation change,” Abe told me.

If your company is impacted by dimensional pricing, here are some fulfillment tips:

1. Evaluate other shipping companies.

The U.S. Postal Service proudly advertises that “this change means that our competitors now apply DIM weight pricing to most packages, while USPS only uses DIM weight pricing in very specific circumstances.”

2. Consider outsourcing your fulfillment.

Of course, Fulfillment by Amazon is well known, but you could also consider working with a 3PL (third-party logistics provider) like Shipwire, Red Stag Fulfillment, Rakuten, etc. for your ecommerce order fulfillment to leverage volume discounts with UPS or FedEx.

3. Re-evaluate your product mix.

Perhaps ecommerce isn’t the most cost-competitive sales channel for products like pregnancy pillows, metal detectors and other lightweight but large items. As Pets.com learned the hard way, even a Super Bowl commercial isn’t powerful enough to overcome a product that isn’t economical to fulfill.

You can follow Daniel Burstein, Director of Editorial Content, MarketingSherpa, @DanielBurstein If you’re interested in more breaking news about the ecommerce sector including FedEx, UPS please follow me on Twitter @AbeGarver

#dimensional weight pricing#DIM Pricing#Daniel Burstein#MarketingSherpa#Amazon#$AMZN#UPS#$UPS#FedEx#$FDX#red stag fulfillment#Eric McCollom#petsmart#Pets.com#Super Bowl#@DanielBurstein#third party logistics provider#3PL#U.S. Postal Service#USPS#ecommerce#e-commerce#Abe Garver#@abegarver#BG Strategic Advisors#Peacock feather#MarketingSherpa Media Center at IRCE 2015#irce2015#Internet Retailer#ecommerce profit margins

2 notes

·

View notes

Text

'Red Monday' time-bomb lit on July 21, 2015 (Apple's Q3 Earnings Announcement)

Picture credit: redpilltimes

From an e-commerce perspective, the time-bomb which exploded this morning in the U.S. markets (Dow down 1,000 points) was lit on July 21. 2015, the day Apple announced its Q3 results, and said China sales had tumbled by 21% from $16.8 billion to $13.2 billion.

To see what I mean (a picture is worth 1,000 words) compare the performance of Alibaba's stock which fell to a new post-IPO low of $58 this morning, to that of Amazon, Google and Facebook over a one (1) day and 6-month period. Alibaba has tanked, while AMZN, GOOG and FB have appreciated.

1-day chart comparing Alibaba to Amazon, Google and Facebook

6-month chart comparing Alibaba to Amazon, Google and Facebook

China is 90% of the issue, our Fed perhaps the other 10%. In the days, weeks and months to come, watch Alibaba. When it turns, we'll all be back to the 'new normal'. In the mean time there is no question in my mind that we will test today’s lows again.

If you’re interested in more insightful perspectives about Alibaba, Amazon, Google, Facebook and Apple, or direction of their stocks, please follow me on Twitter @AbeGarver