Text

Market Profile the technique for successful trading

A market profile is an indicator that shows the number of traded contracts at each price level of a trading instrument. If you want to earn money by trading then you must follow few essential steps they are Observations, studies, and analysis. Stock market speculation has nothing to do with luck but is based on observing trends and developing strategy.

When did the market profile concept start?

The first market profile was shown to the world in 1984. The market profile was developed by Chicago Mercantile Exchange trader Peter Steidlmeier, who also proposed the concept of a market auction. It was believed that the market develops from balance to trend, and then again to balance, and this cycle is constantly repeated. On the chart, the balance can be recognized by a balanced distribution or a bell-shaped curve.

The basic idea:

Every day the market develops a certain range and within it, the value area (area of value), which represents a zone of some equilibrium, where there is an equal number of buyers and sellers.

If prices go beyond the value area, but volumes begin to decline, then there is a possibility that the price will return back to the balance zone. Price movements outside the balance sheet area without significant volumes indicate that the main buyers and sellers are outside the market. The deviation of the price from the balance zone, accompanied by an increase in trading activity, indicates to us that market participants overestimate the existing value.

Popular tool for professionals

Market Profile is an analysis chart, which represents price movements in the market. It was designed by J. Peter Steidlmayer in the 80s and popularized in the 90s by J. Dalton. This financial chart represents the evolution of price volumes and prices, thus allowing us to see the trend and better anticipate their future direction. The Market Profile is used by many industry players, including investors and analysts. Whether the trend is bearish, bullish, or in the range, it can provide essential information for decision-makers. The very purpose of this tool is to contribute to the definition of strategies and decision-making. Due to its efficiency, the Market Profile is constantly used by professionals. And, today, more and more individuals are carrying out their analyzes using this tool, which is just as easy to use.

How does that work?

The market profile is presented as a histogram, in which volume areas and price levels are displayed. The VA or Value Area is specifically the area where 70% of trades were recorded during the session. Val (Value Area Low) represents the lowest level, while VAH (Value Area High) represents the highest level. The POC (Point of control) is the price level most frequently used by the course during the session. The IB (Initial Balance) is the characteristic of the price range during the first 60 minutes of quotation and, finally, the FB (Final Balance) represents the price range during the last hour of quotation. The use of the Market Profile is based on these key elements and above all allows you to anticipate the evolution of the price of an asset.

Market profile indicator and Market profile arithmetic

According to the original theory, in order to work on the market profile, you need to analyze the chart at a 30-minute time interval. The concept of a market profile assumes that there will be some logical form in the market, which consists of price, time, and volume. Typically, the profile corresponds to the mathematical line of the normal distribution.

Every day the market finds a certain zone, which is called the value zone or value area – you can say, the equilibrium zone, where the number of sellers is equal to the number of buyers. Where the current price of an asset is located relative to the equilibrium zone can give you knowledge of what price level you may consider fair to discard speculative prices.

A basic understanding of what a market profile is, how it works, and how to apply it will come in handy for any market participant, with any level of experience and with any trading style. This indicator is developed by us futures market traders and it provides the trader with incredible information about the current state of market affairs. Previously, such data was not available to a simple trader. In the old days, it was known only to traders with "pits" - exchange halls for live trading. The market profile will give a visual representation of the logic of the market and its structure, which is tied to time, trading volume, and price.

The market profile indicator is not an ordinary indicator of technical analysis. It does not give classic signals to enter and exit the market, the trader will have to analyze the incoming data on his own, and make a decision on the entry and exit point himself. The indicator is practically devoid of disadvantages, it will be useful as an independent CU or an addition to any existing trading system because it gives the trader knowledge about where the equilibrium price level is, and who is now gaining a large position to buy or sell.

0 notes

Text

Strategies for Nifty future trading, that you should know!

Nifty future is a very popular term in the trading market. Nifty genuinely represents the market specifically and the economy overall. If you want to know the future contracts on Nifty and Nifty future gives you the best solution. The base lot size of the Nifty is 75 units which make the parcel esteem at a little over Rs.7.50 lakhs. What are the ways to exchange Nifty prospects and what are the Nifty future strategies? Allow us to find some of the most important tips that will help us on the most proficient method to exchange Nifty prospects intraday and for the more extended term.

Strategy 1: Check out the Future spread over spot

In Future trading, the future typically exchanges at a spread over spot cost. Under ordinary circumstances, the prevailing cost of funds decides monthly spread over the spot. It is likewise called the expense of conveying and prospects typically statement along with some built-in costs. Two things you want to recall here. Try not to purchase Nifty prospects when it is at a precarious premium to the spot list as it very well may be an instance of overpricing and an excessive amount of hopefulness. Likewise don't bounce in to purchase when the Nifty fates at a rebate as it very well may be an indication of forceful fates selling. Get the rationale of the spread before exchanging Nifty prospects.

Strategy 2: Utilized this position and treat it appropriately

Like all other future positions nifty future is also leveraged. Whenever you get one parcel of Nifty in close to a month, your edge is around 10% for typical exchanges and 5% for MIS (intraday) exchanges. That implies you get multiple times utilized in an ordinary exchange and multiple times influence in intraday exchanges. This works the two different ways. Influence implies that your benefits can get duplicated however misfortunes can likewise get increased. Consequently, any exchanging Nifty fates must be finished with severe stop misfortunes and benefit targets.

Strategy 3: Before taking a position remember to check open interest data

It generally pays to do a few logical information examinations prior to taking a Nifty futures position. A brief glance at the open interest of the Nifty futures and their aggregation patterns will provide you with a thought of whether the open interest is expanding on the long side or the short side. You can take a more educated view of the Nifty course.

Strategy 4: Try not to get in a liquidity trap

Liquidity is never quite difficult for the Nifty futures as it is perhaps the most fluid agreement however there are events when the Nifty futures can get into your liquidity trap. Initially, on the expiry day, you will ordinarily observe the volumes on the Nifty futures evaporating once the rollovers are significantly finished. Likewise, in a market that is falling forcefully, the spreads can augment considerably expanding your gamble in exchanging Nifty prospects.

Strategy 5: There are various Margin suggestions

Whether you purchase Nifty prospects or you sell Nifty futures, it is a direct situation as it can prompt limitless benefits and losses for the two sides. While stop losses are an absolute necessity while exchanging the Nifty, one likewise needs to get the edges. First and foremost, there is an underlying edge you pay at the hour of taking the position which incorporates the VAR edge and the ELM edges. Presently it is required for agents to gather both these edges and ELM is at this point not discretionary. Also, consistently you really want to pay MTM (imprint to advertise) edges in view of the cost of development. These have capital designation suggestions for you.

Strategy 6: Be careful the short-term risk in Nifty prospects

Regardless of whether you put stop losses during the day, these orders won't cover your short-term risk. For instance, assuming you are long on the Nifty Futures and because of an accident in the Dow on the off chance that the Nifty accidents by 200 on opening, what do you do? Stop misfortunes don't work and you are presented with short-term risk in Nifty futures.

Strategy 7: Look from a counterparty point of view

This is a fascinating part of Nifty futures exchanging. Whenever you are purchasing bank Nifty futures then there is another party that is selling and a similar rationale applies when you are selling Nifty prospects. The other party could be a merchant or a hedger and the open interest information will give you fundamental bits of knowledge. While you are regularly determined by your view on the Nifty, it generally pays to comprehend the counter view as it can give you more noteworthy lucidity in your Nifty view. Here, one should know 8 things to recall while exchanging Nifty Futures

Strategy 8: Keep a tab on the profits, exchanges expenses, and assessment suggestions

Whenever you exchange on Nifty prospects, recall that you are submitting genuine cash and consequently three angles are significant. Finally, Nifty futures are treated as protections for charge purposes so any benefit or misfortune will be treated as a capital increase or a capital misfortune and the duty suggestions will apply in like manner.

0 notes

Text

What is the Market Profile?

The Market Profile is a technique used in intra-day charting. The name comes from the fact that it is based on the intra-day candlestick pattern. In other words, this strategy involves putting a line on the chart in the same shape as the current candlestick. It is an excellent method of analyzing the movement of the price in one direction. This method is very accurate and has a great deal of flexibility. Its effectiveness depends on whether it is used in pairs or individual stocks.

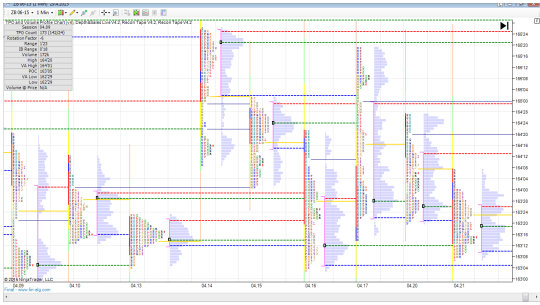

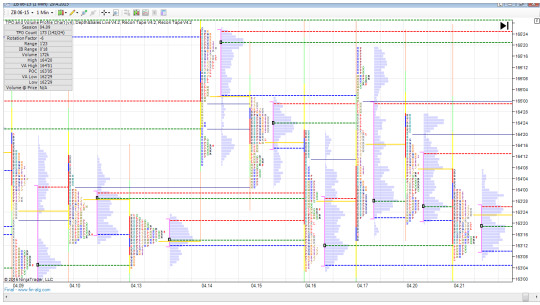

The market profile is a type of candlestick chart that represents the highest and lowest closing prices of each half hour. The letters represent the price at the beginning of the hour. The TPOs represent "Time Price Opportunities" and are often referred to as "time-period". The Market Profile can show price fluctuations that occur when the marketplace is unbalanced. This is because the marketplace is full of traders including scalpers, swing traders, and positional traders, and their combined action causes the price to fluctuate.

As with any trading system, the Market Profile works best with key reference points and testing naked POCs. The most important thing when looking at the footprint chart is to look at the volume imbalance and whether or not the price is going to move upward or downward. A lack of excess means the market is oversold or undersold. This may be a sign of the traders stepping into the market, which means that it is not overly balanced.

The Market Profile provides information that is generated by the market. The data is derived from market activity and reflects actual buy and sell orders. Its structure provides insight into how the marketplace functions and how the price moves in real time. This information is particularly useful for emotional trading, which is often caused by the emotions of traders. If the price drops, the auctioneers will lower it to attract more buyers. In order to avoid being undersold, it is best to buy and sell at the initial balance.

The Market Profile is most helpful when trading in short-term markets. It helps traders understand the current market trends. By considering the latest market data, the Market profile offers a more comprehensive view of the marketplace. The Value Area shows two-third of the day's activity. By identifying the Value Area, it is easy to find a good trading opportunity. If you want to invest in the long-term, it is the best time to buy and sell.

The Market Profile is an indicator that helps you understand the behavior of big players. By using the IB Range, you can learn the price of major players in the market. Moreover, it is useful for day traders. A good trading profile should be able to show the daily price range. If the market is volatile, it can help you make decisions that will increase your profit. So, you need to study the Market Profile before you trade. By following these strategies, you will be able to make the right decision and stay ahead of the competition.

0 notes

Text

Order flow Trading; Professional trader's secret weapon

Do you want professional information about trading order flow? – Then you're right on this page. With many years of experience in the financial markets, we will offer you a world for the flow of trade. For successful and consistently profitable trading in daily trading, it is necessary to know about the flow of the system from the markets. In the next section, you will know exactly why the market is moving and do a system flow analysis.

Daily trading without a flow system is like driving without wheels.

What is order flow trading?

Order flow trading is a type of trading that aims to move the market. When a trader places market orders the market moves based on these sales or purchases. The purpose of order flow trading is to predict large market demands and thus to profit from the movement they make in the market. The flow of orders is usually determined by the large traders in the market such as banks. Banks make up 50% of the forex market, so when the bank executes a trading process, it moves the market.

This type of trading should not be isolated from other types of trades. The idea of trading order flow is to weaken yourself in a place where you can take advantage of the transaction based on the requests of others. Many factors make this movement so that you can other strategic applications to determine how you think about the transaction. What's different about order flow trading is that your ultimate goal is to predict movement based on market demands from others, not necessarily to predict the movement itself.

Differences between order flow trades and chart-based trading

One of the most important differences between order flow trades and technical analysis or chart-based trading is that they are based on movement predictors and order flow trading based on order predictors. This difference may be slight but important because the technical analysis does not always drive the market, but market demands drive the market.

How to recognize the flow of orders?

Order flow traders have a trained eye to be able to know what's going on; many initially trade with charts without indicators or with only a few main indicators where they pay more attention to the current market dynamics of the order flow. Their goal is not what I should do and when, but: what is happening in the market, what is the flow of orders? By recognizing these points, you can more clearly identify the flow of orders; it is also a matter of market experience and interpretation.

Technical conditions

Many order flow traders operate in the futures markets, which guarantees them high liquidity and high-quality market data. This includes an accurate real-time chart (some order flow traders use tick charts), as well as a list of orders executed in the market.

In addition, the order flow trader must have a very direct exchange connection so that his trades are executed with the lowest possible latency.

Advantages of demand flow trading:

See why the market is moving

Learn about important support and comfort areas

Use it for accurate entries and exits of trades

Be faster than regular chart traders

See market liquidity and where there is no liquidity

Orderflow trading strategies suggests that you trade based on understanding and anticipating orders that are about to change the market, rather than waiting to see if orders will occur. This is called selecting levels. When you select levels and place your requests at these levels, you can use narrow loss stops to minimize losses.

Following the flow of requests will help you see when the transaction will occur. By maintaining the order flow book, the broker can see the price and volume of the trade. Brokers can see the plans of all their customers for their benefit and that of their customers because they can advise when there will be a large volume of applications and they can refer to their customers to take advantage of these requests.

Order flow traders sometimes benefit from reverse trading. This is uncomfortable, but it can be very profitable if it succeeds. Order flow trading is more suitable for very expert traders. Financial institutions are in a privileged position when it comes to flow trading and can be very profitable for them.

0 notes

Text

Market Profile trading strategies for successful intraday trading

Are you curious to know about intraday trading as a stock market trader? well, intraday trading involves buying and selling shares on the same day to gain financial gains. Just focus on square off your open position before the end of the day's trading session instead of considering factors like distribution dates, demats, etc. Intraday trading is not easy at all. To get good return you need to focus on several things. As a key rule, you should understand that market profile, intraday trading in stock markets is subject to greater market volatility than regular investment. Also, you need to make a proper assessment of your risk appetite before starting your trading journey.

5 Market Profile trading strategies for successful intraday trading

1. Understand the basic techniques of intraday trading:

Do your research: Before buying shares of a particular company, do extensive research to estimate important standards to know about signs showing the company's strength and weakness.

Risk-management and risk-benefit ratio: As a new investor, you should always invest only the amount you can bear losing. One of the basic intraday trading strategies to invest is to invest in a stock that has a risk profit-ratio of 3:1. This will allow you to lose the amount that will not bother you, as well as provide an opportunity to get good returns. Another technique of risk management is to avoid investing more than 2% of its entire trading capital in the same business.

Select liquid shares: you can select some large-cap shares, instead of investing in many small and mid-cap stocks.

Set market time: when you buy stocks, market experts recommend avoiding trending for the first hour of the trading session.

Avoid emotions and pre-determine returns and risks: Setting your entry level and target price in advance for intraday trading is another basic technique.

2. Use intraday trading time analysis:

The second position in the list of intraday trading strategies is to analyse the daily chart carefully. Daily charts illustrate price movement between opening and closing hours during a day's trading session. You can analyse price fluctuations between short and medium term through daily charts. For intraday trading, you can study a variety of charts such as a 15-minute chart, a five-minute chart, a two-minute chart, and a tick-tack chart.

3. Follow strong intraday trading strategies:

The third in the list of intraday trading strategies is to follow reliable strategies. You can follow the techniques below:

Using opening range breakout (orb) to map resistance and support:

Opening range stockprices fluctuate at the start of a one-day trading session whether it can be high or low. Orb duration can be from 30 minutes to 3 hours. As resistance, after identifying the highest point and assuming the lowest point to be support, you can take different conditions.

For demand-supply imbalances, see: This intraday trading strategy is used to identify stocks, with considerable imbalances between supply and demand, and are used as entry points.

Use relative strength index (RSI) with average directional index (ADX): While RSI is a technical indicator ofmore purchased (over-purchased)and more sold (over-sold) stocks, ASI is a trend indicator supporting the decision to buy and selltraders. Combining the two can help you make informed intraday trading decisions.

4. Understand the difference between investment and trading:

The fourth position in the list of intraday trading strategies is to understand the difference between investment in stock markets and intraday trading. Both trading and investment require different strategies. Investing in stocks requires a more fundamental approach, while intraday trading is more technical.

5. Remember that the market is unpredictable:

Even if you are an experienced businessman with state-of-the-art equipment, you cannot predict the fluctuations in prices with absolute certainty. At times, despite tech indicators predicting the market to be bullish, prices may fall. If the market runs against your expectations, remember to get out of your position immediately.

Conclusion:

Since you know how to do intraday exchanging, follow these intraday exchanging techniques or market profile trading strategies, and amplify your profits. You should always remember to rely on a trusted financial partner to open your intraday trading account.

Hope this article is helpful to you. Share your views with us!

1 note

·

View note

Text

The easiest way to gain more at less risk is to invest from option trading

If you want to invest in the market with the facility of hedging, options trading will be the right choice as compared to future trading. Trading in the option gives you a chance to benefit from the share price without paying the full value of the share. By trading in the option or bank Nifty option, you can get limited control over the stock with much less money than the money required buying the stock completely.

Insurance covers security from fluctuations in security prices

Insurance cover of loss can also be charged by paying some premium during options trading. These insurance covers protect you from fluctuations in the prices of certain security. This is the same as when a car is insured by a scratch, a theft, or an accident. in simple terms, the option is a good option to compensate for the losses caused by price fluctuations.

In futures trading, you buy a lot of gold at the price of 30,000 rupees, but the price of gold breaks by rs. 1000 and comes down to 29,000 rupees. In such a situation, you have to lose one lakh rupees on a lot. On the other hand, if you have purchased the call option in options trading, the loss comes down to just rs. 5000 if you pay a premium of rs. 50 per ten grams.

The future market does not have a hedging tool i.e. leave the deal open or put a stop loss. when a stop loss is imposed, the deal is cut on its own at that level, but the damage does. If the stop loss is not imposed, the loss is more, while the put option can hedge the purchased deal. Similarly, sold deals can limit losses through call options.

Hedging is used to avoid such adverse conditions if prices invested in shares of a company suddenly fall during futures contracts in the stock market. This is done through counterbalancing i.e. in other words, hedging is done through investment in two investment options that have a negative correlation.

There are two types of options.

Call option: A call option is a contract that empowers the investor to buy calls in an asset at a fixed price within a certain time frame. The pre-fixed price is called the strike price, which is known as the expiry date. the call option allows you to buy 100 shares. You can sell call options at profit or loss before the contract expires. When an investor feels that a commodity should bet on a boom they can use this. It has to pay the premium, where the investor loses the maximum.

Put option: The put option is contrary to the call option, it gives the holder the right to buy shares. Put options give the holder the right to sell the underlying shares at the closing date or the strike price before that. When investors feel that the market is on the verge of a further slowdown they can use this. In this case, he either exits the market or buys more as per his requirement.

The first thing to do is to have a trading account to start options trading in the commodity market. If you already have an account in the futures market, your broker will have to give a memorandum of understanding for options trading.

It is through this account that investors can buy or sell a deal in the future or option on commodity exchanges. The same happens in Bank Nifty future and option trading. If you are opening a new account, you will have to fill a separate form for business in the option like future.

The broker through whom the trading account is being opened must be a member of the multi-commodity exchange and the national derivatives exchange. At the same time, the broker should be properly identified in the market.

Futures and options business properties and flaws

When you are learning about how to do business in the future and options, you should also know what you are going to do. Certainly, investing in futures and options has many advantages, such as effectiveness. But futures and options can also be risky. High impact ability enables you to take a bigger position, and if the market does not go in your favour, there will be huge losses.

So before trading take care of these things as much as possible.

0 notes

Text

WHAT IS ORDER FLOW TRADING? – A BEGINNER'S GUIDE

If you are interested in learning the Order flow trading strategies, then connect with the experts now!

Order flow trading is a relatively new method of trading. In these years, the futures traders have been very popular with the attention and favour of the professional institution. This method of trading is quite special compared to other trading methods in the market. Here things happen with keen attention. The order flow is more concerned with why these things happen in the market. About the order flow the first thing you need to know, it is difficult to understand the distribution of the volume before the digital trading era began. It is mainly because the data provider (vendor) does not provide this information as well as software technology the development of network technology

What is an order flow transaction?

Order flow trading itself is not an innovative method in trading techniques. It has existed since the birth of modern financial markets; it's just that the original form of expression is very different from what we see today.

Simply put, the focus of order flow trading is to observe the trading trajectory of large institutional traders. Understanding how institutional orders enter the market, thus following the trend of the market is necessary.

There are too many variables involved in financial markets, so much so that when you use graphical analysis tools to transfer data to the human brain it is almost impossible to infer price behaviour from it. And the power of order flow lies in the fact that you can graphically present the quantity and price data of long-short orders (also known as footprints) for the order flow, making the market more transparent. The concept of market transparency is a cliché, though, but the order flow trading strategies do bring our ideas to life.

What are the important parameter concepts in the order flow trading method?

Price

The imbalance between supply and demand will lead to price fluctuations. If the supply is low, demand tends to increase with price. If the supply is high, demand tends to decrease, the price will go down.

Volume

Volume is the number of trades within a specific period. This parameter is closely related to our order flow, can help you determine whether the supply is low or high. View long-short orders related to price movements do they move together or in different directions? If you start to see the imbalance between supply and demand, then it's trying to choose the direction, this means that there is a trading opportunity.

Buy/sell unevenly

In addition to price and volume another factor to consider is the buy-to-let imbalance. View orders from other dealers and institutions, you can tell if the buyer or seller is influencing the price movement. View meaningful real-time orders, you can predict the direction of future orders.

Delta

Delta refers to the difference between the active buy and active buy within a single line of a symbol. Delta can be positive or negative. This parameter value plays a key role in predicting changes in market prices. Compared to ask and bid in the order flow, when there is an imbalance in the direction of price movement, disagreements can arise. By viewing different long and short orders, you can avoid being trapped by false fluctuations or illusions.

The chart structure of the order flow

The structure of the order flow chart is easy for us to understand.

Think of it as a single column horizontal axis, each row represents a minimum price change (tick). It contains the number of trades that occurred during the time the candle was traded and the long single short order (also known as the footprint). These orders are updated in real-time; provide information on new transactions made at every moment.

1 note

·

View note

Text

Futures and Options Strategy: To be successful in trading!

The futures and options market is more diverse than the foreign exchange market, so it provides more opportunities. It requires professionalism, but it gives a deeper understanding of trading strategies and experience that you can successfully apply later in the foreign exchange market. The first thing you should learn about trading is the derivatives that include Nifty future and Nifty option strategies.

Futures and options are a type of derivatives, derivative financial instruments. A derivative is a written contract for some actions about the underlying assets.

Options and Futures Trading

By choosing this type of trading, you can master all the features of the stock exchange game. When buying and selling futures and options, traders try to predict how the prices of the underlying assets will change. Due to this, make a profit.

Trading on the rise

If you expect futures or options prices to rise, it is profitable for you to buy them for further resale at a new price. Waiting for a period of rapid price increases, you can get multiple profits from the game increase. The risk here is that options and futures have expiration dates. And within these terms, price growth cannot wait.

Short Trading

Anticipating a fall in prices, it is profitable to engage in the sale of futures and options. There are risks here, too. First, you could expect prices to rise, and they begin to fall, and you have to sell at a price lower than you bought. Second, you can sell everything and prices will go up. Then you will lose the possible profit.

Nifty option strategies

If you happen to meet with an options trader, his conversation may be full of complex and incomprehensible jargon. You can hear turns like "butterflies and boxes, jam rolls and conversions" in particular. Despite the incomprehensibility, here we describe Nifty option strategies, and if you internalize the four main types of options trades, you will be able to make sense of more complex transactions.

Let's first consider the attributes and risk factors of the four simple basic methods of applying options.

Buying a call option

- Motivation: "Bullish"; Sale options when investors do not expect the prices of options assets to rise.

- Risk: Unlimited.

– Remuneration: Limited by the amount of the premium received.

Selling a Call Option

- Motivation: "Bear"; Bring options in anticipation of the increase in the prices of options assets.

Risk: Limited by the amount of premium paid.

- Reward: Potentially unlimited.

Buying a put option

- Motivation: "Bear"; Bring options in anticipation of a fall in the prices of the relevant assets.

– Risk: Limited to the premium paid.

- Remuneration: Almost unlimited. Achieve the maximum profit when asset prices fall to zero.

Selling a put option

- Motivation: "Bullish"; Sell the option when the investor does not expect asset prices to fall.

- Risk: Almost unlimited. You can get the maximum loss when the prices of the corresponding asset fall to zero.

– Remuneration: Limited by the amount of the premium received.

How to Trade Options?

Options trading provides a whole new psychology of trading, as there is an extra-value that is beyond price shifts – that's time.

Have price targets

When we talk about price, we usually think of the stock price. But you can also have a price target for the option as well. With a lot of analytics software available today, it's not that difficult.

Have temporary goals

Options have a time component, which is a critical variable that most young traders bypass when planning trades. Suppose you opened a 5-hit bullish put of 1.00. This means that your maximum reward will be 1.00 and your maximum risk will be 4.00. Expiration is 45 days.

Install Deltas

Options do not have a constant directional position. There's a gamma there that shows changes in the price rate of an option (delta) versus a change in the underlying price. Calculating your deltas is an important aspect of trade management.

Convert to option spreads

Options trading offers you many ways to reduce risk, increase your premium and calculate the likely opportunities in trading. You can do this by "developing" trading.

Nifty future strategies

Futures Spreads

Also, build Spreads in the futures markets. There are two types of futures spreads – Inter market and Intra market spreads.

Inter market spreads are futures trades in which futures with a specific delivery month are bought and sold in the delivery month under a contract for a related asset.

One of the important Nifty future strategies is Studying the history of price dynamics for related products, it is often possible to find the relationship of prices, i.e. the price of crude oil is in a certain way related to the prices of petroleum products.

Intra market spreads are futures trades in which futures with one delivery month is bought and sold the same futures with another delivery month. The price of a future with some months of delivery exceeds its justified value.

Hope this article will help you to understand the details about the Nifty option and Nifty future strategies. Stay tuned with us to know more about trading.

1 note

·

View note

Link

Find the best online trading tutorials in India. We offer a dedicated trading room for all active traders, with 2 charts of current month Orderflow Future s, 2 expanded charts of the NF and the BNF running our proprietary OrderFlow software which detects big players and institutions as well as Smart money hunting at Market Tops and Bottoms. Plus access to Real Time Market Analysis and Market Profile + Order Flow charts and 24 x6 Slack access and history of previous sessions including chat and previous charts at our private blog.

1 note

·

View note

Text

Top Strategies you should know for successful Market Profile trading!

Market Profile comes from the idea that markets have a form of organization defined by time, price, and volume. Every day, the market develops a certain range and within its limits. The "Value Area" (VA) is a basic component of the "Market profile" methodology. So let's know about the Value area in the Market profile;

What is the Value area in the Market profile?

The value area represents a zone of some equilibrium, where the number of buyers and sellers is equal. Here in this area, you can find price changes often.

The Market Profile captures these movements, providing an opportunity for traders to correctly interpret this information both in real-time and after a trading session.

The value area shows a price range that reflects the interests of most buyers and sellers.

The goal is to show traders where "cost" is set and provide areas for low-risk, high-reward trading based on a few simple rules and strategies.

One of the most popular ways to use the value area connects the trading activity of the current day with the value area of the previous day.

One of the best examples of a valuable domain is the familiar shape of a normal distribution curve.

Sometimes you will find a skewed curve, but the ease of displaying information provides traders with a new way to objectively observe where other market participants place their orders and help identify value levels.

If you learn these basic trading rules, then it is easy for you to create a good trading strategy. And these strategies help you in trading in any market condition.

One of the key advantages of studying the Market Profile is that you can know the theory of the exchange auction. Equip yourself with a+ set of skills that will stay forever. One thing you can be sure of is the auction in the market.

By learning and practicing the classic Market profile trading strategies below, you will begin to gain confidence in trading with a reasonable methodology that you can rely on.

Market Profile trading strategies

Trading Strategy 1

You can find a strong bullish signal when the market opens above the value area and can stay higher on subsequent tests. If the market begins to trade in the value area and the volume grows, you must exit long positions.

Trading Strategy 2

When the market opens above the value area, but then begins to trade two 30 minute bars down in a row back to the value area, there is a high probability that the price will pass completely through the value area and test the minimum area.

Trading Strategy 3

When the market opens below the value area, but then begins to trade two 30 minute bars up in a row back in the value area, there is a high probability that the price will pass through the value area and test the maximum area

Trading Strategy 4

Another strong bearish signal is when the market opens below the value area and can stay lower on subsequent tests. If the market begins to trade in the area of value, and the volume grows, you must get out of short positions.

Trading Strategy 5

When the market opens in the area of value, it shows signs of a balanced market. The "reciprocal" nature of trading is preferable to the "proactive" one.

Some other factors are;

Initiative sales

When the market opens and remains below the value area, it shows a strong bearish signal and the downside moves should not fade. Often this type of trading activity is the result of the actions of traders trading on higher time frames who are interested in selling and will put pressure on prices during the trading day. Dealing with this type of movement can be exhausting and very unprofitable. Identifying a selling initiative by assessing where the current market is trading relative to an area of value can help to be on the right side of the market and protect against being crushed by a powerful bear market. The best market profile trading strategy on a day showing proactive selling is to sell on rebounds upward until proven otherwise.

Response activity

Here the price trades outside the value domain. So it encounters the opposite momentum and deviates back into the value domain. This type of activity is often present when the market trades in the value area and attempts to trade outside for a long period.

Return purchase

In the first scenario, the market opens up in the value area and attempts to trade below it. Buyers enter the market and drive the price back into the area of value. This shows that return buyers entered a market that trades below value and took advantage of low prices. This strategy works well with sideways market movements.

The second scenario occurs when the market opens below the value area and buyers immediately begin to enter the market. This can be evidenced by prices moving above the opening when buyers "respond" to a price below the cost. For a minimum cost area, a good initial goal is necessary. When this type of return purchase occurs, the 80% rule will likely play a role, which means that in 80% of cases the price will go further to the maximum area of value.

The reverse is true for Responsive Selling. Hope this article is helpful to you. Share your views now. For more information like this, stay tuned with us here!

1 note

·

View note

Text

How order flow can improve your trading?

Trading strategies based on the volumes and Order flow arriving in a market are among the most effective for successful operations. If you are not considering supply and demand in your trading decisions, your trading decisions are lagging, you are taking more risk in your trades using price limits, and you have a hard-to-read chart covered by lines.

The Order flow trading strategies can simplify your approach to trading.

Trading with Order Flow is simple

Now, all you need to understand is what the trading with order flow is about:

keep track of quantities that have been bought and sold at different prices

using this information to identify supply and demand patterns – we can then notice the price levels at which there has been supplying or demand

see if supply or demand is maintained or interrupted when these price levels are revised

You can use various tools to view buy and sell volumes at different price levels. These tools can organize and present the raw purchase and sale data. That's all you need once you're able to interpret supply and demand conditions from raw data. We can help you acquire these skills through our online material, training courses, and coaching..... however, applying order flow indicators to this raw data can save time and perform analyses that are too difficult for humans to do or too fast to interpret. Let your computer analyze the numbers and present this refined data in an easier-to-use way to make decisions. This is what vtrender.com's Order flow trading software does.

Identify significant events in supply and demand

Present them to you, and

Follow the behavior of the levels over time.

You can use this information for manual discretionary trading, for alerts, or even to automate trading.

Another amazing toll is the Order book

The order book is also referred to as DOM (depth of market). You can find the order book with the best bid and ask prices. For most brokers, it can also be used directly for placing and moving orders.

In addition, professional platforms for order flow trading strategies offer a variety of plug-ins and the possibility of customizing the DOM, for example via the so-called "Smart DOM". Nowadays, the biggest problem for order flow traders is algorithms, especially high-frequency (HFT) traders. The Smart DOM tries to recognize and analyse such algorithms.

Ok, so what can I trade with the order flow?

The short answer is anything – the behavior of any market is regulated by the laws of supply and demand. If a market does not observe them, then it is not profitable for trade, however, some goods and markets are more favorable than others. That's why:

Forex

Very popular among retail traders due to the easy access to accounts and the low risk perceived by small pip values. However..... Forex is a decentralized market. If you are able to receive volume data, it will be the volume of your broker, otherwise, your trading platform will approximate the volume based on the number of trades that have moved the price up to and the number of trades that have moved the price down. As a result, supply and demand information is less accurate than information about stocks and futures.

Actions

Better information than forex, but in our opinion not as favourable as futures for day trading or swing trading using order flow. Because.....?

First, although shares are traded on their own exchanges (NASDAQ, NYSE, NYSE, etc.), there are several "trading venues" and dark pools, i.e. parallel exchanges where the same shares can be bought and sold. This means that the volume of information you receive from your broker does not capture the entire picture of buying and selling in the market.

Secondly, the 'pattern day trader' rule requires that if you trade daily 4 or more times in a 5-day period, you must maintain a minimum balance of $25,000 dollars in your account and you can trade up to 4 times your previous excess daily maintenance margin. This rule is designed to reduce risks for small traders, but the minimum account is large compared to that needed for a futures account.

Encryption currency

Popular among traders because of some exchanges that provide great leverage. As with forex, you will only see the volume that is traded on the exchange where you are trading.

Our challenge with crypto currency and order flow is that whenever we have examined these markets in depth, the sense of 'order' in supply and demand is low compared to forward markets.

Future

In our opinion the best markets to trade using the flow of orders.

Forward contracts are traded on a single centralized exchange. This means that you have visibility of all the volumes traded and you have the complete picture of supply and demand.

With Order flow trading strategies, you no longer observe the markets from the outside, but from the inside: you look directly at the heart of the markets.

0 notes

Text

How Market Profile Charts Serve As An Informative Tool for Short & Long-Term Traders?

Are you new to trading? If yes, just do not worry; thorough knowledge of trading would help you invest. Trading is not as easy as making an investment, so first, learn the steps and techniques to succeed. Market profile is not easily understandable study the sequence, profile, and analyzes the whole market.

This process is not for one day but fix a timetable and continue for some days, and this will be helpful to both seasonal investors and long-run investors. Here is the role of the Market Profile Chart, which gives accurate information and acts as a suitable tool that benefits any kind of investors.

These charts best help to understand the market and are based on volume, time frame, and the market risk and show the complete details in one chart. The way you understand the market helps you to understand it better. But don’t be stuck in a place; rather, learn more about the market and the current trading prices and charts.

These charts are the standard point to calculate the exact trading price in a share. These keep updating and show the current and accurate information to the public. It’s been seen those who don’t follow the market chart properly tend to fail.

In every trading, to be pro, you need to be focused and dedicated. Never run to get profit. With time you will gain knowledge about each stage and each development in the share market. First, review the market and then invest in the correct share; this is the main idea.

If you invest properly in shares after reviewing the market, it's risky, but it’s a better investment in the long run than any other. People also prefer to invest in short-term shares where shares seem to be unstable but investing incorrect shares can help for swift profit. Market Profile Trading Strategies guides its customers and helps them in investing in the proper platform.

In the current scenario, Bank Nifty provides standards and positive information to the investors to invest in stock accordingly and gain. It is a mix of both liquid and big trading stocks of India in the trading field.

Twelve banks are involved in stocks from the banking sector and are included in the banking sector. Here in the stock trading and share market trading, India's state banks and private banks are listed, and they help customers gain. These banks from the banking background trade in stocks of the National Stock Exchange of India Ltd.

Market Profile Chart collects data of each section and category and makes it understandable and gives a clear view to the newcomer. The data provided by the market are organized and always show the proper time, price, and proper trading data.

Every day the market gets updated with new values and profiles and shows every point to both buyers and sellers. Besides, it gives information about the distribution of shares in the market. As such, new values are the current price running in the market. But always learn from the success and failure in the market.

It renders a proper idea about the upper and lower price range in the market. In a market profile, always track the graph and chart where adequate indication about the ups and downs in the market.

Market price indicates the amount of money that is in the market and can be sold. But always focus on the last traded price to know the recent price of the market; on some days, price increases and some days decreases.

Normal days – It shows the initial balance in the market

Trend Day – Price move in a single direction without diverting

Distribution Day – It shows about double balance

Market Profile Trading Strategies always helps to maintain good and proper information, and this provides accurate market data. It gives an easier view and assists in unfolding market profiles. Both short- term and long -term market profile is convenient and gives the long -term traders reports.

These data indicate the value and how to control the market and the stock. These charts are standardized and help to create a profile. Be it a larger or smaller trading system, charts always help by suggesting techniques and supporting. These charts give a clear picture of them and how to understand them easily.

Colour and letter combination is given to provide easy indications in the chart. The horizontal histogram is used to display the chart and shows the price and volume. The colors and highlighters are made to understand a layman about the market profile, which will help them buy and sell in a trade.

The market profile always shows the trading system that is based on a larger part. The market always resists a lower price in the long run only rather it supports both the higher and the lower prices so that it can control the trading process.

0 notes

Text

How Bank Nifty Option Current Scenario in Share Market Is the Present Trend?

The Indian trading market has a long history, and trading has become one of the current trends in the country. It promises an easy and higher return on your investment. Lured by the promises with little or half-knowledge, people start trading and don’t reach their goal.

Never take a hasty decision while investing; yes, it will help to build wealth but slowly in the long run. If you invest properly in shares after reviewing the market, it's risky, but it’s a better investment in the long run than any other.

People also prefer to invest in short-term shares where shares seem to be unstable but investing incorrect shares can help for swift profit. Bank Nifty Options are available, which a layman can also refer to get knowledge of the current scenario in the share market.

The oldest and the first stock exchange of Asia Bombay Stock Exchange In earlier times played a vital role in India. It has become one of the standardized measures for finance, and the Indian economy is assessed referring to this.

The stockbrokers sit outside in any park or gather in someplace and trade stocks. But with time the scenario changed, and the National Stock Exchange came into existence and trading in the open market was promoted to a computerized trading environment.

But as you start to learn the share market and start trading with time, you will understand it's not that complex, and everything will be simple. Get connected with some of the institutions, and your task will be simple.

The main aim of those Bank Nifty Futures even provides you with updated and proper information so that it becomes easy and safe to trade. These houses help their customers participate in different classes daily to clear their doubts and understand the trading process. Even they provide current statistics of the market so that it helps even the layman to understand. Some of the functions are:

· They never sell charts or indicators.

· It is a place where one can join and participate in daily class and ask questions.

· It’s an hour-long program.

· Provides accurate and perfect reflection of the market.

· You will also be guided through a live market situation.

· Grab this opportunity to gain knowledge and experience.

Bank Nifty Options gives us detailed information about the banking companies which are enrolled in National Stock Exchange. Its main focus is to provide information on the stock's overall movement, and that is calculated every second to provide updated information.

It renders a directory to trade in Futures & Options like Nifty. Bank Nifty provides standards to the investors where they can invest in stock accordingly. It is a mixture of both liquid and big trading stocks from the banking sector included in the banking sector, and both state banks and private banks of India are listed. These banks from the banking background trade in stocks of the National Stock Exchange of India Ltd.

One needs to opt for a DEMAT & trading account with the bank before getting set for trading. The bank will link the trading account with the saving bank account with the bank to make the process easy for money transactions. Here the bank decides a price at the current time, and the customer promises to buy this at a later stage or time, but the current price for this contract is also made.

This is not the end. Bank Nifty Futures helps the already experienced and trained traders wait for such conditions where stock gets liquid, and this is when they start trading in greater quantities, and it doesn’t affect the market.

#Bank Nifty Futures#Bank Nifty Options#trade#stock market#Nifty#Order Flow Trading Strategies#trading

1 note

·

View note

Text

What is auction market theory?

The market theory or auction market theory that all about the stock trades. According to the theory, there are two types of people, one is the buyer one and another one is the seller one. This is very interesting According to the theory. The seller always tries to sell their stocks at a higher price. Once they purchased stocks from the buyer then he decided to sell those stocks more than he bought. The good thing about this theory is the opposite he or she has to buy some stocks and sell this at a high price. That all thing is to depend upon the profit. In the book of economic the auction theory is applied. And that is in the equilibrium of economic all depends on that stock.

In this theory some members participate that are only two, one is the buyer one and another one is the seller one. This is only for the new candidate who joined recently. The important thing about this theory, that meeting is conducted in the afternoon every day. The theory is all about the framework. This theory is very popular in the stock market. That all thing like the mechanism. All of the stockholder who holds their stocks from many times, when they get the right time that time they sell that stocks. They sell their stocks. The world largest market theory is the New York market theory.

How many types of Auction?

In a world there are four types of Auction, which all are stabilised by the manor auction, that is the ascending bid and another one is descending-bid, the third one is the sealed bid, or the last one or the fourth one is the sealed bid auction. In the market of the auction, the new york market has multiple dealers, to buy the shares. That all happened when that stock owners sell their stocks. But some of the problems are not delivered at the right time in the right place. All the market run by some theory, and this one run by the auction market theory. This theory is like the golden thing for that stockers. All the stockers should have known about this theory. If anyhow some dealers don't know about this theory, then in future he might be in trouble. Because this theory is the only thing if you know about this theory then you can easily sell the stocks to the buyers.

In the market theory, there are many types of strategies and market profile Trading is one of them. This strategy only accepts because by this strategy you get a lot of profit. But deep down and in the last we all know that if you want to make a profit then you should have good knowledge about this market theory. Before invest in the stock market, you should have an inquiry about that stocks. After that, you can invest. Before investment, you have to check all things carefully. In the world, of trading, if you are new there, then you have to learn many things. The all-new one should have known these things which are, for trading the only thing is required which is knowledge. If you have good knowledge of trading then you can make a lot of profit.

Why this type of theory is required in trading?

The freshers of this field should be started from the low one, then go for the big one. If you are new there and you go for the big one first then you might be in trouble. And you have to face a huge loss. You always should avoid penny stocks. In trading you have to remember many things, firstly you have to keep in mind that thing which is the looses cut by the limited order.

The strategy of the trading that is all market and there relative that is the small scale of the production. That strategy Meany in that all areas buyer and suppliers in the under consideration. They have to region. There is a lot of ways where you can develop your strategies. The first thing is you have to some idea about the market. Then you have to check the correct balance, current stock, after all of that you have to be e ready all time to sell your products. The good or excellent time for trade is the day. Because at night the all the experience trader are trading that's why that time is very difficult for trading.

Summary

In the market, there are many types of strategies. And all have their importance in their field. But the very important strategies is the nifty future strategies. That strategies also divided into groups. This means that all are divided into two types. That type is when you invest somewhere there is two way one is for the short period and another one is for the long period.

1 note

·

View note

Text

Things to know about order flow

Order flow trading strategies is a type of analysis that involves monitoring the flow of trading orders and their subsequent impact on prices in order to predict future price movements. In other words, Order flow analysis allows you to see how other market participants are trading (buying or selling).

Order flow trading is also known as strip reading or Order flow analysis.

Order flow analysis keeps you aware of the latest details about trading volumes. The Market provides provides a micro review of candlestick studies. In each candlestick, a lot of information can be analyzed through the Order flow.

Basically, the Market profile trading can be thought of as a volume-based trading system provider. The Order flow chart displays the exact number of buy and sells market orders executed at each price level.

Market Profile strategy of order flow

The Order flow is the rawest form of data that can be accessed during the day trading. This is a combination of the actual contract being bought and sold at a specific price and time and the profitability of the buyer or seller. Tip: Buyers and sellers move the market, and whoever has an advantage moves it in their direction.

The main idea behind this method is to enter nifty future strategies while many other traders are deleting a lost trade. Closing a losing trade means doing the opposite of what you did to make your first trade. For example, if you make a buy trade, the only way to close it is by using a sell order. That is, when you close a trade, a sell order will be executed on the market, regardless of profit or loss. Now, when many traders close all losing trades at the same time, multiple orders enter the market and the price fluctuates.

We use a number of tools for the ordering process. The depth of the market, or the market size of the future asset. Shows buyer and seller interest to varying degrees. These are the contracts that have not been signed on the market yet. Followed by the footprints. This chart shows the market orders placed. Offers and needs are indicated by numbers in this chart. This shows traders that the buyers and sellers have come to maintain their positions. As always, the Order flow is a bullish and bearish mechanism. It is a balance or imbalance between buyers and sellers (offers and inquiries). These are short market sell orders that exceed buy limit buy orders, or fierce attack buys market orders that exceed seller's limit orders.

Compared to other areas of trading, Order flow trading doesn't contain as many trading strategies as possible, at least in the Forex market. The reason is that there is no order book that can be used to see in real-time when buy or sell orders will enter the market.

I think it's important to provide a quick overview of the difference between Order flow trading and other types of trades to clarify Order flow versus price action trading. Command-line trading is a type of trading similar to price action trading, both of which provide a specific way of analyzing the market. Price behavior traders believe they analyze the market price to determine which direction the market will move, but floating traders can predict the market will move simply by understanding the Trader' behavior in the market. I believe I can do it. When asked what kind of trader I am, I consider myself a safe trader using Resistance and Fibonacci retracement and like to average with cash in hand. Resistance-Fibonacci retracement, etc., but used in conjunction with understanding Order flow trading. For example, using my understanding of Order flow trading, I can see when traders are likely to form pegs by taking profits from banks in trading. With this information, you know which pins can reverse the market and which ones fail, so you can make more successful trades with the pin bar.

Finding where stop hunts are likely is based on an understanding of the Order flow and how traders think and decide. This method of search for trades has a variety of precision because it basically needs to know where the trader is going to place a stop loss on the market, rather than knowing the exact position of the trader he did. When the market reaches the sell stop, we can see that the price has risen and a bullish pin formed at the end of the hour. When trading this stop, the up pin is the signal used to enter into buying and reverse trade. This formation shows that the bank traders actually motivated the market to move to a buy stop, execute buy trades, and profit from sell transactions.

#Market Profile strategy#Order flow trading strategies#Order flow#Auction market theory#Market profile#trade#stock market

2 notes

·

View notes