Text

You know what scares me about having money? You can run out. You can spend more debt and know that it isnt due immediately. Credit is something you can spend with, and it doesnt hurt because right now, it's not your money. But when you spend actual money, you're getting rid of something that's currently yours. Giving it away a lot of times to people you don't want to give it to, bills and such. So having money is scary because you can lose it, and you have to every day. It seems like the closer you are to a zero net worth, the scarier it is. Paying off debt is great but then one day you do it and realize that you have no money. Zero money, snd it sucks because even negative numbers look positive when you can use them. You get a higher number when you spend credit, so it doesn't feel like you're losing money. But the reality is that it's getting bigger in the wrong direction. When you spend actual money, the number gets smaller instead of bigger and it hurts more. So having a positive net worth is losing the little high of spending money without "losing" any money.

7 notes

·

View notes

Text

Got a bit of a late start this year, about four months behind.

I'm getting my grandfather paid off this month, with a $385 dollar payment out of my last paycheck. We all got a bonus, so I'm trying to leverage that effectively.

I used $100 out of my $1k emergency fund to run and buy a good ac unit that's approved by my apartment complex, and will also be replacing that $100 out of my last paycheck of the month. It was too good of a deal to pass up for this kind of model. Turned out to be the same woman I got my knife set from too, which was pretty cool.

School starts in July, and a big problem is that I don't qualify for financial aid anymore because my brother doesn't get support from me. So I will need a loan every quarter to keep attending. Average cost is going to be about $1,350 per quarter and I've decided to take as much of that in a loan as I can and put the money I have saved toward debt that is currently accruing interest. Mathematically, it just makes the most sense in the long run in terms of interest paid, and especially with the way loan interest rates are going to be soon.

The next debt I'm tackling is my $553 dollar credit card that does accrue interest at about $10 per month. I'd like to get that paid by the end of August

#fi/re#financial independence#retire early#emergency fund#debt snowball#dave ramsey#student loans#pre-nursing

2 notes

·

View notes

Text

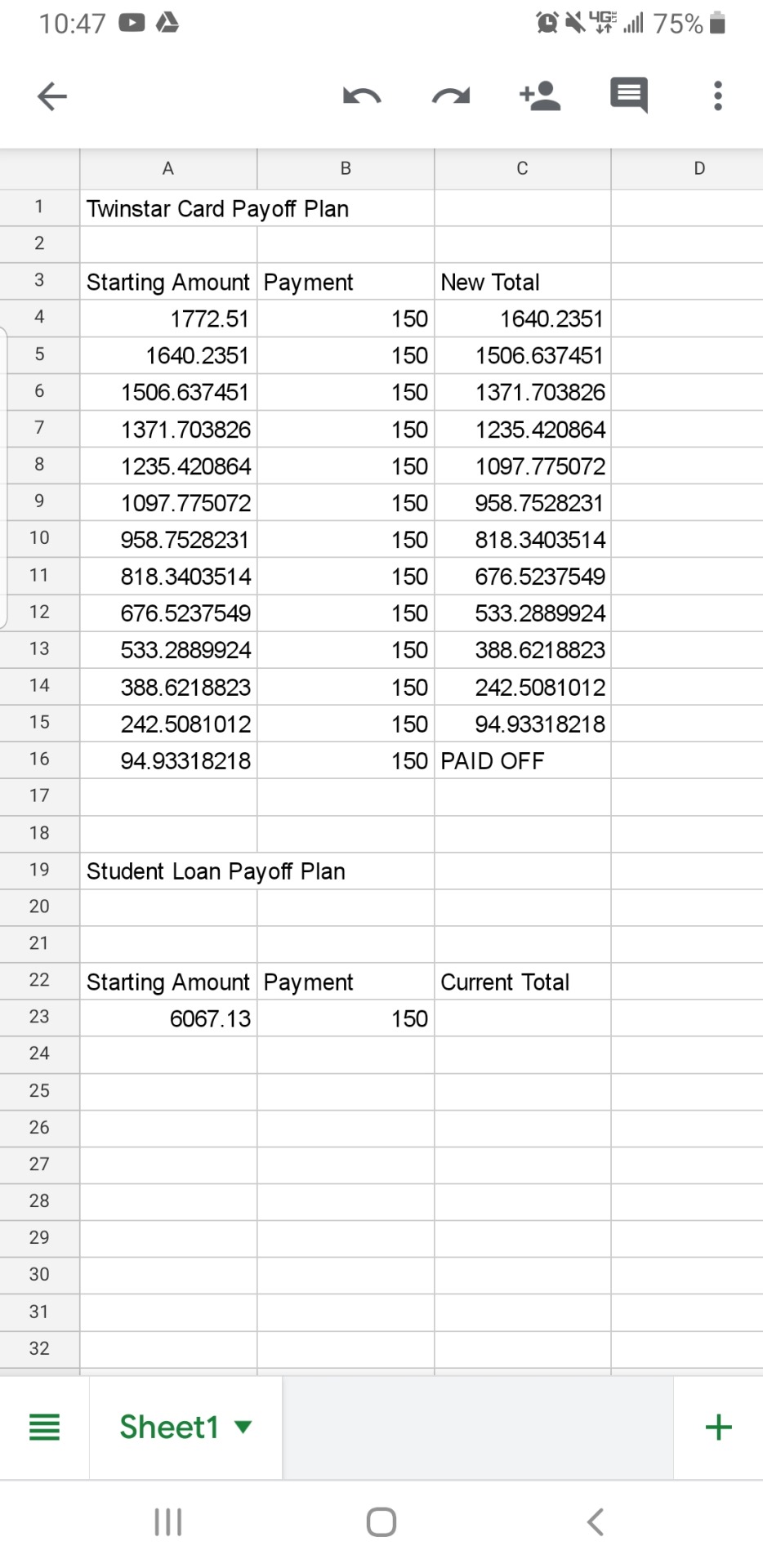

I've got my plan in place to get my last credit card paid off. If I make the minimum payment every month, it'll take 13 months. I'm moving in March and my rent is going down by 200 dollars a month, so I'll be able to make an extra payment here and there and definitely get it done within the year.

The spreadsheet is also interactive and includes the interest percentage, so if I enter in something other than 150 for the month, the whole thing will update.

I'm still working out the payment plan for my student loans because the interest rate applies a little differently than it does on a credit card and I haven't figured it out yet.

Going steady and on track four days into the year 😁

1 note

·

View note

Text

My 2020 smells like:

Your flight confirmation is...

You’ve completed your savings goal!

“The tab’s on me.”

“Do you want me to Zelle or CashApp the deposit to you?”

Your order has been shipped.

New loft, who this?

Your trip is in 10 days!

Your balance has been paid in full.

Your autopay enrollment has been completed.

Dubai or Maldives?

Your new credit card is on its way!

Congratulations, your debt has been cleared.

I paid for your half!

8K notes

·

View notes

Video

Interesting really that she can actually see how she will age in this. I'm amazed she stayed awake during the whole thing. I would have passed tf out

The face of a woman going from 1.5Gs to 7.5Gs and then back down

[ details ]

2K notes

·

View notes

Text

Intro!

Hey, I'm Kyra. I'm 22 years old and have $1 700 in credit card debt, and about $6k in student loans, as well as a small personal loan to a family member and approximately $0 in savings so far.

I'd like to retire by 35, and as such I need to get my financial stuff and spending in order this year. The goal is to be completely out of debt by December 31st, meaning I have 363 days to go. Let's do this.

FI/RE= Financial Independence/Retire Early

2 notes

·

View notes