Text

5 BUSINESSES YOU CAN START WITH ALMOST NO CASH

Hi All,

I always wanted to be an entrepreneur. However, I was told that women can’t get into this domain. It was a man’s world. Plus being a single mother made me vulnerable. Also, I had no savings and no bank was willing to support my case. So while researching online, I found out about a few businesses which required negligible investment. It was an eye opener for me and transformed my life. Today I can proudly call myself a successful entrepreneur. If you want to follow the same path, here is a list of 5 businesses you can start with almost no cash. Go ahead and read it to start following your dream.

https://www.business2sell.com.au/blogs/startup/5-businesses-you-can-start-with-almost-no-cash

0 notes

Link

0 notes

Text

Big pleasure from small things

Hello, friends. I have returned from France and recovered from jetlag. (I'm not good with jetlag.) Later this week, I'll publish an article about how much my cousin Duane and I spent during our ten-day drive across Normandy and Brittany, but today I want to share one small epiphany I had on the trip.

I am a Proust nerd so was happy to stumble upon Combray

Midway through our excursion, we heeded a recommendation from a GRS reader and stayed the night at the Royal Abbey of Our Lady of Fontevraud, a former monastery founded in 1101. Although many old buildings remain (and guests are free to explore them), the site is no longer an abbey. It's a fancy upscale hotel and a Michelin-star restaurant.

Duane and I typically prefer to stay in simple rooms when we travel. We don't need fancy. For us, a hotel is a place to sleep, not a place to be pampered. Our aim is to spend less than 100 per night (or 50 per person). We do make exceptions, though. (On this trip, we also paid extra to stay the night on Mont Saint Michel.)

In this case, we thought the hotel was nice and modern, but at $193.57 for the one night, we wouldn't do it again. That's way too expensive for us. And the restaurant was even more expensive.

Duane would have been perfectly happy eating crepes or galettes (which are savory crepes) at a regular restaurant in the nearby village, but I've always wanted to eat in a Michelin-star restaurant, and this seemed like a perfect opportunity. I mean: It was right there in the same building as our hotel.

I'll pay tonight, I told him. Ignore the prices. I'm making a deliberate decision to do this. You just enjoy the meal. Don't worry about the cost.

We did enjoy the meal. It was a fixed menu at a fixed price, although we could add options. (Duane added mushrooms and I added a cheese plate.) The food was fun and fancy. Here for instance, is the pea soup with bread:

Pea soup with bread as a first course

In the end, I spent $267.41 for our meal. That's the most I've ever paid for a meal in my life. But was it the best meal of my life? No. It was good don't get me wrong and I loved experiencing how a superstar kitchen combines flavors, but this wasn't even in the top twenty meals I've ever eaten. There are several restaurants here in Portland that I'd prefer to dine at, and they cost much less.

But I don't mean to grouse about how little enjoyment we got for the money we spent. Just the opposite, in fact.

When we reached our hotel room after a long day of driving, I needed to freshen up before dinner. I went to the bathroom to wash my face. Wow, I thought as I scrubbed down, this soap smells amazing. I love it. This is a strange thing for me to think. I've never had positive feelings for soap before in my fifty years on this Earth.

When I'd finished, Duane took his turn in the bathroom. Did you smell that soap? he asked when he was done. It smells like wood and smoke and spice. It's fantastic.

I thought same thing! I said. I'd buy some. Maybe we can find it when we get to Paris.

We sound like a couple of gay men, Duane said and we both laughed. (He can get away with jokes like that because he is a gay man.) We forgot about the soap and went to dinner.

In the morning, as we were checking out, we noticed that the soap was for sale in the hotel lobby. On a hunch, I googled the manufacturer. Sure enough: The soap was produced by a small company only three kilometers away.

Let's go buy some soap, I said. We hopped in our rented Peugot 208 and made the short jaunt to the soap factory, Martin de Candre.

Sidenote: We knew nothing about the Peugot 208 before we picked it up at the rental company. Turns out, it's an awesome little car. France is filled with awesome little cars. Unfortunately, none of them are available in the U.S. because the car manufacturers don't think they'll sell well. Americans like big trucks and SUVs. This makes me sad. I'd gladly purchase a Peugot 208 as my next vehicle.

We spent about half an hour looking at (and smelling) the different soaps. A friendly French woman answered our questions and taught us how to better get a sense of each soap's scent. (You need to step out of the shop, she said, and let the soap get warm in the sun. Then you'll know how it really smells.)

In the end, Duane spent 20 on soap. I spent 40. We both believe it's money well spent.

Fancy soaps for sale in rural France

I can't believe I just made a side trip to buy soap, I said as we resumed our journey toward Amboise. But I feel like this is a small thing that will improve my quality of life. Kim and I currently use watered-down liquid soap from a dispenser. I don't like it. Now when I come in from working in the yard, I'll actually enjoy washing my hands. It sounds stupid, I know, but it's real. Plus, it'll remind me of France and this trip with you.

It doesn't sound stupid, Duane said. There are lots of small things that make life better. I don't think we pay enough attention to them. Sometimes you can get big pleasure from small things. More pleasure than from big things, in fact.

Do you really think so? I asked.

Sure, he said. Think of your brother Jeff. He likes gourmet coffee. I'm happy with a cup of coffee from McDonald's but he's not. Every morning, he gets a lot of joy from a fancy cup of coffee. For me, I enjoy having a clean car or a clean house especially since I don't clean either one very often. I'll bet you can think of all sorts of similar examples.

As we drove, I thought more about the pleasure we get from small things. Duane is right. There are certain tiny actions and objects that make my life better. Here are some simple examples:

I like using everyday items I've purchased while traveling: band-aids, jackets, t-shirts, underwear, etc. I like being reminded of my trips.I wear two cheap turtle necklaces. I bought one for ten bucks in Hawaii. I bought the other for two or three bucks in Ecuador. I love them.Like many people, I have a favorite mug. I also have a favorite whisky glass. Each probably cost less than ten bucks, but they make me happy whenever I use them.Kim and I own several pieces of art produced by family and friends. None of these was expensive. (Some were given to us free.) We enjoy having the constant reminder of their creativity.One of the reasons I enjoy gardening is that every year these inexpensive plants bring my pleasure in a variety of ways: pretty flowers, tasty fruit and vegetables for meals I prepare.Most of all, I love to walk. It costs me nothing but gives me so much. I like being outside. I like exercising. I like the time for meditation.

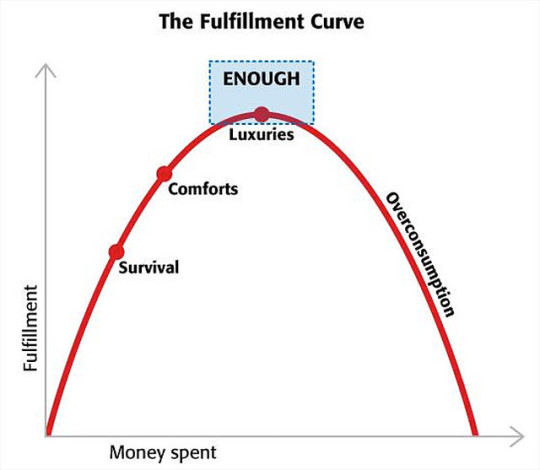

It occurred to me that these are examples of conscious spending in action. When we identify small, inexpensive items and behaviors that make us disproportionately happy, spending on them allows us to get more bang for our buck. This also what Marie Kondo means when she talks about only keeping possessions that spark joy.

I'm unlikely to ever again in my life be so enthusiastic about soap. But I'm glad that Duane and I allowed ourselves to make a small side trip to buy this stuff. Now that I'm home and have the soap in the bathroom, it really is a small thing that gives me big pleasure. (Fortunately, Kim likes the smell of the woodsy soap too.)

Author: J.D. Roth

In 2006, J.D. founded Get Rich Slowly to document his quest to get out of debt. Over time, he learned how to save and how to invest. Today, he's managed to reach early retirement! He wants to help you master your money and your life. No scams. No gimmicks. Just smart money advice to help you reach your goals.

https://www.getrichslowly.org/big-pleasure-small-things/

0 notes

Text

Craig Wright allegedly presents falsified documents in court

At this rate, how long can Bitcoin SV prices resist taking a plunge?

The ongoing multi-billion dollar Kleiman vs Wright court case has tilted once again, with the Kleiman estate's lawyer Stephen Palley presenting evidence suggesting that some of the documents presented by Craig Wright have been fabricated.

This isn't the first time Wright has been dogged with these kinds of allegations. This time it focuses on the document which supposedly dates from 2012, but contains various discrepancies which say otherwise.

a purported 2012 trust doc with font files copyrighted 2015 pic.twitter.com/Gi66glsESh

Palley (@stephendpalley) July 3, 2019

What's happening here is that the document was supposedly created in 2012, but the copyright of the font it uses (Calibri) dates to 2015.

Font enthusiasts point out that Calibri itself was certainly used prior to 2012, but the point here is that the document is meant to be the original, created in 2012, and so the copyright date on it should not be 2015.

Another discrepancy can be found in the details of an email that was supposedly sent in 2011.

The metadata associated with this email, which was presented as evidence...

... gets the day wrong.

the return path. rofl.

also, June 24, 2011 was a Friday. pic.twitter.com/VClq15HRj7

Palley (@stephendpalley) July 3, 2019

The court case is ongoing.

What does this mean for BSV?

Bitcoin SV prices have not noticeably changed following the new set of allegations.

While it might seem incredible that BSV prices are remaining so stoic in the face of the twists and turns this case keeps bringing, it's possible that anyone who was going to sell as a consequence of these sorts of allegations has already done so.

In fact, none of these developments seem to be impacting BSV prices at all. Like any other altcoin it's been down against Bitcoin lately. Indeed, price rises in June have seen Bitcoin market dominance reach its highest point since December 2017.

But as Palley said, being found to have presented fake evidence is very bad news for whoever's caught doing it. The case began with billions of dollars of Bitcoin at stake, but as it's developed, the US$3.5 billion BSV market cap has also been potentially put at risk.

Also watch

Disclosure: The author holds BNB, BTC at the time of writing.

Disclaimer: This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. It is not a recommendation to trade. Cryptocurrencies are speculative, complex and involve significant risks they are highly volatile and sensitive to secondary activity. Performance is unpredictable and past performance is no guarantee of future performance. Consider your own circumstances, and obtain your own advice, before relying on this information. You should also verify the nature of any product or service (including its legal status and relevant regulatory requirements) and consult the relevant Regulators' websites before making any decision. Finder, or the author, may have holdings in the cryptocurrencies discussed.

Latest cryptocurrency news

Picture: Shutterstock

https://www.finder.com.au/craig-wright-allegedly-presents-falsified-documents-in-court

0 notes

Text

New Audi S8 Confirmed

Audi lifts the wraps on its new luxury, performance S8 sedan.

Audi has published the specs for its revised S8 prestige sports sedan, with the key points being a powerful V8, innovative suspension design and a mild-hybrid system.

Mild-hybrid V8 engine

Audi is making a big furore about this new engine, which the Germany-based car builder says delivers "maximum smoothness". It achieves this by combining a large output V8 engine, with dual turbochargers and a 48V hybrid system. The result is a 4.0-litre engine producing 420kW and a guttural 800Nm of torque. Engineers electronically restrict the S8's top-speed to 250km/h. It should sound great too, thanks to actuated butterfly valves in the exhaust system that can accentuate the V8 rumble.

The hybrid system helps further efficiency by enabling the car to coast with the engine effectively paused. The set-up also slashes the ignition time after a start-stop. Audi claims that in everyday use, the hybrid power can better fuel economy by as much as 0.8-litres per 100kms. Another fuel-saving measure engineers put in place, the S8 can shut down cylinders as needed.

Handling technology

In the search for improved handling, Audi has fitted predictive active suspension, that scans the road ahead and then lifts or pushes each wheel individually to suit. The luxury car maker says this makes for a glassy smooth ride and clamps down on body roll and even front to back oscillations. The system is also capable of delivering a firmer, sports-car-like ride, adjusted via Audi's drive select system. The technologies combined give the sedan neutral steering, that leans occasionally to a smidge of oversteer. It echos very similar technology employed on their upcoming SQ8 SUV.

If you're still not convinced about a sportscar using air-suspension, when opening the doors, the car rises 50mm. That should help passengers with bad backs or dodgy knee joints.

Even the steering configuration is unconventional, with an all-wheel steering set-up implemented. The front and rear axles are able to steer independently of one another. In practice, Audi says that the approach creates a perfectly balanced car that handles tautly at low to medium speeds, is planted at highway speeds and still manages to have a compact turning radius.

Handling is further sharpened thanks to torque vectoring. For those looking to take their car on a track-day, optional ceramic brakes reduce unsprung mass and stopping distances. The front callipers have 10 pistons each, with many everyday cars having one, two or four. Six would be considered a heavy duty brake, eight would take it up another notch, 10 is just bonkers - reserved for the likes of the Lamborghini Urus or Porsche Cayenne Turbo SUVs!

Trademark Audi design touches

The new model carries Audi's signature minimal and edgy styling. The car has a chiselled exterior, with unique to the S model fitments. These include a crisp front bumper, side skirts and mirror housings. At the rear, there are quad exhaust tips and a chrome sill line that runs around the car. It's quite a unique embellishment. Audi also promised an extended wheelbase model for major markets like the USA, Canada, China and South Korea. Apparently, this model will not only bring extra leg, but also head room.

Audi designers drew inspiration from upmarket lounges for the interior design. Standard features include things like power-adjustable sports seats with pneumatic side bolsters and three-stage heating elements for each passenger.

As you'd expect, the S8 has a lot of new modern safety assists. One worthy of mention is a pre-collision sensing suite that will raise the car 80mm before a smash to help the strongest parts of the body absorb the most impact. To make this happen, the performance sedan has five radar sensors, six-cameras and a dozen ultrasound sensors, plus a cool-sound laser scanner.

Finishing up the interior, you'll get Amazon Alexa built-in, Audi's hallmark virtual cockpit instead of an analogue instrument cluster and Bang & Olufsen 3D surround sound speakers.

When's the Audi S8 coming to Australia?

Audi expects the car to land here in the second half of 2020. They promise to release further pricing and spec details closer to the launch date.

Recent car reviews

Picture: Shutterstock

https://www.finder.com.au/new-audi-s8-confirmed

0 notes

Text

Bitcoin prices jump 10% following US$100,000,000 Tether print run

Tether is a so-far inextricable part of the cryptocurrency markets, so it's well worth knowing how it works.

There's never a dull moment with Tether, especially now that it has printed off a cool US$100 million. It's reasonable to assume that this will impact Bitcoin prices. The printing run is almost certainly related to the recent Bitcoin price rise and is most likely related to Bitcoin rising back from under $10,000.

The Tether printing press has naturally been quite busy lately, but printing runs of $100 million all at once are quite uncommon. Here's what happened last time Tether printed off as much as $100 million in one go.

BTC/USD chart by TradingView

Most zoologists agree that this is very bull-like behaviour.

Wait, is this price manipulation? How does Tether actually work?

Tether (USDT) is a collateralised stablecoin cryptocurrency. Its price floats, but it's theoretically backed by real money and each Tether is supposedly redeemable for US$1. This is why its price hangs around the $1 mark. The idea is that when big money folks want to buy a lot of crypto, they go to Tether and buy a lot of USDT with fiat currency.

Now, Tether has long been at the centre of price manipulation allegations for two main reasons.

There's an undeniable mathematical correlation between Bitcoin price rises and Tether printing runs. After doing a lot of in-depth analysis, mathematicians have agreed that this is deeply mathematically suspicious.For a long time, Tether's behaviour in the face of these allegations was frankly just ridiculously suspicious.

After putting these two considerations together, a lot of people decided that Tether was just printing fake money in order to pump Bitcoin prices. In other words, there actually weren't any big money folks visiting Tether, and that it was just controlling the Bitcoin markets by printing and dumping USDT whenever it felt like it.

That would very much be price manipulation.

But that's also not what's happening.

Authorities had no intention of letting such rampant weirdness go unaddressed, and in April 2019, it was revealed that the New York Attorney General's Office had been investigating Tether and the affiliated Bitfinex cryptocurrency exchange.

Tether's reserves were naturally a large focus of the investigation. But in a fairly surprising turn of events, one of the things the investigation turned up was that, minus some relatively honest mishaps, Tether was actually fully backed. In other words, big money folks actually are visiting Tether and handing over giant wads of fiat in exchange for USDT.

So that's what's happening here.

What it all means

Whenever Tether fires up the printing press, it means it's helping fulfill big money demand for cryptocurrency usually Bitcoin. That we have such large Tether printing runs going now means there's a lot of buyer interest.

This can result in Bitcoin price rises, in part because people trade on Tether activity as a market indicator and in part because buying simply makes prices rise. It's not price manipulation it's a loosely-regulated low-liquidity market at its finest.

The Tether printing press actually batches orders, so you can't say for sure that each printing run is or isn't an individual buyer or multiple buyers. As such, the best way to interpret the size and frequency of Tether's print runs is probably as an ongoing gauge of whether more money is flowing into or out of crypto.

Conveniently, because of its floating peg around $1 each, you can just use the Tether market cap for an easy sense of how much traffic there is between the fiat and crypto worlds in general. As a rule of thumb, when the USDT market cap goes up, it means more money is flowing from fiat to crypto. When the USDT market cap drops, it means more money is flowing from crypto to fiat.

It's a bit rough because USDT prices float, Tether isn't the only stablecoin in town and there are other factors in play here, but its correlation with Bitcoin price moves says it's a decent enough indicator.

Here's a lightly editorialised look at the last 12 months of BTC prices (gold) next to USDT market cap (green).

CRYPTOCAP USDT chart by TradingView

Which way is Bitcoin going next?

No one knows for sure which way Bitcoin prices are going next, but Tether's activity might provide a hint for anyone who's trying to guess whether the recent pullback from $14,000 is the start of a crash or whether it's just a temporary readjustment.

Right now, Tether is loudly suggesting that there are more rises to come.

https://www.finder.com.au/bitcoin-prices-jump-10-following-us100000000-tether-print-run

0 notes

Text

Deloitte: Blockchain is now seen as a critical focus for organisations

2019 is on track to be a pivotal year for the creation of blockchain consortia.

A new survey from Deloitte has found significant shifts in attitudes towards blockchain between last year and this year. The results, from Deloitte's 2019 Global Blockchain Survey, echo the shifting focus that other big name surveys have found.

KPMG's own blockchain survey from the start of the year found that 2018 was the year organisations made up their minds on blockchain as a technology. In 2017, they were asking "can blockchain work?" but in 2019, they were asking "how can we use blockchain?"

Now, one of the main shifts between 2018 and 2019 highlighted in the Deloitte survey is that the organisations that started exploring blockchain really like what they see.

Source: Deloitte 2019 Global Blockchain Survey

As you can see, most respondents made up their minds in 2018 that blockchain was going to be relevant for them. But between then and now, many of them concluded that it wasn't just relevant it was critical.

Fun facts

One of the most telling statistics is that only 43% of respondents in 2019 (and 39% in 2018) agreed that "blockchain is overhyped." This suggests that most respondents are anticipating some absolutely Earth-shattering applications because blockchain has undeniably been super hyped up.

Over 80% of respondents agreed that they're planning to replace systems of records with blockchain and there's a chance some already have while between 80% and 90% agreed that they're already discussing or working on blockchain with other businesses in their value chain and that blockchain will eventually go mainstream.

There's an interesting gap in there, with 14% of respondents not agreeing with the statement that blockchain is scalable and will go mainstream, but only 6% of the same group saying blockchain will either not be relevant for them or that they were undecided.

This very roughly suggests that maybe 5% of organisations are only doing the blockchain thing to keep up appearances.

Obstacles to adoption

A question on obstacles to adoption clearly shows a shift in an understanding of what blockchain can do, and the current state of the industry.

Source: Deloitte 2019 Global Blockchain Survey

The biggest improvements over the last year include the following:

Regulatory issues becoming much less of an obstacleActual implementation of blockchain seeming much more feasiblePotential security threats proving to be manageableThe return on investment being more demonstrable

But at the same time, businesses are still hungry for proven blockchain uses and a lack of in-house capabilities is turning out to be a tough problem to solve.

Concerns over sensitivity of competitive information are also growing, but this can be seen as a positive development which shows that more organisations have a good idea what their blockchain solutions are going to look like and are now grappling with issues specific to their desired data sharing applications.

Team sports

But blockchain is a team sport, and one of the main obstacles to implementation is finding other organisations to do the blockchain tango with.

As Deloitte put it:

"Joining consortia coming together with others in your horizontal or vertical ecosystem, in common purpose arguably may be blockchain's largest barrier to entry. Why is this so-called co-operation so difficult? Primarily, consortia require a shift in mindset: you must ally within your ecosystem whether direct competitors or not and work toward some greater good. Getting to that place can be difficult to reconcile."

Happily, more than 92% of Deloitte respondents are either currently in a consortium with competitors or are planning to be soon.

Source: Deloitte 2019 Global Blockchain Survey

Incredibly, a whopping 25% of respondents say they're either already leading, or are planning to lead, a consortium, which sounds quite top-heavy maybe there's still some room for improvement on teamwork skills.

But the most notable takeaway here is probably that over 40% of respondents are currently not involved in consortia, but are planning to be within the next 12 months. So, over the next 12 months, we can expect to see consortia participation rise from just 50% to 91%. This is a massive shift, and it looks like the next year will be a pivotal moment for the creation and adoption of working inter-organisational blockchains.

The window of opportunity to be an early-mover in blockchain is definitely closing fast.

What does the blockchain look like?

There's little agreement on what exactly a blockchain solution will look like, and most respondents appear to have indicated that their organisation's blockchain focus is multi-faceted.

Source: Deloitte 2019 Global Blockchain Survey

The world is looking at a mish-mash of internal private blockchains, permissioned networks, public blockchains and the integration of multiple chains, and it looks like the future of blockchain will be very hybrid and very much in need of blockchain interoperability solutions.

Elsewhere, respondents suggested that they're open to whatever benefits blockchain might bring and aren't too fussed about homing in on specific benefits like cost-cutting or improved process efficiency. Rather, they're happy to sample a smorgasbord of whatever benefits blockchain can bring, including entirely new business models.

It looks like blockchain is in for a big 2019.

Also watch

Disclosure: The author holds BNB and BTC at the time of writing.

Disclaimer: This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. It is not a recommendation to trade. Cryptocurrencies are speculative, complex and involve significant risks they are highly volatile and sensitive to secondary activity. Performance is unpredictable and past performance is no guarantee of future performance. Consider your own circumstances, and obtain your own advice, before relying on this information. You should also verify the nature of any product or service (including its legal status and relevant regulatory requirements) and consult the relevant Regulators' websites before making any decision. Finder, or the author, may have holdings in the cryptocurrencies discussed.

Latest cryptocurrency news

Picture: Shutterstock

https://www.finder.com.au/deloitte-blockchain-is-now-seen-as-a-critical-focus-for-organisations

0 notes

Text

8 streetwear brands like Supreme

finder.com.au is one of Australia's leading comparison websites. We compare from a wide set of major banks, insurers and product issuers.

finder.com.au has access to track details from the product issuers listed on our sites. Although we provide information on the products offered by a wide range of issuers, we don't cover every available product. You should consider whether the products featured on our site are appropriate for your needs and seek independent advice if you have any questions.

Products marked as 'Promoted' or "Advertisement" are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Finder may receive remuneration from the Provider if you click on the related link, purchase or enquire about the product. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. We encourage you to use the tools and information we provide to compare your options and find the best option for you.

The identification of a group of products, as 'Top' or 'Best' is a reflection of user preferences based on current website data. On a regular basis, analytics drive the creation of a list of popular products. Where these products are grouped, they appear in no particular order.

Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment.

We try to take an open and transparent approach and provide a broad based comparison service. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market.

Some product issuers may provide products or offer services through multiple brands, associated companies or different labelling arrangements. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. However, we aim to provide information to enable consumers to understand these issues.

Providing or obtaining an estimated insurance quote through us does not guarantee you can get the insurance. Acceptance by insurance companies is based on things like occupation, health and lifestyle. By providing you with the ability to apply for a credit card or loan we are not guaranteeing that your application will be approved. Your application for credit products is subject to the Provider's terms and conditions as well as their application and lending criteria.

Please read our website terms of use for more information about our services and our approach to privacy.

https://www.finder.com.au/brands-like-supreme

0 notes

Text

Big pleasure from small things

Hello, friends. I have returned from France and recovered from jetlag. (I'm not good with jetlag.) Later this week, I'll publish an article about how much my cousin Duane and I spent during our ten-day drive across Normandy and Brittany, but today I want to share one small epiphany I had on the trip.

I am a Proust nerd so was happy to stumble upon Combray

Midway through our excursion, we heeded a recommendation from a GRS reader and stayed the night at the Royal Abbey of Our Lady of Fontevraud, a former monastery founded in 1101. Although many old buildings remain (and guests are free to explore them), the site is no longer an abbey. It's a fancy upscale hotel and a Michelin-star restaurant.

Duane and I typically prefer to stay in simple rooms when we travel. We don't need fancy. For us, a hotel is a place to sleep, not a place to be pampered. Our aim is to spend less than 100 per night (or 50 per person). We do make exceptions, though. (On this trip, we also paid extra to stay the night on Mont Saint Michel.)

In this case, we thought the hotel was nice and modern, but at $193.57 for the one night, we wouldn't do it again. That's way too expensive for us. And the restaurant was even more expensive.

Duane would have been perfectly happy eating crepes or galettes (which are savory crepes) at a regular restaurant in the nearby village, but I've always wanted to eat in a Michelin-star restaurant, and this seemed like a perfect opportunity. I mean: It was right there in the same building as our hotel.

I'll pay tonight, I told him. Ignore the prices. I'm making a deliberate decision to do this. You just enjoy the meal. Don't worry about the cost.

We did enjoy the meal. It was a fixed menu at a fixed price, although we could add options. (Duane added mushrooms and I added a cheese plate.) The food was fun and fancy. Here for instance, is the pea soup with bread:

Pea soup with bread as a first course

In the end, I spent $267.41 for our meal. That's the most I've ever paid for a meal in my life. But was it the best meal of my life? No. It was good don't get me wrong and I loved experiencing how a superstar kitchen combines flavors, but this wasn't even in the top twenty meals I've ever eaten. There are several restaurants here in Portland that I'd prefer to dine at, and they cost much less.

But I don't mean to grouse about how little enjoyment we got for the money we spent. Just the opposite, in fact.

When we reached our hotel room after a long day of driving, I needed to freshen up before dinner. I went to the bathroom to wash my face. Wow, I thought as I scrubbed down, this soap smells amazing. I love it. This is a strange thing for me to think. I've never had positive feelings for soap before in my fifty years on this Earth.

When I'd finished, Duane took his turn in the bathroom. Did you smell that soap? he asked when he was done. It smells like wood and smoke and spice. It's fantastic.

I thought same thing! I said. I'd buy some. Maybe we can find it when we get to Paris.

We sound like a couple of gay men, Duane said and we both laughed. (He can get away with jokes like that because he is a gay man.) We forgot about the soap and went to dinner.

In the morning, as we were checking out, we noticed that the soap was for sale in the hotel lobby. On a hunch, I googled the manufacturer. Sure enough: The soap was produced by a small company only three kilometers away.

Let's go buy some soap, I said. We hopped in our rented Peugot 208 and made the short jaunt to the soap factory, Martin de Candre.

Sidenote: We knew nothing about the Peugot 208 before we picked it up at the rental company. Turns out, it's an awesome little car. France is filled with awesome little cars. Unfortunately, none of them are available in the U.S. because the car manufacturers don't think they'll sell well. Americans like big trucks and SUVs. This makes me sad. I'd gladly purchase a Peugot 208 as my next vehicle.

We spent about half an hour looking at (and smelling) the different soaps. A friendly French woman answered our questions and taught us how to better get a sense of each soap's scent. (You need to step out of the shop, she said, and let the soap get warm in the sun. Then you'll know how it really smells.)

In the end, Duane spent 20 on soap. I spent 40. We both believe it's money well spent.

Fancy soaps for sale in rural France

I can't believe I just made a side trip to buy soap, I said as we resumed our journey toward Amboise. But I feel like this is a small thing that will improve my quality of life. Kim and I currently use watered-down liquid soap from a dispenser. I don't like it. Now when I come in from working in the yard, I'll actually enjoy washing my hands. It sounds stupid, I know, but it's real. Plus, it'll remind me of France and this trip with you.

It doesn't sound stupid, Duane said. There are lots of small things that make life better. I don't think we pay enough attention to them. Sometimes you can get big pleasure from small things. More pleasure than from big things, in fact.

Do you really think so? I asked.

Sure, he said. Think of your brother Jeff. He likes gourmet coffee. I'm happy with a cup of coffee from McDonald's but he's not. Every morning, he gets a lot of joy from a fancy cup of coffee. For me, I enjoy having a clean car or a clean house especially since I don't clean either one very often. I'll bet you can think of all sorts of similar examples.

As we drove, I thought more about the pleasure we get from small things. Duane is right. There are certain tiny actions and objects that make my life better. Here are some simple examples:

I like using everyday items I've purchased while traveling: band-aids, jackets, t-shirts, underwear, etc. I like being reminded of my trips.I wear two cheap turtle necklaces. I bought one for ten bucks in Hawaii. I bought the other for two or three bucks in Ecuador. I love them.Like many people, I have a favorite mug. I also have a favorite whisky glass. Each probably cost less than ten bucks, but they make me happy whenever I use them.Kim and I own several pieces of art produced by family and friends. None of these was expensive. (Some were given to us free.) We enjoy having the constant reminder of their creativity.One of the reasons I enjoy gardening is that every year these inexpensive plants bring my pleasure in a variety of ways: pretty flowers, tasty fruit and vegetables for meals I prepare.Most of all, I love to walk. It costs me nothing but gives me so much. I like being outside. I like exercising. I like the time for meditation.

It occurred to me that these are examples of conscious spending in action. When we identify small, inexpensive items and behaviors that make us disproportionately happy, spending on them allows us to get more bang for our buck. This also what Marie Kondo means when she talks about only keeping possessions that spark joy.

I'm unlikely to ever again in my life be so enthusiastic about soap. But I'm glad that Duane and I allowed ourselves to make a small side trip to buy this stuff. Now that I'm home and have the soap in the bathroom, it really is a small thing that gives me big pleasure. (Fortunately, Kim likes the smell of the woodsy soap too.)

Author: J.D. Roth

In 2006, J.D. founded Get Rich Slowly to document his quest to get out of debt. Over time, he learned how to save and how to invest. Today, he's managed to reach early retirement! He wants to help you master your money and your life. No scams. No gimmicks. Just smart money advice to help you reach your goals.

0 notes

Text

The seven deadly sins of personal finance

I've been reading and writing about personal finance for more than thirteen years. In that time, I've consumed a lot of books about money. Lately, I've found that it's fun to revisit old favorites.

Recently, for instance, I've been re-reading Brett Wilder's The Quiet Millionaire [my review]. It's different than most personal finance books. It's targeted at those who are farther along their financial journeys rather than at those just starting out. Still, there are bits and pieces in The Quiet Millionaire that are applicable to everyone.

Ten years ago, I wrote that I particularly like Wilder's list of the seven enemies to financial success (which is my phrase, not his). I still like them. He writes:

If you want to become and stay the quiet millionaire, you must plan and manage your financial way of lifeYou must be proactive in order to obtain the financial life you want. By doing this, you will overcome the seven major obstacles to financial success.

Wilder is saying that we know there are certain common barriers to wealth. These obstacles arise for everyone. Because of this, it's possible to plan in advance to cope with them. First, however, we have to be able to name these enemies so that we can prepare the proper weapons to fight them.

The Seven Enemies of Financial Success

According to Wilder, the seven enemies of financial success are:

Lack of discipline. Without discipline, it's difficult to build wealth. In fact, it's impossible to get rich slowly or otherwise if you spend more than you earn. The math just doesn't work. Wilder also warns against compulsive spending, and he urges readers to track where their money is going.Materialism. Stuff will not enrich your life. It's so very easy to find yourself keeping up with the Joneses, succumbing to lifestyle inflation. But materialism breeds discontent. Instead, Wilder says, focus on intellectual and spiritual pursuits to obtain fulfillment.Debt. Not all debt is bad, of course. A reasonable mortgage on a sensible home is fine. But consumer debt or a bad mortgage on a big house is an enemy to financial success. In fact, bad debt may be the biggest enemy to financial success.Taxes. It's our responsibility to pay the taxes we owe, but we're under no obligation to pay more than that. It is not unpatriotic to reduce paying your taxes, Wilder writes. We should instead actively work to keep our tax burden as low as possible.Inflation. Inflation is wealth's silent enemy. It will not destroy you all at once. But it's always there, nibbling at the corners of your life, consuming a little cash every year. It's impossible to keep inflation completely at bay, but you can learn to mitigate its effects.Investment mistakes. Poorly structured investment portfolios can be a killer. This enemy is fought through education, through an understanding of diversification and asset allocation, by taking the emotion out of investing.Emergencies. The final enemy to financial success is the unexpected: unemployment, death, illness, and legal complications. Without a plan for emergencies, you leave yourself at the mercy of the fickle fates. Carry adequate insurance and maintain an emergency fund!

I've fought all of these enemies at one time or another. I still fight some from time to time. I feel like I have a good handle on investment mistakes and saving for emergencies, but my tax bill this year was onerous due to my own poor planning. And, of course, I've always struggled with discipline.

The Seven Deadly Sins (and the Last Four Things) by Hieronymus Bosch

The Seven Deadly Sins of Personal Finance

Wilder's seven enemies to financial success always reminds me of Catholicism's traditional list of seven deadly sins. This catalog of transgressions has a long, complicated (and intersting) history. Today, the seven deadly sins are considered to be:

Vanity (or Pride). An inflated belief in your own abilities.Envy. The desire to have what others have.Gluttony. Consuming more than you need, especially with regards to food and drink.Lust. A passion or longing for bodily pleasure.Wrath (or Anger). The tendency toward indignation and the desire for vengeance. Hatred toward others.Greed. The desire for material wealth or gain.Sloth. The avoidance of work. Laziness. A failure to act or make use of your talents.

What would happen if we combined Wilder's idea seven enemies to financial success with this list of seven deadly sins? If we were to make a list of seven deadly financial sins, what would those be? Off the top of my head, these seem like good candidates:

Sloth. The avoidance of work. Laziness. A failure to act or make use of your talents. Procrastination. Expecting others to solve your problems.Envy. The desire to have what others have. Comparing yourself to others. Keeping up with the Joneses.Gluttony. Consuming more than you need. Succumbing to lifestyle inflation, the endless desire to have more. Never being satisfied with what you already have. The inability to defer gratification. Impatience.Aimlessness. A failure to plan for the future. A lack of purpose or direction. Failing to track your progress is also a form of aimlessness.Improvidence. A lack of prudence or care in managing your resources. Spending mindlessly. Wasting what you already have. Not taking care of your possessions. Replacing the things you own before they need to be replaced.Myopia. Making decisions without considering greater implications. Focusing on small, easy steps that make no real difference (clipping coupons, maybe) while ignoring the big things that destroy your financial future (paying too much for housing, for instance).Ignorance. A lack of financial education. Putting blind faith in outside advisors or the news. Failing to do your own research.

Although this list is spontaneous, I like it. These really do feel like seven barriers that prevent people from succeeding with money. But I'm sure it's possible to come up with other (possibly more grievous) sins.

What do you think? If you were to list the seven deadly sins of personal finance, what would you include? And why?

Author: J.D. Roth

In 2006, J.D. founded Get Rich Slowly to document his quest to get out of debt. Over time, he learned how to save and how to invest. Today, he's managed to reach early retirement! He wants to help you master your money and your life. No scams. No gimmicks. Just smart money advice to help you reach your goals.

0 notes

Text

The psychology of passive barriers

A surprising thing happens to people in their forties. After working hard, buying a house, and starting a family, they suddenly realize that they'd better start being responsible with their money. They begin reading financial books and trying to learn how to set up a nest egg for themselves and their families. It's a natural part of growing older.

If you ask these people in their forties what their biggest life worry, the answer often is, quite simply, money. They want to learn to manage their money better, and they'll tell you how important financial stability is to them.

Yet the evidence shows something very different.

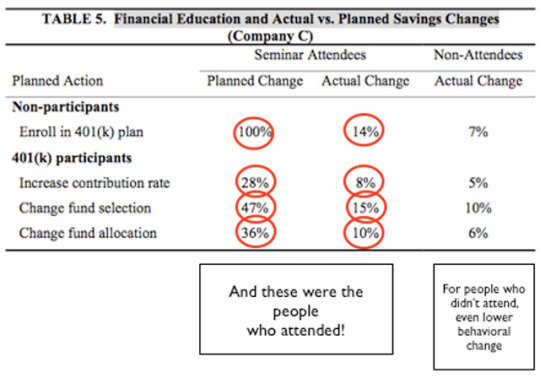

In the table below, researchers followed employees at companies that offered financial-education seminars. Despite the obvious need to learn about their finances, only 17% of company employees attended. This is a common phenomenon.

As Laura Levine of the Jump$tart Coalition told me and I paraphrase Bob doesn't want to attend his 401(k) seminar because he's afraid he'll see his neighbor thereand that would be equivalent to admitting he didn't know about money for all those years.

They also don't like to attend personal-finance events because they don't like to feel bad about themselves. But of those who did attend the employer event, something even more surprising happens.

Of the people who did not have a 401(k), 100% planned to enroll in their company's 401(k) offering after the seminar. Yet only 14% actually did.

Of those who already had a 401(k), 28% planned to increase their participation rate. 47% planned to change their fund selection (most likely because they learned they had picked the default money-market plan, which was earning them virtually nothing). But less than half of people actually made the change.

This is the kind of data that drives economists and engineers crazy, because it clearly shows that people are not rational. Yes, we should max out our 401(k) employer match, but billions of dollars are left on the table each year because we don't. Yes, we should start eating healthy and exercising more, but we don't.

Why not? Why wouldn't we do something that's objectively good for us?

Barriers are one of the implicit reasons you can't achieve your goals. These barriers can be psychological or profoundly physical, like something as simple as not having a pen when you need to fill out a form. But the underlying factor is that they are breathtakingly simple and if I pointed them out to you about someone else, you would be sickened by how seemingly obvious they are to overcome.

It's easy to dismiss these barriers are trivial, and say, Oh, that's so dumb! when you realize that not having an envelope nearby could cost someone over $3,000. But it's true. And by the end of this article, you'll be able to identify at least three barriers in your own life whether you want to or not.

Why People Don't Participate in Their 401(k)s

If you're like me, whenever you hear that one of your co-workers doesn't participate in their 401(k) especially if there's an employer match you scratch your head in confusion.

Even though this is free money, many people still don't participate. Journalists will cite intangibles like laziness and personal responsibility, suggesting that people are getting less responsible with their money over time. Hardly.

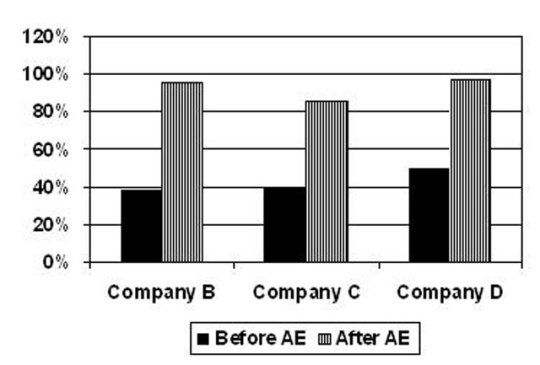

It turns out that getting people to enroll in their 401(k) is just plain hard. Using simple psychological techniques, however, we can dramatically increase the number of people who participate in their company's retirement plan. One technique, automatic enrollment, automatically establishes a retirement plan and contribution. You can opt out at any time, but you're enrolled by default.

Here's how it affects 401(k) enrollment. (AE = automatic enrollment.)

From 40% participation to nearly 100% in one example. Astonishing.

Today, J.D. has given me the opportunity to talk about one of the ways to drive behavioral change when it comes to your money. I call them barriers.

While I do this, I'm going to ask you for a favor. You'll see examples of people who lost thousands of dollars because they wouldn't spend one hour reading a form. It's easy to call these people lazy and there's certainly an element of that but disdainfully calling someone lazy doesn't explain the whole story. Getting people to change their behavior is extraordinarily hard even if it will save them thousands of dollars or save their lives.

If it were easy, you would have a perfect financial situation: You'd have no debt, your asset allocation would be ideal and rebalanced annually, and you'd have a long-term outlook without worrying about the current economic crisis. You'd be at your college weight, with washboard abs and tight legs. You'd have a clean garage.

But you don't.

None of us are perfect. That's why understanding barriers is so important to changing your own behavior.

Just Spend Less Than You Earn!

There's something especially annoying about comments on personal-finance blogs. On nearly every major blog post I ever made, someone left a comment that goes like this: Ugh, not another money tip. All you need to know is: spend less than you earn.

Actually, it's not that simple. If that were the case, as I pointed out above, nobody would be in debt, overweight, or have relationship problems of any kind. Simply knowing a high-level fact doesn't make it useful. I studied persuasion and social influence in college and grad school, for example, but I still get persuaded all of the time.

These commenters make the common mistake of assuming that people are rational actors, meaning they behave as a computer model would predict. We know this is simply untrue: Books like Freakonomics and Judgment in Managerial Decision Making are great places to get an overview of our cognitive biases and psychological motivations.

For example, we say we want to be in shape, but we don't really want to go to the gym. (J.D. is a prime example of this, and he'll be the first to admit it.) We believe we're not affected by advertising, but we're driving a Mercedes or using Tupperware or wearing Calvin Klein jeans.

There are dramatic differences in what we say versus what we do. Often, the reason is so simple that we can't believe it would affect us. I call these barriers, and I've written about them before:

Last weekend, I went home to visit my family. While I was there, I asked my mom if she would make me some food, so like any Indian mom would, she cooked me two weeks' worth. I came back home skipping like a little girl.

Now here's where it gets interesting. When I got back to my place, I took the food out of the brown grocery bag and put the clear plastic bags on the counter. I was about to put the bags in the fridge but I realized something astonishing:

if I got hungry, I'd probably go to the fridge, see the plastic bags, and realize that I'd have to (1) open them up and then I'd have to (2) open the Tupperware to (3) finally get to the food. And the truth was, I just wouldn't do it. The clear plastic bags were enough of a barrier to ignore the fresh-cooked Indian food for some crackers!!

Obviously, once I realized this, I tore the bags apart like a voracious wolf and have provided myself delicious sustenance for the past week.

I think the source of 95%+ of barriers to success isourselves. It's not our lack of resources (money, education, etc). It's not our competition. It's usually just what's in our own heads. Barriers are more than just excuses they're the things that make us not get anything done. And not only do we allow them to exist around us, we encourage them. There are active barriers and passive barriers, but the result is still the same: We don't achieve what we want to.

I believe there are two kinds of barriers.

Active barriers are physical things like the plastic wrap on my food, or someone telling me that it'll never work, etc. These are hard to identify, but easy to fix. I usually just make them go away.Passive barriers are things that don't exist, so they make your job harder. A trivial example is not having a stapler at your desk; imagine how many times a day that gets frustrating. For me, these are harder to identify and also harder to fix. I might rearrange my room to be more productive, or get myself a better pen to write with.

Today, I want to focus on passive barriers: what they are and how to overcome them.

How to Destroy Passive Barriers

Psychologists have been studying college students for decades to understand how to reduce unprotected sex. Among the most interesting findings, they pointed out that it would be rational for women to carry condoms with them, since often the sexual experiences they had were unplanned and these women can control the use of contraceptives.

Except for one thing.

When they asked college women why they didn't carry condoms with them, one young woman typified the responses: I couldn't do thatI'd seem slutty. As a result, she and others often ended up having unprotected sex because of the lack of a condom. Yes, technically they should carry condoms, just as both partners should stop, calmly go to the corner liquor store, and get protection. But often they don't.

In this case, the condom was the passive barrier: Because they didn't have it nearby and conveniently available, they violated their own rule to have safe sex.

Passive barriers exist everywhere. Let's look at some examples.

Passive Barriers in E-mail

I get emails like this all the time:

Hey Ramit, what do you think of that article I sent last week? Any suggested changes?

My reaction? Ugh, what is he talking about? Oh yeah, that article on savings accountsI have to dig that up and reply to him. Where is that? I'll search for it later. Marks email as unread

Note: You can yell at me for not just taking the 30 seconds to find his email right then, but that's exactly the point: By not including the article in this followup email, he triggered a passive barrier of me needing to think about what he was talking about, search for it, and then decide what to reply to. The lack of the attached article is the passive barrier, and our most common response to barriers is to do nothing.

Passive Barriers on Your Desk

A friend of mine lost over $3000 because he didn't cash a check from his workplace, which went bankrupt a few months later. When I asked him why he didn't cash the check immediately, he looked at me and said, I didn't have an envelope handy. What other things do you delay because it's not convenient?

Passive Barriers to Exercise

I think back to when I've failed to hit my workout goals, and it's often the simplest of reasons. One of the most obvious barriers was my workout clothes. I had one pair of running pants, and after each workout, I would throw it in my laundry basket. When I woke up the next morning, the first thing I would think is: Oh god, I have to get up, claw through my dirty clothes, and wear those sweaty pants again.

Once I identified this, I bought a second pair of workout clothes and left them by my door each day. When I woke up, I knew I could walk out of my room, find the fully prepared workout bag and clothes, and get going.

Passive Barriers to Healthy Eating

Too many people create passive barriers to healthy eating. You're sitting at your desk at work and you get hungry. Rather than reach for a healthy snack (because you don't have one with you a passive barrier), you go to the vending machine for a bag of Cheetos.

Here's a real-life example of passive barriers preventing J.D. from eating healthy. We were in Denver together in 2013 for a conference. During a long day with no breaks, he didn't have a healthy snack with him. But he did have Hostess Sno-Balls. Bad J.D. That's not even food.

J.D. needs to remove passive barriers to healthy eating

If you find yourself snacking on Cheetos (or Sno-Balls) all day at work, try this: Dont take any spare change in your pockets for the vending machine. Even if you leave quarters in your car, that walk to the parking lot is barrier enough not to do it. Give yourself an alternative. Carry a healthy snack with you, like apple slices. Remove the passive barrier to eating healthy.

Applying Passive Barrier Theory to Your Own Life

As we've seen, the lack of having something nearby can have profound influences on your behavior. Imagine seeing a complicated mortgage form with interest rates and calculations on over 100 pages. Sure, you should calculate all of it, but if you don't have a calculator handy, the chances of your actually doing it go down dramatically.

Now, we're going to dig into areas where passive barriers are preventing you from making behavioral change sometimes without you even knowing it.

Fundamentally, there are two ways to address a passive barrier.

You're missing something, so you add it to achieve your goals. For example, cutting up your fruit as soon as you bring it home from the grocery store, packing your lunches all at once, or re-adding the attachment to a followup email so the recipient doesn't have to look for it again.Causing an intentional passive barrier by deliberately removing something. You put your credit card in a block of ice in the freezer to prevent overspending. (That's not addressing the cause, but it's immediately stopping the symptom.) Or you put your unhealthiest food on the other side of the house, so you have to walk to them. Or you install software like Freedom to force yourself not to browse Reddit three hours a day.

Personally, here are a few passive barriers I've identified (and removed) for myself: I keep my checkbook by my desk, because for the few bills I receive in the mail, I tend to never mail them in. I keep a gym bag of clothes ready to work out. And I cut up my fruit when I bring it home from the store, because I know I'll get lazy later.

Now let's see how this can work for you. Here's an exercise I'd like you to do:

Get a piece of paper and a pen or open the note-taking app on your phone.Identify ten things you would do if you were perfect. Don't censor. Just write what comes to mind. And focus on actions, not outcomes. Examples: I'd work out four times per week, clean my garage by this Sunday, play with my daughter for 30 minutes each day, and check my spending once per week.Now, play the Five Whys game: Why aren't you doing each of these things?

Let's play out the last step with the example of exercising regularly. Let's assume I say that I want to exercise three times per week, but I only go twice per month. Let's do the Five Whys:

Why do I excercise only twice per month? Because I'm tired when I get home from work.Why? Because I get home from work at 6 p.m.Why? Because I leave late for work, so I have to put in eight hours.Why? Because I don't wake up in time for my alarm clock.Why? HmmBecause when I get in bed, I watch Netflix for a couple of hours.

Here's a possible solution: Put the computer in the kitchen before you go to sleep sleep earlier come home from work at an earlier time feel more rested work out regularly.

That's a gross oversimplification, but you see what I mean.

Homework: Pick ten areas of your life that you want to improve. Force yourself to understand why you haven't done so already. Don't let yourself cop out: I just don't want to isn't the real reason. And once you find out the real reasons you haven't been able to check your spending, or cook dinner, or call your mom, you might be embarrassed at how simple it really was. Don't let that stop you. Passive barriers are valued in their usefulness, not in how difficult they are to identify.

The Bottom Line

Passive barriers are subtle factors that prevent you from changing your behavior. Unlike active barriers, passive barriers describe the lack of something, making them more challenging to identify. But once you do, you can immediately take action to change your behavior.

You can apply barriers to prevent yourself from spending money, cook and eat healthier, exercise more, stay in touch with your friends and family, and virtually any other behavior. You can do this with small changes or big ones. The important factor is to take action today.

A caveat: Sometimes people take this advice to mean, The reason I haven't been sticking to my workout regimen is that I don't have the best running shoes. I should really go buy those $150 shoes I've been eyeingthat will help me change my behavior.

Resolving passive barriers is not a silver bullet: Although they help, you'll be ultimately responsible for changing your own behavior. Instead of buying better shoes immediately, I'd recommend setting a concrete goal Once I run consistently for 20 days in a row, I'll buy those shoes for myself before spending on barriers. Most changes can be done with a minimum of expense.

J.D.'s note: This is one of my favorite guest articles in the history of Get Rich Slowly. It had a profound effect on me, my life, and my work. This piece was originally published on 17 March 2009. I'm reprinting it today to celebrate the newly-published second edition of Ramit's book, I Will Teach You to Be Rich [my review].

0 notes

Text

Book Review: I Will Teach You to Be Rich (2019 Edition)

When I started Get Rich Slowly in 2006, I had no idea other money blogs existed. I'd been blogging about cats, computers, and comic books since 1997 before blog was even a word! and I thought my new venture might be the first blog about personal finance.

I was wrong.

I learned quickly that there were already dozens (dozens!) of people blogging about money on the interwebs. For instance:

Harlan Landes was writing at Consumerism Commentary. He now runs the Plutus Foundation, a financial literacy non-profit.Jim Wang a ginormous money nerd then, a ginormous money nerd now was writing at Blueprint for Financial Prosperity. He now runs Wallet Hacks.John was writing at Free Money Finance (a front for selling Moose Tracks ice cream!). He now runs ESI Money.Ramit Sethi was writing at I Will Teach You to Be Rich. He still runs the site, but his focus has shifted from personal finance to entrepreneurship and marketing.

All four of these folks built and grew successful sites because they produced quality content. But Ramit might be the most successful of all. Nowadays, he produces helpful courses on a variety of personal development subjects. He hosts conferences. He wrote a best-selling book. And he never sold his website.

Instead, I Will Teach You to Be Rich has evolved as he's evolved. In recent years, Ramit has distanced himself from the world of personal finance. Nowadays, he's focused on the many different ways his readers can build a Rich Life.

In fact, how to live a Rich Life is the core theme of the brand-new second edition of I Will Teach You to Be Rich, the book. In 2009, Ramit wrote, I Will Teach You to Be Rich is about sensible, banking, budgeting, saving, and investing. In the 2019 edition, that's been changed to, I Will Teach You to Be Rich is about using money to design your Rich Life. I think you'll agree that this is a much more compelling theme.

If you've read my other book reviews, you'll note that I sometimes shy away from giving an overall evaluation, opting instead to talk about some aspect of the book I liked (or didn't). When this happens, it's usually because I don't think the book is that great.

I won't be coy today. I Will Teach You to Be Rich is one of the best personal-finance books on the market. It's great.

Let's take a closer look at why I like it so much.

Why Do You Want to Be Rich?

Your goal probably isn't to become a financial expert, Ramit writes at the start of I Will Teach You to Be Rich. It's to live your life and let your money serve you. His book aims to show you how to make that happen.

To start, he urges readers to not get hung up on minutiae. He warns them not to give in to modern victim culture. Instead, he wants people to put the excuses aside and agree to take an active role in building their financial future.

Crafting that future starts by asking a simple question: Why do you want to be rich? When you picture your ideal life, he asks, what are you doing in it? Similarly, I ask new GRS readers to take the time to write a personal mission statement. Ramit doesn't go that far, but he does urge his audience to do some self-reflection.

The bulk of the book is devoted to a six-week action plan designed to create a solid financial infrastructure.

Week one focuses on optimizing credit cards and improving your credit history.Week two explains how to find great bank accounts, and how to negotiate away fees.During week three, Ramit helps readers to open a 401(k) and/or a Roth IRA.In week four, Ramit leads readers through he process of drafting a conscious spending plan so that they can make conscious choices about where their money goes.Week five is all about connecting your new financial infrastructure, and automating it so that it hums along without intervention from you.And the final week is an introduction to investing how to use diversification and asset allocation to meet your investment goals.

This six-week action plan gives I Will Teach You to Be Rich a clear, logical structure. Having written one print money manual and two ebooks, I know how difficult this can be. (Of my books, only the Money Boss Manifesto has a structure I like.) Ramit gets this right, and it makes a huge difference.

The last few chapters cover miscellaneous subjects that couldn't be shoe-horned into this six-week program. Ramit discusses pre-nups, for instance, using his own recent marriage as an example. He explores student loans, taxes, and financial independence.

Plus, he includes an excellent eight-page section on salary negotiation. This is something for which he has a $588 for-profit course, yet he doesn't ever mention that course in the book. I appreciate that.

For more about Ramit's opinions of the early retirement movement, check out his appearance on the Mad Fientist podcast.

The Mad Fientist and me, working together in Edinburgh yesterday

Action Not Words

For me, the primary strength of I Will Teach You to Be Rich is (and always has been) that it's packed with actionable advice. Too many money books talk about terms and cover general concepts but never give readers specific steps they can take to implement this info in their lives.

Ramit, on the other hand, is all about action.

In I Will Teach You to Be Rich, he says which credit cards, apps, and bank accounts he uses (and he tells you why). He shares several word-for-word scripts that you can use to dispute charges, get fees waived, and more.

He urges readers to focus on Big Wins, not on small (but painless) actions that have little real impact on their financial future. (What's the point of clipping coupons when your mortgage debt is crushing you? You need a new house, not cheaper toilet paper!)

He explains why it's okay to spend deliberately on the things you love as long as you're careful to cut out the stuff that doesn't matter.

Does all of this sound familiar? Does it sound like the stuff I say all of the time here at Get Rich Slowly? That's because it is. My financial philosophy is closely aligned with Ramit's. And, in fact, key parts of it actually come from from Ramit. (He's where I learned about conscious spending, for instance, and about building barriers.)

In short, Ramit focuses on the choices that will create the greatest improvements in his readers lives. He doesn't pretend to cover everything. He's only interested in the 20% of actions that will help folks achieve 80% of results. He ignores the rest.

Living a Rich Life

Ramit has made significant changes to the new edition of I Will Teach You to Be Rich. He's corrected errors. He's added new material. And he's changed the overall theme.

In this new version, he's deliberately emphasized and expanded on his Rich Life concept, which was little more than an afterthought in the first edition. During the intervening ten years, living a Rich Life has become the focus of Ramit's financial philosophy.

[embedded content]

He's also taken this opportunity to fix problems with the original. Ten years ago, I made three mistakes when writing the first edition of this book, Ramit says. Those mistakes?

I didn't cover the emotions around moneyIf you don't tackle your invisible money scripts, none of it matters. Amen! Ramit calls them invisible money scripts. I call them money blueprints. We both agree they have a profound influence on your attitudes and actions with money.The second mistake I made was being too overbearing. The truth is, you can choose what your Rich Life is and how you get there. In other words: Do what works for you our philosophy here at GRS since day one. Note that this also signals a softening of Ramit's famously abrasive delivery style. He still doesn't hesitate to say what he thinks, but he's no longer so pushy about it.Ramit says that his third mistake was quoting actual rates and numbers. The world of personal finance is in constant flux. A decade ago, you could find 5% interest rates on savings accounts. Not anymore. A decade ago, the annual Roth IRA contribution was $5000. Not anymore. So, in the second edition of his book, Ramit tries to steer clear of quoting numbers that might be outdated next year. Or next week.

In 2009, many GRS readers complained about the book's tone. They found Ramit's in your face style annoying. While the book's voice is still breezy, the irreverence and silliness are much more subdued. You won't find many lines like this anymore: Why does just about everything written about personal finance make me want to paint myself with honey and jump into a nest of fire ants?

Here's a final (but vital) change: The book's numbers and examples have been altered to appeal to a broader audience. The original edition was clearly aimed at young adults. The book's examples featured folks aged 25 to 35. The new edition deliberately includes examples for an older audience.

A Rose By Any Other Name

I had only two real complaints about the first edition of I Will Teach You to Be Rich. Like a lot of people, I didn't care for the tone. But I also didn't like the way Ramit sometimes plays word games.

The tone of the new edition is much improved, as I've mentioned, but the word games remain.

Ramit pretends to hate budgets, for instance, writing: I hate budgeting. Budgeting' is the worst word in the history of the worldBecause we know that budgets don't work, I'm going to show you a better way.

First, budgets do work. According to The Millionaire Next Door, a majority of millionaires have a budget. (Of those who don't, many others create an artificial economic environment of scarcity that mimics a budget.)

Bad budgets don't work. Good ones do. (We looked at how to budget effectively last week.)

Second, Ramit's alternative to budgeting isbudgeting. He calls his budget a conscious spending plan butit's a budget. It's a good budget explicitly based on the 60% Solution. But it's still a budget. (What's more, he advocates You Need a Budget and the envelope system!)

I don't like this sort of semantic gymnastics. It's pointless.

Really, though, this is a trivial complaint, something that'd only bother a money nerd like me. If calling his budget a conscious spending plan will help his readers improve their personal finances, great. Go for it. Play those silly word games.

I Will Teach You to Be Rich

This new edition of I Will Teach You to Be Rich is bigger and better than the first in almost every way (and that's saying a lot!).

In my review of the first edition, I wrote:

Ramits book is great, but its not for everyone. First of all, its targeted almost exclusively at young adults. If youre under 25 and single, and if you make a decent living, this book is perfect. But if youre 45 and married with two children, and if you struggle to make ends meet, this book is less useful.

The second edition of I Will Teach You to Be Rich is different. This time around, I think the book would be useful for somebody who's 45 and married with two children. There's no doubt that the tone and content still skew young, but not in a way that's off-putting for old fogies like me.

Over the past decade, I've recommended (and handed out) I Will Teach You to Be Rich to many young adults. In the decade to come, I'm confident that I'll be recommending (and handing out) copies of the new edition to people of all ages.

Why? Because there's no bullshit in this book. There's no hedging, no obfuscation, no fluff. This book is smart, bold, and practical. It's filled with tips that actually work.

Personally, I'm sad that Ramit isn't as involved in the personal-finance space as he used to be. There are few people with original things to say about money. He's one one of them. Whereas most people parrot tropes without thinking, Ramit is unafraid to challenge conventional assumptions. His voice is valuable. I wish we heard more of it.

Author: J.D. Roth

In 2006, J.D. founded Get Rich Slowly to document his quest to get out of debt. Over time, he learned how to save and how to invest. Today, he's managed to reach early retirement! He wants to help you master your money and your life. No scams. No gimmicks. Just smart money advice to help you reach your goals.

0 notes

Text

The seven deadly sins of personal finance

I've been reading and writing about personal finance for more than thirteen years. In that time, I've consumed a lot of books about money. Lately, I've found that it's fun to revisit old favorites.

Recently, for instance, I've been re-reading Brett Wilder's The Quiet Millionaire [my review]. It's different than most personal finance books. It's targeted at those who are farther along their financial journeys rather than at those just starting out. Still, there are bits and pieces in The Quiet Millionaire that are applicable to everyone.

Ten years ago, I wrote that I particularly like Wilder's list of the seven enemies to financial success (which is my phrase, not his). I still like them. He writes:

If you want to become and stay the quiet millionaire, you must plan and manage your financial way of lifeYou must be proactive in order to obtain the financial life you want. By doing this, you will overcome the seven major obstacles to financial success.

Wilder is saying that we know there are certain common barriers to wealth. These obstacles arise for everyone. Because of this, it's possible to plan in advance to cope with them. First, however, we have to be able to name these enemies so that we can prepare the proper weapons to fight them.

The Seven Enemies of Financial Success

According to Wilder, the seven enemies of financial success are:

Lack of discipline. Without discipline, it's difficult to build wealth. In fact, it's impossible to get rich slowly or otherwise if you spend more than you earn. The math just doesn't work. Wilder also warns against compulsive spending, and he urges readers to track where their money is going.Materialism. Stuff will not enrich your life. It's so very easy to find yourself keeping up with the Joneses, succumbing to lifestyle inflation. But materialism breeds discontent. Instead, Wilder says, focus on intellectual and spiritual pursuits to obtain fulfillment.Debt. Not all debt is bad, of course. A reasonable mortgage on a sensible home is fine. But consumer debt or a bad mortgage on a big house is an enemy to financial success. In fact, bad debt may be the biggest enemy to financial success.Taxes. It's our responsibility to pay the taxes we owe, but we're under no obligation to pay more than that. It is not unpatriotic to reduce paying your taxes, Wilder writes. We should instead actively work to keep our tax burden as low as possible.Inflation. Inflation is wealth's silent enemy. It will not destroy you all at once. But it's always there, nibbling at the corners of your life, consuming a little cash every year. It's impossible to keep inflation completely at bay, but you can learn to mitigate its effects.Investment mistakes. Poorly structured investment portfolios can be a killer. This enemy is fought through education, through an understanding of diversification and asset allocation, by taking the emotion out of investing.Emergencies. The final enemy to financial success is the unexpected: unemployment, death, illness, and legal complications. Without a plan for emergencies, you leave yourself at the mercy of the fickle fates. Carry adequate insurance and maintain an emergency fund!

I've fought all of these enemies at one time or another. I still fight some from time to time. I feel like I have a good handle on investment mistakes and saving for emergencies, but my tax bill this year was onerous due to my own poor planning. And, of course, I've always struggled with discipline.

The Seven Deadly Sins (and the Last Four Things) by Hieronymus Bosch

The Seven Deadly Sins of Personal Finance

Wilder's seven enemies to financial success always reminds me of Catholicism's traditional list of seven deadly sins. This catalog of transgressions has a long, complicated (and intersting) history. Today, the seven deadly sins are considered to be:

Vanity (or Pride). An inflated belief in your own abilities.Envy. The desire to have what others have.Gluttony. Consuming more than you need, especially with regards to food and drink.Lust. A passion or longing for bodily pleasure.Wrath (or Anger). The tendency toward indignation and the desire for vengeance. Hatred toward others.Greed. The desire for material wealth or gain.Sloth. The avoidance of work. Laziness. A failure to act or make use of your talents.