#taxpolicy

Text

An open letter to the U.S. Congress

Pass President Biden’s budget!

890 so far! Help us get to 1,000 signers!

At a time when working families are having trouble affording everything from healthcare to education to housing to food, we need a budget that lowers costs for millions of households―paid for by making the wealthy and big corporations pay their fair share.

President Biden’s FY2025 budget would expand the Child Tax Credit, expand Affordable Care Act subsidies to help millions of people afford healthcare in states that haven’t expanded Medicaid, invest in free pre-K for 2 million kids, implement a national paid family and medical leave program, provide free community college, expand Social Security’s modest benefits, and more.

It would also reduce the national debt by nearly $3 trillion.

He does this by raising the corporate tax rate, implementing a 25% tax on the wealth gains of billionaires and ultra-millionaires, ending tax breaks for excessive CEO pay, closing loopholes that encourage corporations to ship jobs and profits offshore, and much more.

I urge Congress to pass President Biden’s FY2025 budget to invest in working people and our future. By wide margins, the American people think that the wealthy and large profitable corporations should pay more of their fair share in taxes. So endorsing the president’s budget is not only good policy, it’s good politics. Thanks!

▶ Created on March 15 by Jess Craven

📱 Text SIGN PULPMC to 50409

🤯 Liked it? Text FOLLOW JESSCRAVEN101 to 50409

#JESSCRAVEN101#PULPMC#resistbot#open letter#petition#USCongress#PresidentBiden#BidenBudget#FY2025Budget#WorkingFamilies#AffordableHousing#Healthcare#Education#ChildTaxCredit#AffordableCareAct#MedicaidExpansion#PreK#PaidFamilyLeave#CommunityCollege#SocialSecurity#NationalDebt#CorporateTax#WealthTax#TaxFairness#TaxReform#TaxPolicy#IncomeInequality#EconomicEquality#FairShare#BudgetPriorities

2 notes

·

View notes

Text

Central Excise Day is observed in India on February 24th every year to commemorate the enactment of the Central Excise and Salt Act on February 24, 1944. This act marked the beginning of central excise taxation in the country. Central Excise Duty is a significant indirect tax levied on the manufacture or production of goods in India. The revenue generated from central excise forms an essential part of the government's income, contributing to various developmental activities and infrastructure projects.

The Central Excise Day celebration often includes seminars, workshops, and discussions focusing on the importance of excise duties in the economy, as well as highlighting the role of central excise officials in tax administration and revenue collection. It's also an occasion to recognize the efforts of excise officers and staff who work tirelessly to ensure compliance with tax regulations and contribute to the economic progress of the nation.

#CentralExciseDay#ExciseDuty#Taxation#RevenueCollection#TaxAdministration#EconomicDevelopment#TaxPolicy#ExciseOfficials#Compliance

0 notes

Text

Impact Of Economic Policies On Business: 10 Facts You Need To Know

Economic policies on business refer to government actions that influence a country's economic environment, including taxation, trade regulations, monetary policies, and incentives. These policies can impact business operations, growth, and overall economic stability.The intricate interplay between economic policies and the business landscape has long been a subject of fascination for economists, business owners, and policymakers alike.

The impact of economic policies on business is undeniable, shaping everything from market conditions to consumer behavior. Investors, entrepreneurs, and business owners must grasp the massive impact of these restrictions. The 10 Essential Facts You Need to Know About the Impact of Economic Policies on Businesses are covered in this post.

Economic Policies And Business Landscape

Explanation Of Economic Policies:

Economic policies encompass a range of measures adopted by governments to regulate and influence their country's economic performance. These policies can be broadly categorized into several key types:

Monetary Policies: These policies are enacted by central banks and focus on controlling the money supply and interest rates. The central bank's decisions regarding interest rates impact borrowing costs, affecting businesses' access to capital and consumer spending behavior.

Fiscal Policies: Fiscal policies involve government decisions about taxation and government spending. Lowering taxes can stimulate consumer spending and business investments, while increased government spending can boost demand for goods and services.

Trade Policies: Trade policies encompass international trade regulations, tariffs, and trade agreements. They significantly affect businesses engaged in import/export activities, as changes in tariffs or trade agreements can alter the cost of goods and the competitiveness of domestic industries.

Regulatory Policies: Regulatory policies pertain to rules and regulations governing business operations. These include environmental regulations, labor laws, health and safety standards, and more. Compliance with these policies can impact business costs and operational efficiency.

Influence Of Economic Policies On The Business Environment:

The economic policies adopted by governments wield substantial influence over the business environment, often shaping its dynamics and growth prospects. Here's how these policies impact businesses:

Investment Climate: Monetary policies, such as interest rate adjustments, can impact businesses' decisions to invest in expansion or new ventures. Lower interest rates might encourage borrowing for investment, while higher rates can lead to more cautious investment strategies.

Consumer Behavior: Fiscal policies like tax cuts or stimulus measures can directly influence consumer disposable income. When consumers have more money to spend, businesses across various sectors experience increased demand for goods and services.

Market Competitiveness: Trade policies play a crucial role in determining the competitiveness of domestic industries in the global market. Tariff reductions through trade agreements can provide businesses with access to larger markets and foster international growth.

Operational Costs: Regulatory policies impose standards that businesses must adhere to in their operations. Compliance with these policies can lead to additional costs, impacting profit margins, but can also enhance a business's reputation for responsible practices.

Supply Chain Impact: Trade policies, especially those related to imports and exports, can disrupt supply chains. Businesses relying on global suppliers may experience fluctuations in costs and availability due to changes in trade regulations.

Fact 1: Monetary Policy

Monetary policy stands as a pivotal instrument within a country's economic framework, wielding considerable influence over business dynamics. Monetary policy is the control of the money supply and interest rates by a central bank to promote economic stability and growth. Multidimensional economic governance profoundly affects business environments.

Definition And Role Of Monetary Policy:

Monetary policy guides a nation's economy. Open market activities, reserve requirements, and discount rates help it achieve economic goals. Generally, the primary goals include curbing inflation, stimulating employment, and fostering sustainable economic expansion. By adjusting the availability of money and credit, monetary policy exerts a substantial influence on the overall business landscape.

How Changes In Interest Rates Affect Borrowing And Investment By Businesses:

Interest rates, manipulated through monetary policy, wield substantial influence over the financial decisions of businesses. When central banks alter interest rates, it triggers a domino effect across the business realm. Lowering interest rates encourages borrowing, as the cost of capital decreases. This prompts businesses to undertake more investments, expand operations, and innovate. Conversely, higher interest rates can deter borrowing, potentially stalling business growth and investment.

Case Studies/Examples Illustrating The Impact Of Monetary Policy On Businesses:

Concrete instances of how monetary policy translates into real-world business consequences provide valuable insights into its impact. Consider the aftermath of the 2008 financial crisis when central banks globally slashed interest rates and infused liquidity into the market. This decisive action facilitated businesses' access to capital at lower costs, spurring investments and aiding in the recovery process.

Conversely, during periods of tightened monetary policy, like the 'Volcker Shock' in the early 1980s, businesses faced heightened borrowing costs, leading to reduced investments and, in some cases, contraction.Understanding the intricate relationship between monetary policy and businesses is imperative for entrepreneurs, investors, and policymakers alike. These examples underscore the undeniable role of monetary policy in shaping the fortunes of businesses, underscoring the need for a keen awareness of its mechanics and repercussions.

Fact 2: Fiscal Policy

Fiscal policy is a crucial tool that governments around the world employ to manage their economies. It refers to the use of government spending and taxation to influence economic activity, particularly in terms of aggregate demand and overall economic growth. By altering the levels of government expenditure and taxation, fiscal policy aims to stabilize the economy, encourage investment, and promote sustainable growth.

Definition And Role Of Fiscal Policy:

Fiscal policy involves the government's decisions regarding its expenditures and revenues with the intent of achieving specific economic objectives. This policy can be expansionary or contractionary, depending on the prevailing economic conditions. During periods of economic downturns, governments might increase spending and lower taxes to boost demand and stimulate economic activity. In contrast, governments may cut expenditure and raise taxes to cool the economy during strong inflation or growth.

How Changes In Taxation And Government Spending Impact Business Operations:

Changes in taxation and government spending can significantly impact the operations of businesses. Taxation directly affects a company's profitability by influencing its expenses and overall financial health. Alterations in tax rates can influence consumers' purchasing power and disposable income, consequently affecting demand for goods and services. For businesses, changes in tax policies can lead to shifts in production costs, pricing strategies, and investment decisions.

Government spending plays an equally critical role. Increased government spending, particularly in sectors related to infrastructure, healthcare, and education, can create opportunities for businesses to provide goods and services required for these projects. This injection of demand can lead to increased production and employment in relevant industries.

Case Studies/Examples Illustrating The Impact Of Fiscal Policy On Businesses:

The Great Recession (2007-2009): During this period of economic downturn, many governments implemented expansionary fiscal policies to stimulate economic activity. The American Recovery and Reinvestment Act of 2009, for instance, involved significant government spending on infrastructure projects and tax cuts, indirectly aiding industries involved in construction, manufacturing, and technology.

Austerity Measures in Europe: In contrast to expansionary policies, some European countries implemented austerity measures in response to the Eurozone debt crisis. These measures involved substantial cuts in government spending and increases in taxes. The resulting decrease in consumer spending and demand had negative repercussions for numerous businesses, leading to closures, layoffs, and decreased economic growth.

COVID-19 Pandemic Responses: The global response to the COVID-19 pandemic included various fiscal measures. Governments introduced stimulus packages, tax breaks, and financial assistance to businesses in sectors most affected by lockdowns and reduced consumer activity. These interventions aimed to prevent widespread business closures and maintain economic stability during the crisis.

#economicpolicy#businessimpact#economicgrowth#businessregulation#taxpolicy#laborpolicy#tradepolicy#monetarypolicy#fiscalpolicy#investmentclimate#businessconfidence

0 notes

Text

PROFESSIONAL TAX REGISTRATION

Professional tax is a mandatory tax imposed by some state governments in certain countries on individuals engaged in various professions, trades, or employments. This tax is distinct from the income tax and is levied to support the local government's funds and administrative expenses. The aim of professional tax is to ensure that professionals contribute to the state's revenue in proportion to their earnings. In this article, we will explore the fundamentals of professional tax, its significance, and its impact on professionals.

Applicability and Scope

Professional tax is applicable to individuals who earn an income through a profession, trade, calling, employment, or vocation. It includes salaried employees, self-employed professionals, freelancers, and business owners. The tax is typically administered by the respective state government, and the rates and rules may from state to state.

For More Information > Click Here https://ngandassociates.com/professional-tax-registration

1 note

·

View note

Text

Do you want health care or do you want a trillionaire to have more advantages?

#TaxPolicy #HealthCare #M4A

1K notes

·

View notes

Text

During a meeting with representatives fr... #businessregulations #businessfriendlyenvironment #businessfriendly #committed #competitiveness #creating #Economiccollaboration #Economicdevelopment #Economicempowerment #Economicgrowthstrategies #economicpolicy #Economicrecovery #economicresilience #economicrevitalization #economicslowdown #economicstimulus #environment #FinanceMinisterBarshamanPun #fiscalpolicy #governmentprivatesectorpartnership #govt #investmentclimate #investmentpromotion #investmentfriendlylaws #legislativeamendments #Minister #NepalInvestmentSummit #policyadvocacy #privatesectorfriendlypolicies #productivityenhancement #publicprivatecooperation #Pun #regulatoryreform #StakeholderEngagement #taxpolicy #taxratechanges #taxreform

0 notes

Text

Climate tax policy reform options in 2025 |...

"The combination of scheduled expirations of lower tax rates, fiscal pressures, and unmet climate targets suggests that a range of climate policy options could be under consideration as policymakers debate future tax policy." #taxpolicy #climatechange #sustainability

Climate tax policy reform options in 2025 |...

Because much of U.S. climate policy currently operates through the tax code, 2025 could prove to be a crucial year for U.S. climate policy choices

Korn Ferry Connect

0 notes

Video

youtube

TDS ki कक्षा|Part 3|Interest, Fees, Penalty, Prosecution, Expense Disallowance under TDS|Income Tax

TDS ki कक्षा TDS Knowledge series Part 3 @cadeveshthakur #tds #incometax #cadeveshthakur #trending #viral TDS compliance and the consequences associated with it. In this video, we’ll explore various sections of the Income Tax Act related to TDS (Tax Deducted at Source) and discuss the implications for defaulting taxpayers. Here’s the content breakdown: 📌 Timestamps 📌 00:00 to 00:56 Introduction 00:57 to 02:46 Content Part3 02:47 to 03:54 Example 03:55 to 08:48 Assessee in default 08:49 to 11:00 example 11:01 to 17:07 late fees 17:08 to 23:40 interest 23:41 to 31:51 how to calculate interest & fees 31:52 to 37:00 penalties 37:01 to 38:30 prosecution 38:31 to 39:43 disallowance 1. Section 201: Assessee in Default o Explanation of what constitutes an “assessee in default.” o Consequences for failure to deduct or pay TDS. o Key points: Interest (Section 201(1A)): When a deductor fails to deduct tax at source or doesn’t deposit it to the Government’s account, they are deemed an assessee in default. They become liable to pay simple interest: 1% per month (or part of a month) on the amount of tax from the date it was deductible to the date of deduction. 5% per month (or part of a month) on the amount of tax from the date of deduction to the date of actual payment. Interest as Business Expenditure: Clarification that interest paid under Section 201(1A) cannot be claimed as a deductible business expenditure. Penalty (Section 221): If a person is deemed an assessee in default under Section 201(1), they are liable to pay penalty under Section 221 in addition to tax and interest under Section 201(1A). The penalty amount cannot exceed the tax in arrears. Reasonable Opportunity: The assessee has the right to be heard and prove that the default was for good and sufficient reason. 2. Section 234E: Late Fee for TDS/TCS Returns o Explanation of late fees for non-filing or late filing of TDS/TCS returns. o Due dates for filing TDS/TCS returns. o Late fee calculation: INR 200 per day until the default continues (not exceeding the TDS/TCS amount). o FAQs on Section 234E. 3. Section 276B: Prosecution for Failure to Deduct TDS o Overview of prosecution provisions for non-compliance with TDS obligations. 4. Disallowance of Expenses (Section 40(a)(i)/(ii)) o Explanation of disallowance of expenses if TDS is not deducted or paid. #youtubevideos #youtube #youtubeviralvideos #tdsfreecourse #freecourse #taxdeductedatsource #TDSCompliance #IncomeTax #TaxDeduction #TCSReturns #LateFiling #Penalty #BusinessExpenditure #TaxLiabilities #FinancialCompliance #TaxPenalties #TaxationLaws #AssesseeInDefault #InterestPayment #TaxProcedures #LegalObligations #TaxAwareness #TaxEducation #FinancialLiteracy #TaxPlanning #TaxConsultancy #TaxAdvisory #TaxProfessionals #TaxUpdates #TaxGuidance #TaxTips #TaxAccounting #TaxFiling #TaxReturns #TaxPolicies #TaxChallenges #TaxSolutions #TaxExperts #TaxCompliance #TaxAware #TaxMistakes #TaxConsequences #TaxPenalties #TaxKnowledge #TaxRules #TaxRegulations #TaxBestPractices #TaxManagement #TaxUpdates #TaxNews #TaxInsights #TaxGuidelines #TaxCode #TaxEnforcement #TaxEnforcementActions #TaxPenaltyProvisions #TaxPenaltyLaws #TaxPenaltyGuidance #TaxPenaltyExplained #TaxPenaltyFAQs #TaxPenaltyCompliance #TaxPenaltyAvoidance #TaxPenaltyMitigation #TaxPenaltyResolution #TaxPenaltyAdvice #TaxPenaltyConsulting #TaxPenaltyExperts #TaxPenaltyHelp #TaxPenaltyTips #TaxPenaltyEducation #TaxPenaltyAwareness #TaxPenaltyPrevention #TaxPenaltyManagement #TaxPenaltyStrategies #TaxPenaltyUpdates #TaxPenaltyNews For more detailed videos, below is the link for TDS ki कक्षा TDS Knowledge series https://www.youtube.com/playlist?list=PL1o9nc8dxF1RqxMactdpX3oUU2bSw8-_R

#youtube#what is tds#tax deducted at source#how to file tds return#how to issue tds certificate#tds due dates fy 2024-25#tds due dates fy 2023-24#tds free course#cadeveshthakur

0 notes

Text

Climate tax policy reform options in 2025 |...

Much of U.S. climate policy is implemented through the tax code, and this new report from Brookings examines the different options policymakers have to achieve better sustainability. #taxpolicy #climatechange #sustainability

Climate tax policy reform options in 2025 |...

Because much of U.S. climate policy currently operates through the tax code, 2025 could prove to be a crucial year for U.S. climate policy choices

Korn Ferry Connect

0 notes

Video

youtube

📢✨ Short-Term Capital Gains vs. Ordinary Income: Understanding Taxes 📊📈

Hey Tumblr fam! 💻💙 Let's talk about taxes and investment gains! 📉💰 Today, we're diving into the difference between short-term capital gains and ordinary income. 🤔💡

Short-term capital gains are profits made from selling assets held for a year or less, and they're usually taxed at the same rate as your ordinary income. That means you could be paying anywhere from 10% to 37% in taxes on these gains. 💸💼

On the other hand, long-term capital gains tax rates are often lower than ordinary income tax rates. Depending on your total taxable income, long-term capital gains can be taxed at rates of zero, 15, or 20 percent, making them quite advantageous for some investors. 🚀🌟

So, which one do you prefer? 🤷♂️🤷♀️ Cast your vote in the poll below and let's discuss in the comments! 🗳️👇

#Taxes #CapitalGains #InvestmentIncome #ShortTermGains #OrdinaryIncome #TaxRates #FinancialAdvice #InvestingTips #PersonalFinance #TaxTips #FinancialLiteracy #MoneyMatters #TaxPolicy #TaxBracket #IncomeTax #FinancialEducation #InvestmentStrategies #TumblrCommunity

Disclaimer: Remember, this post is for informational purposes only and doesn't replace professional financial advice. Consult a qualified expert for personalized guidance. 💼📚

Let's spread knowledge and empower each other to make smart financial decisions! 🌟💪

https://how-to-hide-money-from-the-irs-legally.s3.amazonaws.com/tax+strategy+pro/index.html

0 notes

Text

House Republicans Need a Tax-Policy Agenda#House #Republicans #TaxPolicy #Agenda

House Republicans Need a Tax-Policy Agenda#House #Republicans #TaxPolicy #Agenda

Here are some crucial steps that GOP members on Ways and Means can take in the new Congress.

#House #Republicans #TaxPolicy #Agenda

View On WordPress

0 notes

Photo

On eve of historic social media message re: #taxes #taxreform #taxpolicy #federaldeficit #congress #potus a #bradley2024 PR insider leaks tantalizing iPhone7 📱 screenshots to @applenews and #instagram from the Methuselah redwood where video broadcast was recorded earlier this morning: “The NeoRules of X: “Tax Code Simplicity Simplicity Simplicity in the POTUS47 White House.” #purplepowermovement (at Methuselah) https://www.instagram.com/p/Cddzh7WJcjD/?igshid=NGJjMDIxMWI=

0 notes

Photo

Employers can show their appreciation for employees in many ways, but they should be aware that all benefits have tax implications.

Employees' gifts and bonuses must be taxed unless the gift is de minimis or an achievement award. To avoid running afoul of the IRS, employers should consult with a professional before making employee gifts.

If you're considering giving an employee a holiday gift this year, make sure that it qualifies as non-taxable benefits first!

Learn more about what employers should know about giving gifts to employees. https://bit.ly/3BtrJjz

#givinggifts#employeegift#fringebenefits#deminimis#employeebenefits#taxpolicy#taxableincome#businesspurpose#taximplications#familybusinesslawyer#lasvegaslawyer#lasveganevada#greggordillo#gordillolawfirm

0 notes

Photo

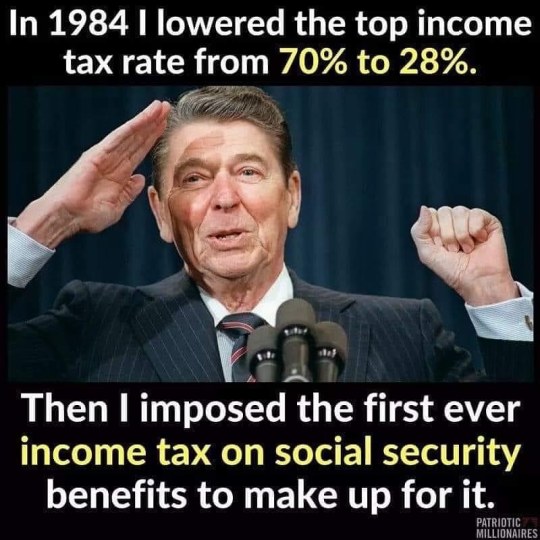

#wealthinequality and #incomeinequality are largely driven by #taxpolicy. When #Reagan #reduced #taxes on the #rich it became #gospel for the #gop and the #rich kept getting #richer. #taxtherich #economicjustice https://www.instagram.com/p/CAif-hnHDKa/?igshid=1in70k8yb6vrv

#wealthinequality#incomeinequality#taxpolicy#reagan#reduced#taxes#rich#gospel#gop#richer#taxtherich#economicjustice

0 notes

Text

Bernie Sanders Has a Plan to Tax the Rich That's About as Radical as What Teddy Roosevelt Proposed

The estate tax was not originated by Bernie Sanders.

More than a century ago, Republican President Theodore Roosevelt fought for the creation of a progressive estate tax to reduce the enormous concentration of wealth that existed during the Gilded Age.

As Teddy Roosevelt said, "The absence of effective state, and, especially, national restraint upon unfair money-getting has tended to create a small class of enormously wealthy and economically powerful men, whose chief object is to hold and increase their power. The prime need is to change the conditions which enable these men to accumulate power. Therefore, I believe in a graduated inheritance tax on big fortunes, properly safeguarded against evasion and increasing rapidly in amount with the size of the estate."

Teddy Roosevelt was exactly right.

When the senator proposes a 77 percent tax on the value of an estate above $1 billion, he's talking about renewing American values.

“The really big fortune, the swollen fortune, by the mere fact of its size, acquires qualities which differentiate it in kind as well as in degree from what is possessed by men of relatively small means. Therefore, I believe in a graduated income tax on big fortunes.”

That’s what Teddy Roosevelt proposed in his agenda-setting “New Nationalism” speech from 1910, when he prodded the United States toward a fuller embrace of progressive reform. As a former president who was preparing to again bid for the position, Roosevelt opened a conversation about tax policy in order to frame a broader debate about at least some of the values that should guide American progress.

At the heart of Roosevelt’s agenda was a specific form of taxation. While progressive taxation in a general sense was desirable and necessary, Roosevelt was particularly enthusiastic about “another tax which is far more easily collected and far more effective—a graduated inheritance tax on big fortunes, properly safeguarded against evasion, and increasing rapidly in amount with the size of the estate.”

Teddy Roosevelt, it should be noted, was a Republican who possessed considerable wealth of his own. He was a flawed figure who let down the progressive cause at many turns and never matched the courageous domestic and foreign policy vision advanced by his rival for leadership of the progressive movement, Wisconsin Senator Robert M. La Follette. But Roosevelt recognized that taxing inherited wealth not merely to collect revenues but to preserve and extend democracy.

.“One of the chief factors in progress is the destruction of special privilege.“ — Teddy Roosevelt, 1910

“The absence of effective state, and, especially, national, restraint upon unfair money-getting has tended to create a small class of enormously wealthy and economically powerful men, whose chief object is to hold and increase their power,” he explained. “The prime need to is to change the conditions which enable these men to accumulate power which it is not for the general welfare that they should hold or exercise.”

Roosevelt’s critics may have characterized him as a radical, but he was never as radical (or as right) as La Follette. Roosevelt was, however, conscious of the threats posed to the American experiment by the rapid consolidation wealth and power. And he knew that progressive taxation could be used to address those threats.

Bernie Sanders knows this, as well. That’s why Sanders is proposing a progressive estate tax on the fortunes of the top 0.2 percent of Americans. The senator from Vermont’s newly introduced “For the 99.8% Act” would collect $2.2 trillion from 588 billionaires.

“At a time of massive wealth and income inequality, when the three richest Americans own more wealth than 160 million Americans, it is literally beyond belief that the Republican leadership wants to provide hundreds of billions of dollars in tax breaks to the top 0.2 percent,” argues Sanders. “Our bill does what the American people want by substantially increasing the estate tax on the wealthiest families in this country and dramatically reducing wealth inequality. From a moral, economic, and political perspective our nation will not thrive when so few have so much and so many have so little.”

Sanders is widely expected to bid for the Democratic presidential nomination in 2020. If he does so, Sanders will not be the only contender with a bold plan to tax the rich. Massachusetts Senator Elizabeth Warren, for instance, has a plan to levy a 2 percent tax on the assets of wealthy Americans with more than $50 million. From those with over $1 billion, she’d demand an additional 1 percent.

The Democrats who seek to dislodge Donald Trump in 2020 will all need to make tax policy a priority. Republicans have for so long practiced reverse Robin Hood politics—take from the poor and give to the rich—that the promised Democrats make will be unobtainable without the infusion of revenues that comes from taxing the wealthy. Changing tax policy also infuses governing with democracy, as it dials down the influence of specially interested billionaires (such as the Koch brothers) and their corporations.

What is notable about the Sanders plan is that, with his proposal to establish a 77 percent tax on the value of an estate above $1 billion, the senator is merely seeking “a return to the top rate from 1941 through 1976.”

Sanders is proposing an approach that renews American values, as notes University of California–Berkeley economics professor Emmanuel Saez. “The estate tax was a key pillar of the progressive tax revolution that the United States ushered one century ago. It prevented self-made wealth from turning into inherited wealth and helped make America more equal,” explains Saez. “However, the estate tax is dying of neglect, as tax avoidance schemes are multiplying and left unchallenged. As wealth concentration is surging in the United States, it is high time to revive the estate tax, plug the loopholes, and make it more progressive. Senator Sanders’ bill is a bold and welcome leap forward in this direction.”

Teddy Roosevelt understood this economic calculus, and this democratic imperative.

“In every wise struggle for human betterment one of the main objects, and often the only object, has been to achieve in large measure equality of opportunity. In the struggle for this great end, nations rise from barbarism to civilization, and through it people press forward from one stage of enlightenment to the next,” the Republican president explained in 1910. “One of the chief factors in progress is the destruction of special privilege. The essence of any struggle for healthy liberty has always been, and must always be, to take from some one man or class of men the right to enjoy power, or wealth, or position, or immunity, which has not been earned by service to his or their fellows. That is what you fought for in the Civil War, and that is what we strive for now.”

This Piece Originally Appeared in The Nation

Read the full article

0 notes

Text

GST Services in Delhi

The Goods and Services Tax is a necessary indirect tax that was imposed in India to replace various taxes. Before we move on to the GST registry, we need to know what GST is. The GST means that taxes on goods and services are hair products. Before GST was introduced in India, the tax system was divided into two parts: direct and indirect taxes. Subsequently, on March 29, 2017, the electronic GST registry was approved in Parliament. This goods and services tax will be levied in India on July 1, 2017 from the day India became a nation and a tax country of the world.

Facebook Media

Instagram Media

Twitter Media

1 note

·

View note