#spending habits don't make my bank account go in the negatives

Text

secret of the wings art book when

#og#i'd kill for the original film's or even the lost treasure one's bc my girlie viola's 2 seconds of screentime#i just want something with clarion in it ;-;#like what if the secret of the wings one has concepts for young!clarion and milori like what then#i would die#does that book even exist? who knows!#i only know about the lost treasure + great fairy rescue ones#but i'm gonna hope someday one of those appear and that it's not so out of budget my impulsive hyperfixation#spending habits don't make my bank account go in the negatives#basically. i assume at least a secret of the wings one exists#and someday i will get a copy and i will go fucking apeshit#no realistically it has not surfaced ever and realistically if it does#it will probably be the cost of my rent#but i am going 2 hold out hope#(if anyone does know about non lost treasure/fairy rescue ones existing tho.... p lease let me know)#i just hate that they made these staff onlyyyyy#so many newer movies are getting theirs actually released to the public ;-;

12 notes

·

View notes

Text

I may have finally unlocked the thing what turns my unhealthy overproductive causes-me-burnout creativity into enjoyable creativity - and it's called working off of vibes.

In the past I've tried just taking breaks from being creative, but that never works. Doing things other than being creative just feels like I've put myself in time out from the thing I actually like doing. Ultimately, I want to be creative. I love making art! I love writing stories! I genuinely get life from being my artistic self like.... all the heckin' time. It's all I genuinely want to do is make stuff.

What I don't get life from is making it a grind. Working to rigid schedules, focusing on daily goals and - oh my lord, I despise the push to monetize it. I'm leaning hard away from that these days, and I'm not sure how far I'll ultimately take my aversion to pursuing profit from my creative ventures. It doesn't make me significantly happier to make money off of it (even though sometimes it's necessary, like when disaster strikes and I don't readily have four digits in the bank account to fix whatever's exploded), especially when making money comes with added stress from things like figuring out the taxes on what I've made, and the horrors of the perpetual chase to make more money. The emotional balance trends towards the negative and I'm over it.

So I'm attempting a vibes-based approach - doing things when it's good for me to, and in a way that is fun. Some of it's a bit of concerted de-programming: for example, my webcomic is a source of truly bad habits for no good reason. It exists only on my Patreon, and it is exceptionally obscure and always was. There is very little point in wearing myself out trying to pour twenty hours a week into a new page every single week just because one is supposed to stick to a schedule, but over the last decade or so I programmed myself very well to do just that. Getting out of that rut so that I can have a healthy relationship with it again is a fight, but I'm winning. I want to chase the short term happy of getting a new page queued up every Monday, but instead I'm refusing to do so. If the page is done, I queue it up a few days late. And then the next week a few days later than that. Always a different number of days, pushing it out of sync so that I can't fall back into routine and neither can my handful of readers. I did not ever promise them a schedule. A schedule is bad for me. Result? I (mostly) drew three pages this weekend and enjoyed it. They're not done, but I made a heck of a dent and didn't feel gross about it. I'll finish them over the course of the next week or so, in bits and pieces rather than forcing myself to sit still for hours at a time until the page is done. I should be stopping when I'm done.

I'm also way happier with the art I'm making. I'm still churning it out quick, but the lack of self-imposed deadlines means that I can have fun with it.

I'm doing similar things with my writing. It's nice when I can keep Alpha Base moving forward, but for the last while I've been muddling around in different directions than forward and it's actually getting the creative wheels spinning in my head better than the methodical one-step-in-front-of-the-other approach. If I have a hankering to jump elsewhere in the plot and write a scene, I do. If I need to explore an aspect of a character that technically falls into a prequel (because dang it, I'm starting to develop prequel material) then I go for that. If writing a drabble that might not even land in the book, or any of the book(s), is what I need, then I'm doing that, and it doesn't matter if I'm "ready" to or "there yet" - I'm just doing it. Vibes. It's all worthwhile.

Hell, I spent most of the weekend writing a purely fluff scene (me! writing fluff!) between two of my antagonists and I think that was one of the best ways to spend a weekend. I feel damn good about it and learned a ton about them both. I think I even know where in the book to put it, and I sure didn't when I started writing. Didn't know that would happen!

Life's too short to spend turning everything into a dang job.

I just want to play.

So to hell with it. We play.

7 notes

·

View notes

Note

i think i have a shopping addiction?

i use klarna which means i dont have to pay for things until im ready and have the money, and i always pay it off, but i cant stop buying more things and im unable to clear my klarna balance because i keep adding to it

i just paid for a house deposit, and need to save up over a grand to pay first months rent before i move in september, but i cant stop spending

any advice?

First of all, congratulations on paying for a house deposit! That's huge and it's super exciting. In terms of what you can to do curb your impulse spending, there are a few things you can try:

When you think you want to buy something, leave it in your online cart for 24 hours. If you still want it after that time period, then buy it. This is a good approach for two reasons: first, after a "waiting period" a lot of items don't look as attractive, and two, a lot of the time companies will send you a coupon if they see you've left an item in your cart. So if you do want to buy it, it's less expensive than it would have been if you bought it immediately.

Before you buy anything, ask yourself the following questions: Is this purchase going to improve my life in some way? Is this purchase going to make me feel better? Does it help me to meet one of my life goals? Will it simplify my life? How often will I use it? If it's a clothing item, does it go with other things in my closet? Does it fit me?

Before you buy anything, ask yourself if there's a way you could get it for free. If it's a book, movie, TV show, or video game, could you get it from your local library? If it's a clothing item, is there something similar in your closet that you could try to style in a new way, or do you have a friend with a similar item? Maybe you could borrow it from them or swap it for an item that you don't wear.

Put the majority of your money in your savings account, and only have the amount you're willing to spend on non-essential items in your checking account. If you don't have money in your account, you can't impulse buy things you don't need.

Remove your credit/debit/bank information from Klarna and from other places where it's saved. If you have to manually enter all of your information each time you want to make a purchase, you'll be less likely to make impulse purchases.

Block the websites you shop on the most. If you can't get to the website, you can't see things you might want to buy.

Try converting the amount an item is worth to how much work it would take to afford. For example, if you make US minimum wage ($7.25 an hour) a $29 shirt would be worth four hours of work. Putting it into perspective that way can help you to assess whether the item is actually worth it. It can also help to think about spending in the context of your rent- "this shirt if 3% of my rent every month. If I don't buy it, I'm 3% closer to my goal". Our brains aren't great at putting dollar amounts into context, but they're better at understanding if we compare the price to something else.

Identify what emotions you're feeling when you're most tempted to buy things, and then think of other ways you can deal with those emotions. Some people spend money as a way of dealing with stress- if that's you, meditation or deep breathing exercises might be an alternative. If you spend money when you're sad, putting on happy music or a comedy special might work instead. If you spend money because you want novelty, it may help to change other things around you- for example, rearranging your bedroom or changing your phone background and lockscreen. It may sound silly, but so many of our bad habits are an attempt to self-soothe when we're feeling a negative emotion.

0 notes

Text

Leveling Up Journal: Where to start?

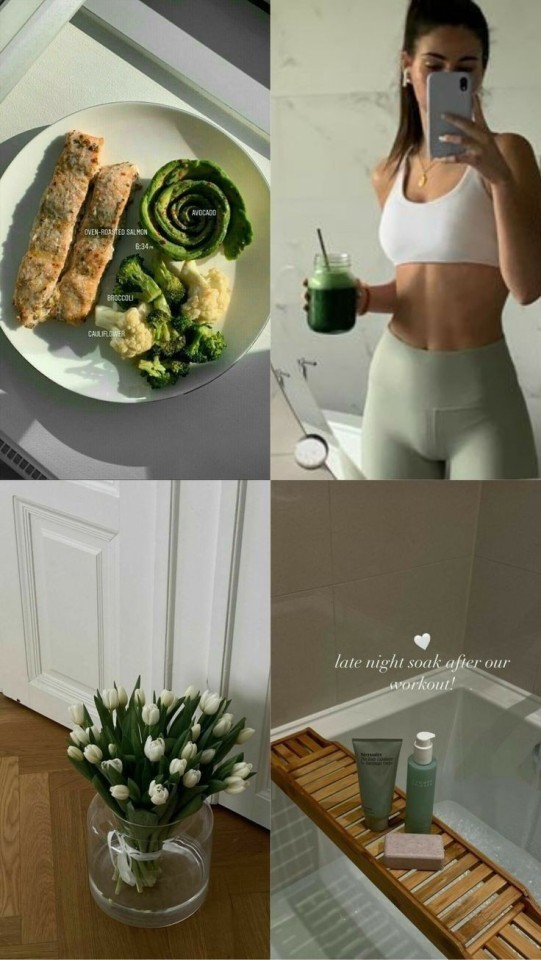

Glowing up sounds amazing but if you're like me, starting is the biggest hurdle. Part of the difficulty is just picking managable goals so I have compiled a short list to show where a glow up should start.

1) You

This one is the most important because it is how others percieve you but your body is your vessel, and you will always need to live with it.

So, make your health a priority. Work out, book dentist appointments, doctor visits and mental health professionals. Make a sleep schedule, a cleaning schedule and a five year plan. Look at yourself from a different point of view and ask yourself "what do I do that no longee serves me?", maybe that's drinking too much, ordering takeout and never cleaning on time or maybe it's being judgey, stressed and negative about yourself.

A forgotten aim of the glow up is to live long and happy. You cannot do that if your habits take off 5 years of your life. And enjoying what you do is so much easier when you are not in pain or thinking negative thoughts.

2) Money

Am I insinuating that you need money to glow up? No. But you do need to know how to manage it. Learn about financial matters and put that education to practice. The sooner you are more independent with your money the sooner you can let go of your dependence on other and fly free.

In my opinion, people who are dependent on financial advice or help from others, unless obviously they are an impartial service you have access to like bank provided financial advisors or others, are more easily influenced and feel different about potentially cutting off toxic family members, friends or acquaintances.

Once you have your money secure, learn how to budget. If you find that you don't like it, that's fine but find something else to keep your spending in check.

If you live in the US or any other country with similar financial systems, become aware of your credit and learn how to improve it.

It is also good to know what to do if any of your accounts are compromised as in a panic, it's sometimes hard to think about researching next steps. Especially when money is involved.

3) Aesthetic

That word has been fairly vilified by the online community but I want to claim it back. To be an aesthetic is a cohesive way of quickly describing or showing others what you are about and who you want to be. Cohesive is the keyword here because that is really the only thing separating rzndom pictures from a moodboard, the same goes for real life. Make sure your clothes match and your makeup too, maybe pick a colour scheme if that helps. Have a signature scent, hairstyle and handbag.

Your aesthetic is what makes you recogniseable to others, it makes you memorable. So go ahead, be the green juice girl, luxury woman or pink pilates princess of your social circle

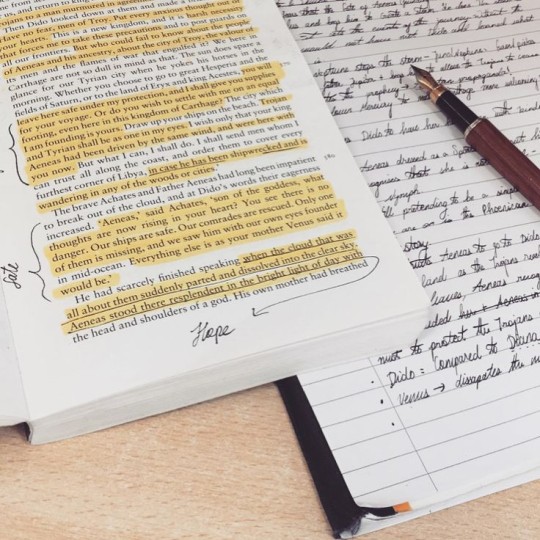

4) Intelligence

I'm a big fake it till you make it fan. Especially in education. Only a small amount of us are (education) smart by nature but we may shine in other useful domains. However, any well-rounded individual strives to be smart in all areas. Getting smarter is easy too; reading, listening to podcasts, watching documentaries or learning new skills all make you smarter. There is almost no need to sit at a desk studying for hours on end.

Take advantage of all these easy ways to learn things and educate yourself. In my opinion, people who strive to educate thelselves and put effort into their intelligance make for more interesting conversation partners and better communicators, both qualities we should hope to improve in ourselves.

5) Mentality

A glow up cannot be successful if you do not believe it will be. This isn't a loa thing, but if you go out everyday believing that you look stupid and ridiculous, you will never glow up. If that is the case, reassess whether you are doing this for the right reasons. Are you, first and foremost doing it to benefit you and your life? Are you doing it to make a positive change? Even if your goal is to feel confident after a career change or to bag the hottest guy in LA, make changes with a "positive change for me", why? Because while everything else spraks of your person and who you are becoming, confidence screams about it.

Or in other terms, confidence is hot and alluring.

This list shows you the first level of you "leveling up journey", treat it as such. Do not end your self improvement there and re-evaluate your goals to find new areas to level up. The goal is to be the best self you can be, and the more life you live the more areas of self improvement you unlock

22 notes

·

View notes

Text

How to Stop Worrying About Money Even If You Don't Earn Much

If you asked anyone to list their top 5 concerns, I’m confident money or finance would be up there. Salaries, loans, mortgages, debts, stocks, investments, or other financial concerns that you can name are concerns we ponder on a daily basis.

So how can I not think about my financial situation? You might ask. The answer is financial freedom.

So What Is Financial Freedom?

Financial freedom, on paper, means not being tied to burdens or concerns financially. In other words, a financially free person spends their money without worrying when is the next paycheck coming or how to pay off debts and loans.

It does not mean acting cool or boast in front of your friends or proving a point to your family, but rather for you to sleep peacefully at night and wake up with positive thoughts, rather than thoughts: “I am desperately searching for money day 34”.

How We Can Benefit from Having Financial Freedom

Unless you live only in the present day, and don’t think about the near future (which is not the smartest decision nowadays), there are only benefits in being financially free. Firstly, it’s your emotional freedom – your thoughts are not constantly stuck to your bank account and unpaid bills. Secondly, you are aware of your expenses (well the majority of them, because we all have unexpected bills) and profits. You know when you can splurge on something you crave or need and when you need to cut back. Thirdly, it lets you make long-term plans like summer holidays or that yoga retreat you’ve been dreaming about.

Financial Control Is Out of Your Reach? Here’s What To Do

Financial freedom will not happen overnight, and it might require doing some damage control as well. I have described a perfect scenario: you start with a solid base (your family) and go step-by-step. However, a lot of us go through a rocky road and get to the focusing point after a few positive and negative experiences. It is important that you are ready to start the path where you are willing to try hard and gain financial freedom. Let’s look at 5 ways to regain control of your finances:

Turn your back on unnecessary loans

There are people out there who take loans for their wedding party. One day of fun and months of paying for it, is that really smart and logical? I understand we live only once and you will only have one (hopefully) wedding day, but there are definitely ways to work around it and have a small, but tasteful wedding. And this is just one of the many examples of unnecessary loans. Do not follow your momentary emotions and think about consequences, about conflicts that might arise and realize that it can all be avoided, if you sit and think smartly and thoroughly about a serious step you are about to make.

Think twice on purchases, buy on second thought

You don’t have to be a shopocholic to buy things you don’t need. At one point of time we all have been there. I am not talking about big purchases, because sometimes the small ones adds up to an even bigger amount. A t-shirt here, a trendy scarf there, endless phones cases (for every mood possible), do not even get me started on cosmetics (for girls) and for car/laptop/bike accessories (for guys). My advice is not to buy something right there on the spot with the first impulse, but think about it a little. Are you sure you need it? May be you already have a similar item? Just really think about, may be even sleep on it (if we are talking about an expensive item), that’s all I am suggesting.

Avoid hooking on any harmful habits (it kills you and your wallet)

The price of addictive items is increasing drastically, however from what I know, it doesn’t make people fight their bad habits. People just carry on doing whatever they were doing, and the only thing that changes is the frequency of them complaining about prices which going up. It’s a matter of a simple math to find out how much you could have saved, if you were not involved in buying these addictive items. Just count how much you spend in a week/month/year on these items, and I’m telling you the number will surprise you.

Do things you like and enjoy and most importantly keep doing them

Have a habit of being active, and by active I mean work, physical activities and emotional activities. Everything that makes your brain work and your soul happy. Find out what kind of literature you enjoy and keep reading (let it be Vogue or comics, if that’s what you love), do sports (for example I’m in love with tennis), do something for your soul and mind (in my case it’s definitely yoga), hobbies are very important (I write, and hope one day it’ll turn into something more serious). You might think: “how will it give me financial freedom”? All these activities will teach you to stay sharp and energetic, and they will make you want to accomplish more and more.

Donate genuinely (sound awkward, doesn’t it?)

I understand that this point is making your finances go another direction. However, I am a firm believer that the more you give the more will come back. The trick is to be as genuine as possible when you make donations (by donations I mean not only money, it can be anythnig which help people in need). This is a rather philosophical approach, because you must set your mind on a thought that you truly want to help and do not hold on to whatever it is that you are giving away.

A combination of these tips will definitely create successful path for regaining your financial freedom or at least making it stronger. The best part is that once you make a habit out of these hints, it’ll become so natural for you to live peacefully without unnecessary worries.

The post How to Stop Worrying About Money Even If You Don’t Earn Much appeared first on Lifehack.

from Viral News HQ http://ift.tt/2raP9VO

via Viral News HQ

0 notes

Text

How to Stop Worrying About Money Even If You Don't Earn Much

If you asked anyone to list their top 5 concerns, I’m confident money or finance would be up there. Salaries, loans, mortgages, debts, stocks, investments, or other financial concerns that you can name are concerns we ponder on a daily basis.

So how can I not think about my financial situation? You might ask. The answer is financial freedom.

So What Is Financial Freedom?

Financial freedom, on paper, means not being tied to burdens or concerns financially. In other words, a financially free person spends their money without worrying when is the next paycheck coming or how to pay off debts and loans.

It does not mean acting cool or boast in front of your friends or proving a point to your family, but rather for you to sleep peacefully at night and wake up with positive thoughts, rather than thoughts: “I am desperately searching for money day 34”.

How We Can Benefit from Having Financial Freedom

Unless you live only in the present day, and don’t think about the near future (which is not the smartest decision nowadays), there are only benefits in being financially free. Firstly, it’s your emotional freedom – your thoughts are not constantly stuck to your bank account and unpaid bills. Secondly, you are aware of your expenses (well the majority of them, because we all have unexpected bills) and profits. You know when you can splurge on something you crave or need and when you need to cut back. Thirdly, it lets you make long-term plans like summer holidays or that yoga retreat you’ve been dreaming about.

Financial Control Is Out of Your Reach? Here’s What To Do

Financial freedom will not happen overnight, and it might require doing some damage control as well. I have described a perfect scenario: you start with a solid base (your family) and go step-by-step. However, a lot of us go through a rocky road and get to the focusing point after a few positive and negative experiences. It is important that you are ready to start the path where you are willing to try hard and gain financial freedom. Let’s look at 5 ways to regain control of your finances:

Turn your back on unnecessary loans

There are people out there who take loans for their wedding party. One day of fun and months of paying for it, is that really smart and logical? I understand we live only once and you will only have one (hopefully) wedding day, but there are definitely ways to work around it and have a small, but tasteful wedding. And this is just one of the many examples of unnecessary loans. Do not follow your momentary emotions and think about consequences, about conflicts that might arise and realize that it can all be avoided, if you sit and think smartly and thoroughly about a serious step you are about to make.

Think twice on purchases, buy on second thought

You don’t have to be a shopocholic to buy things you don’t need. At one point of time we all have been there. I am not talking about big purchases, because sometimes the small ones adds up to an even bigger amount. A t-shirt here, a trendy scarf there, endless phones cases (for every mood possible), do not even get me started on cosmetics (for girls) and for car/laptop/bike accessories (for guys). My advice is not to buy something right there on the spot with the first impulse, but think about it a little. Are you sure you need it? May be you already have a similar item? Just really think about, may be even sleep on it (if we are talking about an expensive item), that’s all I am suggesting.

Avoid hooking on any harmful habits (it kills you and your wallet)

The price of addictive items is increasing drastically, however from what I know, it doesn’t make people fight their bad habits. People just carry on doing whatever they were doing, and the only thing that changes is the frequency of them complaining about prices which going up. It’s a matter of a simple math to find out how much you could have saved, if you were not involved in buying these addictive items. Just count how much you spend in a week/month/year on these items, and I’m telling you the number will surprise you.

Do things you like and enjoy and most importantly keep doing them

Have a habit of being active, and by active I mean work, physical activities and emotional activities. Everything that makes your brain work and your soul happy. Find out what kind of literature you enjoy and keep reading (let it be Vogue or comics, if that’s what you love), do sports (for example I’m in love with tennis), do something for your soul and mind (in my case it’s definitely yoga), hobbies are very important (I write, and hope one day it’ll turn into something more serious). You might think: “how will it give me financial freedom”? All these activities will teach you to stay sharp and energetic, and they will make you want to accomplish more and more.

Donate genuinely (sound awkward, doesn’t it?)

I understand that this point is making your finances go another direction. However, I am a firm believer that the more you give the more will come back. The trick is to be as genuine as possible when you make donations (by donations I mean not only money, it can be anythnig which help people in need). This is a rather philosophical approach, because you must set your mind on a thought that you truly want to help and do not hold on to whatever it is that you are giving away.

A combination of these tips will definitely create successful path for regaining your financial freedom or at least making it stronger. The best part is that once you make a habit out of these hints, it’ll become so natural for you to live peacefully without unnecessary worries.

The post How to Stop Worrying About Money Even If You Don’t Earn Much appeared first on Lifehack.

from Viral News HQ http://ift.tt/2raP9VO

via Viral News HQ

0 notes