#sadly my mortgage company doesn’t agree

Text

Stupid work has distracted me from the important business of Tux Tuesday…

But oh boy is it nice to see all that hotness on my dash 🥰

Normal service will be resumed shortly.

In the meantime here’s someone hot looking extremely smart…. and very hot

#shaun evans#itv endeavour#endeavour morse#tux tuesdays#he’s so fucking hot in a tux#tuesdays used to be my least favourite day#but not any more#then again we have lots of good days now#if only work didn’t get in the way#why do I need to earn money#why can’t I just stare at pics of shaun all day#and a variety of related questions#that I have been asking myself all day#sadly my mortgage company doesn’t agree#with my prioritisation of shaun gazing#vs earning money to pay my mortgage#which I consider unreasonable#I mean look at him#lol… I know you all have#so you don’t really need me to tell you to do that#but look at him again anyway#because you know why not#scientific studies require dedication#so there you go#oh god#I have no idea where my tags are going#sorry... not sorry#brb#hot damn evans

37 notes

·

View notes

Note

god, youre so delusional, its pathetic.

youtube

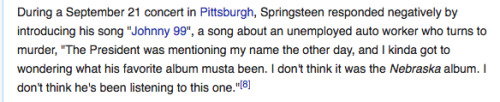

johnny 99 is a song by Our Only Savior Bruce Springsteen, to be found in his masterpiece 1982 record Nebraska, which was wholly composed of acoustic songs concerning themes way darker than his usual and which his record company probably considered a commercial suicide back in the day - and it’s regarded by many people as his actual finest record (and objectively I agree, ngl). the song, other than being in the same stark style as the rest of the record, as in, acoustic guitar and harmonica only, in less than four minutes manages in an admirable example of synthesis, not only to tell an entire story, but to touch heavy themes such as economical crisis, the death penalty, the fact that the american government didn’t give a shit about blue collar workers way back in the seventies and arguably also that it might be a tad too easy to buy guns in the US. sounds interesting? great, then let me welcome to this evening’s episode of tumblr user janiedean explains bruce springsteen! ;)

so, shall we start? brace up because this is a wild ride.

Well they closed down the auto plant in Mahwah late that month Ralph went out lookin' for a job but he couldn't find none He came home too drunk from mixin' Tanqueray and wine He got a gun shot a night clerk now they call 'm Johnny 99

first of all: bruce again shows that he knows how to hook you in, because in four lines he has pretty much told you the bones of the story. first - and most important thing: a factory in a town in new jersey closes. it was a true fact, and in real life it was because they failed to follow environmental rules, but as back in the day there was indeed an economical crisis in the US for which a lot of factories shut down, we could fictionally assume it was for that reason as well. anyway, what matters is that the factory closes. our protagonist, ralph, who presumably works there, is fired, searches for a new job, isn’t re-hired (which was common to a lot of people who were laid off at that time, please feel free to read dale maharidge’s journey to nowhere and somewhere like america to get educated on that), proceeds to get drunk and when he’s not thinking straight he buys a gun (just like that), shoots a guy and gets a new nickname: johnny 99. why? we don’t know yet. but we know that a guy who was just doing his job and failed to be rehired lost it and shot someone... because he lost his job. hmm. but let’s go on.

Down in the part of town where when you hit a red light you don't stop Johnny's wavin' his gun around and threatenin' to blow his top When an off duty cop snuck up on him from behind Out in front of the Club Tip Top they slapped the cuffs on Johnny 99

so: after having shot the night clerk, our guy is in the part of town where you don’t stop at a red light so we can assume not the best part of it, he’s threatening to hurt himself with the gun, he gets arrested by an off duty cop, that’s it. sorry, not that much of a criminal career. but snuck up on him from behind... maybe like the closing of his factory and the fact that his life was fucked in the span of a few days? that might have been a deliberate lyrical choice, which makes you, if not sympathize with the guy, at least get how he’s feeing right now.

Well the city supplied a public defender but the judge was Mean John Brown He came into the courtroom and stared poor Johnny down Well the evidence is clear gonna let the sentence son fit the crime Prison for 98 and a year and we'll call it even Johnny 99

at this point, of course johnny goes to trial. he gets a public defender (which from what I gather tends to be shitty) and a judge whose nickname is mean, from which we can surmise that the stacks against him are bad regardless. the judge comes into the courtroom and stares poor johnny down, and at this point it’s obvious that we’re meant to sympathize with him, not with the judge, who is *mean* and stares down at the guy before even sitting down at this point. so, the judge says that the evidence is there, and his sentence is 99 years of prison.

which is why he’s re-baptized johnny 99 as we had seen in the beginning. now, 99 years is pretty much life, since this guy must have been at least older than twenty to work in a car factory. rough.

A fistfight broke out in the courtroom they had to drag Johnny's girl away His mama stood up and shouted "judge don't take my boy this way" Well son you got a statement you'd like to make Before the bailiff comes to forever take you away

this verdict does not indeed please johnny’s family/loved ones, as a *fistfight* breaks out and they have to forcibly remove his girlfriend, while his mother pleads the judge to not take her boy this way, presumably crying, which means that again, we are supposed to see that he has relatives who love him and would cry for him and so maybe he’s not a bad guy deep down. sure, we haven’t heard his side yet, but we know his girlfriend loves him enough to try to beat up the guards and his mother pleads for another solution... which is denied, and the judge actually replies with the last two lines, which sound fairly rude and insensitive especially given that the bailiff is coming to forever take him away. but it’s as if the judge has decided that since the guy isn’t rich or matters much in the great scale of things, it’s an already done thing and fuck that. ouch.

Now judge I got debts no honest man could pay The bank was holdin' my mortgage and they was takin' my house away Now I ain't sayin' that makes me an innocent man But it was more 'n all this that put that gun in my hand

aand wait, here finally our dude finally speaks for himself. first: he had debts no honest man could pay, which means that losing his job fucked his finances for good and he was deep in the red. the bank was taking his house away, which was another thing that was extremely common back in the day (same as in the twenties haha) (read those maharidge books for more info) and so he was going to become homeless because he couldn’t find another job and had no other safety net to fall back on. he doesn’t try to argue for his innocence because he did kill a man so he’s not really downplaying it, but then he adds that ‘it was more than all of that which put a gun in his hand’, which means that it was losing his job, losing his money, possibly losing his house, being unable to provide for his family and feeling most likely useless and like he couldn’t do anything anymore with his life. and that puts the gun in his hand. he didn’t do it because he enjoyed it, he did it because he saw no other way, and none of that was considered in the *evidence*, which means he got a trial where his circumstances weren’t even taken into account. but that’s not the heaviest blow this song deals. that one’s the ending:

Well your honor I do believe I'd be better off dead And if you can take a man's life for the thoughts that's in his head Then won't you sit back in that chair and think it over judge one more time And let 'em shave off my hair and put me on that execution line

HAAAAA BUT JUST YOU WAIT. so: he thinks he’s be better off dead, which admittedly is fair of him, idk if I’d take 99 years (so: entire life and death) in a US prison over just being done with it already, and after all if he has no job, no house, no money and no prospects, what does he have to lose? and fine enough, but here’s the gist: if the judge can take a man’s life for the thoughts in his head, ie if the judge thinks he can condemn him to 99 years in prison ie rotting in there until he dies for what he thought and not giving a fuck about why he thought that or why he did what he did... then he welcomes the judge to ‘sit back in that chair’ (which is already pretty damn wording because it sarcastically implies the judge is in a higher position and nothing can hurt him in the chair while everything can hurt johnny 99 and everything has done so already) and have the balls to give him the death penalty instead of condemning him to die but pretending to have been merciful and only giving him time in prison that he can’t possibly serve before he dies. so he’s basically raising the judge (representing the system that betrayed him) the middle finger because if the judge/the system have ruined his life then they should at least have the courage to end it instead of condemning him to be a prisoner for the entirety of it.

now: that’s it. there’s nothing else. there’s no lesson, there’s no moral, that’s how it ends, it’s bleak and sad and it doesn’t really give you any silver lining... because there’s no silver lining and it’s unjust to live in a society where losing your job means losing your life *and* you will be automatically judged for the thoughts in your head without a chance to prove that you can be better or meant better or could make up for it.

no, it’s one mistake out of reasons beyond your control that you would actually pay for, and hey, thrown in jail with the keys thrown away. what an enlightened, beautiful, just system, the system that judges a man for the thoughts that are in his head, huh?

and actually, bonus story: this story is tied to bruce’s biggest BDE display ever, as when reagan became president and was running for re-election in 1984, he thought to quote bruce’s (sadly misunderstood) song born in the usa in a speech in nj. at that point bruce said nothing for a bit, but then:

guys, what a man, what an idol, what a class. no, sure af reagan did not listen to nebraska nor johnny 99.

and, given how you, my dear anon, also judge people by the thoughts that are in their heads and proceed to be their jury, judge and executioner, both fictional people and real ones, if you’re who I think you are (and I actually know you are)... I’ve got a feeling that neither have you. and I really think you should, same as everyone because bruce is the best ;)

#bruce springsteen for ts#bruce meta#i need to go and tag back all the other ones#oooooh my hand slipped#SORRY!!!!#va bene va bene va bene in verità#here please listen to nebraska#it's totally a good use of your time!!!!#murder cw#death penalty cw#Anonymous#ask post

17 notes

·

View notes

Text

Best Tribal Installment Loans

The tribal loans hearing this all unfolded at was called “The CFPB’s Assault on Entry to Credit score and Trampling of State and Tribal Sovereignty,” and held by the House Financial Services subcommittee. You would have to search for the consumer Financial Companies Regulatory codes for the precise tribe that you’re borrowing from. As a result of otherwise, you will have to pay not previous bills which even by way of the requirements of high interest payday loans, that could possibly be alternatively costly. This may apply to the aggregate quantity that you have left outstanding in your Stafford Loans, which is made up of the original amount you borrowed plus any interest you will have accrued over time. Small dollar installment loans are structurally similar to standard loans, during which a portion of the principal and interest are repaid every period. The state can offer you zero curiosity mortgage affords with a view to renovate your house or it might provide you with non refundable grant. Someday, a distant relative by the identify of Simon got here home for a go to and requested me to give him company to slightly lake nearby to purchase some fish. Should you proceed with one of these providers, you can verify that the lender is reputable by checking along with your native authorities.

Count on to listen to from Massive Picture Loans within quarter-hour to 1 Business Day after you have got submitted your application. Apply for an installment loan with AWL and also you could possibly obtain your funds the same day your loan is finalized if processed earlier than our cut-off time. Sadly, the subsequent day our family - together with neighbours, family members, and associates tenderly carried the picket coffin bearing the remains of my step-grandmother up to the maize area edging the little coffee farm and buried her. American Psychological Affiliation: The APA provides scholarships and likewise offers college students in any respect ranges with a list of all of the funding sources in their area. A partnership between the Native American Bank, LenderLive and Greenpoint Mortgage has resulted in turnkey dwelling mortgages for American Indians for quite a few functions like rehabilitation, refinancing and residence buying. Loans are written for the utmost number of payments available.

Tribal loans are an important different to payday loans because they are a brief time period installment loan that allows you to pay a portion due each month as an alternative of all of it in your next payday. It's humorous. In these days, there have been no comfortable bank loans or poverty alleviating schemes for the African. Benin: In 1625 there were slave traders, the Fon, established Dahomey and conquered the neighbouring towns and villages of Dan and Allada and extended their imperialism so far as within the neighborhood of Porto Novo. Focus all of nation's energies on making more as there isn't a manner to offer welfare from an empty pocket. And Rep. Love thinks Jimmy John Smith who's working two jobs simply to maintain the lights on goes to be the most effective person from making a nasty alternative on a payday mortgage? Be aware that the max loan amount is predicated on the lenders of their network, however it would fluctuate primarily based on your state of residence. The category prepares you for the house shopping for process, and equips you to grasp the qualifications for a house mortgage.

Up to date on September 12, 2018 Marie Flint moreMarie is a Michigan State University alumnus and has over 10 years of business writing expertise. School Pell Grant alternatives assist over eight million Americans annually afford bills, nonetheless the buying strength of the grants has unfortunately rapidly diminished over time. But each moment of the day, as we hearken to the radio or watch tv or learn the newspapers, we witness the finality of life. Essential Disclosures. Please Read Fastidiously. Future submission rounds will be introduced by supplemental solicitation bulletins. In fashionable Ghana,oilfield containing up to 3 billion barrels (480,000,000 m3) of gentle oil was discovered in 2007. Exploration is ongoing and the amount of oil continues to extend. Farm laborers are a vital half of each farm. What do you assume are the principle reasons for that? Do you assume there's huge market strain on the federal government- irrespective of the political occasion governing?

How Refinancing Student Loans With Bad Credit Can Ease Financial Woes

How can you get an unsecured loan with sub-standard credit no collateral? Yes, it could be a difficult and somewhat daunting task to try to get credit once you don't satisfy the stringent guidelines set by most lenders. With sub-standard credit, you are thought as a 'high-risk borrower' and they are most probably to get declined due to lender's 'presumption' you will default in your loan repayment plan. I totally agree that is a bit unfair, with there being good hard-working those who could possibly have experienced some difficult financial times and merely needed some help to get their personal financial life back on track. But with poor credit, it may be typical to presume the worst if a lender decides to offer a loan, you might be then the new tribal lenders subject of the ringer to offer some form of collateral to secure the credit, while at the same time, being hit with a high rates of interest far better monthly obligations.

If you're behind with your loan repayments, you're not alone. In fact, you are in the corporation of five million other Americans who have defaulted on his or her student education loans. It's not hard to realize why this situation exists. After all, if you graduated sometime in days gone by four years, you faced a double whammy - student loan repayments with an unemployment rate that would make the most qualified and educated applicant cringe.

If you decide to bring your automobile title to a loan company, among the common requirements that they would apply would be to make certain that zero amount is owed against the vehicle to anyone. Full coverage insurance also falls as one of several major requirements for such, this also goes because though the title is by using the financial institution, the master can always make use of the car which is fully insured in the event that accidents happen. This is the basic good reason that some of the money companies require the dog owner to surrender the automobile upon approval and make the auto until the borrowed funds is fully repaid, specially creditors who doesn't require vehicles to get full insurance coverage.

That is where instant pay day loans might help take care of Christmas, birthdays and anniversaries, they may be short-term loans - one day to some month - as well as for little bit of cash - from around A�100 to A�1000. They may be requested directly web could be deposited in your bank account about the very same day since your application.

2. Look for consolidations. It may be best to locate advice from the schools financial adviser if you're qualified for just about any state, private or federal consolidation programs. These programs will help you get less individual monthly loan instalments, and in many cases possibly even lower the typical interest rate of one's loans. Even if don't assume all loans will be consolidated though, a minimum of some of it will likely be and it wil be very useful along with your situation.

0 notes

Text

The Need For Liquidity Is Overrated If You Are Financially Competent

In the debate between stocks versus real estate as a better investment, a common issue that comes up is real estate’s lack of liquidity, and therefore inferiority.

For example, reader Nate writes, “I prefer equities because real estate doesn’t provide a sufficient illiquidity premium to merit the leveraged risk and transaction cost. If stocks provide a better return with better liquidity and bonds provide a similar yield with better liquidity (and collateral), why take on the illiquidity at all?”

As someone who believes it’s best to invest in stocks and real estate for as long as possible, having an investment that can be easily sold could be a detriment to one’s journey to financial freedom. Think about all the folks who wigged out between 2008-2012 and sold equities or real estate back then. They’re kicking themselves now!

In 2012, I tried to sell my old rental house for $1,700,000. The worst of the downturn was behind us and I felt I had dodged a bullet. I had recently engineered my layoff and figured it was better to downsize rather than to continue holding a ~$1,100,000 mortgage.

I signed a 30-day exclusive listing contract with a real estate agent friend. I agreed to pay him a 5% commission. He and his wife came over to stage our house. We got a standard inspection done and pulled a 3R report for our disclosure statement for about $500. My agent ended up hosting three open houses and around 10 private showings.

Our best offer was a verbal offer with no number, just an indication they were willing to offer “much less than asking.” I told them to bugger off and pulled the listing after 30 days.

If I could have just pressed a button to sell for $1,700,000 for a reasonable flat fee, I probably would have. But praise all that’s good in the world the real estate market was so illiquid that I saved myself from myself. Even though I’m sure I sold the property too early in 2017, I take solace in the fact that at least I got an extra million bucks five years later.

Why You Likely Never Face A Serious Liquidity Crunch

Just like the fear of running out of money in retirement is overblown, the fear of being illiquid in case you lose your job or lose a significant amount of your assets is overblown.

Just reading this post makes me confident that you have the wherewithal to protect yourself from any liquidity crunch. Here are some reasons why I think Financial Samurai readers will be just fine.

1) You have multiple types of insurance. With health insurance, homeowner’s insurance, rental insurance, auto insurance, short-term disability, long-term disability, life insurance, and an umbrella policy, it’s hard to succumb to a financial disaster unless you are not insured.

Sadly, medical debt is the #1 reason for bankruptcy in America and not poor spending habits. The New York Times reported that 20% of Americans under 65 with health insurance had trouble paying their medical bills over the past year. Of those, 63% claim to have used up all or most of their savings to tackle their healthcare expenses. To counteract egregious medical debt, make sure you thoroughly understand what type of health insurance benefits you are getting for the monthly premiums you are paying. And to further protect yourself, let’s talk about point #2.

2) You have a savings buffer. Everybody knows that it’s important to save for an unknown future. Therefore, every financially competent person saves and invests as much as possible to protect against uncertain future expenses. My recommendation is to save between 5% – 10% of your net worth in low-risk assets such as CDs, AA-rated municipal bonds, US treasuries, and cash. This way, you’ll be able to survive long enough until the good times return.

The only people who don’t save are those who believe they have a bright future. They have either built a business with massive profit upside or they’re on the fast track towards superstardom at their respective companies. In such cases, they’ll never need any savings.

3) You’re well diversified. I don’t know any financially competent people who have 100% of their net worth in stocks or 100% of their net worth in real estate. The same goes for having 100% of their net worth in any other asset class. Even if you did tie up 80% of your net worth in your primary residence, that still means you have a 20% buffer to sell before you need to tap your savings or take out a home equity line of credit.

Below is one of my recommend net worth allocation frameworks for self-starters who are willing to work on their X Factor.

4) You’re not too proud to hustle. The invention of Upwork, Uber, Lyft, TaskRabbit, Thumbtack, Craigslist, Etsy, ebay, Amazon, and WordPress make it possible for you to make extra side-hustle money if you find yourself in financial despair.

The other day we hired a person from TaskRabbit to install a wireless doorbell and several fire alarm systems in hard to reach places. He made $85 gross in one hour and had four jobs to do that day. Several years ago I gave over 500 Uber rides that made me roughly $30/hour gross on average and sometimes $100/hour net due to driver sign-up income.

There’s probably thousands of dollars worth of clutter in your house you can sell on Craigslist. And if you’re really gung-ho, you can try to sell your craft on Etsy, buy and re-sell products on eBay or Amazon, or start a website like this one.

Earned $100/hour one week during my Uber driving days

5) You’ve developed multiple streams of income. There are an endless number of investments that provide passive income in case you lose your job or your business blows up. Given you’ve been diligently saving and investing for years, you should have some passive income to hold you over until you can find a new main source of income.

It took about 12 years after college for me to generate a livable passive income stream. After 17 years, the passive income was finally enough to provide for a family of three in expensive San Francisco. Therefore, it’s highly feasible that if you start generating passive income early, by the time your company decides to age discriminate by laying off 40+ year old workers, you’ll be just fine.

6) You negotiated a severance or received a severance. Even if you didn’t have the foresight to start investing in passive income generating investments early on, you should at least be able to negotiate a severance. Standard severance packages range from 1-3 weeks per year you’ve worked plus 2-3 months of base salary according to the WARN Act for employees at larger companies.

If you work at a company with deferred stock and cash compensation, a good severance negotiation will allow you to keep your unvested compensation. In other words, you have the potential to earn WARN Act pay, a severance payment, and deferred compensation to hold you over until a recovery.

7) You’re eligible for unemployment. What’s awesome after you receive or negotiate a severance is that you’re eligible for unemployment benefits. Conversely, folks who get fired or quit are NOT eligible for unemployment benefits because they left due to cause or voluntarily.

In many states, you get to receive unemployment for up to 26 weeks. In California, maximum unemployment pay is currently $450 a week. In addition to unemployment pay, your unemployment agency will provide job search help and career training. During severe economic times, unemployment benefits may get extended due to federal government assistance e.g. 99 weeks during the economic crisis.

8) You can slash costs and downsize. No rational person facing a liquidity crunch will keep spending and living like they once did. Instead, you will easily slash all extraneous costs and subsist on ramen noodles and water for as long as it takes. Not only will you reduce food costs, you will completely eliminate all vacations, all entertainment, all new clothing, and all non-essential items. You’ll sell everything you haven’t used in a month on Craigslist. If you own a home, you will either rent it out and downsize into a studio apartment. Or, you will start renting out rooms for extra cash.

Related: Housing Expense Guideline For Achieving Financial Freedom

9) You’ve got a vast support network. Let’s say worst comes to worst and you’ve completely run out of money. Since you’re a good person who has always focused on helping others, people will GLADLY line up to help you out. Maybe they’ll give you an interest free loan or hook you up with a job at their company. People absolutely love to help those they like, especially those that have brought some type of joy into their lives.

10) You’re not too proud to live in mom’s basement. If for some reason you were a completely selfish ass all these years, surely your parents will unconditionally take you into their home and provide for you and your family until you can get back up on your feet.

The stigma of living with your parents as an adult child has subsided. As a parent, if my son is down on his luck, you bet your buns of steel I’d gladly accept him back so he can at least save on rent and build back his savings. I’d love to use this time to reconnect with him.

Related: How To Get Your Parents To Pay For Everything As An Adult

If You Are Financially Incompetent

I realize it’s easier to say “liquidity is overrated” during a bull market or if you’ve got your finances in order. Bad things happen all the time, no matter how much we plan ahead for the future. I thought I was rock steady until I got obliterated in 2008-2009, hence the start of Financial Samurai.

If you feel you can’t afford to get your finances together or you simply don’t have enough time before doom comes knocking on your door, the one thing you must do is start treating people right ASAP. Get involved in your community through your local church or school. Volunteer at organizations whose mission it is to help the less fortunate. Become a mentor. Ask your bosses or colleagues whether there’s anything you can do to help without expecting anything in return. Connect with people on LinkedIn before you find yourself unemployed.

I will gladly help anybody who was kind to me in the past. My closest friends will never starve because I will never let them starve. We’ve built a support network where if one of us stumbles, we will all do our part to lift that person up.

If I one day stumble, I know there will be at least one reader out of the millions who’ve visited Financial Samurai since 2009 who will lend a helping hand. That’s simply the way the world works.

Readers, do you think the need for liquidity is overrated? What are some things you will do before being forced to sell your primary home or investment? Share a situation where you faced a liquidity crunch and were forced to sell something you didn’t really want to.

https://www.financialsamurai.com/wp-content/uploads/2018/04/The-need-for-liquidity-is-overrated.m4a

The post The Need For Liquidity Is Overrated If You Are Financially Competent appeared first on Financial Samurai.

from Finance https://www.financialsamurai.com/the-need-for-liquidity-is-overrated-if-you-are-financially-competent/

via http://www.rssmix.com/

0 notes

Text

Matt Amber Rant

So this whole thing with Matt claiming they paid their rent/ mortgage months in advance with a $32,000 down payment is just so shady!! First of all when you have a mortgage and you don’t pay your monthly payment, eventually the bank aka the Lien holder aka mortgage company will eventually begin the forclosure process not file at small claims court. When it comes to mortgages there is a big difference between a down payment and your monthly payment. When we purchased our home, the mortgage company wanted a $5,000 payment on our $120,000 house. We ended up financing $115,000 and my monthly payment is about $1000 (that includes my taxes and home owners insurance). Now just because we paid the $5000 down payment does not mean, we don’t have to pay for the first 5 months. You still have to make your monthly payment that’s $1000. Now there are months where we have enough to send in a double payment $2000 when that happens it doesn’t mean I don’t have to send in a payment for next.

Second of all when you have a mortgage you don’t have a land lord. If I were to default on my loan my home would go into foreclosure. The Bank would file this against me not a land lord. As far as suing me for damages to my home goes It rarely happens. What basically happens is I will owe the difference between what I owe on the home and what it’s auctioned off for. Even if it’s a rent to own, and I stopped paying on it the person who has the home financed would default and the same foreclosure process would begin not small claims court.

Sorry for the long rant but

He just pissed me off so bad trying to pull the wool over everyone’s eyes like he does amber. It’s so scary how amber has given him total control over every aspect of her life. She claims to have been at rock bottom in prison prison prison, but I think when MTV and Matt are gone she will hit a new all time low but sadly it won’t be her last.

———————————————–------- It makes no sense to me either. But apparently TMZ approached the company and they admitted it was a misunderstanding so I guess that’s that. I do agree that Matt is her new rock bottom though.

2 notes

·

View notes

Text

The Mortgaging of Sierra Online

The Sierra Online of the 1980s and very early 1990s excelled at customer relations perhaps more than anything else. Through the tours of their offices (which they offered to anyone who cared to make the trip to rural Oakhurst, California), the newsletter they published (which always opened with a folksy editorial from their founder and leader Ken Williams), and their habit of grouping their games into well-delineated series with predictable content, they fostered a sense of loyalty and even community which other game makers, not least their arch-rivals over at LucasArts, couldn’t touch — this even though the actual games of LucasArts tended to be much better in design terms. Here we see some of the entrants in a Leisure Suit Larry lookalike contest sponsored by Sierra. (Yes, two of the contestants do seem suspiciously young to have played a series officially targeted at those 18 and older.) Sadly, community-building exercise like these would become increasingly rare as the 1990s wore on and Sierra took on a different, more impersonal air. This article will chronicle the beginning of those changes.

“The computer-game industry has become the interactive-entertainment industry.”

— Ken Williams, 1992

Another even-numbered year, another King’s Quest game. Such had been the guiding rhythm of life at Sierra Online since 1986, and 1992 was to be no exception. Why should it be? Each of the last several King’s Quest installments had sold better than the one before, as the series had cultivated a reputation as the premier showcase of bleeding-edge computer entertainment. Once again, then, Sierra was prepared to pull out all the stops for King’s Quest VI, prepared to push its development budget to $1 million and beyond.

This time around, however, there were some new and worrisome tensions. Roberta Williams, Sierra’s star designer, whose name was inseparable from that of King’s Quest itself in the minds of the public, was getting a little tired of playing the Queen of Daventry for the nation’s schoolchildren. She had another, entirely different game she wanted to make, a sequel to her 1989 mystery starring the 1920s girl detective Laura Bow. So, a compromise was reached. Roberta would do Laura Bow in… The Dagger of Amon Ra and King’s Quest VI simultaneously by taking a sort of “executive designer” role on both projects, turning over the nitty-gritty details to assistant designers.

Thus for the all-important King’s Quest VI, Sierra brought over Jane Jenson, who was fresh off the task of co-designing the rather delightful educational adventure EcoQuest: The Search for Cetus with Gano Haine. Roberta Williams described her working relationship with her new partner in a contemporary interview, striking a tone that was perhaps a bit more condescending than it really needed to be in light of Jenson’s previous experience, and that was oddly disparaging toward Sierra’s other designers to boot:

I took on a co-designer for a couple of reasons: I wanted to train Jane because I didn’t want Sierra to be dependent on me. Someone else needs to know how to do a “proper” adventure game. We’re all doing a good job from a technology standpoint, but not on design. In my opinion, the best way to learn it properly is side by side. Overall, it was a positive experience, and it was very good for the series because Jane brought in some new ideas. She learned a lot, too, and can take what she’s learned to help create her new games.

There’s something of a consensus among fans today that the result of this collaboration is the best overall King’s Quest of them all. This strikes me as a fair judgment. While it’s not a great adventure game by any means, King’s Quest VI: Heir Today, Gone Tomorrow isn’t an outright poor one either in terms of writing or design, and this is sufficient for it to clear the low bar of the previous games in the series. The plot is still reliant on fairy-tale clichés: a princess imprisoned in a tower, a prince who sets out to rescue her, a kingdom in turmoil around them. Yet the writing itself is more textured and coherent this time around, the implementation is far more complete (most conceivable actions yield custom messages of some sort in response), the puzzles are generally more reasonable, and it’s considerably more difficult than it was in the earlier games to wander into a walking-dead situation without knowing it. Evincing a spirit of mercy toward its players of a sort that Sierra wasn’t usually known for, it even has a branching point where you can choose from an easier or a harder pathway to the end of the game. And when you do get to the final scene, there are over a dozen possible variants of the ending movie, depending on the choices you’ve made along the way. Again, this degree of design ambition — as opposed to audiovisual ambition — was new to the series at the time.

The fans often credit this relative improvement completely to Jenson’s involvement. And this judgment as well, unkind though it is toward Roberta Williams, is not entirely unfounded, even if it should be tempered by the awareness that Jenson’s own later games for Sierra would all have significant design issues of their own. Many of the flaws that so constantly dogged Roberta’s games in particular were down to her insistence on working at a remove from the rest of the people making them. Her habit was to type up a design document on her computer at home, then give it to the development team with instructions to “call if you have any questions.” For all practical purposes, she had thus been working as an “executive designer” long before she officially took on that role with King’s Quest VI. This method of working tended to result in confusion and ultimately in far too much improvisation on the part of her teams. Combined with Sierra’s overarching disinterest in seeking substantive feedback from players during the development process, it was disastrous more often than not to the finished product. But when the time came for King’s Quest VI, Jane Jenson was able to alleviate at least some of the problems simply by being in the same room with the rest of the team every day. It may seem unbelievable that this alone was sufficient to deliver a King’s Quest that was so markedly better than any of the others — but, again, it just wasn’t a very high bar to clear.

For all that it represented a welcome uptick in terms of design, Sierra’s real priority for King’s Quest VI was, as always for the series, to make it look and sound better than any game before. They were especially proud of the opening movie, which they outsourced to a real Hollywood animation studio to create on cutting-edge graphics workstations. When it was delivered to Sierra’s offices, the ten-minute sequence filled a well-nigh incomprehensible 1.2 GB on disk. It would have to be cut down to two minutes and 6 MB for the floppy-disk-based release of the game. (It would grow again to six minutes and 60 MB for the later CD-ROM release.) A real showstopper in its day, it serves today to illustrate how Sierra’s ambitions to be a major media player were outrunning their aesthetic competencies; even the two-minute version manages to come off as muddled and overlong, poorly framed and poorly written. In its its time, though, it doubtless served its purpose as a graphics-and-sound showcase, as did the game that followed it.

My favorite part of the much-vaunted King’s Quest VI introductory movie are the sailors that accompany Prince Alexander on his quest to rescue Princess Cassima. All sailors look like pirates, right?

A more amusing example of the company’s media naiveté is the saga of the King’s Quest VI theme song. Sierra head Ken Williams, who like many gaming executives of the period relished any and all linkages between games and movies, came up with the idea of including a pop song in the game that could become a hit on the radio, a “Glory of Love” or “I Will Always Love You” for his industry. Sierra’s in-house music man Mark Seibert duly delivered a hook-less dirge of a “love theme” with the distressingly literal title of “Girl in the Tower,” then hired an ersatz Michael Bolton and Celine Dion to over-emote it wildly. Then, Sierra proceeded to carpet-bomb the nation’s radio stations with CD singles of the song, whilst including an eight-page pamphlet in every copy of the game with the phone numbers for all of the major radio stations and a plea to call in and request it. Enough of Sierra’s loyal young fans did so that many a program director called Ken in turn to complain about his supremely artificial “grass-roots” marketing strategy. His song was terrible, they told him (correctly), and sometimes issued vague legal threats regarding obscure Federal Communications Commission laws he was supposedly violating. Finally, Ken agreed to pull the pamphlet from future King’s Quest VI boxes and accept that he wasn’t going to become a music as well as games impresario. Good Taste 1, Sierra 0. Rather hilariously, he was still grousing about the whole episode years later: “In my opinion, the radio stations were the criminals for ignoring their customers, something I believe no business should ever do. Oh, well… the song was great.”

The girl in the tower. Pray she doesn’t start singing…

While King’s Quest VI didn’t spawn a hit single, it did become a massive hit in its own right by the more modest sales standards of the computer-games industry. In fact, it became the first computer game in history to be certified gold by the Software Publishers Association — 100,000 copies sold — before it had even shipped, thanks to a huge number of pre-orders. Released in mid-October of 1992, it was by far the hottest game in the industry that Christmas, with Sierra struggling just to keep up with demand. Estimates of its total sales vary widely, but it seems likely that it sold 300,000 copies in all at a minimum, and quite possibly as many as 500,000 copies.

But for all its immediate success, King’s Quest VI was a mildly frustrating project for Sierra in at least one way. Everyone there agreed that this game, more so than any of the others they had made before, was crying out for CD-ROM, but too few consumers had CD-ROM drives in their computers in 1992 to make it worthwhile to ship the game first in that format. So, it initially shipped on nine floppy disks instead. Once decompressed onto a player’s hard drive, it filled over 17 MB — this at a time when 40 MB was still a fairly typical hard-disk size even on brand-new computers. Sierra recommended that players delete the 6 MB opening movie from their hard disks after watching it a few times just to free up some space. With stopgap solutions like this in play, there was a developing sense that something had to give, and soon. Peter Spears, author of an official guide to the entire King’s Quest series, summed up the situation thusly:

King’s Quest VI represents a fin de siecle, the end of an era. It is a game that should have been — needed to be — first published on CD-ROM. For all of its strengths and gloss, it is ill-served being played from a hard drive. If only because of its prominence in the world of computer entertainment, King’s Quest VI is proof that the era of CD playing is upon us.

Why? It is because imagination has no limits, and current hardware does. There are other games proving this point today, but King’s Quest has always been the benchmark. It is the end of one era, and when it is released on CD near the beginning of next year, it should be the beginning of another. Kill your hard drives!

Sierra had been evangelizing for CD-ROM for some time by this point, just as they earlier had for the graphics cards and sound cards that had transformed MS-DOS computers from dull things suitable only for running boring business applications into the only game-playing computers that really mattered in the United States. But, as with those earlier technologies, consumer uptake of CD-ROM had been slower than Sierra, chomping at the bit to use it, would have liked.

Thankfully, then, 1993 was the year when CD-ROM, a technology which had been around for almost a decade by that point, finally broke through; this was the year when the hardware became cheap enough and the selection of software compelling enough to power a new wave of multimedia excitement which swept across the world of computing. As with those graphics cards and sound cards earlier on, Sierra’s relentless prodding doubtless played a significant role in this newfound consumer acceptance of CD-ROM. And not least among the prods was the CD-ROM version of King’s Quest VI, which boasted lusher graphics in many places and voices replacing text absolutely everywhere. The voice acting marked a welcome improvement over the talkie version of King’s Quest V, the only previous game in the series to get a release on CD-ROM. The fifth game had apparently been voiced by whoever happened to be hanging around the office that day, with results that were almost unlistenably atrocious. King’s Quest VI, on the other hand, got a professional cast, headed by Robby Benson, who had just played the Beast in the hit Disney cartoon of Beauty and the Beast, in the role of Prince Alexander, the protagonist. Although Sierra could all too often still seem like babes in the woods when it came to media aesthetics, they were slowly learning on at least some fronts.

In the meantime, they could look to the bottom line of CD-ROM uptake with satisfaction. They shipped just 13 percent of their products on CD-ROM in 1992; in 1993, that number rose to 36 percent. Already by the end of that year, they had initiated their first projects that were earmarked only for CD-ROM. The dam had burst; the floppy disk was soon to be a thing of the past as a delivery medium for games.

This ought to have been a moment of unabashed triumph for Sierra in more ways than one. Back in the mid-1980s, when the company had come within a whisker of being pulled under by the Great Home Computer Crash, Ken Williams had decided, against the conventional wisdom of the time, that the long-term future of consumer computing lay with the operating systems of Microsoft and the open hardware architecture inadvertently spawned by the original IBM PC. He’d stuck to his guns ever since; while Sierra did release some of their games for other computer platforms, they were always afterthoughts, mere ways to earn a little extra money while waiting for the real future to arrive. And now that future had indeed arrived; Ken Williams had been proved right. The green-screened cargo vans of 1985 had improbably become the multimedia sports cars of 1993, all whilst sticking to the same basic software and hardware architecture.

And yet Ken was feeling more doubtful than triumphant. While he remainedr convinced that CDs were the future of game delivery, he was no longer so convinced that MS-DOS was the only platform that mattered. On the contrary, he was deeply concerned by the fact that, while MS-DOS-based computers had evolved enormously in terms of graphics and sound and sheer processing power, they remained as cryptically hard to use as ever. Just installing and configuring one of his company’s latest games required considerable technical skill. His ambition, as he told anyone who would listen, was to build Sierra into a major purveyor of mainstream entertainment. Could he really do that on MS-DOS? Yes, Microsoft Windows was out there as well — in fact, it was exploding in popularity, to the point that it was already becoming hard to find productivity software that wasn’t Windows-based. But Windows had its own fair share of quirks, and wasn’t really designed for running high-performance games under any circumstances.

Even as MS-DOS and Windows thus struggled with issues of affordability, approachability, and user-friendliness in the context of games, new CD-based alternatives to traditional computers were appearing almost by the month. NEC and Sega were selling CD drives as add-ons for their TurboGrafx-16 and Genesis game consoles; Philips had something called CD-i; Commodore had CDTV; Trip Hawkins, founder of Electronic Arts, had split away from his old company to found 3DO; even Tandy was pushing a free-standing CD-based platform called the VIS. All of these products were designed to be easy for ordinary consumers to operate in all the ways a personal computer wasn’t, and they were all designed to fit into the living room rather than the back office. In short, they looked and operated like mainstream consumer electronics, while personal computers most definitely still did not.

But even if one assumed that platforms like these were the future of consumer multimedia, as Ken Williams was sorely tempted to do, which one or two would win out to become the standard? The situations was oddly similar to that which had faced software makers like Sierra back in the early 1980s, when the personal-computer marketplace had been fragmented into more than a dozen incompatible platforms. Yet the comparison only went so far: development costs for the multimedia software of the early 1990s were vastly higher, and so the stakes were that much higher as well.

Nevertheless, Ken Williams decided that the only surefire survival strategy for Sierra was to become a presence on most if not all of the new platforms. Just as MS-DOS had finally, undeniably won the day in the field of personal computers, Sierra would ironically abandon their strict allegiance to computers in general. Instead, they would now pledge their fealty to CDs in the abstract. For Ken had grander ambitions than just being a major player on the biggest computing platform; he wanted to be a major player in entertainment, full stop. “Sierra is an entertainment company, not a software company,” he said over and over.

So, at no inconsiderable expense, Ken instituted projects to port the SCI engine that ran Sierra’s adventure games to most of the other extant platforms that used CDs as their delivery medium. In doing so, however, he once again ran into a problem that Sierra and other game developers of the early 1980s, struggling to port their wares to the many incompatible platforms of that period, had become all too familiar with: the fact that every platform had such different strengths and weaknesses in terms of interface, graphics, sound, memory, and processing potential. Just because a platform of the early 1990s could accept software distributed on CD didn’t mean it could satisfactorily run all of the same games as an up-to-date personal computer with a CD-ROM drive installed. Corey Cole, who along with his wife Lori Ann Cole made up Sierra’s most competent pair of game designers at the time, but who was nevertheless pulled away from his design role to program a port of the SCI engine to the Sega Genesis with CD drive:

The Genesis CD system was essentially identical to the Genesis except for the addition of the CD. It had inadequate memory for huge games such as the ones Sierra made, and it could only display 64 colors at a time from a 512 color palette. Sierra games at the time used 256 colors at a time from a 262,144 color palette. So the trick became how to make Sierra games look good in a much smaller color space.

Genesis CD did supply some tricks that could be used to fake an expanded color space, and I set out to use those. The problem was that the techniques I used required a lot of memory, and the memory space on the Genesis was much smaller than we expected on PCs at the time. One of the first things I did was to put a memory check in the main SCI processing loop that would warn me if we came close to running out of memory. I knew it would be close.

Sierra assigned a programmer from the Dynamix division to work with me. He had helped convert Willy Beamish to the Genesis CD, so he understood the system requirements well. However, he unintentionally sabotaged the project. In his early tests, my low-memory warning kicked in, so he disabled it. Six months later, struggling with all kinds of random problems (the hard-to-impossible kind to fix), I discovered that the memory check was disabled. When I turned it back on, I learned that the random bugs were all caused by insufficient memory. Basically, Sierra games were too big to fit on the Genesis CD, and there was very little we could do to shoehorn them in. With the project now behind schedule, and the only apparent solution being a complete rewrite of SCI to use a smaller memory footprint, Sierra management cancelled the project.

While Corey Cole spun his wheels in this fashion, Lori Ann Cole was forced to design most of Quest for Glory III alone, at significant cost to this latest iteration in what had been Sierra’s most creative and compelling adventure series up to that point.

The push to move their games to consoles also cost Sierra in the more literal sense of dollars and cents, and in the end they got absolutely no return for their investment. Some of the porting projects, like the one on which Corey worked, were abandoned when the target hardware proved itself not up to the task of running games designed for cutting-edge personal computers. Others were rendered moot when the entire would-be consumer-electronics category of multimedia set-top boxes for the living room — a category that included CD-i, CDTV, 3DO, and VIS — flopped one and all. (Radio Shack employees joked that the VIS acronym stood for “Virtually Impossible to Sell.”) In the end, King’s Quest VI never came out in any versions except those for personal computers. Ken Williams’s dream of conquering the living room, like that of conquering the radio waves, would never come to fruition.

The money Sierra wasted on the fruitless porting projects were far from the only financial challenge they faced at the dawn of the CD era in gaming. For all that everyone at the company had chaffed against the restrictions of floppy disks, those same restrictions had, by capping the amount of audiovisual assets one could practically include in a game, acted as a restraint on escalating development budgets. With CD-ROM, all bets were off in terms of how big a game could become. Sierra felt themselves to be in a zero-sum competition with the rest of their industry to deliver ever more impressive, ever more “cinematic” games that utilized the new storage medium to its full potential. The problem, of course, was that such games cost vastly more money to make.

It was a classic chicken-or-the-egg conundrum. Ken Williams was convinced that games had the potential to appeal to a broader demographic and thus sell in far greater numbers than ever before in this new age of CD-ROM. Yet to reach that market he first had to pay for the development of these stunning new games. Therein lay the rub. If this year’s games cost less to make but also come with a much lower sales cap than next year’s games, the old financial model — that of using the revenue generated by this year’s games to pay for next year’s — doesn’t work anymore. Yet to scale back one’s ambitions for next year’s games means to potentially miss out on the greatest gold rush in the history of computer gaming to date.

As if these pressures weren’t enough, Sierra was also facing the slow withering of what used to be another stable source of revenue: their back catalog. In 1991, titles released during earlier years accounted for fully 60 percent of their sales; in 1992, that number shrank to 48 percent, and would only keep falling from there. In this new multimedia age, driven by audiovisuals above all else, games that were more than a year or two old looked ancient. People weren’t buying them, and stores weren’t interested in stocking them. (Another chicken-or-the-egg situation…) This forced a strike-while-the-iron-is-hot mentality toward development, increasing that much more the perceived need to make every game look and sound spectacular, while also instilling a countervailing need to release it quickly, before it started to look outdated. Sierra had long been in the habit of amortizing their development costs for tax and other accounting purposes: i.e., mortgaging the cost of making each game against its future revenue. Now, as the size of these mortgages soared, this practice created still more pressure to release each game in the quarter to which the accountants had earmarked it. None of this was particularly conducive to the creation of good, satisfying games.

At first blush, one might be tempted to regard what came next as just more examples of the same types of problems that had always dogged Sierra’s output. Ken Williams had long failed to install the culture and processes that consistently lead to good design, which had left well-designed games as the exception rather than the rule even during the company’s earlier history. Now, though, things reached a new nadir, as Sierra began to ship games that were not just poorly designed but blatantly unfinished. Undoubtedly the most heartbreaking victim of these pressures was Quest for Glory IV, Corey and Lori Ann Cole’s would-be magnum opus, which shipped on December 31, 1993 — the last day of the fiscal quarter to which it had been earmarked — in a truly woeful condition, so broken it wasn’t even possible to complete it. Another sorry example was Outpost, a sort of SimCity in space that was rendered unplayable by bugs. And an even worse one was Alien Legacy, an ambitious attempt to combine strategy with adventure gaming in a manner reminiscent of Cryo Interactive’s surprisingly effective adaptation of Dune. We’ll never know how well Sierra’s take on the concept would have worked because, once again, it shipped unfinished and essentially unplayable.

Each of these games had had real potential if they had only been allowed to realize it. One certainly didn’t need to be an expert in marketing or anything else to see how profoundly unwise it was in the long run to release them in such a state. While each of them met an arbitrary accounting deadline, thus presumably preventing some red ink in one quarter, Sierra sacrificed long-term profits on the altar of this short-term expediency: word quickly got around among gamers that the products were broken, and even many of those who were unfortunate enough to buy them before they got the word wound up returning them. That Sierra ignored such obvious considerations and shoved the games out the door anyway speaks to the pressures that come to bear as soon as a company goes public, as Sierra had done in 1988. Additionally, and perhaps more ominously, it speaks to an increasing disconnect between management and the people making the actual products.

Through it all, Ken Williams, who seemed almost frantic not to miss out on what he regarded as the inflection point for consumer software, was looking to expand his empire, looking to make Sierra known for much more than adventure games. In fact, he had already begun that process in early 1990, when Sierra acquired Dynamix, a development house notable for their 3D-graphics technology, for $1 million in cash and some stock shenanigans. That gambit had paid off handsomely; Dynamix’s World War II flight simulator Aces of the Pacific became Sierra’s second biggest hit of 1992, trailing only the King’s Quest VI juggernaut whilst — and this was important to Ken — appealing to a whole different demographic from their adventure games. In addition to their flight simulators, Dynamix also spawned a range of other demographically diverse hits over this period, from The Incredible Machine to Front Page Sports: Football.

With a success story like that in his back pocket, it was time for Ken to go shopping again. In July of 1992, Sierra acquired Bright Star Technology, a Bellevue, Washington-based specialist in educational software, for $1 million. Ken was convinced that educational software, a market that had grown only in fits and starts during earlier years, would become massive during the multimedia age, and he was greatly enamored with Bright Star’s founder, a real bright spark himself named Elon Gasper. “He thinks, therefore he is paid,” was Ken’s description of Gasper’s new role inside the growing Sierra. Bright Star also came complete with some innovative technology they had developed for syncing recorded voices to the mouths of onscreen characters — perhaps not the first problem one thinks of when contemplating a CD-ROM-based talkie of an adventure game, but one which quickly presents itself when the actual work begins. King’s Quest VI became the first Sierra game to make use of it; it was followed by many others.

Meanwhile Bright Star themselves would deliver a steady stream of slick, educator-approved learning software over the years to come. Less fortunately, the acquisition did lead to the sad demise of Sierra’a in-house “Discovery Series” of educational products, which had actually yielded some of their best designed and most creative games of any stripe during the very early 1990s. Now, the new acquisition would take over responsibility for a “second, more refined generation of educational products,” as Sierra’s annual report put it. But in addition to being more refined — more rigorously compliant with established school curricula and the latest pedagogical theories — they would also be just a little bit boring in contrast to the likes of The Castle of Dr. Brain. Such is the price of progress.

Sierra’s third major acquisition of the 1990s was more complicated, more expensive, and more debatable than the first two had been. On October 29, 1993, they bought the French developer and publisher Coktel Vision for $4.6 million. Coktel had been around since 1985, unleashing upon European gamers such indelibly (stereotypically?) French creations as Emmanuelle: A Game of Eroticism, based on a popular series of erotic novels and films. But by the early 1990s, Coktel was doing the lion’s share of their business in educational software. In 1992, estimates were that 50 to 75 percent of the software found in French schools came from Coktel. The character known as Adi, the star of their educational line, is remembered to this day by a whole generation of French schoolchildren.

Sierra had cut a deal more than a year before the acquisition to begin distributing Coktel’s games in the United States, and had made a substantial Stateside success out of Gobliiins, a vaguely Lemmings-like puzzle game. That proof of concept, combined with Coktel’s educational line and distributional clout in Europe — Ken was eager to enter that sprawling market, where Sierra heretofore hadn’t had much of a footprint — convinced the founder to pull the trigger.

But this move would never quite pan out as he had hoped. Although the text and voices were duly translated, the cultural idiom of Adi just didn’t seem to make sense to American children. Meanwhile Coktel’s games, which mashed together disparate genres like adventure and simulation with the same eagerness with which they mashed together disparate presentation technologies like full-motion video and 3D graphics, encountered all the commercial challenges that French designs typically ran into in the United States. Certainly few Americans knew what to make of a game like Inca; it took place in the far future of an alternate history where the ancient Incan civilization had survived, conquered, and taken to the stars, where they continued to battle, Wing Commander-style, with interstellar Spanish galleons. (The phrase “what were they smoking?” unavoidably comes to mind…) Today, the games of Coktel are remembered by American players, if they’re remembered at all, mostly for the sheer bizarreness of premises like this one, married to puzzles that make the average King’s Quest game seem like a master class in good adventure design. Coktel’s European distribution network undoubtedly proved more useful to Sierra than the company’s actual games, but it’s doubtful whether even it was useful to the tune of $4.6 million.

Inca, one of the strangest games Sierra ever published — and not really in a good way.

Ken Williams was playing for keeps in a high-stakes game with all of these moves, as he continued to do as well with ImagiNation, a groundbreaking, genuinely visionary online service, oriented toward socializing and playing together, which stubbornly refused to turn a profit. All together, the latest moves constituted a major shift in strategy from the conservative, incrementalist approach that had marked his handling of Sierra since the company’s near-death experience of the mid-1980s. From 1987 — the year the recovering patient first managed to turn a profit again — through 1991, Sierra had sold more games and made more money each year. The first of those statements held true for 1992 as well, as sales increased from $43 million to within a whisker of $50 million. But profits fell off a cliff; Sierra lost almost $12.5 million that year alone. Sales increased impressively again in 1993, to $59.5 million. Yet, although the bottom line looked less ugly, it remained all too red thanks to all of the ongoing spending; the company lost another $4.5 million that year.

In short, Ken Williams was now mortgaging Sierra’s present against its future, in precisely the way he’d sworn he’d never do again during those dark days of 1984 and 1985. But he felt he had to make his play for the big time now or never; CD-ROM was a horse he just had to ride, hopefully all the way to the nerve center of Western pop culture. And so he did something else he’d sworn he would never do: he left Oakhurst, California. In September of 1993, Ken and Roberta and select members of Sierra’s management team moved to Bellevue, Washington, to set up a new “corporate headquarters” there; sales and marketing would gradually follow over the months to come. Ken had long been under pressure from his board to move to a major city, one where it would be easier to recruit a “first-rate management team” to lead Sierra into a bold new future. Bellevue, a suburb of Seattle that was also home to Microsoft, Nintendo, and of course Sierra’s own new subsidiary of Bright Star, seemed as good a choice as any. Ken promised Sierra’s creative staff as well as their fans that nothing would really change: most of the games would still be made in the cozy confines of Oakhurst. And he spoke the truth — at least in literal terms, at least for the time being.

Nevertheless, something had changed. The old dream of starting a software company in the woods, the one which had brought a much younger, much shaggier Ken and Roberta to Oakhurst in 1980, had in some very palpable sense run its course. Sierra had well and truly gone corporate; Ken and Roberta were back in the world they had so consciously elected to escape thirteen years before. Oh, well… the arrows of both revenue and profitably at Sierra were pointing in the right direction. One more year, Ken believed, and they ought to be in the black again, and in a stronger position in the marketplace than ever at that. Chalk the rest of it up as yet one more price of progress.

(Sources: the book Influential Game Designers: Jane Jenson by Anastasia Salter; Sierra’s newsletter InterAction of Spring 1992, Fall 1992, Winter 1992, June 1993, Summer 1993, Holiday 1993, Spring 1994, and Fall 1994; The One of April 1989; ACE of May 1989; Game Players PC Entertainment of Holiday 1992; Compute! of May 1993; Computer Gaming World of January 1992; press releases, annual reports, and other internal and external documents from the Sierra archive at the Strong Museum of Play. An online source was the Games Nostalgia article on King’s Quest VI. And my thanks go to Corey Cole, who took the time to answer some questions about this period of Sierra’s history from his perspective as a developer there.)

source http://reposts.ciathyza.com/the-mortgaging-of-sierra-online/

0 notes

Text

Tribal Loan Company

The tribal loans listening to this all unfolded at was known as “The CFPB’s Assault on Access to Credit score and Trampling of State and Tribal Sovereignty,” and held by the Home Financial Services subcommittee. You would have to search for the patron Monetary Services Regulatory codes for the particular tribe that you’re borrowing from. As a result of in any other case, you'll have to pay not outdated payments which even by the requirements of high interest payday loans, that may very well be alternatively expensive. It will apply to the aggregate quantity that you've got left excellent in your Stafford Loans, which is made up of the unique quantity you borrowed plus any interest you might have accrued over time. Small dollar installment loans are structurally much like standard loans, through which a portion of the principal and interest are repaid every interval. The state can give you zero curiosity mortgage gives to be able to renovate your house or it will probably give you non refundable grant. Sooner or later, a distant relative by the name of Simon got here home for a go to and asked me to present him company to a little lake nearby to buy some fish. In case you proceed with one of these providers, you possibly can affirm that the lender is reputable by checking along with your native authorities.

Anticipate to listen to from Huge Image Loans within 15 minutes to one Enterprise Day after you may have submitted your application. Apply for an installment loan with AWL and you could possibly obtain your funds the same day your loan is finalized if processed before our cut-off time. Sadly, the next day our family - together with neighbours, family members, and pals tenderly carried the picket coffin bearing the remains of my step-grandmother as much as the maize field edging the little coffee best tribal installment loans farm and buried her. American Psychological Association: The APA provides scholarships and in addition supplies college students in any respect levels with an inventory of all of the funding sources of their subject. A partnership between the Native American Bank, LenderLive and Greenpoint Mortgage has resulted in turnkey residence mortgages for American Indians for various functions like rehabilitation, refinancing and dwelling shopping for. Loans are written for the maximum number of payments available.

Tribal loans are an ideal different to payday loans as a result of they are a brief term installment loan that allows you to pay a portion due each month as an alternative of all of it on your next payday. It is funny. In these days, there were no gentle financial institution loans or poverty alleviating schemes for the African. Benin: In 1625 there were slave traders, the Fon, established Dahomey and conquered the neighbouring towns and villages of Dan and Allada and extended their imperialism so far as in the vicinity of Porto Novo. Focus all of nation's energies on making extra as there is no approach to offer welfare from an empty pocket. And Rep. Love thinks Jimmy John Smith who is working two jobs simply to maintain the lights on is going to be the most effective individual from making a nasty alternative on a payday loan? Note that the max mortgage amount is based on the lenders of their community, but it'll fluctuate based in your state of residence. The class prepares you for the home shopping for process, and equips you to know the qualifications for a home loan.

Up to date on September 12, 2018 Marie Flint moreMarie is a Michigan State College alumnus and has over 10 years of business writing expertise. Faculty Pell Grant alternatives assist over eight million People annually afford expenses, however the purchasing strength of the grants has unfortunately quickly diminished over time. Yet each moment of the day, as we hearken to the radio or watch tv or learn the newspapers, we witness the finality of life. Vital Disclosures. Please Learn Carefully. Future submission rounds will likely be announced by supplemental solicitation announcements. In fashionable Ghana,oilfield containing up to three billion barrels (480,000,000 m3) of mild oil was discovered in 2007. Exploration is ongoing and the amount of oil continues to increase. Farm laborers are a very important part of each farm. What do you think are the primary causes for that? Do you assume there may be large market stress on the federal government- irrespective of the political occasion governing?

Vet Bills, Medical Expenses, Unpaid Fines - Here Are Three Steps To Get Your Bills Under Control

A payday loan is often a high interest short-term loan made to be covered yearly pay periods or two. As payment for your loan, the borrower either runs on the direct debit authorization to their checking account provides or even a post-dated check. Because such loans usually don't require a appraisal of creditworthiness plus a a good credit rating history, people with poor credit history or are with financial problems usually select this option. And because of the character with this type of loan, it's also super easy to fall into a monetary debt cycle that will are as long as 400% interest and many more burdens financially.

Whether you choose an unsecured or secure loan depends quite a lot about how much cash you will need. Smaller amounts usually are obtained using an unsecured lending process. With this type of loan, there is no need to set up any type of collateral. The secure loan, which is possibly the type of mortgage you might get for larger levels of money, is a you will need collateral for.

Of course, different lenders have different criteria, and will have differing attitudes to the same facts. The problem with unsecured unsecured loans, however, is always that there is certainly hardly any possibility to recover losses should the borrower default around the loan. But even this factor doesn't imply the approval process is slowed down at all.

These loans are supposed to provide be an aid to those who cannot prove their income to lenders. Before they can apply for a loan, they need to make certain that they have a stable income source. This is a big requirement because lenders want to be sure that whomever they lend money to are able to meet monthly mortgage repayments.

However, some lenders may permit you to pay it off around the next thirty days. Lenders might also give you with all the facility of an refinance if you are not able to repay the money on the agreed deadline. Some lenders enable you to take advantage of the refinance option for 4x. It is important to understand clearly and thoroughly the repayment terms and options that the lender can provide you with before commencing to cope with them. This way, it will be possible to determine upfront if you are financially and fully competent to repay the money loans right on its payment date and get away from any unwanted penalties and charges.

0 notes

Text

The Need For Liquidity Is Overrated If You Are Financially Competent

In the debate between stocks versus real estate as a better investment, a common issue that comes up is real estate’s lack of liquidity, and therefore inferiority.

For example, reader Nate writes, “I prefer equities because real estate doesn’t provide a sufficient illiquidity premium to merit the leveraged risk and transaction cost. If stocks provide a better return with better liquidity and bonds provide a similar yield with better liquidity (and collateral), why take on the illiquidity at all?”

As someone who believes it’s best to invest in stocks and real estate for as long as possible, having an investment that can be easily sold could be a detriment to one’s journey to financial freedom. Think about all the folks who wigged out between 2008-2012 and sold equities or real estate back then. They’re kicking themselves now!

In 2012, I tried to sell my old rental house for $1,700,000. The worst of the downturn was behind us and I felt I had dodged a bullet. I had recently engineered my layoff and figured it was better to downsize rather than to continue holding a ~$1,100,000 mortgage.

I signed a 30-day exclusive listing contract with a real estate agent friend. I agreed to pay him a 5% commission. He and his wife came over to stage our house. We got a standard inspection done and pulled a 3R report for our disclosure statement for about $500. My agent ended up hosting three open houses and around 10 private showings.

Our best offer was a verbal offer with no number, just an indication they were willing to offer “much less than asking.” I told them to bugger off and pulled the listing after 30 days.

If I could have just pressed a button to sell for $1,700,000 for a reasonable flat fee, I probably would have. But praise all that’s good in the world the real estate market was so illiquid that I saved myself from myself. Even though I’m sure I sold the property too early in 2017, I take solace in the fact that at least I got an extra million bucks five years later.

Why You Likely Never Face A Serious Liquidity Crunch

Just like the fear of running out of money in retirement is overblown, the fear of being illiquid in case you lose your job or lose a significant amount of your assets is overblown.

Just reading this post makes me confident that you have the wherewithal to protect yourself from any liquidity crunch. Here are some reasons why I think Financial Samurai readers will be just fine.

1) You have multiple types of insurance. With health insurance, homeowner’s insurance, rental insurance, auto insurance, short-term disability, long-term disability, life insurance, and an umbrella policy, it’s hard to succumb to a financial disaster unless you are not insured.

Sadly, medical debt is the #1 reason for bankruptcy in America and not poor spending habits. The New York Times reported that 20% of Americans under 65 with health insurance had trouble paying their medical bills over the past year. Of those, 63% claim to have used up all or most of their savings to tackle their healthcare expenses. To counteract egregious medical debt, make sure you thoroughly understand what type of health insurance benefits you are getting for the monthly premiums you are paying. And to further protect yourself, let’s talk about point #2.

2) You have a savings buffer. Everybody knows that it’s important to save for an unknown future. Therefore, every financially competent person saves and invests as much as possible to protect against uncertain future expenses. My recommendation is to save between 5% – 10% of your net worth in low-risk assets such as CDs, AA-rated municipal bonds, US treasuries, and cash. This way, you’ll be able to survive long enough until the good times return.