#pvt ltd company registration cost

Text

Private Limited Company Registration in India Online at Low Cost

A private limited is a company which is run by a small group of peaople. The shares of a private limited company cannot be traded publically. The shareholders are the owners of the company and the key managerial decisions are taken by the board of directors. It is a body corporate having separate legal entity. It has perpetual succession which means that the company continues to exist even after the death of all its members.

The minimum number of members required to start a private company is 2 and the maximum is 200. The liability of ach member is limited to the extent of shares held by them. The minimum number of directors is also 2.

Get your Private Limited Company Registration in India online with EazyBahi. Consult with our experts to know the pvt ltd company registration cost, process and advantages.

0 notes

Text

Ensuring Smooth Tds Filing Services in Bangalore Tips by Kros Chek

Introduction: When it comes to tax filing for your company, having reliable and professional assistance is essential. Kros Chek is a trusted name in the industry, providing top-notch Tds Filing Services in Bangalore. With their expertise and experience, they have become renowned GST filing consultants HSR Layout, Bangalore. In this article, we will share five valuable tips by Kros Chek to ensure a seamless tax filing process. Whether you require GST registration consultants HSR Layout, Bangalore, or GST return filing consultants near you, these tips will help you navigate the complexities of tax filing.

Maintain Accurate Financial Records: To streamline the tax filing process, it is crucial to maintain accurate financial records throughout the year. Keep track of your income, expenses, receipts, invoices, and other financial documents meticulously. This will help you calculate your taxable income correctly and ensure compliance with tax regulations. Kros Chek advises businesses to adopt robust accounting software to automate record-keeping, making it easier to generate accurate financial statements during Tax Consultants in Bangalore

Seek Professional Assistance: Navigating the intricacies of tax laws can be overwhelming, especially for businesses. Hiring the services of professional tax consultants such as Kros Chek can provide you with expert guidance and ensure compliance with all tax regulations. With their extensive knowledge and experience in tds return filing services near bangalore, Kros Chek can help you maximize deductions, minimize liabilities, and avoid costly mistakes.

Plan Ahead for GST Filing: For businesses that are required to file GST returns, planning ahead is crucial. Engaging the services of reputable Private Limited Company Registration in Bangalore, like Kros Chek, can streamline the GST filing process. They can assist you with timely GST registration, ensuring that you are compliant with all GST regulations. By preparing and organizing your GST records throughout the year, you can avoid last-minute hassles and penalties.

Keep Abreast of Tax Deadlines: Staying informed about tax deadlines is essential to avoid penalties and interest charges. Kros Chek bangalore advises businesses to maintain a calendar specifically for tax-related deadlines, including due dates for filing tax returns, making tax payments, and submitting necessary documentation. By planning well in advance and meeting deadlines promptly, you can avoid unnecessary stress and penalties.

Review and Optimize Tax Strategies: Tax laws are subject to changes and updates regularly. It is crucial for businesses to review their tax strategies periodically and adapt them to any new regulations or incentives. Consulting with experienced tax professionals like Kros Chek can help you identify Company Incorporation near Bangalore, optimize deductions, and ensure compliance with current tax laws. By staying proactive and informed, you can minimize your tax liabilities and maximize your savings.

Conclusion: When it comes to company Company Tax Filing Services in Bangalore Kros Chek is a trusted partner that provides reliable and efficient assistance. Whether you require GST filing consultants in HSR Layout, Bangalore, or GST return filing consultants near you, Kros Chek has the expertise to navigate the complexities of tax filing. By following their valuable tips, including maintaining accurate financial records, seeking professional assistance, planning ahead for GST filing, staying aware of tax deadlines, and reviewing and optimizing tax strategies, you can ensure a smooth and hassle-free tax filing process for your business. Entrust your tax filing needs to Kros Chek, and experience the peace of mind that comes with expert tax assistance.

More information:

365 Shared Space, 2nd Floor,#153, Sector 5,

1st Block Koramangala, HSR Layout,

Bengaluru, Karnataka 560102

+91-9880706841

#private limited company registration in bangalore#pvt ltd company registration in bangalore#pvt ltd company registration in bangalore cost

0 notes

Text

PVT LTD Company Registration Services in Bangalore:9844713239.

Private Limited Company Registration Bangalore Bengaluru Karnataka: Call@ 9844713239. pvt ltd registration bangalore, pvt ltd company registration in bangalore, register a pvt ltd company in bangalore, pvt ltd company registration fees in bangalore, pvt ltd company registration in bangalore cost, private limited company registration bangalore bengaluru karnataka.

#pvt ltd registration bangalore#pvt ltd company registration in bangalore#register a pvt ltd company in bangalore#pvt ltd company registration fees in bangalore#pvt ltd company registration in bangalore cost#private limited company registration bangalore bengaluru karnataka

0 notes

Text

youtube

Business Name:

Company Registration in Mumbai - Virtual Auditor

Street Address:

Office No 2 , Workafella Business Centre AK Estate, Off Veer Savarkar Flyover, SV Rd, Goregaon West

City:

Mumbai

State:

Maharashtra

Zip Code:

400062

Country:

INDIA

Business Phone:

077000 89597

Website:

https://virtualauditor.in/

Business Description:

Company Registration in Mumbai - GST Registration in Mumbai, Valuation services and business valuation

Company Registration in Mumbai process it with you experts Virtual Auditor. Leading Business Setup Firm in Mumbai. Virtual Auditor is India's largest online business advisory services platform dedicated to helping people easily start and grow their business, at an affordable cost. #1 Company Registration Service in Mumbai. We provide all registration services starting form company registration in Mumbai,Income Tax filing services, Digital Service Certificates, We are experts in business valuation and start up valuation we are firm of registered Valuers

Our team specialized in Business advisory Services and best business set up services.

Google My Business CID URL:

https://www.google.com/maps?cid=8657467965498112244

Business Hours:

Sunday Closed

Monday 10am-7pm

Tuesday 10am-7pm

Wednesday 10am-7pm

Thursday 10am-7pm

Friday 10am-7pm

Saturday 10am-7pm

Services:

Company Registration, TAX Filing, Accounting, Annual Compliances

Keywords:

Company Registration in Mumbai, private limited company registration in mumbai, pvt ltd company registration in mumbai, online company registration in mumbai, registration of company in mumbai

Yearly Revenue:

50,000-100,000

Location:

Service Areas:

2 notes

·

View notes

Text

Which is a better OPC or Pvt. Ltd. company in Ghazipur?

Choosing between an OPC (One Person Company) and a Pvt. Ltd. (Private Limited Company) depends on your specific business needs, objectives, and circumstances. Here are some key differences between the two to help you make an informed decision:

Ownership:

OPC: Owned by a single person.

Pvt. Ltd.: Owned by multiple shareholders.

Minimum Requirement:

OPC: Requires only one director and one nominee.

Pvt. Ltd.: Requires a minimum of two directors and two shareholders.

Liability:

OPC: Limited liability protection to the owner.

Pvt. Ltd.: Limited liability protection to shareholders.

Compliance and Regulation:

OPC: Less stringent compliance requirements compared to Pvt. Ltd.

Pvt. Ltd.: More compliance requirements, including annual filings, board meetings, and shareholder meetings.

Growth and Expansion:

OPC: Limited to a turnover of up to Rs. 2 crore in three consecutive years.

Pvt. Ltd.: Suitable for businesses with high growth potential and seeking external investment.

Cost:

OPC: Generally lower initial setup and maintenance costs.

Pvt. Ltd.: Higher setup and operational costs due to increased compliance and regulatory requirements.

Credibility and Perception:

OPC: May be perceived as less established compared to Pvt. Ltd.

Pvt. Ltd.: Often considered more credible and trustworthy due to the involvement of multiple shareholders.

Considering the specific needs and objectives of your business in Ghazipur, you should evaluate these factors carefully. If you want more flexibility and are looking for a simpler business structure with fewer compliance requirements, an OPC might be suitable. On the other hand, if you plan to scale your business, attract external investment, and establish a more credible business image, a Pvt Ltd. company could be a better choice.

Choose Vakilkaro for private limited company in Ghazipur

Do you want to your private limited company registration in Ghazipur? Choose Vakilkaro for a seamless and hassle-free experience. With our expert guidance, you can easily navigate the complexities of Private Limited Company Registration. Trust lawyers to handle all your legal needs efficiently. To get business advice, contact Vakilkaro team today on this number (9828123489).

#company in india|#top mlm company in india#which cement is best for house construction#ultratech super cement is opc or ppc#best mlm company#company utrakhand#company wrong young fashion value marketing#wrong company#direct company se cement kaise kharide#what is difference between rtgs and neft#how many percentage of gypsum is available in ultratech super cement#what is overhead water tank#what is overhead water tank and its construction

0 notes

Text

How do I choose a business structure when applying for company registration?

Before settling on the appropriate business structure for your company registration, it's essential for every entrepreneur to ponder over the following key considerations:

Number of Partners or Members: Entrepreneurs must decide whether they prefer sole ownership or partnership. Single owners or those who wish to retain control over their ideas often lean towards sole proprietorship or One Person Company (OPC). Conversely, businesses with multiple members tend to be perceived as more structured and trustworthy by investors.

Initial Capital Investment: If an individual aims to minimize initial expenses, options like sole proprietorship or partnership can be advantageous, as they typically entail fewer tax obligations and initial registration costs compared to other structures like corporations.

Liability and Personal Risk Management: The level of risk associated with a business hinges on its legal structure. Entities like Hindu Undivided Family (HUF) and partnership firms entail unlimited liabilities, whereas Limited Liability Partnerships (LLPs), Private Limited Companies (Pvt. Ltd.), and Public Limited Companies (PLCs) offer limited personal risk and liability.

Taxation Framework: Entrepreneurs should thoroughly grasp the tax implications of different business structures before proceeding with registration, as tax burdens can vary significantly across structures.

Registration and Ongoing Costs: While the initial registration fees are fairly uniform across most business structures under the Companies Act of 2013, sole proprietorship firms typically incur lower registration costs. Additionally, ongoing maintenance expenses, such as annual compliance fees, can vary depending on the chosen structure.

Access to Investment: Securing investment is vital for business growth, and having an appropriate business structure can facilitate this process. Well-established structures often instill confidence in investors and lenders, making it easier to attract funding or obtain loans.

0 notes

Text

Navigating the Costs: A Guide to Pvt Ltd Company Registration Online in India

It is an exciting task to start the journey of establishing a Private Limited Company but it is necessary to understand the costs that have been involved in the registration process. Here, in this article, we will tell you about the charges that have been associated with the private limited registration so that you can plan for your entrepreneurial journey effectively.

Charges Involved in Pvt Ltd Company Registration Online In India

Incorporation Charge: The incorporation charge of registering a Pvt Ltd. Company usually start from Rs. 8000/-. Charges may vary according to the state stamp duty, authorized share capital and number of directors. Here we will provide you the breakdown of the incorporation fees.

Government Charges & Other Stamp Duty: Stamp duty is payable on a variety of documents that have been filed during the incorporation process, including the MOA and AOA. It varies on the basis of authorized capital & state. It generally ranges from a few hundred rupees to a few thousand rupees.

Name Approval Charges: To register Private Limited Company, entrepreneurs must have to apply for name reservation. And the charges for name approval will be Rs. 1,000/-.

DIN i.e. Director Identification Number: The entrepreneurs who want to register a Ltd company must have to apply for DIN for all the directors of company. The charges of applying DIN of 1 director will be Rs. 500/-.

DSC i.e. Digital Signature Certificate: The cost of obtaining a DSC may vary as per the certifying authority and the validity period of the certificate. The average cost of a DSC ranges from Rs. 500/- to Rs. 2,000/- for 1 director.

Professional Fees: Many entrepreneurs hire a professional, like a chartered accountant or company secretary, to help them with the incorporation procedure. Professional charges vary on the basis of the range of services supplied and the experience of the professional.

Miscellaneous Charges: In addition to the above specified prices, there can be some additional one-time costs such notarization fees, delivery fees and other.

You can check the government fees of different states yourself.

Conclusion

Entrepreneurs can plan their entrepreneurial journey effectively & navigate the registration process confidently by understanding the comprehensive charges of Pvt Ltd Company Registration Online in India.

Thorough financial planning is the key to the success of your business venture.

#pvt ltd company registration online#Private Limited Company Registration#Private Limited Registration#Private Limited Registration Online#pvt ltd company formation#register private limited company#charges for pvt ltd company registration

0 notes

Text

Understanding the Dynamics of Private Limited Companies

In the realm of business entities, the private limited company stands out as one of the most prevalent and versatile structures. This private limited company registration in Andhra Pradesh form of business organization combines the benefits of limited liability with operational flexibility, making it an attractive choice for entrepreneurs worldwide. From startups to well-established enterprises, private limited companies play a pivotal role in various sectors of the economy.

Defining a Private Limited Company:

A private limited company, often abbreviated as Pvt. Ltd., is a privately held business entity incorporated under the company law of a private limited company registration online in andhra Pradesh particular jurisdiction. Unlike public companies, private limited companies cannot offer shares to the general pvt ltd company registration in andhra Pradesh public. Instead, ownership is typically held by a select group of shareholders, often including founders, investors, and employees.

Characteristics of Private Limited Companies:

Limited Liability: One of the most significant advantages of a private limited company is limited liability protection. Shareholders are only liable private limited company registration provider in andhra Pradesh for the debts and obligations of the new ltd company registration in andhra Pradesh company to the extent of their shareholdings. Personal assets of shareholders are safeguarded, barring exceptional circumstances such as fraud or unlawful actions.

Separate Legal Entity: A private limited company is considered a distinct legal entity independent of its shareholders. This separation ensures that the pvt limited gst registration services in andhra Pradesh private limited company incorporation in andhra Pradesh company can enter into contracts, own assets, and incur liabilities in its own name. Consequently, the company's existence is not affected by changes in ownership or management.

Ease of Fundraising: While private limited companies cannot publicly issue shares, they can raise capital through private placements or by inviting investments from venture capitalists, angel investors, or private equity firms.

Advantages of Private Limited Companies:

Credibility and Perception: Operating as a private limited company often enhances the credibility and perception of the business, especially when new pvt ltd company registration in andhra Pradesh dealing with suppliers, customers, and financial institutions. The corporate structure conveys professionalism and stability, instilling trust among stakeholders.

Flexible Management: Private limited companies offer flexibility in management structure and decision-making processes. Directors and pvt ltd registration online in andhra Pradesh shareholders have the autonomy to shape the company's strategies, policies, and operations according to the evolving needs of the business.

Succession Planning: The perpetual existence of a private limited company facilitates seamless succession planning and continuity of operations.

Limited Personal Liability: Shareholders' personal assets are shielded from the company's liabilities, reducing the risk associated with business ventures.

Considerations and Challenges:

Compliance Burden: Private limited companies must adhere to regulatory compliance requirements, which may entail administrative burdens and costs. Failure to comply with statutory obligations can result in penalties, legal repercussions, or even dissolution of the company.

Capital Constraints: While private limited companies have various avenues for raising capital, attracting investments can be challenging, particularly for startups and small businesses with limited track records or market visibility.

Conclusion:

Private limited companies occupy a central position in the business landscape, serving as engines of innovation, growth, and economic development. Their blend of limited liability, operational flexibility, and corporate governance makes them an ideal choice for entrepreneurs seeking to establish sustainable and scalable ventures.

0 notes

Text

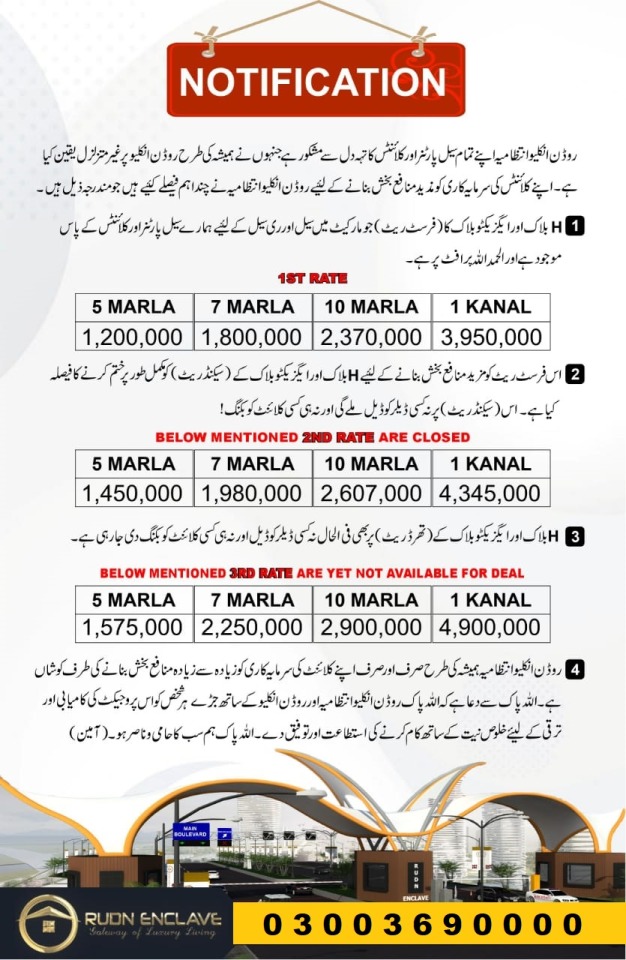

Rudn Enclave Rawalpindi

Rudn Enclave Rawalpindi

RUDN Enclave is a project of RMRSCO (Pvt. Ltd.) with NESPAK as the master planner and consultant. Moreover, the most renowned developer team comprising Urban Planning and Design Limited (UPDL), its subsidiaries Alhaq Builders, and New Leaves has been incorporated as master developers and contractors for the most attractive projects in twin cities.

Most ideally located at the juncture of Adyala Road and Rawalpindi Ring Road, RUDN Enclave offers an unmatched lifestyle living in a serene, secure, and modern gated community where world-class amenities are being ensured through the benchmark planners of NESPAK and the collaboration of developers of international repute. The natural beauty of the terraced landscape is enhanced by the shining waters from Khasala Dam, which renders our location an ultimate destination for families and tourists alike.

RMRSCO (Private) Limited:

RMRSCO (Private) Limited is an organization of accomplished engineers, project managers, technical professionals, and highly professional management that endeavors to take on the most distinguished civil engineering and construction projects in Pakistan. The company is fully equipped with all the core competencies and able to challenge any dynamic project from groundbreaking to completion in an effective manner.

Design Consultant:

NesPak is the main design consultant for Rudn Enclave. It is a prestigious government institute. It is one of the top engineering consulting organizations in Asia and Africa. It came into being in 1973. It aims to gather a pool of engineers in a single place. Currently, NESPAK has a total strength of over 5100 employees. The total speculated turnover for the year 2016–2017 is Rs. 8.8 billion, with the total cumulative cost of the projects undertaken by NESPAK at 288 billion.

Developer's Team:

Management of RUDN Enclave proudly associates a landmark developer’s team comprising Urban Planning and Design Limited (UPDL), their subsidiaries Alhaq Builders, and the horticulture fame New Leafs as the master developers to manage and implement all aspects of project management, development works, and horticulture. Affordability, timeliness, and par excellence are the defining contours of this professional team.

Rudn Enclave NOC:

The Layout Plan (LOP) of Rudn Enclave Rawalpindi is allegedly approved under the PHATA (Punjab Housing and Town Planning Agency) with registration number “DG/PHATA/W-1/ PHS/84/2023. Approved real estate projects have better chances of rapid development.

The NOC approval takes some time because it involves the approval of a dozen approvals that may include those for gas, electricity, water, and land transfer or ownership. All of these are to be obtained from the concerned departments. Hence, the whole process takes several months.

Project Location:

Nestled between two exquisite water bodies, Khasala Dam in the north-east and Jawa Dam in the south-west, stretching along the most vital communication artery, Adyala Road, and extending further north towards Chakri Road, RUDN Enclave is located at an ideal futuristic location. Distances from major hubs of the city are as follows:

- Rawalpindi Saddar to RUDN Enclave via Adyala road: approximately 20 Minutes’ drive

- Dhamyal airbase to RUDN Enclave via Dhamyal road: approximately 15 Minutes’ drive

- Bahria Phase 8 via Gorakhpur-Adyala Road: approximately 10 Minutes’ drive

- M2 via Chakri interchange, Chakri road: approximately 20 Minutes’ drive

- Rawat via Chakbeli road: approx. 35 Minutes’ drive

- M2 via Chakri interchange, Adyala road: approximately 25 Minutes’ drive

The proposed Rawalpindi Ring Road(RRR) project passes through RUDN Enclave, connecting commuters to the motorway, G.T. Road, Rawalpindi City, and Islamabad alike in the future. The locality is a hub for all civic facilities like gas, electricity, optical fiber, water sources, health services, education, transport, and utilities that make an area livable even today. The addition of Rawalpindi Ring Road will be another landmark development in the area, which will surely enhance the value and connectivity of the RUDN Enclave.

ZERO KMS FROM RAWALPINDI RING ROAD:

The RUDN enclave has a promising future due to the Rawalpindi Ring Road. M2 and Islamabad International Airport distances will be considerably reduced, thereby providing speedy and uninterrupted traffic flow to the twin cities as follows:

RUDN enclave to M2 via proposed Ring Road: 10 Minutes’ drive

Rawat to RUDN enclave via proposed Ring Road: 15 Minutes’ drive

RUDN enclave to Islamabad International Airport: 15 Minutes’ drive

MAP

What are the plot sizes, inventory, and layout?

The layout covers two major blocks and future plans, as below:

➢ General block, including A, C, G, and H Blocks

➢ Executive block

➢ Farm Houses Block: D

➢ Upcoming highlights include the Overseas Block

All blocks have a mix of residential and commercial plots, including dedicated spaces for recreation, health, schooling, religious and social gathering spots, entertainment, tourism, shopping, and allied amenities. Few but not all include the Malls, Five-star hotels, Brand outlets, Supermarkets, Grand masjids, indoor and outdoor sports, gyms, parks, Water sports, Offices and corporate spaces, food courts, skywalks, etc. All these will be available inside a safe and secure gated community with round-the-clock maintenance and security infrastructures.

Different plot sizes are:

- RESIDENTIAL PLOTS

- 5 Marla

- 7 Marla

- 10 Marla

- 1 Kanal

- Farm Houses

- 4 Kanal

- 8 Kanal

- COMMERCIALS

- 4 Marla

- 8 Marla

GENERAL BLOCK

Composed of A, C, G, and H blocks, the general block presents a mix of residential and commercial plots, including dedicated spaces for recreation, health, schooling, religious and social gatherings, sports and entertainment, tourism, shopping, and allied amenities. A few, but not all, include malls, Five-star hotels, Brand outlets, Supermarkets, Grand masjids, indoor and outdoor sports, gyms, parks, Water sports, offices and corporate spaces, food courts, skywalks, etc. All these will be available inside a safe and secure gated community with round-the-clock maintenance and security infrastructure. To cater to families with varied income levels, different plot sizes are offered, as below:

5, 7, 10, Marla, and 1 Kanal residential plots are available in the general block.

4, 8 Marla, and 1 Kanal commercial plot are available.

EXECUTIVE BLOCK

The term executive refers to the concepts of luxury and elite living.

NESPAK has designed and named this block "MODEL BLOCK”. A separate entrance is given to this block with the main boulevard, which is 200 feet wide, and the streets of this block are 40–60 feet wide. The block has the attraction maximum green areas, parks, and playlands, besides having the biggest monument in Pakistan, a Sports Stadium, an International Hospital, a Grand Jamia Mosque, Mega Shopping Malls, a Country Club, an Education Zone, and a Smart Security System. To cater to families with varying income levels, different plot sizes are offered as under.

7, 10 Marla, and 1 Kanal are Residential plots are available in the executive block.

4 and 8 Marla Commercial plots in the executive block.

Difference between General and Executive Block:

General Block has Residential, Commercial, and Farmhouses whereas its Boulevard Size is 200 feet wide, street sizes are 30 feet wide, service roads are 40 feet wide. On the other hand, Executive Block has Residential & commercial plots; its main Boulevard is 250 feet wide, street sizes are 40 to 60 feet wide. Its green area, roads, and amenities are covering 60% of the total block.

What amenities are available?

- Shopping malls

- Skywalk

- Hospital

- Zoo

- Cinemax

- Community center

- Educational city

- Jamia mosque

- Water theme park

- Yacht area

- Food courts

- Underground power & electricity

- Jogging tracks

- Sports complex security

Dam View 2 Kanal Mini Farm House Plots

Price Plan (Not available now)

Payment Plan (Not available now)

Prices are rapidly increasing day by day. There is a big difference from the pre-launching rates at this moment and you will witness the increment in prices as the development will begin.

Procedure to book a plot

The applicant shall make the payment of installment by the 10 of every month failing which a late payment charge of 1% per month will be levied on outstanding dues. If any payment/ installment is delayed by 60 days Rudn Enclave shall serve a final notice and subsequently cancel the booking/allotment. Also, in case the purchaser wants to cancel the said plot, the amount will be refunded after a deduction of 25% amount from the plot price & on re-selling of said plot or completion of the project. The new plot rate and new laws shall be applied on the renewal of canceled membership. The management reserves the right to reallot a canceled plot and its right thereof & in this regard decision of the firm shall not be challenged before any authority or court as the case may be.

Procedure for plot transfer

CHECKLIST FOR TRANSFER OF PLOT

1: Transfer fee paid before transfer

Residential 2000 per Marla

Commercial: 2500 per Marla

Farm House: 5000 per Kanal

2: All dues installments must be paid and the balanced sheet updated before the transfer of the plot.

3: Requirements of the seller and purchaser

I-Transfer Form to fill and sign both parties.

II- Orginal Allotment & Documents.

III- Seller Affidavit.

IV- Undertaking form purchaser for payment of dues.

V- Application form for new members.

VI- If the seller is not available the file should proceed only with the power to an attorney on the presenter name.

VII- CNIC Seller & Purchaser.

VIII- CNIC witness (Seller+ Purchaser).

IX- 2x Color Photograph(Purchaser)

P L O T S P K

+92-333-3690000

+92-300-3690000

[email protected]

Other Projects:

Bahria Town Peshawar

Blue World City Islamabad

Kingdom Valley Islamabad

Blue World City Awami Block

Gulberg Islamabad

Capital Smart City Islamabad

Blue World City Sports Valley

Blue World City Waterfront District

New Metro City Gujar Khan

Mivida City Islamabad

Rudn Enclave Islamabad

New City Paradise

Lahore Smart City

Nova City Islamabad

Read the full article

#Rudnenclavedirections#Rudnenclavegooglemaps#rudnenclavelocation#Rudnenclavemap#RudnenclaveNOC#Rudnenclavepaymentplan#RudnEnclaveRawalpindi

0 notes

Text

Best Pvt Ltd Company Registration Services | Start Your Business Journey Now

Looking to establish your business as a Private Limited (Pvt Ltd) Company? Discover the best Pvt Ltd Company Registration Services to kickstart your entrepreneurial journey confidently.

Starting a Pvt Ltd Company requires navigating various legalities, paperwork, and compliance procedures. Partnering with top-notch registration services offers invaluable support throughout this complex process. These services specialize in guiding entrepreneurs step-by-step, ensuring smooth registration and legal compliance.

With a focus on delivering excellence, these registration services streamline the intricate process of Pvt Ltd Company formation. They offer tailored solutions, understanding the unique needs of each business. Whether you're a budding startup or an established business transitioning to Pvt Ltd status, these services cater to all.

Benefit from their expertise in:

Expert Guidance: Access professional guidance from seasoned experts who understand the nuances of Pvt Ltd Company formation. They provide clear instructions, addressing queries and concerns at every stage.

Efficient Processing: Experience seamless registration processing. These services handle paperwork, documentation, and legal formalities efficiently, reducing hassles and saving time.

Compliance Assurance: Ensure compliance with all legal requirements. These services stay updated with the latest regulations, helping you meet statutory obligations effortlessly.

Tailored Solutions: Receive personalized solutions aligned with your business goals and structure. They assist in choosing the most suitable incorporation type and tailor their services accordingly.

Supportive Customer Service: Access responsive customer service throughout the registration journey. They offer continuous support, aiding in swift issue resolution.

Cost-Effective Options: Find cost-effective registration packages tailored to your budget. These services offer transparent pricing, eliminating hidden charges.

Starting your business as a Pvt Ltd Company brings numerous benefits like limited liability, credibility, and enhanced access to funding and partnerships. Choosing reliable registration services ensures a strong foundation for your company.

As you embark on this exciting business journey, rely on these reputable Pvt Ltd Company Registration Services. Their dedication to accuracy, efficiency, and customer satisfaction positions them as industry leaders, offering an indispensable advantage to entrepreneurs.

Partnering with them means unlocking a seamless pathway towards establishing your Pvt Ltd Company, allowing you to focus on business growth and innovation.

0 notes

Text

Best Alibaba Account Management Services in Dwarka Delhi | How Delete Alibaba Cloud Account

Best Alibaba Account Management Services are provided by Nwspl (Numero Web Services Pvt Ltd), a reputable digital marketing company with headquarters in Dwarka, Delhi. For companies looking to grow internationally, maintaining a robust and well-managed online presence on sites like Alibaba is essential in the fast-paced world of digital commerce.

The Role of Alibaba Account Manager

At the core of Nwspl’s services is the expertise of an Alibaba Account Manager. These professionals play a pivotal role in navigating the intricacies of the Alibaba platform. From creating and optimizing accounts to managing product postings, they ensure that businesses can showcase their offerings effectively to a global audience.

Alibaba Product Posting Expertise

One of the key aspects of Alibaba Account Management is the strategic posting of products. Nwspl’s dedicated team understands the nuances of product posting on Alibaba, employing tactics to enhance visibility, attract potential buyers, and drive conversions. This includes crafting compelling product descriptions, optimizing images, and utilizing keywords effectively.

Unlocking the Potential of Alibaba Cloud Account

Alibaba Account Creation Simplified

For businesses entering the Alibaba marketplace, the process of creating an account can be daunting. Nwspl simplifies this journey by providing assistance in Alibaba account creation. Their experts guide businesses through the registration process, ensuring that all necessary information is accurately filled in.

Is Alibaba Account Free?

A common question that businesses often have is whether creating an Alibaba account comes with a cost. Nwspl addresses this query, shedding light on the fact that Alibaba offers both free and premium account options. The article clarifies the features and benefits associated with each account type, helping businesses make informed decisions.

Addressing Alibaba Account Blockages

Encountering issues like account blockages can be a concern for businesses. Nwspl’s expertise extends to troubleshooting such challenges, offering solutions to address and prevent Alibaba account blockages. This proactive approach ensures uninterrupted business operations on the platform.

In conclusion, Nwspl emerges as a trusted partner for businesses seeking comprehensive Alibaba Account Management Services in Dwarka, Delhi. Their proficiency in account creation, product posting, and addressing account-related challenges positions them as a go-to agency for maximizing the potential of Alibaba for businesses of all scales.

Log In:

Access the Alibaba Cloud official website.

Log in to your Alibaba Cloud account using your credentials.

2. Navigate to Console:

Once logged in, navigate to the Alibaba Cloud Console.

3. Account Settings:

In the Console, find and click on your account name or profile picture.

Select “Account Management” or a similar option.

4. Security Settings:

Look for “Security Settings” or a similar menu option.

5. Close Account:

Within the Security Settings, find the option related to closing or deleting your account.

Click on “Close Account” or a similar button.

6. Verification:

Alibaba Cloud may prompt you to verify your identity for security purposes.

Follow the verification steps, which may include providing additional information or confirming through email or mobile verification.

7. Review and Confirm:

Review the terms and conditions related to closing your account.

Confirm your decision to delete the account.

8. Feedback (Optional):

Some platforms may ask for feedback on why you are closing your account. Providing feedback is optional.

9. Final Confirmation:

After completing the steps, the system will provide a final confirmation that your Alibaba Cloud account closure request has been received.

10. Follow-Up:

Check your email for any follow-up instructions or confirmations regarding the closure.

It’s essential to follow the steps carefully and thoroughly to ensure the account closure process is completed successfully. If you encounter any difficulties or have specific questions, consider reaching out to Alibaba Cloud customer support for assistance.

Remember that after the account is closed, you won’t be able to recover any data or services associated with that account. Ensure you have backed up any essential information before initiating the account closure process.

#Alibaba Customer Services in Dwarka#Alibaba Account Manager#Alibaba Product Posting#Alibaba Cloud Account#Alibaba Account Create#Is Alibaba Account Free?#Alibaba Account blocked#Alibaba Cloud Account Management#Alibaba Cloud Account management Console#Delete Alibaba Cloud Account#Delete Alibaba Account on App#How do I check my Alibaba account?#How can I recover my Alibaba account?#Alibaba Account Management Services in Dwarka Delhi#How can I register an account on Alibaba.com?

0 notes

Text

LLP Company Registration in Bangalore by Kros Chek bangalore

Kros Chek Bangalore LLP company registration in bangalore is a legal reality where all the mates have limited and disjoint liability. It can hold contracts and enter into the property in its ownname.LLP Registration In Bangalore is easier with post enrollment obediences less in comparison to a body commercial and unlike cooperation where liability is unlimited LLPs limit the liability of mates to the extent of their capital donation.

More information:

365 Shared Space, 2nd Floor,#153, Sector 5,

1st Block Koramangala, HSR Layout,

Bengaluru, Karnataka 560102

+91-9880706841

#llp company registration services in bangalore#llp registration in bangalore#pvt ltd company registration in bangalore cost

0 notes

Text

How much tax does a Pvt Ltd pay?

The tax liability of a Private Limited Company, often referred to as Pvt Ltd, is a complex matter that depends on several factors, including the company's profits, revenue, location, and various tax laws and regulations.

We will explore the key aspects of taxation for a Pvt Ltd company in a general sense as of my last knowledge update in September 2021. Please note that tax laws and rates can change over time, so it's essential to consult with a qualified tax professional or refer to the most recent tax regulations for the most accurate and up-to-date information.

Understanding Private Limited Companies:

A Company with Private limited company registration in Hyderabad is a separate legal entity distinct from its owners or shareholders. It is a common form of business structure that offers limited liability to its owners, which means that shareholders are not personally liable for the company's debts and losses beyond their investment in the company. This structure provides a level of protection to the shareholders' personal assets.

Types of Taxes Applicable to Pvt Ltd Companies:

Pvt Ltd companies are subject to various taxes, both at the national and state levels, depending on their activities, income, and location. The primary types of taxes that a Pvt Ltd company may be liable for include:

Income Tax:

Pvt Ltd companies are subject to income tax on their profits. The income tax rate can vary depending on the company's annual income and whether it qualifies for any tax incentives or deductions. As of my last knowledge update, the corporate income tax rate in many countries ranged from 15% to 35%, but these rates can change based on the country's tax laws and policies.

Goods and Services Tax (GST) or Value Added Tax (VAT):

Depending on the country and its tax system, Pvt Ltd companies with Private limited company registration in Hyderabad may also be liable for GST or VAT on the sale of goods and services. GST/VAT is usually collected from customers and then remitted to the government after deducting any input tax credits.

Dividend Distribution Tax (DDT):

In some countries, there is a tax on dividends distributed to shareholders. However, this tax may not be applicable in all jurisdictions.

Capital Gains Tax:

Pvt Ltd companies may be subject to capital gains tax if they sell assets, such as real estate or investments, at a profit. The rate and applicability of capital gains tax can vary widely.

Payroll Taxes:

If the company has employees, it may be required to withhold and remit payroll taxes, including income tax and social security contributions, on behalf of its employees.

Tax Calculation for Pvt Ltd Companies:

The calculation of taxes for Pvt Ltd companies typically involves the following steps:

Determine Gross Income:

Calculate the company's total revenue or income from all sources. This includes sales, services rendered, interest income, rental income, and any other sources of income.

Calculate Expenses:

Deduct all allowable business expenses from the gross income. These expenses may include employee salaries, rent, utilities, depreciation, interest on loans, and other legitimate business costs.

Calculate Profit:

Subtract the total expenses from the gross income to determine the company's profit before tax.

Determine Taxable Income:

Apply any deductions, tax credits, or incentives available in the country's tax laws to arrive at the company's taxable income.

Calculate Tax Liability:

Apply the applicable corporate income tax rate to the taxable income to determine the company's income tax liability. Additionally, calculate any other applicable taxes, such as GST or VAT, if they apply to the company's operations.

File Tax Returns:

Prepare and file tax returns with the relevant tax authorities, providing accurate financial information and documentation to support the calculations.

Tax Compliance and Reporting:

Pvt Ltd companies with Private limited company registration in Hyderabad are required to adhere to tax compliance and reporting regulations, which include:

Maintaining Financial Records:

Companies must maintain accurate financial records and accounting books to track income, expenses, and other financial transactions.

Filing Tax Returns:

Companies are required to file periodic tax returns with the appropriate tax authorities. These returns typically provide details of income, expenses, and taxes owed.

Payment of Taxes:

Companies must pay taxes on time, including estimated tax payments if required by the tax authorities.

Audits and Assessments:

Tax authorities may conduct audits or assessments to ensure that the company's financial records and tax calculations are accurate and in compliance with tax laws.

Penalties for Non-compliance:

Non-compliance with tax laws can result in penalties, fines, and legal consequences for the company and its officers.

Tax Planning for Pvt Ltd Companies:

To minimize tax liability and optimize financial management, Pvt Ltd companies that have Private limited company registration in Hyderabad often engage in tax planning strategies. These strategies may include:

Income Deferral:

Timing income recognition to reduce the current year's taxable income by deferring revenue or accelerating deductions.

Expense Optimization:

Maximizing legitimate business expenses to reduce taxable income.

Tax Credits and Incentives:

Taking advantage of available tax credits, deductions, and incentives provided by the government.

Dividend Planning:

Carefully planning the distribution of dividends to shareholders to minimize overall tax liability.

International Tax Planning:

If the company operates internationally, it may use strategies to minimize taxes on cross-border transactions, such as transfer pricing and tax treaties.

Legal Structures:

Choosing the right legal structure for the company, such as a holding company or subsidiary, to optimize tax efficiency.

Conclusion

In conclusion, the tax liability of a Pvt Ltd company is a multifaceted aspect of its financial operations. It involves calculating various types of taxes, complying with tax laws, and engaging in tax planning to minimize tax liability while remaining in legal compliance.

The specific tax obligations and rates can vary significantly depending on the company's location and activities. Therefore, it is crucial for Pvt Ltd companies with Private limited company registration in Hyderabad have to work closely with tax professionals or consultants who are well-versed in the latest tax regulations and can provide tailored guidance to ensure tax compliance and efficient tax management.

#private limited company registration in hyderabad

0 notes

Text

Private Limited Company Registration in Hyderabad: A Comprehensive Guide

Private Limited Company Registration in Hyderabad

Incorporating a private limited company is the preferred choice for company registration, and at Kanakkupillai, we make the process of Pvt Ltd Company Registration in Hyderabad, Telangana, hassle-free. Are you worried that registering a company might be a complex task? Don't worry; it's pretty straightforward. At a competitive cost, we provide top-notch Private Limited company registration services backed by our team of skilled professionals and chartered accountants. Thousands of business owners have registered with us and are now satisfied clients. It's your turn to join them!

Step-by-Step Procedures for Private Limited Company Registration in Hyderabad

Please choose a Unique Name: Select a unique name for your company and check its availability with the Ministry of Corporate Affairs (MCA).

Director Identification Number (DIN): Obtain DIN for all the proposed directors of the company.

Digital Signature Certificate (DSC): Get a Digital Signature Certificate for directors and shareholders.

MOA and AOA: Draft your company's Memorandum of Association (MOA) and Articles of Association (AOA).

Company Name Approval: Apply for company name approval with the Registrar of Companies (ROC).

Filing Documents: Prepare and file the incorporation documents with ROC, including the MOA, AOA, and other required forms.

Payment of Fees: Pay the prescribed registration fees to ROC.

Certificate of Incorporation: Once ROC verifies and approves your application, you'll receive the Certificate of Incorporation.

PAN & TAN: Apply for your company's Permanent Account Number & a Tax Deduction and Collection Account Number.

Bank Account: We have to Establish a bank account in your company's name.

GST Registration: Register for Goods and Services Tax (GST) if applicable.

Benefits for Private Limited Company Registration in Hyderabad

Limited Liability: Shareholders' assets are protected.

Separate Legal Entity: The company is distinct from its owners.

Borrowing Capacity: Easier access to funds compared to other business structures.

Business Continuity: The company exists independently of changes in ownership.

Brand Protection: Exclusive rights to your company's name and logo.

Investor Confidence: Attracts potential investors.

Tax Benefits: Eligible for various tax benefits and incentives.

Documents Required for Private Limited Company Registration in Hyderabad

Identity & address proof of directors and shareholders.

PAN card and Aadhar card.

Address proof for the registered office.

Passport-sized photographs.

Specimen signature of directors.

Certificate of incorporation (in case of another company being a shareholder).

Questions and Answers for Private Limited Company Registration in Hyderabad

1. How long does registering a Private Limited Company in Hyderabad take?

The registration process typically takes 15-20 days, subject to government processing times.

2. Is it possible for a foreign national to hold a directorship in a Private Limited Company?

Indeed, it is permissible for a foreign national to serve as a director in an Indian Private Limited Company.

3. Is it mandatory to have a physical office in Hyderabad?

Yes, it would help if you had a registered office in Hyderabad for communication and legal purposes.

4. Minimum capital requirement for a Private Limited Company?

There is no minimum capital requirement.

5. How long is the Private Limited Company registration valid?

Once registered, it is valid indefinitely unless dissolved or wound up.

Registering a Private Limited Company in Hyderabad provides more advantages, making it an ideal choice for entrepreneurs looking to establish a strong business presence.

Related Articles:

Guide to Indian Private Limited Company for Foreigners

Shares Transfer Procedure for Private Limited Company

Annual Compliance for Private Limited Company in India

Advantages of a Private Limited Company

Conversion of LLP into Private Limited Company

#HyderabadBusiness #PrivateLimitedCompany #LegalCompliance #StartupSuccess #BusinessGrowth #LegalRecognition #Entrepreneurship #LegalShield #CorporateSuccess #BusinessRegistration #BrandProtection #InvestorConfidence #CoimbatoreEntrepreneurs #SmallBusinessSuccess #CompanyRegistration #PrivateLimited #BusinessIncorporation #LegalEntity #LimitedLiability #StartupJourney #SmallBusiness #CorporateStructure #BusinessFormation #InvestorConfidence #BusinessOwnership #LegalFormality #FinancialSecurity #BusinessSuccess #NewVenture #CompanyFormation #EntrepreneurLife

#HyderabadBusiness#PrivateLimitedCompany#LegalCompliance#StartupSuccess#BusinessGrowth#LegalRecognition#Entrepreneurship#LegalShield#CorporateSuccess#BusinessRegistration#BrandProtection#InvestorConfidence#CoimbatoreEntrepreneurs#SmallBusinessSuccess#CompanyRegistration#PrivateLimited#BusinessIncorporation#LegalEntity#LimitedLiability#StartupJourney#SmallBusiness#CorporateStructure#BusinessFormation#BusinessOwnership#LegalFormality#FinancialSecurity#BusinessSuccess#NewVenture#CompanyFormation#EntrepreneurLife

0 notes

Text

Event Management Services - Membrane Decors Pvt. Ltd.

Introduction

When it comes to hosting successful events that leave a lasting impression, the role of event management services cannot be overstated. Membrane Decors, a renowned event management company, has become synonymous with excellence in curating remarkable experiences across Delhi. In this article, we delve into Membrane Decors' exceptional event management services and explore how they transform ordinary gatherings into extraordinary and unforgettable occasions.

Comprehensive Event Management Services

Membrane Decors takes pride in offering comprehensive event management services that cover the entire event lifecycle. From conceptualization and planning to execution and post-event analysis, their skilled team ensures that each event is flawlessly executed, providing clients with a stress-free and enjoyable experience.

Personalized Approach to Event Planning

As a leading event management company, Membrane Decors understands that no two events are alike. They adopt a personalized approach to event planning, taking the time to understand the unique needs, objectives, and preferences of each client. By doing so, they curate tailor-made event solutions that align with the client's vision and deliver remarkable results.

Corporate Events: Conferences and Seminars

Membrane Decors excels in organizing corporate events such as conferences and seminars. They meticulously plan these gatherings, ensuring that they serve as impactful platforms for knowledge sharing, networking, and business growth. From selecting the ideal venue and arranging state-of-the-art audiovisual equipment to managing guest registrations and coordinating with speakers, Membrane Decors ensures that every detail is finely tuned for success.

Social Gatherings: Weddings and Celebrations

For social gatherings like weddings and celebratory events, Membrane Decors brings a touch of elegance and creativity to every occasion. Their event management services encompass theme conceptualization, venue decoration, entertainment coordination, and seamless execution. They strive to create cherished memories for both the hosts and their guests, turning these events into treasured experiences.

Cutting-Edge Technology Integration

Membrane Decors embraces cutting-edge technology to enhance event experiences. From innovative event registration platforms and real-time feedback systems to interactive displays and digital marketing campaigns, they utilize the latest tools to ensure smooth operations and heightened engagement during the event.

Vendor Management Expertise

A crucial aspect of event management services is vendor coordination. Membrane Decors boasts strong vendor partnerships, enabling them to collaborate with reliable and professional suppliers. Their expertise in vendor management ensures timely deliveries, cost efficiency, and seamless execution of each event element.

Event Marketing and Branding

Membrane Decors understands the significance of event marketing and branding in creating a lasting impact. Their team devises effective marketing strategies to promote events, maximize attendance, and enhance brand visibility. By incorporating consistent branding elements throughout the event, they reinforce the client's identity and messaging.

On-Site Coordination and Support

On the day of the event, Membrane Decors' skilled team is present on-site to manage and coordinate all aspects, ensuring a smooth and hassle-free event experience. Their proactive approach allows them to address any unforeseen challenges promptly, ensuring the event runs flawlessly.

Post-Event Analysis and Improvement

Membrane Decors' commitment to excellence doesn't end with the conclusion of an event. They conduct comprehensive post-event analysis to assess the event's success against the set objectives. Feedback from clients and attendees is also sought, providing valuable insights for continuous improvement and better event management services in the future.

Conclusion

Membrane Decors' event management services have set a benchmark for excellence in the industry. With their personalized approach, cutting-edge technology integration, and a meticulous eye for detail, they consistently deliver exceptional event experiences that surpass expectations. Whether it's a corporate conference, a social gathering, or any other occasion, Membrane Decors' event management services create an atmosphere of elegance, creativity, and flawless execution. Their dedication to providing stress-free event planning and unparalleled experiences solidifies their position as a leader in the event management domain in Delhi and beyond.

0 notes

Text

One Person Company (OPC) Registration - Online Process, Documents Required, Cost

One Person Company (OPC) is a type of private limited company which can be formed with just one person who will act as director and shareholder of the company. The need for one person company arised due to the limitations of sole proprietorship firm which is the most popular form of business registration for small businesses in India.

One Person Company or "OPC" is a kind of private limited company which is registered under the Companies Act, 2013. It can be registered with a single person who acts both as the director as well as shareholder of the company. OPC company use "opc private limited" or "opc pvt ltd" at the end of their company name because it is a private company owned by single person.

Benefits of One-Person Company registration

Limited Liability

Credibility

Continuous Existence

Separate Legal Entity

NRIs can register OPC

Process of One-Person Company Registration

Step 1. Application for Digital Signature Certificate (DSC)

Step 2. Application for the name approval

Step 3. Filing of SPICe Form (INC-32)

Step 4. Filing of e-MoA (INC-33) and e-AoA (INC-34)

Step 5. Issuance of PAN, TAN & Certificate of Incorporation

Minimum requirements for OPC registration

Unique business name

No minimum capital requirement

A nominee must be appointed during the incorporation

Address proof of the office

Documents required for One Person Company registration

To know more (click here)

#opc#one person company registration#one person private limited company#global#business#manage business

0 notes