#net 30 60 90 terms

Text

Invoice Payment Terms Definitions, Strategies & Processes

Once you’ve obtained the hang of it and really feel more snug accepting deferred payments, you possibly can open it as a lot as more prospects. Net 30 is a payment agreement during which a buyer pays for their order inside 30 days of receiving the product. It’s most often utilized in business-to-business (B2B) commerce, the place consumers pay for stock once they’ve bought it. These are all legitimate issues, however there are steps you'll be able to take to insulate your small business from unhealthy debt if you’re providing a net 30 payment. Here's how to protect your business and permit prospects versatile payment choices.

If you're a startup business, you may end up strapped by extending credit to your patrons. While giving them the good thing about time, you can be setting yourself up for failure if you don’t have the cash reserves to compensate for delays in payments. Your month-to-month payments might be reported to Equifax Business and PayNet, helping you build business credit. In the longer term, your payments will also be reported to Experian and SBFE. There’s a $99 annual fee to apply for and maintain your net-30 account open, which will be refunded if your utility isn’t approved.

Maybe you would quite they began in a few weeks from the time of the transaction to accommodate your client’s payroll wants. This provides you plenty of versatility in how you service your customers. Regardless of what you and your consumer agree to, you have to be certain to present it in clear writing and get their signature, in addition to your own.

An invoice due date calculator automates this course of, saving useful time and reducing the chance of errors. With just some clicks, invoices can be generated swiftly and precisely, allowing businesses to concentrate on core operations rather than administrative tasks. An invoice due date calculator offers many benefits, benefiting the invoicing process and businesses in multiple ways. That is probably not an issue for a giant business with a lot of clients or good profit margins who can afford to reduce profits slightly. However, for a freelancer who’s barely breaking even and is probably selling merchandise on-line, giving discounts is far from perfect. Credit terms can create serious cash flow points for your company.

This is often only one to 2 percent however may be substantial relying on the circumstances. After that, follow up with the references the client has supplied, as properly as with the credit utility. If they don't wish to fill out an utility form, you'll be able to, and may, verify a business report as an alternative. The first is the "net 30" that we have been discussing, which is a method to define payment terms. Businesses can select completely different net terms based mostly on components such because the creditworthiness of the client, the sort of product, and the relationship between the client and the vendor. Employer Identification Number – The subsequent thing is you’re going to need and EIN also recognized as an employer identification quantity.

You should order an $80 downloadable product and choose “Bill My Net 30” at checkout. New and youthful businesses should think about the corporate due to the convenience of approval. However, if you’re a new business with zero tradelines to report, you should call them directly to discuss your options. Uline provides varied delivery supplies, cleansing and janitorial supplies, and some warehouse equipment.

invoice payment due

Crown Office Supplies is one other office supply vendor that provides net 30 terms to qualified customers, together with new businesses. Building an excellent credit score for business loans could make it easier for you to secure financing sooner or later when your corporation needs it. One straightforward way to start building credit is by using net 30 accounts. Common payment terms for invoices embody net 30, net 60, and net 90. These terms offer totally different payment home windows and are straight ahead in construction, making them easy for each buyers and sellers to agree upon. If you’re a small business that’s often struggling to maintain optimistic cash flow, you must go together with net 30 (or even shorter payment terms, similar to net 15).

The size of the term is designated by a number representing how many days are allowed before payment becomes due. In partnership with three professional business homeowners, the PayPal Bootcamp includes sensible checklists and a brief video loaded with ideas to assist take your corporation to the following level. Think of an invoice as a confirmation that a service has been performed or a product was shipped. To apply, you’ll need to supply fundamental business data as nicely as personal data, together with your Social Security Number. With Creative Analytics, you can get net 30 terms for digital advertising services, corresponding to content material strategy or site seo (SEO). You can discover office décor, corresponding to desk equipment and furniture accents at JJ Gold International.

The reason being is underwriters, suppliers and vendors have their own underwriting team who will verify to make sure your organization is in good standing. Good standing – Make positive your organization is in good standing with the state you included in. To check your standing, go to your state’s website and do a search on your corporation to verify your annual report filings are current and up to date.

#net 30 payment terms#payment terms net 30#payment terms net 30 example#what is net 30 payment terms#what is a net 30 payment term#on july 1 a company receives an invoice#how does net 30 work#what does net 30 mean in a contract#net-30#n 30 payment terms#payment term net 30#payment terms are net 30#net 30 days terms#payment terms net 30 days#what is net 30 payment#net 30 billing terms#payment terms net 0#net30 pay#invoice net terms#payment terms net 60#net 30 60 90 terms#net30 invoice#3/10 net 30#net 30 on a payment invoice means#what does net 30 payment terms mean#what is net 30 terms#3 15 net 30#net 3 payment terms#what does pay net 30 mean#3/10 net 30 meaning

0 notes

Text

The Top 10 Net 30 Distributors To Build Your Small Business Credit Rating

Knowing what objects belong on an invoice and laying it out on knowledgeable invoice template will ensure your corporation maintains an expert status to your clients. Credit offers are meant for residents of, and this isn't an offer for a line of credit to companies outdoors of, the United States and its Territories. Your due date is no much less than 30 days after the close of every billing cycle. We will not charge you any interest on purchases when you pay your complete balance by the due date each month.

This signifies that if the invoice is paid inside the first 10 days after it’s issued, a 1% discount is applied. To verify your business credit rating you will need to contact the business credit bureau for the rating you wish to examine. For example, Dun & Bradstreet's PAYDEX rating is from 1-100, the place one is the worst score and a hundred is the best. Wise Business Plans provides business house owners with business planning sources and instruments. They additionally provide digital advertising services and have affiliations with credit-building and business funding partners.

To be eligible you’ll need to have a business registered within the US, have been working for no less than 90 days, have an employer identification number, and haven't any delinquencies in your document. When signing up for membership at Business T-Shirt Club you’ll get access to top brand clothes names at wholesale prices. The $69.ninety nine annual membership allows you to join Net-30 terms on all invoicing too.

The Net 30 account software process doesn’t require a personal guarantee or private credit examine. Ramp's corporate cards include accounts payable options to automate your invoices so each bill is paid on time. With Ramp's flexible financing, you'll find a way to pay vendors immediately whereas selecting 30, 60, or 90-day terms to pay again your card for a small fee. It’s important to regularly examine your small business credit score for mistakes or signs of fraudulent activity. You can order your corporation credit stories immediately from the three credit report bureaus for a payment. Applicants will must have an EIN, and the licensed officer of the group should submit the application.

Kimball Midwest offers upkeep and restore merchandise for industries. The particulars of their reporting to a business credit bureau are unknown. Regular purchase history and creditworthiness may be standards for their no-fee net 30 account.

3 10 net 30 meaning

This then allows consumers to ingest the 810s and pay their sellers on a fixed schedule, which regularly ends up being 30 days. If you're able to pay the full amount up front, you'll save yourself some cash, as you will not have to pay any curiosity on the outstanding stability. However, when you do need to finance your purchase, 1/ten net 30 is a good possibility. By selecting to have your transactions billed to your account, a industrial credit relationship shall be established between BellaNiecele and your business. On an invoice, net 60 means payment is due inside 60 days of the invoice date. You should be an Authorized Officer and Controlling Party of the business entity to submit this application.

Sometimes net 30 payments embody an incentive to pay before the due date. That incentive is identified as two numbers separated by a forward slash before net 30. The first quantity is the share discount and the second the new due date to receive that low cost.

#net 30 payment terms#payment terms net 30#payment terms net 30 example#what is net 30 payment terms#what is a net 30 payment term#on july 1 a company receives an invoice#how does net 30 work#what does net 30 mean in a contract#net-30#n 30 payment terms#payment term net 30#payment terms are net 30#net 30 days terms#payment terms net 30 days#what is net 30 payment#net 30 billing terms#payment terms net 0#net30 pay#invoice net terms#payment terms net 60#net 30 60 90 terms#net30 invoice#3/10 net 30#net 30 on a payment invoice means#what does net 30 payment terms mean#what is net 30 terms#3 15 net 30#net 3 payment terms#what does pay net 30 mean#3/10 net 30 meaning

1 note

·

View note

Text

Net 30: What It Means, How Companies Use It

Particularly helpful for companies in construction and actual estate, these accounts facilitate uninterrupted work by deferring payments for important supplies. Best of all, Home Depot net 30 reports to Dun & Bradstreet, Experian, and Equifax Business. As some of the widespread payment terms, Net 30 is necessary to understand in the freight and delivery trade. Customers agreeing to those terms promise to pay an excellent invoice within 30 days together with transport instances.

This easy concept connects to other areas of business operations, together with customer communication and accounting. Your company will receive quick payment for the invoices from the financial institution, and the bank will observe up on collection along with your prospects. This method may allow you to remain competitive whereas nonetheless ensuring a secure cash move.

The whole quantity due is received in a matter of days, however bank card fraud is a standard fear. Invoice payment terms within the UK tell purchasers when they are anticipated to pay an invoice and the methods they need to use to submit the payments. There are many various terms of payment that businesses use on their invoices.

billing net 30

When sellers have bills to pay, delayed payments can pose vital challenges. For occasion, the 2/10 Net 30 can be tweaked to 1/10 Net 30, indicating a 1% low cost inside the first ten days of purchase or full payment inside 30 days. The 2/10 Net 30 commerce credit also can appear as 2/10 Net 40 or 2/10 net 60.

New businesses set up net 30 accounts with their distributors in order to build their business credit past the apparent advantage (more time to pay their invoices). These “small vendor strains of credit” might help new companies construct their credit score and access extra capital. Net 30 terms are sometimes accompanied by a discount for early payment to encourage shoppers to pay extra shortly. Small business house owners typically offer net 30 terms with a 2 % discount if the shopper pays in full within 10 days. This shows that you just perceive their state of affairs and want to construct a win-win relationship with them. Net terms can be a door to new clients that might be loyal to buying from you for an extended time frame.

Join our community of finance, operations, and procurement experts and keep updated on the newest buying & payments content material. To see Order.co in motion and enhance cash optimization and accounting for your business, schedule a demo. Yooz offers the smartest, strongest,and easiest-to-use cloud-based E-invoicing and Purchase-to-Pay (P2P) automation resolution. It delivers unmatched financial savings, speed, and security with reasonably priced zero risk subscriptions to more than 5,000 clients and 300,000 customers worldwide. Net 30 at all times begins on the date of the invoice, which means payment is due 30 days from the invoice date. Net 30 signifies that the full payment is due inside 30 days of the invoice issue date.

Thus, if the invoice were acquired in October, they would want to pay the steadiness by the end of November. You can apply the terms to invoices by selecting a term on individual invoices or by setting default terms on customer and vendor records. In the top, it is a set of terms and circumstances that search to guard both the provider and their clients. For example, if an invoice is dated twenty seventh of November, the payment can be this date, plus forty five days, which involves 11th of January, but the end of the month, which is 31st of January.

Otherwise, the whole quantity is due inside 45 days of the invoice date. A buyer-initiated early payment program is managed through accounts payable with either the dynamic discounting technique or provide chain finance methodology. Even although many small business house owners don’t notice it, accepting payment at any level after a service is carried out or items are delivered is extending credit. Net 30 payment terms are among the commonest invoice payment terms, but whether or not they’re best for you depends on your corporation, goals, and different elements. On this web page, you’ll study what net 30 terms are, get an outline of similar terms, and discover alternate options.

It may mean your company is taking too long to gather payments on its receivables. Furthermore, a small company’s cash move is likely to be depending on a smaller range of customers. What a low or high DSO quantity suggests would possibly simply be misleading due to this. If you’re seeking to hear more about how invoice funding might help your small business, contact Triumph today. We work with thousands of business owners every day, offering them the working capital to grow their business operations. While strong invoicing practices can help cut back the hole between finishing work or delivering goods and getting paid, it can be difficult and time-consuming.

As a supplier of goods and companies, now you can perceive why managing simply the credit checking process would cost your inner accounting, sales, and AR group plenty of time. They should ask the client to complete an (often long) credit application, call commerce references, and even make a credit limit decision (when they could not have the expertise to do so). Some companies could count the date that an invoice is postmarked (day of mail delivery) or sent (email) and even when the goods and providers are delivered. These particulars are usually made out there to the shopper beforehand. Typically, everybody agrees on the invoice terms when the gross sales agreements are made. The payment terms Net 30 talks in regards to the discounts and payment terms meant to incentivize patrons to pay on time.

#net 30 payment terms#payment terms net 30#payment terms net 30 example#what is net 30 payment terms#what is a net 30 payment term#on july 1 a company receives an invoice#how does net 30 work#what does net 30 mean in a contract#net-30#n 30 payment terms#payment term net 30#payment terms are net 30#net 30 days terms#payment terms net 30 days#what is net 30 payment#net 30 billing terms#payment terms net 0#net30 pay#invoice net terms#payment terms net 60#net 30 60 90 terms#net30 invoice#3/10 net 30#net 30 on a payment invoice means#what does net 30 payment terms mean#what is net 30 terms#3 15 net 30#net 3 payment terms#what does pay net 30 mean#3/10 net 30 meaning

0 notes

Text

Net 30 Terms: A Information To Distributors With Favorable Payment Situations

On the other hand, offering credit terms to your customers might help grow your business and your buyer base. If you screen your prospects rigorously and are selective with who you offer credit terms to, likelihood is that offering net 30 payment terms could be a clever determination for your small business. Some companies require payment in advance, whereas others expect payment at the time of service or sale. Net 30 is amongst the most frequently used credit terms when extending credit to prospects.

Net 30 accounts provide companies with a priceless software for managing cash move and bettering creditworthiness. Yes, companies with limited credit historical past may qualify for net 30 accounts, as some suppliers have extra lenient approval processes. For example, a company that sells products throughout holiday seasons can use net 30 accounts to finance stock purchases leading up to the busy interval.

This method can build belief between both events and probably allow the client to safe more favorable payment terms. For businesses preferring a shorter payment period, contemplating options like Net 10 or Net 15 may help to hurry up cash move. Under these terms, the buyer is given 10 or 15 days, respectively, to pay the invoice in full. In summary, Net-30 accounts present strategic advantages that transcend mere monetary transactions. They serve as instruments for higher cash circulate management, avenues for building a robust credit profile, and catalysts for fostering robust vendor relationships.

Another alternative is to offer your prospects a unique financing choice. To avoid having to take care of shoppers who haven’t paid you, your invoice should outline payment terms that reinforce your expectations of payment. These could embody incentives for early payment, or penalties for late payments. There are an a wide selection of benefits to providing prolonged payment terms, similar to net 30. These advantages may be especially clear for companies that observe a business-to-business mannequin the place common payment terms are extended.

what does 1 10 n 30 mean

Taking out net 30 credit terms and efficiently repaying them is an efficient way to construct up to a credit score. A score that may qualify your small business for severe, game-changing loans down the highway. All the payment terms discussed right here have professionals and cons, and no system works for each business. When deciding which payment coverage to use with your clients, consider your business cash circulate wants and general objectives for reaching customers.

New purchasers who would actually like a credit line or who want to build business credit with a credit utility can have their history checked with credit bureaus like Equifax business. Usually, pay instantly, and net 10 or net 15 is obtainable to new or late-paying clients. Lastly, providing net 30 payment terms might entice clients who are extra doubtless to take advantage of extended payment periods, leading to a better threat of late payments or non-payment.

#net 30 payment terms#payment terms net 30#payment terms net 30 example#what is net 30 payment terms#what is a net 30 payment term#on july 1 a company receives an invoice#how does net 30 work#what does net 30 mean in a contract#net-30#n 30 payment terms#payment term net 30#payment terms are net 30#net 30 days terms#payment terms net 30 days#what is net 30 payment#net 30 billing terms#payment terms net 0#net30 pay#invoice net terms#payment terms net 60#net 30 60 90 terms#net30 invoice#3/10 net 30#net 30 on a payment invoice means#what does net 30 payment terms mean#what is net 30 terms#3 15 net 30#net 3 payment terms#what does pay net 30 mean#3/10 net 30 meaning

0 notes

Text

Whats The Best Way To Offer Net 30 Terms? Professionals, Cons, & Templates

However, for the reason that foreign money used by the buyer and vendor is the same, the invoice foreign money is assumed to be that foreign money. If your organization does business inside other countries, QuickBooks Online offers multi-currency assist to mechanically adjust for and replicate varied currencies and change rates. By using our payment terms and circumstances templates and embracing technological solutions, you are higher outfitted to create and manage your billing terms and situations successfully. Immediate payment terms are a bit unusual but could be needed in sure business contexts. Let's explore after they're acceptable, a template for these terms, and suggestions for guaranteeing compliance.

Customers will receive a two % low cost if the invoice is paid within 10 days, otherwise the complete amount is due in 30 days. For example, an invoice for $1,000 might be settled for $980 if it’s paid within 10 days. Also, keep in thoughts that 30 days is not at all times equivalent to at least one month. For example, if an invoice is dated 5 March, purchasers are responsible for submitting payment on or before the 4 April.

Be ready to offer something in return, corresponding to a bigger order volume or exclusive partnership. Furthermore, net 30 terms permit small business house owners to raised forecast their cash move since they know precisely when payments are due. This helps in budgeting successfully and avoiding any surprises or sudden cash shortages. Remember, understanding and utilizing net-terms like Net-30 effectively might help enhance your cash circulate and build stronger relationships along with your suppliers!

For example, giving a 2% discount to shoppers who settle their accounts within 10 days is type of common. While getting paid the same day you invoice could also be the principle good thing about factoring, it is far from the one benefit. First, as quickly as you get an order, you will submit it to your factoring for credit approval.

net 30 payment terms

Even when a consumer has good credit, working with someone new will all the time have a stage of uncertainty to it and testing the waters is advisable. First, you can do the project in phases and be certain that you receives a commission in every section before proceeding to the following. Another condition you need to consider is electronic payments, as this makes it easy to keep observe of all payments as a substitute of money. During the cross-border transactions or deals, point out the duty of duties, international taxes, and some other regulations that may make the payment process trouble-free. The costs involved with doing this are about 4% or even more, and if the shopper pays round $10,000 late, you will be shedding $400. Having retained earnings provides your corporation a path to monetary stability, progress and peace.

Even if you were able to have enough workers in-house to handle all these steps, the process nonetheless comes with danger. Floating net terms credit to your clients ties up your cash circulate. This is why many companies choose to implement and use a digital net terms solution instead. Even with an invoice management system, you'll have the ability to run head-first into cash crunch if you don’t send invoices. Make it a habit to create and ship invoices as soon as work is finished or products delivered.

#net 30 payment terms#payment terms net 30#payment terms net 30 example#what is net 30 payment terms#what is a net 30 payment term#on july 1 a company receives an invoice#how does net 30 work#what does net 30 mean in a contract#net-30#n 30 payment terms#payment term net 30#payment terms are net 30#net 30 days terms#payment terms net 30 days#what is net 30 payment#net 30 billing terms#payment terms net 0#net30 pay#invoice net terms#payment terms net 60#net 30 60 90 terms#net30 invoice#3/10 net 30#net 30 on a payment invoice means#what does net 30 payment terms mean#what is net 30 terms#3 15 net 30#net 3 payment terms#what does pay net 30 mean#3/10 net 30 meaning

1 note

·

View note

Text

Net 30: What It Means, How Businesses Use It

Now that payments are nearly instantaneous, you'll be able to offer this leeway to buyers as a gesture of fine religion. As stated within the name, Business T-shirt Club has a membership mannequin, with an annual membership of USD$69.ninety nine. They report to Equifax, Credit Safe, Ansonia, and Cortera, so net 30 purchases are still constructing business credit history whereas also building model fairness in the marketplace. FAQs on any website are additionally a great source of further information. Notification of approval or requests for extra data are often made inside two business days.

Putting the fee into your preliminary contract is one of the only ways to make sure your clients are conscious of your coverage before they start working with you. As together with your net days term, you'll be able to choose no matter low cost and low cost interval you’re comfy with. The first half describes the discount and the term within which it could be claimed, and the second half denotes the complete term deadline for punctual payment. Creative Analytics is a digital marketing agency and management consulting company. Creative Analytics offers companies net 30 account terms as its Business Credit & Net 30 Program.

payment terms 30 days net

The answer is nearly everyone can get approved underneath the condition that the real estate property has equity in it. It makes no difference when you use it to reside in it as a main residence, or as a business workplace, or if it represents just an investment to promote further. As lengthy as it can be leveraged, it makes a sound object for a line of credit contract. Their underwriters generally take hours to approve tradeline credit of $800 to $1,500. Once accredited, you'll a name, a text, a letter, and an e mail from Crown Office Office Supplies with directions on how to entry your tradeline and start doing business with them.

The greatest risk to a supplier when offering trade credit is the potential for bad debt. Since cash does not immediately switch arms in a purchase order, the buyer might end up not paying for the purchases. When companies offer trade credit, an allowance for doubtful accounts is about as much as anticipate the quantity of bad debts from credit purchases.

S&S Worldwide might think about businesses' buy frequency and payment habits for their no-fee net 30 account. To profit from their no-fee net 30 account, companies might need to have a good credit report and consistent ordering habits. HD Supply makes a speciality of maintenance, restore, and operations (MRO) merchandise for various industries. A track document of standard purchases and good credit is required to proceed being qualified for their no-fee net 30 account. They report to Equifax Small Business, Creditsafe, Ansonia, NACM, and SBFE.

But you don’t have to make use of the identical payment terms with all of your purchasers. Consider giving net 15 or less to new clients or serial late payers, and extend net 30 or above to reliable purchasers who frequently pay on time. How you vary between payment periods can additionally be due to how cash-strapped your small business is. Net-30 accounts with consistent purchases and payments are one of the accessible ways to establish and develop business credit. Your company wants supplies or companies anyway, and purchasing them on credit helps handle your cash move. However, there are other methods to assist enhance your corporation credit rating.

US companies operational for a minimal of 90 days, with an EIN and a constructive credit standing, are eligible to apply. Fidextech will also conduct a business credit examine and confirm the authorized officer’s id. A few service suppliers generally entice new members to hitch by providing free insurance coverage in opposition to loss or theft, but it’s usually just added to their common pricing. The best parcel forwarding services have no membership fees and low shipping, however charge round $3 per $100 declared values. Usually, every company may even have a singular record of restricted objects or fragile small items like fragrance for which they provide no insurance coverage coverage. It’s completely free, however you do need a minimal of $75,000 in your financial institution to get accredited for s Ramp company card that will permit you to access their next-generation finance and accounting tools.

When a business doesn’t receive payments on-time, progress targets may be hindered or entirely impossible as a outcome of cash circulate problems, particularly for small businesses or startups. For example, say a small grocer forms a model new partnership with a vendor on Net 30 payment terms. The store receives its first shipment of products from the seller on April 7 and is invoiced for the merchandise on April 14. Invoices include the date of sale, goods or services purchased, payment terms and situations, and so forth. The payment terms refer to the situations under which a purchaser has to pay-off the complete value of the invoice. If the shopper has not paid within 10 days, then the whole amount is due 30 days after the invoice’s due date.

The company additionally makes opening and maintaining net-30 accounts a painless experience. You get an account portal the place you presumably can manage invoices, payments, and notices. The list incorporates vendors for a variety of business provides and providers throughout various industries. However, getting a business line of credit might not be possible until you’ve established a business historical past.

So, if the initial amount of the invoice was $1000, you’ll must pay $1010 simply because you’re late with the payment. So, if you’ve received an invoice on 1 June, you’ll need to pay within the subsequent 30 days, or to be exact – by 1 July. This implies that you’ll have 30 days at your disposal to pay the invoice. For every single customer, we guarantee they will simply open their net 30 vendor account and develop their credit restrict. The debit to the cash account causes the supplier’s cash on hand to increase, whereas the credit to the accounts receivable account reduces the quantity still owed.

#net 30 payment terms#payment terms net 30#payment terms net 30 example#what is net 30 payment terms#what is a net 30 payment term#on july 1 a company receives an invoice#how does net 30 work#what does net 30 mean in a contract#net-30#n 30 payment terms#payment term net 30#payment terms are net 30#net 30 days terms#payment terms net 30 days#what is net 30 payment#net 30 billing terms#payment terms net 0#net30 pay#invoice net terms#payment terms net 60#net 30 60 90 terms#net30 invoice#3/10 net 30#net 30 on a payment invoice means#what does net 30 payment terms mean#what is net 30 terms#3 15 net 30#net 3 payment terms#what does pay net 30 mean#3/10 net 30 meaning

1 note

·

View note

Text

How To Build Your Business Credit Fast

A 2/10 net-30 account means you'll get a 2% low cost when you pay the invoice in the first 10 days. You should preserve a steadiness on the finish of the month to get reported to the credit bureau. Ohana Office Products sells a variety of workplace provides and electronics. You can see a limited selection of objects from their web site but should create an account to see the entire catalog. Larger businesses can use Net-30 accounts not only for operational effectivity but also as a strategic tool for funding bigger tasks that align with their long-term targets. For mid-sized businesses, Net-30 accounts can be a game-changer in terms of inventory administration and meeting consumer demand effectively.

who offers net 30 accounts

When you offer somebody net 30 terms, you’re providing them the possibility to pay you as a lot as 30 calendar days after you bill them for a great or service. Bring these advantages to your small business by offering payment terms to your prospects. The invoice factoring company then sends the invoice to the shopper. The customer pays the third-party company the invoice whole in accordance with their payment terms.

Net 30 isn’t the only payment period you'll be able to embody on an invoice. The quantity indicates how many days the customer has to make their payment. As a purchaser, having net 30 terms permits you to make the most of a product or service for a time period before payment is required.

If you’re an Invoice Simple user, Invoice Simple Payments enables you to hyperlink your professional invoices to PayPal’s Pay in 4 service. This means you can offer net 30 terms with out extending too much credit. Fortunately, a number of financing options are available to small business owners that enable them to offer their clients extra choices whereas nonetheless sustaining their cash move.

Access to lending merchandise, corresponding to term loans, SBA loans, traces of credit, and so forth., creates extra opportunities to help development. There might be different discount incentives, such as a 5/7 account, which implies you’ll receive a 5% discount for paying in the first 7 days. These alternatives to reduce prices often also mean you probably can construct your credit faster since early invoice payments are weighted more heavily than on-time payments.

The first step is to register an LLC, C corporation, or S corp that does not have a high-risk SIC code. Next, you’ll have to apply for an EIN from the IRS and fill out your small business credit profile at Dun & Bradstreet, by registering for a DUNS number. While Nav won’t confirm this, many shoppers point out this being their tradeline reporting date. With all Nav Business plans, however, you will receive a credit alert as quickly as your tradeline is posted. Yes, however only if you probably can meet the card’s minimal purchase necessities to earn rewards, and will pay your card steadiness in full every month. The rates of interest on business fuel cards and fleet fuel playing cards are typically within the 25-30% range.

Enjoy the convenience of streamlined ordering, fast delivery, and distinctive buyer help. Simplify your buying process and expertise the benefits of Uline’s Net30 Account. Visit Uline.com right now to apply and take your business operations to the following stage. Rewards credit cards let you earn cash back rewards and/or journey rewards for eligible purchases.

This implies that the business has 30 days from the date of purchase to pay the invoice in full. Determining whether or not to turn into a net 30 vendor or take on a net 30 account requires considering a number of factors, together with business credit, risk and liability, and cash circulate. For startups trying to construct business credit, a net 30 account may be the solution to buying resources regardless of your company’s credit historical past. As the wholesale arm of The Home Depot, SupplyWorks has every thing you’ll need in relation to workplace repairs, workplace décor, and more. Plants, chairs, and even lighting options, all with net 30 terms. Computer and electronics are expensive, however with NeweggBusiness net 30 terms, companies can get the job done with premium equipment and dependable hardware from NeweggBusiness.

#net 30 payment terms#payment terms net 30#payment terms net 30 example#what is net 30 payment terms#what is a net 30 payment term#on july 1 a company receives an invoice#how does net 30 work#what does net 30 mean in a contract#net-30#n 30 payment terms#payment term net 30#payment terms are net 30#net 30 days terms#payment terms net 30 days#what is net 30 payment#net 30 billing terms#payment terms net 0#net30 pay#invoice net terms#payment terms net 60#net 30 60 90 terms#net30 invoice#3/10 net 30#net 30 on a payment invoice means#what does net 30 payment terms mean#what is net 30 terms#3 15 net 30#net 3 payment terms#what does pay net 30 mean#3/10 net 30 meaning

1 note

·

View note

Text

What Does 2 10 Net 30 Mean: Early Payment Low Cost Information

The most popular ones are Equifax, Experian, and Dun & Bradstreet. By setting this timeframe, there is not any confusion concerning the payment deadline. Even if you’ve communicated your net payment terms as transparently and accurately as potential, there will at all times be some questions coming in out of your clients. To entice users to pay you earlier, you’ll need to offer them a small discount in the event that they pay inside the first 10 days. If a buyer has purchased a product from you and has paid the invoice within the first 30 days, you’ve made the first step in course of securing a loyal customer. Here’s a list of advantages you’ll experience using net 30 payment terms.

With Net 30, there's also an incentive for purchasers to pay on time and avoid late charges. New companies set up net 30 accounts with their vendors so as to build their business credit beyond the plain benefit (more time to pay their invoices). These “small vendor strains of credit” can help new companies construct their credit score and entry further capital.

As an example, if an invoice is dated April 1 and the terms state net 30, the payment is due by April 30. A vendor delivers a services or products first, after which requests payment from the client at a later date. Both Gocardless and Viva are priceless tools for contemporary companies looking for to optimize their financial operations.

net30 payment terms

This is why many companies choose to implement and use a digital net terms answer instead. With dynamic discounting, the patrons provoke an early payment offer on an invoice-by-invoice basis, where the discount varies. The purchaser might offer a 2% low cost to 1 seller and a 1.5 % low cost to another.

If you fall into this bracket, invoice factoring could additionally be your perfect resolution. With factoring, you can offer your prospects nearly any net terms you would like, and then promote your unpaid invoices to a factoring company at a discount. The factoring company supplies you with instant payment and then waits for the customer to pay them. Net 30 is a kind of payment agreement where the customer agrees to pay the invoice within 30 days of receipt. This sort of agreement is frequent in business-to-business transactions.

Having to chase clients who don’t pay on time isn't fun, and you must try to avoid changing into one of those clients that can’t be relied upon to settle invoices on time. If you need to arrange a net 30 account, the very first thing you’ll need to do is establish a vendor who offers those terms. Once you’ve chosen a vendor to work with who offers net 30 accounts, you’ll have to apply to do business with them on those payment terms.

#net 30 payment terms#payment terms net 30#payment terms net 30 example#what is net 30 payment terms#what is a net 30 payment term#on july 1 a company receives an invoice#how does net 30 work#what does net 30 mean in a contract#net-30#n 30 payment terms#payment term net 30#payment terms are net 30#net 30 days terms#payment terms net 30 days#what is net 30 payment#net 30 billing terms#payment terms net 0#net30 pay#invoice net terms#payment terms net 60#net 30 60 90 terms#net30 invoice#3/10 net 30#net 30 on a payment invoice means#what does net 30 payment terms mean#what is net 30 terms#3 15 net 30#net 3 payment terms#what does pay net 30 mean#3/10 net 30 meaning

1 note

·

View note

Text

Best Factoring Companies Of 2024

These expenses, coupled with licensing requirements, can vary from a couple of hundred to a quantity of thousand dollars. In addition, if you apply on your MC authority, you’ll additionally must get a freight broker bond. This $75,000 bond guarantees that your broker company will apply all necessary guidelines and regulations whenever you start moving hundreds.

Most shippers operate on extended fee terms, including net-60 or net-90, which hardly ever involve advance or upfront funds. This is precisely where trucking factoring bridges the monetary divide, providing a substantial advance of round 75-85% of your invoice’s value. Borrowing money using a bank card gives you the chance to maintain 100% of what your customers pay you.

Every service charges a fee, however how much or how typically they cost you'll decide the way you select a supplier. You will also have the ability to trust that the broker is aware of tips on how to safely transport that type of freight. Review the broker’s licensing and working authority for greater perception. Explore the top trucking business trends of 2023 and gain insights into how they might impact your business. Every day, we assist individuals uncover products and services that may assist their enterprise bloom. As a result, no debt is created in your finish and the company protects you from dangerous debt on all of the invoices that they factor.

The following companies are thought-about the best factoring companies for freight brokers and carriers. Choosing a freight invoice factoring service could be difficult, which is why we simplify the method right here at Cota Systems. Scroll down for an entire comparability of the highest trucking factoring suppliers. No matter what, you need to be positive that the invoice factoring company you select does every thing that they can to try to attain payment from your client.

Freight factoring is a smart resolution to handle your money move, and cover expenses like gas, insurance, upkeep and payroll with out creating debt for your small business. In addition to offering instant fee on freight payments, Love’s supplies unbeatable customer support whereas serving to develop your small business. Unlike most factoring companies, Quickpay Funding works with new freight brokers. We prioritize new brokers and ensure they receives a commission fast, develop their enterprise, and succeed within the business. Freight factoring companies offer customers fuel advances as an add-on service.

Reduce deadhead miles and improve income with near real-time lane knowledge. And even worse, some shippers never pay, forcing costly lawsuits or write-offs. Being the co-founder of freightcourse has given him the flexibility to pursue his want to teach others on manufacturing and supply chain topics. We may obtain commissions that may differ depending on the lender, product, or different permissible elements. The nature of any commission model will be confirmed to you before you proceed. The important price of fuel may be budgeted and unfold over the cost of the yr, decreasing its debilitating effect on your company.

While some other companies do that too, TCI Capital stands out for doing this monthly versus other companies that may only change your charges once a year. Breakout Capital is perfect for startups because the approval course of is useless easy. There’s no minimal FICO score required, no minimal monthly revenue requirement, and no minimum time in business. There’s also no utility payment, which means you save even more money when using their service.

factoring company for brokers

Factoring companies advance money to truckers inside a day or two of the trucking company submitting its buyer invoices. This immediate influx of capital is the lifeblood that keeps many truckers going sturdy. When a trucking company delivers a load, it often has to wait 30 days or extra to get paid by the customer. But drivers, fuel, maintenance, and different operating costs must be paid now. With recourse factoring, you must repay the invoice if it is not paid.

#freight broker factoring#factoring freight brokers#freight brokerage factoring#invoice factoring for freight brokers#brokerage factoring#broker factoring#freight factoring company brokers#factoring companies for brokers#factoring companies for new freight brokers#factoring company for brokers#freight factoring companies brokers#factoring company for new freight brokers#factoring freight broker#broker factoring companies#freight broker factoring company#freight factoring companies for brokers#top freight broker factoring companies#factoring company for freight brokers#freight factoring for brokers#factoring companies for freight brokers#factoring for brokers#best freight broker factoring companies#factoring for freight brokers

1 note

·

View note

Text

How To Automate Wholesale Invoicing and Payment Reminders On Shopify Store?

It might take a lot of work to manage a wholesale store on Shopify. Many things need to be monitored, including the addition of new products, handling of orders, answering questions from customers, etc. With few resources, it can be challenging to keep things up to date and remember everything. One thing, though, that you definitely should not overlook is sending out invoices to your wholesale clients and following up with them to ensure that they pay them on schedule. Money is everything! Because you simply cannot afford any losses resulting from unpaid invoices, and because this directly adds to your revenue goals.

What is an invoice for wholesale goods?

An invoice for goods or services sold that a company sends to another company is known as a wholesale invoice. A retail invoice, which is sent to a specific customer, is not the same as this.

Typically, wholesale invoices contain the following details:

The sale's date

Information about the products that were purchased

The cost per unit of the items that were bought

number of goods sold

Total amount owed

Terms of net payment (e.g., "Net 30/60/90")

Details about the seller

Information about the buyer

A Net Payment Term: What Is It?

The amount of days that a buyer has to pay their invoice in full is known as the net payment terms.

For instance, if your company offers a net 30 payment term on purchases totaling $1000 or more, the buyer will have 30 days starting on the sale date to pay the invoice amount of $1000.

It is vital to incorporate the net payment terms on the invoice in case you provide credit terms to your wholesale clients. By doing this, you can make sure that your clients are aware of when they must pay.

0 notes

Text

What Does Net 30 Payment Terms Mean? Invoicely

The free Net 30 invoice template from Agiled helps professionals such as you create and send detailed invoices shortly and ideally.Download now and make your invoicing process tremendous quicker. If you want to be paid instantly, your invoice should embrace all the right info. Just obtain the free net 30 payment terms template from Agiled, add your corporation details, and send it to your buyer for payment. You can send your completed invoice through Agiled email or by way of regular mail.

Companies that consistently make early or on-time payments usually have the leverage to negotiate favorable terms with their suppliers. These could mean extended credit limits, reductions on future purchases, or precedence remedy in supply chains. Although accounting software calculates early payment reductions for invoices, sellers may must do some extra bookkeeping to record customer discounts when really taken. But paying invoices early requires credit terms that outline how and when an invoice will be paid early.

In HLC’s over 35 years in business, it’s discovered that lengthy payment terms promote poor cash administration and, consequently, could also be detrimental to many shoppers. Invoices are an important tool that business house owners can use to keep information of sales. By crafting clear, informative invoices and following an invoicing process, you can appropriately characterize your self to the IRS in the event of an audit. And you'll find a way to increase the chance of getting paid on time, every time.

You can typically make a buy order and won’t be charged curiosity if you pay it off (in full) by your next payment due date. If a business needs to incentivize early payments, it could offer customers an early payment low cost. In some circumstances the reductions and penalties will be tiered, so you can save extra the sooner you pay, but will owe extra as your payment will get more and more overdue. Net 30 terms might help you to realize more clients that otherwise wouldn’t have the flexibility to purchase from you. For example, if a company desires to buy your products however has restricted cash move, the web 30 terms may allow them to get the product, make gross sales, and then pay you out of their income.

And, unlike with an employer/employee relationship, it’s on you to make sure every client knows when and the way a lot to pay for a given period of time or work completed. The biggest advantage of utilizing invoice templates is the time saved. Entering the info into an existing template is way faster than writing new invoices individually. Writing invoices also requires consideration of legal necessities.

The invoice tells the client how much they owe the vendor and units up payment terms for the transaction. This low cost is intended to encourage clients to pay extra shortly. So, whenever you see an invoice that states ‘3/10 net 30’, it signifies that prospects can receive a 3% low cost in the event that they pay inside 10 days. Of course, this also applies to other discounts, so a 2% low cost on payments made within 10 days would read as ‘2/10 net 30’.

Whenever you enter into an agreement for work, your written agreement ought to cowl what happens if payment is late. The legal limits for annual interest rates varies from state to state, so analysis what’s allowed the place you're employed before you set late fees. Their month-to-month payment plan is for purchases between $199 and $10,000 and costs interest of 9.99% to 29.99% APR. Buy Now Pay Later (BNPL) has become some of the popular methods for customers to pay for purchases because the COVID-19 pandemic. Consumers see it as method to use credit without running up bank card balances or affecting their credit score. Your company may additionally get hit with extra bills if your customer pays late or their examine doesn’t clear and there are returned verify fees.

Use of PandaDocs services are ruled by our Terms of Use and Privacy Policy. Plus, you can add eSignature fields, payment buttons, and more to avoid wasting time and improve effectivity for each events. Net invoices are especially helpful for tax-exempt companies and firms trying to keep in-depth spending information. The benefit of including the gross value on invoices is simplicity. On the opposite hand, some companies choose the simplicity of gross invoices for record-keeping.

what does term net 30 mean

But whether you opt for net 10, net 30, or net 90 payments, it’s at all times essential to have a quality buyer relationship administration (CRM) tool. Are you making an attempt to open vendor accounts to construct your business credit profile? If so, it’s crucial to find a net-30 that reports to the business credit bureaus. Wise isn't a financial institution, however a Money Services Business (MSB) provider and a sensible different to banks.

There are loads of advantages to patrons and sellers for using net 30 terms. How you resolve this misunderstanding will decide whether you retain that consumer. That’s why it’s important to exactly define when the clock starts ticking in your net 30 term. In most circumstances right now, it starts at receipt of the invoice, regardless of the invoice date.

#net 30 payment terms#payment terms net 30#payment terms net 30 example#what is net 30 payment terms#what is a net 30 payment term#on july 1 a company receives an invoice#how does net 30 work#what does net 30 mean in a contract#net-30#n 30 payment terms#payment term net 30#payment terms are net 30#net 30 days terms#payment terms net 30 days#what is net 30 payment#net 30 billing terms#payment terms net 0#net30 pay#invoice net terms#payment terms net 60#net 30 60 90 terms#net30 invoice#3/10 net 30#net 30 on a payment invoice means#what does net 30 payment terms mean#what is net 30 terms#3 15 net 30#net 3 payment terms#what does pay net 30 mean#3/10 net 30 meaning

1 note

·

View note

Text

Mastering Cash Flow: Innovative Strategies for Small Businesses

Cash flow management is the lifeblood of small businesses, dictating their ability to operate, invest, and grow. Effective cash flow strategies distinguish businesses that thrive from those merely surviving. Mastering cash flow management enables businesses to navigate the ebbs and flows of their financial cycles with confidence, ensuring they have the necessary funds to cover their obligations and seize growth opportunities.

Small businesses often face a unique set of cash flow challenges that can impede their financial stability and growth. Seasonal fluctuations can lead to periods of significant financial strain, while late payments from customers can disrupt cash flow projections and create a gap in available funds. Additionally, unexpected expenses, such as emergency repairs or sudden market shifts, require immediate financial resources, further complicating cash flow management.

This article is designed to empower small business owners with innovative strategies and practical tips to enhance their cash flow management. By exploring effective techniques for forecasting, receivables management, and leveraging financial tools, we aim to illustrate how small businesses can improve their financial health and position themselves for sustained growth.

Essential Cash Flow Strategies

Accurate Cash Flow Forecasting

The cornerstone of effective cash flow management is the ability to project future cash flows with a high degree of accuracy. Accurate forecasting helps businesses anticipate their financial needs, plan for upcoming expenses, and make informed decisions about investments. It involves analyzing past financial data, understanding market trends, and considering potential variables that could impact the business's finances. By developing a reliable cash flow forecast, businesses can create a financial roadmap that guides them through each fiscal period, ensuring they maintain a positive cash flow position.

Efficient Receivables Management

Managing receivables efficiently is crucial for maintaining healthy cash flow. Strategies such as invoice automation can significantly reduce the time spent on billing processes, ensuring invoices are sent promptly and accurately. Offering early payment discounts can incentivize customers to pay sooner, thereby accelerating cash inflows. Additionally, implementing clear payment terms and following up diligently on overdue accounts can help small businesses minimize late payments and maintain a consistent stream of revenue. By focusing on receivables management, businesses can enhance their liquidity and reduce the risk of cash flow disruptions.

Mastering cash flow is not just about overcoming financial challenges; it's about setting a foundation for growth and stability. By adopting accurate cash flow forecasting and efficient receivables management strategies, small businesses can improve their financial health and navigate the complexities of the business world with greater ease.

Implementing Effective Cash Flow Practices

Optimizing Payment Terms

Optimizing payment terms with both suppliers and customers is crucial for maintaining a healthy cash balance, a key component of effective cash flow management. For small businesses, negotiating favorable payment terms can make a significant difference in how cash moves through the company. With suppliers, aim to negotiate longer payment periods that allow you to keep cash in your business longer, enhancing your liquidity. This might involve discussions to extend payment terms to 45, 60, or even 90 days, if possible.

Conversely, when dealing with customers, shorter payment terms are preferable. Encourage prompt payments by setting terms such as net 30 or offering incentives for early payment, like discounts. Implement clear communication from the start about your payment expectations and adhere to a consistent invoicing schedule to avoid delays. Managing these terms effectively requires a delicate balance, ensuring you're not stretching your resources thin while maintaining positive relationships with partners and clients.

Leveraging Technology for Cash Management

In the digital age, leveraging technology is a game-changer for cash management. Financial software and online tools can automate and streamline cash flow management, offering real-time insights into your business's financial health. Start by selecting a comprehensive accounting software that integrates with your banking and offers features like automated invoicing, expense tracking, and financial reporting. These platforms can significantly reduce the manual labor involved in financial management and provide accurate, up-to-date information on your cash flow status.

Additionally, online payment platforms can expedite the receivables process, allowing customers to make payments quickly and securely online. This not only improves the customer experience but also speeds up the cash inflow, improving your cash balance. Look for tools that offer mobile access, enabling you to manage your cash flow on the go and make informed decisions anytime, anywhere.

Elevating Small Business Through Cash Flow Mastery

Navigating Financial Health with Precision

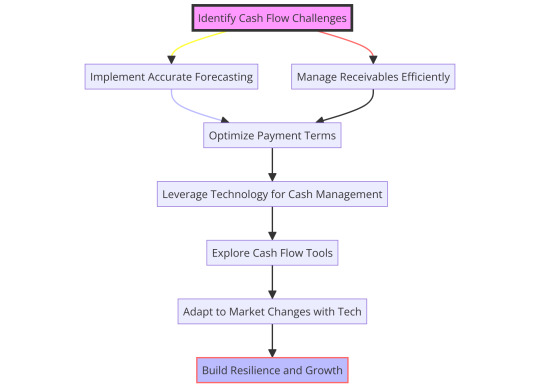

For small businesses, mastering cash flow is akin to navigating through turbulent waters with a reliable compass. As illustrated in the diagram, the journey begins with identifying cash flow challenges unique to each business. Accurate forecasting and efficient receivables management form the core pillars that support sound financial planning, enabling businesses to anticipate future needs and maintain liquidity.

Strategic Adjustments and Technological Leverage

Optimizing payment terms represents a strategic pivot towards enhancing cash flow dynamics between a business and its stakeholders. This step, as highlighted in the flowchart, bridges the gap between incoming and outgoing funds, ensuring a steadier cash balance. The subsequent adoption of technology for cash management marks a critical advancement, introducing automation and real-time insights into financial operations.

Harnessing Tools for Agile Adaptation

Exploring cash flow tools and embracing market-driven technological innovations allow businesses to remain agile and responsive. This adaptability is essential for navigating market changes and seizing growth opportunities, as depicted in the later stages of the diagram. The culmination of these strategies leads to the building of financial resilience and the potential for sustained business growth.

A Blueprint for Financial Stability and Expansion

The flowchart serves not only as a guide to cash flow management but also as a blueprint for achieving financial stability and driving business expansion. By following the outlined steps, small businesses can transcend the challenges posed by financial fluctuations, positioning themselves for prosperity in an ever-evolving economic landscape. Embracing these innovative strategies and tools empowers business owners to steer their enterprises towards a future marked by resilience, adaptability, and growth.

Top 10 Cash Flow Tools for Small Businesses

QuickBooks: A comprehensive accounting solution that offers extensive cash flow management features, including invoicing, expense tracking, and financial reporting.

Xero: Known for its user-friendly interface and powerful cash flow forecasting tools, Xero helps businesses manage their finances efficiently.

FreshBooks: Ideal for small businesses looking for straightforward invoicing and billing solutions that can positively impact cash flow.

Wave: A cost-effective choice offering free basic accounting features, including invoicing and expense tracking, perfect for startups and small enterprises.

Zoho Books: Part of the Zoho suite, this tool provides excellent integration capabilities, making it a great choice for businesses looking for a comprehensive financial management solution.

Sage 50cloud: Combines the reliability of desktop software with the flexibility of cloud access, offering robust cash flow management capabilities.

Kashoo: Simple yet powerful, Kashoo is designed for small businesses needing basic accounting features with a strong emphasis on cash flow management.

Square: Beyond processing payments, Square offers valuable insights into sales trends and cash flow, making it a handy tool for retail businesses.

PayPal: A widely used platform for receiving payments quickly and securely, helping businesses improve their cash inflow.

Plaid: This tool facilitates connections between banking data and your financial apps, allowing for seamless cash flow analysis and management.

By optimizing payment terms and leveraging the right technology, small businesses can implement effective cash flow practices that ensure financial stability and foster growth. The tools listed provide a range of options for managing cash flow, from comprehensive accounting software to specific payment platforms, each contributing to better financial control. Embracing these strategies and tools can transform your business's approach to cash flow management, positioning you for success in the competitive small business landscape.

The Future of Cash Flow Management

Innovations in Financial Technology

The landscape of cash flow management is undergoing a significant transformation, thanks to the advent of emerging financial technologies such as Artificial Intelligence (AI) and blockchain. AI is revolutionizing the way small businesses forecast cash flow, analyze financial data, and make predictive decisions about their financial health. By automating routine accounting tasks, AI enables business owners to focus on strategic financial planning and insights. Blockchain technology, on the other hand, is enhancing the security and transparency of financial transactions, making it easier for businesses to track and manage their cash flow in real-time. These technologies not only streamline financial operations but also provide small businesses with powerful tools previously accessible only to larger corporations, thereby leveling the playing field.

Adapting to Market Changes

In today's fast-paced business environment, the ability to adapt to market changes is crucial for maintaining a healthy cash flow. Small businesses must remain agile in their financial planning, ready to adjust their strategies in response to economic shifts, consumer trends, and unforeseen challenges. This agility is facilitated by embracing financial technologies that provide real-time data and analytics, allowing business owners to make informed decisions quickly. By staying adaptable and leveraging the latest in financial tech, small businesses can better capitalize on growth opportunities and navigate the uncertainties of the market with confidence.

FAQs: Enhancing Cash Flow Management

How can I create a more accurate cash flow forecast?

Creating a more accurate cash flow forecast involves leveraging historical financial data, understanding your business cycles, and incorporating real-time financial insights. Utilize financial software that offers forecasting tools, allowing you to simulate different scenarios and their potential impacts on your cash flow. Regularly updating your forecast with actual financial results will also improve its accuracy over time.

What are some immediate steps I can take to improve my cash flow?

Immediate steps to improve cash flow include invoicing promptly, following up on overdue payments, and reviewing your expenses for potential savings. Consider offering discounts for early payments to encourage quicker cash inflows. Additionally, renegotiating payment terms with suppliers and creditors can help to better align cash outflows with your revenue streams.

How do online payment solutions impact cash flow?

Online payment solutions can significantly improve cash flow by facilitating faster and more convenient transactions. They allow customers to pay invoices promptly, reducing the time between billing and receipt of funds. These solutions also simplify the reconciliation process, providing real-time visibility into your financial position.

Can renegotiating with suppliers really make a difference to my cash flow?

Yes, renegotiating with suppliers can have a profound impact on your cash flow. Extending payment terms with suppliers can delay cash outflows, preserving cash within the business for other operational needs or growth opportunities. It's important to approach renegotiation with a focus on building long-term relationships, ensuring mutually beneficial terms that support your business's cash flow requirements.

In conclusion, mastering cash flow management is essential for the success and sustainability of small businesses. This article has explored a range of innovative strategies and practical tips, from leveraging emerging financial technologies to optimizing payment terms and embracing online payment solutions. These approaches not only help in navigating the complexities of cash flow management but also in harnessing growth opportunities in a competitive marketplace. As we look to the future, the integration of AI, blockchain, and other financial technologies will continue to transform how small businesses manage their cash flow, offering unprecedented accuracy, efficiency, and strategic insight. Business owners are encouraged to embrace these advancements, not merely to withstand financial challenges but to propel their businesses forward, ensuring financial stability and fostering expansion in today's dynamic market environment.

0 notes

Text

Net 30 Terms: Good Or Unhealthy On Your Business?

Before the products are shipped (or typically ordered), the shopper has to offer payment in full. A popular import/export transaction methodology, the client solely submits payment for goods when the products are delivered. The customer could deny payment, which means that the products are returned at the seller’s expense. The consumer has the benefit of being supplied a lower price for the same product or service. Beyond that, particularly for freelancers, net 30 might even mean the period begins after your client has invoiced their consumer.

For example, discount terms may appear as 2/10 Net 30, which implies that the final amount is reduced by 2% if the consumer pays the invoice in full within the first 10 days of the invoice date. It’s essential to use clear wording in your consumer invoices so that they know precisely what to expect when making payment. Net 30 billing often comes with incentivizing reductions, so it’s necessary to spell out exactly what yours are on the invoice itself, and embody them in the masking email. If you charge penalties for a late payment, it’s also necessary to accurately define what those penalties are. For example, should you have been to ship out an invoice on January 2, 2020, you'll count on payment on or before February 1, 2020. The 30 days between preliminary invoicing and when payment is received may be looked at like a credit extension you’re offering to your buyer.

It’s nearly a given all over the world that companies anticipate that they've 30 days to make payment. It allows the client to buy goods or services without quick payment to the seller. In fact, trade credit is the largest use of capital for many B2B sellers within the United States. When a business offers “net 30 terms”, it is providing payment terms and allowing its customers 30 days from the invoice date to pay the quantity due. Businesses that offer net 60 terms or net 90 terms give prospects 60- and 90-days, respectively. If a client agrees with these terms, the vendor offers any terms they want and then sells unpaid invoices to a factoring company at a discount.

Suppliers that stretch net terms to their prospects sometimes give them between 30 to a hundred and twenty days to make full payment. However, the web terms can range depending on the vendor and business. Net 30 would possibly allow you to gain extra shoppers if you have plenty of cash readily available, have many purchasers, and may survive a quantity of late payments from them.

Essentially, a vendor who units payment terms of net 30 is extending 30 days of credit to the buyer after items or services have been delivered. Net 30 means that the customer has 30 calendar days after they’ve been billed to remit payment. Managing late payments can involve implementing late charges as outlined in your payment terms, utilizing invoice reminder software, and adopting a consistent follow-up process. Communication is vital - always talk about late payment issues along with your purchasers to grasp the explanation and discover a mutually useful solution. Advance billing can enhance your cash move and reduce the chance of shedding money. Getting paid in advance could be a main profit for businesses—many companies sweeten the deal by offering discounts to clients who pay in full upfront.

payment net 30

The Ascent is a Motley Fool service that charges and reviews important products for your everyday money matters. We're agency believers within the Golden Rule, which is why editorial opinions are ours alone and haven't been previously reviewed, accredited, or endorsed by included advertisers. Editorial content material from The Ascent is separate from The Motley Fool editorial content and is created by a special analyst team. Mary Girsch-Bock is the professional on accounting software and payroll software program for The Ascent. Offering credit terms to your customers may help establish each belief and loyalty, and possibly even reward you with a customer for all times.

If you experience a lot of write-offs, this can be an indication that your credit checking and credit decisioning packages must be reviewed and redesigned. A excessive loss rate signifies that you're permitting certain clients to pay on terms, even when they don't seem to be creditworthy. While there are numerous advantages to offering net terms, there are also a quantity of challenges to concentrate on.

As a result, quite than writing net 30 on your invoice, you may be higher off writing something along the lines of "payment is to be delivered within 30 days." Net terms dictate how long a buyer has to remit payment upon receipt of an invoice. For instance, net 30 means the shopper has 30 days to settle their account, net 60 allows for 60 days, and so forth. Net terms are a way to offer prospects favorable billing terms and can help you handle your cash flow—when arrange properly. PayPal has a payment processing and foreign foreign money conversion fees.

Offer various payment methods such as bank cards, debit playing cards, on-line payments, ACH or even cryptocurrency payments. A higher variation is offering a reduction if payment is rendered before Net 30. For example, if prospects pay within 10 days as a substitute of 30 days, they receive a 2 % low cost.

Typically, businesses use payment due upon receipt to indicate that payment is due by the following business day. This is a deposit or payment made by a customer before work begins on a project. For example, a customer might make a 50% deposit to start out work on the project with the balance due upon the completion of the project.

#net 30 payment terms#payment terms net 30#payment terms net 30 example#what is net 30 payment terms#what is a net 30 payment term#on july 1 a company receives an invoice#how does net 30 work#what does net 30 mean in a contract#net-30#n 30 payment terms#payment term net 30#payment terms are net 30#net 30 days terms#payment terms net 30 days#what is net 30 payment#net 30 billing terms#payment terms net 0#net30 pay#invoice net terms#payment terms net 60#net 30 60 90 terms#net30 invoice#3/10 net 30#net 30 on a payment invoice means#what does net 30 payment terms mean#what is net 30 terms#3 15 net 30#net 3 payment terms#what does pay net 30 mean#3/10 net 30 meaning

1 note

·

View note

Text

Net 45 Terms: Definition, How They Work & Business Implications

Vendors that report again to Creditsafe are additionally value focusing on, as they often share transaction reports with different smaller business credit reporting companies like Moody’s, Ansonia, and the SBFE. 7) Fostering healthy relationship with customersA good rapport and proactive communication goes a great distance in resolving payment related points with purchasers. Have a transparent and candid discussion with the client whenever you discover a trend of recurring late payments. 5) Early payment remindersAn efficient collections strategy, you'll be able to consider auto arrange of payment reminders couple of days prior to the precise due date. Often clients don't pay late deliberately but are late as they have an inclination to overlook contemplating the reality that they have too many invoices readily available. Automatic reminders can act as a friendly nudge for these prospects and facilitate timely payment as they strategy the invoice due date.

It’s essential to agree on when and the way you’ll be paid before any work starts. As a freelance writer, this used to occur to me the entire time. And normally if I pestered the corporate, I’d hear some lame excuse like “Our bookkeeper is on vacation proper now! ” Or, extra typically, I’d just hear crickets till they randomly determine that they are able to pay me. This is why many companies wish to automate and de-risk their net terms program. True to the revised plan, your client submits the payment on the agreed-upon date.

When making use of for provider credit, select distributors that maximize your corporation credit rating gains with blanket reporting protection of at least three main credit bureaus. Apply for net 30 accounts with Dun & Bradstreet reporting first, as you will need 5-8 active tradelines showing in your DNB business credit profile before shifting on to Tier 2 credit. There aren't any interest charges if a customer pays their invoice within 30 days as specified within the Net 30 payment terms. But if the shopper fails to make the payment on time, the seller can cost them a late payment or interest penalty.

While there was a delay, open communication and suppleness helped resolve the situation amicably. Imagine you run a graphic design business, and you’ve simply delivered a set of customized advertising supplies to your client. This blog post will talk about Net 30, its definition, the way it capabilities, and supply insights into why companies opt for this arrangement. And the designation of net 30 is often included in the terms section of an invoice.

While it’s best to keep away from PG’s when potential, they could be required in some cases, especially when your business is younger and hasn’t established robust revenues and/or business credit. The Consumer Financial Protection Bureau estimates that in 2019, smallbusinesses with beneath $1 million in annual income used greater than $50 billion in trade credit. With Bobtail, factoring freedom is in your hands—and our responsive customer service team is all the time ready to assist. Don’t be shy about asking for quicker payments; the worst you may get is a “no.” But many shippers—especially bigger companies—have pre-set payment terms. If you don’t write these incentives into your contract, nonetheless, you can’t implement them. Payment terms are an agreement, and each agreement could additionally be completely different.

They offer net-30 terms to all of their prospects and report purchases of $80 or more to Equifax Business on the end of the month. You also routinely receive a $2,000 tradeline with Coast to Coast once you make your first $80+ buy. Signing up with Coast to Coast is easy; all you need to do is register for a business account by way of their website. They present a net-30 payment choice to governmental companies, instructional institutions, and qualifying businesses. To apply for net-30 payment terms, you’ll need to ascertain a relationship with a CDW account supervisor; you can do this by reaching out to their gross sales help team to open an account.

Or you would possibly incentivize earlier payments by discounting invoices which would possibly be paid early, say inside a week or 15 days. Net terms provide a grace period from the invoice date on your customers to pay and though it has advantages, implementing terms will result in a longer compensation cycle. Strategically preparing for this longer cash move cycle will help preserve strong working capital and reduce DSO. Consider outsourcing the administration of your net terms to a companion like Resolve Pay, which also decreases your risk, streamlines your financial operations, and improves your monetary velocity. Learn how one can offer net terms in your terms with a free trial right now.

#net 30 payment terms#payment terms net 30#payment terms net 30 example#what is net 30 payment terms#what is a net 30 payment term#on july 1 a company receives an invoice#how does net 30 work#what does net 30 mean in a contract#net-30#n 30 payment terms#payment term net 30#payment terms are net 30#net 30 days terms#payment terms net 30 days#what is net 30 payment#net 30 billing terms#payment terms net 0#net30 pay#invoice net terms#payment terms net 60#net 30 60 90 terms#net30 invoice#3/10 net 30#net 30 on a payment invoice means#what does net 30 payment terms mean#what is net 30 terms#3 15 net 30#net 3 payment terms#what does pay net 30 mean#3/10 net 30 meaning

1 note

·

View note

Text

What Are Net 30 Payment Terms? Definition, Examples, Pros, Cons