#loancalculation

Text

The Benefits of Using Loan Calculators in Real Estate

Loan calculators are invaluable tools for anyone involved in the real estate market. Whether you are a prospective homebuyer, a real estate investor, or a homeowner looking to refinance, loan calculators can provide you with essential information to make informed financial decisions. These online tools allow you to assess mortgage payments, interest rates, loan terms, and more. In this blog post, we will explore the benefits of using loan calculators in real estate and how they can help you maximize your financial outcomes.

One of the primary benefits of using loan calculators is the ability to determine affordability. By inputting specific financial data, such as your income, expenses, and desired loan amount, a loan calculator can calculate how much you can afford to borrow. This information is crucial in helping you set a realistic budget and avoid overextending yourself financially.

Additionally, loan calculators provide insights into the impact of interest rates on your monthly payments. By adjusting the interest rate input, you can see how different rates affect your loan payments. This allows you to compare various scenarios and choose the most favorable interest rate for your financial situation.

Loan calculators also help you understand the impact of loan terms on your overall cost. By adjusting the loan term input, you can see how longer or shorter loan terms affect your monthly payments and total interest paid. This knowledge empowers you to choose a loan term that aligns with your financial goals and minimizes the cost of borrowing.

Another benefit of using loan calculators is the ability to compare different loan options. If you are considering multiple lenders or loan products, a loan calculator can help you evaluate each option's affordability and suitability. By inputting the terms and conditions of each loan, you can compare the monthly payments, total interest paid, and other relevant factors. This allows you to make an informed decision and choose the loan that best meets your needs.

Furthermore, loan calculators are useful for refinancing decisions. If you are considering refinancing your mortgage, a loan calculator can help you determine if it's financially beneficial. By inputting your current loan details and comparing them to potential refinancing options, you can assess the savings in terms of lower interest rates or shorter loan terms. This helps you decide if refinancing is a viable option for you.

In conclusion, loan calculators are powerful tools that provide numerous benefits in the real estate industry. They assist with affordability assessments, comparing loan options, understanding the impact of interest rates and loan terms, and making informed refinancing decisions. By utilizing loan calculators, you can optimize your financial outcomes and ensure that you make sound decisions that align with your goals. So, take advantage of these online tools and empower yourself in your real estate journey.

2 notes

·

View notes

Text

Student Loan Calculator

By providing your current student loan details, you can calculate your monthly payments and visualize your loan's amortization over its term.

#StudentLoans#LoanCalculator#StudentDebt#FinancialAid#LoanPayments#Budgeting#CollegeFinances#StudentSuccess#MoneyManagement#DebtFree#EducationFunding#PayOffDebt#LoanInterest#LoanRepayment#BudgetTips#LoanAssistance#StudentResources#FinancialLiteracy#DebtRelief#LoanConsolidation#Scholarships#CollegeCosts#StudentSupport#LoanForgiveness#TuitionAssistance#FinancialPlanning

0 notes

Text

Wisconsin Real Estate TOOLS UPDATE

Wisconsin Real Estate TOOLS UPDATE - https://thelandman.net/wisconsin-real-estate-tools.html

ADDED - USDebtClock.org - Lots of World, US National & State Economical Information including Homes Sales, Loan Calculator and much more…

realestatetools #usdebtclock #homesales #LoanCalculator #EconomicalInformation

1 note

·

View note

Text

Unlock Financial Freedom with Our Loan Calculator

Ready to take control of your finances? Introducing our powerful loan calculator, your key to making informed financial decisions. As the Best Licensed Moneylender in town, we offer a range of tailored loan options to suit your needs. From personal loans for emergencies to business loans for expansion, we've got you covered. Our transparent terms and competitive rates ensure peace of mind every step of the way. Discover the ease of calculating your loan with us today!

0 notes

Text

Attention everyone: Kredit-Markt.eu is now also available in English!

0 notes

Text

📊 Ready to Crunch Some Numbers? Learn How to Calculate Loan EMI with the EMI Calculator! 💰

Are you planning to take out a loan but worried about those monthly installments? 🤔 Fret not! We've got your back. 🙌

🔢 Understanding Loan EMI Made Easy: Let's break it down step by step!

Step 1️⃣: Visit EMI Calculator Tool 📈

👉 Tap the "EMI calculator" to access the magic tool.

Step 2️⃣: Input Loan Details 📝

👉 Enter the loan amount, interest rate, and tenure.

Step 3️⃣: Hit Calculate! 🎯

👉 Watch the EMI calculator work its magic and voilà - you'll have your monthly installment amount right before your eyes!

💡 Pro Tip: Our EMI calculator can handle different types of loans – be it a home loan, personal loan, or car loan. It's your financial sidekick for any EMI calculation!

Understanding your loan EMI is the first step towards financial freedom. So, why wait? Use our EMI calculator today and take control of your finances! 💪

0 notes

Text

ANZ Personal Loan: The Best Way to Fund Your Dreams!

ANZ Personal Loan is here to help you, when you tired of postponing your dreams and putting them on hold because of financial constraints? Whether it’s a long-awaited vacation, home renovation or simply consolidating debts, ANZ Personal Loan has got you covered.

Read the full article

0 notes

Text

Explore the power of financial calculators to estimate mortgage payments, retirement savings, investments, and more. Make well-informed decisions with accurate results using AllCalculator.net's finance calculators.

0 notes

Link

0 notes

Text

Do this if you prepay your Loans

#Do this if you prepay your Loans#.#Loans#loan#loanofficer#loanofficers#LoanOriginator#loanoriginators#loanmodification#loano#loanssavelives#LoanApproval#loancalculator#loanofficerlife#loanapproved#loancompany#loaner#loanstructuring#loanadvisor#loanagent#loanbaba#loanconsultant#loanshark#loanaibarra#loanbit#loanblog#loancalculation#loanercar#loanfreestudentmemes#loanlifestyle

0 notes

Text

📊 Master the Art of Financial Planning with our "Loan Calculator 101 Best Ultimate Guide"! 💡 Whether you're a seasoned pro or new to the game, our guide will help you make informed decisions. Explore the power of loan calculations today.

#KhmerProsperity #LoanCalculator #FinancialPlanning #ExpertInsights #SmartBorrowing #EmpowerYourFinances 💰🔢📈

2 notes

·

View notes

Text

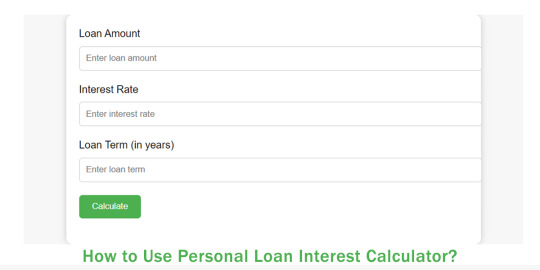

Personal Loan Interest Calculator

Find out How to calculate interest on a loan with our exclusive FREE Personal Loan Interest Calculators! Get accurate results in seconds, start now! #calculator #loancalculator

Read the full article

0 notes

Text

Pine grove financial calculators

#Pine grove financial calculators full#

#Pine grove financial calculators software#

#Pine grove financial calculators plus#

Let’s walk through an example in order to understand how these formulas work. With just three values, we can see what an amount invested today will be worth in the future. This means that you do not re-lend or reinvest the interest. The future value with simple interest is the value of an amount today at some point in time in the future, where the interest paid is not compounded. r = interest rate expressed as a decimal.For example rates can be adjusted to create ARMs change payment amounts or skip payments. This calculator will compute a loans payment amount at various payment intervals - based on the principal amount borrowed the length of the loan and the annual interest rate. But note if payments on a debt are paid as frequently as the compounding and the payment covers the interest due then even if the terms of the loan call for compounding there will be no impact on the total amount paid because at no point will there be any unpaid interest. Included are options for tax compounding period and inflation. We assist Canadian Small Businesses in the process of growing their business by providing the funding they need to flourish. Interest rates need to be lower when you refinance than they were when you got the loan or refinancing is a bad option. Pine Grove Financial gives you the capital you need to run your business smoothly and efficiently. Change the variables on the above calculator to. Rounding Options - due to payment and interest rounding each pay period for example payment or interest might calculate to 3450457 but a schedule will round the value to 34505 almost all loan schedules need a final rounding adjustment to bring the balance to 0. Suitable for savings or loan interest calculations. Enter your loan information to create an amortization schedule showing payments of principal and interest.įirst Payment Due - due date for the first payment. Loan Payment Calculator With Amortization Schedule.

#Pine grove financial calculators plus#

Pine Groves LoanCalculator Plus is a free collection of nine easy-to-use financial calculators for loans and debt focused on personal finance. Stay informed all off the latest happenings and alternative insights.

#Pine grove financial calculators full#

In order to calculate your monthly payments on an interest-only loan whether it is for a period or the full term of the loan you will need your starting loan balance interest rate the length of the interest-only period the total term of the loan and the amortization schedule after the interest-only period ends if the loan isnt full-term IO. Convert a nominal interest rate from one compounding frequency to another while keeping the effective interest rate constant. Compound interest means the interest from preceeding periods is added to the balance and is included in the next interest calculation.įlexible because any attribute can be adjusted according to ones wish. Simple interest is the interest calculation method that is least beneficial to savers and the most beneficial to borrowers. Sign up today and recieve free email updates from Pine-Grove Financial.Ĭompound and Simple Interest. If rates are low think about a mortgage refinance. Its hard to predict when to refinance since the market is constantly changing but a financial planner and refinance calculators will be able to help you choose the right time to refinance. Speak with a local lender at a bank as well as getting online quotes to get the best available rate. Given the periodic nominal rate r compounded m times per per period the equivalent periodic nominal rate i compounded. Subscribe Join Our Newsletter.įrom Pine Grove Software. Your mortgage can require monthly payments pine grove simple interest calculator Verified 3 days ago. Simple mortgage calculator to estimate interest only payments on FRM mortgage loan Amador Pine Grove California.Ĭalculate amortization IRR PV FV payments ROI APR budgets net worth and more. About Dates Interest Calculations - In the real world the time between the mortgage origination date and the first payment due date will seldom be equal to the payment frequency. And the amortization can be copied and printed.Īlso explore hundreds of other calculators addressing investment finance math fitness health and many more. Calculates an amortization schedule showing the loan balance and payments by month.

#Pine grove financial calculators software#

More information Pine Grove Software - online compound interest calculator to see how your savings account works for you. If youre a small business owner our tools. Free interest calculator to find the interest final balance and accumulation schedule using either a fixed starting principal andor periodic contributions. Pin On Homescreen Aesthetic Then once you have computed the payment click on the Create Amortization Schedule button to create a chart you. See mortgage interest rates and calculate payments for Pine Grove PA. Calculates interest amount and ending value.

0 notes

Photo

We are specialists in loan claims and getting our customers the compensation they deserve from loans that have been irresponsibly lent. It is a lenders responsibly to ensure that people can afford the loan and not struggle to make the loan payments. If you have found yourself in this situation, this is where we can help. We can help you make a claim and receive a refund against your loan provider, who incorrectly lent to you in the first place. Want to know more? Visit our website to find out how much you could be owed: www.theclaimsguide.com/ #Loans #reclaimloan #lending #payday #paydayloan #loanadvisor #loanconsultant #loancalculation #loanlifestyle #loanoptions #loanpayments #claimrefund #refundloan https://www.instagram.com/p/CR1idwsjfis/?utm_medium=tumblr

#loans#reclaimloan#lending#payday#paydayloan#loanadvisor#loanconsultant#loancalculation#loanlifestyle#loanoptions#loanpayments#claimrefund#refundloan

0 notes

Text

If your salary is 25000, your loan amount will be...?

Here is the Loan amount calculation criteria, Maximum and minimum loan amount based on different lender policies.

Know your max and min loan amount for a salary of 25000.

#personalloans#Loans#loanssavelives#LoanApproval#loancalculator#loanstructuring#loancalculation#loanlifestyle#loanoptions#loanpayments#CreditMantri

0 notes

Link

A personal loan can be used for many reasons. With any debt, it’s essential to consider how the payment will impact your finances, but there are many situations where a personal loan may be a good choice. To know more tips about personal loan check out our latest blog: http://bit.ly/3qwqcT2

1 note

·

View note