#kehali

Photo

DJ ORANGE CALDERON - HEATWAVES (MIX)

Tracklist: Don’t Choose - Dvsn First F#Ck - 6Lack &Amp; Jhene Aiko Imagination - Adrian Marcel Distance - Sabrina Claudio Nikes - Frank Ocean Doves In The Wind - Sza &Amp; Kendrick Lamar White - Frank Ocean One I Want - Majid Jordan &Amp; Partynextdoor Cassie - Kiss Me T-Shirt - Destiny’s Child Karaoke - Drake Normal Girl - Sza Same Ol Mistakes - Rihanna Bodies - Cee-Lo Green All In My Head - Sir Best Part - Daniel Caesar &Amp; H.E.R. Better - Kyle Dion Oceans - Elhae Get You - Daniel Caesar Permission - Ro James Made Love Lately - Day26 Down For You - Kehlani Good Morning - Preston Harris Just Friends - Tory Lanez 7 Days - Craig David Time Off - Starro &Amp; Kyle Dion Brown Sugar - D’angelo Sugar - Sir After She - Ka-Yu &Amp; Mellow Orange Go Gina - Sza Whippin - Kiiara &Amp; Felix Snow Window Seat - Erykah Badu Tyrant - Kali Uchis &Amp; Jorja Smith Keep You In Mind - Guordan Banks &Amp; Chris Brown On My Way - Anders You Can Do It Too - Pharrell Williams So Creamy So Dreamy - C Y G N. Orion’s Belt - Sabrina Claudio Teenage Fantasy - Jorja Smith You For You - Anders Cheating On Us - Bj The Chicago Kid Emotions (Neptunes Remix) - Destiny’s Child Freak In You - Partynextdoor Freak In You - Drake Somethin Tells Me - Bryson Tiller December - Anders &Amp; Luca Pretty Little Birds - Sza That Far - 6Lack Bless Me - 6Lack Drift - Alina Baraz &Amp; Galimatias Us - Blaq Tuxedo Rendezvous - Partynextdoor Worthy - Jeremih &Amp; Jhene Aiko Hold On To Me - Kyle Dion Lately - Humble &Amp; Blisse (Ft. Cygnaeus) Every Hour - Tone Stith You Rock My World - Michael Jackson I Wanna Be Your Man - Kehlani Keep On - Kehlani In The Morning (Mura Mura Edit) - Nao W$ Boi - Sir Silk - Ymtk &Amp; P-Lo I Think Of You - Jeremih &Amp; Chris Brown Privacy - Chris Brown Better - Iigoz Im So Into You - Swv Senorita - Justin Timberlake Emotional - Snoh Aalegra

OrangeCalderon.com

IG: @OrangeCalderon

Twitter: @OrangeCalderon

#orange calderon#heatwaves#djoj#orange#heat#mix#r&b#chill#vibes#dj orange#oc#sza#snoh aalegra#iigoz#p-lo#kehali#tone stith#jhene aiko#partynextdoor#alina baraz#bryson tiller#drake#anders#jorja smith#sabrina claudio#kiira#kali uchis#daniel caesar

49 notes

·

View notes

Text

Value-based care – no progress since 1997?

By MATTHEW HOLT

Humana is out with a report saying that its Medicare Advantage members who are covered by value-based care (VBC) arrangements do better and cost less than either their Medicare Advantage members who aren’t or people in regular Medicare FFS. To us wonks this is motherhood, apple pie, etc, particularly as proportionately Humana is the insurer that relies the most on Medicare Advantage for its business and has one of the larger publicity machines behind its innovation group. Not to mention Humana has decent slugs of ownership of at-home doctors group Heal and the now publiciy-traded capitated medical group Oak Street Health.

Human has 4m Medicare advantage members with ~2/3rds of those in value based care arrangements. The report has lots of data about how Humana makes everthing better for those Medicare Advantage members and how VBC shows slightly better outcomes at a lower cost. But that wasn’t really what caught my eye. What did was their chart about how they pay their physicians/medical group

What it says on the surface is that of their Medicare Advantage members, 67% are in VBC arrangements. But that covers a wide range of different payment schemes. The 67% VBC schemes include:

Global capitation for everything 19%

Global cap for everything but not drugs 5%

FFS + care coordination payment + some shared savings 7%

FFS + some share savings 36%

FFS + some bonus 19%

FFS only 14%

What Humana doesn’t say is how much risk the middle group is at. Those are the 7% of PCP groups being paid “FFS + care coordination payment + some shared savings” and the 36% getting “FFS + some share savings.” My guess is not much. So they could have been put in the non VBC group. But the interesting thing is the results.

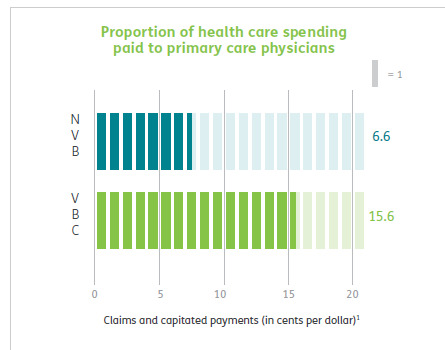

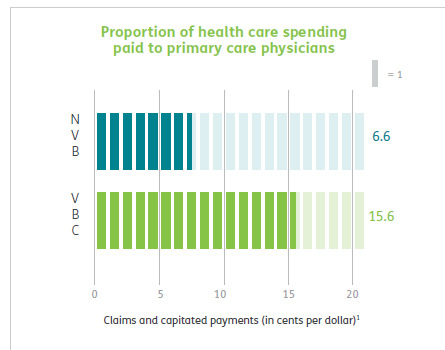

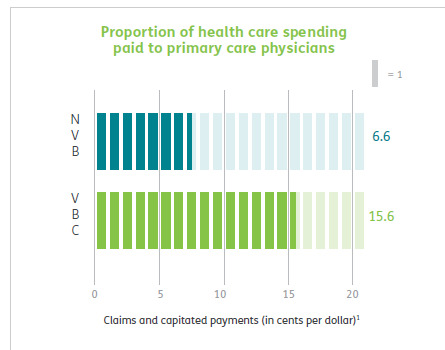

First up Humana is spending a lot more on primary care for all their VBC providers, 15% of all health care spend vs 6.6% for the FFS group, which is more than double. This is more health policy wonkdom motherhood/apple pie, etc and probably represents a lot of those trips by Oak Street Health coaches to seniors houses fixing their sinks and loose carpets. (A story often told by the Friendly Hills folk in 1994 too).

But then you get into some fuzzy math.

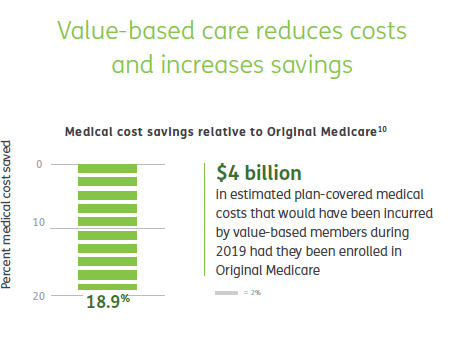

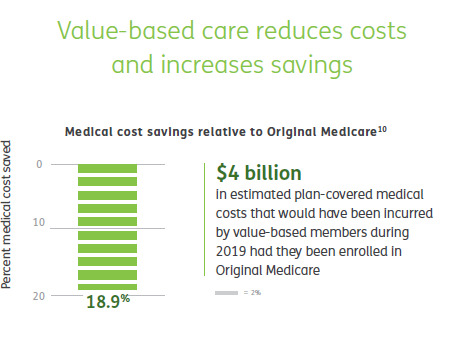

According to Humana their VBC Medicare Advantage members cost 19% less than if they had been in traditional FFS Medicare, and therefore those savings across their 2.4m members in VBC are $4 billion. Well, Brits of a certain age like me are wont to misquote Mandy Rice-Davis — “they would say that wouldn’t they”.

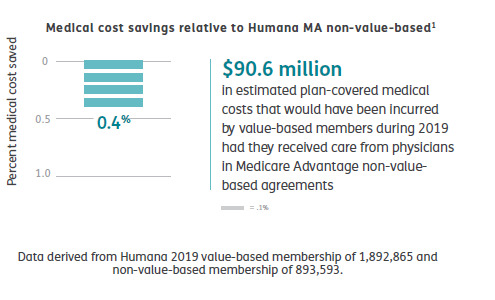

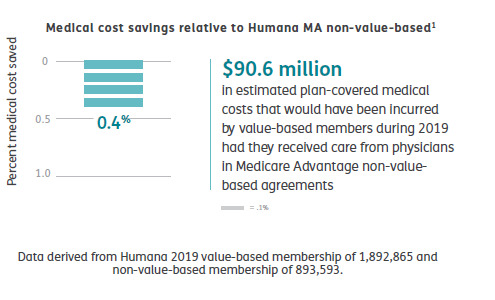

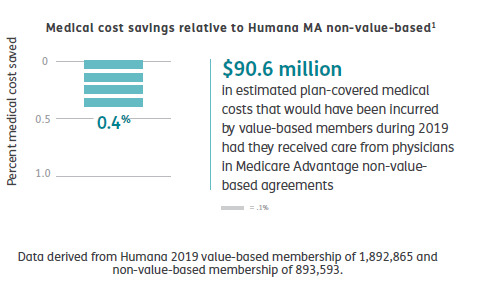

But on the very same page Humana compares the cost of their VBC Medicare Advantage members to those 33% of their Medicare Advantage members in non-VBC arrangements. Ponder this chart a tad.

Yup, that’s right. Despite the strung and dram and excitement about VBC, the cost difference between Humana’s VBC program and its non-VBC program is a rounding error of 0.4%. The $90m saved probably barely covered what they spent on the fancy website & report they wrote about it

Maybe there’s something going on in Humana’s overall approach that means that FFS PCPs in Medicare Advantage practice lower cost medicine that PCPs in regular ol’ Medicare. This might be that some of the prevention, care coordination or utilization review done by the plan has a big impact.

Or it might be that the 19% savings versus regular old Medicare is illusionary.

It’s also a little frustrating that they didn’t break out the difference between the full risk groups and the VBC “lite” who are getting FFS but also some shared savings and/or care coordination payments, but you have to assume there’s a limited difference between them if all VBC is only 0.4% cheaper than non-VBC. Presumably if the full risk groups were way different they would have broken that data out. Hopefully they may release some of the underlying data, but I’m not holding my breath.

Finally, it’s worth remembering how many people are in these arrangements. In 2019 34% of Medicare recipients were in Medicare Advantage. Humana has been one of the most aggressive in its use of value based care so it’s fair to assume that my estimates here are probably at the top end of how Medicare Advantage patients get paid for. So we are talking maybe 67% of 34% of all Medicare recipients in VBC, and only 25% of that 34% = 8.5% in what looks like full risk (including those not at risk for the drugs). This doesn’t count ACOs which Dan O’Neill points out are about another 11m people or about 25% of those not in Medicare Advantage. (Although as far as I can tell Medicare ACOs don’t save bupkiss unless they are run by Aledade).

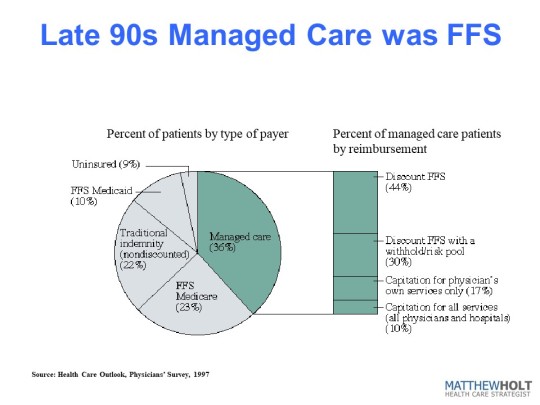

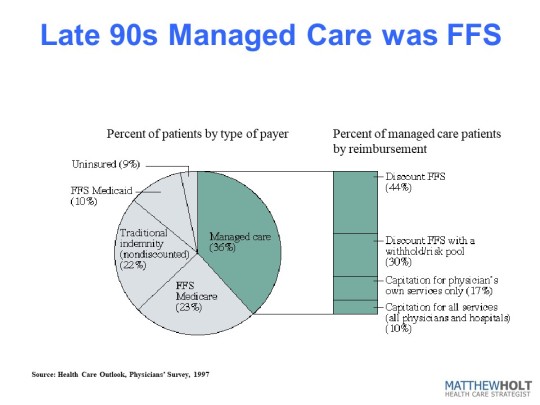

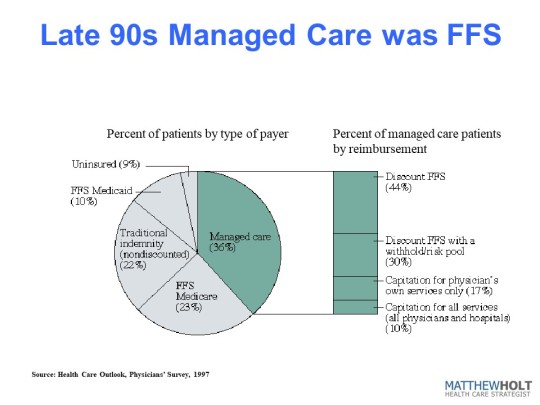

I did a survey in 1997 which some may recall as the height of the (fake) managed care revolution. Those around at the time may recall that managed care was how the health insurance industry was going to save America after they killed the Clinton plan. (Ian Morrison used to call this “The market is working but managed care sucks”). At the time there was still a lot of excitement about medical groups taking full risk capitation from health plans and then like now there was a raft of newly publicly-traded medical groups that were going to accept full risk capitation, put hospitals and over-priced specialists out of business, and do it all for 30% less. The Advisory Board, bless their very expensive hearts, put out a report called The Grand Alliance which said that 95% of America would soon be under capitation. Yeah, right. Every hospital in America bought their reports for $50k a year and made David Bradley a billionaire while they spent millions on medical groups that they then sold off at a massive loss in the early 2000s. (A process they then reversed in the 2010s but with the clear desire not to accept capitation but to lock up referrals, but I digress!).

In the 1997 IFTF/Harris Health Care Outlook survey I asked doctors how they/their organization got paid. And the answer was that they were at full risk/capitation for ~3.6% of their patients. Bear in mind this is everyone, not just Medicare, so it’s not apples to apples with the Humana data. But if you look at the rest of the 36% of their patients that were “managed care” it kind of compares to the VBC break down from Humana. There’s a lot of “withholds” which was 1990s speak for shared savings and dscounted fee-for-service. The other 65% of Americans were in some level of PPO-based or straight Medicare fee-for-service. Last year I heard BCBS Arizona CEO Pam Kehaly say that despite all the big talk, the industry was at about 10% VBC and the Humana data suggests this is still about right.

So this policy wonk is a bit depressed, and he’s not alone. There’s a little school of rebels (for example Kip Sullivan on THCB last year) saying that Medicare Advantage, capitated primary care and ACOs don’t really move the needle on cost and anyway no one’s really adopted them. On this evidence they’re right.

Matthew Holt is the Publisher of THCB and is still allowed to write for it occasionally

Value-based care – no progress since 1997? published first on https://wittooth.tumblr.com/

0 notes

Text

Value-based care – no progress since 1997?

By MATTHEW HOLT

Humana is out with a report saying that its Medicare Advantage members who are covered by value-based care (VBC) arrangements do better and cost less than either their Medicare Advantage members who aren’t or people in regular Medicare FFS. To us wonks this is motherhood, apple pie, etc, particularly as proportionately Humana is the insurer that relies the most on Medicare Advantage for its business and has one of the larger publicity machines behind its innovation group. Not to mention Humana has decent slugs of ownership of at-home doctors group Heal and the now publiciy-traded capitated medical group Oak Street Health.

Human has 4m Medicare advantage members with ~2/3rds of those in value based care arrangements. The report has lots of data about how Humana makes everthing better for those Medicare Advantage members and how VBC shows slightly better outcomes at a lower cost. But that wasn’t really what caught my eye. What did was their chart about how they pay their physicians/medical group

What it says on the surface is that of their Medicare Advantage members, 67% are in VBC arrangements. But that covers a wide range of different payment schemes. The 67% VBC schemes include:

Global capitation for everything 19%

Global cap for everything but not drugs 5%

FFS + care coordination payment + some shared savings 7%

FFS + some share savings 36%

FFS + some bonus 19%

FFS only 14%

What Humana doesn’t say is how much risk the middle group is at. Those are the 7% of PCP groups being paid “FFS + care coordination payment + some shared savings” and the 36% getting “FFS + some share savings.” My guess is not much. So they could have been put in the non VBC group. But the interesting thing is the results.

First up Humana is spending a lot more on primary care for all their VBC providers, 15% of all health care spend vs 6.6% for the FFS group, which is more than double. This is more health policy wonkdom motherhood/apple pie, etc and probably represents a lot of those trips by Oak Street Health coaches to seniors houses fixing their sinks and loose carpets. (A story often told by the Friendly Hills folk in 1994 too).

But then you get into some fuzzy math.

According to Humana their VBC Medicare Advantage members cost 19% less than if they had been in traditional FFS Medicare, and therefore those savings across their 2.4m members in VBC are $4 billion. Well, Brits of a certain age like me are wont to misquote Mandy Rice-Davis — “they would say that wouldn’t they”.

But on the very same page Humana compares the cost of their VBC Medicare Advantage members to those 33% of their Medicare Advantage members in non-VBC arrangements. Ponder this chart a tad.

Yup, that’s right. Despite the strung and dram and excitement about VBC, the cost difference between Humana’s VBC program and its non-VBC program is a rounding error of 0.4%. The $90m saved probably barely covered what they spent on the fancy website & report they wrote about it

Maybe there’s something going on in Humana’s overall approach that means that FFS PCPs in Medicare Advantage practice lower cost medicine that PCPs in regular ol’ Medicare. This might be that some of the prevention, care coordination or utilization review done by the plan has a big impact.

Or it might be that the 19% savings versus regular old Medicare is illusionary.

It’s also a little frustrating that they didn’t break out the difference between the full risk groups and the VBC “lite” who are getting FFS but also some shared savings and/or care coordination payments, but you have to assume there’s a limited difference between them if all VBC is only 0.4% cheaper than non-VBC. Presumably if the full risk groups were way different they would have broken that data out. Hopefully they may release some of the underlying data, but I’m not holding my breath.

Finally, it’s worth remembering how many people are in these arrangements. In 2019 34% of Medicare recipients were in Medicare Advantage. Humana has been one of the most aggressive in its use of value based care so it’s fair to assume that my estimates here are probably at the top end of how Medicare Advantage patients get paid for. So we are talking maybe 67% of 34% of all Medicare recipients in VBC, and only 25% of that 34% = 8.5% in what looks like full risk (including those not at risk for the drugs). This doesn’t count ACOs which Dan O’Neill points out are about another 11m people or about 25% of those not in Medicare Advantage. (Although as far as I can tell Medicare ACOs don’t save bupkiss unless they are run by Aledade).

I did a survey in 1997 which some may recall as the height of the (fake) managed care revolution. Those around at the time may recall that managed care was how the health insurance industry was going to save America after they killed the Clinton plan. (Ian Morrison used to call this “The market is working but managed care sucks”). At the time there was still a lot of excitement about medical groups taking full risk capitation from health plans and then like now there was a raft of newly publicly-traded medical groups that were going to accept full risk capitation, put hospitals and over-priced specialists out of business, and do it all for 30% less. The Advisory Board, bless their very expensive hearts, put out a report called The Grand Alliance which said that 95% of America would soon be under capitation. Yeah, right. Every hospital in America bought their reports for $50k a year and made David Bradley a billionaire while they spent millions on medical groups that they then sold off at a massive loss in the early 2000s. (A process they then reversed in the 2010s but with the clear desire not to accept capitation but to lock up referrals, but I digress!).

In the 1997 IFTF/Harris Health Care Outlook survey I asked doctors how they/their organization got paid. And the answer was that they were at full risk/capitation for ~3.6% of their patients. Bear in mind this is everyone, not just Medicare, so it’s not apples to apples with the Humana data. But if you look at the rest of the 36% of their patients that were “managed care” it kind of compares to the VBC break down from Humana. There’s a lot of “withholds” which was 1990s speak for shared savings and dscounted fee-for-service. The other 65% of Americans were in some level of PPO-based or straight Medicare fee-for-service. Last year I heard BCBS Arizona CEO Pam Kehaly say that despite all the big talk, the industry was at about 10% VBC and the Humana data suggests this is still about right.

So this policy wonk is a bit depressed, and he’s not alone. There’s a little school of rebels (for example Kip Sullivan on THCB last year) saying that Medicare Advantage, capitated primary care and ACOs don’t really move the needle on cost and anyway no one’s really adopted them. On this evidence they’re right.

Matthew Holt is the Publisher of THCB and is still allowed to write for it occasionally

Value-based care – no progress since 1997? published first on https://venabeahan.tumblr.com

0 notes

Text

Ethiopia records highest single-day spike in COVID-19 infections

Ethiopia records highest single-day spike in COVID-19 infections

Habtamu Kehali, respiratory therapist gives a training on the mechanical ventilator for health professionals as part of preparations to treat COVID-19 patients at St. Peter’s hospital on the outskirts of Addis Ababa, Ethiopia May 2, 2020. Picture taken May 2, 2020. REUTERS/Tiksa Negeri

Ethiopia on Friday announced 760 new COVID-19 cases, its highest single-day increase in infections since…

View On WordPress

0 notes

Text

Latest restrictions on Obamacare could mean higher premiums in Arizona

Sarabeth Henne

Monday, July 16, 2018

Latest restrictions on Obamacare could mean higher premiums in Arizona

WASHINGTON - The White House's decision to suspend billions in Obamacare "risk adjustment" payments to insurance companies could hit tens of thousands of Arizonans in the pocketbook, as insurance companies grapple with new market uncertainty. That was the assessment of advocates and insurers both after the Centers for Medicare and Medicaid Service this month stopped the payments that are aimed at helping insurance companies that agree to take on riskier, less-healthy clients. It comes as insurers are considering which markets to enter and what premiums to set for 2019, and is just the latest in a string of Trump administration changes that critics say are chipping away at the Affordable Care Act. "Putting the specifics of the risk adjustment program aside, the bigger challenge continues to be the stream of ongoing changes to the ACA," said Blue Cross Blue Shield of Arizona President and CEO Pam Kehaly in an emailed statement. "The impact of this uncertainty falls squarely on individuals who are faced with higher premiums as insurers attempt to navigate a constantly changing landscape," Kehaly's statement said. Advocates were more direct, calling it just another step in the Trump administration's "sabotage of the health insurance marketplace," where more than 165,000 Arizonans bought health care coverage this year, according to the latest figures from the Kaiser Family Foundation. The Centers for Medicare and Medicaid Services, or CMS, announced on July 7 that it had little choice but to suspend payments in the program, which reached $10.4 billion last year, because of conflicting opinions from federal district courts on the legality of the program. A U.S. District judge in Massachusetts ruled in January that the Department of Health and Human Services was acting properly when it developed the formula for deciding which insurers pay and which are paid under the risk-adjustment program, "even when the consequences of its choices may not always be optimal." But a month later, a U.S. District judge in New Mexico found the opposite in a separate challenge to the law, ruling that the formula for calculating payments was "arbitrary and capricious." "We were disappointed by the court's recent ruling," CMS Administrator Seema Verma said in the July 7 statement. "CMS has asked the court to reconsider its ruling, and hopes for a prompt resolution that allows CMS to prevent more adverse impacts on Americans who receive their insurance in the individual and small group markets." In the meantime, Verma said the New Mexico ruling bars her agency from redistributing payments from the 2017 coverage year. In a report accompanying the suspension announcement, CMS said the risk-adjustment program "functioned smoothly" in 2017 and was "working as intended, spreading the financial risk borne by issuers that enrolled higher-risk individuals" and allowing them to offer "products that serve all types of consumers." Michael Tanner, a senior fellow at the Cato Institute, said suspension of the risk-adjustment program is "liable to speed up the adverse selection death spiral that the Affordable Care Act was in." "The system was not stable. We were having a problem with risk-adverse people essentially staying out of ... buying insurance and the people who were healthy and young not buying insurance," Tanner said. "This is going to make that more likely and, therefore, speed up the problem." In the short term, advocates said that suspending the program is bad news for consumers. "Anyone who buys their insurance in the individual marketplace is going to be hurt by this because it means that insurance companies are going to have to raise their rates," said Rodd McLeod, a spokesman for Arizona Health Care Voters. "What we've seen since President Trump took office is sabotage of the health insurance marketplace and health insurance in general," said McLeod, who said that voters will remember when they go to the polls in November. Rep. Tom O'Halleran, D-Sedona, echoed Kehaly, saying that suspending the risk-adjustment program injects uncertainty into a system that relies on certainty. "The decision to end risk adjustment payments made by the Administration will hurt hardworking Arizona families who are struggling to make ends meet," O'Halleran said in a statement. "I urge the Administration to reverse this decision to undermine access to affordable coverage," he said. "We should be working on stabilizing the health insurance marketplace and bringing down health care costs for Americans."

Source

https://cronkitenews.azpbs.org/2018/07/16/latest-restrictions-on-obamacare-could-mean-higher-premiums-in-arizona/

0 notes

Text

Raamatukogud

Frustratsioon ja nukrus tekivad vahel justkui iseenesest. Võime taandada need mingite suurte kontseptsioonide või hirmudeni, aga need võivad tulla ka pisiasjadest.

Mind häirib näiteks hetkiti see, kuidas ma ei oska ega saa lõpuni väljendada seda, mida ma kogen või tunnen. Eriti siis, kui seda kogetavat ja tunnetatavat on korraga tohutupalju või üksteisele vastukäival moel. Nõnda ei saa ma kõiki oma kogemusi ega tundmusi, millest nagunii saavad vahetult pärast nende lõppemist mälestused, enda jaoks alati talletada. Kaduvuse maik on küljes kõigel.

Ometi tajun ja tean, ka tunnen, et kõik mu kogetu on kusagil tallel. Vahest siis rakutasandil, kehalis-tunnetuslikul. Kust muidu tuleb nii aistitaval kujul järsku meelde möödunud rõõm või meeleheide, rahu- ja vaikiolek või hirm. Kõik mu kogetu on mu salasahtlites alles, mind lõhkumas ja toetamas samaaegselt. Mind ehitamas, mu koostisosi hoidmas ja õigetesse struktuuridesse ladumas.

Inimene kui oma mälestuste raamatukogu. Kui kehastunud mälu, mida ta ise enam ei mäleta.

0 notes

Text

Value-based care – no progress since 1997?

By MATTHEW HOLT

Humana is out with a report saying that its Medicare Advantage members who are covered by value-based care (VBC) arrangements do better and cost less than either their Medicare Advantage members who aren’t or people in regular Medicare FFS. To us wonks this is motherhood, apple pie, etc, particularly as proportionately Humana is the insurer that relies the most on Medicare Advantage for its business and has one of the larger publicity machines behind its innovation group. Not to mention Humana has decent slugs of ownership of at-home doctors group Heal and the now publiciy-traded capitated medical group Oak Street Health.

Human has 4m Medicare advantage members with ~2/3rds of those in value based care arrangements. The report has lots of data about how Humana makes everthing better for those Medicare Advantage members and how VBC shows slightly better outcomes at a lower cost. But that wasn’t really what caught my eye. What did was their chart about how they pay their physicians/medical group

What it says on the surface is that of their Medicare Advantage members, 67% are in VBC arrangements. But that covers a wide range of different payment schemes. The 67% VBC schemes include:

Global capitation for everything 19%

Global cap for everything but not drugs 5%

FFS + care coordination payment + some shared savings 7%

FFS + some share savings 36%

FFS + some bonus 19%

FFS only 14%

What Humana doesn’t say is how much risk the middle group is at. Those are the 7% of PCP groups being paid “FFS + care coordination payment + some shared savings” and the 36% getting “FFS + some share savings.” My guess is not much. So they could have been put in the non VBC group. But the interesting thing is the results.

First up Humana is spending a lot more on primary care for all their VBC providers, 15% of all health care spend vs 6.6% for the FFS group, which is more than double. This is more health policy wonkdom motherhood/apple pie, etc and probably represents a lot of those trips by Oak Street Health coaches to seniors houses fixing their sinks and loose carpets. (A story often told by the Friendly Hills folk in 1994 too).

But then you get into some fuzzy math.

According to Humana their VBC Medicare Advantage members cost 19% less than if they had been in traditional FFS Medicare, and therefore those savings across their 2.4m members in VBC are $4 billion. Well, Brits of a certain age like me are wont to misquote Mandy Rice-Davis — “they would say that wouldn’t they”.

But on the very same page Humana compares the cost of their VBC Medicare Advantage members to those 33% of their Medicare Advantage members in non-VBC arrangements. Ponder this chart a tad.

Yup, that’s right. Despite the strung and dram and excitement about VBC, the cost difference between Humana’s VBC program and its non-VBC program is a rounding error of 0.4%. The $90m saved probably barely covered what they spent on the fancy website & report they wrote about it

Maybe there’s something going on in Humana’s overall approach that means that FFS PCPs in Medicare Advantage practice lower cost medicine that PCPs in regular ol’ Medicare. This might be that some of the prevention, care coordination or utilization review done by the plan has a big impact.

Or it might be that the 19% savings versus regular old Medicare is illusionary.

It’s also a little frustrating that they didn’t break out the difference between the full risk groups and the VBC “lite” who are getting FFS but also some shared savings and/or care coordination payments, but you have to assume there’s a limited difference between them if all VBC is only 0.4% cheaper than non-VBC. Presumably if the full risk groups were way different they would have broken that data out. Hopefully they may release some of the underlying data, but I’m not holding my breath.

Finally, it’s worth remembering how many people are in these arrangements. In 2019 34% of Medicare recipients were in Medicare Advantage. Humana has been one of the most aggressive in its use of value based care so it’s fair to assume that my estimates here are probably at the top end of how Medicare Advantage patients get paid for. So we are talking maybe 67% of 34% of all Medicare recipients in VBC, and only 25% of that 34% = 8.5% in what looks like full risk (including those not at risk for the drugs). This doesn’t count ACOs which Dan O’Neill points out are about another 11m people or about 25% of those not in Medicare Advantage. (Although as far as I can tell Medicare ACOs don’t save bupkiss unless they are run by Aledade).

I did a survey in 1997 which some may recall as the height of the (fake) managed care revolution. Those around at the time may recall that managed care was how the health insurance industry was going to save America after they killed the Clinton plan. (Ian Morrison used to call this “The market is working but managed care sucks”). At the time there was still a lot of excitement about medical groups taking full risk capitation from health plans and then like now there was a raft of newly publicly-traded medical groups that were going to accept full risk capitation, put hospitals and over-priced specialists out of business, and do it all for 30% less. The Advisory Board, bless their very expensive hearts, put out a report called The Grand Alliance which said that 95% of America would soon be under capitation. Yeah, right. Every hospital in America bought their reports for $50k a year and made David Bradley a billionaire while they spent millions on medical groups that they then sold off at a massive loss in the early 2000s. (A process they then reversed in the 2010s but with the clear desire not to accept capitation but to lock up referrals, but I digress!).

In the 1997 IFTF/Harris Health Care Outlook survey I asked doctors how they/their organization got paid. And the answer was that they were at full risk/capitation for ~3.6% of their patients. Bear in mind this is everyone, not just Medicare, so it’s not apples to apples with the Humana data. But if you look at the rest of the 36% of their patients that were “managed care” it kind of compares to the VBC break down from Humana. There’s a lot of “withholds” which was 1990s speak for shared savings and dscounted fee-for-service. The other 65% of Americans were in some level of PPO-based or straight Medicare fee-for-service. Last year I heard BCBS Arizona CEO Pam Kehaly say that despite all the big talk, the industry was at about 10% VBC and the Humana data suggests this is still about right.

So this policy wonk is a bit depressed, and he’s not alone. There’s a little school of rebels (for example Kip Sullivan on THCB last year) saying that Medicare Advantage, capitated primary care and ACOs don’t really move the needle on cost and anyway no one’s really adopted them. On this evidence they’re right.

Matthew Holt is the Publisher of THCB and is still allowed to write for it occasionally

Value-based care – no progress since 1997? published first on https://wittooth.tumblr.com/

0 notes

Text

The Lynne Chou O’Keefe Fallacy

By MATTHEW HOLT

Rob Coppedge and Bryony Winn wrote an interesting article in Xconomy yesterday. I told Rob (& the world) on Twitter yesterday that it was good but wrong. Why was it wrong? Well it encompasses something I’m going to call the Lynne Chou O’Keefe Fallacy. And yes, I’ll get to that in a minute. But first. What did Rob and Bryony say?

Having walked the halls and corridors and been deafened by the DJs at HLTH, Rob & Bryony determined why many digital health companies have failed (or will fail) and a few have succeeded. They’ve dubbed the winners “Digital Health Survivors.” And they go on to say that many of the failures have been backed by VCs who don’t know health care while the companies they’ve invested in have “product-market fit problems, sales traction hiccups, or lack of credible proof points.”

What did the ” Survivors” do? They have:

“hired health care experts, partnered effectively, and have even co-developed their models alongside legacy players. Many raised venture capital from strategic corporate investors who have helped them refine their product, accelerate channel access, and get past the risk of “death by pilot.”

Now it won’t totally shock you to discover that Rob heads Echo Health Ventures, the joint VC fund from Cambia Heath Solutions (Blues of Oregon) & BCBS of N. Carolina, and Bryony runs innovation at BCBS of N. Carolina. So they may be a tad biased towards the strategic venture = success model. But they do have a point. Many but not all of their portfolio are selling tools and services to the incumbents in health care, which mostly includes health plans, hospitals and pharma.

And now we get to the Lynne Chou O’Keefe fallacy. (You might argue that fallacy is the wrong term, but bear with me).

Lynne is another super smart VC and having decamped from the break up of Kleiner Perkins, has just started her own fund, Define Ventures. About two years ago she gave a talk at a Health 2.0 Chapter meeting in San Francisco which was a wonderful roadmap for what a tech company needed to do to “partner with” (i.e. sell to) hospitals, plans and pharma. As you might imagine it included a bunch of getting to know your customers’ problems, doing a whole amount of data analytics, getting your clinical process correct, etc, etc. But in the end, Lynne’s assessment was that the best bet for a health tech startup’s success was to improve the life of an incumbent.

I don’t have a problem with that advice per se, and frankly I send many of the startups I advise to incumbents, hoping that they’ll become clients or investors. But here’s the mistake made by Rob & Bryony. They say:

“Despite being attacked on all sides from innovative startups, well-capitalized tech companies, big retail brands, and government regulators, traditional health care services companies simply don’t seem disrupted yet. In fact, driven by consolidation and strong financial performance, many are healthier and appear more confident than ever. And some of the more successful ones even seem downright innovative themselves, having learned from innovators to build, buy, and partner their way to new capabilities.” <snip> “These Innovative Incumbents are differentiated by their commitment to becoming good partners with the “Digital Health Survivors.” They have realized that winning in the future means bringing together better solutions and consumer experiences than their competitors.”

There’s an illusion out there that these incumbents are doing well financially because they are able to take the best of the digital health tech and ideas and change what they are doing.

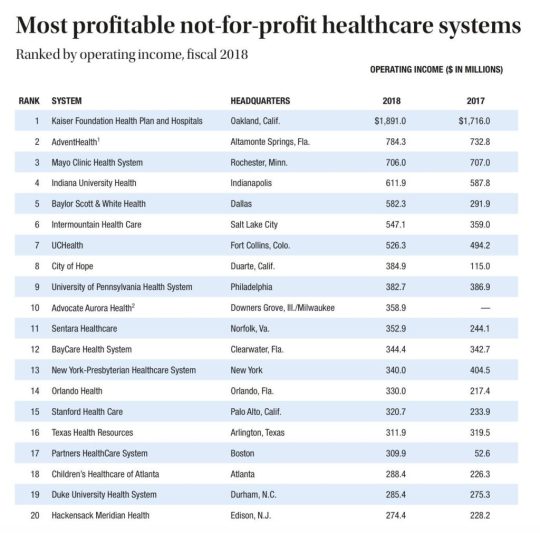

No one who looks at the US health care system can possibly believe that the incumbents have changed their behavior to adopt the consumer friendly ethos of the digital health tech crowd. They are making money the old fashioned way, by creating monopolies (including buying up physician networks to feed the inpatient beast), ramping up drug prices, (something Rob’s boss Mark Ganz has been very explicit about) and aggressively pursuing patients for collections. And when they get caught in the act, they settle to keep it out of the media. Now, given that the Obama administration was set on HITECH and trying to roll out the ACA, and the Trump administration can’t manage to create a coherent policy on anything, regulators have been more or less absent so it’s no surprise that we’ve had a decade plus of incumbents running rampant. That’s why we are in the mess we are in today and why 35% of the country wants single payer and another 35% want a massive expansion of the ACA.

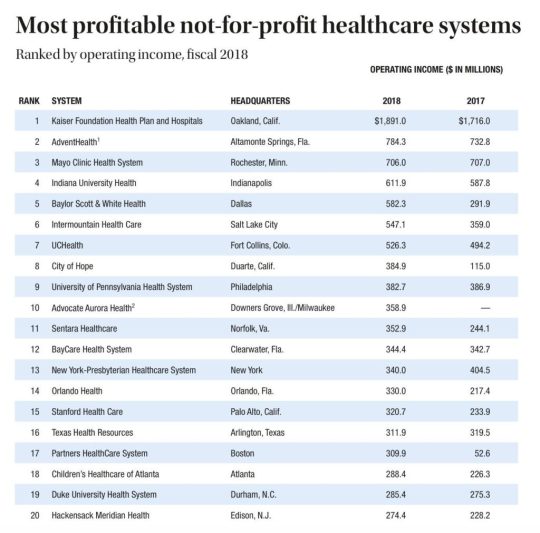

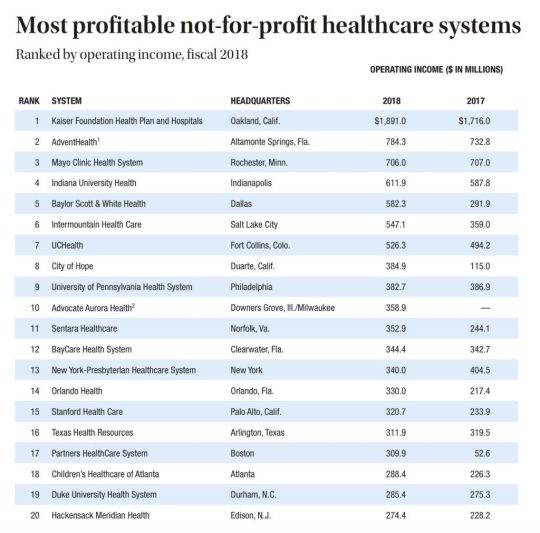

I’m not sure if Rob & Bryony caught the talk from one of the incumbents at HLTH, but Pam Kehaly, CEO of Blues of Arizona, said something very revealing: “we pat ourselves on the back about value based care but 90% of America is just doing fee-for-service.” The incumbents know how to play that game and they are winning. Just look at the profit totals for those top provider systems.

(Stolen from Modern Healthcare via Eric Topol)

Which brings me to what’s wrong with all of this and it’s the question I asked Lynne at that talk, mindful of her Kleiner Perkins heritage and the alleged $1bn profit Kleiner made on their Amazon investment.

When Jeff Bezos came to pitch John Doerr to invest in Amazon, did he explain how he was going to build a system to help Barnes & Noble sell more books or help Sears sell more clothes? No, he came to put those companies out of business.

Where are the VCs who want to invest in today’s health care equivalent? Because that’s what we need.

Matthew Holt is the Founder and publisher of THCB

The post The Lynne Chou O’Keefe Fallacy appeared first on The Health Care Blog.

The Lynne Chou O’Keefe Fallacy published first on https://wittooth.tumblr.com/

0 notes

Text

The Lynne Chou O’Keefe Fallacy

By MATTHEW HOLT

Rob Coppedge and Bryony Winn wrote an interesting article in Xconomy yesterday. I told Rob (& the world) on Twitter yesterday that it was good but wrong. Why was it wrong? Well it encompasses something I’m going to call the Lynne Chou O’Keefe Fallacy. And yes, I’ll get to that in a minute. But first. What did Rob and Bryony say?

Having walked the halls and corridors and been deafened by the DJs at HLTH, Rob & Bryony determined why many digital health companies have failed (or will fail) and a few have succeeded. They’ve dubbed the winners “Digital Health Survivors.” And they go on to say that many of the failures have been backed by VCs who don’t know health care while the companies they’ve invested in have “product-market fit problems, sales traction hiccups, or lack of credible proof points.”

What did the ” Survivors” do? They have:

“hired health care experts, partnered effectively, and have even co-developed their models alongside legacy players. Many raised venture capital from strategic corporate investors who have helped them refine their product, accelerate channel access, and get past the risk of “death by pilot.”

Now it won’t totally shock you to discover that Rob heads Echo Health Ventures, the joint VC fund from Cambia Heath Solutions (Blues of Oregon) & BCBS of N. Carolina, and Bryony runs innovation at BCBS of N. Carolina. So they may be a tad biased towards the strategic venture = success model. But they do have a point. Many but not all of their portfolio are selling tools and services to the incumbents in health care, which mostly includes health plans, hospitals and pharma.

And now we get to the Lynne Chou O’Keefe fallacy. (You might argue that fallacy is the wrong term, but bear with me).

Lynne is another super smart VC and having decamped from the break up of Kleiner Perkins, has just started her own fund, Define Ventures. About two years ago she gave a talk at a Health 2.0 Chapter meeting in San Francisco which was a wonderful roadmap for what a tech company needed to do to “partner with” (i.e. sell to) hospitals, plans and pharma. As you might imagine it included a bunch of getting to know your customers’ problems, doing a whole amount of data analytics, getting your clinical process correct, etc, etc. But in the end, Lynne’s assessment was that the best bet for a health tech startup’s success was to improve the life of an incumbent.

I don’t have a problem with that advice per se, and frankly I send many of the startups I advise to incumbents, hoping that they’ll become clients or investors. But here’s the mistake made by Rob & Bryony. They say:

“Despite being attacked on all sides from innovative startups, well-capitalized tech companies, big retail brands, and government regulators, traditional health care services companies simply don’t seem disrupted yet. In fact, driven by consolidation and strong financial performance, many are healthier and appear more confident than ever. And some of the more successful ones even seem downright innovative themselves, having learned from innovators to build, buy, and partner their way to new capabilities.” <snip> “These Innovative Incumbents are differentiated by their commitment to becoming good partners with the “Digital Health Survivors.” They have realized that winning in the future means bringing together better solutions and consumer experiences than their competitors.”

There’s an illusion out there that these incumbents are doing well financially because they are able to take the best of the digital health tech and ideas and change what they are doing.

No one who looks at the US health care system can possibly believe that the incumbents have changed their behavior to adopt the consumer friendly ethos of the digital health tech crowd. They are making money the old fashioned way, by creating monopolies (including buying up physician networks to feed the inpatient beast), ramping up drug prices, (something Rob’s boss Mark Ganz has been very explicit about) and aggressively pursuing patients for collections. And when they get caught in the act, they settle to keep it out of the media. Now, given that the Obama administration was set on HITECH and trying to roll out the ACA, and the Trump administration can’t manage to create a coherent policy on anything, regulators have been more or less absent so it’s no surprise that we’ve had a decade plus of incumbents running rampant. That’s why we are in the mess we are in today and why 35% of the country wants single payer and another 35% want a massive expansion of the ACA.

I’m not sure if Rob & Bryony caught the talk from one of the incumbents at HLTH, but Pam Kehaly, CEO of Blues of Arizona, said something very revealing: “we pat ourselves on the back about value based care but 90% of America is just doing fee-for-service.” The incumbents know how to play that game and they are winning. Just look at the profit totals for those top provider systems.

(Stolen from Modern Healthcare via Eric Topol)

Which brings me to what’s wrong with all of this and it’s the question I asked Lynne at that talk, mindful of her Kleiner Perkins heritage and the alleged $1bn profit Kleiner made on their Amazon investment.

When Jeff Bezos came to pitch John Doerr to invest in Amazon, did he explain how he was going to build a system to help Barnes & Noble sell more books or help Sears sell more clothes? No, he came to put those companies out of business.

Where are the VCs who want to invest in today’s health care equivalent? Because that’s what we need.

Matthew Holt is the Founder and publisher of THCB

The post The Lynne Chou O’Keefe Fallacy appeared first on The Health Care Blog.

The Lynne Chou O’Keefe Fallacy published first on https://wittooth.tumblr.com/

0 notes

Text

The Lynne Chou O’Keefe Fallacy

By MATTHEW HOLT

Rob Coppedge and Bryony Winn wrote an interesting article in Xconomy yesterday. I told Rob (& the world) on Twitter yesterday that it was good but wrong. Why was it wrong? Well it encompasses something I’m going to call the Lynne Chou O’Keefe Fallacy. And yes, I’ll get to that in a minute. But first. What did Rob and Bryony say?

Having walked the halls and corridors and been deafened by the DJs at HLTH, Rob & Bryony determined why many digital health companies have failed (or will fail) and a few have succeeded. They’ve dubbed the winners “Digital Health Survivors.” And they go on to say that many of the failures have been backed by VCs who don’t know health care while the companies they’ve invested in have “product-market fit problems, sales traction hiccups, or lack of credible proof points.”

What did the ” Survivors” do? They have:

“hired health care experts, partnered effectively, and have even co-developed their models alongside legacy players. Many raised venture capital from strategic corporate investors who have helped them refine their product, accelerate channel access, and get past the risk of “death by pilot.”

Now it won’t totally shock you to discover that Rob heads Echo Health Ventures, the joint VC fund from Cambia Heath Solutions (Blues of Oregon) & BCBS of N. Carolina) and Bryony runs innovation at BCBS of N. Carolina. So they may be a tad biased towards the strategic venture = success model. But they do have a point. Many but not all of their portfolio are selling tools and services to the incumbents in health care, which mostly includes health plans, hospitals and pharma.

And now we get to the Lynne Chou O’Keefe fallacy. (You might argue that fallacy is the wrong term, but bear with me).

Lynne is another super smart VC and having decamped from the break up of Kleiner Perkins, has just started her own fund, Define Ventures. About two years ago she gave a talk at a Health 2.0 Chapter meeting in San Francisco which was a wonderful roadmap for what a tech company needed to do to “partner with” (i.e. sell to) hospitals, plans and pharma. As you might imagine it included a bunch of getting to know your customers’ problems, doing a whole amount of data analytics, getting your clinical process correct, etc, etc. But in the end, Lynne’s assessment was that the best bet for a health tech startup’s success was to improve the life of an incumbent.

I don’t have a problem with that advice per se, and frankly I send many of the startups I advise to incumbents, hoping that they’ll become clients or investors. But here’s the mistake made by Rob & Bryony. They say:

“Despite being attacked on all sides from innovative startups, well-capitalized tech companies, big retail brands, and government regulators, traditional health care services companies simply don’t seem disrupted yet. In fact, driven by consolidation and strong financial performance, many are healthier and appear more confident than ever. And some of the more successful ones even seem downright innovative themselves, having learned from innovators to build, buy, and partner their way to new capabilities.” <snip> “These Innovative Incumbents are differentiated by their commitment to becoming good partners with the “Digital Health Survivors.” They have realized that winning in the future means bringing together better solutions and consumer experiences than their competitors.”

There’s an illusion out there that these incumbents are doing well financially because they are able to take the best of the digital health tech and ideas and change what they are doing.

No one who looks at the US health care system can possibly believe that the incumbents have changed their behavior to adopt the consumer friendly ethos of the digital health tech crowd. They are making money the old fashioned way, by creating monopolies (including buying up physician networks to feed the inpatient beast), ramping up drug prices, (something Rob’s boss Mark Ganz has been very explicit about) and aggressively pursuing patients for collections. And when they get caught in the act, they settle to keep it out of the media. Now, given that the Obama administration was set on HITECH and trying to roll out the ACA, and the Trump administration can’t manage to create a coherent policy on anything, regulators have been more or less absent so it’s no surprise that we’ve had a decade plus of incumbents running rampant. That’s why we are in the mess we are in today and why 35% of the country wants single payer and another 35% want a massive expansion of the ACA.

I’m not sure if Rob & Bryony caught the talk from one of the incumbents at HLTH, but Pam Kehaly, CEO of Blues of Arizona, said something very revealing: “we pat ourselves on the back about value based care but 90% of America is just doing fee-for-service.” The incumbents know how to play that game and they are winning. Just look at the profit totals for those top provider systems.

(Stolen from Modern Healthcare via Eric Topol)

Which brings me to what’s wrong with all of this and it’s the question I asked Lynne at that talk, mindful of her Kleiner Perkins heritage and the alleged $1bn dollar profit Kleiner made on their Amazon investment.

When Jeff Bezos came to pitch John Doerr to invest in Amazon, did he explain how he was going to build a system to help Barnes & Noble sell more books or help Sears sell more clothes? No, he came to put those companies out of business.

Where are the VCs who want to invest in today’s health care equivalent? Because that’s what we need.

Matthew Holt is the Founder and publisher of THCB

The post The Lynne Chou O’Keefe Fallacy appeared first on The Health Care Blog.

The Lynne Chou O’Keefe Fallacy published first on https://venabeahan.tumblr.com

0 notes